Exhibit 99.1

SCBT 2006 annual report

As outlined in this annual report, SCBT’s “Golden Rules” describe what is at... ‘the heart of SCBT’ - a commitment to each and every customer and employee to do what is right. Our employees are committed to providing service that is second to none, and to performing at a high level for our shareholders, customers, and each other. • Operating 45 branches statewide • Entered the Charleston market • Opened three full-service branches in the Columbia area • Earnings per share increased 11% • Loans grew $225 million, up 15% to $1.8 billion • Deposits grew $233 million, up 16% to $1.7 billion • South Carolina Bank and Trust of the Piedmont celebrated its 10th anniversary - Robert R. Hill, Jr., President and CEO, SCBT Financial Corporation 2006 Highlights INSIDE FRONT COVER Group shot of some of SCBT’s dedicated employees, Orangeburg, SC 1 How can we make your day?

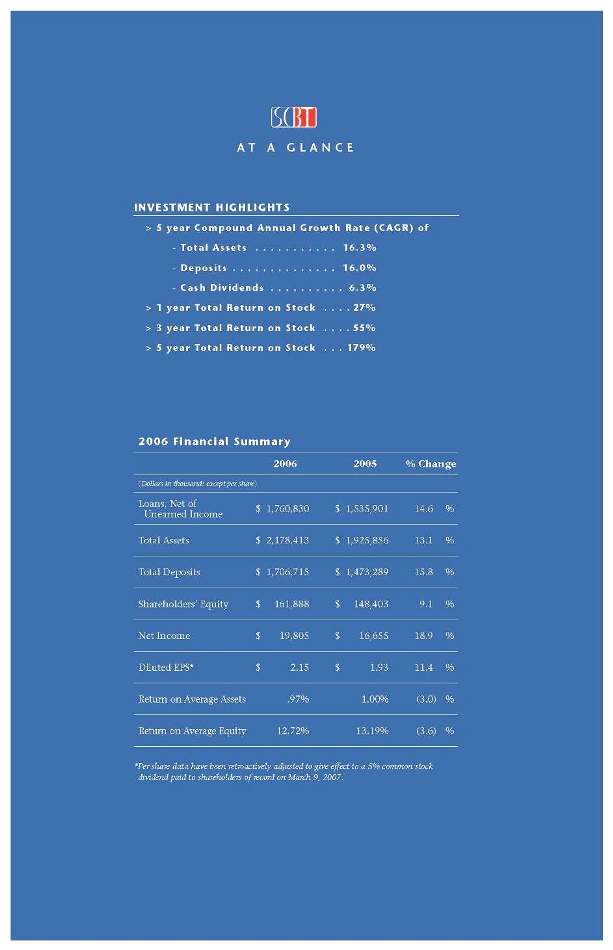

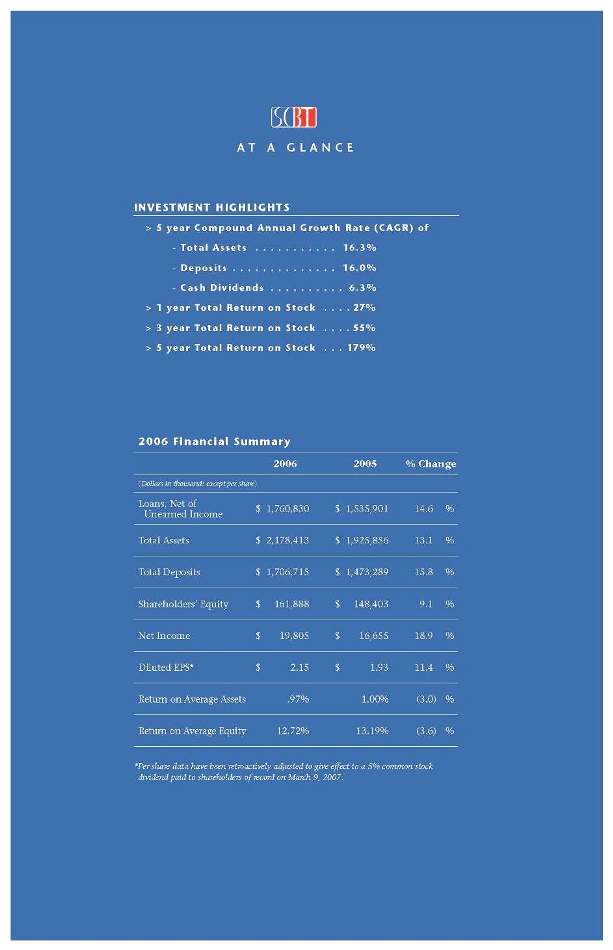

SCBT at a glance A T A G L A N C E INVESTMENT HIGHLIGHTS > 5 year Compound Annual Growth Rate (CAGR) of - Total Assets . . . . . . . . . . . 16.3% - Deposits . . . . . . . . . . . . . . 16.0% - Cash Dividends . . . . . . . . . . 6.3% > 1 year Total Return on Stock . . . . 27% > 3 year Total Return on Stock . . . . 55% > 5 year Total Return on Stock . . . 179% 2006 Financial Summary 2006 2005 % Change (Dollars in thousands except per share) Loans, Net of Unearned Income $ 1,760,830 $ 1,535,901 14.6 % Total Assets $ 2,178,413 $ 1,925,856 13.1 % Total Deposits $ 1,706,715 $ 1,473,289 15.8 % Shareholders’ Equity $ 161,888 $ 148,403 9.1 % Net Income $ 19,805 $ 16,655 18.9 % Diluted EPS* $ 2.15 $ 1.93 11.4 % Return on Average Assets .97% 1.00% (3.0) % Return on Average Equity 12.72% 13.19% (3.6) % *Per share data have been retroactively adjusted to give effect to a 5% common stock dividend paid to shareholders of record on March 9, 2007.

DEAR SHAREHOLDERS, CUSTOMERS, and FRIENDS, Robert R. Horger Chairman of the Board SCBT Financial Corporation Robert R. Hill, Jr. President and CEO SCBT Financial Corporation in Charleston for future growth and expansion. Our Columbia operations also made major strides as this region expanded with new offi ces in Lexington, Irmo, and Forest Acres. SCBT of the Piedmont opened new offices in Fort Mill and Indian Land. These investments will help our company continue to produce signifi cant growth for years to come. We also consolidated SunBank into SCBT, and we will open a full-service Myrtle Beach offi ce early in 2007. Our existing branches and support staff continued to provide service at the highest levels while increasing market share and controlling costs. These are the main reasons we were able to make substantial growth investments for the future, while reducing our average effi ciency ratio from 66% to 65%. We are very pleased to report that 2006 was another record year for our company. The SCBT team produced the best ever results in a year that presented more economic and interest rate related challenges than we have seen in recent history. During 2006, we began to close in on some of the objectives we set for our company years ago. We have made major strides over the last few years in achieving our goal of operating statewide. In 2006, we were very fortunate to attract a very talented group of bankers in Charleston. This highly respected team has made amazing progress in nine months by producing $49 million in loans and $35 million in deposits. We continue to be very excited about the opportunities

Some members of our support staff are featured in this year’s report. The SCBT support team’s effort and the performance of the existing offi ces have been extraordinary and have been primary drivers of our success. SCBT’s performance in 2006 was exceptional in several respects. Our credit quality remained strong, our bankers produced signifi cant growth in loans and deposits, and the number of new customers increased at a rapid rate. Our earnings performance also continued to be strong as we produced net income growth of 19%. We measure our success by our soundness, profi tability, and growth. 2006 was a success on all fronts. Again, we attribute these achievements to having talented bankers who provide high levels of service. Our growth plans for the future revolve around continuing to attract highly talented bankers, supporting them with a great place to work, and empowering them so they can provide the highest service levels. We will also continue to look for opportunities inside and outside of South Carolina where we feel an opportunity exists to provide a community banking culture with the right team of bankers who share our core values. In 2007, we will continue to focus on our team and customers. As the marketplace and many other banks continue to have turbulence resulting from acquisitions and other distractions, we plan to be opportunistic in adding additional talented bankers to a great team and continuing to invest in the future of our company. We will also focus on continuing to fi nd ways to operate more effi ciently to reduce our effi ciency ratio to 62% over time. Operating effi ciently is critical as our industry faces the ongoing challenges of a fl at yield curve and the potential for increased credit costs. We will also focus on ensuring that the investments we have made in prior years are performing at acceptable levels. $1.63 $1.73 $1.64 $1.93 $2.15 02 03 04 05 06 Earnings Per Share (diluted) $863 $939 $1,153 $1,536 $1,761 02 03 04 05 06 Loans (at year end, excluding loans held for sale, in millions)

