Exhibit 99.1

Governance Presentation First United Corporation Investor Meetings April 30, 2021

2 2 Forward looking statements This presentation contains forward - looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward - looking statements do not represent historical facts, but are statements about management's beliefs, plans and objectives about the future, as well as its assumptions and judgments concerning such beliefs, plans and objectives. These statements are evidenced by terms such as "anticipate," "estimate," "should," "expect," "believe," "intend," and similar expressions. Although these statements reflect management's good faith beliefs and projections, they are not guarantees of future performance and they may not prove true. The beliefs, plans and objectives on which forward - looking statements are based involve risks and uncertainties that could cause actual results to differ materially from those addressed in the forward - looking statements. For a discussion of these risks and uncertainties, see the section of the periodic reports that First United Corporation files with the Securities and Exchange Commission entitled "Risk Factors", including the risk factor set forth in First United Corporation’s Annual Report on Form 10 - K, as amended, for the year ended December 31, 2020 entitled, “The outbreak of the recent coronavirus (“COVID - 19”), or an outbreak of another highly infectious or contagious disease, could adversely affect First United Corporation’s business, financial condition and results of operations.” and any updates thereto that might be contained in subsequent reports filed by First United Corporation. The risks and uncertainties associated with the COVID - 19 pandemic and its impact on First United Corporation will depend on, among other things, the length of time that the pandemic continues; the potential imposition of further restrictions on travel in the future; the effect of the pandemic on the global, national, and local economies and on the businesses of our borrowers and their ability to make payments on their obligations; the remedial actions and stimulus measures adopted by federal, state, and local governments; and the inability of employees to work due to illness, quarantine, or government mandates. Whether actual results will conform to expectations and predictions is subject to known and unknown risks and uncertainties. Actual results could be materially different from management’s expectations. This presentation should be read in conjunction with our Annual Report on Form 10 - K, as amended, for the year ended December 31, 2020, including the sections of the report entitled “Risk Factors”, as well as the reports and other documents that we subsequently file with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov or at our website at www.mybank.com . Except as required by law, we do not intend to publish updates or revisions of any forward - looking statements we make to reflect new information, future events or otherwise.

3 3 Table of Contents I. First United Overview Pg. 4 II. Our Commitment To Strong Governance Pg. 11 III. First United 2021 Annual Meeting Pg. 16 IV. Appendix Pg. 19

4 4 I. First United

5 5 Executive Summary First United has proactively responded to COVID - 19 and is now re - imagining the future Execution of our strategy is driving steady profitable growth Continuing to strengthen our governance, and would like your support at the Annual Meeting – Our pandemic policies and procedures prioritized the health and well - being of our associates and clients. – Flexible work schedules, work - at - home accommodations and enhanced communication have maintained culture and connectedness, in the “new - normal” environment. – Our learnings from the pandemic will enhance our business model execution in a post - pandemic world. – Enhanced shareholder engagement and communication – Ongoing board refreshment, including formal adoption of diversity policy – 2021 Management Proposals to enhance shareholder rights, with full Board support: Board declassification Majority vote standard Proxy access – In 2020 we grew earnings per share by 7% and increased our dividend by 30% – Pre - tax, pre - provision earnings for 2020 increased 30% over prior year – Capital, liquidity and asset quality remain strong

