Exhibit 13.1

20 ANNUAL REPORT 17 INFORME ANUAL

CONTENTS I NDICE Letter from the Executive Chairman. 1 Letter from the President & Chief Executive Officer . 2 25-Year Historical Financial Summary .6 Management & Board of Directors. 8 Carta del Presidente Ejecutivo de la Junta de Directores. 9 Carta del Presidente y Principal Oficial Ejecutivo. 10 Resumen Financiero Historico (25 anos) . 14 Gerencia y Junta de Directores . 16 Popular, Inc. (NASDAQ:BPOP) is a Popular, Inc. (NASDAQ:BPOP) es un full-service financial provider based in proveedor de servicios financieros con Puerto Rico, with operations in Puerto sede en Puerto Rico y operaciones en Rico, the Virgin Islands and the Puerto Rico, Islas VI rgenes y Estados United States. In Puerto Rico, Popular Unidos. En Puerto Rico es la institucion is the leading banking institution, by bancaria lI der, tanto en activos como both assets and deposits, and ranks en depositos, y se encuentra entre los among the largest 50 banks in the 50 bancos m s grandes de Estados U.S. by assets. Unidos por total de activos. CORPORATE INFORMATION INFORMACION CORPORATIVA Independent Registered Public Firma registrada de Contabilidad Accounting Firm: Publica Independiente: PricewaterhouseCoopers LLP PricewaterhouseCoopers LLP The company s Form 10-K, proxy El Formulario 10-K, el proxy y statement and any other financial otra informaciOn financiera est n information is available on disponibles en popular.com/en/ popular.com/ investor-relations/annual-reports/ accionistas/informe-anual/ ANNUAL MEETING REUNION ANUAL The 2018 Annual Stockholders La ReuniOn Anual de Accionistas 2018 Meeting of Popular, Inc. will be held de Popular, Inc., se llevara a cabo el on Tuesday, May 8, at 9:00 a.m. at martes, 8 de mayo, a las 9:00 a.m. the penthouse of the Popular Center en el piso PH de Popular Center, San Building, San Juan, Puerto Rico. Juan, Puerto Rico.

After 26 years as Popular s CEO, in July of 2017 I assumed the position of Executive Chairman and was proud to see my colleague and friend, Ignacio Alvarez, named as the new CEO by the Board of Directors. Serving as the CEO for over two decades has undoubtedly been one of the most While I have officially rewarding experiences of my life. It is immensely gratifying to see an organization been a part of Popular that is not only financially strong, but that remains committed to fulfilling the for 41 years, Popular has needs of our customers, caring for our employees and taking an active role in the been, and will be, a part communities we serve. The values that have guided us since our beginnings 125 years ago are stronger than ever today, and it fills me with pride that Popular is, of me for my entire life. particularly in Puerto Rico, a symbol of excellence and progress. I am grateful to all my colleagues for being a constant source of inspiration, to our clients for their trust and to you, fellow shareholders, for your support throughout all of these years. With Popular on a solid position, the time was right for both Ignacio and me to assume our new roles. Since he joined Popular in 2010 as General Counsel, and more recently as President and COO, Ignacio demonstrated he has the experience, the skills and the vision to lead this organization. It is a privilege for me to continue serving Popular from a different position and it is exciting to collaborate with Ignacio and his team as they take Popular into the future. The vision and the strategy are clear, and the energy is evident. While I have officially been a part of Popular for 41 years, Popular has been, and will be, a part of me for my entire life. From a special vantage point, I have witnessed this organization thrive during good times and persevere and strengthen in challenging ones. The response of all our colleagues in the aftermath of the 2017 s hurricanes is the most recent example of the spirit that makes Popular a successful, and unique organization. I am confident that Popular s best days lie ahead. Sincerely, RICHARD L. CARRION Executive Popular, Inc. Chairman 2017 ANNUAL REPORT | 1

POPULAR, YEAR IN REVIEW INC. Dear Shareholders, It is an honor to provide my first annual compared to $358 million in the approximately $1.5 billion in retail auto shareholder update as Popular s CEO, a previous year. The adjusted results for loans and $340 million in commercial position that I was privileged to assume 2017 were adversely affected by the loans. We anticipate the transaction in July of 2017. impact of the hurricanes on provision, to close during the second quarter of revenues and expenses, which totaled 2018 and be accretive to earnings. I am grateful and humbled by the $73 million, net of income tax, and a confidence the Board of Directors and $38 million loan loss provision expense, Despite concerns about Puerto Rico s Richard have placed in me. Richard is in net of income tax, related to our taxi economic and fiscal situation, for the many ways the founder of the modern medallion portfolio in the U.S. acquired first nine months of 2017, the price of Popular, helping it evolve during his in 2015 as part of the Doral transaction. Popular s shares roughly correlated tenure as CEO from a much smaller bank to the movement of the U.S. KBW in Puerto Rico to a diversified financial Credit quality remained stable during Regional Bank Index, albeit with a services institution that currently ranks 2017. In Puerto Rico, our credit metrics higher volatility. However, the price of among the top 50 in the United States. for the first eight months of the year our share was severely affected by the were stable despite a weak economy. impact of Hurricane Maria, closing the As everyone knows, 2017 was an eventful Year-end results include the effect year at $35.49, 19% lower than 2016 year for Popular and for Puerto Rico. of the loan payment moratorium and below our U.S. Peers and the KBW Barely three months after I became CEO, granted to consumer and commercial Regional Bank Index. Nevertheless, this two major hurricanes, Irma and Maria, borrowers after the hurricanes, which performance compared favorably to struck the Virgin Islands and Puerto Rico paused in ows into delinquent status. other Puerto Rican banks. I am happy in the span of two weeks, leaving a trail In our U.S. operation, excluding the to report that our share price has of destruction in their wake. Throughout impact of the taxi medallion portfolio, increased 21% through the first eight this difficult period, we demonstrated the asset quality remained strong. weeks of 2018. power and resilience of our organization by continuing to serve our clients in an During the first quarter of 2017, we incredibly challenging environment. executed a series of actions that re ect We mobilized to restore the strength of our capital position. operations, support In 2017, we achieved net income of $108 We increased the quarterly common million, compared with $217 million in stock dividend from $0.15 per share our colleagues in need 2016. Our 2017 results include a $168 to $0.25 per share and completed the and assist the most million expense related to the impact of repurchase of $75 million in common affected communities. the U.S. tax reform on the deferred tax stock. Our capital base remains strong, asset (DTA) of our U.S. operation. Net closing the year with a Common Equity The hurricanes devastated critical income in 2016 included, among other Tier 1 ratio of 16.3%. infrastructure, leaving the entire significant items, the effects of two population without access to electricity, adverse arbitration awards related to In February 2018, we announced an agreement to acquire and assume from water and telecommunications in claims made by us under the commercial its aftermath. Further complicating loss-share agreement with the FDIC, as Reliable Financial Services, Inc. and Reliable Finance Holding Company, matters, the severe damage to roads receiver for Westernbank, which resulted and the scarcity of fuel delayed initial in an expense of $131 million, net of tax. both subsidiaries of Wells Fargo & Company, certain assets and liabilities recovery efforts and hindered the After adjusting for the impact of related to Wells Fargo s auto finance supply of basic necessities such as these items, among others, adjusted business in Puerto Rico. As part of food, medicines and drinking water. net income for 2017 was $276 million, the transaction, Popular will acquire Against this backdrop, as soon as 2 | POPULAR, INC.

it was safe, we mobilized to restore severe damages, and we accelerated operations, support our colleagues the payout of the annual statutory in need and assist the most affected Christmas bonus to employees in communities. Puerto Rico and the U.S. and British Virgin Islands. In Puerto Rico, cash became in many cases the only viable payment method We also mobilized quickly to help due to the impact that the lack of severely impacted communities by In Puerto Rico, our electricity and telecommunications launching the Embracing Puerto Rico had on the point-of-sale (POS) and fund, which today has commitments deposit balances automatic teller machines (ATMs) of more than $6 million, including our increased by $4.3B networks. To help stabilize the situation, initial contribution of $1 million. We are and our customer we provided access to cash and other grateful for the generous donations of base by close to 31K. essential banking services through our many business partners and friends ATM and branch network as quickly that enabled us to deliver immediate as possible. Despite many operational relief to the areas most affected by the transformation of our retail network challenges, thanks to the remarkable disaster. The fund, which is managed with the renovation or relocation of efforts of our colleagues, we opened by our foundation, FundaciOn Banco eight branches, which has helped the first branches within 72 hours of Popular, is now focused on helping spur branch deposit growth. Hurricane Maria s landfall. Thereafter, community-based organizations implement innovative solutions to pressing We continued making headway the number of branches and ATMs social problems. in simplifying our technology in operation increased consistently, infrastructure and migrating trans-reaching 124 or 74% and 333 or 52%, While much of the discussion of 2017 actions to digital channels to achieve respectively, within four weeks of the naturally centers on the hurricanes, greater efficiencies and deliver storm s passing. In addition, as owners of the most extensive ATM network the year also included other important a superior customer experience. accomplishments: Digital deposit transactions sur-on the Island, we waived all ATM fees passed 40% of total deposits in both for several weeks after the storm to Puerto Rico and the United States. In Puerto Rico, we continued all customers, including those of other financial institutions. On the credit side, to improve our leading market position. Notwithstanding the pro- We also expanded our efforts to we provided relief to our customers tracted economic recession and attract, develop and retain the best by offering a principal and interest the effects of the hurricanes, our talent in the markets we serve. payment moratorium on residential, deposit balances increased by $4.3 We launched and strengthened consumer and commercial loans and billion and our customer base by initiatives in areas such as training, waived late payment fees, close to 31,000. We also achieved diversity and inclusion and wellness. . growth in several portfolios, such as commercial loans and auto loans. We look forward to 2018, aware of At the same time, we made it a priority the challenges, but ready to seize to take care of our colleagues during In the United States, we grew opportunities that will undoubtedly this difficult time. Among many commercial loans by 16%, launched arise. The Puerto Rico economy remains initiatives, we increased the Employee a private banking initiative, and the most significant headwind we Emergency Fund to offer financial strengthened our mortgage face. An environment that was already assistance to those who suffered origination unit. We continued the extremely complex due to the fiscal and 2017 ANNUAL REPORT | 3

