UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04244

SOUND SHORE FUND, INC.

Three Canal Plaza, Suite 600

Portland, Maine 04101

John P. DeGulis, President

8 Sound Shore Drive

Greenwich, Connecticut 06830

Date of fiscal year end: December 31

Date of reporting period: January 1, 2024 – June 30, 2024

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Sound Shore Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at https://soundshorefund.com/investor-resources-documents/. You can also request this information by contacting us at (800) 551-1980.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference(a) |

|---|

| Institutional Class | $40 | 0.75% |

| Footnote | Description |

Footnote(a) | Annualized for a period less than one year. |

How did the Fund perform in the last six months?

The Fund's year to date strong performance was driven by a diverse group of holdings led by investments in the utility, health care and information technology sectors.

The first half of the year has been full of typical apprehension on Wall Street as geopolitical tensions continue, the macro outlook remains uncertain and the political cycle enters the scene. The Federal Reserve has kept investors guessing on its decision and timing of a rate cut, while inflationary pressure on the economy and markets remained front and center.

We believe in the current environment, our emphasis on stock specific sources of out-performance should prove as relevant as ever, despite this long list of concerns about the economy and market volatility.

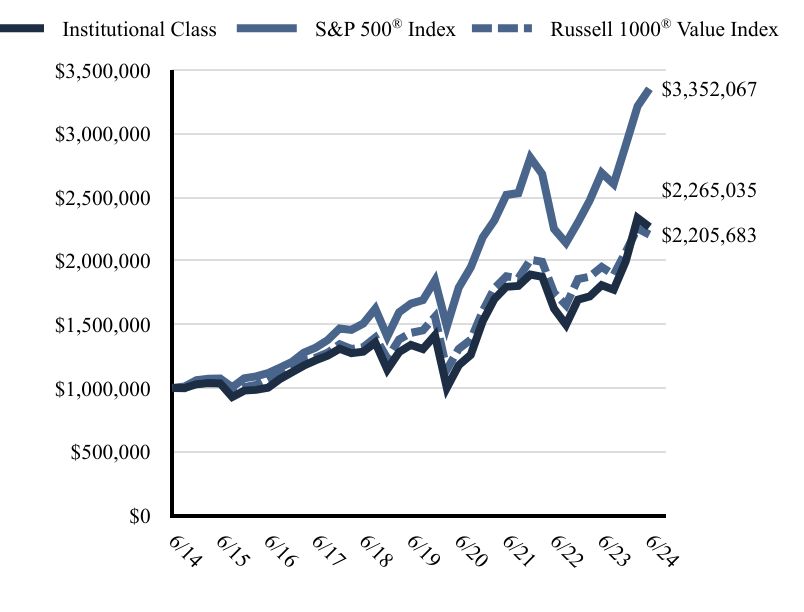

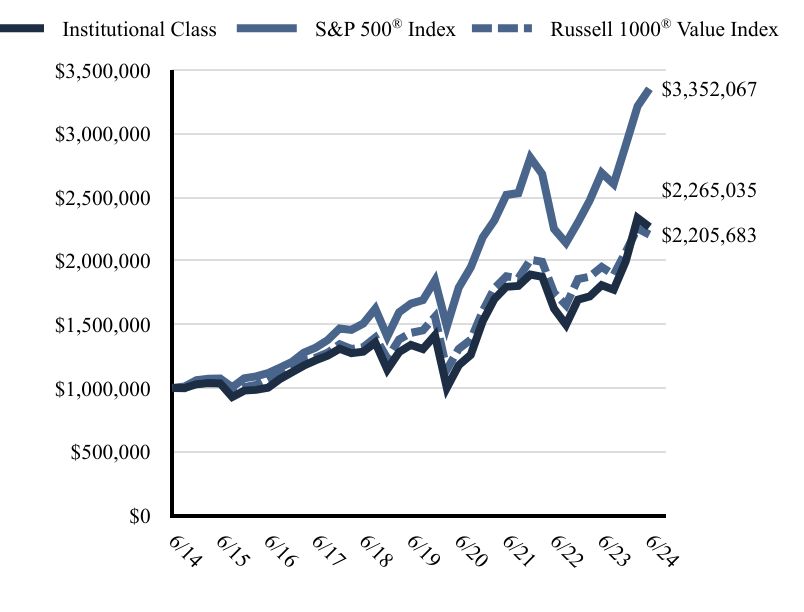

Total Return Based on a $1,000,000 Investment

| Date | Institutional Class | S&P 500® Index | Russell 1000® Value Index |

|---|

| 6/14 | $1,000,000 | $1,000,000 | $1,000,000 |

| 9/14 | $998,663 | $1,011,279 | $998,068 |

| 12/14 | $1,028,546 | $1,061,163 | $1,047,773 |

| 3/15 | $1,038,227 | $1,071,249 | $1,040,209 |

| 6/15 | $1,035,405 | $1,074,228 | $1,041,336 |

| 9/15 | $928,732 | $1,005,065 | $953,917 |

| 12/15 | $978,811 | $1,075,847 | $1,007,676 |

| 3/16 | $984,724 | $1,090,347 | $1,024,181 |

| 6/16 | $1,001,752 | $1,117,119 | $1,071,122 |

| 9/16 | $1,070,313 | $1,160,151 | $1,108,403 |

| 12/16 | $1,123,645 | $1,204,518 | $1,182,410 |

| 3/17 | $1,175,146 | $1,277,585 | $1,221,052 |

| 6/17 | $1,217,167 | $1,317,039 | $1,237,470 |

| 9/17 | $1,253,927 | $1,376,048 | $1,276,024 |

| 12/17 | $1,307,997 | $1,467,483 | $1,343,976 |

| 3/18 | $1,273,635 | $1,456,343 | $1,305,898 |

| 6/18 | $1,284,581 | $1,506,351 | $1,321,251 |

| 9/18 | $1,356,899 | $1,622,503 | $1,396,611 |

| 12/18 | $1,144,530 | $1,403,143 | $1,232,868 |

| 3/19 | $1,280,864 | $1,594,644 | $1,380,004 |

| 6/19 | $1,338,772 | $1,663,274 | $1,433,057 |

| 9/19 | $1,306,285 | $1,691,522 | $1,452,484 |

| 12/19 | $1,413,474 | $1,844,942 | $1,560,087 |

| 3/20 | $1,001,528 | $1,483,370 | $1,143,076 |

| 6/20 | $1,177,492 | $1,788,104 | $1,306,429 |

| 9/20 | $1,260,217 | $1,947,771 | $1,379,494 |

| 12/20 | $1,525,937 | $2,184,390 | $1,603,703 |

| 3/21 | $1,699,388 | $2,319,275 | $1,784,199 |

| 6/21 | $1,795,499 | $2,517,546 | $1,877,123 |

| 9/21 | $1,802,333 | $2,532,199 | $1,862,482 |

| 12/21 | $1,891,788 | $2,811,427 | $2,007,199 |

| 3/22 | $1,874,491 | $2,682,144 | $1,992,393 |

| 6/22 | $1,623,117 | $2,250,289 | $1,749,108 |

| 9/22 | $1,496,818 | $2,140,416 | $1,650,853 |

| 12/22 | $1,695,088 | $2,302,254 | $1,855,900 |

| 3/23 | $1,718,962 | $2,474,856 | $1,874,572 |

| 6/23 | $1,807,961 | $2,691,211 | $1,950,953 |

| 9/23 | $1,772,943 | $2,603,116 | $1,889,206 |

| 12/23 | $1,994,516 | $2,907,462 | $2,068,636 |

| 3/24 | $2,335,592 | $3,214,371 | $2,254,515 |

| 6/24 | $2,265,035 | $3,352,067 | $2,205,683 |

The above chart represents historical performance of a hypothetical $1,000,000 investment over the past 10 years. Updated performance can be found at www.soundshorefund.com. Effective May 1, 2024, the Fund changed its primary benchmark index from the Russell 1000 Value Index to the S&P 500 Index due to regulatory requirements. The Fund retained the Russell 1000 Value Index as a secondary benchmark because the Russell 1000 Value Index more closely aligns with the Fund's investment strategies and restrictions.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Class | 25.28% | 11.09% | 8.52% |

S&P 500® Index | 24.56% | 15.05% | 12.86% |

Russell 1000® Value Index | 13.06% | 9.01% | 8.23% |

| Total Net Assets | $998,565,460 |

| # of Portfolio Holdings | 38 |

| Portfolio Turnover Rate | 33% |

| Investment Advisory Fees Paid (Net of Expense Reimbursements) | $3,413,517 |

What did the Fund invest in?

