- MO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Altria (MO) DEFA14AAdditional proxy soliciting materials

Filed: 8 Sep 08, 12:00am

Altria Group, Inc. and UST Inc. Announce Agreement for Altria to Acquire UST Inc. September 8, 2008 Exhibit 99.2 |

Page 2 of 21 Safe Harbor Statements in this presentation that are not reported financial results or other historical information are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on current plans, estimates and expectations, and are not guarantees of future performance. They are based on management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. The parties undertake no obligation to publicly update or revise any forward-looking statement. The risks and uncertainties relating to the forward-looking statements in this presentation include those described under the caption “Cautionary Factors that May Affect Future Results” in the parties’ respective Annual Reports for 2007, Quarterly Reports for the quarter ended June 30, 2008 and in the September 8, 2008 press release announcing Altria’s agreement to acquire UST Inc. |

Page 3 of 21 Other Information In connection with the proposed acquisition, UST intends to file relevant materials with the SEC, including a proxy statement on Schedule 14A. INVESTORS AND SHAREHOLDERS ARE URGED TO READ UST’S PROXY STATEMENT AND ALL RELEVANT DOCUMENTS FILED WITH THE SEC (WHEN THEY BECOME AVAILABLE) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain the documents free of charge through the website maintained by the SEC at www.sec.gov. A free copy of the proxy statement and other relevant documents, when they become available, also may be obtained from UST Inc., 6 High Ridge Park, Building A, Stamford, Connecticut 06905-1323, Attn: Investor Relations. Investors and security holders may access copies of the documents filed with the U.S. Securities and Exchange Commission by UST on its website at www.ustinc.com. Such documents are not currently available. |

Page 4 of 21 Other Information Altria and UST and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from UST’s shareholders in connection with the merger. Information about Altria’s directors and executive officers is set forth in Altria’s proxy statement on Schedule 14A filed with the SEC on April 24, 2008 and Altria’s Annual Report on Form 10-K filed on February 28, 2008. Information about UST’s directors and executive officers is set forth in UST’s proxy statement on Schedule 14A filed with the SEC on March 24, 2008 and UST’s Annual Report on Form 10-K filed on February 22, 2008. Additional information regarding the interests of participants in the solicitation of proxies in connection with the merger will be included in the proxy statement that UST intends to file with the SEC. |

Page 5 of 21 |

Page 6 of 21 Altria & UST: Transaction Overview Altria agrees to acquire UST for $69.50 per share in cash – 28.9% premium to three-month average UST share price $11.7 billion enterprise value for UST – Includes assumption of $1.3 billion of debt – EV / EBITDA multiple of 12.1x Subject to UST shareholder approval and customary regulatory approvals |

Page 7 of 21 Altria & UST: Compelling Strategic Rationale Expected to: Create total tobacco platform with premier tobacco brands including Marlboro, Copenhagen, Skoal and Black & Mild Generate annual synergies of approximately $250 million by 2011 Be accretive to Altria’s adjusted diluted earnings per share within twelve months of closing Enhance Altria’s ability to generate an attractive total shareholder return that is expected to exceed its 12% goal Diversify Altria’s revenues and operating income |

Page 8 of 21 Altria’s Acquisition Criteria Fits with Altria’s mission of owning and developing businesses that responsibly provide superior branded products to adult tobacco consumers Enhances Altria’s ability to increase revenues and earnings growth rates over the long-term Exceeds Altria’s financial return hurdle rates Utilizes and complements Altria’s existing strengths and infrastructure Allows Altria to leverage its strong and flexible balance sheet |