POPULAR, YEAR IN REVIEW INC. public debt situation has become even hurricanes. We now have a unique more challenging after the hurricanes. opportunity to make significant Fit for the Future Strengthening our foundation Processes that were already underway changes in areas such as energy, by attracting and developing will have to be adjusted to re ect the housing, health and education. As our talent around the post-hurricane reality. the leading financial institution on the Island, Popular is ready to play capabilities needed for the future and enhancing In the months following the hurricanes, an important role, as we have done our internal controls to economic activity was inevitably throughout our history, in efforts to effectively manage risks impacted mainly due to delays in the build a stronger and more sustainable restoration of electricity in Puerto Rico. Puerto Rico. This framework ensures that we Nevertheless, we are heartened to consistently balance our focus between see signs that the economic situation Our U.S. business continues to be present and future needs, and helps us on the Island has begun to stabilize, strategically important to Popular identify the necessary steps to achieve with several metrics such as our as the main source of diversification our strategic goals. customers debit card purchases and of risk, expansion of revenues, and auto sales returning to pre-storm potential growth. We remain focused I take this opportunity to express levels. There has also been a great deal on diversifying our loan portfolio, my gratitude to our Board of of discussion of an acceleration of out- strengthening our deposit franchise, Directors and my colleagues for their migration after the hurricanes. While driving fee income, and transforming extraordinary response to the crisis the increase is undeniable, estimates our retail network. brought about by the hurricanes. vary considerably, and it still is unclear Managing responsibilities at Popular how many of those who have left the In December 2017, we unveiled a new while tending to difficult situations in Island will eventually return as the strategic framework founded on a their home, our employees in Puerto situation continues to stabilize. In the vision to deliver an excellent customer Rico and the U.S. and British Virgin end, the solution to the migration issue experience by offering financial Islands responded heroically, and we is to accelerate economic growth in solutions in a simple way. This vision is could not have achieved what we did Puerto Rico. supported by four strategic pillars: without their dedication and hard work. The support of our colleagues The pace of economic recovery will in the mainland United States was be heavily dependent on the speed of Sustainable and Profitable Growth also very important throughout those the remaining power restoration and Identifying sustainable trying months. on the magnitude and timing of funds and profitable growth owing into Puerto Rico from federal opportunities I also want to thank N stor O. Rivera, agencies and insurance companies. former head of the Retail Banking Simplicity These funds, which are estimated to Group, who retired in 2017 after a Simplifying our company exceed $25 billion, are likely to have a by streamlining our long and successful career at Popular stimulative effect on the economy on processes and technological spanning close to 50 years. N stor s the short to medium term. platform to reduce costs legacy will endure, as he worked to grow our Puerto Rico branch network, Puerto Rico s longer-term economic Customer Focus helped shape Popular s technology prospects will hinge on the decisions Creating a customer- strategy and mentored generations of regarding Puerto Rico s rebuilding. The focused service culture with leaders who learned the importance of a consistent experience Island was facing serious structural our values and organizational culture across channels problems before the impact of the through his counsel and example. Luis 4 | POPULAR, INC.

Cestero, who joined Popular in 1995 and has close to 20 years of experience in the Retail Banking Group, assumed leadership of this group after Nestor s retirement. Luis has proven his deep knowledge of the business, and, more importantly, has demonstrated strong leadership skills, earning the respect of everyone around him. Popular is today a much stronger organization than it was before the 2017 hurricanes. We worked as a team, adapted to change, developed creative solutions and responded decisively. We demonstrated all that we can achieve when we have a shared purpose. We begin 2018, year in which we celebrate our 125th anniversary, committed to preserving the spirit and the attitudes that allowed us to not only face 2017 s challenges, but to become a better organization as a result of them. We do not need a crisis to show our very best. Our colleagues, our customers, our communities and our shareholders expect, deserve and will get our best, every day. Sincerely, IGNACIO ALVAREZ President and Chief Executive Popular, Officer Inc. CLIENTS,COLLEAGUES COMMITTED TO OUR AND COMMUNITIES In September 2017, Puerto Rico and the Virgin Islands suffered the catastrophic impact of two major hurricanes in the span of two weeks, destroying structures, devastating the natural landscape and leaving entire populations without access to electricity, water, telecommunications, medical services and basic supplies. Popular demonstrated its unwavering commitment to its clients, employees and communities, rapidly restoring access to banking services and reaching out to those who needed it most. Our Customers Wellness and support Access to cash and other basic banking Distributed water, food vouchers and services despite operational challenges packages with basic supplies to Operating 31% of branches and 24% of employees in need. ATMs one week after Hurricane Maria; Established childcare centers for reached 92% and 82%, respectively, employees children in our main by year-end. buildings. Reestablished call center operations Temporarily lifted restrictions in the on September; resumed 24/7 service medical insurance plan to ensure care on October 23. in urgent cases, extended our On Site Offered uninterrupted online and Health and Wellness Center services mobile banking services. to employees dependents and coordinated specialized programs to address emotional aspects. Relief and support Implemented a payment moratorium for credit cards, personal OUR COMMUNITIES loans, auto loans and mortgages. Embracing Puerto Rico Waived ATM fees for 25 days to our Established the Embracing Puerto customers and customers of other Rico fund with an initial contribution financial institutions. of $1 million; has reached $6.1 million in Opened seven hubs across the island commitments. to offer commercial clients work Completed 34 missions to distribute spaces with Internet access. over 800k pounds of basic provisions, Offered customers and the general impacting over 140k individuals public guidance on insurance and FEMA claims processes. Currently focused on projects that will stabilize communities by providing OUR PEOPLE access to clean water, solar energy and jump-starting Puerto Rico s economic Financial Assistance recovery. Increased the Employee Emergency Supported various initiatives, such Fund and deployed over $800k to as United for Puerto Rico and Somos employees who suffered major losses. Una Voz. Advanced payroll the week of the We are moving into a new phase of hurricane and accelerated the payout actions, centered on transitioning our of the Christmas bonus. communities across the Island into Offered bank-owned properties to long-term recovery. colleagues who needed housing.

