UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04244

SOUND SHORE FUND, INC.

Three Canal Plaza, Suite 600

Portland, Maine 04101

T. Gibbs Kane, Jr., President

8 Sound Shore Drive

Greenwich, Connecticut 06830

Date of fiscal year end: December 31

Date of reporting period: January 1, 2018 - December 31, 2018

Item 1. Reports to Stockholders.

THREE CANAL PLAZA, PORTLAND, ME 04101 1-800-551-1980

December 31, 2018

(Unaudited)

Dear Investor:

The Sound Shore Fund Investor (SSHFX) and Institutional (SSHVX) class shares declined 15.68% and 15.65%, respectively, in the 4th quarter of 2018, which trailed the declines of 11.72% for the Russell 1000 Value Index (Russell Value) and 13.52% for the Standard & Poor’s 500 Index (S&P 500). The 2018 full year declines for SSHFX of 12.62% and for SSHVX of 12.50% were also behind the declines of the Russell Value’s 8.27% and the S&P 500’s 4.38%. As long term investors, we know patience is a must, even though the market is currently showing none. We are proud to highlight that our 20 year average annual returns of 6.47% for the SSHFX and 6.68% for the SSHVX were ahead of the Russell Value’s return of 6.16% and the S&P 500’s return of 5.62%.

We are required by FINRA to say that: Past performance is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For the most recent month-end performance, please visit the Fund’s website at www.soundshorefund.com.

Stocks sold off sharply and broadly in the fourth quarter of 2018, leaving the major indices with their worst annual return since 2008. Equity investors had plenty of company. Among the major asset classes, only treasury bills and the US dollar finished up for the year. Indeed, 2018 is being dubbed by many as “the year nothing worked.”

Consensus estimates for 2018 Standard & Poor’s 500 earnings actually rose more than 10% during the year. With the 6.5% decline in the index price, the value placed on those earnings declined from 18.4 times at the beginning of the year to 15.5 times by year end. Concerns about tightening monetary policy in the U.S. and its implications for global GDP growth, trade wars, and geopolitical uncertainties built throughout the year. Fears about the outlook elevated further during the fourth quarter. Despite their persistently high P/E multiples, the “bond proxy” utility and consumer staples stocks significantly outperformed the last three months.

As with the broader market, many of Sound Shore’s holdings delivered strong earnings in 2018 only to experience even greater declines in their price-earnings valuations. One such example is Capital One, a long-term investment. Entering 2018, consensus earnings estimates for Capital One were slightly below $9 per share. Capital One needed only three quarters to achieve this level of profitability, as credit metrics improved more than expected. Current earnings estimates for 2019 are now more than $11. Capital One has a seasoned management team that has steered capably through previous cycles. Strong credit management along with advanced technology platforms (for example, Capital One has one of the highest rated mobile banking apps in the industry) keep us enthusiastic about the investment, which currently trades below 7 times 2019 consensus earnings estimates and at a 20% discount to book value.

AIG was another holding which underperformed in 2018. In this case, near-term earnings estimates declined moderately as underwriting performance improvement lagged and as insurance claims due to unpredictable natural disaster losses exceeded expectations. We started the investment early in the year at below book value, seeing great opportunity with proven CEO Brian

Duperreault attracting key senior management hires out of Marsh & McLennan, Berkshire Hathaway, Aon, and Arch Capital. We believe that this leadership team, with a strengthened balance sheet, has ample room to greatly improve performance over time. Currently valued at 60% of book value, we see significant upside over the coming years. And while we wait for performance to improve, management has increased dividends and share repurchases, which are very accretive to growth in book value per share at current valuation levels.

During the first half of the year, we sold several technology positions as they hit our price targets, including Intel, Micron and long-held Keysight Technologies. We still own electronic payments firm First Data, which while flat for the year, outperformed the tech sector. We invested in First Data in 2016 when its shares were valued under 10 times earnings and after it had underperformed. In contrast to Wall Street's bearish view, our research indicated that First Data's plans to improve its core merchant acquiring product and reduce debt would create significant value. Our 34% gain in the stock since our initial purchase coincides with the company executing on its plan. First Data remains a full position and was still valued at a 30% discount to peers on price to free cash flow. [NOTE: As we were finishing our letter, First Data agreed to be acquired by a competitor for a 25% premium.]

Meanwhile, Sound Shore’s best contributor for the year was drug maker Merck, which provides a classic Sound Shore case study. We initiated our position in 2015 when the stock was valued below normal at 15 times earnings. At that time, we believed consensus concerns were overstating the impact of patent expirations and undervaluing Merck's strong new product pipeline. Benefitting from a “best-in-class” research and development team, Merck’s progress is being fueled by the impressive growth of its immuno-oncology cancer drug, Keytruda. In fact, revenue estimates for Keytruda have increased from $3 billion when we invested, to approaching $8 billion for next year. The stock remains a full position and is still attractive at less than 16 times 2019 earnings.

Despite the difficult backdrop, we used the fourth quarter selloff to invest opportunistically, as stock prices often change significantly more than the underlying value of the companies. There have been a number of sharp selloffs in the last ten years, post-crisis, including two greater than 10% in 2018. As the cycle debate continues, the market may be entering an era of more normal, but higher volatility. Recent market weakness may indicate a recession is imminent, but even the best prognosticators don’t know for sure. With that in mind, we are keenly aware that risks build over time and we remain focused on the durability of our holdings, including their strong balance sheets, to withstand an uncertain outlook. To quote Warren Buffett, “The most common cause of low prices is pessimism – sometimes pervasive, sometimes specific to a company or industry. We want to do business in such an environment, not because we like the pessimism, but because we like the prices it produces.”

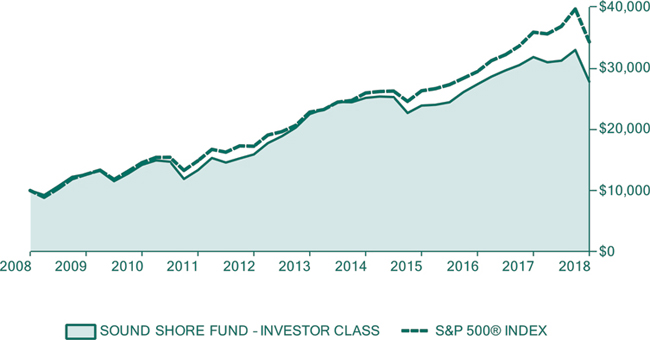

If history is any guide, now is a good time to invest with Sound Shore. For the past 20 years, we have outperformed the value and broad market indices as shown in the Exhibit below. These results include shorter term periods, like the current one, where our process is out of step and we lag. We believe this track record confirms the merits of our consistent process, though timing is always uncertain.

Sound Shore Fund vs. S&P 500 vs. Russell 1000 Value

Cumulative Returns

January 1999 -December 2018

Our conviction is high and we remain steadfast in our approach. Sound Shore’s portfolio is attractively valued at 10.9 times forward earnings versus 14.4 times for the S&P 500 and 12.3 times for the Russell 1000 Value. As markets return to rewarding company specific drivers, our holdings should benefit. Thank you for your investment in Sound Shore.

