UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

VBI VACCINES INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: | |

| 2. | Aggregate number of securities to which transaction applies: | |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4. | Proposed maximum aggregate value of transaction: | |

| 5. | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1. | Amount previously paid: | |

| 2. | Form, Schedule or Registration Statement No.: | |

| 3. | Filing Party: | |

| 4. | Date Filed: |

VBI Vaccines Inc.

April 26, 2021

Dear Shareholders of VBI Vaccines Inc. (the “Company” or “we”):

We are pleased to inform you that the Annual General Meeting of Shareholders of VBI Vaccines Inc. will be held on Wednesday, June 9, 2021, at 12:30 p.m., Eastern Time, at the offices of the Company, located at 222 Third St., Suite 2240, Cambridge, MA 02142.

As of the date of this notice we are intending to hold the Annual Meeting in a physical format; however, as part of our precautions regarding the ongoing COVID-19 pandemic, we also have a contingency plan in place to move to a hybrid format by adding the option for online/teleconference participation or a virtual meeting format by way of online/teleconference participation only. As entry to the physical location of the Annual Meeting may be limited due to the requirements of applicable laws or orders restricting the size of public gatherings, either of these alternatives would enable remote participation by shareholders at the Annual Meeting. If we take this step, we will announce the decision to do so as soon as practicable, and not less than one week prior to the Annual Meeting, via a press release that will be filed with the SEC as proxy material and on SEDAR. The updated details will also be posted on our website at https://www.vbivaccines.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information.

The attached Notice of Annual Meeting of Shareholders and proxy statement describe the formal business that we will transact at the Annual Meeting.

The Board of Directors of the Company has determined that an affirmative vote on each matter set forth herein for a vote is in the best interest of the Company and its shareholders and unanimously recommends a vote “For” in all such matters considered at the Annual Meeting.

Your vote is very important, independent of the number of shares you own. Regardless of the format of the Annual Meeting, we strongly encourage you to please read the Proxy Statement and promptly submit your proxy by internet, telephone, or mail prior to the Annual Meeting.

On behalf of the Board of Directors and the employees of VBI Vaccines Inc., we thank you for your continued support.

| Sincerely, | |

| /s/ Jeffrey Baxter | |

| Jeffrey Baxter | |

| President and Chief Executive Officer |

If you have any questions, please email IR@vbivaccines.com or call us at (617) 830-3031 x128

VBI VACCINES INC.

222 Third Street, Suite 2241

Cambridge, MA 02142

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

| DATE: | Wednesday, June 9, 2021 |

| TIME: | 12:30 p.m. Eastern Time |

| PLACE: | 222 Third Street, Suite 2240 |

| Cambridge, MA 02142 |

As of the date of this Proxy Statement we are intending to hold the Annual Meeting in a physical format; however, as part of our precautions regarding the ongoing COVID-19 pandemic, we also have a contingency plan in place to move to a hybrid format by adding the option for online/teleconference participation or a virtual meeting format by way of online/teleconference participation only. As entry to the physical location of the Annual Meeting may be limited due to the requirements of applicable laws or orders restricting the size of public gatherings, either of these alternatives would enable remote participation by shareholders at the Annual Meeting. If we take this step, we will announce the decision to do so as soon as practicable, and not less than one week prior to the Annual Meeting, via a press release that will be filed with the SEC as proxy material and on SEDAR. The updated details will also be posted on our website at https://www.vbivaccines.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information. Regardless of the format of the Annual Meeting, we strongly encourage you to vote your shares by proxy via internet, telephone, or mail prior to the Annual Meeting.

| ITEMS OF BUSINESS: | At the Annual Meeting, we will consider and act on the following items of business, which are more fully described in the accompanying proxy statement (the “Proxy Statement”): | |

| (1) | Election of the nominated directors of the Company to serve until the next annual meeting or until the appointment or election and qualification of their successors (“Proposal 1”). | |

(2) | Approval of the appointment of EisnerAmper LLP as the independent registered public accounting firm of the Company until the next annual meeting of shareholders, and authorization of the audit committee of the board of directors of the Company to fix EisnerAmper LLP’s remuneration (“Proposal 2”). | |

| (3) | Transaction of any other business properly brought before the Annual Meeting or any adjournment thereof. | |

| RECORD DATE: | The record date for the Annual Meeting is April 16, 2021 (the “Record Date”). Only shareholders of record as of close of business on that date may vote at the Annual Meeting or at any postponement(s) or adjournment(s) of the Annual Meeting. |

| NOTICE OF INTERNET AVAILABILITY: | Following the same process as last year, we will be using the “Notice and Access” method of providing proxy materials to you via the Internet instead of mailing printed copies. We believe that this process will provide you with a convenient and quick way to access the proxy materials, including the accompanying Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2020 (the “Annual Report”), while also allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. Accordingly, unless otherwise specifically requested by a particular shareholder, shareholders of record at the close of business on April 16, 2021, will receive a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) with details on accessing the proxy materials for the Annual Meeting. Beneficial holders of the Common Shares at the close of business on the Record Date will receive separate notices on behalf of their brokers, banks or other intermediaries through which they hold our Common Shares. |

| PROXY VOTING: | All shareholders as of close of business on the Record Date are cordially invited to attend the Annual Meeting. If you choose to attend the Annual Meeting, please read the accompanying Proxy Statement carefully to ensure that you have proper evidence of share ownership as of April 16, 2021 in order to vote at the Annual Meeting. |

| If your shares are registered in your name, even if you plan to attend the Annual Meeting or any postponement or adjournment of the Annual Meeting, we request that you vote by telephone, over the internet, or if you requested to receive printed proxy materials, complete, sign and mail your proxy card to ensure that your shares will be represented at the Annual Meeting. | |

| If your shares are held in the name of a broker, trust, bank or other nominee, and you receive notice of the Annual Meeting through your broker or through another intermediary, please vote or complete and return the materials in accordance with the instructions provided to you by such broker or other intermediary or contact your broker directly in order to obtain a proxy issued to you by your nominee holder to vote at the Annual Meeting. Failure to do so may result in your shares not being eligible to be voted by proxy at the Annual Meeting. |

| By Order of the Board of Directors, | |

| /s/ Jeffrey Baxter | |

| Jeffrey Baxter | |

| President and Chief Executive Officer |

Cambridge, MA

April 26, 2021

| i |

PROXY STATEMENT

FOR THE 2021 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TABLE OF CONTENTS

| ii |

VBI Vaccines Inc.

222 Third Street, Suite 2241

Cambridge, MA 02142

PROXY STATEMENT

FOR THE 2021 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 9, 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

Our official Notice of Annual Meeting of Shareholders, proxy statement (the “Proxy Statement”), and our Annual Report on Form 10-K for the year ended December 31, 2020 (the “Annual Report”) are available at https://materials.proxyvote.com/91822J

This Proxy Statement is being furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of VBI Vaccines Inc. (which may be referred to in this Proxy Statement as the “Company,” “VBI,” “we,” “us,” or “our”) to be voted at the 2021 annual general meeting (the “Annual Meeting”) of the holders of the common shares of the Company (the “Common Shares”) to be held on June 9, 2021, at 12:30 p.m., Eastern Time, at the offices of the Company, located at 222 Third St., Suite 2240, Cambridge, MA 02142.

