UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO

SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For quarterly period ended March 31, 2007

Commission file number 0-14237

First United Corporation

(Exact name of registrant as specified in its charter)

Maryland | | 52-1380770 |

| (State or other jurisdiction of incorporation or organization) | | (I. R. S. Employer Identification No.) |

19 South Second Street, Oakland, Maryland 21550-0009

(Address of principal executive offices) (Zip Code)

(800) 470-4356

(Registrant's telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer x Non-accelerated filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 6,146,443 shares of common stock, par value $.01 per share, as of April 30, 2007.

INDEX TO QUARTERLY REPORT

FIRST UNITED CORPORATION

| PART I. FINANCIAL INFORMATION | |

| | |

| Item 1. Financial Statements | |

| | |

| Consolidated Statements of Financial Condition - March 31, 2007 (unaudited) and December 31, 2006 (audited) | |

| | |

| Consolidated Statements of Income (unaudited) - for the three months ended March 31, 2007 and 2006 | |

| | |

| Consolidated Statements of Cash Flows (unaudited) - for the three months ended March 31, 2007 and 2006 | |

| | |

| Notes to Consolidated Financial Statements (unaudited) | |

| | |

| Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations | |

| | |

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | |

| | |

| Item 4. Controls and Procedures | |

| | |

| PART II. OTHER INFORMATION | |

| | |

| Item 1. Legal Proceedings | |

| | |

| Item 1A. Risk Factors | |

| | |

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | |

| | |

| Item 3. Defaults Upon Senior Securities | |

| | |

| Item 4. Submission of Matters to a Vote of Security Holders | |

| | |

| Item 5. Other Information | |

| | |

| Item 6. Exhibits | |

| | |

| SIGNATURES | |

| | |

| EXHIBIT INDEX | |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

FIRST UNITED CORPORATION

Consolidated Statements of Financial Condition

(In thousands, except per share data)

| | | March 31, 2007 | | December 31, 2006 | |

| | | (Unaudited) | | | |

Assets | | | |

| Cash and due from banks | | $ | 16,251 | | $ | 23,325 | |

| Interest-bearing deposits in banks | | | 14,613 | | | 2,463 | |

| Investment securities trading (at fair value) | | | 72,591 | | | - | |

| Investment securities available-for-sale (at fair value) | | | 210,763 | | | 263,272 | |

| Federal Home Loan Bank stock, at cost | | | 9,149 | | | 9,620 | |

| Loans | | | 958,072 | | | 963,656 | |

| Allowance for loan losses | | | (6,343 | ) | | (6,530 | ) |

| Net loans | | | 951,729 | | | 957,126 | |

| Premises and equipment, net | | | 30,781 | | | 29,852 | |

| Goodwill and other intangible assets, net | | | 13,894 | | | 14,033 | |

| Bank owned life insurance | | | 28,185 | | | 27,926 | |

| Accrued interest receivable and other assets | | | 20,464 | | | 21,700 | |

| | | | | | | | |

| Total Assets | | $ | 1,368,420 | | $ | 1,349,317 | |

| | | | | | | | |

Liabilities and Shareholders' Equity | | | | | | | |

| Liabilities: | | | | | | | |

| Non-interest bearing deposits | | $ | 108,097 | | $ | 106,579 | |

| Interest-bearing deposits | | | 892,477 | | | 864,802 | |

| Total deposits | | | 1,000,574 | | | 971,381 | |

| Short-term borrowings | | | 89,261 | | | 99,379 | |

| Long-term borrowings | | | 164,569 | | | 166,330 | |

| Accrued interest payable and other liabilities | | | 14,132 | | | 14,202 | |

| Dividends payable | | | 1,201 | | | 1,169 | |

| Total Liabilities | | | 1,269,737 | | | 1,252,461 | |

| Shareholders' Equity | | | | | | | |

| Preferred stock --no par value; | | | | | | | |

| Authorized and unissued 2,000 shares | | | | | | | |

| Capital Stock - actual par value $.01 per share; | | | | | | | |

| Authorized 25,000 shares; issued and outstanding 6,146 shares at March 31, 2007 and 6,141 shares at December 31, 2006 | | | 61 | | | 61 | |

| Surplus | | | 21,565 | | | 21,448 | |

| Retained earnings | | | 81,757 | | | 80,927 | |

| Accumulated other comprehensive loss | | | (4,700 | ) | | (5,580 | ) |

| Total Shareholders' Equity | | | 98,683 | | | 96,856 | |

| | | | | | | | |

| Total Liabilities and Shareholders' Equity | | $ | 1,368,420 | | $ | 1,349,317 | |

FIRST UNITED CORPORATION

Consolidated Statements of Income

(in thousands, except per share data)

| | | Three Months Ended March 31, | |

| | | 2007 | | 2006 | |

| | | (Unaudited) | |

| | | | | | |

Interest income | | | | | |

| Loans, including fees | | $ | 17,885 | | $ | 16,443 | |

| Investment securities: | | | | | | | |

| Taxable | | | 2,595 | | | 1,715 | |

| Exempt from federal income tax | | | 727 | | | 647 | |

| Total investment income | | | 3,322 | | | 2,362 | |

| Dividends on FHLB stock | | | 138 | | | 115 | |

| Federal funds sold and interest bearing deposits | | | 73 | | | 57 | |

| Total interest income | | | 21,418 | | | 18,977 | |

| | | | | | | | |

Interest expense | | | | | | | |

| Deposits | | | 8,325 | | | 6,036 | |

| Short-term borrowings | | | 963 | | | 1,020 | |

| Long-term borrowings | | | 2,065 | | | 1,784 | |

| Total interest expense | | | 11,353 | | | 8,840 | |

| Net interest income | | | 10,065 | | | 10,137 | |

| Provision/(credit) for loan losses | | | 163 | | | (77 | ) |

| Net interest income after provision for loan losses | | | 9,902 | | | 10,214 | |