Sincerely,

SOUND SHORE FUND

Harry Burn, III

John P. DeGulis

T. Gibbs Kane, Jr.

Co-Portfolio Managers

Important Information

The Standard & Poor’s 500 Index is an unmanaged index representing the average performance of 500 widely held, publicly traded, large capitalization stocks. The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. It is not possible to invest directly in an Index. “Best-in-class” is solely the opinion of Sound Shore Management, Inc. and is subject to change. Those companies that hold leading market share positions, strong growth potential, historically good profitability, and management teams known for integrity and good corporate governance are generally considered to be “best- in-class.”

An investment in the Fund is subject to risk, including the possible loss of principal amount invested. Mid Cap Risk: Securities of medium sized companies may be more volatile and more difficult to liquidate during market downturns than securities of large, more widely traded companies. Foreign Securities Risk: The Fund may invest in foreign securities primarily in the form of American Depositary Receipts. Investing in the securities of foreign issuers also involves certain special risks, which are not typically associated with investing in U.S. dollar-denominated securities or quoted securities of U.S. issuers including increased risks of adverse issuer, political, regulatory, market or economic developments, changes in currency rates and in exchange control regulations. The Fund is also subject to other risks, including, but not limited to, risks associated with value investing.

The views in this letter were those of the Fund managers as of 12/31/18 and may not necessarily reflect their views on the date this letter is first published or anytime thereafter.

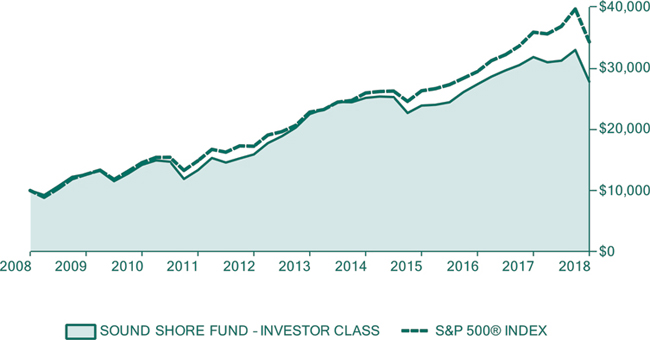

Investment and Performance Comparison (Unaudited)

The following chart reflects a ten-year comparison in the change in value of a hypothetical $10,000 investment in shares of the Investor Class of the Fund, including reinvested dividends and distributions, with a broad-based securities market index. The Standard and Poor’s 500 Index (the “S&P 500”) is a market-weighted index composed of 500 large capitalization companies and reflects the reinvestment of dividends and distributions. The Fund is professionally managed, while the S&P 500 is unmanaged and is not available for investment. The S&P 500 excludes the effect of any expenses, which have been deducted from the Fund’s return. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance cannot predict nor guarantee future results. Investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Results of an investment made today may differ substantially from the Fund’s historical performance. Current performance may be lower or higher than the performance data quoted.

SOUND SHORE FUND - INVESTOR CLASS VS. S&P 500

| AVERAGE ANNUAL TOTAL RETURN as of December 31, 2018 |

| | One Year | Five Years | Ten Years |

| Sound Shore Fund, Inc. Fund — Investor Class | (12.62)% | 4.32% | 10.77% |

| Sound Shore Fund, Inc. Fund — Institutional Class | (12.50)% | 4.49% | 10.96% |

| S&P 500® Index | (4.38)% | 8.49% | 13.12% |

| 1 | Performance information for the Institutional Class, prior to the commencement of operations on December 9, 2013, is based on the performance of the Investor Class, and adjusted for the lower expenses applicable to the Institutional Class. As stated in the current prospectus, dated May 1, 2018, the total annual fund operating expense ratio (gross) is 0.91% for the Investor Class and 0.82% for the Institutional Class. Subsequently for the fiscal year ended December 31, 2018, the total annual operating expense ratio (gross) for the Investor Class was 0.90% and 0.75% for the Institutional Class, as shown in the financial highlights. The Institutional Class’ net expense ratio is 0.76% since the Fund Adviser has agreed to reimburse essentially all of the ordinary expenses of the Institutional Class. This agreement is in effect until at least May 1, 2019. For more information about expense reimbursements please see the Notes to Financial Statements. |

SOUND SHORE FUND, INC.

SCHEDULE OF INVESTMENTS

DECEMBER 31, 2018

Sector Weightings(a) (as of December 31, 2018)

as a percentage of Net Assets (Unaudited)

| | | Share Amount | | | Value | |

| Common Stock (95.7%) (a) | | | | | | | | |

| Communication Services (9.3%) | | | | | | | | |

| Alphabet, Inc., Class A (b) | | | 35,795 | | | $ | 37,404,343 | |

| CBS Corp., Class B | | | 962,500 | | | | 42,080,500 | |

| Comcast Corp., Class A | | | 1,456,800 | | | | 49,604,040 | |

| Vodafone Group PLC, ADR | | | 1,341,550 | | | | 25,865,084 | |

| | | | | | | | 154,953,967 | |

| Consumer Discretionary (4.2%) | | | | | | | | |

| Lennar Corp., Class A | | | 896,400 | | | | 35,094,060 | |

| The Goodyear Tire & Rubber Co. | | | 1,688,250 | | | | 34,457,183 | |

| | | | | | | | 69,551,243 | |

| Consumer Staples (6.1%) | | | | | | | | |

| Mondelez International, Inc., Class A | | | 1,206,500 | | | | 48,296,195 | |

| Walmart, Inc. | | | 565,600 | | | | 52,685,640 | |

| | | | | | | | 100,981,835 | |

See Notes to Financial Statements.

SOUND SHORE FUND, INC.

SCHEDULE OF INVESTMENTS (Continued)

