Cliffs Does Not Have a New Strategy

Despite Cliffs’ assertions around its “new strategic direction,” Casablanca sees only variations on what it considers to be the same failed strategy of international expansion and diversification.

Set to Continue with a Failed Expansion Strategy.Approximately three weeks ago, Cliffs reiterated its “ability to gain scale and diversify our geographic footprint”as a key component of its overall strategy.11 On Cliffs’ February 14, 2014 earnings call, Mr. Halverson, while discussing Asia Pacific’s mine life beyond 2020, stated that Cliffs is “looking at adjacent properties in the neighborhood” and “there's more to be added there.”12 In fact, Cliffs’ website highlights expansion and diversification as core tenets of the Company’s strategy, despite the extraordinary costs incurred pursuing this very strategy.

Kick the Can(ada).Idling the Bloom Lake expansion was in Casablanca’s view an obvious step that should have been taken long ago. As management acknowledges, however, this is only a temporary measure, and we do not accept an indefinite suspension as evidence of a new strategy.Beyond this preliminary step, Cliffs has only offered what we consider to be a vague outline for a permanent solution. We remain concerned that its preferred solution of a joint venture (or sale) transaction will be difficult to execute in a reasonable time frame and on reasonable terms. If these efforts fail, Cliffs intends to shut down Bloom Lake altogether—a move that, in our view, would permanently extinguish any hope of recouping the approximately $6.5 billion (and growing) cost of Bloom Lake. Similarly, the Company’s decisions to stop pursing the costly chromite project and to idle the loss-making Wabush mine underscore the Board’s multi-billion dollar mistakes.

Asia Pacific: Not Enough to Anchor an International Strategy.With Bloom Lake on indefinite hold, Wabush idled, the chromite project suspended and Amapa divested, Cliffs’ international portfolio has been reduced to its Asia Pacific asset. Management has indicated it expects this asset to reach the end of its productive life between 2020 and 2021. Given its location on the other side of the globe and its expected life, we believe the Asia Pacific asset alone is insufficient to anchor a continuing international strategy.

Managing Capital to Fund Expansion Efforts

Hoarding Cash.Cliffs has aligned its capital allocation policy with its expansion strategy, announcing its intention to retain cash on the balance sheet—a step it characterized as “reducing net debt,”but that Casablanca believes merely constitutes hoarding cash. With no immediate significant debt maturities,13 Company-projected year-end 2014 cash balances of approximately $600 million and access to the undrawn $1.75 billion revolver, Cliffs appears to be saving up for the next “opportunity.”

11 See Cliffs Form 10K filed February 14, 2014 for the period ending December 31, 2013 (“Strategy” section).

12 Cliffs earnings conference call on February 14, 2014.

13 The Company’s first bond maturity, for $497 million, won’t occur until 2018, and the lion’s share of its bonds don’t mature until 2020-2021 ($1,059 and $699 million, respectively), per Bloomberg. Debt maturities exclude $1.75 billion revolving credit facility (since it is undrawn) and recently-announced equipment financing of $103 million, which Casablanca assumes will amortize over the life of the financing.

Beyond the Current Dividend, No Return of Capital for Shareholders.Last year, the Board cut the dividend by 76% to “improve the future cash flows available for investment in the Phase II expansion at Bloom Lake, as well as to preserve our investment-grade credit ratings.” Yet, with Bloom Lake now on indefinite hold and an improved financial profile, Cliffs has not indicated any intention to increase distributions to shareholders.

Casablanca Proposes a New Strategy Focused on Cliffs’ Core U.S. Assets

We believe Cliffs should refocus on its core U.S. operations, cement customer relationships, position itself to capitalize ondomestic growth opportunities, accelerate cost cuts and return additional capital to shareholders. Cliffs’ assets have strategic value and, under the right management, warrant a valuation far in excess of what the market accords them today, in our view.

