- CLF Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cleveland-Cliffs (CLF) 8-KRegulation FD Disclosure

Filed: 11 Jan 11, 12:00am

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Building Scale and Providing Substantial Future Growth Opportunities Exhibit 99 |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 1 “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995 1 This presentation and accompanying oral remarks contain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by the use of predictive, future-tense or forward-looking terminology, such as “believes,” “anticipates,” “expects,” “estimates,” “intends,” “may,” “will” or similar terms. These statements speak only as of the date of this presentation or the date of the document incorporated by reference, as applicable, and we undertake no ongoing obligation, other than that imposed by law, to update these statements. These statements appear in a number of places in this presentation, including the documents incorporated by reference, and relate to, among other things, the successful completion of the proposed acquisition, our intent, belief or current expectations of our directors or our officers with respect to: our future financial condition, results of operations or prospects; estimates of our economic iron ore and coal reserves; our business and growth strategies; and our financing plans and forecasts. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those contained in or implied by the forward looking statements as a result of various factors, some of which are unknown, including, without limitation: • our ability to successfully complete the proposed acquisition; • our ability to successfully integrate Consolidated Thompson’s operations; • our ability to achieve the synergies of the proposed acquisition; • our ability to achieve the strategic and other objectives related to the proposed acquisition; • the impact of the current global economic crisis, including downward pressure on prices; • trends affecting our and/or Consolidated Thompson’s financial condition, results of operations or future prospects; • the outcome of any contractual disputes with our customers; • the ability of our customers to meet their obligations to us on a timely basis or at all; • our ability to maintain good relationships with Consolidated Thompson’s customers following consummation of the acquisition; • our actual economic iron ore and coal reserves; • the success of our business and growth strategies; • our ability to successfully identify and consummate any strategic investments; • adverse changes in currency values; • the outcome of any contractual disputes with our significant energy, material or service providers; • the success of our cost-savings efforts; • our ability to maintain adequate liquidity and successfully implement our financing plans; • our ability to maintain appropriate relations with unions and employees; • uncertainties associated with unanticipated geological conditions related to underground mining; • the potential existence of significant deficiencies or material weakness in our internal control over financial reporting; and • the risk factors referred to in the “Risk Factors” section of our documents filed with the Securities and Exchange Commission. Reference is made to the detailed explanation of the many factors and risks that may cause such predictive statements to turn out differently, set forth in the Company's Annual Report and Reports on Form 10-K, Form 10-Q and previous documents filed with the Securities and Exchange Commission, which are publicly available on Cliffs Natural Resources' website. The information contained in this document speaks as of today and may be superseded by subsequent events. We caution you that the foregoing list of important factors is not exclusive. In addition, in light of these risks and uncertainties, the matters referred to in our forward-looking statements may not occur. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as may be required by law. The information concerning Consolidated Thompson, including Cliffs’ expectations relating to the impact of the completion of an acquisition of Consolidated Thompson, contained in this release has been taken from or based upon publicly available documents and records filed with the Canadian securities regulatory authorities and other public sources at the time of this release and has not been independently verified by Cliffs. Cliffs assumes no responsibility for the accuracy or completeness of such information, or for any failure by Consolidated Thompson to disclose publicly facts, events or acts that may have occurred or come into existence or that may affect the significance or accuracy of any such information but which are unknown to Cliffs. We also strongly urge you to not rely on any single financial measure to evaluate our business. Please see refer to the appendix for important information. |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 2 Joseph Carrabba Chairman, President & Chief Executive Officer Laurie Brlas Executive Vice President, Finance and Administration & Chief Financial Officer Steve Baisden Senior Director, Investor Relations & Communications |