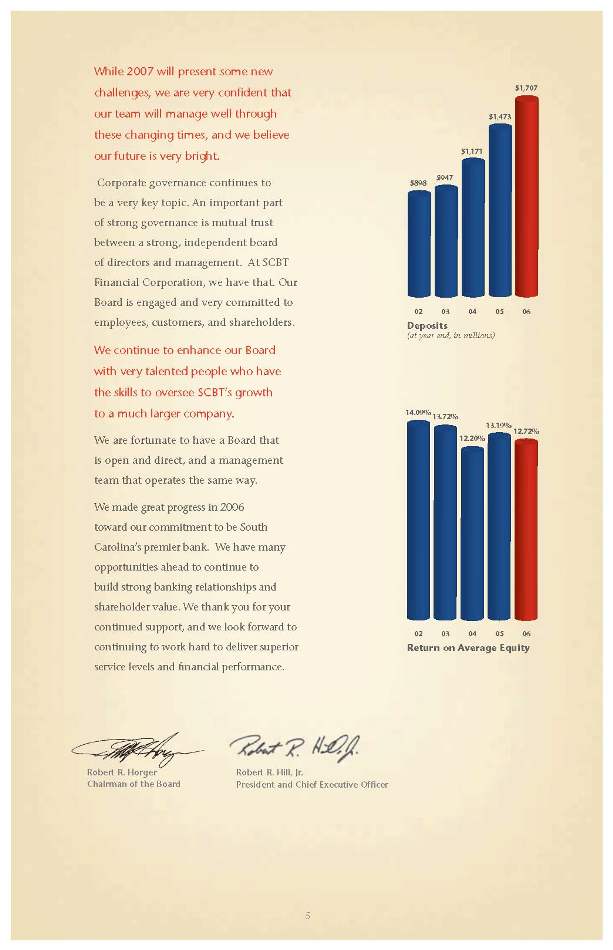

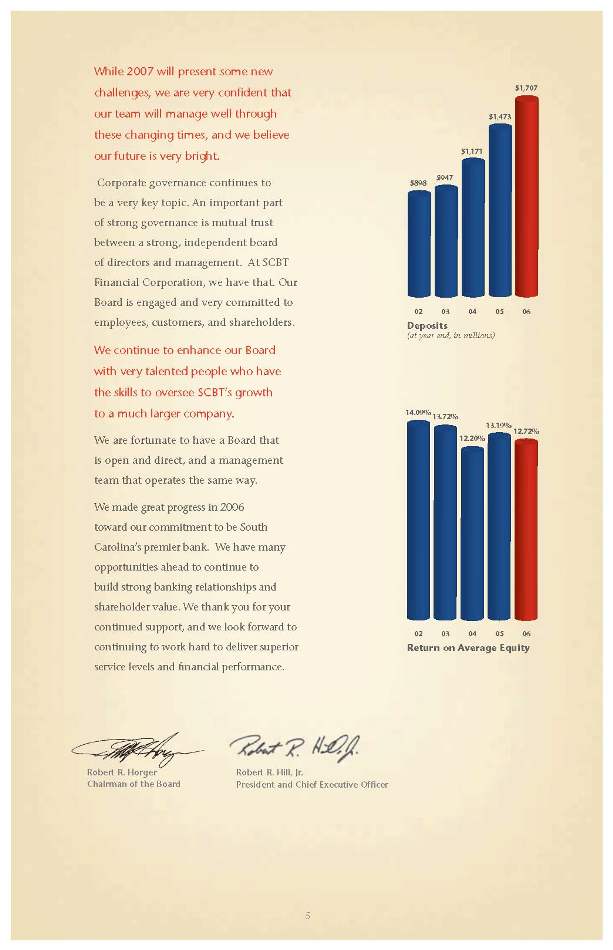

While 2007 will present some new challenges, we are very confi dent that our team will manage well through these changing times, and we believe our future is very bright. Corporate governance continues to be a very key topic. An important part of strong governance is mutual trust between a strong, independent board of directors and management. At SCBT Financial Corporation, we have that. Our Board is engaged and very committed to employees, customers, and shareholders. We continue to enhance our Board with very talented people who have the skills to oversee SCBT’s growth to a much larger company. We are fortunate to have a Board that is open and direct, and a management team that operates the same way. We made great progress in 2006 toward our commitment to be South Carolina’s premier bank. We have many opportunities ahead to continue to build strong banking relationships and shareholder value. We thank you for your continued support, and we look forward to continuing to work hard to deliver superior service levels and fi nancial performance. Robert R. Horger Chairman of the Board Robert R. Hill, Jr. President and Chief Executive Offi cer $898 $947 $1,171 $1,473 $1,707 02 03 04 05 06 Deposits (at year end, in millions) 14.09%13.72% 12.20% 13.19% 12.72% 02 03 04 05 06 Return on Average Equity

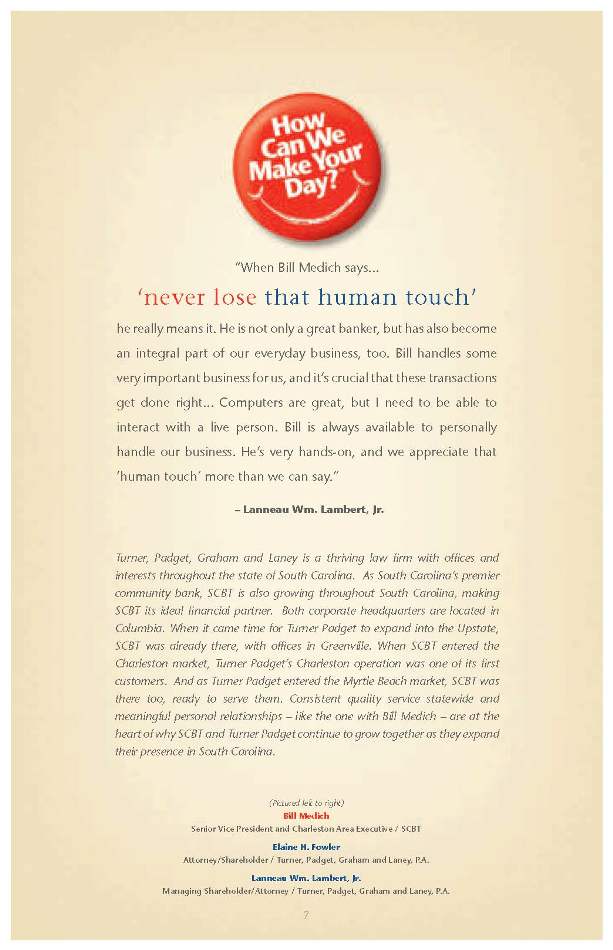

Turner, Padget, Graham and Laney is a thriving law fi rm with offi ces and interests throughout the state of South Carolina. As South Carolina’s premier community bank, SCBT is also growing throughout South Carolina, making SCBT its ideal fi nancial partner. Both corporate headquarters are located in Columbia. When it came time for Turner Padget to expand into the Upstate, SCBT was already there, with offi ces in Greenville. When SCBT entered the Charleston market, Turner Padget’s Charleston operation was one of its fi rst customers. And as Turner Padget entered the Myrtle Beach market, SCBT was there too, ready to serve them. Consistent quality service statewide and meaningful personal relationships - like the one with Bill Medich - are at the heart of why SCBT and Turner Padget continue to grow together as they expand their presence in South Carolina. - Lanneau Wm. Lambert, Jr. “When Bill Medich says... ‘never lose that human touch’ he really means it. He is not only a great banker, but has also become an integral part of our everyday business, too. Bill handles some very important business for us, and it’s crucial that these transactions get done right... Computers are great, but I need to be able to interact with a live person. Bill is always available to personally handle our business. He’s very hands-on, and we appreciate that ‘human touch’ more than we can say.” (Pictured left to right) Bill Medich Senior Vice President and Charleston Area Executive / SCBT Elaine H. Fowler Attorney/Shareholder / Turner, Padget, Graham and Laney, P.A. Lanneau Wm. Lambert, Jr. Managing Shareholder/Attorney / Turner, Padget, Graham and Laney, P.A.

