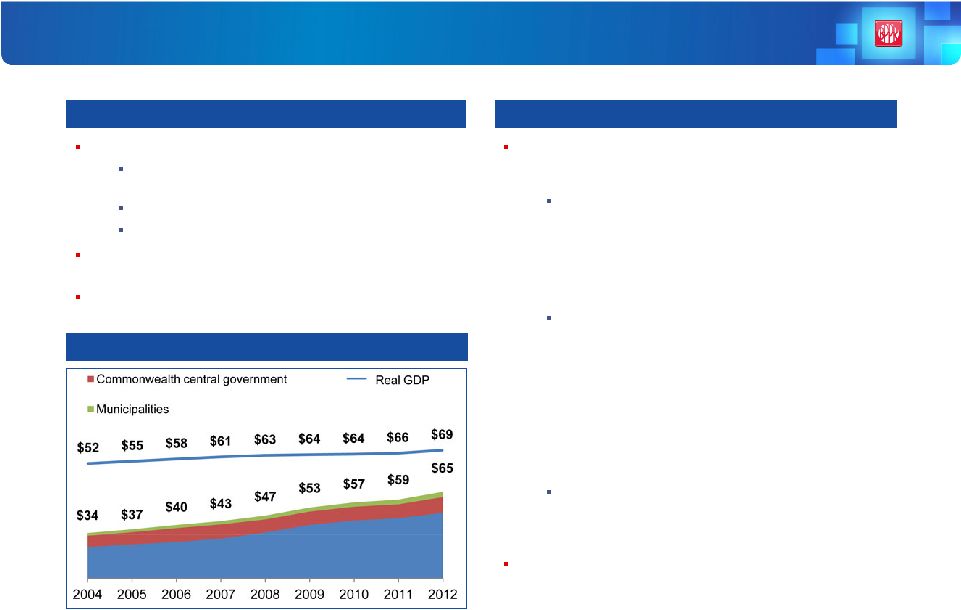

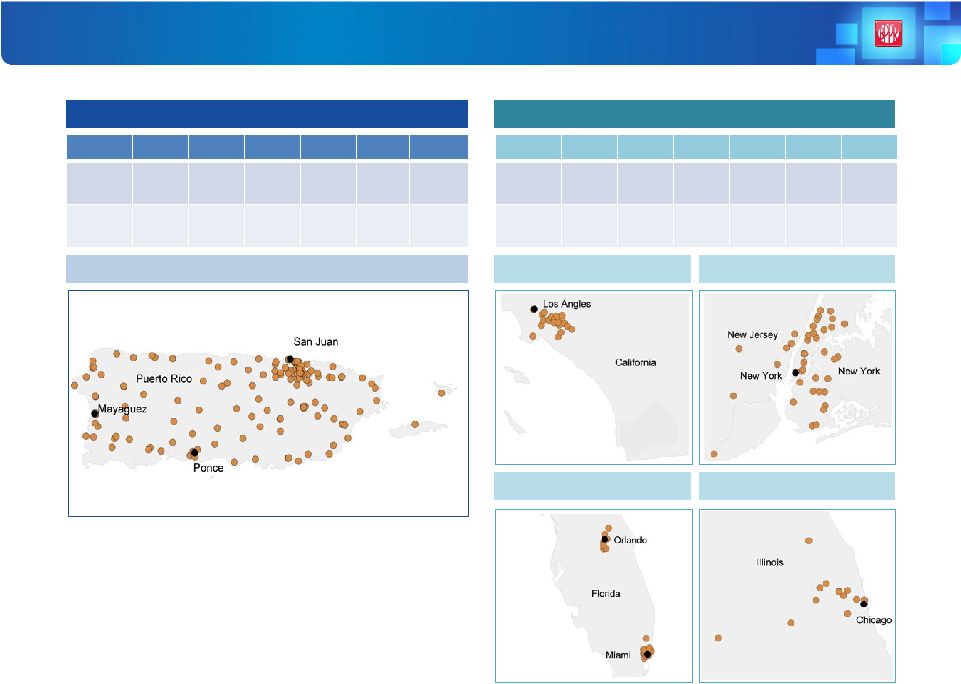

17 Puerto Rico’s Indebtedness Has Been a Recent Area of Focus Background on Puerto Rico’s Public Debt Mitigating Actions Taken by the Government Gross Public Debt of Puerto Rico ($bn) Puerto Rico has ~$70bn total debt outstanding Represents ~$14,000 debt per capita and 71% of total GDP 24% of the public debt is insured 9% of Puerto Rico’s debt matures in or before 2015 Puerto Rico’s 2013 budget deficit was $1.3bn, or ~ 13% of the budget Puerto Rico is not eligible to file under Chapter 9 due to its legal status Fiscal 2014 budget was approved, reducing deficit by 36% from $1.3bn to $820mm, resulting in no change in the Commonwealth credit ratings; reforms included: Tax reform: – Increased marginal corporate tax rate from 30% to 39% – Act 154 excise tax was increased and fixed at 4%; also extended for five years – Non-tax sources of revenue, such as utility fees were increased Pension overhaul: – Converted the pension system from a defined benefit to a defined contribution plan, effective June 30 – Reforms have made the pension cash sufficient, requiring no additional government outlays beyond its $140mm contribution – Raised retirement age for some state workers, increased the worker pension contribution requirement, and changed monthly benefits for some workers Privatization of Public Facilities: – Completed privatization of Luis Muñoz Marín International Airport and Highway 22 In October 2013, Moody’s affirmed Puerto Rico’s general obligation rating at Baa3 (outlook negative), citing the government’s significant fiscal measures Source: Government Development Bank of Puerto Rico; Puerto Rico Planning Board Statistical Index 2012; Equity research reports |