UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-04244

SOUND SHORE FUND, INC.

Three Canal Plaza, Suite 600

Portland, Maine 04101

John P. DeGulis, President

8 Sound Shore Drive

Greenwich, Connecticut 06830

Date of fiscal year end: December 31

Date of reporting period: January 1, 2024 – December 31, 2024

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act, as amended (“Act”), is attached hereto.

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about the Sound Shore Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://soundshorefund.com/investor-resources-documents/. You can also request this information by contacting us at (800) 551-1980.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Institutional Class | $84 | 0.75% |

|---|

How did the Fund perform in the last year?

It was a strong year for Sound Shore’s portfolio, finishing substantially ahead of the Russell 1000 Value Index. Within the widely followed Standard & Poor’s 500 Index, the year featured familiar winners, which got even bigger as the “Magnificent 7” now represents 33% of the cap-weighted S&P 500 Index and accounted for over 50% of that Index’s return.

In stark contrast to these concentrated, passive indices, this year our performance was driven by 18 stocks (from 8 different sectors) that rose 20% or more. While many investors are focused on the exciting, high-growth potential of artificial intelligence (AI) and technology, we see compelling value in out-of-favor companies undergoing fundamental transformations, regardless of the drivers. High quality, overlooked businesses can often trade at discounted valuations, setting the stage for substantial returns as the market recognizes their true potential.

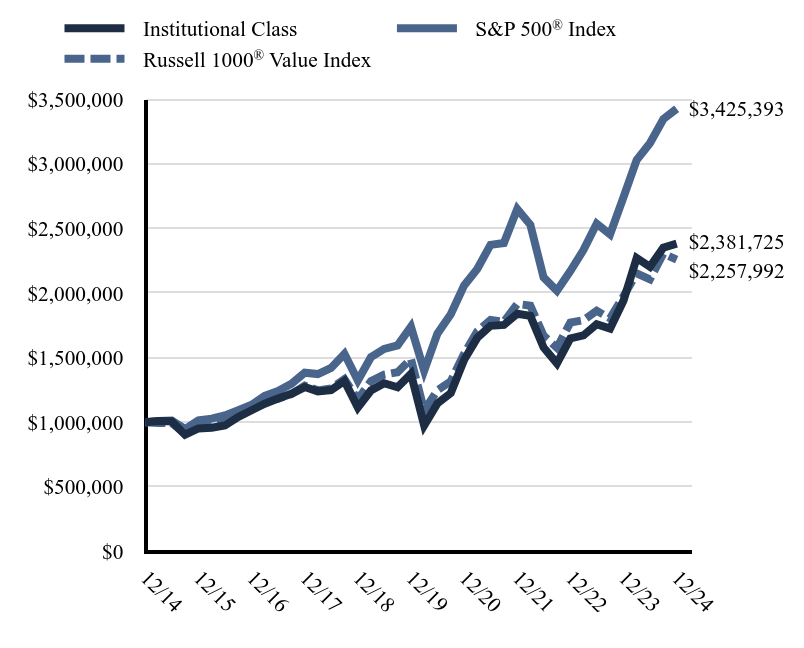

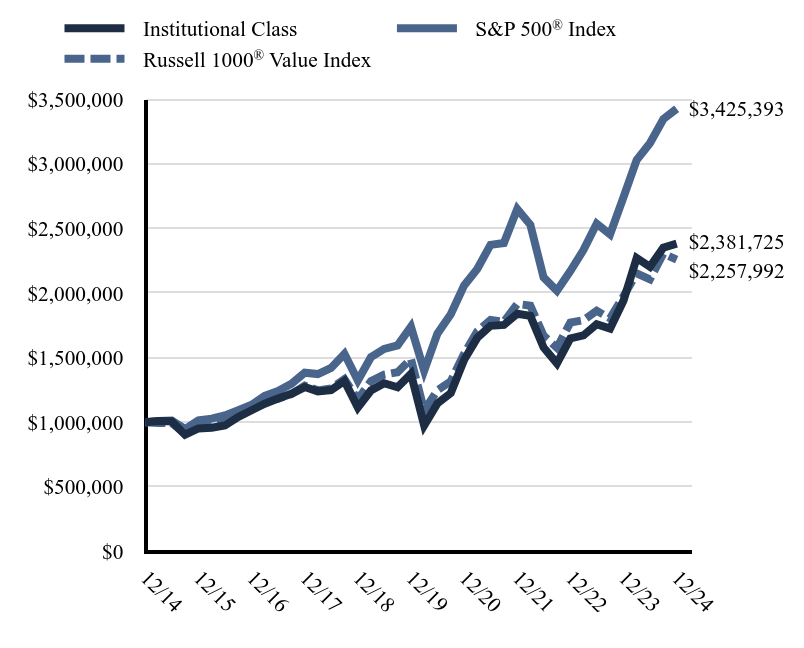

Total Return Based on a $1,000,000 Investment

| Date | Institutional Class | S&P 500® Index | Russell 1000® Value Index |

|---|

| 12/14 | $1,000,000 | $1,000,000 | $1,000,000 |

|---|

| 3/15 | $1,009,413 | $1,009,505 | $992,781 |

|---|

| 6/15 | $1,006,668 | $1,012,312 | $993,856 |

|---|

| 9/15 | $902,956 | $947,136 | $910,423 |

|---|

| 12/15 | $951,645 | $1,013,838 | $961,732 |

|---|

| 3/16 | $957,394 | $1,027,503 | $977,484 |

|---|

| 6/16 | $973,950 | $1,052,731 | $1,022,285 |

|---|

| 9/16 | $1,040,608 | $1,093,282 | $1,057,866 |

|---|

| 12/16 | $1,092,459 | $1,135,092 | $1,128,499 |

|---|

| 3/17 | $1,142,531 | $1,203,949 | $1,165,378 |

|---|

| 6/17 | $1,183,386 | $1,241,129 | $1,181,048 |

|---|

| 9/17 | $1,219,126 | $1,296,736 | $1,217,844 |

|---|

| 12/17 | $1,271,695 | $1,382,901 | $1,282,697 |

|---|

| 3/18 | $1,238,288 | $1,372,403 | $1,246,355 |

|---|

| 6/18 | $1,248,929 | $1,419,529 | $1,261,009 |

|---|

| 9/18 | $1,319,240 | $1,528,986 | $1,332,933 |

|---|

| 12/18 | $1,112,765 | $1,322,269 | $1,176,655 |

|---|

| 3/19 | $1,245,316 | $1,502,733 | $1,317,083 |

|---|

| 6/19 | $1,301,616 | $1,567,407 | $1,367,717 |

|---|

| 9/19 | $1,270,031 | $1,594,027 | $1,386,258 |

|---|

| 12/19 | $1,374,245 | $1,738,604 | $1,488,955 |

|---|

| 3/20 | $973,732 | $1,397,872 | $1,090,958 |

|---|

| 6/20 | $1,144,812 | $1,685,042 | $1,246,862 |

|---|

| 9/20 | $1,225,241 | $1,835,506 | $1,316,597 |

|---|

| 12/20 | $1,483,587 | $2,058,487 | $1,530,583 |

|---|

| 3/21 | $1,652,224 | $2,185,598 | $1,702,849 |

|---|

| 6/21 | $1,745,667 | $2,372,441 | $1,791,536 |

|---|

| 9/21 | $1,752,311 | $2,386,249 | $1,777,562 |

|---|

| 12/21 | $1,839,284 | $2,649,384 | $1,915,681 |

|---|

| 3/22 | $1,822,467 | $2,527,552 | $1,901,550 |

|---|

| 6/22 | $1,578,069 | $2,120,588 | $1,669,358 |

|---|

| 9/22 | $1,455,276 | $2,017,048 | $1,575,583 |

|---|

| 12/22 | $1,648,043 | $2,169,558 | $1,771,280 |

|---|

| 3/23 | $1,671,255 | $2,332,211 | $1,789,102 |

|---|

| 6/23 | $1,757,784 | $2,536,096 | $1,861,999 |

|---|

| 9/23 | $1,723,738 | $2,453,079 | $1,803,069 |

|---|

| 12/23 | $1,939,161 | $2,739,883 | $1,974,317 |

|---|

| 3/24 | $2,270,771 | $3,029,103 | $2,151,721 |

|---|

| 6/24 | $2,202,172 | $3,158,863 | $2,105,115 |

|---|

| 9/24 | $2,350,677 | $3,344,812 | $2,303,625 |

|---|

| 12/24 | $2,381,725 | $3,425,393 | $2,257,992 |

|---|

The above chart represents historical performance of a hypothetical $1,000,000 investment over the past 10 years. Updated performance can be found at www.soundshorefund.com. Effective May 1, 2024, the Fund changed its primary benchmark index from the Russell 1000 Value Index to the S&P 500 Index due to regulatory requirements. The Fund retained the Russell 1000 Value Index as a secondary benchmark because the Russell 1000 Value Index more closely aligns with the Fund's investment strategies and restrictions.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Institutional Class | 22.82% | 11.62% | 9.06% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.10% |

