- CLF Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Cleveland-Cliffs (CLF) 8-KRegulation FD Disclosure

Filed: 28 Jun 11, 12:00am

CLIFFS NATURAL RESOURCES INC. CLF ROCKS NYC TUESDAY JUNE 28 2011 THE NEW YORK STOCK EXCHANGE PROGRAM AGENDA 10:00 a.m. WELCOME Steve Baisden Vice President, Investor Relations and Communications 10:05 a.m. Cliffs’ Overall Strategy Joseph Carrabba Chairman, President and Chief Executive Officer 10:35 a.m. Global Marketing Donald Gallagher Executive Vice President, President – Global Commercial Terrence Mee Senior Vice President – Global Iron Ore & Metallic Sales William Hart Vice President – Global Marketing 11:10 a.m. Eastern Canada Integration & Expansion David Blake Senior Vice President, North American Iron Ore – Operations 11:25 a.m. Asia Pacific Iron Ore & North American Coal Duncan Price Executive Vice President, President – Global Operations 11:50 a.m. Ferroalloys William Boor Senior Vice President – Global Ferroalloys 12:15 p.m. LUNCH BREAK 1:25 p.m. Global Exploration Clifford Smith Senior Vice President – Global Business Development 1:45 p.m. Sustainability P. Kelly Tompkins Executive Vice President – Legal, Government Affairs and Sustainability & Chief Legal Officer 2:00 p.m. Capital Structure & Asset Allocation Laurie Brlas Executive Vice President – Finance and Administration & Chief Financial Officer 2:15 p.m. Summary Joseph Carrabba Chairman, President and Chief Executive Officer 2:20 p.m. Q&A Cliffs Executive Leadership Team 3:00 p.m. PROGRAM CLOSE Exhibit 99.1 |

PLEASE SUBMIT YOUR ELECTRONIC QUESTIONS TO: NYSE@CliffsNR.com 2 |

3 “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995 This presentation and accompanying oral remarks contain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by the use of predictive, future-tense or forward-looking terminology, such as “believes,” “anticipates,” “expects,” “estimates,” “intends,” “may,” “will” or similar terms. These statements speak only as of the date of this presentation and we undertake no ongoing obligation, other than that imposed by law, to update these statements. These statements appear in a number of places in this presentation and relate to our intent, belief or current expectations of our directors or our officers with respect to: our future financial condition, results of operations or prospects; estimates of our economic iron ore and coal reserves; our business and growth strategies; and our financing plans and forecasts. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that actual results may differ materially from those contained in or implied by the forward- looking statements as a result of various factors, some of which are unknown, including, without limitation: • the ability to successfully integrate acquired companies into our operations, including without limitation, Consolidated Thompson Iron Mines Limited; • uncertainty or weaknesses in global and/or market economic conditions, including any related impact on prices; • trends affecting our financial condition, results of operations or future prospects; • the ability to reach agreement with our iron ore customers regarding modifications to sales contract pricing escalation provisions to reflect a shorter-term or spot-based pricing mechanism; • the outcome of any contractual disputes with our customers or significant energy, material or service providers; • the outcome of any arbitration or litigation; • changes in sales volume or mix; • the impact of price-adjustment factors on our sales contracts; • the ability of our customers to meet their obligations to us on a timely basis or at all; • our actual economic ore reserves or reductions in current resource estimates; • the success of our business and growth strategies; • our ability to successfully identify and consummate any strategic investments; • our ability to achieve post-acquisition synergies; • events or circumstances that could impair or adversely impact the viability of a mine and the carrying value of associated assets; • the results of pre-feasibility and feasibility studies in relation to projects; • impacts of increasing governmental regulation including failure to receive or maintain required environmental permits, approvals, modifications or other authorization of, or from, any governmental or regulatory entity; • adverse changes in currency values, currency exchange rates and interest rates; • the success of our cost-savings efforts; • our ability to maintain adequate liquidity and successfully implement our financing plans; • our ability to maintain appropriate relations with unions and employees; • uncertainties associated with unanticipated geological conditions, natural disasters, weather conditions, supply and price of energy, equipment failures and other unexpected events; • risks related to international operations; • the potential existence of significant deficiencies or material weakness in our internal control over financial reporting; and • the risk factors referred to or described in the “Risk Factors” section of our documents filed with the Securities and Exchange Commission. Reference is made to the detailed explanation of the many factors and risks that may cause such predictive statements to turn out differently, set forth in the Company's Annual Report and Reports on Form 10-K, Form 10-Q and previous documents filed with the Securities and Exchange Commission, which are publicly available on Cliffs Natural Resources Inc.’s website. The information contained in this document speaks as of today and may be superseded by subsequent events. We caution you that the foregoing list of important factors is not exclusive. In addition, in light of these risks and uncertainties, the matters referred to in our forward-looking statements may not occur. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as may be required by law. We also strongly urge you to not rely on any single financial measure to evaluate our business. |

Joe Carrabba CLIFFS NATURAL RESOURCES INC. CLIFFS’ OVERALL STRATEGY 4 |

SAFETY IS A TOP PRIORITY • Safety has been and will always be at the core of Cliffs’ strategy • Continuing focus of investment • Safety approach and lower trending LTIFR position Cliffs as an employer of choice 5 |

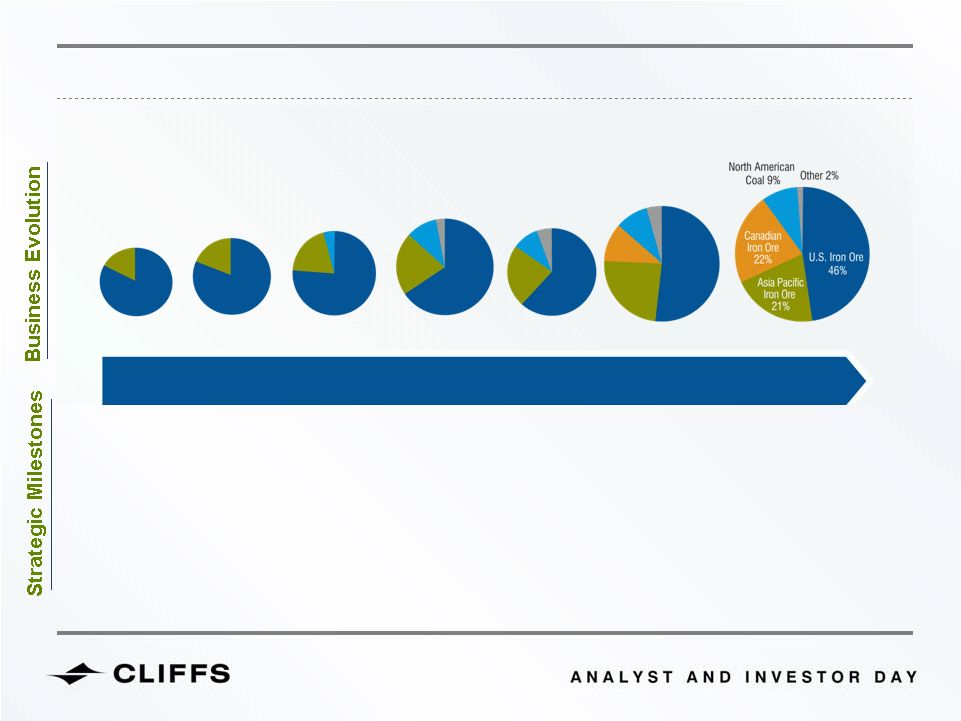

THE CLIFFS JOURNEY HAS JUST BEGUN... 6 • Since 2004 Cliffs has transitioned from a geographically concentrated mine operator to a diversified mine owner • In the process we have created tremendous value for our shareholders by providing 36% returns annually – an achievement that puts us near the top of our peer group • Moving forward our aspirations are ambitious – continue to deliver outstanding shareholder value and gain scale through diversification • To accomplish this, it's critical we deliver on our organic growth through execution and operational excellence |

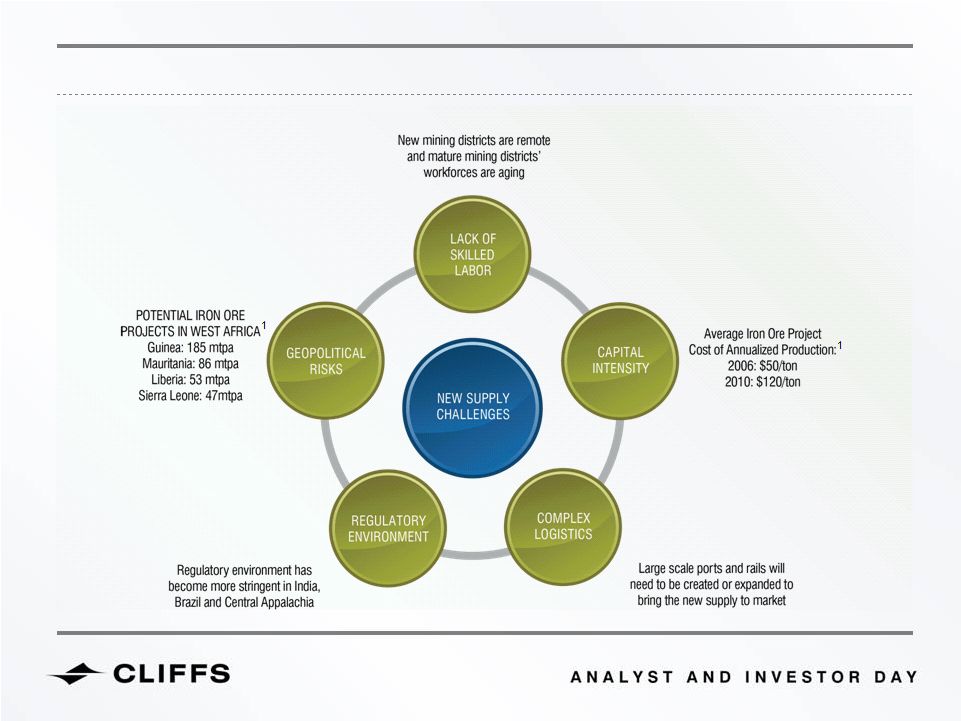

NEAR- & LONG-TERM TACTICS • Increase Seaborne Exposure • Enhance Project Pipeline • Customer & Mineral Diversification • Apply Technical Competencies CLIFFS WILL CONTINUE EXECUTING ITS SOUND STRATEGY SUPPORTED BY FUNDAMENTAL BELIEFS CLIFFS’ LONG-LASTING STRATEGY • Build Scale in Steelmaking Raw Materials INCREASING GLOBAL DEMAND FOR STEEL • Urbanization of BRIC Economies • GDP Growth DEGRADING ORE QUALITY & GRADE • Increased Stripping Ratios • New Projects are Lower- Grade Magnetite Ore NEW SUPPLY CHALLENGES • Complex Logistics • Capital Intensity • Environmental Permitting 7 |

Building scale through diversification • Multiple Revenue Streams • Product Diversification • Geographic Presence Operational excellence • Safety • Technical Competencies • Operating Efficiencies Global execution • Competencies of the Firm • Outlook of Personnel • Global Scalability Shareholder returns • Shareholder Value • Risk Management • “Earning the Right to Grow” OUR STRATEGIC IMPERATIVES REMAIN THE SAME 8 |

• Portman I 1 2011 sales based on Cliffs’ • Amapa • Sonoma • PinnOak • Portman II • United Taconite • Wabush • Freewest & Spider • INR Energy’s Coal Operations • Consolidated Thompson STRATEGY HAS RESULTED IN SIGNIFICANT GROWTH 2011E 2010 2009 2008 2007 2006 2005 Revenue: $1.7 B Revenue: $1.9 B Revenue: $2.3 B Revenue: $3.6 B Revenue: $2.3 B Revenue: $4.7 B Revenue: $7.3 B 1 9 (in millions) 2011 outlook |

Note: TSRs are from Dec 31, 2004 through Dec 31, 2010 SINCE 2004 CLIFFS HAS DELIVERED SIGNIFICANT SHAREHOLDER VALUE 10 |

CLIFFS’ 36% TSR WAS ACHIEVED THROUGH STRONG EXECUTION OF STRATEGY 1. Volume • Volumes grew substantially, supported by strategic diversifying acquisitions 2. Price • Proactively managing our price realization ensured we could capitalize on strong industry demand 3. Margin Expansion • Aggressively managed costs • Net impact from other drivers reflects significant investments to support growth, including debt and share issuance THREE KEY DRIVERS OF CLIFFS’ HISTORIC VALUE CREATION 11 "Other" includes change in valuation multiple and cash contribution, including impact from net change in debt, dividends, and shares outstanding Note: TSRs are from Dec 31, 2004 through Dec 31, 2010; all cross-product impact from volume and price attributed to price; totals may not sum due to rounding 1 |

Cliffs bought 80% of Portman in 2005, and remaining 20% in 2008... ...Improved core infrastructure throughout our ownership... Cliffs invested in infrastructure to enable growth • Rail • Mobile Fleet • Resources ...And delivered significant results 6 mtpa 9 mtpa $4 Billion PORTMAN ACQUISITION & EXPANSION STRONG EXECUTION ESSENTIAL TO SUCCESS 1 Management’s estimate 12 1 |

A NUMBER OF HIGH-PRIORITY LEVERS THAT SUPPORT ORGANIC GROWTH HAVE BEEN IDENTIFIED Operational Excellence Safety Shareholder Returns Cost Management Talent Management Business Improvement Megatrends Ferroalloys Koolyanobbing Expansion Moving Toward World Prices North American Coal Eastern Canada Expansion Exploration Global Execution Building Scale through Diversification Increasing Market Capitalization 13 |

GROWTH STRATEGY (MINERALS AND GEOGRAPHIES) Integrate Consolidated Thompson’s operations 2011 Focus Execute Delivery of various capital projects Beyond 2011 gaining scale is important NORTH AMERICA ASIA PACIFIC (AUSTRALIA) SOUTH AMERICA (BRAZIL) NORTH AMERICAN MET COAL SEABORNE IRON ORE IRON ORE SEABORNE MET COAL SEABORNE FERROALLOYS Cliffs’ Long-term Acquisition Strategy Remains Intact Minerals Geographies 14 |

LOOKING FORWARD, WE WILL CONTINUE PURSUING OUR HISTORIC STRATEGY SUPPORTED BY FUNDAMENTAL BELIEFS Our reasons for the chosen strategy have been consistent over the past several years • Guided by our understanding of the external environment (Megatrends) • Informed by Cliffs’ competitive position and capabilities Beliefs • With growing demand (BRIC economies) and increasing supply constraints (regulatory, cost), the mining sector represents outstanding return potential • Significant scale is both achievable and necessary 15 |