Other operating income | | | | | | | |

| Service charges | | | 1,281 | | | 1,329 | |

| Trust department | | | 1,007 | | | 880 | |

| Securities (losses)/gains | | | (1,511 | ) | | 4 | |

| Insurance commissions | | | 620 | | | 375 | |

| Earnings on Bank owned life insurance | | | 259 | | | 205 | |

| Other income | | | 705 | | | 723 | |

| Total other operating income | | | 2,361 | | | 3,516 | |

Other operating expenses | | | | | | | |

| Salaries and employee benefits | | | 4,890 | | | 5,271 | |

| Occupancy, equipment and data processing | | | 1,738 | | | 1,622 | |

| Other expense | | | 2,615 | | | 2,625 | |

| Total other operating expenses | | | 9,243 | | | 9,518 | |

| Income before income taxes | | | 3,020 | | | 4,212 | |

| Applicable income taxes | | | 959 | | | 1,407 | |

| Net income | | $ | 2,061 | | $ | 2,805 | |

| | | | | | | | |

| Earnings per share | | $ | .34 | | $ | .46 | |

| Dividends per share | | $ | .195 | | $ | .190 | |

| Weighted average number of shares | | | | | | | |

| outstanding | | | 6,145 | | | 6,121 | |

FIRST UNITED CORPORATION

Consolidated Statements of Cash Flows

(in thousands)

| | | Three Months Ended March 31, | |

| | | 2007 | | 2006 | |

| | | (Unaudited) | |

Operating activities | | | | | |

| Net income | | $ | 2,061 | | $ | 2,805 | |

| Adjustments to reconcile net income to net | | | | | | | |

| cash provided by operating activities: | | | | | | | |

| Provision/(credit) for loan losses | | | 163 | | | (77 | ) |

| Depreciation | | | 609 | | | 631 | |

| Amortization of intangible assets | | | 139 | | | 118 | |

| Net accretion and amortization of investment securities discounts and premiums | | | 68 | | | 54 | |

| Loss/(Gain) on investment securities | | | 1,511 | | | (4 | ) |

| Decrease/(increase) in accrued interest receivable and other assets | | | 660 | | | (368 | ) |

| Decrease in accrued interest payable and other liabilities | | | (70 | ) | | (604 | ) |

| Earnings on bank owned life insurance | | | (259 | ) | | (205 | ) |

| Net cash provided by operating activities | | | 4,882 | | | 2,350 | |

Investing activities | | | | | | | |

| Net (increase)/decrease in interest-bearing deposits in banks | | | (12,150 | ) | | 3,524 | |

| Proceeds from maturities of investment securities trading | | | 2,782 | | | - | |

| Proceeds from maturities of investment securities available-for-sale | | | 17,562 | | | 10,901 | |

| Proceeds from sales of investment securities available-for-sale | | | - | | | 468 | |

| Purchases of investment securities available-for-sale | | | (40,549 | ) | | (11,116 | ) |

| Net decrease in loans | | | 5,234 | | | 5,620 | |

| Net decrease/(increase) in FHLB stock | | | 471 | | | (210 | ) |

| Purchases of premises and equipment | | | (1,538 | ) | | (348 | ) |

| Net cash (used in)/provided by investing activities | | | (28,188 | ) | | 8,839 | |

| | | | | | | | |

Financing activities | | | | | | | |

| Net decrease in short-term borrowings | | | (10,118 | ) | | (39,073 | ) |

| Repayments of long-term borrowings | | | (1,761 | ) | | (1,761 | ) |

| New issues of long-term borrowings | | | -- | | | 30,000 | |

| Net increase/(decrease) in deposits | | | 29,193 | | | (3,109 | ) |

| Cash dividends paid | | | (1,199 | ) | | (1,163 | ) |

| Proceeds from issuance of common stock | | | 117 | | | 119 | |

| Net cash provided by/(used in) financing activities | | | 16,232 | | | (14,987 | ) |

| Decrease in cash | | | (7,074 | ) | | (3,798 | ) |

| Cash at beginning of the year | | | 23,325 | | | 24,610 | |

| Cash at end of period | | $ | 16,251 | | $ | 20,812 | |

FIRST UNITED CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

March 31, 2007

Note A - Basis of Presentation

The accompanying unaudited consolidated financial statements of First United Corporation (the “Corporation”) and its consolidated subsidiaries have been prepared in accordance with U.S. generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X. Accordingly, they do not include all the information and footnotes required for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation, consisting of normal recurring items, have been included. Operating results for the three-month period ended March 31, 2007 are not necessarily indicative of the results that may be expected for the full year or for any other interim period. These consolidated financial statements should be read in conjunction with the audited consolidated financial statements and footnotes thereto included in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2006.

Note B - Reclassifications

Certain amounts reported in the prior year have been reclassified to conform with the 2007 presentation. These reclassifications did not impact First United's financial condition or results of operations.

Note C - Earnings per Share

Earnings per share is computed by dividing net income by the weighted average number of shares of common stock outstanding. The Corporation does not have any common stock equivalents.

Note D -New Accounting Standards

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities-Including an amendment of FASB Statement No. 115.” SFAS No. 159 permits entities to choose to measure many financial instruments and certain other items at fair value. Unrealized gains and losses on items for which the fair value option has been elected will be recognized in earnings at each subsequent reporting date.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements”, which defines fair value, establishes a framework for measuring fair value under GAAP, and expands disclosures about fair value measurements. SFAS No. 157 applies to other accounting pronouncements that require or permit fair value measurements. .

SFAS No. 159 is effective for financial statements issued for fiscal years beginning after November 15, 2007. SFAS No. 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and for interim periods within those fiscal years. Entities had the option, however, to early adopt SFAS No. 159 as of the beginning of the fiscal year that begins on or before November 15, 2007, so long as they also early adopted SFAS No. 157 and met certain other conditions. These statements will be effective for the Corporation on January 1, 2008. The Corporation is evaluating the impact that the adoption of SFAS No. 157 and SFAS No. 159 may have on its consolidated financial position, results of operations and cash flows.

In June 2006, the FASB issued Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN No. 48”) to clarify the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes.” FIN No. 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return, and provides guidance on derecognition, classification, interest and penalties, interim period accounting, and disclosures. FIN No. 48 requires companies to determine whether it is more likely than not that a tax position will be sustained upon examination (including appeals and litigation) based upon its technical merits. If a tax position meets the more likely than not recognition threshold, it is measured to determine the benefit amount to recognize in the financial statements. The tax position is measured at the largest amount of benefit that is greater than fifty percent likely of being realized upon ultimate settlement. FIN No. 48 was adopted on January 1, 2007. The adoption of FIN No. 48 did not have a material impact on the Corporation’s consolidated financial statements.

Note E - Investments

Trading securities: Securities that are held principally for resale in the near future are reported at their fair values as investment securities - trading, with changes in fair value reported in earnings. Interest and dividends on trading securities are included in investment income.

Securities available-for-sale: Securities available-for-sale are stated at fair value, with the unrealized gains and losses, net of tax, reported as a separate component of accumulated other comprehensive income (loss) in shareholders’ equity.

The amortized cost of debt securities classified as available-for-sale is adjusted for amortization of premiums to the first call date, if applicable, or to maturity, and for accretion of discounts to maturity, or in the case of mortgage-backed securities, over the estimated life of the security. Such amortization and accretion plus interest and dividends, are included in interest income from investments.

Management systematically evaluates available for sale securities for impairment on a quarterly basis. Declines in the fair value of available for sale securities below their cost that are considered other-than-temporary declines are recognized in earnings as realized losses in the period in which the impairment determination is made. In estimating other-than-temporary impairment losses, management considers (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) the intent and ability of the Corporation to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value. Gains and losses on the sale of securities are recorded using the specific identification method.