|---|

Russell 1000® Value Index | 14.37% | 8.68% | 8.49% |

|---|

| Total Net Assets | $998,549,149 |

|---|

| # of Portfolio Holdings | 41 |

|---|

| Portfolio Turnover Rate | 77% |

|---|

| Investment Advisory Fees Paid (Net of Expense Reimbursements) | $7,029,769 |

|---|

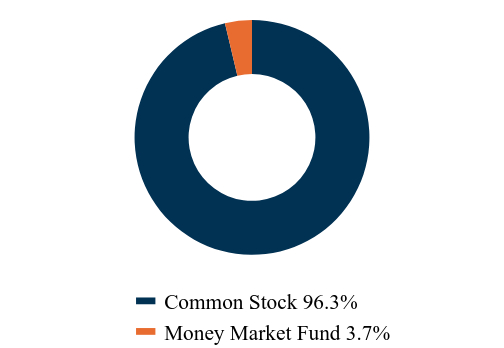

What did the Fund invest in?

The Adviser seeks to meet the Fund’s investment objective of growth of capital by employing a value investment strategy to its selection of predominantly large cap and mid cap common stocks for the portfolio.

Asset Class Weightings

(% of total investments)

| Value | Value |

|---|

| Common Stock | 96.3% |

| Money Market Fund | 3.7% |

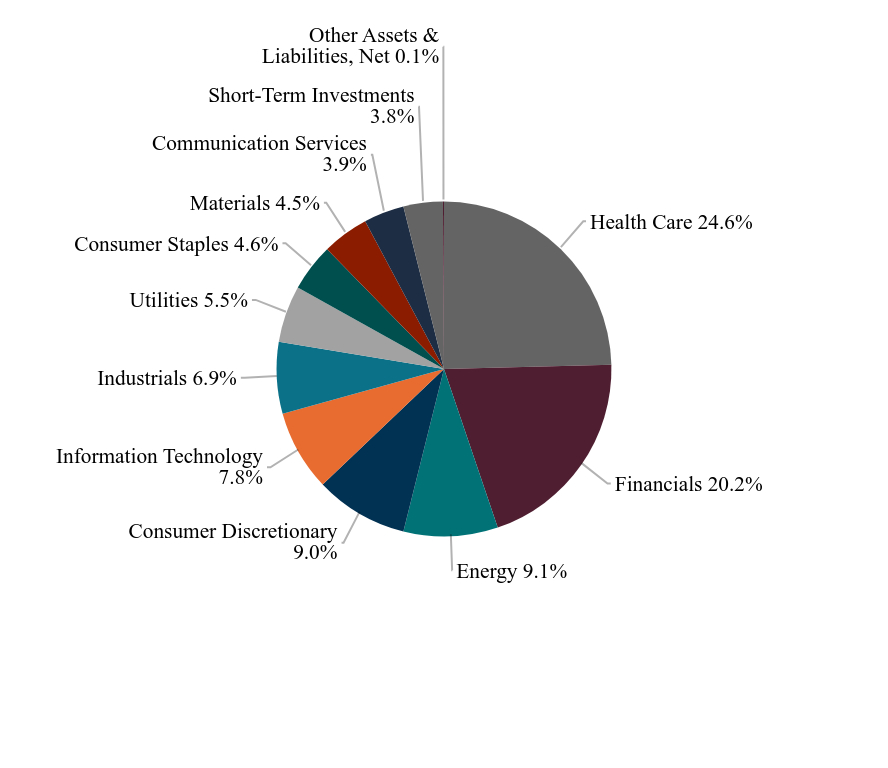

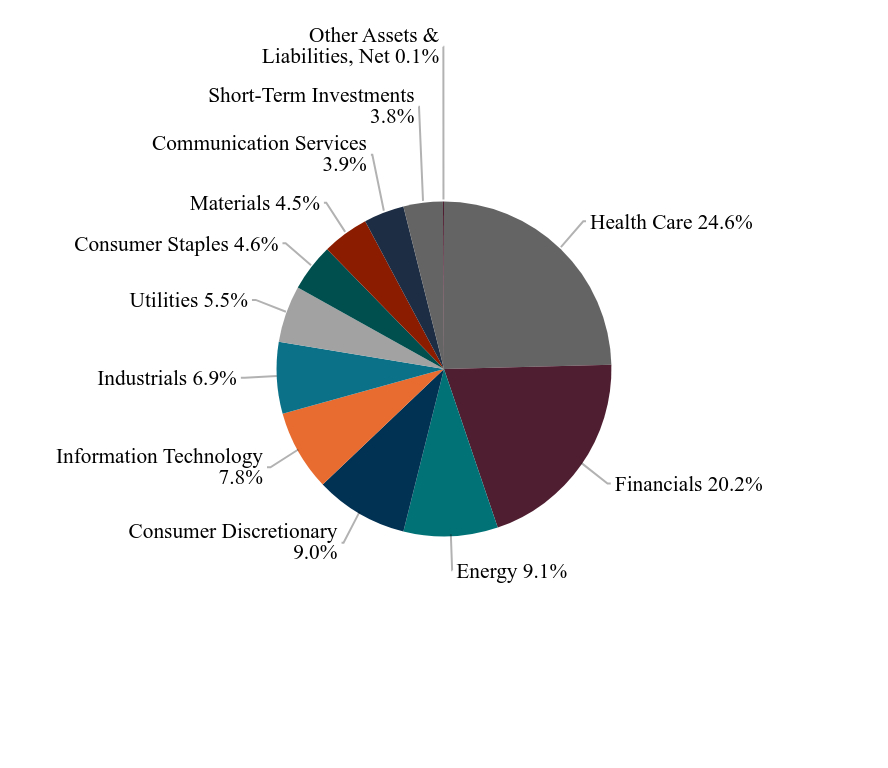

Sector Weightings

(% of total net assets)

| Value | Value |

|---|

| Health Care | 24.6% |

| Financials | 20.2% |

| Energy | 9.1% |

| Consumer Discretionary | 9.0% |

| Information Technology | 7.8% |

| Industrials | 6.9% |

| Utilities | 5.5% |

| Consumer Staples | 4.6% |

| Materials | 4.5% |

| Communication Services | 3.9% |

| Short-Term Investments | 3.8% |

| Other Assets & Liabilities, Net | 0.1% |

Top Ten Holdings

(% of total net assets)

| Capital One Financial Corp. | 3.92% |

| Wells Fargo & Co. | 3.35% |

| Teva Pharmaceutical Industries, Ltd., ADR | 3.26% |

| Avantor, Inc. | 3.19% |

| Coterra Energy, Inc. | 3.13% |

| NXP Semiconductors NV | 2.90% |

| Willis Towers Watson PLC | 2.87% |

| Check Point Software Technologies, Ltd. | 2.85% |

| PVH Corp. | 2.84% |

| Bath & Body Works, Inc. | 2.79% |

Where can I find additional information about the fund?

Additional information is available by scanning the QR code or at https://soundshorefund.com/investor-resources-documents/, including its:

prospectus

financial information

holdings

proxy voting information

Annual Shareholder Report - December 31, 2024

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about the Sound Shore Fund for the period of January 1, 2024, to December 31, 2024. You can find additional information about the Fund at https://soundshorefund.com/investor-resources-documents/. You can also request this information by contacting us at (800) 551-1980.