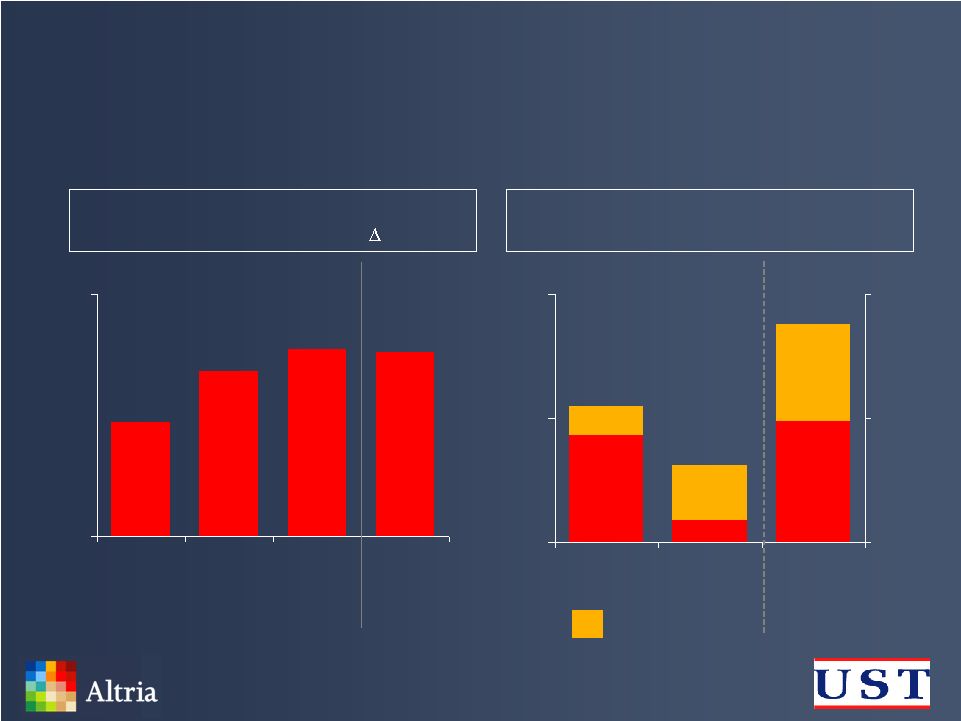

Page 9 of 21 Tobacco Category Dynamics MST Category Growth (Can Shipments - Yearly ) Tobacco Companies’ Profit Pools (2007 Estimates – in Billions) Other Mfrs Source: NSDUH 2006 (Adult users), Maxwell Reports (April 2007), ACNielsen, Swedish Match 2007 Annual Report, Altria internal estimates and *UST RAD-SVT 26weeks ended 6/14/08 per UST 2Q 2008 Press Release July 24, 2008 $1.1 $0.6 PM USA Middleton USSTC $8.8 $0.0 $1.0 $2.0 MST Large Mass Cigars Cigarettes $0.0 $5.0 $10.0 6.8% 7.7% 7.6% 4.7% 0% 10% 2005 2006 2007 2008 6 Months YTD* |