The Adviser seeks to meet the Fund’s investment objective of growth of capital by employing a value investment strategy to its selection of predominantly large cap and mid cap common stocks for the portfolio.

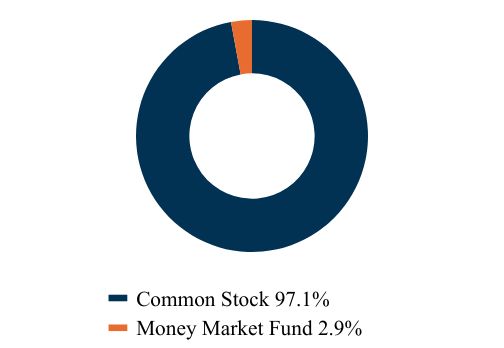

Asset Class Weightings

(% of total investments)

| Value | Value |

|---|

| Common Stock | 97.1% |

| Money Market Fund | 2.9% |

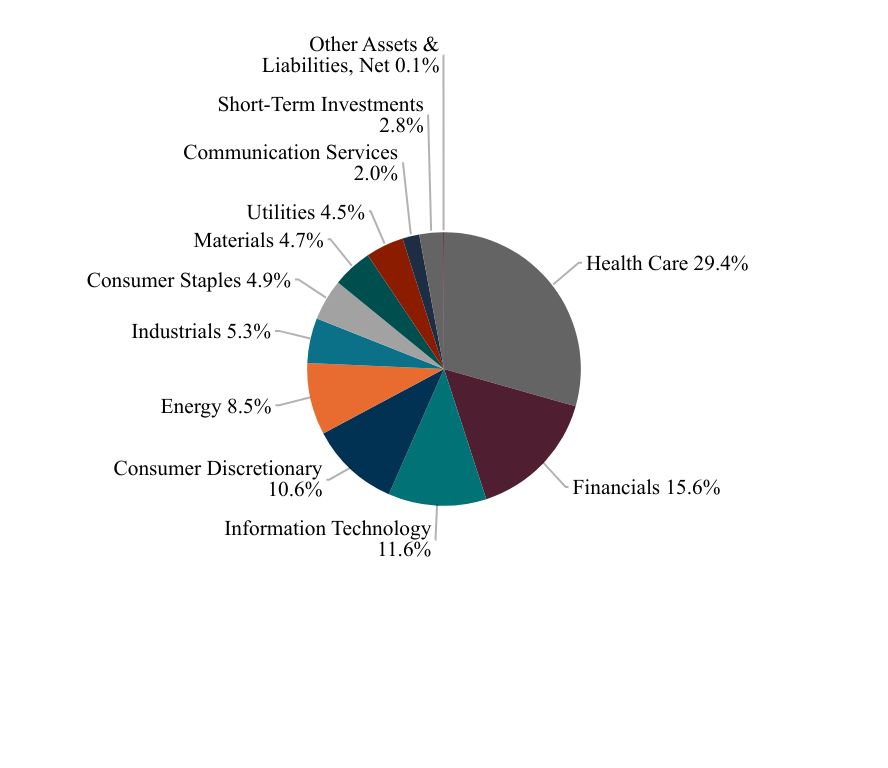

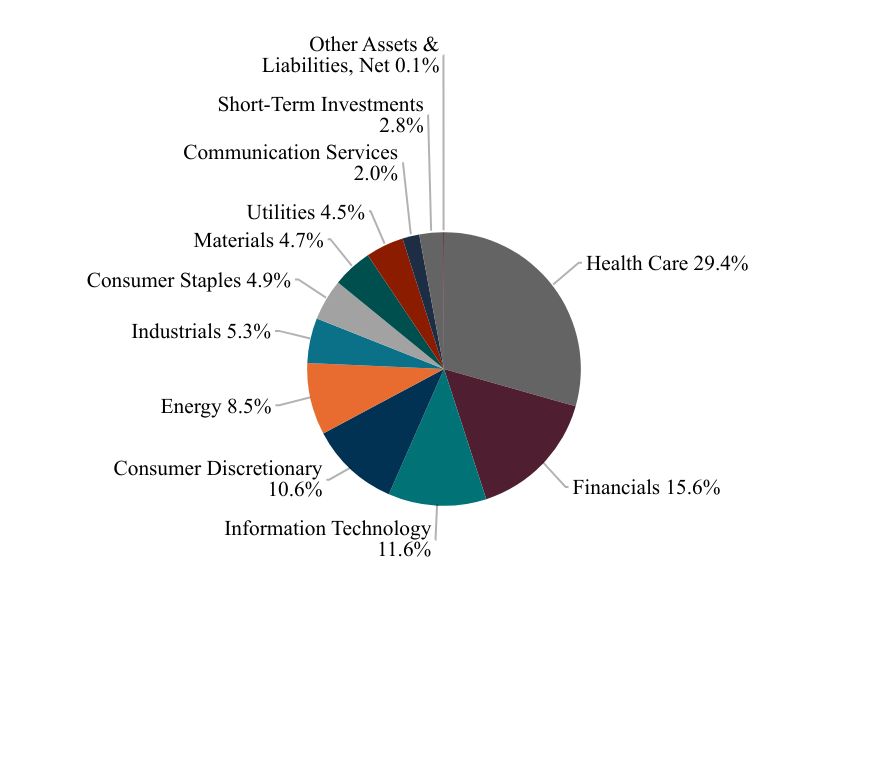

Sector Weightings

(% of total net assets)

| Value | Value |

|---|

| Health Care | 29.4% |

| Financials | 15.6% |

| Information Technology | 11.6% |

| Consumer Discretionary | 10.6% |

| Energy | 8.5% |

| Industrials | 5.3% |

| Consumer Staples | 4.9% |

| Materials | 4.7% |

| Utilities | 4.5% |

| Communication Services | 2.0% |

| Short-Term Investments | 2.8% |

| Other Assets & Liabilities, Net | 0.1% |

Top Ten Holdings

(% of total net assets)

| Teva Pharmaceutical Industries, Ltd., ADR | 3.57% |

| Fidelity National Information Services, Inc. | 3.55% |

| Capital One Financial Corp. | 3.34% |

| Organon & Co. | 3.33% |

| Oracle Corp. | 3.16% |

| PVH Corp. | 3.12% |

| Kinder Morgan, Inc. | 3.09% |

| Willis Towers Watson PLC | 3.05% |

| Flex, Ltd. | 3.03% |

| Wells Fargo & Co. | 3.02% |

Where can I find additional information about the fund?

The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group). Additional information is available by scanning the QR code or at https://soundshorefund.com/investor-resources-documents/, including its:

prospectus

financial information

holdings

proxy voting information

Semi-Annual Shareholder Report - June 30, 2024

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about the Sound Shore Fund for the period of January 1, 2024, to June 30, 2024. You can find additional information about the Fund at https://soundshorefund.com/investor-resources-documents/. You can also request this information by contacting us at (800) 551-1980.

What were the Fund's costs for the last six months?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investmentFootnote Reference(a) |

|---|

| Investor Class | $50 | 0.95% |

| Footnote | Description |

Footnote(a) | Annualized for a period less than one year. |

How did the Fund perform in the last six months?

The Fund's year to date strong performance was driven by a diverse group of holdings led by investments in the utility, health care and information technology sectors.