Note F - Comprehensive Income

Unrealized gains and losses on investment securities available-for-sale and on pension obligations are included in accumulated other comprehensive income/(loss). Total comprehensive income (which consists of net income plus the change in unrealized gains (losses) on investment securities available-for-sale, net of taxes and pension obligations) was $2.9 million and $2.4 million for the three months ended March 31, 2007 and 2006, respectively.

Note G - Junior Subordinated Debentures

In March 2004, the Corporation formed two Connecticut statutory business trusts, First United Statutory Trust I (“FUST I”) and First United Statutory Trust II (collectively with FUST I, the “Trusts”), for the purpose of selling $30.9 million of mandatorily redeemable preferred securities to third party investors. The Trusts used the proceeds of their sales of preferred securities to purchase an equal amount of junior subordinated debentures from the Corporation, as follows:

$20.6 million--6.02% fixed rate for five years payable quarterly, converting to floating rate based on three-month LIBOR plus 275 basis points, maturing in 2034, redeemable five years after issuance at the Corporation’s option.

$10.3 million--floating rate payable quarterly based on three-month LIBOR plus 275 basis points (8.10% at March 31, 2007) maturing in 2034, redeemable five years after issuance at the Corporation’s option.

The debentures represent the sole assets of the Trusts, and the Corporation’s payments under the debentures are the only sources of cash flow for the Trusts. The preferred securities qualify as Tier 1 capital of the Corporation.

The Corporation issued an additional $5.0 million of junior subordinated debentures in a private placement in December 2004. These debentures have a fixed rate of 5.88% for the first five years and then convert to a floating rate based on the three month LIBOR plus 185 basis points. Interest is payable on a quarterly basis. Although these debentures mature in 2014, they are redeemable five years after issuance at the Corporation’s option. The entire $5.0 million qualifies as Tier II capital.

Note H - Borrowed Funds

The following is a summary of short-term borrowings with original maturities of less than one year (dollars in thousands):

| | | March 31, 2007 | | December 31, 2006 | |

| Short-term FHLB advance, Daily borrowings, interest rate of 5.50% at December 31, 2006 | | $ | - | | $ | 4,500 | |

| Short-term FHLB advance, One year advance, interest rate of 5.44% | | | 20,000 | | | 20,000 | |

| Securities sold under agreements to repurchase, with weighted average interest rate at end of period of 3.81% and 3.96%, respectively | | | 69,261 | | | 74,879 | |

| | | $ | 89,261 | | $ | 99,379 | |

The following is a summary of long-term borrowings with original maturities exceeding one year (dollars in thousands):

| FHLB advances, bearing interest at rates ranging From 3.15% to 5.40% at March 31, 2007 | | $ | 128,640 | | $ | 130,401 | |

| Junior subordinated debentures, bearing interest at rates ranging from 5.88% to 8.10% at March 31, 2007 | | | 35,929 | | | 35,929 | |

| | | $ | 164,569 | | $ | 166,330 | |

Note I - Pension and SERP Plans

The following table presents the net periodic pension plan cost for the Corporation’s Defined Benefit Pension Plan and the related components:

| (In thousands) | | Pension For the three months ended March 31 | | SERP For the three months ended March 31 | |

| | | 2007 | | 2006 | | 2007 | | 2006 | |

| Service cost | | $ | 202 | | $ | 202 | | $ | 45 | | $ | 35 | |

| Interest cost | | | 289 | | | 268 | | | 64 | | | 50 | |

| Expected return on assets | | | (448 | ) | | (392 | ) | | - | | | - | |

| Amortization of transition asset | | | (10 | ) | | (10 | ) | | - | | | - | |

| Recognized loss | | | 42 | | | 43 | | | 51 | | | 30 | |

| Prior service cost | | | 3 | | | 3 | | | 28 | | | 28 | |

| Net pension expense included in employee benefits | | $ | 78 | | $ | 114 | | $ | 188 | | $ | 143 | |

The Corporation intends to contribute $1.0 million to its pension plan in 2007. As of March 31, 2007, the Corporation has not made any contributions to the plan.

Note J - Commitments

On March 22, 2007, the Corporation entered into an agreement to purchase approximately $25 million of residential mortgage loans. The loans being acquired consist of conventional three, five, seven, and ten year adjustable rate (based on LIBOR) loans. The purchase of these loans was consummated on April 27, 2007 through funding from the brokered deposit market.

Note K - Letters of Credit

First United Bank & Trust, the Corporation’s wholly-owned trust company subsidiary (the “Bank”), does not issue any guarantees that would require liability recognition or disclosure other than its standby letters of credit. Standby letters of credit are conditional commitments issued by the Bank to guarantee the performance of a customer to a third party. Generally, all of our letters of credit are issued with expiration dates within one year. The credit risk involved in issuing letters of credit is essentially the same as that involved in extending loan facilities to customers. The Bank generally holds collateral and/or personal guarantees supporting these commitments. The Bank had $7.2 million of outstanding standby letters of credit at March 31, 2007 and December 31, 2006. Management believes that the proceeds obtained through a liquidation of collateral and the enforcement of guarantees would be sufficient to cover the potential amount of future payment required by the letters of credit. Management does not believe that the amount of the liability associated with guarantees under standby letters of credit issued at March 31, 2007 and December 31, 2006 is material.

Note L - Subsequent Event

On April 13, 2007, the Corporation announced its decision to early adopt SFAS No. 159 and SFAS No. 157 effective January 1, 2007. In connection with this early adoption, the Corporation transferred approximately $77 million of available-for-sale securities to trading securities. Following this election, the Corporation sold approximately $73 million of the securities held in the trading portfolio at March 31, 2007 and realized a loss of approximately $.1 million before taxes. Proceeds from the sale of these securities were used to purchase approximately $72 million of primarily agency and municipal securities, all of which were classified as available-for-sale securities. Because of subsequent developments in respect of SFAS No. 159, the Corporation has since rescinded its early adoption of SFAS No. 159 and SFAS No. 157. More detailed information about the foregoing is provided in the section of this report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” under the heading “FINANCIAL CONDITION - Investment Securities”.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

INTRODUCTION

The following discussion and analysis is intended as a review of material changes in and significant factors affecting the financial condition and results of operations of the Corporation and its consolidated subsidiaries for the periods indicated. This discussion and analysis should be read in conjunction with the unaudited consolidated financial statements and the notes thereto contained in Item 1 of Part I of this report. Unless the context clearly suggests otherwise, references in this report to “us”, “we”, “our”, and “the Corporation” are to First United Corporation and its consolidated subsidiaries.