“I really do think that if you looked up ‘customer service’ in the dictionary, you’d fi nd a smiling picture of Jane Brissette. Jane believes that... ‘banker’s hours are 24/7’ and that’s pretty much the way we see it, too. Jane does whatever it takes to maximize our interaction with SCBT, and if there’s something I need, I just pick up the phone and call her... No matter what time of day or night; Jane answers.” - Dr. Edward Catalano, M.D. On the day of a crucial business endeavor for Professional Pathology Services, it was imperative that essential documents get fi nalized before the midnight deadline to save a signifi cant tax advantage. As the end of the business day approached, the accountants and attorneys began leaving with the package still incomplete. Fearing the transaction might fail and result in a large tax exposure, Ed called Jane to discuss his practice’s potential loss. She put his fears to rest by staying past 11:00 p.m. to work out the fi nal document details, just in the nick of time. (Pictured left to right) Jane C. Brissette Senior Vice President and Private Banker / SCBT Dr. Edward Catalano, M.D. Professional Pathology Services, Inc.

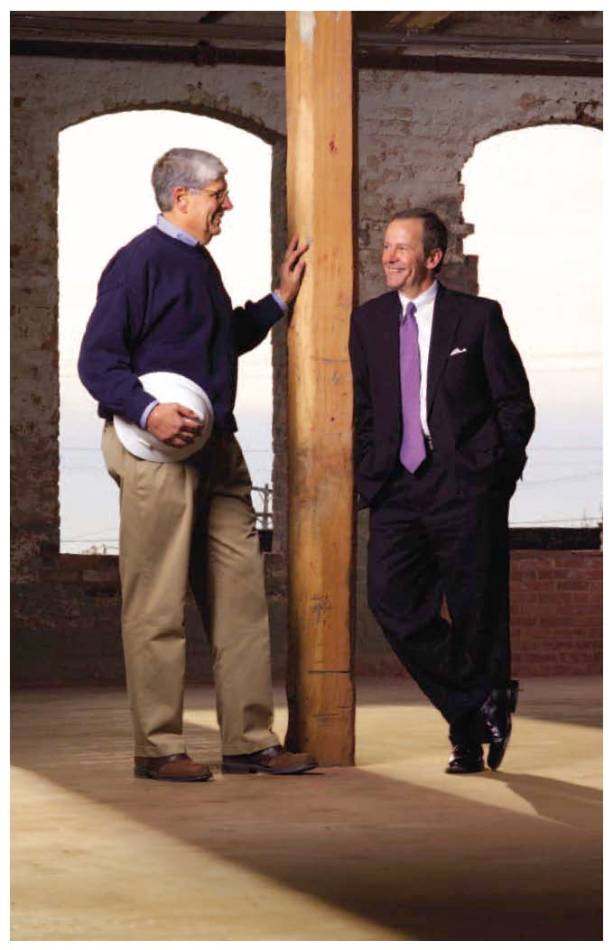

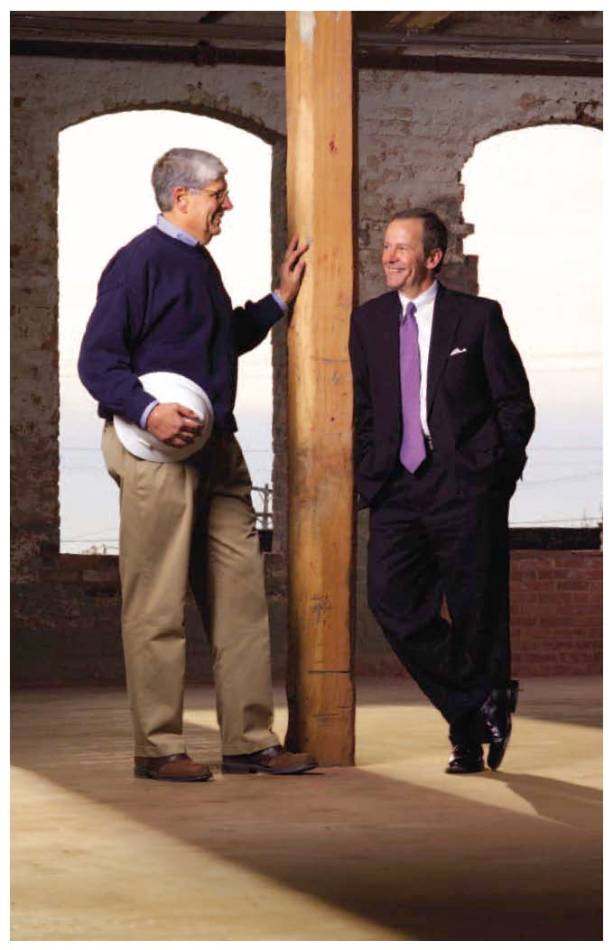

“I have built my career on being innovative and taking risks, and Tom Camp and SCBT are the best that I’ve seen when it comes to working with our team. Tom is a gifted thinker, and when he says to be creative and... ‘think outside the box’ what he really means is think outside, inside, underneath, above, below and all around the box. SCBT has empowered Tom to use his good judgment and creativity to help make my goals a reality, and I appreciate his willingness to be bold and courageous with my business.” - Gary Williams Gary Williams had a vision to turn a vacant and delapidated historical cotton factory into a state-of-the-art business complex in Rock Hill, SC. When Gary needed help navigating the ins-and-outs of a complex transaction to qualify for the available commercial tax credits, he called Tom Camp. Tom and his SCBT teammates studied the intricacies involved in the renovation of this historical site and found a way to turn Gary’s vision into a reality. (Pictured left to right) Gary Williams CEO / Williams & Fudge, Inc. Thomas S. Camp President and Chief Executive Officer / SCBT of the Piedmont

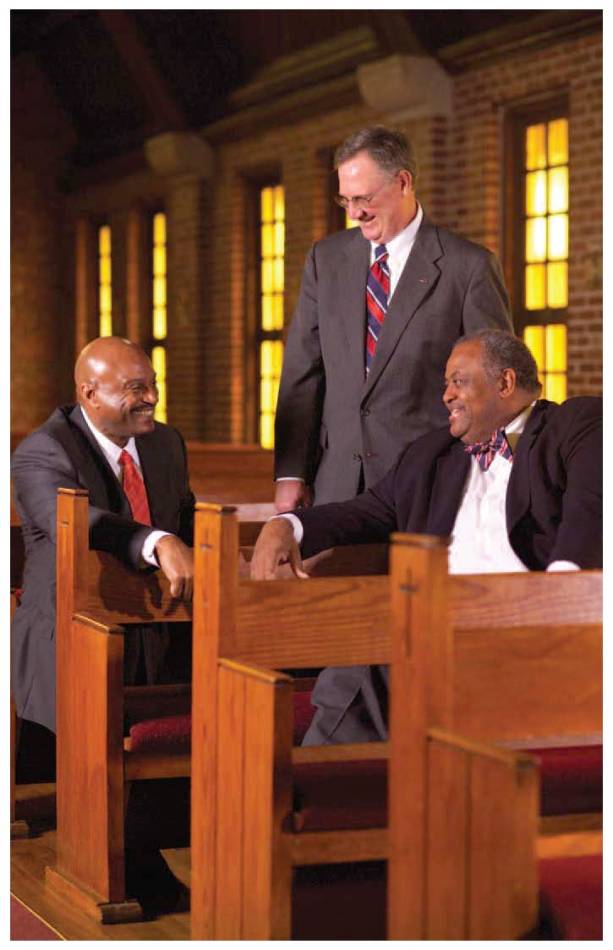

- Dr. Lee E. Monroe “Dane Murray and Nate Barber are great assets to Voorhees College. The SCBT team is incredibly helpful, and the advice they offer me and my colleagues is invaluable to our philanthropic initiatives. They believe that... ‘we’re all in this together’ and that’s how they are able to embrace the good things we are trying to accomplish in the town of Denmark. SCBT not only understands our goals, they are committed to seeing them succeed. Dane and Nate will serve as invaluable mentors as we begin to focus on Bamberg County.” When Voorhees College purchased 45 laptop computers for local elementary students this year, Dane Murray and Nate Barber helped walk them through the process of getting funds. Voorhees also sought advice from SCBT as they worked through Denmark’s Master Plan, including new housing and technology upgrades throughout the town. (Pictured left to right) Nathaniel Barber CRA/Community Development Offi cer / SCBT Dane H. Murray Senior Executive Vice President / SCBT Dr. Lee E. Monroe President / Voorhees College

FAMILY FUN ON THE GRAND STRAND Sydney Presley tries to catch the $100 bill in the SCBT Money Machine and one of our youngest SCBT customers enjoys Family Fun Day during the Grand Reopening of our Murrells Inlet office. < LEXINGTON COUNTY Our two new Lexington County locations opened de novo and currently have over $12 million in deposits and over $20 million in loans in less than a year. Pictured below are Brent Mackie, City Executive and Terry Roof, owner of Roof Basket Works. SERVING FIVE NEW COMMUNITIES SCBT opened fi ve new offi ces statewide during the year. The photo to the right is the Offi cial Ribbon Cutting Ceremony for the new Forest Drive offi ce in the Midlands Region. This region includes two of South Carolina’s fastest growing counties. A PENNY SAVED IS A PENNY EARNED John Pollok, SCBT’s Chief Operating Offi cer conducts a unique program targeted to elementary schools, which teaches children responsible saving habits at an early age. During 2006, over 1,800 students attended presentations with Pollok and Trusty, SCBT’s mascot, which is the state dog of South Carolina - the Boykin Spaniel. Pictured here is one of the second grade classes at Hyatt Park Elementary School in Richland School District 1.