What were the Fund's costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Class | $105 | 0.95% |

|---|

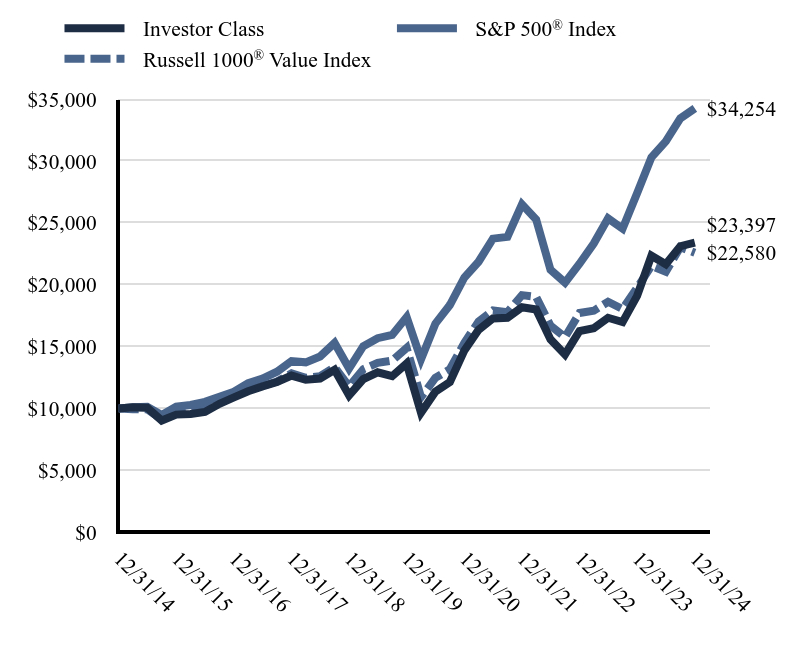

How did the Fund perform in the last year?

It was a strong year for Sound Shore’s portfolio, finishing substantially ahead of the Russell 1000 Value Index. Within the widely followed Standard & Poor’s 500 Index, the year featured familiar winners, which got even bigger as the “Magnificent 7” now represents 33% of the cap-weighted S&P 500 Index and accounted for over 50% of that Index’s return.

In stark contrast to these concentrated, passive indices, this year our performance was driven by 18 stocks (from 8 different sectors) that rose 20% or more. While many investors are focused on the exciting, high-growth potential of artificial intelligence (AI) and technology, we see compelling value in out-of-favor companies undergoing fundamental transformations, regardless of the drivers. High quality, overlooked businesses can often trade at discounted valuations, setting the stage for substantial returns as the market recognizes their true potential.

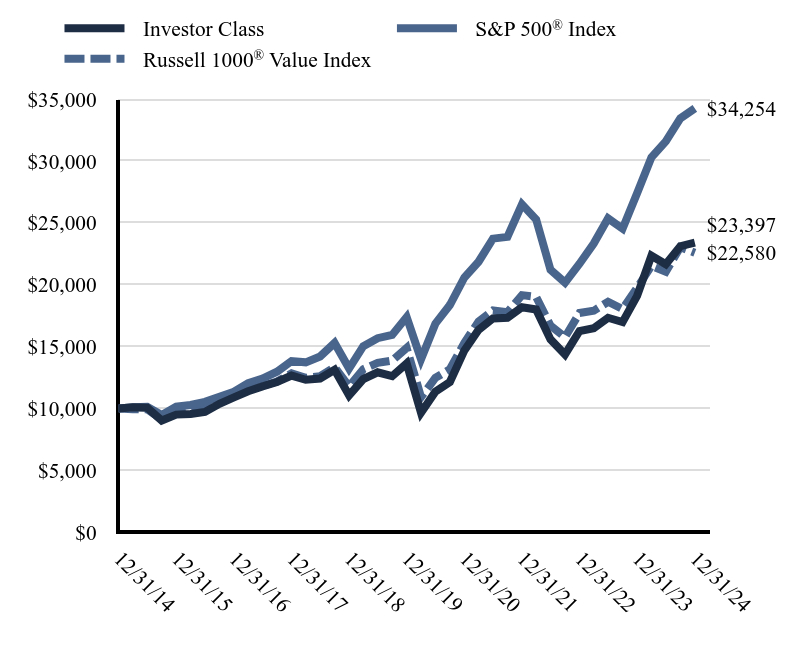

Total Return Based on a $10,000 Investment

| Date | Investor Class | S&P 500® Index | Russell 1000® Value Index |

|---|

| 12/31/14 | $10,000 | $10,000 | $10,000 |

|---|

| 03/31/15 | $10,090 | $10,095 | $9,928 |

|---|

| 06/30/15 | $10,058 | $10,123 | $9,939 |

|---|

| 09/30/15 | $9,017 | $9,471 | $9,104 |

|---|

| 12/31/15 | $9,498 | $10,138 | $9,617 |

|---|

| 03/31/16 | $9,553 | $10,275 | $9,775 |

|---|

| 06/30/16 | $9,714 | $10,527 | $10,223 |

|---|

| 09/30/16 | $10,376 | $10,933 | $10,579 |

|---|

| 12/31/16 | $10,887 | $11,351 | $11,285 |

|---|

| 03/31/17 | $11,383 | $12,039 | $11,654 |

|---|

| 06/30/17 | $11,783 | $12,411 | $11,810 |

|---|

| 09/30/17 | $12,135 | $12,967 | $12,178 |

|---|

| 12/31/17 | $12,653 | $13,829 | $12,827 |

|---|

| 03/31/18 | $12,317 | $13,724 | $12,464 |

|---|

| 06/30/18 | $12,417 | $14,195 | $12,610 |

|---|

| 09/30/18 | $13,114 | $15,290 | $13,329 |

|---|

| 12/31/18 | $11,054 | $13,223 | $11,767 |

|---|

| 03/31/19 | $12,368 | $15,027 | $13,171 |

|---|

| 06/30/19 | $12,921 | $15,674 | $13,677 |

|---|

| 09/30/19 | $12,603 | $15,940 | $13,863 |

|---|

| 12/31/19 | $13,629 | $17,386 | $14,890 |

|---|

| 03/31/20 | $9,654 | $13,979 | $10,910 |

|---|

| 06/30/20 | $11,345 | $16,850 | $12,469 |

|---|

| 09/30/20 | $12,137 | $18,355 | $13,166 |

|---|

| 12/31/20 | $14,689 | $20,585 | $15,306 |

|---|

| 03/31/21 | $16,353 | $21,856 | $17,028 |

|---|

| 06/30/21 | $17,270 | $23,724 | $17,915 |

|---|

| 09/30/21 | $17,326 | $23,862 | $17,776 |

|---|

| 12/31/21 | $18,177 | $26,494 | $19,157 |

|---|

| 03/31/22 | $18,000 | $25,276 | $19,016 |

|---|

| 06/30/22 | $15,579 | $21,206 | $16,694 |

|---|

| 09/30/22 | $14,363 | $20,170 | $15,756 |

|---|

| 12/31/22 | $16,256 | $21,696 | $17,713 |

|---|

| 03/31/23 | $16,478 | $23,322 | $17,891 |

|---|

| 06/30/23 | $17,325 | $25,361 | $18,620 |

|---|

| 09/30/23 | $16,976 | $24,531 | $18,031 |

|---|

| 12/31/23 | $19,092 | $27,399 | $19,743 |

|---|

| 03/31/24 | $22,341 | $30,291 | $21,517 |

|---|

| 06/30/24 | $21,658 | $31,589 | $21,051 |

|---|

| 09/30/24 | $23,109 | $33,448 | $23,036 |

|---|

| 12/31/24 | $23,397 | $34,254 | $22,580 |

|---|

The above chart represents historical performance of a hypothetical $10,000 investment over the past 10 years. Updated performance can be found at www.soundshorefund.com. Effective May 1, 2024, the Fund changed its primary benchmark index from the Russell 1000 Value Index to the S&P 500 Index due to regulatory requirements. The Fund retained the Russell 1000 Value Index as a secondary benchmark because the Russell 1000 Value Index more closely aligns with the Fund's investment strategies and restrictions.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

Average Annual Total Returns

| | One Year | Five Year | Ten Year |

|---|

| Investor Class | 22.54% | 11.41% | 8.87% |

|---|

S&P 500® Index | 25.02% | 14.53% | 13.10% |

|---|

Russell 1000® Value Index | 14.37% | 8.68% | 8.49% |

|---|

| Total Net Assets | $998,549,149 |

|---|

| # of Portfolio Holdings | 41 |

|---|

| Portfolio Turnover Rate | 77% |

|---|

| Investment Advisory Fees Paid (Net of Expense Reimbursements) | $7,029,769 |

|---|

What did the Fund invest in?

