Investor Presentation Third Quarter 2019 Exhibit 99.2

This presentation contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance, are based on the current expectations of Popular, Inc.’s (the “Corporation”) management and, by their nature, involve risks, uncertainties, estimates and assumptions. Potential factors, some of which are beyond the Corporation’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. Information on the risks and important factors that could affect the Corporation’s future results and financial condition is included in our Annual Report on Form 10-K for the year ended December 31, 2018, our Form 10-Q for the quarters ended March 31, 2019 and June 30, 2019 and in our Form 10-Q for the quarter ended September 30, 2019 to be filed with the Securities and Exchange Commission. Our filings are available on the Corporation’s website (www.popular.com) and on the Securities and Exchange Commission website (www.sec.gov). The Corporation assumes no obligation to update or revise any forward-looking statements which speak as of their respective dates. Cautionary Note Regarding Forward-Looking Statements

NPLs decreased by $7 million QoQ; ratio at 2.1% NCO ratio increased to 1.01% from 0.71% the previous quarter Credit Metrics Net income of $165.3 million Net interest margins: Popular, Inc. 4.00%, BPPR 4.26% Earnings Robust capital; Common Equity Tier 1 Capital ratio of 17.5% Tangible book value per share of $53.41 compared to $51.44 in Q2 2019 Capital Q3 2019 Highlights

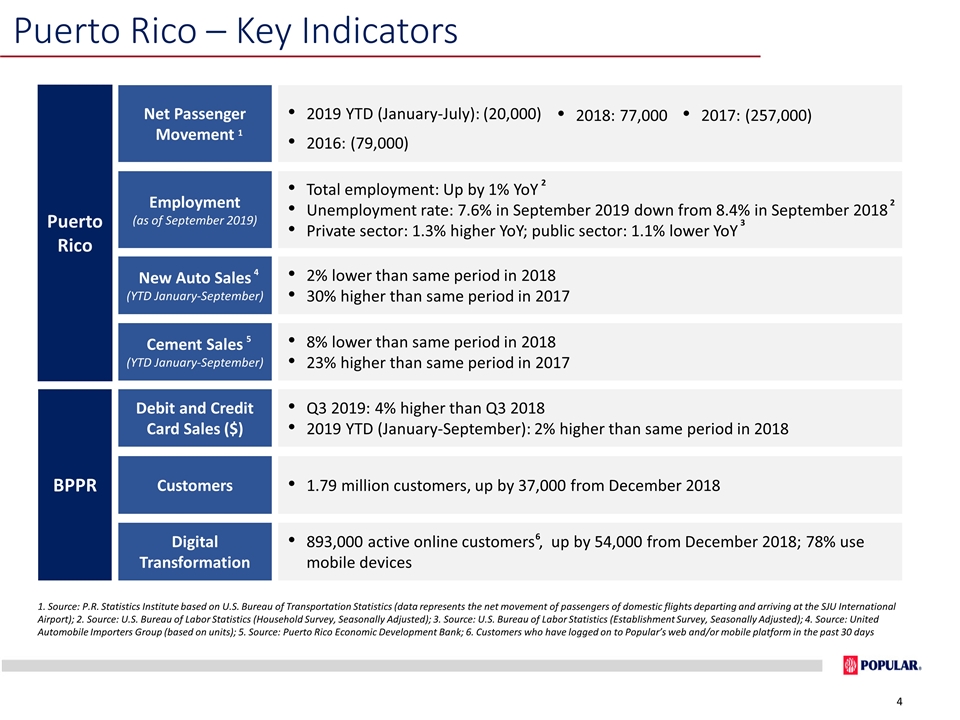

Puerto Rico – Key Indicators 1. Source: P.R. Statistics Institute based on U.S. Bureau of Transportation Statistics (data represents the net movement of passengers of domestic flights departing and arriving at the SJU International Airport); 2. Source: U.S. Bureau of Labor Statistics (Household Survey, Seasonally Adjusted); 3. Source: U.S. Bureau of Labor Statistics (Establishment Survey, Seasonally Adjusted); 4. Source: United Automobile Importers Group (based on units); 5. Source: Puerto Rico Economic Development Bank; 6. Customers who have logged on to Popular’s web and/or mobile platform in the past 30 days Net Passenger Movement 2019 YTD (January-July): (20,000) Employment (as of September 2019) Total employment: Up by 1% YoY Unemployment rate: 7.6% in September 2019 down from 8.4% in September 2018 Private sector: 1.3% higher YoY; public sector: 1.1% lower YoY New Auto Sales (YTD January-September) 2% lower than same period in 2018 30% higher than same period in 2017 Cement Sales (YTD January-September) 8% lower than same period in 2018 23% higher than same period in 2017 1 2 4 5 Debit and Credit Card Sales ($) Q3 2019: 4% higher than Q3 2018 2019 YTD (January-September): 2% higher than same period in 2018 Customers 1.79 million customers, up by 37,000 from December 2018 Puerto Rico BPPR Digital Transformation 893,000 active online customers , up by 54,000 from December 2018; 78% use mobile devices 2 3 2018: 77,000 2017: (257,000) 2016: (79,000) 6

Financial Summary (GAAP) 5

Net Interest Margin Dynamics Q3 2019 net interest margin at 4.00% Loan yield decreased 11 basis points to 6.70% Stable loan portfolio Low deposit betas in P.R. Total deposit cost decreased 2 basis points to 73 basis points in Q3 2019 Loan Yield, Deposit Cost and NIM Total Loans and Deposits ($ in billions) Money Market and Investment Securities ($ in billions) Note: Yields and net interest margin figures are not tax-equivalent

