Exhibit 99.1

Investor Presentation May 2020

2 2 Forward looking statements This presentation contains forward - looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward - looking statements do not represent historical facts, but are statements about management's beliefs, plans and objectives about the future, as well as its assumptions and judgments concerning such beliefs, plans and objectives. These statements are evidenced by terms such as "anticipate," "estimate," "should," "expect," "believe," "intend," and similar expressions. Although these statements reflect management's good faith beliefs and projections, they are not guarantees of future performance and they may not prove true. The beliefs, plans and objectives on which forward - looking statements are based involve risks and uncertainties that could cause actual results to differ materially from those addressed in the forward - looking statements. For a discussion of these risks and uncertainties, see the section of the periodic reports that First United Corporation files with the Securities and Exchange Commission entitled "Risk Factors", including the risk factor set forth in First United Corporation’s Annual Report on Form 10 - K, as amended, for the year ended December 31, 2019 entitled, “The outbreak of the recent coronavirus (“COVID - 19”), or an outbreak of another highly infectious or contagious disease, could adversely affect First United Corporation’s business, financial condition and results of operations.” and any updates thereto that might be contained in subsequent reports filed by First United Corporation. The risks and uncertainties associated with the COVID - 19 pandemic and its impact on First United Corporation will depend on, among other things, the length of time that the pandemic continues; the duration of shelter - in - place orders and the potential imposition of further restrictions on travel in the future; the effect of the pandemic on the global, national, and local economies and on the businesses of our borrowers and their ability to make payments on their obligations; the remedial actions and stimulus measures adopted by federal, state, and local governments; and the inability of employees to work due to illness, quarantine, or government mandates.

3 3 Important additional information F irst United, its directors and certain of its executive officers will be deemed to be participants in the solicitation of proxies from First United's shareholders in connection with the 2020 annual meeting of shareholders. First United has filed a definitive proxy statement and a BLUE proxy card with the SEC in connection with any such solicitation of proxies from First United shareholders. SHAREHOLDERS OF FIRST UNITED ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING BLUE PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION. Information regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, are set forth in the definitive proxy statement and other materials filed with the SEC in connection with the 2020 annual meeting of shareholders. Shareholders can obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by First United with the SEC at no charge at the SEC's website www.sec.gov. Copies are also available at no charge at First United's website at http://investors.mybank.com /.

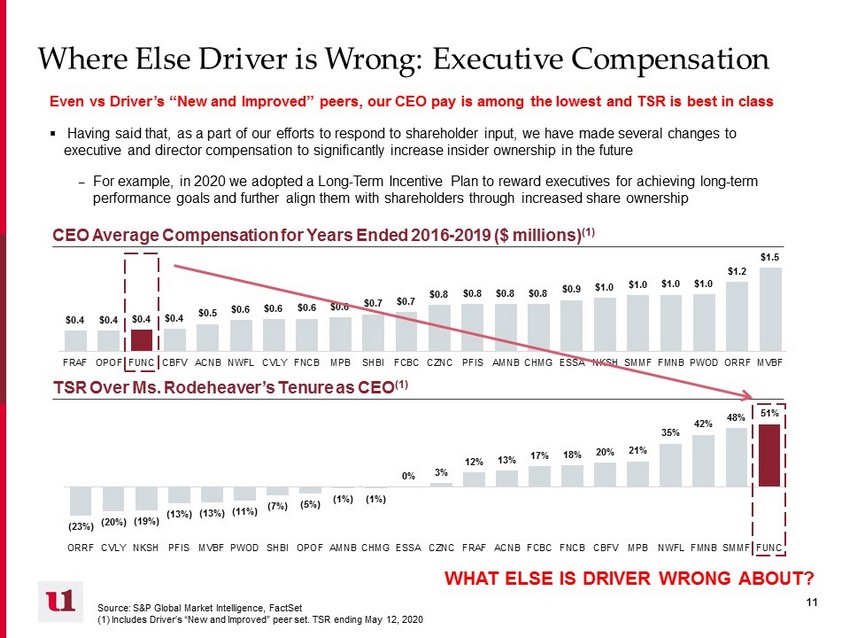

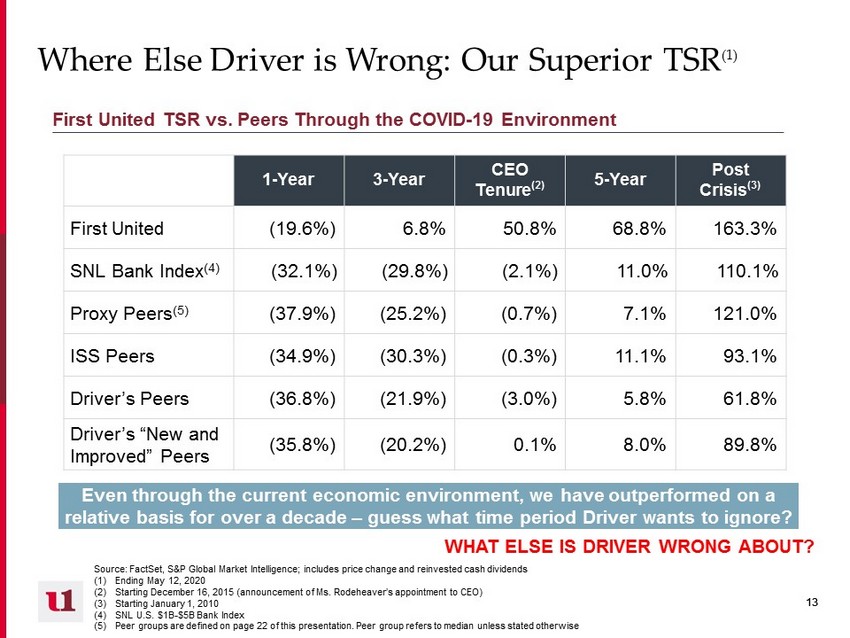

4 4 Executive Summary First United is delivering superior shareholder returns Our strategy is producing steady profitable growth We have the right Board to maximize long - term shareholder value Driver’s campaign is contrary to the long - term best interests of our shareholders – An investment in First United has significantly outperformed our peers over 1 - , 3 - , and 5 - year holding periods, as well as over Carissa Rodeheaver’s tenure as CEO – We have a diverse and experienced Board that has been conducting a robust refreshment plan – Our Board is aligned with shareholders and is responsive to their input and concerns – Trying to force a sale of First United in what has turned out to be a very unfavorable M&A market – Flip - flopping on key demands: e.g., opposed our share repurchase program, then called for a buyback – Waging a costly proxy fight to replace several highly - qualified directors in an unstable economy – Has thwarted our calls for settlement and resorted to making several misleading claims about First United – Last year we grew earnings per share by 23% and increased our quarterly dividend by over 40% – Importantly , we are well prepared to weather the impact of COVID - 19 and are playing a key role in supporting the recovery of the communities we serve

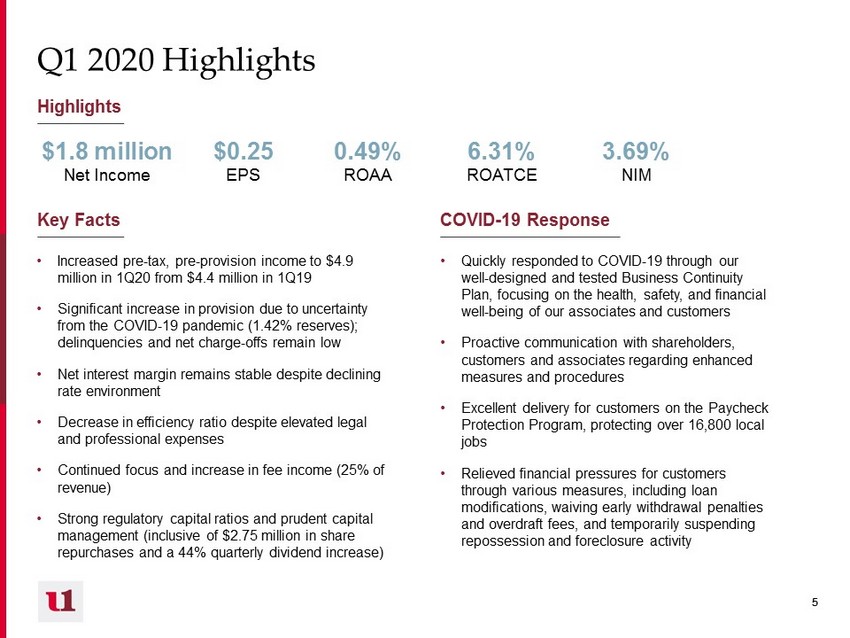

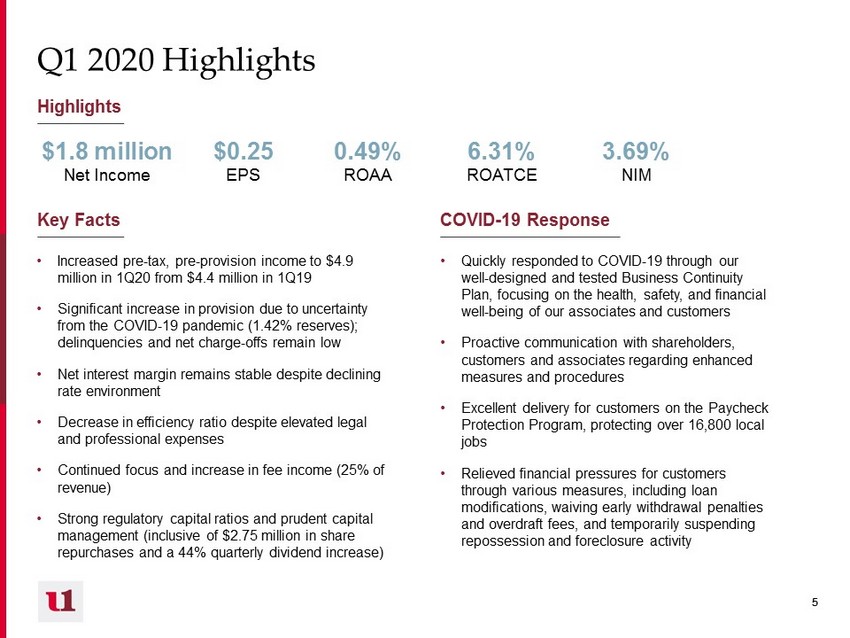

5 5 Q1 2020 Highlights Highlights • Increased pre - tax, pre - provision income to $4.9 million in 1Q20 from $4.4 million in 1Q19 • Significant increase in provision due to uncertainty from the COVID - 19 pandemic (1.42% reserves); delinquencies and net charge - offs remain low • Net interest margin remains stable despite declining rate environment • Decrease in efficiency ratio despite elevated legal and professional expenses • Continued focus and increase in fee income (25% of revenue) • Strong regulatory capital ratios and prudent capital management (inclusive of $2.75 million in share repurchases and a 44% quarterly dividend increase) $1.8 million Net Income $0.25 EPS 0.49% ROAA 6.31% ROATCE 3.69% NIM • Quickly responded to COVID - 19 through our well - designed and tested Business Continuity Plan, focusing on the health, safety, and financial well - being of our associates and customers • Proactive communication with shareholders, customers and associates regarding enhanced measures and procedures • Excellent delivery for customers on the Paycheck Protection Program, protecting over 16,800 local jobs • Relieved financial pressures for customers through various measures, including loan modifications, waiving early withdrawal penalties and overdraft fees, and temporarily suspending repossession and foreclosure activity Key Facts COVID - 19 Response

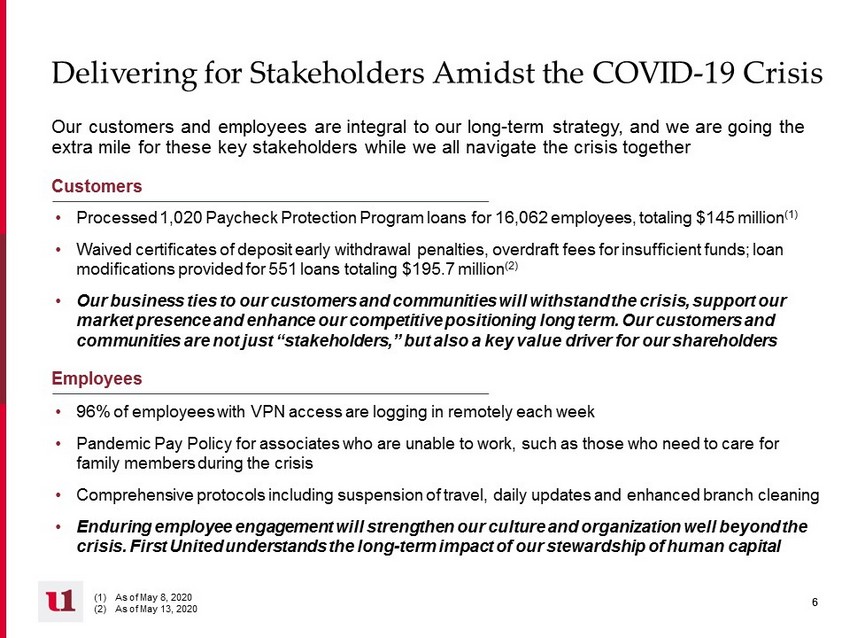

6 6 Customers • 96% of employees with VPN access are logging in remotely each week • Pandemic Pay Policy for associates who are unable to work, such as those who need to care for family members during the crisis • Comprehensive protocols including suspension of travel, daily updates and enhanced branch cleaning • Enduring employee engagement will strengthen our culture and organization well beyond the crisis. First United understands the long - term impact of our stewardship of human capital Employees • Processed 1,020 Paycheck Protection Program loans for 16,062 employees, totaling $ 145 million (1 ) • Waived certificates of deposit early withdrawal penalties, overdraft fees for insufficient funds; loan modifications provided for 551 loans totaling $195.7 million (2) • Our business ties to our customers and communities will withstand the crisis, support our market presence and enhance our competitive positioning long term . Our customers and communities are not just “stakeholders,” but also a key value driver for our shareholders Our customers and employees are integral to our long - term strategy, and we are going the extra mile for these key stakeholders while we all navigate the crisis together (1) As of May 8, 2020 (2) As of May 13, 2020 Delivering for Stakeholders Amidst the COVID - 19 Crisis

7 7 Table of Contents I. Introduction to First United II. Strategic Plan, Operating Performance and Outlook III. Driver’s Flawed Sale Thesis IV. Our Commitment To Strong Governance V. Driver’s Costly and Distracting Proxy Contest VI. Appendix

8 8 I. Introduction to First United

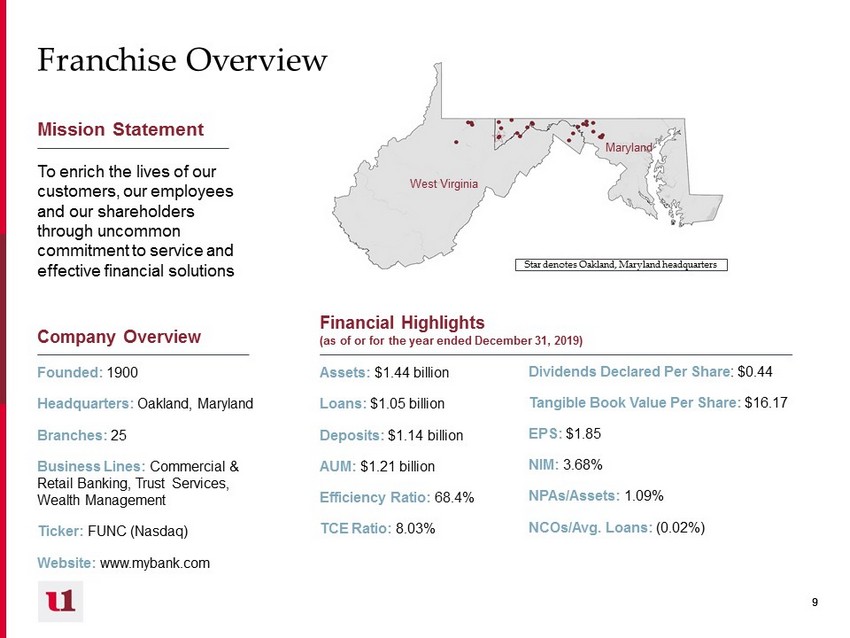

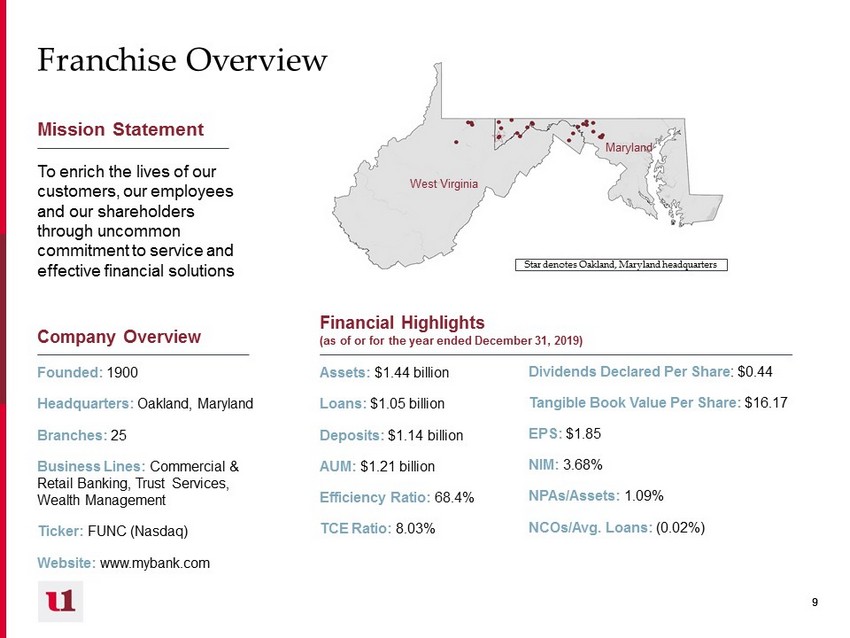

9 9 Mission Statement To enrich the lives of our customers, our employees and our shareholders through uncommon commitment to service and effective financial solutions Company Overview Founded: 1900 Headquarters: Oakland, Maryland Branches: 25 Business Lines: Commercial & Retail Banking, Trust Services, Wealth Management Ticker: FUNC (Nasdaq) Website: www.mybank.com Financial Highlights (as of or for the year ended December 31, 2019) Assets: $ 1.44 billion Loans: $ 1.05 billion Deposits: $1.14 billion AUM: $1.21 billion Efficiency Ratio: 68.4 % TCE Ratio: 8.03% Dividends Declared Per Share : $ 0.44 Tangible Book Value Per Share: $ 16.17 EPS: $ 1.85 NIM: 3.68% NPAs/Assets: 1.09% NCOs/Avg. Loans: ( 0.02%) West Virginia Maryland Star denotes Oakland, Maryland h eadquarters Franchise Overview

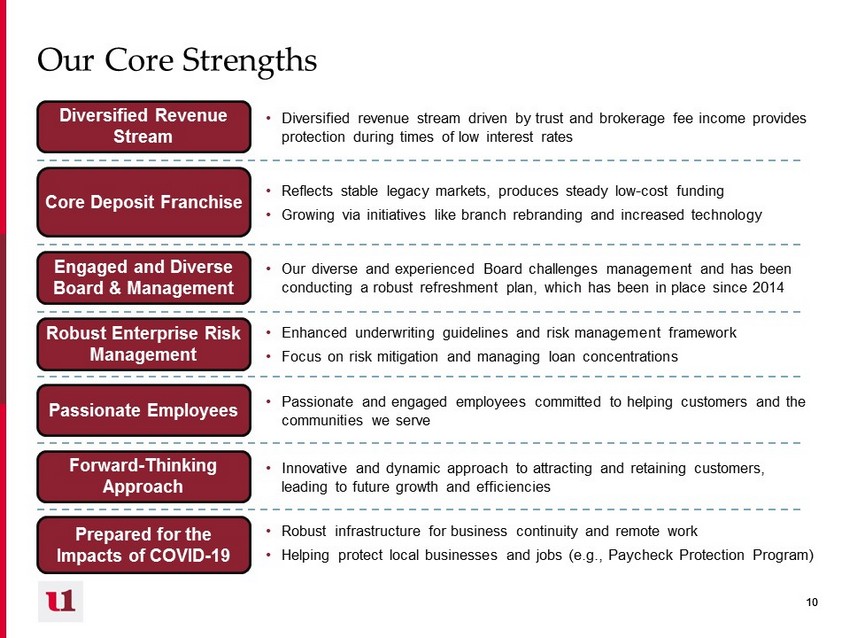

10 10 Our Core Strengths Engaged and Diverse Board & Management • Our diverse and experienced Board challenges management and has been conducting a robust refreshment plan, which has been in place since 2014 Core Deposit Franchise Diversified Revenue Stream Forward - Thinking Approach Robust Enterprise Risk Management Passionate Employees • Reflects stable legacy markets, produces steady low - cost funding • Growing via initiatives like branch rebranding and increased technology • Diversified revenue stream driven by trust and brokerage fee income provides protection during times of low interest rates • Innovative and dynamic approach to attracting and retaining customers, leading to future growth and efficiencies • Enhanced underwriting guidelines and risk management framework • Focus on risk mitigation and managing loan concentrations • Passionate and engaged employees committed to helping customers and the communities we serve Prepared for the Impacts of COVID - 19 • Robust infrastructure for business continuity and remote work • Helping protect local businesses and jobs (e.g., Paycheck Protection Program)

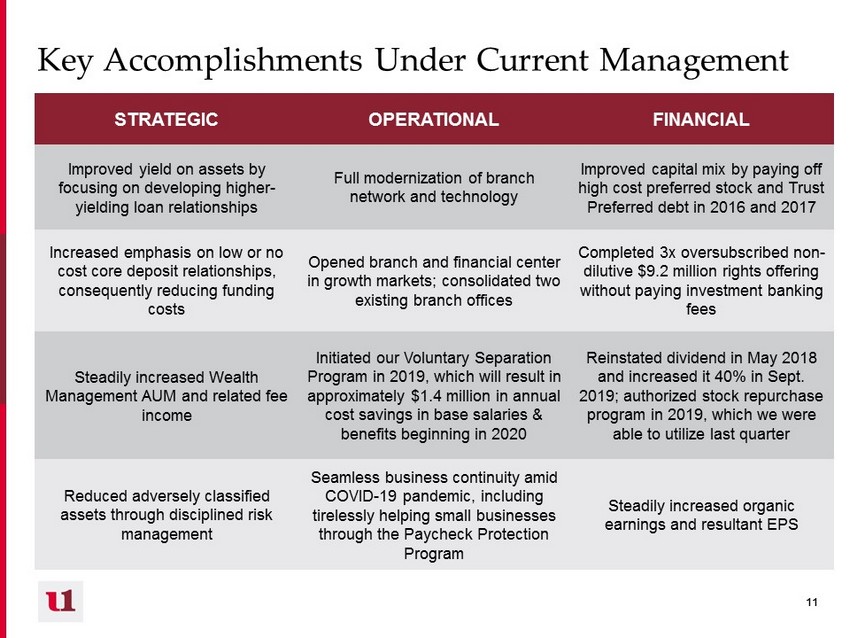

11 11 Key Accomplishments Under Current Management STRATEGIC OPERATIONAL FINANCIAL Improved yield on assets by focusing on developing higher - yielding loan relationships Full modernization of branch network and technology Improved capital mix by paying off high cost preferred stock and Trust Preferred debt in 2016 and 2017 Increased emphasis on low or no cost core deposit relationships, consequently reducing funding costs Opened branch and financial center in growth markets; consolidated two existing branch offices Completed 3x oversubscribed non - dilutive $9.2 million rights offering without paying investment banking fees Steadily increased Wealth Management AUM and related fee income Initiated our Voluntary Separation Program in 2019, which will result in approximately $1.4 million in annual cost savings in base salaries & benefits beginning in 2020 Reinstated dividend in May 2018 and increased it 40% in Sept. 2019; authorized stock repurchase program in 2019, which we were able to utilize last quarter Reduced adversely classified assets through disciplined risk management Seamless business continuity amid COVID - 19 pandemic, including tirelessly helping small businesses through the Paycheck Protection Program Steadily increased organic earnings and resultant EPS

12 12 Recognition of Our Diversity Leadership A “Winning” Company Recognized as a “Winning (W)” company by 2020 Women on Boards , the premier global education and advocacy campaign committed to increasing the number of women on corporate boards A “Winning” company is selected from companies in the Russell 3000 index for having achieved the goal of at least 20% of its board seats being held by women “Top” Management Carissa Rodeheaver was named as one of “Maryland’s Top 100 Women” by The Daily Record Maryland’s Top 100 Women was founded in 1996 to recognize outstanding achievements by women as demonstrated through professional accomplishments, community leadership and mentoring. A panel of business professionals and previous honorees reviewed the candidates and selected honorees

13 13 Recent Awards & Accolades A “5 Star” Bank Since 2018, First United has been awarded a 5 - Star (Superior) rating from BauerFinancial , an independent ratings agency that has been rating banks and credit unions since 1983 A 5 - Star rating indicates that First United shines in capital adequacy, profitability and asset quality, among other categories The “People’s Choice” First United was voted as the “Diamond” winner for favorite local financial institution in the 2019 deepcreektimes.com People’s Choice Challenge Each nomination was made and voted on by members of the Deep Creek Lake community

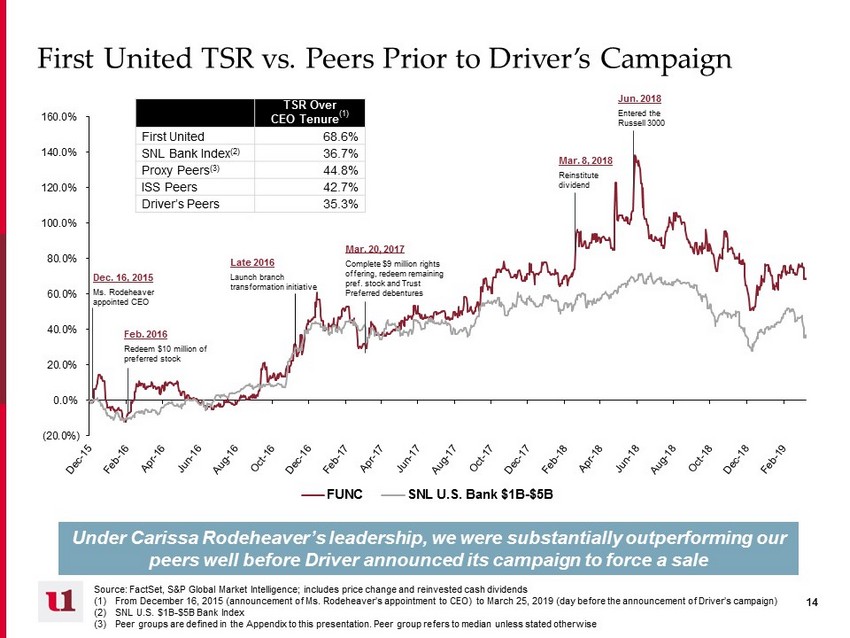

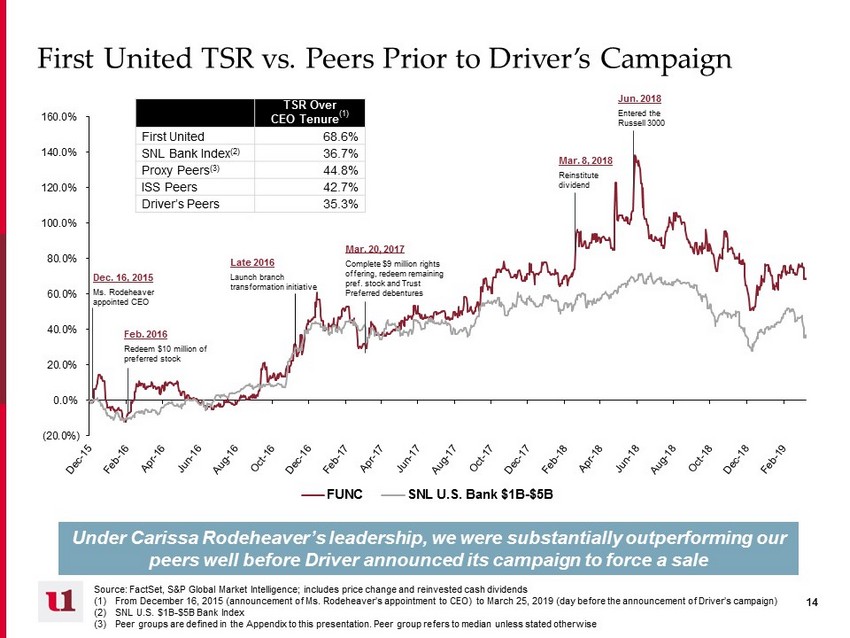

14 14 (20.0%) 0.0% 20.0% 40.0% 60.0% 80.0% 100.0% 120.0% 140.0% 160.0% FUNC SNL U.S. Bank $1B-$5B First United TSR vs. Peers Prior to Driver’s Campaign Under Carissa Rodeheaver’s leadership, we were substantially outperforming our peers well before Driver announced its campaign to force a sale TSR Over CEO Tenure (1) First United 68.6% SNL Bank Index (2) 36.7% Proxy Peers (3) 44.8% ISS Peers 42.7% Driver’s Peers 35.3% Source: FactSet , S&P Global Market Intelligence; includes price change and reinvested cash dividends (1) From December 16, 2015 (announcement of Ms. Rodeheaver’s appointment to CEO ) to March 25, 2019 (day before the announcement of Driver’s campaign) (2) SNL U.S. $1B - $5B Bank Index (3) Peer groups are defined in the Appendix to this presentation. Peer group refers to median unless stated otherwise Dec. 16, 2015 Ms. Rodeheaver appointed CEO Mar. 20, 2017 Complete $ 9 million rights offering, redeem remaining pref. stock and Trust Preferred debentures Mar. 8, 2018 Reinstitute dividend Feb. 2016 Redeem $ 10 million of preferred stock Late 2016 Launch branch transformation initiative Jun. 2018 Entered the Russell 3000

