Investor Presentation First Quarter 2020 Exhibit 99.2

This presentation contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future performance, are based on the current expectations of Popular, Inc.’s (the “Corporation”) management and, by their nature, involve risks, uncertainties, estimates and assumptions. Potential factors, some of which are beyond the Corporation’s control, could cause actual results to differ materially from those expressed in, or implied by, such forward-looking statements. Such factors include, but are not limited to, the scope and duration of the coronavirus (COVID-19) pandemic, actions taken by governmental authorities in response to the pandemic, and the direct and indirect impact of the pandemic on the Corporation, our customers, service providers and third parties. Information on the risks and important factors that could affect the Corporation’s future results and financial condition is included in our Annual Report on Form 10-K for the year ended December 31, 2019 and our Form 10-Q for the quarter ended March 31, 2020 to be filed with the Securities and Exchange Commission. Our filings are available on the Corporation’s website (www.popular.com) and on the Securities and Exchange Commission website (www.sec.gov). The Corporation assumes no obligation to update or revise any forward-looking statements which speak as of their respective dates. Cautionary Note Regarding Forward-Looking Statements

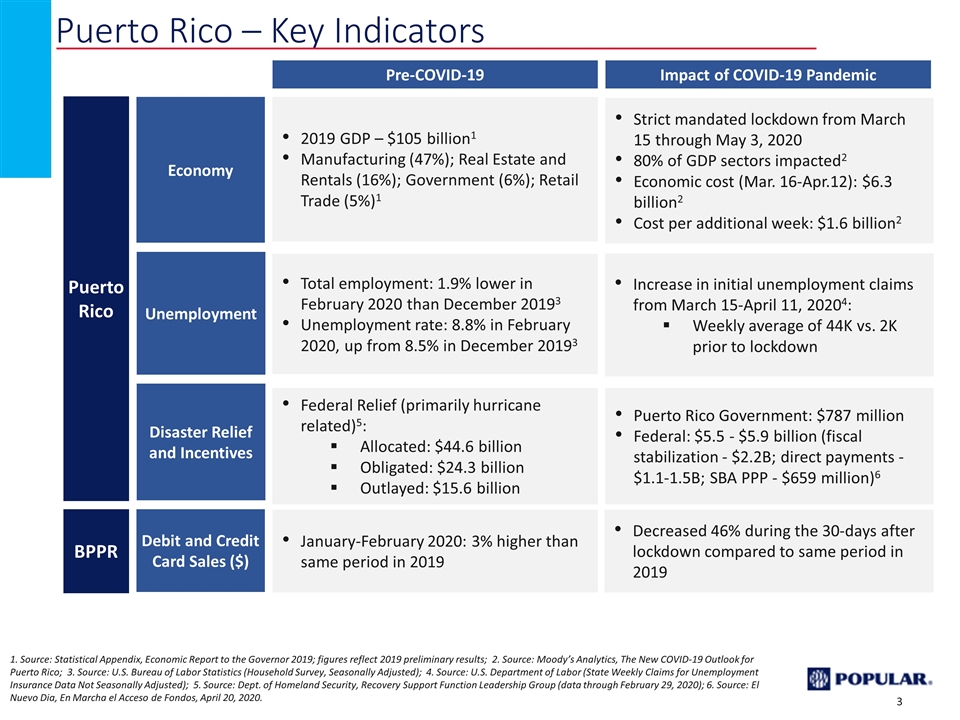

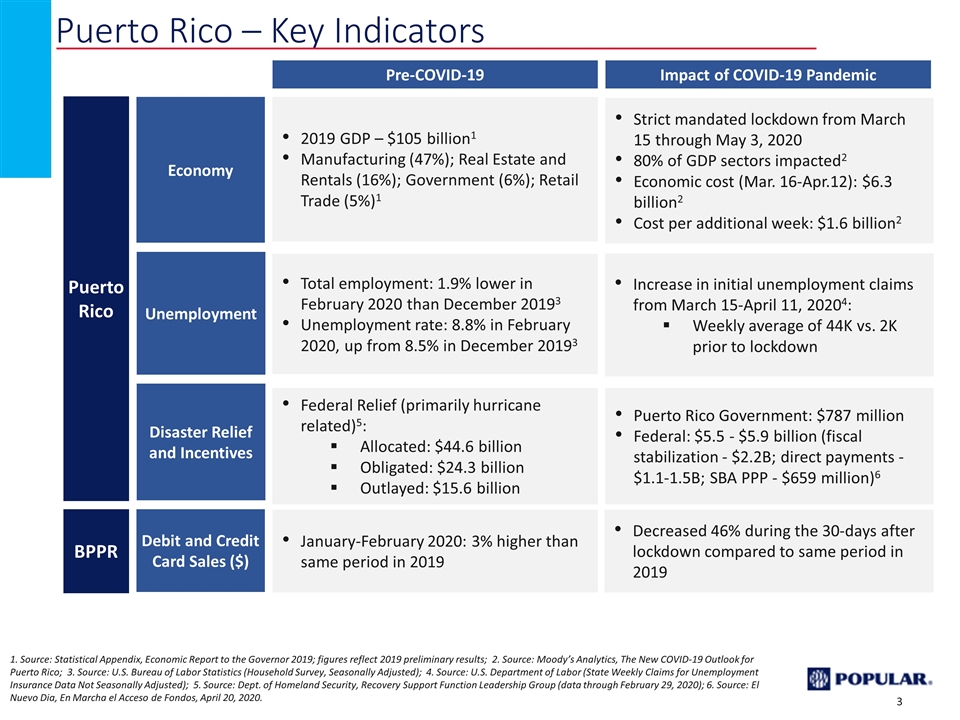

Puerto Rico – Key Indicators Unemployment Total employment: 1.9% lower in February 2020 than December 20193 Unemployment rate: 8.8% in February 2020, up from 8.5% in December 20193 Economy Strict mandated lockdown from March 15 through May 3, 2020 80% of GDP sectors impacted2 Economic cost (Mar. 16-Apr.12): $6.3 billion2 Cost per additional week: $1.6 billion2 Disaster Relief and Incentives Puerto Rico Government: $787 million Federal: $5.5 - $5.9 billion (fiscal stabilization - $2.2B; direct payments - $1.1-1.5B; SBA PPP - $659 million)6 Debit and Credit Card Sales ($) Puerto Rico BPPR 1. Source: Statistical Appendix, Economic Report to the Governor 2019; figures reflect 2019 preliminary results; 2. Source: Moody’s Analytics, The New COVID-19 Outlook for Puerto Rico; 3. Source: U.S. Bureau of Labor Statistics (Household Survey, Seasonally Adjusted); 4. Source: U.S. Department of Labor (State Weekly Claims for Unemployment Insurance Data Not Seasonally Adjusted); 5. Source: Dept. of Homeland Security, Recovery Support Function Leadership Group (data through February 29, 2020); 6. Source: El Nuevo Dia, En Marcha el Acceso de Fondos, April 20, 2020. Increase in initial unemployment claims from March 15-April 11, 20204: Weekly average of 44K vs. 2K prior to lockdown Decreased 46% during the 30-days after lockdown compared to same period in 2019 January-February 2020: 3% higher than same period in 2019 Impact of COVID-19 Pandemic Pre-COVID-19 2019 GDP – $105 billion1 Manufacturing (47%); Real Estate and Rentals (16%); Government (6%); Retail Trade (5%)1 Federal Relief (primarily hurricane related)5: Allocated: $44.6 billion Obligated: $24.3 billion Outlayed: $15.6 billion

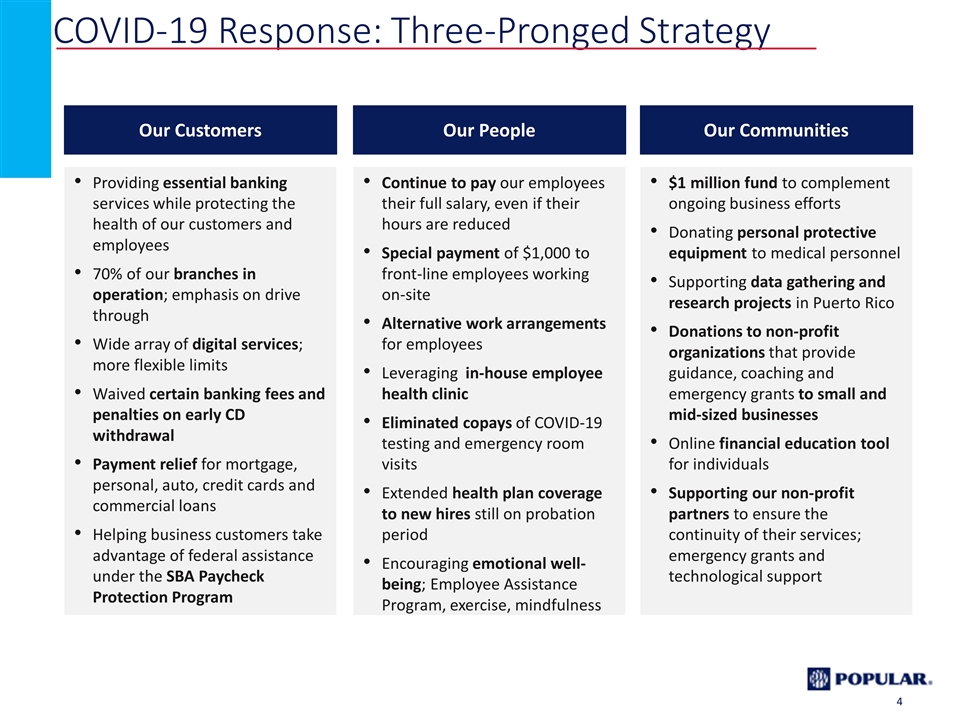

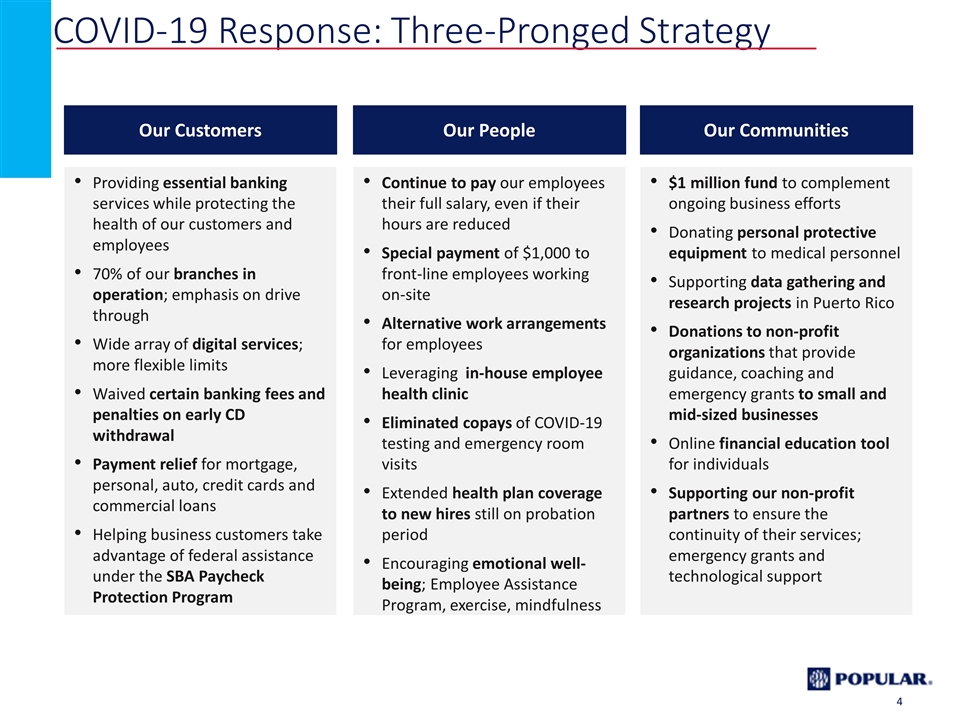

COVID-19 Response: Three-Pronged Strategy Our Customers Our People Our Communities Providing essential banking services while protecting the health of our customers and employees 70% of our branches in operation; emphasis on drive through Wide array of digital services; more flexible limits Waived certain banking fees and penalties on early CD withdrawal Payment relief for mortgage, personal, auto, credit cards and commercial loans Helping business customers take advantage of federal assistance under the SBA Paycheck Protection Program Continue to pay our employees their full salary, even if their hours are reduced Special payment of $1,000 to front-line employees working on-site Alternative work arrangements for employees Leveraging in-house employee health clinic Eliminated copays of COVID-19 testing and emergency room visits Extended health plan coverage to new hires still on probation period Encouraging emotional well-being; Employee Assistance Program, exercise, mindfulness $1 million fund to complement ongoing business efforts Donating personal protective equipment to medical personnel Supporting data gathering and research projects in Puerto Rico Donations to non-profit organizations that provide guidance, coaching and emergency grants to small and mid-sized businesses Online financial education tool for individuals Supporting our non-profit partners to ensure the continuity of their services; emergency grants and technological support