FORWARD-LOOKING STATEMENTS

This report may contain forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Readers of this report should be aware of the speculative nature of “forward-looking statements.” Statements that are not historical in nature, including those that include the words “anticipate,” “estimate,” “should,” “expect,” “believe,” “intend,” and similar expressions, are based on current expectations, estimates and projections about, among other things, the industry and the markets in which we operate, and they are not guarantees of future performance. Whether actual results will conform to expectations and predictions is subject to known and unknown risks and uncertainties, including risks and uncertainties discussed in this report; general economic, market, or business conditions; changes in interest rates, deposit flow, the cost of funds, and demand for loan products and financial services; changes in our competitive position or competitive actions by other companies; changes in the quality or composition of our loan and investment portfolios; our ability to manage growth; changes in laws or regulations or policies of federal and state regulators and agencies; and other circumstances beyond our control. Consequently, all of the forward-looking statements made in this report are qualified by these cautionary statements, and there can be no assurance that the actual results anticipated will be realized, or if substantially realized, will have the expected consequences on our business or operations. These and other risk factors are discussed in detail the Corporation’s periodic reports that it files with the Securities and Exchange Commission (the “SEC”) (see Item 1A of Part II of this report for further information). Except as required by applicable laws, we do not intend to publish updates or revisions of any forward-looking statements we make to reflect new information, future events or otherwise.

OUR BUSINESS

First United Corporation is a Maryland corporation that was incorporated in 1985 and is a registered financial holding company under the federal Bank Holding Company Act of 1956, as amended. The Corporation’s primary business activity is acting as the parent company of First United Bank & Trust, a Maryland trust company (the “Bank”), OakFirst Loan Center, Inc., a West Virginia finance company, OakFirst Loan Center, LLC, a Maryland finance company, the Trusts, and First United Insurance Group, LLC, a full service insurance producer organized under Maryland law (the “Insurance Group”). OakFirst Loan Center, Inc. has one subsidiary, First United Insurance Agency, Inc., which is a Maryland insurance agency. The Bank provides a complete range of retail and commercial banking services to a customer base serviced by a network of 25 offices and 34 automated teller machines.

We maintain an Internet site at www.mybankfirstunited.com on which we make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to the foregoing as soon as reasonably practicable after these reports are electronically filed with, or furnished to, the SEC.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

This discussion and analysis of our financial condition and results of operations is based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent liabilities. (See Note 1 of the Notes to Consolidated Financial Statements included in Item 8 of Part II of Form 10-K for the year ended December 31, 2006). On an on-going basis, management evaluates its estimates, including those related to loan losses, intangible assets, other-than-temporary-impairment of investment securities and pension plan assumptions. Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. Management described its critical accounting policies in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2006. Management believes that there have been no significant changes in our critical accounting policies since December 31, 2006.

SELECTED FINANCIAL DATA

The following table sets forth certain selected financial data for the three months ended March 31, 2007 and 2006 and is qualified in its entirety by the detailed information and unaudited financial statements including the notes thereto, included elsewhere in this quarterly report.

| | | At or For the Three Months | |

| | | Ended March 31 | |

| | | 2007 | | 2006 | |

| Per Share Data | | | | | | | |

| Net Income | | $ | .34 | | $ | .46 | |

| Dividends Declared | | | .195 | | | .190 | |

| Book Value | | | 16.06 | | | 15.25 | |

| | | | | | | | |

| Significant Ratios | | | | | | | |

| Return on Average Assets (a) | | | .62 | % | | .87 | % |

| Return on Average Equity (a) | | | 8.43 | | | 12.12 | |

| Dividend Payout Ratio | | | 58.14 | | | 41.46 | |

| Average Equity to Average Assets | | | 7.68 | | | 7.17 | |

| | | | | | | | |

Note: (a) Annualized | | | | | | | |

RESULTS OF OPERATIONS

Overview

Consolidated net income for the first three months of 2007 totaled $2.06 million or $.34 per share, compared to $2.81 million or $.46 per share for the same period of 2006. The decrease in net income resulted from a one-time pre-tax charge of approximately $1.5 million ($1.0 million or $.17 per share, net of tax) associated with the transfer of investment securities from the available-for-sale category to the trading category, discussed in more detail below under the heading “FINANCIAL CONDITION - Investment Securities”. The loss was partially offset by increases in trust department income and insurance commissions and lower operating expenses. The Corporation experienced increased earnings on interest-earning assets, which was a direct result of the increases in the general level of interest rates that occurred during 2006 and continued into 2007 as well as increased average balances on our interest-earning assets. However, this increase in interest income was offset by increased interest expense paid on our interest-bearing liabilities due to rising interest rates and an increase in our average balances. Net interest income, for the first three months of 2007 decreased $.1 million when compared to the same period of 2006. Our net interest margin also declined from 3.57% in the first quarter of 2006 to 3.39% in the first quarter of 2007. The provision for loan losses was $ .2 million for the three months ended March 31, 2007, compared to a credit of $.08 million for the same period of 2006. Other operating income decreased $1.2 million during the first three months of 2007 when compared to the same period of 2006. The decrease resulted from the recognition of a $1.5 million loss incurred from the transfer of investment securities from the available-for-sale category to the trading category. This loss was offset by strong trust department earnings and insurance commissions. Operating expenses decreased $.3 million in the first three months of 2007 when compared to the first three months of 2006 due primarily to reduced personnel costs.

As a result of the one-time charge associated with our investment portfolio restructuring, performance ratios for the first three months of 2007 declined when compared to the same period of 2006. Annualized Returns on Average Assets (“ROAA”) were .62% and .87%, respectively. Annualized Returns on Average Equity (“ROAE”) were 8.43% and 12.12% for the three-month periods ending March 31, 2007 and 2006, respectively.

Net Interest Income

Net interest income is the largest source of operating revenue and is the difference between the interest earned on interest-earning assets and the interest expense incurred on interest-bearing liabilities. For analytical and discussion purposes, net interest income is adjusted to a fully taxable equivalent basis to facilitate performance comparisons between taxable and tax-exempt assets. Fully taxable equivalent income is determined by increasing tax-exempt income by an amount equal to the federal income taxes that would have been paid if this income were taxable at the statutorily applicable rate. The following table sets forth the average balances, net interest income and expense, and average yields and rates of our interest-earning assets and interest-bearing liabilities for the three months ended March 31, 2007 and 2006.

| | | For the Three Months Ended March 31 | |

| | | 2007 | | 2006 | |

| (Dollars in thousands) | | Average Balance | | Interest | | Average Rate | | Average Balance | | Interest | | Average Rate | |

Interest-Earning Assets: | | | | | | | | | | | | | |

| Loans | | $ | 961,908 | | $ | 17,892 | | | 7.44 | % | $ | 935,269 | | $ | 16,449 | | | 7.04 | % |

| Investment securities | | | 272,198 | | | 3,714 | | | 5.53 | | | 227,791 | | | 2,709 | | | 4.76 | |

| Other interest earning assets | | | 15,179 | | | 211 | | | 5.63 | | | 13,563 | | | 172 | | | 5.09 | |