15 15 II. Strategic Plan, Operating Performance and Outlook

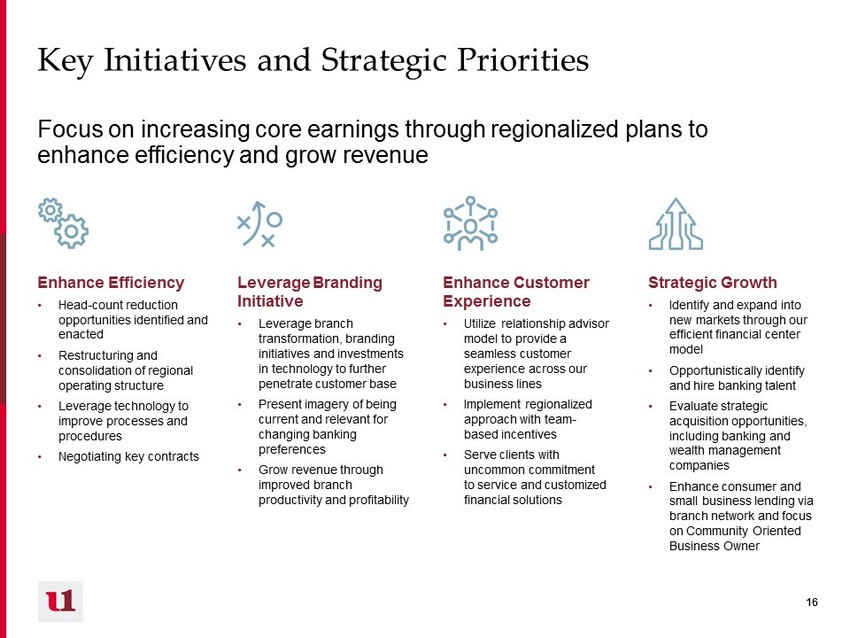

16 16 Key Initiatives and Strategic Priorities Focus on increasing core earnings through regionalized plans to enhance efficiency and grow revenue Enhance Efficiency • Head - count reduction opportunities identified and enacted • Restructuring and consolidation of regional operating structure • Leverage technology to improve processes and procedures • Negotiating key contracts Enhance Customer Experience • Utilize relationship advisor model to provide a seamless customer experience across our business lines • Implement regionalized approach with team - based incentives • Serve clients with uncommon commitment to service and customized financial solutions Strategic Growth • Identify and expand into new markets through our efficient financial center model • Opportunistically identify and hire banking talent • Evaluate strategic acquisition opportunities, including banking and wealth management companies • Enhance consumer and small business lending via branch network and focus on Community Oriented Business Owner Leverage Branding Initiative • Leverage branch transformation, branding initiatives and investments in technology to further penetrate customer base • Present imagery of being current and relevant for changing banking preferences • Grow revenue through improved branch productivity and profitability

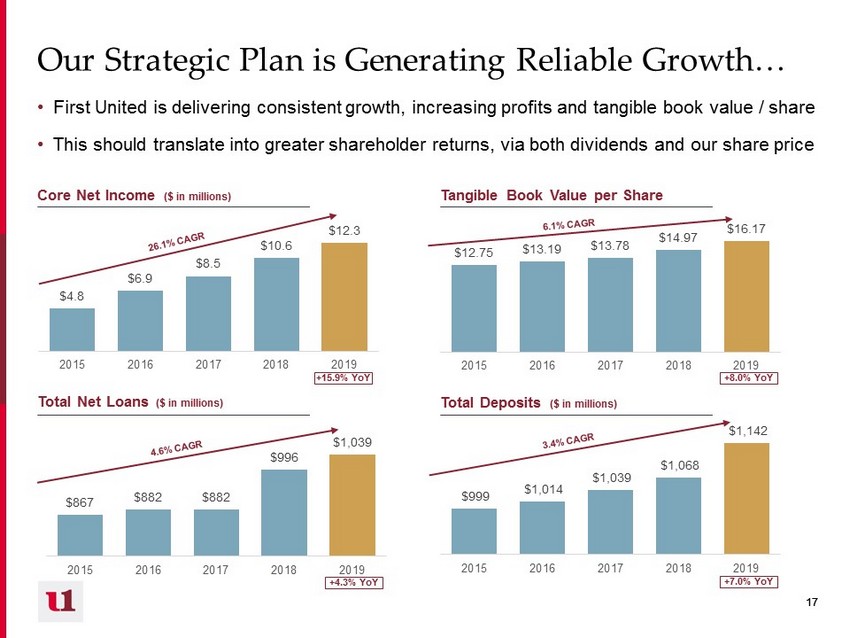

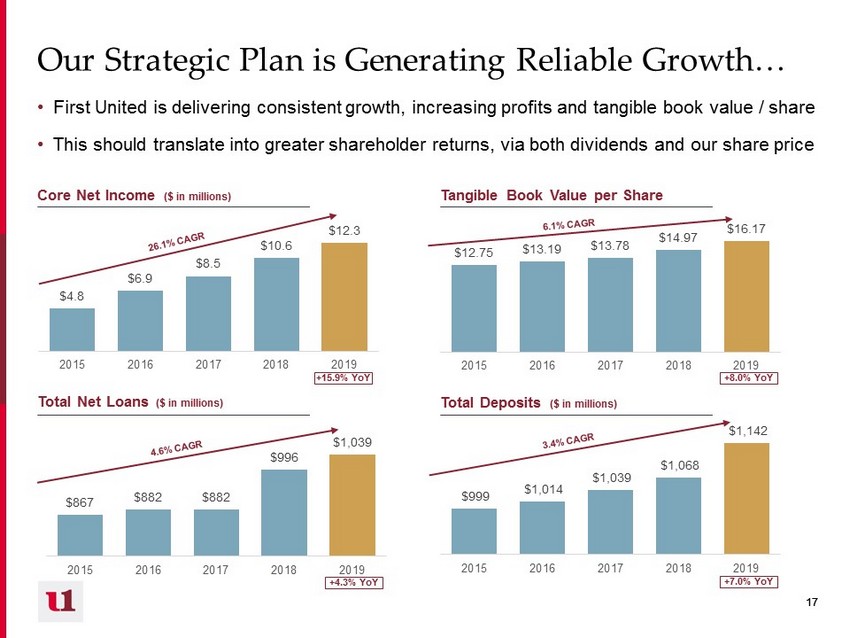

17 17 $4.8 $6.9 $8.5 $10.6 $12.3 2015 2016 2017 2018 2019 $999 $1,014 $1,039 $1,068 $1,142 2015 2016 2017 2018 2019 $867 $882 $882 $996 $1,039 2015 2016 2017 2018 2019 Our Strategic Plan is Generating Reliable Growth… Core Net Income ($ in millions) Tangible Book Value per Share Total Deposits ($ in millions) Total Net Loans ($ in millions) • First United is delivering consistent growth, increasing profits and tangible book value / share • This should translate into greater shareholder returns, via both dividends and our share price $12.75 $13.19 $13.78 $14.97 $16.17 2015 2016 2017 2018 2019 +15.9% YoY +8.0% YoY +4.3% YoY +7.0% YoY

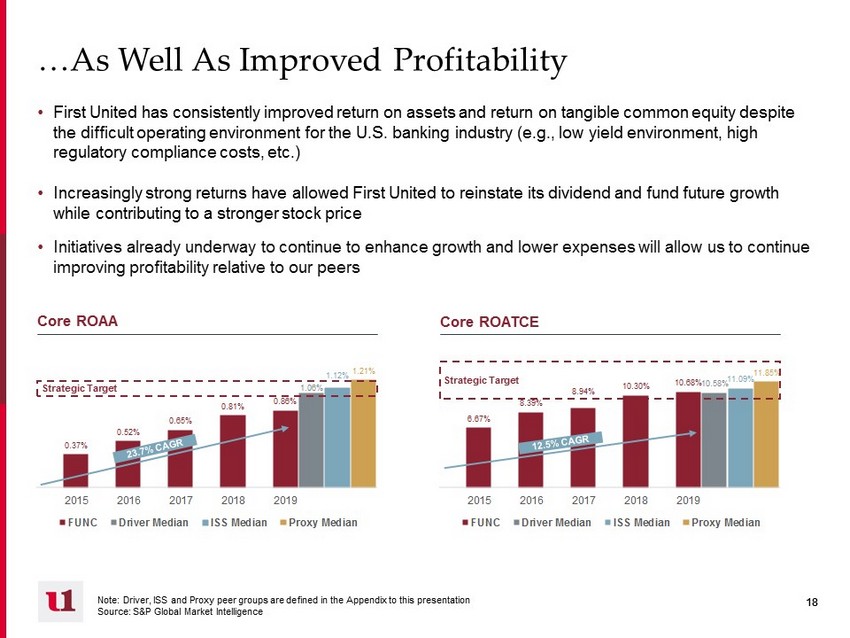

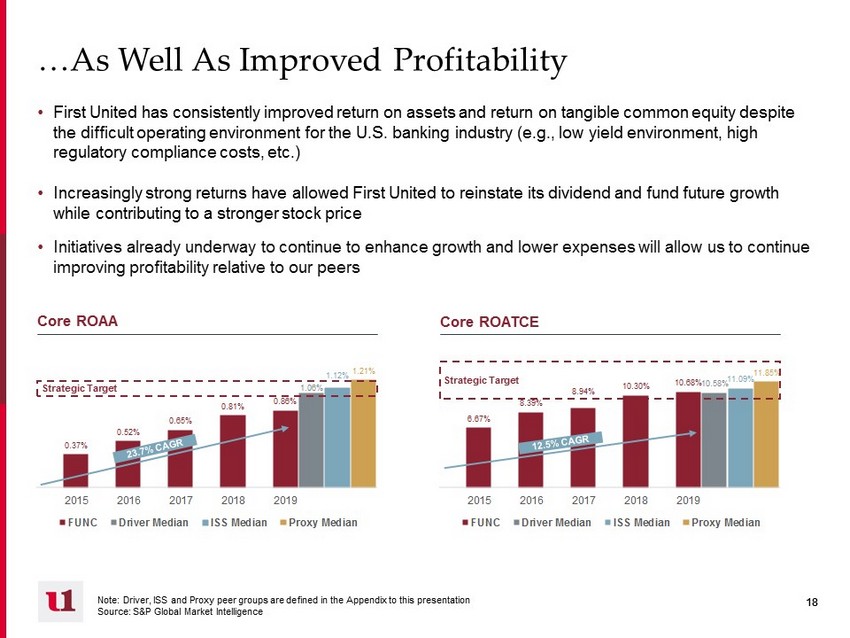

18 18 0.37% 0.52% 0.65% 0.81% 0.86% 1.06% 1.12% 1.21% 2015 2016 2017 2018 2019 FUNC Driver Median ISS Median Proxy Median …As Well As Improved Profitability • First United has consistently improved return on assets and return on tangible common equity despite the difficult operating environment for the U.S. banking industry (e.g., low yield environment, high regulatory compliance costs, etc.) • Increasingly strong returns have allowed First United to reinstate its dividend and fund future growth while contributing to a stronger stock price • Initiatives already underway to continue to enhance growth and lower expenses will allow us to continue improving profitability relative to our peers 6.67% 8.39% 8.94% 10.30% 10.68% 10.58% 11.09% 11.85% 2015 2016 2017 2018 2019 FUNC Driver Median ISS Median Proxy Median Core ROATCE Core ROAA Note : Driver, ISS and Proxy peer groups are defined in the Appendix to this presentation Source: S&P Global Market Intelligence Strategic Target Strategic Target

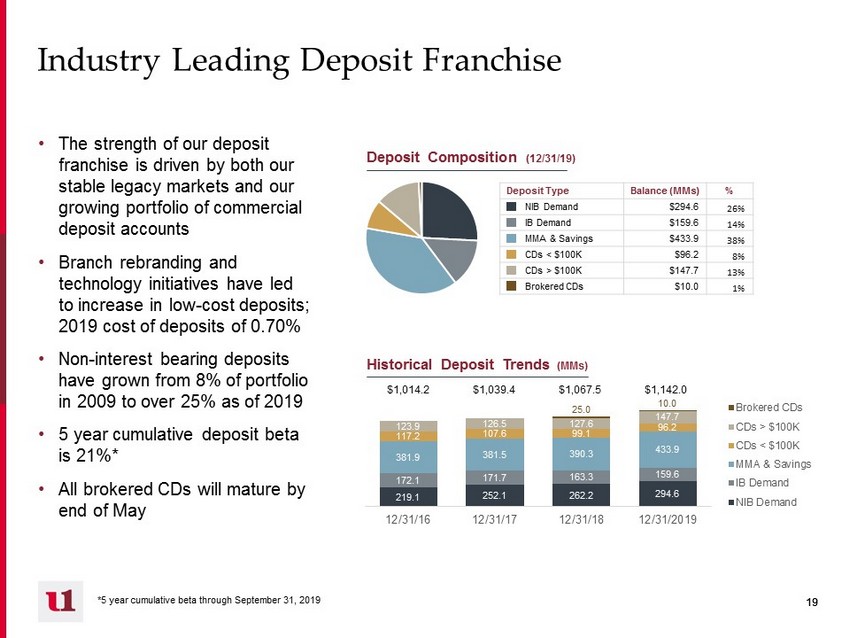

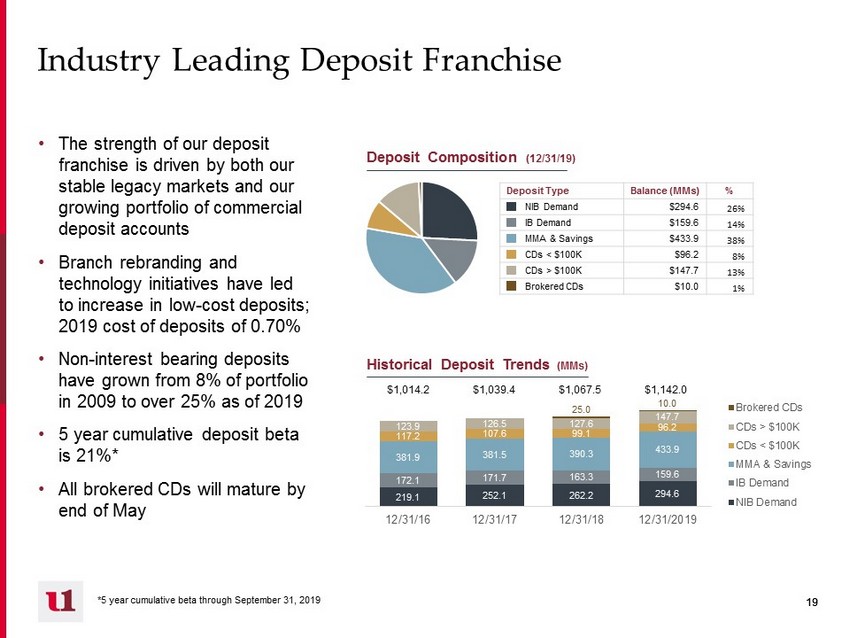

19 19 Industry Leading Deposit Franchise • The strength of our deposit franchise is driven by both our stable legacy markets and our growing portfolio of commercial deposit accounts • Branch rebranding and technology initiatives have led to increase in low - cost deposits; 2019 cost of deposits of 0.70% • Non - interest bearing deposits have grown from 8% of portfolio in 2009 to over 25% as of 2019 • 5 year cumulative deposit beta is 21 %* • All brokered CDs will mature by end of May Deposit Composition (12/31/19 ) 219.1 252.1 262.2 294.6 172.1 171.7 163.3 159.6 381.9 381.5 390.3 433.9 117.2 107.6 99.1 96.2 123.9 126.5 127.6 147.7 25.0 10.0 12/31/16 12/31/17 12/31/18 12/31/2019 Brokered CDs CDs > $100K CDs < $100K MMA & Savings IB Demand NIB Demand Historical Deposit Trends (MMs) $1,014.2 $1,039.4 $1,067.5 $ 1,142.0 Deposit Type Balance (MMs) % NIB Demand $294.6 26% IB Demand $ 159.6 14% MMA & Savings $ 433.9 38% CDs < $100K $ 96.2 8 % CDs > $100K $ 147.7 13% Brokered CDs $10.0 1 % *5 year cumulative beta through September 31, 2019

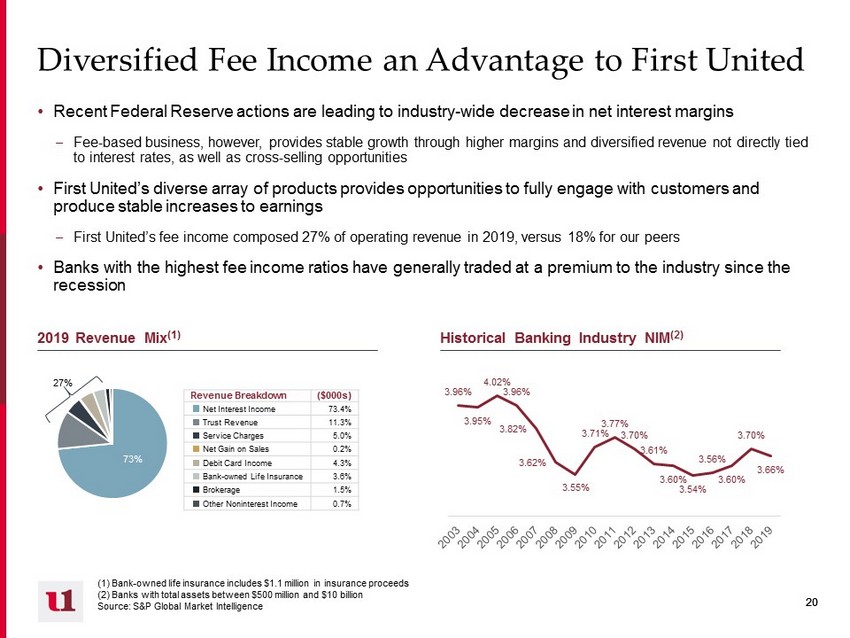

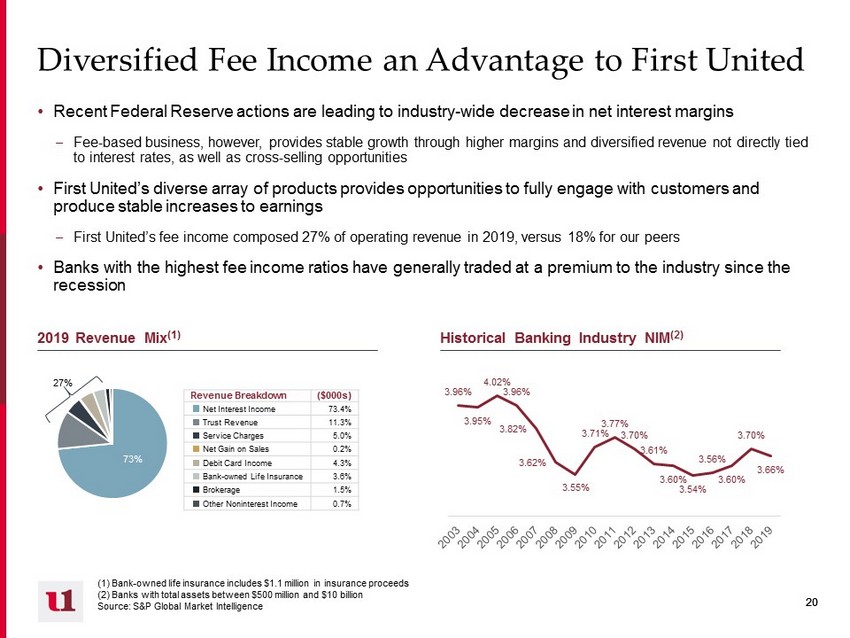

20 20 Diversified Fee Income an Advantage to First United • Recent Federal Reserve actions are leading to industry - wide decrease in net interest margins – Fee - based business, however, provides stable growth through higher margins and diversified revenue not directly tied to interest rates, as well as cross - selling opportunities • First United’s diverse array of products provides opportunities to fully engage with customers and produce stable increases to earnings – First United’s fee income composed 27% of operating revenue in 2019, versus 18% for our peers • Banks with the highest fee income ratios have generally traded at a premium to the industry since the recession Historical Banking Industry NIM (2) 2019 Revenue Mix (1) 3.96% 3.95% 4.02% 3.96% 3.82% 3.62% 3.55% 3.71% 3.77% 3.70% 3.61% 3.60% 3.54% 3.56% 3.60% 3.70% 3.66% (1) Bank - owned life insurance includes $1.1 million in insurance proceeds ( 2 ) Banks with total assets between $500 million and $10 billion Source: S&P Global Market Intelligence Revenue Breakdown ($000s) Net Interest Income 73.4% Trust Revenue 11.3% Service Charges 5.0% Net Gain on Sales 0.2% Debit Card Income 4.3% Bank - owned Life Insurance 3.6% Brokerage 1.5% Other Noninterest Income 0.7% 73% 27%

21 21 Branch Modernization Key Improvements Sabraton Lobby Before and After Riverside Lobby Before and After • New ATMs and cash recyclers at all of our branches • Upgraded lobbies featuring a full complement of digital/ mobile banking offerings • Installing energy efficient lighting systems that reduce costs • A robust call center to assist with remote banking for our customers who prefer to speak with a person, but who cannot visit one of our branches

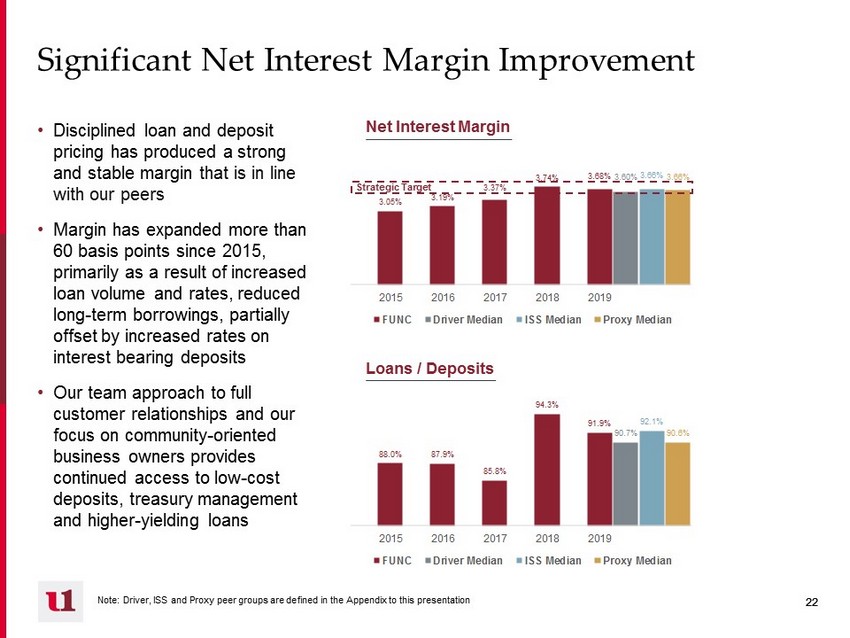

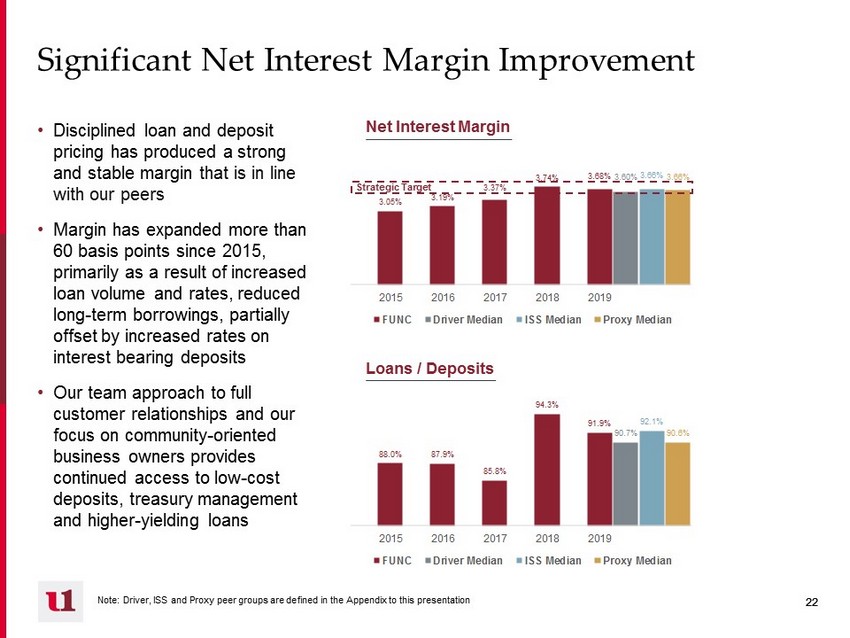

22 22 Significant Net Interest Margin Improvement • Disciplined loan and deposit pricing has produced a strong and stable margin that is in line with our peers • Margin has expanded more than 60 basis points since 2015, primarily as a result of increased loan volume and rates, reduced long - term borrowings, partially offset by increased rates on interest bearing deposits • Our team approach to full customer relationships and our focus on community - oriented business owners provides continued access to low - cost deposits, treasury management and higher - yielding loans Net Interest Margin 3.05% 3.19% 3.37% 3.74% 3.68% 3.60% 3.66% 3.66% 2015 2016 2017 2018 2019 FUNC Driver Median ISS Median Proxy Median Loans / Deposits Strategic Target 88.0% 87.9% 85.8% 94.3% 91.9% 90.7% 92.1% 90.6% 2015 2016 2017 2018 2019 FUNC Driver Median ISS Median Proxy Median Note : Driver, ISS and Proxy peer groups are defined in the Appendix to this presentation

23 23 Expense Discipline • Significant portion of earnings improvement can be attributed to steps taken to reduce expenses • First United’s investment in its wealth management business line generates additional expenses; even so, e fficiency ratio has decreased ~9 points since 2015 and is approaching peer levels • We have identified several initiatives, already underway, to continue lowering expenses and to be more competitive versus our peers • We believe these initiatives will continue to create future profitability and earnings growth Efficiency Ratio Source: S&P Global Market Intelligence Note: Driver, ISS and Proxy peer groups are defined in the Appendix to this presentation • Head - count reduction enacted last year will produce projected annual cost savings of approximately $1.4 million (net of additional compensation expense) • Restructuring and consolidation of regional operating structure • Leverage video conferencing and imaging technology to improve processes and procedures • Contract negotiation with core processor underway • Reviewing benefits structure and tax - saving strategies Future Identified Efficiencies Underway 78.1% 73.2% 71.1% 70.3% 69.5% 64.9% 63.0% 66.2% 2015 2016 2017 2018 2019 FUNC Driver Median ISS Median Proxy Median Strategic Target