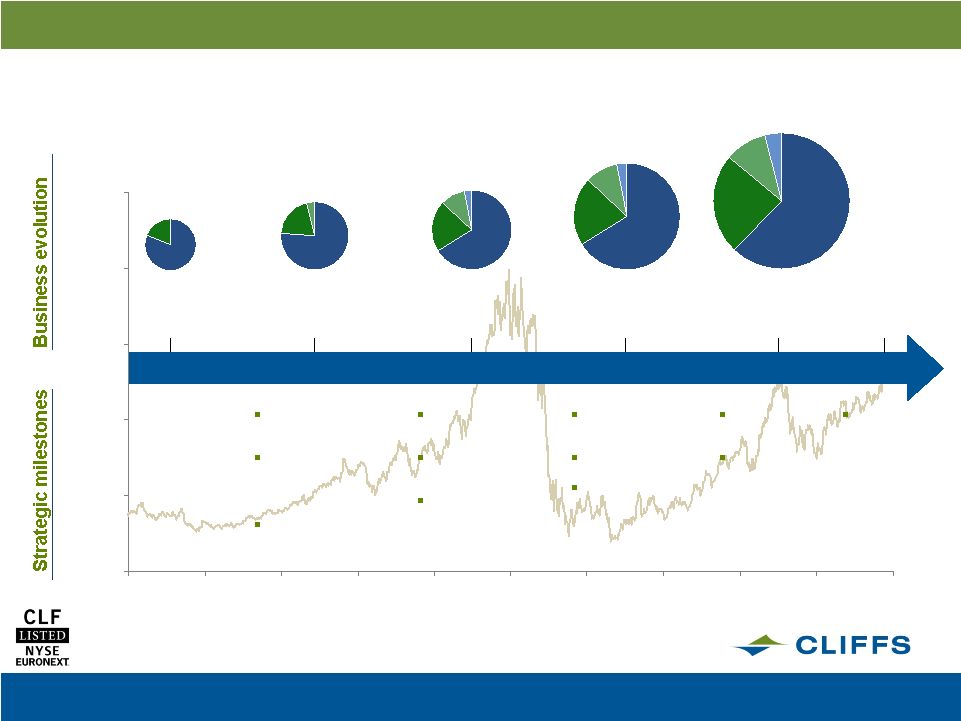

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP $0 $30 $60 $90 $120 $150 Jan 2006 Jul 2006 Jan 2007 Jul 2007 Jan 2008 Jul 2008 Jan 2009 Jul 2009 Jan 2010 Jul 2010 Jan 2011 3 2006 Sales: $2.0 Cliffs’ Strategic Execution – Diversifying, Building Scale, and Adding Shareholder Value 2007 Sales: $2.3 2008 Sales: $3.6 2008 Acquired remaining stake in Portman Limited (15%) Acquired remaining stake in United Taconite (30%) Acquired stake in Golden West, an Australian iron ore junior mining company 2009 Sales: $2.3 Sales¹: $4.4 2010E 2007 Acquired 30% interest in Amapá iron ore project in Brazil Acquired 45% economic interest in Sonoma, hard coking and thermal coal mine in Queensland, Australia Acquired PinnOak, Central Appalachian high-quality, low-volatility met coal mines 2010 Acquisition of INR Energy’s West Virginia coal assets Control of Big Daddy chromite deposit consolidated 2009 Announced acquisition of remaining stake in Wabush Mines (73%) Announced acquisition of Freewest Resources Added to S&P 500 Index 3 North American Iron Ore 62% North American Coal 10% Other 4% Asia Pacific Iron Ore 24% 1 Company guidance as per December 2010 Investor Presentation 2011 2011 Announced Consolidated Thompson acquisition |