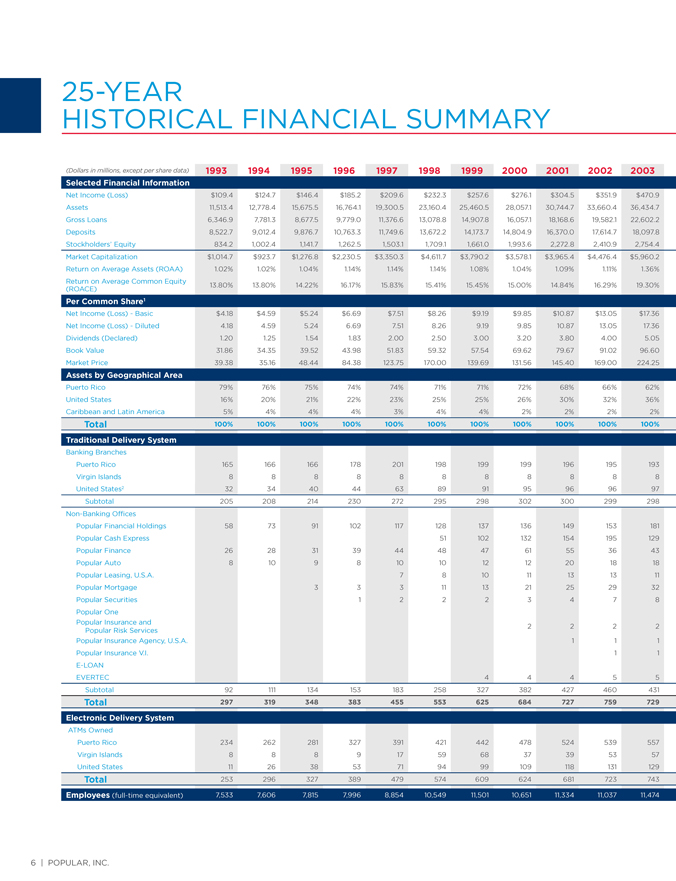

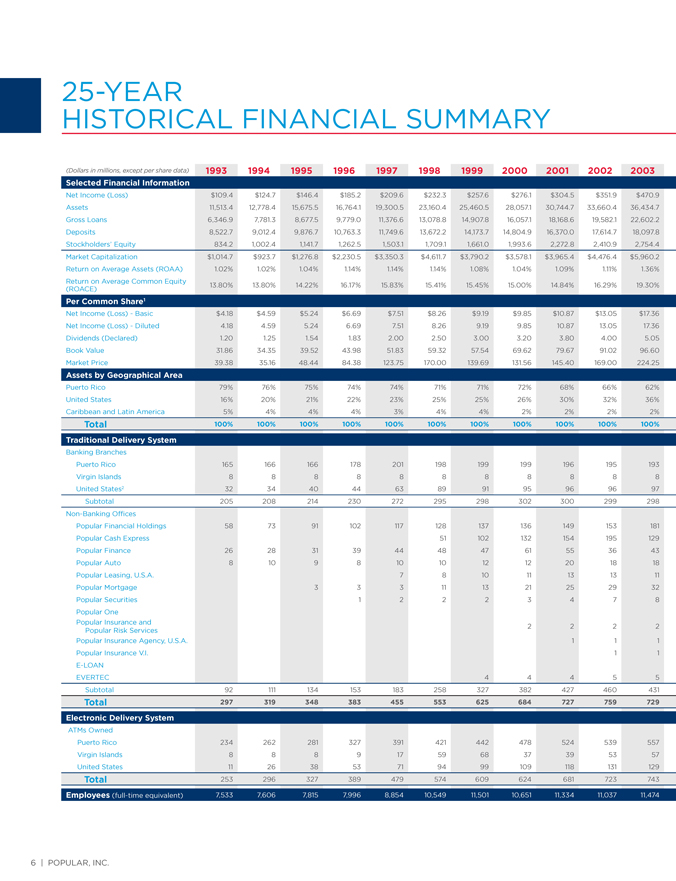

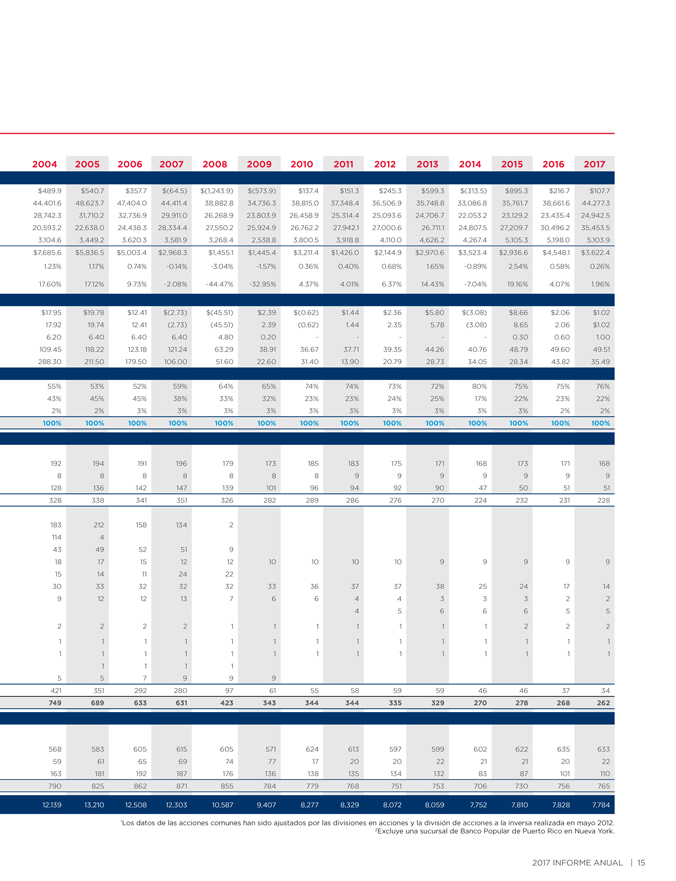

HISTORICAL 25-YEAR FINANCIAL SUMMARY (Dollars in millions, except per share data) 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 Selected Financial Information Net Income (Loss) $109.4 $124.7 $146.4 $185.2 $209.6 $232.3 $257.6 $276.1 $304.5 $351.9 $470.9 Assets 11,513.4 12,778.4 15,675.5 16,764.1 19,300.5 23,160.4 25,460.5 28,057.1 30,744.7 33,660.4 36,434.7 Gross Loans 6,346.9 7,781.3 8,677.5 9,779.0 11,376.6 13,078.8 14,907.8 16,057.1 18,168.6 19,582.1 22,602.2 Deposits 8,522.7 9,012.4 9,876.7 10,763.3 11,749.6 13,672.2 14,173.7 14,804.9 16,370.0 17,614.7 18,097.8 Stockholders Equity 834.2 1,002.4 1,141.7 1,262.5 1,503.1 1,709.1 1,661.0 1,993.6 2,272.8 2,410.9 2,754.4 Market Capitalization $1,014.7 $923.7 $1,276.8 $2,230.5 $3,350.3 $4,611.7 $3,790.2 $3,578.1 $3,965.4 $4,476.4 $5,960.2 Return on Average Assets (ROAA) 1.02% 1.02% 1.04% 1.14% 1.14% 1.14% 1.08% 1.04% 1.09% 1.11% 1.36% Return on Average Common Equity 13.80% 13.80% 14.22% 16.17% 15.83% 15.41% 15.45% 15.00% 14.84% 16.29% 19.30% (ROACE) Per Common Share1 Net Income (Loss)—Basic $4.18 $4.59 $5.24 $6.69 $7.51 $8.26 $9.19 $9.85 $10.87 $13.05 $17.36 Net Income (Loss)—Diluted 4.18 4.59 5.24 6.69 7.51 8.26 9.19 9.85 10.87 13.05 17.36 Dividends (Declared) 1.20 1.25 1.54 1.83 2.00 2.50 3.00 3.20 3.80 4.00 5.05 Book Value 31.86 34.35 39.52 43.98 51.83 59.32 57.54 69.62 79.67 91.02 96.60 Market Price 39.38 35.16 48.44 84.38 123.75 170.00 139.69 131.56 145.40 169.00 224.25 Assets by Geographical Area Puerto Rico 79% 76% 75% 74% 74% 71% 71% 72% 68% 66% 62% United States 16% 20% 21% 22% 23% 25% 25% 26% 30% 32% 36% Caribbean and Latin America 5% 4% 4% 4% 3% 4% 4% 2% 2% 2% 2% Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% Traditional Delivery System Banking Branches Puerto Rico 165 166 166 178 201 198 199 199 196 195 193 Virgin Islands 8 8 8 8 8 8 8 8 8 8 8 United States2 32 34 40 44 63 89 91 95 96 96 97 Subtotal 205 208 214 230 272 295 298 302 300 299 298 Non-Banking Offices Popular Financial Holdings 58 73 91 102 117 128 137 136 149 153 181 Popular Cash Express 51 102 132 154 195 129 Popular Finance 26 28 31 39 44 48 47 61 55 36 43 Popular Auto 8 10 9 8 10 10 12 12 20 18 18 Popular Leasing, U.S.A. 7 8 10 11 13 13 11 Popular Mortgage 3 3 3 11 13 21 25 29 32 Popular Securities 1 2 2 2 3 4 7 8 Popular One Popular Insurance and 2 2 2 2 Popular Risk Services Popular Insurance Agency, U.S.A. 1 1 1 Popular Insurance V.I. 1 1 E-LOAN EVERTEC 4 4 4 5 5 Subtotal 92 111 134 153 183 258 327 382 427 460 431 Total 297 319 348 383 455 553 625 684 727 759 729 Electronic Delivery System ATMs Owned Puerto Rico 234 262 281 327 391 421 442 478 524 539 557 Virgin Islands 8 8 8 9 17 59 68 37 39 53 57 United States 11 26 38 53 71 94 99 109 118 131 129 Total 253 296 327 389 479 574 609 624 681 723 743 Employees (full-time equivalent) 7,533 7,606 7,815 7,996 8,854 10,549 11,501 10,651 11,334 11,037 11,474 6 | POPULAR, INC.