The Adviser seeks to meet the Fund’s investment objective of growth of capital by employing a value investment strategy to its selection of predominantly large cap and mid cap common stocks for the portfolio.

Asset Class Weightings

(% of total investments)

| Value | Value |

|---|

| Common Stock | 96.3% |

| Money Market Fund | 3.7% |

Sector Weightings

(% of total net assets)

| Value | Value |

|---|

| Health Care | 24.6% |

| Financials | 20.2% |

| Energy | 9.1% |

| Consumer Discretionary | 9.0% |

| Information Technology | 7.8% |

| Industrials | 6.9% |

| Utilities | 5.5% |

| Consumer Staples | 4.6% |

| Materials | 4.5% |

| Communication Services | 3.9% |

| Short-Term Investments | 3.8% |

| Other Assets & Liabilities, Net | 0.1% |

Top Ten Holdings

(% of total net assets)

| Capital One Financial Corp. | 3.92% |

| Wells Fargo & Co. | 3.35% |

| Teva Pharmaceutical Industries, Ltd., ADR | 3.26% |

| Avantor, Inc. | 3.19% |

| Coterra Energy, Inc. | 3.13% |

| NXP Semiconductors NV | 2.90% |

| Willis Towers Watson PLC | 2.87% |

| Check Point Software Technologies, Ltd. | 2.85% |

| PVH Corp. | 2.84% |

| Bath & Body Works, Inc. | 2.79% |

Where can I find additional information about the fund?

Additional information is available by scanning the QR code or at https://soundshorefund.com/investor-resources-documents/, including its:

prospectus

financial information

holdings

proxy voting information

Annual Shareholder Report - December 31, 2024

(b) Not applicable.

Item 2. Code of Ethics.

(a) As of the end of the period covered by this report, Sound Shore Fund, Inc. (the “Registrant”) has adopted a code of ethics, which applies to its Principal Executive Officer and Principal Financial Officer (the “Code of Ethics”).

(c) There have been no amendments to the Registrant’s Code of Ethics during the period covered by this report.

(d) There have been no waivers to the Registrant’s Code of Ethics during the period covered by this report.

(e) Not applicable.

(f)(1) A copy of the Code of Ethics is being filed under Item 19(a)(1) hereto.

Item 3. Audit Committee Financial Expert.

(a)(1) The Board of Trustees has determined that the Registrant has an audit committee financial expert, as defined in Item 3 of Form N-CSR, serving on its audit committee.

(a)(2) The audit committee financial expert, Mr. David Blair Kelso, is a non-“interested” Trustee (as defined in Item 3(a)(2) of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees – The aggregate fees billed for each of the last two fiscal years (the “Reporting Periods”) for professional services rendered by the Registrant’s principal accountant for the audit of the Registrant’s annual financial statements, or services that are normally provided by the principal accountant in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $22,200 in 2024 and $20,300 in 2023.

(b) Audit-Related Fees – The aggregate fees billed in the Reporting Periods for assurance and related services rendered by the principal accountant that were reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this item 4 were $0 in 2024 and $0 in 2023.

(c) Tax Fees – The aggregate fees billed in the Reporting Periods for professional services rendered by the principal accountant to the Registrant for tax compliance, tax advice and tax planning (“Tax Fees”) were $3,000 in 2024 and $3,000 in 2023. These services consisted of review or preparation of U.S. federal, state, local and excise tax returns.

(d) All Other Fees – There were no other fees billed in the Reporting Periods for products and services provided by the principal accountant to the Registrant, other than the services reported in paragraphs (a) through (c) of this Item.

(e)(1) Pre-Approval Requirements for Audit and Non-Audit Services. The Audit Committee reviews and approves in advance all audit and “permissible non-audit services” to be provided to Sound Shore Management, Inc. (“Sound Shore Management”), the Fund’s investment adviser, by the Fund’s independent auditor if the engagement relates to the operations and financial reporting of the Fund. The Audit Committee considers whether fees paid by Sound Shore Management for audit and permissible non-audit services are consistent with the independent auditor’s independence. Pre-approval of any permissible non-audit services provided to the Fund is not required so long as: (i) the aggregate amount of all such permissible non-audit services provided to the Fund constitutes not more than 5% of the total amount of revenues paid by the Fund to its auditor during the fiscal year in which the permissible non-audit services are provided; (ii) the permissible non-audit services were not recognized by the Fund at the time of engagement to be non-audit services; and (iii) such services are promptly brought to the attention of the Audit Committee and approved prior to the completion of the audit by the Audit Committee or its authorized delegate(s). Pre-approval of permissible non-audit services rendered to Sound Shore Management is not required if provided. The Audit Committee may delegate to one or more of its members authority to pre-approve permissible non-audit services to be provided to the Fund. Any pre-approval determination of a delegate will be presented to the full Audit Committee at its next meeting.

(e)(2) No services included in (b) - (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2- 01 of Regulation S-X.

(f) Not applicable as less than 50%.

(g) The aggregate fees billed in the Reporting Periods for Non-Audit Services by the principal accountant to the Registrant were $4,650 in 2024 and $4,650 in 2023. The non-audit fees billed by the Registrant’s principal accountant for non-audit services provided to the Sound Shore Management (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser) and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant affiliated were $21,150 in 2024 and $21,150 in 2023.

(h) The Registrant’s Audit Committee considers the provision of any non-audit services rendered to the investment adviser, to the extent applicable, in evaluating the independence of the Registrant’s principal accountant. Any services provided by the principal accountant to the Registrant or to Sound Shore Management requiring pre-approval were pre-approved.

(i) Not applicable. The Registrant has not retained, for the preparation of the audit report on the financial statements included in the Form N-CSR, a registered public accounting firm that has a branch or office that is located in a foreign jurisdiction and that the Public Company Accounting Oversight Board (the “PCAOB”) has determined that the PCAOB is unable to inspect or investigate completely because of a position taken by an authority in the foreign jurisdiction.

(j) Not applicable. The Registrant is not a “foreign issuer,” as defined in 17 CFR 240.3b-4.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Included as part of financial statements filed under Item 7(a). |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies

(a)

Annual

Financials

and

Other

Information

207-ANR-1224

This

report

is

submitted

for

the

general

information

of

the

shareholders

of

the

Fund.

It

is

not

authorized

for

distribution

to

prospective

investors

in

the

Fund

unless

preceded

or

accompanied

by

an

effective

prospectus,

which

includes

information

regarding

the

Fund’s

objectives

and

policies,

experience

of

its

management,

and

other

information.

SOUND

SHORE

FUND,

INC.

Three

Canal

Plaza

Portland,

ME

04101

www.soundshorefund.com

(800)

551-1980

See

Notes

to

Financial

Statements.

Sound

Shore

Fund,

Inc.

SCHEDULE

OF

INVESTMENTS

December

31,

2024

Sound

Shore

Fund,

Inc.

SCHEDULE

OF

INVESTMENTS

December

31,

2024

Share

Amount

Value

Common

Stock

(96.1%)

(a)

Communication

Services

(

3.9%

)

Match

Group,

Inc.

(b)

387,995

$

12,691,317

The

Walt

Disney

Co.

233,875

26,041,981

38,733,298

Consumer

Discretionary

(

9.0%

)

Bath

&

Body

Works,

Inc.

717,905

27,833,177

General

Motors

Co.

316,890

16,880,730

Lennar

Corp.,

Class A

125,935

17,173,756

PVH

Corp.

268,795

28,425,071

90,312,734

Consumer

Staples

(

4.6%

)

Nestle

SA,

ADR

246,575

20,145,178

The

Kroger

Co.

417,720

25,543,578

45,688,756

Energy

(

9.1%

)

Baker

Hughes

Co.

504,520

20,695,410

Coterra

Energy,

Inc.

1,222,390

31,219,841

EOG

Resources,

Inc.

164,705

20,189,539

Kinder

Morgan,

Inc.

696,265

19,077,661

91,182,451

Financials

(

20.2%

)

Berkshire

Hathaway,

Inc.,

Class B

(b)

50,275

22,788,652

Capital

One

Financial

Corp.

219,590

39,157,289

Citigroup,

Inc.

384,160

27,041,022

Fidelity

National

Information

Services,

Inc.

284,755

22,999,661

PayPal

Holdings,

Inc.

(b)

322,865

27,556,528

Wells

Fargo

&

Co.