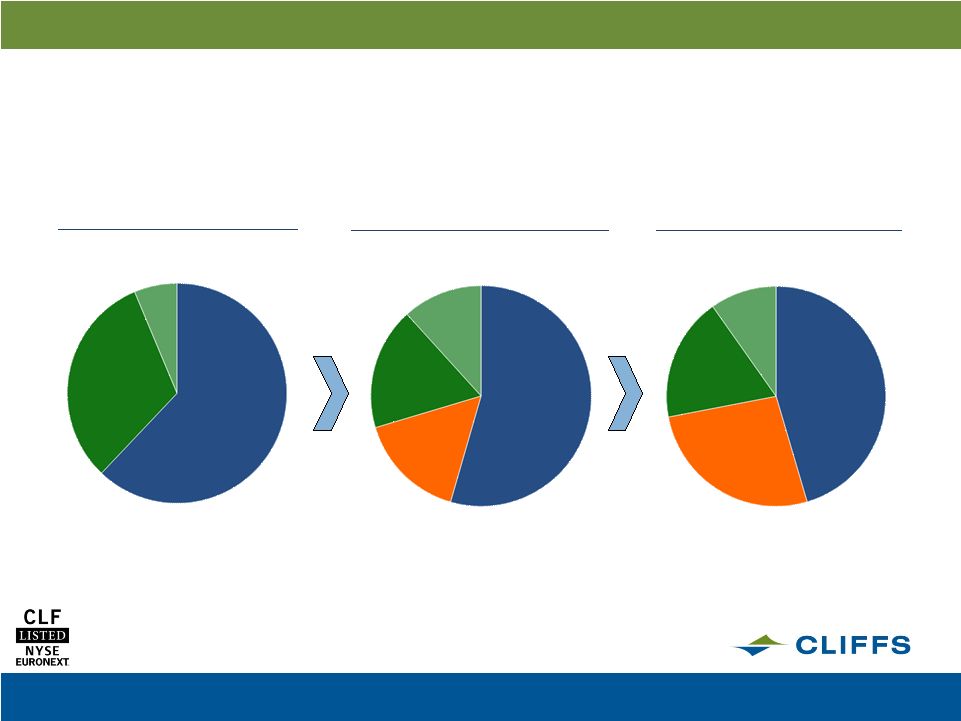

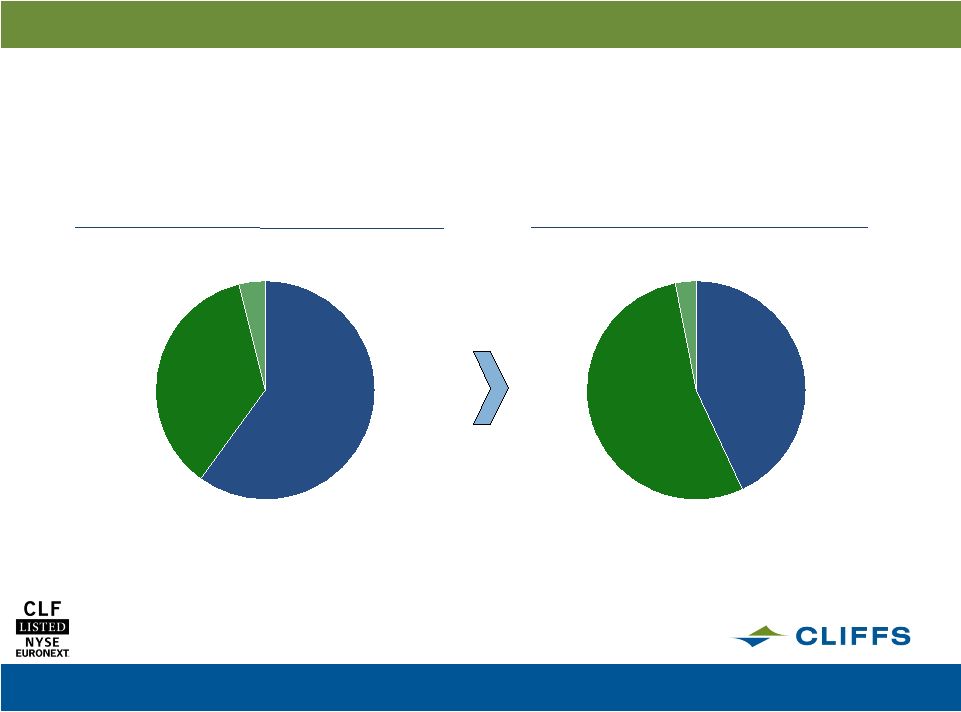

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Diversifying Cliffs’ Product Mix (by metric tons) 4 2009 Cliffs product mix North American Iron Ore 62% Asia Pacific Iron Ore 32% North American Coal 6% North American Iron Ore 54% Asia Pacific Iron Ore 18% North American Coal 12% Seaborne Concentrate to Asia 16% 2011E Cliffs product mix Beyond 2013E Cliffs product mix North American Iron Ore 45% Asia Pacific Iron Ore 18% Seaborne Concentrate to Asia 27% 1 Based on Cliffs’ 2009 From 10-K reported tons sold by product segment (all figures converted to metric tons) 2 Assumes (a) completion of the acquisition; (b) Cliffs’ 2011 guidance disclosed within its 3 rd quarter 2010 Form 10-Q and (c) Consolidated Thompson’s June 2010 Feasibility Study 3 Assumes (a) completion of the acquisition; (b) Cliffs’ 2011 guidance used for 2013 production and (c) completion of Consolidated Thompson’s expansion projects disclosed in June 2010 Feasibility Study with total capacity reaching 16 million metric tons Note: Excludes Cliffs’ Asia Pacific Coal and Amapà North American Coal 10% 1 2 3 |