SOUPER BOWL ’06 “What makes the Souper Bowl of Caring a good fit for SCBT is that funds raised are donated to charities in the local communities,” said Robert R. Hill, Jr., President and CEO of SCBT. “This way, 100 percent of the funds stay in the communities in which they were raised.” “I am so proud of our employees,” Hill added. “Their efforts have raised a bank-wide total of $36,263.34 for this worthwhile effort.” < BAR•B•QUE ON LADY’S ISLAND Heather Burnett and Jean Fowlkes served up BBQ and slaw sandwiches at their Annual July Customer Appreciation Day, which included a visit from Trusty in his “How Can We Make Your Day” VW. > > WE’RE #1 As the number one SCBT Souper Bowl Team, the Walterboro Jeffries offi ce won the corporate match of $5,000 for their charities. Team members Lee Petrolawicz, Paula Dantzler, Chastity Ginn and Deborah Barnes are pictured here preparing food bags at Edgewood Baptist Church. A GREAT DAY FOR A PARADE Stephanie Bost and Heather Burnett engage the crowd, while being driven by Mortgage Banker Doug Jacobs during the Beaufort Water Festival Parade. Since August of 1999, SCBT has grown to number three in market share in fast growing Beaufort County.

SCBT FINANCIAL CORPORATION / Summary of Operations Years Ended December 31, (Dollars in thousands) 2006 2005 2004 2003 2002 Interest income $ 131,647 $ 94,293 $ 67,913 $ 64,854 $ 67,324 Interest expense 54,281 28,710 14,643 14,622 18,752 Net interest income 77,366 65,583 53,270 50,232 48,572 Provision for loan losses 5,268 4,907 4,332 2,345 3,227 Net interest income after provision for loan losses 72,098 60,676 48,938 47,887 45,345 Noninterest income 26,709 23,855 22,650 22,915 17,848 Noninterest expense 68,718 60,053 51,135 48,715 42,567 Income before provision for income taxes 30,089 24,478 20,453 22,087 20,626 Provision for income taxes 10,284 7,823 6,437 7,301 6,792 Net income $ 19,805 $ 16,655 $ 14,016 $ 14,786 $ 13,834 TOTAL RETURN PERFORMANCE Index Value SCBT Financial Corporation NASDAQ Composite SNL Southeast Bank Index 50 100 150 200 250 300 06 05 04 03 02 01 16 The performance graph above compares SCBT’s cumulative total return over the most recent fi ve-year period with the NASDAQ Composite and the SNL Southeast Bank Index, a banking industry performance index for the southeastern United States. Returns are shown on a total return basis, assuming the reinvestment of dividends and a beginning stock index value of 100 per share. The value of SCBT’s stock as shown in the graph is based on published prices for transactions in SCBT’s stock. Source: SNL Financial LC, Charlottesville, VA ©2007