DECEMBER 31, 2018

| | | Share Amount | | | Value | |

| Energy (9.1%) | | | | | | |

| Antero Resources Corp. (b) | | | 2,842,900 | | | $ | 26,694,831 | |

| EQT Corp. | | | 2,066,150 | | | | 39,029,573 | |

| Equitrans Midstream Corp. (b) | | | 1,696,240 | | | | 33,958,725 | |

| Total SA, ADR | | | 982,750 | | | | 51,279,895 | |

| | | | | | | | 150,963,024 | |

| Financials (25.0%) | | | | | | | | |

| American International Group, Inc. | | | 964,050 | | | | 37,993,210 | |

| Aon PLC | | | 337,200 | | | | 49,015,392 | |

| Bank of America Corp. | | | 2,317,550 | | | | 57,104,432 | |

| Berkshire Hathaway, Inc., Class B (b) | | | 330,750 | | | | 67,532,535 | |

| Capital One Financial Corp. | | | 682,350 | | | | 51,578,836 | |

| Chubb, Ltd. | | | 417,950 | | | | 53,990,781 | |

| Citigroup, Inc. | | | 1,048,350 | | | | 54,577,101 | |

| Marsh & McLennan Cos., Inc. | | | 568,450 | | | | 45,333,888 | |

| | | | | | | | 417,126,175 | |

| Health Care (15.4%) | | | | | | | | |

| Alexion Pharmaceuticals, Inc. (b) | | | 339,700 | | | | 33,073,192 | |

| Allergan PLC | | | 359,550 | | | | 48,057,453 | |

| Merck & Co., Inc. | | | 1,120,200 | | | | 85,594,482 | |

| Pfizer, Inc. | | | 1,113,800 | | | | 48,617,370 | |

| Thermo Fisher Scientific, Inc. | | | 185,950 | | | | 41,613,750 | |

| | | | | | | | 256,956,247 | |

| Industrials (10.1%) | | | | | | | | |

| Delta Air Lines, Inc. | | | 1,036,300 | | | | 51,711,370 | |

| Eaton Corp. PLC | | | 678,100 | | | | 46,558,346 | |

| Fluor Corp. | | | 1,047,000 | | | | 33,713,400 | |

| nVent Electric PLC | | | 1,615,250 | | | | 36,278,515 | |

| | | | | | | | 168,261,631 | |

| Information Technology (13.9%) | | | | | | | | |

| Applied Materials, Inc. | | | 1,237,350 | | | | 40,510,839 | |

| First Data Corp., Class A (b) | | | 3,206,100 | | | | 54,215,151 | |

| Microsoft Corp. | | | 450,450 | | | | 45,752,207 | |

| NXP Semiconductors NV | | | 465,700 | | | | 34,126,496 | |

See Notes to Financial Statements.

SOUND SHORE FUND, INC.

SCHEDULE OF INVESTMENTS (Concluded)

DECEMBER 31, 2018

| | | Share Amount | | | Value | |

| Information Technology (13.9%) (continued) | | | | | | | | |

| Sabre Corp. | | | 2,666,950 | | | $ | 57,712,798 | |

| | | | | | | | 232,317,491 | |

| Utilities (2.6%) | | | | | | | | |

| Exelon Corp. | | | 975,550 | | | | 43,997,305 | |

| Total Common Stock (95.7%) (cost $1,438,063,086) | | | | | | | 1,595,108,918 | |

| | | | | | | | | |

| Short-Term Investments (4.3%) | | | | | | | | |

| Money Market Fund (4.3%) | | | | | | | | |

| Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class, 2.21% (c) | | | 71,446,670 | | | | 71,446,670 | |

| Total Short-Term Investments (4.3%) (cost $71,446,670) | | | | | | | 71,446,670 | |

| | | | | | | | | |

| Investments, at value (100.0%) (cost $1,509,509,756) | | | | | | $ | 1,666,555,588 | |

| Other Assets Less Liabilities (0.0%) | | | | | | | 604,856 | |

| Net Assets (100.0%) | | | | | | $ | 1,667,160,444 | |

| (a) | More narrow industries are utilized for compliance purposes, whereas broad sectors are utilized for reporting purposes. |

| (b) | Non-income producing security. |

| (c) | Percentage disclosed reflects the money market fund’s institutional class shares 30-day effective yield as of December 31, 2018. |

| ADR | American Depositary Receipt |

| PLC | Public Limited Company |

See Notes to Financial Statements.

SOUND SHORE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

DECEMBER 31, 2018

| ASSETS | | | | |

| Investments, at value (Cost $1,509,509,756) | | $ | 1,666,555,588 | |

| Receivables: | | | | |

| Capital shares sold | | | 2,995,560 | |

| Dividends | | | 4,355,051 | |

| Foreign tax reclaims | | | 253,306 | |

| Prepaid expenses | | | 61,983 | |

| Total Assets | | | 1,674,221,488 | |

| | | | | |

| LIABILITIES | | | | |

| Payables: | | | | |

| Capital shares redeemed | | | 5,790,562 | |

| Accrued liabilities: | | | | |

| Advisory fees | | | 1,073,389 | |

| Administrator fees | | | 19,449 | |

| Transfer agent fees and expenses | | | 95,667 | |

| Custodian fees | | | 19,083 | |

| Compliance and Treasurer Services fees | | | 12,500 | |

| Professional fees | | | 22,000 | |

| Other accrued liabilities | | | 28,394 | |

| Total Liabilities | | | 7,061,044 | |

| Net Assets | | $ | 1,667,160,444 | |

| | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| Common stock, at Par Value | | $ | 44,941 | |

| Paid-in Capital | | | 1,517,849,800 | |

| Distributable earnings | | | 149,265,703 | |

| Net Assets | | $ | 1,667,160,444 | |

| | | | | |

| NET ASSET VALUE | | | | |

| Net Assets - Investor Class Shares | | $ | 945,244,238 | |

| Shares Outstanding - Investor Class (100,000,000 shares authorized, par value $0.001) | | | 25,529,380 | |

| Net Asset Value (offering & redemption price per share) - Investor Class Shares | | $ | 37.03 | |

| Net Assets - Institutional Class Shares | | $ | 721,916,206 | |

| Shares Outstanding - Institutional Class (100,000,000 shares authorized, par value $0.001) | | | 19,411,287 | |

| Net Asset Value (offering & redemption price per share) - Institutional Class Shares | | $ | 37.19 | |

See Notes to Financial Statements.

SOUND SHORE FUND, INC.

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2018

| INVESTMENT INCOME | | | |

| Income: | | | |

| Dividend income (net of foreign withholding taxes of $275,635) | | $ | 41,126,457 | |

| Total Income | | | 41,126,457 | |

| | | | | |

| Expenses: | | | | |

| Advisory fees (Note 3) | | | 15,333,303 | |

| Administrator fees | | | 254,598 | |

| Transfer agent fees and expenses - Investor Class Shares | | | 1,220,294 | |

| Transfer agent fees and expenses - Institutional Class Shares | | | 46,034 | |

| Custodian fees | | | 126,749 | |

| Compliance and Treasurer Services fees and expenses (Note 3) | | | 153,682 | |

| Directors' fees and expenses (Note 3) | | | 181,291 | |

| Professional fees | | | 99,500 | |

| Registration fees - Investor Class Shares | | | 28,879 | |

| Registration fees - Institutional Class Shares | | | 26,219 | |

| Printing and postage fees - Investor Class Shares | | | 61,788 | |

| Printing and postage fees - Institutional Class Shares | | | 43,700 | |

| Miscellaneous | | | 111,999 | |

| Total Expenses | | | 17,688,036 | |

| Expense Reimbursements - Institutional Class Shares (Note 3) | | | (495,881 | ) |

| Net Expenses | | | 17,192,155 | |

| Net Investment Income | | | 23,934,302 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | |

| Net realized gain on investments | | | 102,587,810 | |

| Net change in unrealized appreciation on investments | | | (373,094,090 | ) |

| Net realized and unrealized loss on investments | | | (270,506,280 | ) |

| Net decrease in net assets from operations | | $ | (246,571,978 | ) |

See Notes to Financial Statements.

SOUND SHORE FUND, INC.