The first half of the year has been full of typical apprehension on Wall Street as geopolitical tensions continue, the macro outlook remains uncertain and the political cycle enters the scene. The Federal Reserve has kept investors guessing on its decision and timing of a rate cut, while inflationary pressure on the economy and markets remained front and center.

We believe in the current environment, our emphasis on stock specific sources of out-performance should prove as relevant as ever, despite this long list of concerns about the economy and market volatility.

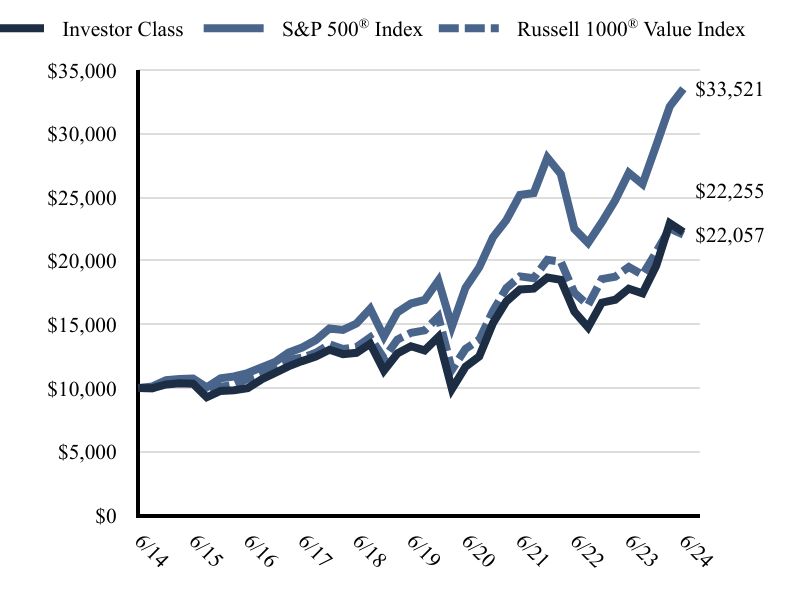

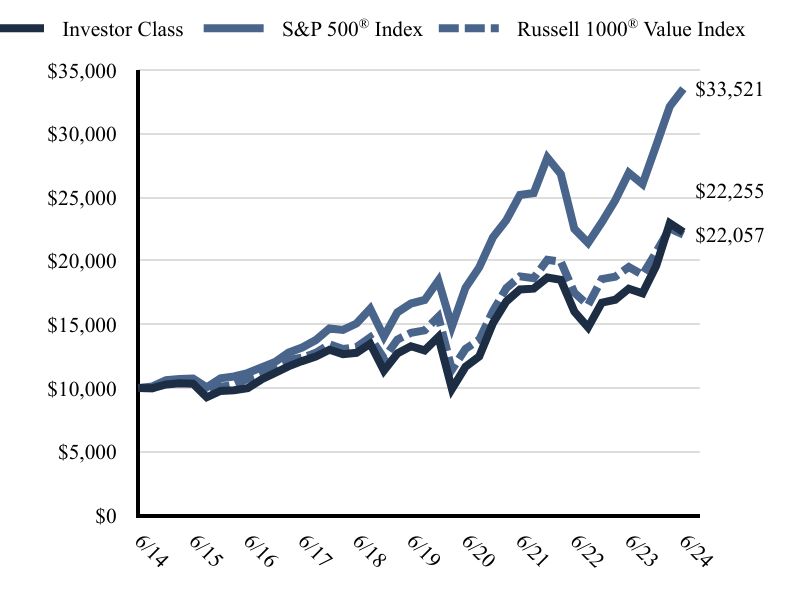

Total Return Based on a $10,000 Investment

| Date | Investor Class | S&P 500® Index | Russell 1000® Value Index |

|---|

| 6/14 | $10,000 | $10,000 | $10,000 |

| 9/14 | $9,981 | $10,113 | $9,981 |

| 12/14 | $10,276 | $10,612 | $10,478 |

| 3/15 | $10,369 | $10,712 | $10,402 |

| 6/15 | $10,335 | $10,742 | $10,413 |

| 9/15 | $9,266 | $10,051 | $9,539 |

| 12/15 | $9,760 | $10,758 | $10,077 |

| 3/16 | $9,817 | $10,903 | $10,242 |

| 6/16 | $9,982 | $11,171 | $10,711 |

| 9/16 | $10,662 | $11,602 | $11,084 |

| 12/16 | $11,188 | $12,045 | $11,824 |

| 3/17 | $11,697 | $12,776 | $12,211 |

| 6/17 | $12,108 | $13,170 | $12,375 |

| 9/17 | $12,470 | $13,760 | $12,760 |

| 12/17 | $13,003 | $14,675 | $13,440 |

| 3/18 | $12,657 | $14,563 | $13,059 |

| 6/18 | $12,760 | $15,064 | $13,213 |

| 9/18 | $13,476 | $16,225 | $13,966 |

| 12/18 | $11,359 | $14,031 | $12,329 |

| 3/19 | $12,709 | $15,946 | $13,800 |

| 6/19 | $13,277 | $16,633 | $14,331 |

| 9/19 | $12,951 | $16,915 | $14,525 |

| 12/19 | $14,005 | $18,449 | $15,601 |

| 3/20 | $9,920 | $14,834 | $11,431 |

| 6/20 | $11,658 | $17,881 | $13,064 |

| 9/20 | $12,472 | $19,478 | $13,795 |

| 12/20 | $15,095 | $21,844 | $16,037 |

| 3/21 | $16,805 | $23,193 | $17,842 |

| 6/21 | $17,747 | $25,175 | $18,771 |

| 9/21 | $17,804 | $25,322 | $18,625 |

| 12/21 | $18,679 | $28,114 | $20,072 |

| 3/22 | $18,497 | $26,821 | $19,924 |

| 6/22 | $16,009 | $22,503 | $17,491 |

| 9/22 | $14,760 | $21,404 | $16,509 |

| 12/22 | $16,705 | $23,023 | $18,559 |

| 3/23 | $16,933 | $24,749 | $18,746 |

| 6/23 | $17,803 | $26,912 | $19,510 |

| 9/23 | $17,445 | $26,031 | $18,892 |

| 12/23 | $19,614 | $29,075 | $20,686 |

| 3/24 | $22,958 | $32,144 | $22,545 |

| 6/24 | $22,255 | $33,521 | $22,057 |

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. Updated performance can be found at www.soundshorefund.com. Effective May 1, 2024, the Fund changed its primary benchmark index from the Russell 1000 Value Index to the S&P 500 Index due to regulatory requirements. The Fund retained the Russell 1000 Value Index as a secondary benchmark because the Russell 1000 Value Index more closely aligns with the Fund's investment strategies and restrictions.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Investor Class | 25.01% | 10.88% | 8.33% |

S&P 500® Index | 24.56% | 15.05% | 12.86% |

Russell 1000® Value Index | 13.06% | 9.01% | 8.23% |

| Total Net Assets | $998,565,460 |

| # of Portfolio Holdings | 38 |

| Portfolio Turnover Rate | 33% |

| Investment Advisory Fees Paid (Net of Expense Reimbursements) | $3,413,517 |

What did the Fund invest in?

The Adviser seeks to meet the Fund’s investment objective of growth of capital by employing a value investment strategy to its selection of predominantly large cap and mid cap common stocks for the portfolio.

Asset Class Weightings

(% of total investments)

| Value | Value |

|---|

| Common Stock | 97.1% |

| Money Market Fund | 2.9% |

Sector Weightings

(% of total net assets)

| Value | Value |

|---|

| Health Care | 29.4% |

| Financials | 15.6% |

| Information Technology | 11.6% |

| Consumer Discretionary | 10.6% |

| Energy | 8.5% |

| Industrials | 5.3% |

| Consumer Staples | 4.9% |

| Materials | 4.7% |

| Utilities | 4.5% |

| Communication Services | 2.0% |

| Short-Term Investments | 2.8% |

| Other Assets & Liabilities, Net | 0.1% |

Top Ten Holdings

(% of total net assets)

| Teva Pharmaceutical Industries, Ltd., ADR | 3.57% |

| Fidelity National Information Services, Inc. | 3.55% |

| Capital One Financial Corp. | 3.34% |

| Organon & Co. | 3.33% |

| Oracle Corp. | 3.16% |

| PVH Corp. | 3.12% |

| Kinder Morgan, Inc. | 3.09% |

| Willis Towers Watson PLC | 3.05% |

| Flex, Ltd. | 3.03% |

| Wells Fargo & Co. | 3.02% |

Where can I find additional information about the fund?