Total earning assets | | $ | 1,249,285 | | | 21,817 | | | 7.08 | % | $ | 1,176,623 | | | 19,330 | | | 6.57 | % |

| | | | | | | | | | | | | | | | | | | | |

Interest-bearing liabilities | | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits | | $ | 876,926 | | | 8,325 | | | 3.85 | % | $ | 847,900 | | | 6,036 | | | 2.85 | % |

| Short-term borrowings | | | 92,365 | | | 963 | | | 4.23 | | | 103,207 | | | 1,020 | | | 3.95 | |

| Long-term borrowings | | | 165,669 | | | 2,065 | | | 5.05 | | | 160,173 | | | 1,784 | | | 4.46 | |

Total interest-bearing liabilities | | $ | 1,134,960 | | | 11,353 | | | 4.06 | % | $ | 1,111,280 | | | 8,840 | | | 3.18 | % |

| | | | | | | | | | | | | | | | | | | | |

| Net interest income and spread | | | | | $ | 10,464 | | | 3.02 | % | | | | $ | 10,490 | | | 3.39 | % |

| | | | | | | | | | | | | | | | | | | | |

| Net interest margin | | | | | | | | | 3.39 | % | | | | | | | | 3.57 | % |

| Note: Interest income and yields are presented on a fully taxable equivalent basis using a 35% tax rate. | | | |

Net interest income decreased $.03 million during the first three months of 2007 over the same period in 2006, due to a $2.49 million (13%) increase in interest income offset by a $2.52 million (28%) increase in interest expense. The increase in interest income resulted from an increase in average interest-earning assets of $72.7 million (6.2%) during the first three months of 2007 when compared to the first three months of 2006. This increase is primarily attributable to the growth that we experienced in our investment portfolio during the latter half of 2006 in connection with the investment leverage strategy implemented during the fourth quarter of 2006, which used brokered certificates of deposit to fund the purchase of higher yielding corporate bonds. The rising interest rate environment and the increase in the investment portfolio contributed to the increase in the average rate on our average earning assets of 51 basis points, from 6.57% for the first three months of 2006 to 7.08% for the first three months of 2007 (on a fully tax equivalent basis). Interest expense increased during the first three months of 2007 when compared to the same period of 2006 due to the higher interest rate environment, and an overall increase in average interest-bearing liabilities of $23.7 million. Deposits have increased in 2007 by approximately $29 million due to an increase in brokered certificates of deposit and a successful retail promotion of a nine month certificate of deposit. The combined effect of the increasing rate environment and the volume increases in our average interest-bearing liabilities resulted in an 88 basis point increase in the average rate paid on our average interest-bearing liabilities from 3.18% for the three months ended March 31, 2006 to 4.06% for the same period of 2007. The net result of the aforementioned factors was an 18 basis point decrease in the net interest margin during the first three months of 2007 to 3.39% from 3.57% when compared to the same time period of 2006. Management believes that the investment leverage strategy will result in increased earnings, but it will have a negative impact on our net interest margin.

Other Operating Income

Other operating income decreased $1.2 million during the first three months of 2007 when compared to the same period of 2006. The decrease resulted from the recognition of the aforementioned $1.5 million loss associated with the above mentioned transfer of investment securities from the available-for-sale category to the trading category. Excluding this one-time charge, other operating income would have increased $.4 million for the first three months of 2007 when compared to the same period of 2006. Trust department earnings was strong for the quarter as a result of successful business development efforts, resulting in increases in the average market value of assets under management. Insurance commissions also increased due to collection of contingency income. Contingency income is received from the insurance carriers based upon claims histories and varies from year to year. These increases were offset by a slight decrease in service charge income due to lower overdraft fees. The composition of operating income is illustrated below.

| | | Income as % of Total Other Operating Income | |

| | | Three Months ended | |

| | | March 31, 2007 | | March 31, 2006 | |

| Service charges | | | 54 | % | | 38 | % |

| Trust department | | | 43 | % | | 25 | % |

| Securities (losses)/gains | | | (64 | %) | | -- | % |

| Insurance commissions | | | 26 | % | | 11 | % |

| Bank owned life insurance | | | 11 | % | | 6 | % |

| Other income | | | 30 | % | | 20 | % |

| | | | 100 | % | | 100 | % |

Other Operating Expenses

Other operating expenses declined 3% for the first quarter of 2007 when compared to the same time periods of 2006. The decrease was due to decreased salaries and related benefits offset by a slight increase in occupancy and equipment expenses. However, the composition of operating expenses has remained consistent as illustrated below.

| | | Expense as % of Total Other Operating Expenses | |

| | | Three Months ended | |

| | | March 31, 2007 | | March 31, 2006 | |

| Salaries and employee benefits | | | 53 | % | | 55 | % |

| Occupancy, equipment and data processing | | | 19 | % | | 17 | % |

| Other | | | 28 | % | | 28 | % |

| | | | 100 | % | | 100 | % |

Applicable Income Taxes

The effective tax rate for the first three months of 2007 decreased to 32% from 33% for the first three months of 2006. This decrease reflects management’s strategy to restructure the composition of the investment portfolio to include more tax exempt municipal securities and additional purchases of bank owned life insurance, which is also tax-exempt.

FINANCIAL CONDITION

Balance Sheet Overview

Total assets were $1.37 billion at March 31, 2007, an increase of $19 million (1.4%) since December 31, 2006. During this time period, gross loans decreased $6 million, cash and interest-bearing deposits in banks increased $5 million and our investment portfolio increased $20 million. Total liabilities increased by approximately $17 million during the first three months of 2007, reflecting increases in total deposits of $29 million offset by decreases in short-term borrowings of $10 million and long-term borrowings of $2 million. The decrease in short-term borrowings reflects the growth in deposits and the investment of funds with correspondent banks.

Loan Portfolio

The following table presents the composition of our loan portfolio at the dates indicated:

| (Dollars in millions) | | March 31, 2007 | | December 31, 2006 | |

| Commercial | | $ | 417.6 | | | 43 | % | $ | 408.4 | | | 42 | % |

| Residential - Mortgage | | | 354.5 | | | 37 | | | 359.6 | | | 37 | |

| Installment | | | 170.3 | | | 18 | | | 181.6 | | | 19 | |

| Residential - Construction | | | 15.7 | | | 2 | | | 14.1 | | | 2 | |

| Total Loans | | $ | 958.1 | | | 100 | % | $ | 963.7 | | | 100 | % |

Comparing loans at March 31, 2007 to loans at December 31, 2006, our loan portfolio has decreased by $5.6 million (.6%). Continued growth in residential construction loans ($1.6 million) and growth in commercial loans ($9.2 million) was offset by a decline in the residential mortgage portfolio ($5.1 million) and a decline in our installment portfolio ($11.3 million). The decline in mortgage loan growth is a result of a flat interest rate yield curve and a consumer preference for locking in fixed rate mortgage loans. The Bank has opted to originate these fixed rate loans for the secondary mortgage market. The decrease in installment loans is primarily attributable to a decline in the indirect loan portfolio resulting from a slower than normal economy. The declines in these portfolios negated the growth in the commercial portfolio experienced thus far in 2007. At March 31, 2007, approximately 81% of the commercial loan portfolio was collateralized by real estate compared to 82% at December 31, 2006.