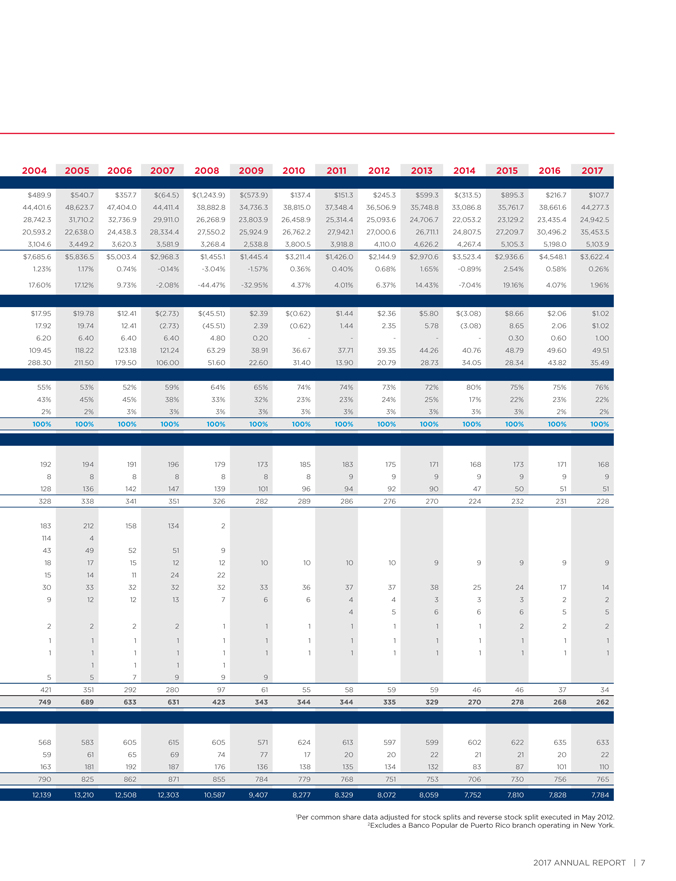

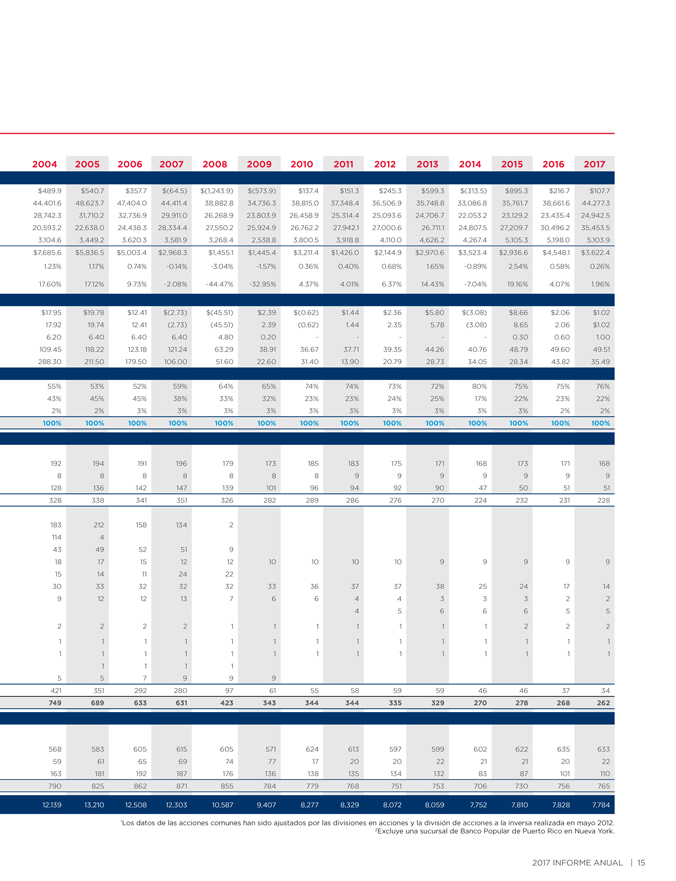

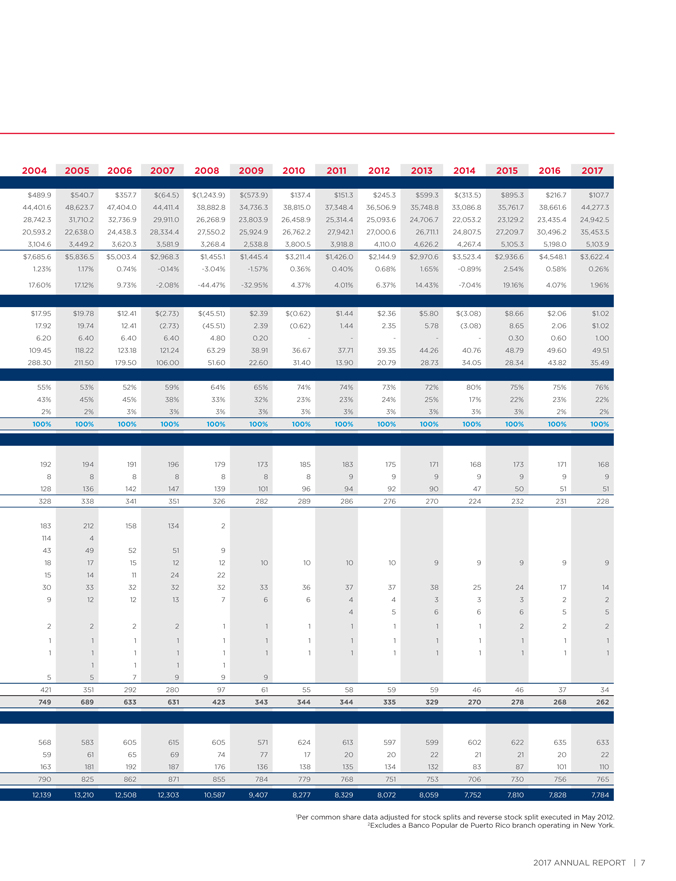

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 $489.9 $540.7 $357.7 $(64.5) $(1,243.9) $(573.9) $137.4 $151.3 $245.3 $599.3 $(313.5) $895.3 $216.7 $107.7 44,401.6 48,623.7 47,404.0 44,411.4 38,882.8 34,736.3 38,815.0 37,348.4 36,506.9 35,748.8 33,086.8 35,761.7 38,661.6 44,277.3 28,742.3 31,710.2 32,736.9 29,911.0 26,268.9 23,803.9 26,458.9 25,314.4 25,093.6 24,706.7 22,053.2 23,129.2 23,435.4 24,942.5 20,593.2 22,638.0 24,438.3 28,334.4 27,550.2 25,924.9 26,762.2 27,942.1 27,000.6 26,711.1 24,807.5 27,209.7 30,496.2 35,453.5 3,104.6 3,449.2 3,620.3 3,581.9 3,268.4 2,538.8 3,800.5 3,918.8 4,110.0 4,626.2 4,267.4 5,105.3 5,198.0 5,103.9 $7,685.6 $5,836.5 $5,003.4 $2,968.3 $1,455.1 $1,445.4 $3,211.4 $1,426.0 $2,144.9 $2,970.6 $3,523.4 $2,936.6 $4,548.1 $3,622.4 1.23% 1.17% 0.74% -0.14% -3.04% -1.57% 0.36% 0.40% 0.68% 1.65% -0.89% 2.54% 0.58% 0.26% 17.60% 17.12% 9.73% -2.08% -44.47% -32.95% 4.37% 4.01% 6.37% 14.43% -7.04% 19.16% 4.07% 1.96% $17.95 $19.78 $12.41 $(2.73) $(45.51) $2.39 $(0.62) $1.44 $2.36 $5.80 $(3.08) $8.66 $2.06 $1.02 17.92 19.74 12.41 (2.73) (45.51) 2.39 (0.62) 1.44 2.35 5.78 (3.08) 8.65 2.06 $1.02 6.20 6.40 6.40 6.40 4.80 0.20 ————— 0.30 0.60 1.00 109.45 118.22 123.18 121.24 63.29 38.91 36.67 37.71 39.35 44.26 40.76 48.79 49.60 49.51 288.30 211.50 179.50 106.00 51.60 22.60 31.40 13.90 20.79 28.73 34.05 28.34 43.82 35.49 55% 53% 52% 59% 64% 65% 74% 74% 73% 72% 80% 75% 75% 76% 43% 45% 45% 38% 33% 32% 23% 23% 24% 25% 17% 22% 23% 22% 2% 2% 3% 3% 3% 3% 3% 3% 3% 3% 3% 3% 2% 2% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 192 194 191 196 179 173 185 183 175 171 168 173 171 168 8 8 8 8 8 8 8 9 9 9 9 9 9 9 128 136 142 147 139 101 96 94 92 90 47 50 51 51 328 338 341 351 326 282 289 286 276 270 224 232 231 228 183 212 158 134 2 114 4 43 49 52 51 9 18 17 15 12 12 10 10 10 10 9 9 9 9 9 15 14 11 24 22 30 33 32 32 32 33 36 37 37 38 25 24 17 14 9 12 12 13 7 6 6 4 4 3 3 3 2 2 4 5 6 6 6 5 5 2 2 2 2 1 1 1 1 1 1 1 2 2 2 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 5 5 7 9 9 9 421 351 292 280 97 61 55 58 59 59 46 46 37 34 749 689 633 631 423 343 344 344 335 329 270 278 268 262 568 583 605 615 605 571 624 613 597 599 602 622 635 633 59 61 65 69 74 77 17 20 20 22 21 21 20 22 163 181 192 187 176 136 138 135 134 132 83 87 101 110 790 825 862 871 855 784 779 768 751 753 706 730 756 765 12,139 13,210 12,508 12,303 10,587 9,407 8,277 8,329 8,072 8,059 7,752 7,810 7,828 7,784 1Per common share data adjusted for stock splits and reverse stock split executed in May 2012. 2Excludes a Banco Popular de Puerto Rico branch operating in New York. 2017 ANNUAL REPORT | 7

POPULAR, INC. MANAGEMENT & BOARD OF DIRECTORS Senior Management Team RICHARD L. CARRION IGNACIO ALVAREZ CAMILLE BURCKHART LUIS CESTERO MANUEL A. CHINEA JAVIER D. FERRER Executive Chairman President and Executive Vice President & Executive Vice President Executive Vice President Executive Vice President, Chief Legal Popular, Inc. Chief Executive Officer Chief Information and Digital Officer Retail Banking Group Popular, Inc. Officer & Corporate Secretary Popular, Inc. Innovation, Technology & Banco Popular de Puerto Rico Chief Operating Officer General Counsel & Operations Group Popular Community Bank Corporate Matters Group Popular, Inc. Popular, Inc. JUAN O. GUERRERO GILBERTO MONZON EDUARDO J. NEGRON ELI S. SEP LVEDA LIDIO V. SORIANO CARLOS J. VAZQUEZ Executive Vice President Executive Vice President Executive Vice President Executive Vice President Executive Vice President & Executive Vice President & Financial and Insurance Individual Credit Group Administration Group Commercial Credit Group Chief Risk Officer Chief Financial Officer Services Group Banco Popular de Puerto Rico Popular, Inc. Banco Popular de Puerto Rico Corporate Risk Management Group Popular, Inc. Banco Popular de Puerto Rico Popular, Inc. Board of Directors RICHARD L. CARRION IGNACIO ALVAREZ JOAQUI N E. ALEJANDRO M. JOHN W. DIERCKSEN MARI A LUISA FERR Executive Chairman President and BACARDI , III BALLESTER Principal President & Chief Executive Officer Popular, Inc. Chief Executive Officer Chairman President Greycrest, LLC FRG, Inc. Popular, Inc. Edmundo B. Fernandez, Inc. Ballester Hermanos, Inc. DAVID E. GOEL C. KIM GOODWIN WILLIAM J. CARLOS A. UNANUE Managing General Partner Private Investor TEUBER JR. President Matrix Capital Private Investor Goya de Puerto Rico Management Company, LP

Despu s de 26 anos como CEO de Popular, en julio del 2017 asumI el cargo de Presidente Ejecutivo de la Junta de Directores y me llenO de orgullo ver a mi companero y amigo, Ignacio Alvarez, designado por la Junta como el nuevo CEO. Servir de CEO por mas de dos d cadas ha sido, sin duda alguna, una de las Mientras que oficialmente experiencias mas gratificantes de mi vida. Siento una gran satisfacciOn al ver he formado parte de una organizaciOn que no solo es financieramente fuerte, sino que permanece Popular por 41 anos, comprometida con atender las necesidades de nuestros clientes, cuidar de Popular ha sido, y nuestros empleados y asumir un papel activo en las comunidades que servimos. Los valores que nos han guiado desde nuestros inicios hace 125 anos son hoy mas continuara siendo, fuertes que nunca, y me enorgullece que Popular es, particularmente en Puerto una parte de mI por Rico, un sI mbolo de excelencia y progreso. Agradezco a mis colegas por ser una toda mi vida. fuente constante de inspiraciOn, a nuestros clientes por su confianza y a ustedes, mis companeros accionistas, por su apoyo a trav s de todos estos anos. Con Popular en una posiciOn sOlida, ste era el momento indicado para que Ignacio y yo asumi ramos nuevos roles. Desde que se uniO a Popular en el 2010, y mas recientemente como presidente y COO, Ignacio demostrO que tiene la experiencia, las destrezas y la visiOn para liderar esta organizaciOn. Es un privilegio para mI continuar sirviendo a Popular desde una posiciOn diferente y estoy sumamente entusiasmado de colaborar con Ignacio y su equipo mientras trazan el futuro de Popular. La visiOn y la estrategia estan claras, y la energI a es evidente. Mientras que oficialmente he formado parte de Popular por 41 anos, Popular ha sido, y continuara siendo, una parte de mI por toda mi vida. Desde un punto de vista especial, he sido testigo de cOmo esta organizaciOn prospera en tiempos buenos y persevera y se fortalece en tiempos difI ciles. La respuesta de nuestros colegas a la crisis provocada por los huracanes del 2017 es el ejemplo mas reciente del espI ritu que hace a Popular una organizaciOn exitosa y nica. No tengo duda de que los mejores dI as de Popular estan por delante. Sinceramente, RICHARD L. CARRION Presidente Junta de Directores Ejecutivo de la Popular, Inc. 2017 INFORME ANUAL | 9

POPULAR, RESUMEN DEL INC . ANO Estimados accionistas: Es un honor presentar mi primer Luego de ajustar para excluir el Holding Company, subsidiarias de informe a los accionistas como impacto de estas partidas, entre otras, Wells Fargo & Company, relacionados Principal Oficial Ejecutivo (CEO) de el ingreso neto ajustado para el 2017 a su negocio de financiamiento de Popular, una posiciOn que tuve el fue de $276 millones, comparado autos en Puerto Rico. Como parte privilegio de asumir en julio de 2017. con $358 millones en el ano anterior. de la transacciOn, Popular adquirira Los resultados ajustados del 2017 aproximadamente $1,500 millones en Agradezco humildemente la confianza se afectaron negativamente por pr stamos de auto y $340 millones en que la Junta de Directores y Richard han el impacto de los huracanes en la pr stamos comerciales. Anticipamos puesto en mI . Richard es, en muchos provisiOn, en ingresos y en gastos, que la transacciOn se completara aspectos, el fundador del Popular que alcanzO $73 millones, netos de en el segundo trimestre del 2018 y moderno. Durante sus anos como CEO, contribuciones, y a una provisiOn para que contribuira positivamente a los ayudO a evolucionar la organizaciOn p rdidas en pr stamos de $38 millones, ingresos de la corporaciOn. de un banco mucho mas pequeno netos de contribuciones, relacionada en Puerto Rico a una instituciOn de a nuestra cartera de pr stamos para A pesar de las preocupaciones servicios financieros diversificados licencias de taxis en los Estados Unidos relacionadas a la situaciOn fiscal y que hoy se encuentra entre las 50 adquirida como parte de la transacciOn econOmica de Puerto Rico, durante principales en los Estados Unidos. de Doral. los primeros nueve meses del 2017, el precio de las acciones de Popular Como todos sabemos, el 2017 fue un La calidad de cr dito permaneciO tuvo un movimiento parecido al I ndice ano retante para Popular y para Puerto estable durante el 2017. En Puerto Rico, Regional de Bancos de KBW en los Rico. Luego de tan solo tres meses los indicadores para los primeros ocho Estados Unidos, aunque mas volatil. de ser CEO, dos huracanes de gran meses del ano se mantuvieron estables Sin embargo, el precio de nuestras magnitud, Irma y MarI a, azotaron las a pesar de la debilidad de la economI a. acciones se vio severamente afectado Islas VI rgenes y Puerto Rico en menos Las m tricas para el fin de ano incluyen por el impacto del huracan MarI a, de dos semanas, dejando a su paso el efecto de la moratoria de pagos cerrando el ano en $35.49, 19% mas una extensa destrucciOn. Durante este de pr stamos ofrecida a clientes bajo que en el 2016 y por debajo de momento difI cil, demostramos la fuerza individuales y comerciales tras el nuestros bancos pares en Estados y resiliencia de nuestra organizaciOn, paso de los huracanes, que suspendiO Unidos y del I ndice Regional de Bancos sirviendo a nuestros clientes en un temporeramente el que estos fuesen de KBW. No obstante, este desempeno ambiente increI blemente desafiante. considerados como delincuentes. En compara favorablemente con el de los Estados Unidos, excluyendo la otros bancos en Puerto Rico. Me En el 2017 alcanzamos un ingreso neto cartera de licencias de taxi, la calidad complace informar que el precio de la de $108 millones, comparado con $217 del cr dito se mantuvo fuerte. acciOn ha aumentado un 21% durante millones en el 2016. Nuestros resultados las primeras ochos semanas del 2018. para el 2017 incluyen un gasto de $168 Durante el primer trimestre del 2017, millones como resultado del impacto tomamos una serie de acciones que de la reforma contributiva federal reflejan la fortaleza de nuestra posiciOn Nos movilizamos para sobre nuestro activo de contribuciones de capital. Aumentamos el dividendo restablecer nuestras diferidas relacionado a nuestras trimestral de $0.15 a $0.25 por acciOn operaciones, apoyar a operaciones en Estados Unidos. El com n y recompramos $75 millones ingreso neto en el 2016 incluyO, entre de acciones comunes. Nuestra base de aquellos companeros otros eventos significativos, el efecto de capital contin a fuerte, terminando el que lo necesitaban y a dos decisiones adversas relacionadas a ano con una relaciOn de capital basico asistir a las comunidades reclamaciones hechas por nosotros al (Common Equity Tier 1) de 16.3%. mas afectadas. FDIC como sI ndico de Westernbank bajo el acuerdo de participaciOn de En febrero del 2018, anunciamos un p rdidas en pr stamos comerciales, acuerdo para adquirir y asumir ciertos Los huracanes devastaron infraes- que resultaron en un gasto de $131 activos y pasivos de Reliable Financial tructura crI tica, dejando tras su paso millones, neto de contribuciones. Services, Inc. y Reliable Finance a la poblaciOn entera sin acceso a 10 | POPULAR, INC.