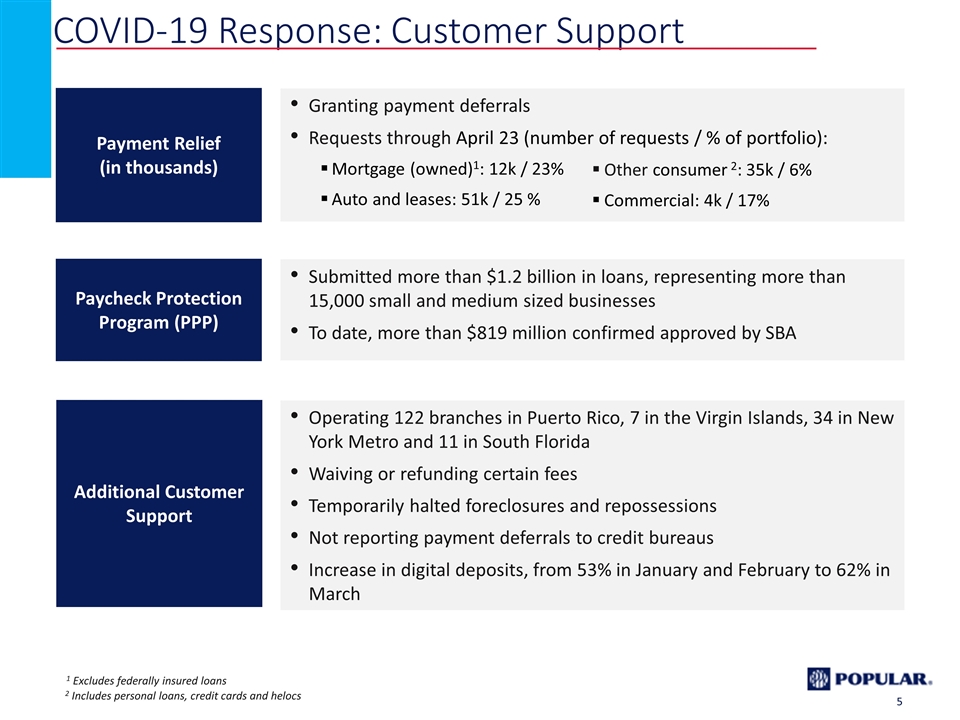

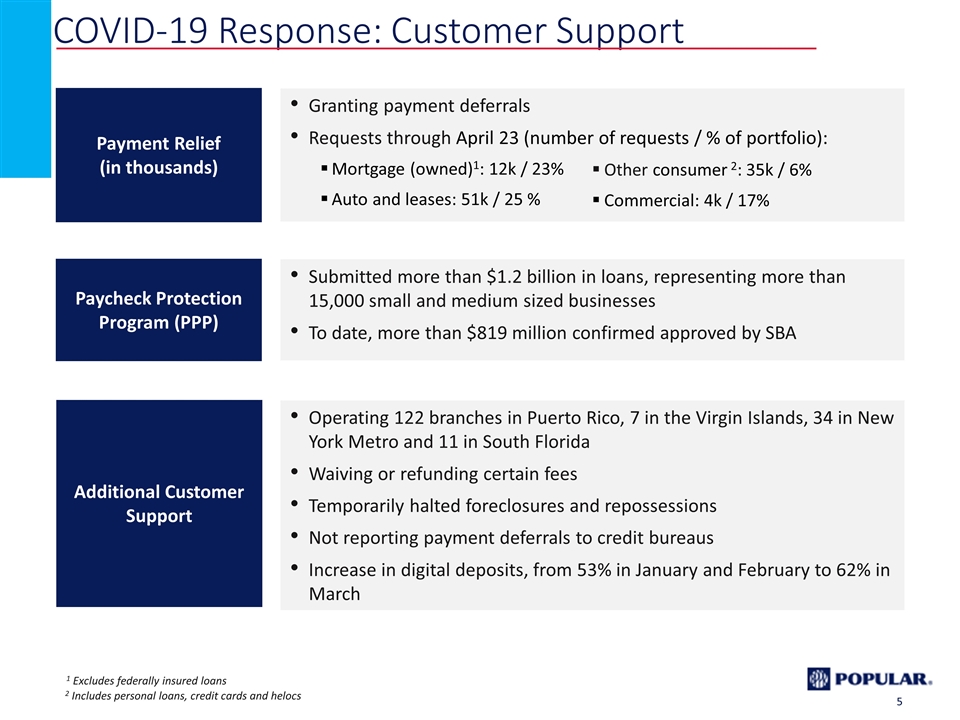

COVID-19 Response: Customer Support 5 Payment Relief (in thousands) Additional Customer Support Paycheck Protection Program (PPP) Submitted more than $1.2 billion in loans, representing more than 15,000 small and medium sized businesses To date, more than $819 million confirmed approved by SBA Granting payment deferrals Requests through April 23 (number of requests / % of portfolio): Mortgage (owned)1: 12k / 23% Auto and leases: 51k / 25 % Operating 122 branches in Puerto Rico, 7 in the Virgin Islands, 34 in New York Metro and 11 in South Florida Waiving or refunding certain fees Temporarily halted foreclosures and repossessions Not reporting payment deferrals to credit bureaus Increase in digital deposits, from 53% in January and February to 62% in March Other consumer 2: 35k / 6% Commercial: 4k / 17% 1 Excludes federally insured loans 2 Includes personal loans, credit cards and helocs

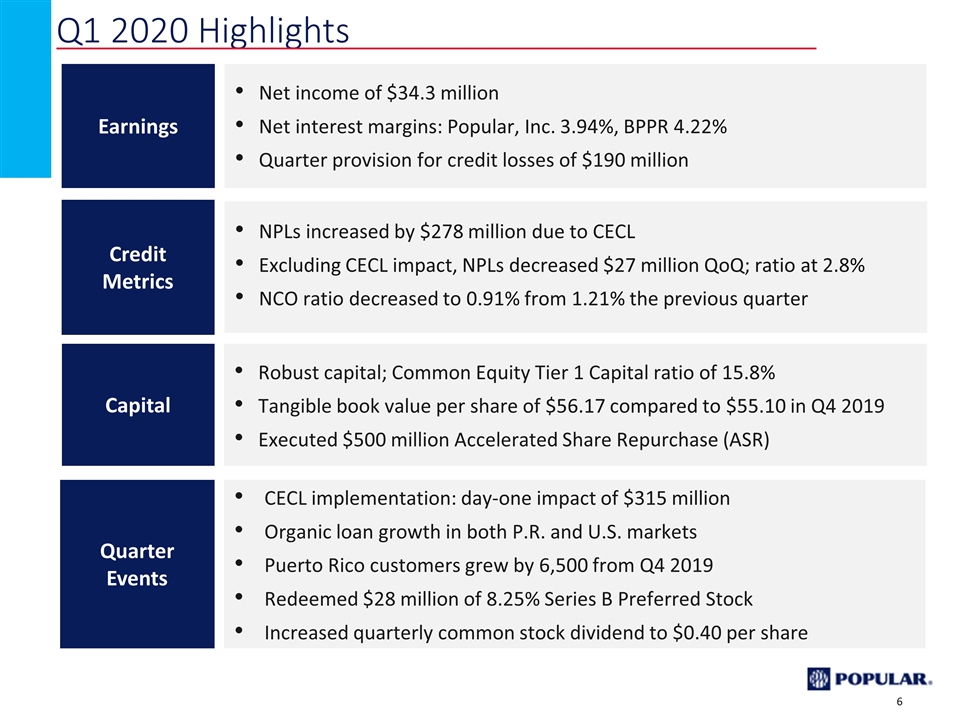

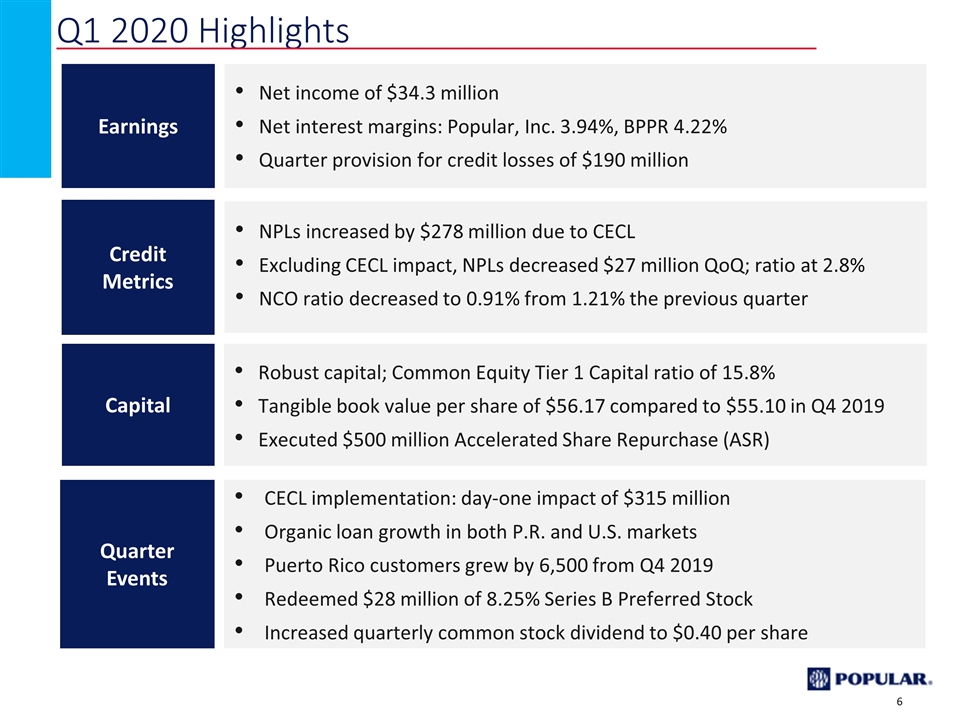

NPLs increased by $278 million due to CECL Excluding CECL impact, NPLs decreased $27 million QoQ; ratio at 2.8% NCO ratio decreased to 0.91% from 1.21% the previous quarter Credit Metrics Net income of $34.3 million Net interest margins: Popular, Inc. 3.94%, BPPR 4.22% Quarter provision for credit losses of $190 million Earnings Robust capital; Common Equity Tier 1 Capital ratio of 15.8% Tangible book value per share of $56.17 compared to $55.10 in Q4 2019 Executed $500 million Accelerated Share Repurchase (ASR) Capital Q1 2020 Highlights CECL implementation: day-one impact of $315 million Organic loan growth in both P.R. and U.S. markets Puerto Rico customers grew by 6,500 from Q4 2019 Redeemed $28 million of 8.25% Series B Preferred Stock Increased quarterly common stock dividend to $0.40 per share Quarter Events