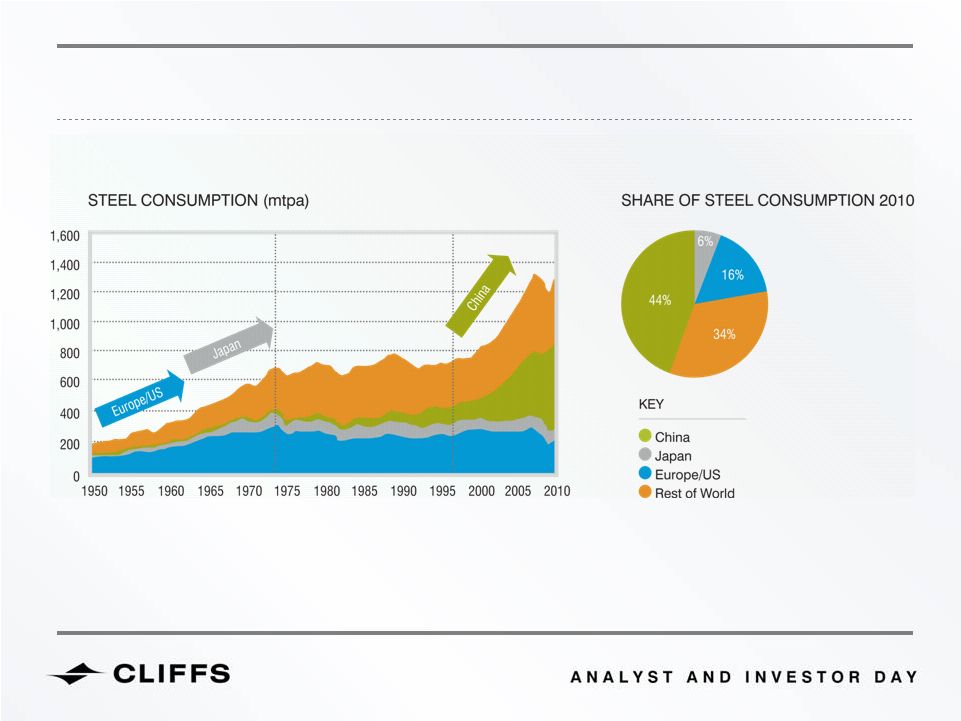

Source: Cliffs Natural Resources; World Steel Organization; The World Bank; World Steel Association Note: India comprises 4% of total steel consumption in 2010 EMERGENCE OF JAPAN AND CHINA HAVE DRIVEN GLOBAL STEEL CONSUMPTION GROWTH SINCE THE 1960s 16 |

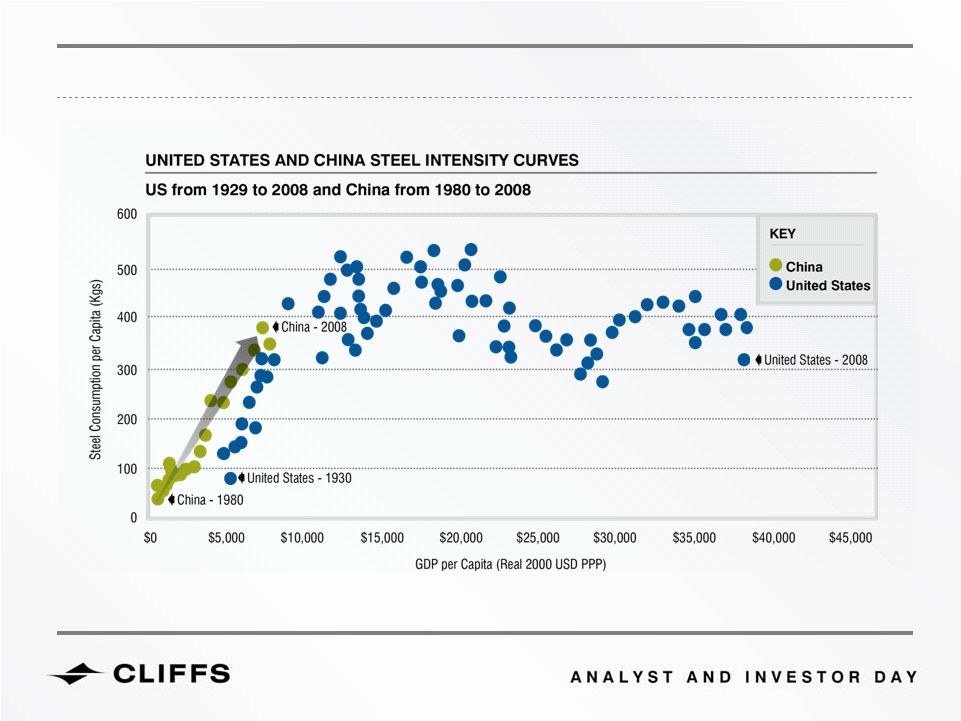

US AND CHINA: STEEL INTENSITY CURVES Source: Bloomberg, Worldsteel, IMF, USGS 17 Although China has recently experienced strong growth in steel consumption, there is still potential for further growth. |

STEEL INTENSITY IS CLOSELY RELATED TO STAGE OF ECONOMIC DEVELOPMENT AND INCOME LEVELS Source: VCI Analysis; International Iron & Steel Institute; McKinsey; Rio Tinto; World Bank; “China Steel Outlook”; Citigroup; Deutsche Bank Research. Note: China regional consumption estimates are based on 2008 data 18 |

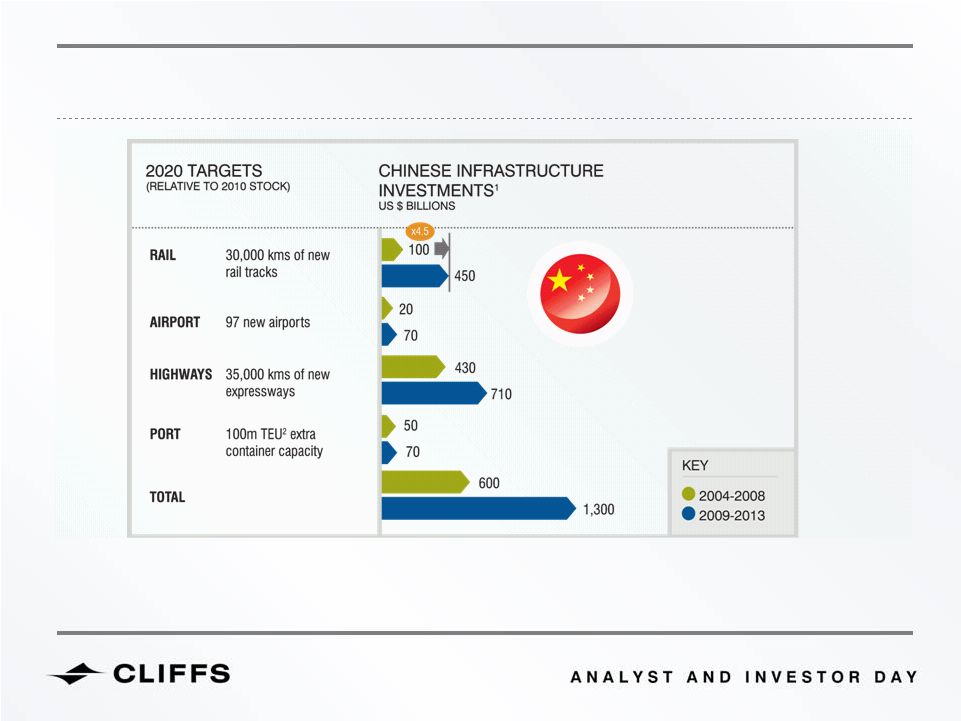

GROWING INFRASTRUCTURE CONGESTION: CHINA IS EXPECTED TO DRAMATICALLY EXPAND ITS INFRASTRUCTURE Source: McKinsey & Company 1 Key assumptions for 2009-2013: 1) Rail and airport are estimated with central gov’t source as it is centrally planned; 2) Highway 2009-2010 is estimated with provincial gov’t source and 2011-2013 central gov’t source (lack of provincial source); 3) Port is estimated from central source due to lack of provincial estimates 19 2 Twenty-foot-container equivalent unit |

Source: McKinsey & Company 20 THE URBANIZATION IN CHINA, INDIA AND AFRICA IS OF UNPRECEDENTED SCALE |

NEW SUPPLY CHALLENGES The barriers to entry are becoming higher as new supply is more challenging to bring into production 1 Source: Macquarie 21 |

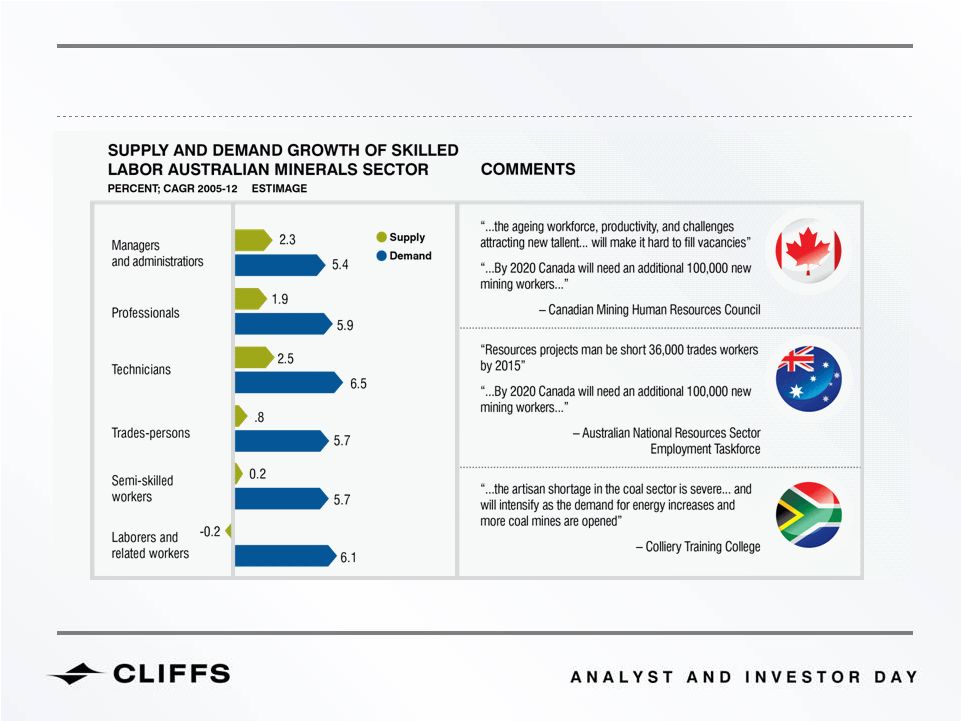

THERE IS A GROWING DEFICIT OF SKILLED LABOR IN THE MINING INDUSTRY GLOBALLY Source: Staffing the Supercycle: Labor Force Outlook in the Minerals Sector, 2005-2015 (Minerals Council of Australia); Canadian Mining Human Resources Council; McKinsey analysis 22 |

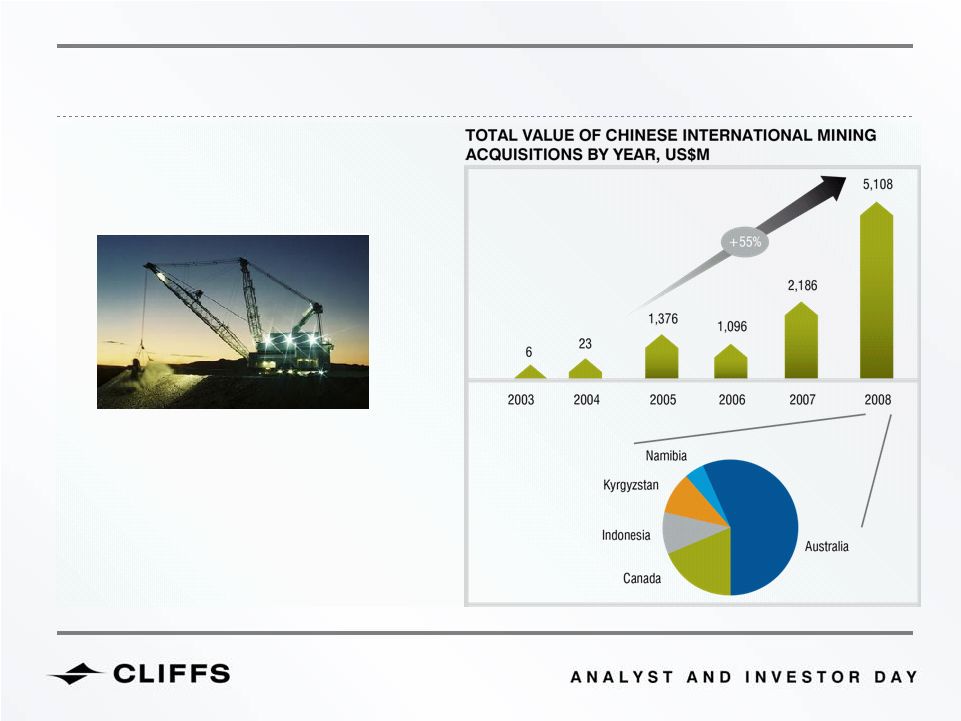

AS RESOURCES ARE BECOMING MORE SCARCE, GOVERNMENTS ARE PLAYING A MORE ACTIVE ROLE Governments are increasingly trying to reap benefits from domestic assets (Reuters) – Australia’s government angered its booming resources sector on Sunday by unveiling a new tax on mining projects from July 2012 under a sweeping pre-election tax overhaul which will also boost pension savings for workers. 5 10 10 19 57 Australia unveils mining tax By James Grubel CANBERRA | Sun May 2, 2010 4:24am EDT Source: Dealogic, RMG 23 |

DECLINING ORE GRADES AND THINNER SEAM THICKNESSES • We believe declining ore grades will be a new challenge for mining companies looking ahead • With the consolidation of the Chinese steel industry on the horizon, it is likely newer blast furnaces will be larger and more efficient, which will require a higher quality of ore • Developed coal basins around the world are experiencing thinner seam thicknesses, making mining challenging and requiring significant capital • As metallurgical coal prices remain high, the premium for higher quality of iron ore is more desired 24 |