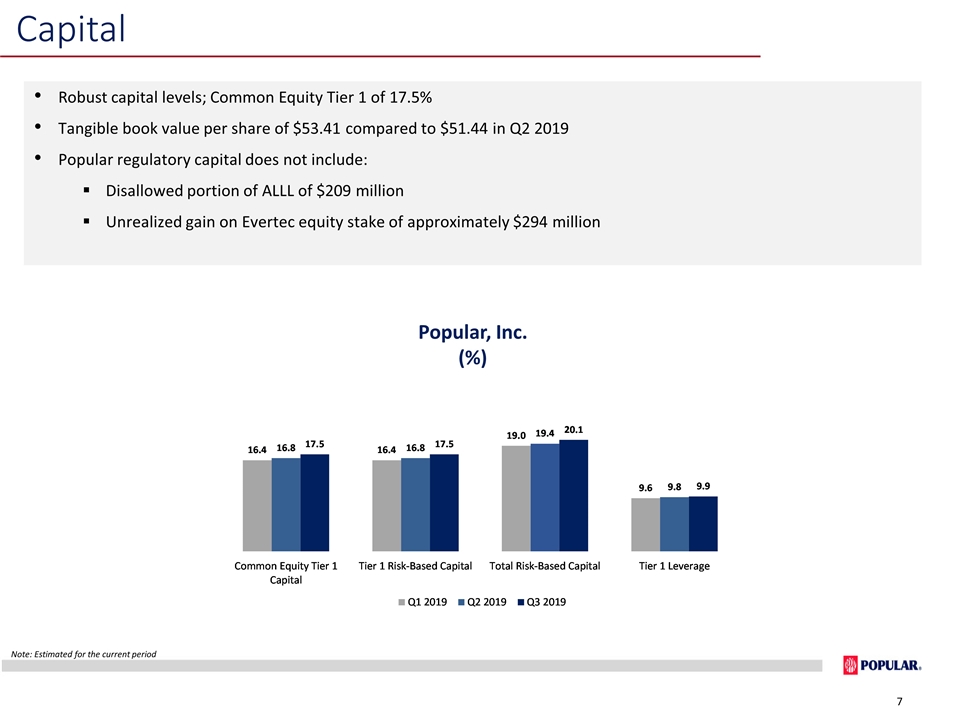

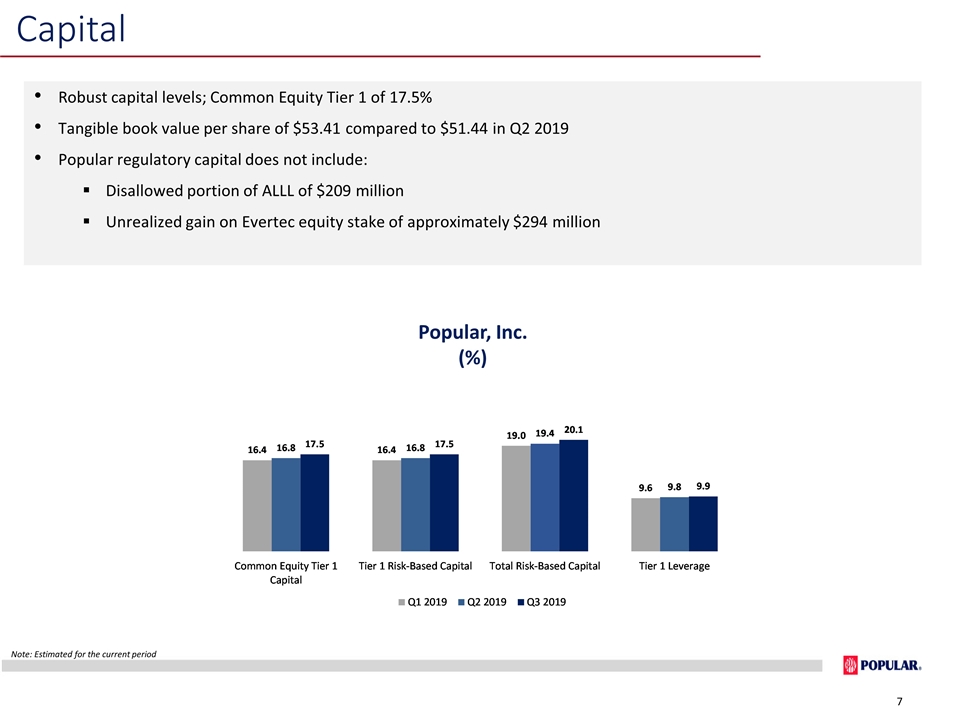

Capital Note: Estimated for the current period Robust capital levels; Common Equity Tier 1 of 17.5% Tangible book value per share of $53.41 compared to $51.44 in Q2 2019 Popular regulatory capital does not include: Disallowed portion of ALLL of $209 million Unrealized gain on Evertec equity stake of approximately $294 million Popular, Inc. (%)

Estimate of Current Expected Credit Losses (CECL) 3 4 5 Impact on Allowance for Loan and Lease Losses (“ALLL’’) ALLL as of June 30, 2019 would have increased by approximately $360-$400 million or 85-95% Increase led by P.R. mortgage, auto and credit cards loan portfolios Impact on Capital Tangible book value would have decreased by approximately $3 per share as of September 30, 2019 Impact on regulatory capital will be phased-in over 3 years Day 1 - CET1 and Total Capital would have decreased by approximately 30 basis points Implementation Status Preliminary estimates subject to further work and analysis Qualitative factors, composition of the portfolio, and economic conditions and forecast at time of adoption could impact current estimates Model and assumption validations are in process Assumptions for Estimate Portfolio balances as of June 30, 2019 Macroeconomic forecast scenarios as of June 30, 2019 Estimated range does not include purchased credit-impaired loans (ASC 310-30) Reasonable and supportable period of 2 years reverting to historical macroeconomic observations 1 1 1 Total disallowed portion of ALLL will increase by the estimated CECL impact