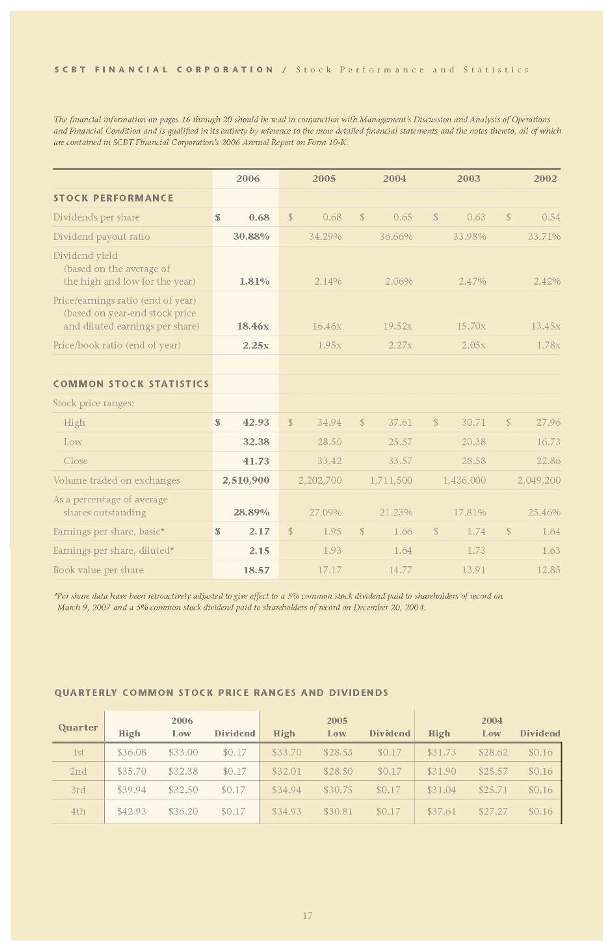

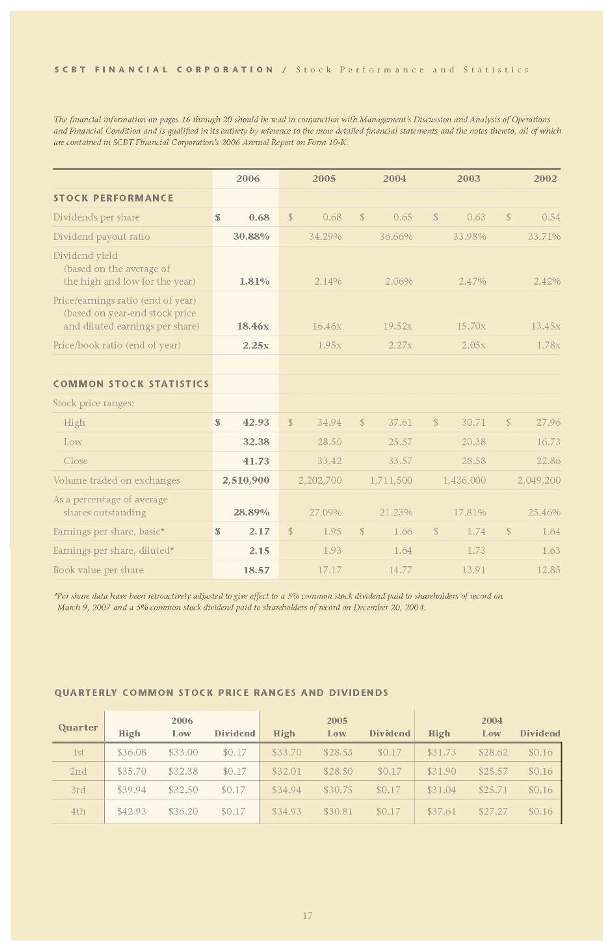

The financial information on pages 16 through 20 should be read in conjunction with Management’s Discussion and Analysis of Operations and Financial Condition and is qualifi ed in its entirety by reference to the more detailed fi nancial statements and the notes thereto, all of which are contained in SCBT Financial Corporation’s 2006 Annual Report on Form 10-K. 2006 2005 2004 2003 2002 STOCK PERFORMANCE Dividends per share $ 0.68 $ 0.68 $ 0.65 $ 0.63 $ 0.54 Dividend payout ratio 30.88% 34.29% 36.66% 33.98% 33.71% Dividend yield (based on the average of the high and low for the year) 1.81% 2.14% 2.06% 2.47% 2.42% Price/earnings ratio (end of year) (based on year-end stock price and diluted earnings per share) 18.46x 16.46x 19.52x 15.70x 13.45x Price/book ratio (end of year) 2.25x 1.95x 2.27x 2.05x 1.78x COMMON STOCK STATISTICS Stock price ranges: High $ 42.93 $ 34.94 $ 37.61 $ 30.71 $ 27.96 Low 32.38 28.50 25.57 20.38 16.73 Close 41.73 33.42 33.57 28.58 22.86 Volume traded on exchanges 2,510,900 2,202,700 1,711,500 1,436,000 2,049,200 As a percentage of average shares outstanding 28.89% 27.09% 21.23% 17.81% 25.46% Earnings per share, basic* $ 2.17 $ 1.95 $ 1.66 $ 1.74 $ 1.64 Earnings per share, diluted* 2.15 1.93 1.64 1.73 1.63 Book value per share 18.57 17.17 14.77 13.91 12.85 *Per share data have been retroactively adjusted to give effect to a 5% common stock dividend paid to shareholders of record on March 9, 2007 and a 5% common stock dividend paid to shareholders of record on December 20, 2004. QUARTERLY COMMON STOCK PRICE RANGES AND DIVIDENDS Quarter 2006 High Low Dividend 2005 High Low Dividend 2004 High Low Dividend 1st $36.08 $33.00 $0.17 $33.70 $28.53 $0.17 $31.73 $28.62 $0.16 2nd $35.70 $32.38 $0.17 $32.01 $28.50 $0.17 $31.90 $25.57 $0.16 3rd $39.94 $32.50 $0.17 $34.94 $30.75 $0.17 $31.04 $25.71 $0.16 4th $42.93 $36.20 $0.17 $34.93 $30.81 $0.17 $37.61 $27.27 $0.16 SCBT FINANCIAL CORPORATION / Stock Performance and Statistics

SCBT FINANCIAL CORPORATION / Selected Consolidated Financial Data LOAN MIX CRE & Commercial Secured by Real Estate 42% Commercial & Industrial 12% Consumer 10% Consumer Real Estate 27% Equity Line 9% DEPOSIT MIX Time Deposits 46% Demand Deposits (NIBL) 15% NOW Accounts 16% Money Market 18% Savings 5% December 31, (Dollars in thousands) 2006 2005 2004 2003 2002 Assets $2,178,413 $ 1,925,856 $ 1,436,977 $ 1,197,692 $ 1,144,948 Loans, net of unearned income* 1,760,830 1,535,901 1,153,230 938,760 863,422 Investment securities 210,391 182,744 165,446 152,009 164,951 Deposits 1,706,715 1,473,289 1,171,313 947,399 898,163 Nondeposit borrowings 293,521 294,420 141,136 133,017 138,116 Shareholders’ equity 161,888 148,403 118,798 112,349 103,495 Number of locations 45 41 34 32 32 Full-time equivalent employees 634 590 513 514 480 SELECTED RATIOS Return on average equity 12.72% 13.19% 12.20% 13.72% 14.09% Return on average assets 0.97 1.00 1.05 1.23 1.28 Average equity as a percentage of average assets 7.59 7.56 8.65 9.00 9.05 ASSET QUALITY RATIOS Allowance for loan losses to period end loans 1.29% 1.30% 1.25% 1.25% 1.28% Allowance for loan losses to period end nonperforming loans 492.14 468.74 442.64 173.30 233.47 Nonperforming assets to period end loans and OREO 0.30 0.32 0.43 0.87 0.67 Nonperforming assets to period end total assets 0.24 0.24 0.35 0.88 0.51 Net charge-offs to average loans 0.16 0.11 0.15 0.19 0.25 *Excludes loans held for sale

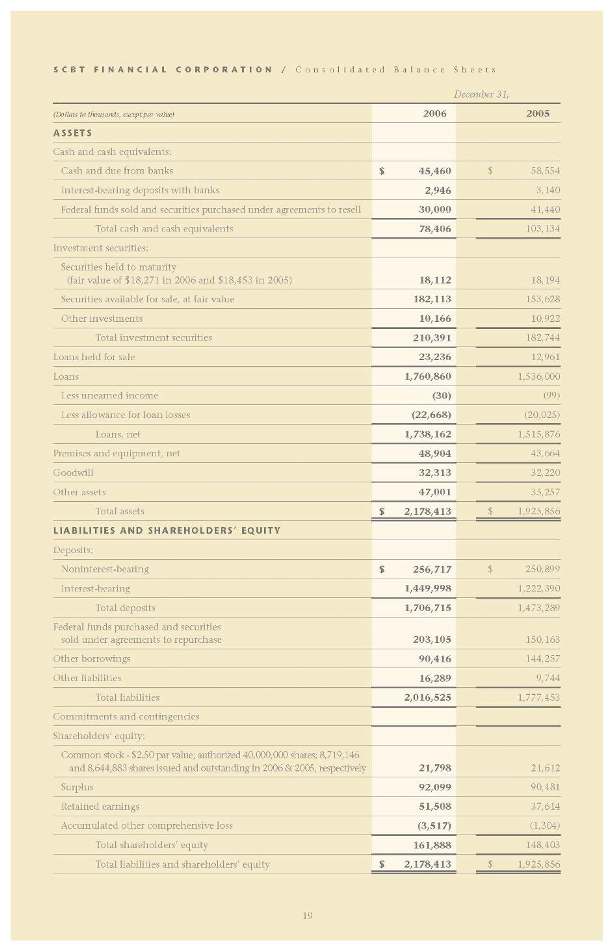

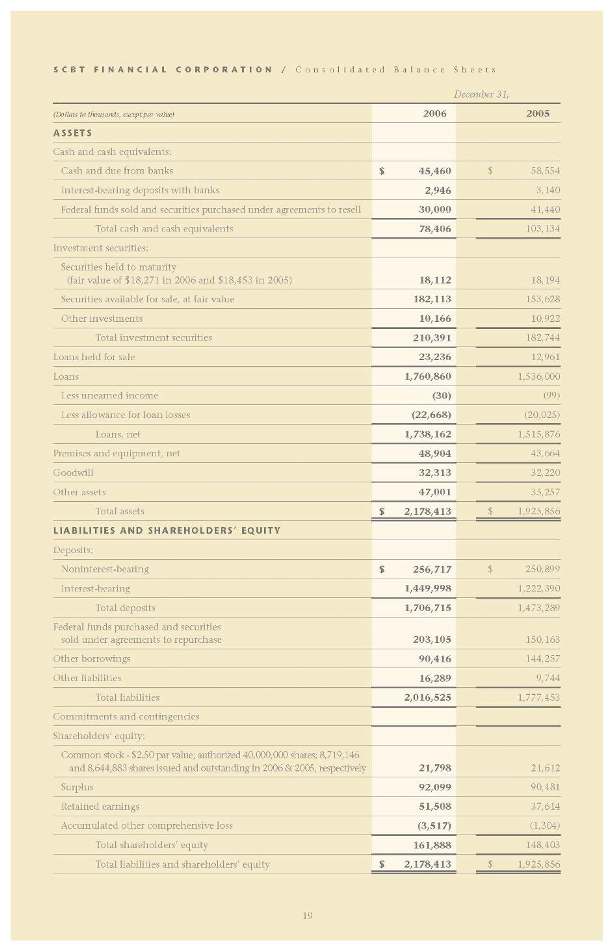

SCBT FINANCIAL CORPORATION / Consolidated Balance Sheets December 31, (Dollars in thousands, except par value) 2006 2005 ASSETS Cash and cash equivalents: Cash and due from banks $ 45,460 $ 58,554 Interest-bearing deposits with banks 2,946 3,140 Federal funds sold and securities purchased under agreements to resell 30,000 41,440 Total cash and cash equivalents 78,406 103,134 Investment securities: Securities held to maturity (fair value of $18,271 in 2006 and $18,453 in 2005) 18,112 18,194 Securities available for sale, at fair value 182,113 153,628 Other investments 10,166 10,922 Total investment securities 210,391 182,744 Loans held for sale 23,236 12,961 Loans 1,760,860 1,536,000 Less unearned income (30) (99) Less allowance for loan losses (22,668) (20,025) Loans, net 1,738,162 1,515,876 Premises and equipment, net 48,904 43,664 Goodwill 32,313 32,220 Other assets 47,001 35,257 Total assets $ 2,178,413 $ 1,925,856 LIABILITIES AND SHAREHOLDERS’ EQUITY Deposits: Noninterest-bearing $ 256,717 $ 250,899 Interest-bearing 1,449,998 1,222,390 Total deposits 1,706,715 1,473,289 Federal funds purchased and securities sold under agreements to repurchase 203,105 150,163 Other borrowings 90,416 144,257 Other liabilities 16,289 9,744 Total liabilities 2,016,525 1,777,453 Commitments and contingencies Shareholders’ equity: Common stock - $2.50 par value; authorized 40,000,000 shares; 8,719,146 and 8,644,883 shares issued and outstanding in 2006 & 2005, respectively 21,798 21,612 Surplus 92,099 90,481 Retained earnings 51,508 37,614 Accumulated other comprehensive loss (3,517) (1,304) Total shareholders’ equity 161,888 148,403 Total liabilities and shareholders’ equity $ 2,178,413 $ 1,925,856

