Exhibit 13.1

compete create build discover inspire

[ evolve ]

2004 Annual Report

| | | | | |

| | 1 | | | Evolve |

| | 2 | | | Letter to Shareholders |

| | 7 | | | Corporate Organizational Structure |

| | 8 | | | Popular Puerto Rico |

| | 12 | | | Banco Popular North America |

| | 16 | | | Popular Financial Holdings |

| | 20 | | | EVERTEC |

| | 24 | | | Our Community |

| | 29 | | | Institutional Values |

| | 30 | | | Corporate Leadership Circle |

| | 31 | | | Board of Directors, Popular, Inc. |

| | 32 | | | Financial Summary |

| | 36 | | | Corporate Information |

Popular, Inc., a financial holding company with $44.4 billion in assets, is a complete financial services provider with operations in Puerto Rico, the United States, the Caribbean and Latin America. As the leading financial institution in Puerto Rico, the Corporation offers full retail and commercial banking services through its main subsidiary, Banco Popular, as well as brokerage and investment banking, auto and equipment leasing and financing, mortgage loans, consumer lending, insurance and information processing through specialized subsidiaries. In the United States, the Corporation has established the largest Hispanic financial services franchise, providing complete financial solutions to all the communities it serves. The Corporation continues to use its expertise in technology and electronic banking as a competitive advantage in its Caribbean and Latin America expansion, and is exporting its 111 years of experience to the region. Popular, Inc. has always been committed to meeting the needs of retail and business clients through innovation, and to fostering growth in the communities it serves.

[ evolve ]

Great achievers — in the arts, sports, science and other fields — describe an effortlessness and ease that comes from using their skills to the maximum while being inspired to do even more. The challenge before any corporation, especially one driven by service and customer satisfaction, is gaining strength without becoming fixed in its ways. Popular continues to grow and evolve by expanding our franchise, investing in new technology and entering new markets. At the same time, we develop our capacity for change. Across the enterprise, Popular employees are rethinking, adapting and renewing their commitment. The result is a palpable curiosity and energy, melting resistance into cooperation, and transforming ideas and new initiatives into measurable change and lasting results.

compete / create / build / discover / inspire

[P1]

[ Letter to Shareholders ]

EVOLVE

Evolution is a necessity. Organizations evolve or become obsolete. Unlike nature, an organization’s evolution is not an automatic process. It requires a clear vision, will, commitment and a lot of work to keep the organization on the desired track.

Popular has been evolving since our foundation more than a century ago. However, the pace of change has accelerated dramatically in recent decades. Twenty-five years ago, our operations in Puerto Rico accounted for approximately 95% of our assets and all of our net income. Today, more than 40% of our assets and almost 25% of our net income comes from operations outside of Puerto Rico. In terms of our lines of business, banking operations account for approximately 76% of our net income, down from 86% in 2000. These numbers reflect Popular’s evolution from a commercial bank based in Puerto Rico to a diverse financial services institution with operations in Puerto Rico, 30 states in the United States, the Caribbean and Central America.

In 2004, we announced important changes that reflect this evolution and place us in a stronger position to continue growing and delivering solid results.

We reorganized our corporate structure to better reflect our business strategy and our working philosophy. We have done away with organizational charts full of rectangles which stress hierarchy and rigidity. Instead, our concept of the organization is based on the circle, emphasizing collaboration and flexibility. There are five principal circles in our new design: one for the corporate group and one for each of our four principal businesses.

| | |

|

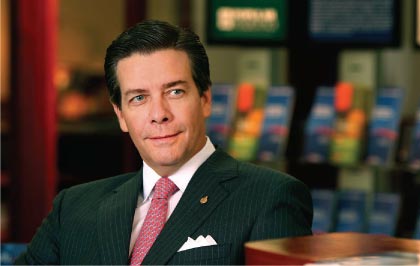

“Every well-thought change has a

reasoning behind it. This is the case

of the reorganization Popular has

undergone.”

Richard L. Carrión

Chairman

President

Chief Executive Officer

|

Popular/ 2004 / Annual Report

[P2]

The corporate group consists of the CEO, the presidents of the four business circles — Popular Puerto Rico, Banco Popular North America, Popular Financial Holdings and EVERTEC — and the leaders of four administrative areas we identified as critical for the organization — Finance, Risk Management, Legal and People, Communications and Planning. The leaders of these four areas have the responsibility of establishing policy, setting up controls and coordinating the activities of their corresponding groups in each of the business circles. In effect, their role is to add value so that the business circles, in turn, can focus on their markets, clients and specific strategies. We believe that this design will result in stronger controls, greater efficiency and solid business growth.

Net income for 2004 totaled $489.9 million, 4% higher than the $470.9 million reported in 2003. The results for 2003 included $71.1 million in gain on sale of securities, compared with $15.3 million in 2004. Net income for 2004 represented a return on assets (ROA) of 1.23% and a return on common equity (ROE) of 17.60%, compared with 1.36% and 19.30%, respectively, in 2003. Earnings per common share (EPS), basic and diluted, for 2004 were $1.79, compared with $1.74 in 2003. Per share figures have been restated to reflect the two-for-one stock split that became effective on July of 2004.

In April of 2004, the Board of Directors declared an 18.5% increase in the quarterly cash dividend, from $0.135 to $0.16 per common share.

During the year, the Corporation issued junior subordinated debentures as part of two offerings of $250 million and $130 million of trust preferred securities. These funds were primarily used for our expansion in the United States, which included two acquisitions announced in 2004.

Popular’s stock, which increased 28.6% in 2004, was identified by American Banker as the best-performing stock in the large cap bank group. Even though we are focused on the long-term, on winning the marathon, it is good to win a gold medal in the 100-meter event.

Our financial results reflect the solid performance of each of our four main business areas: Popular Puerto Rico, Banco Popular North America, Popular Financial Holdings and EVERTEC.

COMPETE:

POPULAR PUERTO RICO

Our business in Puerto Rico represents an interesting challenge for us. We have established a strong leadership position in most product categories and population segments, but we have seen increased competition from local and national niche players. We have addressed the challenge head on, emphasizing the advantages of doing business with the whole Popular organization: a complete spectrum of products, competitive pricing and superior service. Last year, we maintained our leadership position and grew at a faster rate than the market in specific businesses.

Banco Popular de Puerto Rico relaunched its credit card business, adjusting our product offering and introducing aggressive offers to compete more effectively, opening four times the number of accounts opened in the previous year.

We continued to offer competitive prices in personal, mortgage and auto loans; growing our portfolio while substantially improving asset quality. Our business in Popular Securities and Popular Insurance also grew at a healthy rate. Results in the commercial

compete / create / build / discover / inspire

[P3]

[ Letter to Shareholders ]

area also exceeded our expectations. The corporate area of our commercial business saw an increase in revenues due to new clients, the strengthening of existing relationships and business in our new corporate finance division. A comprehensive project designed to better serve small and middle businesses, tailoring products and streamlining processes, also started to yield results and should further strengthen our position in this segment in 2005 and beyond.

As part of the reorganization mentioned above, David H. Chafey Jr. was named President of Banco Popular de Puerto Rico and is now in charge of all financial services offered in Puerto Rico. I am confident that this new structure will allow us to better function as one organization for the benefit of our clients. Popular has all the necessary elements to compete and win in Puerto Rico.

CREATE:

BANCO POPULAR NORTH AMERICA

Our banking operations in the United States have grown and prospered since Banco Popular North America launched “A New Day” in 2002, a set of strategies designed to improve financial results through 2005. The focus on the first two years of this plan was on reengineering and laying the operational foundations for growth. Having executed the first phase of the plan, by 2004 BPNA was ready to turn its attention to revenue growth, and it did so with great success.

BPNA experienced outstanding organic growth in 2004 due to revenue-generating initiatives in the consumer and commercial loan markets, the implementation of a Customer Acquisition Program that has “free checking” products and viral marketing as the main attractors, as well as the continuation of a segmentation strategy to offer better service to business clients. Deposits, loans and fee income increased by 19%, 14% and 18%, respectively.

In 2004, BPNA announced two acquisitions that strengthen our presence in two of the markets we serve. In California, Quaker City Bancorp added 27 branches, $2.1 billion in assets and $1.2 billion in deposits, making California BPNA’s largest region. The acquisition became effective on September 1, 2004. Kislak National Bank in South Florida, which officially became a part of BPNA in January of 2005, added eight branches in the Miami area, $965 million in assets and $659 million in deposits, as well as an interesting portfolio of loans to condominium and homeowner associations. We have established a dedicated team focused on completing the integration of these two institutions.

These revenue-enhancing initiatives, coupled with continued attention to expenses, translated into strong financial results. Net income for BPNA grew 54% compared to the previous year. We are confident that BPNA has the right foundation, the correct vision and the leadership to create additional opportunities to improve financial performance and become the best community bank in each of the communities it serves.

IN 2004, BPNA ANNOUNCED TWO ACQUISITIONS THAT STRENGTHEN OUR PRESENCE IN TWO OF THE MARKETS WE SERVE. IN CALIFORNIA, QUAKER CITY BANCORP ADDED 27 BRANCHES, $2.1 BILLION IN ASSETS AND $1.2 BILLION IN DEPOSITS, MAKING CALIFORNIA BPNA’S LARGEST REGION.

BUILD:

POPULAR FINANCIAL HOLDINGS

Celebrating its 15th anniversary, Equity One, Popular’s non-prime mortgage lending and servicing company, took important steps in 2004 to build a strong foundation for future growth. Popular, Inc. formed Popular Financial Holdings, Inc. (PFH), a new holding company that allows it to pursue new business strategies while leveraging the strength of the Popular brand.

Popular Housing Services is one of these new business opportunities identified by PFH. This group provides

Popular/ 2004 / Annual Report

[P4]

consumer financing for manufactured housing through national dealer networks. PFH also constituted Popular Mortgage Servicing, which extends our servicing capabilities and will increase servicing-related revenues. Other initiatives designed to create new businesses and grow existing ones include a cross-selling project and the creation of a product development unit.

A lot of attention was devoted to the enhancement of systems and platforms to support the different businesses of PFH. In 2005, PFH will launch a new consumer finance origination and servicing platform that will expand the product line, increase efficiency and improve the level of service.

And last, but not least, PFH put together a team of employees from various areas and levels in the organization to clarify and articulate PFH’s mission, practices, promises and personality. The result, known as PFH’s Compass, will serve as a navigational tool guiding PFH as it continues to build and strengthen its business.