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the Year Ended December 31, | |

| | | 2018 | | | 2017 | |

| Operations: | | | | | | |

| Net investment income | | $ | 23,934,302 | | | $ | 23,142,578 | |

| Net realized gain on investments | | | 102,587,810 | | | | 208,494,216 | |

| Net change in unrealized appreciation on investments | | | (373,094,090 | ) | | | 79,123,421 | |

| Increase (decrease) in net assets from operations | | | (246,571,978 | ) | | | 310,760,215 | |

| | | | | | | | | |

| Distributions to shareholders: | | | | | | | | |

| Investor Class Shares | | | (75,565,883 | ) | | | (148,331,822 | )* |

| Institutional Class Shares | | | (56,962,796 | ) | | | (83,241,456 | )** |

| Total dividends/distributions to shareholders | | | (132,528,679 | ) | | | (231,573,278 | ) |

| | | | | | | | | |

| Net capital share transactions (Note 6): | | | | | | | | |

| Investor Class Shares | | | (205,326,630 | ) | | | (165,369,287 | ) |

| Institutional Class Shares | | | 120,368,754 | | | | 253,243,617 | |

| Total capital share transactions | | | (84,957,876 | ) | | | 87,874,330 | |

| Total increase (decrease) | | | (464,058,533 | ) | | | 167,061,267 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of the year | | | 2,131,218,977 | | | | 1,964,157,710 | |

| End of the year | | $ | 1,667,160,444 | | | $ | 2,131,218,977 | *** |

| * | Book basis distributions were sourced from net investment income and net realized gain in the amounts of $14,857,273 and $133,474,549, respectively, at December 31, 2017. |

| ** | Book basis distributions were sourced from net investment income and net realized gain in the amounts of $8,221,795 and $75,019,661, respectively, at December 31, 2017. |

| *** | Includes undistributed net investment income of $152,555 at December 31, 2017. The requirement to disclose the corresponding amount as of December 31, 2018 was eliminated pursuant to Final Rule 33-10532 (Note 8). |

See Notes to Financial Statements.

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2018

1. Organization

Sound Shore Fund, Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on February 19, 1985 and is registered as a diversified, open-end management investment company under the Investment Company Act of 1940 (the “Act”). The investment objective of the Fund is growth of capital. The Fund qualifies as an investment company as defined in the Financial Accounting Standards Codification 946 — Financial Services — Investment Companies.

The total number of shares of common stock which the Fund is authorized to issue is 200,000,000, par value $0.001 per share of which 100,000,000 shares are designated to the Investor Class and 100,000,000 shares are designated to the Institutional Class. The Board of Directors (the “Board”) may, without shareholder approval, classify or reclassify any unissued shares into other classes or series of shares.

Each share of the Fund has equal dividend, distribution, liquidation and voting rights (except as to matters relating exclusively to one class of shares), and fractional shares have those rights proportionately.

2. Significant Accounting Policies

These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent liabilities, if any, at the date of the financial statements, and the reported amounts of increase and decrease in net assets from operations during the fiscal period. Actual results could differ from those estimates.

The following represents the significant accounting policies of the Fund:

a. Security Valuation

Exchange-traded securities including those traded on the National Association of Securities Dealers’ Automated Quotation system (“NASDAQ”), are valued at the last quoted sale price or official closing price as provided by independent pricing services as of the close of trading on the system or exchange on which they are primarily traded, on each Fund business day. In the absence of a sale, such securities are valued at the mean of the last bid and asked prices. Non-exchange-traded securities for which over-the-counter market quotations are readily available are generally valued at the mean between the current bid and asked prices provided by independent pricing services. Investments in other open-end regulated investment companies are valued at their publicly traded net asset value (“NAV”).

The Fund values securities at fair value pursuant to procedures adopted by the Board if market quotations are not readily available (including a short and temporary lapse in the provision of a price by the regular pricing source) or, if in the judgment of the Adviser, as defined in Note 3, the prices or values available do not represent the fair value of the instrument. Factors which may cause the Adviser to make such a judgment include, but are not limited to, the following: (i) only a bid price or an asked price is available, (ii) the spread between the bid price and the asked price is substantial, (iii) the frequency of sales, (iv) the thinness of the market, (v) the size of reported trades, and (vi) actions of the securities markets, such as

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2018

the suspension or limitation of trading. Fair valuation is based on subjective factors and, as a result, the fair value price of a security may differ from the security’s market price and may not be the price at which the security may be sold. Fair valuation could result in a NAV different from one determined by using market quotations.

Valuation inputs used to determine the value of the Fund’s investments are summarized in the three broad levels listed below:

Level 1 - quoted prices in active markets for identical assets

Level 2 - other significant observable inputs (including quoted prices of similar securities, interest rates, prepayment speeds, credit risk, etc.)

Level 3 - significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Pursuant to the valuation procedures noted previously, equity securities (including exchange-traded securities and other open-end regulated investment companies) are generally categorized as Level 1 securities in the fair value hierarchy. Investments for which there are no quotations, or for which quotations do not appear reliable, are valued at fair value as determined in good faith by the Pricing Committee under the direction of the Board. These valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy.

The following table summarizes the Fund’s investments categorized in the fair value hierarchy as of December 31, 2018:

| Security Type | | Level 1 | | | Level 2 | | | Level 3 | | | Total Investments in Securities | |

| Common Stock | | $ | 1,595,108,918 | | | $ | – | | | $ | – | | | $ | 1,595,108,918 | |

| Short-Term Investments | | | 71,446,670 | | | | – | | | | – | | | | 71,446,670 | |

| Total Investments | | $ | 1,666,555,588 | | | $ | – | | | $ | – | | | $ | 1,666,555,588 | |

At December 31, 2018, all equity securities and open-end regulated investment companies were included in Level 1 in the table above. Please refer to the Schedule of Investments to view equity securities categorized by sector/industry type.

The Fund’s policy is to disclose transfers between Levels based on valuations at the end of the reporting period. There were no transfers between Levels as of December 31, 2018, based on the valuation input Levels on December 31, 2017.

b. Security Transactions

Security transactions are recorded on a trade date basis. Realized gain and loss on investments sold are recorded on the basis of identified cost. Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2018

basis. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding tax, which is accrued as applicable. Investment income, realized and unrealized gains and losses and certain Fund-level expenses are allocated to each class based on relative average daily net assets. Certain expenses are incurred at the class level and charged directly to that particular class. Class level expenses are denoted as such on the Fund’s Statement of Operations.

c. Dividends and Distributions to Shareholders

Dividends are declared separately for each class. No class has preferential dividend rights; differences in per-share dividend rates are generally due to class-specific fee waivers and expenses. Dividends and distributions payable to shareholders are recorded by the Fund on the ex-dividend date. Dividends from net investment income, if any, are declared and paid semiannually. Capital gains, if any, are distributed to shareholders at least annually. The Fund determines its net investment income and capital gains distributions in accordance with income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gains on various securities held by the Fund, timing differences and differing characterizations of distributions made by the Fund. To the extent distributions exceed net investment income and net realized capital gains for tax purposes, they are reported as a return of capital.

d. Federal Taxes

The Fund intends to qualify each year as a regulated investment company and to distribute substantially all of its taxable income. In addition, by distributing in each calendar year substantially all of its net investment income, capital gain and certain other amounts, if any, the Fund will not be subject to federal taxation. Therefore, no federal income or excise tax provision is required. For all open tax years and all major taxing jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require the Fund to record a tax liability or would otherwise require recognition in the financial statements. Open tax years are those that are open for examination by taxing authorities (i.e., generally, the last three tax year-ends 2015 - 2017, and the interim tax period since then).