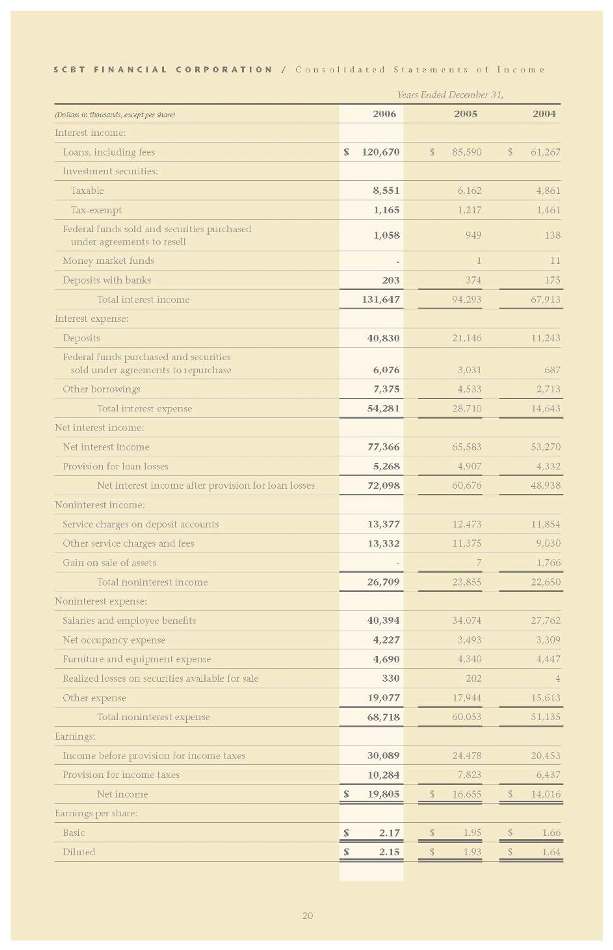

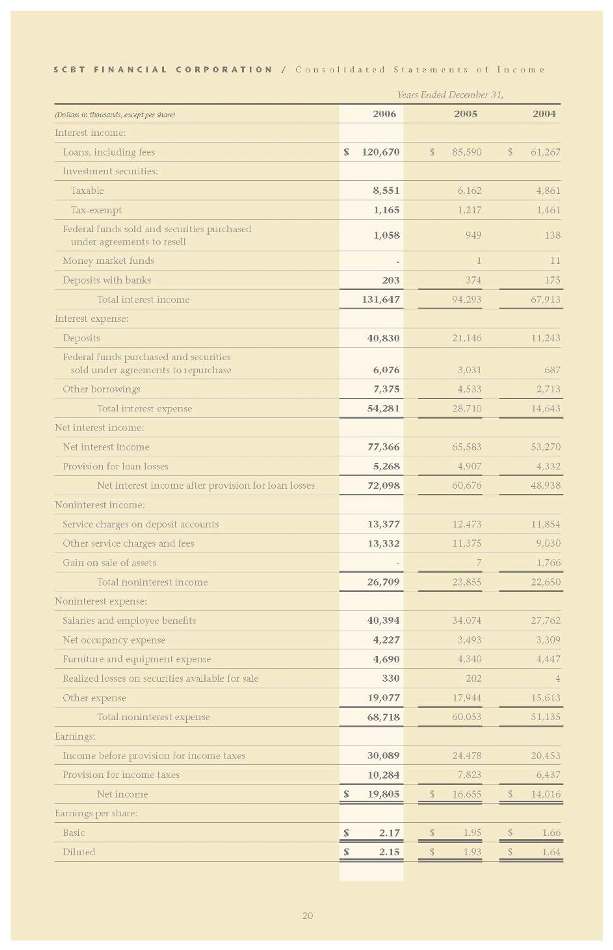

SCBT FINANCIAL CORPORATION / Consolidated Statements of Income Years Ended December 31, (Dollars in thousands, except per share) 2006 2005 2004 Interest income: Loans, including fees $ 120,670 $ 85,590 $ 61,267 Investment securities: Taxable 8,551 6,162 4,861 Tax-exempt 1,165 1,217 1,461 Federal funds sold and securities purchased under agreements to resell 1,058 949 138 Money market funds - 1 11 Deposits with banks 203 374 175 Total interest income 131,647 94,293 67,913 Interest expense: Deposits 40,830 21,146 11,243 Federal funds purchased and securities sold under agreements to repurchase 6,076 3,031 687 Other borrowings 7,375 4,533 2,713 Total interest expense 54,281 28,710 14,643 Net interest income: Net interest income 77,366 65,583 53,270 Provision for loan losses 5,268 4,907 4,332 Net interest income after provision for loan losses 72,098 60,676 48,938 Noninterest income: Service charges on deposit accounts 13,377 12,473 11,854 Other service charges and fees 13,332 11,375 9,030 Gain on sale of assets - 7 1,766 Total noninterest income 26,709 23,855 22,650 Noninterest expense: Salaries and employee benefi ts 40,394 34,074 27,762 Net occupancy expense 4,227 3,493 3,309 Furniture and equipment expense 4,690 4,340 4,447 Realized losses on securities available for sale 330 202 4 Other expense 19,077 17,944 15,613 Total noninterest expense 68,718 60,053 51,135 Earnings: Income before provision for income taxes 30,089 24,478 20,453 Provision for income taxes 10,284 7,823 6,437 Net income $ 19,805 $ 16,655 $ 14,016 Earnings per share: Basic $ 2.17 $ 1.95 $ 1.66 Diluted $ 2.15 $ 1.93 $ 1.64

SCBT FINANCIAL CORPORATION / Board of Directors Standing, left to right: Luther J. Battiste, III* Partner and Attorney Johnson, Toal & Battiste, PA Columbia and Orangeburg, SC Ralph W. Norman, Jr. President Warren Norman Co., Inc. Rock Hill, SC Dwight W. Frierson* Vice Chairman of the Board Vice President and General Manager Coca-Cola Bottling Company Orangeburg, SC J.W. Williamson, III* President J.W. Williamson Ginnery, Inc. Denmark, SC Robert R. Hill, Jr.* President and Chief Executive Officer South Carolina Bank and Trust Columbia, SC Robert R. Horger* Chairman of the Board Attorney Horger, Barnwell & Reid Orangeburg, SC A. Dewall Waters* Partner/Owner A.D. Waters Enterprises, LLC Orangeburg, SC Susie H. VanHuss, Ph.D.* Executive Director University of South Carolina Foundations Columbia, SC Colden R. Battey, Jr.* Partner and Attorney Harvey & Battey, PA Beaufort, SC Harry M. Mims, Jr.* President J.F. Cleckley & Company Orangeburg, SC Jimmy E. Addison* Senior Vice President and Chief Financial Offi cer SCANA Corporation Columbia, SC Caine Halter* President Coldwell Banker Commercial Caine Greenville, SC Seated, left to right: Cathy Cox Yeadon* Vice President, Human Resources Cox Industries, Inc. Orangeburg, SC Dalton B. Floyd, Jr.* Attorney and Owner The Floyd Law Firm, PC Surfside Beach, SC Thomas E. Suggs* President and Chief Executive Offi cer Keenan & Suggs, Inc. Columbia, SC M. Oswald Fogle* President and Chief Executive Offi cer Decolam, Inc. Orangeburg, SC Not pictured: James W. Roquemore* Chief Executive Officer Patten Seed Company, Inc. General Manager Super-Sod/Carolina Orangeburg, SC *Also serves on South Carolina Bank and Trust Board of Directors