The Fund is distributed by Foreside Fund Services, LLC, a wholly owned subsidiary of Foreside Financial Group, LLC (dba ACA Group). Additional information is available by scanning the QR code or at https://soundshorefund.com/investor-resources-documents/, including its:

prospectus

financial information

holdings

proxy voting information

Semi-Annual Shareholder Report - June 30, 2024

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Included as part of financial statements filed under Item 7(a). |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

(a)

Semi-Annual

Financials

and

Other

Information

(Unaudited)

207-SAR-0624

This

report

is

submitted

for

the

general

information

of

the

shareholders

of

the

Fund.

It

is

not

authorized

for

distribution

to

prospective

investors

in

the

Fund

unless

preceded

or

accompanied

by

an

effective

prospectus,

which

includes

information

regarding

the

Fund’s

objectives

and

policies,

experience

of

its

management,

and

other

information.

SOUND

SHORE

FUND,

INC.

Three

Canal

Plaza

Portland,

ME

04101

www.soundshorefund.com

(800)

551-1980

Sound

Shore

Fund,

Inc.

SCHEDULE

OF

INVESTMENTS

(Unaudited)

June

30,

2024

See

Notes

to

Financial

Statements.

Share

Amount

Value

Common

Stock

(97.1%)

(a)

Communication

Services

(

2.0%

)

The

Walt

Disney

Co.

200,920

$

19,949,347

Consumer

Discretionary

(

10.6%

)

Bath

&

Body

Works,

Inc.

671,640

26,227,542

General

Motors

Co.

632,495

29,385,718

Lennar

Corp.,

Class A

129,115

19,350,465

PVH

Corp.

293,725

31,096,666

106,060,391

Consumer

Staples

(

4.9%

)

The

Kraft

Heinz

Co.

774,265

24,946,818

The

Kroger

Co.

488,775

24,404,536

49,351,354

Energy

(

8.5%

)

Baker

Hughes

Co.

797,910

28,062,495

Kinder

Morgan,

Inc.

1,549,770

30,793,930

TotalEnergies

SE,

ADR

385,005

25,672,133

84,528,558

Financials

(

15.6%

)

Berkshire

Hathaway,

Inc.,

Class B

(b)

64,605

26,281,314

Capital

One

Financial

Corp.

241,070

33,376,141

Fidelity

National

Information

Services,

Inc.

470,520

35,458,387

Wells

Fargo

&

Co.

507,745

30,154,976

Willis

Towers

Watson

PLC

115,985

30,404,308

155,675,126

Health

Care

(

29.4%

)

Avantor,

Inc.

(b)

1,159,110

24,573,132

Cardinal

Health,

Inc.

214,125

21,052,770

Centene

Corp.

(b)

274,875

18,224,212

CVS

Health

Corp.

368,460

21,761,247

Elevance

Health,

Inc.

39,345

21,319,482

GE

HealthCare

Technologies,

Inc.

311,725

24,289,612

Hologic,

Inc.

(b)

375,765

27,900,551

Merck

&

Co.,

Inc.

170,320

21,085,616

Sound

Shore

Fund,

Inc.

SCHEDULE

OF

INVESTMENTS

(Unaudited)(Continued)

June

30,

2024

See

Notes

to

Financial

Statements.

Share

Amount

Value

Health

Care

(29.4%)

(continued)

Organon

&

Co.

1,605,690

$

33,237,783

Perrigo

Co.

PLC

770,225

19,779,378

Pfizer,

Inc.

866,020

24,231,240

Teva

Pharmaceutical

Industries,

Ltd.,

ADR

(b)

2,193,215

35,639,744

293,094,767

Industrials

(

5.3%

)

FedEx

Corp.

83,920

25,162,573

Huntington

Ingalls

Industries,

Inc.

112,770

27,778,634

52,941,207

Information

Technology

(

11.6%

)

Check

Point

Software

Technologies,

Ltd.

(b)

152,663

25,189,395

Flex,

Ltd.

(b)

1,024,020

30,198,350

NXP

Semiconductors

NV

107,055

28,807,430

Oracle

Corp.

223,325

31,533,490

115,728,665

Materials

(

4.7%

)

Barrick

Gold

Corp.

1,537,435

25,644,416

CF

Industries

Holdings,

Inc.

285,295

21,146,065

46,790,481

Utilities

(

4.5%

)

Public

Service

Enterprise

Group,

Inc.

311,600

22,964,920

Vistra

Corp.

259,395

22,302,782

45,267,702

Total

Common

Stock

(97.1%)

(cost

$725,630,792)

969,387,598

Short-Term

Investments

(2.8%)

Money

Market

Fund

(

2.8%

)

First

American

Government

Obligations

Fund,

Class X,

5.2

3

%

(c)

28,623,303

28,623,303

Total

Short-Term

Investments

(2.8%)

(cost

$28,623,303)

28,623,303

Investments,

at

value

(99.9%)

(cost

$754,254,095)

$

998,010,901

Other

Assets

Less

Liabilities

(0.1%)

554,559

Net

Assets

(100.0%)

$

998,565,460

See

Notes

to

Financial

Statements.

Sound

Shore

Fund,

Inc.

SCHEDULE

OF

INVESTMENTS

(Unaudited)(Concluded)

June

30,

2024

(a)

More

narrow

industries

are

utilized

for

compliance

purposes,

whereas

broad

sectors

are

utilized

for

reporting

purposes.

(b)

Non-income

producing

security.

(c)

Percentage

disclosed

reflects

the

money

market

fund’s

institutional

class

shares

7-day

yield

as

of

June

30,

2024.

ADR

American

Depositary

Receipt

PLC

Public

Limited

Company

Sound

Shore

Fund,

Inc.

STATEMENT

OF

ASSETS

AND

LIABILITIES

(Unaudited)

June

30,

2024

See

Notes

to

Financial

Statements.

ASSETS

Investments,

at

value

(Cost

$754,254,095)

$

998,010,901

Receivables:

Capital

shares

sold

892,086

Dividends

850,38

7

Foreign

tax

reclaims

242,69

6

Prepaid

expenses

31,438

Total

Assets

1,000,027,508

LIABILITIES

Payables:

Capital

shares

redeemed

739,726

Accrued

liabilities:

Advisory

fees

582,517

Administrator

fees

14,255

Transfer

agent

fees

and

expenses

52,422

Custodian

fees

11,616

Compliance

and

Treasurer

Services

fees

and

expenses

15,429

Professional

fees

33,199

Other

accrued

liabilities

12,884

Total

Liabilities

1,462,048

Net

Assets

$

998,565,460

COMPONENTS

OF

NET

ASSETS

Common

stock,

at

Par

Value

$

22,313

Paid-in

Capital

648,126,093

Distributable

earnings

350,417,054

Net

Assets

$

998,565,460

NET

ASSET

VALUE

Net

Assets

-

Investor

Class

Shares

$

535,876,426

Shares

Outstanding

-

Investor

Class

(100,000,000

shares

authorized,

par

value

$0.001)

12,050,021

Net

Asset

Value

(offering

&

redemption

price

per

share)

-

Investor

Class

Shares

$

44.47

Net

Assets

-

Institutional

Class

Shares

$

462,689,034

Shares

Outstanding

-

Institutional

Class

(100,000,000

shares

authorized,

par

value

$0.001)

10,263,012

Net

Asset

Value

(offering

&

redemption

price

per

share)

-

Institutional

Class

Shares

$

45.08

Sound

Shore

Fund,

Inc.