CLIFFS’ PIPELINE OF ORGANIC GROWTH 2011 2012 2013 2014 2015 GLOBAL EXECUTION BUILDING SCALE THROUGH DIVERSIFICATION Moving Towards World Prices Coal Expansion APIO Expansion Eastern Canada Expansion Ferroalloys Exploration 25 |

Don Gallagher Bill Hart Terry Mee CLIFFS NATURAL RESOURCES INC. GLOBAL MARKETING 26 |

OUR GLOBAL COMMERCIAL FOCUS • Sustained demand growth • Chinese urbanization and government policy • Indian growth • Tight global supply • Dependent upon capital availability, pricing perceptions, inflation risks, sovereign risks • High-quality iron ore production • Cliffs has a strong quality advantage • Strategic marketing capabilities • Deep customer insight and targeting • Maximizing value for shareholders • Leverage our competitive advantage MAXIMIZING VALUE FOR SHAREHOLDERS TIGHT GLOBAL SUPPLY STRATEGIC MARKETING CAPABILITIES HIGH QUALITY PRODUCTS 27 SUSTAINED DEMAND GROWTH |

CLIFFS’ HISTORIC PRODUCT FLOW 2005 1mt 20mt 5.9mt 28 |

CLIFFS’ FORECASTED PRODUCT FLOW 2013 26mt 33mt 2mt 2mt 2mt 2mt 3mt 29 |

EXAMPLE OF CHINESE URBANIZATION - SHANGHAI Shanghai - 1990 Shanghai - 2010 30 |

CHINESE URBANIZATION WILL CONTINUE TO DRIVE STEEL CONSUMPTION GROWTH Source: EIU; “Putting BRIC growth in perspective”, Worldpress Note: US$4,600 equivalent to RMB30,000 140 cities with 1m or more people currently. Number is expected to grow to 235 cities by 2025. NUMBER OF CITIES IN CHINA WITH AVERAGE DISPOSABLE INCOME OVER US$4,600 31 |

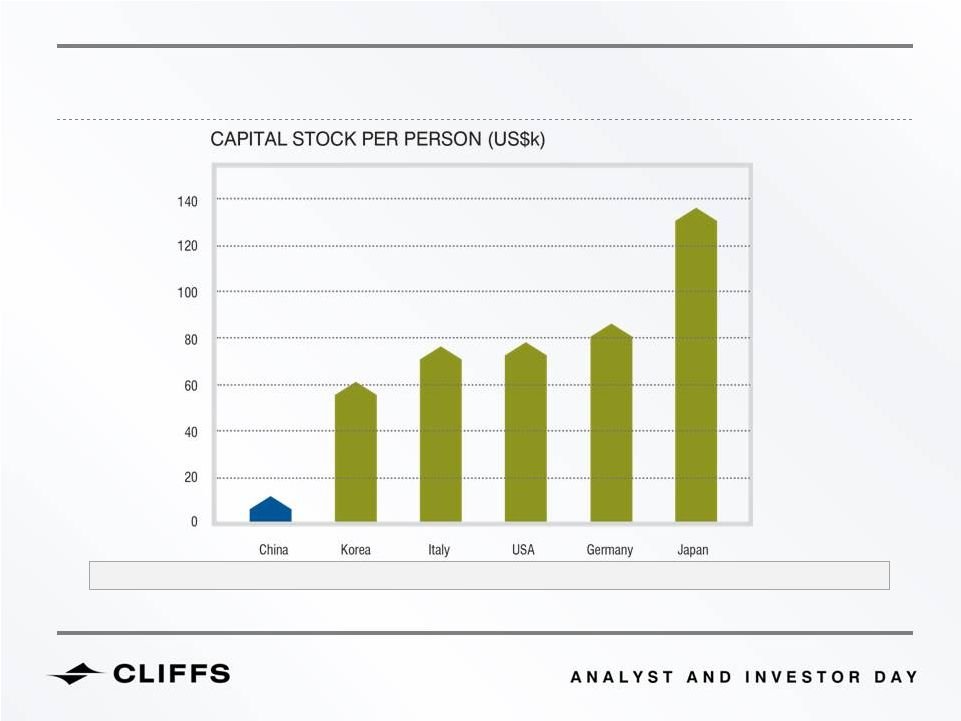

Source: “The Confessions and Concerns Of A China Bull”, Urandaline Investments; Andy Stoeckel, former Head of the Australian Bureau of Agricultural and Resource Economics; People’s Daily Online, February 2010 Reaching developed world capital stock levels would drive an immense increase in Chinese steel consumption. CHINESE CAPITAL STOCK IS STILL VERY LOW BY GLOBAL STANDARDS, PROVIDING SIGNIFICANT GROWTH UPSIDE 32 |

Source: The World Bank; UN World Population Prospects Note: T 0 = 1978 for China, 1991 for India based on assumed start of modern “reformed” period (see Morgan Stanley 2010) INDIA’S DEMAND GROWTH CORRELATES CLOSELY TO CHINESE GROWTH TO DATE 1978 1991 2009 2009 33 |

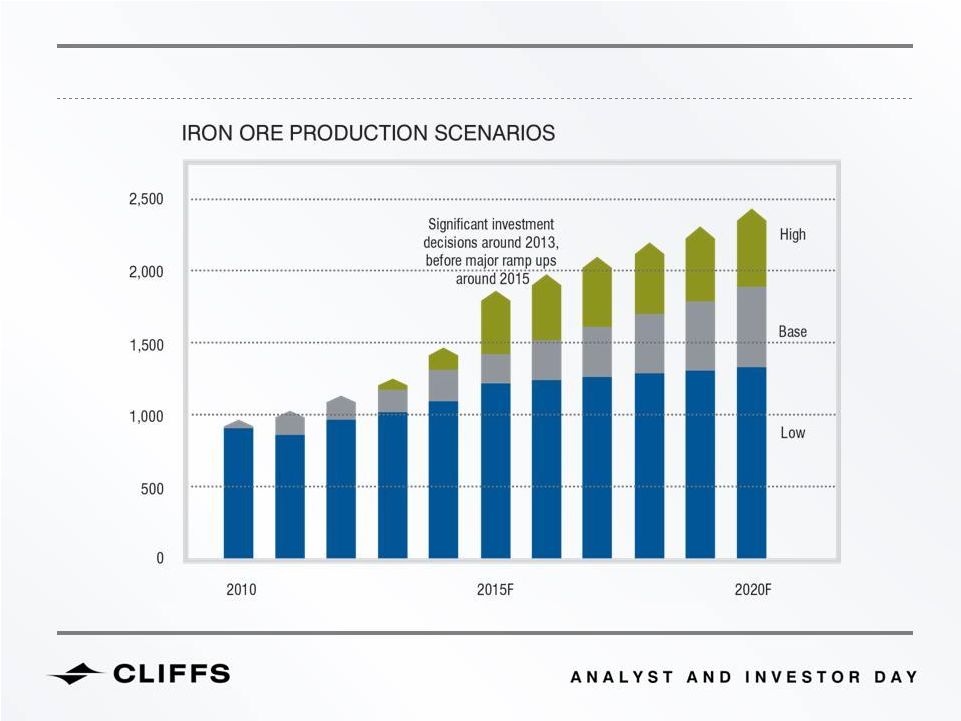

CAPACITY EXPANSIONS ARE UNLIKELY TO BE DELIVERED ON TIME OR ON BUDGET 34 Source: Cliffs Natural Resources; AME; Company announcements and data; “African Iron Ore Supply: Potential For New Projects”, RBC Capital Markets; Engineering and Mining Journal. |

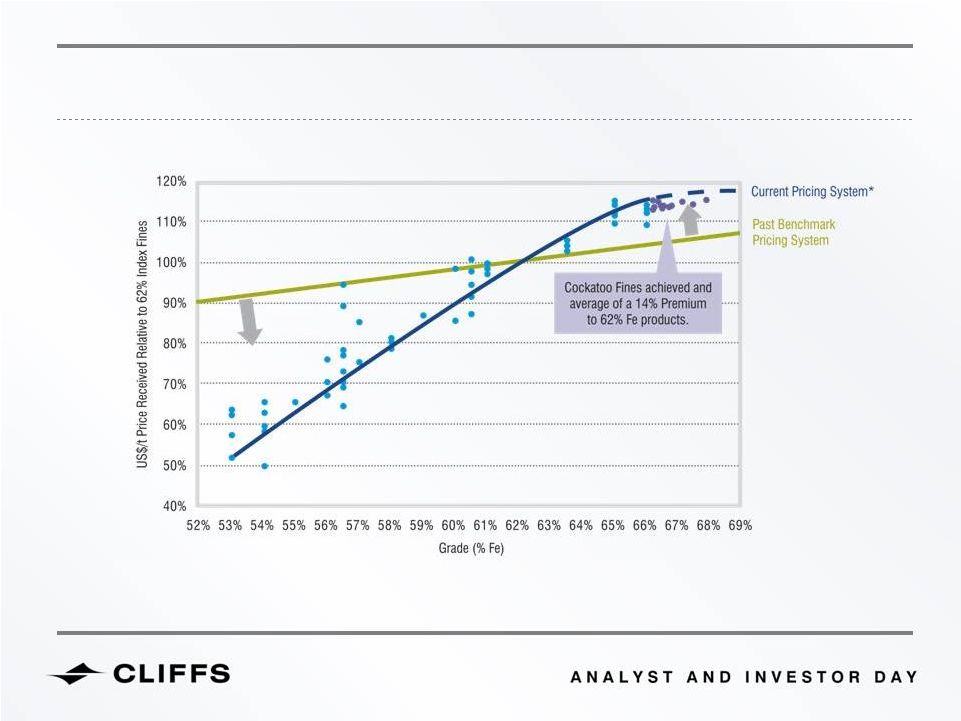

HIGHER-QUALITY IRON ORE IS ATTRACTING AN INCREASED PREMIUM OVER LOWER QUALITY 35 Source: Cliffs Natural Resources; “Australian Iron and Steel Review”, Credit Suisse; 4 months of daily spot trade data (Platts) Note: *Based on a trend line for actual spot |

IRON ORE QUALITY TRADED BY MAJOR PRODUCERS IS TRENDING LOWER Quality was exceptionally stable between 1994 and 2003. Recent declines are likely driven by no availability of quality and “ship anything” response. CONTAINED IRON BY PRODUCT (%Fe) Ongoing quality declines increase production requirements and worsen environmental footprint • Volume required to maintain Fe units • 1% reduction in quality every 5 years implies additional 200mt of seaborne ore required between 2012 and 2020* • Higher volumes of met coal required to process lower grade material and CO 2 emissions per steel ton increase • Appropriate quality lump likely to be increasingly scarce. Coupled with broader quality pressures puts upwards demand pressure on pellets • Falling average quality provides favorable environment for high-quality pellet producers 36 Source: Cliffs Analysis for current quality; Tex reports for 1994-2003 (excludes 1999) Note: * Based on “Base Case” cumulative seaborne demand of 15.3bt and 62% contained Fe starting point in 2010 |

HIGH-QUALITY IRON ORE PRODUCER IN A MARKET OF DECREASING QUALITY Source: Cliffs Analysis Note: Steelmaker inputs are pre-sinter Relative Quality of Iron Ore Producers 64 63 62 61 60 59 58 57 56 55 54 53 52 Grade (% Fe) 66 65 67 68 Robe Yandi FMG PBF Koolyanobbing Mt N Vale IOC Cockatoo Wabush Ore Producers Increasing demand for quality CLF US Mines Steel Mills Bloom Lake CLF US Mines Standard Pellet Value-Added Flux Pellet Decreasing quality of supply 37 |

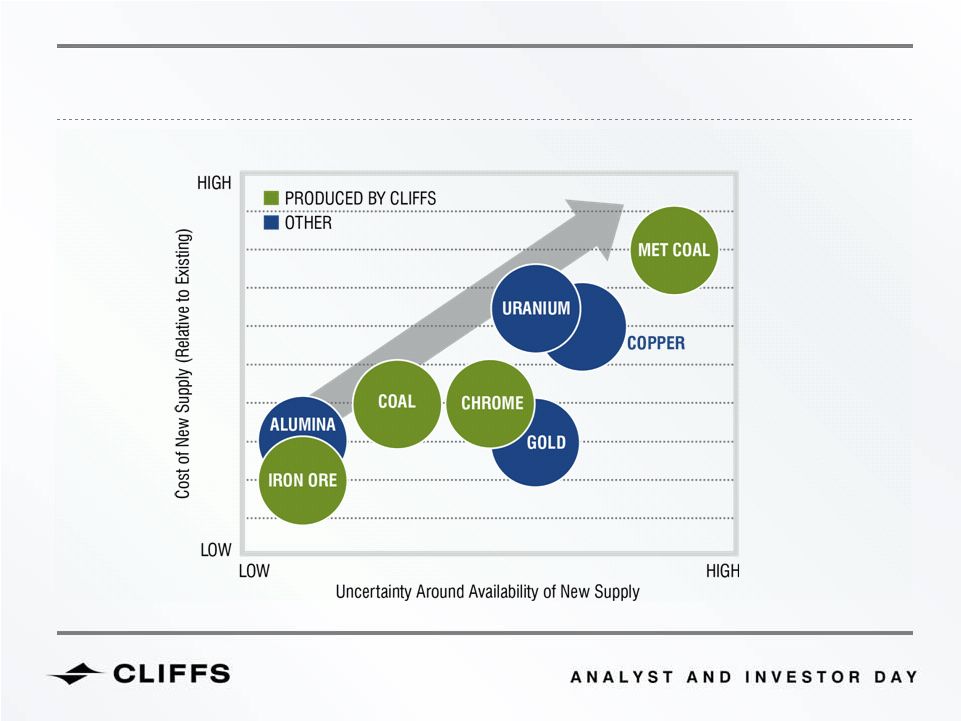

Source: VCI Analysis Note: Analysis is illustrative only METALLURGICAL COAL PRICES CAN BE EXPECTED TO INCREASE FURTHER GIVEN RELATIVE COST OF NEW SUPPLY AVAILABILITY AND COST OF NEW COMMODITY SUPPLY 38 |

SEABORNE METALLURGICAL COAL HAS A FAVORABLE INDUSTRY STRUCTURE WHICH HELPS DRIVE STRONG RETURNS Source: VCI Analysis; Citigroup; BMA; BHP Billiton; McKinsey; Cliffs Natural Resources Note: Estimated ROCE for 15 years to 2003 based on publicly available data, Manganese is based on a weighted average of sources ranging from 5 to 10 years COMMODITY MARKET RETURNS AND CONSOLIDATION 39 |