SCBT FINANCIAL CORPORATION / EXECUTIVE MANAGEMENT TEAM Standing, left to right: Dane H. Murray Senior Executive Vice President Retail Banking Manager and Division Head Lowcountry and Orangeburg Regions Joe E. Burns Executive Vice President and Chief Credit Officer Robert R. Hill, Jr. President and Chief Executive Officer SCBT Financial Corporation Chief Executive Officer South Carolina Bank and Trust John C. Pollok Senior Executive Vice President and Chief Operating Officer John F. Windley President South Carolina Bank and Trust Seated, left to right: Thomas S. Camp President and Chief Executive Officer SCBT of the Piedmont Richard C. Mathis Executive Vice President and Chief Financial Officer Bernard N. Ackerman, CPA, PA Rock Hill, SC Vice Chairman of the Board and Secretary Bryant G. Barnes President and CEO Comporium Group Rock Hill, SC Thomas S. Camp President and Chief Executive Officer Rock Hill, SC Frank S. Campbell Retired President and CEO AME, Inc. Fort Mill, SC R. Wesley Hayes, Jr. Chairman of the Board Attorney Harrelson and Hayes Rock Hill, SC Ralph W. Norman, Jr. President Warren Norman Co., Inc. Rock Hill, SC John C. Pollok Senior Executive Vice President and Chief Operating Officer South Carolina Bank and Trust Columbia, SC Jolene Stepp-Tuttle President Homes of the Piedmont Rock Hill, SC Jay K. Shah, MD Carolina Cardiology Associates Rock Hill, SC Jacob D. Smith Retired President and CEO Smith Enterprises, Inc. Rock Hill, SC Frank M. Wilkerson, Jr. President Wilkerson Fuel Co., Inc. Rock Hill, SC SCBT of the PIEDMONT / Board of Directors

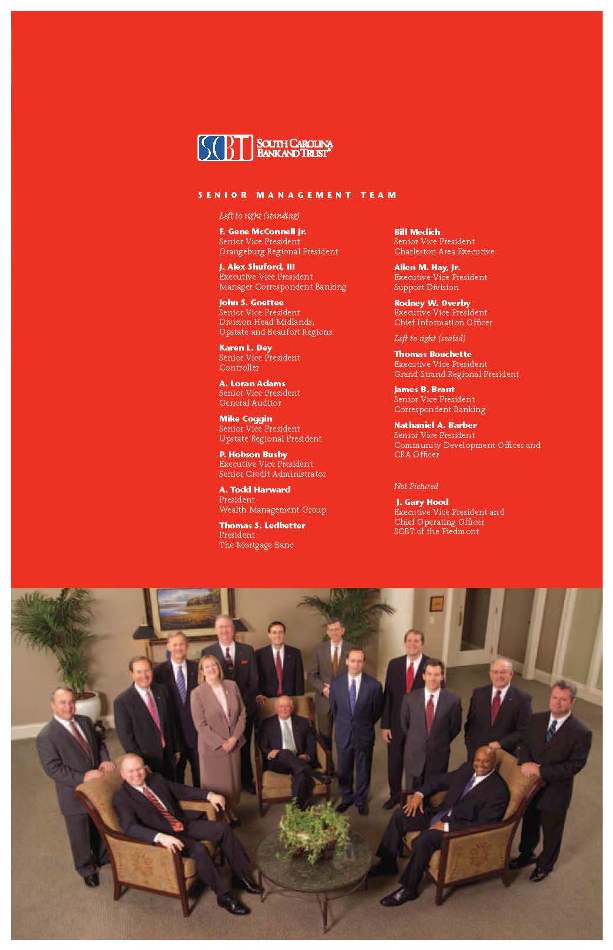

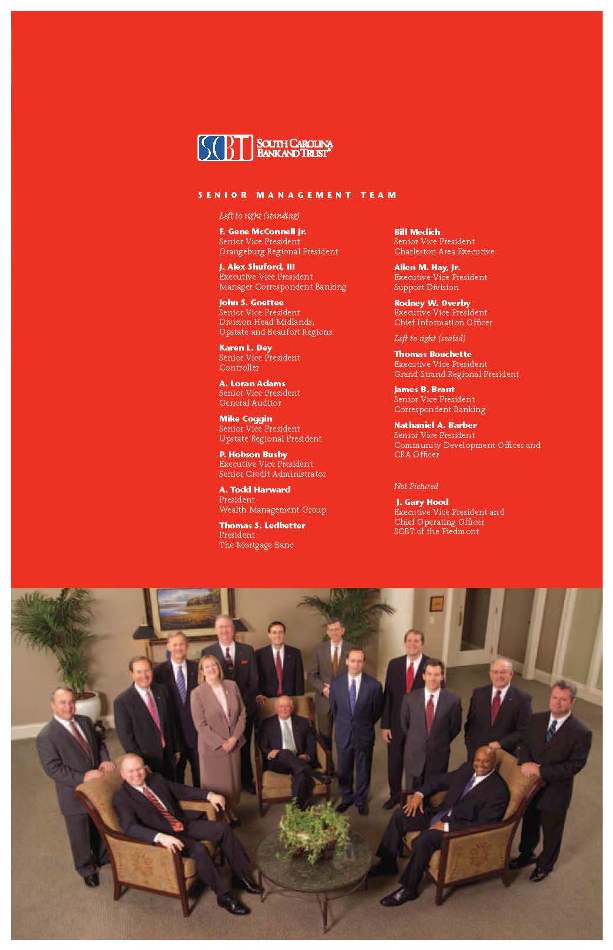

Left to right (standing) F. Gene McConnell Jr. Senior Vice President Orangeburg Regional President J. Alex Shuford, III Executive Vice President Manager Correspondent Banking John S. Goettee Senior Vice President Division Head Midlands, Upstate and Beaufort Regions Karen L. Dey Senior Vice President Controller A. Loran Adams Senior Vice President General Auditor Mike Coggin Senior Vice President Upstate Regional President P. Hobson Busby Executive Vice President Senior Credit Administrator A. Todd Harward President Wealth Management Group Thomas S. Ledbetter President The Mortgage Banc Bill Medich Senior Vice President Charleston Area Executive Allen M. Hay, Jr. Executive Vice President Support Division Rodney W. Overby Executive Vice President Chief Information Officer Left to right (seated) Thomas Bouchette Executive Vice President Grand Strand Regional President James B. Brant Senior Vice President Correspondent Banking Nathaniel A. Barber Senior Vice President Community Development Officer and CRA Officer Not Pictured J. Gary Hood Executive Vice President and Chief Operating Officer SCBT of the Piedmont SENIOR MANAGEMENT TEAM