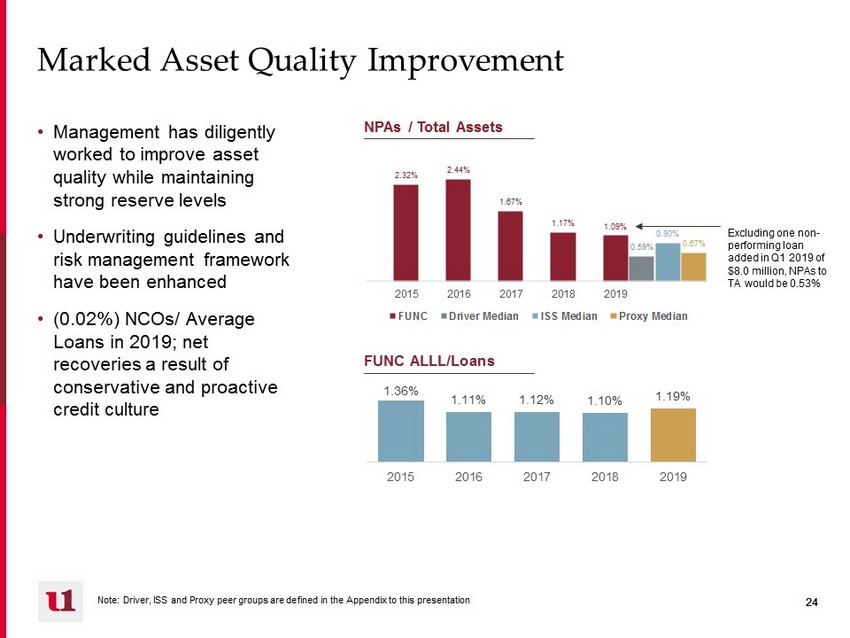

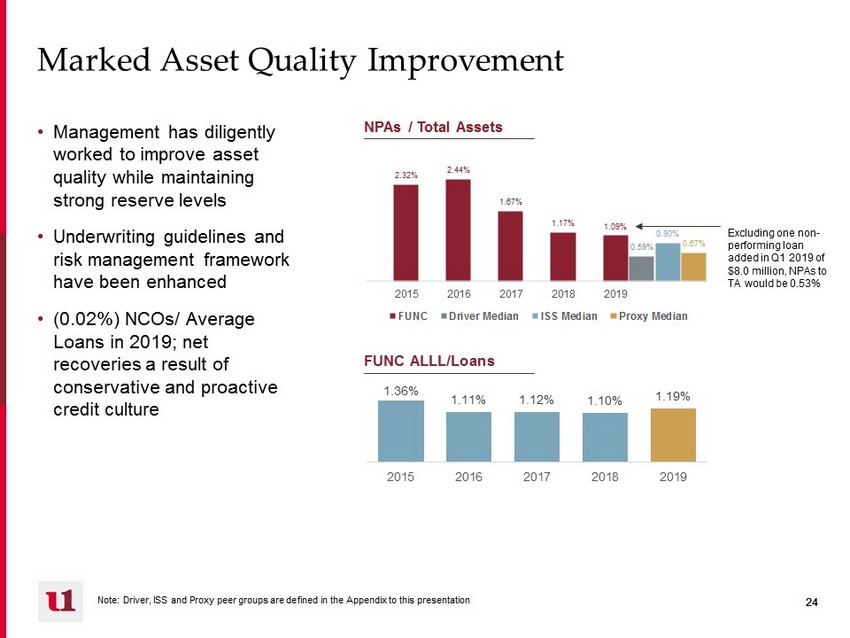

24 24 2.32% 2.44% 1.67% 1.17% 1.09% 0.59% 0.90% 0.67% 2015 2016 2017 2018 2019 FUNC Driver Median ISS Median Proxy Median Marked Asset Quality Improvement • Management has diligently worked to improve asset quality while maintaining strong reserve levels • Underwriting guidelines and risk management framework have been enhanced • (0.02%) NCOs/ Average Loans in 2019; net recoveries a result of conservative and proactive credit culture NPAs / Total Assets 1.36% 1.11% 1.12% 1.10% 1.19% 2015 2016 2017 2018 2019 FUNC ALLL/Loans Excluding one non - performing loan added in Q1 2019 of $8.0 million, NPAs to TA would be 0.53% Note : Driver, ISS and Proxy peer groups are defined in the Appendix to this presentation

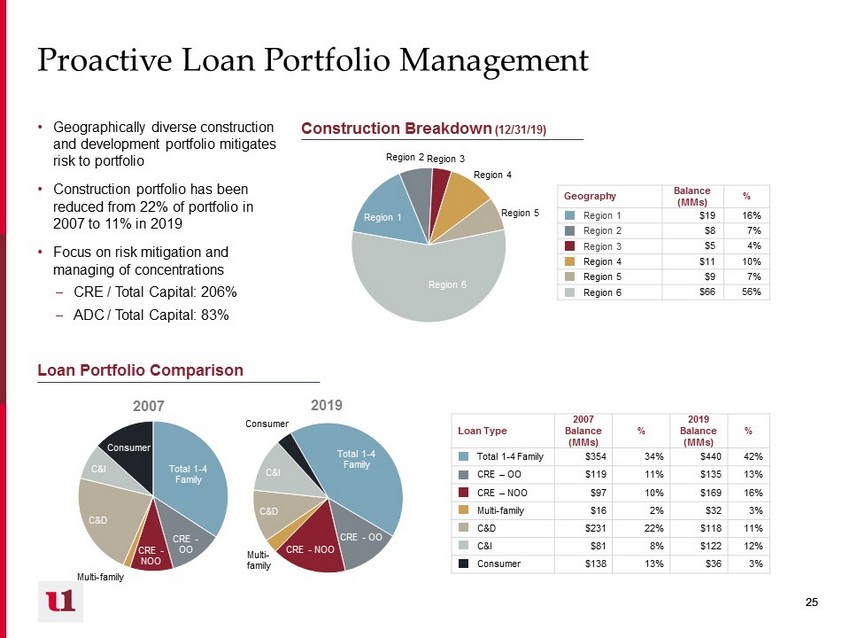

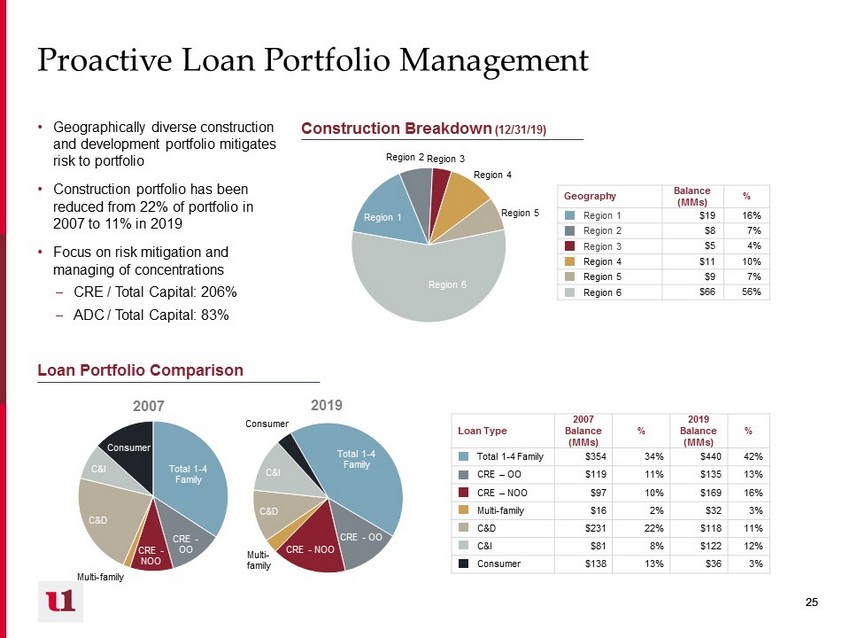

25 25 Total 1 - 4 Family CRE - OO CRE - NOO Multi - family C&D C&I Consumer Total 1 - 4 Family CRE - OO CRE - NOO Multi - family C&D C&I Consumer Proactive Loan Portfolio Management • Geographically diverse construction and development portfolio mitigates risk to portfolio • Construction portfolio has been reduced from 22% of portfolio in 2007 to 11% in 2019 • Focus on risk mitigation and managing of concentrations – CRE / Total Capital: 206% – ADC / Total Capital: 83% Construction Breakdown (12/31/19 ) Region 1 Region 2 Region 3 Region 4 Region 5 Region 6 Loan Type 2007 Balance (MMs) % 2019 Balance (MMs) % Total 1 - 4 Family $354 34% $ 440 42% CRE – OO $119 11% $135 13% CRE – NOO $97 10% $169 16% Multi - family $16 2% $ 32 3% C&D $231 22% $ 118 11% C&I $81 8% $ 122 12% Consumer $138 13% $36 3 % Geography Balance (MMs) % Region 1 $19 16% Region 2 $8 7% Region 3 $5 4% Region 4 $11 10% Region 5 $9 7% Region 6 $66 56% Loan Portfolio Comparison 2007 2019

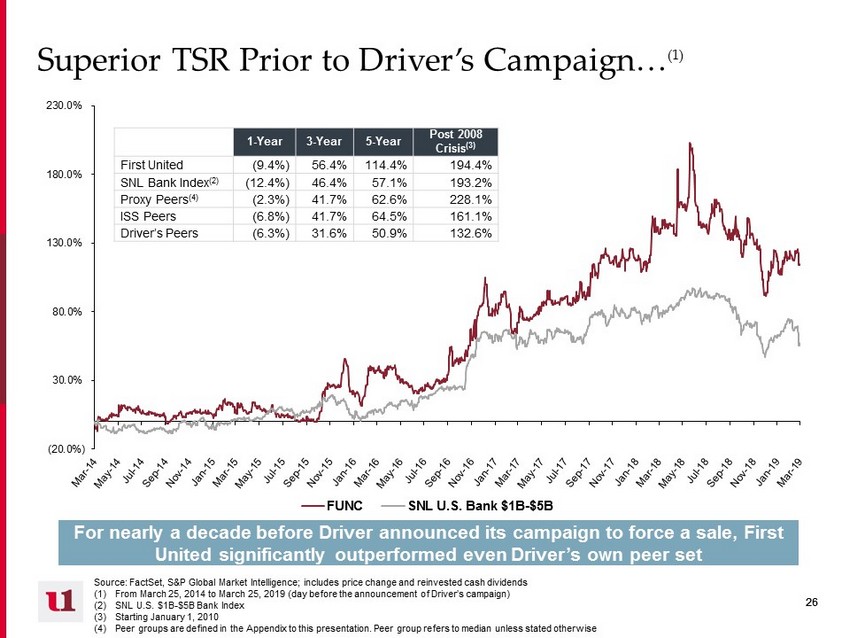

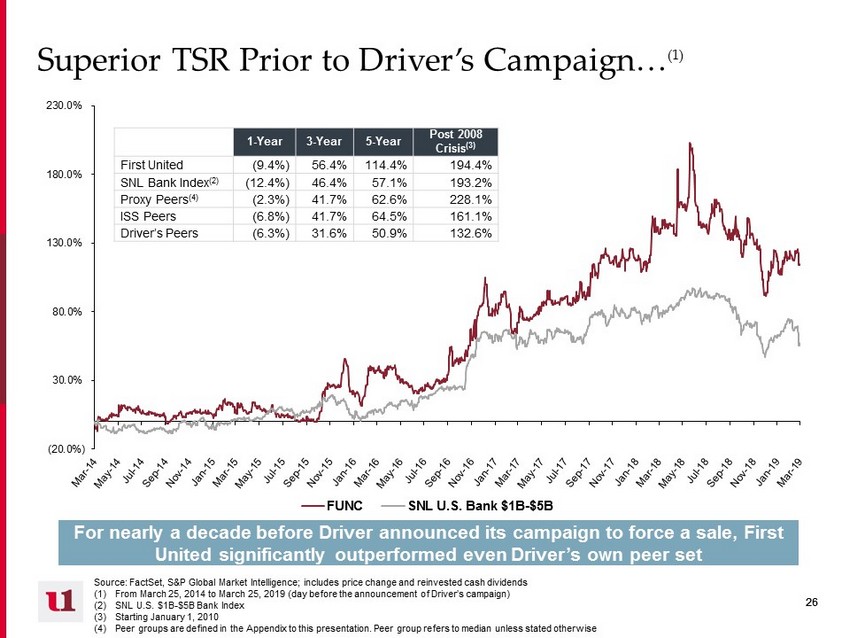

26 26 (20.0%) 30.0% 80.0% 130.0% 180.0% 230.0% FUNC SNL U.S. Bank $1B-$5B Superior TSR Prior to Driver’s Campaign… (1 ) Source: FactSet , S&P Global Market Intelligence ; includes price change and reinvested cash dividends (1) From March 25, 2014 to March 25, 2019 (day before the announcement of Driver’s campaign) (2) SNL U.S. $1B - $5B Bank Index (3) Starting January 1, 2010 (4) Peer groups are defined in the Appendix to this presentation. Peer group refers to median unless stated otherwise 1 - Year 3 - Year 5 - Year Post 2008 Crisis (3) First United (9.4%) 56.4% 114.4% 194.4% SNL Bank Index (2) (12.4%) 46.4% 57.1% 193.2% Proxy Peers (4) (2.3%) 41.7% 62.6% 228.1% ISS Peers (6.8%) 41.7% 64.5% 161.1% Driver’s Peers (6.3%) 31.6% 50.9% 132.6% For nearly a decade before Driver announced its campaign to force a sale, First United significantly outperformed even Driver’s own peer set

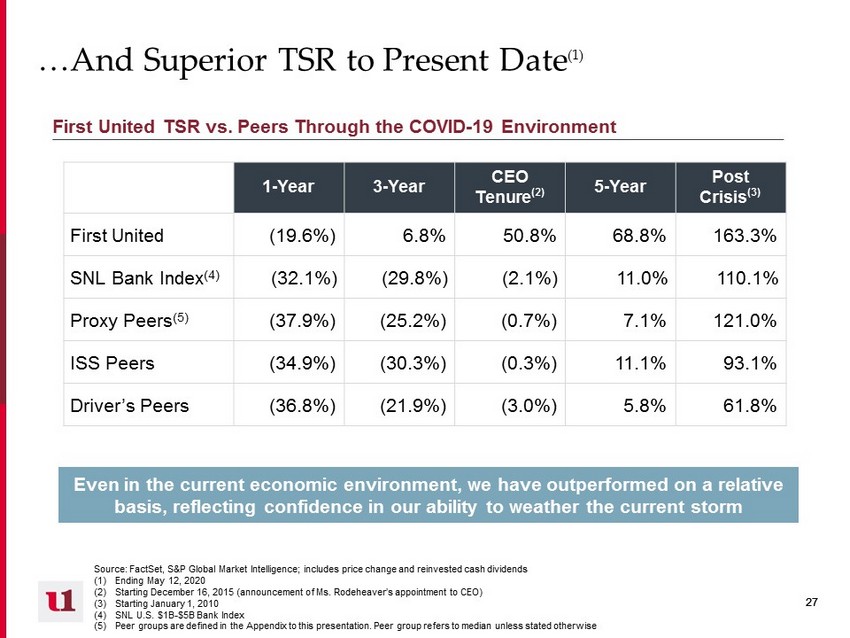

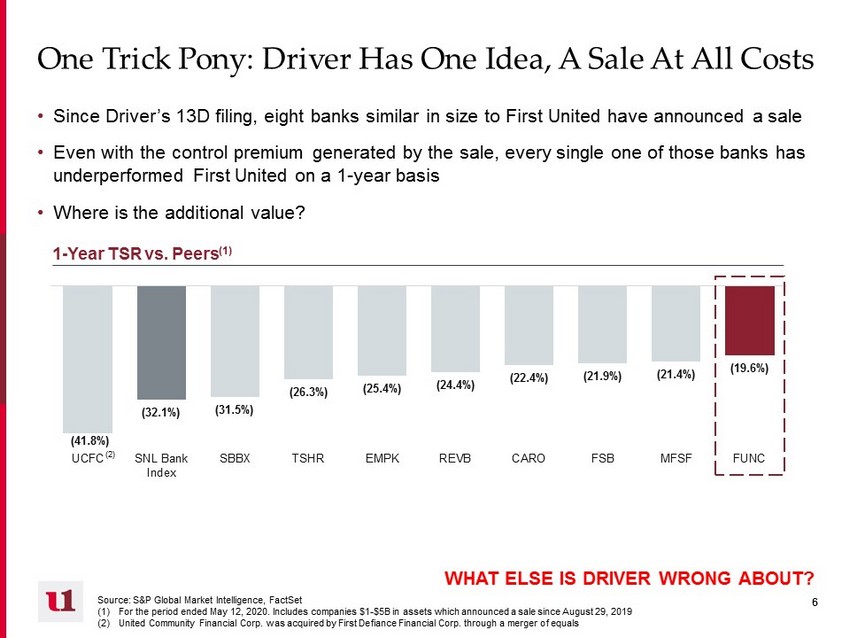

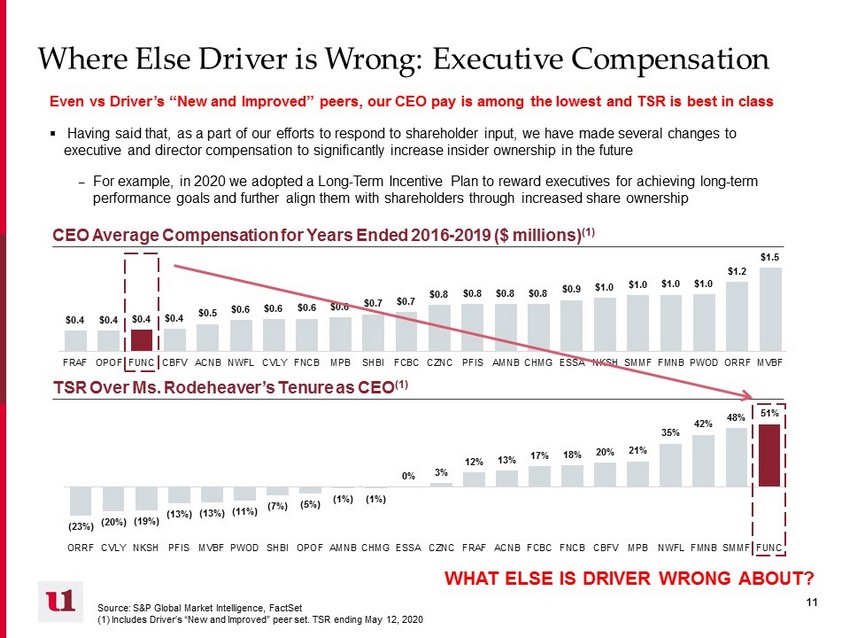

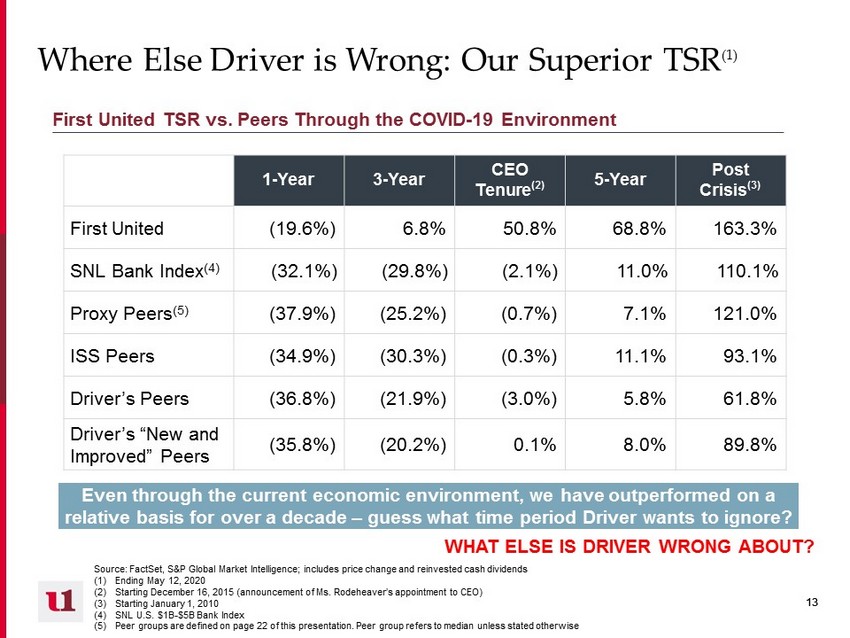

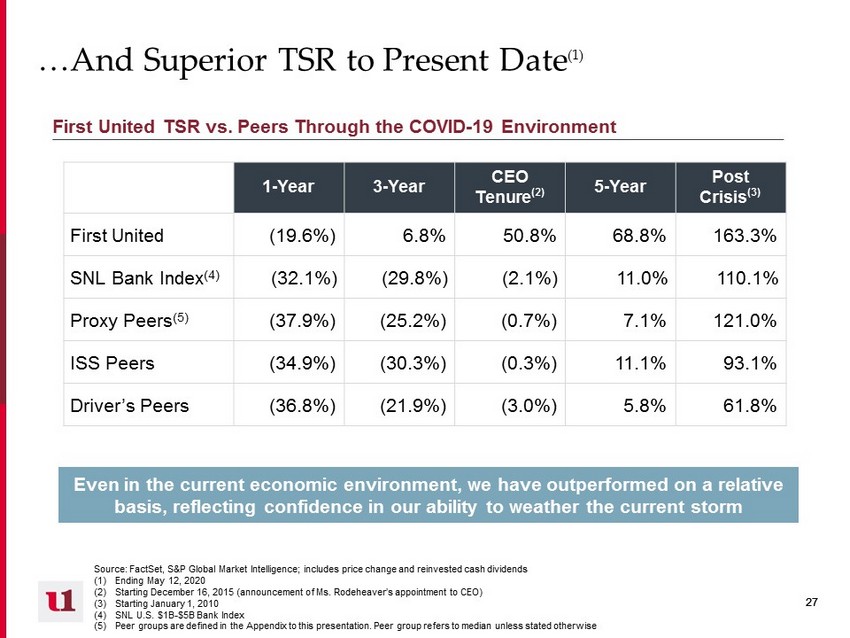

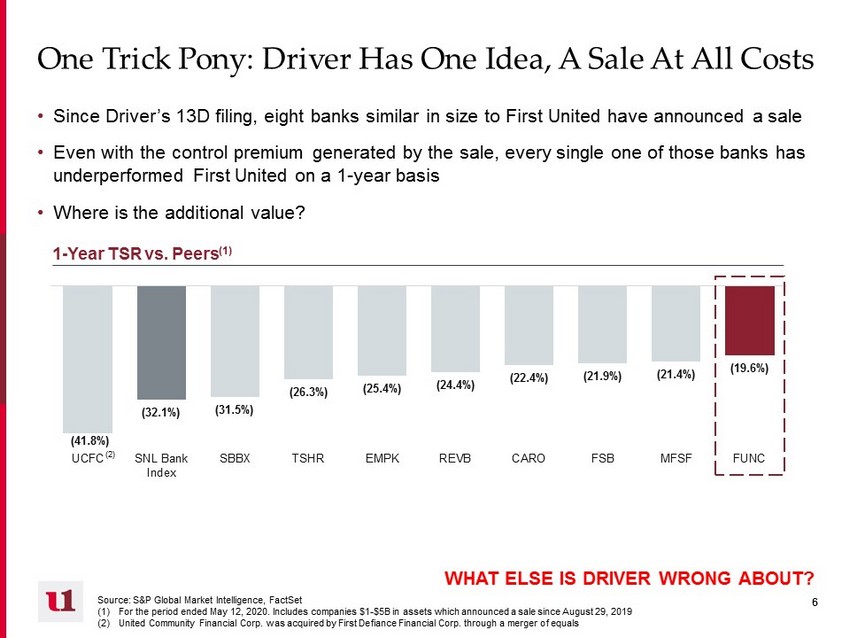

27 27 …And Superior TSR to Present Date (1 ) Source: FactSet , S&P Global Market Intelligence ; includes price change and reinvested cash dividends (1) Ending May 12, 2020 (2) Starting December 16, 2015 (announcement of Ms. Rodeheaver’s appointment to CEO) (3) Starting January 1, 2010 (4) SNL U.S. $1B - $5B Bank Index (5) Peer groups are defined in the Appendix to this presentation. Peer group refers to median unless stated otherwise Even in the current economic environment, we have outperformed on a relative basis, reflecting confidence in our ability to weather the current storm 1 - Year 3 - Year CEO Tenure (2) 5 - Year Post Crisis (3) First United (19.6%) 6.8% 50.8% 68.8% 163.3% SNL Bank Index (4) (32.1%) (29.8%) (2.1%) 11.0% 110.1% Proxy Peers (5) ( 37.9%) (25.2%) (0.7%) 7.1% 121.0% ISS Peers (34.9%) (30.3%) (0.3%) 11.1% 93.1% Driver’s Peers (36.8%) (21.9%) (3.0%) 5.8% 61.8% First United TSR vs. Peers T hrough the COVID - 19 Environment

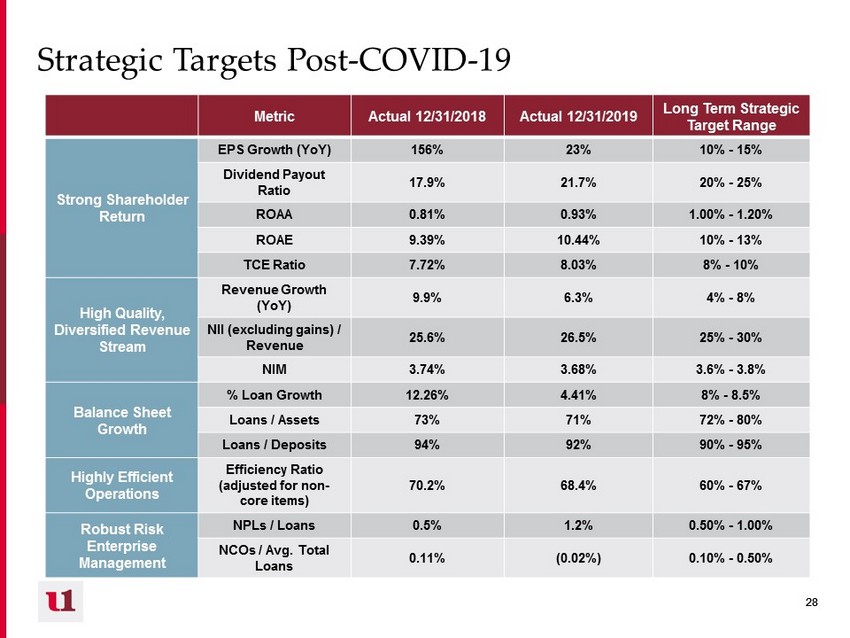

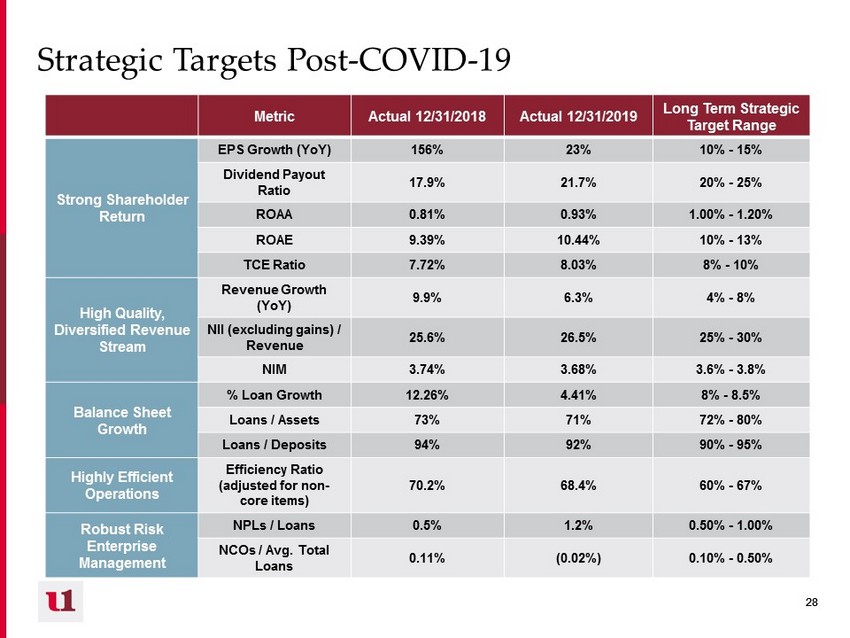

28 28 Strategic Targets Post - COVID - 19 Metric Actual 12/31/2018 Actual 12/31/2019 Long Term Strategic Target Range Strong Shareholder Return EPS Growth (YoY) 156% 23% 10% - 15% Dividend Payout Ratio 17.9% 21.7% 20% - 25% ROAA 0.81% 0.93% 1.00% - 1.20% ROAE 9.39% 10.44% 10% - 13% TCE Ratio 7.72% 8.03% 8% - 10% High Quality, Diversified Revenue Stream Revenue Growth (YoY) 9.9% 6.3% 4% - 8% NII (excluding gains) / Revenue 25.6% 26.5% 25% - 30% N IM 3.74% 3.68% 3.6% - 3.8% Balance Sheet Growth % Loan Growth 12.26% 4.41% 8% - 8.5% Loans / Assets 73% 71% 72% - 80% Loans / Deposits 94% 92% 90% - 95% Highly Efficient Operations Efficiency Ratio (adjusted for non - core items) 70.2% 68.4% 60% - 67% Robust Risk Enterprise Management NPLs / Loans 0.5% 1.2% 0.50% - 1.00% NCOs / Avg. Total Loans 0.11% (0.02%) 0.10% - 0.50%

