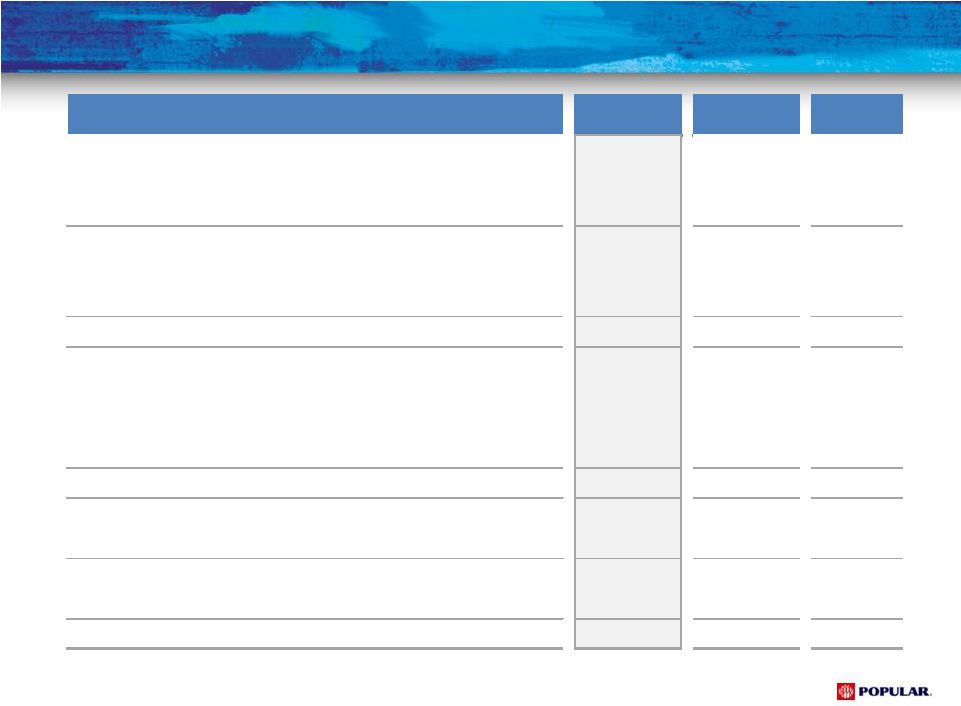

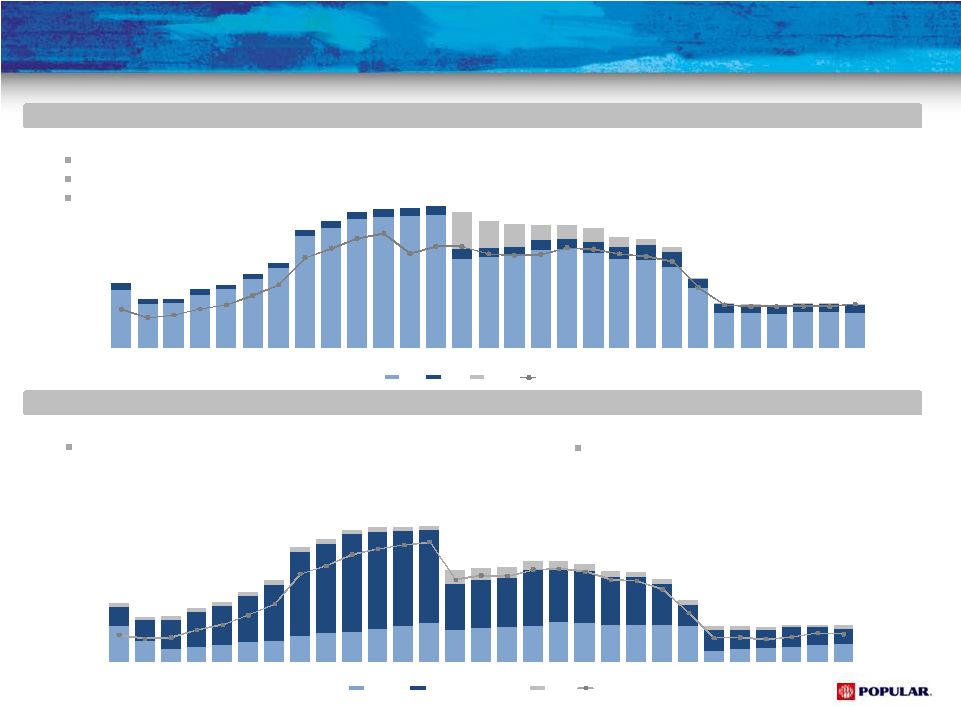

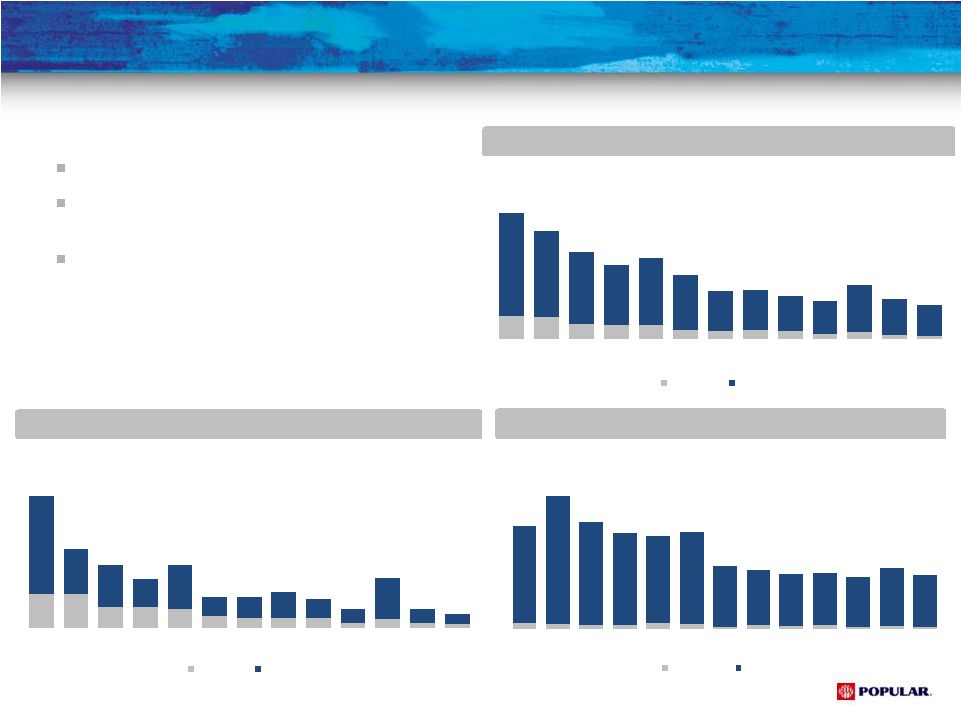

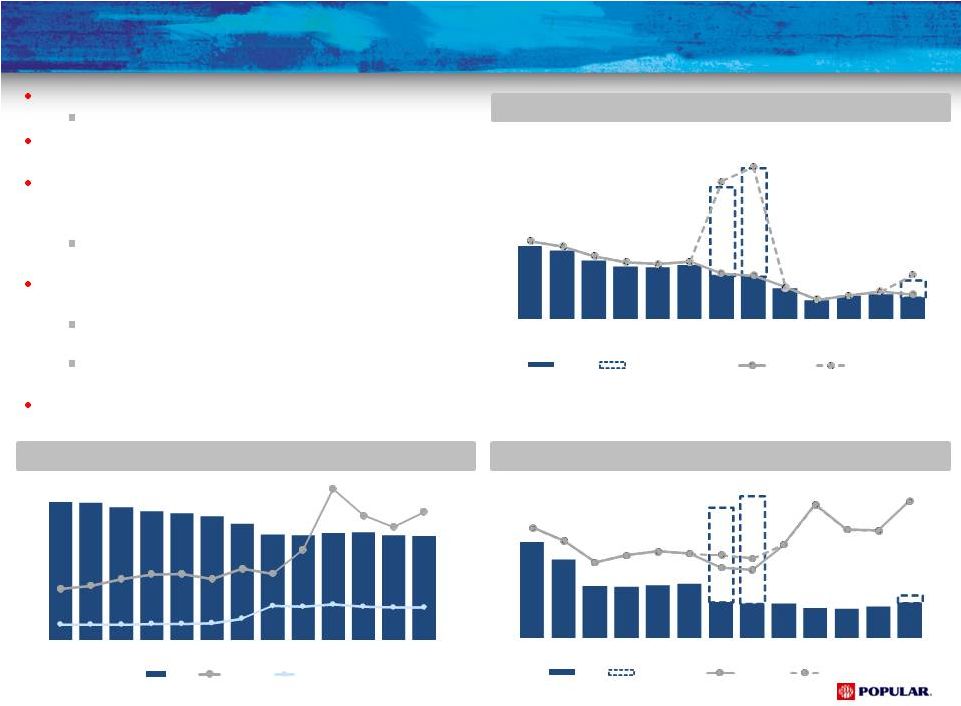

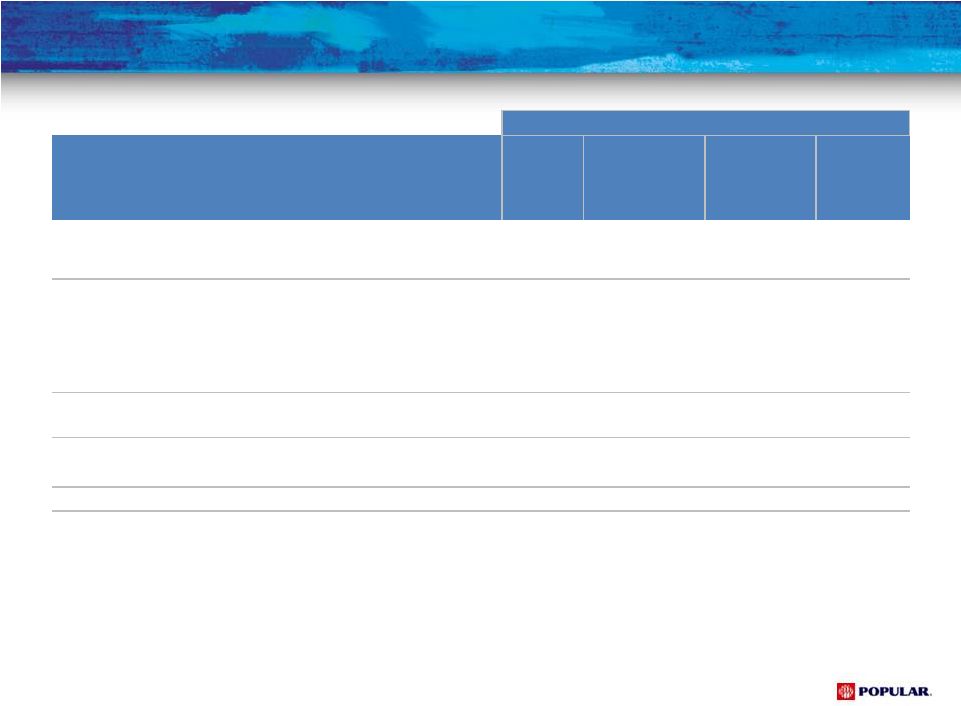

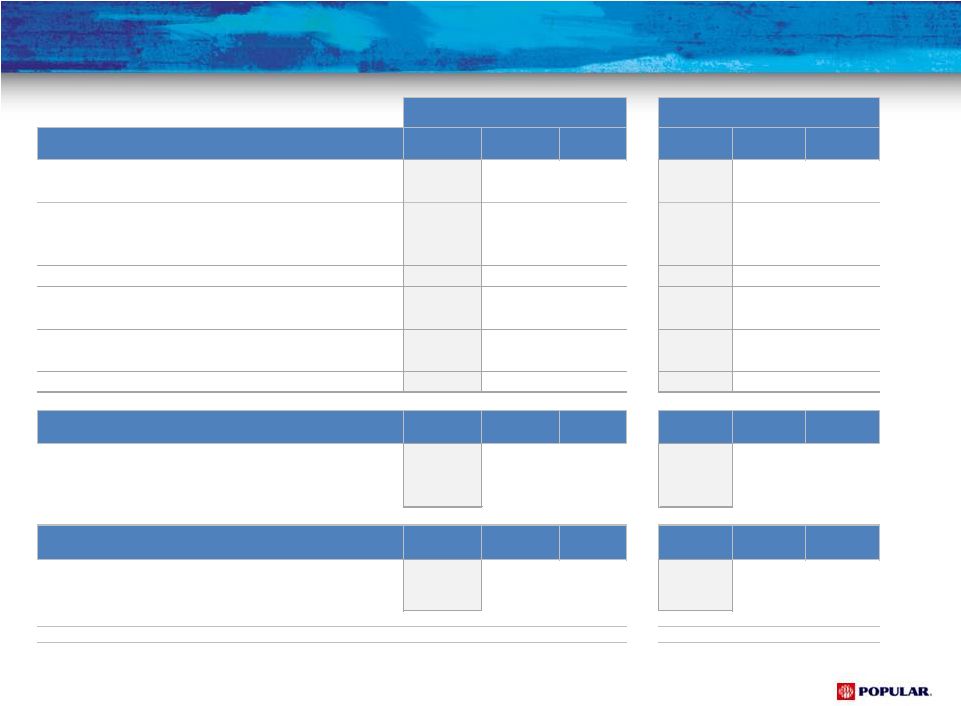

BPPR Commercial & Construction Distribution Loan Composition (Held-in Portfolio) De-risked Loan Portfolios • The Corporation has derisked its loan portfolios by reducing its exposure in asset classes with historically high loss content • In the BPPR commercial