As of the date of this Proxy Statement we are intending to hold the Annual Meeting in a physical format; however, as part of our precautions regarding the ongoing COVID-19 pandemic, we also have a contingency plan in place to move to a hybrid format by adding the option for online/teleconference participation or a virtual meeting format by way of online/teleconference participation only. As entry to the physical location of the Annual Meeting may be limited due to the requirements of applicable laws or orders restricting the size of public gatherings, either of these alternatives would enable remote participation by shareholders at the Annual Meeting. If we take this step, we will announce the decision to do so as soon as practicable, and not less than one week prior to the Annual Meeting, via a press release that will be filed with the SEC as proxy material and on SEDAR. The updated details will also be posted on our website at https://www.vbivaccines.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information.

Our Board has fixed the close of business on April 16, 2021 (the “Record Date”) as the record date for determining the shareholders entitled to notice of and to vote at the Annual Meeting and any adjournment or postponements thereof. This Proxy Statement and accompanying form of proxy are expected to be first provided to shareholders on or about April 26, 2021.

In accordance with the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”), unless otherwise requested by a particular shareholder, we are mailing to our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) instead of a paper copy of the proxy materials and providing shareholders access to the proxy materials for the Annual Meeting over the Internet, which we believe allows us to provide our shareholders with the information they need in a timely manner while reducing the environmental impact and costs associated with our Annual Meeting.

Accordingly, if you are a shareholder of record (meaning those persons whose names appear on the records of the Company as a registered holder of Common Shares, each a “Registered Shareholder”), and you did not previously request proxy materials be sent to you via e-mail, a one-page Notice of Internet Availability has been mailed to you on or about April 26, 2021. Registered Shareholders may access the proxy materials on the website https://materials.proxyvote.com/91822J or request a printed set of the proxy materials be sent to them by following the instructions in the Notice of Internet Availability. The Notice of Internet Availability also explains how you may request that we send future proxy materials to you by e-mail or in printed form by mail. If you choose the e-mail option, you will receive an e-mail next year with links to those materials and to the proxy voting site should you remain a shareholder of record at that time. We encourage you to choose this e-mail option, which will allow us to provide you with the information you need in a more-timely manner while also helping us to conserve natural resources and save the cost of printing and mailing documents to you. Your election to receive proxy materials by e-mail or in printed form by mail will remain in effect until you terminate it.

In this Proxy Statement, references to “Beneficial Shareholders” means shareholders who do not hold Common Shares in their own name; “Intermediaries” refers to brokers, investment firms, clearing houses and similar entities that hold securities on behalf of Beneficial Shareholders. For more information, please refer to the question 11 in the “About the Meeting: Questions and Answers and Procedural Matters” section below.

If you are a Beneficial Shareholder and received Annual Meeting materials, you did not receive these materials directly from us; instead, your Intermediary forwarded you a notice with instructions on accessing our proxy materials and directing that Intermediary on how to vote your Common Shares, as well as other options that may be available to you for receiving our proxy materials.

| 1 |

About The Meeting: Questions and Answers AND PROCEDURAL MATTERS

1. What is a proxy?

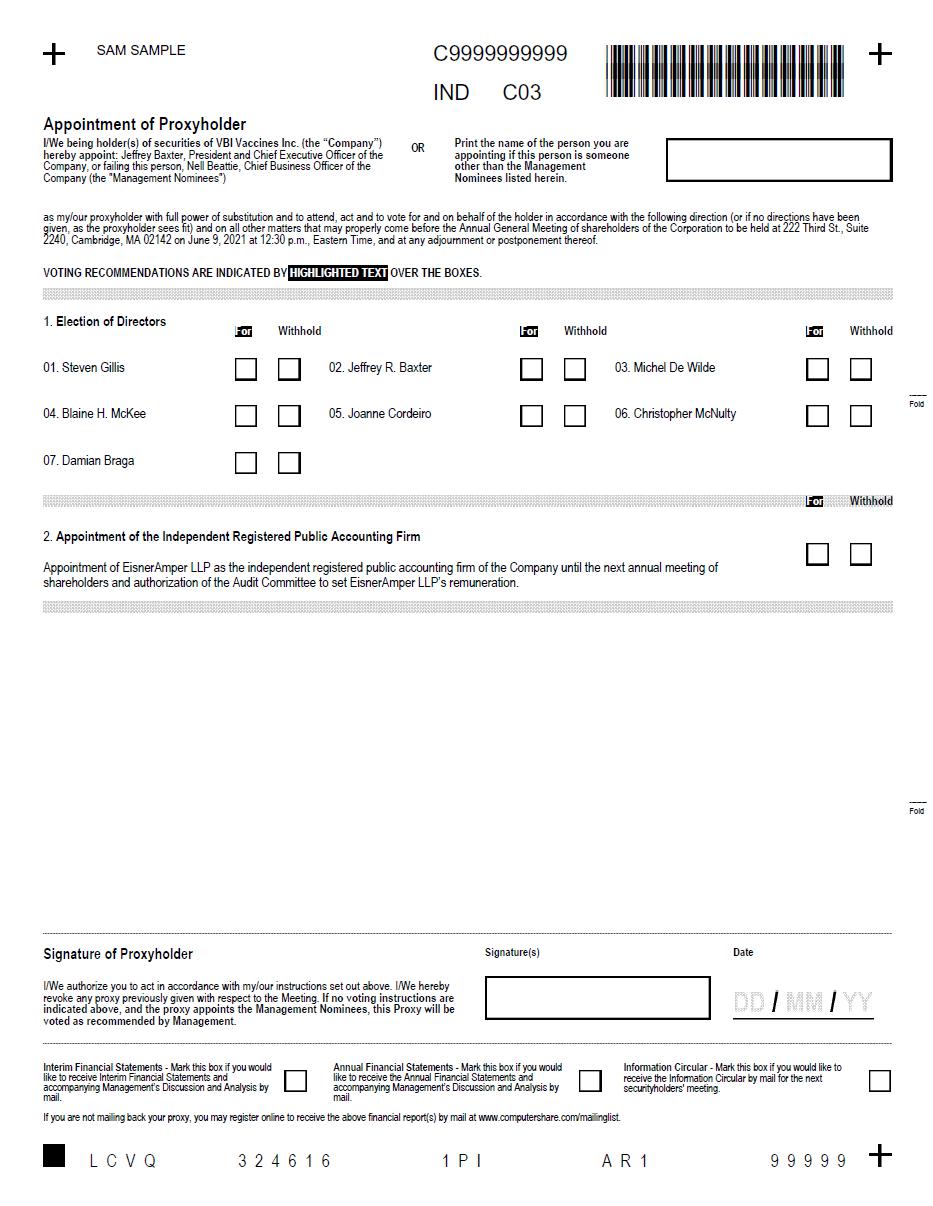

A proxy is a person you appoint to vote, or withhold a vote, on your behalf in accordance with your instructions as a Registered Shareholder or a Beneficial Shareholder. If you specify a choice with respect to any matter to be acted upon, the proxy will vote accordingly. If you are a Registered Shareholder and you submit your proxy to us by using any of the methods described below in question 14, “How can I vote my Common Shares without attending the Annual Meeting?”, you will be appointing Jeffrey Baxter, our President and Chief Executive Officer, or, failing him, Nell Beattie, our Chief Business Officer, as your proxy (together, the “Management Proxyholders”). The Management Proxyholders will have the authority to appoint a substitute to act as proxy. Regardless of whether or not you are able to attend the Annual Meeting, we encourage you to please vote by proxy so that your Common Shares may be voted at the Annual Meeting.