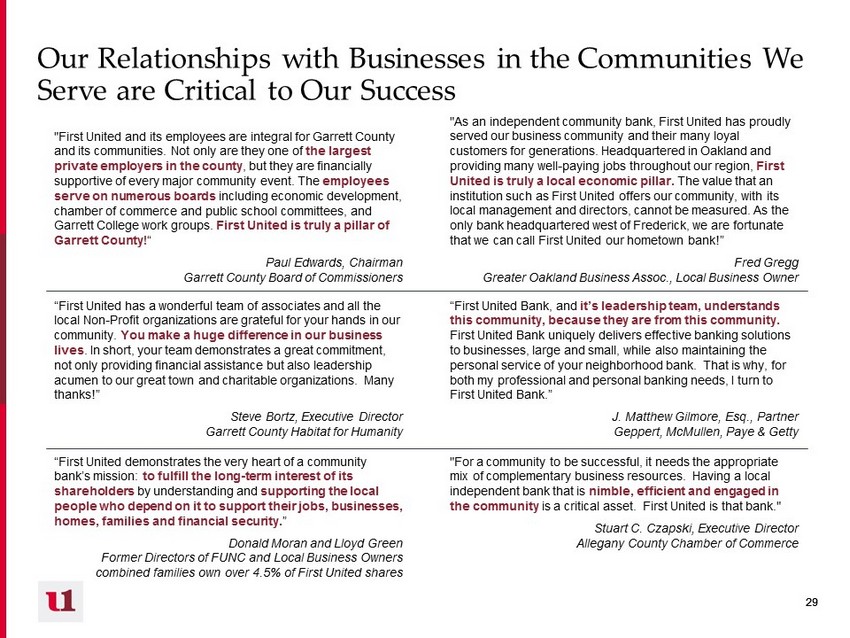

29 29 Our Relationships with Businesses in the Communities We Serve are Critical to Our Success "First United and its employees are integral for Garrett County and its communities. Not only are they one of the largest private employers in the county , but they are financially supportive of every major community event. The employees serve on numerous boards including economic development, chamber of commerce and public school committees, and Garrett College work groups. First United is truly a pillar of Garrett County ! “ Paul Edwards, Chairman Garrett County Board of Commissioners “First United has a wonderful team of associates and all the local Non - Profit organizations are grateful for your hands in our community. You make a huge difference in our business lives . In short, your team demonstrates a great commitment, not only providing financial assistance but also leadership acumen to our great town and charitable organizations. Many thanks !” Steve Bortz , Executive Director Garrett County Habitat for Humanity “First United demonstrates the very heart of a community bank’s mission: to fulfill the long - term interest of its shareholders by understanding and supporting the local people who depend on it to support their jobs, businesses, homes, families and financial security . ” Donald Moran and Lloyd Green Former Directors of FUNC and Local Business Owners combined families own over 4.5% of First United shares "As an independent community bank, First United has proudly served our business community and their many loyal customers for generations. Headquartered in Oakland and providing many well - paying jobs throughout our region, First United is truly a local economic pillar. The value that an institution such as First United offers our community, with its local management and directors, cannot be measured. As the only bank headquartered west of Frederick, we are fortunate that we can call First United our hometown bank !” Fred Gregg Greater Oakland Business Assoc., Local Business Owner “First United Bank, and it’s leadership team, understands this community, because they are from this community. First United Bank uniquely delivers effective banking solutions to businesses, large and small, while also maintaining the personal service of your neighborhood bank. That is why, for both my professional and personal banking needs, I turn to First United Bank .” J. Matthew Gilmore, Esq., Partner Geppert , McMullen, Paye & Getty "For a community to be successful, it needs the appropriate mix of complementary business resources. Having a local independent bank that is nimble, efficient and engaged in the community is a critical asset. First United is that bank ." Stuart C. Czapski , Executive Director Allegany County Chamber of Commerce

30 30 III. Driver’s Flawed Sale Thesis

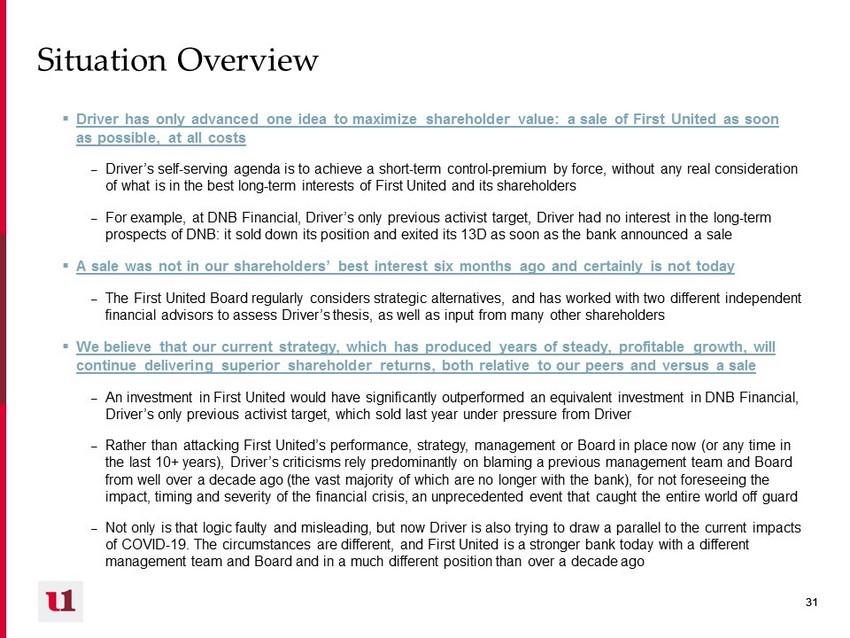

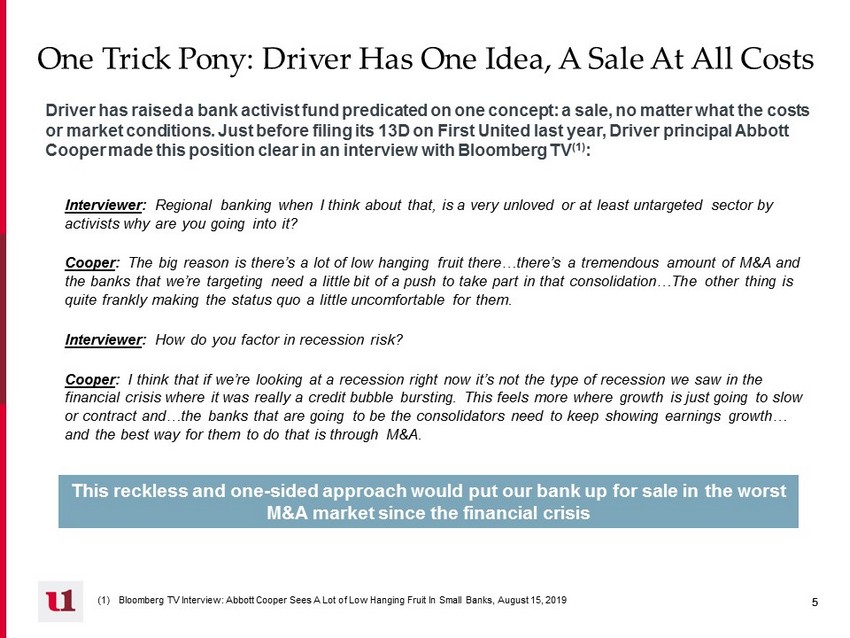

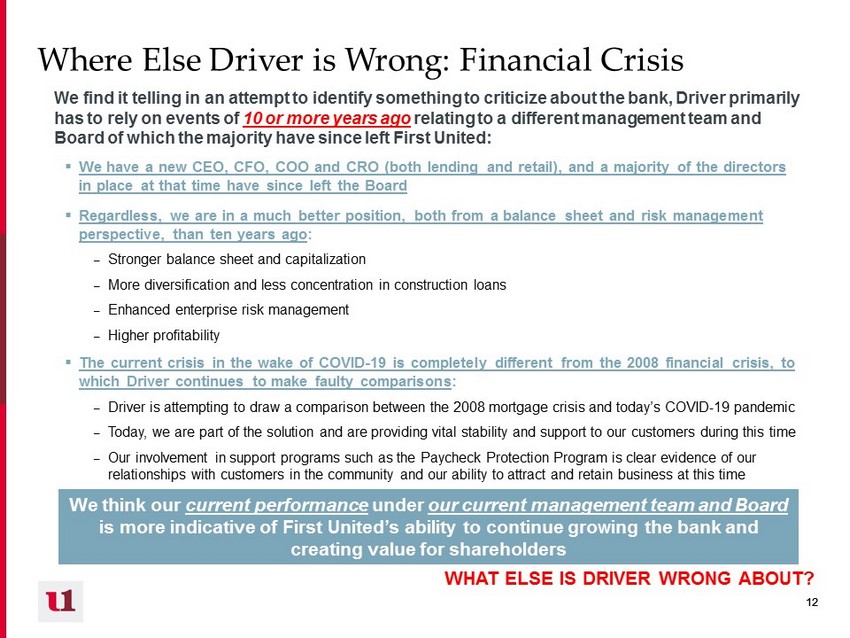

31 31 Situation Overview ▪ Driver has only advanced one idea to maximize shareholder value: a sale of First United as soon as possible, at all costs – Driver’s self - serving agenda is to achieve a short - term control - premium by force, without any real consideration of what is in the best long - term interests of First United and its shareholders – For example, at DNB Financial, Driver’s only previous activist target, Driver had no interest in the long - term prospects of DNB: it sold down its position and exited its 13D as soon as the bank announced a sale ▪ A sale was not in our shareholders’ best interest six months ago and certainly is not today – The First United Board regularly considers strategic alternatives, and has worked with two different independent financial advisors to assess Driver’s thesis, as well as input from many other shareholders ▪ We believe that our current strategy, which has produced years of steady, profitable growth, will continue delivering superior shareholder returns, both relative to our peers and versus a sale – An investment in First United would have significantly outperformed an equivalent investment in DNB Financial, Driver’s only previous activist target, which sold last year under pressure from Driver – Rather than attacking First United’s performance, strategy, management or Board in place now (or any time in the last 10+ years), Driver’s criticisms rely predominantly on blaming a previous management team and Board from well over a decade ago (the vast majority of which are no longer with the bank), for not foreseeing the impact, timing and severity of the financial crisis, an unprecedented event that caught the entire world off guard – Not only is that logic faulty and misleading, but now Driver is also trying to draw a parallel to the current impacts of COVID - 19. The circumstances are different, and First United is a stronger bank today with a different management team and Board and in a much different position than over a decade ago

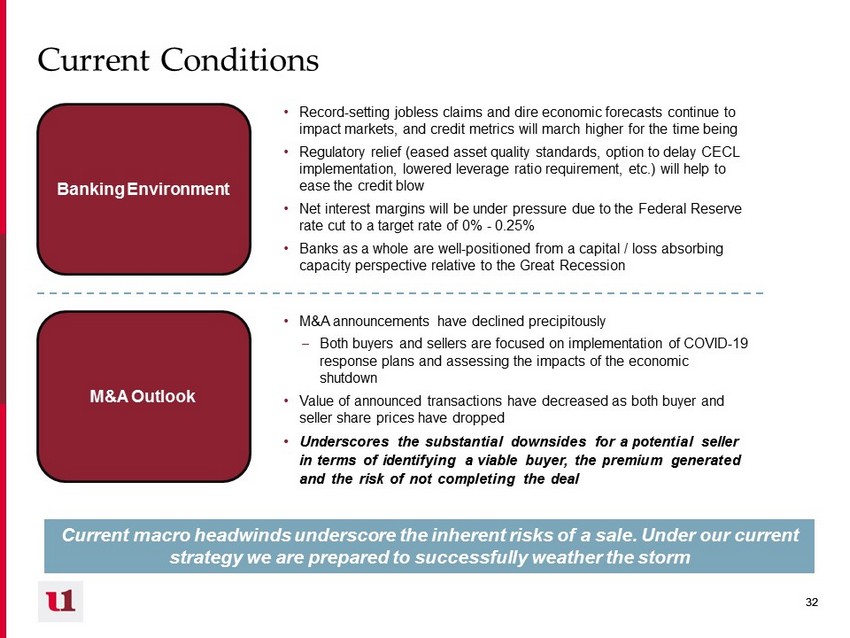

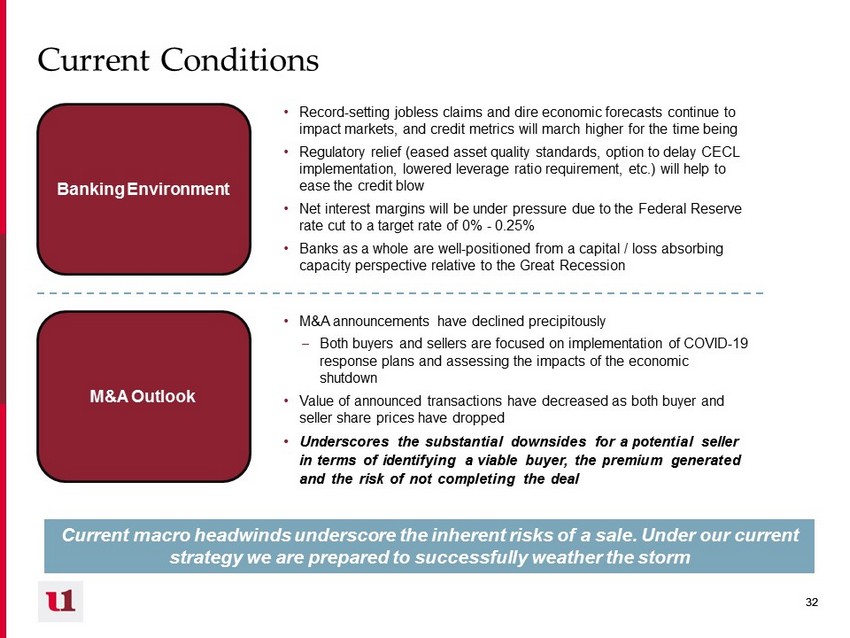

32 32 Current Conditions Banking Environment • Record - setting jobless claims and dire economic forecasts continue to impact markets, and credit metrics will march higher for the time being • Regulatory relief (eased asset quality standards, option to delay CECL implementation, lowered leverage ratio requirement, etc.) will help to ease the credit blow • Net interest margins will be under pressure due to the Federal Reserve rate cut to a target rate of 0% - 0.25% • Banks as a whole are well - positioned from a capital / loss absorbing capacity perspective relative to the Great Recession M&A Outlook • M&A announcements have declined precipitously – B oth buyers and sellers are focused on implementation of COVID - 19 response plans and assessing the impacts of the economic shutdown • Value of announced transactions have decreased as both buyer and seller share prices have dropped • Underscores the substantial downsides for a potential seller in terms of identifying a viable buyer, the premium generated and the risk of not completing the deal Current macro headwinds underscore the inherent risks of a sale. Under our current strategy we are prepared to successfully weather the storm

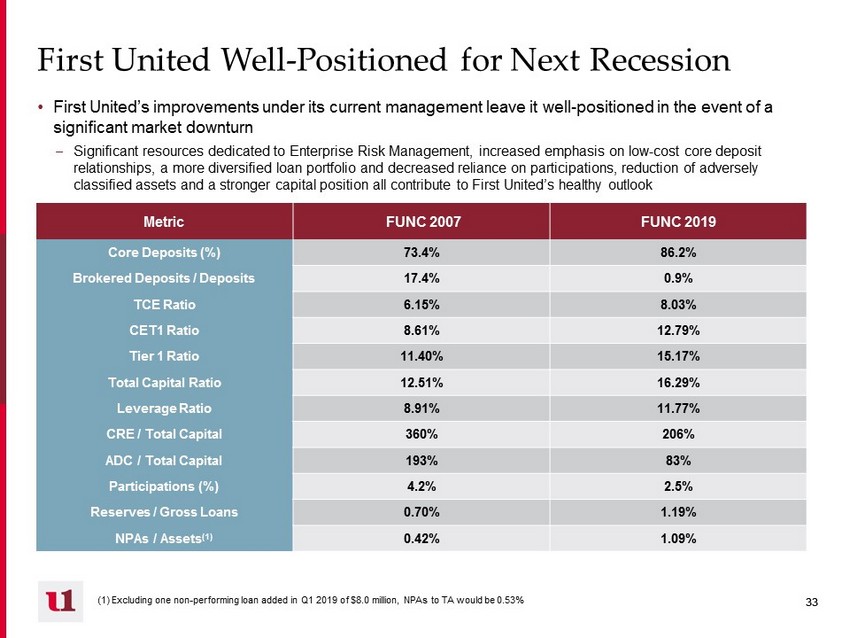

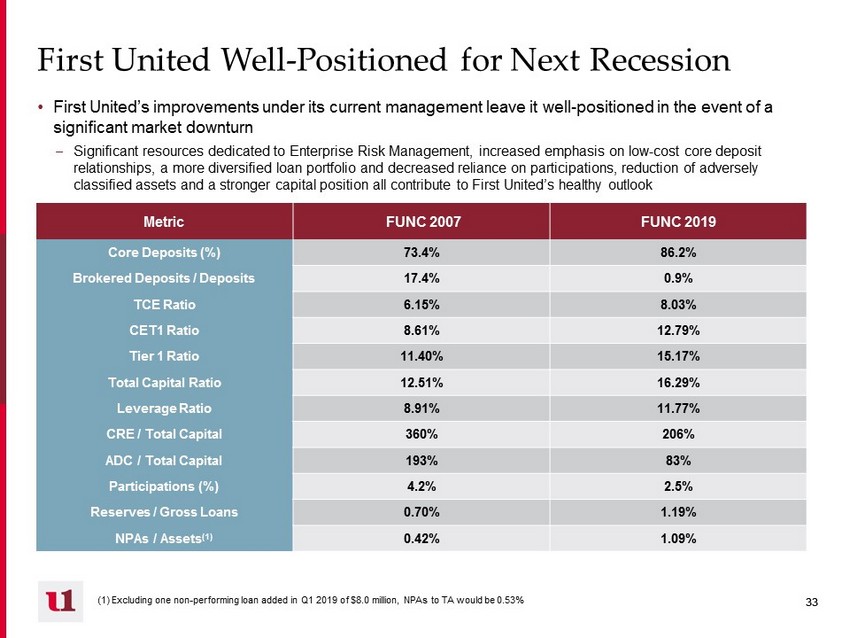

33 33 First United Well - Positioned for Next Recession • First United’s improvements under its current management leave it well - positioned in the event of a significant market downturn – Significant resources dedicated to Enterprise Risk Management, increased emphasis on low - cost core deposit relationships, a more diversified loan portfolio and decreased reliance on participations, reduction of adversely classified assets and a stronger capital position all contribute to First United’s healthy outlook Metric FUNC 2007 FUNC 2019 Core Deposits (%) 73.4% 86.2% Brokered Deposits / Deposits 17.4% 0.9% TCE Ratio 6.15% 8.03% CET1 Ratio 8.61% 12.79% Tier 1 Ratio 11.40% 15.17% Total Capital Ratio 12.51% 16.29% Leverage Ratio 8.91% 11.77% CRE / Total Capital 360% 206% ADC / Total Capital 193% 83% Participations (%) 4.2% 2.5% Reserves / Gross Loans 0.70% 1.19% NPAs / Assets (1) 0.42% 1.09% (1 ) Excluding one non - performing loan added in Q1 2019 of $8.0 million, NPAs to TA would be 0.53%

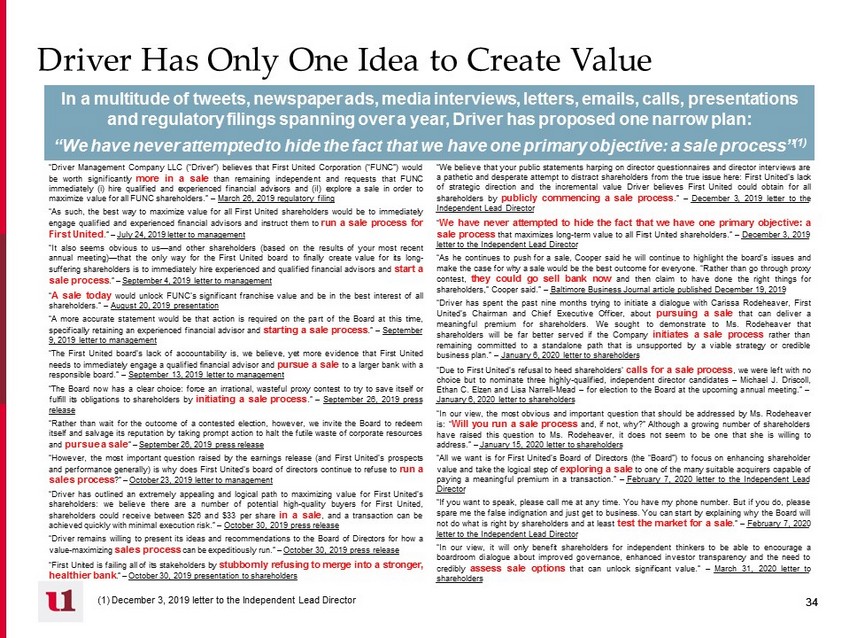

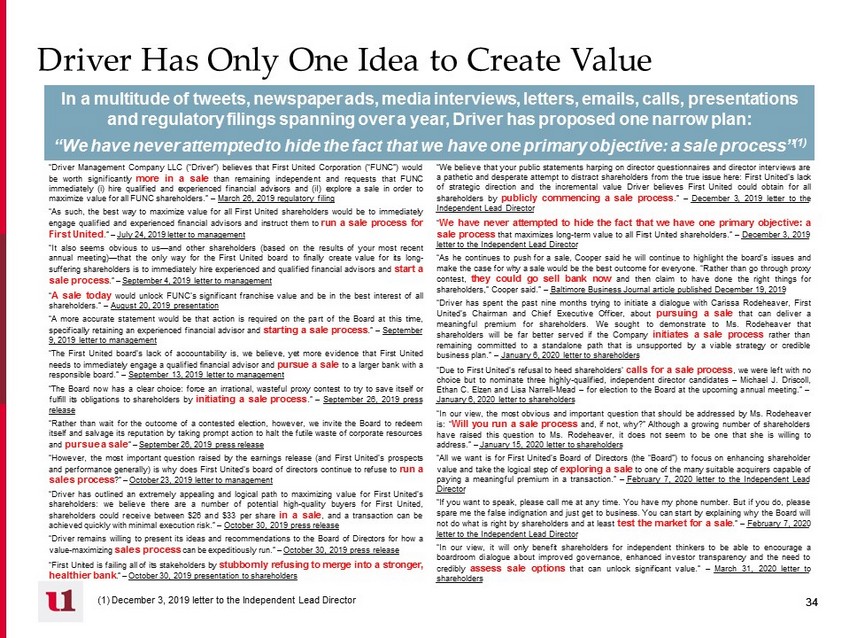

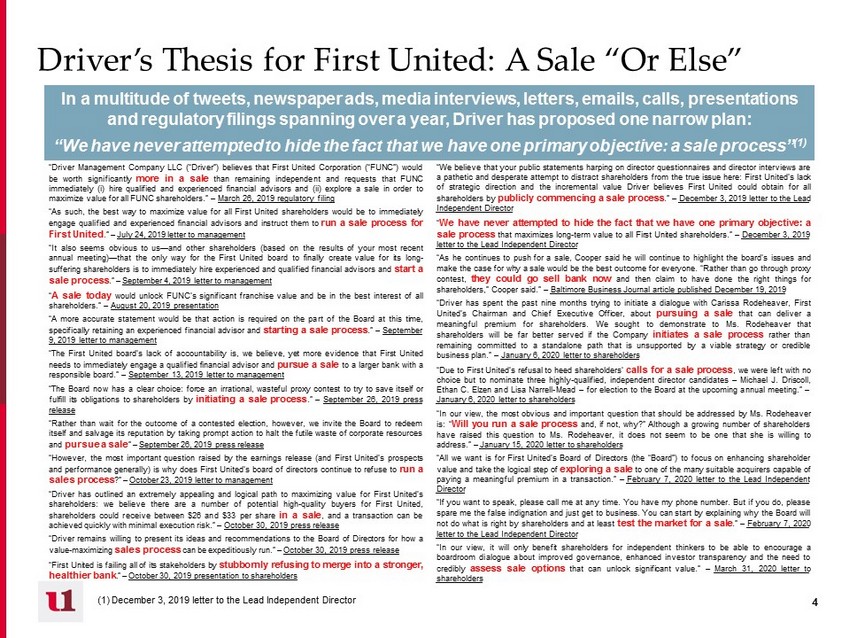

34 34 Driver Has Only One Idea to Create Value In a multitude of tweets, newspaper ads, media interviews, letters, emails, calls, presentations and regulatory filings spanning over a year, Driver has proposed one narrow plan: “We have never attempted to hide the fact that we have one primary objective: a sale process” (1) “Driver Management Company LLC (“Driver”) believes that First United Corporation (“FUNC”) would be worth significantly more in a sale than remaining independent and requests that FUNC immediately (i) hire qualified and experienced financial advisors and ( iI ) explore a sale in order to maximize value for all FUNC shareholders . ” – March 26 , 2019 regulatory filing “As such, the best way to maximize value for all First United shareholders would be to immediately engage qualified and experienced financial advisors and instruct them to run a sale process for First United . ” – July 24 , 2019 letter to management “It also seems obvious to us — and other shareholders (based on the results of your most recent annual meeting) — that the only way for the First United board to finally create value for its long - suffering shareholders is to immediately hire experienced and qualified financial advisors and start a sale process . ” – September 4 , 2019 letter to management “ A sale today would unlock FUNC’s significant franchise value and be in the best interest of all shareholders . ” – August 20 , 2019 presentation “A more accurate statement would be that action is required on the part of the Board at this time, specifically retaining an experienced financial advisor and starting a sale process . ” – September 9 , 2019 letter to management “The First United board’s lack of accountability is, we believe, yet more evidence that First United needs to immediately engage a qualified financial advisor and pursue a sale to a larger bank with a responsible board . ” – September 13 , 2019 letter to management “The Board now has a clear choice : force an irrational, wasteful proxy contest to try to save itself or fulfill its obligations to shareholders by initiating a sale process . ” – September 26 , 2019 press release “Rather than wait for the outcome of a contested election, however, we invite the Board to redeem itself and salvage its reputation by taking prompt action to halt the futile waste of corporate resources and pursue a sale ” – September 26 , 2019 press release “However , the most important question raised by the earnings release (and First United’s prospects and performance generally) is why does First United’s board of directors continue to refuse to run a sales process ?” – October 23 , 2019 letter to management “Driver has outlined an extremely appealing and logical path to maximizing value for First United’s shareholders : we believe there are a number of potential high - quality buyers for First United, shareholders could receive between $ 26 and $ 33 per share in a sale , and a transaction can be achieved quickly with minimal execution risk . ” – October 30 , 2019 press release “Driver remains willing to present its ideas and recommendations to the Board of Directors for how a value - maximizing sales process can be expeditiously run . ” – October 30 , 2019 press release “First United is failing all of its stakeholders by stubbornly refusing to merge into a stronger, healthier bank . ” – October 30 , 2019 presentation to shareholders “We believe that your public statements harping on director questionnaires and director interviews are a pathetic and desperate attempt to distract shareholders from the true issue here : First United’s lack of strategic direction and the incremental value Driver believes First United could obtain for all shareholders by publicly commencing a sale process . ” – December 3 , 2019 letter to the Independent Lead Director “ We have never attempted to hide the fact that we have one primary objective : a sale process that maximizes long - term value to all First United shareholders . ” – December 3 , 2019 letter to the Independent Lead Director “As he continues to push for a sale, Cooper said he will continue to highlight the board’s issues and make the case for why a sale would be the best outcome for everyone . “Rather than go through proxy contest, they could go sell bank now and then claim to have done the right things for shareholders,” Cooper said . ” – Baltimore Business Journal article published December 19 , 2019 “Driver has spent the past nine months trying to initiate a dialogue with Carissa Rodeheaver , First United’s Chairman and Chief Executive Officer, about pursuing a sale that can deliver a meaningful premium for shareholders . We sought to demonstrate to Ms . Rodeheaver that shareholders will be far better served if the Company initiates a sale process rather than remaining committed to a standalone path that is unsupported by a viable strategy or credible business plan . ” – January 6 , 2020 letter to shareholders “Due to First United’s refusal to heed shareholders’ calls for a sale process , we were left with no choice but to nominate three highly - qualified, independent director candidates – Michael J . Driscoll, Ethan C . Elzen and Lisa Narrell - Mead – for election to the Board at the upcoming annual meeting . ” – January 6 , 2020 letter to shareholders “In our view, the most obvious and important question that should be addressed by Ms . Rodeheaver is : “ Will you run a sale process and, if not, why?” Although a growing number of shareholders have raised this question to Ms . Rodeheaver , it does not seem to be one that she is willing to address . ” – January 15 , 2020 letter to shareholders “All we want is for First United’s Board of Directors (the “Board”) to focus on enhancing shareholder value and take the logical step of exploring a sale to one of the many suitable acquirers capable of paying a meaningful premium in a transaction . ” – February 7 , 2020 letter to the Independent Lead Director “If you want to speak, please call me at any time . You have my phone number . But if you do, please spare me the false indignation and just get to business . You can start by explaining why the Board will not do what is right by shareholders and at least test the market for a sale . ” – February 7 , 2020 letter to the Independent Lead Director “In our view, it will only benefit shareholders for independent thinkers to be able to encourage a boardroom dialogue about improved governance, enhanced investor transparency and the need to credibly assess sale options that can unlock significant value . ” – March 31 , 2020 letter to shareholders (1 ) December 3, 2019 letter to the Independent Lead Director