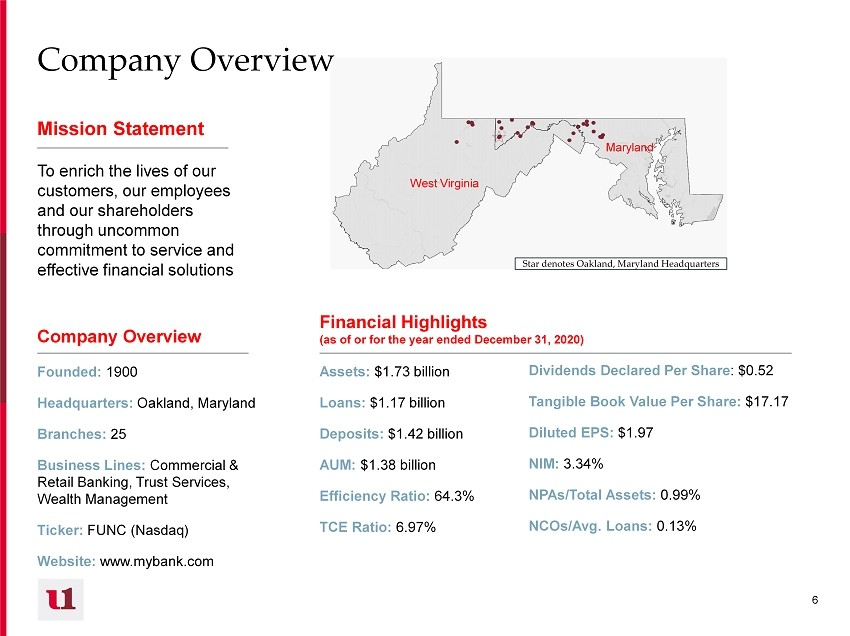

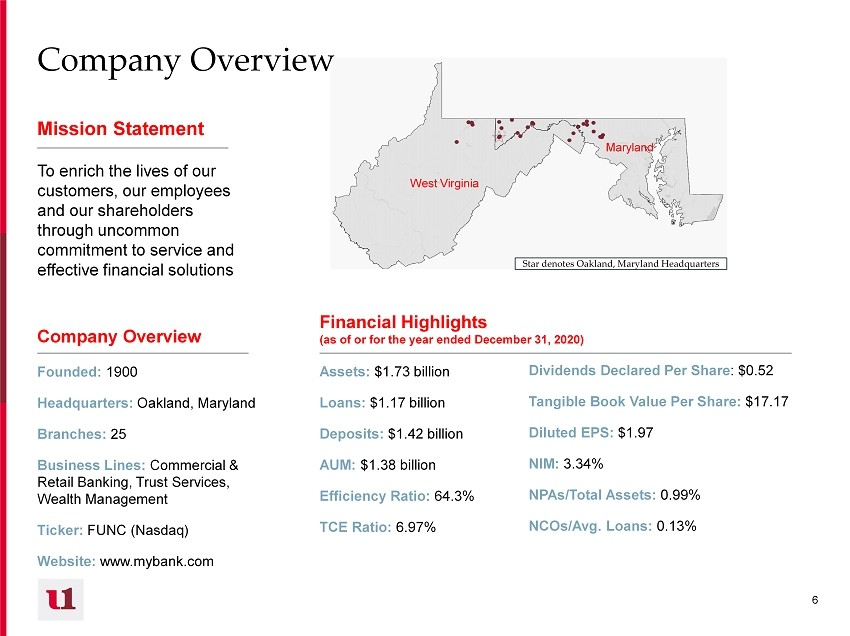

6 6 Mission Statement To enrich the lives of our customers, our employees and our shareholders through uncommon commitment to service and effective financial solutions Company Overview Founded: 1900 Headquarters: Oakland, Maryland Branches: 25 Business Lines: Commercial & Retail Banking, Trust Services, Wealth Management Ticker: FUNC (Nasdaq) Website: www.mybank.com Financial Highlights (as of or for the year ended December 31, 2020) Assets: $1.73 billion Loans: $1.17 billion Deposits: $1.42 billion AUM: $1.38 billion Efficiency Ratio: 64.3 % TCE Ratio: 6.97% Dividends Declared Per Share : $0.52 Tangible Book Value Per Share: $17.17 Diluted EPS: $1.97 NIM: 3.34% NPAs/Total Assets: 0.99% NCOs/Avg. Loans: 0.13% West Virginia Maryland Star denotes Oakland, Maryland Headquarters Company Overview