DISCOVER:EVERTEC

EVERTEC as a company was born on April of 2004, but it has been in the making for many years. Last year, I mentioned that we were in the process of reorganizing our technology and operations functions throughout the organization. As a result, we merged GM Group, our processing arm, with the operational and programming services of Popular Puerto Rico. This new company, presided by Félix M. Villamil, will allow us to strengthen our services through substantial growth in the transaction processing area and the development of new technological services in Puerto Rico, the Caribbean, Central America and the United States.

During 2004, EVERTEC integrated its people, systems, operations and facilities, while accomplishing important business goals. In Puerto Rico, we continued to expand our traditional processing activities. We strengthened the health care transaction processing business, completing the acquisition of one of the largest health care application providers and processing companies in Puerto Rico.

We continued expanding our presence in the Caribbean and Central America, including the acquisition of an additional equity stake in Consorcio de Tarjetas Dominicanas, the largest payment network in the Dominican Republic.

The processing business is extremely important for Popular’s future because it represents an area with great potential for growth, high margins and a source of recurring, non-interest income. Processing is something we have done very well for many years, initially for ourselves and more recently for others. Now we have gone a step further — forming a new company and giving them the mission to discover the endless opportunities for us in this field.

INSPIRE:COMMUNITY

I introduced and described our new corporate structure and talked about each of these circles, their strategies and their achievements. However, more important than each of these circles is the vision and the values that tie them together. An integral part of this vision is our commitment to the communities we serve.

In Puerto Rico, our companies provided more than $3,700,000 in donations and sponsorships to a wide variety of community-based projects. Our employees donated more than 11,000 hours of their personal time and contributed more than $300,000 to the Fundación Banco Popular through our payroll deduction program. The Fundación, which focuses on education and community development in Puerto Rico, granted more than $850,000 to 57 non-profit organizations.

In the United States, Banco Popular North America worked alongside national organizations, primarily in

compete / create / build / discover / inspire

[P5]

[ Letter to Shareholders ]

the area of education and assistance to minorities. Last year, we announced the creation of the Banco Popular Foundation in the United States. Its mission is to strengthen the social and economic well being of the communities we serve. Similar to the Fundación in Puerto Rico, it will support philanthropic initiatives in the areas of community development and education.

In all of our community endeavors we seek the active involvement of our employees, we focus our energy on ensuring that we place our resources where they will have the biggest impact and we strive to inspire our communities to dream and work for a brighter future.

CONCLUSION

The area of corporate governance has received much attention in recent years. Sarbanes-Oxley, enacted in the wake of large corporate scandals, is the most far-reaching legislation impacting public corporations in the last 50 years. It is still too early to tell the impact these changes will have, but my concern is that too much emphasis is being placed on legalistic form over organizational function. This, coupled with an often antagonistic regulatory environment, where discretion has been usurped from regulators and corporate conduct often is criminalized; can have a stifling, if not chilling, effect on innovation and risk-taking.

At Popular, like most public corporations, we have taken a careful look at our corporate governance policies and practices and are confident that we are conducting our business according to the highest ethical standards. In 2004, I announced some changes in our Board of Directors. In addition, I am happy to announce that William J. Teuber Jr., Chief Financial Officer of EMC Corporation, joined our Board on November of 2004. It is a privilege for me to count on the guidance of such an active, committed and prestigious Board of Directors. They have been tested in difficult moments and have always shown their mettle. This year, Félix J. Serrallés Nevares will retire from the Popular, Inc. Board upon reaching the mandatory retirement age, but we will continue to benefit from his guidance in the Banco Popular de Puerto Rico and Banco Popular North America Boards. Mr. Serrallés served as a member of the BanPonce/Popular Board for 20 years. We are grateful for his counsel and dedication.

Early in 2005, we learned that Popular was listed as one of FORTUNE magazine’s “100 Best Places to Work For.” This was the first time that a company of Hispanic-origin was included in this group. We are extremely proud of this acknowledgment, particularly since the most important factor in the decision by FORTUNE is an independent survey conducted among employees. Our future will continue to be shaped by our people, and we are committed to attract, develop, compensate and retain the best. This award is a tribute to that commitment.

Several years ago, we started including in our annual report a table with 25 years worth of financial and operational results. I have to admit it is my favorite part, because it describes our journey more eloquently than I ever could. It tells the story of an organization that has undergone changes, completed major acquisitions and experienced the ups and downs of several economic cycles. Through it all, we have remained faithful to our values, we have delivered solid results and we have continued to evolve, taking our franchise into new products and geographies. Some may say that past performance is not necessarily an indicator of future performance. That is undoubtedly true. It is no less true, however, that if I had to make a judgment about the future of an organization’s performance, I would rather have more information about its past, not less. As we look to the future, our horizon is also 25 years.

We are currently in the midst of that evolutionary process — proud of what we have accomplished thus far, but never content to rest. We are energized by what we have envisioned for Popular for 2005 and beyond.

Richard L. Carrión

Chairman

President

Chief Executive Officer

Popular /2004 / Annual Report

[P6]

[ evolve ]

We have reorganized the Popular business model with one clear objective — to evolve from a corporation that assigns value from above to one that acknowledges that value creation is in the hands of individuals, specifically our customers and employees. Our new structure enhances the ability of each Popular company to compete in broader markets. As we strive to improve each client interaction, we believe that excellence will create new opportunities. As we reward employee initiatives, we believe that individuals hold the power to discover new approaches, products and solutions. Moving forward, we maintain our core values and promote the idea that every Popular employee holds the potential to inspire — pushing the enterprise to new heights in support of all of our customers and shareholders.

compete / create / build / discover / inspire

[P7]

| | |

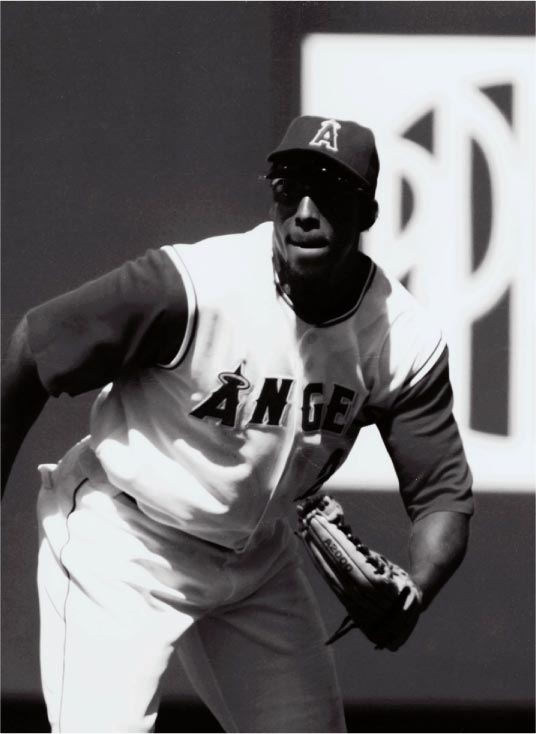

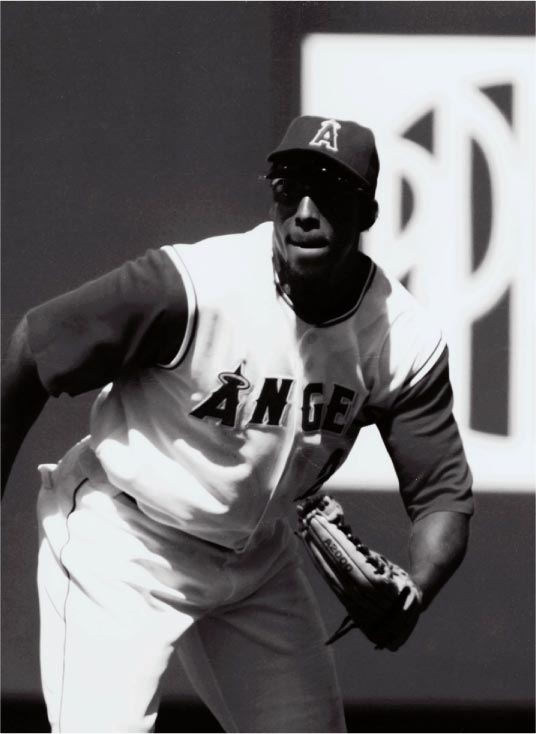

| Popular /2004 / Annual Report | | Anaheim Angels’ Vladimir Guerrero, a committed competitor. |

[P8]

No. 1

[ compete ]

All great athletes and competitors share an odd mix of confidence and humility: a sense of knowing one’s strengths, without assuming that ability or any other single advantage is enough. This explains why winning is not saved for the most athletic, but for those who maintain their positive focus. Popular challenges itself in this same way — to compete for and win every customer. We do it by focusing on the highest result we can achieve, not simply once or only when success appears within our grasp, but every day.

compete / create / build / discover / inspire

[P9]

[ Popular Puerto Rico ]

David H. Chafey Jr.

Senior Executive Vice President, Popular, Inc.

President, Banco Popular de Puerto Rico

Winning market share means anticipating customer needs.

Popular offers retail and commercial banking services through its banking subsidiary, Banco Popular de Puerto Rico, as well as investment banking, auto and equipment leasing and financing, mortgage loans, consumer lending and insurance through specialized subsidiaries.We are the leading financial institution in Puerto Rico, but we continue to build on opportunities to keep growing and improving our results.

During 2004, we focused on competing aggressively, enhancing the customer experience by emphasizing service and convenience. Clear objectives, coupled with effective execution, translated into significant achievements in an extremely competitive marketplace.

Banco Popular’s deposits reached $13.8 billion in 2004. Our loan portfolio, which totaled $13.0 billion at the end of 2004, grew by 18% when compared to 2003, reflecting aggressive efforts to grow our credit portfolios. We refreshed our credit card offering with the launch of Visa NovelSMand Amex UltraSM, resulting in a dramatic increase in new accounts in 2004.

Banco Popular has historically reached out to unbanked segments of the population, developing products and programs specific to their needs. We held more than 200 community banking activities in low-income communities to foster financial literacy. Acceso Popular, our deposit account

Popular /2004 / Annual Report

[P10]

tailored to this segment, grew by 32.1% in 2004. Given that approximately one-third of Puerto Ricans currently do not have a relationship with a financial institution, we will continue to look for ways to serve this segment in an effective, efficient and profitable manner.