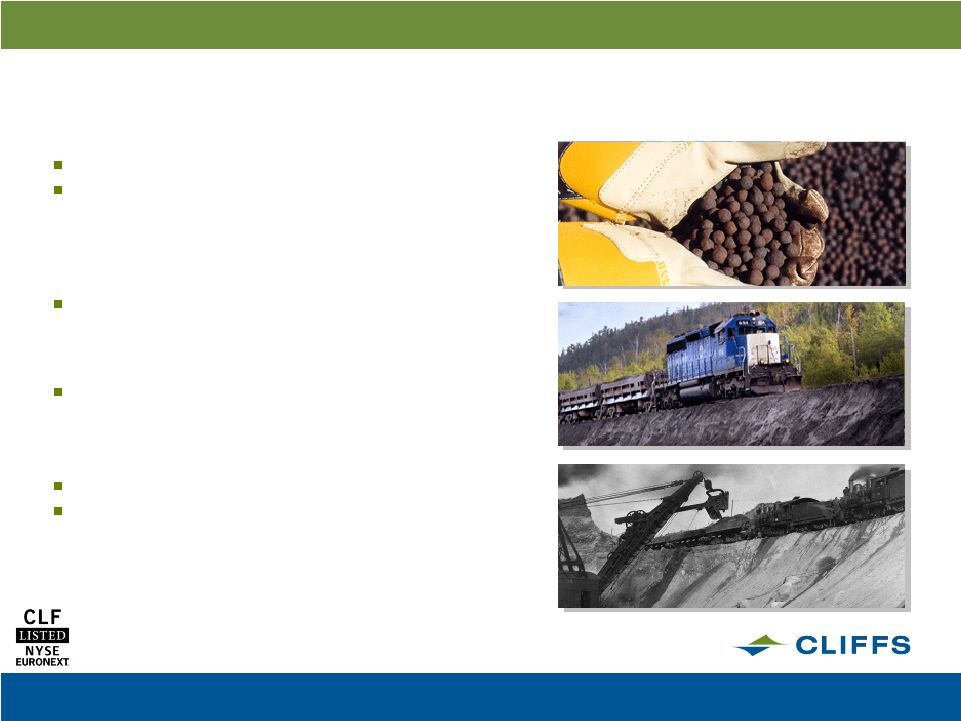

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 5 Consolidated Thompson An Emerging World-Class Iron Ore Producer 5 One of the fastest developing iron ore producers in North America with over 580 million tonnes of reserves Access to Asia market Profitable and positive operating cash flow in its second quarter of production Excellent infrastructure with power, rail and port access capable of supporting growth profile Expected to double its annual iron ore capacity to an annualized 16 million tons Attractive development opportunities at Lamêlée and Peppler Lake with approximately 935mt of indicated iron ore resources Expected to be a low-cost producer |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Significant Synergy Potential 6 Conveyor, dock and loading — Leverage Wabush port and loading capacity — Lower loading costs — Increase loading rates and potential annual shipping tonnage Capture pellet premium margin — Potential to feed currently idled furnace capacity at Wabush Parts, supplies and warehouse efficiencies Technical expertise, management and administrative tasks Expect to realize ~$75mm in pre-tax annual operating synergies |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Strategic Diversification in Cliffs’ Core Product 7 Significantly increases exposure to seaborne customers Major diversification of Cliffs’ client base – Substantially all of Consolidated Thompson’s production sold into Asian markets – Long-term contracts with Wuhan Iron and Steel (Group) Corporation (“WISCO”) and others Establishes a strategic relationship with one of the leading Chinese steel producers – WISCO, China’s 3 largest steel maker is Consolidated Thompson’s largest customer and 25% partner in Bloom Lake Significantly enhances Cliffs’ growth profile – Consolidated Thompson expected to double production from current run rate – Potential further development of reserve base Expected to be a low-cost producer and globally competitive Low operating risk and achievable synergies — Adjacent to Cliffs’ Wabush operation — Cliffs has mined in Quebéc for 45 years — Consolidated Thompson has attractive technical characteristics — Sound regulatory environment rd |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Transaction Overview 8 Cliffs Natural Resources to acquire all of the common shares of Consolidated Thompson Iron Mines Ltd. The total transaction value is approximately C$4.9 billion (including net debt) Consolidated Thompson’s Board has recommended that its shareholders approve the transaction Consolidated Thompson’s existing off-take agreement with WISCO is expected to continue with Cliffs – WISCO will continue to hold a 25% partnership interest in Bloom Lake Transaction Under the terms of the transaction, Consolidated Thompson’s shareholders will receive C$17.25 per share, C$4.9 billion in aggregate, consisting of all cash The transaction represents an implied premium of 30% to Consolidated Thompson’s closing share price as of January 10, 2011. Bridge financing for the transaction has been committed by J.P. Morgan Cliffs expects to access capital markets to arrange permanent financing It is Cliffs’ objective to maintain current BBB-/Baa3 ratings Financing Significant synergy potential with Cliffs’ Eastern Canadian operations Transaction is expected to be modestly accretive to earnings and cash flow in 2011 and 2012 Financial Impact The transaction is expected to close in early second quarter, subject to satisfaction or waiver of customary closing conditions Anticipated Closing Consideration |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Maintaining a Strong Financial Position 9 Committed Financing — Committed 364-day bridge facility — Available liquidity Targeted Permanent Financing — Expect to access capital markets Strong Pro Forma Balance Sheet — Ample liquidity — Manageable debt maturity profile — Strong cash flow generation — It is Cliffs’ objective to maintain current BBB-/Baa3 ratings |