7 7 Key Strategic Priorities Optimize shareholder return through a keen focus on four priorities: Create Exceptional Client Experience • Provide seamless client experience across all business lines using integrated relationship teams • Educate clients on digital banking and technology utilizing high - tech branch network • Customize financial solutions to grow client relationships and loyalty • Develop focused marketing plans utilizing data analytics to increase relationship and product profitability Grow Strategically • Amplify consumer and small business relationships through community relationship managers and universal relationship advisors • Identify and hire banking talent to capitalize on market disruption and client acquisition • Expand into new markets with Financial Center model and mortgage originations • Pursue wealth management M&A and strategic bank partnerships Optimize Profitability, Enhance Efficiency • Fine tune regional/line of business financial goals and incentive plans to achieve improved operating leverage • Utilize profitability metrics to focus and align customer engagement efforts • Capitalize on existing infrastructure to build stronger revenue streams • Implement next stages of operational restructure and consolidation initiative • Leverage technology to streamline processes and procedures Underlying all initiatives is strong risk management, monitoring and mitigation. Reimagine the Future • Develop hybrid work environment to capture efficiencies and attract/ retain talent • Explore real estate partnerships and physical space alternatives • Further promote diversity, equity and inclusion in workforce and client base • Establish Fintech partnerships to capitalize on digital financial offerings

8 8 $13.2 $14.7 $15.5 $17.8 $23.2 2016 2017 2018 2019 2020 $1,014 $1,039 $1,068 $1,142 $1,422 2016 2017 2018 2019 2020 $882 $882 $996 $1,039 $1,168 2016 2017 2018 2019 2020 $1,057 Our Strategic Plan is Generating Reliable Growth… Pre - tax Pre - Provision Income ($ in millions) Tangible Book Value per Share Total Deposits ($ in millions) Total Net Loans, including PPP ($ in millions) First United is delivering consistent growth, increasing profits and tangible book value / share which should translate into increased long - term shareholder return $13.19 $13.78 $14.97 $16.17 $17.17 2016 2017 2018 2019 2020 +30.4% YoY +6.2% YOY +12.4% YOY +24.5% YOY $114 PPP

9 9 Total Shareholder Return Source: S&P Global Market Intelligence; includes price change and reinvested cash dividends (1) SNL U.S. $1B - $5B Bank Index (2) Peer groups are defined in the Appendix to this presentation. Peer group refers to median unless stated otherwise • Our long - term performance reflects our fundamental operations and earnings growth • The banking industry has been significantly impacted by the COVID - 19 pandemic. • Our short - term stock price reflects the pandemic’s uncertain impact to our clients, our local economic environment and our balance sheet Total Return as of December 31, 2020 1 - Year 3 - Year 5 - Year

10 10 COVID - 19: Our Board and Management in Action Our Leaders have taken a hands - on approach through the crisis. Our team is grounded in our Mission and focused on the Long - Term. • Continued customer access • Customer - specific solutions • Leveraging technology • PPP delivery • Loan modifications & payment deferrals Strategic Focus Identifying opportunities to make our business even more enduring • Health and safety • Balance sheet liquidity • Credit Quality • Business continuity plan execution • Human capital management Active Risk Oversight Continuous engagement on risk matters including: • Customers • Employees • Communities • Shareholders Stakeholder Stewardship Focusing on what matters and providing for our:

11 11 II. Our Commitment to Strong Corporate Governance

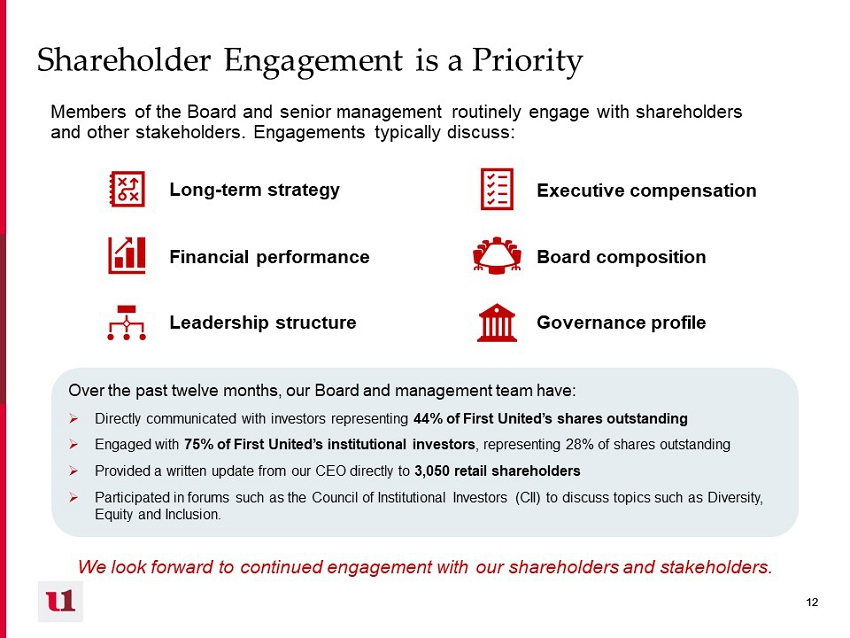

12 12 Shareholder Engagement is a Priority Members of the Board and senior management routinely engage with shareholders and other stakeholders. Engagements typically discuss: Long - term strategy Financial performance Leadership structure Board composition Executive compensation Governance profile Over the past twelve months, our Board and management team have: » Directly communicated with investors representing 44% of First United’s shares outstanding » Engaged with 75% of First United’s institutional investors , representing 28% of shares outstanding » Provided a written update from our CEO directly to 3,050 retail shareholders » Participated in forums such as the Council of Institutional Investors (CII) to discuss topics such as Diversity, Equity and Inclusion. We look forward to continued engagement with our shareholders and stakeholders.