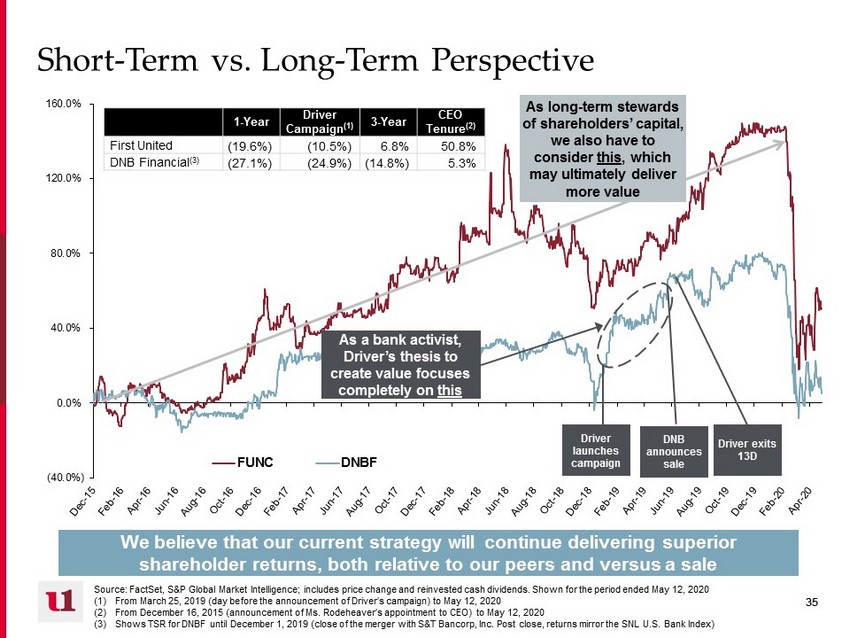

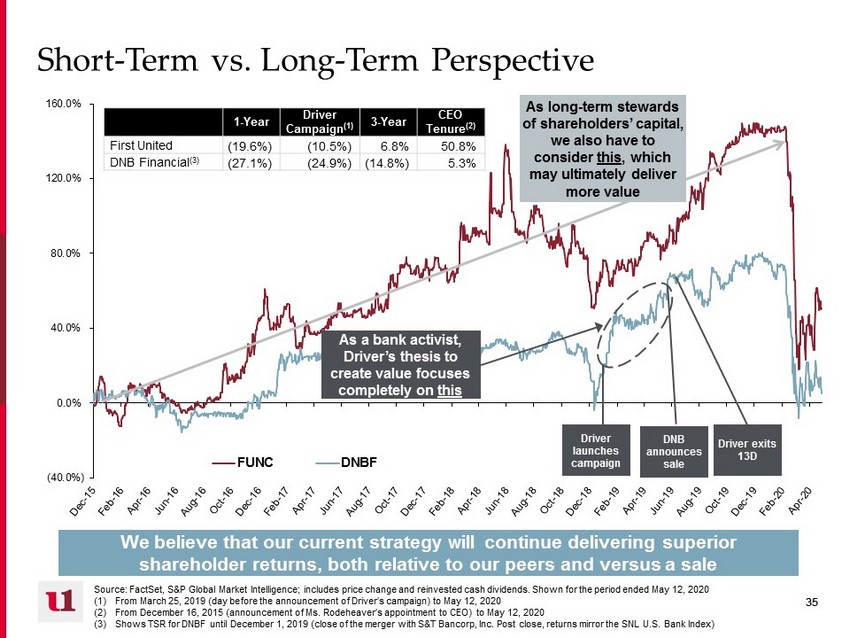

35 35 (40.0%) 0.0% 40.0% 80.0% 120.0% 160.0% FUNC DNBF Short - Term vs. Long - Term Perspective We believe that our current strategy will continue delivering superior shareholder returns, both relative to our peers and versus a sale Source: FactSet , S&P Global Market Intelligence ; includes price change and reinvested cash dividends. Shown for the period ended May 12, 2020 (1) From March 25, 2019 (day before the announcement of Driver’s campaign ) to May 12, 2020 (2) From December 16, 2015 (announcement of Ms. Rodeheaver’s appointment to CEO) to May 12, 2020 (3) Shows TSR for DNBF until December 1, 2019 (close of the merger with S&T Bancorp, Inc. Post close, returns mirror the SNL U.S. Ba nk Index) Driver launches campaign As a bank activist, Driver’s thesis to create value focuses completely on this Driver exits 13D DNB announces sale As long - term stewards of shareholders’ capital, we also have to consider this , which may ultimately deliver more value 1 - Year Driver Campaign (1) 3 - Year CEO Tenure (2) First United ( 19.6%) (10.5%) 6.8% 50.8% DNB Financial (3) (27.1%) (24.9%) (14.8%) 5.3%

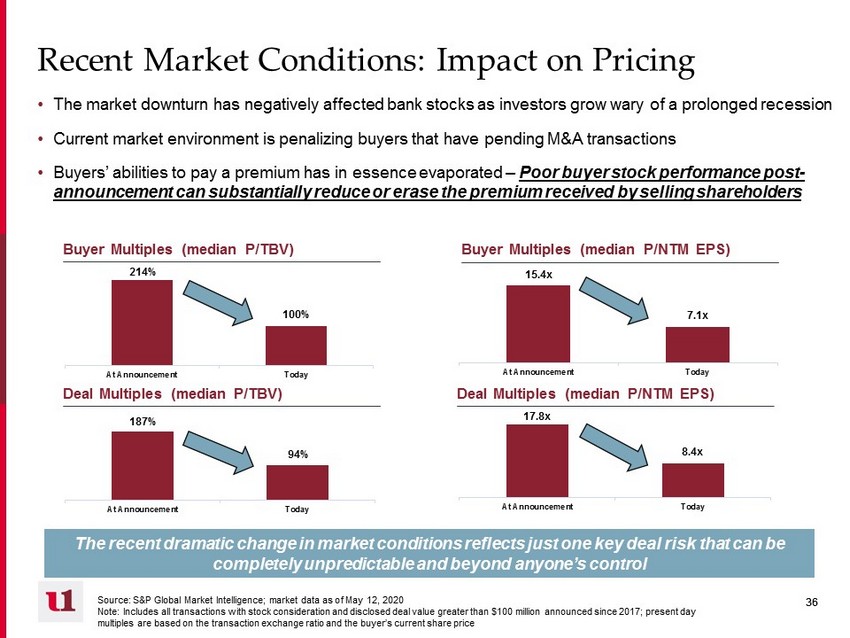

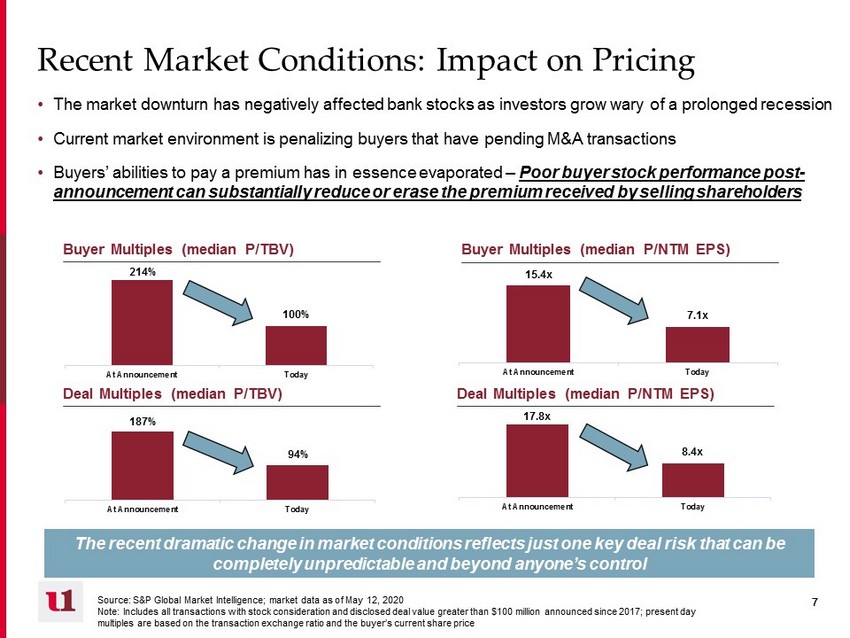

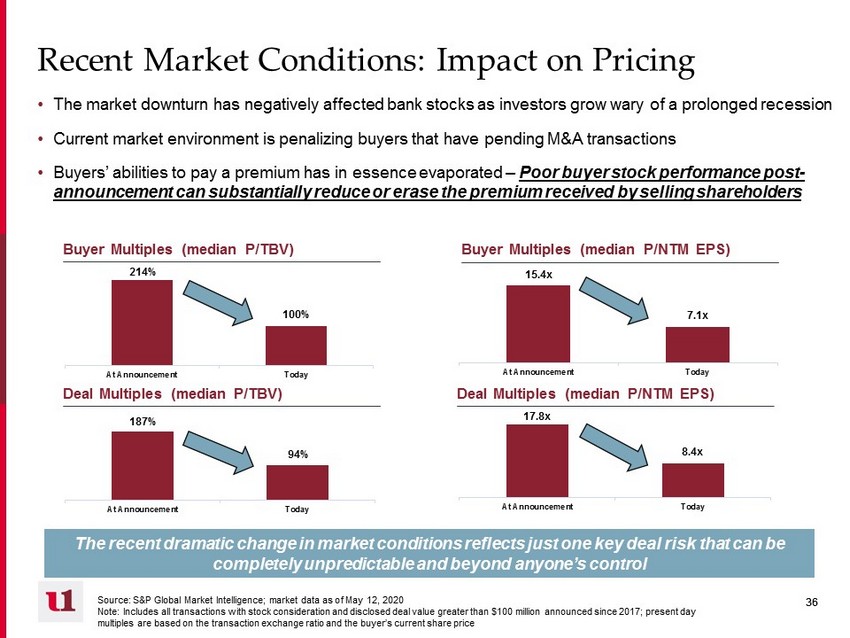

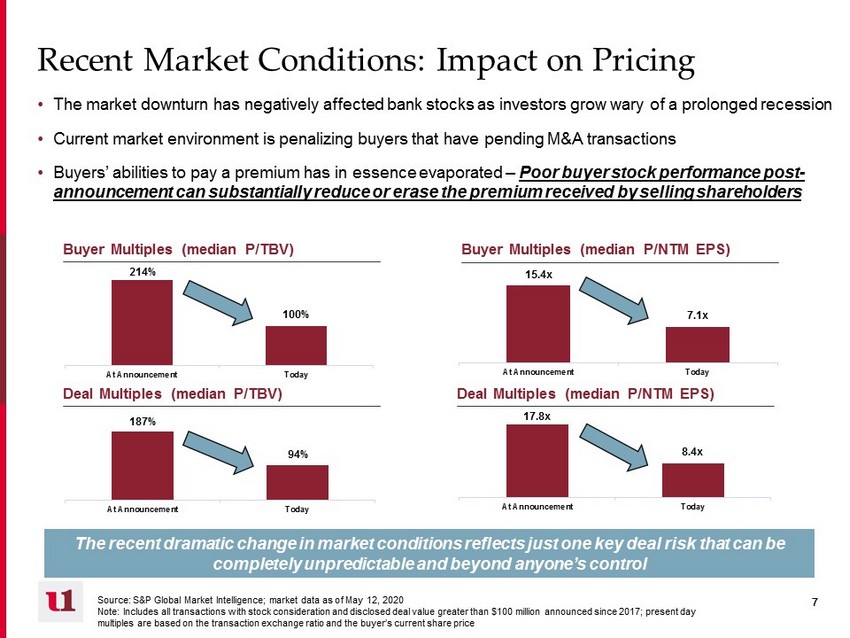

36 36 17.8x 8.4x At Announcement Today 15.4x 7.1x At Announcement Today 187% 94% At Announcement Today 214% 100% At Announcement Today Recent Market Conditions: Impact on Pricing Source: S&P Global Market Intelligence; market data as of May 12, 2020 Note: Includes all transactions with stock consideration and disclosed deal value greater than $100 million announced since 2 017 ; present day multiples are based on the transaction exchange ratio and the buyer’s current share price Buyer Multiples (median P/TBV) Deal Multiples ( median P/TBV) Deal Multiples (median P/NTM EPS) Buyer Multiples (median P/NTM EPS) The recent dramatic change in market conditions reflects just one key deal risk that can be completely unpredictable and beyond anyone’s control • The market downturn has negatively affected bank stocks as investors grow wary of a prolonged recession • Current market environment is penalizing buyers that have pending M&A transactions • Buyers’ abilities to pay a premium has in essence evaporated – Poor buyer stock performance post - announcement can substantially reduce or erase the premium received by selling shareholders

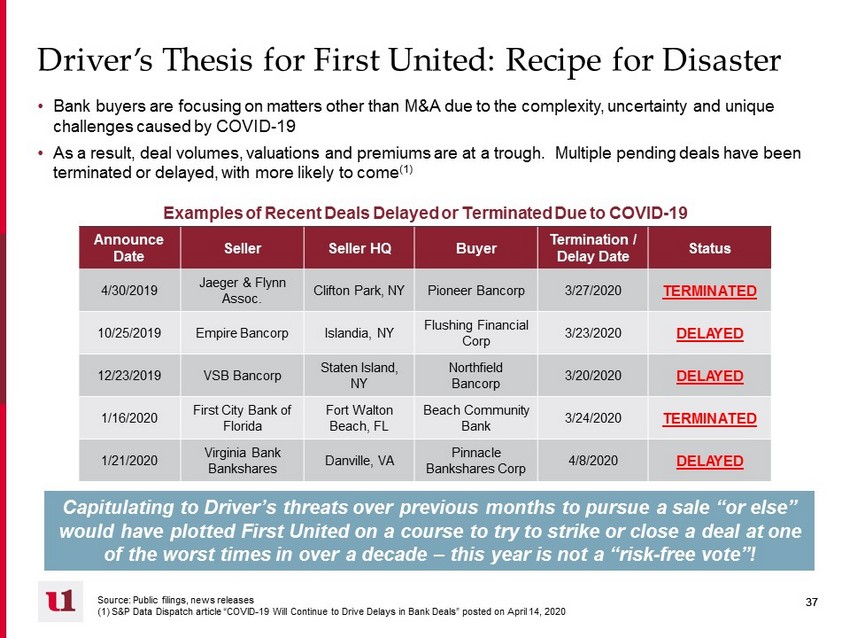

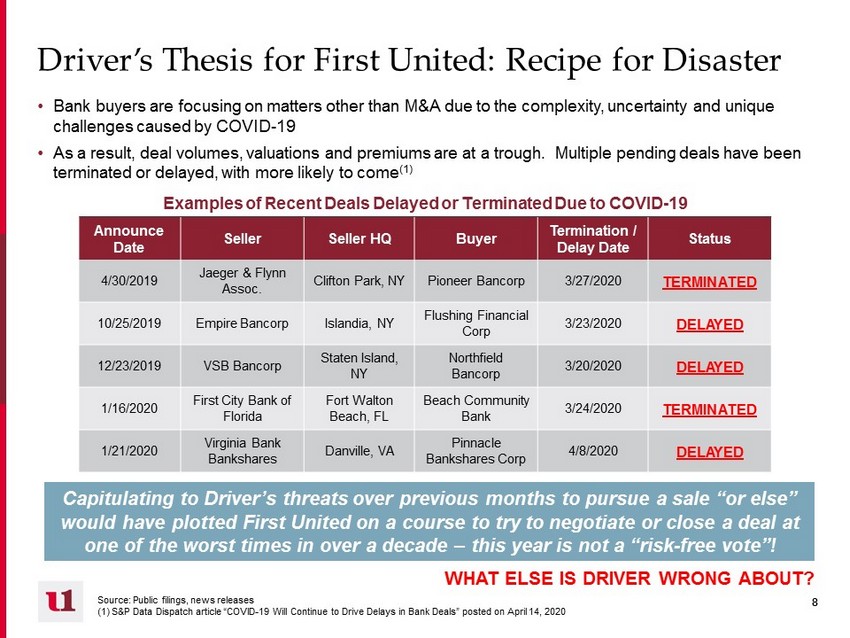

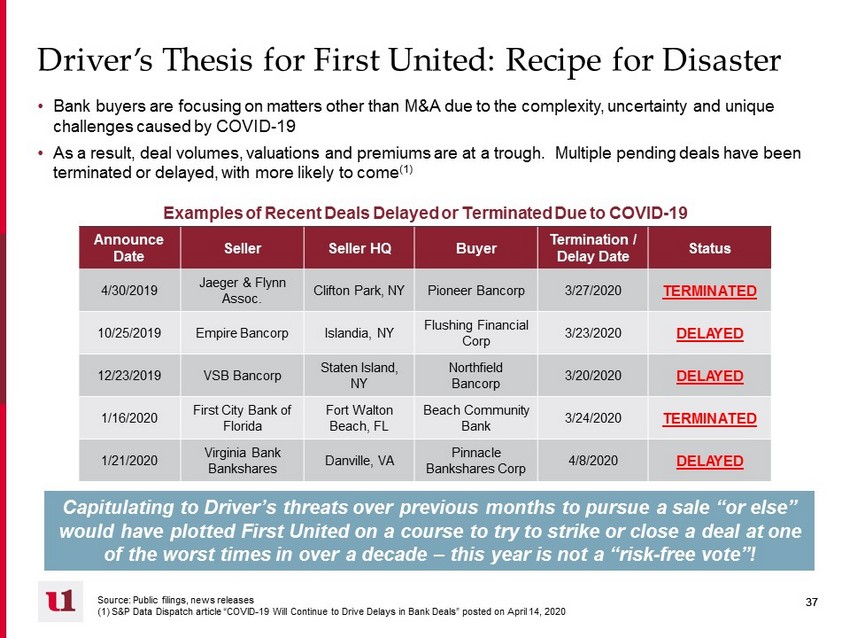

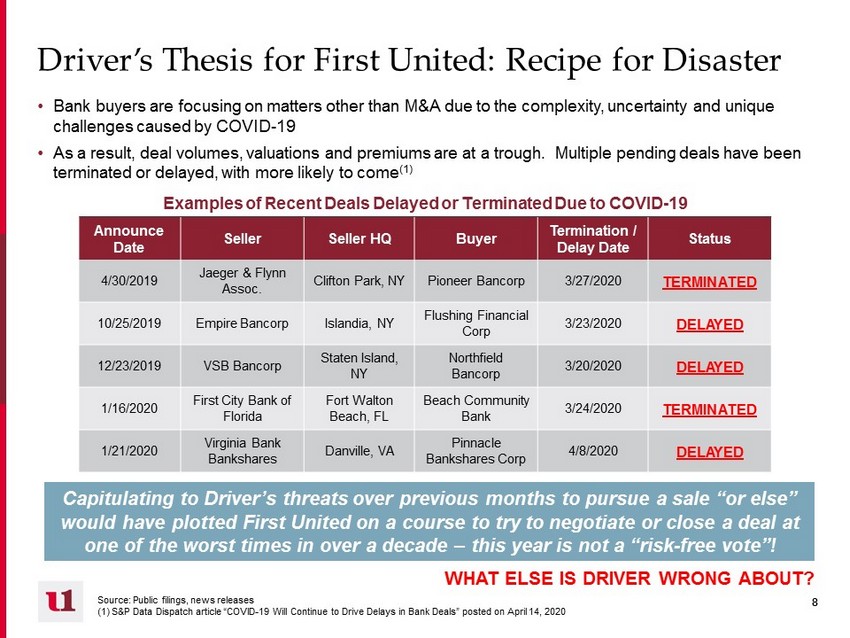

37 37 Driver’s Thesis for First United: Recipe for Disaster Source: Public filings, news releases (1) S&P Data Dispatch article “COVID - 19 Will Continue to Drive Delays in Bank Deals” posted on April 14, 2020 Capitulating to Driver’s threats over previous months to pursue a sale “or else” would have plotted First United on a course to try to strike or close a deal at one of the worst times in over a decade – this year is not a “risk - free vote”! • Bank buyers are focusing on matters other than M&A due to the complexity, uncertainty and unique challenges caused by COVID - 19 • As a result, deal volumes, valuations and premiums are at a trough. Multiple pending deals have been terminated or delayed, with more likely to come (1) Announce Date Seller Seller HQ Buyer Termination / Delay Date Status 4/30/2019 Jaeger & Flynn Assoc. Clifton Park, NY Pioneer Bancorp 3/27/2020 TERMINATED 10/25/2019 Empire Bancorp Islandia , NY Flushing Financial Corp 3/23/2020 DELAYED 12/23/2019 VSB Bancorp Staten Island, NY Northfield Bancorp 3/20/2020 DELAYED 1/16/2020 First City Bank of Florida Fort Walton Beach, FL Beach Community Bank 3/24/2020 TERMINATED 1/21/2020 Virginia Bank Bankshares Danville, VA Pinnacle Bankshares Corp 4/8/2020 DELAYED Examples of Recent Deals Delayed or Terminated Due to COVID - 19

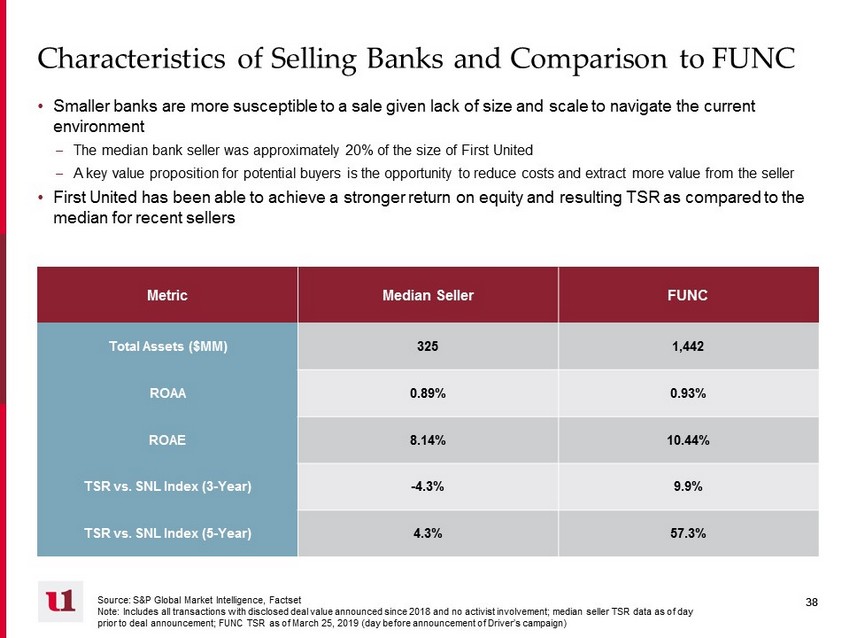

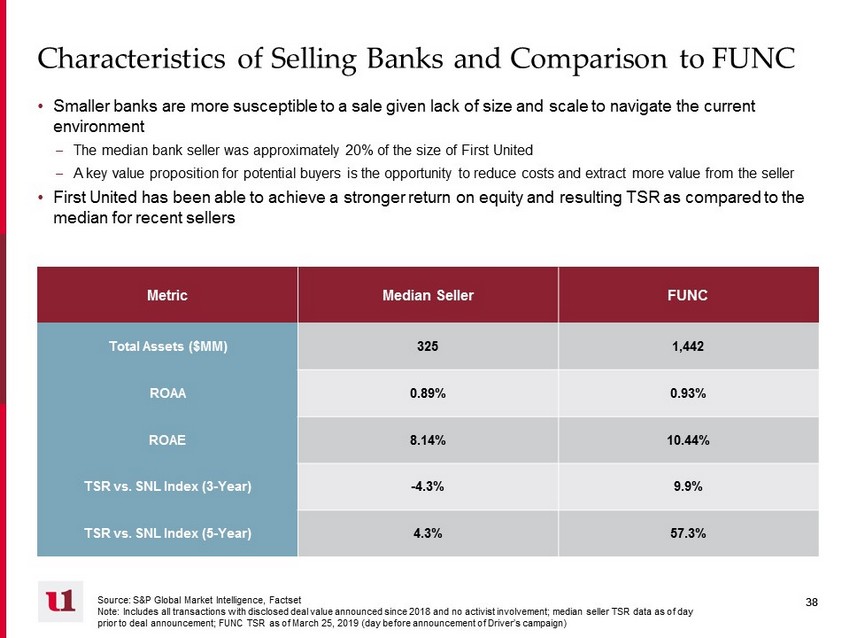

38 38 Characteristics of Selling Banks and Comparison to FUNC • Smaller banks are more susceptible to a sale given lack of size and scale to navigate the current environment – The median bank seller was approximately 20% of the size of First United – A k ey value proposition for potential buyers is the opportunity to reduce costs and extract more value from the seller • First United has been able to achieve a stronger return on equity and resulting TSR as compared to the median for recent sellers Source: S&P Global Market Intelligence, Factset Note: Includes all transactions with disclosed deal value announced since 2018 and no activist involvement; median seller TSR da ta as of day prior to deal announcement; FUNC TSR as of March 25, 2019 (day before announcement of Driver’s campaign) Metric Median Seller FUNC Total Assets ($MM) 325 1,442 ROAA 0.89% 0.93% ROAE 8.14% 10.44% TSR vs. SNL Index (3 - Year) - 4.3% 9.9% TSR vs. SNL Index (5 - Year) 4.3% 57.3%

