Exhibit 99.1

Investor Presentation

Third Quarter 2016

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties. Please refer to our Annual Report on Form 10-K for the year ended December 31, 2015, the Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016 and June 30, 2016, and our other filings with the Securities and Exchange Commission for a discussion of factors that may cause the Corporation’s actual results to differ materially from any future results expressed or implied by such forward-looking statements. Those filings are available on the Corporation’s website (www.popular.com) and on the Securities and Exchange Commission website (www.SEC.gov). The Corporation does not undertake to update or revise any forward-looking statement to reflect events or circumstances that may arise after the date of such statements.

|

|

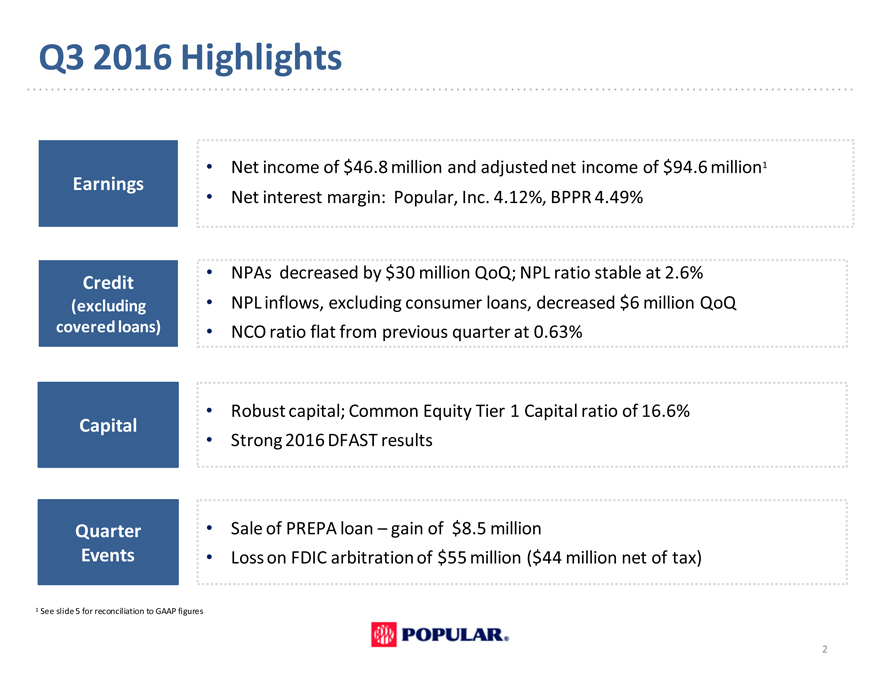

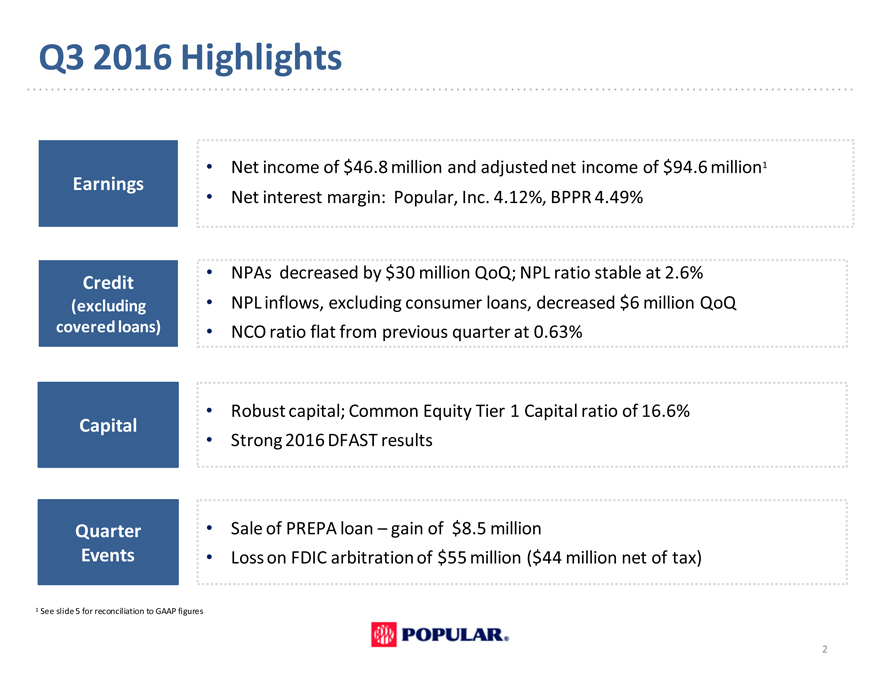

Q3 2016 Highlights

Earnings

• Net income of $46.8 million and adjusted net income of $94.6 million1

• Net interest margin: Popular, Inc. 4.12%, BPPR 4.49%

Credit

(excluding

covered loans)

• NPAs decreased by $30 million QoQ; NPL ratio stable at 2.6%

NPL inflows, excluding consumer loans, decreased $6 million QoQ

NCO ratio flat from previous quarter at 0.63%

Capital

Quarter

Events

Strong 2016 DFAST results

• Robust capital; Common Equity Tier 1 Capital ratio of 16.6%

Sale of PREPA loan – gain of $8.5 million

Loss on FDIC arbitration of $55 million ($44 million net of tax)

1 See slide 5 for reconciliation to GAAP figures

2

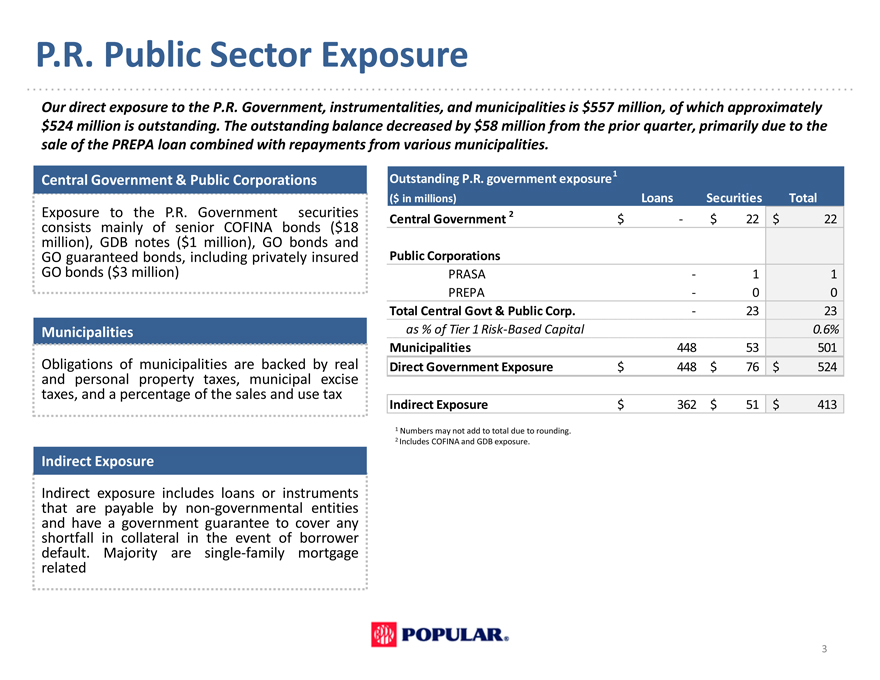

P.R. Public Sector Exposure

Our direct exposure to the P.R. Government, instrumentalities, and municipalities is $557 million, of which approximately $524 million is outstanding. The outstanding balance decreased by $58 million from the prior quarter, primarily due to the sale of the PREPA loan combined with repayments from various municipalities.

