- SSB Dashboard

- Financials

- Filings

- Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

10-K/A Filing

SouthState (SSB) 10-K/A2019 FY Annual report (amended)

Filed: 6 Mar 20, 5:26pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

Amendment No. 1

| |

☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2019 | |

☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to | |

Commission file number 001-12669

(Exact name of registrant as specified in its charter)

| |

South Carolina | 57-0799315 |

| |

520 Gervais Street Columbia, South Carolina | 29201 |

(800) 277-2175

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

| Trading Symbol |

| Name of each exchange on which registered: |

Common Stock, $2.50 par value | | SSB | | Nasdaq Global Select Market |

Securities registered pursuant to Section 12 (g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | |||

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ | Emerging growth company ☐ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒.

The aggregate market value of the voting stock of the registrant held by non-affiliates was $2,512,032,000 based on the closing sale price of $73.67 per share on June 30, 2019. For purposes of the foregoing calculation only, all directors and executive officers of the registrant have been deemed affiliates. The number of shares of common stock outstanding as of March 5, 2020 was 33,450,861.

Documents Incorporated by Reference

None.

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (“Amendment No. 1”) amends our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 (“Original Filing”), filed with the U.S. Securities and Exchange Commission (“SEC”) on February 21, 2020 (“Original Filing Date”). The sole purpose of this Amendment No. 1 is to include the information required by Items 10 through 14 of Part III of Form 10-K. This information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K, which permits the information in the above referenced items to be incorporated in the Form 10-K by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year-end. We are filing this amendment No. 1 to include Part III information in our Form 10-K because we will not file a definitive proxy statement containing such information within 120 days after the end of the fiscal year covered by the Original Filing. The reference on the cover of the Original Filing to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Filing is hereby deleted.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (“Exchange Act”), Part III, Items 10 through 14 and Part IV, Item 15 of the Original Filing are hereby amended and restated in their entirety. This Amendment No. 1 does not amend, modify, or otherwise update any other information in the Original Filing. Accordingly, this Amendment No. 1 should be read in conjunction with the Original Filing. In addition, this Amendment No. 1 does not reflect events that may have occurred subsequent to the Original Filing Date.

Pursuant to Rule 12b-15 under the Exchange Act, this Amendment No. 1 also contains new certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002, which are attached hereto. Because no financial statements are included in this Amendment No. 1 and this Amendment No. 1 does not contain or amend any disclosure with respect to Items 307 and 308 of Regulation S-K, paragraphs 3, 4, and 5 of the certifications have been omitted.

Unless otherwise indicated, references to “we,” “us,” “our,” “Company,” or “South State” mean South State Corporation and its subsidiaries, and references to “fiscal” mean the Company’s fiscal year ended December 31. References to the “parent company” mean South State Corporation.

2

South State Corporation

Index

| | ||||

|

| |

| Page |

|

| | | | | |

| | | | | |

| | 4 | | ||

| | 14 | | ||

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters(1) | | 48 | | |

| Certain Relationships and Related Transactions, and Director Independence(1) | | 50 | | |

| | 51 | | ||

| | | | | |

| | | | | |

| | 52 | | ||

| | | 57 | |

3

Part III

Item 10. Directors, Executive Officers and Corporate Governance.

The table below sets forth for each director’s name, age, when first elected and current term expiration, business experience for at least the past five years, and the qualifications that led to the conclusion that the individual should serve as a director.

| | | | | | | | | |

| | | | First | | Current | | | |

| | | | Elected | | Term | | Business Experience for the Past Five Years and | |

Name |

| Age |

| Director |

| Expires |

| Director Qualifications |

|

Robert R. Horger Chairman South State Bank Employee | | 69 | | 1991 | | 2022 | | Chairman of the Company and its wholly-owned banking subsidiary, South State Bank (sometimes also referred to herein as the “Bank”), since 1998. He also has served as Vice Chairman of the Company and the Bank, from 1994 to 1998. Mr. Horger has been an attorney with Horger, Barnwell and Reid in Orangeburg, South Carolina, since 1975. During his tenure as Chairman, Mr. Horger has developed knowledge of the Company’s business, history, organization, and executive management which, together with his experience and personal understanding of many of the markets that we serve, has enhanced his ability to lead our board through challenging economic conditions. Mr. Horger’s legal training and experience enhance his ability to understand the Company’s regulatory framework. | |

Robert R. Hill, Jr. Chief Executive Officer South State Bank Employee | | 53 | | 1996 | | 2020 | | Mr. Hill has served as Chief Executive Officer of the Company since November 6, 2004. Mr. Hill also served as President of the Company from November 6, 2004 to July 26, 2013. Prior to that time, Mr. Hill served as President and Chief Operating Officer of South State Bank, from 1999 to November 6, 2004. Mr. Hill joined us in 1995. He was appointed to serve on the Federal Reserve Board of Directors in December 2010. Mr. Hill brings to our Board an intimate understanding of our business and organization, as well as substantial leadership ability, banking industry expertise, and management experience. | |

John C. Pollok Chief Financial Officer South State Bank Employee | | 54 | | 2012 | | 2021 | | Mr. Pollok has served as Chief Financial Officer since March 21, 2012 and as Chief Operating Officer of the Company from February 15, 2007 until July 19, 2018. Mr. Pollok also previously served as the Chief Operating Officer of the Bank from February 15, 2007 until March 21, 2012. Prior to that time, Mr. Pollok served as the Chief Financial Officer of the Company from February 15, 2007 until January 3, 2010. Mr. Pollok brings to our Board an overall institutional knowledge of our business, banking industry expertise, and leadership experience. | |

4

| | | | | |||||

Paula Harper Bethea | | 64 | | 2013 | | 2020 | | Mrs. Bethea has served as Vice-Chairman of our Board of the Company and its subsidiary, South State Bank since 2013. Mrs. Bethea is the Senior advisor to the President and the COO at the University of SC and is Executive Chair of the Board of the JM Smith Corporation in Spartanburg, SC. Prior to this role, she was the Executive Director of the SC Education Lottery (2009-2016) and was one of nine South Carolinians chosen in 2001 to establish the Lottery. Prior to this position, Mrs. Bethea was with the McNair Law Firm from 2006 to 2009 where she served as Director of External Relations. Mrs. Bethea served on the Board of directors of FFHI from 1996 until FFHI merged with the Company in 2013. Her business and personal experience in certain of the communities that the Bank serves provides her with an appreciation and understanding of markets that we serve, and her leadership experiences provide her with insights regarding organizational behavior and management. | |

James C. Cherry | | 69 | | 2017 | | 2020 | | Mr. Cherry served as the Chief Executive Officer and as a director of Park Sterling Corporation from its formation in 2010 until November 2017 when it merged with the Company. Mr. Cherry has served as a consultant to the Bank since November 2017. He retired as the Chief Executive Officer for the Mid-Atlantic Banking Region at Wachovia Corporation in 2006, and previously served as President of Virginia Banking, Head of Trust and Investment Management, and in various positions in North Carolina and Virginia banking including Regional Executive, Area Executive, City Executive, Corporate Banking and Loan Administration Manager, and Retail Banking Branch Manager for Wachovia. He is currently a director of Armada Hoffler Properties Inc. (NYSE: AHH), a Virginia-based publicly traded real estate company; Beach Community Bank, a Fort Walton, Florida based private commercial bank; and, Magna Imperio Systems Corporation, a private water purification company based in Houston, Texas. Mr. Cherry’s extensive experience in commercial and retail banking operations, credit administration, product management and merger integration at Wachovia and Park Sterling Bank, which was focused in the Carolinas and Virginia, provides our Board with significant expertise important to the oversight of the Company and expansion into our target markets. | |