portfolio reductions include: Commercial portfolio, including construction, has decreased from 55% of total loans held- in-portfolio to 41% Construction portfolio is down by 88% since Q4 2007 SME lending is down by 55% from Q4 2007 • Collateralized exposure now represents a larger portion of consumer loan portfolio • Unsecured loans credit quality has improved as overall FICO scores have increased 1 Small and Medium Enterprise 2 NCOs distribution represents the percentage allocation of NCOs from Q1 2008 through Q2 2014 per each loan category Legacy portfolio is comprised of certain commercial, construction and lease financings lending products exited by the US. 18 NCOs ($mm) (%) ($mm) (%) ($mm) (%) Distribution (2) CRE SME ¹ $2,938 33% $1,497 23% ($1,441) -49% 24% C&I SME ¹ 2,287 25% 859 13% (1,428) -62% 29% C&I Corp 1,592 18% 1,870 29% 278 17% 6% Construction 1,231 14% 149 2% (1,082) -88% 37% CRE Corp 892 10% 1,983 31% 1,091 122% 4% Multifamily 64 1% 60 1% (4) -6% 1% Total $9,004 $6,419 ($2,585) -29% 100% Q4 2007 Q3 2014 Variance 1 $ in millions Q4 2007 Q3 2014 Q4 2007 Q3 2014 Q4 2007 Q3 2014 Variance Commercial $7,774 $6,270 $4,515 $1,789 $12,288 $8,059 ($4,229) Consumer 3,552 3,401 1,698 491 5,249 3,892 (1,357) Mortgage 2,933 5,453 3,139 1,102 6,071 6,555 484 Construction 1,231 149 237 63 1,468 212 (1,256) Leases 814 550 - - 814 550 (264) Legacy - - 2,130 91 2,130 91 (2,039) Total $16,304 $15,823 $11,718 $3,536 $28,020 $19,359 ($8,661) Puerto Rico US Total Numbers may not add to total due to rounding |