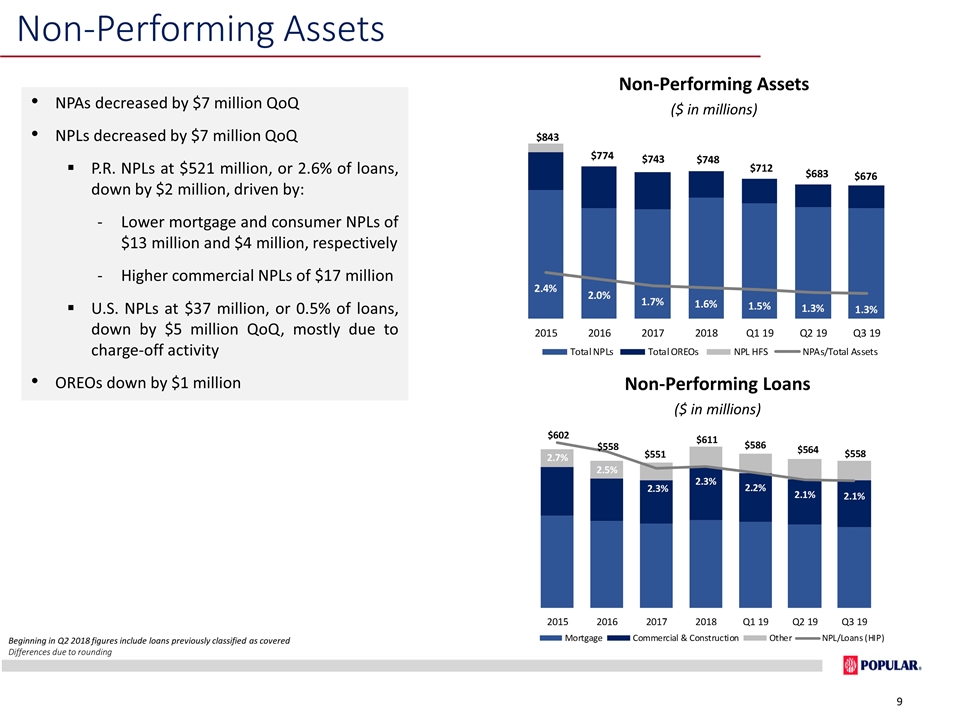

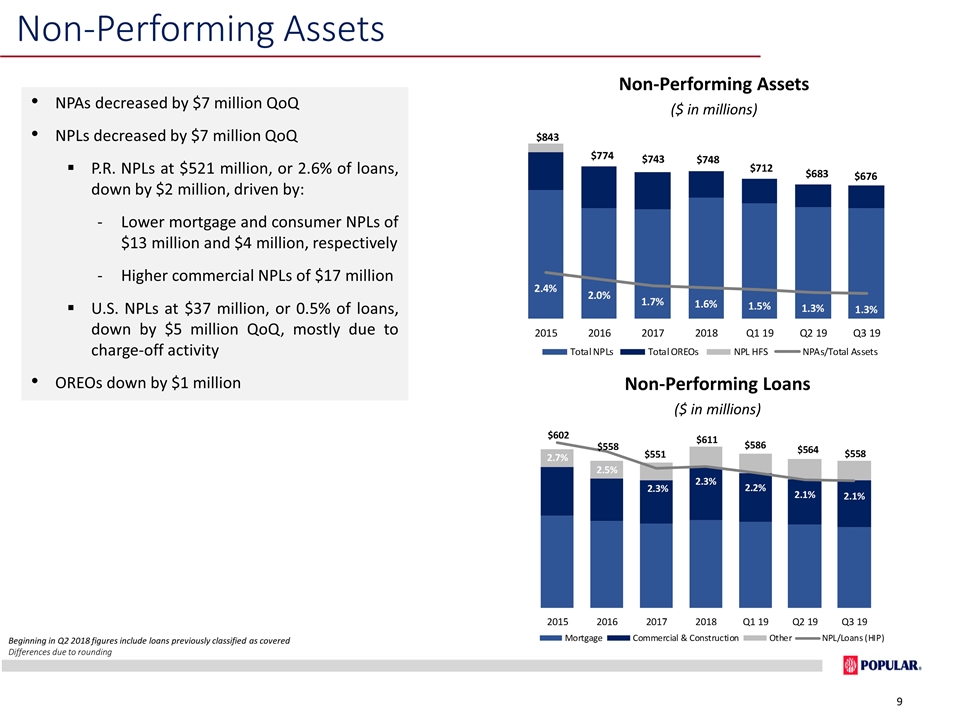

Non-Performing Assets ($ in millions) Non-Performing Assets Beginning in Q2 2018 figures include loans previously classified as covered Differences due to rounding Non-Performing Loans ($ in millions) NPAs decreased by $7 million QoQ NPLs decreased by $7 million QoQ P.R. NPLs at $521 million, or 2.6% of loans, down by $2 million, driven by: Lower mortgage and consumer NPLs of $13 million and $4 million, respectively Higher commercial NPLs of $17 million U.S. NPLs at $37 million, or 0.5% of loans, down by $5 million QoQ, mostly due to charge-off activity OREOs down by $1 million