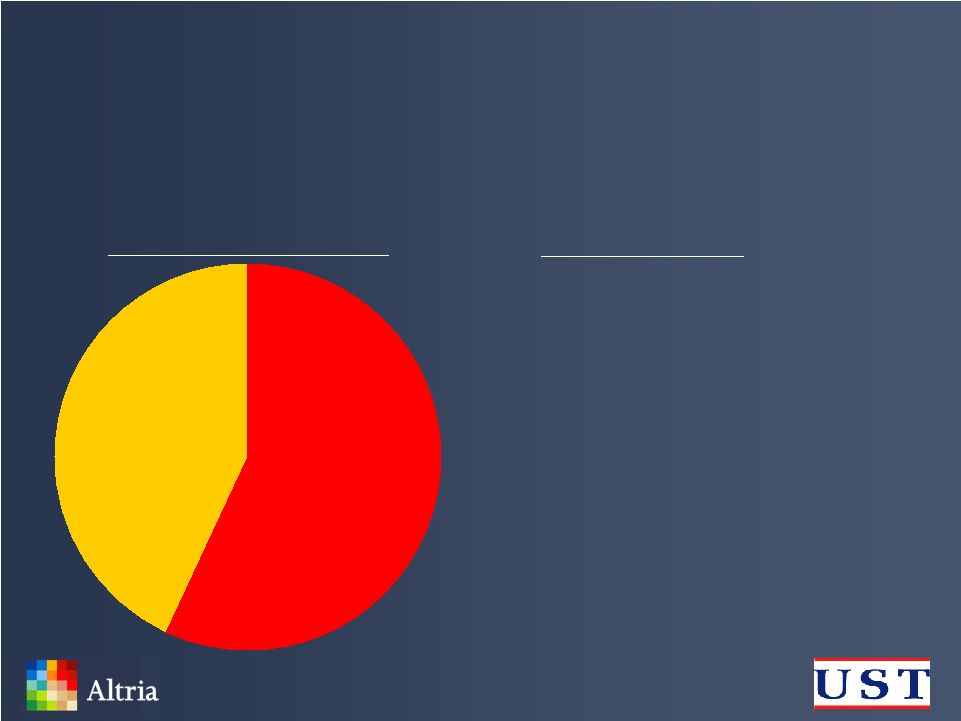

Page 10 of 21 US Smokeless Tobacco’s Operating Profile Over 70% of category’s pre-tax profit pool (1) 56% adjusted operating margins (2) 58% share of the MST category (3) Copenhagen and Skoal have a combined category share of almost 50% (4) Source: (1) UST internal estimates for 2007; (2) UST Q4 2007 Press Release; Reconciliations of non-GAAP measures included in this presentation to most comparable GAAP measures are set forth on a subsequent slide and also are available on Altria’s and UST’s respective websites at altria.com and ustinc.com; (3) UST Q2 2008 Press Release July 24, 2008; (4) UST internal estimates |

Page 11 of 21 |

Page 12 of 21 |

Page 13 of 21 USSTC’s Brands Lead the Smokeless Category Share of MST Category USSTC’s Brands • Copenhagen • Skoal • Red Seal • Husky Source: UST Q2 Earnings Press Release July 24, 2008 |

Page 14 of 21 Altria’s and UST’s Common Philosophies Responsibly marketing high quality premium-branded products Investing in brand-building equity programs Developing innovative new products Reducing costs through disciplined cost management Addressing societal concerns relevant to their respective businesses |

Page 15 of 21 Expected Acquisition Benefits to UST Combines experience and knowledge in managing highly profitable premium brands Provides access to more comprehensive infrastructure and resources of Altria’s companies Enhances efficiency and profitability |

Page 16 of 21 Expected Acquisition Benefits to Altria Accretive to Altria’s adjusted diluted earnings per share within twelve months of closing Generates an attractive double-digit economic return Grows and diversifies Altria’s revenues and operating income Leverages Altria’s strong balance sheet |

Page 17 of 21 Altria’s Anticipated Cash Return to Shareholders Modified three-year (2008-2010) $4.0 billion share repurchase program – Spent $1.2 billion purchasing shares in 2008 – Expect to resume purchasing shares in 2009 Altria anticipates a 75% dividend payout ratio post-transaction – Current annualized dividend rate of $1.28 per common share |

Page 18 of 21 Altria & UST: Planning and Approvals Transition planning by companies to occur over the coming months Transaction subject to UST shareholder and customary regulatory approvals which will be pursued promptly |

Page 19 of 21 Altria & UST: A Compelling Transaction Demonstrates Altria’s commitment to deliver superior shareholder return over the long-term Advances Altria’s mission to own and develop businesses that are leaders in responsibly providing adult tobacco consumers with superior branded products |

Page 20 of 21 |

Page 21 of 21 Regulation G Disclosure Reconciliation – Non-GAAP Financial Measures Source: UST Q4 2007 Press Release, reconciliation between GAAP and non-GAAP financial measures. ($ - Millions) 2007 Smokeless Tobacco GAAP Operating Profit 715.7 $ Other Items: Antitrust litigation 137.1 Restructuring charges 8.2 Adj. non-GAAP operating profit (excluding above items) 861.0 $ Smokeless Tobacco net sales 1,546.6 $ Adj. Operating Margin 55.7% (2007 Adj. non-GAAP operating profit divided by 2007 smokeless tobacco net sales) Reconciliation to UST Inc.'s 2007 Reported Financial Statements |