Banco Popular continues to offer its clients the most complete distribution network in Puerto Rico. With 192 branches, more than 560 ATMs, a 24/7 customer contact center and a state of the art online banking system, Popular clients can conduct their transactions when and where it is more convenient for them. We continue to reward our customers for banking with us through PREMIA®, an innovative loyalty program. Enrollment in the program, as well as redemptions in exchange for prizes, continue to increase. In 2004, we further improved convenience by adding extended hours in branches and enhanced the branch experience by adding more tellers. We also introduced new elements in our online banking system, such as new payment features and account aggregation. The TicketpopSMnetwork, Banco Popular’s ticketing processing service, expanded its point-of-sale terminals to 30 throughout Puerto Rico, and processed more than 650,000 tickets in 2004.

POPULAR MORTGAGE originated $1.6 billion in mortgage loans. In addition to offering competitive pricing, we enhanced all delivery channels to increase convenience and improve customer service. We strengthened relationships with real estate developers and brokers to lay the foundation for future growth.

POPULAR SECURITIES is one of the leading securities and investment banking firms in Puerto Rico. Combined assets under management of the retail and institutional operations reached $4.2 billion in 2004 and we completed 54 deals totaling $17.7 billion in value. In 2004, we opened an office in New York to expand our institutional business.

POPULAR AUTO strengthened its leadership position in the Puerto Rico market, reaching $1.5 billion in its portfolio of loans and leases. Aggressive marketing programs and joint promotions with car dealers resulted in an increase in our market share.

POPULAR FINANCE, which offers small personal loans and mortgages through a network of 43 offices, is an important part of our effort to serve the low and moderate income segment. Its portfolio reached $197 million in 2004.

POPULAR INSURANCE continued its accelerated growth, capitalizing on Popular’s client base. By the end of 2004, it had subscribed $137.7 million in premiums, for an increase of 17%. In 2004, Popular Insurance acquired J. Argomaniz & Associates, Inc., a general agency specializing in life insurance.

Energized by our results in 2004, we will continue to compete aggressively in all products and segments to maintain and strengthen our market position and we will devote much attention and resources to initiatives that enhance the satisfaction of our customers.

BANCO POPULAR DE PUERTO RICO

| • | $23.1 billion in total assets |

| |

| • | 192 branches |

| |

| • | $13.8 billion in deposits |

| |

| • | $13.0 billion in loans |

| |

| • | 119,000 Internet Banking active clients |

| |

| • | 223,000 PREMIA®registered clients |

POPULAR MORTGAGE

| • | $1.6 billion in originations |

| |

| • | 30 offices |

POPULAR SECURITIES

| • | $4.2 billion in assets under management |

POPULAR AUTO

| • | $1.5 billion in auto loan and lease portfolio |

| |

| • | 8 sales and service centers |

| |

| • | 10 daily rental offices |

POPULAR FINANCE

| • | 36 offices and 7 mortgage centers |

| |

| • | $197 million in loan portfolio |

POPULAR INSURANCE

| • | Represents more than 80 insurance companies in Puerto Rico and in the U.S. Virgin Islands |

| |

| • | $137.7 million in premiums |

compete / create / build / discover / inspire

[P11]

| | |

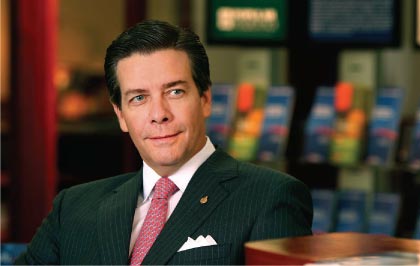

| Popular /2004 / Annual Report | | Jorge Zeno, renowned Puerto Rican creator. |

[P12]

No. 2

[ create ]

Before the artist differentiates his or her work with color or brush stroke or subject matter, he or she first sees. It’s this simple act, of looking and then representing, that allows the artist to transform the familiar into something more powerful. Popular applies the same principle to entering new markets and developing products. Looking closely and seeing beyond preconception is an essential step to revealing truths and finding opportunities that others ignore.

compete / create / build / discover / inspire

[P13]

[ Banco Popular North America ]

Roberto R. Herencia

Executive Vice President, Popular, Inc.

President, Banco Popular North America

We continue to create new opportunities in the U.S. market.

Banco Popular North America, grounded in Popular’s rich history and strong institutional values, is committed to transforming and redefining community banking in the United States. We focus with hope and possibility on the needs of the people, communities and institutions we serve in California, Florida, Illinois, New York/New Jersey, and Texas. We resolve to create an extraordinary legacy in North America in partnership with our employees, better known as “DreamMakers”.

BPNA continues to execute with precision on our “New Day” — the strategic theme created in 2002 with initiatives to strengthen our competitive position within a four-year horizon through 2005. After two years of reorganizing, converting systems and preparing our platform for growth, BPNA began to execute the phase of sharp organic and acquired revenue growth. Net income increased by 54% in 2004.

BPNA announced the closing of two acquisitions: Quaker City Bancorp (QCB) in Whittier, California, effective September 1, 2004, and Kislak National Bank in Miami, Florida, effective in January 2005.

Popular /2004 / Annual Report

[P14]

BANCO POPULAR NORTH AMERICA’S organic growth (excluding acquisitions) in 2004 was outstanding, with deposits increasing by 19%; loans growing by 14%; and fee income up by 18%. Expenses, the focus of our efficiency efforts over the last three years, grew by less than 2% in 2004.

A new Customer Acquisition Program (CAP) was launched on October 22, 2004, with more than 14,000 new checking accounts opened, a 67% increase over our pre-CAP campaign. Over 18 months, our merchandising program gave our branches a fresh, consistent look that furthered our CAP success.

We extended our reach to customers with 163 ATMs. Our acquisition of QCB added 27 branches in the third quarter of 2004, with $2.1 billion in assets and $7.7 million in net income.

Small Business Association (SBA) lending efforts positioned BPNA among the top lenders in the country to this important business segment. BPNA loaned $183 million, placing us fifteenth in terms of loan value and nineteenth in number of loans.

In 2004, we created the structural underpinnings to execute as a passionately customer-driven organization. We offered a streamlined, competitive product line in conjunction with improved service delivery to our customers. Our business banking alignment initiative offered the highest level of service and attention. Centralized, upgraded credit support functions provided increased capabilities to lending units.

POPULAR CASH EXPRESS (PCE) operates 114 check-cashing stores in Arizona, California, Florida, New Jersey, New York, and Texas, serving the unbanked. Throughout 2004, PCE focused on restructuring its field operations and improving financial results, with store revenues increasing for 2004. Check cashing fees saw a 12.5% increase and money order fees experienced a 53% increase, while total fees generated a 9.5% increase. PCE added seven new products, resulting in $750,000 in additional revenue in 2004.

POPULAR INSURANCE AGENCY USA offers investment and insurance services across the BPNA branch network, achieving more than $100 million in sales from investment and insurance programs in 2004. In addition, the group increased revenues by 40% over 2003 and more than tripled net income for the same period. The sales force increased to 25 registered financial consultants and 54 licensed bankers. In 2004, we launched Popular Choice, a private label annuity program.

POPULAR LEASING, USA provides small- to mid-ticket commercial and medical equipment financing. In 2004, we reached $306 million in assets. We doubled headquarters capacity and are expanding our Capital Markets Group to attract both medical and commercial mid-ticket transactions by offering broader product availability to include municipal and federal government leases.

Bolstered by a journey of excellence in 2004, we continue our commitment to creating a strong financial performance for our shareholders and Popular.

BANCO POPULAR NORTH AMERICA

| • | 54% net income growth |

| |

| • | 128 branches |

| |

| • | 163 ATMs in NY, NJ, IL, CA, FL, TX |

| |

| • | 19% increase in deposits |

| |

| • | 14% increase in loans |

| |

| • | 18% increase in fee income |

POPULAR CASH EXPRESS (PCE)

| • | 114 check-cashing stores in AZ, CA, FL, NJ, NY, TX |

| |

| • | 12.5% increase in check cashing fees |

| |

| • | 53% increase in money order fees |

| |

| • | 9.5% increase in total fees |

POPULAR INSURANCE AGENCY USA

| • | $100 million in sales |

| |

| • | 40% increase in revenues |

| |

| • | 25 registered financial consultants |

| |

| • | 54 licensed bankers |

| |

| • | 18% increase in fee income |

POPULAR LEASING, USA

complete / create / build / discover / inspire

[P15]

| | |

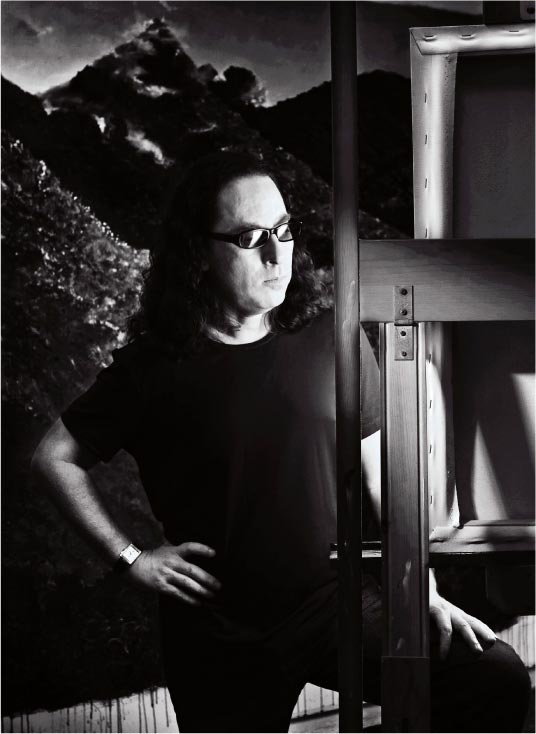

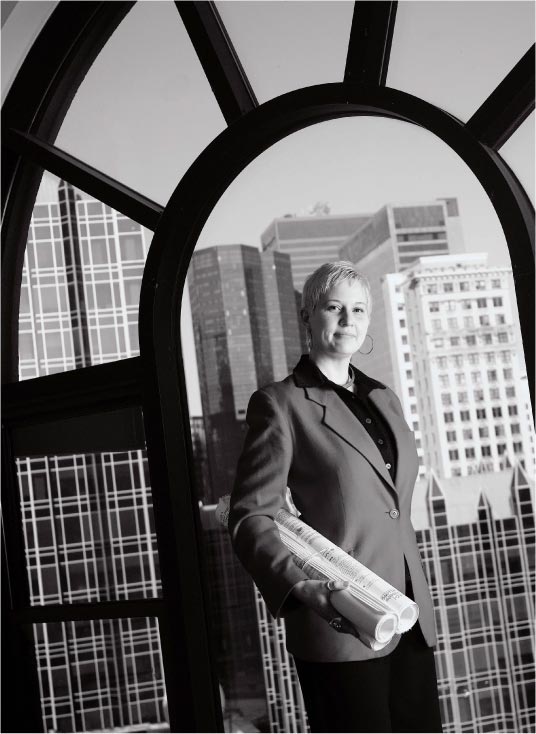

| Popular /2004 / Annual Report | | Popular Financial Holdings, architects of solid financial landscapes. |

[P16]

No. 3

[ build ]

Before a house becomes a home, first there must be a foundation to build upon. Hard work and persistence create a framework for the future. The same can be said for the steadfast approach to growth of Popular Financial Holdings, part of Popular’s financial services operation in the United States. In less than 15 years, it already represents approximately 20 percent of the Corporation’s assets. We have begun to build on our solid foundation, offering a range of new and innovative mortgage products and services and venturing into new markets. U.S. borrowers have come to associate Popular Financial Holdings with a reputation for stability and financial strength to meet any financial need.

compete / create / build / discover / inspire

[P17]

[ Popular Financial Holdings ]

Bill Williams

Executive Vice President, Popular, Inc.