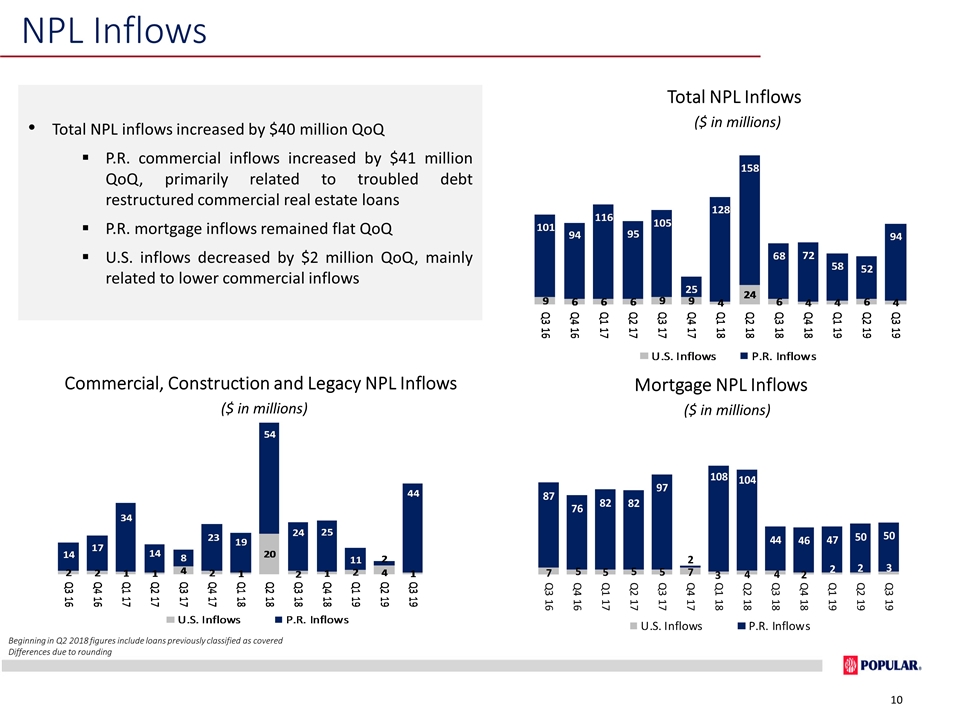

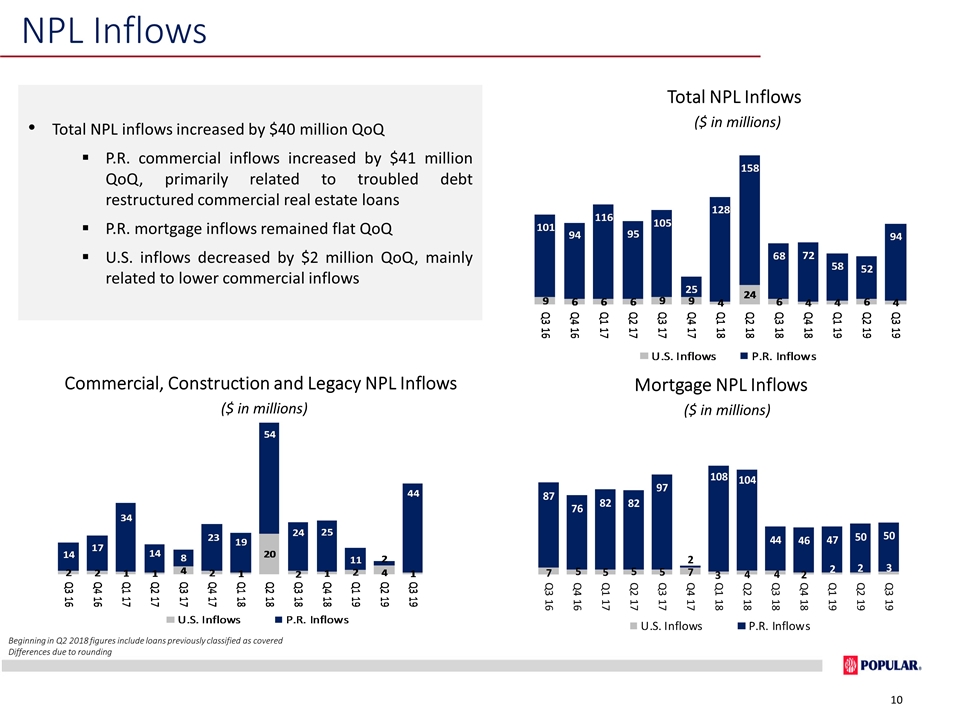

NPL Inflows Total NPL Inflows ($ in millions) Mortgage NPL Inflows ($ in millions) Commercial, Construction and Legacy NPL Inflows ($ in millions) Beginning in Q2 2018 figures include loans previously classified as covered Differences due to rounding Total NPL inflows increased by $40 million QoQ P.R. commercial inflows increased by $41 million QoQ, primarily related to troubled debt restructured commercial real estate loans P.R. mortgage inflows remained flat QoQ U.S. inflows decreased by $2 million QoQ, mainly related to lower commercial inflows