Jean E. Davis | | 64 | | 2017 | | 2020 | | Ms. Davis, former Park Sterling Corporation Board member, retired as the head of Operations, Technology and e-Commerce of Wachovia Corporation in 2006. She previously served as the Head of Operations and Technology, Head of Human Resources, Head of Retail Banking, and in several office executive, regional executive and corporate banking roles for Wachovia. Ms. Davis brings extensive knowledge of bank operations and technology, as well as human resources, to our Board of Directors, both of which are important to the Company’s long-term success. In addition, she brings a strong background in retail banking, merger due diligence and merger integration experience. | |

5

| | | | | |||||

Martin B. Davis | | 56 | | 2016 | | 2020 | | Mr. Davis is executive vice president of Southern Company Services and chief information officer of Southern Company. Mr. Davis has spent nearly 30 years leading complex technology organizations in highly regulated environments. Mr. Davis serves on the American Heart Association’s South East region board of directors. Mr. Davis served on the Board of trustees at Winston-Salem State University. He has been recognized as one of the “50 Most Important African-Americans in Technology” by U.S. Black Engineers & Information Technology magazine and one of the “75 Most Powerful African-Americans in Corporate America” by Black Enterprise. Mr. Davis' technology-related experience provides him with useful insight regarding this area of increasing strategic importance to bank marketing and operations. | |

Robert H. Demere, Jr. | | 71 | | 2012 | | 2022 | | Mr. Demere serves as Chairman and Chief Executive Officer of Colonial Group, Inc., a private petroleum marketing company located in Savannah, Georgia. Mr. Demere has been employed by Colonial Group, Inc. since 1974. As the former President of Colonial Group, Inc., Mr. Demere has attained valuable experience in raising equity in the capital markets. Prior to working for Colonial, Mr. Demere worked as a stockbroker for Robinson-Humphrey Company. Mr. Demere served on the Board of Directors of Savannah Bancorp Inc. from 1989 until we acquired it in 2012. His business and personal experience in certain of the communities that the Bank serves also provides him with an appreciation of and useful insight regarding certain markets that we serve. | |

Cynthia A. Hartley | | 71 | | 2011 | | 2021 | | Mrs. Hartley retired in 2011 as Senior Vice President of Human Resources with Sonoco Products Company in Hartsville, South Carolina. Mrs. Hartley served as the Chairman of the Board of Trustees for Coker College in Hartsville, South Carolina. Mrs. Hartley was first elected to our Board of Directors in May of 2011. Her leadership experience, knowledge of human resource matters, and business and personal ties with many of the Bank’s market areas enhance her ability to contribute as a director. | |

Thomas J. Johnson | | 69 | | 2013 | | 2020 | | Mr. Johnson is President, Chief Executive Officer, and Owner of F&J Associates, a company that owns and operates automobile dealerships in the southeastern United States and the U.S. Virgin Islands. He serves on our Board of Directors of the South Carolina Automobile Dealers Association, the Board of Visitors of the Coastal Carolina University School of Business and the South Carolina Business Resources Board. Mr. Johnson served on the Board of directors of FFHI from 1998 until it merged with us in 2013. Mr. Johnson’s extensive business experience and knowledge of markets that we serve enhance his ability to contribute as a director. | |

6

Grey B. Murray | | 54 | | 2017 | | 2022 | | Mr. Murray, a former Georgia Bank & Trust board member, has served as President of United Brokerage Company, Inc., headquartered in Augusta, Georgia since 1991. Mr. Murray also serves as a Commissioner on the Augusta Aviation Commission and is a graduate of Leadership Georgia. An active member of the community, Mr. Murray has served on the Board of directors of the American Heart Association, University Health Care Foundation, Augusta Country Club, Secession Golf Club, St. Paul’s Building Authority, Exchange Club of Augusta, Georgia Movers Association, and Augusta Preparatory Day School (past Chairman of the Board). Mr. Murray’s extensive business experience and knowledge of markets that we serve enhance his ability to contribute as a director. | |

James W. Roquemore | | 65 | | 1994 | | 2022 | | Mr. Roquemore has served as Chief Executive Officer of Patten Seed Company, Inc. of Lakeland, Georgia, and General Manager of Super-Sod/Carolina, a company that produces and markets turf grass, sod and seed, since 1997. As the chief executive officer of a company, Mr. Roquemore has experience with management, marketing, operations, and human resource matters. His business and personal experience in certain of the communities that the Bank serves also provides him with an appreciation of markets that we serve. Moreover, during his tenure as a director he has developed knowledge of the Company’s business, history, organization, and executive management which, together with the relationships that he has developed, enhance his leadership and consensus-building ability. | |

Thomas E. Suggs | | 70 | | 2001 | | 2021 | | Mr. Suggs has served as President and Chief Executive Officer of HUB Carolinas, a region of HUB International, the eighth largest insurance broker in the world, since August 2016. Mr. Suggs was the President and Chief Executive Officer of Keenan & Suggs, Inc., an insurance brokerage and consulting firm, before it was acquired by HUB International in August 2016. Mr. Suggs has over 23 years of experience in the insurance industry and 25 years of banking experience. As the chief executive officer of the HUB Carolinas region, Mr. Suggs has experience with management, marketing, operations, and human resource matters, and his experience with the banking industry also provides him with certain insights. His business and personal experience in communities that the Bank serves also provides him with an appreciation of markets that we serve. | |

Kevin P. Walker | | 69 | | 2010 | | 2021 | | Mr. Walker, CPA/ABV, CFE, is a founding partner of GreerWalker LLP in Charlotte, North Carolina. GreerWalker LLP is the largest certified public accounting firm founded and headquartered in Charlotte and currently employs approximately 125 people. Mr. Walker is also a member of the American Institute of Certified Public Accountants, the North Carolina Association of Certified Public Accountants, the Financial Consulting Group, the Association of Certified Fraud Examiners, and the American Arbitration Association Panel of Arbitrators. Mr. Walker was first elected to the South State Corporation Board in October 2010. Mr. Walker’s leadership experience, accounting knowledge and business and personal experience in certain of the Company’s markets enhance his ability to contribute as a director. | |

7

THE BOARD OF DIRECTORS AND COMMITTEES

During 2019, our Board of Directors held eight meetings. Each director attended at least 75% of the aggregate of the total number of board meetings and the total number of meetings held by the committees of the Board on which he or she served.

There is no formal policy regarding director attendance at annual shareholder meetings, though we strongly encourage such attendance. We recognize that conflicts may occasionally arise that will prevent a director from attending an annual meeting. All of our directors attended the 2019 annual meeting.

8

Our Board of Directors maintains executive, audit, compensation, governance, and risk committees. The composition and frequency of meetings for these committees during 2019 were as follows:

| | | | | | | | | | | | | | |

| | | | Committees of the Board of Directors | | |||||||||

| | Independent | | Executive | | Audit | | Compensation | | Governance | | Risk | | |

Name |

| Requirements (2) |

| (7 meetings) |

| (10 meetings) |

| (6 meetings) |

| (4 meetings) |

| (7 meetings) |

| |

Robert R. Horger | | No | | ● Chair | | | | | | | | | | |

Robert R. Hill, Jr. | | No | | ● | | | | | | | | | | |

John C. Pollok | | No | | | | | | | | | | | | |

Jimmy E. Addison (1) | | Yes | | ● | | | | | | ● Chair | | | | |

Paula Harper Bethea | | Yes | | ● | | | | ● | | | | | | |

James C. Cherry | | No | | | | | | | | | | ● | | |

Jean E. Davis (1) | | Yes | | | | | | ● | | ● Chair | | | | |

Martin B. Davis | | Yes | | | | ● | | | | | | ● Chair | | |

Robert H. Demere Jr. | | Yes | | | | ● | | | | | | ● | | |

Cynthia A. Hartley | | Yes | | | | | | ● Chair | | ● | | | | |

Thomas J. Johnson | | Yes | | | | | | ● | | ● | | | | |

Grey B. Murray | | Yes | | | | ● | | | | | | ● | | |

James W. Roquemore | | Yes | | ● | | | | ● | | | | | | |

Thomas E. Suggs | | Yes | | ● | | | | | | | | ● | | |

Kevin P. Walker | | Yes | | | | ● Chair | | | | | | ● | | |

| (1) | Mr. Addison served as chair of the Governance Committee until his retirement from the Board of Directors effective as of April 25, 2019 and was replaced by Mrs. Davis. |

| (2) | All directors other than Robert R. Horger, Robert R. Hill, Jr., John C. Pollok and James C. Cherry meet the independence requirements of The NASDAQ Stock Market. Therefore, under these requirements, a majority of the members of our Board of Directors is independent. |

The functions of these committees are as follows:

Executive Committee—The Executive Committee may, between meetings of the Board of Directors, exercise authority on behalf of the Board of Directors except with respect to those matters specifically delegated to another Board committee and those matters required by law, the rules and regulations of any securities exchange on which the Company’s securities are listed, or the Company’s or Bank’s charter or bylaws to be exercised by the full Board of Directors. The Executive Committee has the authority to recommend and approve new policies and to review and approve present policies or policy updates and changes. The Executive Committee charter can be found on our website at https://www.southstatebank.com/ under Investor Relations.