STAINLESS STEEL DRIVES CHROMITE AND FeCr MARKETS Source: Heinz Pariser 40 |

Source: Cliffs Analysis STAINLESS EXCEEDING CARBON STEEL GROWTH AND CHINA IS THE DRIVER 41 |

42 MARKET METRICS GDP per Capita, Indexed A MATURING CHINESE ECONOMY WILL CONTINUE TO DEMAND INCREASING AMOUNTS OF CHROMITE Source: Heinz Pariser 42 42 |

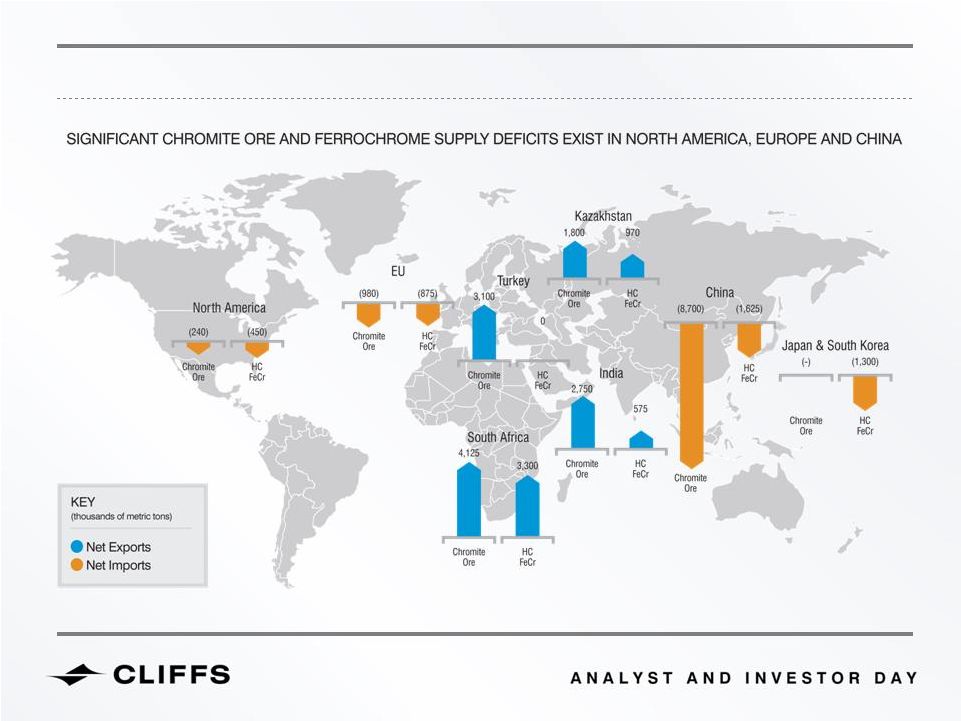

2010 CHROMITE ORE AND FERROCHROME PRODUCTION AND CONSUMPTION Note: Map above excludes production and consumption from ROW Source: Metal Bulletin, Heinz Pariser 43 |

TARGET LIST TOP 20 GO, NO-GO DECISIONS DETAILED ASSESSMENT PURSUE DEVELOP TARGET LIST 1. PRIORITIZATION MODEL 2. INTERNAL ASSESSMENT 3. CUSTOMER VISITS Top 100 mills in China Key mills in Japan & Korea Technical models Commercial models Strategic synergies Site visits Contract performance Strategic location CLIFFS IS TARGETING SALES USING A COMPREHENSIVE TECHNICAL, COMMERCIAL AND STRATEGIC PROCESS 44 |

CLIFFS’ SALES & MARKETING PROCESS IS DELIVERING POSITIVE PRICING OUTCOMES Source: Cliffs analysis, ABS 2010 ASIA PACIFIC IRON ORE 45 |

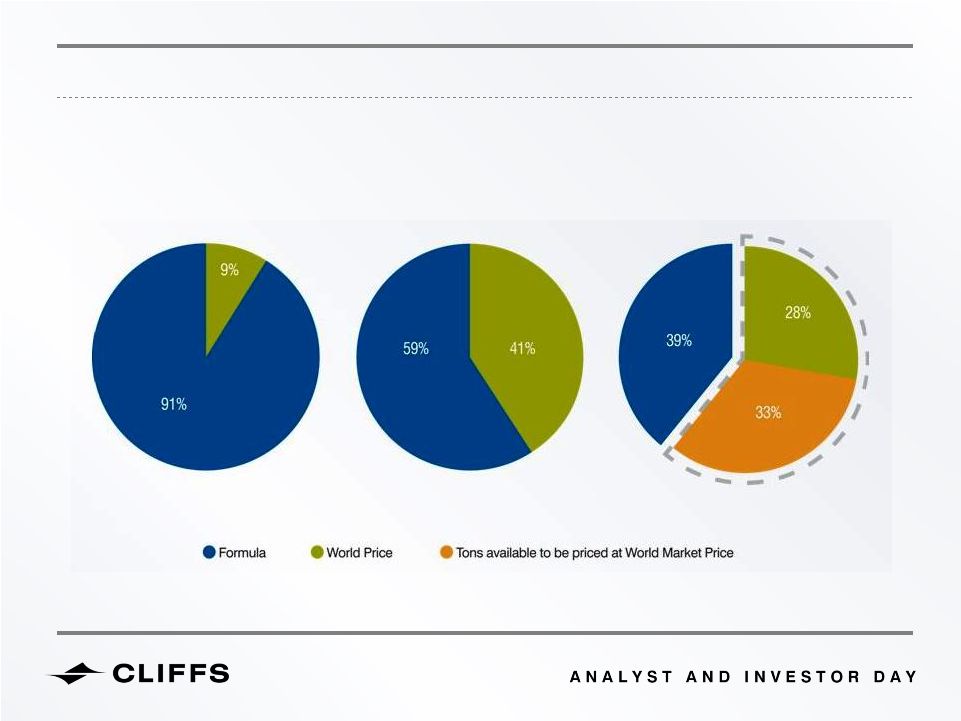

MOVING NORTH AMERICAN IRON ORE CONTRACTS TO WORLD MARKET PRICING Analysis of North American Iron Ore legacy contracts shows opportunity to achieve World Market Pricing 23 million tons 29 million tons 29 million tons 2008 2011E 2014E 46 1 1 Assumes current production capacity of 29.5 million long tons and excludes Eastern Canada concentrate from Cliffs’ Bloom Lake Mine |

Dave Blake CLIFFS NATURAL RESOURCES INC. EASTERN CANADA INTEGRATION & EXPANSION 47 |

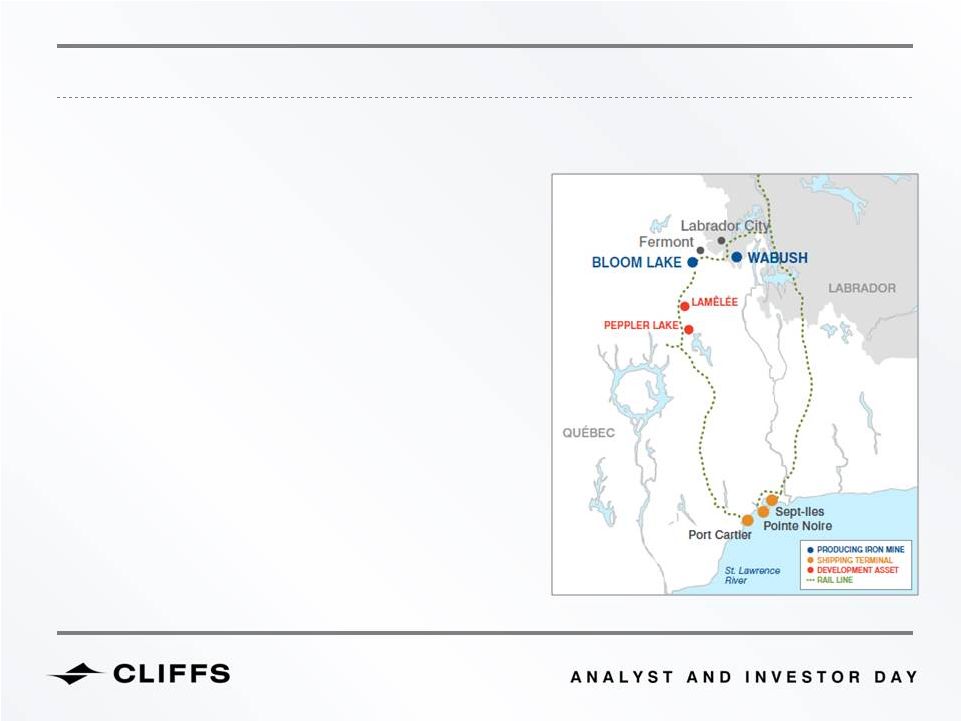

BLOOM LAKE OPERATIONS • Established access to Asian markets • Excellent infrastructure with power, rail and port access capable of supporting growth profile • Attractive development opportunities at Lamêlée and Peppler Lake • Low-cost production A WORLD-CLASS MINING OPERATION 48 |

BLOOM LAKE OPERATIONS Mining Processing Logistics • Open pit • Drill and blast • Load and haul • Primary crushing • Grinding • Screening • Spiral classification • Filter de-watering • Eastern Canada location • Load-out facility • Additional rail capacity • Adjacent port at Sept-Îles 49 |

BLOOM LAKE INTEGRATION OVERVIEW • Secured key operations management responsible for ramp up and expansion • Back office (accounting, IT, HR and brand) integration well underway • Attraction and retention of skilled employees – over 7,000 applications currently on file • Continue Bloom Lake’s best practices around employee engagement • Maintain competitive compensation and “pay for performance” • Continue active community, government and First Nations relations programs 50 |

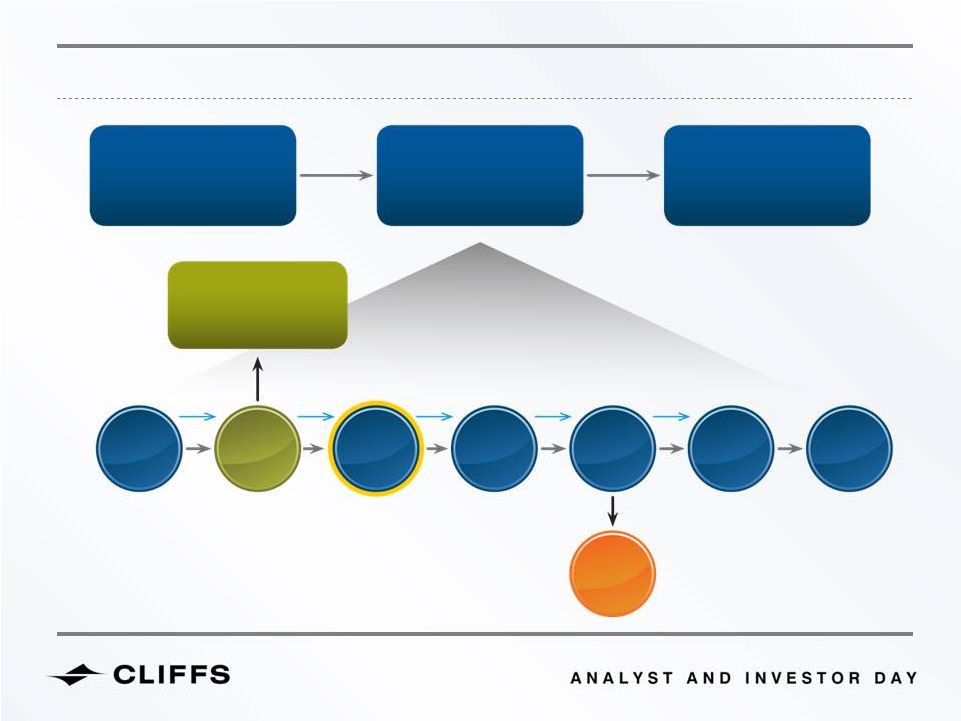

APPLICATION OF THEORY OF CONSTRAINTS MINE CONCENTRATOR LOGISTICS BUFFER MANAGEMENT CRUSHER STOCKPILE AG MILL Subordinate Subordinate Exploit SCREEN SPIRALS FILTERS SILO TAILINGS 51 |

RESULTS OF IMPROVED OPERATIONAL PARAMETERS 2011 MONTHLY CONCENTRATE PRODUCTION (IN THOUSANDS OF METRIC TONS) 52 |

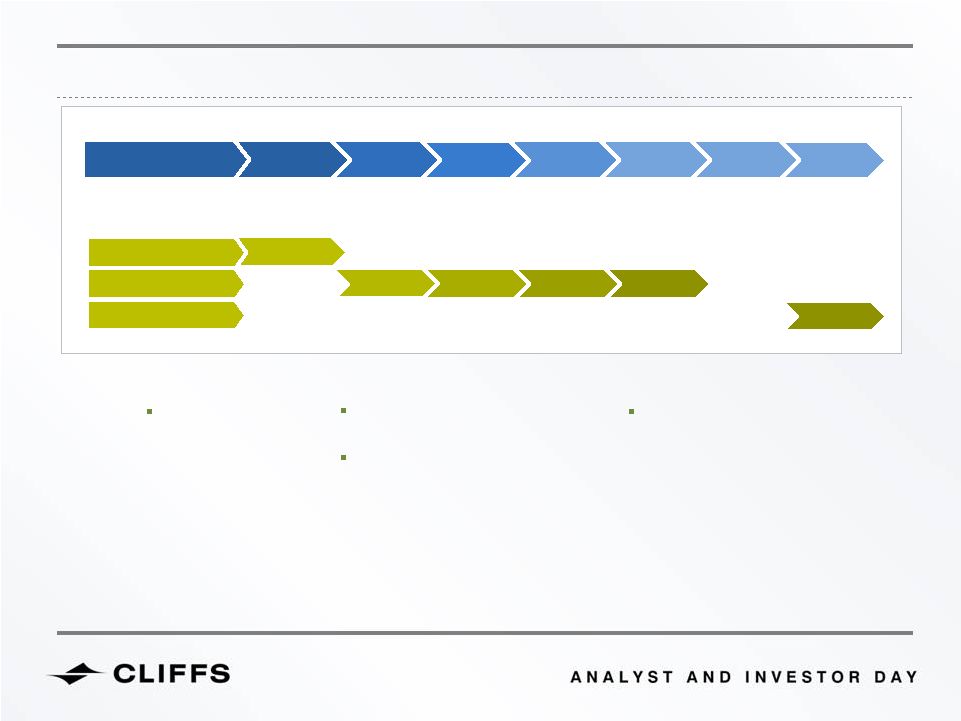

BLOOM LAKE PHASE II EXPANSION - 16 MTPA 53 2011 2012 2013 2014 CAPITAL SPEND - 100% BASIS 8mtpa 16mtpa Bloom Lake’s expansion to 16mtpa is a mirror image of the current operation $300 M $350 M PHASE I – RAMP UP Anticipated annual production rate in millions of tons PHASE I – STABILIZED, PHASE II BUILD PHASE II - COMMISSIONING PHASE II - STABILIZED |