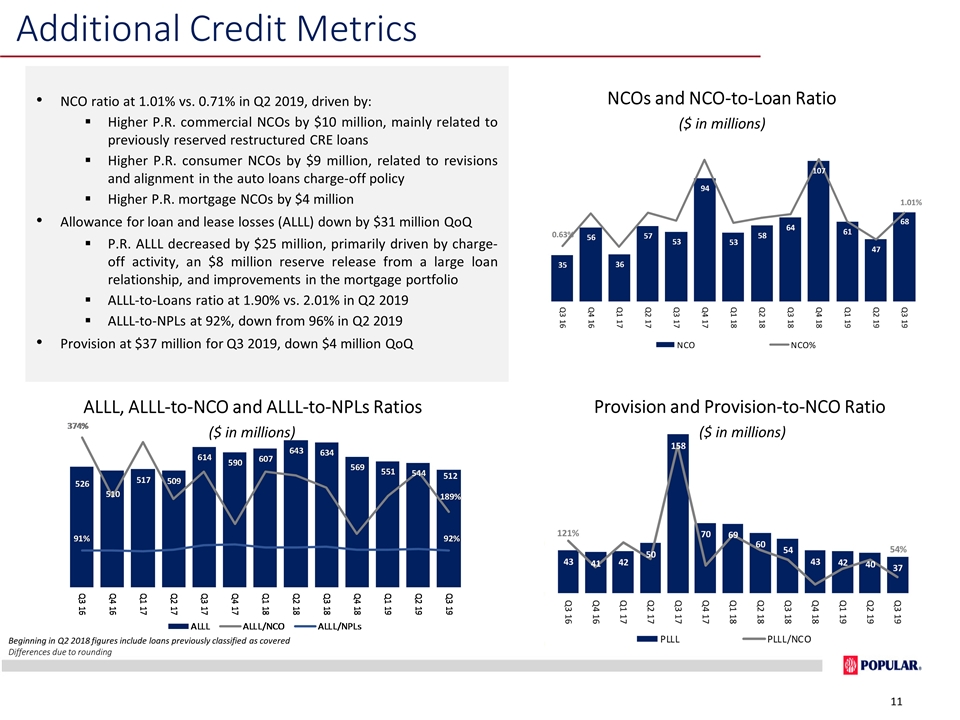

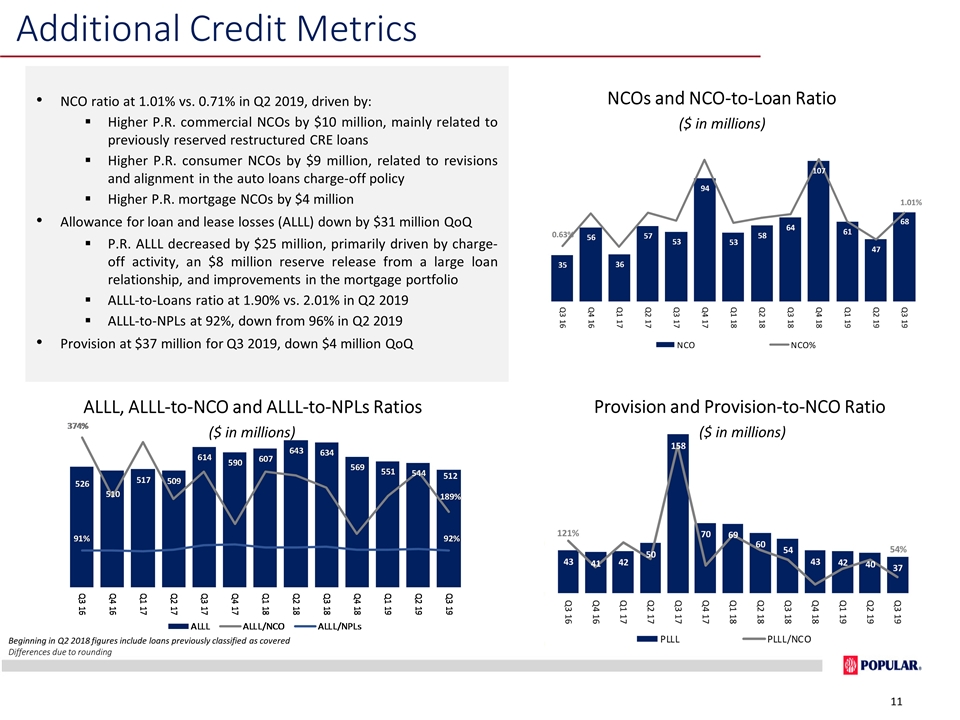

NCOs and NCO-to-Loan Ratio ($ in millions) Provision and Provision-to-NCO Ratio ($ in millions) Beginning in Q2 2018 figures include loans previously classified as covered Differences due to rounding ALLL, ALLL-to-NCO and ALLL-to-NPLs Ratios ($ in millions) Additional Credit Metrics NCO ratio at 1.01% vs. 0.71% in Q2 2019, driven by: Higher P.R. commercial NCOs by $10 million, mainly related to previously reserved restructured CRE loans Higher P.R. consumer NCOs by $9 million, related to revisions and alignment in the auto loans charge-off policy Higher P.R. mortgage NCOs by $4 million Allowance for loan and lease losses (ALLL) down by $31 million QoQ P.R. ALLL decreased by $25 million, primarily driven by charge-off activity, an $8 million reserve release from a large loan relationship, and improvements in the mortgage portfolio ALLL-to-Loans ratio at 1.90% vs. 2.01% in Q2 2019 ALLL-to-NPLs at 92%, down from 96% in Q2 2019 Provision at $37 million for Q3 2019, down $4 million QoQ

Driving Shareholder Value Capital Robust capital with Common Equity Tier 1 Capital of 17.5% Tangible book value per share of $53.41 Franchise Additional Value Investments in Evertec and Banco BHD León Puerto Rico Uniquely poised to take advantage of improving economic backdrop in Puerto Rico Leading market position Focus on customer service supported by broad branch network Differentiated digital offering for retail and commercial customers Diversified fee income driven by unmatched product breadth and depth Strong risk-adjusted margins driven by de-risked and well-diversified loan portfolio Substantial excess liquidity with low deposit beta United States Mainland banking operation provides geographic diversification Branch footprint in key New York and South Florida MSAs National niche banking focus in condo association and healthcare Evolving income streams, led by private wealth management and mortgage origination