STATEMENT

OF

OPERATIONS

(Unaudited)

FOR

THE

SIX

MONTHS

ENDED

JUNE

30,

2024

See

Notes

to

Financial

Statements.

INVESTMENT

INCOME

Income:

Dividend

income

(net

of

foreign

withholding

taxes

of

$162,792)

$

9,175,303

Total

Income

9,175,303

Expenses:

Advisory

fees

(Note

3

)

3,654,780

Administrator

fees

77,327

Transfer

agent

fees

and

expenses

-

Investor

Class

Shares

277,906

Transfer

agent

fees

and

expenses

-

Institutional

Class

Shares

27,525

Custodian

fees

39,512

Compliance

and

Treasurer

Services

fees

and

expenses

(Note

3

)

79,023

Directors'

fees

and

expenses

(Note

3

)

98,716

Professional

fees

55,199

Registration

fees

-

Investor

Class

Shares

14,178

Registration

fees

-

Institutional

Class

Shares

17,725

Printing

and

postage

fees

-

Investor

Class

Shares

20,785

Printing

and

postage

fees

-

Institutional

Class

Shares

17,945

Miscellaneous

41,224

Total

Expenses

4,421,845

Expense

Reimbursements

-

Institutional

Class

Shares

(Note

3

)

(241,263)

Net

Expenses

4,180,582

Net

Investment

Income

4,994,721

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

ON

INVESTMENTS

Net

realized

gain

on

investments

108,504,366

Net

change

in

unrealized

appreciation

on

investments

7,420,488

Net

realized

and

unrealized

gain

on

investments

115,924,854

Net

increase

in

net

assets

from

operations

$

120,919,575

Sound

Shore

Fund,

Inc.

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

See

Notes

to

Financial

Statements.

For

the

Six

Months

Ended

June

30,

2024

(Unaudited)

For

the

Year

Ended

December

31,

2023

Operations:

Net

investment

income

$

4,994,721

$

8,792,618

Net

realized

gain

on

investments

108,504,366

35,751,231

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

7,420,488

97,315,104

Increase

in

net

assets

from

operations

120,919,575

141,858,953

Distributions

to

shareholders:

Investor

Class

Shares

(3,119,799)

(22,054,579)

Institutional

Class

Shares

(2,846,105)

(17,868,996)

Total

distributions

to

shareholders

(5,965,904)

(39,923,575)

Net

capital

share

transactions

(Note

6

):

Investor

Class

Shares

(26,100,160)

(77,275,519)

Institutional

Class

Shares

4,165,139

(19,448,325)

Total

capital

share

transactions

(21,935,021)

(96,723,844)

Total

increase

93,018,650

5,211,534

NET

ASSETS

Beginning

of

the

period

905,546,810

900,335,276

End

of

the

period

$

998,565,460

$

905,546,810

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Unaudited)

June

30,

2024

1.

Organization

Sound

Shore

Fund,

Inc.

(the

“Fund”)

was

incorporated

under

the

laws

of

the

State

of

Maryland

on

February

15,

1985

and

is

registered

as

a

diversified,

open-end

management

investment

company

under

the

Investment

Company

Act

of

1940

(the

“Act”).

The

investment

objective

of

the

Fund

is

growth

of

capital.

The

Fund

qualifies

as

an

investment

company

as

defined

in

Financial

Accounting

Standards

Codification

946

—

Financial

Services

—

Investment

Companies.

The

total

number

of

shares

of

common

stock

which

the

Fund

is

authorized

to

issue

is

200,000,000,

par

value

$0.001

per

share

of

which

100,000,000

shares

are

designated

to

the

Investor

Class

and

100,000,000

shares

are

designated

to

the

Institutional

Class.

The

Board

of

Directors

(the

“Board”)

may,

without

shareholder

approval,

classify

or

reclassify

any

unissued

shares

into

other

classes

or

series

of

shares.

Each

share

of

the

Fund

has

equal

dividend,

distribution,

liquidation

and

voting

rights

(except

as

to

matters

relating

exclusively

to

one

class

of

shares),

and

fractional

shares

have

those

rights

proportionately.

2.

Significant

Accounting

Policies

These

financial

statements

are

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“GAAP”),

which

require

management

to

make

estimates

and

assumptions

that

affect

the

reported

amounts

of

assets

and

liabilities,

disclosure

of

contingent

liabilities,

if

any,

at

the

date

of

the

financial

statements,

and

the

reported

amounts

of

increase

and

decrease

in

net

assets

from

operations

during

the

fiscal

period.

Actual

results

could

differ

from

those

estimates.

The

following

represents

the

significant

accounting

policies

of

the

Fund:

a.

Security

Valuation

Exchange-traded

securities

including

those

traded

on

the

National

Association

of

Securities

Dealers’

Automated

Quotation

system

(“NASDAQ”),

are

valued

at

the

last

quoted

sale

price

or

official

closing

price

as

provided

by

independent

pricing

services

as

of

the

close

of

trading

on

the

system

or

exchange

on

which

they

are

primarily

traded,

on

each

Fund

business

day.

In

the

absence

of

a

sale,

such

securities

are

valued

at

the

mean

of

the

last

bid

and

asked

prices.

Non-exchange-traded

securities

for

which

over-the-counter

market

quotations

are

readily

available

are

generally

valued

at

the

mean

between

the

current

bid

and

asked

prices

provided

by

independent

pricing

services.

Investments

in

other

open-end

regulated

investment

companies

are

valued

at

their

publicly

traded

net

asset

value

(“NAV”).

Pursuant

to

Rule

2a-5

under

the

Investment

Company

Act,

the

Board

has

designated

the

Adviser,

as

defined

in

Note

3,

as

the

Fund's

valuation

designee

to

perform

any

fair

value

determinations

for

securities

and

other

assets

held

by

the

Fund.

The

Adviser

is

subject

to

the

oversight

of

the

Board

and

certain

reporting

and

other

requirements

intended

to

provide

the

Board

the

information

needed

to

oversee

the

Adviser's

fair

value

determinations.

The

Adviser

is

responsible

for

determining

the

fair

value

of

investments

for

which

market

quotations

are

not

readily

available

in

accordance

with

policies

and

procedures

that

have

been

approved

by

the

Board.

Under

these

procedures,

the

Adviser

convenes

on

a

regular

and

ad

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Unaudited)(Continued)

June

30,

2024

hoc

basis

to

review

such

investments

and

considers

a

number

of

factors,

including

valuation

methodologies

and

significant

unobservable

inputs,

when

arriving

at

fair

value.

The

Board

has

approved

the

Adviser’s

fair

valuation

procedures

as

a

part

of

the

Fund’s

compliance

program

and

will

review

any

changes

made

to

the

procedures.

The

Adviser

provides

fair

valuation

inputs

pursuant

to

its

fair

valuation

procedures

if

market

quotations

are

not

readily

available

(including

a

short

and

temporary

lapse

in

the

provision

of

a

price

by

the

regular

pricing

source)

or,

if

in

the

judgment

of

the

Adviser

the

prices

or

values

available

do

not

represent

the

fair

value

of

the

instrument.

Factors

which

may

cause

the

Adviser

to

make

such

a

judgment

include,

but

are

not

limited

to,

the

following:

(i)

only

a

bid

price

or

an

asked

price

is

available,

(ii)

the

spread

between

the

bid

price

and

the

asked

price

is

substantial,

(iii)

the

frequency

of

sales,

(iv)

the

thinness

of

the

market,

(v)

the

size

of

reported

trades,

and

(vi)

actions

of

the

securities

markets,

such

as

the

suspension

or

limitation

of

trading.

Fair

valuation

is

based

on

subjective

factors

and,

as

a

result,

the

fair

value

price

of

a

security

may

differ

from

the

security’s

market

price

and

may

not

be

the

price

at

which

the

security

may

be

sold.

Fair

valuation

could

result

in

a

NAV

different

from

one

determined

by

using

market

quotations.