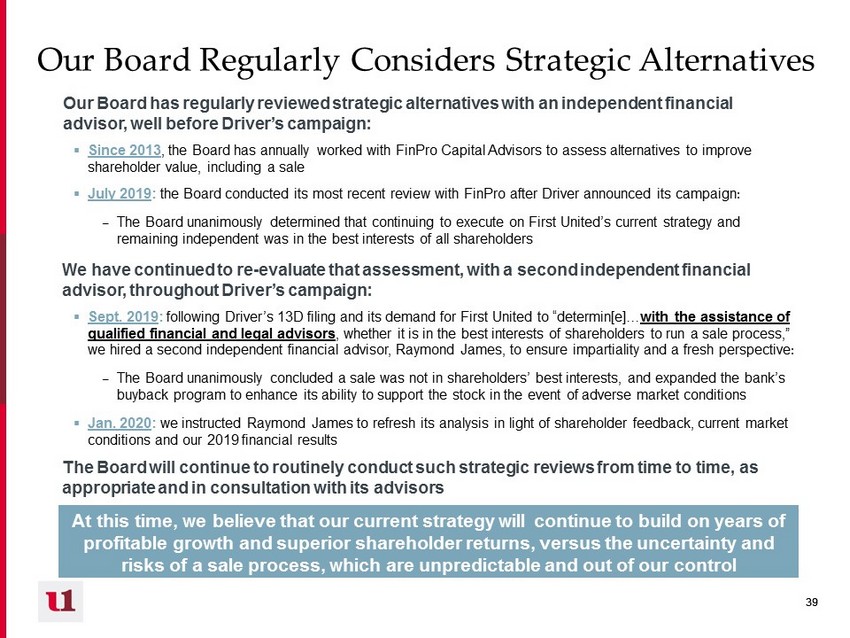

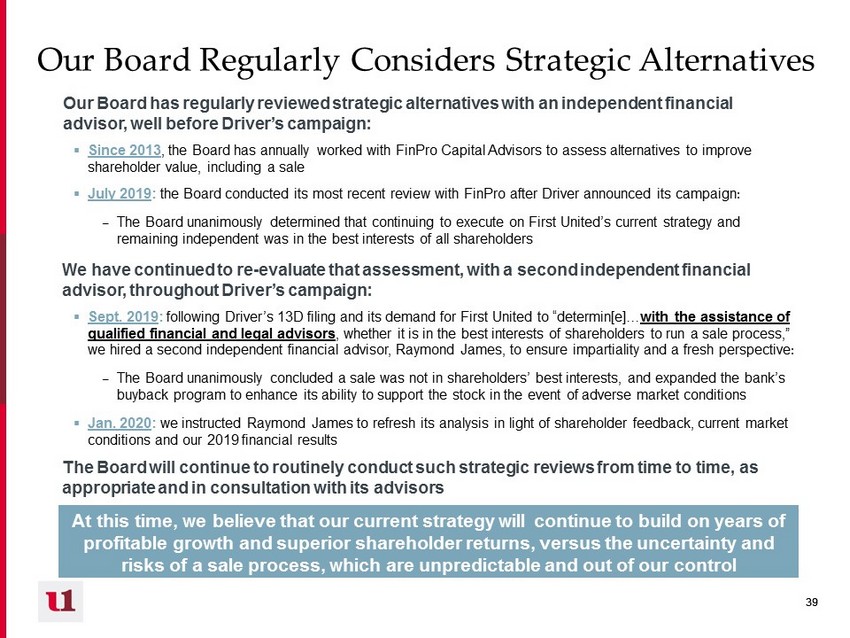

39 39 Our Board has regularly reviewed strategic alternatives with an independent financial advisor, well before Driver’s campaign: ▪ Since 2013 , the Board has annually worked with FinPro Capital Advisors to assess alternatives to improve shareholder value, including a sale ▪ July 2019 : the Board conducted its most recent review with FinPro after Driver announced its campaign : – The Board unanimously determined that continuing to execute on First United’s current strategy and remaining independent was in the best interests of all shareholders We have continued to re - evaluate that assessment, with a second independent financial advisor, throughout Driver’s campaign: ▪ Sept. 2019 : following Driver’s 13D filing and its demand for First United to “ determin [e]… with the assistance of qualified financial and legal advisors , whether it is in the best interests of shareholders to run a sale process,” we hired a second independent financial advisor, Raymond James, to ensure impartiality and a fresh perspective : – The Board unanimously concluded a sale was not in shareholders’ best interests, and expanded the bank’s buyback program to enhance its ability to support the stock in the event of adverse market conditions ▪ Jan. 2020 : we instructed Raymond James to refresh its analysis in light of shareholder feedback, current market conditions and our 2019 financial results At this time, we believe that our current strategy will continue to build on years of profitable growth and superior shareholder returns, versus the uncertainty and risks of a sale process, which are unpredictable and out of our control Our Board Regularly Considers Strategic Alternatives The Board will continue to routinely conduct such strategic reviews from time to time, as appropriate and in consultation with its advisors

40 40 IV. Our Commitment to Strong Corporate Governance

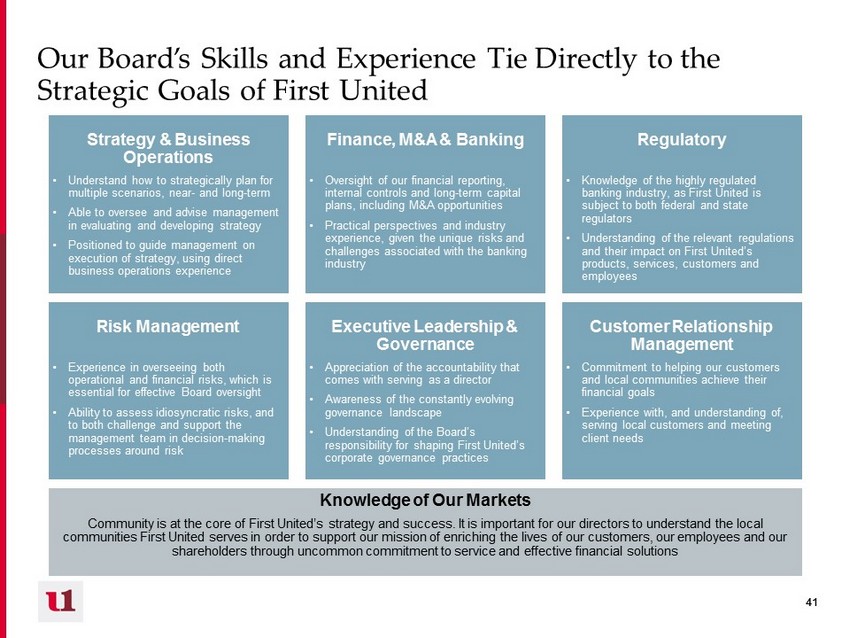

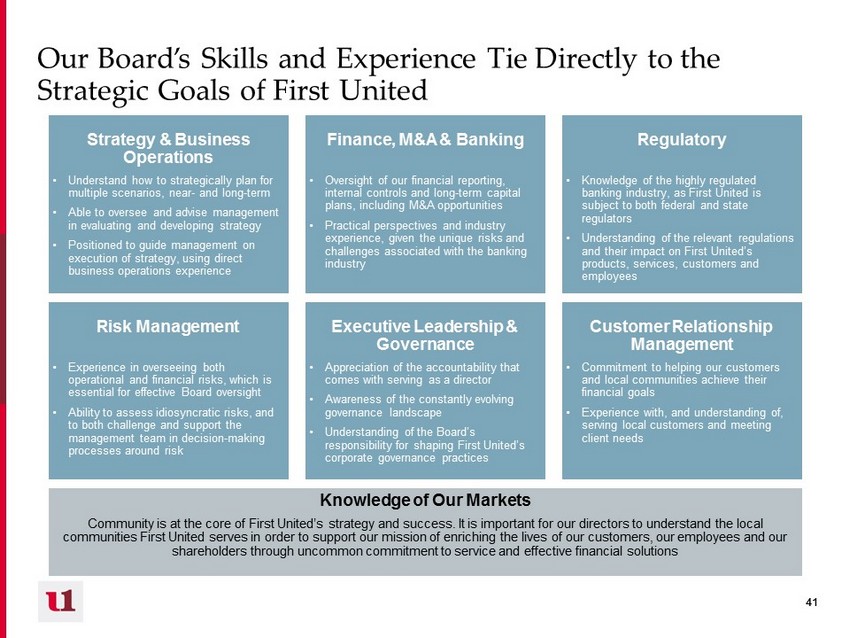

41 41 Our Board’s Skills and Experience Tie Directly to the Strategic Goals of First United Strategy & Business Operations • Understand how to strategically plan for multiple scenarios, near - and long - term • Able to oversee and advise management in evaluating and developing strategy • Positioned to guide management on execution of strategy, using direct business operations experience Finance, M&A & Banking • Oversight of our financial reporting, internal controls and long - term capital plans, including M&A opportunities • Practical perspectives and industry experience, given the unique risks and challenges associated with the banking industry Regulatory • Knowledge of the highly regulated banking industry, as First United is subject to both federal and state regulators • Understanding of the relevant regulations and their impact on First United’s products, services, customers and employees Risk Management • Experience in overseeing both operational and financial risks, which is essential for effective Board oversight • Ability to assess idiosyncratic risks, and to both challenge and support the management team in decision - making processes around risk Executive Leadership & Governance • Appreciation of the accountability that comes with serving as a director • Awareness of the constantly evolving governance landscape • Understanding of the Board’s responsibility for shaping First United’s corporate governance practices Customer Relationship Management • Commitment to helping our customers and local communities achieve their financial goals • Experience with, and understanding of, serving local customers and meeting client needs Knowledge of Our Markets Community is at the core of First United’s strategy and success. It is important for our directors to understand the local communities First United serves in order to support our mission of enriching the lives of our customers, our employees and our shareholders through uncommon commitment to service and effective financial solutions

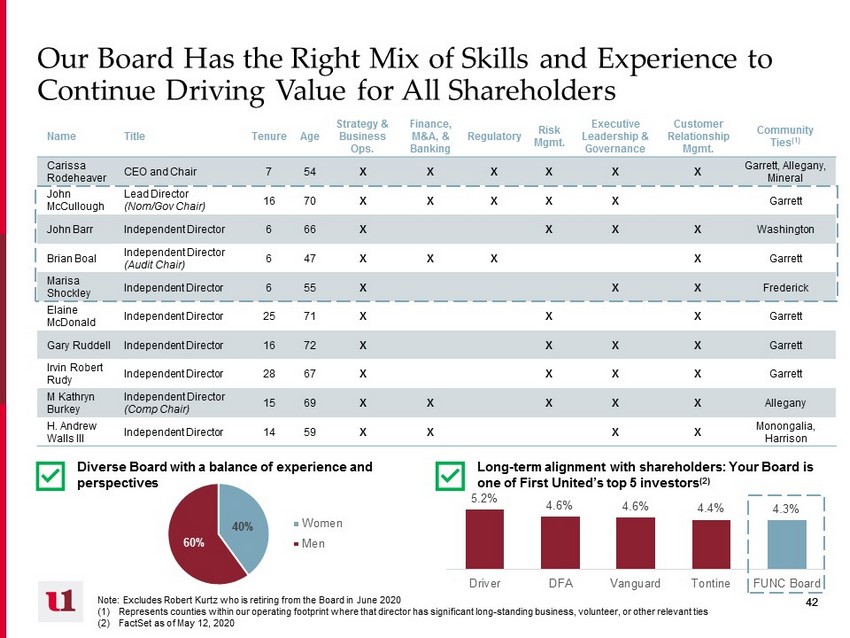

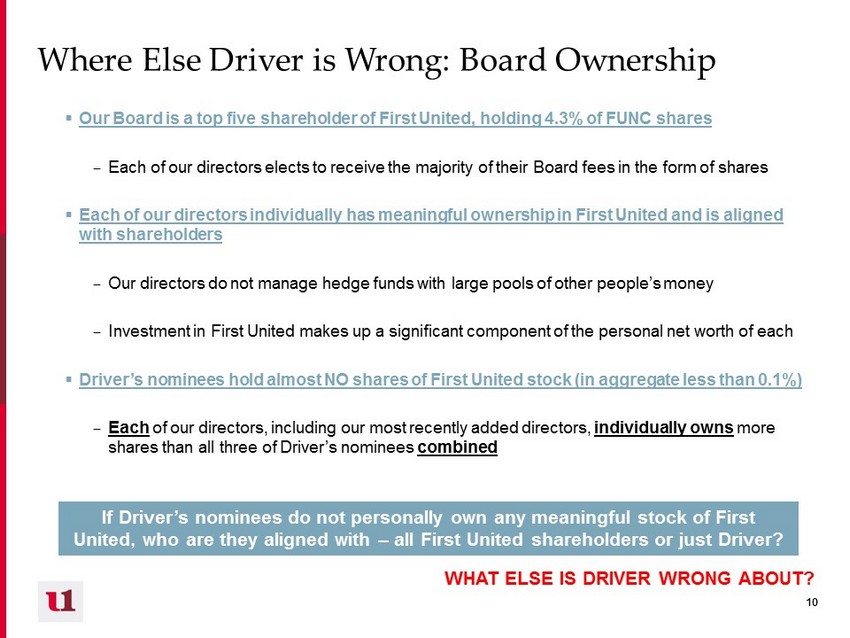

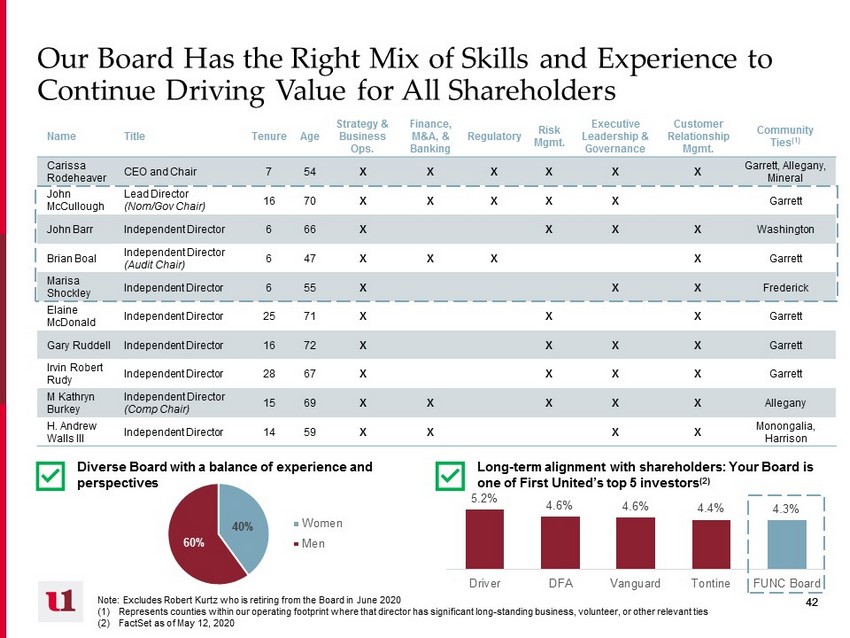

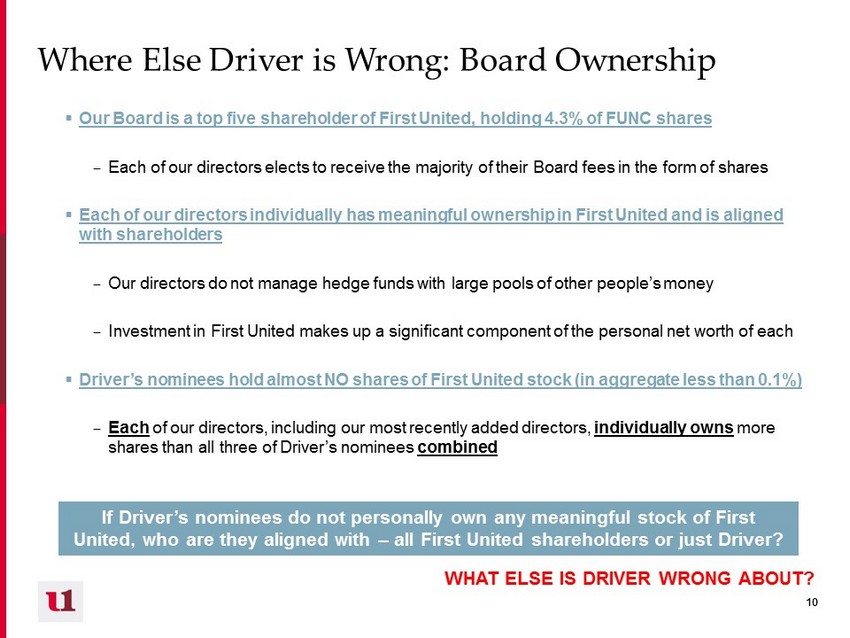

42 42 Our Board Has the Right Mix of Skills and Experience to Continue Driving Value for All Shareholders Name Title Tenure Age Strategy & Business Ops. Finance, M&A, & Banking Regulatory Risk Mgmt. Executive Leadership & Governance Customer Relationship Mgmt. Community Ties (1) Carissa Rodeheaver CEO and Chair 7 54 X X X X X X Garrett, Allegany, Mineral John McCullough Lead Director ( Nom/ Gov Chair) 16 70 X X X X X Garrett John Barr Independent Director 6 66 X X X X Washington Brian Boal Independent Director (Audit Chair) 6 47 X X X X Garrett Marisa Shockley Independent Director 6 55 X X X Frederick Elaine McDonald Independent Director 25 71 X X X Garrett Gary Ruddell Independent Director 16 72 X X X X Garrett Irvin Robert Rudy Independent Director 28 67 X X X X Garrett M Kathryn Burkey Independent Director (Comp Chair) 15 69 X X X X X Allegany H. Andrew Walls III Independent Director 14 59 X X X X Monongalia, Harrison Note: Excludes Robert Kurtz who is retiring from the Board in June 2020 (1) Represents counties within our operating footprint where that director has significant long - standing business, volunteer, or oth er relevant ties (2) FactSet as of May 12, 2020 40% 60% Women Men Diverse Board with a balance of experience and perspectives Long - term alignment with shareholders: Your Board is one of First United’s top 5 investors (2) 5.2% 4.6% 4.6% 4.4% 4.3% Driver DFA Vanguard Tontine FUNC Board

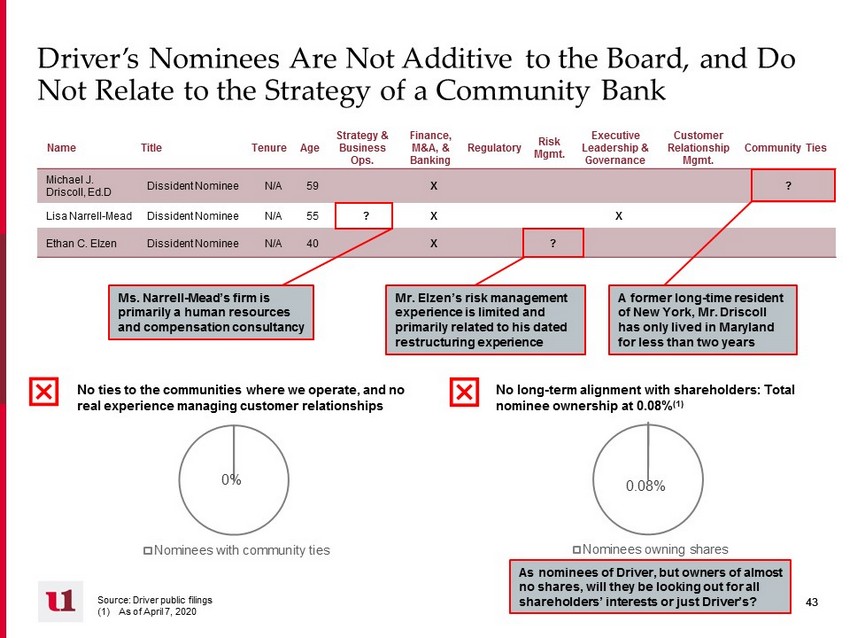

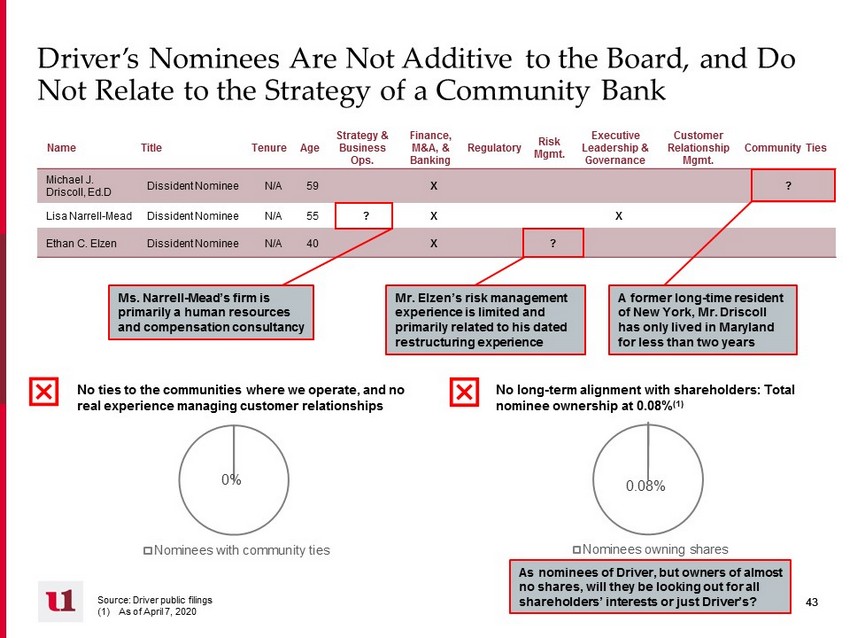

43 43 Driver’s Nominees Are Not Additive to the Board, and Do Not Relate to the Strategy of a Community Bank Name Title Tenure Age Strategy & Business Ops. Finance, M&A, & Banking Regulatory Risk Mgmt. Executive Leadership & Governance Customer Relationship Mgmt. Community Ties Michael J. Driscoll, Ed.D Dissident Nominee N/A 59 X ? Lisa Narrell - Mead Dissident Nominee N/A 55 ? X X Ethan C. Elzen Dissident Nominee N/A 40 X ? Source: Driver public filings (1) As of April 7, 2020 No ties to the communities where we operate, and no real experience managing customer relationships No long - term alignment with shareholders: Total nominee ownership at 0.08 % (1) 0.08% Nominees owning shares 0% Nominees with community ties A former long - time resident of New York, Mr. Driscoll has only lived in Maryland for less than two years Ms. Narrell - Mead’s firm is primarily a human resources and compensation consultancy Mr. Elzen’s risk management experience is limited and primarily related to his dated restructuring experience As nominees of Driver, but owners of almost no shares, will they be looking out for all shareholders’ interests or just Driver’s?

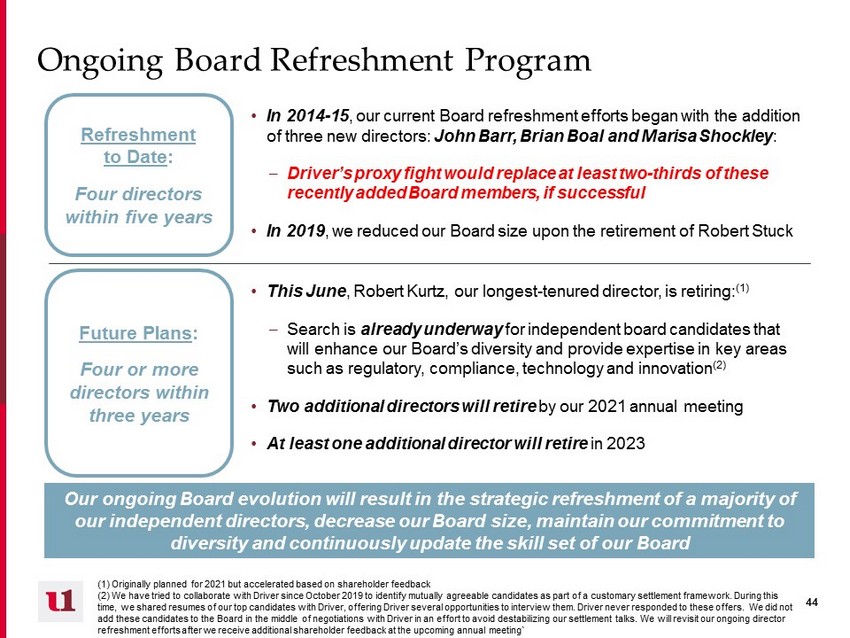

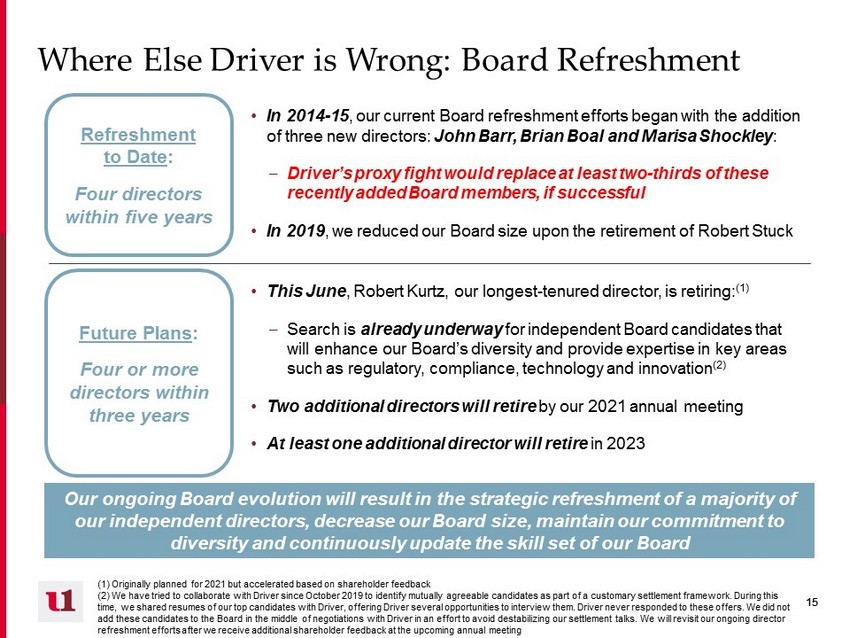

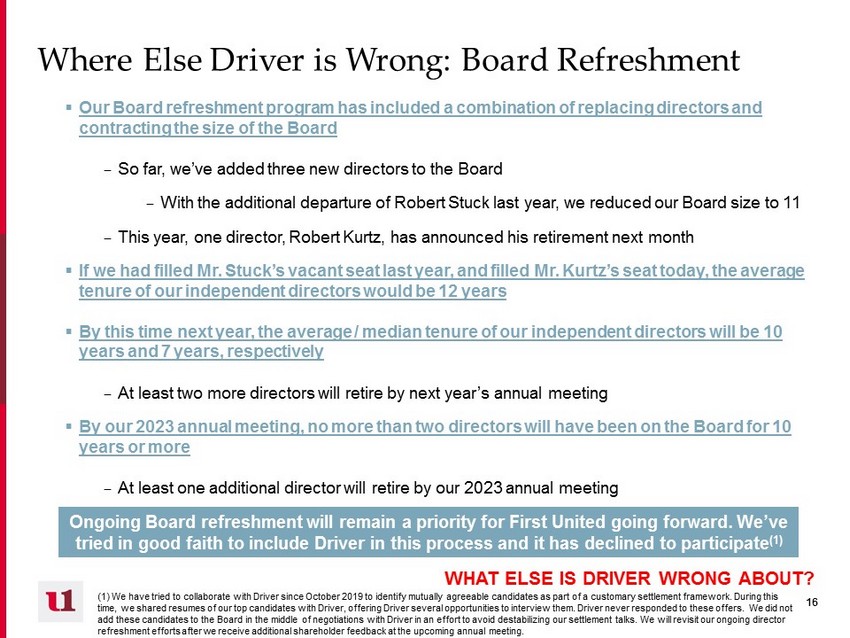

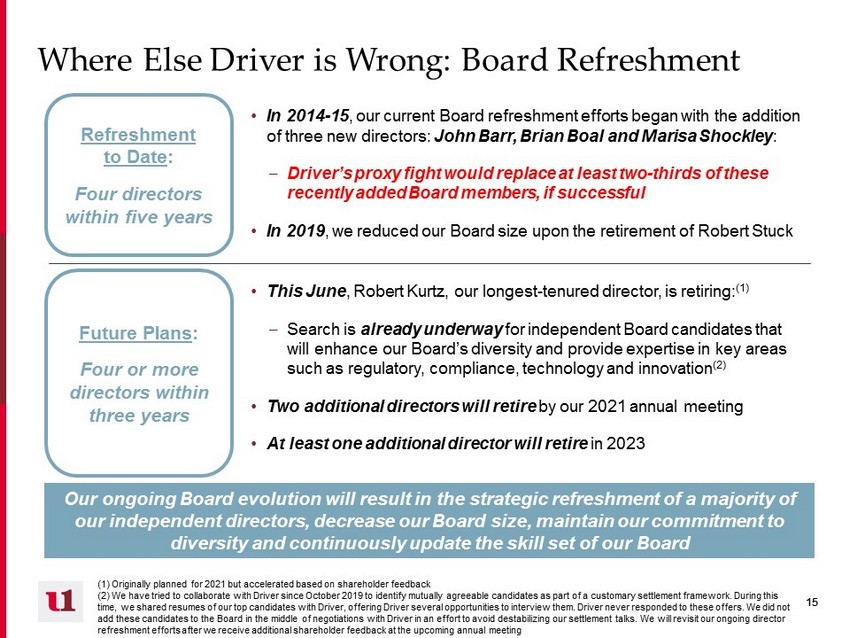

44 44 Ongoing Board Refreshment Program Our ongoing Board evolution will result in the strategic refreshment of a majority of our independent directors, decrease our Board size, maintain our commitment to diversity and continuously update the skill set of our Board • This June , Robert Kurtz, our longest - tenured director, is retiring: (1) – Search is already underway for independent board candidates that will enhance our Board’s diversity and provide expertise in key areas such as regulatory, compliance, technology and innovation (2) • Two additional directors will retire by our 2021 annual meeting • At least one additional director will retire in 2023 Future Plans : Four or more directors within three years • In 2014 - 15 , our current Board refreshment efforts began with the addition of three new directors: John Barr, Brian Boal and Marisa Shockley : – Driver’s proxy fight would replace at least two - thirds of these recently added Board members, if successful • In 2019 , we reduced our Board size upon the retirement of Robert Stuck Refreshment t o Date : Four directors within five years (1) Originally planned for 2021 but accelerated based on shareholder feedback (2) We have tried to collaborate with Driver since October 2019 to identify mutually agreeable candidates as part of a customary settlement framework. During this time, we shared resumes of our top candidates with Driver, offering Driver several opportunities to interview them. Driver never responded to these offers. We did not add these candidates to the Board in the middle of negotiations with Driver in an effort to avoid destabilizing our settlement talks. We will revisit our ongoing director refreshment efforts after we receive additional shareholder feedback at the upcoming annual meeting`