Central Government & Public Corporations

Exposure to the P.R. Government securities consists mainly of senior COFINA bonds ($18 million), GDB notes ($1 million), GO bonds and GO guaranteed bonds, including privately insured GO bonds ($3 million)

Municipalities

Obligations of municipalities are backed by real and personal property taxes, municipal excise taxes, and a percentage of the sales and use tax

Indirect Exposure

Indirect exposure includes loans or instruments that are payable by non-governmental entities and have a government guarantee to cover any shortfall in collateral in the event of borrower default. Majority are single-family mortgage related

Outstanding P.R. government exposure 1

($ in millions) Loans Securities Total

Central Government 2 $—$ 22 $ 22

Public Corporations

PRASA—1 1

PREPA—0 0

Total Central Govt & Public Corp.—23 23

as % of Tier 1 Risk-Based Capital 0.6%

Municipalities 448 53 501

Direct Government Exposure $ 448 $ 76 $ 524

Indirect Exposure $ 362 $ 51 $ 413

1 Numbers may not add to total due to rounding.

2 Includes COFINA and GDB exposure.

3

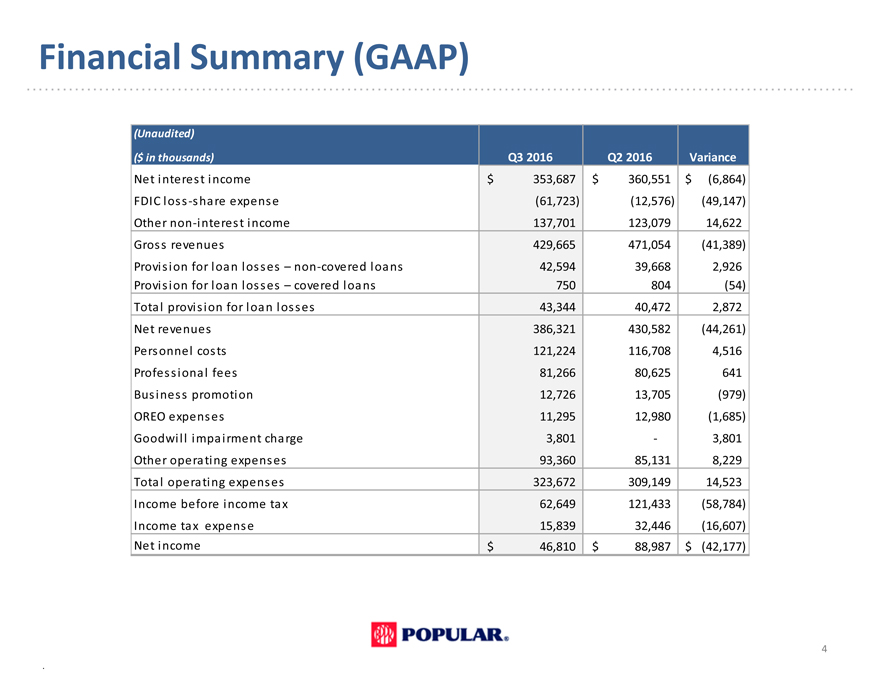

Financial Summary (GAAP)

(Unaudited)

($ in thousands) Q3 2016 Q2 2016 Variance

Net interest income $ 353,687 $ 360,551 $ (6,864)

FDIC loss -share expense(61,723)(12,576)(49,147)

Other non -interest income 137,701 123,079 14,622

Gross revenues 429,665 471,054(41,389)

Provision for loan losses – non -covered loans 42,594 39,668 2,926

Provision for loan losses – covered loans 750 804(54)

Total provision for loan losses 43,344 40,472 2,872

Net revenues 386,321 430,582(44,261)

Personnel costs 121,224 116,708 4,516

Professional fees 81,266 80,625 641

Business promotion 12,726 13,705(979)

OREO expenses 11,295 12,980(1,685)

Goodwill impairment charge 3,801—3,801

Other operating expenses 93,360 85,131 8,229

Total operating expenses 323,672 309,149 14,523

Income before income tax 62,649 121,433(58,784)

Income tax expense 15,839 32,446(16,607)

Net income $ 46,810 $ 88,987 $ (42,177)

4

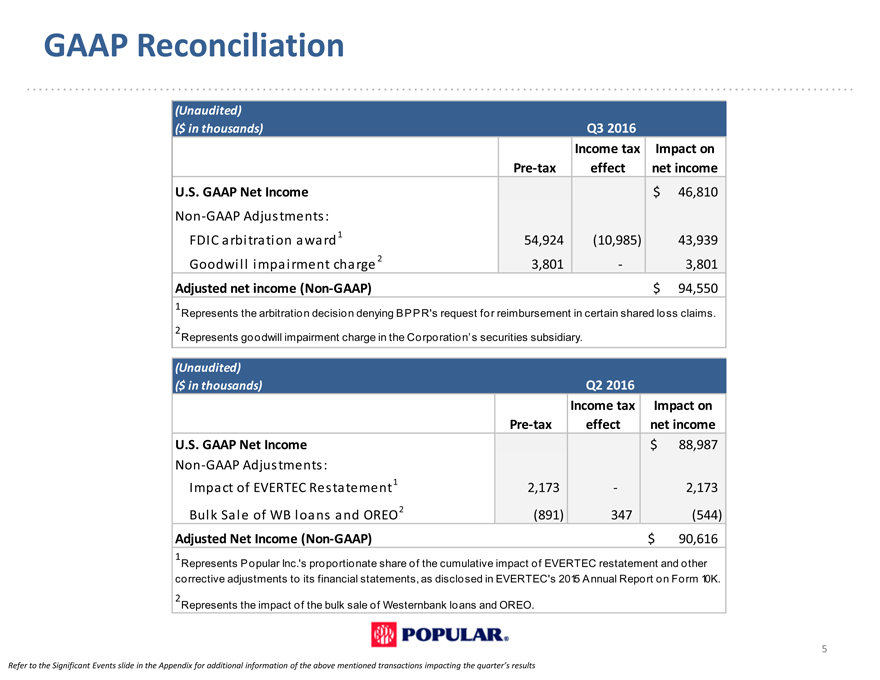

GAAP Reconciliation

(Unaudited)

($ in thousands) Q3 2016

Income tax Impact on

Pre-tax effect net income

U.S. GAAP Net Income $ 46,810

Non -GAAP Adjustments:

FDIC arbitration award 1 54,924(10,985) 43,939

Goodwill impairment charge 2 3,801—3,801

Adjusted net income (Non-GAAP) $ 94,550

1

Represents the arbitration decision denying BPPR’s request for reimbursement in certain shared loss claims.