President, Popular Financial Holdings

Popular Financial Holdings continued to enjoy a steady growth in assets in 2004.

Popular Financial Holdings (formerly known as Equity One), Popular’s U.S.- based non-prime mortgage lending and servicing group, represented more than 12% of Popular’s net income in 2004. Popular, Inc. formed Popular Financial Holdings in 2004 to expand growth opportunities and pursue new business strategies. This new holding company better leverages the Popular brand, while opening the door for increased revenue and growth.

Popular Financial Holdings has assets of $9 billion. Steady organic growth has been the order of the day as assets have increased at a 42% compounded annual growth rate. Total originations have grown as well at a 31% annual rate. We improved the quality of our portfolio with investments in people and technology.

During 2004, we rolled out our mission and values: Our success is measured by being the employer of choice for employees, the lender of choice for our customers, and the investment of choice for our investors.

Popular /2004 / Annual Report

[P18]

POPULAR FINANCIAL HOLDINGS

| • | $9 billion in assets |

| |

| • | 183 offices in 28 states |

Today, Popular Financial Holdings serves retail customers, mortgage brokers, bankers, and investors through 183 offices in 28 states, while we are licensed to operate in more than 40. Seven new locations were opened in 2004. We have three primary business areas that are supported centrally.

EQUITY ONE serves our retail customers directly through 139 decentralized branches in 16 states. We provide prime and non-prime mortgage loans, unsecured loans and sales finance. In 2004, we launched Project Cross-Sell to offer additional products and services to current customers. More than $28 million in incremental business was generated in the first year.

POPULAR FINANCIAL SERVICES, LLC acquires pools of non-prime loans from mortgage bankers, and originates individual mortgage loans through a network of more than 2,000 approved mortgage brokers and bankers through-out the U.S. Wholesale origination volume has been growing more than 50% every year since 1999 as we expand our agency and broker network. New, web-based platforms efficiently support our broker network.

POPULAR WAREHOUSE LENDING, LLC provides revolving credit lines ranging from $2 to $15 million to small- and mid-size mortgage bankers throughout our markets. We expand the best relationships through cross-selling into our wholesale operation. Our intimate knowledge of this very localized clientele, as well as our consistent, effective execution, has turned this into our fastest growing source of mortgage originations, which today represents more than a quarter of our loan production.

Expansion of our retail product line, further expansion of our footprint into Texas, Ohio and Idaho, as well as the launch of two new businesses will both diversify and continue to organically grow our business in 2005 and beyond. Specifically, Popular Housing Services will provide consumer financing through national dealer networks in the manufactured housing market. Popular Mortgage Servicing will allow us to generate revenue through diverse fees related to mortgage servicing rights we acquire.

We look to continue to leverage our people and technology to aggressively build a nationwide network with a wide and loyal client base.

compete / create / build / discover / inspire

[P19]

| | |

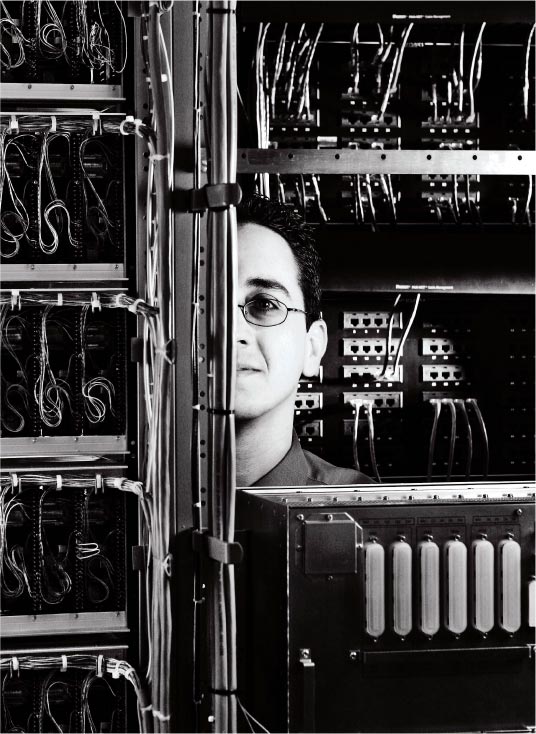

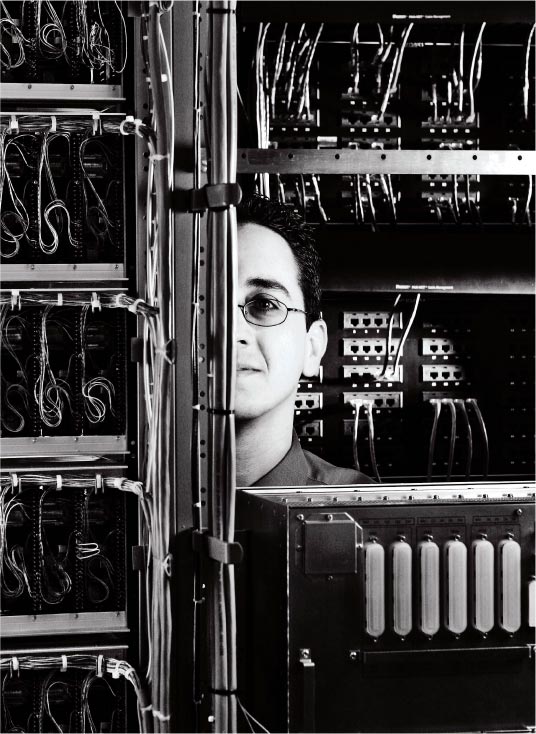

| Popular /2004 / Annual Report | | At EVERTEC’s Network Control Center: the spirit of discovery in the service of financial transactions processing. |

[P20]

No. 4

[ discover ]

With complex systems, nothing is static — the flow of input and output is staggering. Still, life maintains a steady-state balance thanks to elaborate feedback mechanisms. Popular’s ongoing investment in corporate technology is guided by similar goals. Competing in a crowded marketplace requires monitoring, adjusting and responding on a minute-by-minute basis. Popular continues to invest in technology to increase the speed and quality of our services. These investments ensure our future as a company. With growth comes complexity, and the need to learn faster and respond more quickly.

compete / create / build / discover / inspire

[P21]

[ EVERTEC ]

Félix M. Villamil

Executive Vice President, Popular, Inc.

President, EVERTEC, Inc.

Staying ahead of the technology curve ensures future opportunity.

EVERTEC, Popular’s new processing company, is the result of a merger of our former processing company with Popular’s operational and technology resources in Puerto Rico. During 2004, we began and mostly completed a complex reorganization into a completely new management and business structure which entailed the integration of people, facilities and technological platforms.

EVERTEC provides processing and outsourcing services to third parties as well as Popular companies, representing a significant potential source of additional revenue and business growth. With a team of more than 1,600 professionals, EVERTEC operates in three geographic areas: Puerto Rico, the Greater Caribbean basin which includes Central America, and the United States.

EVERTEC currently offers a wide variety of transaction processing services to the financial services, government and health sectors. Services provided to financial institutions include the issuance and processing of credit and debit cards, support of merchant acquisition business and driving ATM networks, among others. For the government, we currently process electronic transactions related to Electronic Benefit Transfers (EBT).

Popular/ 2004 / Annual Report

[P22]

We also have ample experience in the area of outsourcing services, including application processing, business processes outsourcing, IT consulting and cash processing services.

In addition to the achievements related to the creation of EVERTEC and the integration processes it entailed, we reached important business goals. We continued to expand our traditional processing activities in Puerto Rico. The ATH network in Puerto Rico currently manages 1,334 ATMs and 47,358 point-of-sale (POS) terminals and processes more than 28 million trans- actions every month. We strengthened the health care transaction processing business, which we have grown through strategic acquisitions in recent years. We are now poised to become one of the main processors of health care- related transactions in Puerto Rico.

We strengthened our presence and our processing business in the Caribbean and Central America. In the Dominican Republic, we acquired an additional equity stake in Consorcio de Tarjetas Dominicanas (CONTADO), the largest payment network in that country with 1,224 ATMs and 23,605 POS terminals. ATH Costa Rica, S.A./ CreST, S.A. closed the year with 804 ATMs and 5,500 POS terminals, and with more than 36 financial institutions as clients. We also have a leadership position in El Salvador, where Servicios Financieros, S.A. has become a leading ATM/POS network with 772 ATMs, and 3,500 POS terminals. In Venezuela, we process credit card transactions for eight local institutions and provide debit card services through our local switch.

One of our main areas of focus is the redesign of Popular’s banking technology infrastructure in Puerto Rico, one of the most important long-term investments. The main objective of this project is to have a complete and consistent view of a customer’s multiple relationships while adapting our systems and infra- structure to an environment in which electronic transactions dominate. During 2004, we completed the design of one of the main components of the infrastructure, a transaction vault that will hold all customer information that currently resides in separate applications. Implementation of the vault, and the connection of several of our main delivery channels to it, is scheduled for 2005 — milestones that will result in tangible benefits in terms of efficiency and customer service.