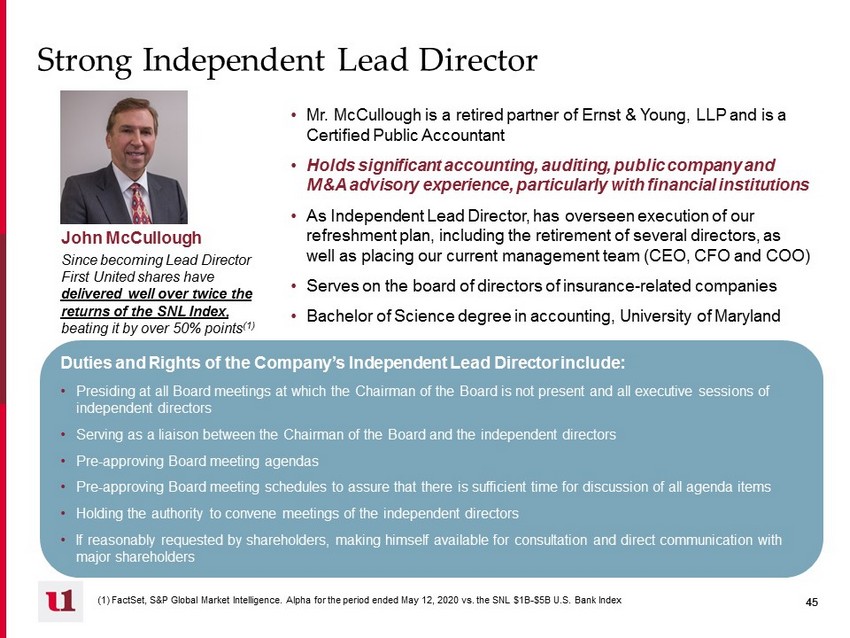

45 45 Strong Independent Lead Director • Mr. McCullough is a retired partner of Ernst & Young, LLP and is a Certified Public Accountant • H olds significant accounting, auditing, public company and M&A advisory experience, particularly with financial institutions • As Independent Lead Director, has overseen execution of our refreshment plan, including the retirement of several directors, as well as placing our current management team (CEO, CFO and COO) • Serves on the board of directors of insurance - related companies • Bachelor of Science degree in accounting, University of Maryland Duties and Rights of the Company’s Independent Lead Director include: • Presiding at all Board meetings at which the Chairman of the Board is not present and all executive sessions of independent directors • Serving as a liaison between the Chairman of the Board and the independent directors • Pre - approving Board meeting agendas • Pre - approving Board meeting schedules to assure that there is sufficient time for discussion of all agenda items • Holding the authority to convene meetings of the independent directors • If reasonably requested by shareholders, making himself available for consultation and direct communication with major shareholders John McCullough Since becoming Lead Director First United shares have delivered well over twice the returns of the SNL Index, beating it by over 50% points (1) (1) FactSet , S&P Global Market Intelligence. Alpha for the period ended May 12, 2020 vs. the SNL $1B - $5B U.S. Bank Index

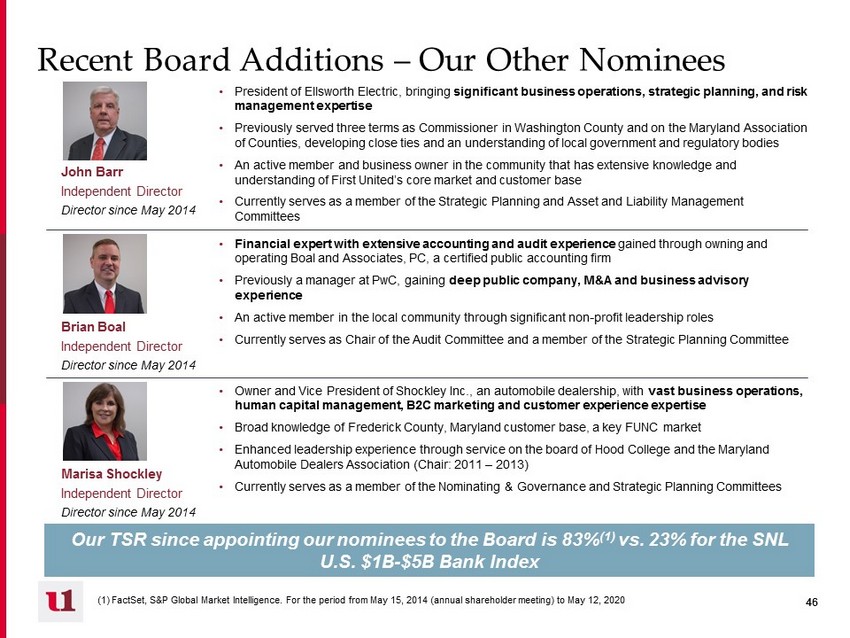

46 46 Recent Board Additions – Our Other Nominees • President of Ellsworth Electric, bringing significant business operations, strategic planning, and risk management expertise • Previously served three terms as Commissioner in Washington County and on the Maryland Association of Counties, developing close ties and an understanding of local government and regulatory bodies • An active member and business owner in the community that has extensive knowledge and understanding of First United’s core market and customer base • Currently serves as a member of the Strategic Planning and Asset and Liability Management Committees John Barr Independent Director Director since May 2014 • Financial expert with extensive accounting and audit experience gained through owning and operating Boal and Associates, PC, a certified public accounting firm • Previously a manager at PwC, gaining deep public company, M&A and business advisory experience • An active member in the local community through significant non - profit leadership roles • Currently serves as Chair of the Audit Committee and a member of the Strategic Planning Committee Brian Boal Independent Director Director since May 2014 • Owner and Vice President of Shockley Inc., an automobile dealership, with vast business operations, human capital management, B2C marketing and customer experience expertise • Broad knowledge of Frederick County, Maryland customer base, a key FUNC market • Enhanced leadership experience through service on the board of Hood College and the Maryland Automobile Dealers Association (Chair: 2011 – 2013) • Currently serves as a member of the Nominating & Governance and Strategic Planning Committees Marisa Shockley Independent Director Director since May 2014 (1) FactSet , S&P Global Market Intelligence. For the period from May 15, 2014 (annual shareholder meeting) to May 12, 2020 Our TSR since appointing our nominees to the Board is 83% (1) vs. 23% for the SNL U.S. $1B - $5B Bank Index

47 47 Strong Investor Relations and Shareholder Communications and Engagement Clear long - term strategic plan with performance targets x Dedicated Investor Relations contact x Investor non - deal roadshows x Members of the Board and senior management routinely engage with shareholders and other stakeholders , and management regularly updates the B oard on the context of ongoing investor discussions. These engagements help the Board and management gain feedback on a variety of topics, including strategic and financial performance, executive compensation, Board composition and leadership structure Quarterly investor presentation and outreach to institutional and retail shareholders x How to contact your Board: Shareholders and interested parties wishing to contact our Board may send a letter to First United Cor por ation Board of Directors, c/o Tonya K. Sturm, Secretary, First United Corporation, 19 South Second Street, Oakland, Maryland, 21550 - 0009 or by e - mail at tsturm@mybank.com. The Secretary will deliver all shareholder communications directly to the Board for consideration

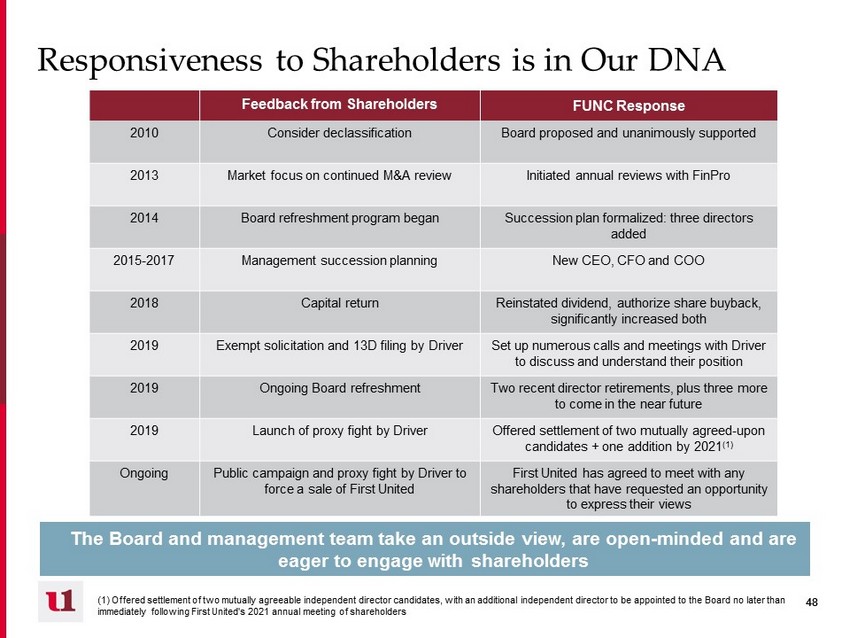

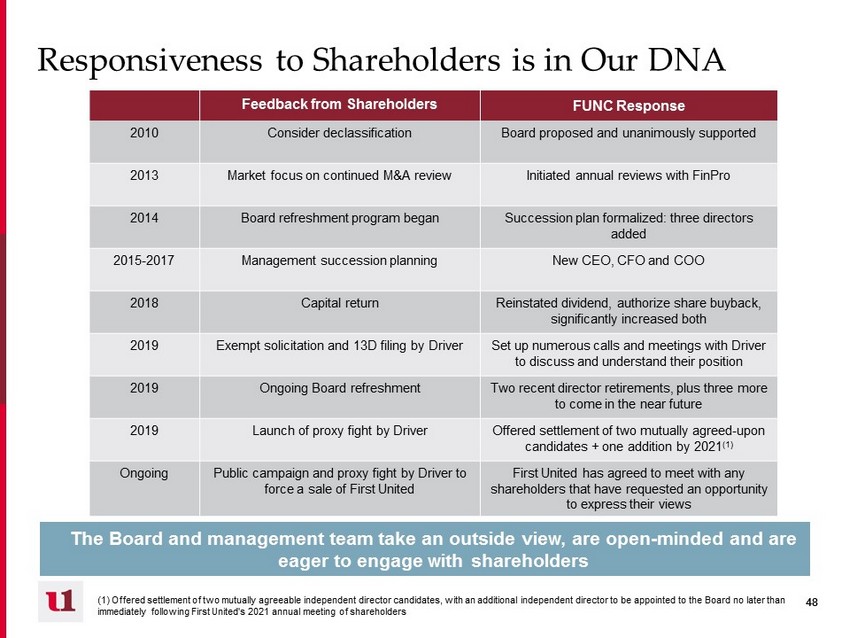

48 48 Responsiveness to Shareholders is in Our DNA Feedback from Shareholders FUNC Response 2010 Consider declassification Board proposed and unanimously supported 2013 Market focus on continued M&A review Initiated annual reviews with FinPro 2014 Board refreshment program began Succession plan formalized: three directors added 2015 - 2017 Management succession planning New CEO, CFO and COO 2018 Capital return Reinstated dividend, authorize share buyback, significantly increased both 2019 Exempt solicitation and 13D filing by Driver Set up numerous calls and meetings with Driver to discuss and understand their position 2019 Ongoing Board refreshment Two recent director retirements, plus three more to come in the near future 2019 Launch of proxy fight by Driver Offered settlement of two mutually agreed - upon candidates + one addition by 2021 (1) Ongoing Public campaign and proxy fight by Driver to force a sale of First United First United has agreed to meet with any shareholders that have requested an opportunity to express their views The Board and management team take an outside view, are open - minded and are eager to engage with shareholders (1) O ffered settlement of two mutually agreeable independent director candidates, with an additional independent director to be appointed to the Board no later than immediately following First United's 2021 annual meeting of shareholders

49 49 V . Driver’s Proxy Contest

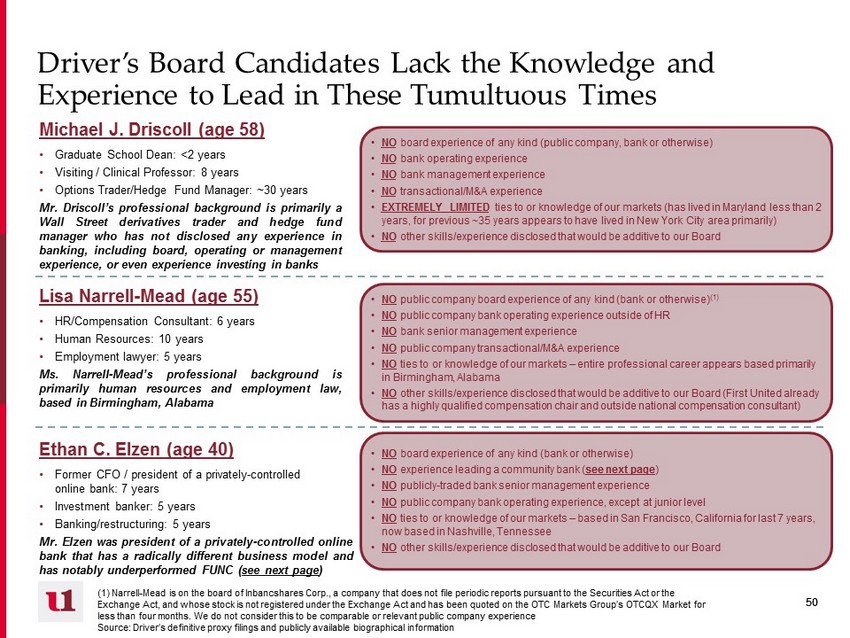

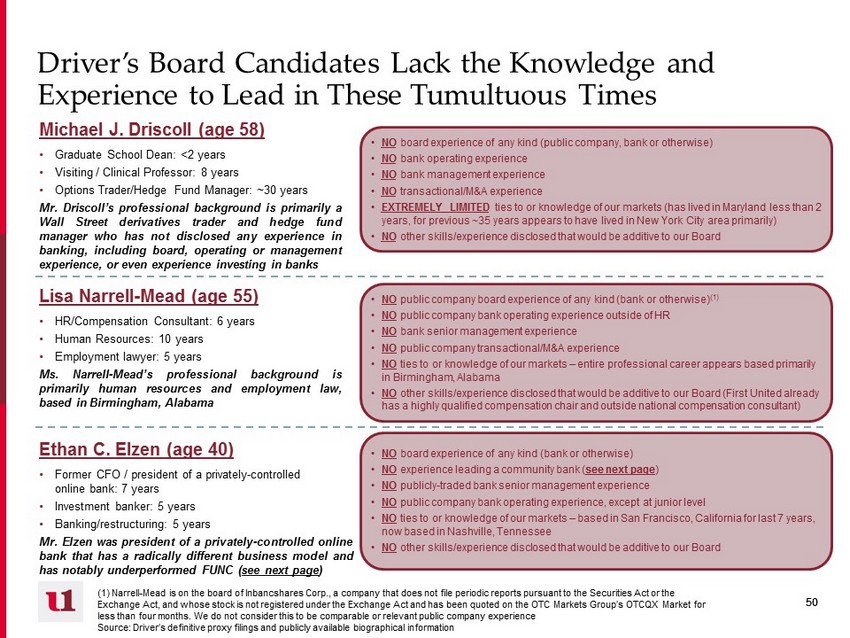

50 50 Driver’s Board Candidates Lack the Knowledge and Experience to Lead in These Tumultuous Times Michael J. Driscoll (age 58 ) • Graduate School Dean: <2 years • Visiting / Clinical Professor: 8 years • Options Trader/Hedge Fund Manager: ~30 years Mr . Driscoll’s professional background is primarily a Wall Street derivatives trader and hedge fund manager who has not disclosed any experience in banking , including board, operating or management experience, or even experience investing in banks Lisa Narrell - Mead (age 55 ) • HR/Compensation Consultant: 6 years • Human Resources: 10 years • Employment lawyer: 5 years Ms . Narrell - Mead’s professional background is primarily human resources and employment law, based in Birmingham, Alabama Ethan C. Elzen (age 40) • Former CFO / president of a privately - controlled online bank: 7 years • Investment banker: 5 years • Banking/restructuring: 5 years Mr . Elzen was president of a privately - controlled online bank that has a radically different business model and has notably underperformed FUNC ( see next page ) • NO board experience of any kind (public company, bank or otherwise) • NO bank operating experience • NO bank management experience • NO transactional/M&A experience • EXTREMELY LIMITED ties to or knowledge of our markets (has lived in Maryland less than 2 years, for previous ~35 years appears to have lived in New York City area primarily) • NO other skills/experience disclosed that would be additive to our Board • NO public company board experience of any kind (bank or otherwise ) (1) • NO public company bank operating experience outside of HR • NO bank senior management experience • NO public company transactional/M&A experience • NO ties to or knowledge of our markets – entire professional career appears based primarily in Birmingham, Alabama • NO other skills/experience disclosed that would be additive to our Board (First United already has a highly qualified compensation chair and outside national compensation consultant) • NO board experience of any kind (bank or otherwise) • NO experience leading a community bank ( see next page ) • NO publicly - traded bank senior management experience • NO public company bank operating experience, except at junior level • NO ties to or knowledge of our markets – based in San Francisco, California for last 7 years, now based in Nashville, Tennessee • NO other skills/experience disclosed that would be additive to our Board (1) Narrell - Mead is on the board of Inbancshares Corp., a company that does not file periodic reports pursuant to the Securities Act or the Exchange Act, and whose stock is not registered under the Exchange Act and has been quoted on the OTC Markets Group’s OTCQX Market for less than four months. We do not consider this to be comparable or relevant public company experience Source: Driver’s definitive proxy filings and publicly available biographical information

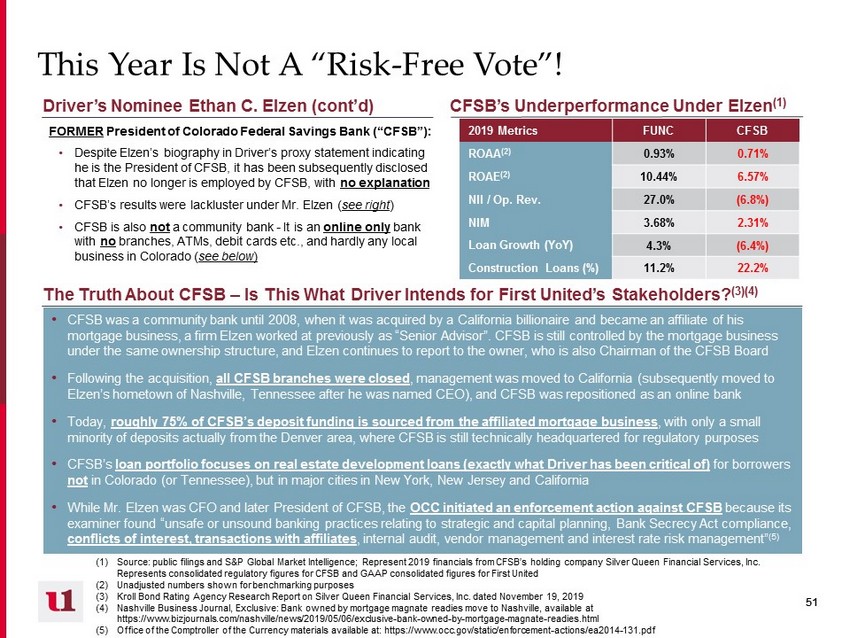

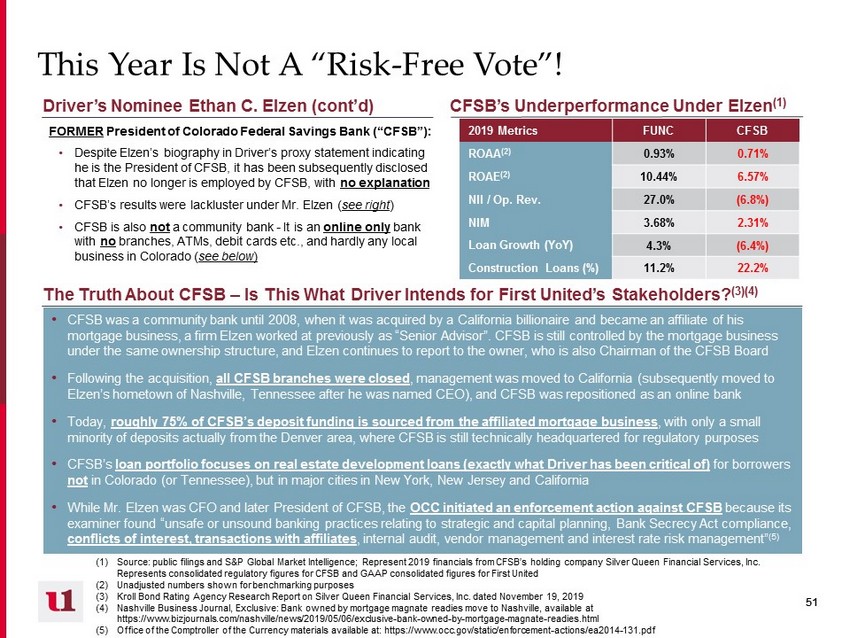

51 51 This Year Is Not A “Risk - Free Vote”! FORMER President of Colorado Federal Savings Bank (“CFSB”): • Despite Elzen’s biography in Driver’s proxy statement indicating he is the President of CFSB, it has been subsequently disclosed that Elzen no longer is employed by CFSB, with no explanation • CFSB’s results were lackluster under Mr. Elzen ( see right ) • CFSB is also not a community bank - It is an online only bank with no branches, ATMs, debit cards etc., and hardly any local business in Colorado ( see below ) • CFSB was a community bank until 2008, when it was acquired by a California billionaire and became an affiliate of his mortgage business, a firm Elzen worked at previously as “Senior Advisor”. CFSB is still controlled by the mortgage business under the same ownership structure, and Elzen continues to report to the owner, who is also Chairman of the CFSB Board • Following the acquisition, all CFSB branches were closed , management was moved to California (subsequently moved to Elzen’s hometown of Nashville, Tennessee after he was named CEO ), and CFSB was repositioned as an online bank • Today, roughly 75% of CFSB’s deposit funding is sourced from the affiliated mortgage business , with only a small minority of deposits actually from the Denver area, where CFSB is still technically headquartered for regulatory purposes • CFSB’s loan portfolio focuses on real estate development loans (exactly what Driver has been critical of) for borrowers not in Colorado (or Tennessee), but in major cities in New York, New Jersey and California • While Mr. Elzen was CFO and later President of CFSB, the OCC initiated an enforcement action against CFSB because its examiner found “unsafe or unsound banking practices relating to strategic and capital planning, Bank Secrecy Act compliance, conflicts of interest, transactions with affiliates , internal audit, vendor management and interest rate risk management ” (5) The Truth About CFSB – Is This What Driver Intends for First United’s Stakeholders ? (3)(4) Driver’s Nominee Ethan C. Elzen (cont’d) 2019 Metrics FUNC CFSB ROAA (2) 0.93% 0.71% ROAE (2) 10.44% 6.57% NII / Op. Rev. 27.0% (6.8%) NIM 3.68% 2.31% Loan Growth (YoY) 4.3% (6.4%) Construction Loans (%) 11.2% 22.2% CFSB’s Underperformance Under Elzen (1) (1) Source: public filings and S&P Global Market Intelligence; Represent 2019 financials from CFSB’s holding company Silver Queen Fi nancial Services, Inc. Represents consolidated regulatory figures for CFSB and GAAP consolidated figures for First United (2) Unadjusted numbers shown for benchmarking purposes (3) Kroll Bond Rating Agency Research Report on Silver Queen Financial Services, Inc. dated November 19, 2019 (4) Nashville Business Journal, Exclusive: Bank owned by mortgage magnate readies move to Nashville, available at https://www.bizjournals.com/nashville/news/2019/05/06/exclusive - bank - owned - by - mortgage - magnate - readies.html (5) Office of the Comptroller of the Currency materials available at: https://www.occ.gov/static/enforcement - actions/ea2014 - 131.pdf

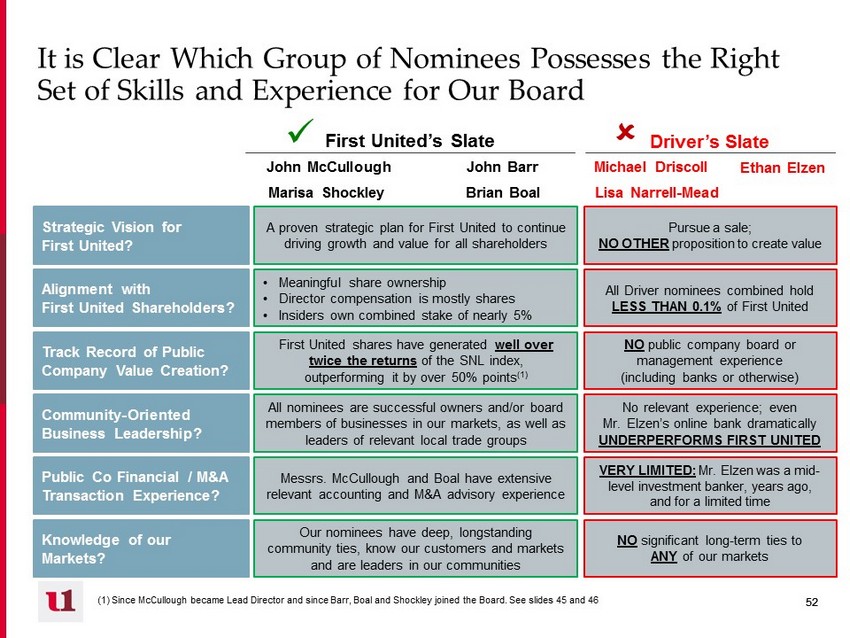

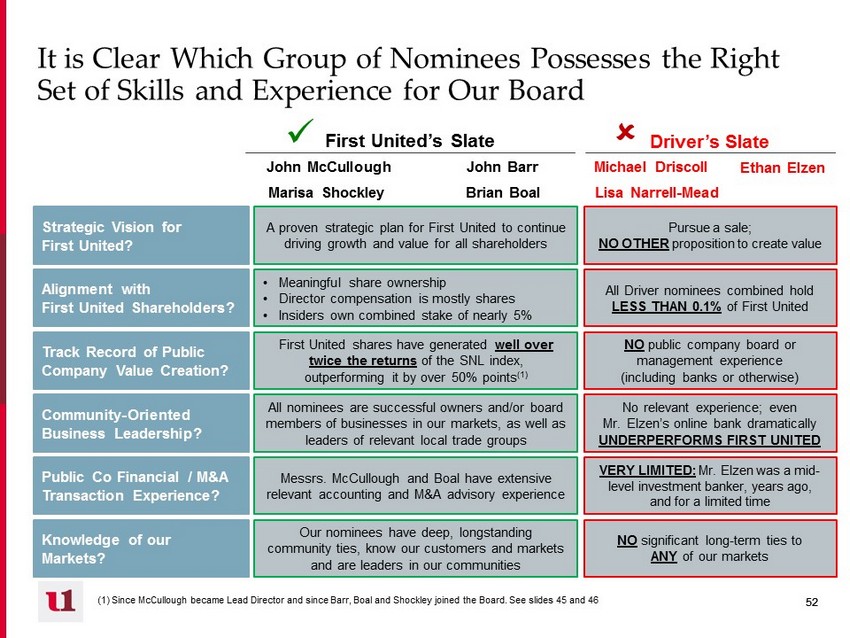

52 52 It is Clear Which Group of Nominees Possesses the Right Set of Skills and Experience for Our Board Strategic Vision for First United? Alignment with First United Shareholders? Track Record of Public Company Value Creation? Community - Oriented Business Leadership? Public Co Financial / M&A Transaction Experience? Knowledge of our Markets? A proven strategic plan for First United to continue driving growth and value for all shareholders • Meaningful share ownership • Director compensation is mostly shares • Insiders own combined stake of nearly 5% First United shares have generated well over twice the returns of the SNL index, outperforming it by over 50 % points (1) All nominees are successful owners and/or board members of businesses in our markets, as well as leaders of relevant local trade groups Messrs. McCullough and Boal have extensive relevant accounting and M&A advisory experience Our nominees have deep, longstanding community ties, know our customers and markets and are leaders in our communities Pursue a sale; NO OTHER proposition to create value All Driver nominees combined hold LESS THAN 0.1% of First United NO public company board or management experience (including banks or otherwise) No relevant experience; even Mr. Elzen’s online bank dramatically UNDERPERFORMS FIRST UNITED VERY LIMITED: Mr. Elzen was a mid - level investment banker, years ago, and for a limited time NO significant long - term ties to ANY of our markets John McCullough John Barr Brian Boal Marisa Shockley First United’s Slate Driver’s Slate Michael Driscoll Ethan Elzen Lisa Narrell - Mead x (1) Since McCullough became Lead Director and since Barr, Boal and Shockley joined the Board. See slides 45 and 46