2

Represents goodwill impairment charge in the Corporation’s securities subsidiary.

(Unaudited) Q2 2016

($ in thousands) Pre-tax Income tax effect Impact on net income

U.S. GAAP Net Income $ 88,987

Non -GAAP Adjustments:

Impact of EVERTEC Restatement 1 2,173—2,173

Bulk Sale of WB loans and OREO 2(891) 347(544)

Adjusted Net Income (Non-GAAP) $ 90,616

1

Represents Popular Inc.‘s proportionate share of the cumulative impact of EVERTEC restatement and other corrective adjustments to its financial statements, as disclosed in EVERTEC’s 2015 Annual Report on Form 10K.

2

Represents the impact of the bulk sale of Westernbank loans and OREO.

Refer to the Significant Events slide in the Appendix for additional information of the above mentioned transactions impacting the quarter’s results

5

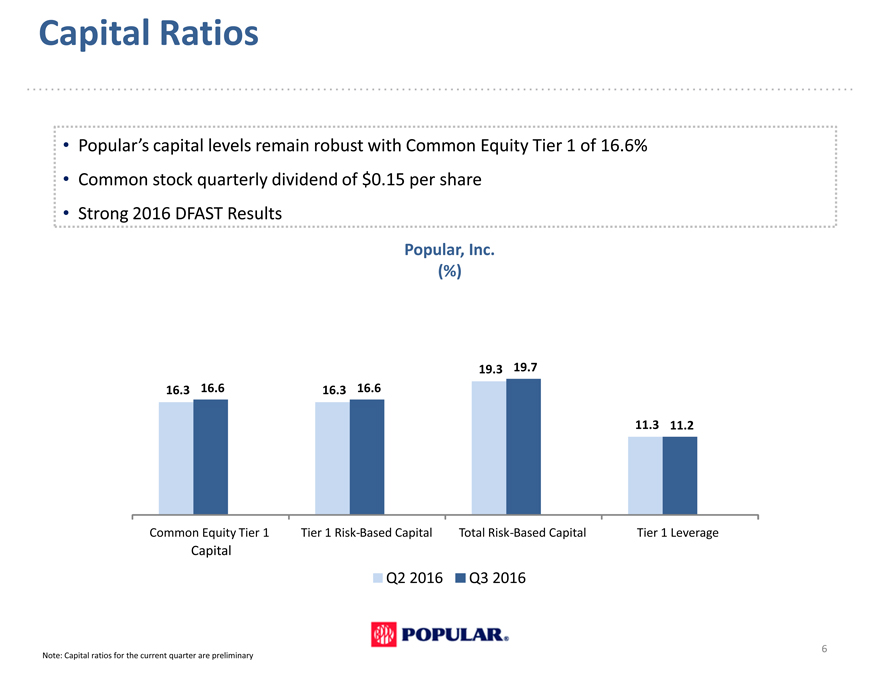

Capital Ratios

Popular’s capital levels remain robust with Common Equity Tier 1 of 16.6%

Common stock quarterly dividend of $0.15 per share

Strong 2016 DFAST Results

Popular, Inc. (%)

19.3 19.7

16.3 16.6 16.3 16.6

11.3 11.2

Common Equity Tier 1 Tier 1 Risk-Based Capital Total Risk-Based Capital Tier 1 Leverage

Capital

Q2 2016 Q3 2016

Note: Capital ratios for the current quarter are preliminary

6

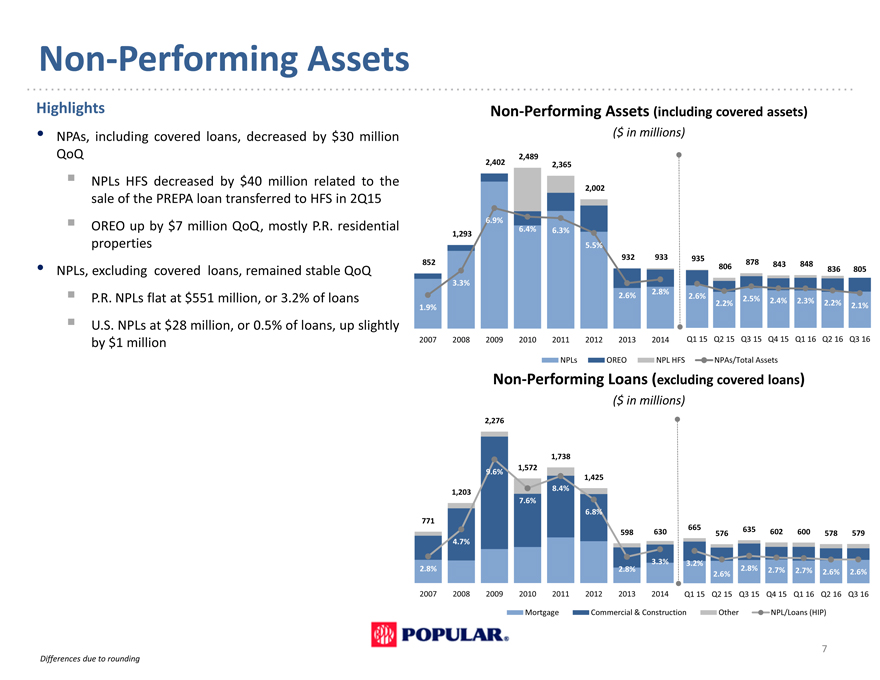

Non-Performing Assets

Highlights

NPAs, including covered loans, decreased by $30 million QoQ

? NPLs HFS decreased by $40 million related to the sale of the PREPA loan transferred to HFS in 2Q15 ? OREO up by $7 million QoQ, mostly P.R. residential properties

NPLs, excluding covered loans, remained stable QoQ

? P.R. NPLs flat at $551 million, or 3.2% of loans ? U.S. NPLs at $28 million, or 0.5% of loans, up slightly by $1 million