You also have the right to appoint a person other than the Management Proxyholders to represent you at the Annual Meeting by striking out the names of the Management Proxyholders in the accompanying form of proxy and by inserting the desired proxyholder’s name in the blank space provided. A proxyholder need not be a shareholder.

2. What is a proxy statement?

A proxy statement is a document provided by the Company to you, as required by SEC regulations (also referred to as an “information circular” under Canadian securities laws), in which we ask you to sign a proxy card to vote your Common Shares at the Annual Meeting.

3. Why am I receiving these proxy materials?

As of the Record Date, April 16, 2021, you were a Registered Shareholder or Beneficial Shareholder of VBI Vaccines Inc. We have made the proxy materials available, either on the Internet or in printed form, to all shareholders on record. We do this in order to solicit voting proxies for use at our Annual Meeting to be held on June 9, 2021, at 12:30 p.m., Eastern Time, and at any adjournment or postponement thereof.

If you are a Registered Shareholder and you submit your proxy to us, you direct the Management Proxyholders to vote your Common Shares in accordance with the voting instructions in your proxy.

If you are a Beneficial Shareholder and received Annual Meeting materials through your Intermediary and you follow the voting instructions provided in the notice you received from your Intermediary, you direct such Intermediary to vote your Common Shares in accordance with your instructions.

These proxy materials are being made available or distributed to you on or about April 26, 2021.

4. What proposals will be voted on at the Annual Meeting?

The proposals to be voted on by the holders of our Common Shares as of the Record Date at the Annual Meeting are:

| (1) | The election of directors, such nominees as set forth herein, to serve until the next annual meeting or until the appointment or election and qualification of their successors; |

(2) | The appointment of EisnerAmper LLP as the independent registered public accounting firm of the Company until the next annual meeting of shareholders, and the authorization of the audit committee of the Board (the “Audit Committee”) to set EisnerAmper LLP’s remuneration; and |

| (3) | The transaction of any other business properly brought before the Annual Meeting or any adjournments thereof. |

| 2 |

5. What is the record date and what does it mean?

The record date is a date identified by the Board, as required by the Business Corporations Act (British Columbia) (the “BCBCA”), such that only registered holders of Common Shares on that date are entitled to notice of and to vote at the Annual Meeting. The record date for our 2021 Annual Meeting is the close of business on April 16, 2021 (the “Record Date”). On the Record Date, 254,195,435 Common Shares were issued and outstanding.

6. Who is entitled to vote at the Annual Meeting?

Holders of Common Shares at the close of business on the Record Date may vote at the Annual Meeting.

7. Can I attend the Annual Meeting?

You may attend the Annual Meeting if you were a Registered Shareholder or a Beneficial Shareholder as of the Record Date. If you decide to attend the Annual Meeting in-person, you will be asked to show photo identification and the following:

| ● | if you are a Registered Shareholder, your Notice of Internet Availability, or admission ticket that you received with a paper proxy card or that you obtained from our shareholder voting site at www.investorvote.com; or | |

| ● | if you are a Beneficial Shareholder, the notice you received from your Intermediary, or a printed statement from such organization, or online access to your brokerage or other account showing your Common Share ownership on the Record Date. |

We will not be able to accommodate guests without proper evidence of Common Share ownership as of the Record Date at the Annual Meeting, including guests of our shareholders.

You should not attend the Annual Meeting in-person if you are or have been experiencing any cold or flu-like symptoms, or if you have been in contact with someone that has had such symptoms, within 14 days prior to the Annual Meeting. Regardless of whether or not you attend the Annual Meeting, we strongly encourage you to vote your shares by proxy via internet, telephone, or mail prior to the Annual Meeting.

8. When is the Annual Meeting?

The Annual Meeting will be held on June 9, 2021. Check-in and seating for the Annual Meeting starts at 12:15 p.m., Eastern Time. The Annual Meeting will begin promptly at 12:30 p.m., Eastern Time. Please leave ample time for the check-in procedures.

9. Where is the Annual Meeting?

The Annual Meeting will be held at the offices of the Company, located at 222 Third St., Suite 2240, Cambridge, MA 02142.

10. What happens if a change to the Annual Meeting is necessary due to exigent circumstances?

As of the date of this Proxy Statement we intend to hold the Annual Meeting in a physical format; however, as part of our precautions regarding the ongoing COVID-19 pandemic, we also have a contingency plan in place to move to a hybrid format by adding the option for online/teleconference participation or a virtual meeting format by way of online/teleconference participation only. As entry to the physical location of the Annual Meeting may be limited due to the requirements of applicable laws or orders restricting the size of public gatherings, either of these alternatives would enable remote participation by shareholders at the Annual Meeting. If we take this step, we will announce the decision to do so as soon as practicable, and not less than one week prior to the Annual Meeting, via a press release that will be filed with the SEC as proxy material and on SEDAR. The updated details will also be posted on our website at https://www.vbivaccines.com/. Please monitor our press releases and check our website regularly until the Annual Meeting for updated information. Regardless of the format of the Annual Meeting, we strongly encourage you to vote your shares by proxy via internet, telephone, or mail prior to the Annual Meeting.

11. What is the difference between holding Common Shares as a Registered Shareholder or as a Beneficial Shareholder?

You are a Registered Shareholder if: Common Shares are registered directly in your name on the share register of the Company, which is maintained and kept by the Company’s transfer agent, Computershare Trust Company of Canada. If you are a Registered Shareholder, we have sent the Notice of Internet Availability directly to you. As a Registered Shareholder, you may grant your voting proxy directly to the Company or to a third party, or you may vote at the Annual Meeting.

You are a Beneficial Shareholder if: Common Shares are listed in an account statement provided to you by an Intermediary, where in almost all cases those Common Shares will not be registered in your name on the share register of the Company. Such Common Shares will more likely be registered in the name of your Intermediary or an agent of your Intermediary.