Investor Presentation Third Quarter 2019 Appendix

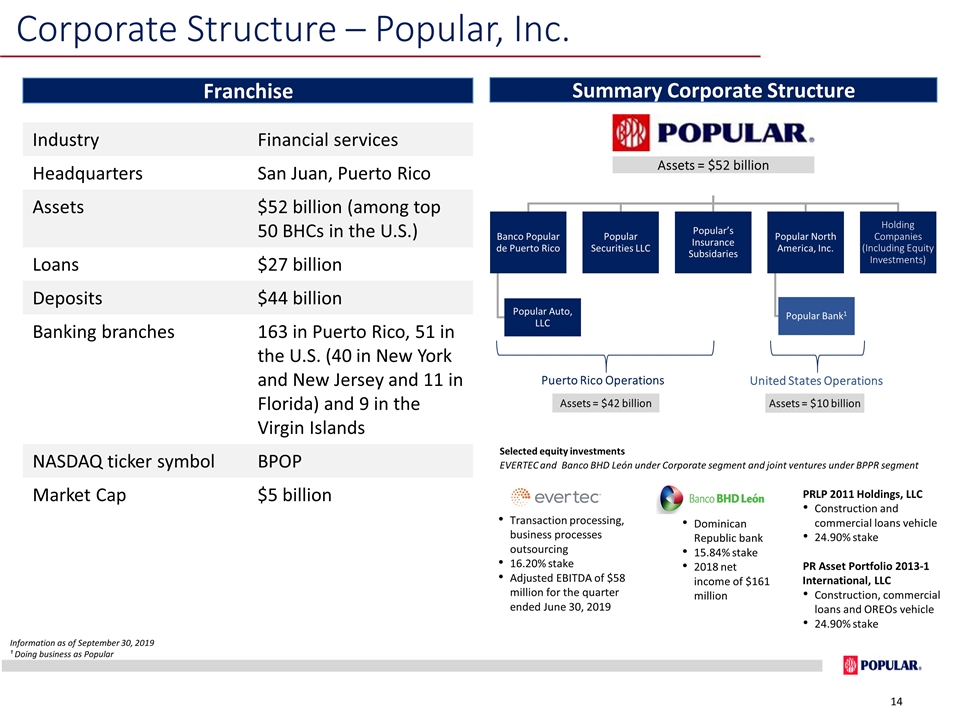

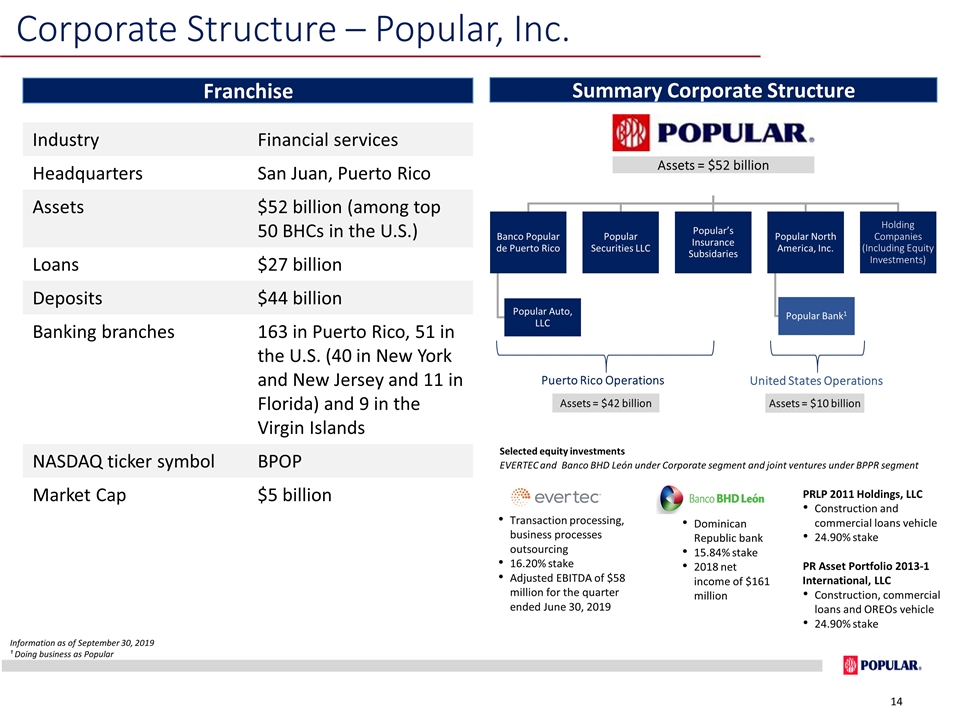

Franchise Summary Corporate Structure Assets = $42 billion Assets = $10 billion Puerto Rico Operations United States Operations Assets = $52 billion Corporate Structure – Popular, Inc. Information as of September 30, 2019 ¹ Doing business as Popular Selected equity investments EVERTEC and Banco BHD León under Corporate segment and joint ventures under BPPR segment Transaction processing, business processes outsourcing 16.20% stake Adjusted EBITDA of $58 million for the quarter ended June 30, 2019 Dominican Republic bank 15.84% stake 2018 net income of $161 million PRLP 2011 Holdings, LLC Construction and commercial loans vehicle 24.90% stake PR Asset Portfolio 2013-1 International, LLC Construction, commercial loans and OREOs vehicle 24.90% stake Industry Financial services Headquarters San Juan, Puerto Rico Assets $52 billion (among top 50 BHCs in the U.S.) Loans $27 billion Deposits $44 billion Banking branches 163 in Puerto Rico, 51 in the U.S. (40 in New York and New Jersey and 11 in Florida) and 9 in the Virgin Islands NASDAQ ticker symbol BPOP Market Cap $5 billion Banco Popular de Puerto Rico Popular’s Insurance Subsidaries Popular North America, Inc. Popular Securities LLC Holding Companies (Including Equity Investments) Popular Bank 1 Popular Auto, LLC

Municipalities Obligations of municipalities are backed by real and personal property taxes, municipal excise taxes, and/or a percentage of the sales and use tax. 75% of our total exposure is to four large municipalities in the San Juan metro area. Indirect exposure includes loans or securities that are payable by non-governmental entities, but which carry a government guarantee to cover any shortfall in collateral in the event of borrower default. Majority are single-family mortgage related. Indirect Exposure The Corporation does not own any debt issued by the P.R. central government or its public corporations. Our direct exposure to P.R. municipalities was $431 million, down $24 million QoQ, as a result of principal payments. P.R. Public Sector Exposure