Non-Performing Assets (including covered assets)

($ in millions)

2,489

2,402 2,365

2,002

6.9%

1,293 6.4% 6.3%

5.5%

932 933 935

852 806 878 843 848 836 805

3.3%

2.8%

2.6% 2.6% 2.5% 2.4% 2.3%

1.9% 2.2% 2.2% 2.1%

2007 2008 2009 2010 2011 2012 2013 2014 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16

NPLs OREO NPL HFS NPAs/Total Assets

Non-Performing Loans (excluding covered loans)

($ in millions)

2,276 12.0%

1,738 10.0%

9.6% 1,572

1,425 8.0%

1,203 8.4%

7.6%

6.8% 6.0%

771

598 630 665 576 635 602 600 578 579

4.7% 4.0%

3.3% 3.2%

2.8% 2.8% 2.6% 2.8% 2.7% 2.7% 2.2. 0%6% 2.6%

2007 2008 2009 2010 2011 2012 2013 2014 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 0.Q2 0%16 Q3 16

Mortgage Commercial & Construction Other NPL/Loans (HIP)

Differences due to rounding

7

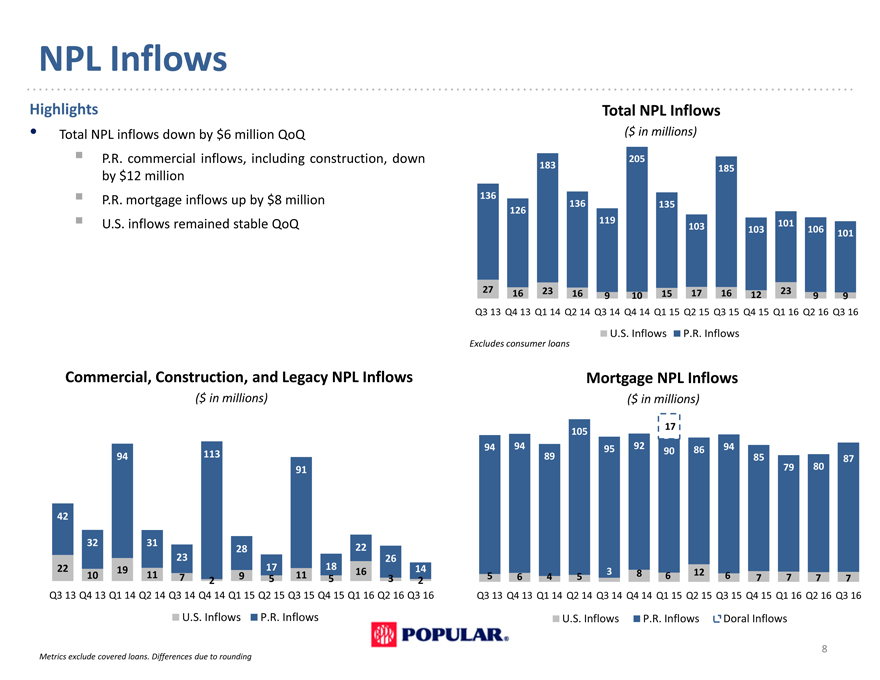

NPL Inflows

Highlights

Total NPL inflows down by $6 million QoQ

? P.R. commercial inflows, including construction, down by $12 million ? P.R. mortgage inflows up by $8 million ? U.S. inflows remained stable QoQ

Commercial, Construction, and Legacy NPL Inflows ($ in millions)

94 113

91

42

32 31 28 22

23 26

22 19 17 18 16 14

10 11 7 2 9 5 11 5 3 2

Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16

U.S. Inflows P.R. Inflows

Total NPL Inflows

($ in millions)

205

183 185

136

136 135

126

119 101

103 103 106

101

27 16 23 16 9 10 15 17 16 12 23 9 9

Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16

U.S. Inflows P.R. Inflows

Excludes consumer loans

Mortgage NPL Inflows

($ in millions)

105 17

94 94 95 92 90 86 94

89 85 87

79 80

5 6 4 5 3 8 6 12 6 7 7 7 7

Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16

U.S. Inflows P.R. Inflows Doral Inflows

Metrics exclude covered loans. Differences due to rounding

8

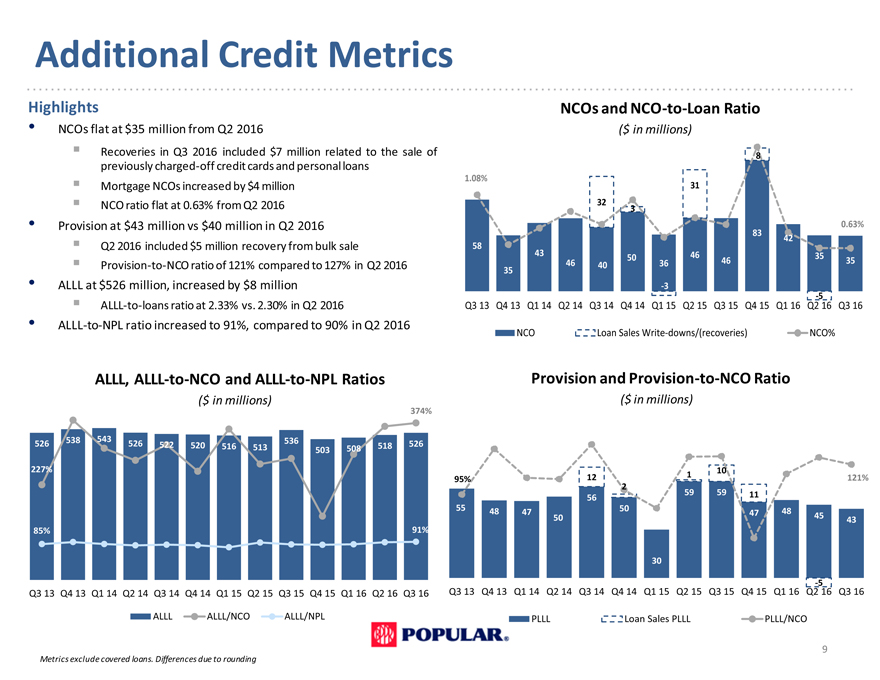

Additional Credit Metrics

Highlights

NCOs flat at $35 million from Q2 2016

Recoveries in Q3 2016 included $7 million related to the sale of previously charged-off credit cards and personal loans ? Mortgage NCOs increased by $4 million ? NCO ratio flat at 0.63% from Q2 2016