Risk Elements of Loan Portfolio

The following table presents the risk elements of our loan portfolio at the dates indicated. Management is not aware of any potential problem loans other than those listed in this table.

| (Dollars in millions) | | March 31, 2007 | | December 31, 2006 | |

| Non-accrual loans | | $ | 3,252 | | $ | 3,190 | |

| Accruing loans past due 90 days or more | | | 701 | | | 658 | |

Total | | $ | 3,953 | | $ | 3,848 | |

Total as a percentage of total loans | | | .41 | % | | .40 | % |

Allowance and Provision for Loan Losses

An allowance for loan losses is maintained to absorb losses resulting from the nonperformance of our loan portfolio. The allowance for loan losses is based on management’s continuing evaluation of the quality of the loan portfolio, assessment of current economic conditions, diversification and size of the portfolio, adequacy of collateral, past and anticipated loss experience, and the amount of non-performing loans.

We use the methodology outlined in the FFIEC December 2006 Statement of Policy on Allowance for Loan and Lease Losses. The starting point for this methodology is to segregate the loan portfolio into two pools, non-homogeneous (i.e., commercial) and homogeneous (i.e., consumer and residential mortgage) loans. Each loan pool is analyzed with general allowances and specific allocations being made as appropriate. For general allowances, the previous eight quarters of loss activity are used in the estimation of losses in the current portfolio. These historical loss amounts are modified by the following qualitative factors: levels of and trends in delinquency and non-accrual loans; trends in volumes and terms of loans; effects of changes in lending policies; experience, ability, and depth of management; national and local economic trends and conditions; and concentrations of credit in the determination of the general allowance. The qualitative factors are updated each quarter by information obtained from internal, regulatory, and governmental sources. The Watchlist represents loans, identified and closely monitored by management, which possess certain qualities or characteristics that may lead to collection and loss issues. Allocations are not made for loans that are cash secured, for the Small Business Administration and Farm Service Agency guaranteed portion of loans, or for loans that are sufficiently collateralized.

The allowance for loan losses is based on estimates, and actual losses may vary materially from current estimates. These estimates are reviewed quarterly, and as adjustments, either positive or negative, become necessary a corresponding increase or decrease is made in the provision for loan losses. The methodology used to determine the adequacy of the allowance for loan losses is consistent with prior years.

The following table presents a summary of the activity in the allowance for loan losses for the three months ended March 31 (dollars in thousands):

| | | 2007 | | 2006 | |

| Balance, January 1 | | $ | 6,530 | | $ | 6,416 | |

| Gross charge offs | | | (471 | ) | | (274 | ) |

| Recoveries | | | 121 | | | 148 | |

| Net credit losses | | | (350 | ) | | (126 | ) |

| Provision/(credit) for loan losses | | | 163 | | | (77 | ) |

| Balance at end of period | | $ | 6,343 | | $ | 6,213 | |

| Allowance for Loan Losses to loans outstanding (as %) | | | .66 | % | | .65 | % |

Net charge-offs to average loans outstanding during the period, annualized (as %) | | | .15 | % | | .05 | % |

The allowance for loan losses decreased to $6.3 million at March 31, 2007, compared to $6.5 million at December 31, 2006. This decrease is the result of a decrease in the loan portfolio of $5.6 million during the first three months of 2007. Non-accrual loans have increased slightly to $3.3 million at March 31, 2007, compared to $3.2 million at December 31, 2006.

Net charge offs relating to the installment loan portfolio represent 53% of our total net charge-offs for the first three months of 2007. Generally, installment loans are charged off after they are 120 days contractually past due. The quality of the installment loan portfolio has improved, as loans past due 30 days or more were $1.9 million or 1.1% of the installment portfolio at March 31, 2007, compared to $3.3 million or 1.8% at December 31, 2006.

The provision for loan losses was $.2 million for the first three months of 2007, compared to a credit of $.08 million for the same period of 2006. As a result of the evaluation of the loan portfolio using the factors and methodology discussed previously, the allowance for loan losses decreased to $6.3 million at March 31, 2007, compared to $6.5 million at December 31, 2006. The decrease in the allowance for loan losses is due primarily to the $5.6 million decrease in the loan portfolio that has occurred since December 31, 2006. Management believes that the allowance at March 31, 2007 is adequate to provide for probable losses inherent in our loan portfolio.

Amounts that will be recorded for the provision for loan losses in future periods will depend upon trends in the loan balances, including the composition of the loan portfolio, changes in loan quality and loss experience trends, potential recoveries on previously charged-off loans and changes in other qualitative factors.

Investment Securities

In an April 13, 2007 press release, we announced our decision to early adopt Statement of Financial Accounting Standards No. 159 “The Fair Value Option for Financial Assets and Liabilities” (���SFAS 159”) and Statement of Financial Accounting Standards No. 157 “Fair Value Measurement” (“SFAS 157”), and presented financial information related to an associated restructuring of our investment portfolio. The decision to early adopt fair value accounting was made on a basis believed to be an appropriate interpretation of SFAS 159 at that time after consulting with our independent registered public accounting firm and was influenced by a desire to substantially change the economic position of our investment portfolio by shifting the anticipated cash flow of the investment portfolio (from maturing securities, amortizing securities and securities subject to call) from the short-term period of six months to three years into the intermediate term of three to eight years. Since that press release was issued, however, informal guidance has emerged that has created confusion as to the proper interpretation of these accounting statements and caused us to re-evaluate our initial intent to early adopt them for the selected investment securities. As a result of our re-evaluation, and considering the totality of the current circumstances, we decided to rescind our initial early adoption of SFAS 159 and SFAS 157. We nevertheless believe that our investment portfolio restructuring will provide long-term benefits to shareholders.

We were able to improve our portfolio by replacing certain securities with securities having a longer duration. To accomplish this, we transferred available-for-sale securities with a carrying value of $76.9 million at the beginning of the quarter to trading securities with the anticipation of selling the securities and replacing them with higher yielding investments. We determined that the securities earmarked for sale would, if retained, have subjected earnings to higher volatility in a declining interest rate environment. As a result of transferring these securities to the trading category and our decision to rescind SFAS 159 and SFAS 157, we recognized a pre-tax loss of approximately $1.5 million in earnings for the first quarter of 2007. We expect that this loss will be partially offset during the remainder of the year by an increase in investment income that we expect to recognize from the restructuring. On April 11, 2007, we sold $73 million of the securities held in trading at March 31, 2007. The securities sold had an average book yield of 4.28%. The proceeds from the sale of these securities were reinvested in securities having an average book yield of approximately 5.55%. The securities purchased included government agency bonds with a longer duration than those sold as well as tax-free municipal bonds. The longer duration bonds were purchased at a discount and better position the Corporation in a declining interest rate environment by protecting against premium and reinvestment risk. The municipal bonds assist in lowering our effective tax rate. Over the past couple of years, we have undertaken several strategies to protect against the risk of future investment cash flow being reinvested in a lower interest rate environment. The restructuring of our investment portfolio allowed us to rebalance the portfolio and restructure the maturity schedule of the portfolio to mitigate the effects of premium and call risk and to manage our future interest rate risk and effective tax yield. We expect the restructuring to result in an on-going stream of higher interest income for shareholders and to have a positive impact on our net interest margin.