475,335

33,387,530

Willis

Towers

Watson

PLC

91,445

28,644,232

201,574,914

Health

Care

(

24.6%

)

Avantor,

Inc.

(b)

1,514,380

31,907,987

Baxter

International,

Inc.

786,370

22,930,549

Bristol-Myers

Squibb

Co.

417,675

23,623,698

See

Notes

to

Financial

Statements.

Sound

Shore

Fund,

Inc.

SCHEDULE

OF

INVESTMENTS

(Continued)

December

31,

2024

Sound

Shore

Fund,

Inc.

SCHEDULE

OF

INVESTMENTS

(Continued)

December

31,

2024

Share

Amount

Value

Health

Care

(24.6%)

(continued)

GE

HealthCare

Technologies,

Inc.

230,515

$

18,021,663

Hologic,

Inc.

(b)

284,425

20,504,198

Incyte

Corp.

(b)

374,885

25,893,307

Organon

&

Co.

1,491,355

22,251,017

Perrigo

Co.

PLC

870,395

22,377,855

Teva

Pharmaceutical

Industries,

Ltd.,

ADR

(b)

1,476,070

32,532,583

Zimmer

Biomet

Holdings,

Inc.

246,375

26,024,591

246,067,448

Industrials

(

6.9%

)

CSX

Corp.

667,650

21,545,066

FedEx

Corp.

71,830

20,207,934

Southwest

Airlines

Co.

807,010

27,131,676

68,884,676

Information

Technology

(

7.8%

)

Check

Point

Software

Technologies,

Ltd.

(b)

152,375

28,448,413

Flex,

Ltd.

(b)

535,760

20,567,826

NXP

Semiconductors

NV

139,645

29,025,213

78,041,452

Materials

(

4.5%

)

Barrick

Gold

Corp.

1,437,500

22,281,250

CF

Industries

Holdings,

Inc.

260,970

22,265,960

44,547,210

Utilities

(

5.5%

)

Public

Service

Enterprise

Group,

Inc.

156,595

13,230,712

The

AES

Corp.

1,697,890

21,851,844

Vistra

Corp.

143,605

19,798,821

54,881,377

Total

Common

Stock

(96.1%)

(cost

$748,563,731)

959,914,316

See

Notes

to

Financial

Statements.

Sound

Shore

Fund,

Inc.

SCHEDULE

OF

INVESTMENTS

(Concluded)

December

31,

2024

Share

Amount

Value

Short-Term

Investments

(3.8%)

Money

Market

Fund

(

3.8%

)

First

American

Government

Obligations

Fund,

Class X,

4.

41

%

(c)

37,286,030

$

37,286,030

Total

Short-Term

Investments

(3.8%)

(cost

$37,286,030)

37,286,030

Investments,

at

value

(99.9%)

(cost

$785,849,761)

$

997,200,346

Other

Assets

Less

Liabilities

(0.1%)

1,348,803

Net

Assets

(100.0%)

$

998,549,149

(a)

More

narrow

industries

are

utilized

for

compliance

purposes,

whereas

broad

sectors

are

utilized

for

reporting

purposes.

(b)

Non-income

producing

security.

(c)

Percentage

disclosed

reflects

the

money

market

fund’s

C

lass

X

shares

7-day

yield

as

of

December

31,

2024.

ADR

American

Depositary

Receipt

PLC

Public

Limited

Company

See

Notes

to

Financial

Statements.

Sound

Shore

Fund,

Inc.

STATEMENT

OF

ASSETS

AND

LIABILITIES

December

31,

2024

Sound

Shore

Fund,

Inc.

STATEMENT

OF

ASSETS

AND

LIABILITIES

December

31,

2024

ASSETS

Investments,

at

value

(Cost

$785,849,761)

$

997,200,346

Receivables:

Capital

shares

sold

2,430,494

Dividends

933,132

Foreign

tax

reclaims

93,825

Prepaid

expenses

47,615

Total

Assets

1,000,705,412

LIABILITIES

Payables:

Capital

shares

redeemed

1,363,382

Accrued

liabilities:

Advisory

fees

616,874

Administrator

fees

12,867

Transfer

agent

fees

and

expenses

55,529

Custodian

fees

13,187

Compliance

and

Treasurer

Services

fees

and

expenses

12,500

Professional

fees

46,300

Other

accrued

liabilities

35,624

Total

Liabilities

2,156,263

Net

Assets

$

998,549,149

COMPONENTS

OF

NET

ASSETS

Common

stock,

at

Par

Value

$

25,777

Paid-in

Capital

786,926,402

Distributable

earnings

211,596,970

Net

Assets

$

998,549,149

NET

ASSET

VALUE

Net

Assets

-

Investor

Class

Shares

$

533,076,885

Shares

Outstanding

-

Investor

Class

(100,000,000

shares

authorized,

par

value

$0.001)

13,874,575

Net

Asset

Value

(offering

&

redemption

price

per

share)

-

Investor

Class

Shares

$

38.42

Net

Assets

-

Institutional

Class

Shares

$

465,472,264

Shares

Outstanding

-

Institutional

Class

(100,000,000

shares

authorized,

par

value

$0.001)

11,902,584

Net

Asset

Value

(offering

&

redemption

price

per

share)

-

Institutional

Class

Shares

$

39.11

See

Notes

to

Financial

Statements.

Sound

Shore

Fund,

Inc.

STATEMENT

OF

OPERATIONS

FOR

THE

YEAR

ENDED

DECEMBER

31,

2024

Sound

Shore

Fund,

Inc.

STATEMENT

OF

OPERATIONS

FOR

THE

YEAR

ENDED

DECEMBER

31,

2024

INVESTMENT

INCOME

Income:

Di

vidend

income

(net

of

foreign

withholding

taxes

of

$281,723)

$

19,121,382

Total

Income

19,121,382

Expenses:

Advisory

fees

(Note

3

)

7,499,736

Administrator

fees

152,077

Transfer

agent

fees

and

expenses

-

Investor

Class

Shares

570,359

Transfer

agent

fees

and

expenses

-

Institutional

Class

Shares

56,438

Custodian

fees

80,856

Compliance

and

Treasurer

Services

fees

and

expenses

(Note

3

)

151,095

Directors’

fees

and

expenses

(Note

3

)

191,207

Professional

fees

112,300

Registration

fees

-

Investor

Class

Shares

26,575

Registration

fees

-

Institutional

Class

Shares

27,283

Printing

and

postage

fees

-

Investor

Class

Shares

43,623

Printing

and

postage

fees

-

Institutional

Class

Shares

33,254

Miscellaneous

85,828

Total

Expenses

9,030,631

Expense

Reimbursements

-

Institutional

Class

Shares

(Note

3

)

(469,967)

Net

Expenses

8,560,664

Net

Investment

Income

10,560,718

REALIZED

AND

UNREALIZED

GAIN

(LOSS)

ON

INVESTMENTS

Net

realized

gain

on

investments

214,262,782

Net

change

in

unrealized

appreciation

(depreciation)

on

investments

(24,985,733)

Net

realized

and

unrealized

gain

on

investments

189,277,049

Net

increase

in

net

assets

from

operations

$

199,837,767

See

Notes

to

Financial

Statements.

Sound

Shore

Fund,

Inc.

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

Sound

Shore

Fund,

Inc.

STATEMENTS

OF

CHANGES

IN

NET

ASSETS

For

the

Year

Ended

December

31,

2024

2023

Operations:

Net

investment

income

$

10,560,718

$

8,792,618

Net

realized

gain

on

investments

214,262,782

35,751,231

Net

change

in

unrealized

appreciation

(

depreciation

)

on

investments

(24,985,733)

97,315,104

Increase

in

net

assets

from

operations

199,837,767

141,858,953

Distributions

to

shareholders

:

Investor

Class

Shares

(113,996,541)

(22,054,579)

Institutional

Class

Shares

(96,536,807)

(17,868,996)

Total

distributions

to

shareholders

(210,533,348)

(39,923,575)

Net

capital

share

transactions

(Note

6

):

Investor

Class

Shares

39,521,488

(77,275,519)

Institutional

Class

Shares

64,176,432

(19,448,325)

Total

capital

share

transactions

103,697,920

(96,723,844)

Total

increase

in

net

assets

93,002,339

5,211,534

NET

ASSETS

Beginning

of

the

year

905,546,810

900,335,276

End

of

the

year

$

998,549,149

$

905,546,810

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

December

31,

2024

1.