If you are a Beneficial Shareholder, you did not receive a Notice of Internet Availability directly from the Company, but your Intermediary forwarded you a notice together with voting instructions (a “VIF”) for directing the Intermediary on how to vote your Common Shares. As a Beneficial Shareholder, you may also attend the Annual Meeting, but because a Beneficial Shareholder is not a Registered Shareholder, you may not vote at the Annual Meeting unless you obtain a “legal proxy” as set forth in the VIF from your Intermediary, which will grant you or your nominee the right to attend and vote at the Annual Meeting.

| 3 |

Beneficial Shareholders who have not objected to their intermediary disclosing certain ownership information about themselves to the Company are referred to as “non-objecting beneficial owners” (“NOBOs”). Those non-registered holders who have objected to their intermediary disclosing ownership information about themselves to the Company are referred to as “objecting beneficial owners” (“OBOs”).

For NOBOs, the Company is not sending the Notice of Internet Availability directly to NOBOs in connection with the Annual Meeting, but rather has distributed copies of the Notice of Internet Availability (and where specifically requested, the printed proxy materials) to Intermediaries for distribution to NOBOs.

For OBOs, the Company does not intend to pay for Intermediaries to deliver the Notice of Internet Availability (and where specifically requested, the printed proxy materials) and Form 54-101F7 – Request for Voting Instructions Made by Intermediary to OBOs. As a result, OBOs will not receive the Annual Meeting materials unless their Intermediary assumes the costs of delivery.

12. How many votes do I have?

Each Common Share of VBI has one vote. The number of votes you have corresponds to the number of Common Shares of VBI you owned at the close of business on the Record Date, pursuant to the rights of our shareholders contained in our organizational documents. Each vote may be voted on each matter to be voted upon at the Annual Meeting. VBI’s Common Shares are its only outstanding class of shares.

13. How can I vote my Common Shares at the Annual Meeting?

If you are a Registered Shareholder, you may vote your Common Shares at the Annual Meeting.

If you are a Beneficial Shareholder, you may vote your Common Shares at the Annual Meeting only if you obtain a “legal proxy” from your Intermediary, giving you the right to vote the Common Shares. Even if you plan to attend the Annual Meeting, we recommend that you also direct the voting of your Common Shares by proxy as described below in the question 14, so that your vote will be counted even if you later decide not to attend the Annual Meeting.