electricidad, agua y telecomunicaciones. durante ese momento difI cil. Entre Complicando a n mas la situaciOn, muchas iniciativas, aumentamos el los danos severos a las carreteras y la Fondo de Emergencia de Empleados escasez de combustible obstaculizaron para ofrecer asistencia financiera a la distribuciOn de bienes basicos como empleados que sufrieron danos severos, alimentos, medicamentos y agua y aceleramos el pago del bono anual potable. En este contexto, tan pronto de Navidad establecido por ley a los como fue seguro, nos movilizamos empleados en Puerto Rico y las Islas para restablecer nuestras operaciones, VI rgenes estadounidenses y britanicas. En Puerto Rico, nuestros apoyar a aquellos companeros que lo balances de depOsitos necesitaban y a asistir a las comunidades Tambi n, nos movilizamos rapida- aumentaron por mas afectadas. mente para ayudar a comunidades severamente afectadas, lanzando $4,300 millones y nuestra En Puerto Rico, el dinero en efectivo el fondo Abrazando a Puerto Rico, base de clientes por se convirtiO en muchos casos en el que hoy tiene compromisos de mas aproximadamente 31K. nico m todo de pago viable debido de $6 millones, incluyendo nuestra al impacto que la falta de electricidad contribuciOn inicial de $1 millOn. y telecomunicaciones tuvo en las Agradecemos las donaciones generosas Continuamos la transformaciOn redes de puntos de venta y de cajeros de muchos socios y amigos que nos de nuestra red de sucursales, automaticos. Para ayudar a estabilizar permitieron llevar socorro inmediato a remodelando o relocalizando ocho de la situaciOn, proporcionamos acceso a las areas mas afectadas por el desastre. El fondo, que es manejado por la estas, lo que ha ayudado a promover efectivo a trav s de nuestras sucursales FundaciOn Banco Popular, ahora esta el crecimiento de depOsitos en las y cajeros automaticos a la mayor enfocado en apoyar a organizaciones sucursales. brevedad posible. A pesar de m ltiples retos operacionales, abrimos las comunitarias en la implantaciOn de Seguimos progresando en la simplifi-primeras sucursales 72 horas despu s soluciones innovadoras a problemas caciOn de nuestra infraestructura del embate del huracan MarI a. A sociales apremiantes. de tecnologI a y en la migraciOn de partir de ese momento, el n mero de Aunque gran parte de la discusiOn del transacciones a canales digitales, para sucursales y cajeros automaticos en 2017 naturalmente gira alrededor de alcanzar mayores eficiencias y ofrecer operaciOn aumentO consistentemente, los huracanes, durante el ano tambi n una experiencia superior a nuestros alcanzando 124 o 74% y 333 o 52%, alcanzamos otros logros importantes: clientes. Los depOsitos a trav s de respectivamente, cuatro semanas canales digitales sobrepasaron el despu s del paso del huracan. Ademas, En Puerto Rico, continuamos forta- 40% del total de depOsitos, tanto en como duenos de la red de cajeros Puerto Rico como los Estados Unidos. automaticos mas extensa en la isla, leciendo nuestra posiciOn de liderazgo en el mercado. A pesar de Ademas, expandimos nuestros eliminamos todos los cargos por uso de la recesiOn econOmica prolongada y esfuerzos por atraer, desarrollar los cajeros automaticos durante varias del efecto de los huracanes, nuestros y retener el mejor talento en los semanas despu s del huracan a todos balances de depOsitos aumentaron mercados que servimos. Lanzamos los clientes, incluyendo a aquellos de por $4,300 millones y nuestra base y fortalecimos iniciativas en areas otras instituciones financieras. En el lado de clientes por aproximadamente como adiestramientos, diversidad e de cr dito, brindamos alivio a nuestros 31,000. Alcanzamos crecimiento, inclusiOn y bienestar. clientes, ofreciendo una moratoria ademas, en varias carteras, como Comenzamos el 2018 con entusiasmo, de pago de inter s y principal en los las de pr stamos comerciales y conscientes de los retos, pero listos pr stamos hipotecarios, personales y pr stamos de auto. comerciales y suspendiendo los cargos para aprovechar las oportunidades por pagos tardI os, En los Estados Unidos, aumentamos que sin duda surgiran. La economI a de . los pr stamos comerciales por 16%, Puerto Rico contin a siendo el desafI o lanzamos una iniciativa de banca principal que enfrentamos. Un entorno A la misma vez, establecimos como una privada y fortalecimos nuestra que era complicado de por sI debido a prioridad apoyar a nuestros companeros unidad de originaciOn hipotecaria. la situaciOn fiscal y de la deuda p blica, 2017 INFORME ANUAL | 11

POPULAR, RESUMEN DEL INC . ANO se tornO a n mas retante tras el paso de oportunidad nica para hacer cambios los huracanes. Procesos que ya habI an significativos en areas como energI a, Preparados para el futuro comenzado tendran que ser ajustados vivienda, salud y educaciOn. Como la Fortalecer nuestra para re ejar una nueva realidad. principal instituciOn financiera en la organizaciOn, atrayendo isla, Popular esta listo para jugar un y desarrollando nuestro En los meses posteriores a los papel importante, como hemos hecho talento alrededor de las huracanes, la actividad econOmica a trav s de nuestra historia, en los capacidades necesarias se impactO inevitablemente por esfuerzos por construir un Puerto Rico para el futuro y enfatizando demoras en el restablecimiento del mas fuerte y sustentable. nuestros controles servicio el ctrico en Puerto Rico. internos para manejar Sin embargo, nos alienta ver senales Nuestro negocio en los Estados Unidos efectivamente el riesgo. de que la situaciOn econOmica en la contin a teniendo una importancia isla ha comenzado a estabilizarse. estrat gica como nuestra fuente Este marco asegura que consis-Algunas m tricas, como las compras principal de diversificaciOn de riesgo, tentemente balanceemos nuestro de nuestros clientes con tarjetas de expansiOn de ingresos y potencial enfoque entre las necesidades d bito y las ventas de autos, ya estan de crecimiento. Seguimos enfocados presentes y futuras, y nos ayuda regresando a los niveles previos a los en diversificar nuestra cartera de a identificar los pasos necesarios huracanes. Se ha discutido mucho pr stamos, generar ingresos que no para alcanzar nuestros objetivos sobre la aceleraciOn de la emigraciOn provienen de intereses y transformar estrat gicos. despu s de los huracanes. Aunque el nuestra red de sucursales. aumento es innegable, los estimados Aprovecho esta oportunidad para varI an considerablemente y todavI a no En diciembre del 2017, develamos un expresar mi agradecimiento a la Junta esta claro cuantos de los que se fueron nuevo marco estrat gico fundamen- de Directores y a mis companeros de la Isla regresaran eventualmente, tado en una visiOn de brindar una por su respuesta extraordinaria ante a medida que la situaciOn contin e experiencia excelente a nuestros clientes, la crisis provocada por los huracanes. estabilizandose. A fin de cuentas, la ofreci ndoles soluciones financieras de No hubi semos logrado lo que hicimos soluciOn para el tema de migraciOn es una forma sencilla. Esta visiOn se apoya sin la dedicaciOn y trabajo de nuestros acelerar el crecimiento econOmico en en cuatro pilares estrat gicos: empleados en Puerto Rico y las Islas Puerto Rico. VI rgenes estadounidenses y britanicas, Crecimiento quienes respondieron de forma heroica, El ritmo de la recuperaciOn econOmica rentable y sostenible manejando sus responsabilidades dependera en gran parte de la Identificar oportunidades en Popular a la vez que atendI an rapidez con que se restablezca el de crecimiento situaciones difI ciles en sus hogares. servicio el ctrico restante, asI como la rentable y sostenible El apoyo de nuestros companeros en magnitud y la velocidad del ujo de los los Estados Unidos tambi n fue de fondos de las agencias federales y de Sencillez mucho valor a trav s de esos meses las companI as de seguros hacia Puerto Simplificar nuestra tan complicados. Rico. Estos fondos, que se estima organizaciOn, optimizando excederan los $25,000 millones, nuestros procesos y nuestra Quiero agradecer tambi n a N stor posiblemente serviran de estI mulo a la plataforma tecnolOgica O. Rivera, anteriormente jefe del economI a a corto y mediano plazo. para reducir costos Grupo de Banca Individual, quien se Enfoque en el cliente retirO en el 2017 luego de una larga y El futuro econOmico de Puerto exitosa carrera en Popular abarcando Rico a largo plazo dependera de Crear una cultura enfocada cerca de 50 anos. El legado de N stor las decisiones que se tomen sobre en el servicio al cliente y perdurara, pues trabajO para crecer durante el proceso de reconstrucciOn. proveer una experiencia nuestra red de sucursales en Puerto La isla enfrentaba serios problemas consistente a trav s de Rico, ayudO a forjar la estrategia de estructurales antes del impacto de todos los canales tecnologI a de Popular y sirviO de los huracanes. Ahora tenemos una mentor a generaciones de lI deres que 12 | POPULAR, INC.