Valuation

inputs

used

to

determine

the

value

of

the

Fund’s

investments

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

-

quoted

prices

in

active

markets

for

identical

assets

Level

2

-

other

significant

observable

inputs

(including

quoted

prices

of

similar

securities,

interest

rates,

prepayment

speeds,

credit

risk,

etc.)

Level

3

-

significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

in

determining

the

fair

value

of

investments)

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risk

associated

with

investing

in

those

securities.

Pursuant

to

the

valuation

procedures

noted

previously,

equity

securities

(including

exchange-traded

securities

and

other

open-end

regulated

investment

companies)

are

generally

categorized

as

Level

1

securities

in

the

fair

value

hierarchy.

Investments

for

which

there

are

no

quotations,

or

for

which

quotations

do

not

appear

reliable,

are

valued

at

fair

value

as

determined

in

good

faith

by

the

Adviser

under

the

Adviser’s

fair

valuation

procedures.

These

valuations

are

typically

categorized

as

Level

2

or

Level

3

in

the

fair

value

hierarchy.

The

following

table

summarizes

the

Fund’s

investments

categorized

in

the

fair

value

hierarchy

as

of

June

30,

2024:

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Unaudited)(Continued)

June

30,

2024

At

June

30,

2024

,

all

equity

securities

and

open-end

regulated

investment

companies

were

included

in

Level

1

in

the

table

above.

Please

refer

to

the

Schedule

of

Investments

to

view

equity

securities

categorized

by

sector/industry

type.

b.

Security

Transactions

Security

transactions

are

recorded

on

a

trade

date

basis.

Realized

gain

and

loss

on

investments

sold

are

recorded

on

the

basis

of

identified

cost.

Dividend

income

is

recorded

on

the

ex-dividend

date.

Interest

income

is

recorded

on

an

accrual

basis.

Foreign

dividend

income

is

recorded

on

the

ex-dividend

date

or

as

soon

as

practicable

after

the

Fund

determines

the

existence

of

a

dividend

declaration

after

exercising

reasonable

due

diligence.

Income

and

capital

gains

on

some

foreign

securities

may

be

subject

to

foreign

withholding

tax,

which

is

accrued

as

applicable.

Investment

income,

realized

and

unrealized

gains

and

losses

and

certain

Fund-level

expenses

are

allocated

to

each

class

based

on

relative

average

daily

net

assets.

Certain

expenses

are

incurred

at

the

class

level

and

charged

directly

to

that

particular

class.

Class

level

expenses

are

denoted

as

such

on

the

Fund’s

Statement

of

Operations.

c.

Dividends

and

Distributions

to

Shareholders

Dividends

are

declared

separately

for

each

class.

No

class

has

preferential

dividend

rights;

differences

in

per-share

dividend

rates

are

generally

due

to

class-specific

fee

waivers

and

expenses.

Dividends

and

distributions

payable

to

shareholders

are

recorded

by

the

Fund

on

the

ex-dividend

date.

Dividends

from

net

investment

income,

if

any,

are

declared

and

paid

semiannually.

Capital

gains,

if

any,

are

distributed

to

shareholders

at

least

annually.

The

Fund

determines

its

net

investment

income

and

capital

gains

distributions

in

accordance

with

income

tax

regulations,

which

may

differ

from

GAAP.

These

differences

are

due

primarily

to

differing

treatments

of

income

and

gains

on

various

securities

held

by

the

Fund,

timing

differences

and

differing

characterizations

of

distributions

made

by

the

Fund.

To

the

extent

distributions

exceed

net

investment

income

and

net

realized

capital

gains

for

tax

purposes,

they

are

reported

as

a

return

of

capital.

d.

Federal

Taxes

The

Fund

intends

to

qualify

each

year

as

a

regulated

investment

company

and

to

distribute

substantially

all

of

its

taxable

income.

In

addition,

by

distributing

in

each

calendar

year

substantially

all

of

its

net

investment

income,

capital

gain

and

certain

other

amounts,

if

any,

the

Fund

will

not

be

subject

to

federal

taxation.

Therefore,

no

federal

income

or

excise

tax

provision

is

required.

For

all

open

tax

years

and

all

major

taxing

jurisdictions,

management

of

the

Fund

has

concluded

that

there

are

no

significant

uncertain

tax

positions

that

would

require

the

Fund

to

record

a

tax

liability

or

would

otherwise

require

recognition

in

the

financial

statements.

Open

tax

years

are

those

that

are

open

for

examination

by

taxing

authorities

(i.e.,

generally,

the

last

three

tax

year-ends

2021

–

2023,

and

the

interim

tax

period

since

then).

Security

Type

Level

1

Level

2

Level

3

Total

Investments

in

Securities

Common

Stock

$

969,387,598

$

–

$

–

$

969,387,598

Short-Term

Investments

28,623,303

–

–

28,623,303

Total

Investments

$

998,010,901

$

–

$

–

$

998,010,901

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Unaudited)(Continued)

June

30,

2024

3.

Fees

and

Expenses

Investment

Adviser

The

Fund’s

investment

adviser

is

Sound

Shore

Management,

Inc.

(the

“Adviser”).

Pursuant

to

an

investment

advisory

agreement,

the

Adviser

receives

an

advisory

fee,

accrued

daily

and

paid

monthly

at

an

annual

rate

of

0.75%

of

the

Fund’s

average

daily

net

assets.

Pursuant

to

an

expense

limitation

agreement

between

the

Adviser

and

the

Fund,

the

Adviser

has

agreed

to

reimburse

all

of

the

ordinary

expenses

of

the

Institutional

Class,

excluding

advisory

fees,

interest,

taxes,

securities

lending

costs,

brokerage

commissions,

acquired

fund

fees

and

expenses,

extraordinary

expenses

and

all

litigation

costs

until

at

least

May

1,

2025.

This

reimbursement

is

shown

on

the

Statement

of

Operations

as

a

reduction

of

expenses,

and

such

amounts

are

not

subject

to

future

recoupment

by

the

Adviser.

Other

Services

Atlantic

Fund

Administration,

LLC,

a

wholly

owned

subsidiary

of

Apex

US

Holdings

LLC

(d/b/a

Apex

Fund

Services)

(“Apex”),

provides

certain

administration

and

portfolio

accounting

services

to

the

Fund.

US

Bank,

N.A.

(“US

Bank”)

serves

as

custodian

to

the

Fund.

Apex

provides

transfer

agency

services

to

the

Fund.

The

Fund

also

has

agreements

with

various

financial

intermediaries

and

“mutual

fund

supermarkets”

under

which

customers

of

these

intermediaries

may

purchase

and

hold

Fund

shares.

These

intermediaries

effectively

provide

subtransfer

agent

services

that

the

Fund’s

transfer

agent

would

have

otherwise

had

to

provide.

In

recognition

of

this,

the

transfer

agent,

the

Fund

and

the

Fund’s

Adviser

have

entered

into

an

agreement

whereby

the

transfer

agent

agrees

to

pay

financial

intermediaries

a

portion

of

the

amount

denoted

on

the

Statement

of

Operations

as

“Transfer

agent

fees

and

expenses

—

Investor

Class

Shares”

that

it

receives

from

the

Fund

for

its

services

as

transfer

agent

for

the

Investor

Class

and

the

Adviser

agrees

to

pay

the

excess,

if

any,

charged

by

a

financial

intermediary

for

that

class.

Foreside

Fund

Services,

LLC

is

the

Fund’s

distributor

(the

“Distributor”).

The

Distributor

is

not

affiliated

with

the

Adviser,

Apex,

US

Bank,

or

its

affiliated

companies.

The

Distributor

receives

no

compensation

from

the

Fund

for

its

distribution

services.

Pursuant

to

a

Compliance

Services

Agreement

with

the

Fund,

Foreside

Fund

Officer

Services,

LLC

(“FFOS”),

an

affiliate

of

the

Distributor,

provides

a

Chief

Compliance

Officer

and

Anti-Money

Laundering

Officer

to

the

Fund

as

well

as

some

additional

compliance

support

functions.