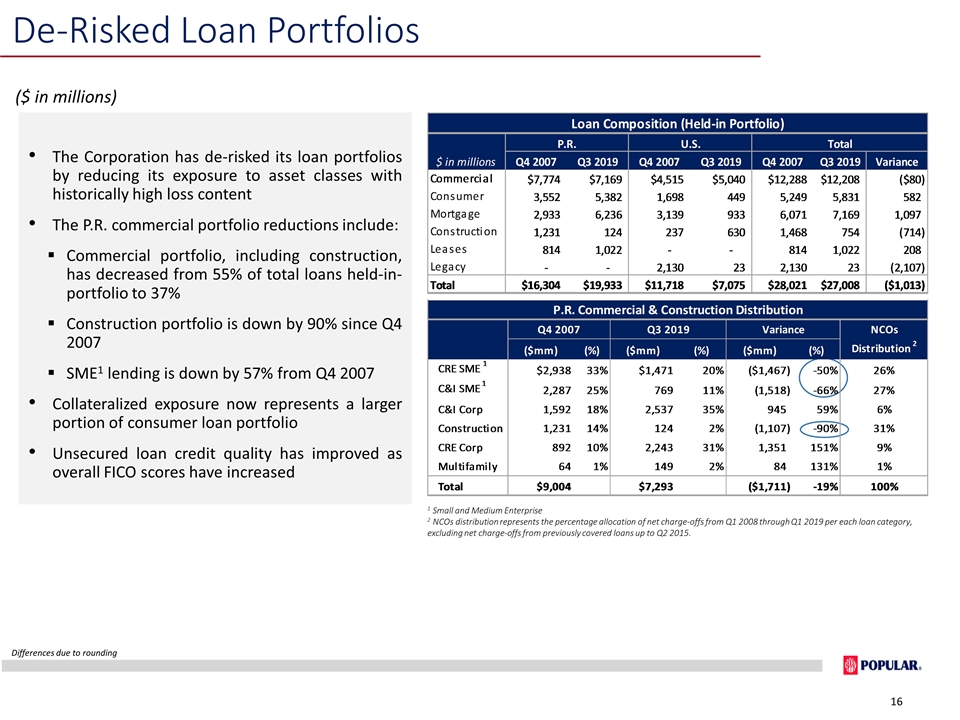

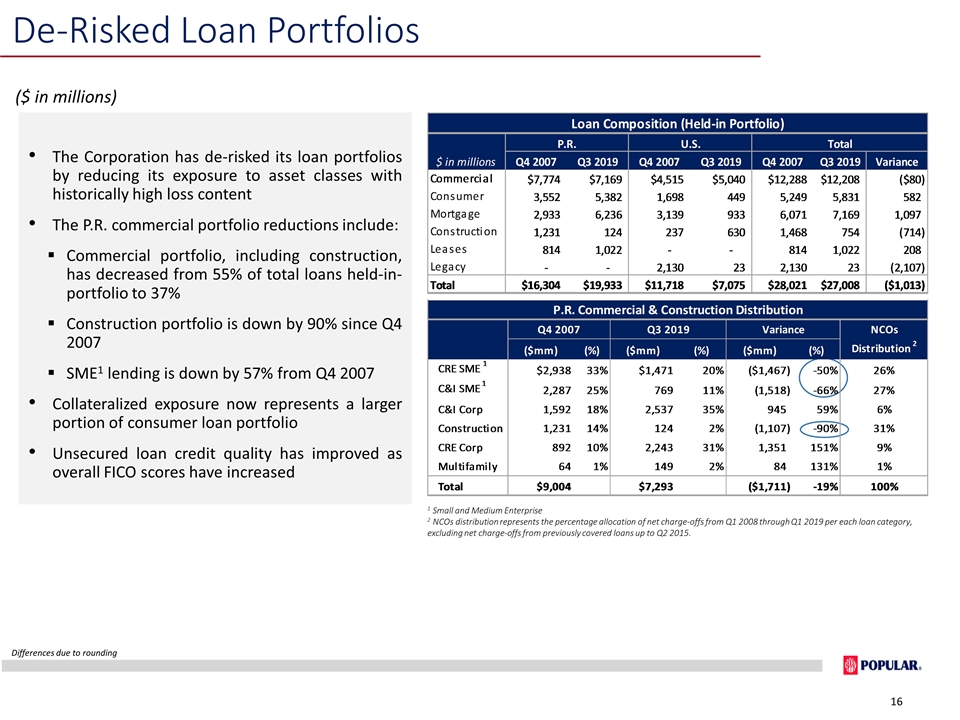

De-Risked Loan Portfolios Differences due to rounding ($ in millions) 1 Small and Medium Enterprise 2 NCOs distribution represents the percentage allocation of net charge-offs from Q1 2008 through Q1 2019 per each loan category, excluding net charge-offs from previously covered loans up to Q2 2015. The Corporation has de-risked its loan portfolios by reducing its exposure to asset classes with historically high loss content The P.R. commercial portfolio reductions include: Commercial portfolio, including construction, has decreased from 55% of total loans held-in-portfolio to 37% Construction portfolio is down by 90% since Q4 2007 SME1 lending is down by 57% from Q4 2007 Collateralized exposure now represents a larger portion of consumer loan portfolio Unsecured loan credit quality has improved as overall FICO scores have increased

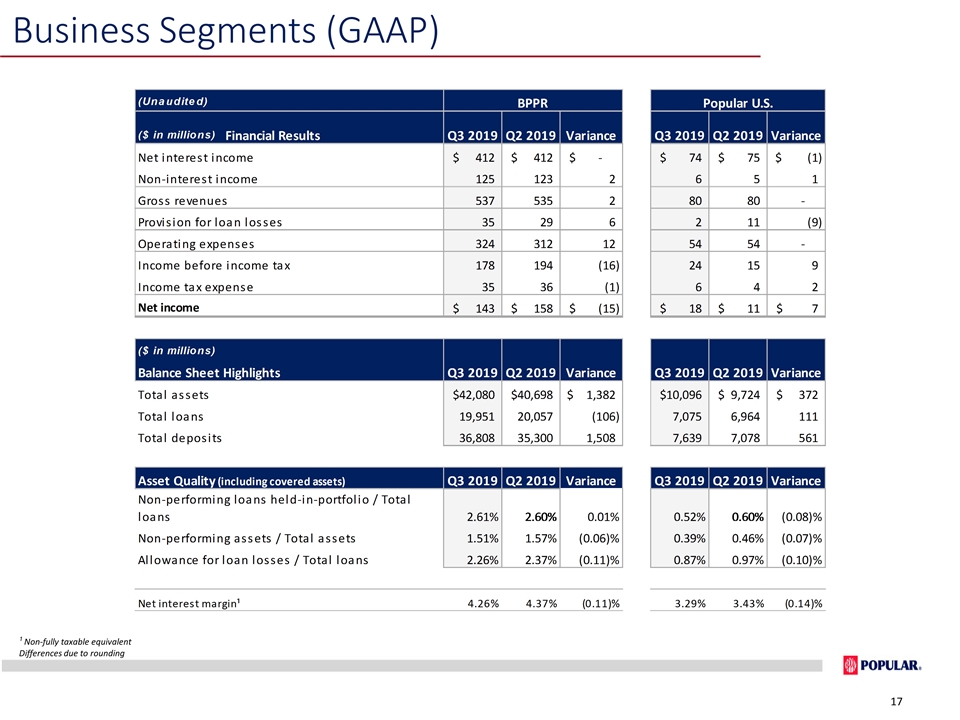

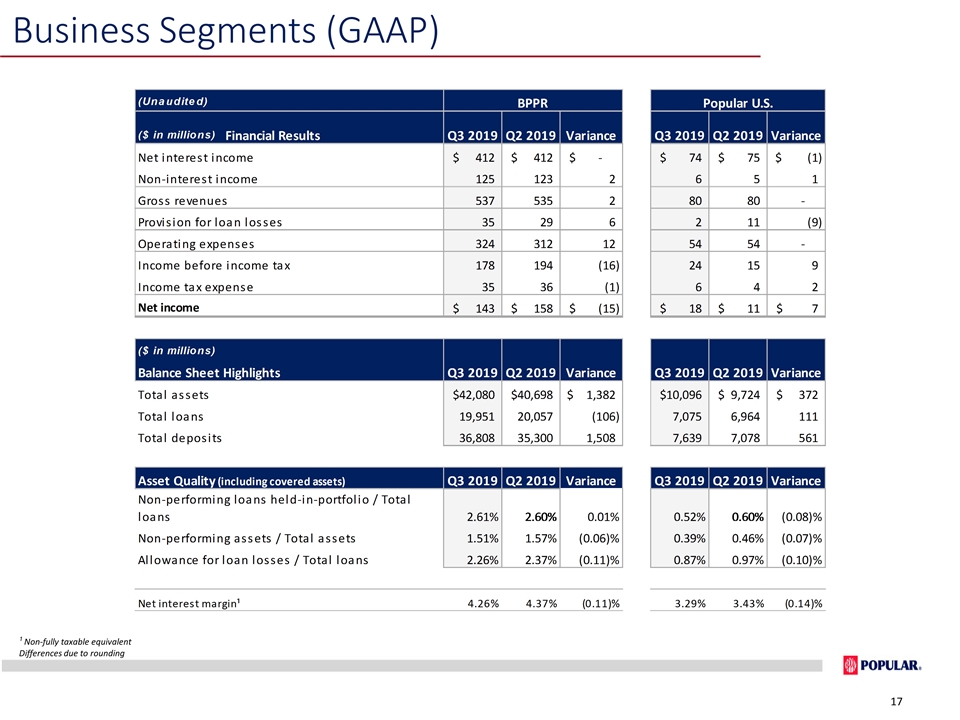

Business Segments (GAAP) ¹ Non-fully taxable equivalent Differences due to rounding