Organization

Sound

Shore

Fund,

Inc.

(the

“Fund”)

was

incorporated

under

the

laws

of

the

State

of

Maryland

on

February

15,

1985

and

is

registered

as

a

diversified,

open-end

management

investment

company

under

the

Investment

Company

Act

of

1940

(the

“Act”).

The

investment

objective

of

the

Fund

is

growth

of

capital.

The

Fund

qualifies

as

an

investment

company

as

defined

in

Financial

Accounting

Standards

Codification

946

—

Financial

Services

—

Investment

Companies.

The

total

number

of

shares

of

common

stock

which

the

Fund

is

authorized

to

issue

is

200,000,000,

par

value

$0.001

per

share

of

which

100,000,000

shares

are

designated

to

the

Investor

Class

and

100,000,000

shares

are

designated

to

the

Institutional

Class.

The

Board

of

Directors

(the

“Board”)

may,

without

shareholder

approval,

classify

or

reclassify

any

unissued

shares

into

other

classes

or

series

of

shares.

Each

share

of

the

Fund

has

equal

dividend,

distribution,

liquidation

and

voting

rights

(except

as

to

matters

relating

exclusively

to

one

class

of

shares),

and

fractional

shares

have

those

rights

proportionately.

2.

Significant

Accounting

Policies

These

financial

statements

are

prepared

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“GAAP”),

which

require

management

to

make

estimates

and

assumptions

that

affect

the

reported

amounts

of

assets

and

liabilities,

disclosure

of

contingent

liabilities,

if

any,

at

the

date

of

the

financial

statements,

and

the

reported

amounts

of

increase

and

decrease

in

net

assets

from

operations

during

the

fiscal

period.

Actual

results

could

differ

from

those

estimates.

The

following

represents

the

significant

accounting

policies

of

the

Fund:

a.

Security

Valuation

Exchange-traded

securities

including

those

traded

on

the

National

Association

of

Securities

Dealers’

Automated

Quotation

system

(“NASDAQ”),

are

valued

at

the

last

quoted

sale

price

or

official

closing

price

as

provided

by

independent

pricing

services

as

of

the

close

of

trading

on

the

system

or

exchange

on

which

they

are

primarily

traded,

on

each

Fund

business

day.

In

the

absence

of

a

sale,

such

securities

are

valued

at

the

mean

of

the

last

bid

and

asked

prices.

Non-exchange-traded

securities

for

which

over-the-counter

market

quotations

are

readily

available

are

generally

valued

at

the

mean

between

the

current

bid

and

asked

prices

provided

by

independent

pricing

services.

Investments

in

other

open-end

regulated

investment

companies

are

valued

at

their

publicly

traded

net

asset

value

(“NAV”).

Pursuant

to

Rule

2a-5

under

the

Investment

Company

Act,

the

Board

has

designated

the

Adviser,

as

defined

in

Note

3,

as

the

Fund's

valuation

designee

to

perform

any

fair

value

determinations

for

securities

and

other

assets

held

by

the

Fund.

The

Adviser

is

subject

to

the

oversight

of

the

Board

and

certain

reporting

and

other

requirements

intended

to

provide

the

Board

the

information

needed

to

oversee

the

Adviser's

fair

value

determinations.

The

Adviser

is

responsible

for

determining

the

fair

value

of

investments

for

which

market

quotations

are

not

readily

available

in

accordance

with

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Continued)

December

31,

2024

policies

and

procedures

that

have

been

approved

by

the

Board.

Under

these

procedures,

the

Adviser

convenes

on

a

regular

and

ad

hoc

basis

to

review

such

investments

and

considers

a

number

of

factors,

including

valuation

methodologies

and

significant

unobservable

inputs,

when

arriving

at

fair

value.

The

Board

has

approved

the

Adviser’s

fair

valuation

procedures

as

a

part

of

the

Fund’s

compliance

program

and

will

review

any

changes

made

to

the

procedures.

The

Adviser

provides

fair

valuation

inputs

pursuant

to

its

fair

valuation

procedures

if

market

quotations

are

not

readily

available

(including

a

short

and

temporary

lapse

in

the

provision

of

a

price

by

the

regular

pricing

source)

or,

if

in

the

judgment

of

the

Adviser

the

prices

or

values

available

do

not

represent

the

fair

value

of

the

instrument.

Factors

which

may

cause

the

Adviser

to

make

such

a

judgment

include,

but

are

not

limited

to,

the

following:

(i)

only

a

bid

price

or

an

asked

price

is

available,

(ii)

the

spread

between

the

bid

price

and

the

asked

price

is

substantial,

(iii)

the

frequency

of

sales,

(iv)

the

thinness

of

the

market,

(v)

the

size

of

reported

trades,

and

(vi)

actions

of

the

securities

markets,

such

as

the

suspension

or

limitation

of

trading.

Fair

valuation

is

based

on

subjective

factors

and,

as

a

result,

the

fair

value

price

of

a

security

may

differ

from

the

security’s

market

price

and

may

not

be

the

price

at

which

the

security

may

be

sold.

Fair

valuation

could

result

in

a

NAV

different

from

one

determined

by

using

market

quotations.

Valuation

inputs

used

to

determine

the

value

of

the

Fund’s

investments

are

summarized

in

the

three

broad

levels

listed

below:

Level

1

-

quoted

prices

in

active

markets

for

identical

assets

Level

2

-

other

significant

observable

inputs

(including

quoted

prices

of

similar

securities,

interest

rates,

prepayment

speeds,

credit

risk,

etc.)

Level

3

-

significant

unobservable

inputs

(including

the

Fund’s

own

assumptions

in

determining

the

fair

value

of

investments)

The

inputs

or

methodology

used

for

valuing

securities

are

not

necessarily

an

indication

of

the

risk

associated

with

investing

in

those

securities.

Pursuant

to

the

valuation

procedures

noted

previously,

equity

securities

(including

exchange-traded

securities

and

other

open-end

regulated

investment

companies)

are

generally

categorized

as

Level

1

securities

in

the

fair

value

hierarchy.

Investments

for

which

there

are

no

quotations,

or

for

which

quotations

do

not

appear

reliable,

are

valued

at

fair

value

as

determined

in

good

faith

by

the

Adviser

under

the

Adviser’s

fair

valuation

procedures.

These

valuations

are

typically

categorized

as

Level

2

or

Level

3

in

the

fair

value

hierarchy.

The

following

table

summarizes

the

Fund’s

investments

categorized

in

the

fair

value

hierarchy

as

of

December

31,

2024:

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Continued)

December

31,

2024

At

December

31,

2024,

all

equity

securities

and

open-end

regulated

investment

companies

were

included

in

Level

1

in

the

table

above.

Please

refer

to

the

Schedule

of

Investments

to

view

equity

securities

categorized

by

sector/industry

type.

b.

Security

Transactions

Security

transactions

are

recorded

on

a

trade

date

basis.

Realized

gain

and

loss

on

investments

sold

are

recorded

on

the

basis

of

identified

cost.

Dividend

income

is

recorded

on

the

ex-dividend

date.

Interest

income

is

recorded

on

an

accrual

basis.

Foreign

dividend

income

is

recorded

on

the

ex-dividend

date

or

as

soon

as

practicable

after

the

Fund

determines

the

existence

of

a

dividend

declaration

after

exercising

reasonable

due

diligence.

Income

and

capital

gains

on

some

foreign

securities

may

be

subject

to

foreign

withholding

tax,

which

is

accrued

as

applicable.

Investment

income,

realized

and

unrealized

gains

and

losses

and

certain

Fund-level

expenses

are

allocated

to

each

class

based

on

relative

average

daily

net

assets.

Certain

expenses

are

incurred

at

the

class

level

and

charged

directly

to

that

particular

class.

Class

level

expenses

are

denoted

as

such

on

the

Fund’s

Statement

of

Operations.

c.

Dividends

and

Distributions

to

Shareholders

Dividends

are

declared

separately

for

each

class.

No

class

has

preferential

dividend

rights;

differences

in

per-share

dividend

rates

are

generally

due

to

class-specific

fee

waivers

and

expenses.

Dividends

and

distributions

payable

to

shareholders

are

recorded

by

the

Fund

on

the

ex-dividend

date.

Dividends

from

net

investment

income,

if

any,

are

declared

and

paid

semiannually.

Capital

gains,

if

any,

are

distributed

to

shareholders

at

least

annually.