Looking ahead, we will continue focusing on the consolidation of our new organization, strengthening our business in the various geographies where we operate and enhancing the quality of our products and services.

EVERTEC, INC.

| • | Over 749 million transactions |

| |

| • | 4,220 ATMs |

| |

| • | 80,463 POS terminals |

| |

| • | Serves clients in Puerto Rico, United States, Dominican Republic, Costa Rica, Venezuela, Haiti, El Salvador, Honduras, Bermuda, Belize, Nicaragua |

ATH COSTA RICA, S.A./CREST, S.A.

| • | Serve 36 financial institutions |

| |

| • | 804 ATMs |

| |

| • | 5,500 POS terminals |

CONSORCIO DE TARJETAS DOMINICANAS

| • | 1,224 ATMs |

| |

| • | 23,605 POS terminals |

SERVICIOS FINANCIEROS, S.A.

| • | 772 ATMs |

| |

| • | 3,500 POS terminals |

| |

| • | Serves 8 local financial institutions |

compete / create / build / discover / inspire

[P23]

| | |

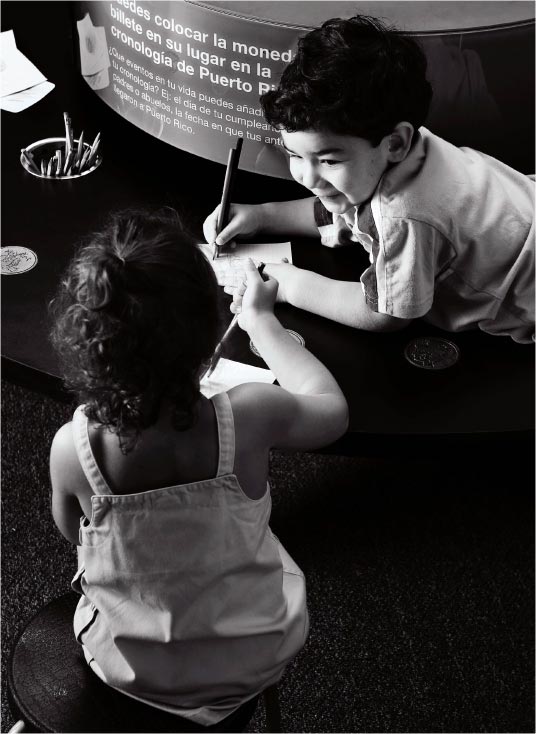

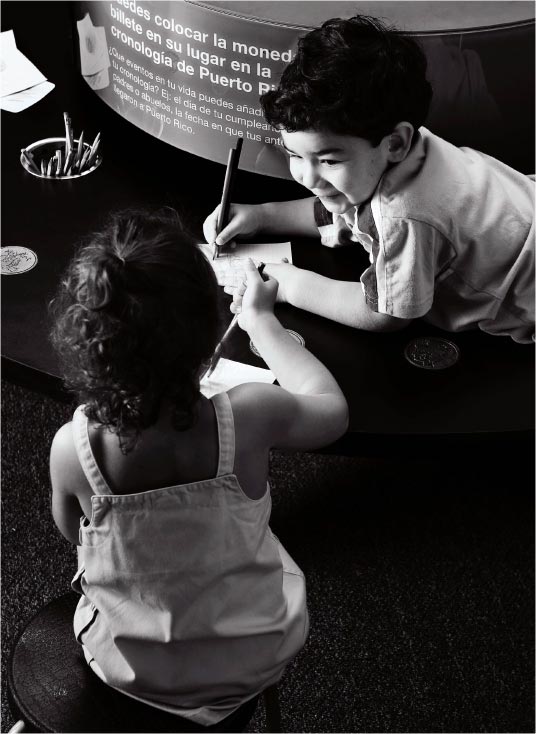

| Popular /2004 / Annual Report | | “Algo de Valor” (Something of Value) exhibit at the Rafael Carrión Pacheco Exhibit Hall, San Juan, Puerto Rico, inspires learning in a creative manner. |

[P24]

No. 5

[ inspire ]

Anywhere you find community identity and involvement, people passionate about where and how they live, you will find the arts. The arts draw people together and help educate by opening people’s hearts and minds to new ideas and possibilities. Popular has recognized and supported that connection between self-expression, education and community for years. Our annual TV musical special, and countless community projects have established a bond with our customers. As we extend our reach into other markets, we continue to believe that education yields the greatest return on investment.

compete / create / build / discover / inspire

[P25]

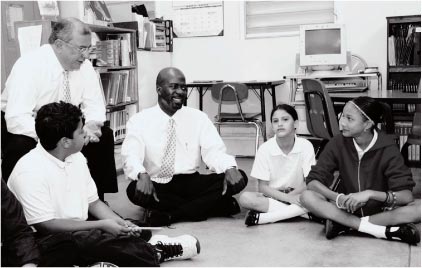

[ Our Community ]

We have recognized and supported the connection between self-expression, education and community for years.

Achieving the growth of a high- performing company is directly tied to the vision that inspired the founding of our company 111 years ago: to build a profitable business while simultaneously being of service to our communities. Today, we remain just as true to our aspirations for social commitment and service.

PUERTO RICO:

INSPIRING OUR COMMUNITIES

The Fundación Banco Popular is the philanthropic arm of Popular. Its goal is to cultivate long-term relationships with community organizations, while inspiring the process of change through education and community development initiatives. The Fundación serves as a central resource for employees to support these initiatives both financially and with their time and knowledge. Specific initiatives include our Volunteers in Action program, a voluntary payroll deduction program, the Rafael Carrión Jr. Scholarship Fund for children of employees and retirees, our matching gift program and the Rafael Carrión Pacheco Exhibit Hall.

Strong links with the organizations receiving funds are made possible by encouraging active employee participation in their initiatives. These relationships are the “soul of outreach” to our communities, representing

Popular/ 2004 / Annual Report

[P26]

the depth and discipline of our commitment. In 2004, 36% of Fundación- funded initiatives enjoyed the added benefits of the engagement of our employees in their projects.

Our Fundación coordinated, for the second consecutive year, employees’ participation in Make a Difference Day. We participated in 145 community service projects, all proactively identified by our employee team leaders. With 2,500 employees and their families participating, a variety of organizations and projects received needed assistance that day.

In addition, our ongoing Volunteers in Action program attracted more than 3,000 employees who donated 11,150 hours of personal time to community service projects in 2004. Yet another instance of our employees’ strong relationships with community projects is the Asamblea Virgilio Dávila, an after-school program located in a low-income housing project. Volunteers in Action has helped to improve the program’s space planning and provided expertise regarding its financial administration.

We achieved 53% participation in our voluntary payroll deduction program, with $301,700 in contributions. Furthermore, 57 not-for-profit organizations received funding support of $850,000. In 2004, the Fundación granted 119 scholarships, representing a total of $174,400 to the Rafael Carrión Jr. Scholarship Fund. In addition a second fund was established with The Wharton School of the University of Pennsylvania in 1994 and, most recently, with Fairfield University.

During 2004, our traditional focus on projects related to education continued. Through the “Sister Schools Initiative,” branch managers are connecting to participating schools in their branch’s communities. Currently, there are 13 schools taking part in this initiative. The manager becomes an agent of change in the school’s transformation, participating beyond the distribution of funds.

Our exhibit, Algo de Valor (Something of Value), located in the Rafael Carrión Pacheco Exhibit Hall, educates both adults and children about the history of money. The exhibit furthers our educational focus by creating a fun and creative atmosphere for learning. To date, more than 13,300 visitors have viewed Algo de Valor. In keeping with our focus to create lasting alliances, the Fundación partnered with Puerto Rico’s Department of Education to create a teacher’s guide and student activities guide as part of the exhibit’s public program.

compete / create / build / discover / inspire

[P27]

[ Our Community ]

UNITED STATES:

MAKING DREAMS HAPPEN FOR THE COMMUNITIES WE SERVE

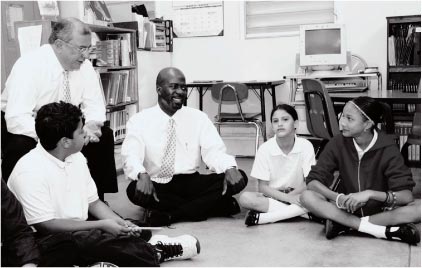

In North America, 2004 was a benchmark year with numerous community and leadership milestones, starting with the establishment of the Banco Popular Foundation in the United States. The new organization is entrusted with an ambitious task: to identify needs in the communities served by Banco Popular North America, and the resources within BPNA to best meet them. As is the philanthropic tradition within Popular, the Banco Popular Foundation will focus on education and community building projects.

We also announced three national strategic community partnerships. With a combined focus on education, financial literacy, and community development, BPNA joined forces with Junior Achievement and Operation Hope. Together, the team is dedicated to investing in targeted efforts to pro- vide a multiplier effect — encompassing education, empowerment and hope — for the youth of our communities. Inspired by one common philosophy of service, our DreamMakers — BPNA employees — across our regions participated in our annual Junior Achievement Bowl-A-Thon, raising $140,000.

A third national partnership, with Acción, supports the inspiration of minority entrepreneurs as they pursue their dreams of owning their own businesses. Acción, with its micro-loan program, is a synergistic partner with BPNA. Our loan referral program generated 240 referrals and $162,000 in loans to date in less than a year.

A BPNA initiative, “It’s In Our Hands,” translated into a powerful call to action to help make a difference in many people’s lives. Under this initiative, employees pledged their hearts and hands to serve more than 200 diverse community organizations and projects in need and delivered approximately 10,000 service hours that positively affected nearly 20,000 people from the most remote towns in Florida, New York, New Jersey, Illinois, Texas, and California.

Popular Financial Holdings also held a number of initiatives based on a collaboration recommended by employees with community organizations, many of them focused on health-related matters.

Both in Puerto Rico and the United States, our people honor Popular’s institutional value that refers to social commitment: We are committed to work actively in promoting the social and economic well-being of the communities we serve.

Popular/ 2004 / Annual Report

[P28]

OUR CREED

Banco Popular is a local institution dedicating its efforts exclusively to the enhancement of the social and economic conditions in Puerto Rico and inspired by the most sound principles and fundamental practices of good banking.

Banco Popular pledges its efforts and resources to the development of a banking service for Puerto Rico within strict commercial practices and so efficient that it could meet the requirement of the most progressive community of the world.

These words, written in 1928 by Don Rafael Carrión Pacheco, Executive Vice President and President (1927-1956), embody the philosophy of Popular, Inc.