COMPROMETIDOS CON NUESTROS CLIENTES, COMPANEROS Y COMUNIDADES aprendieron la importancia de nuestros En septiembre del 2017, Puerto Rico y las Islas VI rgenes enfrentaron el impacto valores y cultura organizacional a catastrOfico de los poderosos huracanes Irma y MarI a en un periodo de dos trav s de su consejo y ejemplo. Luis semanas, destruyendo estructuras, devastando el paisaje natural y dejando a Cestero, quien se uniO a Popular en poblaciones enteras sin acceso a electricidad, agua, telecomunicaciones, servicios m dicos y suministros basicos. Popular demostrO su compromiso inquebrantable el 1995 y tiene aproximadamente 20 con sus clientes, empleados y comunidades, restableciendo rapidamente el acceso anos de experiencia en el Grupo de a servicios bancarios y ofreciendo ayuda a los mas necesitados. Banca Individual, asumiO el liderato del grupo tras el retiro de N stor. Luis ha demostrado su profundo conocimiento Nuestros Clientes Ofrecimos propiedades del banco a del negocio y, a n mas importante, sus empleados que necesitaban un hogar. cualidades como lI der, ganandose el Acceso a efectivo y a otros servicios Bienestar y apoyo respeto de todos los que le rodean. bancarios basicos a pesar de retos operacionales Distribuimos agua, vales de comida y Popular es hoy una organizaciOn Operando 31% de las sucursales y paquetes con suministros basicos a mucho mas fuerte de lo que era antes 24% de los cajeros automaticos empleados necesitados. una semana luego del Huracan de los huracanes del 2017. Trabajamos MarI a; alcanzamos 92% y 82%, Establecimos centros de cuido de en equipo, nos adaptamos al cambio, respectivamente, para fin de ano. ninos para los hijos de empleados en desarrollamos soluciones creativas y nuestros edificios principales. respondimos decisivamente. Demos- Restablecimos la operaciOn del centro de llamadas el 25 de septiembre; Suspendimos temporeramente las tramos todo lo que podemos lograr reanudamos el servicio 24/7 el 23 de restricciones en el plan m dico para cuando tenemos un propOsito com n. octubre. asegurar cuidado en casos urgentes, Ofrecimos servicio ininterrumpido a extendimos el servicio de nuestro Comenzamos el 2018, ano en el que trav s del Internet y dispositivos mOviles. Centro Interno de Salud y Bienestar a los celebramos nuestro 125 aniversario, Alivio y apoyo dependientes de nuestros empleados y coordinamos programas especiales para comprometidos con preservar el Implantamos una moratoria dI as atender aspectos emocionales. espI ritu y las actitudes que nos para tarjetas de cr dito, pr stamos permitieron no solo enfrentar los retos personales, pr stamos de auto e Nuestras Comunidades del 2017, sino fortalecernos como hipotecas. resultado de ellos. No necesitamos una Abrazando a Puerto Rico Eliminamos los cargos en cajeros crisis para mostrar lo mejor de nosotros. automaticos por 25 dI as a clientes Establecimos el fondo Abrazando a Nuestros companeros, nuestros nuestros y de otras instituciones Puerto Rico con una contribuciOn clientes, nuestras comunidades y financieras. inicial de $1 millOn; ha alcanzado $6.1 nuestros accionistas esperan, merecen Abrimos siete centros a trav s de la millones en compromisos. y recibiran lo mejor de nosotros, todos isla para ofrecer a nuestros clientes comerciales lugares de trabajo con Completamos 35 misiones para dis-los dI as. tribuir mas de 800,000 libras de acceso al Internet. suministros basicos, impactando mas Sinceramente, Ofrecimos asesorI a a clientes y al p blico de 140,000 individuos. general sobre el proceso de reclamaciOn a FEMA y a companI as de seguro. Enfocados en proyectos para estabilizar comunidades a trav s de acceso a agua potable y energI a Nuestra Gente solar, y para fomentar la recuperaciOn econOmica de Puerto Rico. Asistencia Financiera Apoyamos varias iniciativas, como Aumentamos el Fondo de Emergencia Unidos por Puerto Rico y Somos una Voz. de Empleados y distribuimos mas de $800,000 a empleados que sufrieron Evolucionando a una nueva fase p rdidas severas. enfocada en transicionar nuestras IGNACIO ALVAREZ Adelantamos la nOmina la semana comunidades en una recuperaciOn a Presidente y Principal Oficial Ejecutivo del huracan y aceleramos el pago del largo plazo. Popular, Inc. bono de Navidad.

RESUMEN 25 ANOS FINANCIERO HISTORICO (DOlares en millones, excepto informaciOn 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 por acciOn) InformaciOn Financiera Seleccionada Ingreso neto (P rdida Neta) $109.4 $124.7 $146.4 $185.2 $209.6 $232.3 $257.6 $276.1 $304.5 $351.9 $470.9 Activos 11,513.4 12,778.4 15,675.5 16,764.1 19,300.5 23,160.4 25,460.5 28,057.1 30,744.7 33,660.4 36,434.7 Pr stamos Brutos 6,346.9 7,781.3 8,677.5 9,779.0 11,376.6 13,078.8 14,907.8 16,057.1 18,168.6 19,582.1 22,602.2 DepOsitos 8,522.7 9,012.4 9,876.7 10,763.3 11,749.6 13,672.2 14,173.7 14,804.9 16,370.0 17,614.7 18,097.8 Capital de Accionistas 834.2 1,002.4 1,141.7 1,262.5 1,503.1 1,709.1 1,661.0 1,993.6 2,272.8 2,410.9 2,754.4 Valor agregado en el mercado $1,014.7 $923.7 $1,276.8 $2,230.5 $3,350.3 $4,611.7 $3,790.2 $3,578.1 $3,965.4 $4,476.4 $5,960.2 Rendimiento de Activos Promedio (ROAA) 1.02% 1.02% 1.04% 1.14% 1.14% 1.14% 1.08% 1.04% 1.09% 1.11% 1.36% Rendimiento de Capital Com n Promedio 13.80% 13.80% 14.22% 16.17% 15.83% 15.41% 15.45% 15.00% 14.84% 16.29% 19.30% (ROACE) Por AcciOn Com n1 Ingreso neto (P rdida Neta)—Basico $4.18 $4.59 $5.24 $6.69 $7.51 $8.26 $9.19 $9.85 $10.87 $13.05 $17.36 Ingreso neto (P rdida Neta)—Diluido 4.18 4.59 5.24 6.69 7.51 8.26 9.19 9.85 10.87 13.05 17.36 Dividendos (Declarados) 1.20 1.25 1.54 1.83 2.00 2.50 3.00 3.20 3.80 4.00 5.05 Valor en los Libros 31.86 34.35 39.52 43.98 51.83 59.32 57.54 69.62 79.67 91.02 96.60 Precio en el Mercado 39.38 35.16 48.44 84.38 123.75 170.00 139.69 131.56 145.40 169.00 224.25 Activos por Area Geografica Puerto Rico 79% 76% 75% 74% 74% 71% 71% 72% 68% 66% 62% Estados Unidos 16% 20% 21% 22% 23% 25% 25% 26% 30% 32% 36% Caribe y Latinoam rica 5% 4% 4% 4% 3% 4% 4% 2% 2% 2% 2% Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% Sistema de DistribuciOn Tradicional Sucursales Bancarias Puerto Rico 165 166 166 178 201 198 199 199 196 195 193 Islas VI rgenes 8 8 8 8 8 8 8 8 8 8 8 Estados Unidos2 32 34 40 44 63 89 91 95 96 96 97 Subtotal 205 208 214 230 272 295 298 302 300 299 298 Oficinas No Bancarias Popular Financial Holdings 58 73 91 102 117 128 137 136 149 153 181 Popular Cash Express 51 102 132 154 195 129 Popular Finance 26 28 31 39 44 48 47 61 55 36 43 Popular Auto 8 10 9 8 10 10 12 12 20 18 18 Popular Leasing, U.S.A. 7 8 10 11 13 13 11 Popular Mortgage 3 3 3 11 13 21 25 29 32 Popular Securities 1 2 2 2 3 4 7 8 Popular One Popular Insurance y 2 2 2 2 Popular Risk Services Popular Insurance Agency, U.S.A. 1 1 1 Popular Insurance V.I. 1 1 E-LOAN EVERTEC 4 4 4 5 5 Subtotal 92 111 134 153 183 258 327 382 427 460 431 Total 297 319 348 383 455 553 625 684 727 759 729 Sistema ElectrOnico de DistribuciOn Cajeros Automaticos Propios y Administrados Puerto Rico 234 262 281 327 391 421 442 478 524 539 557 Islas VI rgenes 8 8 8 9 17 59 68 37 39 53 57 Estados Unidos 11 26 38 53 71 94 99 109 118 131 129 Total 253 296 327 389 479 574 609 624 681 723 743 Empleados 7,533 7,606 7,815 7,996 8,854 10,549 11,501 10,651 11,334 11,037 11,474 (equivalente a tiempo completo) 14 | POPULAR, INC.

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 $489.9 $540.7 $357.7 $(64.5) $(1,243.9) $(573.9) $137.4 $151.3 $245.3 $599.3 $(313.5) $895.3 $216.7 $107.7 44,401.6 48,623.7 47,404.0 44,411.4 38,882.8 34,736.3 38,815.0 37,348.4 36,506.9 35,748.8 33,086.8 35,761.7 38,661.6 44,277.3 28,742.3 31,710.2 32,736.9 29,911.0 26,268.9 23,803.9 26,458.9 25,314.4 25,093.6 24,706.7 22,053.2 23,129.2 23,435.4 24,942.5 20,593.2 22,638.0 24,438.3 28,334.4 27,550.2 25,924.9 26,762.2 27,942.1 27,000.6 26,711.1 24,807.5 27,209.7 30,496.2 35,453.5 3,104.6 3,449.2 3,620.3 3,581.9 3,268.4 2,538.8 3,800.5 3,918.8 4,110.0 4,626.2 4,267.4 5,105.3 5,198.0 5,103.9 $7,685.6 $5,836.5 $5,003.4 $2,968.3 $1,455.1 $1,445.4 $3,211.4 $1,426.0 $2,144.9 $2,970.6 $3,523.4 $2,936.6 $4,548.1 $3,622.4 1.23% 1.17% 0.74% -0.14% -3.04% -1.57% 0.36% 0.40% 0.68% 1.65% -0.89% 2.54% 0.58% 0.26% 17.60% 17.12% 9.73% -2.08% -44.47% -32.95% 4.37% 4.01% 6.37% 14.43% -7.04% 19.16% 4.07% 1.96% $17.95 $19.78 $12.41 $(2.73) $(45.51) $2.39 $(0.62) $1.44 $2.36 $5.80 $(3.08) $8.66 $2.06 $1.02 17.92 19.74 12.41 (2.73) (45.51) 2.39 (0.62) 1.44 2.35 5.78 (3.08) 8.65 2.06 $1.02 6.20 6.40 6.40 6.40 4.80 0.20 ————— 0.30 0.60 1.00 109.45 118.22 123.18 121.24 63.29 38.91 36.67 37.71 39.35 44.26 40.76 48.79 49.60 49.51 288.30 211.50 179.50 106.00 51.60 22.60 31.40 13.90 20.79 28.73 34.05 28.34 43.82 35.49 55% 53% 52% 59% 64% 65% 74% 74% 73% 72% 80% 75% 75% 76% 43% 45% 45% 38% 33% 32% 23% 23% 24% 25% 17% 22% 23% 22% 2% 2% 3% 3% 3% 3% 3% 3% 3% 3% 3% 3% 2% 2% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% 192 194 191 196 179 173 185 183 175 171 168 173 171 168 8 8 8 8 8 8 8 9 9 9 9 9 9 9 128 136 142 147 139 101 96 94 92 90 47 50 51 51 328 338 341 351 326 282 289 286 276 270 224 232 231 228 183 212 158 134 2 114 4 43 49 52 51 9 18 17 15 12 12 10 10 10 10 9 9 9 9 9 15 14 11 24 22 30 33 32 32 32 33 36 37 37 38 25 24 17 14 9 12 12 13 7 6 6 4 4 3 3 3 2 2 4 5 6 6 6 5 5 2 2 2 2 1 1 1 1 1 1 1 2 2 2 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 5 5 7 9 9 9 421 351 292 280 97 61 55 58 59 59 46 46 37 34 749 689 633 631 423 343 344 344 335 329 270 278 268 262 568 583 605 615 605 571 624 613 597 599 602 622 635 633 59 61 65 69 74 77 17 20 20 22 21 21 20 22 163 181 192 187 176 136 138 135 134 132 83 87 101 110 790 825 862 871 855 784 779 768 751 753 706 730 756 765 12,139 13,210 12,508 12,303 10,587 9,407 8,277 8,329 8,072 8,059 7,752 7,810 7,828 7,784 1Los datos de las acciones comunes han sido ajustados por las divisiones en acciones y la divisiOn de acciones a la inversa realizada en mayo 2012. 2Excluye una sucursal de Banco Popular de Puerto Rico en Nueva York. 2017 INFORME ANUAL | 15