Audit Committee—Our Board of Directors has determined that all members of the Audit Committee are independent directors under the independence requirements of The NASDAQ Stock Market, including the requirements of SEC Rule 10A-3. Our Board of Directors has also determined that Kevin P. Walker is an “Audit Committee financial expert” for purposes of the rules and regulations of the SEC adopted pursuant to the Sarbanes-Oxley Act of 2002 and has “banking or related financial expertise” as defined by the FDIC. The primary function of the Audit Committee is to assist our Board of Directors in overseeing (i) our accounting and financial reporting processes generally, (ii) the audits of our financial statements and (iii) our systems of internal controls regarding finance and accounting. In such role, the Audit Committee reviews the qualifications, performance, effectiveness and independence of our independent accountants and has the authority to appoint, evaluate and, where appropriate, replace our independent accountants. The Audit Committee also oversees our internal audit department and consults with management regarding the internal audit process and the effectiveness and reliability of our internal accounting controls. Our Board of Directors has adopted a charter for the Audit Committee, a copy of which is located on our website at https://www.southstatebank.com/ under Investor Relations.

Compensation Committee—Our Board of Directors has determined that all members of the Compensation Committee are independent directors under the independence requirements of The NASDAQ Stock Market applicable to directors who serve on the Compensation Committee. Further, our Board of Directors has also determined that each of the

9

members of the Compensation Committee qualifies as a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act and an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code (the “Code”). The Compensation Committee, among other functions, has overall responsibility for evaluating, and approving or recommending to the Board for approval, our director and officer compensation plans, policies and programs. Until January 2019, following recommendations by the Compensation Committee, the full Board of Directors was responsible for approving or disapproving compensation paid to our Chief Executive Officer and each of our other executive officers, other than compensation that was approved by the Compensation Committee under our Omnibus Stock and Performance Plan or our Annual Incentive Plan. The Compensation Committee charter was amended in January of 2019 to provide that the Compensation Committee shall review and approve the compensation of all our executives and officers as it deems appropriate. The Compensation Committee, which currently consists of five independent directors, is required to be made up of no fewer than three independent directors who are recommended by the Chairman of the Board of Directors and approved by the Board. The Compensation Committee’s processes and procedures for considering and determining executive compensation are described below under “Compensation Discussion and Analysis.” The Compensation Committee charter can be found on our website at https://www.southstatebank.com/ under Investor Relations.

Governance Committee—Our Board of Directors has determined that all members of the Governance Committee are independent directors under the independence requirements of The NASDAQ Stock Market applicable to directors who serve on the Governance Committee. The Governance Committee identifies and recommends individuals qualified to become Board members, reviews our corporate governance practices and recommends changes thereto, and assists our Board in its periodic review of the Board’s performance. The Governance Committee charter can be found on our website at https://www.southstatebank.com/ under Investor Relations.

The Governance Committee acts as the nominating committee for the purpose of recommending to the Board of Directors nominees for election to the Board. The Governance Committee has not established any specific, minimum qualifications that must be met for a person to be nominated to serve as a director, and the Governance Committee has not identified any specific qualities or skills that it believes are necessary to be nominated as a director. The Governance Committee charter provides that potential candidates for the Board, including any nominees submitted by shareholders in accordance with our Bylaws, are to be reviewed by the Governance Committee and that candidates are selected based on a number of criteria, including a proposed nominee’s independence, age, skills, occupation, diversity, experience and any other factors beneficial to the Company in the context of the needs of the Board. The Governance Committee has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees. In determining whether to recommend a director nominee, Governance Committee members consider and discuss diversity, among other factors, with a view toward the needs of the Board of Directors as a whole. The Governance Committee members generally conceptualize diversity expansively to include, without limitation, concepts such as race, gender, national origin, differences of viewpoints, professional experience, education, skills and other qualities or attributes that contribute to Board heterogeneity when identifying and recommending director nominees. The Governance Committee believes that the inclusion of diversity as one of many factors considered in selecting director nominees is consistent with its goal of creating a Board of Directors that best serves our needs and the interest of our shareholders.

The Governance Committee has performed a review of the experience, qualifications, attributes and skills of the Board’s current membership, including the director nominees for election to the Board of Directors and the other members of the Board, and believes that the current members of the Board, including the director nominees, as a whole possess a variety of complementary skills and characteristics, including the following:

| ● | successful business or professional experience; |

| ● | various areas of expertise or experience, which are desirable to our current business, such as general management, planning, legal, marketing, technology, banking and financial services; |

| ● | personal characteristics such as character, integrity and accountability, as well as sound business judgment and personal reputation; |

| ● | willingness and ability to commit the necessary time to fully discharge the responsibilities of Board membership; |

10

| ● | leadership and consensus building skills; and |

| ● | commitment to our success. |

Each individual director has qualifications and skills that the Governance Committee believes, together as a whole, create a strong, well-balanced Board. The experiences and qualifications of our directors are found in the table on pages 4-7.

The Governance Committee will consider director nominees identified by its members, other directors, our officers and employees and other persons, including our shareholders. For a shareholder to nominate a director candidate, the shareholder must comply with the advance notice provisions and other requirements of our Bylaws. Each notice must state, among other things:

| ● | as to the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made |

| o | the name and address of the shareholder who intends to make the nomination and of such beneficial owner, if any; |

| o | the class or series and number of shares of the Company which are, directly or indirectly, owned beneficially and of record by such shareholder and such beneficial owner, |

| o | any option, warrant, convertible security, stock appreciation right, or similar right with an exercise or conversion privilege or a settlement payment or mechanism at a price related to any class or series of shares of the Company or with a value derived in whole or in part from the value of any class or series of shares of the Company, whether or not such instrument or right shall be subject to settlement in the underlying class or series of capital stock of the Company or otherwise directly or indirectly owned beneficially by such shareholder or such beneficial owner and any other direct or indirect opportunity to profit or share in any profit derived from any increase or decrease in the value of shares of the Company, |

| o | any proxy, contract, arrangement, understanding, or relationship pursuant to which such shareholder or such beneficial owner has a right to vote any shares of any security of the Company, |

| o | any short interest in any security of the Company, |

| o | any rights to dividends on the shares of the Company owned beneficially by such shareholder or such beneficial owner that are separated or separable from the underlying shares of the Company, |

| o | any proportionate interest in shares of the Company or derivative instruments held, directly or indirectly, by a general or limited partnership in which such shareholder or such beneficial owner is a general partner or, directly or indirectly, beneficially owns an interest in a general partner, |

| o | any performance-related fees (other than an asset-based fee) that such shareholder or such beneficial owner is entitled to, based on any increase or decrease in the value of shares of the Company or derivative instruments, if any, as of the date of such notice, including without limitation any such interests held by members of such shareholder’s or such beneficial owner’s immediate family sharing the same household (which information shall be supplemented by such shareholder and beneficial owner, if any, not later than 10 days after February 26, 2020 to disclose such ownership as of February 26, 2020), |

| o | any pending or threatened legal proceeding in which such shareholder or such beneficial owner is a party or participant involving the Company or any of its officers or directors, or any affiliate of the Company, |

| o | any other material relationship between such shareholder or such beneficial owner, on the one hand, and the Company, any affiliate of the Company or any principal competitor of the Company, on the other hand, and |

| o | to the extent known to such shareholder or such beneficial owner, the name(s) of any other shareholder(s) of the Company (whether holders of record of beneficial owners) that support the business that the shareholder proposes to bring before the meeting or the nominees whom the shareholder proposes to nominate for election or reelection to the Board, as applicable; |

| ● | a representation of such shareholder and such beneficial owner, if any, that such person (or a qualified representative thereof) intends to appear in person at the meeting, and |

| ● | any other information relating to such shareholder and beneficial owner, if any, that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for, |