OUR PEOPLE

The men and women who work for our institution, from the highest executive to the employees who handle the most routine tasks, feel a special pride in serving our customers with care and dedication. All of them feel the personal satisfaction of belonging to the “Banco Popular Family,” which fosters affection and understanding among its members, and which at the same time firmly complies with the highest ethical and moral standards of behavior.

These words by Don Rafael Carrión Jr., President and Chairman of the Board (1956-1991), were written in 1988 to commemorate the 95th anniversary of Banco Popular de Puerto Rico, and reflect our commitment to human resources.

INSTITUTIONAL VALUES

Social Commitment

We are committed to work actively in promoting the social and economic well-being of the communities we serve.

Customer

We achieve satisfaction for our customers and earn their loyalty by adding value to each interaction. Our relationship with the customer takes precedence over any particular transaction.

Integrity

We are guided by the highest standards of ethics, integrity and morality. Our customers’ trust is of utmost importance to our institution.

Excellence

We believe there is only one way to do things: the right way.

Innovation

We foster a constant search for new solutions as a strategy to enhance our competitive advantage.

Our People

We strive to attract, develop, compensate and retain the most qualified people in a work environment characterized by discipline and affection.

Shareholder Value

Our goal is to produce high and consistent financial returns for our shareholders, based on a long-term view.

STRATEGIC OBJECTIVES

Puerto Rico

Strengthen our competitive position in our main market by offering the best and most complete financial services in an efficient and convenient manner. Our services will respond to the needs of all segments of the market in order to earn their trust, satisfaction and loyalty.

United States

Expand our franchise in the United States by offering the most complete financial services to the communities we serve while capitalizing on our strengths in the Hispanic market.

Processing

Provide added value by offering integrated technological solutions and financial transaction processing.

compete / create / build / discover / inspire

[P29]

[ Corporate Leadership Circle ]

standing, from left to right

RICHARD L. CARRIÓN

Chairman

President

Chief Executive Officer

Popular, Inc.

BILL WILLIAMS

Executive Vice President, Popular, Inc.

President, Popular Financial Holdings

AMÍLCAR JORDÁN, ESQ.

Executive Vice President

Risk Management

Popular, Inc.

FÉLIX M. VILLAMIL

Executive Vice President, Popular, Inc.

President, EVERTEC, Inc.

seated, from left to right

ROBERTO R. HERENCIA

Executive Vice President, Popular, Inc.

President, Banco Popular North America

DAVID H. CHAFEY JR.

Senior Executive Vice President, Popular, Inc.

President, Banco Popular de Puerto Rico

TERE LOUBRIEL

Executive Vice President

People, Communications and Planning

Popular, Inc.

JORGE A. JUNQUERA

Senior Executive Vice President, Chief Financial Officer

Popular, Inc.

BRUNILDA SANTOS DE ÁLVAREZ, ESQ.

Executive Vice President, Chief Legal Counsel

Popular, Inc.

Popular/ 2004 / Annual Report

[P30]

[ Board of Directors, Popular, Inc. ]

standing, from left to right

MANUEL MORALES JR.

President, Parkview Realty, Inc.

JOSÉ B. CARRIÓN JR.

President, Collosa Corporation

FÉLIX J. SERRALLÉS NEVARES

President and Chief Executive Officer

Destilería Serrallés, Inc.

SAMUEL T. CÉSPEDES, ESQ.

Secretary of the Board of Directors

Popular, Inc.

WILLIAM J. TEUBER JR.

Chief Financial Officer, EMC Corporation

FRANCISCO M. REXACH JR.

President, Capital Assets, Inc.

seated, from left to right

JOSÉ R. VIZCARRONDO

Vice President and Chief Operating Officer

Desarrollos Metropolitanos, S.E.

FREDERIC V. SALERNO

Investor

RICHARD L. CARRIÓN

Chairman

President

Chief Executive Officer

Popular, Inc.

MARÍA LUISA FERRÉ

Executive Vice President, Grupo Ferré Rangel

JUAN J. BERMÚDEZ

Partner, Bermúdez & Longo, S.E.

compete / create / build / discover / inspire

[P31]

[ Condensed Consolidated Statements of Condition ]

| | | | | | | | | | | |

| | | | At December 31, |

| (In thousands) | | | 2004 | | | 2003 |

| | | | | | | |

Assets | | | | | | | | | | |

| Cash and due from banks | | | $ | 716,459 | | | | $ | 688,090 | |

| Money market investments | | | | 879,640 | | | | | 772,893 | |

| Trading securities, at market value | | | | 385,139 | | | | | 605,119 | |

| Investment securities available-for-sale, at market value | | | | 11,162,145 | | | | | 10,051,579 | |

| Investment securities held-to-maturity, at amortized cost | | | | 340,850 | | | | | 186,821 | |

| Other investment securities, at lower of cost or realizable value | | | | 302,440 | | | | | 233,144 | |

| Loans held-for-sale, at lower of cost or market | | | | 750,728 | | | | | 271,592 | |

| | | | | | | |

| Loans held-in-portfolio | | | | 28,253,923 | | | | | 22,613,879 | |

| Less – Unearned income | | | | 262,390 | | | | | 283,279 | |

| Allowance for loan losses | | | | 437,081 | | | | | 408,542 | |

| | | | | | | |

| | | | | 27,554,452 | | | | | 21,922,058 | |

| | | | | | | |

| Premises and equipment | | | | 545,681 | | | | | 485,452 | |

| Other real estate | | | | 59,717 | | | | | 53,898 | |

| Accrued income receivable | | | | 207,542 | | | | | 176,152 | |

| Other assets | | | | 1,046,374 | | | | | 769,037 | |

| Goodwill | | | | 411,308 | | | | | 191,490 | |

| Other intangible assets | | | | 39,101 | | | | | 27,390 | |

| | | | | | | |

| | | | $ | 44,401,576 | | | | $ | 36,434,715 | |

| | | | | | | |

Liabilities and Stockholders’ equity | | | | | | | | | | |

Liabilities: | | | | | | | | | | |

| Deposits: | | | | | | | | | | |

| Non-interest bearing | | | $ | 4,173,268 | | | | $ | 3,726,707 | |

| Interest bearing | | | | 16,419,892 | | | | | 14,371,121 | |

| | | | | | | |

| | | | | 20,593,160 | | | | | 18,097,828 | |

| Federal funds purchased and assets sold under agreements to repurchase | | | | 6,436,853 | | | | | 5,835,587 | |

| Other short-term borrowings | | | | 3,139,639 | | | | | 1,996,624 | |

| Notes payable | | | | 10,180,710 | | | | | 6,992,025 | |

| Subordinated notes | | | | 125,000 | | | | | 125,000 | |

| Other liabilities | | | | 821,491 | | | | | 633,129 | |

| | | | | | | |

| | | | | 41,296,853 | | | | | 33,680,193 | |

| | | | | | | |

| Minority interest in consolidated subsidiaries | | | | 102 | | | | | 105 | |

| | | | | | | |

Stockholders’ equity: | | | | | | | | | | |

| Preferred stock | | | | 186,875 | | | | | 186,875 | |

| Common stock | | | | 1,680,096 | | | | | 837,566 | |

| Surplus | | | | 278,840 | | | | | 314,638 | |

| Retained earnings | | | | 1,129,793 | | | | | 1,601,851 | |

| Accumulated other comprehensive income, net of tax | | | | 35,454 | | | | | 19,014 | |

| Treasury stock – at cost | | | | (206,437 | ) | | | | (205,527 | ) |

| | | | | | | |

| | | | | 3,104,621 | | | | | 2,754,417 | |

| | | | | | | |

| | | | $ | 44,401,576 | | | | $ | 36,434,715 | |

| | | | | | | |

Popular/ 2004 / Annual Report

[P32]

[ Condensed Consolidated Statements of Income ]

| | | | | | | | | | | | | | | |

| | | | Year ended December 31, |

| (In thousands, except per share information) | | | 2004 | | | 2003 | | 2002 |

| | | | | | | |

Interest income | | | | | | | | | | | | | | |

| Loans | | | $ | 1,751,150 | | | | $ | 1,550,036 | | | $ | 1,528,903 | |

| Money market investments | | | | 25,660 | | | | | 25,881 | | | | 32,505 | |

| Investment securities | | | | 413,492 | | | | | 422,295 | | | | 445,925 | |

| Trading securities | | | | 25,963 | | | | | 36,026 | | | | 16,464 | |

| | | | | | | |

| | | | | 2,216,265 | | | | | 2,034,238 | | | | 2,023,797 | |

| | | | | | | |

Interest expense | | | | | | | | | | | | | | |

| Deposits | | | | 330,351 | | | | | 342,891 | | | | 432,415 | |

| Short-term borrowings | | | | 165,425 | | | | | 147,456 | | | | 185,343 | |

| Long-term debt | | | | 344,978 | | | | | 259,203 | | | | 245,795 | |

| | | | | | | |

| | | | | 840,754 | | | | | 749,550 | | | | 863,553 | |

| | | | | | | |

| Net interest income | | | | 1,375,511 | | | | | 1,284,688 | | | | 1,160,244 | |

| Provision for loan losses | | | | 178,657 | | | | | 195,939 | | | | 205,570 | |

| | | | | | | |

| Net interest income after provision for loan losses | | | | 1,196,854 | | | | | 1,088,749 | | | | 954,674 | |

| Service charges on deposit accounts | | | | 165,241 | | | | | 161,839 | | | | 157,713 | |

| Other service fees | | | | 295,551 | | | | | 284,392 | | | | 265,806 | |

| Gain (loss) on sale of investment securities | | | | 15,254 | | | | | 71,094 | | | | (3,342 | ) |