14. How can I vote my Common Shares without attending the Annual Meeting?

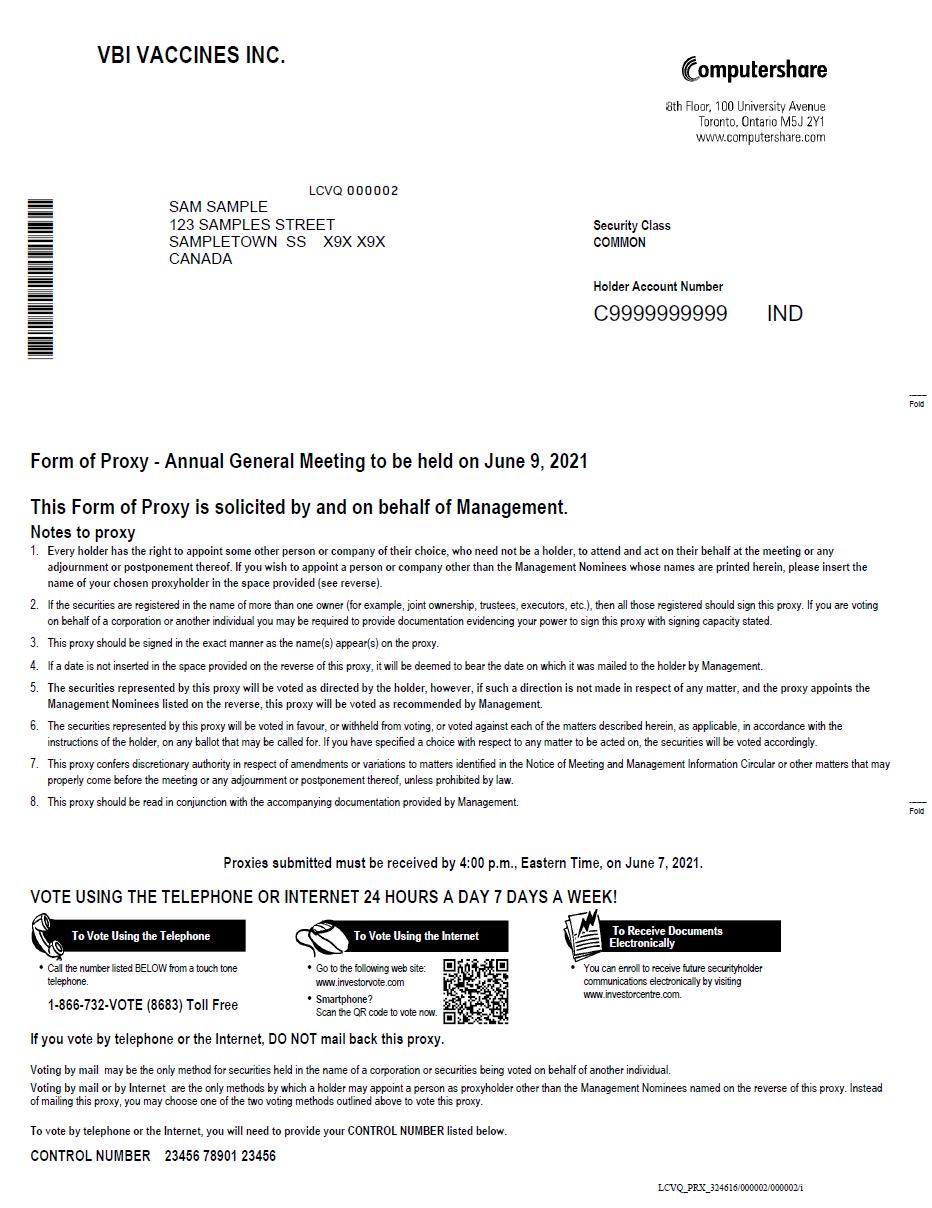

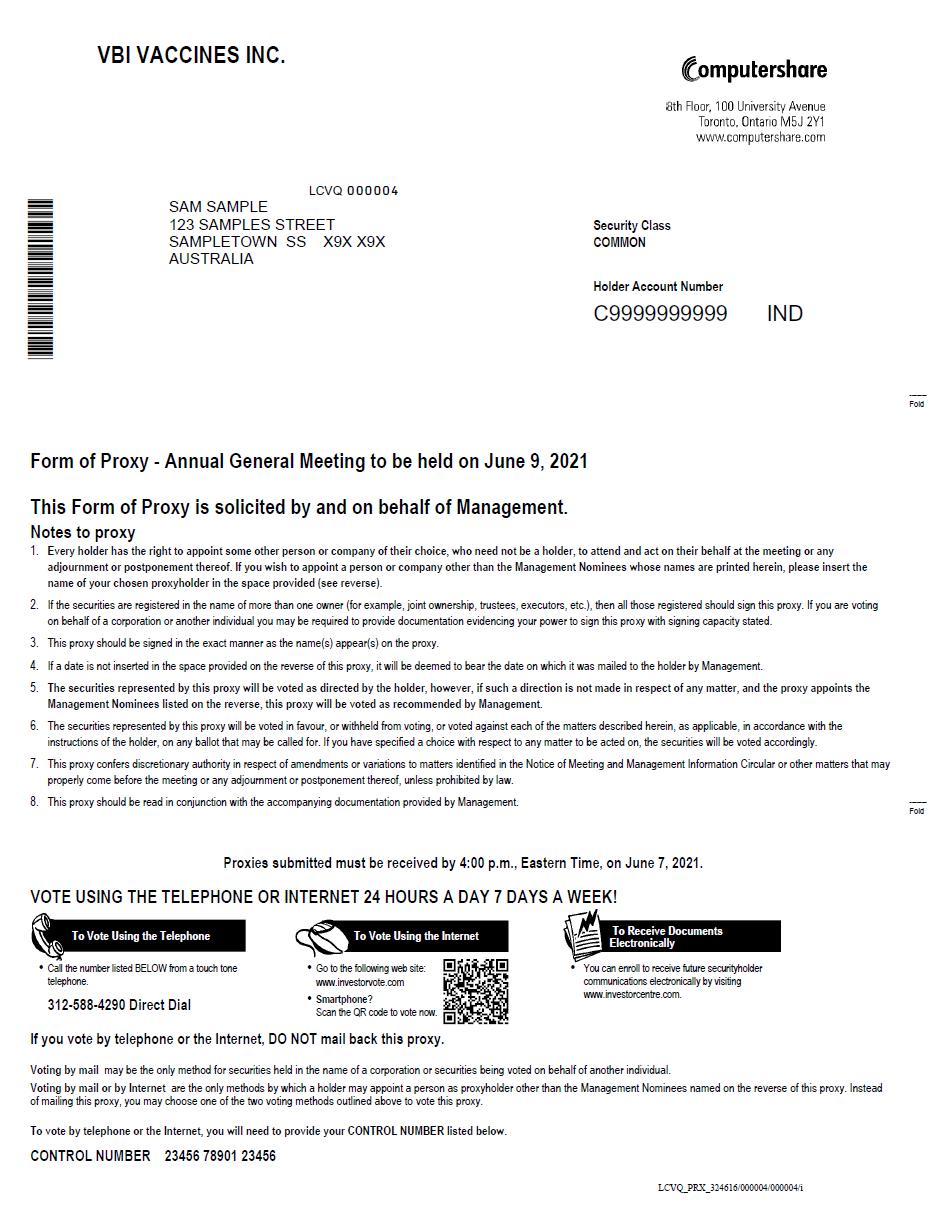

If you are a Registered Shareholder, you may vote your Common Shares without attending the Annual Meeting. Registered Shareholders may vote in any of the three ways listed below, but in each case, your vote must be received by the Company by 4:00 p.m., Eastern Time, on June 7, 2021, being two business days before the Annual Meeting:

| ● | Vote by Internet: Registered Shareholders with Internet access may submit proxies by following the “Vote by Internet” instructions on the Notice of Internet Availability. | |

| ● | Vote by Telephone: Registered Shareholders who live in the United States or Canada can vote by touchtone telephone using the toll-free telephone number on the proxy card following the procedures in the Notice of Internet Availability, and can submit proxies by telephone by following the “Vote by Telephone” instructions on the proxy card. | |

| ● | Vote by Mail: Registered Shareholders may request a paper proxy card from VBI by following the procedures in the Notice of Internet Availability. If you elect to vote by mail, please complete, sign and date the proxy card where indicated and return it in the prepaid envelope included with the proxy card. |

If you are a Beneficial Shareholder, you should carefully follow the specific instructions noted on the VIF in order to ensure that your Common Shares are voted at the Annual Meeting.

If you submit an incomplete proxy card, then for proposals without voting instructions, the designated proxies will vote your shares in the manner described under “What is the effect of not casting a vote or if I submit a proxy but do not specify how my Common Shares are to be voted?” (question 21) below.

| 4 |

15. What is the quorum requirement for the business to be conducted at the Annual Meeting?

A quorum of shareholders is necessary to hold a valid Annual Meeting. Under the Company’s Articles, the quorum for the transaction of business at a meeting of shareholders is two shareholders, or one or more proxyholders representing two members, or one member and a proxyholder representing another member. Notwithstanding the quorum provisions of the Company’s Articles, pursuant to the rules of the NASDAQ Stock Market LLC (“NASDAQ”), the Company is required to have a minimum quorum of at least one third of the outstanding shares represented by shareholders present at the Annual Meeting or by proxy. On the Record Date, there were 254,195,435 shares outstanding and entitled to vote. Thus 84,731,812 shares must be represented by shareholders in attendance at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker) or you vote at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

If within one-half hour from the time set for the Annual Meeting, a quorum is not present, the Annual Meeting stands adjourned to the same day in the next week at the same place.

16. What vote is required to approve each proposal?

Proposal 1: Election of Directors. For an uncontested election, the affirmative vote of the holders of Common Shares having a majority of the votes cast by the holders of all Common Shares present or represented by proxy and voting on such matter will be required to elect each nominee as a director. The Majority Voting Policy (as discussed in the section below titled “Proposal 1 – Election of Directors”) provides that, at a meeting for the uncontested election of directors (being an election where the number of nominees for director is not greater than the number of directors to be elected), each director of the Company that is not elected by the affirmative vote of the holders of Common Shares having a majority of the votes cast by the holders of all Common Shares present or represented and voting on such matter must promptly tender his resignation. You may choose to vote, or withhold your vote, separately for each nominee. A properly executed proxy or voting instructions marked “WITHHOLD” with respect to the election of one or more directors will not be voted in favor of the director or directors indicated although it will be counted for the purposes of determining whether there is a quorum.

Proposal 2: Approval of the Appointment of EisnerAmper LLP as the independent registered public accounting firm of the Company until the next annual meeting of shareholders, and authorization of the Audit Committee to set EisnerAmper LLP’s remuneration. The affirmative vote of the holders of Common Shares having a majority of the votes cast by the holders of all Common Shares present or represented and voting on such matter will be required to approve the appointment of the Company’s independent registered public accounting firm until the next annual meeting of shareholders and to authorize the Audit Committee to set EisnerAmper LLP’s remuneration. Under the BCBCA, unless waived unanimously by shareholders, the shareholders of a company must, by ordinary resolution, appoint an authorized person as auditor to hold office until the next annual meeting of shareholders.

Other Proposals. Any other proposal that might properly come before the meeting will require the affirmative vote of the holders of Common Shares having a majority of the votes cast by the holders of all Common Shares present or represented by proxy and voting on such matter at the meeting in order to be approved, except when a different vote is required by law, or the Company’s articles (i.e., the British Columbia equivalent of a U.S. corporation’s bylaws), as amended from time to time (the “Articles”).

17. Who is our Independent Registered Public Accounting Firm and will they be represented at the Annual Meeting?

VBI’s shareholders approved the appointment of EisnerAmper LLP as the independent registered public accounting firm of the Company on June 18, 2020, to serve for the ensuing year. Accordingly, EisnerAmper LLP served as the independent registered public accounting firm auditing and reporting on our financial statements for the fiscal year ended December 31, 2020. We expect that representatives of EisnerAmper LLP will be present telephonically at the Annual Meeting. They will have an opportunity to make a statement, if they desire, and will be available to answer appropriate questions at the Annual Meeting.