ORANGEBURG Region Orangeburg 950 John C. Calhoun Drive Orangeburg, SC 29115 (803) 534-2175 Michael Weeks, Manager 2705 Old Edisto Drive Orangeburg, SC 29115 (803) 531-0540 (Drive Thru Only) 1255 St. Matthews Road Orangeburg, SC 29118 (803) 531-0520 Dianne Dukes, Manager 3025 St. Matthews Road Orangeburg, SC 29115 (803) 268-9452 Janet F. Fields, Manager Elloree 6512 Old No. 6 Highway Elloree, SC 29047 (803) 897-2121 Barbara Butler, Manager Santee 657 Bass Drive Santee, SC 29142 (803) 854-2451 Susie Sims, Manager LOWCOUNTRY Region St. George 5542 Memorial Boulevard St. George, SC 29477 (843) 563-2324 Gail Fralix, Manager Harleyville 122 West Main Street Harleyville, SC 29448 (843) 462-7687 Bruce Blanchard, Manager Ridgeland 10671 S. Jacob Smart Blvd. Ridgeland, SC 29936 (843) 726-5596 Marian Middleton, Manager Hardeeville 21979 Whyte Hardee Blvd. Hardeeville, SC 29927 (843) 784-3151 Sherry Floyd, Manager Moncks Corner 317 North Highway 52 Moncks Corner, SC 29461 (843) 761-8024 Vickie Walling, Manager Summerville 402-D North Main Street Summerville, SC 29483 (843) 873-7221 Bill Duke, City Executive Denmark 18587 Heritage Highway Denmark, SC 29042 (803) 793-3324 Al Matheny, Manager Bamberg 2770 Main Highway Bamberg, SC 29003 (803) 245-2416 Ronny Maxwell, Manager Norway 8403 Savannah Highway Norway, SC 29113 (803) 263-4295 Sue Watson, Manager Walterboro 520 North Jeffries Blvd. Walterboro, SC 29488 (843) 549-1553 Gloria Langdale, Manager 600 Robertson Boulevard Walterboro, SC 29488 (843) 549-1553 Cindy Hunt, Manager Florence 1600 West Palmetto Street Florence, SC 29501 (843) 673-9900 Evette Gamble, Manager Lake City 266 West Main Street Lake City, SC 29560 (843) 394-1417 Jo Etta Floyd, Manager BEAUFORT Region Beaufort 1121 Boundary Street Beaufort, SC 29901 (843) 521-5600 Daniel Bates, Manager Lady’s Island 184 Sea Island Parkway Lady’s Island, SC 29907 (843) 521-5660 Stephanie Bost, Manager Bluffton 1328 Fording Island Road Bluffton, SC 29910 (843) 837-2100 Chrissie Casas, Manager Hilton Head 81 Main Street Hilton Head, SC 29926 (843) 342-2100 Emily Provchy, Manager 5 Park Lane Hilton Head, SC 29928 (843) 842-4637 Lori Schmidt, Manager MIDLANDS Region Columbia 520 Gervais Street Columbia, SC 29201 (803) 771-2265 Tracy Young, Manager 2010 Clemson Road Columbia, SC 29229 (803) 788-7845 Gabe McMeekin, Manager 3920 Forest Drive Suite 100 Columbia, SC 29204 (803) 256-6501 Will White, Manager Cayce 1100 Knox Abbott Drive Cayce, SC 29033 (803) 739-0276 Chris Pricenor, Manager Lexington 5140 East Sunset Boulevard Lexington, SC 29072 (803) 951-3360 Brent Mackie, City Executive Irmo 945 Lake Murray Boulevard Suite G Irmo, SC 29063 (803) 407-9430 Brent Mackie, City Executive UPSTAT E Region Greenville 200 East Broad Street Suite 100 Greenville, SC 29601 (864) 250-4455 Sandy Elvington, Manager 3622 Pelham Road Greenville, SC 29615 (864) 254-9460 Carolyn Herbert, Manager 501 New Commerce Court Greenville, SC 29607 (864) 297-6333 Emily Sherman, Manager Simpsonville 1 Five Forks Plaza Simpsonville, SC 29681 (864) 234-3954 Lesley Pethel, Manager GRAND STRAND Region Murrells Inlet 4210 Highway 17 Bypass Murrells Inlet, SC 29576 (843) 357-7007 Leisa Sellers, Manager Georgetown 1134 North Fraser Street Georgetown, SC 29440 (843) 436-2265 Chuck Duke, Manager Myrtle Beach 1125 48th Avenue North Myrtle Beach, SC 29578 (843) 839-5009 (Loan Production Offi ce) CHARLESTON Region Charleston 304 Meeting Street Suite 200 Charleston, SC 29401 (843)853-6540 Ellen Williams, Manager 115 River Landing Drive Suite 102 Daniel Island, SC 29492 (843) 216-5994 (Loan Production Offi ce) S C B T of the Piedmont Fort Mill 808 East Tom Hall Street Fort Mill, SC 29715 (803) 548-6292 Sarah Adkins, Manager 817 Dave Gibson Boulevard Fort Mill, SC 29708 (803) 802-2040 Harvey Hawkins, Manager Indian Land 9789 Charlotte Highway Suite 100 Indian Land, SC 29715 (803) 802-2750 Anne Lambert, Manager Rock Hill 1274 East Main Street Rock Hill, SC 29730 (803) 329-5100 Daphne Chisholm, Manager 1127 Ebenezer Road Rock Hill, SC 29732 (803) 329-1222 Charles “Bo” Redmond, Manager York 801 East Liberty Street York, SC 29745 (803) 684-5554 Christina Dover, Manager SCBT FINANCIAL CORPORATION / Branches This information is current as of February 15, 2007.

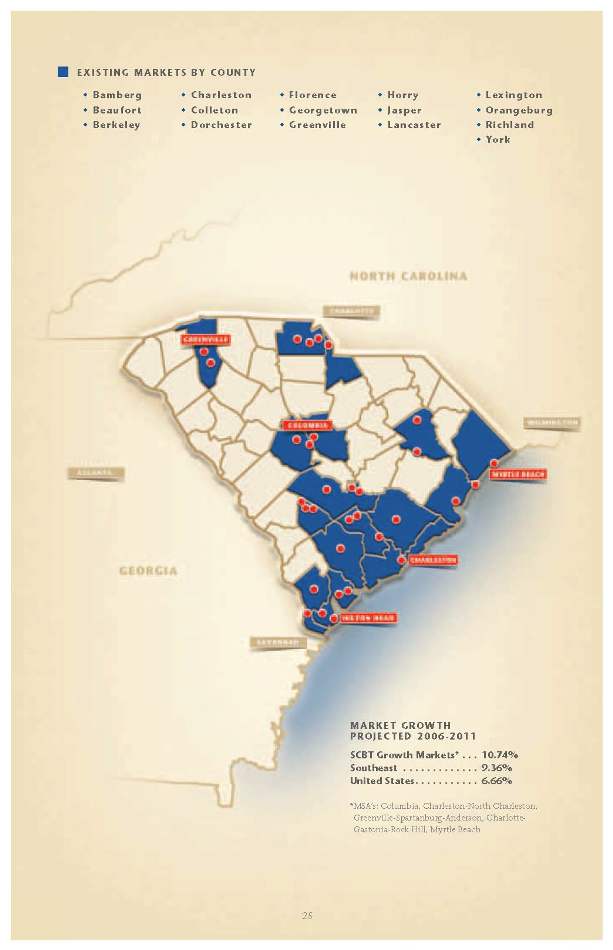

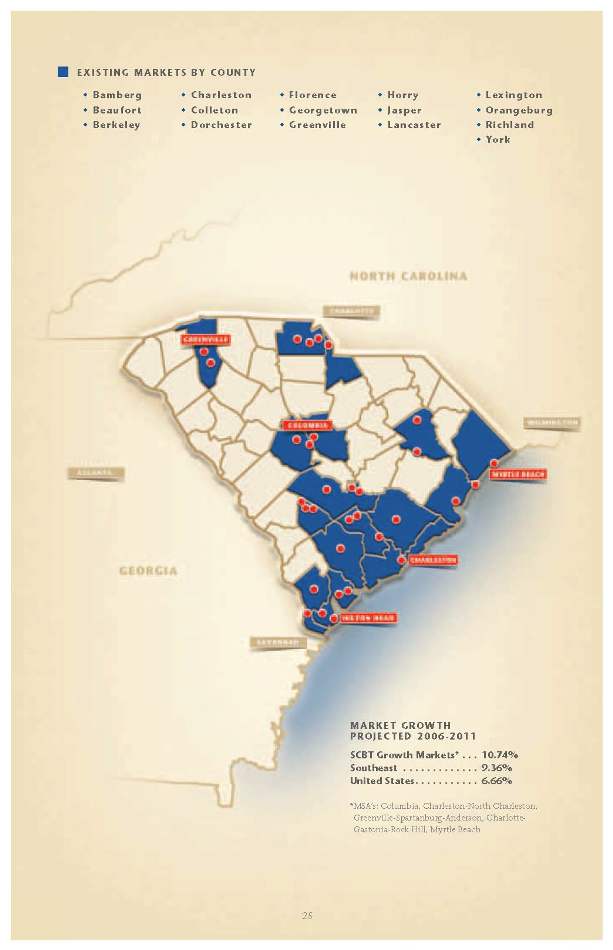

MARKET GROWTH PROJECTED 2006-2011 SCBT Growth Markets* . . . 10.74% Southeast . . . . . . . . . . . . . 9.36% United States . . . . . . . . . . . 6.66% *MSA’s: Columbia, Charleston-North Charleston, Greenville-Spartanburg-Anderson, Charlotte- Gastonia-Rock Hill, Myrtle Beach

General Office SCBT Financial Corporation 520 Gervais Street Columbia, SC 29201 www.SCBTonline.com Annual Meeting The Annual Meeting of Shareholders will be held at 2 p.m. on Tuesday, April 24, 2007 in the Dorchester-Jasper Room on the 2nd Floor, 520 Gervais Street in Columbia, South Carolina. Form 10-K and Other Information Copies of SCBT Financial Corporation’s Annual Report to the Securities and Exchange Commission on Form 10-K (excluding exhibits thereto), and other information may be obtained without charge by written request to: Karen L. Dey Controller SCBT Financial Corporation Post Offi ce Box 1030 Columbia, SC 29202 (803) 765-4621 Analyst Contact Richard C. Mathis Chief Financial Offi cer SCBT Financial Corporation Post Offi ce Box 1030 Columbia, SC 29202 (803) 765-4618 Stock Information The Company’s Common Stock is listed on the NASDAQ Global Select MarketSM under the trading symbol SCBT. www.SCBTonline.com CORPORATE INFORMATION