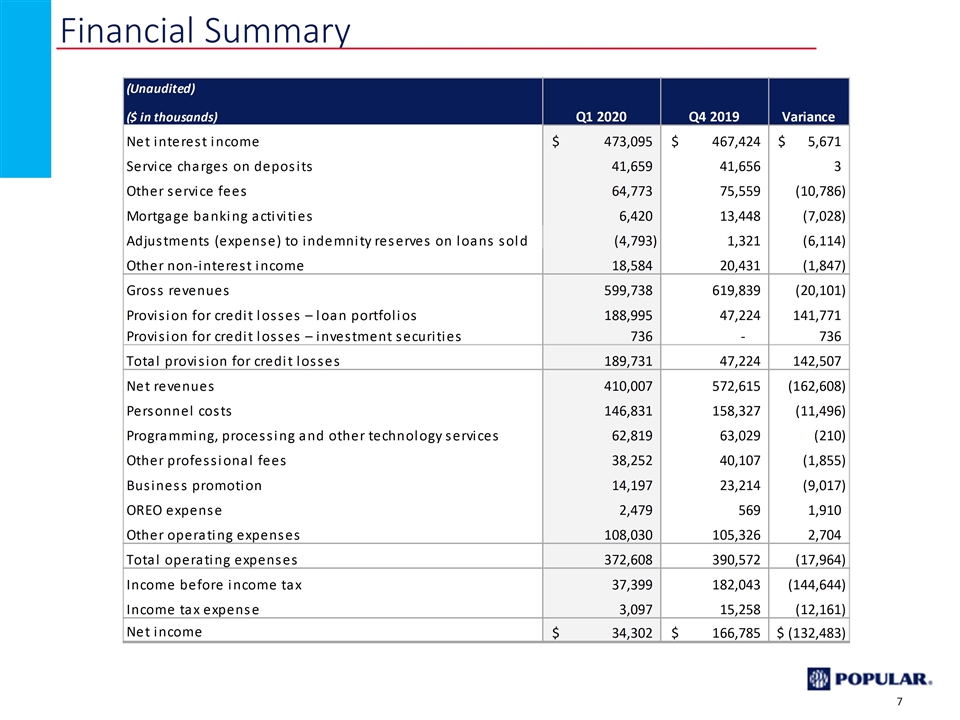

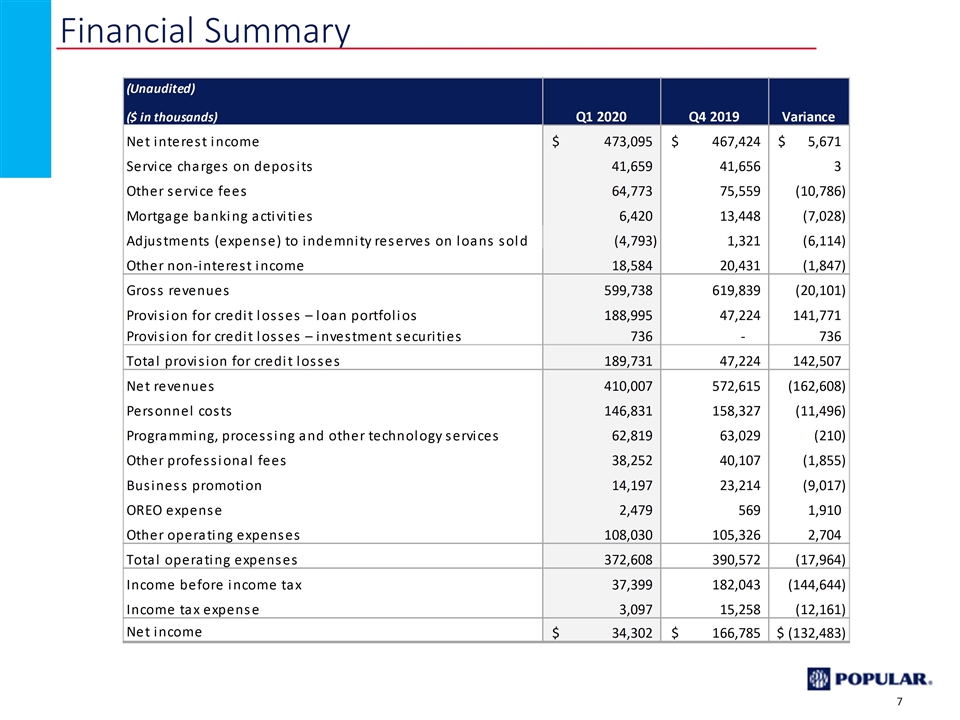

Financial Summary 7

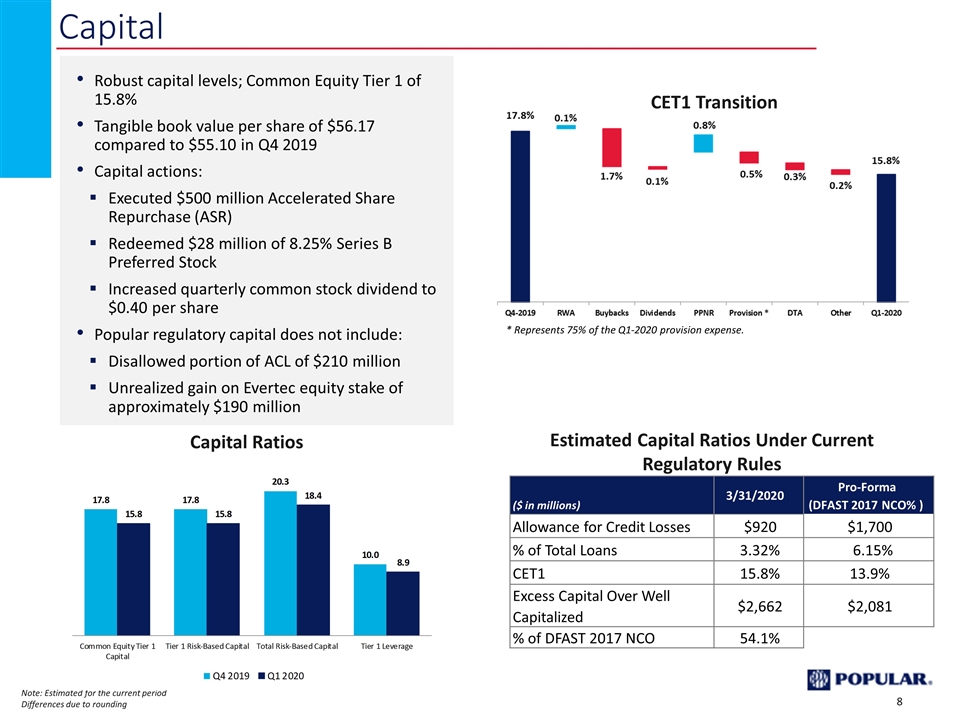

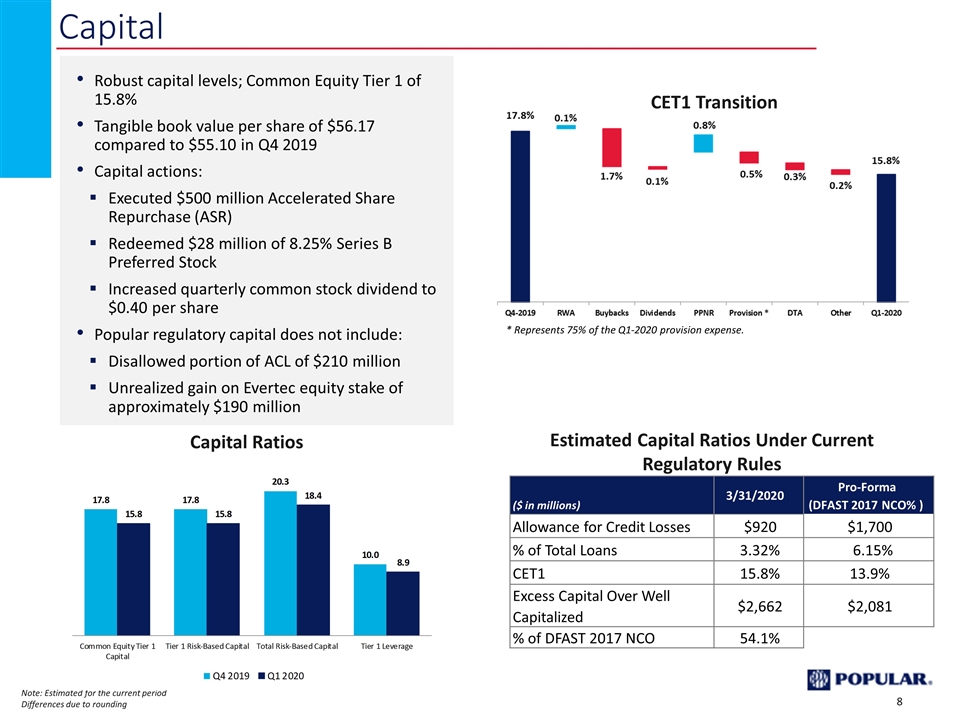

Capital Note: Estimated for the current period Differences due to rounding Robust capital levels; Common Equity Tier 1 of 15.8% Tangible book value per share of $56.17 compared to $55.10 in Q4 2019 Capital actions: Executed $500 million Accelerated Share Repurchase (ASR) Redeemed $28 million of 8.25% Series B Preferred Stock Increased quarterly common stock dividend to $0.40 per share Popular regulatory capital does not include: Disallowed portion of ACL of $210 million Unrealized gain on Evertec equity stake of approximately $190 million CET1 Transition * Represents 75% of the Q1-2020 provision expense. Estimated Capital Ratios Under Current Regulatory Rules Capital Ratios ($ in millions) 3/31/2020 Pro-Forma (DFAST 2017 NCO% ) Allowance for Credit Losses $920 $1,700 % of Total Loans 3.32% 6.15% CET1 15.8% 13.9% Excess Capital Over Well Capitalized $2,662 $2,081 % of DFAST 2017 NCO 54.1%