Provision at $43 million vs $40 million in Q2 2016

Q2 2016 included $5 million recovery from bulk sale

Provision-to-NCO ratio of 121% compared to 127% in Q2 2016

ALLL at $526 million, increased by $8 million

ALLL-to-loans ratio at 2.33% vs. 2.30% in Q2 2016

ALLL-to-NPL ratio increased to 91%, compared to 90% in Q2 2016

ALLL, ALLL-to-NCO and ALLL-to-NPL Ratios

($ in millions)

374%

538 543 536

526 526 522 520 516 513 503 508 518 526

227%

85% 91%

Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16

ALLL ALLL/NCO ALLL/NPL

NCOs and NCO-to-Loan Ratio

($ in millions)

8

1.08%

31

32

3

0.63%

83 42

58

43 50 46 35

35 46 40 36 46 35

-3

-5

Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16

NCO Loan Sales Write-downs/(recoveries) NCO%

Provision and Provision-to-NCO Ratio

($ in millions)

1 10

95% 12 121%

2

56 59 59 11

55 48 47 50 47 48

50 45 43

30

-5

Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16

PLLL Loan Sales PLLL PLLL/NCO

Metrics exclude covered loans. Differences due to rounding

9

Driving Shareholder Value

Earnings

• Unique franchise in P.R. provides strong, stable revenue-generating capacity

Continued loan growth in the U.S.Capital

• Robust capital with Common Equity Tier 1 Capital of 16.6% Additional Value

• EVTC ownership and Banco BHD León stake

10

Investor Presentation

Third Quarter 2016

APPENDIX

Who We Are – Popular, Inc.

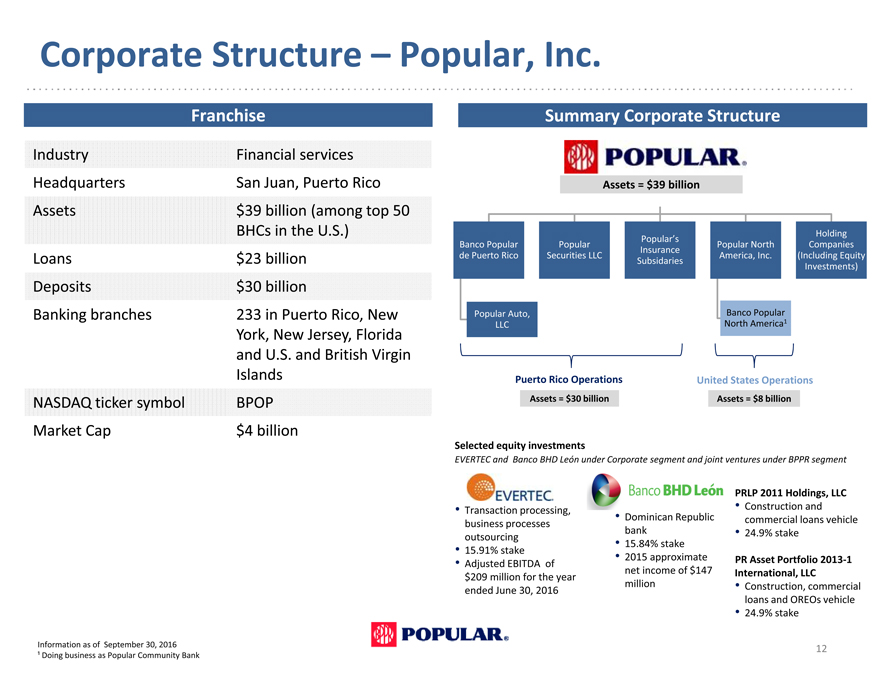

Corporate Structure – Popular, Inc.

Franchise

Industry Financial services

Headquarters San Juan, Puerto Rico

Assets $39 billion (among top 50

BHCs in the U.S.)

Loans $23 billion

Deposits $30 billion

Banking branches 233 in Puerto Rico, New

York, New Jersey, Florida

and U.S. and British Virgin

Islands

NASDAQ ticker symbol BPOP

Market Cap $4 billion

Summary Corporate Structure

Assets = $39 billion

Popular’s Holding

Banco Popular Popular Popular North Companies

Insurance

de Puerto Rico Securities LLC America, Inc.(Including Equity

Subsidaries Investments)

Popular Auto, Banco Popular

LLC North America1

Puerto Rico Operations United States Operations

Assets = $30 billion Assets = $8 billion

Selected equity investments

EVERTEC and Banco BHD León under Corporate segment and joint ventures under BPPR segment