The

Fund

determines

its

net

investment

income

and

capital

gains

distributions

in

accordance

with

income

tax

regulations,

which

may

differ

from

GAAP.

These

differences

are

due

primarily

to

differing

treatments

of

income

and

gains

on

various

securities

held

by

the

Fund,

timing

differences

and

differing

characterizations

of

distributions

made

by

the

Fund.

To

the

extent

distributions

exceed

net

investment

income

and

net

realized

capital

gains

for

tax

purposes,

they

are

reported

as

a

return

of

capital.

d.

Federal

Taxes

The

Fund

intends

to

continue

to

qualify

each

year

as

a

regulated

investment

company

and

to

distribute

substantially

all

of

its

taxable

income.

In

addition,

by

distributing

in

each

calendar

year

substantially

all

of

its

net

investment

income,

capital

gain

and

certain

other

amounts,

if

any,

the

Fund

will

not

be

subject

to

federal

taxation.

Therefore,

no

federal

income

or

excise

tax

provision

is

required.

For

all

open

tax

years

and

all

major

taxing

jurisdictions,

management

of

the

Fund

has

concluded

that

there

are

no

significant

uncertain

tax

positions

that

would

require

the

Fund

to

record

a

tax

liability

or

would

otherwise

require

recognition

in

the

financial

statements.

Open

tax

years

are

those

that

are

open

for

Security

Type

Level

1

Level

2

Level

3

Total

Investments

in

Securities

Common

Stock

$

959

,

914

,

316

$

–

$

–

$

959,914,316

Short-Term

Investments

37,286,030

–

–

37,286,030

Total

Investments

$

997,200,346

$

–

$

–

$

997,200,346

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Continued)

December

31,

2024

examination

by

taxing

authorities

(i.e.,

generally,

the

last

three

tax

year-ends

2021

–

2023,

and

the

interim

tax

year

since

then).

3.

Fees

and

Expenses

Investment

Adviser

The

Fund’s

investment

adviser

is

Sound

Shore

Management,

Inc.

(the

“Adviser”).

Pursuant

to

an

investment

advisory

agreement,

the

Adviser

receives

an

advisory

fee,

accrued

daily

and

paid

monthly

at

an

annual

rate

of

0.75%

of

the

Fund’s

average

daily

net

assets.

Pursuant

to

an

expense

limitation

agreement

between

the

Adviser

and

the

Fund,

the

Adviser

has

agreed

to

reimburse

all

of

the

ordinary

expenses

of

the

Institutional

Class,

excluding

advisory

fees,

interest,

taxes,

securities

lending

costs,

brokerage

commissions,

acquired

fund

fees

and

expenses,

extraordinary

expenses

and

all

litigation

costs

until

at

least

May

1,

2025.

This

reimbursement

is

shown

on

the

Statement

of

Operations

as

a

reduction

of

expenses,

and

such

amounts

are

not

subject

to

future

recoupment

by

the

Adviser.

Other

Services

Atlantic

Fund

Administration,

LLC,

a

wholly

owned

subsidiary

of

Apex

U.S.

Holdings

LLC

(d/b/a

Apex

Fund

Services)

(“Apex”),

provides

certain

administration

and

portfolio

accounting

services

to

the

Fund.

U.S.

Bank,

N.A.

(“U.S.

Bank”)

serves

as

custodian

to

the

Fund.

Apex

provides

transfer

agency

services

to

the

Fund.

The

Fund

also

has

agreements

with

various

financial

intermediaries

and

“mutual

fund

supermarkets”

under

which

customers

of

these

intermediaries

may

purchase

and

hold

Fund

shares.

These

intermediaries

effectively

provide

sub-transfer

agent

services

that

the

Fund’s

transfer

agent

would

have

otherwise

had

to

provide.

In

recognition

of

this,

the

transfer

agent,

the

Fund

and

the

Fund’s

Adviser

have

entered

into

an

agreement

whereby

the

transfer

agent

agrees

to

pay

financial

intermediaries

a

portion

of

the

amount

denoted

on

the

Statement

of

Operations

as

“Transfer

agent

fees

and

expenses

—

Investor

Class

Shares”

that

it

receives

from

the

Fund

for

its

services

as

transfer

agent

for

the

Investor

Class

and

the

Adviser

agrees

to

pay

the

excess,

if

any,

charged

by

a

financial

intermediary

for

that

class.

Foreside

Fund

Services,

LLC,

a

wholly

owned

subsidiary

of

Foreside

Financial

Group,

LLC

(d/b/a

ACA

Group),

is

the

Fund’s

distributor

(the

“Distributor”).

The

Distributor

is

not

affiliated

with

the

Adviser,

Apex,

U.S.

Bank,

or

its

affiliated

companies.

The

Distributor

receives

no

compensation

from

the

Fund

for

its

distribution

services.

Pursuant

to

a

Compliance

Services

Agreement

with

the

Fund,

Foreside

Fund

Officer

Services,

LLC

(“FFOS”),

an

affiliate

of

the

Distributor,

provides

a

Chief

Compliance

Officer

and

Anti-Money

Laundering

Officer

to

the

Fund

as

well

as

some

additional

compliance

support

functions.

Under

a

Treasurer

Services

Agreement

with

the

Fund,

Foreside

Management

Services,

LLC

(“FMS”),

an

affiliate

of

the

Distributor,

provides

a

Treasurer

to

the

Fund.

Neither

the

Distributor,

FFOS,

FMS,

nor

their

employees

that

serve

as

officers

of

the

Fund,

have

any

role

in

determining

the

investment

policies

of

or

securities

to

be

purchased

or

sold

by

the

Fund.

The

Fund

pays

each

director

who

is

not

an

“interested

person”

of

the

Fund,

as

defined

in

Section

2(a)(19)

of

the

Act

(“Independent

Director”),

quarterly

fees

of

$5,000,

plus

$10,000

per

quarterly

meeting

attended

in-person

or

telephonically,

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Continued)

December

31,

2024

and

$2,000

per

special

meeting

attended

in

person

or

telephonically.

In

addition,

the

Chairman

of

the

Audit

Committee

receives

a

quarterly

fee

of

$2,500.

Certain

Officers

and

Directors

of

the

Fund

are

officers,

directors,

or

employees

of

the

aforementioned

companies.

4.

Purchases

and

Sales

of

Securities

The

cost

of

securities

purchased

and

proceeds

from

sales

of

securities

(excluding

short-term

investments)

for

the

fiscal

year

ended

December

31,

2024,

aggregated

$747,141,492

and

$842,821,897,

respectively.

5.

Federal

Income

Tax

Cost

for

federal

income

tax

purposes

is

$785,681,169

and

net

unrealized

appreciation

consists

of:

Distributions

during

the

fiscal

years

ended

December

31,

2024

and

December

31,

2023

were

characterized

for

tax

purposes

as

follows:

Equalization

debits

(amounts

not

included

in

the

above

distributions)

were

as

follows:

On

the

Statement

of

Assets

and

Liabilities,

primarily

as

a

result

of

equalization

and

prior

year

adjustments,

the

following

amounts

have

been

reclassified

for

the

year

ended

December

31,

2024:

Components

of

net

assets

on

a

federal

income

tax

basis

at

December

31,

2024,

were

as

follows:

Gross

Unrealized

Appreciation

$

229,187,316

Gross

Unrealized

Depreciation

(17,668,139)

Net

Unrealized

Appreciation

$

211,519,177

2024

2023

Ordinary

Income

$

59,003,941

$

6,

596

,

105

Long-Term

Capital

Gain

151,529,407

33,

327

,

470

Total

Taxable

Distributions

$

210,533,348

$

39,923,575

2024

2023

Ordinary

Income

$

338,092

$

783

,

876

Long-Term

Capital

Gain

12,806,777

69,422

Total

Taxable

Distributions

$

13,144,869

$

853

,

298

Paid-in-Capital

$

13,170,832

Distributable

Earnings

$

(13,170,832)

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Continued)

December

31,

2024

At

December

31,

2024,

the

Fund,

for

federal

income

tax

purposes,

had

no

capital

loss

carryforwards.

6.

Capital

Stock

Transactions

in

capital

stock

for

the

years

ended

December

31,

2024

and

December

31,

2023,

were

as

follows:

7.

Segment

Reporting

In

this

reporting

period,

the

Fund

adopted

FASB

Accounting

Standards

Update

2023-07,

Segment

Reporting

(Topic

280)

-

Improvements

to

Reportable

Segment

Disclosures

("ASU

2023-07").