11

| as applicable, the proposal and/or for the election of directors in a contested election pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. |

In addition to the information required above, each notice must also state, among other things, as to each person, if any, whom the shareholder proposes to nominate for election or re-election to the board of directors:

| ● | all information relating to such person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors in a contested election pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected), and |

| ● | a description of all direct and indirect compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material relationships, between or among such shareholder and beneficial owner, if any, and their respective affiliates and associates, or others acting in concert therewith, on the one hand, and each proposed nominee, and his or her respective affiliates and associates, or others acting in concert therewith, on the other hand, including, without limitation all information that would be required to be disclosed pursuant to Rule 404 promulgated under Regulation S-K if the shareholder making the nomination and any beneficial owner on whose behalf the nomination is made, if any, or any affiliate or associate thereof or person acting in concert therewith, were the “registrant” for purposes of such rule and the nominee were a director or executive officer of such registrant. |

For a complete description of the procedures and disclosure requirements to be complied with by shareholders in connection with submitting director nominations, shareholders should refer to our Bylaws.

Risk Committee—The Risk Committee of our Board of Directors provides assistance to the Board of Directors by striving to identify, assess, and monitor key business risks that may impact our operations and results. The charter for the Risk Committee can be found at https://www.southstatebank.com/ under Investors Relations.

While the Risk Committee oversees and reviews our risk functions to monitor key business risks, management is ultimately responsible for designing, implementing, and maintaining an effective risk management program to identify, plan for, and respond to our material risks. The Risk Committee charter acknowledges that our Audit Committee is primarily responsible for certain risks, including accounting and financial reporting. Although the Risk Committee does not have primary responsibility for the risks which are subject to the jurisdiction of the Audit Committee, it is anticipated that on occasion certain results from audit functions will be reviewed by the Risk Committee.

Code of Ethics and Corporate Governance Guidelines

Code of Ethics—Our Board of Directors and the Board of Directors of the Bank have adopted a Code of Ethics to provide ethical guidelines for the activities of our, and our subsidiaries’, agents, attorneys, directors, officers, and employees (including, among others, our chief executive officer, chief financial officer, principal accounting officer and all mangers reporting to these individuals who are responsible for accounting and financial reporting). The Code of Ethics is intended to promote, train, and encourage adherence in business and personal affairs to a high ethical standard and also helps maintain the Company as an institution that serves the public with honesty, integrity and fair-dealing. The Code of Ethics is designed to comply with the Sarbanes-Oxley Act of 2002, and certain other laws that provide guidelines in connection with possible breaches of fiduciary duty, dishonest efforts to undermine financial institution transactions and the intent to corrupt or reward a Company employee or other Company representative. A copy of the Code of Ethics can be found on our website at https://www.southstatebank.com/ under Investor Relations. We will disclose any future amendments to, or waivers from, provisions of these ethics policies and standards on our website promptly as practicable, as and to the extent required under The NASDAQ Stock Market listing standards and applicable SEC rules.

Board of Directors’ Corporate Governance Guidelines—Our Board of Directors and the Board of Directors of the Bank have each adopted certain guidelines governing the qualifications, conduct and operation of the Board. Among other things, these guidelines outline the duties and responsibilities of each director, and establish certain minimum requirements for director training. Each director is required to read, review and sign the corporate governance guidelines on an annual basis. A copy of these guidelines can be found on our website at https://www.southstatebank.com/ under Investor Relations.

12

Board Leadership Structure and Role in Risk Oversight

We are focused on our corporate governance practices and value independent Board oversight as an essential component of strong corporate performance to enhance shareholder value. Our commitment to independent oversight is demonstrated by the fact that over 73% of all of our directors are independent. In addition, our Board has determined all of the members of our Board’s Audit, Compensation, Risk and Governance Committees are independent. See the discussion entitled “Certain Relationships and Related Transactions” on page 50 for additional information concerning Board independence.

In view of the Board of Directors extensive oversight responsibilities, we believe it is beneficial to have separate individuals in the role of Chairman and Chief Executive Officer. Our Board believes that it is preferable for Mr. Horger to serve as Chairman of the Board because of his strong institutional knowledge of our business, history, industry, markets, organization and executive management gained in his 20 years of experience in a leadership position on the Board. We believe it is the Chief Executive Officer’s responsibility to manage the Company and the Chairman’s responsibility to guide the Board as the Board provides leadership to our executive management. Traditionally, the Company has maintained the separateness of the roles of the Chairman and the Chief Executive Officer. In making its decision to continue to have a separate individual serve as Chairman and Chief Executive Officer, the Board considered the time and attention that Mr. Hill is required to devote to managing our day-to-day operations. We believe that this Board leadership structure is appropriate in maximizing the effectiveness of Board oversight and in providing perspective to our business that is independent from executive management.

Our Board of Directors oversees risk through the various Board standing committees, principally the Audit Committee and the Risk Committee, which report directly to the Board. Our Audit Committee is primarily responsible for overseeing our accounting and financial reporting risk management processes on behalf of the full Board of Directors. The Audit Committee focuses on financial reporting risk and oversight of the internal audit process. It receives reports from management at least quarterly regarding our assessment of risks and the adequacy and effectiveness of internal control systems, and also reviews credit and market risk (including liquidity and interest rate risk), and operational risk (including compliance and legal risk). Our Chief Credit Officer and Chief Financial Officer meet with the Audit Committee on a quarterly basis in executive sessions to discuss any potential risks or control issues involving management. Our Chief Risk Officer meets with the Risk Committee each quarter to identify, assess, and monitor key business risks that may impact our operations and results.

With respect to cybersecurity, the goal is to manage the Cybersecurity and Information Security Risk across the Enterprise to safeguard sensitive Bank Information including NPPI and to ensure the availability and integrity of the Technology Systems that the Bank relies upon to serve and protect its customers. On a regular basis, we track and report our results/data in the form of Key Risk Indicators and Key Performance Indicators to the Risk Committee to demonstrate compliance with industry best practices, governmental standards and guidelines. In addition, the Bank continually strives to further the Cyber and Information Security Program maturity via new and evolving Cyber controls as a way to address and prevent future risks and continually reports those to the Risk Committee. While the Risk Committee, and the Board of Directors to which it reports, oversees our cybersecurity risk management, management is responsible for the day-to-day cybersecurity risk management processes. Threat from cyber-attacks is severe, attacks are sophisticated and increasing in volume, and attackers respond rapidly to changes in defensive measures. Our systems and those of our customers and third-party service providers are under constant threat and it is possible that we could experience a significant event in the future. While we believe that our cybersecurity programs are appropriate and have been effective to prevent material incidents thus far, risks and exposures related to cybersecurity attacks are expected to remain high for the foreseeable future due to the rapidly evolving nature and sophistication of these threats, as well as due to the expanding use of Internet banking, mobile banking and other technology-based products and services by us and our customers.