PRLP 2011 Holdings, LLC

Transaction processing, Construction and

business processes • Dominican Republic commercial loans vehicle

bank • 24.9% stake

15.91% outsourcing stake 15.84% stake

• Adjusted EBITDA of • 2015 approximate PR Asset Portfolio 2013-1

$209 million for the year net income of $147 International, LLC

ended June 30, 2016 million • Construction, commercial

loans and OREOs vehicle

• 24.9% stake

Information as of September 30, 2016

¹ Doing business as Popular Community Bank

12

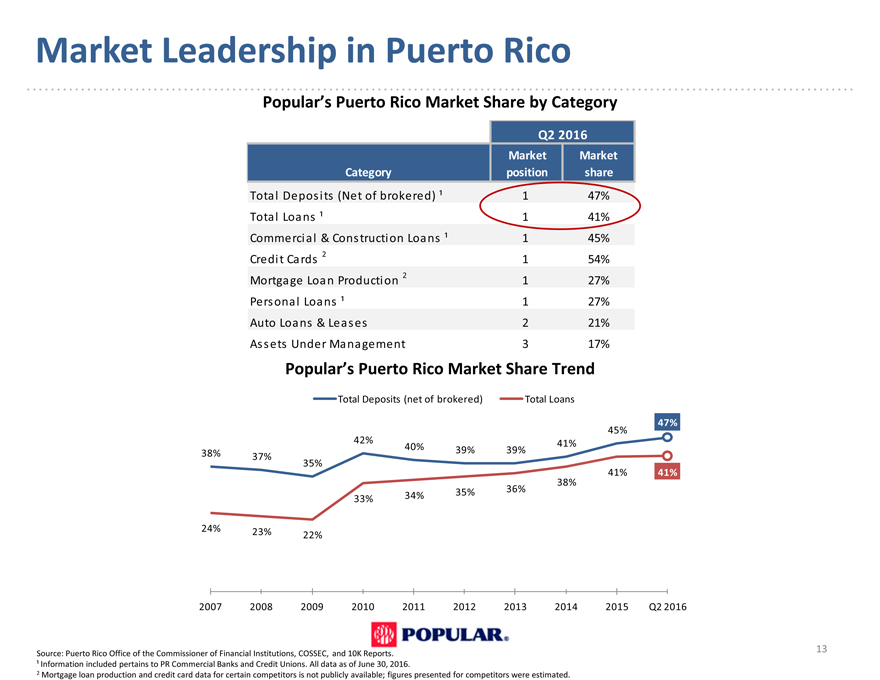

Market Leadership in Puerto Rico

Popular’s Puerto Rico Market Share by Category

Q2 2016

Market Market

Category position share

Total Deposits (Net of brokered) ¹ 1 47%

Total Loans ¹ 1 41%

Commercial & Construction Loans ¹ 1 45%

Credit Cards 2 1 54%

Mortgage Loan Production 2 1 27%

Personal Loans ¹ 1 27%

Auto Loans & Leases 2 21%

Assets Under Management 3 17%

Popular’s Puerto Rico Market Share Trend

Total Deposits (net of brokered) Total Loans

47%

45%

42%

40% 39% 39% 41%

38% 37%

35%

41% 41%

38%

36%

33% 34% 35%

24%

23% 22%

2007 2008 2009 2010 2011 2012 2013 2014 2015 Q2 2016

Source: Puerto Rico Office of the Commissioner of Financial Institutions, COSSEC, and 10K Reports. ¹ Information included pertains to PR Commercial Banks and Credit Unions. All data as of June 30, 2016.

2 Mortgage loan production and credit card data for certain competitors is not publicly available; figures presented for competitors were estimated.

13

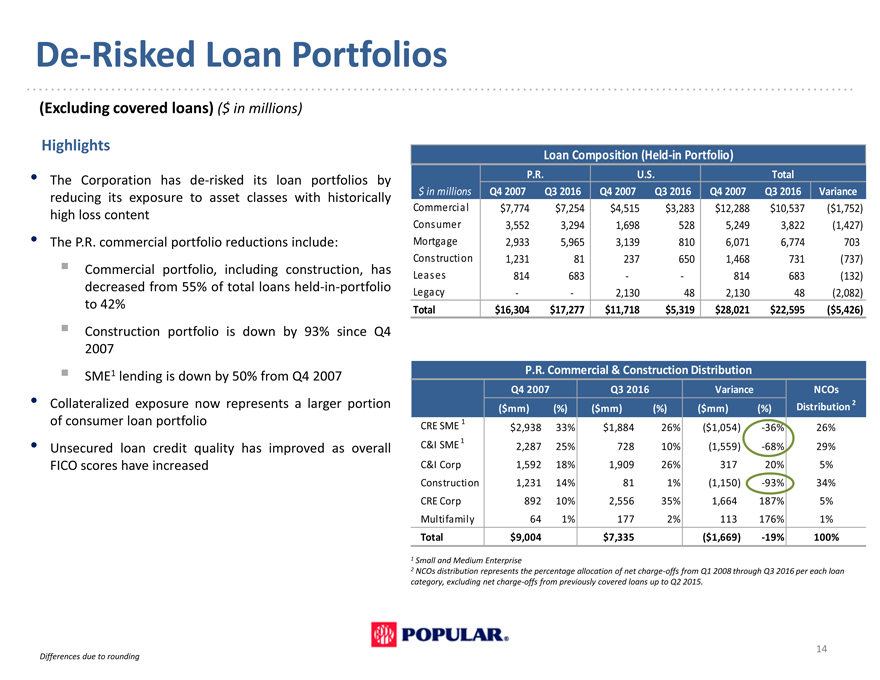

De-Risked Loan Portfolios

(Excluding covered loans) ($ in millions)

Highlights

The Corporation has de-risked its loan portfolios by reducing its exposure to asset classes with historically high loss content

The P.R. commercial portfolio reductions include: ? Commercial portfolio, including construction, has decreased from 55% of total loans held-in-portfolio to 42% ? Construction portfolio is down by 93% since Q4 2007 ? SME1 lending is down by 50% from Q4 2007

Collateralized exposure now represents a larger portion of consumer loan portfolio

Unsecured loan credit quality has improved as overall FICO scores have increased

Loan Composition (Held-in Portfolio)

P.R. U.S. Total

$ in millions Q4 2007 Q3 2016 Q4 2007 Q3 2016 Q4 2007 Q3 2016 Variance

Commercial $7,774 $7,254 $4,515 $3,283 $ 12,288 $ 10,537($1,752)

Consumer 3,552 3,294 1,698 528 5,249 3,822(1,427)

Mortgage 2,933 5,965 3,139 810 6,071 6,774 703

Construction 1,231 81 237 650 1,468 731(737)

Leases 814 683 — 814 683(132)

Legacy — 2,130 48 2,130 48(2,082)

Total $16,304 $17,277 $11,718 $5,319 $ 28,021 $ 22,595($5,426)

P.R. Commercial & Construction Distribution

Q4 2007 Q3 2016 Variance NCOs

($mm)(%)($mm)(%)($mm)(%) Distribution 2

CRE SME 1 $2,938 33% $1,884 26%($1,054) -36% 26%

C&I SME 1 2,287 25% 728 10%(1,559) -68% 29%

C&I Corp 1,592 18% 1,909 26% 317 20% 5%

Construction 1,231 14% 81 1%(1,150) -93% 34%

CRE Corp 892 10% 2,556 35% 1,664 187% 5%

Multifamily 64 1% 177 2% 113 176% 1%

Total $9,004 $7,335($1,669) -19% 100%

1 Small and Medium Enterprise

2 NCOs distribution represents the percentage allocation of net charge-offs from Q1 2008 through Q3 2016 per each loan category, excluding net charge-offs from previously covered loans up to Q2 2015.

Differences due to rounding

14

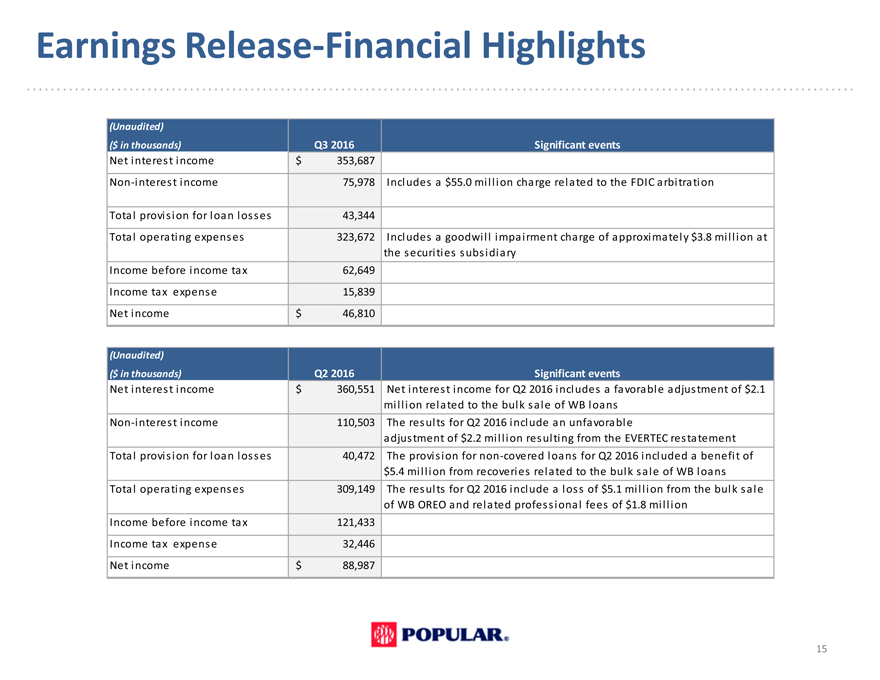

Earnings Release-Financial Highlights

(Unaudited)

