Exhibit 99.2

Building The Carolinas' Premier Community Bank Transaction Overview August 30, 2007

Additional Information about the Merger and Where to Find It SCBT will file a registration statement, a proxy statement/prospectus and other relevant documents concerning the proposed transaction with the Securities and Exchange Commission (the “SEC”). TSB shareholders are urged to read the registration statement and the proxy statement/prospectus when they become available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. You will be able to obtain a free copy of the proxy statement/prospectus, as well as other filings containing information about SCBT and TSB, at the SEC’s Internet site (http://www.sec.gov). Copies of the proxy statement/prospectus to be filed by SCBT and the other filings also can be obtained, when available and without charge, by directing a request to TSB Financial Corporation, 1057 Providence Road, Charlotte, North Carolina 28207, Attention: Jan H. Hollar, or to SCBT Financial Corporation, 520 Gervais Street, Columbia, South Carolina 29201, Attention: Richard C. Mathis, Executive Vice President and Chief Risk Officer.

Participants in the Plan of Merger CBT, TSB and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of TSB in connection with the merger. Information about the directors and executive officers of TSB and their ownership of TSB common stock is set forth in TSB’s most recent proxy statement as filed with the SEC, which is available at the SEC’s Internet site (http://www.sec.gov) and at TSB’s address in the preceding paragraph. Information about the directors and executive officers of SCBT is set forth in SCBT’s most recent proxy statement filed with the SEC and available at the SEC’s Internet site and from SCBT at the address set forth in the preceding paragraph. Additional information regarding the interests of these participants may be obtained by reading the proxy statement/prospectus regarding the proposed transaction when it becomes available.

Forward Looking Statements Statements contained in this presentation, which are not historical facts, are forwardlooking statements. In addition, SCBT Financial Corporation (SCBT) through its senior management or directors may from time to time make forward-looking public statements concerning matters herein. Such forward-looking statements are necessary estimates reflecting the best judgment of SCBT’s senior management or directors based upon current information and involve a number of risks and uncertainties. Certain factors which could affect the accuracy of such forward-looking statements are identified in the public filings made by SCBT with the Securities and Exchange Commission, and forward-looking statements contained in this presentation or in other public statements of SCBT or its senior management or directors should be considered in light of those factors. There can be no assurance that such factors or other factors will not affect the accuracy of such forward-looking statements.

Transaction Overview Consideration Mix: 939,372 shares of SCBT common stock issued Fixed exchange ratio: 0.993x $9.4 million in aggregate cash consideration (includes cash-out value of options) Approximately 85% stock / 15% cash (1) Based on consideration mix and SCBT’s 10-day average closing stock price of $36.25 as of August 29, 2007. Transaction Structure: Merger of TSB Financial Corporation into SCBT Financial Corporation The Scottish Bank to operate as a bank subsidiary Transaction Value: $35.74 blended price per share (1) $43.4 million in the aggregate Summary Terms Due Diligence: Completed Anticipated Closing: Q4’ 2007 Other Terms: Subject to TSB shareholder approval as well as customary regulatory approvals