Adoption

did

not

affect

the

Fund’s

financial

position

or

its

results

from

operations.

The

intent

of

ASU

2023-07

is

to

enable

investors

to

better

understand

an

entity's

overall

performance

and

to

assess

its

potential

future

cash

flows.

The

Fund’s

Principal

Executive

Officer

acts

as

the

Fund’s

chief

operating

decision

maker

(CODM).

The

Fund

is

party

to

the

expense

agreements

as

disclosed

in

the

notes

to

the

financial

statements

and

resources

are

not

allocated

to

the

Fund

based

on

performance

measurements.

The

CODM

has

determined

the

Fund

to

be

an

individual

reporting

segment,

not

part

of

a

consolidated

reporting

entity.

The

objective

and

strategy

of

the

Fund,

along

with

the

terms

of

its

prospectus

are

used

by

the

Adviser

to

inform

investment

decisions.

The

financial

information

provided

to

and

reviewed

by

the

CODM

is

consistent

with

that

presented

in

the

Fund’s

Portfolio

of

Investments,

Statement

of

Changes

in

Net

Assets

and

Financial

Highlights.

Par

Value

+

Paid-in

Capital

$

786,952,179

Undistributed

Ordinary

Income

12

,

154

Undistributed

Long-Term

Gain

65,639

Net

Unrealized

Appreciation

211,519,177

Net

Assets

$

998,549,149

For

the

Year

Ended

December

31,

2024

Investor

Class

Institutional

Class

Shares

Amount

Shares

Amount

Sale

of

shares

716,867

$

32,083,068

1,211,023

$

53,588,094

Reinvestment

of

dividends

2,804,766

108,887,064

2,381,970

94,143,367

Redemption

of

shares

(2,308,262)

(101,448,644)

(1,864,092)

(83,555,029)

Net

increase

from

capital

transactions

1,213,371

$

39,521,488

1,728,901

$

64,176,432

For

the

Year

Ended

December

31,

2023

Investor

Class

Institutional

Class

Shares

Amount

Shares

Amount

Sale

of

shares

285,351

$

10,513,301

762,184

$

28,620,764

Reinvestment

of

dividends

534,041

20,953,937

439,919

17,481,706

Redemption

of

shares

(2,951,328)

(108,742,757)

(1,764,562)

(65,550,795)

Net

decrease

from

capital

transactions

(2,131,936)

$

(77,275,519)

(562,459)

$

(19,448,325)

Sound

Shore

Fund,

Inc.

NOTES

TO

FINANCIAL

STATEMENTS

(Concluded)

December

31,

2024

8.

Subsequent

Events

Subsequent

events

occurring

after

the

date

of

this

report

have

been

evaluated

for

potential

impact

to

this

report

through

the

date

the

report

was

issued.

Management

has

evaluated

the

need

for

additional

disclosures

and/or

adjustments

resulting

from

subsequent

events.

Based

on

this

evaluation,

no

additional

disclosures

or

adjustments

were

required

to

the

financial

statements

as

of

the

date

the

financial

statements

were

issued.

Sound

Shore

Fund,

Inc.

FINANCIAL

HIGHLIGHTS

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

year.

For

the

Year

Ended

December

31,

2024

2023

2022

2021

2020

Investor

Class

Shares

Net

Asset

Value,

Beginning

of

Year

$

39.43

$

35.10

$

41.16

$

42.29

$

42.41

Investment

Operations

Net

investment

income

(a)

0.44

0.33

0.36

0.41

0.30

Net

realized

and

unrealized

gain

(loss)

on

investments

8.50

5.78

(4.75)

9.66

2.90

Total

from

Investment

Operations

8.94

6.11

(4.39)

10.07

3.20

Distributions

from

Net

investment

income

(0.50)

(0.27)

(0.35)

(0.44)

(0.32)

Net

realized

gains

(9.45)

(1.51)

(1.32)

(10.76)

(3.00)

Total

Distributions

(9.95)

(1.78)

(1.67)

(11.20)

(3.32)

Net

Asset

Value,

End

of

Year

$

38.42

$

39.43

$

35.10

$

41.16

$

42.29

Total

Return

22.5

4

%

17.45%

(10.59)%

23.76%

7.78%

Ratios/Supplemental

Data

Net

Assets

at

End

of

Year

(in

thousands)

$533,077

$499,178

$519,227

$671,380

$641,165

Ratios

to

Average

Net

Assets:

Expenses

0.95%

0.96%

0.94%

0.93%

0.93%

Net

Investment

Income

0.97%

0.90%

0.94%

0.85%

0.80%

Portfolio

Turnover

Rate

(b)

77%

69%

72%

44%

77%

(a)

Calculated

based

on

average

shares

outstanding

during

each

year.

(b)

Portfolio

turnover

is

calculated

on

the

basis

of

the

Fund,

as

a

whole,

without

distinguishing

between

the

classes

of

shares

issued.

Sound

Shore

Fund,

Inc.

FINANCIAL

HIGHLIGHTS

(Concluded)

These

financial

highlights

reflect

selected

data

for

a

share

outstanding

throughout

each

year.

For

the

Year

Ended

December

31,

2024

2023

2022

2021

2020

Institutional

Class

Shares

Net

Asset

Value,

Beginning

of

Year

$

39.94

$

35.50

$

41.56

$

42.59

$

42.65

Investment

Operations

Net

investment

income

(a)

0.53

0.41

0.43

0.51

0.37

Net

realized

and

unrealized

gain

(loss)

on

investments

8.63

5.84

(4.78)

9.70

2.93

Total

from

Investment

Operations

9.16

6.25

(4.35)

10.21

3.30

Distributions

from

Net

investment

income

(0.54)

(0.30)

(0.39)

(0.48)

(0.36)

Net

realized

gains

(9.45)

(1.51)

(1.32)

(10.76)

(3.00)

Total

Distributions

(9.99)

(1.81)

(1.71)

(11.24)

(3.36)

Net

Asset

Value,

End

of

Year

$

39.11

$

39.94

$

35.50

$

41.56

$

42.59

Total

Return

22.82%

17.67%

(10.40)%

23.95%

7.98%

Ratios/Supplemental

Data

Net

Assets

at

End

of

Year

(in

thousands)

$465,472

$406,369

$381,109

$575,184

$517,449

Ratios

to

Average

Net

Assets:

Expenses

(gross)

(b)

0.85%

0.86%

0.85%

0.83%

0.84%

Expenses

(net)

0.75%

0.75%

0.75%

0.75%

0.75%

Net

Investment

Income

1.16%

1.11%

1.13%

1.03%

0.98%

Portfolio

Turnover

Rate

(c)

77%

69%

72%

44%

77%

(a)

Calculated

based

on

average

shares

outstanding

during

each

year.

(b)

Reflects

the

expense

ratio

excluding

any

waivers

and/or

reimbursements.

Expense

waivers

and/or

reimbursements

would

decrease

the

total

return

had

such

reductions

not

occurred.

(c)

Portfolio

turnover

is

calculated

on

the

basis

of

the

Fund,

as

a

whole,

without

distinguishing

between

the

classes

of

shares

issued.

REPORT

OF

INDEPENDENT

REGISTERED

PUBLIC

ACCOUNTING

FIRM

To

the

Board

of

Directors

and

the

Shareholders

of

Sound

Shore

Fund,

Inc.

Opinion

on

the

Financial

Statements

We

have

audited

the

accompanying

statement

of

assets

and

liabilities,

including

the

schedule

of

investments,

of

Sound

Shore

Fund,

Inc.

(the

“Fund”)

as

of

December

31,

2024,

the

related

statement

of

operations

for

the

year

then

ended,

and

the

statements

of

changes

in

net

assets

and

the

financial

highlights

for

each

of

the

two

years

in

the

period

then

ended,

and

the

related

notes

(collectively

referred

to

as

the

“financial

statements”).

In

our

opinion,

the

financial

statements

present

fairly,

in

all

material

respects,

the

financial

position

of

the

Fund

as

of

December

31,

2024,

the

results

of

its

operations

for

the

year

then

ended,

and

the

changes

in

net

assets

and

the

financial

highlights

for

each

of

the

two

years

in

the

period

then

ended,

in

conformity

with

accounting

principles

generally

accepted

in

the

United

States

of

America.