POPULAR, INC. GERENCIA Y JUNTA DE DIRECTORES Gerencia RICHARD L. CARRION IGNACIO ALVAREZ CAMILLE BURCKHART LUIS CESTERO MANUEL A. CHINEA JAVIER D. FERRER Presidente Ejecutivo Presidente y Vicepresidenta Ejecutiva y Vicepresidente Ejecutivo Vicepresidente Ejecutivo Vicepresidente Ejecutivo, de la Junta de Directores Principal Oficial Ejecutivo Principal Oficial de Informatica y Grupo de Banca Individual Popular, Inc. Principal Oficial Legal y Popular, Inc. Popular, Inc. Estrategia Digital Banco Popular de Puerto Rico Principal Oficial de Operaciones Secretario Corporativo Grupo de InnovaciOn, TecnologI a y Popular Community Bank Grupo de ConsejerI a General y Operaciones Asuntos Corporativos Popular, Inc. Popular, Inc. JUAN O. GUERRERO GILBERTO MONZON EDUARDO J. NEGRON ELI S. SEP LVEDA LIDIO V. SORIANO CARLOS J. VAZQUEZ Vicepresidente Ejecutivo Vicepresidente Ejecutivo Vicepresidente Ejecutivo Vicepresidente Ejecutivo Vicepresidente Ejecutivo y Vicepresidente Ejecutivo y Grupo de Servicios Financieros y Grupo de Cr dito a Individuo Grupo de AdministraciOn Grupo de Cr dito Comercial Principal Oficial de Riesgo Principal Oficial Financiero Seguros Banco Popular de Puerto Rico Popular, Inc. Banco Popular de Puerto Rico Grupo Corporativo de Popular, Inc. Banco Popular de Puerto Rico Manejo de Riesgo Popular, Inc. Junta de Directores RICHARD L. CARRION IGNACIO ALVAREZ JOAQUI N E. ALEJANDRO M. JOHN W. DIERCKSEN MARI A LUISA FERR Presidente Ejecutivo Presidente y BACARDI , III BALLESTER Principal Presidenta y de la Junta de Directores Principal Oficial Ejecutivo Presidente de la Presidente Greycrest, LLC Principal Oficial Ejecutiva Popular, Inc. Popular, Inc. Junta de Directores Ballester Hermanos, Inc. FRG, Inc. Edmundo B. Fernandez, Inc. DAVID E. GOEL C. KIM GOODWIN WILLIAM J. CARLOS A. UNANUE Socio Gerente General Inversionista Privada TEUBER JR. Presidente Matrix Capital Inversionista Privado Goya de Puerto Rico Management Company, LP

P.O. BOX 362708 SAN JUAN, PUERTO RICO 00936-2708

Financial Review and Supplementary Information

| | | | |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 2 | |

| |

Statistical Summaries | | | 75 | |

| |

Financial Statements Report of Management on Internal Control Over Financial Reporting | | | 80 | |

| |

Report of Independent Registered Public Accounting Firm | | | 81 | |

| |

Consolidated Statements of Financial Condition as of December 31, 2017 and 2016 | | | 83 | |

| |

Consolidated Statements of Operations for the years ended December 31, 2017, 2016 and 2015 | | | 84 | |

| |

Consolidated Statements of Comprehensive Income (Loss) for the years ended December 31, 2017, 2016 and 2015 | | | 85 | |

| |

Consolidated Statements of Changes in Stockholders’ Equity for the years ended December 31, 2017, 2016 and 2015 | | | 86 | |

| |

Consolidated Statements of Cash Flows for the years ended December 31, 2017, 2016 and 2015 | | | 87 | |

| |

Notes to Consolidated Financial Statements | | | 88 | |

1

Management’s Discussion and Analysis of Financial Condition and Results of Operations

| | |

| |

Forward-Looking Statements | | 3 |

| |

Overview | | 4 |

| |

Critical Accounting Policies / Estimates | | 12 |

| |

Statement of Operations Analysis | | 19 |

| |

Net Interest Income | | 19 |

| |

Provision for Loan Losses | | 22 |

| |

Non-Interest Income | | 23 |

| |

Operating Expenses | | 24 |

| |

Income Taxes | | 26 |

| |

Fourth Quarter Results | | 26 |

| |

Reportable Segment Results | | 27 |

| |

Statement of Financial Condition Analysis | | 30 |

| |

Assets | | 30 |

| |

Liabilities | | 34 |

| |

Stockholders’ Equity | | 35 |

| |

Regulatory Capital | | 35 |

| |

Off-Balance Sheet Arrangements and Other Commitments | | 37 |

| |

Contractual Obligations and Commercial Commitments | | 37 |

| |

Risk Management | | 39 |

| |

Risk Management Framework | | 39 |

| |

Market / Interest Rate Risk | | 40 |

| |

Liquidity | | 46 |

| |

Credit Risk | | 51 |

| |

Enterprise Risk and Operational Risk Management | | 71 |

| |

Adoption of New Accounting Standards and Issued But Not Yet Effective Accounting Standards | | 72 |

| |

Adjusted net income –Non-GAAP Financial Measure | | 73 |

| |

Statistical Summaries | | 75 |

| |

Statements of Financial Condition | | 75 |

| |

Statements of Operations | | 76 |

| |

Average Balance Sheet and Summary of Net Interest Income | | 77 |

| |

Quarterly Financial Data | | 79 |

2

The following Management’s Discussion and Analysis (“MD&A”) provides information which management believes is necessary for understanding the financial performance of Popular, Inc. and its subsidiaries (the “Corporation” or “Popular”). All accompanying tables, consolidated financial statements, and corresponding notes included in this “Financial Review and Supplementary Information - 2017 Annual Report” (“the report”) should be considered an integral part of this MD&A.

FORWARD-LOOKING STATEMENTS

The information included in this report contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may relate to Popular, Inc’s (“Popular,” the “Corporation,” “we,” “us,” “our”) financial condition, results of operations, plans, objectives, future performance and business, including, but not limited to, statements with respect to the adequacy of the allowance for loan losses, delinquency trends, market risk and the impact of interest rate changes, capital market conditions, capital adequacy and liquidity, the effect of legal and regulatory proceedings and new accounting standards on the Corporation’s financial condition and results of operations, the impact of Hurricanes Irma and Maria on us, and the anticipated impact of our acquisition and assumption, if consummated, of certain assets and liabilities of Reliable Financial Services and Reliable Finance Holding Company, subsidiaries of Wells Fargo & Company, related to Wells Fargo’s retail auto loan and commercial auto dealership financing business in Puerto Rico (the “Reliable Transaction”). All statements contained herein that are not clearly historical in nature are forward-looking, and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,” “intend,” “project” and similar expressions and future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions are generally intended to identify forward-looking statements.

Forward-looking statements are not guarantees of future performance and are based on management’s current expectations and, by their nature, involve certain risks, uncertainties, estimates and assumptions by management that are difficult to predict. Various factors, some of which are beyond the Corporation’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. Factors that might cause such a difference include, but are not limited to, the rate of growth or decline in the economy and employment levels, as well as general business and economic conditions in the geographic areas we serve and, in particular, in Puerto Rico, where a significant portion of our business in concentrated; the impact of Hurricanes Irma and Maria on the economies of Puerto Rico and the U.S. and British Virgin Islands, and on our customers and our business, including the impact of measures taken by us to address customer needs; the impact of the Commonwealth of Puerto Rico’s fiscal crisis, and the measures taken and to be taken by the Puerto Rico Government and the Federally-appointed oversight board, on the economy, our customers and our business; the impact of the Commonwealth’s fiscal and economic condition on the value and performance of our portfolio of Puerto Rico government securities and loans to governmental entities, as well as on our commercial, mortgage and consumer loan portfolios where private borrowers could be directly affected by governmental action; changes in interest rates, as well as the magnitude of such changes; the fiscal and monetary policies of the federal government and its agencies; changes in federal bank regulatory and supervisory policies, including required levels of capital and the impact of proposed capital standards on our capital ratios; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Financial Reform Act) on the Corporation’s businesses, business practices and costs of operations; regulatory approvals that may be necessary to undertake certain actions or consummate strategic transactions such as acquisitions and dispositions; the relative strength or weakness of the consumer and commercial credit sectors and of the real estate markets in Puerto Rico and the other markets in which borrowers are located; the performance of the stock and bond markets; competition in the financial services industry; additional FDIC assessments; and possible legislative, tax or regulatory changes; a failure in or breach of our operational or security systems or infrastructure as a result of cyberattacks or otherwise, including those of EVERTEC, Inc., our provider of core financial transaction processing and information technology services, and other third parties providing services to us; and risks related to the Reliable Transaction, if consummated. Other possible events or factors that could cause results or performance to differ materially from those expressed in these forward-looking statements include the following: negative economic conditions that adversely affect the housing prices, the job market, consumer confidence and spending habits which may affect, among other things, the level ofnon-performing assets, charge-offs and provision expense; risks associated with maintaining customer relationships from our acquisition of certain assets and deposits (other than certain brokered deposits) of Doral Bank from the FDIC as receiver; changes in interest rates and market liquidity which may reduce interest margins, impact funding sources and affect our ability to originate and distribute financial products in the primary and secondary markets; changes in market rates and prices which may adversely impact the value of financial assets and liabilities; liabilities resulting from litigation and regulatory investigations; changes in accounting standards, rules and interpretations; our ability to grow our core businesses; decisions to downsize, sell or close units or otherwise change our business mix; and management’s ability to identify and manage these and other risks. Moreover, the outcome of legal and regulatory proceedings, as discussed in “Part I, Item 3. Legal Proceedings”, is inherently uncertain and depends on judicial interpretations of law and the findings of regulators, judges and juries.

All forward-looking statements included in this report are based upon information available to the Corporation as of the date of this report, and other than as required by law, including the requirements of applicable securities laws, management assumes no obligation to update or revise any such forward-looking statements to reflect occurrences or unanticipated events or circumstances after the date of such statements.

The description of the Corporation’s business and risk factors contained in Item 1 and 1A of its Form10-K for the year ended December 31, 2017 discusses additional information about the business of the Corporation and the material risk factors that, in addition to the other information in this report, readers should consider.