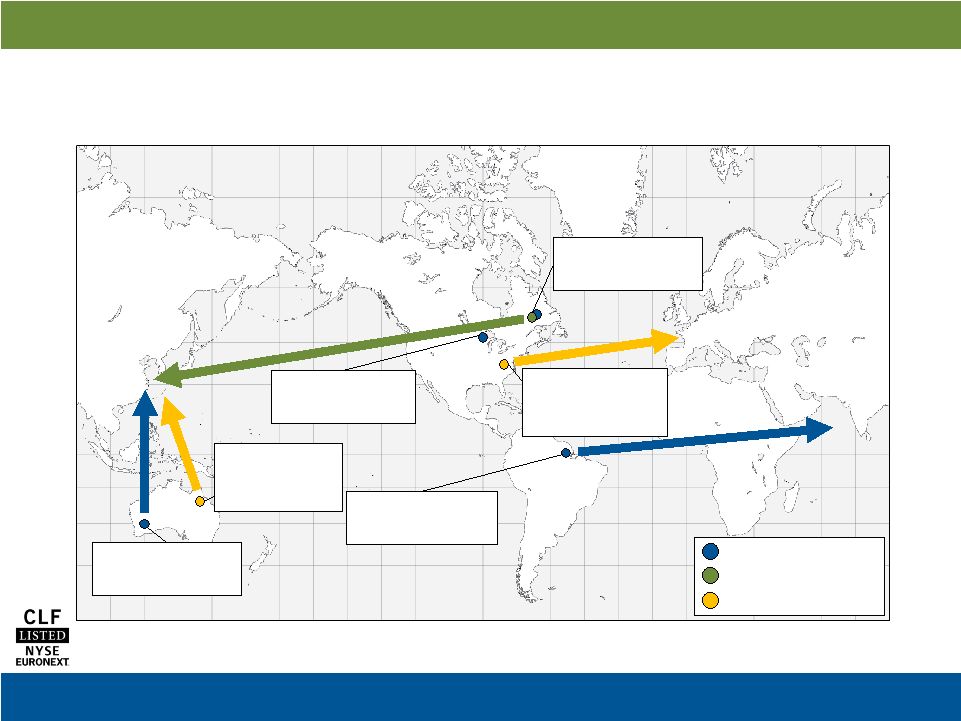

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 10 Source: Cliffs Management Estimates, Technical Reports, Company Filings, Anglo American Annual Report 2009 = CLF Iron Ore Capacity = CLM Iron Ore Capacity US Iron Ore Production Capacity: 24.5Mt Canadian Iron Ore Production Capacity: 5.6Mt + 16.0Mt Australian Iron Ore Production Capacity: 11.0Mt Brazilian Iron Ore Production Capacity: 1.5Mt Expanding Cliffs’ Global Reach at Seaborne Rates = CLF Coal Capacity Australian Coal Production Capacity: 1.5Mt US Coal Production Capacity: 7.9Mt (3.5Mt shipped to Europe) Notes: Tonnage in metric tonnes. Reflects attributable portion of total production capacity as stated in public filings, adjusted for subsequent public announcements regarding CT and Cliffs’ Australia capital expenditure projects. Capacity figures are estimated at 2013 equity levels. |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 11 Why Consolidated Thompson? Seaborne iron ore Strategic relationship with leading global steel producer Builds on platform in Eastern Canada Strategic High-quality concentrate Open-pit mining Proximity to Cliffs’ existing Eastern Canadian operating Constructive mining jurisdiction Excellent health, safety and environmental record Operational Meaningful earnings and cash flow potential Strong growth profile Accretive Significant and achievable synergy opportunities Financial |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Building Scale and Providing Substantial Future Growth Opportunities |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 13 Appendix |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 14 The Acquisition Is at the Core of Cliffs’ Growth Strategy 14 NORTH AMERICA ASIA PACIFIC (AUSTRALIA) SOUTH AMERICA (BRAZIL) NORTH AMERICAN MET COAL SEABORNE IRON ORE IRON ORE SEABORNE MET COAL SEABORNE FERROALLOYS Cliffs’ strategy: Geographic and mineral diversification Minerals Geographies Diversify into other end-markets and other steel-related minerals Expand geographically into low-political-risk geographies Emphasize cash-flow positive, profitable, commercial-stage businesses Also evaluate opportunities in the early stage of development |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Increasing Exposure to High Growth Seaborne Customers (by metric tonnes) 15 Cliffs’ 2009 Iron Ore Markets served¹ North American Pellets 60% Seaborne to Europe and the Middle East 4% Seaborne to Asia 36% Cliffs’ 2009 Iron Ore markets served + Consolidated Thompson’s markets served 1 Based on Cliffs’ 2009 10K reported annual capacity for North American Iron Ore and Asia Pacific Iron Ore; Assumes Wabush, Koolyanobbing, and Cockatoo Island capacity is sold to seaborne customers in Asia; Amapà capacity is sold to Europe and the Middle East; Empire, Tilden, Hibbing, Northshore, and United Taconite capacity is sold as pellets into the North American market; Production figures above represent Cliffs’ equity capacity 2 Assumes completion of Consolidated Thompson’s expansion projects disclosed in June 2010 Feasibility Study with total capacity reaching 16mm metric tons per year North American Pellets 43% Seaborne to Europe and the Middle East 3% Seaborne to Asia 54% 1 2 |