($ in thousands) Q3 2016 Significant events

Net interest income $ 353,687

Non-interest income 75,978 Includes a $55.0 million charge related to the FDIC arbitration

Total provision for loan losses 43,344

Total operating expenses 323,672 Includes a goodwill impairment charge of approximately $3.8 million at

the securities subsidiary

Income before income tax 62,649

Income tax expense 15,839

Net income $ 46,810

(Unaudited)

($ in thousands) Q2 2016 Significant events

Net interest income $ 360,551 Net interest income for Q2 2016 includes a favorable adjustment of $2.1

million related to the bulk sale of WB loans

Non-interest income 110,503 The results for Q2 2016 include an unfavorable

adjustment of $2.2 million resulting from the EVERTEC restatement

Total provision for loan losses 40,472 The provision for non-covered loans for Q2 2016 included a benefit of

$5.4 million from recoveries related to the bulk sale of WB loans

Total operating expenses 309,149 The results for Q2 2016 include a loss of $5.1 million from the bulk sale

of WB OREO and related professional fees of $1.8 million

Income before income tax 121,433

Income tax expense 32,446

Net income $ 88,987

15

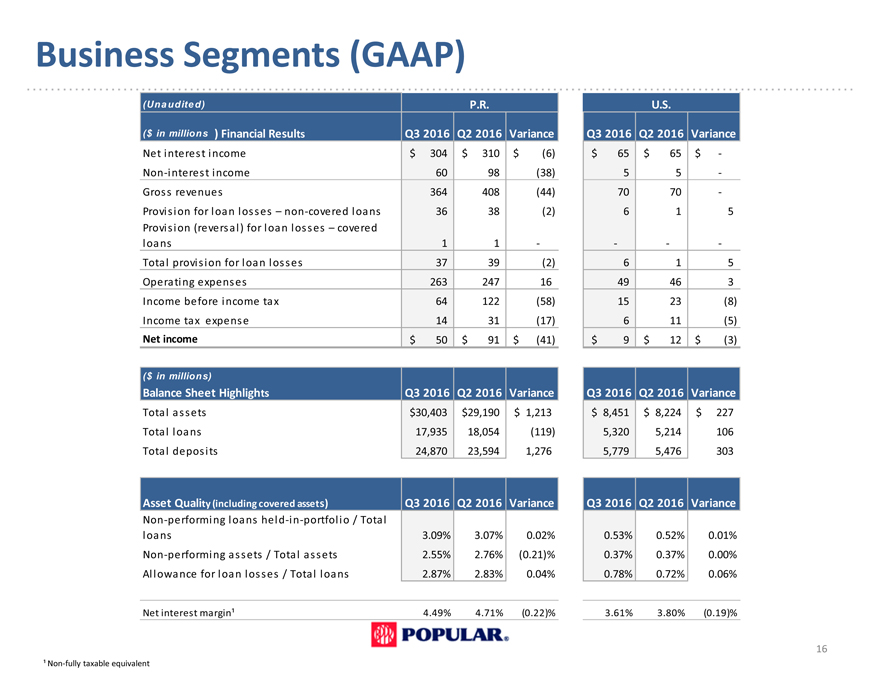

Business Segments (GAAP)

(Una udite d) P.R. U.S.

($ in millions ) Financial Results Q3 2016 Q2 2016 Variance Q3 2016 Q2 2016 Variance

Net interest income $ 304 $ 310 $(6) $ 65 $ 65 $ -

Non-interest income 60 98(38) 5 5 -

Gross revenues 364 408(44) 70 70 -

Provision for loan losses – non-covered loans 36 38(2) 6 1 5

Provision (reversal) for loan losses – covered

loans 1 1 — —

Total provision for loan losses 37 39(2) 6 1 5

Operating expenses 263 247 16 49 46 3

Income before income tax 64 122(58) 15 23(8)

Income tax expense 14 31(17) 6 11(5)

Net income $ 50 $ 91 $(41) $ 9 $ 12 $(3)

($ in millions)

Balance Sheet Highlights Q3 2016 Q2 2016 Variance Q3 2016 Q2 2016 Variance

Total assets $30,403 $29,190 $ 1,213 $ 8,451 $ 8,224 $ 227

Total loans 17,935 18,054(119) 5,320 5,214 106

Total deposits 24,870 23,594 1,276 5,779 5,476 303

Asset Quality (including covered assets) Q3 2016 Q2 2016 Variance Q3 2016 Q2 2016 Variance