Under

a

Treasurer

Services

Agreement

with

the

Fund,

Foreside

Management

Services,

LLC

(“FMS”),

an

affiliate

of

the

Distributor,

provides

a

Treasurer

to

the

Fund.

Neither

the

Distributor,

FFOS,

FMS,

nor

their

employees

that

serve

as

officers

of

the

Fund,

have

any

role

in

determining

the

investment

policies

of

or

securities

to

be

purchased

or

sold

by

the

Fund.

The

Fund

pays

each

director

who

is

not

an

“interested

person”

of

the

Fund,

as

defined

in

Section

2(a)(19)

of

the

Act

(“Independent

Director”),

quarterly

fees

of

$5,000,

plus

$10,000

per

quarterly

meeting

attended

in-person

or

telephonically,

and

$2,000

per

special

meeting

attended

in

person

or

telephonically.

In

addition,

the

Chairman

of

the

Audit

committee

receives

a

quarterly

fee

of

$2,500.

Certain

Officers

and

Directors

of

the

Fund

are

officers,

directors,

or

employees

of

the

aforementioned

companies.

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Unaudited)(Continued)

June

30,

2024

4.

Purchases

and

Sales

of

Securities

The

cost

of

securities

purchased

and

proceeds

from

sales

of

securities

(excluding

short-term

investments)

for

the

period

ended

June

30,

2024,

aggregated

$310,767,077

and

$326,327,895

respectively.

5.

Federal

Income

Tax

Cost

for

federal

income

tax

purposes

is

substantially

the

same

as

for

financial

statement

purposes

and

net

unrealized

appreciation

consists

of:

Distributions

during

the

fiscal

years

ended

December

31,

2023

and

December

31,

2022

were

characterized

for

tax

purposes

as

follows:

Equalization

debits

(amounts

not

included

in

the

above

distributions)

were

as

follows:

Components

of

net

assets

on

a

federal

income

tax

basis

at

December

31,

2023,

were

as

follows:

At

December

31,

2023,

the

Fund,

for

federal

income

tax

purposes,

had

no

capital

loss

carryforwards.

Gross

Unrealized

Appreciation

$

257,384,560

Gross

Unrealized

Depreciation

(13,627,754)

Net

Unrealized

Appreciation

$

243,756,806

2023

2022

Ordinary

Income

$

6

,

596

,

105

$

9

,

575

,

100

Long-Term

Capital

Gain

3

3,327,470

32,979,480

Total

Taxable

Distributions

$

39

,

923

,

575

$

42

,

554

,

580

2023

2022

Ordinary

Income

$

783,876

$

–

Long-Term

Capital

Gain

69,422

–

Total

Taxable

Distributions

$

853,298

$

–

Par

Value

+

Paid-in

Capital

$

670,083,427

Undistributed

Ordinary

Income

458,782

Net

Unrealized

Appreciation

235,004,601

Net

Assets

$

905,546,810

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Unaudited)(Concluded)

June

30,

2024

6.

Capital

Stock

Transactions

in

capital

stock

for

the

period

ended

June

30,

2024

and

the

year

ended

December

31,

2023,

were

as

follows:

7.

Subsequent

Events

Subsequent

events

occurring

after

the

date

of

this

report

have

been

evaluated

for

potential

impact

to

this

report

through

the

date

the

report

was

issued.

Management

has

evaluated

the

need

for

additional

disclosures

and/or

adjustments

resulting

from

subsequent

events.

Based

on

this

evaluation,

no

additional

disclosures

or

adjustments

were

required

to

the

financial

statements

as

of

the

date

the

financial

statements

were

issued.

For

the

Period

Ended

June

30,

2024

Investor

Class

Institutional

Class

Shares

Amount

Shares

Amount

Sale

of

shares

407,046

$

17,895,953

851,478

$

37,022,893

Reinvestment

of

dividends

66,012

2,952,050

61,279

2,777,760

Redemption

of

shares

(1,084,241)

(46,948,163)

(823,428)

(35,635,514)

Net

increase

(decrease)

from

capital

transactions

(611,183)

$

(26,100,160)

89,329

$

4,165,139

For

the

Year

Ended

December

31,

2023

Investor

Class

Institutional

Class

Shares

Amount

Shares

Amount

Sale

of

shares

285,351

$

10,513,301

762,184

$

28,620,764

Reinvestment

of

dividends

534,041

20,953,937

439,919

17,481,706

Redemption

of

shares

(2,951,328)

(108,742,757)

(1,764,562)

(65,550,795)

Net

decrease

from

capital

transactions

(2,131,936)

$

(77,275,519)

(562,459)

$

(19,448,325)

Sound

Shore

Fund,

Inc.

FINANCIAL

HIGHLIGHTS

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

period

.

Six

Months

Ended

June

30,

2024

(unaudited)

For

the

Year

Ended

December

31,

2023

2022

2021

2020

2019

Investor

Class

Shares

Net

Asset

Value,

Beginning

of

Period

$

39.43

$

35.

10

$

41.16

$

42.29

$

42.41

$

37.03

Investment

Operations

Net

investment

income

(a)

0.20

0.33

0.36

0.41

0.30

0.40

Net

realized

and

unrealized

gain

(loss)

on

investments

5.10

5.7

8

(4.75)

9.66

2.90

8.20

Total

from

Investment

Operations

5.30

6.1

1

(4.39)

10.07

3.20

8.60

Distributions

from

Net

investment

income

(0.26)

(0.27)

(0.35)

(0.44)

(0.32)

(0.39)

Net

realized

gains

–

(1.51)

(1.32)

(10.76)

(3.00)

(2.83)

Total

Distributions

(0.26)

(1.78)

(1.67)

(11.20)

(3.32)

(3.22)

Net

Asset

Value,

End

of

Period

$

44.47

$

39.43

$

35.10

$

41.16

$

42.29

$

42.41

Total

Return

13.47%(b)

17.4

5

%

(10.59)%

23.76%

7.78%

23.26%

Ratios/Supplemental

Data

Net

Assets

at

End

of

Period

(in

thousands)

$535,876

$499,178

$519,227

$671,380

$641,165

$853,588

Ratios

to

Average

Net

Assets:

Expenses

0.95%(c)

0.96%

0.94%

0.93%

0.93%

0.91%

Net

Investment

Income

0.93%(c)

0.90%

0.94%

0.85%

0.80%

0.95%

Portfolio

Turnover

Rate

(d)

33%(b)

69%

72%

44%

77%

46%

(a)

Calculated

based

on

average

shares

outstanding

during

each

period.

(b)

Not

annualized.

(c)

Annualized.

(d)

Portfolio

turnover

is

calculated

on

the

basis

of

the

Fund,

as

a

whole,

without

distinguishing

between

the

classes

of

shares

issued.

Sound

Shore

Fund,

Inc.

FINANCIAL

HIGHLIGHTS

(Concluded)

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

period

.

Six

Months

Ended

June

30,

2024

(unaudited)

For

the

Year

Ended

December

31,

2023

2022

2021

2020

2019

Institutional

Class

Shares

Net

Asset

Value,

Beginning

of

Period

$

39.94

$

35.50

$

41.56

$

42.59

$

42.65

$

37.19

Investment

Operations

Net

investment

income

(a)

0.25

0.41

0.43

0.51

0.37

0.47

Net

realized

and

unrealized

gain

(loss)

on

investments

5.17

5.84

(4.78)

9.70

2.93

8.25

Total

from

Investment

Operations

5.42

6.25

(4.35)

10.21

3.30

8.72

Distributions

from

Net

investment

income

(0.28)

(0.30)

(0.39)

(0.48)

(0.36)

(0.43)

Net

realized

gains

–

(1.51)

(1.32)

(10.76)

(3.00)

(2.83)

Total

Distributions

(0.28)

(1.81)

(1.71)

(11.24)

(3.36)

(3.26)

Net

Asset

Value,

End

of

Period

$

45.08

$

39.94

$

35.50

$

41.56

$

42.59

$

42.65

Total

Return

13.57%(b)

17.67%

(10.40)%

23.95%

7.98%

23.50%

Ratios/Supplemental

Data

Net

Assets

at

End

of

Period

(in

thousands)

$462,689

$406,369

$381,109

$575,184

$517,449

$684,295

Ratios

to

Average

Net

Assets:

Expenses

(gross)

(c)

0.86%(d)

0.86%

0.85%

0.83%

0.84%

0.82%

Expenses

(net)

0.75%(d)

0.75%

0.75%

0.75%

0.75%

0.75%

Net

Investment

Income

1.13%(d)

1.11%

1.13%

1.03%

0.98%

1.12%

Portfolio

Turnover

Rate

(e)

33%(b)

69%

72%

44%

77%

46%

(a)

Calculated

based

on

average

shares

outstanding

during

each

period.