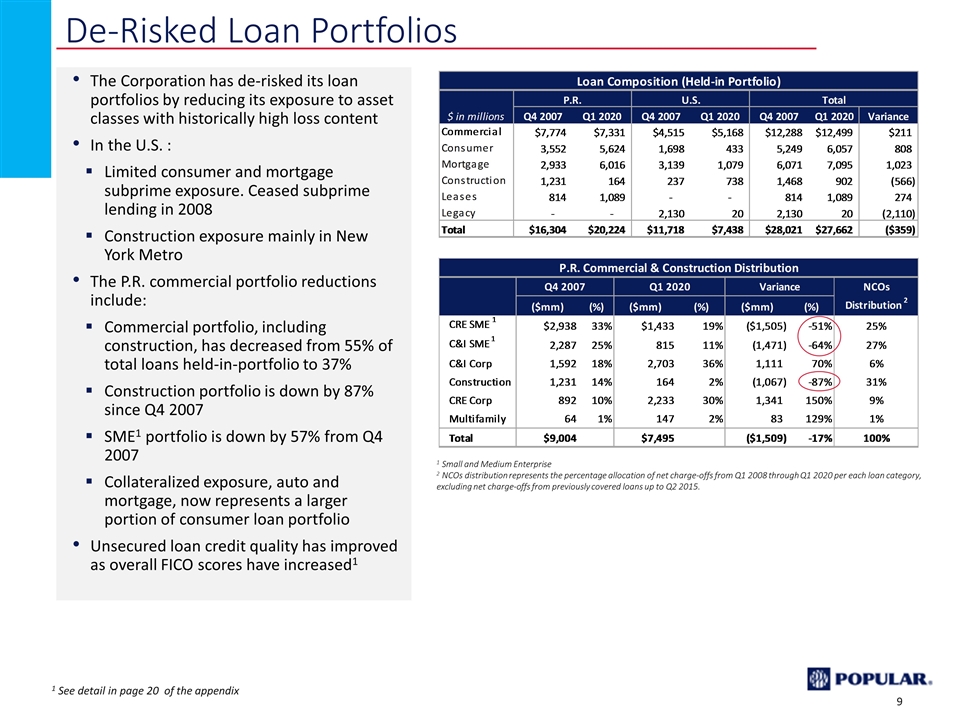

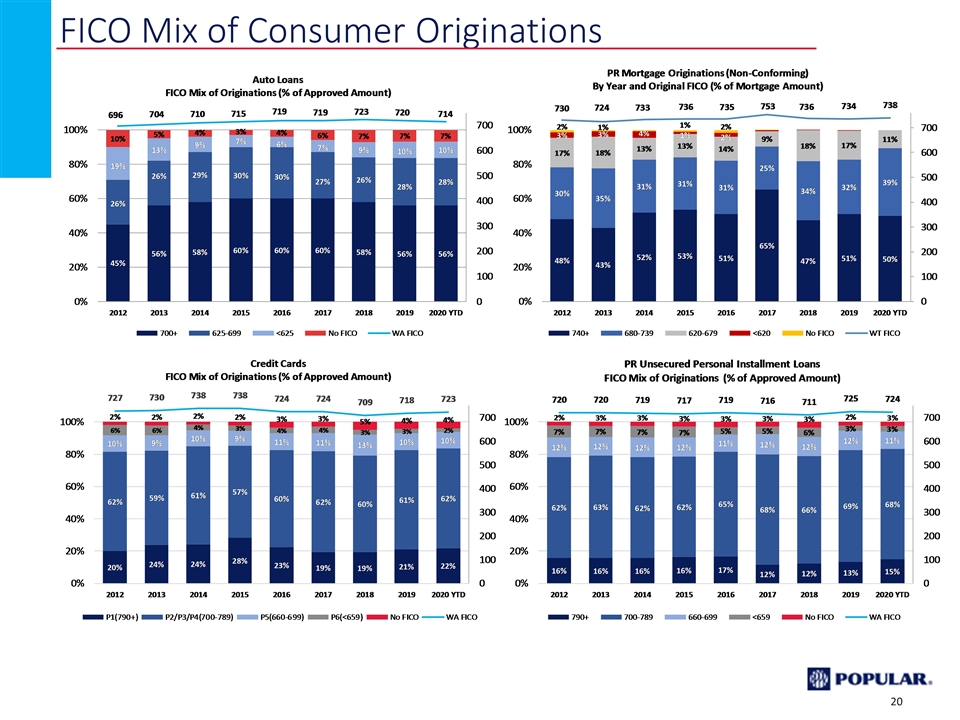

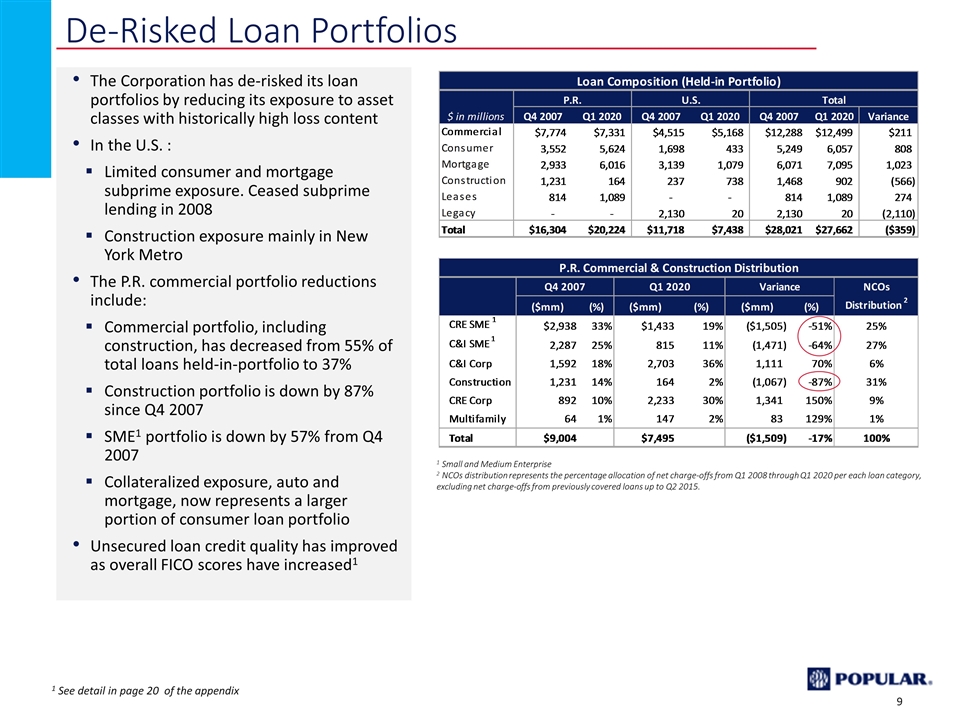

De-Risked Loan Portfolios 1 Small and Medium Enterprise 2 NCOs distribution represents the percentage allocation of net charge-offs from Q1 2008 through Q1 2020 per each loan category, excluding net charge-offs from previously covered loans up to Q2 2015. The Corporation has de-risked its loan portfolios by reducing its exposure to asset classes with historically high loss content In the U.S. : Limited consumer and mortgage subprime exposure. Ceased subprime lending in 2008 Construction exposure mainly in New York Metro The P.R. commercial portfolio reductions include: Commercial portfolio, including construction, has decreased from 55% of total loans held-in-portfolio to 37% Construction portfolio is down by 87% since Q4 2007 SME1 portfolio is down by 57% from Q4 2007 Collateralized exposure, auto and mortgage, now represents a larger portion of consumer loan portfolio Unsecured loan credit quality has improved as overall FICO scores have increased1 1 See detail in page 20 of the appendix

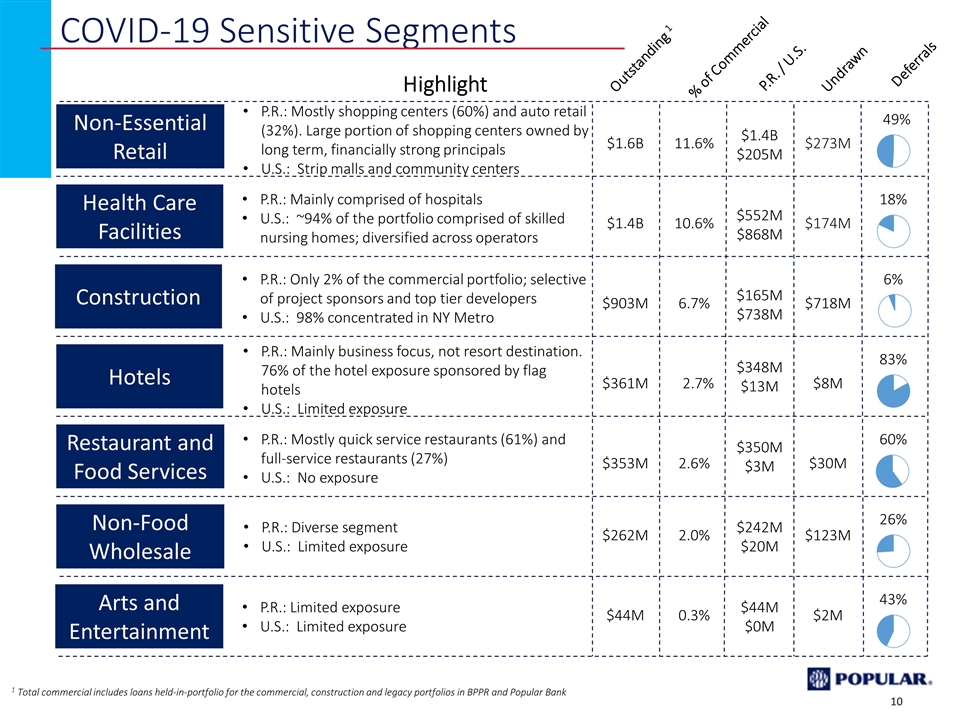

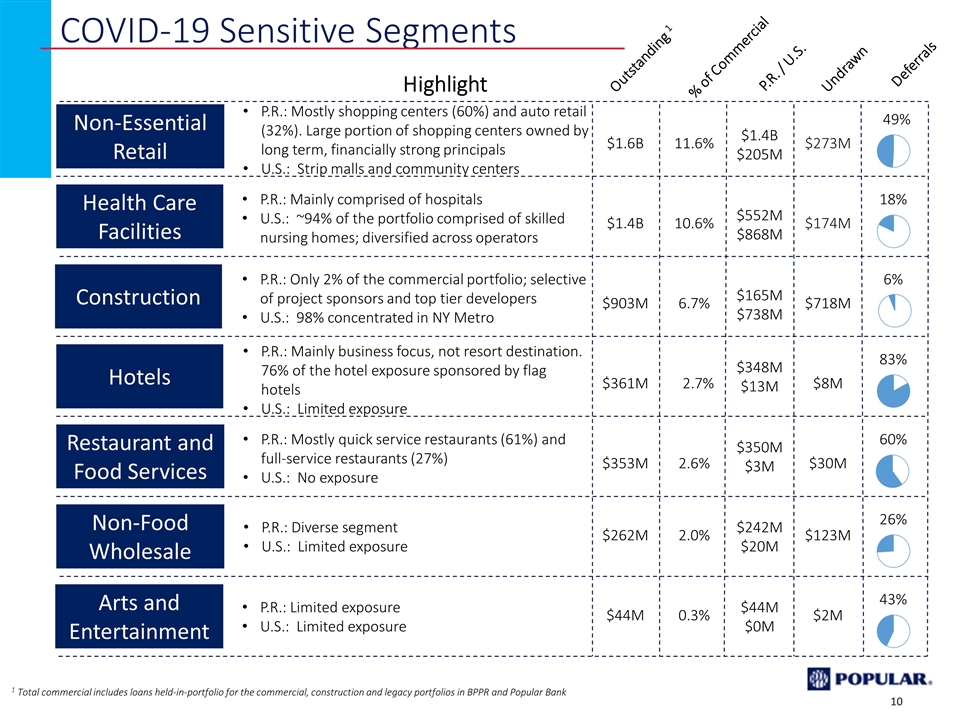

COVID-19 Sensitive Segments Health Care Facilities Non-Essential Retail Construction Hotels Non-Food Wholesale Arts and Entertainment Restaurant and Food Services P.R.: Mostly shopping centers (60%) and auto retail (32%). Large portion of shopping centers owned by long term, financially strong principals U.S.: Strip malls and community centers P.R.: Mainly comprised of hospitals U.S.: ~94% of the portfolio comprised of skilled nursing homes; diversified across operators P.R.: Only 2% of the commercial portfolio; selective of project sponsors and top tier developers U.S.: 98% concentrated in NY Metro P.R.: Mainly business focus, not resort destination. 76% of the hotel exposure sponsored by flag hotels U.S.: Limited exposure P.R.: Mostly quick service restaurants (61%) and full-service restaurants (27%) U.S.: No exposure P.R.: Limited exposure U.S.: Limited exposure P.R.: Diverse segment U.S.: Limited exposure Highlight 1 Total commercial includes loans held-in-portfolio for the commercial, construction and legacy portfolios in BPPR and Popular Bank Outstanding 1 % of Commercial P.R. / U.S. Undrawn Deferrals $1.6B $903M 11.6% $552M $868M $273M 49% $1.4B $361M $353M $262M $44M 10.6% 6.7% 2.7% 2.6% 2.0% 0.3% $1.4B $205M $165M $738M $348M $13M $350M $3M $242M $20M $44M $0M $174M 18% $718M 6% $8M 83% $30M 60% $123M 26% $2M 43%

