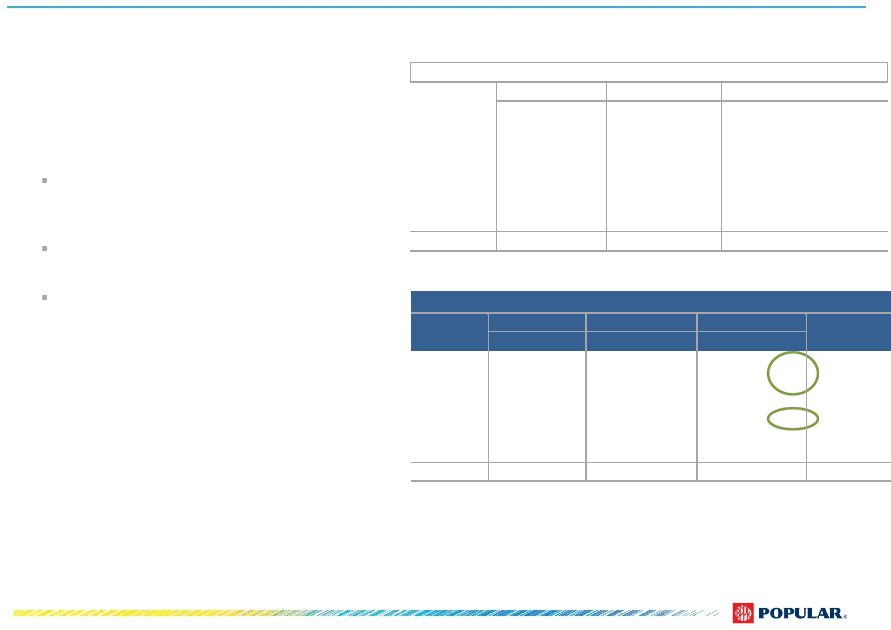

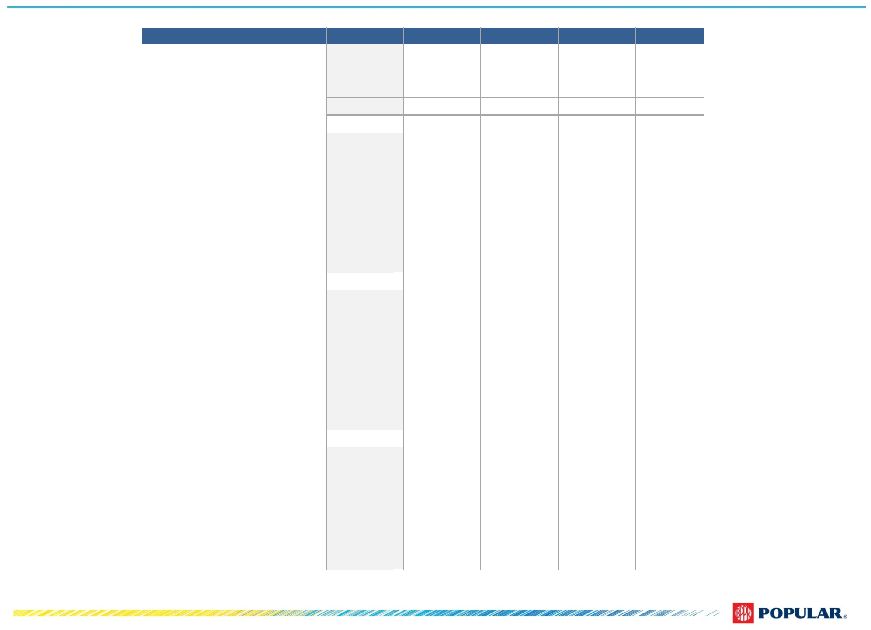

GAAP Reconciliation Q2 2015 * Unaudited. ¹ Covered loans represent loans acquired in the Westernbank FDIC-assisted transaction that are covered under FDIC loss sharing agreements. 15 ($ in thousands) Actual Results BPNA (US GAAP) Reorganization Doral Acquisition OTTI Reversal DTA - BPNA Loss on Bulk Sale of Covered OREOs Adjustment to FDIC Indemnification Asset Adjusted Results (Non- GAAP) Net interest income $ 362,553 $ - $ - $ - $ - $ - $ - $ 362,553 Provision for loan losses – non-covered loans 60,468 - - - - - - 60,468 Provision for loan losses – covered loans ¹ 15,766 - - - - - - 15,766 Net interest income after provision for loan losses 286,319 - - - - - - 286,319 Net (loss) and valuation adjustments on investment securities (14,440) - - (14,445) - - - 5 FDIC loss share income 19,075 - - - - 17,566 (10,887) 12,396 Other non-interest income 136,124 - 961 - - - - 135,163 Total non-interest income $ 140,759 $ - $ 961 $ (14,445) $ - $ 17,566 $ (10,887) $ 147,564 Personnel costs 120,977 - 3,865 - - - - 117,112 Net occupancy expenses 23,286 - 2,309 - - - - 20,977 Equipment expenses 15,925 - 725 - - - - 15,200 Professional fees 78,449 - 4,885 - - - - 73,564 Communications 6,153 - 70 - - - - 6,083 Business promotion 13,776 - 401 - - - - 13,375 Other real estate owned (OREO) expenses 44,816 - - - - 21,957 - 22,859 Restructuring costs 6,174 6,174 - - - - - - Other operating expenses 53,618 - 509 - - - - 53,109 Total operating expenses $ 363,174 $ 6,174 $ 12,764 $ - $ - $ 21,957 $ - $ 322,279 Income from continuing operations before income tax 63,904 (6,174) (11,803) (14,445) - (4,391) (10,887) 111,604 Income tax (benefit) expense (533,533) - (3,744) (2,486) (544,927) (1,712) (2,177) 21,513 Income from continuing operations $ 597,437 $ (6,174) $ (8,059) $ (11,959) $ 544,927 $ (2,679) $ (8,710) $ 90,091 Income from discontinued operations, net of tax $ 15 $ 15 $ - $ - $ - $ - $ - $ - Net income $ 597,452 $ (6,159) $ (8,059) $ (11,959) $ 544,927 $ (2,679) $ (8,710) $ 90,091 Basic EPS 5.80 $ Diluted EPS 5.79 $ Net interest margin 4.54% Tangible common book value per common share 41.75 $ Market value per common share 28.86 $ Q2 2015 * |