| Trading account loss | | | | (159 | ) | | | | (10,214 | ) | | | (804 | ) |

| Gain on sale of loans | | | | 44,168 | | | | | 53,572 | | | | 52,077 | |

| Other operating income | | | | 88,716 | | | | | 65,327 | | | | 72,313 | |

| | | | | | | |

| | | | | 1,805,625 | | | | | 1,714,759 | | | | 1,498,437 | |

| | | | | | | |

Operating expenses | | | | | | | | | | | | | | |

| Personnel costs | | | | 571,018 | | | | | 526,444 | | | | 488,741 | |

| Net occupancy expenses | | | | 89,821 | | | | | 83,630 | | | | 78,503 | |

| Equipment expenses | | | | 108,823 | | | | | 104,821 | | | | 99,099 | |

| Other taxes | | | | 40,260 | | | | | 37,904 | | | | 37,144 | |

| Professional fees | | | | 95,084 | | | | | 82,325 | | | | 84,660 | |

| Communications | | | | 60,965 | | | | | 58,038 | | | | 53,892 | |

| Business promotion | | | | 75,708 | | | | | 73,277 | | | | 61,451 | |

| Printing and supplies | | | | 17,938 | | | | | 19,111 | | | | 19,918 | |

| Other operating expenses | | | | 103,551 | | | | | 119,689 | | | | 96,490 | |

| Amortization of intangibles | | | | 7,844 | | | | | 7,844 | | | | 9,104 | |

| | | | | | | |

| | | | | 1,171,012 | | | | | 1,113,083 | | | | 1,029,002 | |

| | | | | | | |

| Income before income tax and minority interest | | | | 634,613 | | | | | 601,676 | | | | 469,435 | |

| Income tax | | | | 144,705 | | | | | 130,326 | | | | 117,255 | |

| Net gain of minority interest | | | | — | | | | | (435 | ) | | | (248 | ) |

| | | | | | | |

Net income | | | $ | 489,908 | | | | $ | 470,915 | | | $ | 351,932 | |

| | | | | | | |

Net income applicable to common stock | | | $ | 477,995 | | | | $ | 460,996 | | | $ | 349,422 | |

| | | | | | | |

Net income per common share (basic and diluted) | | | $ | 1.79 | | | | $ | 1.74 | | | $ | 1.31 | |

| | | | | | | |

Dividends declared per common share | | | $ | 0.62 | | | | $ | 0.51 | | | $ | 0.40 | |

| | | | | | | |

For a complete set of audited consolidated financial statements in conformity with accounting principles generally accepted in the United States of America, refer to Popular, Inc.’s 2004 Financial Review and Supplementary Information to Stockholders incorporated by reference in Popular, Inc.’s Annual Report on Form 10-K for the year ended December 31, 2004.

[P33]

[ Historical Financial Summary — 25 Years ]

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions, | | | | | | | | | | | | | | | | | | | | | | |

| except per share data) | | 1980 | | 1981 | | 1982 | | 1983 | | 1984 | | 1985 | | 1986 | | 1987 | | 1988 | | 1989 | | 1990 |

Selected Financial Information | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Income | | $ | 130.0 | | | $ | 135.9 | | | $ | 151.7 | | | $ | 144.9 | | | $ | 156.8 | | | $ | 174.9 | | | $ | 184.2 | | | $ | 207.7 | | | $ | 232.5 | | | $ | 260.9 | | | $ | 284.2 | |

| Non-Interest Income | | | 14.2 | | | | 15.8 | | | | 15.9 | | | | 19.6 | | | | 19.0 | | | | 26.8 | | | | 41.4 | | | | 41.0 | | | | 54.9 | | | | 63.3 | | | | 70.9 | |

| Operating Expenses | | | 101.3 | | | | 109.4 | | | | 121.2 | | | | 127.3 | | | | 137.2 | | | | 156.0 | | | | 168.4 | | | | 185.7 | | | | 195.6 | | | | 212.4 | | | | 229.6 | |

| Net Income | | | 23.5 | | | | 24.3 | | | | 27.3 | | | | 26.8 | | | | 29.8 | | | | 32.9 | | | | 38.3 | | | | 38.3 | | | | 47.4 | | | | 56.3 | | | | 63.4 | |

| |

| Assets | | | 2,630.1 | | | | 2,677.9 | | | | 2,727.0 | | | | 2,974.1 | | | | 3,526.7 | | | | 4,141.7 | | | | 4,531.8 | | | | 5,389.6 | | | | 5,706.5 | | | | 5,972.7 | | | | 8,983.6 | |

| Net Loans | | | 988.4 | | | | 1,007.6 | | | | 976.8 | | | | 1,075.7 | | | | 1,373.9 | | | | 1,715.7 | | | | 2,271.0 | | | | 2,768.5 | | | | 3,096.3 | | | | 3,320.6 | | | | 5,373.3 | |

| Deposits | | | 2,060.5 | | | | 2,111.7 | | | | 2,208.2 | | | | 2,347.5 | | | | 2,870.7 | | | | 3,365.3 | | | | 3,820.2 | | | | 4,491.6 | | | | 4,715.8 | | | | 4,926.3 | | | | 7,422.7 | |

| Stockholders’ Equity | | | 122.1 | | | | 142.3 | | | | 163.5 | | | | 182.2 | | | | 203.5 | | | | 226.4 | | | | 283.1 | | | | 308.2 | | | | 341.9 | | | | 383.0 | | | | 588.9 | |

| |

| Market Capitalization | | $ | 45.0 | | | $ | 66.4 | | | $ | 99.0 | | | $ | 119.3 | | | $ | 159.8 | | | $ | 216.0 | | | $ | 304.0 | | | $ | 260.0 | | | $ | 355.0 | | | $ | 430.1 | | | $ | 479.1 | |

| Return on Assets (ROA) | | | 0.92 | % | | | 0.90 | % | | | 0.96 | % | | | 0.95 | % | | | 0.94 | % | | | 0.89 | % | | | 0.88 | % | | | 0.76 | % | | | 0.85 | % | | | 0.99 | % | | | 1.09 | % |

| Return on Equity (ROE) | | | 19.96 | % | | | 18.36 | % | | | 17.99 | % | | | 15.86 | % | | | 15.83 | % | | | 15.59 | % | | | 15.12 | % | | | 13.09 | % | | | 14.87 | % | | | 15.87 | % | | | 15.55 | % |

Per Common Share1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Income | | $ | 0.17 | | | $ | 0.17 | | | $ | 0.19 | | | $ | 0.19 | | | $ | 0.21 | | | $ | 0.23 | | | $ | 0.25 | | | $ | 0.24 | | | $ | 0.30 | | | $ | 0.35 | | | $ | 0.40 | |

| Dividends (Declared) | | | 0.04 | | | | 0.03 | | | | 0.04 | | | | 0.06 | | | | 0.06 | | | | 0.07 | | | | 0.08 | | | | 0.09 | | | | 0.09 | | | | 0.10 | | | | 0.10 | |

| Book Value | | | 0.83 | | | | 0.97 | | | | 1.11 | | | | 1.24 | | | | 1.38 | | | | 1.54 | | | | 1.73 | | | | 1.89 | | | | 2.10 | | | | 2.35 | | | | 2.46 | |

| Market Price | | $ | 0.51 | | | $ | 0.46 | | | $ | 0.69 | | | $ | 0.83 | | | $ | 1.11 | | | $ | 1.50 | | | $ | 2.00 | | | $ | 1.67 | | | $ | 2.22 | | | $ | 2.69 | | | $ | 2.00 | |

Assets by Geographical Area | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Puerto Rico | | | 95.53 | % | | | 94.65 | % | | | 94.63 | % | | | 93.70 | % | | | 91.31 | % | | | 92.42 | % | | | 91.67 | % | | | 94.22 | % | | | 93.45 | % | | | 92.18 | % | | | 88.59 | % |

| United States | | | 4.47 | % | | | 5.14 | % | | | 5.01 | % | | | 5.23 | % | | | 7.52 | % | | | 6.47 | % | | | 7.23 | % | | | 5.01 | % | | | 5.50 | % | | | 6.28 | % | | | 9.28 | % |

| Caribbean and Latin America | | | | | | | 0.21 | % | | | 0.36 | % | | | 1.07 | % | | | 1.17 | % | | | 1.11 | % | | | 1.10 | % | | | 0.77 | % | | | 1.05 | % | | | 1.54 | % | | | 2.13 | % |

| |

| Total | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % |

Traditional Delivery System | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Banking Branches | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Puerto Rico | | | 110 | | | | 110 | | | | 110 | | | | 112 | | | | 113 | | | | 115 | | | | 124 | | | | 126 | | | | 126 | | | | 128 | | | | 173 | |

| Virgin Islands | | | | | | | 1 | | | | 2 | | | | 3 | | | | 3 | | | | 3 | | | | 3 | | | | 3 | | | | 3 | | | | 3 | | | | 3 | |

| United States | | | 7 | | | | 7 | | | | 7 | | | | 6 | | | | 9 | | | | 9 | | | | 9 | | | | 9 | | | | 10 | | | | 10 | | | | 24 | |

| |

| Subtotal | | | 117 | | | | 118 | | | | 119 | | | | 121 | | | | 125 | | | | 127 | | | | 136 | | | | 138 | | | | 139 | | | | 141 | | | | 200 | |

| |

| Non-Banking Offices | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Popular Financial Holdings | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Popular Cash Express | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Popular Finance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 14 | | | | 17 | | | | 18 | | | | 26 | |

| Popular Auto | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 4 | | | | 9 | |

| Popular Leasing,U.S.A. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Popular Mortgage | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Popular Securities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Popular Insurance | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Popular Insurance Agency U.S.A | | | . | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Popular Insurance,V.I. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EVERTEC | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Subtotal | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 14 | | | | 17 | | | | 22 | | | | 35 | |

| |

| Total | | | 117 | | | | 118 | | | | 119 | | | | 121 | | | | 125 | | | | 127 | | | | 136 | | | | 152 | | | | 156 | | | | 163 | | | | 235 | |

Electronic Delivery System | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

ATMs2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Owned and Driven | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Puerto Rico | | | | | | | | | | | | | | | 30 | | | | 78 | | | | 94 | | | | 113 | | | | 136 | | | | 153 | | | | 151 | | | | 211 | |

| Caribbean | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 3 | | | | 3 | | | | 3 | | | | 3 | |

| United States | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Subtotal | | | | | | | | | | | | | | | 30 | | | | 78 | | | | 94 | | | | 113 | | | | 139 | | | | 156 | | | | 154 | | | | 214 | |

| |

| Driven | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Puerto Rico | | | | | | | | | | | | | | | | | | | 6 | | | | 36 | | | | 51 | | | | 55 | | | | 68 | | | | 65 | | | | 54 | |

| Caribbean | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Subtotal | | | | | | | | | | | | | | | | | | | 6 | | | | 36 | | | | 51 | | | | 55 | | | | 68 | | | | 65 | | | | 54 | |

| |

| Total | | | | | | | | | | | | | | | 30 | | | | 84 | | | | 130 | | | | 164 | | | | 194 | | | | 224 | | | | 219 | | | | 268 | |