Each of the Board’s standing committees, as described above, is involved to varying extents in the following:

| ● | determining risk appetites, policies and limits |

| ● | monitoring and assessing exposures, trends and the effectiveness of risk management; |

| ● | reporting to the Board of Directors; and |

| ● | promoting a sound risk management culture. |

13

The full Board of Directors focuses on the risks that it believes to be the most significant facing the Company and our general risk management strategy. The full Board of Directors also seeks to ensure that risks undertaken by the Company are consistent with the Board of Directors’ approved risk management strategies. While the Board of Directors oversees our risk management, management is responsible for the day-to-day risk management processes. We believe this division of responsibility is the most effective approach for addressing the risks facing our Company and that our Board leadership structure supports this approach.

We recognize that different Board leadership structures may be appropriate for companies in different situations. We will continue to reexamine our corporate governance policies and leadership structures on an ongoing basis in an effort to ensure that they continue to meet our needs.

DELINQUENT SECTION 16(A) REPORTS

As required by Section 16(a) of the Exchange Act, our directors and executive officers are required to report periodically their ownership of our stock and any changes in ownership to the SEC. Based on written representations made by these affiliates to the Company and a review of the Forms 3, 4 and 5, it appears that all such reports for these persons were filed timely in 2019, except for one late Form 4 relating to 1,332 shares of Restricted Stock Units granted to Keith S. Rainwater, Principal Accounting Officer, on October 23, 2019, pursuant to which the related Form 4 was inadvertently not reported until October 29, 2019.

Item 11. Executive Compensation.

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (“CD&A”) explains our 2019 executive compensation programs and decisions with respect to our executive officers and, in particular, our named executive officers (as defined below). In this discussion, we explain, among other things, our compensation philosophy and program, factors considered by the Compensation Committee in making compensation decisions and additional details about our compensation program and practices. The following discussion is organized into four parts:

14

Part 1—Executive Summary

The Compensation Committee seeks to provide compensation arrangements for our executive officers that are designed to retain and attract talented executives who can perform at a high level and manage the Company in our shareholders’ best interest. Among other things, these compensation arrangements are intended to align executive compensation with our performance, both on a short-term basis and a long-term basis. This is accomplished through incentive compensation that is based primarily on our performance and secondarily on individual contributions. In this Amendment No. 1, our “named executive officers,” or NEOs, are the individuals who served as our principal executive officer, our principal financial officer and our three other most highly compensated executive officers in 2019, as set forth in the following table:

| | | | | |

Name |

| Title |

| Years of |

|

Robert R. Hill, Jr. | | Chief Executive Officer of South State Corporation | | 24 | |

John C. Pollok | | Senior Executive Vice President and Chief Financial Officer | | 24 | |

Greg A. Lapointe | | President of South State Bank | | 10 | |

Renee R. Brooks | | Senior Executive Vice President and Chief Operating Officer | | 23 | |

John S. Goettee | | President of South Carolina and Georgia Markets | | 14 | |

Our mission is to build a high-performing bank based on a balance of soundness, profitability and growth, moving us forward to our longer-term financial targets. We believe we will accomplish this through relationship banking, delivered by engaged employees with clear strategic goals, objectives and values. These priorities have enabled us to be well-positioned to take advantage of strategic growth opportunities in the past ten years. Our culture, focused values and strong management team seek to drive these priorities and are the core contributors of our success.

The following summarizes certain significant events for us in 2019:

Additionally, on January 25, 2020, we entered into a merger agreement with CenterState Bank Corporation, a Florida corporation (“CenterState”). Under the merger agreement, the Company and CenterState have agreed to combine their respective companies in an all-stock merger of equals, pursuant to which CenterState will merge with and into the Company, with the Company continuing as the surviving entity. The merger agreement was approved by the boards of directors of the Company and CenterState and is subject to shareholder and regulatory approval and other customary closing conditions. If the merger is completed, our total assets are expected to exceed $34 billion and will create the eighth largest bank headquartered in the Southeast.

We believe that key 2019 indicators of soundness, profitability and growth include the following:

15

Soundness - Our loan portfolio is our largest asset and having a sound loan portfolio is a foundation of our business model.

For 2019:

| ● | Total nonperforming assets remained low at 0.29%, or $46.2 million of total assets, compared to 0.28%, or $40.5 million of total assets at December 31, 2018. |

| ● | Net charge-offs on nonacquired loans totaled four basis points, or $3.6 million, compared to four basis points or $3.0 million, in 2018. |

| ● | Other real estate owned (OREO) remained at a low level totaling $12.0 million, compared to $11.4 million at December 31, 2018. |

As discussed below, our performance-based annual cash incentive plan included a metric related to regulatory soundness, which includes an asset quality component, weighed at 25%.

Profitability - We believe earnings per share (EPS) is generally highly correlated with value creation for our shareholders.

For 2019:

| ● | Diluted EPS increased 10.3% to $5.36 per share, from $4.86 per share in 2018, driven primarily by the decrease in weighted average shares resulting from the repurchase of 2.2 million shares of our common stock in 2019. |

| ● | Net income increased by 4.3% to $186.5 million, from $178.9 million in 2018, primarily as a result of lower non-interest expense as compared to 2018 (as 2018 included higher operating expenses associated with integration of the acquisition of Park Sterling Corporation). |

| ● | Return on average common equity totaled 8.26%, compared to 7.63% for 2018. |

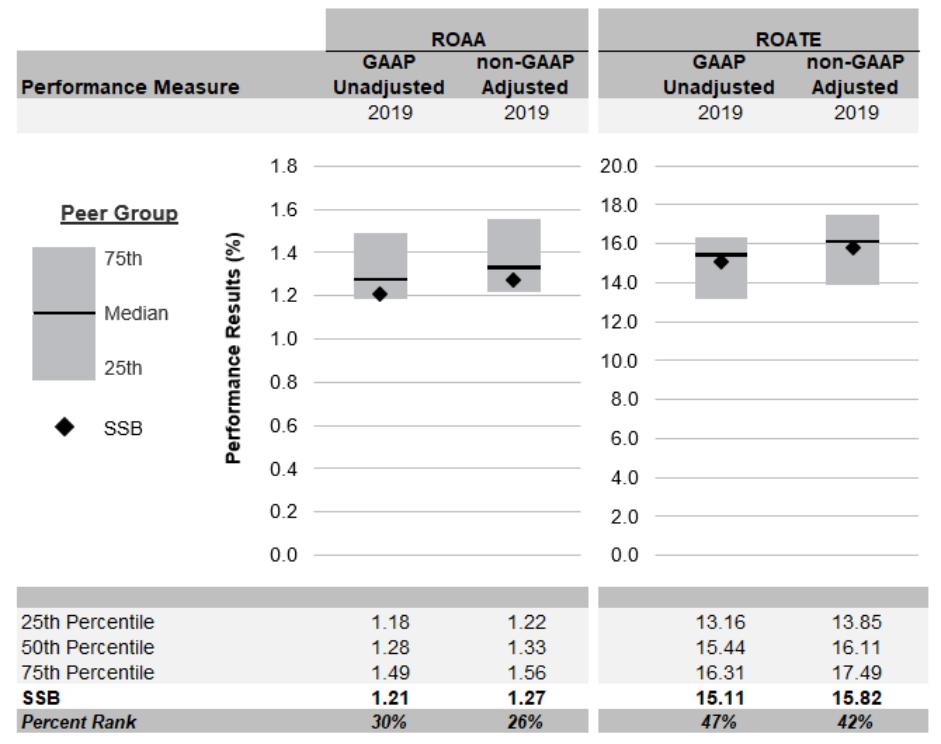

| ● | Adjusted return on average tangible common equity (“ROATCE”) (non-GAAP) totaled 15.82%, compared to 16.76% in 2018. |

| ● | Adjusted EPS, diluted (non-GAAP) increased 2.4% to $5.63 per common share, compared to $5.50 per common share in 2018.* We believe that it is important to examine the results of our performance on an adjusted basis as well as on a GAAP basis due to certain non-core expenses or gains that impact our GAAP financial statements. We believe these adjusted performance results provide insight into how our core ongoing business performance changes from year to year, excluding certain items. In 2019, we incurred $7.6 million of pension plan termination expense, $3.7 million in branch consolidation related expense, $2.2 million of securities gains, and $107,000 of FHLB prepayment fees, each net of tax. The adjustments were compared to those from 2018 of $520,000 in securities losses, $23.7 million of merger and conversion related expense, and $990,000 of benefit from deferred tax revaluations, related to the tax law changes from 2017, each net of tax. |

| ● | Adjusted earnings (non-GAAP) declined by 3.1% to $195.8 million, from $202.1 million for 2018, primarily as a result of lower net income and non-interest income, partially offset by lower non-interest expense, a lower provision for loan losses and lower provision for income taxes. |

16

As discussed below, our performance-based annual cash incentive plan included a profitability metric of adjusted EPS, weighted at 75%. Our long-term incentive plan also includes profitability metrics of adjusted EPS (weighted at 67%) and adjusted ROATCE (weighted at 33%).