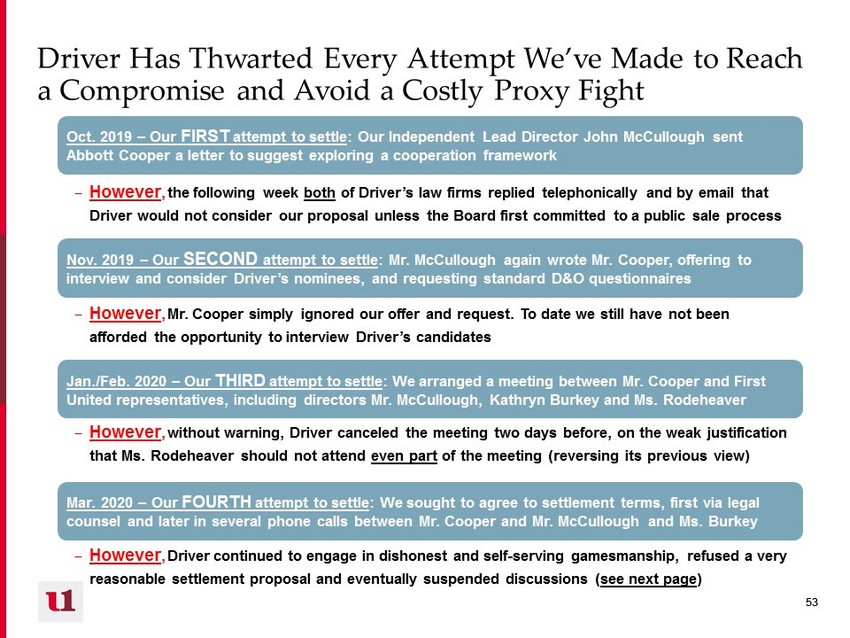

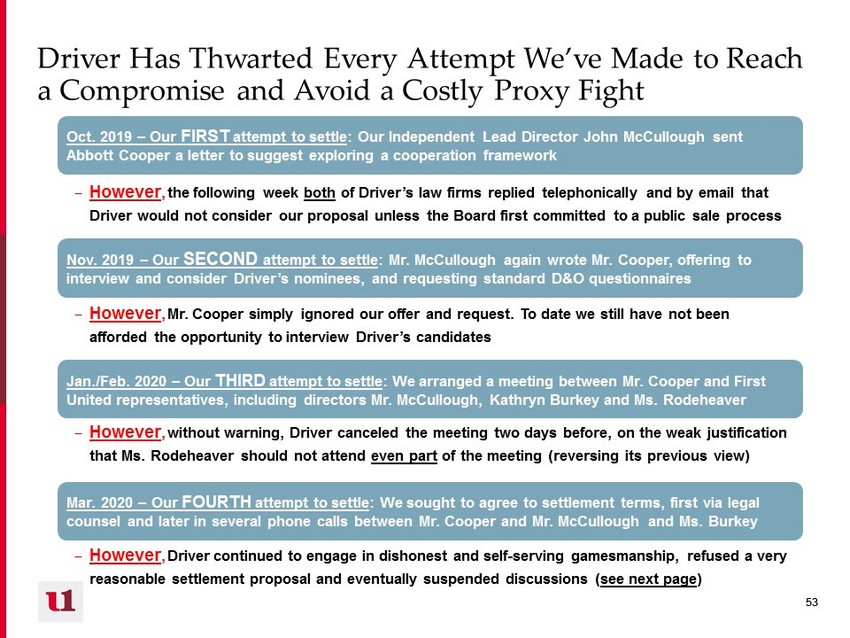

53 53 Driver Has Thwarted Every Attempt We’ve Made to Reach a Compromise and Avoid a Costly Proxy Fight Oct. 2019 – Our FIRST attempt to settle : Our Independent Lead D irector John McCullough sent Abbott Cooper a letter to suggest exploring a cooperation framework Nov. 2019 – Our SECOND attempt to settle : Mr . McCullough again wrote Mr. Cooper, offering to interview and consider Driver’s nominees, and requesting standard D&O questionnaires Jan./Feb. 2020 – Our THIRD attempt to settle : We arranged a meeting between Mr . Cooper and First United representatives, including directors Mr. McCullough, Kathryn Burkey and Ms. Rodeheaver Mar. 2020 – Our FOURTH attempt to settle : We sought to agree to settlement terms, first via legal counsel and later in several phone calls between Mr. Cooper and Mr . McCullough and Ms. Burkey – However , the following week both of Driver’s law firms replied telephonically and by email that Driver would not consider our proposal unless the Board first committed to a public sale process – However , Mr. Cooper simply ignored our offer and request. To date we still have not been afforded the opportunity to interview Driver’s candidates – However , without warning, Driver canceled the meeting two days before, on the weak justification that Ms. Rodeheaver should not attend even part of the meeting (reversing its previous view) – However , Driver continued to engage in dishonest and self - serving gamesmanship, refused a very reasonable settlement proposal and eventually suspended discussions ( see next page )

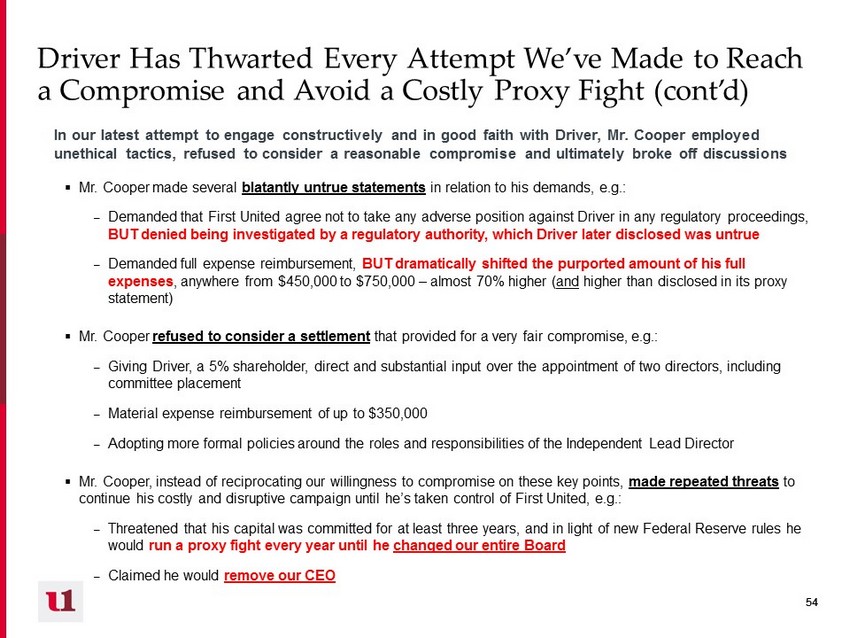

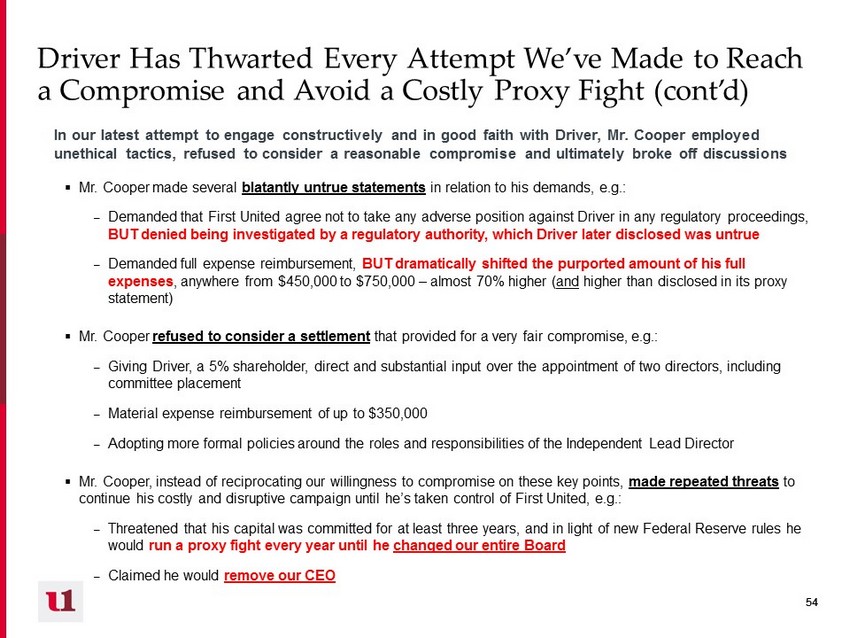

54 54 Driver Has Thwarted Every Attempt We’ve Made to Reach a Compromise and Avoid a Costly Proxy Fight (cont’d) In our latest attempt to engage constructively and in good faith with Driver, Mr. Cooper employed unethical tactics, refused to consider a reasonable compromise and ultimately broke off discussions ▪ Mr. Cooper made several blatantly untrue statements in relation to his demands, e.g.: – Demanded that First United agree not to take any adverse position against Driver in any regulatory proceedings, BUT denied being investigated by a regulatory authority, which Driver later disclosed was untrue – Demanded full expense reimbursement, BUT dramatically shifted the purported amount of his full expenses , anywhere from $450,000 to $750,000 – almost 70% higher ( and higher than disclosed in its proxy statement) ▪ Mr. Cooper refused to consider a settlement that provided for a very fair compromise, e.g .: – Giving Driver, a 5% shareholder, direct and substantial input over the appointment of two directors, including committee placement – Material expense reimbursement of up to $350,000 – A dopting more formal policies around the roles and responsibilities of the Independent Lead Director ▪ Mr. Cooper, instead of reciprocating our willingness to compromise on these key points, made repeated threats to continue his costly and disruptive campaign until he’s taken control of First United, e.g.: – Threatened that his capital was committed for at least three years, and in light of new Federal Reserve rules he would run a proxy fight every year until he changed our entire Board – Claimed he would remove our CEO

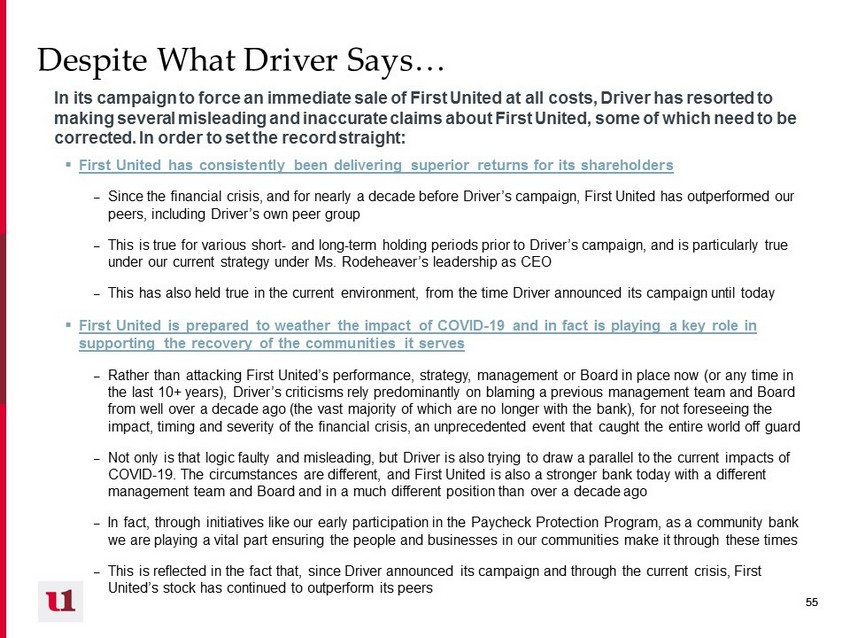

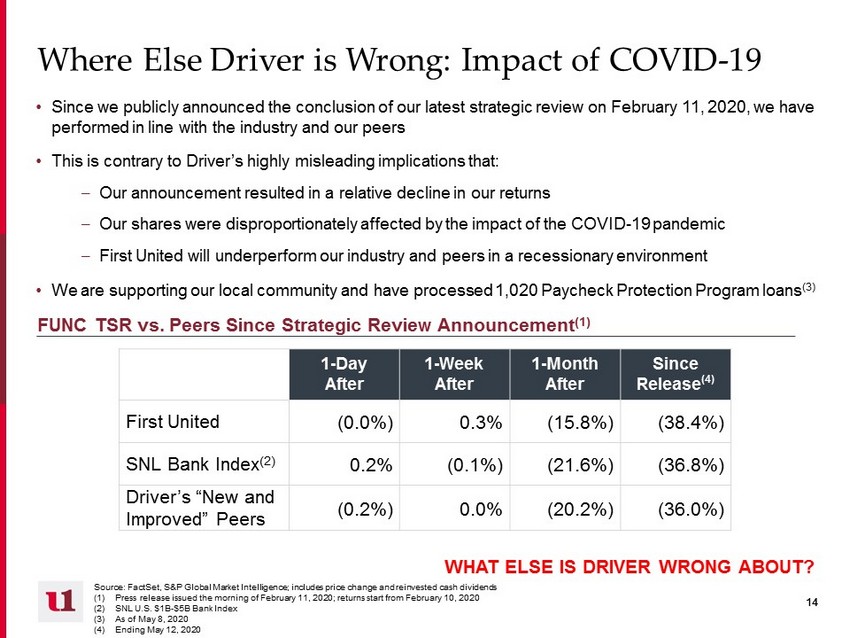

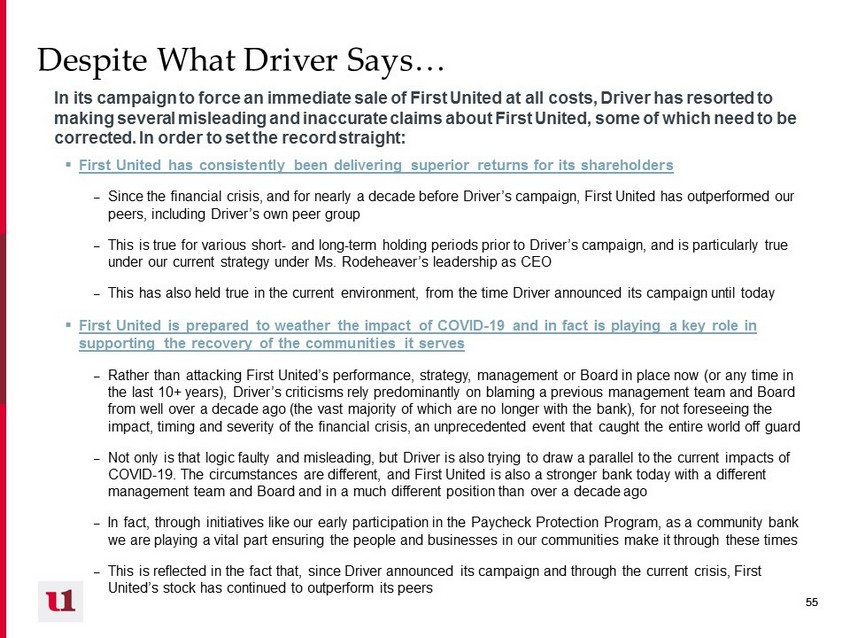

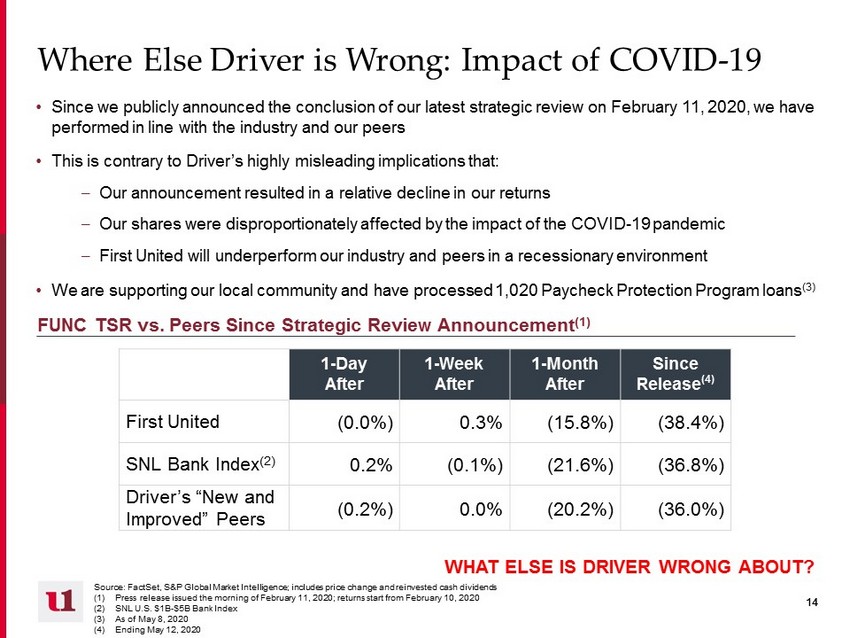

55 55 In its campaign to force an immediate sale of First United at all costs, Driver has resorted to making several misleading and inaccurate claims about First United, some of which need to be corrected. In order to set the record straight: ▪ First United has consistently been delivering superior returns for its shareholders – Since the financial crisis, and for nearly a decade before Driver’s campaign, First United has outperformed our peers, including Driver’s own peer group – This is true for various short - and long - term holding periods prior to Driver’s campaign, and is particularly true under our current strategy under Ms. Rodeheaver’s leadership as CEO – This has also held true in the current environment, from the time Driver announced its campaign until today ▪ First United is prepared to weather the impact of COVID - 19 and in fact is playing a key role in supporting the recovery of the communities it serves – Rather than attacking First United’s performance, strategy, management or Board in place now (or any time in the last 10+ years), Driver’s criticisms rely predominantly on blaming a previous management team and Board from well over a decade ago (the vast majority of which are no longer with the bank), for not foreseeing the impact, timing and severity of the f inancial crisis , an unprecedented event that caught the entire world off guard – Not only is that logic faulty and misleading, but Driver is also trying to draw a parallel to the current impacts of COVID - 19. The circumstances are different, and First United is also a stronger bank today with a different management team and Board and in a much different position than over a decade ago – In fact, through initiatives like our early participation in the Paycheck Protection Program, as a community bank we are playing a vital part ensuring the people and businesses in our communities make it through these times – This is reflected in the fact that, since Driver announced its campaign and through the current crisis, First United’s stock has continued to outperform its peers Despite What Driver Says…

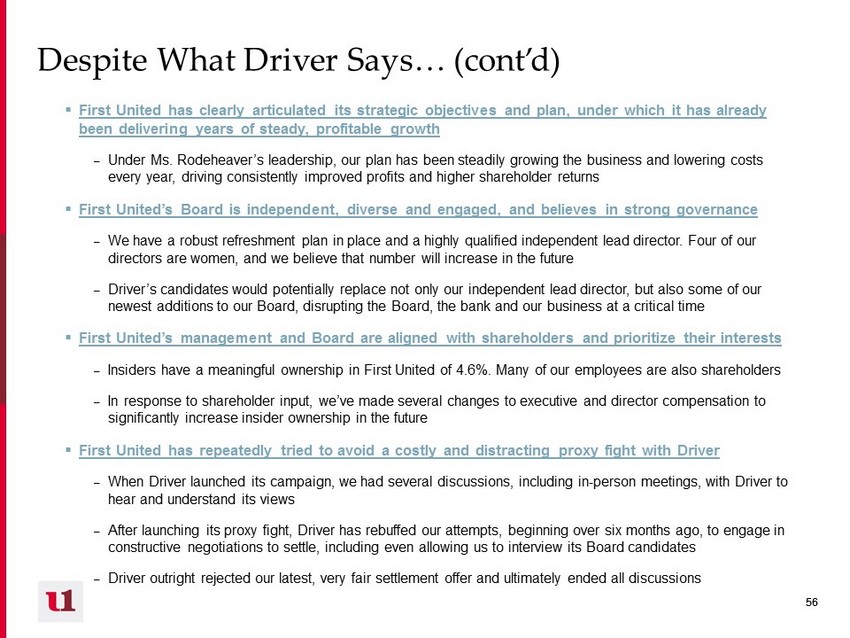

56 56 ▪ First United has clearly articulated its strategic objectives and plan, under which it has already been delivering years of steady, profitable growth – Under Ms. Rodeheaver’s leadership, our plan has been steadily growing the business and lowering costs every year, driving consistently improved profits and higher shareholder returns ▪ First United’s Board is independent, diverse and engaged, and believes in strong governance – We have a robust refreshment plan in place and a highly qualified independent lead director . Four of our directors are women, and we believe that number will increase in the future – Driver’s candidates would potentially replace not only our independent lead director , but also some of our newest additions to our Board, disrupting the Board, the bank and our business at a critical time ▪ First United’s management and Board are aligned with shareholders and prioritize their interests – Insiders have a meaningful ownership in First United of 4.6%. Many of our employees are also shareholders – In response to shareholder input, we’ve made several changes to executive and director compensation to significantly increase insider ownership in the future ▪ First United has repeatedly tried to avoid a costly and distracting proxy fight with Driver – When Driver launched its campaign, we had several discussions, including in - person meetings, with Driver to hear and understand its views – After launching its proxy fight, Driver has rebuffed our attempts, beginning over six months ago, to engage in constructive negotiations to settle, including even allowing us to interview its Board candidates – Driver outright rejected our latest, very fair settlement offer and ultimately ended all discussions Despite What Driver Says… (cont’d)

57 57 ▪ First United’s Board made the right decision to approve the share buyback program last year, and doing so enabled us to respond quickly and prudently to our shareholders’ concerns following the downturn in financial markets due to COVID - 19 – The Board approved a buyback program in April of last year and in November expanded it to 500,000 shares – After the market selloff related to COVID - 19, several of our shareholders contacted us to express their view that we should begin repurchasing shares. This even included Driver, despite its earlier public criticisms of the buyback program – We listened to our shareholders' input and were able to respond quickly, repurchasing shares under the program to the degree we felt prudent, allowing us to effectively support our stock and provide liquidity to our shareholders ▪ First United’s directors are leaders in business and in our communities, which benefits the bank and enhances the knowledge and skill set of the Board – Our directors participate and hold leadership positions in various local, regional and national organizations, including bank associations, trade groups, county commissions and nonprofit institutions – These positions enhance the leadership skills and experience of our Board and help ensure we know about relevant events in our markets – It also helps us to develop new business and better serve our customers, especially in times of crisis ▪ For example, we were aware of the latest developments with the recently launched Payment Protection Program under the CARES Act. This allowed us to be an early participant in the loan program, helping to protect employees and small businesses in our communities, while banks that reacted more slowly experienced significant delays or have been unable to participate Despite What Driver Says… (cont’d)

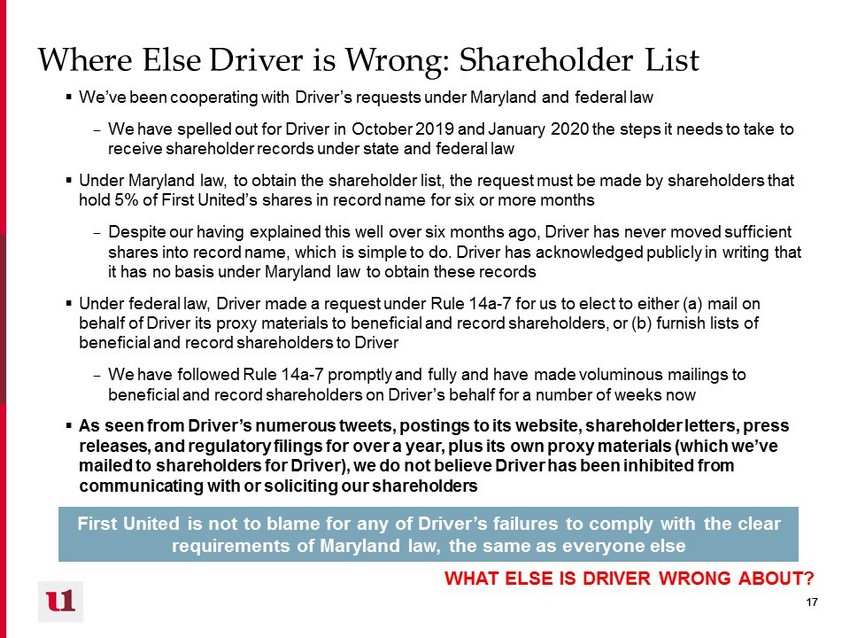

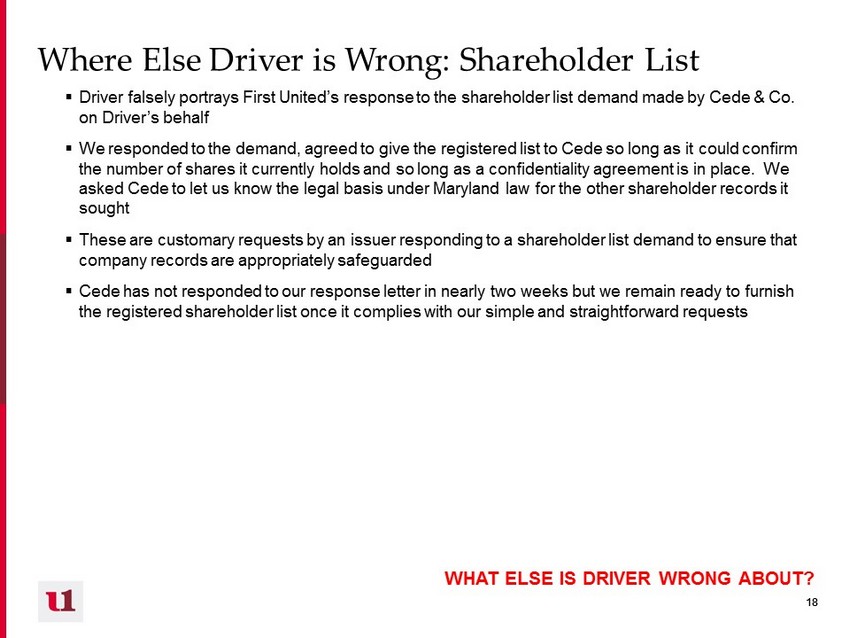

58 58 ▪ First United is not to blame for any of Driver’s failures to comply with the clear requirements of Maryland law, the same as everyone else – We gave Driver a roadmap in 2019 of what steps to take to obtain different types of shareholder records under state and federal law. We have cooperated with Driver’s requests under Maryland and federal law, including voluminous mailings to beneficial and record shareholders on Driver’s behalf, for a number of weeks now – Most importantly, as seen from Driver's tweets, website, shareholder letters, press releases, regulatory filings from over a year and its own proxy materials (the last of which we've mailed for Driver at its request), we do not believe Driver has been inhibited from communicating with or soliciting our shareholders – Driver is also under investigation by the Office of the Maryland Commissioner of Financial Regulation for possible violation of Maryland’s Stock Acquisition Statute. This may result in Driver being unable to vote its shares for five years, including at the upcoming annual meeting. Although this is a matter between Driver and the regulator, Driver appears to be trying to blame First United for its own actions, which may not have complied with Maryland law Despite What Driver Says… (cont’d)

59 59 Support First United - Vote on the BLUE Proxy Card! 1. First United’s management team and Board have delivered over a decade of superior shareholder returns and are continuing to do so in the current environment 2. The strategic plan has produced several years of consistent, profitable growth, and will continue to do so as the current market and economic turmoil stabilizes 3. Our Board regularly considers strategic alternatives with its independent outside advisors and made every effort to hear and understand Driver’s views. A sale would not have been in shareholders’ best interests six months ago and it certainly is not today 4. We made repeated, unreciprocated attempts to avoid a costly proxy fight with Driver 5. Driver’s proxy fight would be highly disruptive to our Board, strategy and business at a critical time, replacing several highly - qualified directors with candidates that have zero public company experience, ties to our communities or knowledge of our markets 6. Instead of Driver’s self - serving campaign to force a sale of First United as soon as possible, our shareholders would be best served by our continuing to focus on meeting the needs of our customers in our communities and to support them in this difficult time YOUR VOTE COUNTS! SUPPORT ALL FOUR OF YOUR BOARD’S NOMINEES ON THE BLUE PROXY CARD!

60 60 VI. Appendix