3. Fees and Expenses

Investment Adviser

The Fund’s investment adviser is Sound Shore Management, Inc. (the “Adviser”). Pursuant to an investment advisory agreement, the Adviser receives an advisory fee, accrued daily and paid monthly at an annual rate of 0.75% of the Fund’s average daily net assets. Pursuant to an expense limitation agreement between the Adviser and the Fund, the Adviser has agreed to reimburse all of the ordinary expenses of the Institutional Class, excluding advisory fees, interest, taxes, securities lending costs, brokerage commissions, acquired fund fees and expenses, extraordinary expenses and all litigation costs until at least May 1, 2019. This reimbursement is shown on the Statement of Operations as a reduction of expenses, and such amounts are not subject to future recoupment by the Adviser.

Other Services

Atlantic Fund Administration, LLC (d/b/a Atlantic Fund Services) (“Atlantic”) provides certain administration and portfolio accounting services to the Fund. MUFG Union Bank, N.A. (“Union Bank”) serves as custodian to the Fund.

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2018

Atlantic Shareholder Services, LLC provides transfer agency services to the Fund.

The Fund also has agreements with various financial intermediaries and “mutual fund supermarkets” under which customers of these intermediaries may purchase and hold Fund shares. These intermediaries effectively provide subtransfer agent services that the Fund’s transfer agent would have otherwise had to provide. In recognition of this, the transfer agent, the Fund and the Fund’s Adviser have entered into an agreement whereby the transfer agent agrees to pay financial intermediaries a portion of the amount denoted on the Statement of Operations as “Transfer agent fees and expenses — Investor Class Shares” that it receives from the Fund for its services as transfer agent for the Investor Class and the Adviser agrees to pay the excess, if any, charged by a financial intermediary for that class.

Foreside Fund Services, LLC is the Fund’s distributor (the “Distributor”). The Distributor is not affiliated with the Adviser, Atlantic, Union Bank, or its affiliated companies. The Distributor receives no compensation from the Fund for its distribution services.

Pursuant to a Compliance Services Agreement with the Fund, Foreside Fund Officer Services, LLC (“FFOS”), an affiliate of the Distributor, provides a Chief Compliance Officer and Anti-Money Laundering Officer to the Fund as well as some additional compliance support functions. Under a Treasurer Services Agreement with the Fund, Foreside Management Services, LLC (“FMS”), an affiliate of the Distributor, provides a Treasurer to the Fund. Neither the Distributor, FFOS, FMS, nor their employees that serve as officers of the Fund, have any role in determining the investment policies of or securities to be purchased or sold by the Fund.

The Fund pays each director who is not an “interested person” of the Fund, as defined in Section 2(a)(19) of the Act (“Independent Director”), quarterly fees of $5,000 (effective as of July 2018), plus $10,000 per quarterly in-person meeting, $4,000 per quarterly meeting attended telephonically, and $2,000 per special meeting attended in person or telephonically. In addition, the Chairman of the Audit Committee receives a quarterly fee of $2,500 (effective as of July 2018).

Certain Officers and Directors of the Fund are officers, directors, or employees of the aforementioned companies.

4. Purchases and Sales of Securities

The cost of securities purchased and proceeds from sales of securities (excluding short-term investments and in kind transactions) for the fiscal year ending December 31, 2018, aggregated $1,091,038,193 and $1,306,992,170, respectively.

5. Federal Income Tax

Cost for federal income tax purposes is $1,517,536,924 and net unrealized appreciation consists of:

| Gross Unrealized Appreciation | | $ | 318,039,306 | |

| Gross Unrealized Depreciation | | | (169,020,642 | ) |

| Net Unrealized Appreciation | | $ | 149,018,664 | |

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Continued)

DECEMBER 31, 2018

Distributions during the fiscal years ended December 31, 2018 and December 31, 2017 were characterized for tax purposes as follows:

| | | 2018 | | | 2017 | |

| Ordinary Income | | $ | 23,066,133 | | | $ | 23,079,072 | |

| Long-Term Capital Gain | | | 109,462,546 | | | | 208,494,206 | |

| Total Taxable Distributions | | $ | 132,528,679 | | | $ | 231,573,278 | |

Components of net assets on a federal income tax basis at December 31, 2018, were as follows:

| Par Value + Paid-in Capital | | $ | 1,517,894,741 | |

| Undistributed Ordinary Income | | | 247,039 | |

| Net Unrealized Appreciation | | | 149,018,664 | |

| Net Assets | | $ | 1,667,160,444 | |

At December 31, 2018, the Fund, for federal income tax purposes, had no capital loss carryforwards.

6. Capital Stock

Transactions in capital stock for the period ended December 31, 2018 and the year ended December 31, 2017, were as follows:

| | | For the Year Ended December 31, 2018 | |

| | | | Investor Class | | | | Institutional Class | |

| | | Shares | | | | Amount | | | | Shares | | | | Amount | |

| Sale of shares | | | 1,131,174 | | | $ | 51,112,771 | | | | 6,225,471 | | | $ | 282,702,739 | |

| Reinvestment of dividends | | | 1,930,363 | | | | 72,477,713 | | | | 1,377,223 | | | | 51,908,303 | |

| Redemption of shares | | | (7,297,404 | ) | | | (328,917,114 | ) | | | (4,807,643 | ) | | | (214,242,288 | ) |

| Net increase (decrease) from capital transactions | | | (4,235,867 | ) | | $ | (205,326,630 | ) | | | 2,795,051 | | | $ | 120,368,754 | |

| | | For the Year Ended December 31, 2017 |

| | | | Investor Class | | | | Institutional Class | |

| | | Shares | | | | Amount | | | | Shares | | | | Amount | |

| Sale of shares | | | 3,304,068 | | | $ | 156,826,544 | | | | 6,331,314 | | | $ | 304,347,221 | |

| Reinvestment of dividends | | | 3,107,756 | | | | 142,937,146 | | | | 1,670,081 | | | | 77,072,000 | |

| Redemption of shares | | | (9,802,101 | ) | | | (465,132,977 | ) | | | (2,664,780 | ) | | | (128,175,604 | ) |

| Net increase (decrease) from capital transactions | | | (3,390,277 | ) | | $ | (165,369,287 | ) | | | 5,336,615 | | | $ | 253,243,617 | |

SOUND SHORE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Concluded)

DECEMBER 31, 2018

7. Risks

As of December 31, 2018, the Fund invested a significant portion of its assets in securities in the Financials sector. Changes in economic conditions affecting such sector would have a greater impact on the Fund and could affect the value, income and/or liquidity of positions in such securities.