Transactions (in millions) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Electronic Transactions3 | | | | | | | | | | | | | | | 0.6 | | | | 4.4 | | | | 7.0 | | | | 8.3 | | | | 12.7 | | | | 14.9 | | | | 16.1 | | | | 18.0 | |

| Items Processed | | | 94.8 | | | | 96.9 | | | | 98.5 | | | | 102.1 | | | | 110.3 | | | | 123.8 | | | | 134.0 | | | | 139.1 | | | | 159.8 | | | | 161.9 | | | | 164.0 | |

Employees (full-time equivalent) | | | 3,838 | | | | 3,891 | | | | 3,816 | | | | 3,832 | | | | 4,110 | | | | 4,314 | | | | 4,400 | | | | 4,699 | | | | 5,131 | | | | 5,213 | | | | 7,023 | |

| 1 | | Per common share data adjusted for stock splits |

| 2 | | Does not include host-to-host ATMs (2,047 in 2004) which are neither owned nor driven, but are part of the ATH Network |

| 3 | | From 1980-2003, electronic transactions include ACH, Direct Payment, TelePago and Internet Banking and ATH Network transactions in Puerto Rico. 2004 was adjusted to reflect the entire processing business which includes ATH Network transactions in the Dominican Republic, Costa Rica, El Salvador and United States and health care transactions, in addition to those previously stated |

Popular/ 2004 / Annual Report

[P34]

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1991 | | 1992 | | 1993 | | 1994 | | 1995 | | 1996 | | 1997 | | 1998 | | 1999 | | 2000 | | 2001 | | 2002 | | 2003 | | 2004 |

| $ 407.8 | | $ | 440.2 | | | $ | 492.1 | | | $ | 535.5 | | | $ | 584.2 | | | $ | 681.3 | | | $ | 784.0 | | | $ | 873.0 | | | $ | 953.7 | | | $ | 982.8 | | | $ | 1,056.8 | | | $ | 1,160.2 | | | $ | 1,284.7 | | | $ | 1,375.5 | |

| 131.8 | | | 124.5 | | | | 125.2 | | | | 141.3 | | | | 173.3 | | | | 205.5 | | | | 247.6 | | | | 291.2 | | | | 372.9 | | | | 464.1 | | | | 491.8 | | | | 543.8 | | | | 626.0 | | | | 608.8 | |

| 345.7 | | | 366.9 | | | | 412.3 | | | | 447.8 | | | | 486.8 | | | | 541.9 | | | | 636.9 | | | | 720.4 | | | | 837.5 | | | | 876.4 | | | | 926.2 | | | | 1,029.0 | | | | 1,113.1 | | | | 1,171.0 | |

| 64.6 | | | 85.1 | | | | 109.4 | | | | 124.7 | | | | 146.4 | | | | 185.2 | | | | 209.6 | | | | 232.3 | | | | 257.6 | | | | 276.1 | | | | 304.5 | | | | 351.9 | | | | 470.9 | | | | 489.9 | |

| |

| 8,780.3 | | | 10,002.3 | | | | 11,513.4 | | | | 12,778.4 | | | | 15,675.5 | | | | 16,764.1 | | | | 19,300.5 | | | | 23,160.4 | | | | 25,460.5 | | | | 28,057.1 | | | | 30,744.7 | | | | 33,660.4 | | | | 36,434.7 | | | | 44,401.6 | |

| 5,195.6 | | | 5,252.1 | | | | 6,346.9 | | | | 7,781.3 | | | | 8,677.5 | | | | 9,779.0 | | | | 11,376.6 | | | | 13,078.8 | | | | 14,907.8 | | | | 16,057.1 | | | | 18,168.6 | | | | 19,582.1 | | | | 22,602.2 | | | | 28,742.3 | |

| 7,207.1 | | | 8,038.7 | | | | 8,522.7 | | | | 9,012.4 | | | | 9,876.7 | | | | 10,763.3 | | | | 11,749.6 | | | | 13,672.2 | | | | 14,173.7 | | | | 14,804.9 | | | | 16,370.0 | | | | 17,614.7 | | | | 18,097.8 | | | | 20,593.2 | |

| 631.8 | | | 752.1 | | | | 834.2 | | | | 1,002.4 | | | | 1,141.7 | | | | 1,262.5 | | | | 1,503.1 | | | | 1,709.1 | | | | 1,661.0 | | | | 1,993.6 | | | | 2,272.8 | | | | 2,410.9 | | | | 2,754.4 | | | | 3,104.6 | |

| |

| $ 579.0 | | $ | 987.8 | | | $ | 1,014.7 | | | $ | 923.7 | | | $ | 1,276.8 | | | $ | 2,230.5 | | | $ | 3,350.3 | | | $ | 4,611.7 | | | $ | 3,790.2 | | | $ | 3,578.1 | | | $ | 3,965.4 | | | $ | 4,476.4 | | | $ | 5,960.2 | | | $ | 7,685.6 | |

| 0.72 | % | | 0.89 | % | | | 1.02 | % | | | 1.02 | % | | | 1.04 | % | | | 1.14 | % | | | 1.14 | % | | | 1.14 | % | | | 1.08 | % | | | 1.04 | % | | | 1.09 | % | | | 1.11 | % | | | 1.36 | % | | | 1.23 | % |

| 10.57 | % | | 12.72 | % | | | 13.80 | % | | | 13.80 | % | | | 14.22 | % | | | 16.17 | % | | | 15.83 | % | | | 15.41 | % | | | 15.45 | % | | | 15.00 | % | | | 14.84 | % | | | 16.29 | % | | | 19.30 | % | | | 17.60 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $ 0.27 | | $ | 0.35 | | | $ | 0.42 | | | $ | 0.46 | | | $ | 0.53 | | | $ | 0.67 | | | $ | 0.75 | | | $ | 0.83 | | | $ | 0.92 | | | $ | 0.99 | | | $ | 1.09 | | | $ | 1.31 | | | $ | 1.74 | | | $ | 1.79 | |

| 0.10 | | | 0.10 | | | | 0.12 | | | | 0.13 | | | | 0.15 | | | | 0.18 | | | | 0.20 | | | | 0.25 | | | | 0.30 | | | | 0.32 | | | | 0.38 | | | | 0.40 | | | | 0.51 | | | | 0.62 | |

| 2.63 | | | 2.88 | | | | 3.19 | | | | 3.44 | | | | 3.96 | | | | 4.40 | | | | 5.19 | | | | 5.93 | | | | 5.76 | | | | 6.96 | | | | 7.97 | | | | 9.10 | | | | 9.66 | | | | 10.95 | |

| $ 2.41 | | $ | 3.78 | | | $ | 3.88 | | | $ | 3.52 | | | $ | 4.85 | | | $ | 8.44 | | | $ | 12.38 | | | $ | 17.00 | | | $ | 13.97 | | | $ | 13.16 | | | $ | 14.54 | | | $ | 16.90 | | | $ | 22.43 | | | $ | 28.83 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 86.67 | % | | 87.33 | % | | | 79.42 | % | | | 75.86 | % | | | 75.49 | % | | | 73.88 | % | | | 74.10 | % | | | 71.32 | % | | | 70.95 | % | | | 71.80 | % | | | 67.66 | % | | | 66.27 | % | | | 61.84 | % | | | 54.56 | % |

| 10.92 | % | | 10.27 | % | | | 16.03 | % | | | 19.65 | % | | | 20.76 | % | | | 22.41 | % | | | 23.34 | % | | | 24.44 | % | | | 25.17 | % | | | 25.83 | % | | | 29.84 | % | | | 31.60 | % | | | 36.29 | % | | | 43.48 | % |

| 2.41 | % | | 2.40 | % | | | 4.55 | % | | | 4.49 | % | | | 3.75 | % | | | 3.71 | % | | | 2.56 | % | | | 4.24 | % | | | 3.88 | % | | | 2.37 | % | | | 2.50 | % | | | 2.13 | % | | | 1.87 | % | | | 1.96 | % |

| |

| 100.00 | % | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % | | | 100.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 161 | | | 162 | | | | 165 | | | | 166 | | | | 166 | | | | 178 | | | | 201 | | | | 198 | | | | 199 | | | | 199 | | | | 196 | | | | 195 | | | | 193 | | | | 192 | |

| 3 | | | 3 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | | | | 8 | |

| 24 | | | 30 | | | | 32 | | | | 34 | | | | 40 | | | | 44 | | | | 63 | | | | 89 | | | | 91 | | | | 95 | | | | 96 | | | | 96 | | | | 97 | | | | 128 | |

| |

| 188 | | | 195 | | | | 205 | | | | 208 | | | | 214 | | | | 230 | | | | 272 | | | | 295 | | | | 298 | | | | 302 | | | | 300 | | | | 299 | | | | 298 | | | | 328 | |

| |

| 27 | | | 41 | | | | 58 | | | | 73 | | | | 91 | | | | 102 | | | | 117 | | | | 128 | | | | 137 | | | | 136 | | | | 149 | | | | 153 | | | | 181 | | | | 183 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | 51 | | | | 102 | | | | 132 | | | | 154 | | | | 195 | | | | 129 | | | | 114 | |

| 26 | | | 26 | | | | 26 | | | | 28 | | | | 31 | | | | 39 | | | | 44 | | | | 48 | | | | 47 | | | | 61 | | | | 55 | | | | 36 | | | | 43 | | | | 43 | |

| 9 | | | 9 | | | | 8 | | | | 10 | | | | 9 | | | | 8 | | | | 10 | | | | 10 | | | | 12 | | | | 12 | | | | 20 | | | | 18 | | | | 18 | | | | 18 | |

| | | | | | | | | | | | | | | | | | | | | | | | 7 | | | | 8 | | | | 10 | | | | 11 | | | | 13 | | | | 13 | | | | 11 | | | | 15 | |

| | | | | | | | | | | | | | | | 3 | | | | 3 | | | | 3 | | | | 11 | | | | 13 | | | | 21 | | | | 25 | | | | 29 | | | | 32 | | | | 30 | |

| | | | | | | | | | | | | | | | | | | | 1 | | | | 2 | | | | 2 | | | | 2 | | | | 3 | | | | 4 | | | | 7 | | | | 8 | | | | 9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 2 | | | | 2 | | | | 2 | | | | 2 | | | | 2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1 | | | | 1 | | | | 1 | | | | 1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | 1 | | | | 1 | | | | 1 | |