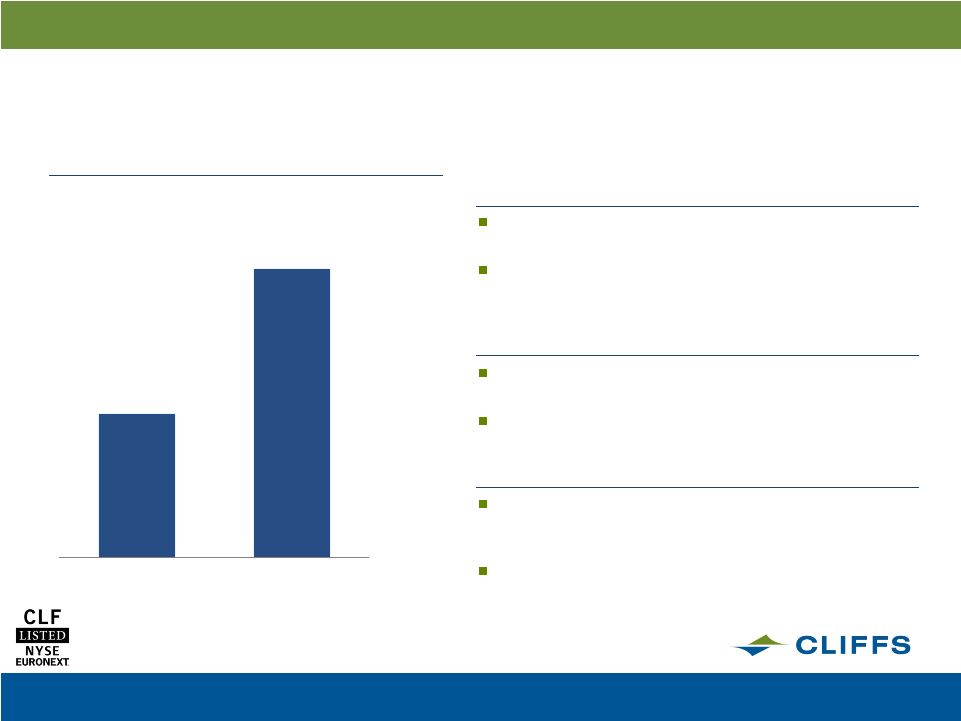

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 16 Attractive Commercial Relationships with Leading Asian Players 16 8 2011E Beyond 2013 Wuhan Iron & Steel (Group) Corporation (“WISCO”) China’s 3 rd -largest steel producer – produced more than 30mm metric tons of steel in 2009 WISCO affiliate to purchase minimum of 50% of total annual production for first 8 million tons of iron ore produced each year by Consolidated Thompson Worldlink Resources (“Worldlink”) A leading integrated commercial company that imports and exports iron ore, coal, and other bulk solids Agreement to purchase 7 million metric tons of iron ore concentrate per year over a seven-year period SK Networks (“SKN”) Subsidiary of SK Group, South Korea’s 3 rd -largest conglomerate operating in trading, information technology, energy distribution, and overseas resource development Agreement to purchase one million metric tons of iron ore concentrate from the Bloom Lake mine Consolidated Thompson’s est. production (metric tons mm) Source: Consolidated Thompson June 2010 Feasibility Study |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 17 Cliffs Natural Resources’ Global Footprint Access to high-growth Asian markets Pricing correlates to Australian pricing for lump and fines Largest iron ore producer in North America Significant position in North American metallurgical coal A developing project in a low-cost mining district Asia Pacific North America Latin America |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Cliffs’ Strategic Imperatives Going Forward 18 Scale through diversification Global execution Operational excellence Building scale through diversification Multiple Revenue Streams Product Diversification Geographic Presence Operational excellence Safety Technical Competencies Operating Efficiencies Global execution Competencies of the Firm Outlook of Personnel Global Scalability Shareholder returns Shareholder Value Risk Management “Earning the Right to Grow” Shareholder returns |