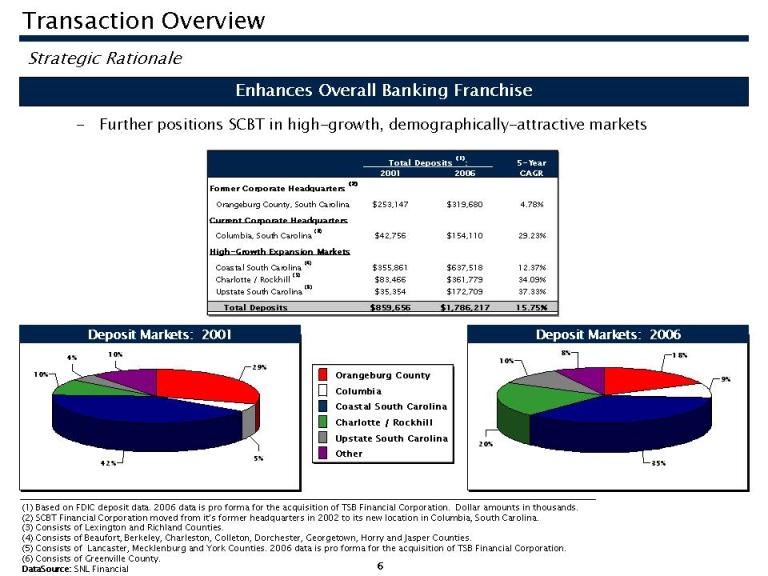

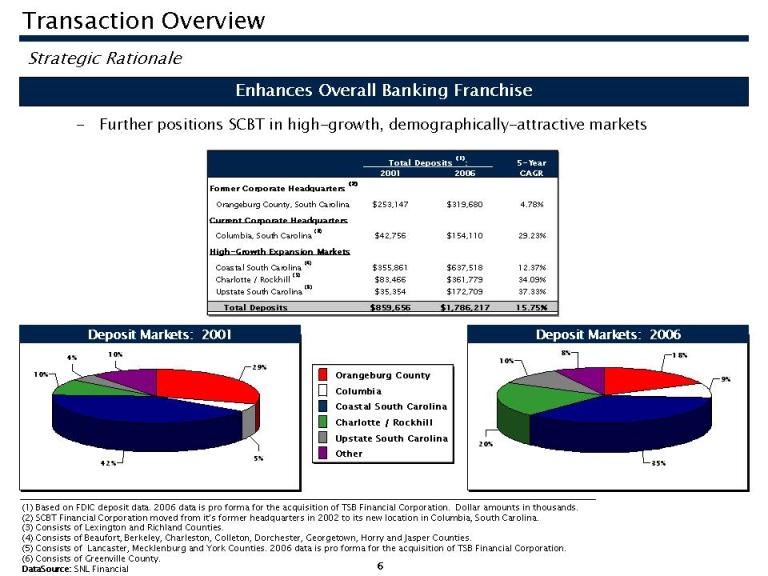

Transaction Overview Strategic Rationale Enhances Overall Banking Franchise - Further positions SCBT in high-growth, demographically-attractive markets (1) Based on FDIC deposit data. 2006 data is pro forma for the acquisition of TSB Financial Corporation. Dollar amounts in thousands. (2) SCBT Financial Corporation moved from it’s former headquarters in 2002 to its new location in Columbia, South Carolina. (3) Consists of Lexington and Richland Counties. (4) Consists of Beaufort, Berkeley, Charleston, Colleton, Dorchester, Georgetown, Horry and Jasper Counties. (5) Consists of Lancaster, Mecklenburg and York Counties. 2006 data is pro forma for the acquisition of TSB Financial Corporation. (6) Consists of Greenville County. DataSource: SNL Financial Total Deposits (1 ): 5-Year 2001 2006 CAGR Former Corporate Headquarters (2) Orangeburg County, South Carolina $253,147 $319,680 4.78% Current Corporate Headquarters Columbia, South Carolina (3) $42,756 $154,110 29.23% High-Growth Expansion Markets Coastal South Carolina (4) $355,861 $637,518 12.37% Charlotte / Rockhill (5) $83,466 $361,779 34.09% Upstate South Carolina (6) $35,354 $172,709 37.33% Total Deposits $859,656 $1,786,217 15.75% Deposit Markets: 2001 Deposit Markets: 2006 Orangeburg County Columbia Coastal South Carolina Charlotte / Rockhill Upstate South Carolina Other 10% 29% 5% 42% 10% 4% 10% 29% 5% 42% 10% 4% 10% 20% 35% 9% 18% 8% 10%

Transaction Overview Strategic Rationale Results in Top 10 Deposit Market Share in the Charlotte MSA - Population: 1.6 million; Total deposits: $94.0 billion - Historical population growth of 22% - approximately 2.5x the national average - 5th highest median household income in the Southeast Branch Map Deposit Market Share – Charlotte MSA (1) (1) FDIC data as of June 30, 2006 DataSource: SNL Financial, FDIC TSBC SCBT TSBC SCBT MSA: Charlotte Deposits: $93,953,456 2006 2005 Deposits Market Market 2006 Branch in Market Share Share Rank Institution Type Count ($000s) (%) (%) 1 Wachovia Corp. (NC) Bank 86 $60,486,030 64.38 62.03 2 Bank of America Corp. (NC) Bank 57 21,703,919 23.10 26.65 3 BB&T Corp. (NC) Bank 54 2,999,457 3.19 2.93 4 Fifth Third Bancorp (OH) Bank 34 2,229,037 2.37 2.32 5 SunTrust Banks Inc. (GA) Bank 35 1,239,512 1.32 1.37 6 Royal Bank of Canada Bank 18 1,116,922 1.19 0.87 7 First Citizens BancShares Inc. (NC) Bank 30 902,066 0.96 0.93 8 Pro Forma Company Bank 9 361,744 0.38 0.34 8 Citizens South Banking Corp. (NC) Thrift 10 336,583 0.36 0.35 9 American Community Bancshares (NC) Bank 10 318,877 0.34 0.32 10 First Trust Bank (NC) Bank 2 261,252 0.28 0.23 Top 10 Institutions 336 $91,593,655 97.49 98.00 11 SCBT Financial Corp. (SC) Bank 5 199,689 0.21 0.19 15 TSB Financial Corp. (NC) Bank