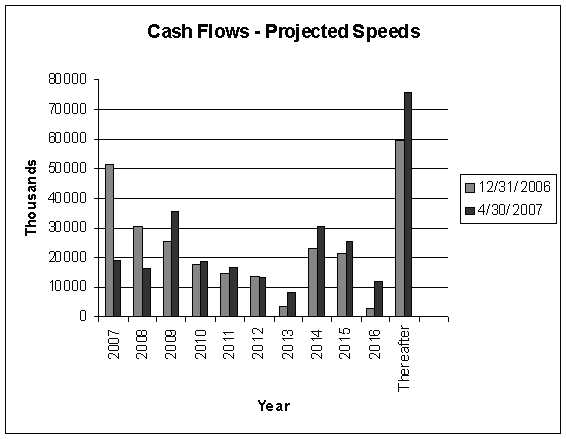

The following charts show the anticipated cash flow from maturities and expected payback of our total investment portfolio both before and after the investment portfolio restructuring.

Our entire investment securities portfolio is carried at fair value. Unrealized gains and losses on securities held-for-trading are reported in earnings at each reporting date. Unrealized gains and losses on securities available-for-sale are reflected in other comprehensive income. At March 31, 2007, the total cost basis of the investment portfolio was $284.6 million compared to a fair value of $283.4 million.

The following table presents the composition of our securities portfolio (fair values) at the dates indicated:

| (Dollars in millions) | | | March 31, 2007 | | | December 31, 2006 | |

| Securities Available-for-Sale: | | | | | | | | | | | | | |

| U.S. government and agencies | | $ | 69.6 | | | 24 | % | $ | 97.5 | | | 37 | % |

| Mortgage-backed securities | | | 6.2 | | | 2 | | | 50.9 | | | 19 | |

| Obligations of states and political subdivisions | | | 67.8 | | | 24 | | | 68.4 | | | 26 | |

| Corporate and other debt securities | | | 67.2 | | | 24 | | | 46.5 | | | 18 | |

| Securities Held-for-Trading: | | | | | | | | | | | | | |

| U.S. government and agencies | | | 31.0 | | | 11 | | | -- | | | -- | |

| Mortgage-backed securities | | | 41.6 | | | 15 | | | -- | | | -- | |

| Total Investment Securities | | $ | 283.4 | | | 100 | % | $ | 263.3 | | | 100 | % |

The increase in our investment portfolio since year-end 2006 is due to the purchase of $20 million in corporate bonds during the first quarter of 2007 as part of a leverage strategy implemented during the fourth quarter of 2006.

At March 31, 2007, the securities classified as available-for-sale included a net unrealized gain of $.2 million, which represents the difference between the fair value and amortized cost of securities in the portfolio. The comparable amount at December 31, 2006 was an unrealized loss of $1.2 million. The fair values of securities available-for-sale and securities held for trading will generally decrease whenever interest rates increase, and the fair values will typically increase in a declining rate environment.

Management does not believe that an unrealized loss on any individual security as of March 31, 2007 represents an other-than-temporary impairment. We have both the intent and ability to hold the securities available-for-sale presented in the preceding table for the period of time necessary to recover their amortized cost or until maturity.

Deposits

The following table presents the composition of our deposits as of the dates indicated:

| (Dollars in millions) | | March 31, 2007 | | December 31, 2006 | |

| Non-interest-bearing demand deposits | | $ | 108.1 | | | 11 | % | $ | 106.6 | | | 11 | % |

| Interest-bearing demand deposits | | | 291.6 | | | 29 | | | 279.5 | | | 29 | |

| Savings deposits | | | 44.3 | | | 5 | | | 43.1 | | | 4 | |

| Time deposits less than $.1 | | | 232.9 | | | 23 | | | 236.8 | | | 24 | |

| Time deposits $.1 or more | | | 323.7 | | | 32 | | | 305.4 | | | 32 | |

| Total Deposits | | $ | 1,000.6 | | | 100 | % | $ | 971.4 | | | 100 | % |

Total deposits increased $29.2 million during the first three months of 2007 in comparison to deposits at December 31, 2006. The composition of deposits has not materially changed. We did increase brokered certificates of deposit to fund corporate bonds purchased as part of our investment leverage strategy during the first quarter of 2007.

Borrowed Funds

The following table presents the composition of our borrowings at the dates indicated:

| (Dollars in millions) | | March 31, 2007 | | December 31, 2006 | |

| | | | | | |

| FHLB short-term borrowings | | $ | 20.0 | | $ | 24.5 | |

| Securities sold under agreements to repurchase | | | 69.3 | | | 74.9 | |

| Total short-term borrowings | | $ | 89.3 | | $ | 99.4 | |

| | | | | | | | |

| FHLB advances | | $ | 128.6 | | $ | 130.4 | |

| Junior subordinated debt | | | 35.9 | | | 35.9 | |

| Total long-term borrowings | | $ | 164.5 | | $ | 166.3 | |

Total short-term borrowings decreased by approximately $10 million during the first three months of 2007, primarily as a result of a decline in municipal funds invested in our treasury management product and no overnight borrowings at March 31, 2007. Long-term borrowings decreased by $2 million during the same period.

Liquidity and Capital

We derive liquidity through increased customer deposits, maturities in or sale of the investment portfolio, loan repayments and income from earning assets. When deposits are not adequate to fund customer loan demand, liquidity needs can be met in the short-term funds markets through arrangements with our correspondent banks or through the purchase of brokered certificates of deposit. The Bank is also a member of the Federal Home Loan Bank of Atlanta, which provides another source of liquidity. As discussed in Note H to the consolidated financial statements presented elsewhere in this report, we may from time to time access capital markets and/or borrow funds from private investors to meet some of our liquidity needs. We actively manage our liquidity position through the Asset and Liability Management Committee of the Board of Directors. Monthly reviews by management and quarterly reviews by the committee under prescribed policies and procedures are designed to ensure that we will maintain adequate levels of available funds.

Management believes that we have adequate liquidity available to respond to current and anticipated liquidity demands and is unaware of any trends or demands, commitments, events or uncertainties that will materially affect our ability to maintain liquidity at satisfactory levels.