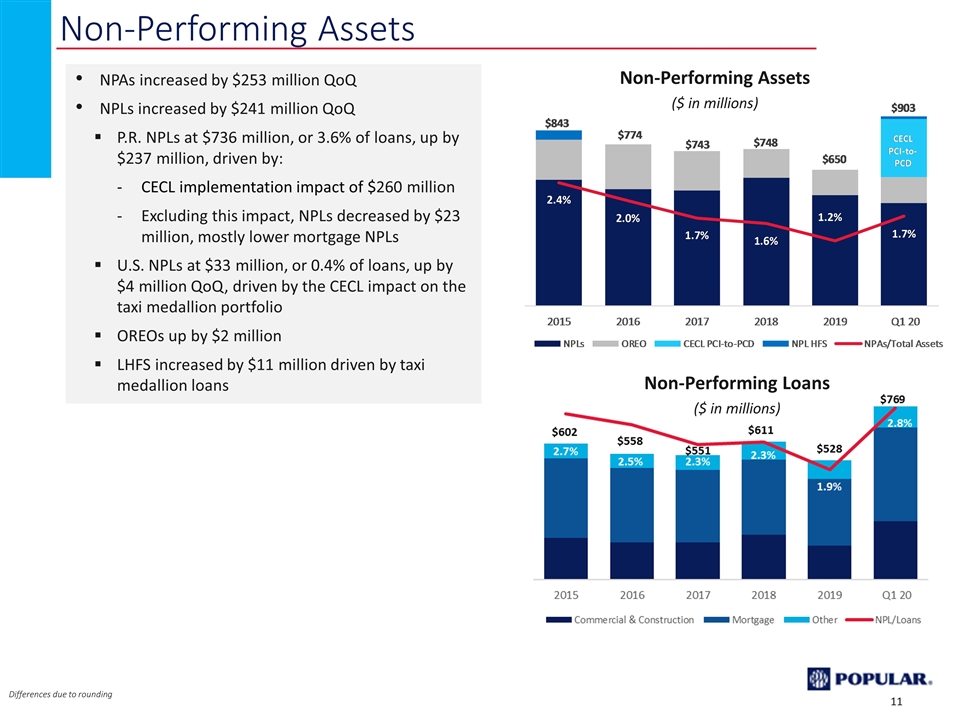

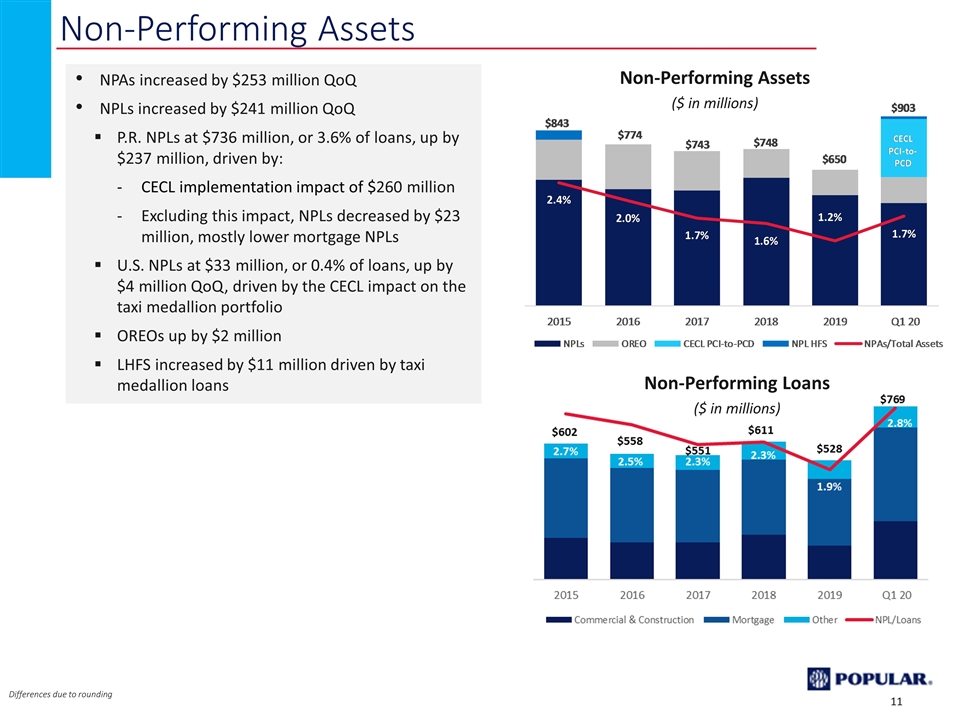

Non-Performing Assets ($ in millions) Non-Performing Assets NPAs increased by $253 million QoQ NPLs increased by $241 million QoQ P.R. NPLs at $736 million, or 3.6% of loans, up by $237 million, driven by: CECL implementation impact of $260 million Excluding this impact, NPLs decreased by $23 million, mostly lower mortgage NPLs U.S. NPLs at $33 million, or 0.4% of loans, up by $4 million QoQ, driven by the CECL impact on the taxi medallion portfolio OREOs up by $2 million LHFS increased by $11 million driven by taxi medallion loans Differences due to rounding Non-Performing Loans ($ in millions)

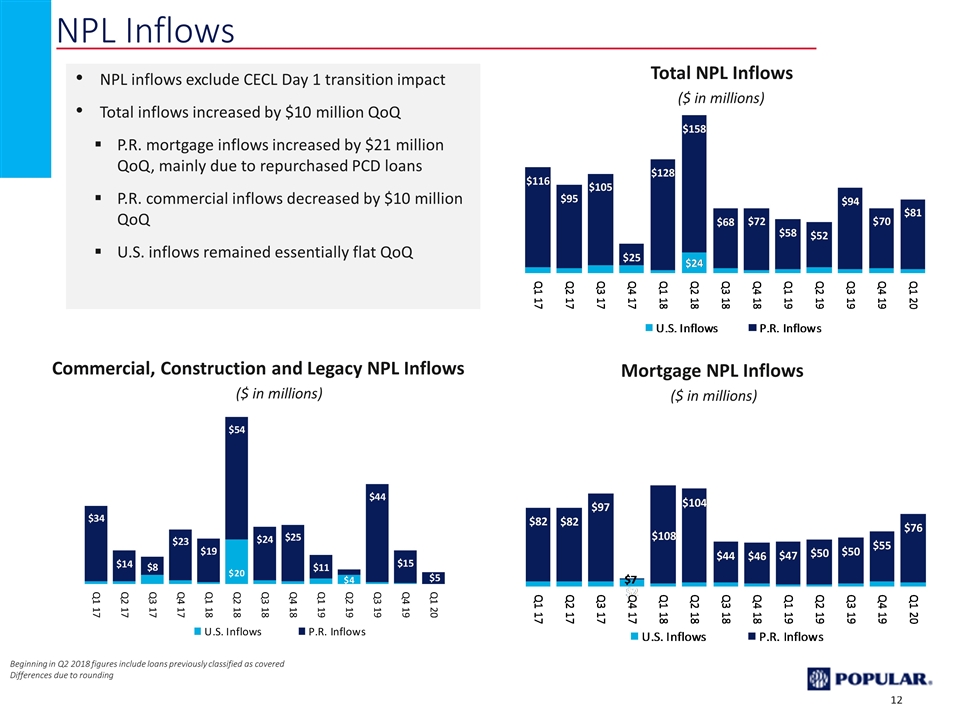

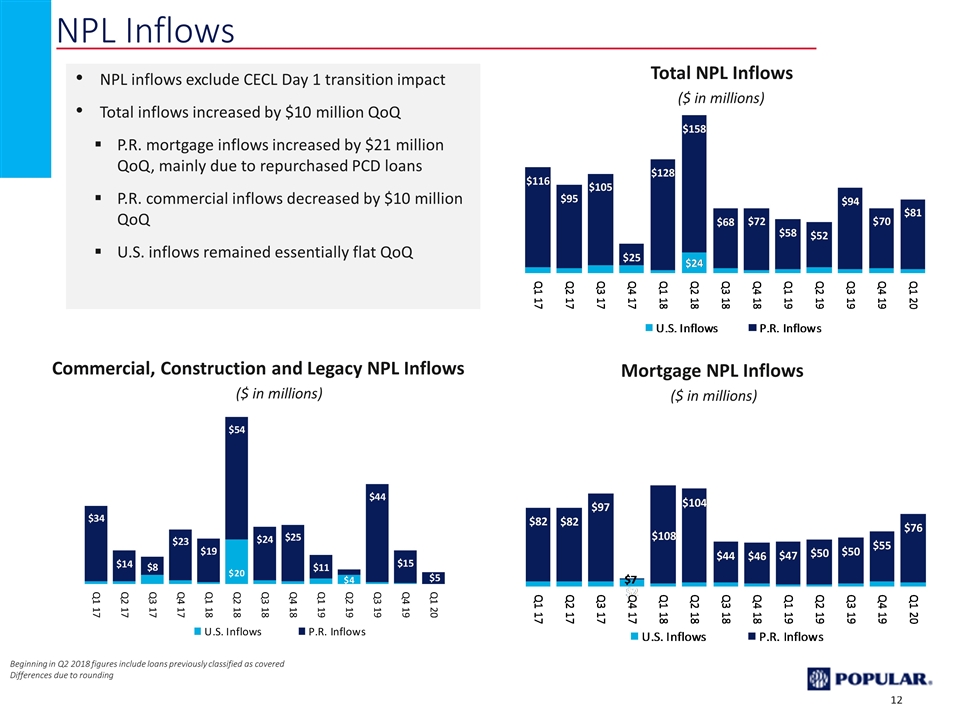

NPL Inflows Total NPL Inflows ($ in millions) Mortgage NPL Inflows ($ in millions) Commercial, Construction and Legacy NPL Inflows ($ in millions) Beginning in Q2 2018 figures include loans previously classified as covered Differences due to rounding NPL inflows exclude CECL Day 1 transition impact Total inflows increased by $10 million QoQ P.R. mortgage inflows increased by $21 million QoQ, mainly due to repurchased PCD loans P.R. commercial inflows decreased by $10 million QoQ U.S. inflows remained essentially flat QoQ

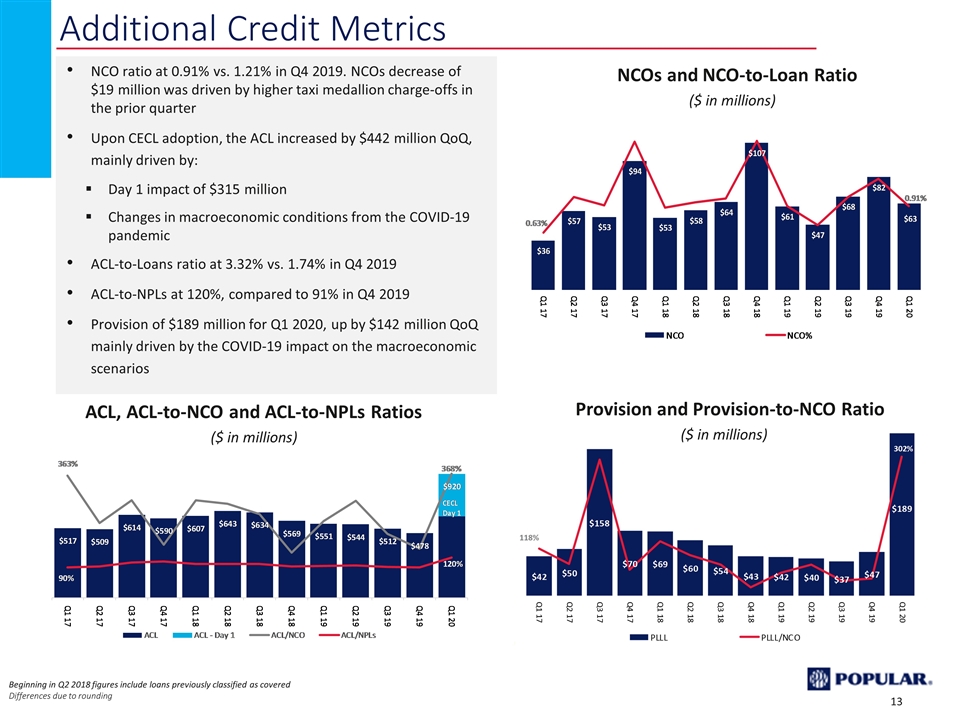

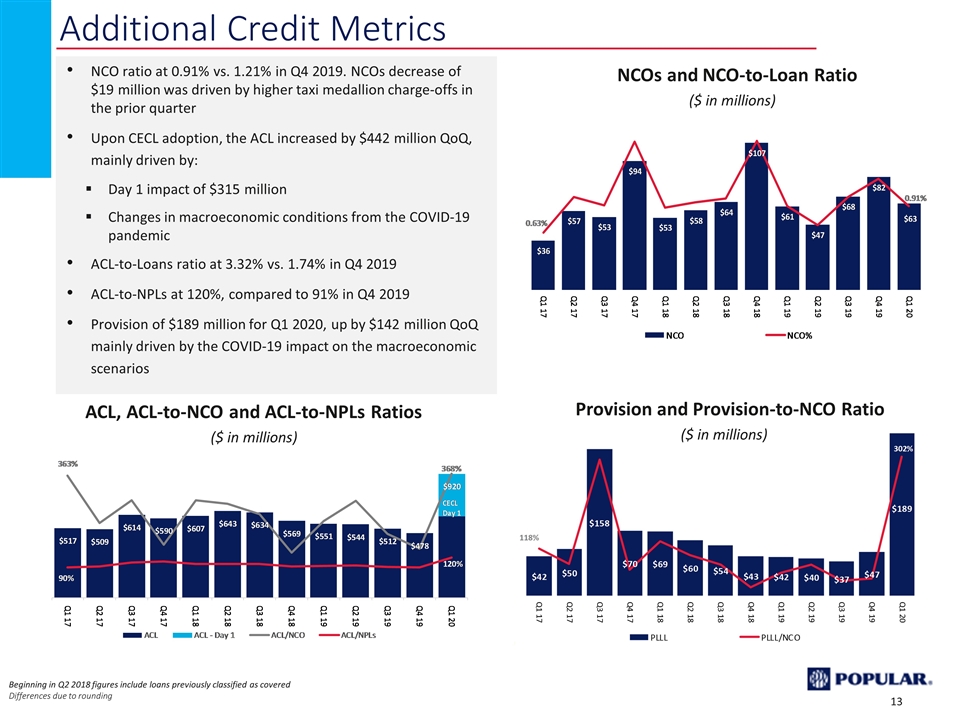

NCOs and NCO-to-Loan Ratio ($ in millions) Provision and Provision-to-NCO Ratio ($ in millions) Beginning in Q2 2018 figures include loans previously classified as covered Differences due to rounding Additional Credit Metrics NCO ratio at 0.91% vs. 1.21% in Q4 2019. NCOs decrease of $19 million was driven by higher taxi medallion charge-offs in the prior quarter Upon CECL adoption, the ACL increased by $442 million QoQ, mainly driven by: Day 1 impact of $315 million Changes in macroeconomic conditions from the COVID-19 pandemic ACL-to-Loans ratio at 3.32% vs. 1.74% in Q4 2019 ACL-to-NPLs at 120%, compared to 91% in Q4 2019 Provision of $189 million for Q1 2020, up by $142 million QoQ mainly driven by the COVID-19 impact on the macroeconomic scenarios ACL, ACL-to-NCO and ACL-to-NPLs Ratios ($ in millions)