Refocus on Core U.S. Business.We continue to believe that Cliffs’ U.S. assets remain its greatest opportunity. Cliffs has close to 60% of the iron ore production capacity in the geographically-protected Great Lakes region and is the largest iron ore producer in the United States. At current production rates, its proven reserves offer over 40 years of mine life. According to our analysis, these assets should continue to operate profitably, even in a depressed commodity pricing environment. Cliffs needs to better emphasize this dominant position, both strategically and financially, and minimize commodity price exposure to highlight value.

Extract Value through Immediate Divestiture of Asia Pacific.Since Casablanca publicly announced its position in Cliffs, we have received a number of unsolicited expressions of interest in the Asia Pacific assets. Accordingly, we believe these assets should command an attractive valuation if sold—an alternative transaction to a spin-off that achieves most of the same objectives and dovetails with Cliffs’ announcement to suspend the Bloom Lake expansion. Proceeds from the sale of Asia Pacific could finance remaining obligations at Bloom Lake, debt reductionand return of capital to shareholders. Given the remaining life of these assets, we believe Cliffs must act immediately to capture this strategic value. While we previously proposed a spin-off of the international assets, a separation between Cliffs’ core business and the international businesses,by any mechanism,was and continues to be our ultimate objective.

Address Bloated Cost Structure.Cliffs must reduce its cost structure far more aggressively, as its proposed cuts are insufficient given an oversized corporate infrastructure, and cash costs remain too high, in our opinion. We expect, with a more narrowly-focused company, management will be better able to concentrate on further reducing SG&A expenses and improving operating margins.

Return More Capital to Shareholders.With the international assets divested, commodity price exposure greatly reduced, and costs addressed, we believe a de-risked and more profitable Cliffs will have ample capacity to return more capital without eroding credit metrics.A commitment to return capital will, in our view, instill financial discipline, clearly communicate priorities and better position Cliffs to realize its full potential value.

Second-Stage Value Creation—by MLP, Sale or Otherwise.Casablanca has conducted significant research with both MLP capital markets bankers and investors, and continues to believe the transaction can be executed successfully. We also believe Cliffs, after taking the steps outlined above, could potentially realize an attractive valuation in a sale of the Company, as it is the only pure-play iron ore miner of this scale to offer strategic access to the U.S. market. However, we are ultimately indifferent as to whether an MLP, sale or other mechanism is utilized to realize Cliffs’ potential value.

Casablanca Proposes Leadership Changes to Cliffs Executive Ranks and Board

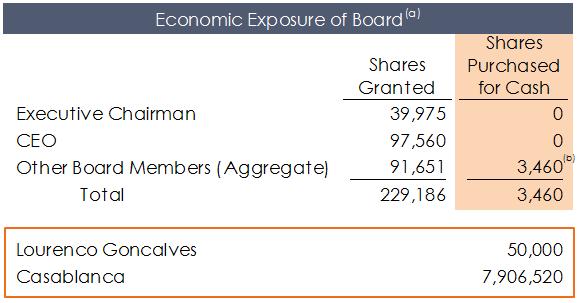

Casablanca Believes New Leadership Is Required. We are putting forward a new slate of directors that, together with Lourenco Goncalves as CEO, will be better equipped, in our view, to implement a new strategic direction for Cliffs and to take the steps required for it to realize its full value potential.

Lourenco Goncalves Is a Proven Value Creator.As previously announced, we are proposing that Lourenco Goncalves lead Cliffs. A 30-year veteran of the metals and mining industry, Mr. Goncalves is a proven value creator who brings deep experience with companies in the ferrous value chain and has both the strategic and operational skills needed to effect urgent change and restore the fundamental value of Cliffs.

Casablanca’s Board Candidates Are Well Qualified to Oversee the Restoration of Value. Cliffs requires a fresh perspective, independent thinking, and analytical rigor—traits that we believe the incumbent Board lacks. Casablanca has nominated six highly-qualified directors whose experience should immediately add value to a Board that in our view is entrenched and unaccountable.

Conclusion

As a significant shareholder, we are troubled by the value destruction that has occurred under the current Board’s watch and firmly believe the status quo is unacceptable—shareholders have suffered enough. Cliffs desperately needs a new strategy and leadership with a fresh perspective. We are confident that substantial shareholder representation among a group of highly-qualified, independent directors on Cliffs’ Board and a new CEO are critical components of any solution. We firmly believe Casablanca’s slate of nominees is overwhelmingly qualified and offers a superior alternative to the incumbent directors up for reelection at the 2014 annual meeting.