18. When will the next shareholder advisory vote on executive compensation occur?

At our 2017 Annual Meeting of Shareholders, we submitted to shareholders an advisory vote on whether an advisory vote on executive compensation should be held every one, two or three years. “Three years” was the frequency that received the highest number of votes. In light of such outcome, we hold an advisory vote on executive compensation every three years (with the last vote having occurred in 2020). The next “say-on-pay” vote is expected to occur at the annual meeting of our shareholders in 2023.

We will submit to shareholders an advisory vote on the frequency of the advisory vote on executive compensation at the annual meeting of our shareholders in 2023, as well.

19. What votes will be counted?

All Common Shares entitled to vote and that are voted in person at the Annual Meeting will be counted, and all Common Shares represented by properly-executed and unrevoked proxies received by 4:00 p.m., Eastern Time, on June 7, 2021, being two business days before the Annual Meeting, will be voted at the Annual Meeting as indicated in such proxies.

You may vote “FOR” or “WITHHOLD” on each of the nominees for election as director (Proposal 1) and on the appointment of EisnerAmper LLP as auditor for the ensuing year and authorizing the Audit Committee of the Board to set EisnerAmper LLP’s remuneration (Proposal 2).

The Common Shares represented by your proxy will be voted or withheld from voting in accordance with your instructions on any ballot that may be called for and, if you specify a choice with respect to any matter to be acted upon, your Common Shares will be voted accordingly.

| 5 |

20. What are the recommendations of our Board on how I should vote my shares?

The recommendations of our Board are set forth together with the description of each proposal in this Proxy Statement. In summary, however, the Board recommends a vote:

| ● | FOR the election of the nominated directors (see Proposal 1); | |

●

| FOR the approval of the appointment EisnerAmper LLP as the independent registered public accounting firm of the Company to serve until the next annual meeting of shareholders, and the authorization of the Audit Committee of the Board to set EisnerAmper LLP’s remuneration (see Proposal 2). |

21. What is the effect of not casting a vote or of submitting a proxy that does not specify how my Common Shares are to be voted?

If you are a Registered Shareholder and you do not vote by proxy card, by telephone, via the Internet, or at the Annual Meeting, your Common Shares will not be voted at the Annual Meeting. If you submit a proxy, but you do not provide voting instructions, your Common Shares will be voted as recommended by the Board.

If you are a Beneficial Shareholder and you do not provide your Intermediary with voting instructions, the Intermediary will determine if it has the discretionary authority to vote on the particular matter.

22. What is the effect of an Intermediary non-vote?

An Intermediary will have the discretion to vote on routine proposals if it has not received voting instructions from a Beneficial Shareholder at least 10 calendar days prior to the Annual Meeting. An Intermediary non-vote occurs when an Intermediary that is otherwise counted as present or represented by proxy does not receive voting instructions from the Beneficial Shareholder and does not have the discretion to vote the Common Shares. An Intermediary non-vote will not impact our ability to obtain a quorum for the Annual Meeting and will not otherwise affect the approval of a majority of the votes present in person or represented by proxy and entitled to vote for any Proposals.

23. What happens if additional matters are presented at the Annual Meeting?

If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place, the named proxyholders will vote the proxies held by them as recommended by the Board or, if no recommendation is given, in their own discretion. We do not intend to bring any other matter for a vote at the Annual Meeting, and we do not know of anyone else who intends to do so.

24. Can I change my vote?

If you are a Registered Shareholder, you may change or revoke your vote by:

| ● | submitting a new proxy bearing a later date (which automatically revokes the earlier proxy, but is received by the Company no later than 4:00 p.m., Eastern Time, on June 7, 2021) using any of the voting methods described above in the question 14; or | |

| ● | providing a signed written notice of your revocation to VBI Vaccines Inc. at 222 Third Street, Suite 2241, Cambridge, MA 02142, Attn: Chief Business Officer, which must be received at any time up to and including 12:30 pm, Eastern Time, on the last business day preceding the date of the Annual Meeting; or | |

| ● | attending the Annual Meeting and providing a signed written notice revoking your proxy to the Chair of the Annual Meeting, which will supersede any proxy previously submitted by you. |

However, please note that merely attending the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically request it.

If you are a Beneficial Shareholder and you wish to change or revoke your vote, you should do the following:

| ● | contact your Intermediary and carefully follow the instructions provided by your Intermediary to revoke your VIF and submit new voting instructions; or | |

| ● | if you have obtained a legal proxy from your Intermediary giving you the right to vote your Common Shares, attend the Annual Meeting and vote at the meeting. |

However, in either case, please consult your Intermediary for any specific rules it may have regarding your ability to change your voting instructions.

| 6 |

25. What is “householding” and how does it affect me?

We and some US brokers have adopted “householding,” a procedure under which shareholders who have the same address will receive a single Notice of Internet Availability or set of proxy materials, unless one or more of these shareholders provides notice that they wish to continue receiving individual copies. If you participate in householding and wish to receive a separate Notice of Internet Availability or set of proxy materials, or if you wish to receive separate copies of future notices, annual reports, and proxy statements, please contact your broker directly, or VBI Vaccines Inc., 222 Third Street, Suite 2241, Cambridge, MA 02142, Attn: Chief Business Officer, telephone number 617-830-3031 x128.

We hereby undertake to deliver promptly, upon written or oral request, a copy of the Notice of Internet Availability to a shareholder at a shared address to which a single copy of the document was delivered. Requests should be directed to the address or phone number set forth above.

SEC rules permit companies to send you a notice that proxy information is available on the Internet, instead of mailing you a complete set of materials. As such, we have elected to distribute proxy information in this manner.

26. Why am I receiving more than one Notice of Internet Availability, notice from my Intermediary, or set of proxy materials, and what should I do?

You may receive more than one Notice of Internet Availability, notice from your Intermediary, or set of proxy materials, including multiple copies of proxy cards or VIFs.

For example:

| ● | If you are a Registered Shareholder and your Common Shares are registered in more than one name, you will receive more than one Notice of Internet Availability or proxy card. | |

| ● | If you are a Beneficial Shareholder with Common Shares in more than one brokerage account, you may receive a separate notice or VIF for each brokerage account in which your Common Shares are held. |

Please complete, sign, date and return each proxy card or VIF that you receive, and follow the voting instructions on each Notice of Internet Availability or other notice you receive to ensure that all your Common Shares are voted.

27. Who will serve as inspector of election at the Annual Meeting?

A representative from Computershare Trust Company of Canada will act as the inspector of election (scrutineer) and count the votes at the Annual Meeting.

| 7 |

28. Where can I find the voting results of the Annual Meeting?

Within four business days following the Annual Meeting, the final voting results will be published in a press release and will also be available in a Current Report on Form 8-K, filed with the SEC and made available on its website at www.sec.gov, and in an equivalent Report of Voting Results, filed with the Canadian Securities Administrators (the “CSA”) and made available on www.SEDAR.com.

