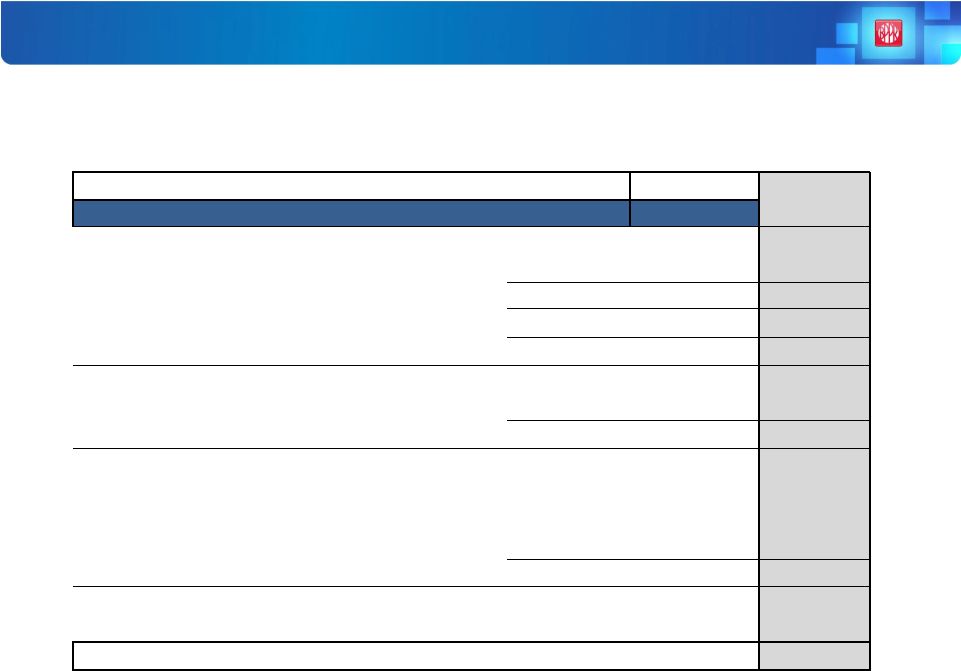

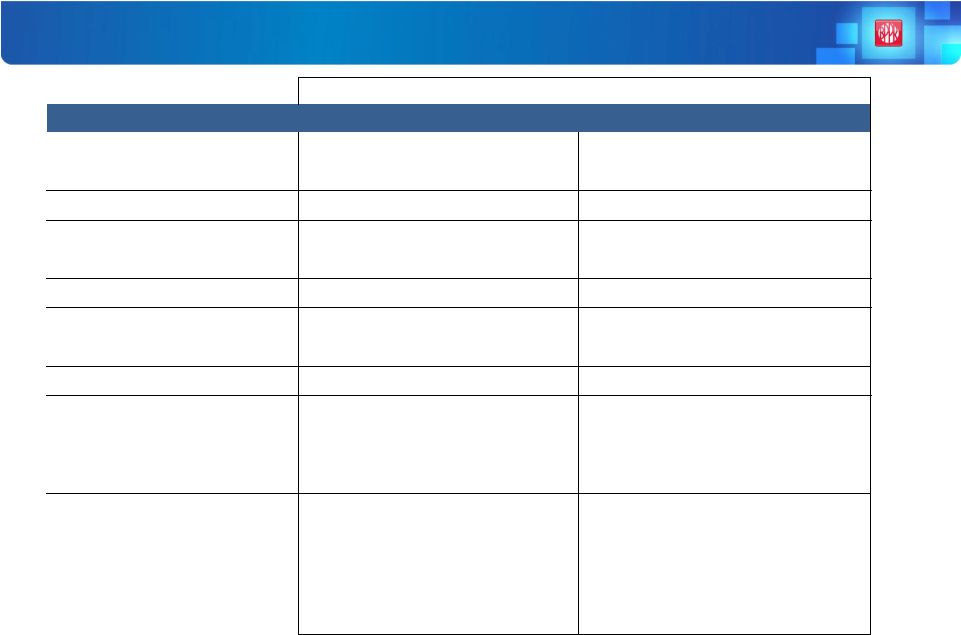

[1] Covered loans represent loans acquired in the Westernbank FDIC-assisted transaction that are covered under FDIC loss sharing agreements. [2] Represents the impact of the gross receipt tax corresponding to the first quarter 2013, recorded during the second quarter after enactment. [3] Represents the net benefit of $215.6 million for the increase on the net deferred tax asset from the change of the corporate tax rate from 30% to 39%, $7.9 million resulting from the adjustment in tax rate for distributions from EVERTEC from 15% to 4%, offset by an adjustment of $11.9 million on the deferred tax liability related to the covered loans portfolio. 15 GAAP Reconciliation Q2 2013 US GAAP Non GAAP In thousands, except per share amount Actual NPL Sale EVERTEC's IPO Income Tax Adjustment [2][3] Adjusted Net interest income $355,719 $1,502 $354,217 Service fees & other oper. income 290,874 (3,047) 162,091 131,830 Gain (loss) on sale of investments, loans & trading 6,244 (3,865) 5,856 4,253 Non interest income (loss) 297,118 (6,912) 167,947 - 136,083 Total revenues before FDIC income (expense) 652,837 (6,912) 169,449 490,300 FDIC loss-share income (expense) (3,755) (3,755) Gross revenues 649,082 (6,912) 169,449 486,545 Provision for loan losses (excluding covered loans) [1] 223,908 169,248 54,660 Provision for loan losses (covered loans) 25,500 25,500 Total provision 249,408 169,248 80,160 Net revenues 399,674 (176,160) 169,449 406,385 Personnel costs 114,679 114,679 Other real estate owned (OREO) expenses 5,762 5,762 Other operating expenses 189,145 856 1,656 186,633 Total operating expenses 309,586 856 1,656 307,074 Income before tax 90,088 (176,160) 168,593 (1,656) 99,311 Income tax (benefit) expense (237,380) (68,987) 11,988 (211,588) 31,207 Net income (loss) $327,468 ($107,173) $156,605 $209,932 $68,104 EPS - Basic $3.18 EPS - Diluted $3.17 NIM 4.46% Tangible book value per share (quarter end) $33.38 Q2 2013 |