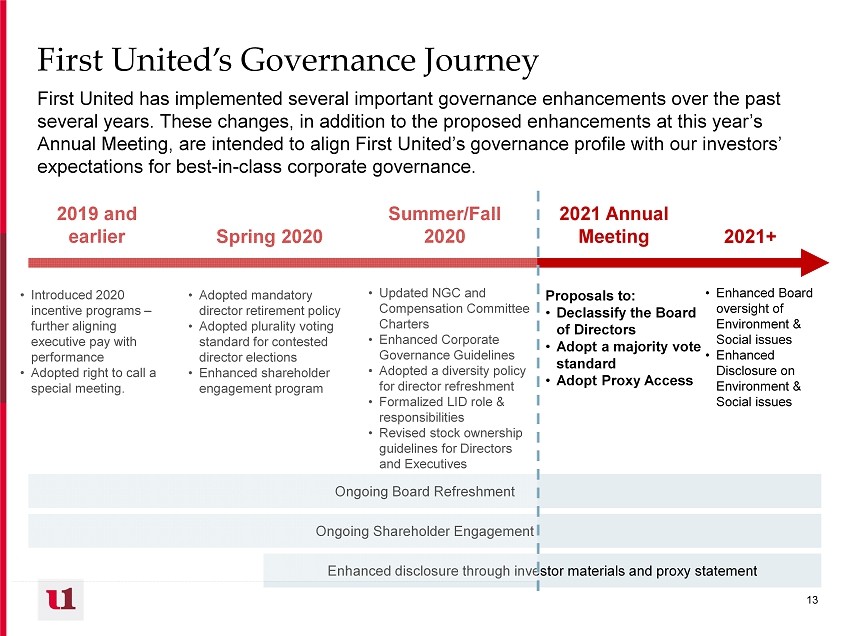

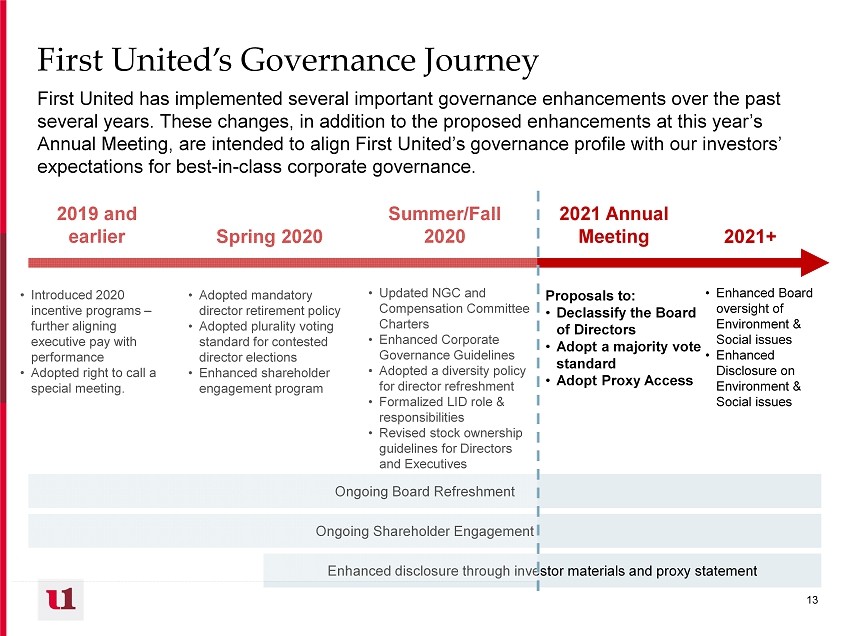

13 13 Ongoing Shareholder Engagement Proposals to: • Declassify the Board of Directors • Adopt a majority vote standard • Adopt Proxy Access • Updated NGC and Compensation Committee Charters • Enhanced Corporate Governance Guidelines • Adopted a diversity policy for director refreshment • Formalized LID role & responsibilities • Revised stock ownership guidelines for Directors and Executives • Enhanced Board oversight of Environment & Social issues • Enhanced Disclosure on Environment & Social issues Ongoing Board Refreshment Enhanced disclosure through investor materials and proxy statement • Introduced 2020 incentive programs – further aligning executive pay with performance • Adopted right to call a special meeting. • Adopted mandatory director retirement policy • Adopted plurality voting standard for contested director elections • Enhanced shareholder engagement program 2021 Annual Meeting 2021+ Summer/Fall 2020 Spring 2020 2019 and earlier First United’s Governance Journey First United has implemented several important governance enhancements over the past several years. These changes, in addition to the proposed enhancements at this year’s Annual Meeting, are intended to align First United’s governance profile with our investors’ expectations for best - in - class corporate governance.

14 14 Two additional directors in the next two years Six new directors in six years Ongoing Board Refreshment Our proactive board refreshment strategy, coupled with regular director retirements, has resulted in the addition of several talented and diverse directors to First United’s Board. Board refreshment efforts began with the addition of three new directors: • John Barr • Brian Boal • Marisa Shockley Patricia Milon was named to the Board in July Sanu Chadha and Christy DiPietro were named to the Board in January 2014 - 2015 2020 2021 … 2022 2023 Key Skills Prioritized Banking & Finance Regulatory Technology & Innovation Compliance Key Skills Added Brokerage & Investment Banking Finance & Accounting Public Company Board Experience IT & Cybersecurity Regulatory & Compliance Process Improvement Anticipated Director addition Anticipated Director addition Our ongoing Board evolution will continue to provide strategic refreshment of our independent directors, maintain our commitment to diversity, and continuously update the skill set of our Board.

15 15 Board Declassification Our Board’s Diverse and Relevant Skills and Experience 55% 45% Women Men Name Carissa Rodeheaver CEO and Chair 7 54 X X X X X X Sanu Chadha Independent Director 0 44 X X X X Christy M. DiPietro Independent Director 0 60 X X X X Patricia Milon Independent Director 1 58 X X X X X X X John McCullough Lead Director (Nom/Gov Chair) 16 70 X X X X X X John Barr Independent Director 6 66 X X X Brian Boal Independent Director (Audit Chair) 6 47 X X X X Marisa Shockley Independent Director 6 55 X X X Kathryn Burkey Independent Chair (Comp Chair) 15 69 X X X X X Irvin Robert Rudy Independent Director 28 67 X X X H. Andrew Walls III Independent Director 14 59 X X X X Regulatory Strategic Planning Financial Services / Banking Industry Risk Management Executive Leadership & Governance Accounting / Finance/ Investment Banking Information Technology Tenure Age Name Gender Diverse board with a balance of experience and perspectives Long - term alignment with shareholders: Your board is one of the company’s top 5 investors* 2021 Director nominees X Qualified Financial Expert Note: Excludes Gary Ruddell who is retiring from the Board in May 2021 5.6% 5.2 5.9 4.7% 4.3% BlackRock First United Trust & Investments Vanguard Dimensional FUNC Board *As of 4/5/2021