ACHIEVABLE SYNERGIES Cliffs anticipates achieving approximately $75 million in annual synergies Transportation – 80% • Shared rail track at Arnaud Junction • Modify existing ship loader operations to load at overall faster rates • Cliffs’ Pointe Noire will accommodate larger vessels to transport Bloom Lake concentrate Product Mix – 10% • Potential to use Bloom Lake concentrate to produce pellets at Pointe Noire • Bloom Lake to produce 10-20% magnetite concentrate lowers energy rates at pelletizing operation • Potential to blend Bloom Lake ore with Scully ore to maximize concentrator throughputs Other – 10% • Purchasing power • Global marketing • Global recruiting efforts • Technical expertise 54 |

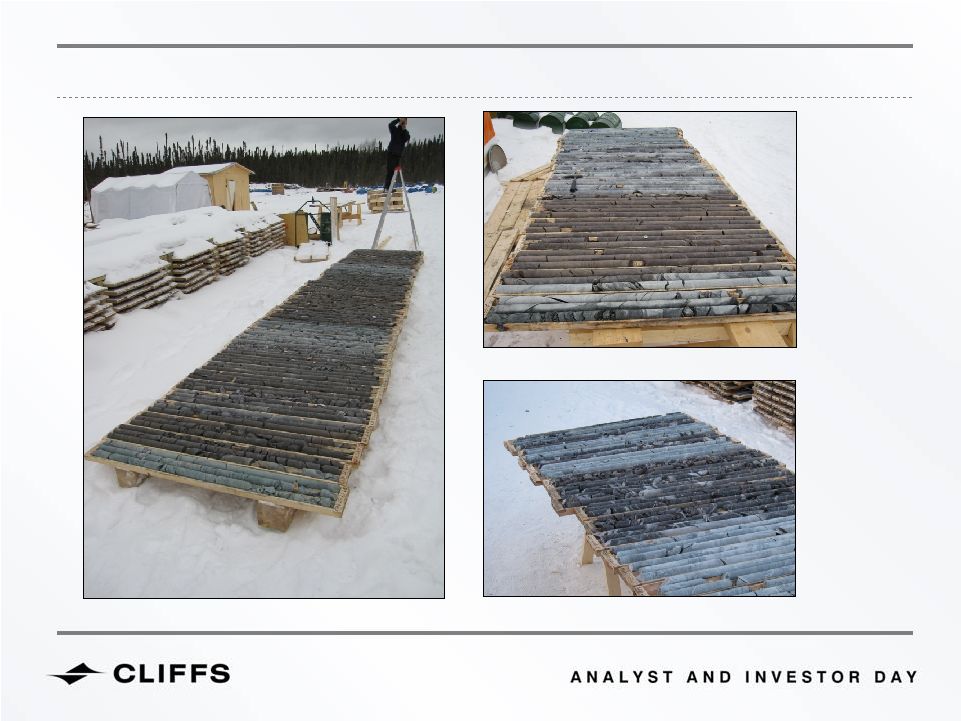

• Cliffs intends to expand concentrate operations in Eastern Canada to 24mtpa by 2015 - 2016 • Crude ore to be sourced from Bloom Lake western resources and main pit to be extended • Current year drilling campaign of West Bloom Lake deposit indicated significant resource exists • Anticipated capital cost approximately the same as Phase II expansion of ~$600 million • Lamêlée and Peppler Lake reserves available for future expansion PHASE III – EASTERN CANADA EXPANSION TO 24MTPA 1 Sufficient drilling to quantify resources under SEC proven & probable standards has not yet occurred. 55 1 |

PRODUCTION OUTLOOK INCLUDING PHASE III BLOOM LAKE’S INCREASING PRODUCTION PROFILE (IN MILLIONS OF METRIC TONS) 56 |

Duncan Price CLIFFS NATURAL RESOURCES INC. ASIA PACIFIC IRON ORE & NORTH AMERICAN COAL 57 |

100% ownership of Koolyanobbing • 8.5mtpa total production and growing • Expansion plans to 11mtpa by second quarter 2012 50% ownership of Cockatoo Island • 1.5mtpa total production (to EO3Q 2012) CLIFFS’ ASIA PACIFIC IRON ORE CURRENT OPERATIONS – WESTERN AUSTRALIA 58 |

3 RD PARTY RAIL (575KM) 3 RD PARTY PORT ROAD HAUL MINING KOOLYANOBBING OPERATIONS Infrastructure network is central to operations ORE PROCESSING PLANT 59 |

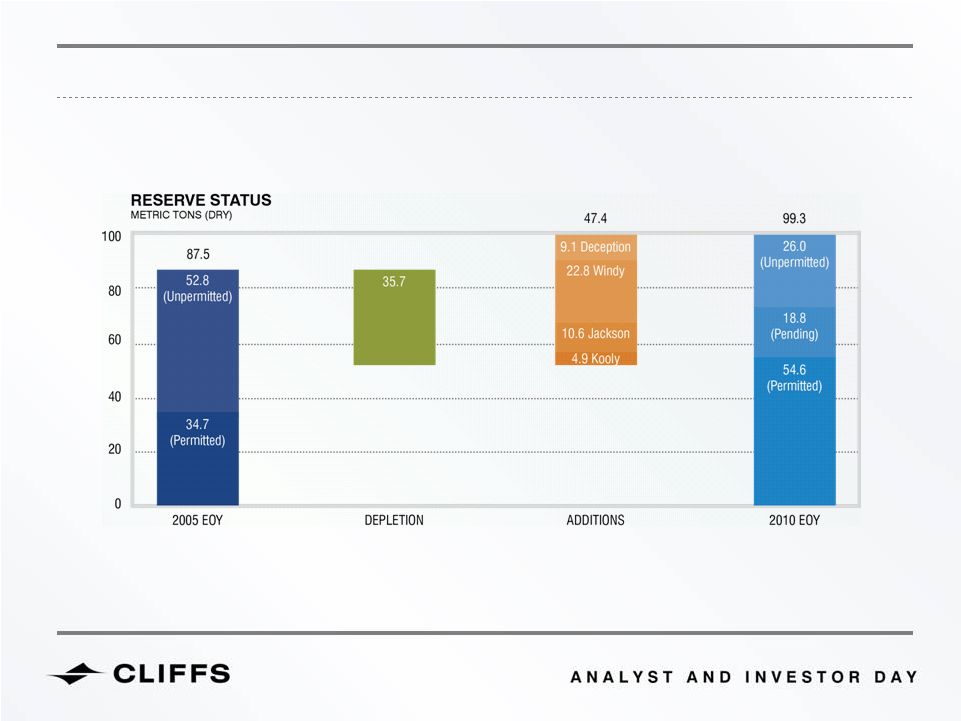

RESERVE GROWTH THE CORNERSTONE OF EXPANSIONS 60 |

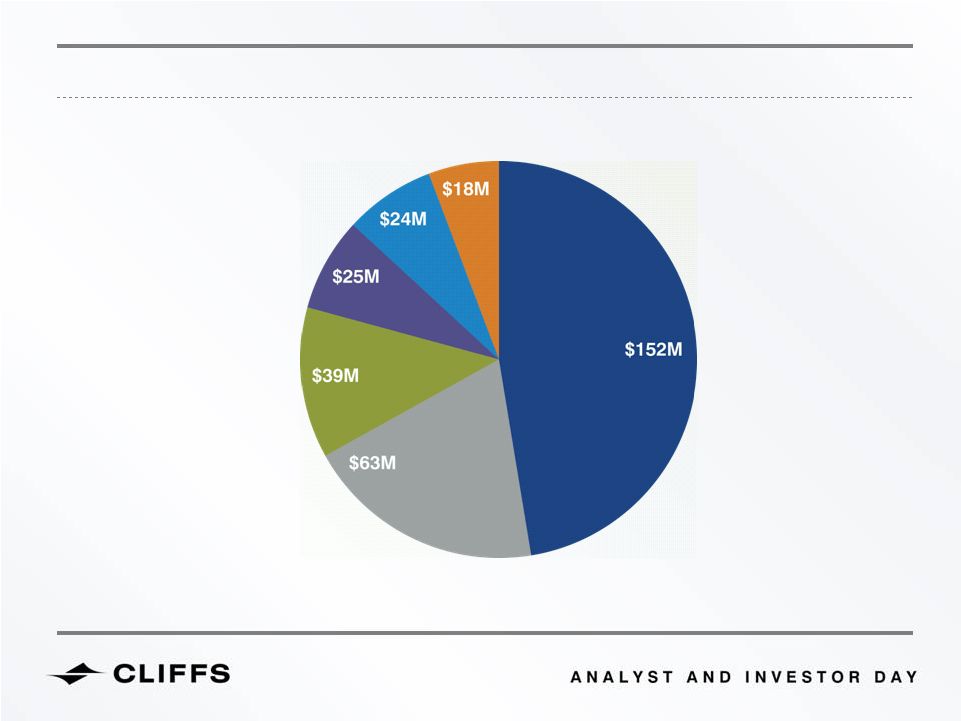

Rail – A$152M • New locomotives and wagons • Upgrade of rail yards and maintenance facilities • Extension of passing loops Plant Upgrade – A$63M • Primary crushing and screening facilities • Update of secondary crushing circuit • New interconnecting conveyors Mining Capacity – A$39M • Mobile fleet • Additional road train fleet • Infrastructure works Port – A$25M • Upgrades to existing RDC and conveyor systems • New road over rail pass EPCM – $24M Other – A$18M ASIA PACIFIC IRON ORE EXPANSION TO 11MTPA 61 |

TIMELINE OVERVIEW Q2 Q3 Q4 Q1 Q2 9mtpa 11mtpa 2011 2012 Mining Upgrade Plant Upgrade Rail Upgrade Port Upgrade 62 |

APIO resources Other regional resources • Western Arc will be depleted by 2020 • “Phase I” drilling for conceptual direct shipping ore targeting 50-150mt commenced May 2011 at Mt Richardson • Potential development options include: • Sequential operation • Parallel development with expanded total capacity EASTERN FRONT POTENTIAL TO BE THE NEXT GROWTH PLATFORM 63 |

CLIFFS NATURAL RESOURCES INC. NORTH AMERICAN COAL 64 |

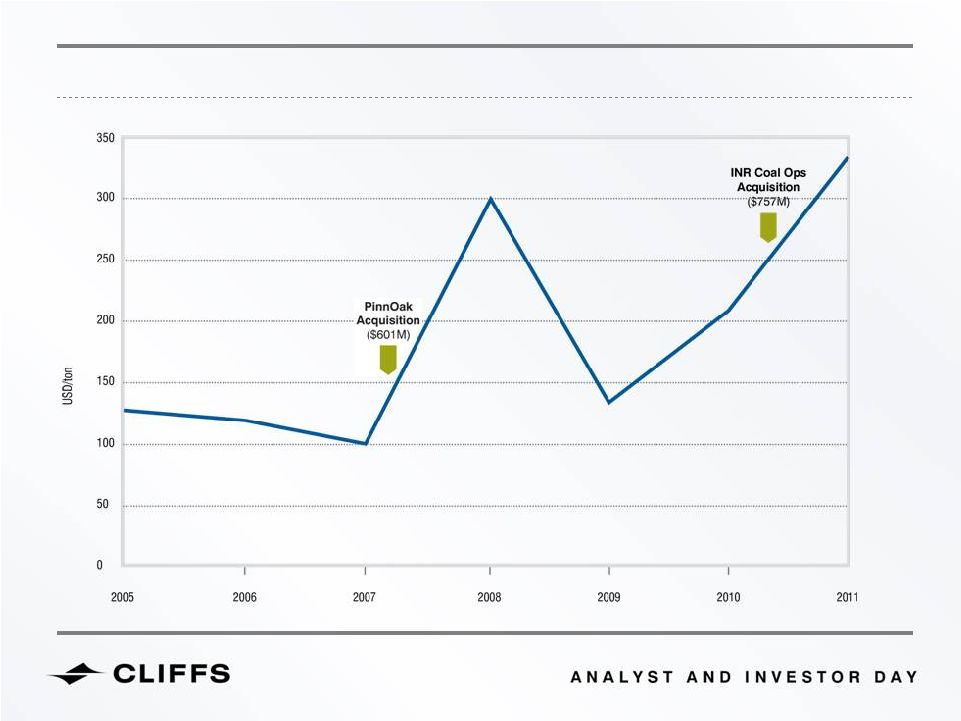

STRATEGIC ENTRY INTO METALLURGICAL COAL… BMA Benchmark Prices 65 |

...SECURED LONG LIFE MET COAL ASSETS 1 Reserve review due at end of 2011 2 Premier low vol, low sulfur metallurgical coal 3 Low vol metallurgical coal 4 High vol metallurgical coal 66 Reserves 1 Metallurgical Coal Thermal Coal Oak Grove 2 42.1mt Pinnacle 3 62.2mt INR Coal Operations 58.9mt 4 61.8mt |

CHALLENGES BEYOND EXPECTATIONS DEWATERING CHALLENGES GLOBAL FINANCIAL CRISIS (GFC) NATURAL DISASTER ADVERSE GEOLOGY HIGH CO READINGS 67 |

TORNADO DAMAGE AT OAK GROVE MINE • Damaged overland conveyer system • 2.5 miles of 5-mile system connecting Oak Grove Mine to the Concord Preparation Plant rendered inoperable • Requires stockpiling of crude coal until repairs are completed and recommissioning occurs • Concord Preparation Plant rendered completely inoperable • Top four floors of plant structurally damaged • New structure expected to be in place end of September • Recommissioning of plant targeted for mid- to late-November • Opportunity to enact some improvement, including deployment of 40 new spiral separators 68 |

CARBON MONOXIDE READINGS AT PINNACLE MINE • Regulatory agencies have denied initial remediation plan • Production not expected to resume before fourth quarter • Considering appeal of decision • Remediation effort includes: • Assessment of various options • Prospective installation of seals to allow operations in continuous mining sections to proceed • Prospective installation of temporary seal to deprive suspected “hotspot” of oxygen 69 |