Non-performing loans held-in-portfolio / Total

loans 3.09% 3.07% 0.02% 0.53% 0.52% 0.01%

Non-performing assets / Total assets 2.55% 2.76%(0.21)% 0.37% 0.37% 0.00%

Allowance for loan losses / Total loans 2.87% 2.83% 0.04% 0.78% 0.72% 0.06%

Net interest margin¹ 4.49% 4.71%(0.22)% 3.61% 3.80%(0.19)%

¹ Non-fully taxable equivalent

16

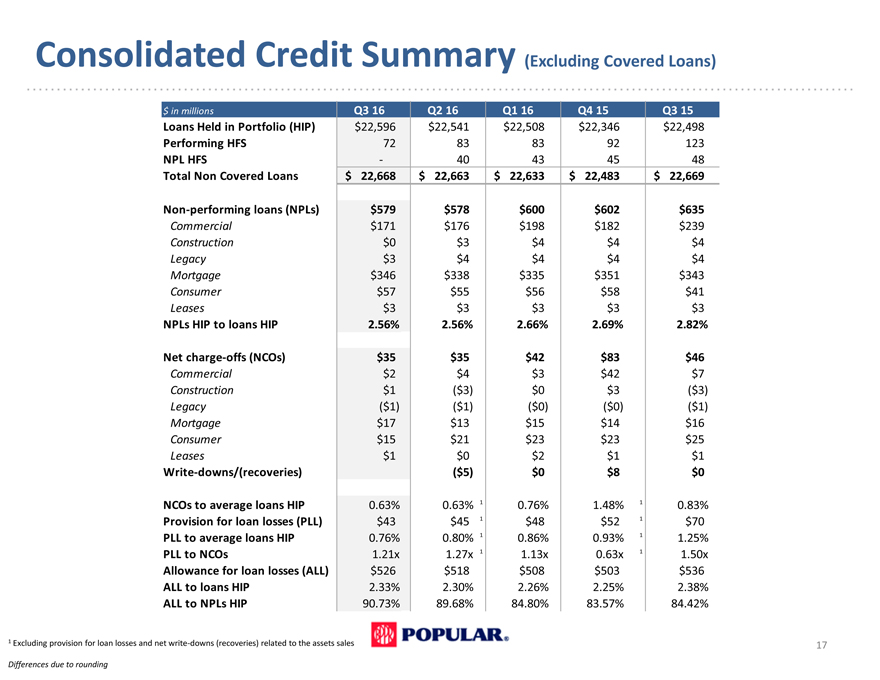

Consolidated Credit Summary (Excluding Covered Loans)

$ in millions Q3 16 Q2 16 Q1 16 Q4 15 Q3 15

Loans Held in Portfolio (HIP) $22,596 $22,541 $22,508 $22,346 $22,498

Performing HFS 72 83 83 92 123

NPL HFS—40 43 45 48

Total Non Covered Loans $ 22,668 $ 22,663 $ 22,633 $ 22,483 $ 22,669

Non-performing loans (NPLs) $579 $578 $600 $602 $635

Commercial $171 $176 $198 $182 $239

Construction $0 $3 $4 $4 $4

Legacy $3 $4 $4 $4 $4

Mortgage $346 $338 $335 $351 $343

Consumer $57 $55 $56 $58 $41

Leases $3 $3 $3 $3 $3

NPLs HIP to loans HIP 2.56% 2.56% 2.66% 2.69% 2.82%

Net charge-offs (NCOs) $35 $35 $42 $83 $46

Commercial $2 $4 $3 $42 $7

Construction $1($3) $0 $3($3)

Legacy($1)($1)($0)($0)($1)

Mortgage $17 $13 $15 $14 $16

Consumer $15 $21 $23 $23 $25

Leases $1 $0 $2 $1 $1

Write-downs/(recoveries)($5) $0 $8 $0

NCOs to average loans HIP 0.63% 0.63% 1 0.76% 1.48% 1 0.83%

Provision for loan losses (PLL) $43 $45 1 $48 $52 1 $70

PLL to average loans HIP 0.76% 0.80% 1 0.86% 0.93% 1 1.25%

PLL to NCOs 1.21x 1.27x 1 1.13x 0.63x 1 1.50x

Allowance for loan losses (ALL) $526 $518 $508 $503 $536

ALL to loans HIP 2.33% 2.30% 2.26% 2.25% 2.38%

ALL to NPLs HIP 90.73% 89.68% 84.80% 83.57% 84.42%

1 Excluding provision for loan losses and net write-downs (recoveries) related to the assets sales

Differences due to rounding

17

FDIC Loss Share Asset

Composition of FDIC Loss Share Asset

$900 ($ in millions)

$798 $800

$713 $700 $636

$600 $542

$500

$410 $393 $400

$312 $310 $300

$219 $214 $200 $152

$65 $100 $87

$-

FDIC LSA FDIC LSA FDIC LSA FDIC LSA FDIC LSA FDIC LSA FDIC LSA FDIC LSA FDIC LSA FDIC LSA FDIC LSA Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Q2 15 Q3 15 Q4 15 Q1 16 Q2 16 Q3 16

Single family FDIC LSA Commercial FDIC LSA Claims in Dispute

18

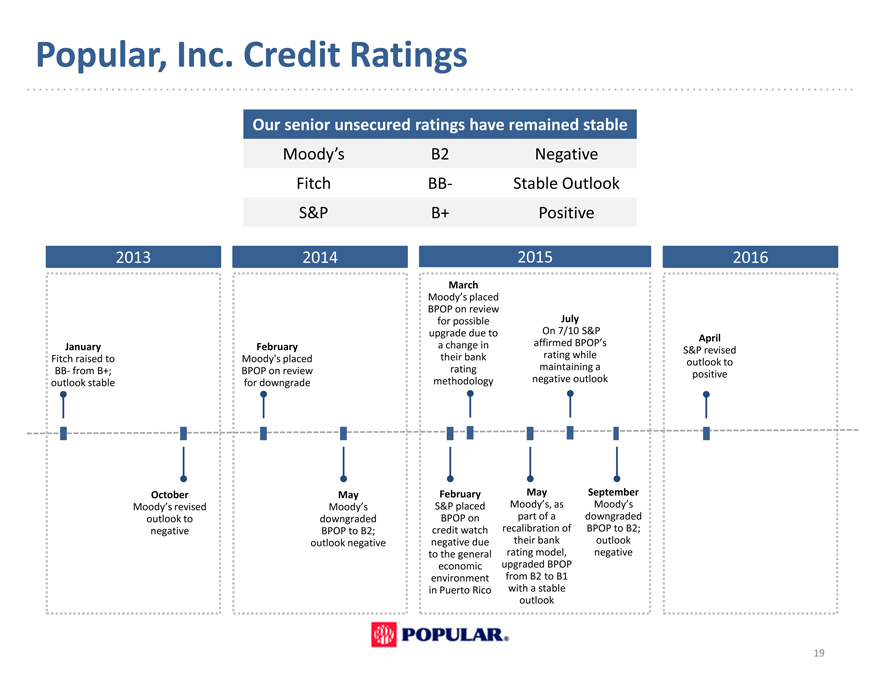

Popular, Inc. Credit Ratings

Our senior unsecured ratings have remained stable

Moody’s B2 Negative Fitch BB- Stable Outlook S&P B+ Positive

2013 2014 2015 2016

March

Moody’s placed

BPOP on review for possible July upgrade due to On 7/10 S&P

April January February a change in affirmed BPOP’s

S&P revised Fitch raised to Moody’s placed their bank rating while outlook to BB- from B+; BPOP on review rating maintaining a positive outlook stable for downgrade methodology negative outlook

October May February May September

Moody’s revised Moody’s S&P placed Moody’s, as Moody’s outlook to downgraded BPOP on part of a downgraded negative BPOP to B2; credit watch recalibration of BPOP to B2; outlook negative negative due their bank outlook to the general rating model, negative economic upgraded BPOP environment from B2 to B1 in Puerto Rico with a stable outlook

19

Investor Presentation

Third Quarter 2016