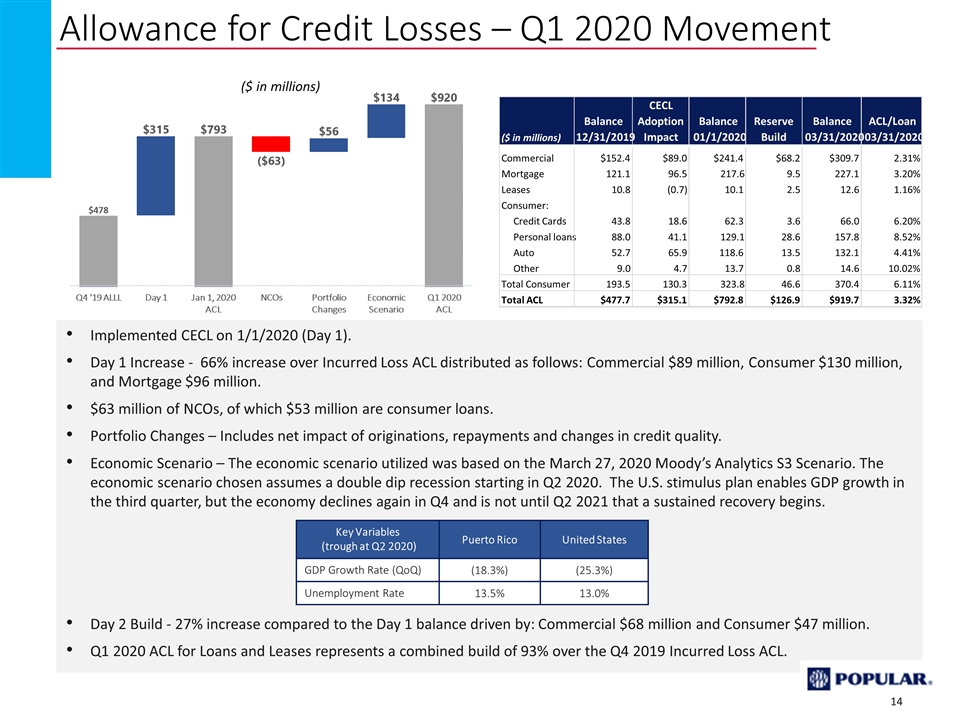

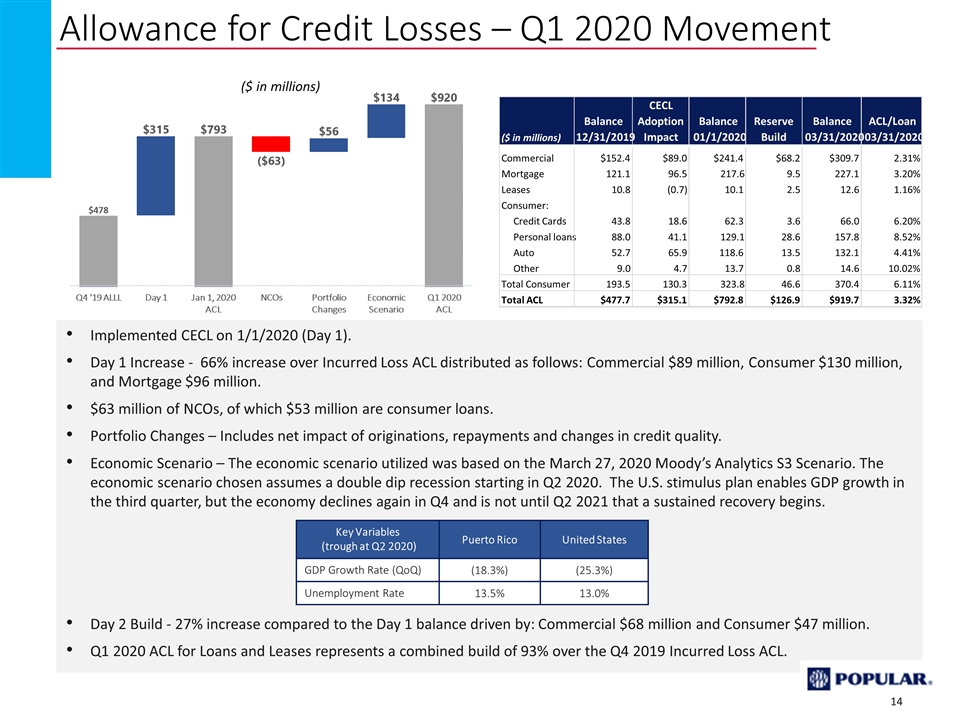

Implemented CECL on 1/1/2020 (Day 1). Day 1 Increase - 66% increase over Incurred Loss ACL distributed as follows: Commercial $89 million, Consumer $130 million, and Mortgage $96 million. $63 million of NCOs, of which $53 million are consumer loans. Portfolio Changes – Includes net impact of originations, repayments and changes in credit quality. Economic Scenario – The economic scenario utilized was based on the March 27, 2020 Moody’s Analytics S3 Scenario. The economic scenario chosen assumes a double dip recession starting in Q2 2020. The U.S. stimulus plan enables GDP growth in the third quarter, but the economy declines again in Q4 and is not until Q2 2021 that a sustained recovery begins. Day 2 Build - 27% increase compared to the Day 1 balance driven by: Commercial $68 million and Consumer $47 million. Q1 2020 ACL for Loans and Leases represents a combined build of 93% over the Q4 2019 Incurred Loss ACL. Allowance for Credit Losses – Q1 2020 Movement ($ in millions) Key Variables (trough at Q2 2020) Puerto Rico United States GDP Growth Rate (QoQ) (18.3%) (25.3%) Unemployment Rate 13.5% 13.0% ($ in millions) Balance 12/31/2019 CECL Adoption Impact Balance 01/1/2020 Reserve Build Balance 03/31/2020 ACL/Loan 03/31/2020 Commercial $152.4 $89.0 $241.4 $68.2 $309.7 2.31% Mortgage 121.1 96.5 217.6 9.5 227.1 3.20% Leases 10.8 (0.7) 10.1 2.5 12.6 1.16% Consumer: Credit Cards 43.8 18.6 62.3 3.6 66.0 6.20% Personal loans 88.0 41.1 129.1 28.6 157.8 8.52% Auto 52.7 65.9 118.6 13.5 132.1 4.41% Other 9.0 4.7 13.7 0.8 14.6 10.02% Total Consumer 193.5 130.3 323.8 46.6 370.4 6.11% Total ACL $477.7 $315.1 $792.8 $126.9 $919.7 3.32%

Driving Shareholder Value Capital Capital Actions for 2020: Executed $500 million Accelerated Share Repurchase (ASR) Redeemed $28 million of 8.25% Series B Preferred Stock Increased quarterly common stock dividend to $0.40 per share Franchise Additional Value Investments in Evertec and Banco BHD León Puerto Rico Leading market position in Puerto Rico: Focus on customer service supported by broad branch network Differentiated digital offering for retail and commercial customers Diversified fee income driven by unmatched product breadth and depth Strong risk-adjusted margins driven by de-risked and well-diversified loan portfolio Substantial excess liquidity with low deposit beta United States Mainland banking operation provides geographic diversification Branch footprint in key New York and South Florida MSAs National niche banking focus in condo association and healthcare Evolving income streams, led by private wealth management and mortgage origination