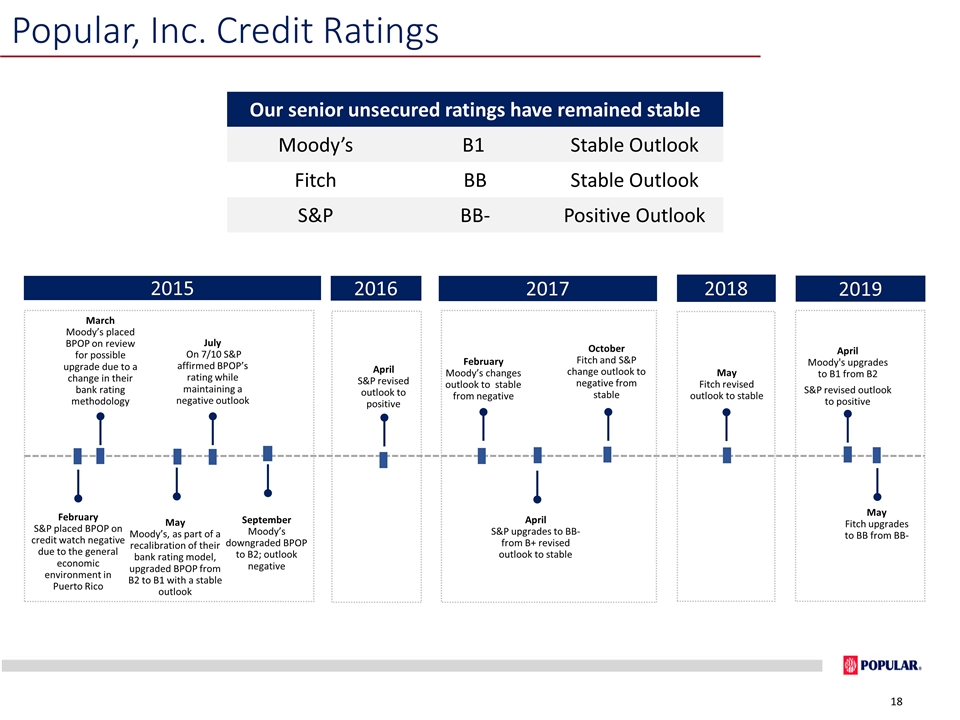

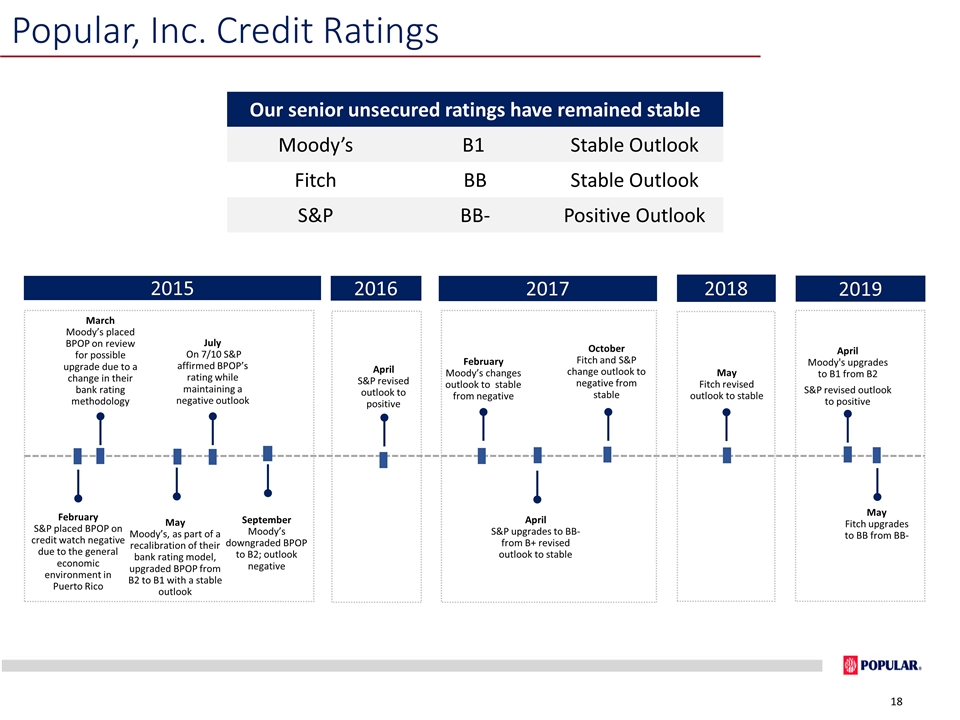

Popular, Inc. Credit Ratings Our senior unsecured ratings have remained stable Moody’s B1 Stable Outlook Fitch BB Stable Outlook S&P BB- Positive Outlook February Moody’s changes outlook to stable from negative April S&P upgrades to BB- from B+ revised outlook to stable 2017 February S&P placed BPOP on credit watch negative due to the general economic environment in Puerto Rico 2015 May Moody’s, as part of a recalibration of their bank rating model, upgraded BPOP from B2 to B1 with a stable outlook July On 7/10 S&P affirmed BPOP’s rating while maintaining a negative outlook March Moody’s placed BPOP on review for possible upgrade due to a change in their bank rating methodology September Moody’s downgraded BPOP to B2; outlook negative 2016 April S&P revised outlook to positive October Fitch and S&P change outlook to negative from stable 2018 May Fitch revised outlook to stable 2019 April Moody's upgrades to B1 from B2 S&P revised outlook to positive May Fitch upgrades to BB from BB-

Investor Presentation Third Quarter 2019