16 16 III. Our 2021 Annual Meeting

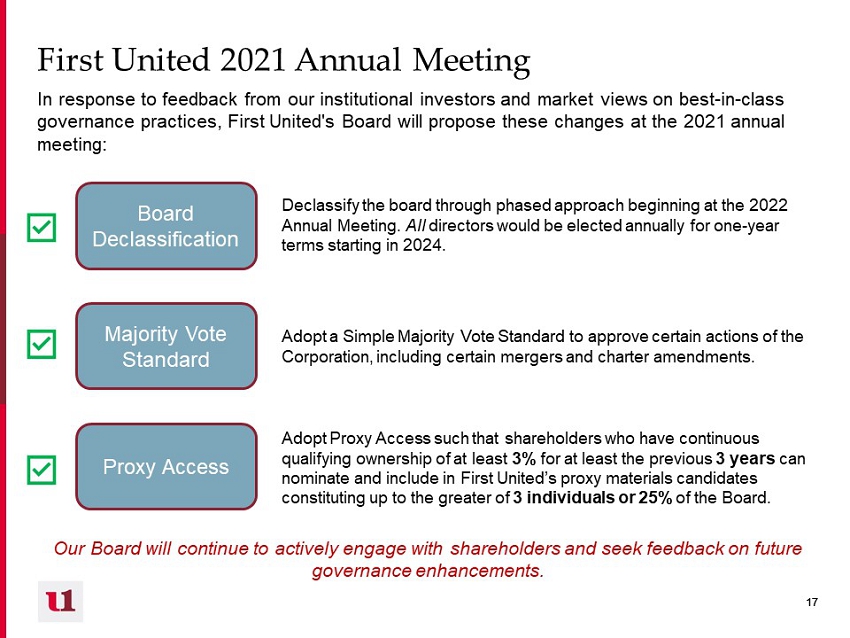

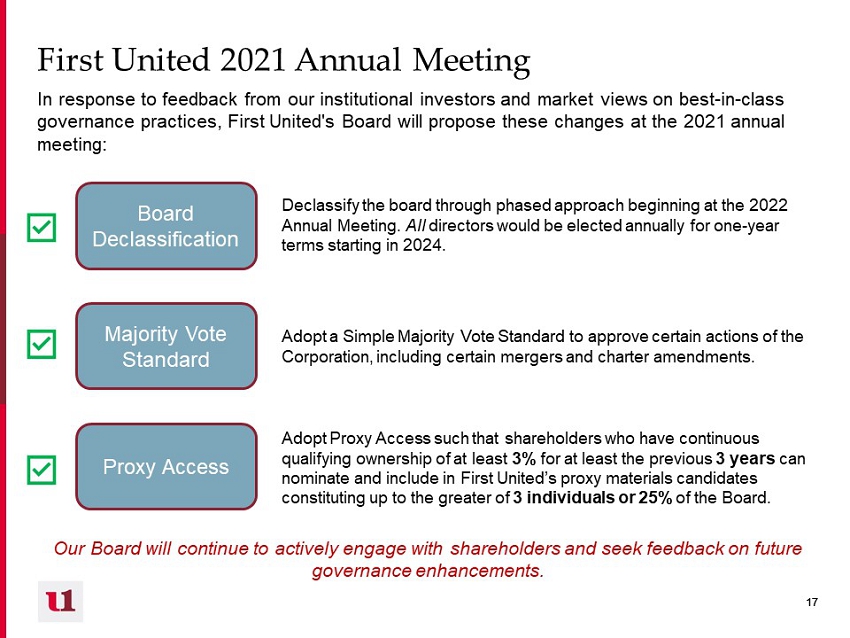

17 17 Board Declassification First United 2021 Annual Meeting In response to feedback from our institutional investors and market views on best - in - class governance practices, First United's Board will propose these changes at the 2021 annual meeting: Board Declassification Majority Vote Standard Proxy Access Adopt Proxy Access such that shareholders who have continuous qualifying ownership of at least 3% for at least the previous 3 years can nominate and include in First United’s proxy materials candidates constituting up to the greater of 3 individuals or 25% of the Board. Declassify the board through phased approach beginning at the 2022 Annual Meeting. All directors would be elected annually for one - year terms starting in 2024. Adopt a Simple Majority Vote Standard to approve certain actions of the Corporation, including certain mergers and charter amendments. Our Board will continue to actively engage with shareholders and seek feedback on future governance enhancements.