*Please see “Non-GAAP Financial Measures” beginning on page 43 in our Annual Report on Form 10-K for the year ended December 31, 2019, for a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure.

17

Growth - Growth results in potentially higher profitability and is measured by loans, deposits and total assets. For 2019:

| ● | Net loan growth totaled $356.8 million, or 3.2%, with non-acquired loan growth of $1.3 billion, or 16.6%, and a decline in acquired loans of $962.7 million, or 31.3%. |

| ● | Total assets grew by $1.2 billion, or 8.5%, primarily in our investment securities portfolio, cash and loans. |

| ● | Total deposits grew by $530.2 million, or 4.6%, with $183.5 million, or 6.0%, growth in non-interest bearing deposits and $346.6 million, or 4.0%, growth in interest bearing deposits. |

Key 2019 Compensation Decisions by the Compensation Committee

Our Compensation Committee made the following key compensation decisions during 2019:

| ● | We increased the base salary for each NEO to better align their compensation with those in our peer group. |

| ● | We continued our Executive Incentive Plan, which has two components: (1) our performance-based annual cash incentive plan, sometimes referred to as the “AIP,” and (2) long-term equity incentive awards, sometimes referred to as the “LTIP,” each weighted at 50% of each NEO’s 2019 annual incentive opportunity grants, with goals and opportunity levels that reflected our size in 2019. |

| o | The AIP included performance metrics tied to our regulatory soundness, which we refer to as the “soundness measure” (weighted at 25%), and our profitability (adjusted EPS) (weighted at 75%), with an increase in the level of incentive opportunity as a percentage of base salary from 2018. |

| o | The LTIP consisted of grants of performance-based restricted stock units, or “PRSUs,” with three-year performance periods (2019-2021) tied to the profitability metrics of adjusted EPS (weighted at 67%) and adjusted ROATCE (weighted at 33%), which are intended to provide alignment with increased shareholder value and long-term performance. |

| ● | In addition to the performance metrics referenced above, each of the following “minimum performance triggers” were required to be achieved for each NEO to receive any cash incentives under the AIP: |

| o | aggregate net income for 2019 had to be positive and sufficient to cover aggregate dividends; and |

| o | we had to achieve the soundness measure discussed in more detail below under “2019 Executive Incentive Plan—Annual Cash Incentive Plan (AIP)”. |

18

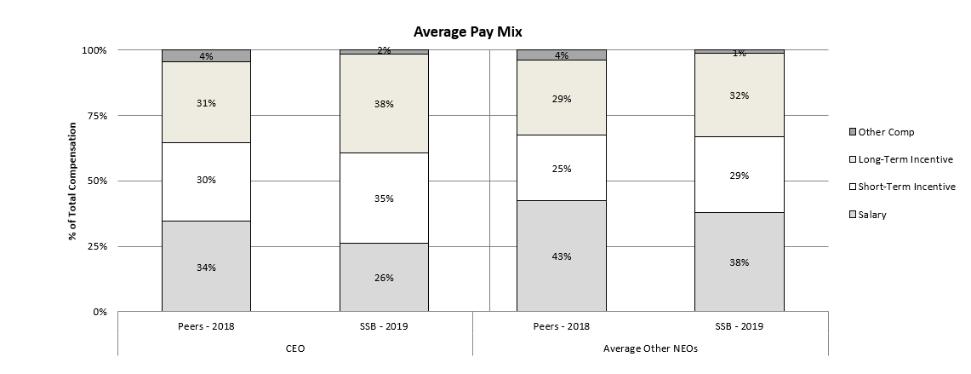

Consistent with our compensation philosophy, our NEO compensation is focused on performance-based compensation that is variable and subject to the attainment of specified performance metrics. The chart below shows the average pay mix for the Chief Executive Officer and the average of our other NEOs compared to recent peer practices. As reflected in the chart, the pay mix for our Chief Executive Officer and other NEOs was more weighted toward performance-based compensation than at peer companies.

For 2019, we paid CEO cash incentives at 73.12% of the maximum grant level and paid between 72.90% to 74.50% of the maximum grant level for our other NEOs, based on results for the year as set forth under the annual cash incentive component of the 2019 Executive Incentive Plan described below.

Part 2—South State Executive Compensation Process

Compensation Philosophy

In 2019, the Compensation Committee reviewed and validated its compensation philosophy with the assistance of the Compensation Committee’s independent compensation consultant. The purpose of the review was to ensure that compensation decisions made by the Compensation Committee and the Board of Directors were consistent with this philosophy. The fundamental philosophy of our compensation program is to offer competitive compensation opportunities for executive officers that:

| ● | align executive compensation with shareholder value, through the use of equity-based compensation; |

| ● | link pay to performance by including elements of compensation designed to reward executive officers based on our overall profitability on both a short-term and long-term basis; |

| ● | encourage safety and soundness by including performance metrics tied to regulatory rating; |

| ● | attract, retain and motivate high-performing executive officers; and |

| ● | reflect each executive officer’s individual contribution. |

Our philosophy is to structure compensation that is designed to retain and reward executive officers who are capable of leading us in achieving our business objectives. The Compensation Committee considers this philosophy as it develops incentive plans. Cash incentives for 2019 were designed to reward executives for achieving annual financial and performance goals based on soundness and profitability, reflecting this focus. Long-term equity awards for 2019 were designed to reward our executive officers for the achievement of business objectives that benefit shareholders, to align their interests with those of our shareholders and to support the retention of a talented management team over time. When making compensation determinations for our executive officers, the Compensation Committee considers many

19

factors in establishing executive officer compensation levels, including peer data and individual roles, responsibilities, tenure, and performance.

Role of the Compensation Committee

The Compensation Committee is responsible for the design, implementation and administration of the compensation programs for our executive officers and directors in a manner consistent with our compensation philosophy. The Compensation Committee keeps the full Board of Directors apprised of its decisions and activities, and when appropriate, makes recommendations to the Board of Directors on items that require approval by the full Board of Directors.

Under the Compensation Committee’s Charter, the committee, among other things, annually:

| ● | reviews and approves the compensation of all executive officers, and in doing so, the committee may consider the results of the most recent shareholder advisory vote on executive compensation; |

| ● | reviews and approves corporate goals and objectives used in our annual cash or long-term incentive plans; and |

| ● | reviews and evaluates our compensation policies and practices to consider whether there are risks arising from such policies that are likely to have a material adverse effect on us and whether such policies comply with bank regulatory guidance. |

The Compensation Committee may receive recommendations from the chairman of the Board of Directors with respect to the Chief Executive Officer’s performance in light of the goals and objectives relevant to the compensation of our Chief Executive Officer. As part of the Compensation Committee’s review and approval of the compensation of the other NEOs, the Chief Executive Officer reviews the performance of the other NEOs with the Compensation Committee and makes recommendations to the Compensation Committee about the total compensation of the other NEOs. The Chief Executive Officer does not participate in, and is not present during, deliberations or approvals by the Compensation Committee or the Board of Directors with respect to his own compensation.