29. Who will bear the cost of soliciting votes for the Annual Meeting?

VBI will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes. We may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing Beneficial Shareholders for their reasonable expenses in forwarding solicitation material to NOBOs. Our directors, officers, and employees may also solicit proxies in person or by other means. These directors, officers, and employees will not be additionally compensated but may be reimbursed for reasonable out-of-pocket expenses incurred in doing so.

30. What percentage of our Common Shares do our directors and executive officers own?

As of the Record Date, our director-nominees and executive officers beneficially owned approximately 7.8% of our outstanding Common Shares. See the discussion under the heading “Security Ownership of Certain Beneficial Owners and Management” on page 39 for more details.

31. Do I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Annual Meeting?

No. None of our shareholders have any dissenters’ or appraisal rights with respect to the matters to be voted on at the Annual Meeting.

32. I have additional questions, who can help answer them?

The information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the information contained in this Proxy Statement. We urge you to carefully read this entire Proxy Statement, including the documents we refer to in this Proxy Statement. If you have any questions, or need additional material, please feel free to email IR@vbivaccines.com.

The proxy card gives the persons named as proxyholders discretionary authority regarding amendments or variations to matters identified in the Notice of Meeting, this Proxy Statement and any other matter that may properly come before the Annual Meeting. As of the date of this Proxy Statement, management is not aware of any such amendment, variation, or other matter proposed or likely to come before the Annual Meeting. However, if any amendment, variation, or other matter properly comes before the Annual Meeting, it is the intention of the persons named in the accompanying form of proxy to vote the shares represented by the proxies held by them in accordance with applicable law and their judgment on such matters.

IF YOU DO NOT SPECIFY A VOTE ON YOUR PROXY CARD OR YOU VOTE FOR BOTH CHOICES, YOUR COMMON SHARES WILL BE VOTED IN FAVOR OF THE MOTIONS PROPOSED TO BE MADE AT THE ANNUAL MEETING AS SET OUT IN THE NOTICE OF MEETING AND THIS PROXY STATEMENT.

| 8 |

Our business, property and affairs are managed by, or under the direction of, our Board, in accordance with the BCBCA and the Articles of the Company. Members of the Board are kept informed of our business through discussions with the Chief Executive Officer and other key members of management, by reviewing materials provided to them by management, and by participating in meetings of the Board and its committees. There are no family relationships among any of our directors, executive officers or persons nominated to become a director.

We continue to review our corporate governance policies and practices by comparing our policies and practices with those suggested by various groups or authorities active in evaluating or setting best practices for corporate governance of public companies. Based on this review, we have adopted, and will continue to adopt, changes that the Board believes are the appropriate corporate governance policies and practices for our Company.

Shareholders may communicate with the members of the Board, either individually or collectively, by writing to the Board at VBI Vaccines Inc., 222 Third Street, Suite 2241, Cambridge, MA 02142. These communications will be reviewed by the office of the Chief Business Officer, as agent for the non-employee directors in facilitating direct communication to the Board. The Chief Business Officer’s office will treat communications containing complaints relating to accounting, internal accounting controls or auditing matters as reports under our Code of Business Conduct and Ethics (“Code of Ethics”). Further, the Chief Business Officer’s office will disregard communications that are bulk mail, solicitations to purchase products or services not directly related either to us or the non-employee directors’ roles as members of the Board, sent other than by shareholders in their capacities as such or from particular authors or regarding particular subjects that the non-employee directors may specify from time to time, and all other communications which do not meet the applicable requirements or criteria described below, consistent with the instructions of the non-employee directors.

General Communications. The Chief Business Officer’s office will review all shareholder communications directly relating to our business operations, the Board, our officers, our activities or other matters and opportunities closely related to us. From time to time, as needed, the Chief Business Officer will circulate summaries of shareholder communications and copies of the actual shareholder communications to the Chairperson of our Nominating and Governance Committee.

Shareholder Proposals and Director Nominations and Recommendations. Shareholder proposals are reviewed by the Chief Business Officer’s office for compliance with the requirements for such proposals set forth in our Articles, the BCBCA, and Regulation 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Shareholder proposals that meet these requirements will be summarized by the Chief Business Officer’s office. Summaries and copies of the shareholder proposals are circulated to the Chairperson of the Nominating and Governance Committee.

Shareholder nominations for directors are reviewed by the Board for compliance with the requirements for director nominations that are set forth in our Articles. Shareholder nominations for directors that meet these requirements are then circulated to the Chairperson of the Nominating and Governance Committee for consideration and evaluation by the Nominating and Governance Committee consisting entirely of independent directors.

The Nominating and Governance Committee will consider director candidates recommended by shareholders. If a director candidate is recommended by a shareholder, the Nominating and Governance Committee expects to evaluate such candidate in the same manner it evaluates director candidates it identifies. Shareholders desiring to make a recommendation to the Nominating and Governance Committee should follow the procedures set forth herein and in the Company’s Articles regarding shareholder nominations for directors.

Retention of Shareholder Communications. Any shareholder communications that are not circulated to the Chairperson of the Nominating and Governance Committee because they do not meet the applicable requirements or criteria described above will be retained by the Chief Business Officer’s office for at least 90 calendar days from the date on which they are received, so that these communications may be reviewed by the directors generally if such information relates to the Board as a whole, or by any individual to whom the communication was addressed, should any director elect to do so.

Distribution of Shareholder Communications. Except as otherwise required by law or upon the request of a non-employee director, the Chairperson of the Nominating and Governance Committee will determine when and whether a shareholder communication should be circulated among one or more members of the Board and/or Company management.

| 9 |

In determining the independence of our directors, we apply the definition of “independent director” provided under the listing rules of The NASDAQ and National Instrument 58-101 – Disclosure of Corporate Governance Practices of the Canadian Securities Administrators (“CSA”) (“NI 58-101”). Pursuant to these rules, the Nominating and Governance Committee concluded its review of director independence on April 16, 2021. The Board affirmatively determined that each of Drs. Gillis (the Chairperson), De Wilde and McKee, Ms. Cordeiro, and Mr. Braga (being the majority of the Board) is independent under these rules, since none of these directors have a direct or indirect material relationship with the Company or its subsidiaries. In making its independence determinations, the Nominating and Governance Committee sought to identify and analyze all of the facts and circumstances relating to any relationship between a director, his/her immediate family or affiliates and VBI and its affiliates and did not rely on categorical standards other than those contained in the NASDAQ rule and NI 58-101 referenced above.

Mr. Baxter is not an independent member of the Board because he is the Chief Executive Officer and President of the Company and thus has a material interest in the Company. Mr. McNulty is not an independent member of the Board because he is the Chief Financial Officer and Head of Business Development and thus has a material interest in the Company.