(b)

Not

annualized.

(c)

Reflects

the

expense

ratio

excluding

any

waivers

and/or

reimbursements.

(d)

Annualized.

(e)

Portfolio

turnover

is

calculated

on

the

basis

of

the

Fund,

as

a

whole,

without

distinguishing

between

the

classes

of

shares

issued.

Sound

Shore

Fund,

Inc.

ADDITIONAL

INFORMATION

(Unaudited)

June

30,

2024

Changes

in

and

Disagreements

with

Accountants

for

Open-End

Management

Investment

Companies

(Item

8

of

Form

N-CSR)

Not

applicable.

Proxy

Disclosures

for

Open-End

Management

Investment

Companies

(Item

9

of

Form

N-CSR)

Not

applicable.

Remuneration

Paid

to

Directors,

Officers,

and

Others

of

Open-End

Management

Investment

Companies

(Item

10

of

Form

N-CSR)

Please

see

financial

statements

in

Item

7(a).

Statement

Regarding

Basis

for

Approval

of

Investment

Advisory

Contract

(Item

11

of

Form

N-CSR)

At

the

January

25,

2024

Board

meeting,

the

Board,

including

the

Independent

Directors,

considered

the

approval

of

the

continuance

of

the

investment

advisory

agreement

between

the

Adviser

and

the

Fund.

In

preparation

for

its

deliberations,

the

Board

requested

and

reviewed

written

responses

from

the

Adviser

to

a

due

diligence

questionnaire

circulated

on

the

Board's

behalf

concerning

the

services

provided

by

the

Adviser.

The

Board

also

discussed

the

materials

with

Fund

counsel

and

received

an

oral

presentation

from

the

Adviser.

At

the

Meeting,

the

Board

reviewed,

among

other

matters:

(1)

the

nature,

extent

and

quality

of

the

services

provided

to

the

Fund

by

the

Adviser,

including

information

on

the

investment

performance

of

the

Fund

and

the

Adviser;

(2)

the

costs

of

the

services

provided

and

profitability

to

the

Adviser

of

its

relationship

with

the

Fund;

(3)

the

advisory

fee

and

total

expense

ratio

of

the

Fund

as

compared

to

those

of

a

relevant

peer

group

of

funds;

(4)

the

extent

to

which

economies

of

scale

may

be

realized

as

the

Fund

grows

and

whether

the

advisory

fee

enables

the

Fund's

investors

to

share

in

the

benefits

of

economies

of

scale;

and

(5)

other

benefits

received

by

the

Adviser

from

its

relationship

with

the

Fund.

In

addition,

the

Board

recognized

that

the

evaluation

process

with

respect

to

the

Adviser

was

an

ongoing

one

and,

in

this

regard,

the

Board

considered

information

provided

by

the

Adviser

at

regularly

scheduled

meetings

during

the

past

year.

In

particular,

the

Board

considered,

among

other

things,

the

following:

(1)

The

nature,

extent

and

quality

of

services

provided

by

the

Adviser.

The

Board

considered

the

scope

and

quality

of

services

provided

by

the

Adviser,

particularly

the

qualifications,

capabilities

and

experience

of

the

investment,

operational,

compliance,

and

other

personnel

who

are

responsible

for

providing

services

to

the

Fund.

The

Board

also

considered

the

fact

that

the

Adviser

pays

the

costs

of

all

investment

and

management

facilities

necessary

Sound

Shore

Fund,

Inc.

ADDITIONAL

INFORMATION

(Unaudited)(Continued)

June

30,

2024

for

the

efficient

conduct

of

its

services

as

well

as

all

distribution

costs

incurred

on

behalf

of

the

Fund

and

all

servicing

costs

to

financial

intermediaries

beyond

the

10

basis

points

borne

by

the

Fund

and

reimbursed

by

the

Fund’s

transfer

agent.

In

addition,

the

Board

considered

that

the

Adviser

manages

the

overall

investment

program

of

the

Fund

and

that

the

Adviser

keeps

the

Board

informed

of

important

developments

affecting

the

Fund,

both

in

connection

with

the

Board’s

annual

review

of

the

Advisory

Agreement

and

at

each

Board

meeting.

The

Board

evaluated

these

factors

based

on

its

direct

experience

with

the

Adviser,

and

in

consultation

with

Counsel

to

the

Fund

and

Counsel

to

the

Independent

Directors.

The

Board

also

considered

the

Adviser’s

effectiveness

in

ensuring

that

the

Fund

remains

in

compliance

with

its

investment

policies

and

restrictions

and

the

requirements

of

the

1940

Act

and

related

securities

regulations.

The

Board

further

noted

the

Adviser’s

efforts

to

oversee

the

Fund’s

other

service

providers,

including

those

providing

administrative,

accounting

and

custodial

services.

Based

on

these

factors,

as

well

as

other

factors

discussed

at

the

Meeting,

the

Board

concluded

that

the

nature,

extent

and

quality

of

services

provided

by

the

Adviser

have

been

and

continue

to

be

satisfactory.

(2)

The

performance

of

the

Fund

and

the

Adviser.

The

Board’s

analysis

of

the

Fund’s

performance

included

the

discussion

and

review

of

the

performance

data

of

the

Fund

against

securities

benchmarks

as

well

as

against

a

group

of

comparable

funds,

based

on,

in

part,

information

provided

by

an

independent,

third-party

mutual

fund

data

provider

–

Strategic

Insight,

Inc.

(“Strategic

Insight”)

–

engaged

by

the

Board

for

this

purpose.

The

Board

also

considered

the

performance

of

the

Fund

against

a

comparative

universe

of

similar

funds

as

identified

by

the

Adviser.

The

Board

reviewed

comparative

performance

over

long-,

intermediate-

and

short-term

periods.

In

reviewing

performance,

the

Board

placed

greater

emphasis

on

longer-term

performance

than

on

shorter-term

performance,

taking

into

account

that

over

short

periods

of

time

underperformance

may

be

transitory.

The

Board

further

took

into

account

that

performance

returns

over

longer

periods

can

be

impacted

dramatically

by

the

end

point

date

from

which

performance

is

measured.

In

this

regard

the

Board

observed

that

the

Fund

outperformed

the

Russell

1000

Value

Index,

the

Fund’s

primary

benchmark,

over

the

one-,

three-,

and

five-year

periods

ended

December

31,

2023,

and

underperformed

the

primary

benchmark

over

the

10-year

period

ended

December

31,

2023.

The

Board

also

observed

that

the

Fund’s

Institutional

Class

Shares

outperformed

the

primary

benchmark

index

over

the

20-

and

30-year

periods

ended

December

31,

2023,

and

the

Fund’s

Investor

Class

Shares

performed

in

line

with

the

primary

benchmark

index

over

the

same

periods.

The

Board

also

considered

the

performance

of

the

Fund

in

the

context

of

whether

the

Fund

was

meeting

the

expectations

of

the

clients

invested

in

the

Fund.

The

Board

also

considered

the

performance

of

the

Fund

against

similarly

managed

accounts

managed

by

the

Adviser.

When

reviewing

performance

against

similarly

managed

accounts,

the

Board

considered,

among

other

things,

differences

in

the

nature

of

such

accounts

from

a

regulatory

and

tax

perspective

and

differences

in

the

investment

mandate

from

that

of

the

Fund.