8. Recent Accounting Pronouncements

In August 2018, the Financial Accounting Standards Board issued Accounting Standards Update No. 2018-13 “Fair Value Measurement (Topic 820): Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement” (“ASU 2018-13”) which includes amendments intended to improve the effectiveness of security valuation disclosures. ASU 2018-13 is effective for interim and annual periods beginning after December 15, 2019. Management is currently evaluating the impact that ASU 2018-13 will have on the Fund’s financial statements and related disclosures.

In September 2018, the Securities and Exchange Commission released Final Rule 33-10532 captioned “Disclosure Update and Simplification” which is intended to amend certain disclosure requirements that have become redundant, duplicative, overlapping, outdated, or superseded, in light of other Commission disclosure requirements, GAAP, or changes in the information environment. These changes were effective November 5, 2018. These amendments are reflected in the Fund’s financial statements for the year ended December 31, 2018.

9. Subsequent Events

Subsequent events occurring after the date of this report have been evaluated for potential impact to this report through the date the report was issued.

SOUND SHORE FUND, INC.

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each year.

| | | For the Year Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Investor Class Shares | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 45.89 | | | $ | 44.17 | | | $ | 41.30 | | | $ | 48.79 | | | $ | 49.05 | |

| Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.50 | | | | 0.51 | | | | 0.45 | | | | 0.39 | | | | 0.98 | |

| Net realized and unrealized gain (loss) on investments | | | (6.27 | ) | | | 6.63 | | | | 5.57 | | | | (2.75 | ) | | | 4.83 | |

| Total from Investment Operations | | | (5.77 | ) | | | 7.14 | | | | 6.02 | | | | (2.36 | ) | | | 5.81 | |

| Distributions from | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.51 | ) | | | (0.52 | ) | | | (0.46 | ) | | | (0.39 | ) | | | (0.98 | ) |

| Return of capital | | | – | | | | – | | | | – | | | | – | | | | (0.03 | ) |

| Net realized gains | | | (2.58 | ) | | | (4.90 | ) | | | (2.69 | ) | | | (4.74 | ) | | | (5.06 | ) |

| Total Distributions | | | (3.09 | ) | | | (5.42 | ) | | | (3.15 | ) | | | (5.13 | ) | | | (6.07 | ) |

| Net Asset Value, End of Year | | $ | 37.03 | | | $ | 45.89 | | | $ | 44.17 | | | $ | 41.30 | | | $ | 48.79 | |

| Total Return | | | (12.62 | )% | | | 16.22 | % | | | 14.63 | % | | | (5.02 | )% | | | 11.76 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (in thousands) | | $ | 945,244 | | | $ | 1,365,922 | | | $ | 1,464,566 | | | $ | 1,462,946 | | | $ | 1,786,366 | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 0.90 | % | | | 0.90 | % | | | 0.91 | % | | | 0.93 | % | | | 0.92 | % |

| Net Investment Income | | | 1.10 | % | | | 1.06 | % | | | 1.05 | % | | | 0.80 | % | | | 1.92 | %(b) |

| Portfolio Turnover Rate (c) | | | 56 | % | | | 44 | % | | | 46 | % | | | 39 | %(d) | | | 47 | % |

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | Net investment income for the period includes/reflects the divestiture by Vodafone (one of the Fund's portfolio holdings) of its 45% stake in Verizon Wireless in a transaction that included the payment of an extraordinary dividend of cash and shares of Verizon to Vodafone shareholders. Absent this distribution, the ratio of net investment income to average net assets would have been 0.53% for the period. |

| (c) | Portfolio turnover is calculated on the basis of the Fund, as a whole, without distinguishing between the classes of shares issued. |

| (d) | Amount excludes redemption in-kind of $30,223,998. |

SOUND SHORE FUND, INC.

FINANCIAL HIGHLIGHTS (Continued)

These financial highlights reflect selected data for a share outstanding throughout each year.

| | | For the Year Ended December 31, | |

| | | 2018 | | | 2017 | | | 2016 | | | 2015 | | | 2014 | |

| Institutional Class Shares | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 46.06 | | | $ | 44.29 | | | $ | 41.38 | | | $ | 48.87 | | | $ | 49.06 | |

| Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.58 | | | | 0.60 | | | | 0.52 | | | | 0.48 | | | | 0.67 | |

| Net realized and unrealized gain (loss) on investments | | | (6.32 | ) | | | 6.64 | | | | 5.58 | | | | (2.75 | ) | | | 5.23 | |

| Total from Investment Operations | | | (5.74 | ) | | | 7.24 | | | | 6.10 | | | | (2.27 | ) | | | 5.90 | |

| Distributions from | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.55 | ) | | | (0.57 | ) | | | (0.50 | ) | | | (0.48 | ) | | | (1.00 | ) |

| Return of capital | | | – | | | | – | | | | – | | | | – | | | | (0.03 | ) |

| Net realized gains | | | (2.58 | ) | | | (4.90 | ) | | | (2.69 | ) | | | (4.74 | ) | | | (5.06 | ) |

| Total Distributions | | | (3.13 | ) | | | (5.47 | ) | | | (3.19 | ) | | | (5.22 | ) | | | (6.09 | ) |

| Net Asset Value, End of Year | | $ | 37.19 | | | $ | 46.06 | | | $ | 44.29 | | | $ | 41.38 | | | $ | 48.87 | |

| Total Return | | | (12.50 | )% | | | 16.40 | % | | | 14.80 | % | | | (4.84 | )% | | | 11.94 | % |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| Net Assets at End of Year (in thousands) | | $ | 721,916 | | | $ | 765,297 | | | $ | 499,591 | | | $ | 450,442 | | | $ | 551,261 | |

| Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | |

| Expenses (gross) (b) | | | 0.81 | % | | | 0.81 | % | | | 0.82 | % | | | 0.83 | % | | | 0.83 | % |

| Expenses (net) | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % | | | 0.75 | % |

| Net Investment Income | | | 1.27 | % | | | 1.25 | % | | | 1.21 | % | | | 0.98 | % | | | 1.29 | %(c) |

| Portfolio Turnover Rate (d) | | | 56 | % | | | 44 | % | | | 46 | % | | | 39 | %(e) | | | 47 | % |

| (a) | Calculated based on average shares outstanding during each year. |

| (b) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

| (c) | Net investment income for the period includes/reflects the divestiture by Vodafone (one of the Fund's portfolio holdings) of its 45% stake in Verizon Wireless in a transaction that included the payment of an extraordinary dividend of cash and shares of Verizon to Vodafone shareholders. Absent this distribution, the ratio of net investment income to average net assets would have been 0.72% for the period. |

| (d) | Portfolio turnover is calculated on the basis of the Fund, as a whole, without distinguishing between the classes of shares issued. |

| (e) | Amount excludes redemption in-kind of $30,223,998. |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and the Shareholders of Sound Shore Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Sound Shore Fund, Inc. (the “Fund”), including the schedule of investments, as of December 31, 2018, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the three-year period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2018, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the three-year period then ended, in conformity with accounting principles generally accepted in the United States of America. The financial highlights for each of the years in the two-year period ended December 31, 2015 were audited by other auditors whose report, dated February 29, 2016, expressed an unqualified opinion on such financial highlights.