OPERATIONAL HIGHLIGHTS…AGAINST THE TIDE • Integrated INR’s coal operations into North American Coal business segment...bolted on a 35% capacity increment without a glitch • INR’s coal operations are delivering tons and costs at expected rates • New longwall machine at Pinnacle Mine • Preparation plant able to clean high ash and improving yields • Major capital projects on schedule • Installed dewatering capacity 1.7M gallons/day 70 |

DELIVERING CAPITAL PROJECTS • Pinnacle preparation plant upgrade - $25M • Delivered on budget, 6 months ahead of schedule • Demonstrated efficiency uplift - plant yield up to 86-95% from 63-70% organic efficiency • Portal set for August 2011 delivery • Permitting/weather delays partially recovered through effective project management 71 |

OVERALL GROWTH AHEAD OF PLAN GREEN RIDGE (LOW VOL METALLURGICAL COAL) • Well ahead of plan ... 117kt production in 2011 • Costs well below initial expectation LOWER WAR EAGLE (HIGH VOL METALLURGICAL COAL) • Slope completed in Q1; continuing to staff up • Ramping up in 2011 (40kt); up to 540kt in 2012 TONEY FORK (THERMAL) • Behind on haulage in Q1 due to weather • Full year production target approximately 1mt in 2011 CHILTON ELK LICK (HIGH VOL METALLURGIAL COAL) • Approvals a critical path activity • First production in 2012 with full production 2013 72 |

GROWTH TARGET: 9MTPA BY 2015 73 1 Outlook as of June 2, 2011. On June 24, 2011 Cliffs reported that regulators denied a remediation plan at its Pinnacle Mine, which will likely delay production into the fourth quarter of 2011. Prior to this event, Cliffs expected Pinnacle Mine to produce more than 1mt of low-vol met coal in the last six months of 2011. PRODUCTION (mt) |

NORTH AMERICAN COAL’S OPERATIONS STRATEGY SHORT-TERM DELIVERY… • Consolidate and leverage current initiatives • Drive continuous improvement • Recovery from tornado • Pinnacle Mine up and running GROWTH & RENEWAL… • Maintain the momentum on current growth projects • Explore RGSS and coal shipment options • Next generation capital improvement projects THE NEXT “NEXT” THING • Creating fresh options 1 YEAR 1-3 YEARS 3+ YEARS 74 |

• Recovery from the tornado • Remediate Carbon Monoxide Challenge • Translate the portal & sealing investments into outcomes • Consolidate & leverage early wins at Pinnacle • Maintain growth momentum...and pursue next generation growth ... and continuously evaluating our direction WHAT’S NEXT? 75 |

Bill Boor CLIFFS NATURAL RESOURCES INC. FERROALLOYS 76 |

Q3 Q2 ACQUISITION OF CLIFFS’ OWNERSHIP KWG Purchased 19% for $7.5 million Freewest Resources Purchased 7% for $11 million Completed acquisition for $200 million Spider Resources Completed acquisition for $120 million • Cliffs’ Chromite project represents the start of Ferroalloys, a new business for Cliffs • Upon completion, Cliffs will be the only North American chromite mining and processing operation Q1 Q2 Q3 Q4 Q1 2009 2010 Freewest Spider 7% 93% 100% CLIFFS’ FERROALLOYS ORIGIN 77 KWG 19% |

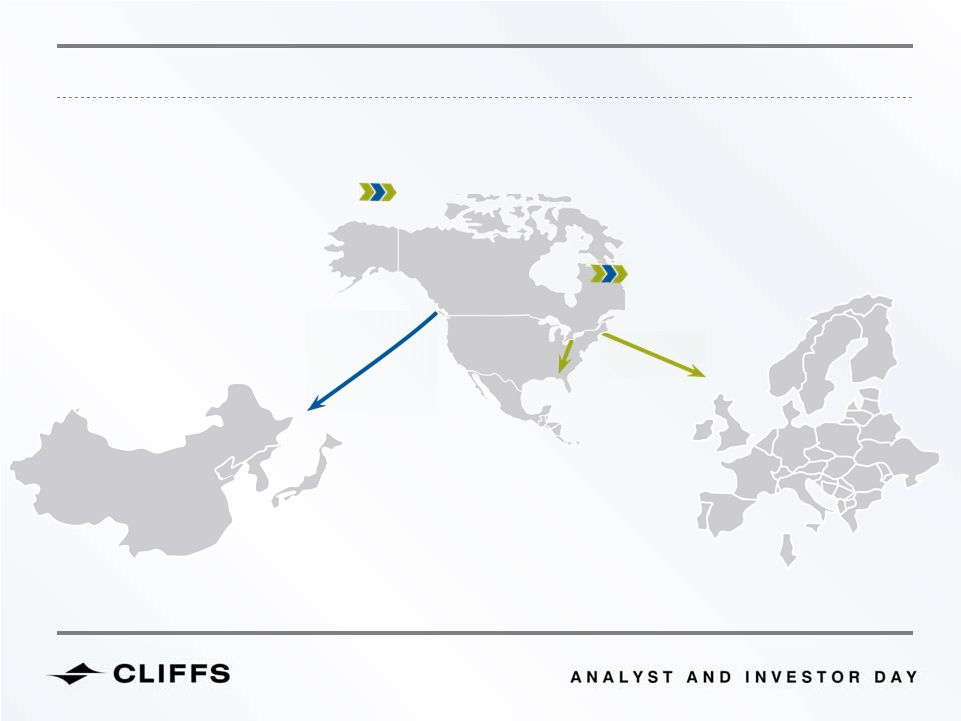

CHROMITE PROJECT AND FUTURE CUSTOMERS OPEN-PIT MINE (~4mtpa crude ore) PROCESSING FACILITY (~1.3mtpa Concentrate to FeCr Facility) FeCr PRODUCTION FACILITY CONCENTRATE TO MARKET (1mtpa) Asia Europe North America FeCr TO MARKET (600ktpa) 78 |

CLIFFS CHROME PROJECT VIDEO CLIP #1 |

Cliffs’ Black Thor deposit compares very well with world-class benchmarks CLIFFS’ BLACK THOR DEPOSIT BENCHMARKS VERY WELL RELATIVE TO WORLD-CLASS CHROMITE MINES Cr:Fe Location Seam Thickness (meters) Open Pit or Underground ROM Grade (Cr2O3) Cliffs (Black Thor) Xstrata Samancor Outokumpu ENRC Canada South Africa South Africa Finland Kazakhstan ~20 to >100 0.8 & 1.0 1.1 to 1.8 30 to 90 Not Reported OP and/or UG UG UG UG 1 OP / 2 UG ~30% to 32% 38% to 39% 37% to 39% 25% 42% ~1.8 to 2.0 1.55 1.45 1.52 >2.5 80 |

CORE SAMPLES FROM BLACK THOR DEPOSIT 81 |

CLIFFS CHROME PROJECT VIDEO CLIP #2 |

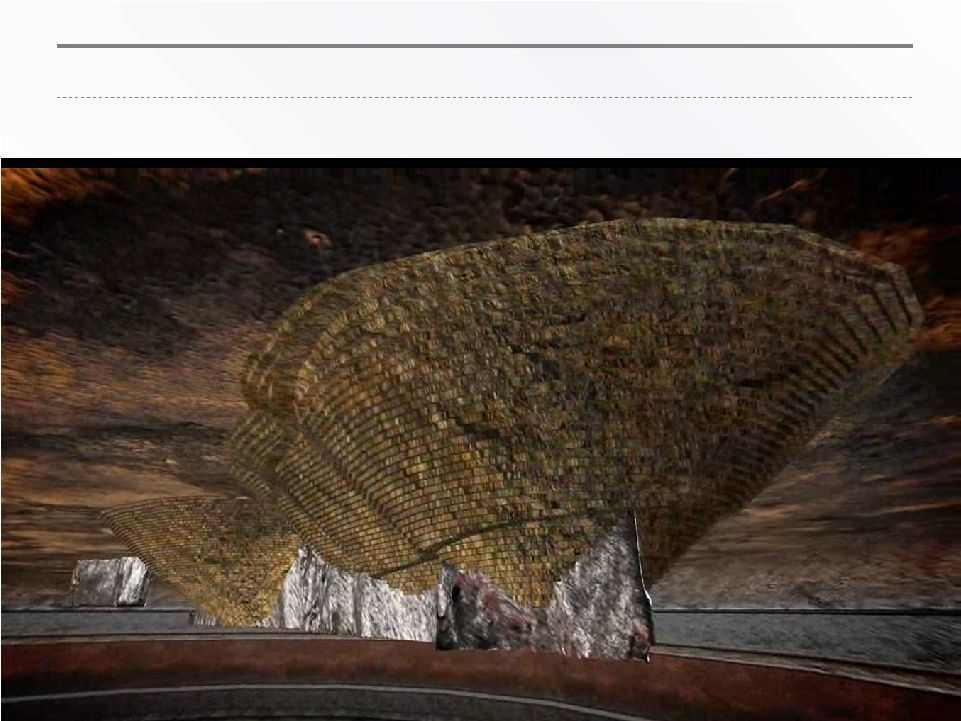

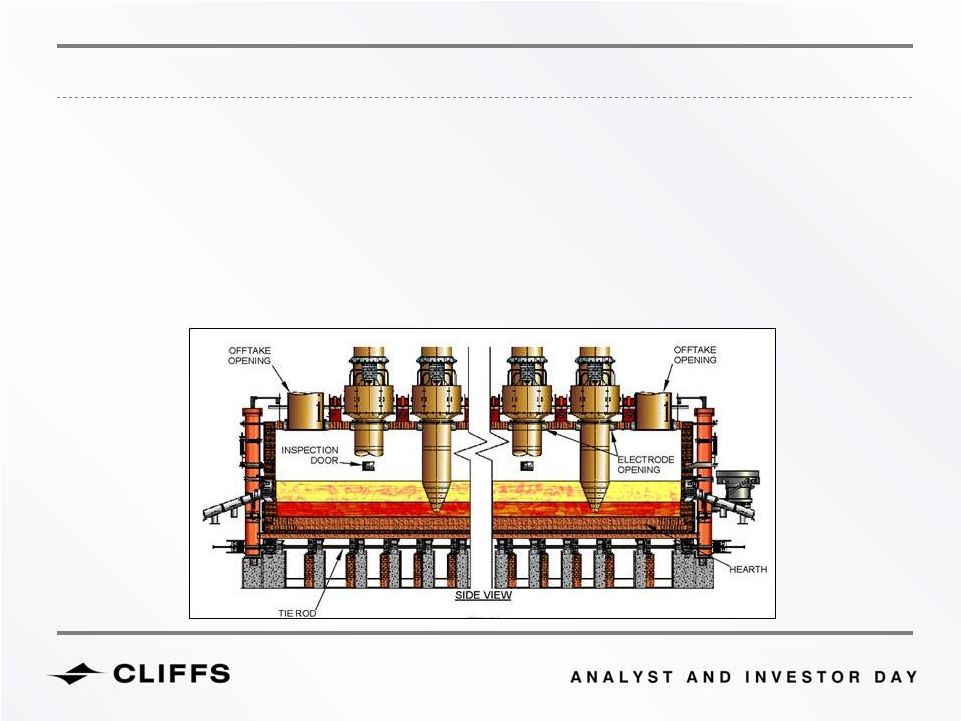

CHROMITE PROJECT OVERVIEW Ferrochrome Production Facility • Final step in Project is to refine ore and concentrate into metal to be sold for use in stainless-steel manufacturing • The facility requires approximately 300 MWH to process the material in an electric arc furnace • Multiple technology options under consideration to develop state-of-the-art process which maximizes power efficiency and reduces costs • Will be situated near existing rail infrastructure for transport to customers in U.S. and ports in Canada for shipment to world markets 83 |

CHROMITE PROJECT OVERVIEW Ferrochrome Production Facility • Site location studies on-going anticipated need for 1-2 km site (brownfield preferred) • Power cost and grid stability are key drivers for selection • Canada relies on hydroelectric power which offers clean electric energy with long-term price stability • Power constraints elsewhere are driving up cost curve 84 2 |

85 WORLD CHROMITE ORE PRODUCTION 85 85 |

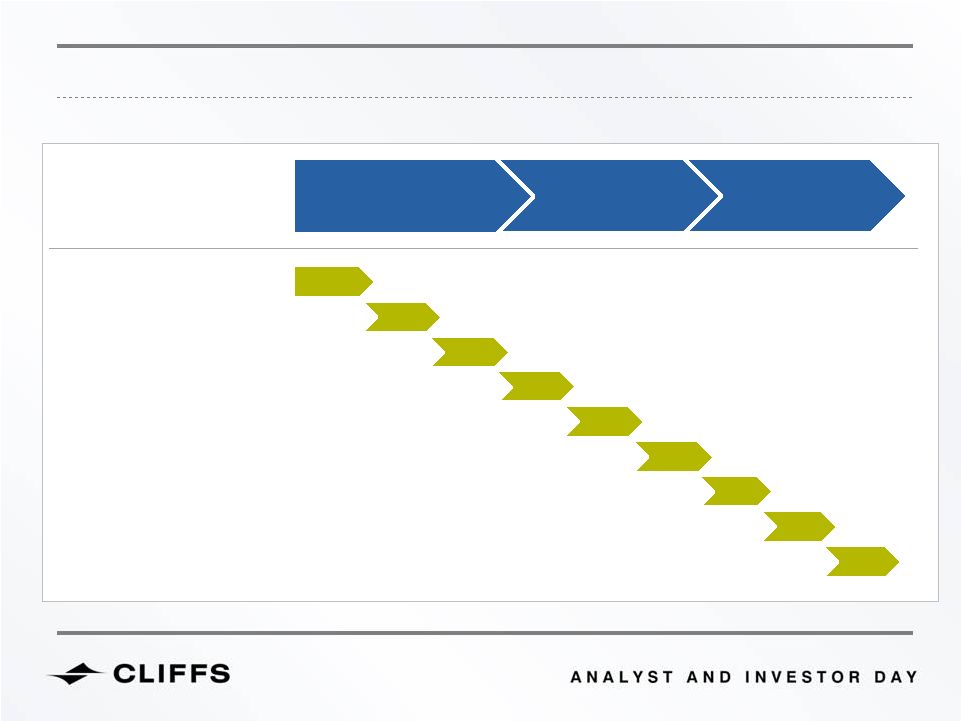

86 CHROMITE PROJECT TIMELINE PROJECT MILESTONES Construction Production Complete Feasibility Permitting • Investigations of environmental baseline conditions underway • Submitted a “Project Description” in May – First step in EA process • Permits needed for construction and operation may be issued by governmental agencies only after the EA is successfully completed 2010 2011 2015 2012 2013 2014 CRITICAL PATH Complete Prefeasibility Acquired Control of Deposits Feasibility study will be completed in 2012, leaving the environmental assessment (EA) and permitting process as the determinants of start-up timing 86 86 |