3

OVERVIEW

The Corporation is a diversified, publicly-owned financial holding company subject to the supervision and regulation of the Board of Governors of the Federal Reserve System. The Corporation has operations in Puerto Rico, the United States (“U.S.”) mainland, and the U.S. and British Virgin Islands. In Puerto Rico, the Corporation provides retail, mortgage and commercial banking services through its principal banking subsidiary, Banco Popular de Puerto Rico (“BPPR”), as well as investment banking, broker-dealer, auto and equipment leasing and financing, and insurance services through specialized subsidiaries. The Corporation’s mortgage origination business is conducted under the brand name Popular Mortgage, a division of BPPR. In the U.S. mainland, the Corporation operates Banco Popular North America (“BPNA”), including its wholly-owned subsidiaryE-LOAN, Inc. The BPNA franchise operates under the brand name of Popular Community Bank. BPNA focuses efforts and resources on the core community banking business. BPNA operates branches in New York, New Jersey and Southern Florida.E-LOAN, Inc. marketed deposit accounts under its name for the benefit of BPNA until March 31, 2017, when said operations were transferred to Popular Direct, a division of BPNA. Commencing in July 2017, theE-LOAN brand is being used by BPPR to offer personal loans through an online platform. Note 41 to the consolidated financial statements presents information about the Corporation’s business segments.

The Corporation has several investments which it accounts for under the equity method. These include the 16.10% interest in EVERTEC, a 15.84% interest in Centro Financiero BHD Leon, S.A. (“BHD Leon”), a 24.9% interest in PR Asset Portfolio2013-1 International, LLC and a 24.9% interest in PRLP 2011 Holdings LLP, among other investments in limited partnerships which mainly hold investment securities. EVERTEC provides transaction processing services throughout the Caribbean and Latin America, including servicing many of the Corporation’s systems infrastructure and transaction processing businesses. BHD León is a diversified financial services institution operating in the Dominican Republic. PR Asset Portfolio2013-1 International, LLC is a joint venture to which the Corporation sold construction and commercial loans and commercial and residential real estate owned assets, most of which werenon-performing, with a fair value of $306 million during the year 2013. PRLP 2011 Holdings LLP is a joint venture to which the Corporation sold construction and commercial loans, most of which werenon-performing, with a fair value of $148 million during the year 2011. For the year ended December 31, 2017, the Corporation recorded approximately $34.1 million in earnings from these investments on an aggregate basis. The carrying amounts of these investments as of December 31, 2017 were $215.3 million. Refer to Note 17 to the consolidated financial statements for additional information of the Corporation’s investments under the equity method.

SIGNIFICANT EVENTS

Entry into an Agreement to Acquire Wells Fargo’s Auto Finance Business in Puerto Rico

On February 14, 2018, Banco Popular de Puerto Rico entered into an agreement to acquire and assume from Reliable Financial Services, Inc. and Reliable Finance Holding Company, subsidiaries of Wells Fargo & Company (“Wells Fargo”), certain assets and liabilities related to Wells Fargo’s auto finance business in Puerto Rico (“Reliable”).

As part of the transaction, Banco Popular will acquire approximately $1.5 billion in retail auto loans and $340 million in commercial loans. The acquired auto loan portfolio has credit characteristics that are similar to Banco Popular’s existing self-originated portfolio. Banco Popular will also acquire certain other assets and assume certain liabilities of Reliable.

The purchase price for theall-cash transaction is expected to be approximately $1.7 billion, reflecting an aggregate discount of 4.5% on the assets to be acquired. Banco Popular will fund the purchase price with existing liquidity. The transaction is not subject to the receipt by the parties of any further regulatory approvals. Subject to satisfaction of customary closing conditions, Popular anticipates the transaction to close during the second quarter of 2018 and be accretive to earnings.

On or after closing, Reliable employees will become employees of Banco Popular. Reliable will continue operating independently as a division of Banco Popular for a period of time after closing to provide continuity of service to Reliable customers while allowing Popular to assess best practices before integrating Reliable’s operations with Popular Auto’s operations.

Hurricanes Irma and Maria

During September 2017, Hurricanes Irma and Maria (the “hurricanes”), impacted Puerto Rico, the U.S. and British Virgin Islands, causing extensive damage and disrupting the markets in which Banco Popular de Puerto Rico (“BPPR”) does business.

On September 6, 2017, Hurricane Irma made landfall in the USVI and the BVI as a Category 5 hurricane on the Saffir-Simpson scale, causing catastrophic wind and water damage to the islands’ infrastructure, homes and businesses. Hurricane Irma’s winds and resulting flooding also impacted certain municipalities of Puerto Rico, causing the failure of electricity infrastructure in a significant portion of the island. While hurricane Irma also struck Popular’s operations in Florida, neither our operations nor those of our clients in the region were materially impacted.

4

Two weeks later, on September 20, 2017, Hurricane Maria, made landfall in Puerto Rico as a Category 4 hurricane, causing extensive destruction and flooding throughout Puerto Rico. Following the passage of Hurricane Maria, all Puerto Rico was left without electrical power, other basic utility and infrastructure services (such as water, communications, ports and other transportation networks) were severely curtailed and the government imposed a mandatory curfew. The hurricanes caused a significant disruption to the island’s economic activity. Most business establishments, including retailers and wholesalers, financial institutions, manufacturing facilities and hotels, were closed for several days.

Puerto Rico and the USVI were declared disaster zones by President Trump due to the impact of the hurricanes, thus making them eligible for Federal assistance. Notwithstanding the significant recovery operation that is underway by the Federal, state and local governments, as of the date of this report, many businesses and homes in Puerto Rico and the USVI remain without power, other basic utility and infrastructure remains significantly impacted, and many businesses are partially operating or remain closed and others have permanently closed. Electronic transactions, a significant source of revenue for the bank, declined significantly in the months following the hurricanes as a result of the lack of power and telecommunication services. Several reports indicate that the hurricanes have also accelerated the outmigration trends that Puerto Rico was experiencing, with many residents moving to the mainland United States, either on a temporary or permanent basis.

The damages caused by the hurricanes are substantial and have had a material adverse impact on economic activity in Puerto Rico, as reflected by, among other things, the slowdown in production and sales activity and the reduction in the government’s tax revenues. Employment levels are also expected to decrease at least in the short-term. It is still, however, too early, to fully assess and quantify the extent of the damage caused by the hurricanes, as well as their long-term economic impact on economic activity. Furthermore, the hurricanes severely damaged or destroyed buildings, homes and other structures, impacting the value of such properties, some of which may serve as collateral to our loans. While our collateral is generally insured, the value of such insured structures, as well as other structures unaffected by the hurricanes, may be significantly impacted. Although some of the impact of the hurricanes, including its short-term impact on economic activity, may be offset by recovery and reconstruction activity and the influx of Federal emergency funds and private insurance proceeds, it is too early to know the amount of Federal and private insurance money to be received and whether such transfers will significantly offset the negative economic, fiscal and demographic impact of the hurricanes.

Prior to the hurricanes, the Corporation had implemented its business continuity action program. Although the Corporation’s business critical systems experienced minimal outages as a result of the storms, the Corporation’s physical operations in Puerto Rico, the USVI and the BVI, including its branch and ATM networks, were materially disrupted by the storms mostly due to lack of electricity and communication as well as limited accessibility.

After the hurricanes, Popular has worked diligently to provide service to the Puerto Rico and Virgin Islands markets, including reopening retail locations and providing assistance to the communities it serves. A priority for Popular has been to maintain cash in its branches and ATM’s and to mobilize its workforce to ensure continuity of service to its customers and that of other financial institutions. Popular has implemented several initiatives to provide assistance to individuals and businesses impacted by the hurricanes. Actions taken by Popular, directly or through its affiliated P.R. and U.S.-based foundations, include:

Payment Moratoriums. Payment moratoriums for eligible customers in mortgage, consumer, auto and commercial loans, subject to certain terms and conditions.

Fee Waivers. The waiver of certain fees and service charges, including late-payment charges and ATM transaction fees in hurricane-affected areas.

Employee Relief. Popular increased the Employee Relief Fund to $750,000 to assist affected employees. Popular also assisted employees by providing means to obtain water, food and other supplies, child care services, orientation on how to submit claims to the Federal Emergency Management Agency (“FEMA”) and other special offers.

Other Charitable Initiatives. The Corporation’s philanthropic arms, Fundación Banco Popular and the Popular Community Bank Foundation, launched relief efforts for the victims of hurricane Irma and Maria, through the “Embracing Puerto Rico” and “Embracing the Islands” campaigns, to which Popular has donated $1.2 million. As needs unfold, the Foundations are expected to direct funding to address immediate and long-term needs arising from the impact of the hurricanes. Popular also contributed to “Unidos por Puerto Rico”, a fundraising campaign spearheaded by Puerto Rico’s First Lady and was one of two sponsors of the “Somos Una Voz” concert that has raised over $35 million for earthquake victims in Mexico and hurricane victims in Texas, Florida, Puerto Rico and the Caribbean. Fundación Banco Popular is leveraging the relationships it has developed withnon-profit organizations and community leaders throughout its almost40-year history, delivering assistance directly to those who need it most.

During the fourth quarter of 2017, the Corporation continued normalizing its operations after the impact of the hurricanes. The government’s restoration of the electric and telecommunication services in the areas in which our branch network operates was the most critical factor leading the Corporation to operate under improved conditions. Reconstruction of the island’s electric infrastructure and restoration of the telecommunications network remain the most critical challenges for Puerto Rico’s recovery from the hurricanes.

5

Financial impact of the hurricanes

During the year ended December 31, 2017, the Corporation recorded $88.0 million inpre-tax hurricane-related expenses, including an incremental provision for loan losses of $67.7 million, which includes $5.8 million for the covered loan portfolio. These amounts are net of amounts receivable for related insurance claims of $1.1 million related to physical damages to the Corporation’s premises, equipment and other real estate owned (“OREO”). Refer to additional information on Note 2 to the Financial Statements, Hurricanes Irma and Maria, and the Provision for Loan Losses and Operating Expenses sections of this MD&A.

In addition to the incremental provision and direct operating expenses, results for the year ended December 31, 2017 were impacted by the hurricanes in the form of a reduction in revenue resulting from reduced merchant transaction activity, the waiver of certain late fees and service charges, including ATM transaction fees, to businesses and consumers in hurricane-affected areas, as well as the economic and operational disruption in the Corporation’s mortgage origination, servicing and loss mitigation activities. These resulted in a decrease in revenue of approximately $31 million when compared topre-hurricane levels.

While significant progress has been made in economic and transactional activity since September, the continued impact on transactional and collection based revenues will depend on the speed at which electricity, telecommunications and general merchant services can be restored across the region.

We expect the hurricanes to continue to impact the Corporation’s earnings in future periods. For additional information of the financial impact associated with the hurricanes, refer to Note 2 to the accompanying Financial Statements. Also, refer to the Net Interest Income,Non-Interest Income, Operating Expenses and Credit Quality sections in this MD&A for additional discussions of the impact of the hurricanes in the Corporation’s financial statements.

Tax Cuts and Jobs Act