Investor Presentation First Quarter 2020 Appendix

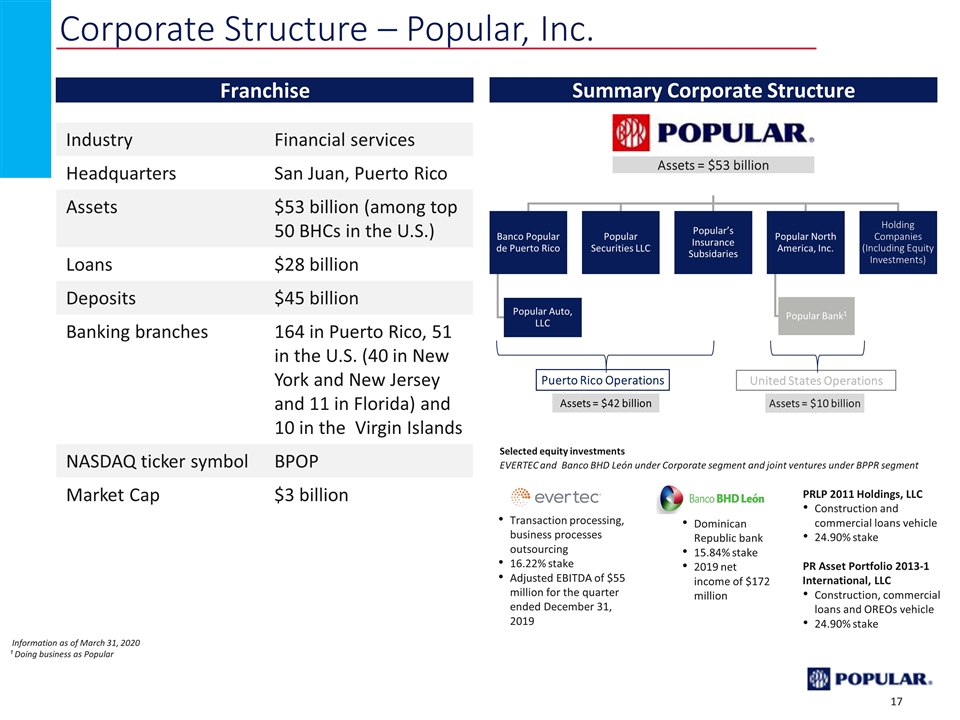

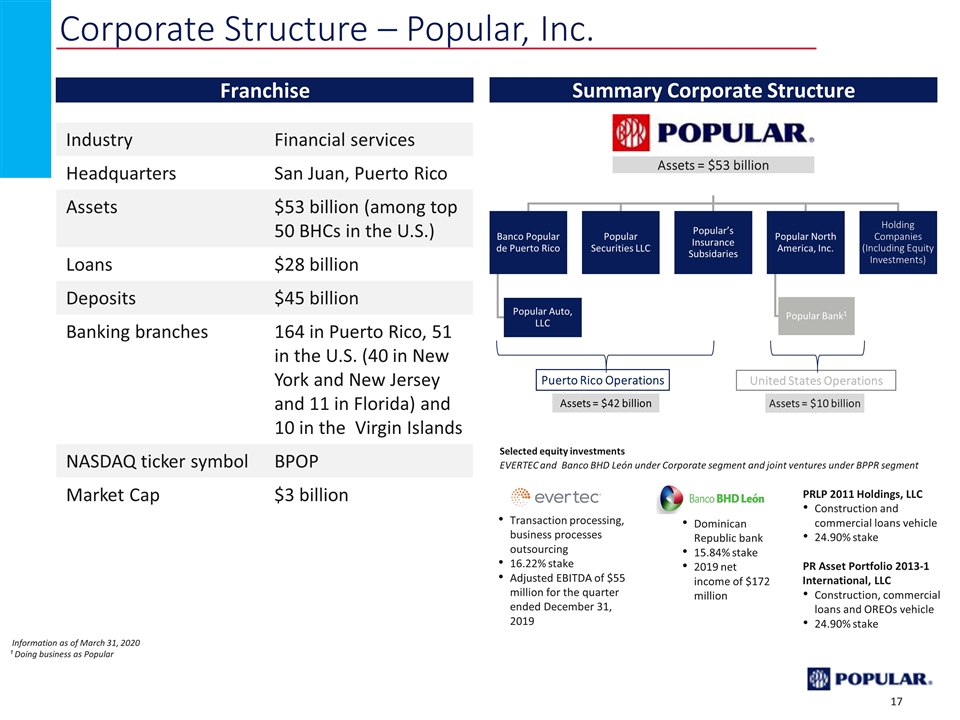

Franchise Summary Corporate Structure Assets = $42 billion Assets = $10 billion Puerto Rico Operations United States Operations Assets = $53 billion Corporate Structure – Popular, Inc. Information as of March 31, 2020 ¹ Doing business as Popular Selected equity investments EVERTEC and Banco BHD León under Corporate segment and joint ventures under BPPR segment Transaction processing, business processes outsourcing 16.22% stake Adjusted EBITDA of $55 million for the quarter ended December 31, 2019 Dominican Republic bank 15.84% stake 2019 net income of $172 million PRLP 2011 Holdings, LLC Construction and commercial loans vehicle 24.90% stake PR Asset Portfolio 2013-1 International, LLC Construction, commercial loans and OREOs vehicle 24.90% stake Industry Financial services Headquarters San Juan, Puerto Rico Assets $53 billion (among top 50 BHCs in the U.S.) Loans $28 billion Deposits $45 billion Banking branches 164 in Puerto Rico, 51 in the U.S. (40 in New York and New Jersey and 11 in Florida) and 10 in the Virgin Islands NASDAQ ticker symbol BPOP Market Cap $3 billion Banco Popular de Puerto Rico Popular’s Insurance Subsidaries Popular North America, Inc. Popular Securities LLC Holding Companies (Including Equity Investments) Popular Bank 1 Popular Auto, LLC

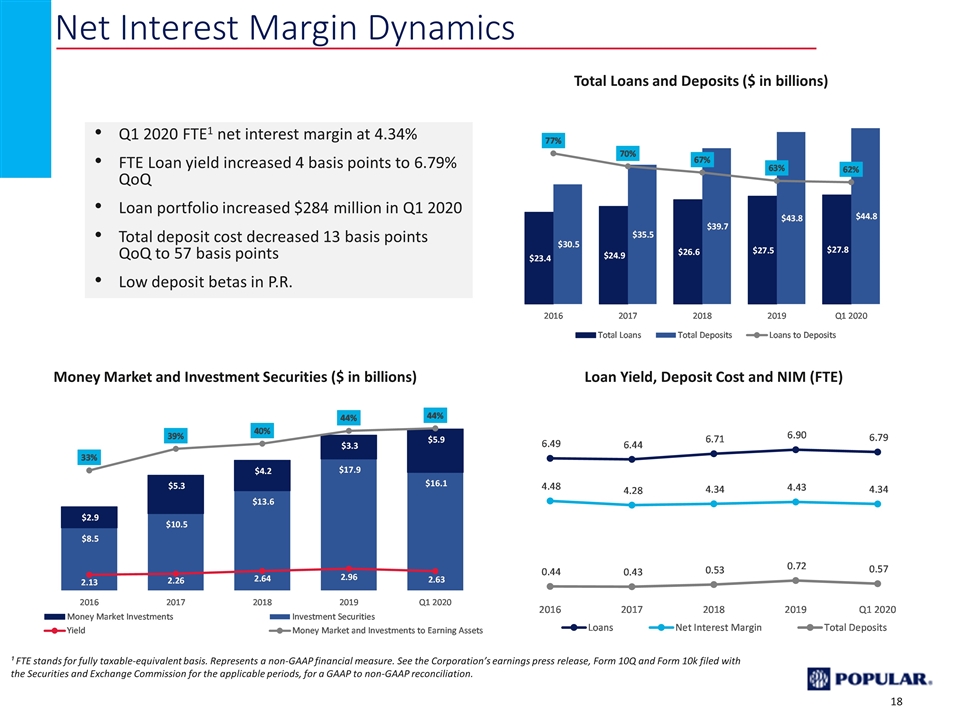

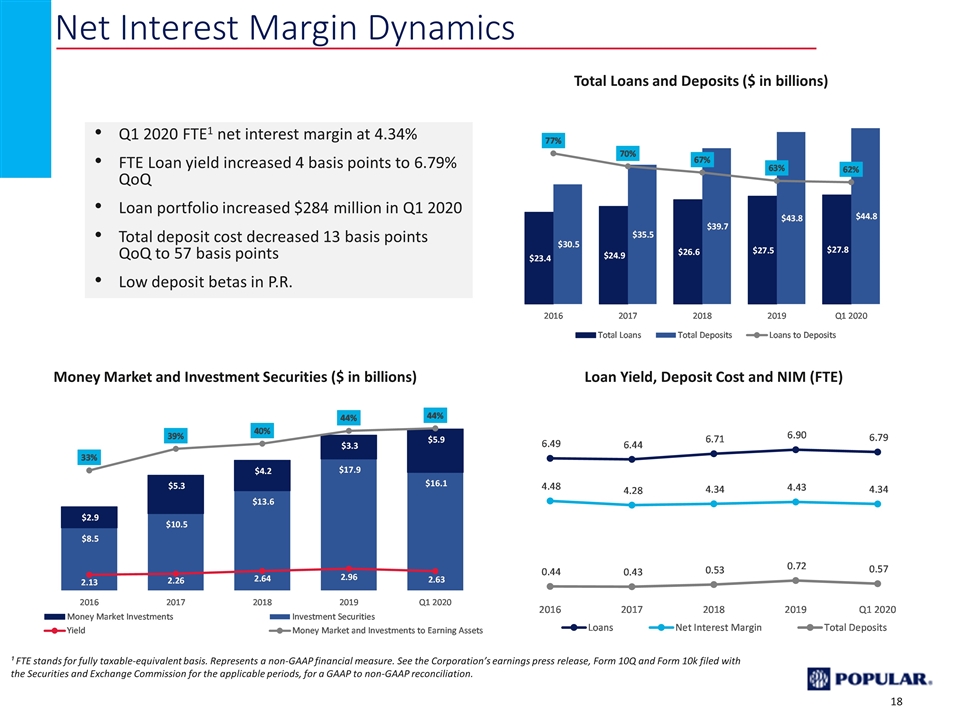

Net Interest Margin Dynamics Q1 2020 FTE1 net interest margin at 4.34% FTE Loan yield increased 4 basis points to 6.79% QoQ Loan portfolio increased $284 million in Q1 2020 Total deposit cost decreased 13 basis points QoQ to 57 basis points Low deposit betas in P.R. Loan Yield, Deposit Cost and NIM (FTE) Total Loans and Deposits ($ in billions) Money Market and Investment Securities ($ in billions) ¹ FTE stands for fully taxable-equivalent basis. Represents a non-GAAP financial measure. See the Corporation’s earnings press release, Form 10Q and Form 10k filed with the Securities and Exchange Commission for the applicable periods, for a GAAP to non-GAAP reconciliation.

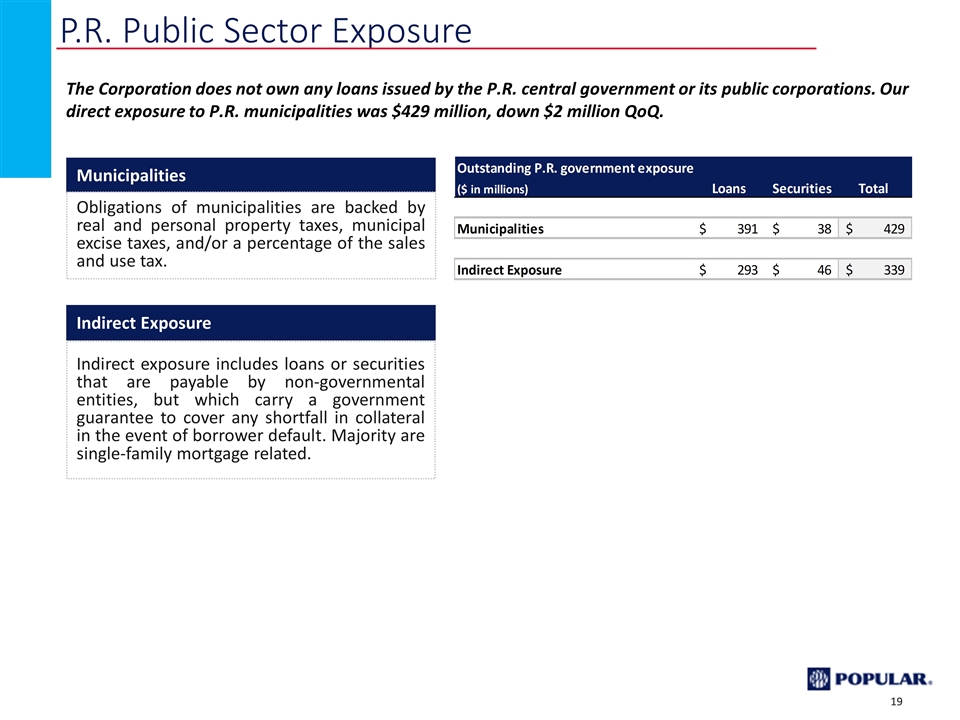

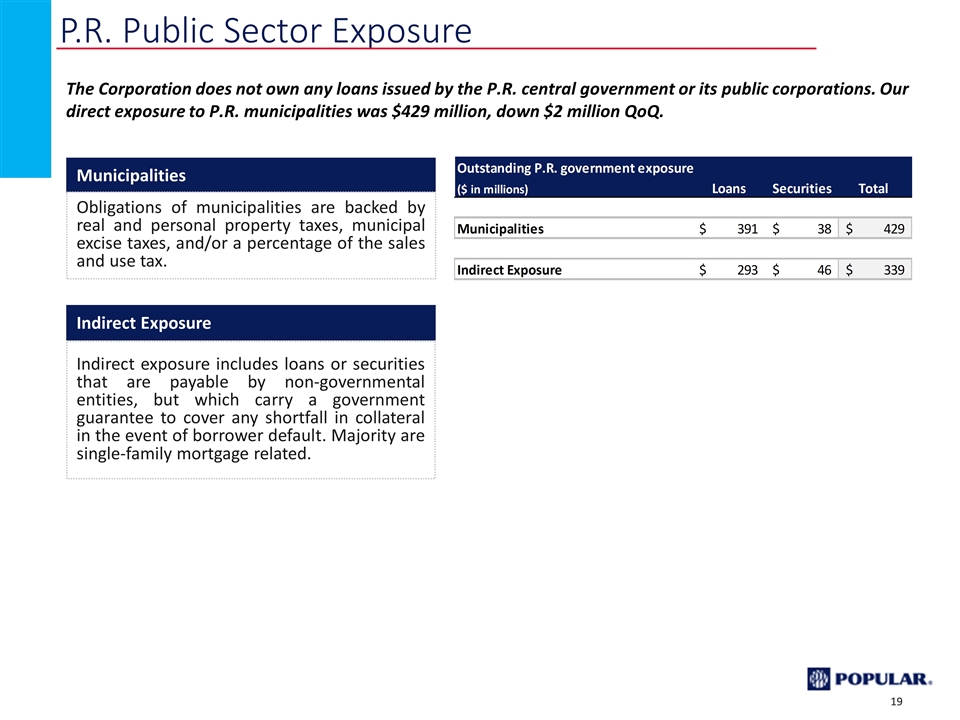

Municipalities Obligations of municipalities are backed by real and personal property taxes, municipal excise taxes, and/or a percentage of the sales and use tax. Indirect exposure includes loans or securities that are payable by non-governmental entities, but which carry a government guarantee to cover any shortfall in collateral in the event of borrower default. Majority are single-family mortgage related. Indirect Exposure The Corporation does not own any loans issued by the P.R. central government or its public corporations. Our direct exposure to P.R. municipalities was $429 million, down $2 million QoQ. P.R. Public Sector Exposure