Basis for Opinion

These financial statements are the responsibility of the Fund's management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities law and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risk of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures include examining, on a test basis,

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM (Concluded)

evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2018 by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

BBD, LLP

We have served as the auditor of the Sound Shore Fund, Inc. since 2016.

Philadelphia, Pennsylvania

February 22, 2019

SOUND SHORE FUND, INC.

ADDITIONAL INFORMATION (Unaudited)

DECEMBER 31, 2018

Shareholder Expense Example

As a shareholder of the Fund, you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The following example is based on $1,000 invested at the beginning of the period and held for the entire period from July 1, 2018 through December 31, 2018.

Actual Expenses - The Actual Return lines of the table below provide information about actual account values and actual expenses for each share class. You may use the information in these lines, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the Actual Return line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes - The Hypothetical Return lines of the table below provide information about hypothetical account values and hypothetical expenses based on each class’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the Hypothetical Return lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | Beginning Account Value July 1, 2018 | Ending Account Value December 31, 2018 | Expenses Paid During Period* |

| Investor Class Actual Return | $1,000.00 | $890.46 | $4.29 |

| Investor Class Hypothetical Return | $1,000.00 | $1,020.67 | $4.58 |

| Institutional Class Actual Return | $1,000.00 | $891.00 | $3.57 |

| Institutional Class Hypothetical Return | $1,000.00 | $1,021.42 | $3.82 |

| * | Expenses are equal to the Investor Class' and Institutional Class' annualized expense ratios of 0.90% and 0.75% respectively, multiplied by the average account value over the period, multiplied by 184/365 to reflect the most recent one-half year period. |

SOUND SHORE FUND, INC.

ADDITIONAL INFORMATION (Unaudited)(Continued)

DECEMBER 31, 2018

Federal Tax Status of Dividends Declared during the Fiscal Year (Unaudited)

Income Dividends - For federal income tax purposes, dividends from short-term capital gains are classified as ordinary income. The Fund paid income dividends of $23,066,133 for the tax year ended December 31, 2018, of which $0 were short-term capital gain dividends. The Fund designated 100% of its income dividend distributed as qualifying for the corporate dividends-received deductions (DRD) and 100% for the qualified dividend rate (QDI) as defined in Section 1(h)(11) of the Internal Revenue Code. The Fund also designates 0% of its income dividends as qualified interest income (QII) and 0% as qualified short-term capital gain dividends exempt from U.S. tax for foreign shareholders (QSD).

Capital Gain and other distributions - The Fund paid long-term capital gain dividends of $109,462,546.

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to securities held in the Fund’s portfolio is available, without charge and upon request, by calling (800) 551-1980 or by visiting the Fund’s website at http://www.soundshorefund.com. This information is also available on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov under the name of the Sound Shore Fund.

The Fund’s proxy voting record for the most recent 12-month period ended June 30 is available, without charge and upon request, by calling (800) 551-1980 or by visiting the Fund’s website at http://www.soundshorefund.com. This information is available on the SEC’s website at http://www.sec.gov under the name of the Sound Shore Fund.

Availability of Quarterly Portfolio Schedule

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This information is available on the SEC’s website at http://www.sec.gov under the name of the Sound Shore Fund.

SOUND SHORE FUND, INC.

ADDITIONAL INFORMATION (Unaudited)(Continued)

DECEMBER 31, 2018

Directors and Officers of the Fund

The following is relevant information regarding the Directors and Officers of the Fund:

Name, Address and Birth Date | Position(s) With the Fund | Length of Time Served(1) | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Director |

| Independent Directors |

Harry W. Clark c/o Sound Shore Fund, Inc. Three Canal Plaza, Suite 600 Portland, ME 04101 Birth Date: March 1949 | Director; Audit Committee (member); Nominating Committee (member); Valuation Oversight Committee (member) | January 2006 to present | Managing Partner, Stanwich Group LLC (public policy consulting firm) since January 2001; Senior Counselor, Brunswick Group LLC (international financial communications consulting firm) since January 2005; Senior Director, Albright Stonebridge Group (international political risk consultancy) since May, 2012. | Director, U.S. Chamber of Commerce Foundation since 2005. |

H. Williamson Ghriskey, Jr. c/o Sound Shore Fund, Inc. Three Canal Plaza, Suite 600 Portland, ME 04101 Birth Date: May 1944 | Director; Audit Committee (member); Nominating Committee (member); Valuation Oversight Committee (member) | January 2006 to present | Senior Managing Director/Portfolio Management, First Republic Investment Management (investment counseling firm) since September 1978. | Past President of Investment Advisor Association 1990-1992. |

David Blair Kelso c/o Sound Shore Fund, Inc. Three Canal Plaza, Suite 600 Portland, ME 04101 Birth Date: September 1952 | Lead Independent Director; Audit Committee (Chair); Nominating Committee (Chair); Valuation Oversight Committee (member); Audit Committee Financial Expert | January 2006 to present | Managing Partner, Kelso Advisory Services (consulting firm), since October 2003; Trustee Emeritus, Connecticut College, since October 2007; Trustee, Darden School of Business Administration, University of Virginia, since October 2015; Director, Round Hill Development Corp. (resort development firm), since 2006; Trustee, New Orleans Museum of Art, since February 2016; Director, Aspen Holdings, Inc. (insurance firm), (2005 – April 2011); Executive Vice President, Strategy & Finance, Aetna, Inc. (insurance firm); Chairman Aetna Life Insurance Company, (September 2001 – September 2003); Chief Financial Officer, Executive Vice President, and Managing Director, Chubb, Inc. (insurance firm), August 1996 –August 2001. | Director, EXL Service Holdings, Inc. (since July 2006) Director, Assurant, Inc. (March 2007 - February 2015). |

| (1) | Terms of Service is until his/her successor is elected or qualified or until his/her earlier resignation or removal. |

SOUND SHORE FUND, INC.