• Cliffs chromite mine will be world class, positioned in a AAA country and with very low mining costs • Cliffs is working to develop an efficient transportation network and build a state-of-the-art furnace operation to supply world markets with both chromite ore and ferrochrome • Ferrochrome processing is critical to access North American and European markets that don’t have processing capacity • Significant value and access to growth markets will be generated from the chromite ore delivered to Asian customers • With a very large potential resource, Cliffs has the ability to expand its position in the market through time IN CLOSING 87 |

Cliff Smith CLIFFS NATURAL RESOURCES INC. GLOBAL EXPLORATION 88 |

2011 Budget: Approximately $50 - $55 million North America; Peru, Brazil, Chile, Argentina; Mongolia and Australia ACTIVE COUNTRIES 89 |

TYPICAL STAGES OF EXPLORATION PROJECTS EXPLORATION PIPELINE STUDIES EXPLORATION ACTIVITIES EXPLORATION DEAL STRATEGIC FIT DISCOVERY POTENTIAL RESOURCE LOI / TERM SHEET LEGAL AGREEMENT TARGET IDENTIFICATION PRE-FEASIBILITY STUDY FEASIBILITY STUDY SCOPING STUDY 90 |

Altius Minerals • December 2010 Strategic Alliance Agreement targeting ferroalloys in Eastern Canada First Point Minerals • November 2009 option agreement to earn 51% JV interest to advance Decar nickel alloy property • Currently funding year two of earn-in agreement Zenyetta Minerals • January 2010 option agreement for Albany project targeting nickel, copper and PGMs CANADA DRILLING PROGRAMS 91 |

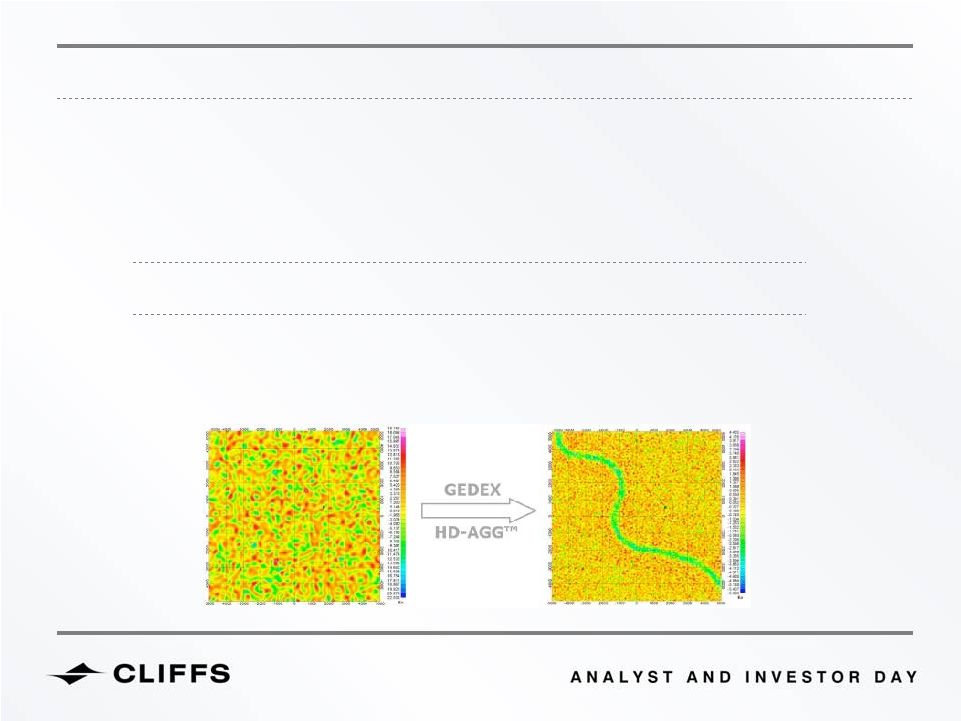

ACCESS TO EMERGING, PROPRIETARY TECHNOLOGY • November 2010 Strategic Agreement provides Cliffs global access to Gedex’s HD-AGGTM™ airborne subsurface mapping system: • Used in airborne platform, outperforms gravimeters by order of magnitude • 3D spatial gradient of gravity vectors • For exploration anomalies, gravimeters must sense 1:1,000,000, whereas Gedex technology can sense 1:3,000 • Capable of “seeing” buried structures by mass and quickly detects ore bodies • Cliffs intends to deploy for non-chromite “Ring of Fire” exploration Conventional Technology Gedex Technology 92 |

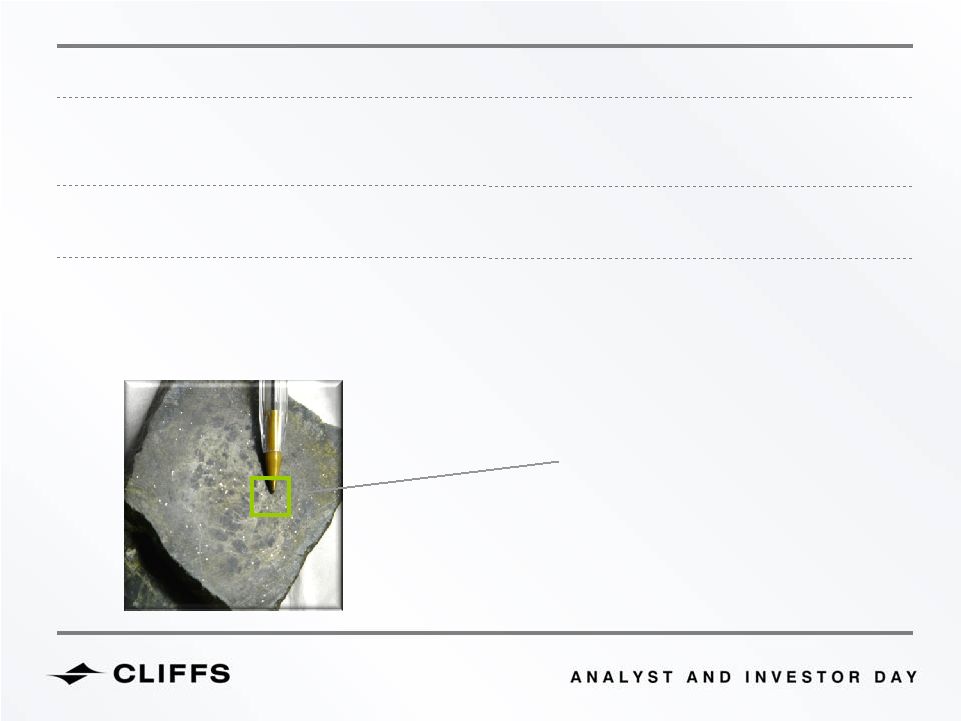

• Geology indicates potentially large resource conducive to an open-pit operation • Products could include a low-grade nickel with simple process flowsheet and 30-55% Fe magnetite concentrate with 3% nickel, 2% chromite • Successful resource definition and studies needed to lead to an actual mine, but potential does exist FOCUS ON DECAR NICKEL ALLOY PROPERTY Small silver flakes are the targeted nickel in the deposit 93 |

Riverside Resources • June 2010 Alliance Agreement for iron oxide copper gold (IOCG) exploration in Mexico • Exploration for IOCG projects in Northwest Baja California State and along the Pacific Coast from Western Sinaloa State to Oaxaca State, Mexico • Focus on identifying major target areas using Riverside’s proprietary Mexico-specific databases with extensive field follow up to delineate a minimum of four IOCG deposits within an area of 1,500,000 km² MEXICO EXPLORATION ACTIVITY 94 |

SOUTH AMERICA EXPLORATION ACTIVITY Estrella Gold (Peru) • February 2011 Exploration Alliance Agreement targeting IOCGs AusQuest Peru • IOCG earn-in agreement Mariana Resources (Chile) • June 2010 Alliance and JV agreement targeting IOCGs Other Chile and Argentina Drilling Programs • Number of additional private ventures targeting manganese and other steelmaking raw materials 95 |

MONGOLIA EXPLORATION ACTIVITY • Private target generation focused on chromite, nickel and molybdenum • A new frontier – combination of great geology, historically underexplored and attractive investment climate • Most other mining companies focused on vast metallurgical coal projects, but Cliffs sees opportunity in ferroalloys • Established, local partner with one person, Cliffs’ in-country presence 96 |

AUSTRALIA DRILLING PROGRAMS AusQuest • September 2008 Cliffs strategic alliance, subscription and option agreement Reedy Lagoon • February 2011 JV to explore for magnetite iron ore in Southwest Yilgarn, Western Australia 97 |

CLIFFS NATURAL RESOURCES INC. SUSTAINABILITY Kelly Tompkins 98 |

SUSTAINABILITY AT CLIFFS Sustainability is the Cliffs’ social license to operate SOCIAL • Safety • Diversity • Labor Relations • Community Engagement • Aboriginal Relations ENVIRONMENTAL • Energy • Climate Change • Waste, Emissions • Water • Land Use/Reclamation ECONOMIC • Economic Development • Community Development • Market Presence • Indirect Economic Impacts GOVERNANCE • Corporate Governance Structure • Risk & Crisis Management • Codes of Conduct, Corruption & Bribery 99 |

KEY STAKEHOLDERS ARE INCREASINGLY AWARE OF SUSTAINABILITY • Investors demand more transparency and comparability • Regulators hold industry participants to tighter and additional standards • Communities are increasingly aware, skeptical and active • Employees want to know their employer has high sustainability standards 100 |

WORDS IN ACTION Land Reclamation Operations Impacts & Efficiency • Cliffs has demonstrated reclamation plans to return former mine sites to beneficial public use long after the economic benefits are derived • Unique Cliffs-led-tree-planting initiative with community, government and public interest groups; enhanced Cliffs' reputation for sustainable mining practices in West Virginia • Emission reduction standards obstacle to optimizing UTAC mine production capability in Minnesota • Investment in redesigned fuel system to handle lower emission, solid fuels and biomass, providing fuel flexibility • Secured permit to produce incremental tons and avoided substantial pollution- control cost 101 |

WORDS IN ACTION Koolyanobbing Expansion Aboriginal Relationships • Unique collaboration between Cliffs and government agencies, interest groups and Aboriginal communities • Improved relationships and benefits for all parties • Conservation of rare flora and fauna and flexibility and certainty in accessing the mineral resource • Innovative designation of the area as a conservation and mining reserve • Understanding the evolving nature of Aboriginal relations; building upon Cliffs’ historical commitment to community engagement • Recognize and respect traditional ecological knowledge and develop progressive Impact Benefits Agreements with First Nations communities 102 |

PUBLIC POLICY OUTLOOK • Greenhouse Gas • % Depletion • MSHA • Water quality regulations • Air quality regulations • Environmental permitting • Fisheries Act - Metal Mining Effluent Regulations • Air quality regulations • Permitting and Approvals • Plan du Nord – (Plan North) • Energy and Infrastructure Incentives (Plan North) • Mining Tax • Carbon Tax • Biodiversity Conservation • Permitting Mine Reserves • Energy • Land Management • Water Permitting Strategies in place to manage legislative and regulatory risks and opportunities 103 |

AWARDS AND RECOGNITION • Earned LEED certification • Selected finalist for Golden Gecko Award, Western Australia • Conservation Award from Marquette County, Michigan • Inclusion in Maplecroft Climate Innovation Indexes • Named Global 1000 Sustainability Performance Leader • Awarded Mincom Innovation and Excellence in Asset Management Vision • No. 9 on Bloomberg Businessweek’s Inaugural Top Performers List 104 |

BUILDING ON THE FUNDAMENTALS OPERATIONAL EXCELLENCE SHAREHOLDER RETURNS SUSTAINABILITY ENVIRONMENTAL SOCIAL ECONOMIC GOVERNANCE 105 |

CLIFFS NATURAL RESOURCES INC. CAPITAL STRUCTURE & ASSET ALLOCATION Laurie Brlas 106 |

STRATEGIC CAPITAL DECISIONS – A COMPREHENSIVE CAPITAL MANAGEMENT AND DISTRIBUTION PROCESS DESIGNED TO DRIVE TOP QUARTILE TSR Considerations for uses of cash and excess cash flow Business Investments • Re-invest in business – organic growth and capital expenditures • Mergers & Acquisition – focus on value-creating opportunities • Build long-term, optimal structure that is sustainable “through-cycle” • Investment grade rating/profile is core to strategy Balance Sheet Structure Return to Shareholders • Sustainable ordinary dividend increases • Special dividends • Share repurchase 107 |

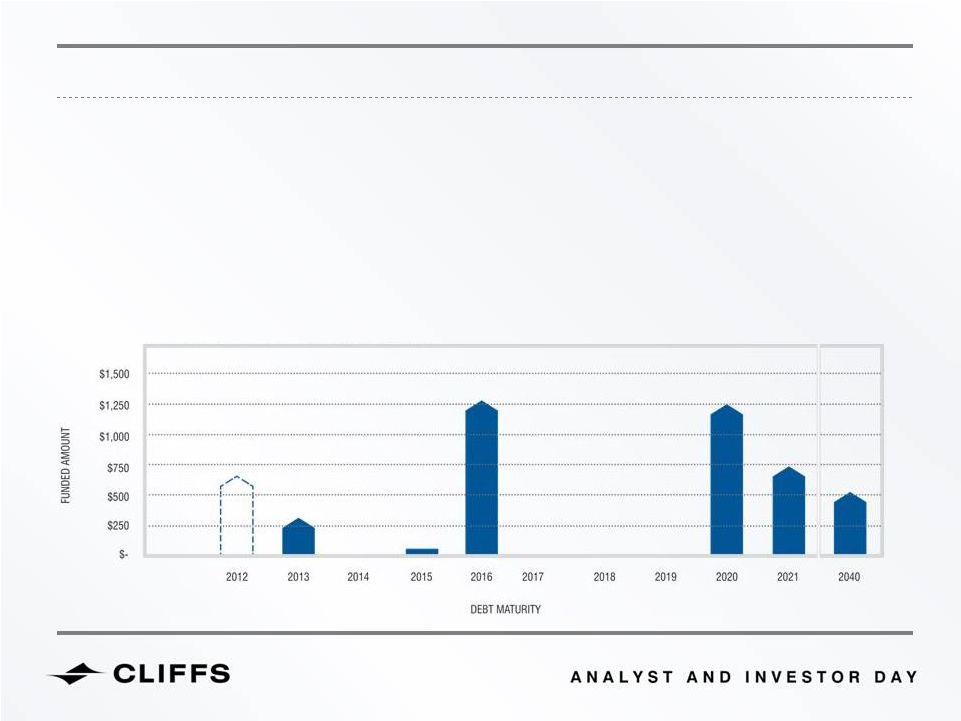

CLIFFS’ CURRENT BALANCE SHEET STRUCTURE • Increased scale provides ability to support higher leverage metrics, while remaining investment grade • Active management positions Cliffs to capitalize on growth and distribution opportunities • Average duration of current funded debt is ~9 years • Currently maintaining a ~60% / 40% fixed to floating rate debt mix • Reserve liquidity is key to capital structure strategy APPROXIMATE TOTAL DEBT: $4 Billion¹ 1 As of 6/15/11 108 |