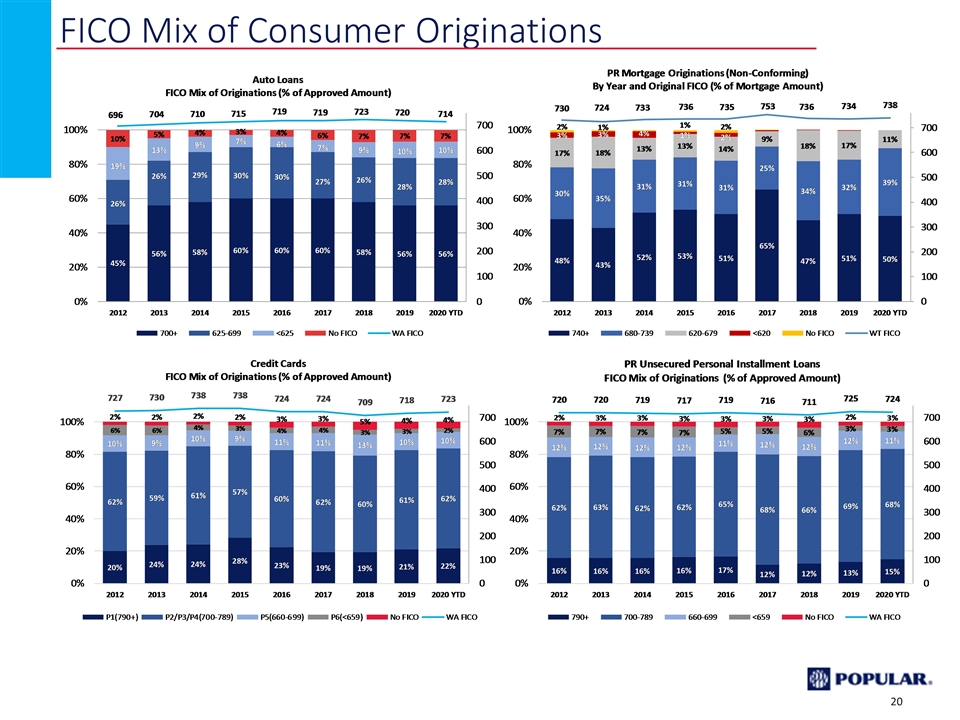

FICO Mix of Consumer Originations

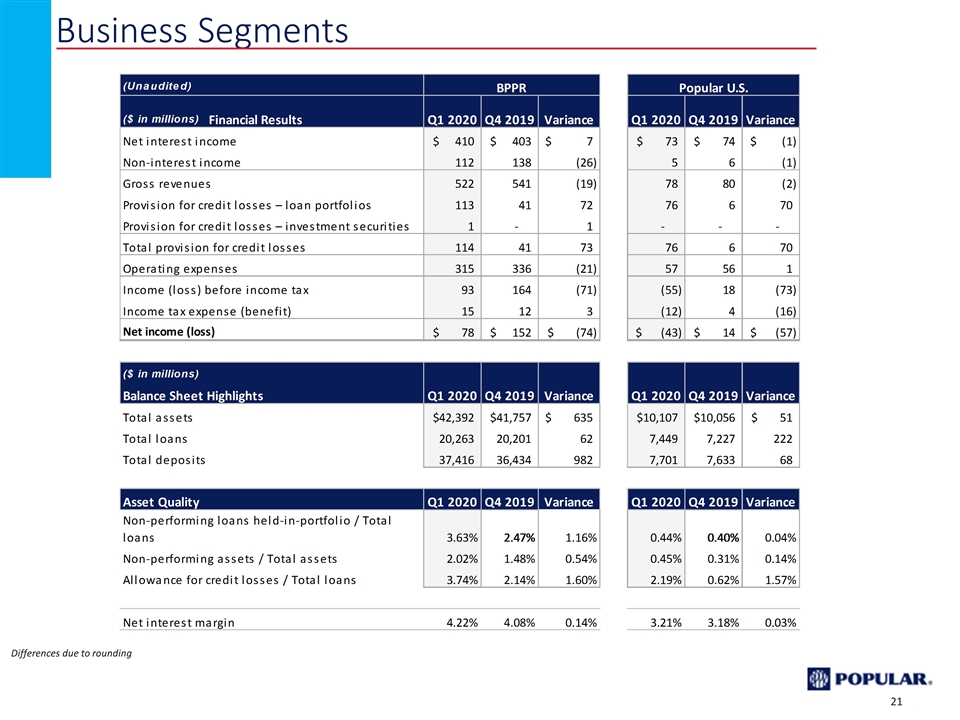

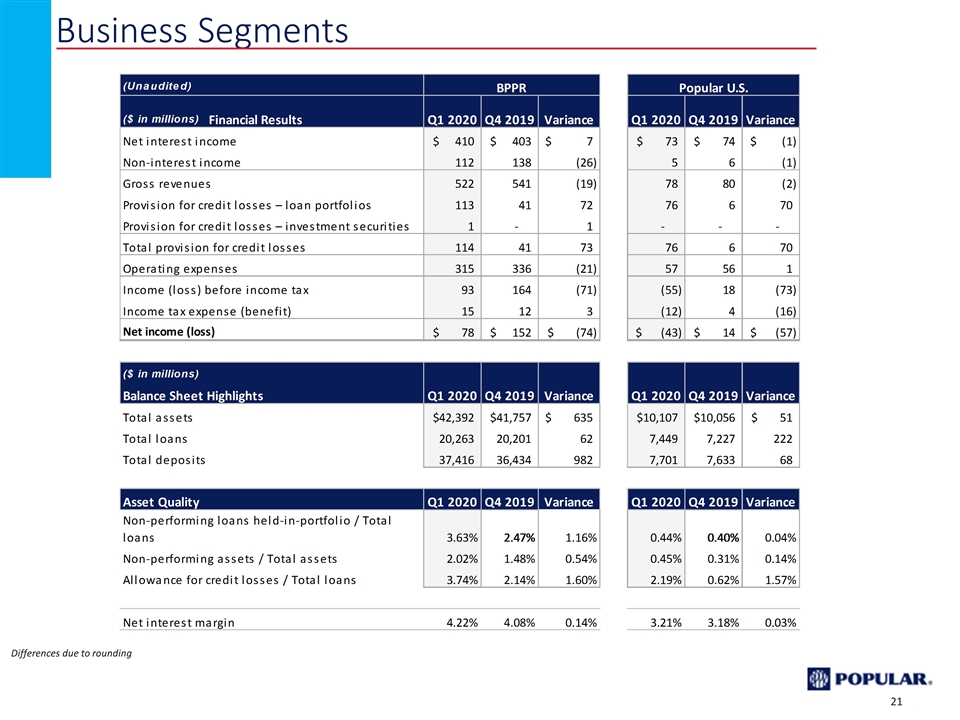

Business Segments Differences due to rounding

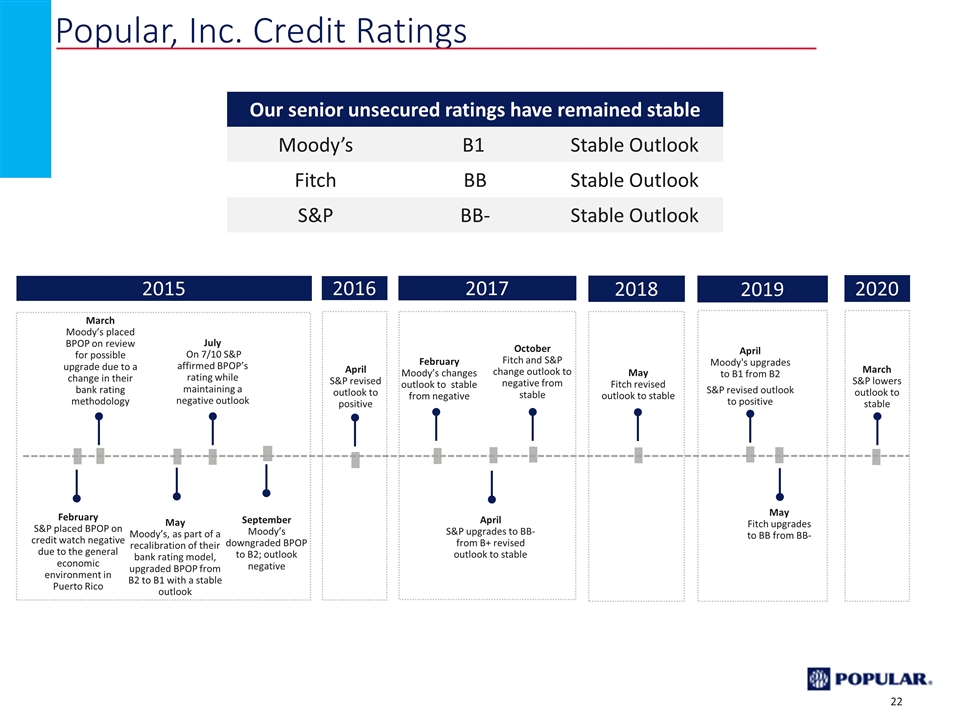

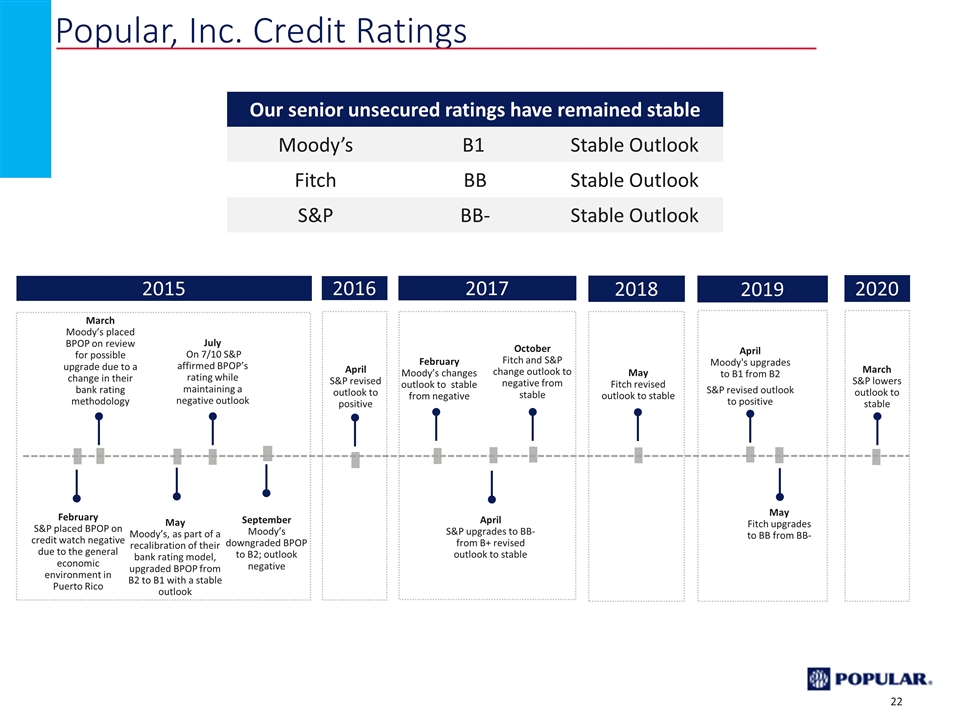

Popular, Inc. Credit Ratings Our senior unsecured ratings have remained stable Moody’s B1 Stable Outlook Fitch BB Stable Outlook S&P BB- Stable Outlook February Moody’s changes outlook to stable from negative April S&P upgrades to BB- from B+ revised outlook to stable 2017 February S&P placed BPOP on credit watch negative due to the general economic environment in Puerto Rico 2015 May Moody’s, as part of a recalibration of their bank rating model, upgraded BPOP from B2 to B1 with a stable outlook July On 7/10 S&P affirmed BPOP’s rating while maintaining a negative outlook March Moody’s placed BPOP on review for possible upgrade due to a change in their bank rating methodology September Moody’s downgraded BPOP to B2; outlook negative 2016 April S&P revised outlook to positive October Fitch and S&P change outlook to negative from stable 2018 May Fitch revised outlook to stable 2019 April Moody's upgrades to B1 from B2 S&P revised outlook to positive May Fitch upgrades to BB from BB- 2020 March S&P lowers outlook to stable

Investor Presentation First Quarter 2020