18 18 2021 Director Nominees Carissa Rodeheaver CEO & Chair • 29 - year career with First United with in - depth industry, sales, wealth management, financial, credit and operational experience • Holds leadership positions in the American & Maryland Bankers Associations as well as in Garrett County, one of our key markets Skills and Qualifications : Banking, financial, accounting and auditing expertise, executive leadership, risk management, strategic planning, industry experience [Photo] Sanu Chadha Independent Director • Managing Partner of M&S Consulting, a management and solutions company that provides advice on strategic process and technology solutions, project management, data analytics, and cloud solutions • Certified Project Management Professional Skills and Qualifications : Information technology, strategic planning, executive leadership, risk management, international business [Photo] Christy DiPietro Independent Director • Former Vice President and Portfolio Manager – Fixed Income at T. Rowe Price Associates, Inc • Manages Hidden Code Advisory, a private family investment office: responsible for investment analysis, asset allocation, tax matters, and other family office matters Skills and Qualifications : Strategic planning, banking, finance, investments, executive management, risk management, international business, wealth management [Photo] Patricia Milon Independent Director • Accomplished bank regulatory expert, with over 30 years of enterprise risk management and corporate governance experience. • Former Enterprise Chief Compliance Officer for E*TRADE Financial • Respected fintech and reg - tech consultant Skills and Qualifications: Banking, financial, executive management and leadership, risk management, strategic planning [Photo]

19 19 V. Appendix

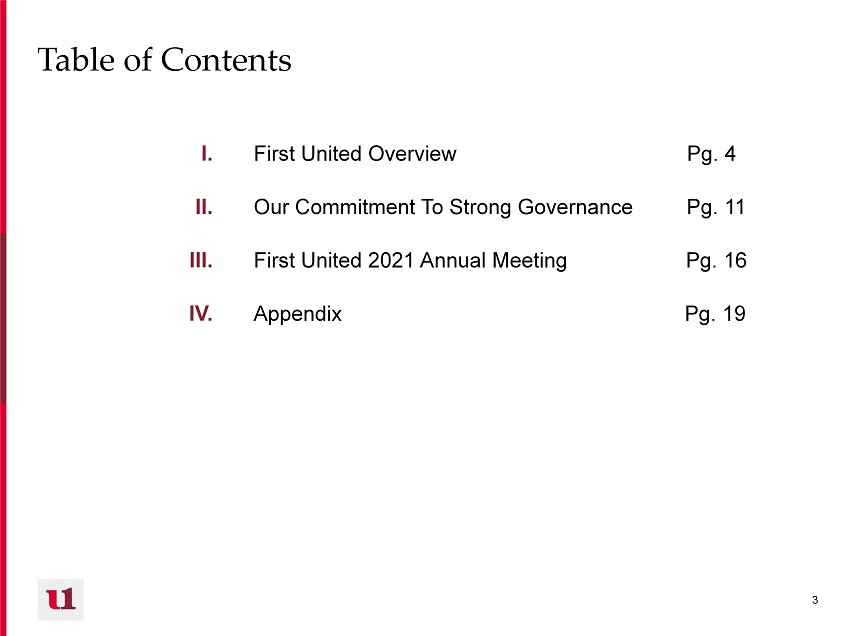

20 20 Selected Peer Groups • Proxy peers can be found in First United’s 2020 definitive proxy statement found here: https://www.sec.gov/Archives/edgar/data/763907/000110465920048280/tm2016149d1_defc14a.htm – Proxy peers include: ACNB, ASRV, CFFI, CHMG, CVLY, CZFS, CZNC, EVBN, FDBC, FRAF, MVBF, NKSH, OPOF, ORRF, PWOD, RIVE, SAL, SMMF and UNB • ISS peers can be found in the 2020 ISS Annual Benchmark Report – Includes ACNB, ASRV, CFFI, CHMG, CVLY, CZFS, CZNC, ESXB, EVBN, FBIZ, FBLV, FBSS, FRAF, MBCN, MVBF, NKSH, NWFL, OPOF, PEBK, PFBI, PWOD, SHBI, SLCT and TCFC