Compensation Consultant

During 2019, the Compensation Committee engaged the services of McLagan, an Aon company, to provide independent compensation consulting services for both directors and executive management of the Company. McLagan reports directly to the Compensation Committee. The Compensation Committee has the sole authority to hire consultants and set the engagements and the related fees of those consultants.

The following consulting services were provided to the Compensation Committee in 2019:

| ● | Provided education to the Compensation Committee regarding compensation related trends in the banking industry. |

| ● | Revised the Company's compensation peer group of publicly-traded financial institutions (the peer group is described below). |

| ● | Reviewed the competitiveness of the compensation elements currently offered by the Company to its top executives, including base salary, annual incentive or bonus, long-term incentives (stock options, restricted stock, RSUs and PRSUs), all other compensation, and changes in retirement benefits as compared to that of the customized peer group. |

| ● | Reviewed the competitiveness of the Company’s director compensation elements as compared to that of the customized peer group. |

| ● | Recommended and made observations regarding the potential alignment of the Company's executive compensation practices with the Company's overall business strategy and culture relative to the market as defined by the peer group. This included a review of the current performance based programs with respect to the annual cash incentives and annual equity grants. |

20

| ● | Assisted the Company in its preparation of compensation disclosures as required under Regulation S-K with respect to this Amendment No. 1 including this CD&A and associated tables and disclosures included herein by reference. |

| ● | Assisted the Company with the development of the Company’s 2019 Omnibus Incentive Plan. |

Compensation Committee’s Relationship with its Independent Compensation Consultant

The Compensation Committee considered the independence of McLagan in light of applicable SEC rules and The Nasdaq Stock Market listing standards. The Compensation Committee requested and received a report from McLagan addressing the independence of McLagan and its senior advisors. The following factors were considered: (1) services other than compensation consulting provided to us by McLagan; (2) fees paid by us as a percentage of McLagan’s total revenue; (3) policies or procedures maintained by McLagan that are designed to prevent a conflict of interest; (4) any business or personal relationships between the senior advisors of McLagan and a member of our Compensation Committee; (5) any stock of the Company owned by the senior advisors of McLagan; and (6) any business or personal relationships between our executive officers and the senior advisors of McLagan. The Compensation Committee discussed these considerations and concluded that the work performed by McLagan and McLagan’s senior advisors involved in the engagements did not raise any conflict of interest.

Compensation Benchmarking and Compensation Committee Functions

Each year, with assistance from McLagan, the Compensation Committee reviews the compensation practices of our peers in order to assess the competitiveness of the compensation arrangements of our NEOs. Although benchmarking is an active tool used to measure compensation structures among peers, it is only one of the tools used by the Compensation Committee to determine total compensation. Benchmarking is used by the Compensation Committee primarily to ascertain competitive total compensation levels (including base salary, equity awards, cash incentives, etc.) with comparable institutions. Using this data as a reference point, the Compensation Committee addresses pay-for-performance (meritocracy) as discussed further in the sections below on cash incentives and long-term retention. Peer performance, market factors, our performance and personal performance are all factors that the Compensation Committee considers when establishing total compensation, including incentives. This practice is in line with our meritocracy philosophy of pay. The Compensation Committee, at its discretion, may determine that it is in our best interest to negotiate total compensation packages that deviate from regular compensation and incentive levels in order to attract and retain specific talent.

The Compensation Committee reviews the composition of the peer group annually, at a minimum, and may change it as a result of mergers, changes to banks within the group, or changes within the Company. For 2019, the Company elected to maintain the 2018 peer group, with three peers excluded due to acquisition. The criteria used to select the 2018 peer group are as follows:

| ● | Banks with total year-end assets from $9.5 billion to $22.5 billion; |

| ● | No thrifts; |

| ● | the bank must have branch locations; |

| ● | Satisfactory Performance Measures (positive profitability, 3-year asset growth greater than 10%); and |

| ● | Commercial loan portfolio less than 85% of total loan portfolio. |

21

When making compensation determinations for our NEOs, our Compensation Committee uses many factors, peer data being one of them. In addition to peer pay data, we also assess individual roles, responsibilities, tenure, and performance to set NEO pay levels. When considering compensation decisions disclosed herein, the Compensation Committee reviewed a group of 23 peers with median assets of $14.3 billion. The specific members of the peer group selected for reference in determining 2019 compensation are as follows:

Banc of California Inc. (BANC) | FCB Financial Holdings, Inc. (FCB) | Renasant Corp. (RNST) |

BancorpSouth Inc. (BXS) | First Midwest Bankcorp Inc. (FMBI) | Simmons First National Corp. (SFNC) |

Bank of Hawaii Corp. (BOH) | First Interstate BancSys. (FIBK) | Trustmark Corp. (TRMK) |

Bank of the Ozarks Inc. (OZRK) | Fulton Financial Corp. (FULT) | UMB Financial Corp. (UMBF) |

Berkshire Hills Bancorp (BHLB) | Glacier Bancorp Inc. (GBCI) | United Bankshares Inc. (UBSI) |

Cathay General BankCorp (CATY) | Home BancShares Inc. (HOMB) | United Community Banks Inc. (UCBI) |

Chemical Financial Corp. (CHFC) | MB Financial Inc. (MBFI) | WesBanco Inc. (WSBC) |

Community Bank System (CBU) | Pinnacle Financial Partners (PNFP) | |

| ||

|

22

Part 3—Key Components of Executive Compensation

| | | | | |

Compensation Component |

| Objective |

| Determination |

|

Base Salary | | Provide a measure of income stability competitive with organizations of comparable size and complexity to allow executives to focus on the execution of our strategic goals and to attract and retain highly qualified NEOs. | | The Compensation Committee reviews base salary market practices at least annually through the use of a peer group comparative analysis and an analysis prepared by its compensation consultant. The Compensation Committee reviews the base salaries of the NEOs individually and uses a variety of peer data, each executive's performance, scope of responsibility and tenure in determining salary levels. | |

Performance-Based Annual Cash Incentive | | Designed to (i) encourage, recognize and reward achievement of performance metrics (based on profitability and soundness), (ii) reward NEOs for shareholder value creation, and (iii) align NEO and shareholder interests. | | Annual cash incentive awards are based on financial and performance metrics established by the Compensation Committee. | |

Long-Term Incentive Plan | | Designed to reward NEOs for shareholder value creation, to align NEO and shareholder interests, and to retain and motivate talented NEOs. Long-term incentives are equity-based and are provided under shareholder-approved plans that permit us to grant a variety of equity-based awards, including restricted stock, restricted stock units, performance-based restricted stock units and stock options. | | Long-term incentives are generally determined using a formula-based approach. The size, form and performance criteria, if any, of long-term incentive awards are determined by the Compensation Committee based on a number of factors, including its evaluation of market practice, base salary, length of service, responsibilities of the NEO, ownership of company common stock and the quantity, amount, and vesting schedule of previous grants. For 2019, long-term incentive plan awards consisted solely of PRSUs that vest based on our performance at the end of the three-year performance period. | |

Base Salary

The Compensation Committee, with the assistance of McLagan, determines base salaries based on historical and anticipated individual contribution and performance, and reviews base salaries in the context of comparability with the key executives of our peer group. Effective January 1, 2019, the Compensation Committee provided the following merit increases in base salary to our NEOs as a result of our 2018 performance and to maintain competitive salaries within our peer group: Mr. Hill (8.68%); Mr. Lapointe (15.95%); Mr. Goettee (2.75%); Mr. Pollok (10%); and Mrs. Brooks (17.16%). The increase in base salary for Mr. Lapointe was also due to his new role as President of the Bank.