Transaction Overview Strategic Rationale North Carolina Banking Franchise Offers Significant Organic and Acquisitive Growth Potential - Only 5 banks under $10 Billion in Assets operate in both North and South Carolina (1) Note: Dollar values in thousands. (1) Includes SCBT Financial Corporation. (2) The “Big 4” consists of Bank of America Corporation, BB&T Corporation, SunTrust Banks, Inc. & Wachovia Corporation. North South Carolina Carolina Total Deposits ($B) $195,193 $59,153 % Controlled by "The Big 4" (2) 73.1% 44.9% Population 9,068,106 4,425,765 '00 - '07 Population Growth 12.7% 10.3% '07 - '12 Proj. Population Growth 8.9% 7.2% Median Household Income $49,687 $46,513 '00 - '07 Median HHI Growth 26.8% 25.3% '00 - '12 Proj. HHI Growth 17.5% 16.6%

Transaction Overview Strategic Rationale Significant Upside Potential to Scottish Bank’s Financial Performance - Cost savings opportunities: YTD efficiency ratio of 78.4% - Revenue synergies and cross-sale opportunities: YTD non-interest income / Avg. Assets of 0.34% - Higher legal-lending limit expected to positively effect commercial lending business - Repurchase loan participations: approximately $4.5 million as of June 30, 2007 (1) Publicly-traded commercial banks headquartered in North or South Carolina with total assets of $100 - $500 million Data Source: SNL Financial, Company filings Financial Comparison: YTD June 30, 2007 Results Scottish Bank SCBT NC & SC Peers (1) Net Loans / Assets 76.36% 78.36% 76.20% Net Interest Margin 3.38% 3.96% 3.72% Fees / Total Revenue 9.45% 27.27% 13.84% Noninterest Income / Avg. Assets 0.34% 1.35% 0.62% Efficiency Ratio 78.39% 67.69% 63.51% Noninterest Expense / Avg. Assets 2.83% 3.39% 2.60% Return on Average Assets 0.51% 0.98% 0.81% Return on Average Equity 6.51% 13.08% 8.46%

Transaction Overview Strategic Rationale Manageable Execution Risk - Market knowledge through existing presence in the Charlotte MSA - Due diligence completed - CEO and relationship managers to remain Pro Forma Financial Results - Long-term accretive as the Scottish Bank leverages the resources of SCBT Manageable

TSB Financial Corporation Established in 1998 Meaningful insider ownership: 26.4% - John Stedman, TSB’s CEO, is the largest shareholder with 7.5% ownership Currently operates four branches and one LPO in the Charlotte MSA - New South Park corporate headquarters expected to open in November 2007 Financial Summary – June 30, 2007 - Total Assets: $192.9 million (14.6% ’01-’06 CAGR) - Net Loans: $147.3 million (16.4% ’01-’06 CAGR) - Deposits: $159.0 million (15.4% ’01-’06 CAGR) - Shareholders’ Equity: $15.6 million (7.7% ’01-’06 CAGR) CorpoExecution Risk Pro Forma Financial Results Corporate Overview

1.3% 33.7% 16.7% 28.4% Noninterest Bear ing NOW, MMDA & Savings Time Deposits < $100,000 Time Deposits> $100,000 10.4% 1.5% 19.4% 24.8% 0.4% 43.6% 1-4 Family Multifamily Commercial Real Estate Construction & Development Commer cial & Industr ial Consumer 10.4% 1.5% 19.4% 24.8% 0.4% 43.6% 1-4 Family Multifamily Commercial Real Estate Construction & Development Commer cial & Industr ial Consumer Business Mix TSB Financial Corporation Loan Composition Deposit Mix Note: Financial data as of June 30, 2007.

SCBT Financial Corporation Third largest independent commercial bank headquartered in South Carolina Eighth largest commercial bank in South Carolina (1) Operates in 5 of the top 50 income and population growth MSA’s in the Southeastern United States (2) Mission: To be South Carolina’s premier community bank and a top-performing bank in the Southeast (1) Per FDIC data as of June 30, 2006 (2) SNL Financial

SCBT Financial Corporation Closing Price as of August 29, 2007 $37.25 YTD June 30, 2007 Earnings Per Share $1.17 June 30, 2007 Book Value $18.47 Price / Earnings 15.9x Market Capitalization as of August 29, 2007 $342.8 MM Listed on the NASDAQ Global Select Market At a Glance

SCBT Financial Corporation Robert R. Hill, Jr. Chief Executive Officer John C. Pollok Senior Executive Vice President and Chief Operating and Financial Officer Richard C. Mathis Executive Vice President and Chief Risk Officer SCBT Financial Corporation 520 Gervais Street Columbia, South Carolina 29201 803-771-2265 www.scbtonline.com Investor Contacts