Very truly yours,

/s/ | /s/ | /s/ |

Donald G. Drapkin Chairman | Douglas Taylor Chief Executive Officer | Gregory S. Donat Partner & Portfolio Manager |

About Casablanca Capital LP

Casablanca Capital is an Event Driven and Activist investment manager based in New York, founded in 2010 by Donald G. Drapkin and Douglas Taylor. Casablanca invests in high quality but underperforming public companies that have multiple levers to unlock shareholder value. The firm seeks to engage with the management, boards, and shareholders of those companies in a constructive dialogue in order to enhance shareholder value through improved operational efficiencies, strategic divestitures, capital structure optimization and increased corporate focus. In 2011, Casablanca successfully initiated a campaign at Mentor Graphics Corporation to improve profitability and enhance value at the company, working with shareholders to elect three nominees to Mentor’s Board.

Cautionary Statement Regarding Opinions and Forward-Looking Statements

Certain information contained herein constitutes “forward-looking statements” with respect to Cliffs Natural Resources Inc. ("Cliffs"), which can be identified by the use of forward-looking terminology such as “may,” “will,” “seek,” “should,” "could," “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities. Due to various risks, uncertainties and assumptions, actual events or results or actual performance may differ materially from those reflected or contemplated in such forward-looking statements. The opinions of Casablanca Capital LP ("Casablanca") are for general informational purposes only and do not have regard to the specific investment objective, financial situation, suitability or particular need of any specific person, and should not be taken as advice on the merits of any investment decision. This material does not recommend the purchase or sale of any security. Casablanca reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Casablanca disclaims any obligation to update the information contained herein. Casablanca and/or one or more of the investment funds it manages may purchase additional Cliffs shares or sell all or a portion of their shares or trade in securities relating to such shares.

# # #

Media Contacts:

Sard Verbinnen & Co

George Sard/Matt Benson

212-687-8080

Investor Contacts:

Okapi Partners

Bruce H. Goldfarb/Patrick McHugh/Lydia Mulyk

212-297-0720

CASABLANCA CAPITAL LP, DONALD G. DRAPKIN AND DOUGLAS TAYLOR (COLLECTIVELY, “CASABLANCA") INTEND TO FILE WITH THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF PROXY CARD TO BE USED IN CONNECTION WITH THE SOLICITATION OF PROXIES FROM STOCKHOLDERS OF CLIFFS NATURAL RESOURCES INC. (THE "COMPANY") IN CONNECTION WITH THE COMPANY'S 2014 ANNUAL MEETING OF STOCKHOLDERS. ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY CASABLANCA, ROBERT P. FISHER, JR., CELSO LOURENCO GONCALVES, PATRICE E. MERRIN, JOSEPH RUTKOWSKI AND GABRIEL STOLIAR (COLLECTIVELY, THE "PARTICIPANTS"), WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO THE PARTICIPANTS. WHEN COMPLETED, THE DEFINITIVE PROXY STATEMENT AND AN ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE COMPANY'S STOCKHOLDERS AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, OKAPI PARTNERS LLC, CASABLANCA'S PROXY SOLICITOR, WILL PROVIDE COPIES OF THE DEFINITIVE PROXY STATEMENT AND ACCOMPANYING PROXY CARD WITHOUT CHARGE UPON REQUEST BY CALLING (212) 297-0720 OR TOLL-FREE AT (877) 274-8654.

INFORMATION ABOUT THE PARTICIPANTS AND A DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS BY SECURITY HOLDINGS WILL BE CONTAINED IN THE PRELIMINARY PROXY STATEMENT ON SCHEDULE 14A TO BE FILED BY CASABLANCA WITH THE SEC ON MARCH 6, 2014. THIS DOCUMENT CAN BE OBTAINED FREE OF CHARGE FROM THE SOURCES INDICATED ABOVE.