ADDITIONAL INFORMATION (Unaudited)(Concluded)

DECEMBER 31, 2018

Name, Address and Birth Date | Position(s) With the Fund | Length of Time Served(1) | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Director |

| Interested Directors(2) |

Harry Burn, III, M.B.A. 8 Sound Shore Drive Greenwich, Connecticut 06830 Birth Date: January 1944 | Chairman and Director | April 1985 to present (Chairman September 1992 to present) | Co-Chairman and Director, Sound Shore Management, Inc., since 1978; Chartered Financial Analyst. | |

T. Gibbs, Kane, Jr. 8 Sound Shore Drive Greenwich, Connecticut 06830 Birth Date: May 1947 | President and Director | April 1985 to present | Co-Chairman and Director, Sound Shore Management, Inc., since 1977; Chartered Financial Analyst. | |

| Officers |

Lowell E. Haims 8 Sound Shore Drive Greenwich, Connecticut 06830 Birth Date: May 1967 | Secretary; Valuation Oversight Committee (Chair) | October 2010 to present | Chief Administrative Officer, Sound Shore Management, Inc., since October 2005; Chief Compliance Officer, Sound Shore Management Inc., since June 2007; Chartered Financial Analyst. | |

Charles S. Todd Three Canal Plaza, Suite 100 Portland, ME 04101 Birth Date: September 1971 | Treasurer; Valuation Oversight Committee (member) | June 2009 to present | Foreside, Senior Managing Director, Fund and Adviser Compliance (since 2018); Foreside, Business Head Fund Officer & Compliance Services, since (2015-2017); Foreside Management Services, LLC, Business Head, Treasurer Services (2012 – 2015). | |

Julie L. Walsh 10 High Street, Suite 302 Boston, Massachusetts 02110 Birth Date: October 1970 | Chief Compliance Officer; AMLCO | May 2011 to present | Managing Director, Foreside Fund Officer Services, LLC (f/k/a Foreside Compliance Services, LLC) (May 2010 to present). | |

| (1) | Terms of Service is until his/her successor is elected or qualified or until his/her earlier resignation or removal. |

| (2) | Harry Burn, III and T. Gibbs Kane, Jr. are “interested persons” of the Fund as defined in Section 2(a)(19) of the 1940 Act by virtue of their position as shareholders, senior officers, and Directors of the Adviser. Each is a portfolio manager of the Fund. |

The Fund’s Statement of Additional Information (“SAI”) contains additional information about the Fund’s Directors. The SAI is available without charge, by contacting the Fund at (800) 551-1980.

Investment Adviser

Sound Shore Management, Inc.

Greenwich, Connecticut

Administrator

Atlantic Fund Administration, LLC

Portland, Maine

Distributor

Foreside Fund Services, LLC

Portland, Maine

www.foreside.com

Transfer and Distribution Paying Agent

Atlantic Shareholder Services, LLC

Portland, Maine

Custodian

MUFG Union Bank, N.A.

San Francisco, California

Fund Counsel

Schiff Hardin LLP

New York, New York

Independent Registered

Public Accounting Firm

BBD, LLP

Philadelphia, Pennsylvania

Item 2. Code of Ethics.

Sound Shore Fund, Inc. maintains a code of ethics, as defined in Item 2 of Form N-CSR, that applies to its President and Treasurer. A copy of the code of ethics is filed as an exhibit to this Form N-CSR. During the period covered by the Report, there were no amendments to the Code of Ethics as filed nor were there any waivers from its provisions granted.

Item 3. Audit Committee Financial Expert.

The Board of Directors has determined that David Blair Kelso, who meets the definition of an independent director as specified by Item 3, is an “audit committee financial expert” as that term is defined by applicable regulator guideline.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees – The aggregate fees billed for each of the last two fiscal years (the “Reporting Periods”) for professional services rendered by the Registrant’s principal accountant for the audit of the Registrant’s annual financial statements, or services that are normally provided by the principal accountant in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $20,000 in 2018 and $20,000 in 2017.

(b) Audit-Related Fees – The aggregate fees billed in the Reporting Periods for assurance and related services rendered by the principal accountant that were reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this item 4 were $0 in 2018 and $0 in 2017.

(c) Tax Fees – The aggregate fees billed in the Reporting Periods for professional services rendered by the principal accountant to the Registrant for tax compliance, tax advice and tax planning (“Tax Fees”) were $2,500 in 2018 and $2,000 in 2017. These services consisted of review or preparation of U.S. federal, state, local and excise tax returns.

(d) All Other Fees – There were no other fees billed in the Reporting Periods for products and services provided by the principal accountant to the Registrant, other than the services reported in paragraphs (a) through (c) of this Item.

(e)(1) Pre-Approval Requirements for Audit and Non-Audit Services. The Audit Committee reviews and approves in advance all audit and “permissible non-audit services” to be provided to Sound Shore Management, Inc. (“Sound Shore Management”), the Fund’s investment adviser, by the Fund’s independent auditor if the engagement relates to the operations and financial reporting of the Fund. The Audit Committee considers whether fees paid by Sound Shore Management for audit and permissible non-audit services are consistent with the independent auditor’s independence. Pre-approval of any permissible non-audit services provided to the Fund is not required so long as: (i) the aggregate amount of all such permissible non-audit services provided to the Fund constitutes not more than 5% of the total amount of revenues paid by the Fund to its auditor during the fiscal year in which the permissible non-audit services are provided; (ii) the permissible non-audit services were not recognized by the Fund at the time of engagement to be non-audit services; and (iii) such services are promptly brought to the attention of the Audit Committee and approved prior to the completion of the audit by the Audit Committee or its authorized delegate(s). Pre-approval of permissible non-audit services rendered to Sound Shore Management is not required if provided. The Audit Committee may delegate to one or more of its members authority to pre-approve permissible non-audit services to be provided to the Fund. Any pre-approval determination of a delegate will be presented to the full Audit Committee at its next meeting.

(e)(2) No services included in (b) - (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2- 01 of Regulation S-X.

(f) Not applicable as less than 50%.

(g) The aggregate fees billed in the Reporting Periods for Non-Audit Services by the principal accountant to the Registrant and Sound Shore Management were $2,500 in 2018 and $2,000 in 2017.

(h) The Registrant’s Audit Committee considers the provision of any non-audit services rendered to the investment adviser, to the extent applicable, in evaluating the independence of the Registrant’s principal accountant. Any services provided by the principal accountant to the Registrant or to Sound Shore Management requiring pre-approval were pre-approved.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

| (a) | Included as part of the report to stockholders under Item 1. |

| (b) | Not applicable. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) were effective as of a date within 90 days of the filing date of this report (the “Evaluation Date”) based on their evaluation of the registrant’s disclosure controls and procedures as of the Evaluation Date.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13. Exhibits.

(a)(1) A copy of the Code of Ethics (Exhibit filed herewith).

(a)(2) Certifications pursuant to Rule 30a-2(a) of the Investment Company Act of 1940 as amended, and Section 302 of the Sarbanes-Oxley Act of 2002 (Exhibit filed herewith).

(a)(3) Not applicable.

(b) Certifications pursuant to Rule 30a-2(b) of the Investment Company Act of 1940, as amended, and Section 906 of the Sarbanes-Oxley Act of 2002 (Exhibit filed herewith).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SOUND SHORE FUND, INC.

| By | /s/ T. Gibbs Kane, Jr.

| |

| | T. Gibbs Kane, Jr., President | |

| | | |

| Date | 2/26/19

| |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ T. Gibbs Kane, Jr.

| |

| | T. Gibbs Kane, Jr., President | |

| | | |

| Date | 2/26/19

| |

| By | /s/ Charles S. Todd

| |

| | Charles S. Todd, Treasurer | |

| | | |

| Date | 2/26/19

| |