23

2019 Executive Incentive Plan

The 2019 Executive Incentive Plan was composed of two elements—(1) the Annual Cash Incentive Plan, and (2) the Long-Term Equity Incentive Awards, with grants made under the 2012 Omnibus Stock and Performance Plan, as amended and restated (the “Omnibus Plan”), each weighted at 50% of the NEOs incentive opportunity, as follows:

| ● | Annual Cash Incentive Plan, or AIP: For 2019, the Compensation Committee established performance metrics for the AIP based on our profitability and a soundness measure. |

| ● | Long-Term Equity Incentive Plan, or LTIP: For 2019, we issued PRSUs under the LTIP, which vest based on the achievement of three-year performance goals and are disclosed at target value in the Summary Compensation table on page 33. PRSUs vest at the end of the three-year performance period based on company performance and require the NEO to remain employed through the performance period, subject to certain exceptions. |

Annual Cash Incentive Plan (AIP)

Under our AIP, each year the Compensation Committee selects eligible employees who will participate in the AIP and sets the amount of each participant’s threshold, target and maximum award that can be awarded under the AIP, determined as a percentage of the participant’s base salary. For 2019, the Compensation Committee set the potential cash incentive payment, expressed as a percentage of each NEO’s base salary, as follows:

| | | | | | | | | |

| | 2019 Annual Incentive Opportunity as a | | ||||||

Name |

| Threshold |

| Target |

| Maximum |

| Actual |

|

Robert R. Hill, Jr. | | 70 | % | 140 | % | 180 | % | 132 | % |

John C. Pollok | | 60 | % | 120 | % | 150 | % | 112 | % |

Greg A. Lapointe | | 39 | % | 78 | % | 100 | % | 73 | % |

Renee R. Brooks | | 35 | % | 70 | % | 90 | % | 66 | % |

John S. Goettee | | 35 | % | 70 | % | 90 | % | 66 | % |

For 2019, the Compensation Committee chose the following two metrics:

| ● | Profitability (with a 75% weighting): The profitability metric was adjusted diluted EPS (non-GAAP), defined as diluted EPS, excluding the after-tax impact of $2.2 million in securities gains, $7.6 million in pension plan termination expense, $3.7 million in branch consolidation related expense and $107,000 in FHLB prepayment fees. |

| ● | Soundness (with a 25% weighting): Under the soundness measure, the Bank must achieve a minimum specified regulatory rating in its most recent regulatory report. |

The Compensation Committee chose the profitability metric because it believes this metric is a key component in building shareholder value and chose the soundness measure to ensure that our regulatory soundness was not sacrificed at the expense of our growth or profitability. The Compensation Committee established threshold, target and maximum performance goals for the profitability metric, with threshold representing the minimum level of performance for which the NEO would earn a payment. Actual performance between threshold, target and maximum performance levels is interpolated linearly to determine the exact level of achievement (provided the minimum performance triggers are achieved).

The soundness measure is considered a “yes/no” objective, as the level of performance is either met or is not met. If the soundness measure is met, the Compensation Committee determined that each NEO would receive the maximum performance level for this metric.

In addition to the performance metrics referenced above, each of the following “minimum performance triggers”

24

were required to be achieved for each NEO to receive any cash incentives under the AIP (both of which were achieved):

| ● | aggregate net income for 2019 had to be positive and sufficient to cover aggregate dividends; and |

| ● | we had to achieve the soundness measure. |

The goals and the actual results of the AIP are outlined in the table below:

| | | | | |

| | Soundness (25%) | | Profitability (75%) | |

|

| 2019 Asset Quality |

| 2019 Adjusted Diluted EPS |

|

Threshold | | Yes/No | | $ 5.50 | |

Target | | Yes/No | | 5.70 | |

Maximum | | Yes/No | | 5.90 | |

Actual | | Yes, Achieved at Maximum | | 5.63 | |

Long-Term Equity Incentive Plan

We do not disclose forward-looking goals for our multi-year incentive programs, because we do not provide forward-looking guidance to our investors with respect to multi-year periods and this information is competitively sensitive. Consistent with our past and current practice, we disclose multi-year performance goals in full after the close of the performance period.

2019 Long-Term Incentive Plan Performance Goals

The 2019 LTIP opportunities as a percentage of salary for each of the NEOs are outlined in the table below:

| | | | | | | |

| | 2019-2021 Long-Term Incentive Opportunity | | ||||

Name |

| Threshold |

| Target |

| Maximum |

|

Robert R. Hill, Jr. | | 70 | % | 140 | % | 180 | % |

John C. Pollok | | 60 | % | 120 | % | 150 | % |

Greg A. Lapointe | | 39 | % | 78 | % | 100 | % |

Renee R. Brooks | | 35 | % | 70 | % | 90 | % |

John S. Goettee | | 35 | % | 70 | % | 90 | % |

The PRSUs granted in 2019 vest based on the attainment of the following pre-established performance goals over the three-year period ending December 31, 2021, if the NEO remains employed through the performance period subject to certain exceptions.

Performance Goal |

| Goal Weighting (% of PRSU Target Award) |

3-Year Cumulative Adjusted EPS Growth | | 67% |

3-Year Return on Adjusted ROATCE | | 33% |

The grants are reported in the “Summary Compensation Table” on page 33 at target level, in accordance with FASB ASC Topic 718.

Results of 2017 Long-Term Incentive Plan Which Ended in 2019

On January 1, 2017, the Compensation Committee granted PRSUs to each of our NEOs. The vesting of 67% of these PRSUs was dependent on achieving pre-determined levels of cumulative adjusted EPS, with the remaining 33% vesting based on adjusted ROATCE. Both objectives were measured over the three-year performance period from January 1, 2017 through December 31, 2019. Vesting also required achievement of positive earnings sufficient to cover dividends for the performance period and a minimum specified regulatory rating as of the end of the performance period (both of which were achieved). The Compensation Committee determined that payouts with respect to the performance goals were earned at 100% of the maximum award on December 31, 2019, as indicated in the table below.

25

| | | | | | | | | | | | | | | |

| | | | | Performance Goals | ||||||||||

Performance Metrics | | Weight | | | Threshold | | Target | | Maximum | | Actual | ||||

3-Year Cumulative Adjusted EPS Growth | | 67 | % | | 0 | % | | 9.1 | % | | 20.1 | % | | 23.7 | % |

3-Year Adjusted ROATCE | | 33 | % | | 13.5 | % | | 13.9 | % | | 14.4 | % | | 16.0 | % |

The PRSUs that have been earned and have vested in 2019 are shown in the Option Exercises and Stock Vested table on page 36.

Part 4—Other Aspects of Our Executive Compensation Program

Benefits

During 2019, we maintained various employee benefit plans that constitute a portion of the total compensation package available to the NEOs and all eligible employees. These plans consisted of the following:

Employees’ Pension Plan— The NEOs (other than Mr. Lapointe) were participants in a non-contributory defined pension plan which covered substantially all of our employees hired by legacy SCBT Financial Corporation (now the Company) before January 1, 2006. Pension benefits are paid based upon age of the employee and years of service with the Company. We froze the pension plan in July 2009, and no further benefits are being accrued. In March 2018, the Board voted to terminate the pension plan effective September 1, 2018. Assets of the pension plan were fully distributed in the fourth quarter of 2019. See the Pension Benefits table and the accompanying footnotes and narrative for more information.

Retirement Savings Plan-401(k)—Each of the NEOs are participants in a defined contribution plan which in 2019 permitted employees to contribute a portion of their compensation, on a tax-deferred basis, up to certain IRS compensation deferral amount limits applicable to a tax-qualified retirement plan. We matched 100% up to 4% of participants’ deferrals (Safe Harbour) and 0.375% discretionary at year-end. See the table in footnote 7 of the Summary Compensation Table.

Health Care—The NEOs are eligible to receive medical and dental coverage that is provided to all eligible employees.

Other Welfare Benefits—The NEOs receive Paid Time Off (PTO) and other benefits available to all of our eligible employees.

The employee benefits for the NEOs discussed in the subsection above are determined by the same criteria applicable to all of our employees. These benefits help keep us competitive in attracting and retaining employees. We believe that our employee benefits are generally competitive with benefits provided by our peer group and are consistent with industry standards.