The following table presents our capital ratios at March 31, 2007:

| | | | | Required | | Required | |

| | | | | For Capital | | To Be | |

| | | | | Adequacy | | Well | |

| | | Actual | | Purposes | | Capitalized | |

| | | | | | | | |

| Total Capital (to risk-weighted assets) | | | 12.91 | % | | 8.00 | % | | 10.00 | % |

| Tier 1 Capital (to risk-weighted assets) | | | 11.80 | | | 4.00 | | | 6.00 | |

| Tier 1 Capital (to average assets) | | | 8.90 | | | 3.00 | | | 5.00 | |

At March 31, 2007, the Corporation was categorized as “well capitalized” under federal banking regulatory capital requirements.

The Corporation paid a cash dividend of $.195 per share on February 1, 2007. On March 21, 2007, the Board of Directors declared another dividend of an equal amount, to be paid on May 1, 2007 to shareholders of record as of April 16, 2007.

Contractual Obligations, Commitments and Off-Balance Sheet Arrangements

Loan commitments are made to accommodate the financial needs of our customers. Letters of credit commit us to make payments on behalf of customers when certain specified future events occur. The credit risks inherent in loan commitments and letters of credit are essentially the same as those involved in extending loans to customers, and these arrangements are subject to our normal credit policies. Loan commitments and letters of credit totaled $131.9 million and $7.2 million, respectively, at March 31, 2007, compared to $119.8 million and $7.2 million, respectively, at December 31, 2006. We are not a party to any other off-balance sheet arrangements. There have been no significant changes in contractual obligations since December 31, 2006.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

Our primary market risk is interest rate fluctuation and we have procedures in place to evaluate and mitigate this risk. This market risk and our procedures are described in our Annual Report on Form 10-K for the year ended December 31, 2006 under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operation - Interest Rate Sensitivity”. Management believes that no material changes in our market risks or in the procedures used to evaluate and mitigate these risks have occurred since December 31, 2006.

Item 4. Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934 with the SEC, such as this Quarterly Report, is recorded, processed, summarized and reported within the periods specified in those rules and forms, and that such information is accumulated and communicated to our management, including the Chief Executive Officer (“CEO”) and the Chief Financial Officer (“CFO”), as appropriate, to allow for timely decisions regarding required disclosure. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. These inherent limitations include the realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control. The design of any system of controls is also based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, controls may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate.

An evaluation of the effectiveness of these disclosure controls as of March 31, 2007 was carried out under the supervision and with the participation of Management, including the CEO and the CFO. Based on that evaluation, Management, including the CEO and the CFO, has concluded that our disclosure controls and procedures are, in fact, effective at the reasonable assurance level.

During the first quarter of 2007, there was no change in our internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Part II. OTHER INFORMATION

Item 1. Legal Proceedings

None.

Item 1A. Risk Factors

The risks and uncertainties to which our financial condition and operations are subject are discussed in detail in Item 1A of Part I of the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2006. Management does not believe that any material changes in our risk factors have occurred since they were last updated.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults upon Senior Securities

None.

Item 4. Submission of Matters to a Vote of Security Holders

None.

Item 5. Other Information

None.

Item 6. Exhibits

The exhibits filed or furnished with this quarterly report are listed in the Exhibit Index that follows the signatures, which index is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | |

| | FIRST UNITED CORPORATION |

|

|

|

| Date: May 14, 2007 | | /s/ William B. Grant |

| |

William B. Grant, Chairman of the Board and Chief Executive Officer |

| | |

| | | |

| | |

| Date May 14, 2007 | | /s/ Carissa L. Rodeheaver |

| |

Carissa L. Rodeheaver, Senior Vice-President and Chief Financial Officer |

| | |

EXHIBIT INDEX

| Exhibit | | Description |

| | | |

| 3.1 | | Amended and Restated Articles of Incorporation (incorporated by reference to Exhibit 3.1 of the Corporation's Quarterly Report on Form 10-Q for the period ended September 30, 1998) |

| | | |

| 3.2 | | Amended and Restated By-Laws (incorporated by reference to Exhibit 3(ii) of the Corporation's Annual Report on Form 10-K for the year ended December 31, 1997) |

| | | |

| 10.1 | | First United Bank & Trust Amended and Restated Supplemental Executive Retirement Plan(“SERP”) (incorporated by reference to Exhibit 10.4 of the Corporation’s Current Report on Form 8- K filed on February 21, 2007) |

| | | |

| | | |

| 10.2 | | Amended and Restated SERP Agreement with William B. Grant (incorporated by reference to Exhibit 10.5 of the Corporation’s Current Report on Form 8-K filed on February 21, 2007) |

| | | |

| 10.3 | | Form of Amended and Restated SERP Agreement with executive officers other than William B. Grant (incorporated by reference to Exhibit 10.6 of the Corporation’s Current Report on Form 8-K filed on February 21, 2007) |

| | | |

| 10.4 | | Form of Endorsement Split Dollar Agreement between the Bank and each of William B. Grant, Robert W. Kurtz, Jeannette R. Fitzwater, Phillip D. Frantz, Eugene D. Helbig, Jr., Steven M. Lantz, Robin M. Murray, Carissa L. Rodeheaver, and Frederick A. Thayer, IV (incorporated by reference to Exhibit 10.3 of the Corporation’s Quarterly Report on Form 10-Q for the period ended September 30, 2003) |

| | | |

| 10.5 | | First United Corporation Executive and Director Deferred Compensation Plan (incorporated by reference to Exhibit 10.10 of the Corporation’s Quarterly Report on Form 10-Q for the period ended September 30, 2003) |

| | | |

| 10.6 | | First United Corporation Change in Control Plan (incorporated by reference to Exhibit 10.1 of the Corporation’s Current Report on Form 8-K filed on February 21, 2007) |

| | | |

| 10.7 | | Change in Control Severance Plan Agreement with William B. Grant (incorporated by reference to Exhibit 10.2 the Corporation’s Current Report on Form 8-K filed on February 21, 2007) |

| | | |

| 10.8 | | Form of Change in Control Severance Plan Agreement with executive officers other than William B. Grant (incorporated by reference to Exhibit 10.3 the Corporation’s Current Report on Form 8-K filed on February 21, 2007) |

| | | |

| 10.9 | | First United Corporation Omnibus Equity Compensation Plan (incorporated by reference to Appendix B of the Corporation’s 2007 definitive proxy statement filed on March 23, 2007) |

| | | |

| 31.1 | | Certifications of the CEO pursuant to Section 302 of the Sarbanes-Oxley Act (filed herewith) |

| | | |

| 31.2 | | Certifications of the CFO pursuant to Section 302 of the Sarbanes-Oxley Act (filed herewith) |

| | | |

| 32.1 | | Certification of the CEO pursuant to Section 906 of the Sarbanes-Oxley Act (furnished herewith) |

| | | |

| 32.2 | | Certification of the CFO pursuant to Section 906 of the Sarbanes-Oxley Act (furnished herewith) |