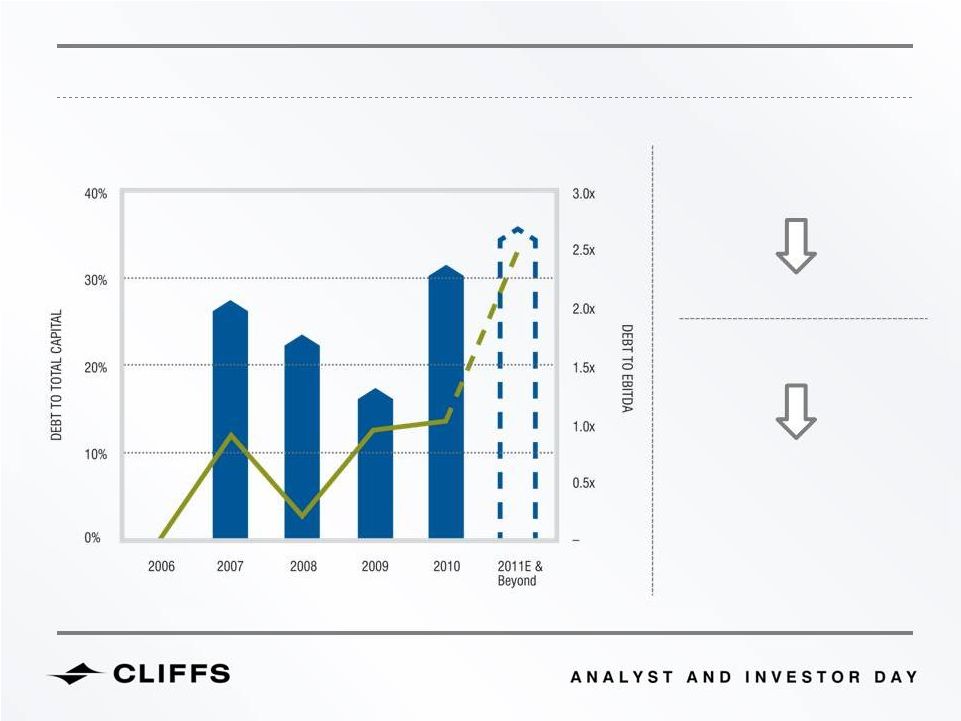

FINANCIAL FLEXIBILITY TO FUND FUTURE GROWTH TARGETED LEVERAGE PARAMETERS DEBT TO TOTAL CAPITAL 30% to 40% DEBT TO EBITDA 2x to 2.5x HISTORICAL DEBT TO TOTAL CAPITAL & DEBT TO EBITDA 109 |

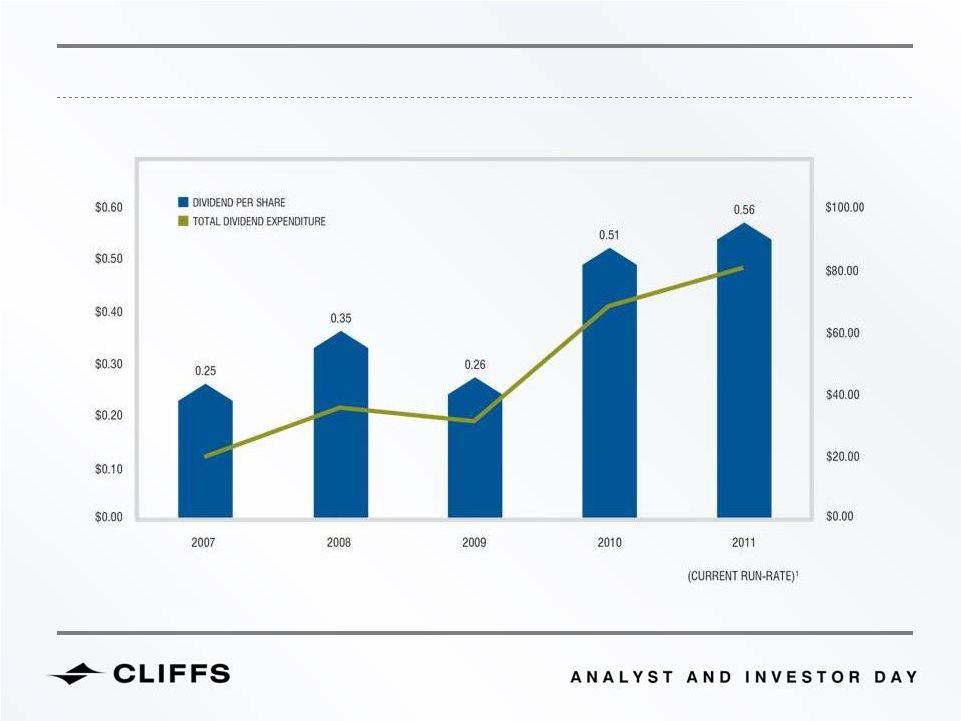

ANNUAL DIVIDENDS PER SHARE AND HISTORICAL TOTAL SPEND 1 Based on shares outstanding of approximately 147 million 110 |

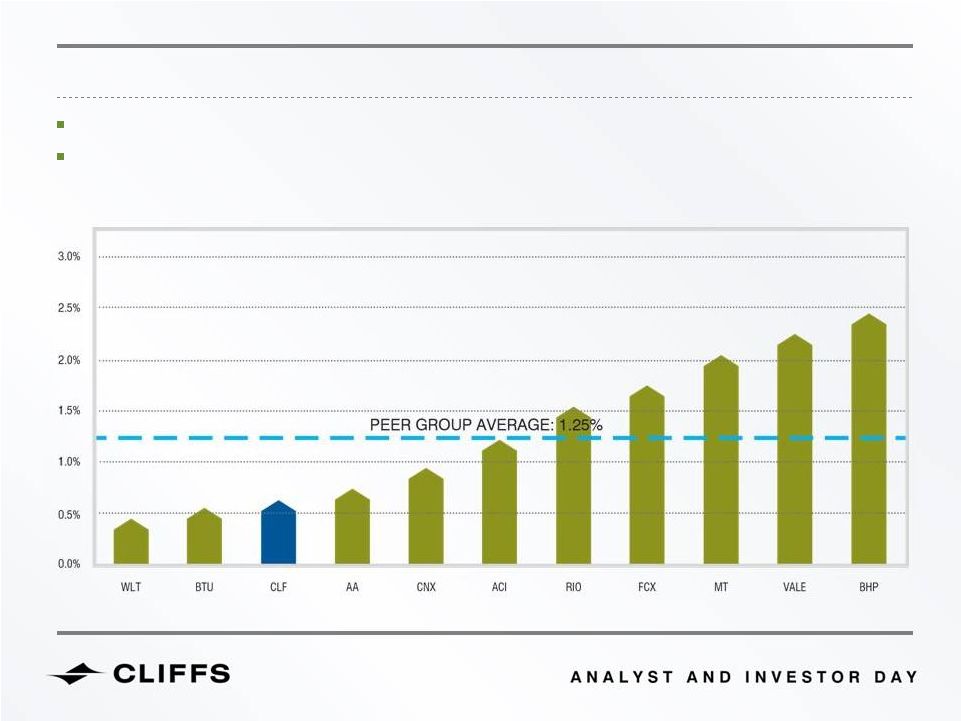

CLIFFS’ CURRENT DIVIDEND PAYOUT AND POLICY Cliffs employs a progressive philosophy that steadily increases or maintains dividend levels Current objective is to consistently migrate toward yields similar to comparable companies 111 |

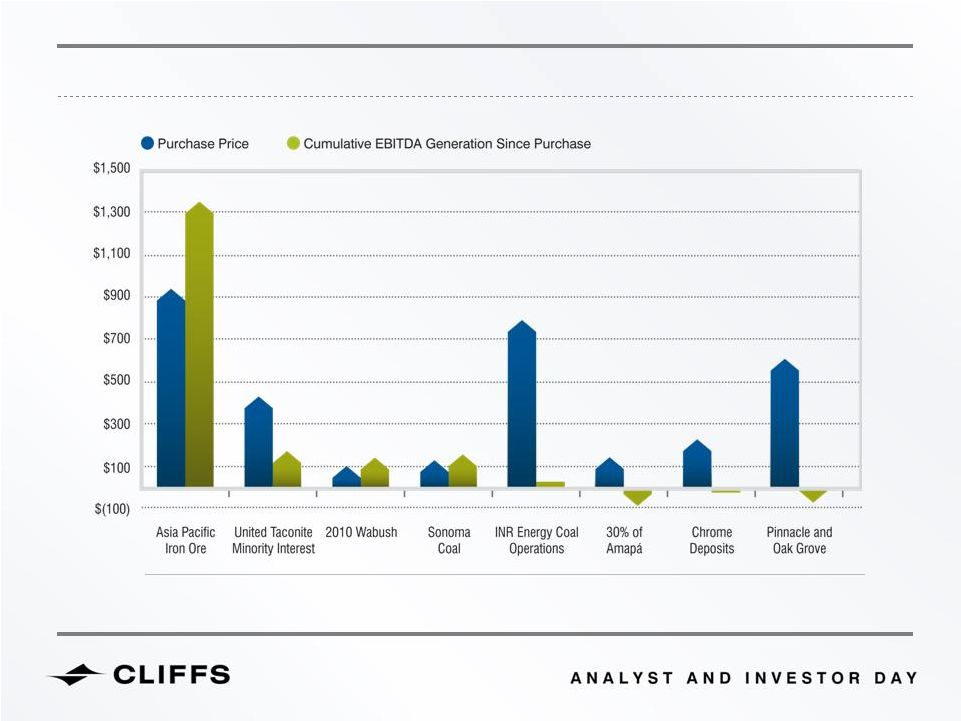

ACQUISTION SCORECARD – 2005 THROUGH 2010 1 The figures above for the loss at Amapá depict cumulative equity loss since date of initial investment 2005/2008 2008 2010 2007 2010 2007 2010 2007 Year Acquired 1 (in millions) 112 |

113 PROJECTED CAPITAL SPENDING RELATED TO VOLUME GROWTH |

114 PROJECTED CAPITAL SPENDING RELATED TO VOLUME GROWTH 1 Assumes 1mt of chromite concentrate and 600kt of ferrochrome 2 Assumes production from Amapá and Bloom Lake Mine and excludes Bloom Lake Mine’s ramp up to 24mtpa 1 2 |

IN 2014, NEARLY 80% OF CLIFFS’ GLOBAL IRON ORE VOLUME IS EXPECTED TO BE PRICED WITH THE WORLD MARKET 1 Assumes 29.5mt of iron ore pellets, 11mt of iron ore lump and fines iron ore and 16mt of iron ore concentrate 115 2008 2011E 2014E |

BREAKING OUT U.S. IRON ORE AND CANADIAN IRON ORE SEGMENTS 116 (in millions) 2011E |

WITH EXECUTION OF GROWTH PLANS, VALUE CREATION WILL OCCUR 1 Reuters 5/27/11 117 |

Joe Carrabba CLIFFS NATURAL RESOURCES INC. SUMMARY AND CONCLUSION 118 |

• Megatrends within the commodities space are underpinning our industry: New supply delays, increasing demand and degrading ore quality • As a business, Cliffs has transformed: • Positioned to become a nearly 60mtpa iron ore, 10mpta coal and 1mpta ferroalloy producer • Seaborne exposure and customer diversification is increasing, with half of future revenues poised to come from markets outside North America • The Company strives to allocate capital in value-generating ways, with a strong pipeline of internal growth THE CLIFFS JOURNEY HAS JUST BEGUN... 119 |

CLIFFS NATURAL RESOURCES INC. CLIFFS EXECUTIVE LEADERSHIP TEAM QUESTION & ANSWER SESSION 120 |

PLEASE SUBMIT YOUR ELECTRONIC QUESTIONS TO: NYSE@CliffsNR.com 121 |

CLIFFS NATURAL RESOURCES INC. APPENDIX 122 |

Portman Limited United Taconite 2010 Wabush Sonoma Coal INR Energy Coal Operations Chrome Deposits PinnOak Operating Income (GAAP as reported) 3,537.9 $ 995.4 $ 139.8 $ 106.9 $ 95.3 $ 12.6 $ (18.4) $ (232.0) $ 2,438.5 $ Depreciation, Depletion & Amortization 983.9 391.1 29.6 24.6 47.8 14.6 - 153.4 322.9 Other Non-Operating Income 35.0 (1.4) - - 1.9 - 10.6 2.1 21.8 EBITDA (Non-GAAP) 4,556.8 $ 1,385.0 $ 169.4 $ 131.5 $ 145.0 $ 27.2 $ (7.8) $ (76.5) $ 2,783.1 $ Reconciliation of Operating Income (GAAP) to EBITDA (Non-GAAP) Other 2005-2010 (Cumulative) Summary of Acquisitions 2005 - 2010 (Cumulative) Cliffs Consolidated 2005-2010 (Cumulative) RECONCILIATION OF NON-GAAP FINANCIAL METRICS 1 1 Other primarily represents Cliffs' legacy North American Iron Ore mines, including Northshore (100%), Tilden (85%), Empire (79%), United Taconite (30%), Wabush (27%) and Hibbing (23%). ($ in millions) 123 |