The independent directors are not expected to hold regularly scheduled meetings at which non-independent directors and members of management are not in attendance. To facilitate the Board’s exercise of independent judgement in carrying out its responsibilities where deemed necessary by the independent directors, the independent directors hold sessions exclusive of the non-independent directors and members of management, which process facilitates open and candid discussion amongst the independent directors. At the end of each Board call or meeting, the independent directors have the option to hold executive sessions, as needed, where non-independent directors and members of management are not in attendance. In 2020, such executive sessions were held at the end of 5 Board Meetings. To-date in 2021, no such session has been held.

The Board held 12 meetings during the year ended December 31, 2020. Attendance was as follows: Mr. Baxter (12); Dr. De Wilde (10); Dr. Gillis (12); Dr. McKee (12); Ms. Cordeiro (12); Mr. McNulty (12); and Mr. Braga (10). Mr. Braga joined the Board on March 9, 2020.

The Board held 3 meetings between January 1, 2021 and April 26, 2021. Attendance was as follows: Dr. Gillis (3); Mr. Baxter (3); Dr. De Wilde (3); Dr. McKee (3); Ms. Cordeiro (2); Mr. McNulty (3); Mr. Braga (3).

Each member of our Board attended at least 75% of the aggregate of (i) the total number of meetings of the Board (held during the period for which he or she was a director) and (ii) the total number of meetings held by all committees of the Board on which such director served (held during the period that such director served).

We encourage our Board members to attend the annual meeting each year. One of the seven directors attended our 2020 Annual General Meeting of Shareholders.

A copy of the Board Mandate, adopted as of September 23, 2016 can be viewed on our website at www.vbivaccines.com (under the “Investors” section). Among other things, the Board Mandate includes written position descriptions for the Chairperson of the Board and the respective Chairpersons of each of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee, as well as the Chief Executive Officer.

The Board has three standing committees, the Audit Committee, the Compensation Committee, and the Nominating and Governance Committee. The following table provides the current membership, for each committee:

| Name | Audit Committee | Compensation Committee | Nominating & Governance Committee | |||

| Steven Gillis, Ph.D. | X | X | Chair | |||

| Jeffrey Baxter | ||||||

| Damian Braga | X | |||||

| Joanne Cordeiro | X | Chair | X | |||

| Michel De Wilde, Ph.D. | X | |||||

| Blaine McKee, Ph.D. | Chair | |||||

| Christopher McNulty | ||||||

| Total Meetings in 2020 | 4 | 1 | 1 |

| 10 |

Below is a description of each committee of the Board:

Audit Committee

The role of the Audit Committee is to:

| ● | oversee the Company’s accounting and financial reporting processes; | |

| ● | review management’s maintenance of internal controls and procedures for financial reporting; | |

| ● | advise our Board with respect to our compliance with applicable legal and regulatory requirements, including without limitation, those requirements relating to financial controls and reporting; | |

| ● | oversee the independent auditor’s qualifications and independence; | |

| ● | oversee the performance of the independent auditors, including the annual independent audit of our financial statements; | |

| ● | prepare the report required by the rules of the SEC to be included in our Proxy Statement; and | |

| ● | discharge such duties and responsibilities as may be required of the Committee by the provisions of applicable law, rule or regulation. |

Our Audit Committee is comprised of Blaine McKee, Steven Gillis and Joanne Cordeiro, with Dr. McKee serving as Chairperson.

Our Nominating and Governance Committee has determined each of Dr. Gillis, Dr. McKee, and Ms. Cordeiro to be financially literate and qualify as independent directors under Section 5605(a)(2) and Section 5605(c)(2)(A) of the NASDAQ rules. Further, each member of our Audit Committee is also considered independent under SEC Rule 10A-3. In addition, Dr. McKee qualifies as the audit committee financial expert within the meaning of Item 407(d)(5) of Regulation S-K. The Audit Committee operates pursuant to a charter, the current copy of which can be viewed on our website at www.vbivaccines.com (under the “Investors” section).

During 2020, the Audit Committee met by video conference four times.

Report of the Audit Committee of the Board of Directors

The Audit committee has reviewed and discussed the Company’s audited consolidated financial statements and related footnotes for the year ended December 31, 2020, and the independent auditor’s report on those financial statements, with management and with our independent auditor, EisnerAmper LLP. The Audit Committee has also discussed with EisnerAmper LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the SEC. The Audit Committee has also received the written disclosures and the letter from EisnerAmper LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding EisnerAmper LLP’s communications with the audit committee concerning independence, and has discussed with EisnerAmper LLP that firm’s independence.

Based on the review and discussions referred to in the preceding paragraph, the Audit Committee recommended to the Board that the consolidated financial statements audited by EisnerAmper LLP for the fiscal year ended December 31, 2020 be included in its Annual Report on Form 10-K for such fiscal year that was filed with the SEC.

VBI Vaccines Inc.

Audit Committee of the Board

Blaine McKee, Chairperson

Steven Gillis

Joanne Cordeiro

| 11 |

Compensation Committee

The purpose of the Compensation Committee is to aid the Board in meeting its responsibilities with regard to oversight and determination of executive compensation. Among other things, the Compensation Committee reviews, recommends and approves salaries and other compensation of the Company’s executive officers, and will administer the Company’s equity incentive plans (including reviewing, recommending and approving stock option and other equity incentive grants to executive officers). A copy of the current charter of the Compensation Committee is available on our website at www.vbivaccines.com (under the “Investors” section).

The Compensation Committee may form and delegate a subcommittee consisting of one or more members to perform the functions of the Compensation Committee. To ensure an objective process for determining compensation, the Compensation Committee may engage outside advisers, including outside auditors, attorneys and consultants, as it deems necessary to discharge its responsibilities. The Compensation Committee has sole authority to retain and terminate any compensation expert or consultant to be used to provide advice on compensation levels, including sole authority to approve the fees of any expert or consultant and other retention terms. In addition, the Compensation Committee considers, but is not bound by, the recommendations of our Chief Executive Officer with respect to the compensation packages of our other executive officers.

Our Compensation Committee is comprised of Joanne Cordeiro, Steven Gillis, and Michel De Wilde, with Ms. Cordeiro serving as Chairperson.

Each of Ms. Cordeiro, Dr. Gillis, and Dr. De Wilde, is considered independent in accordance with the NASDAQ rules, an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended, and a “non-employee director” for purposes of Section 16b-3 under the Exchange Act, and do not have a relationship with the Company which is material to their ability to be independent from management in connection with the duties of a compensation committee member, as described in Section 5605(d)(2) of the NASDAQ rules. Such members are also considered independent in accordance with NI 58-101.

During 2020, the Compensation Committee met by video conference one time.

Compensation Committee Interlocks and Insider Participation

None of our executive officers currently serve, or in the past year have served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board or Compensation Committee.

| 12 |

Nominating and Governance Committee

The role of the Nominating and Governance Committee is, among other things, to:

| ● | nominate and recommend nominees for the Board and submit the names of such nominees to the full Board for their approval; | |

| ● | evaluate the composition, independence, size and governance of the Board and its committees and make recommendations regarding future planning and appointment of directors to the committees; and | |

| ● | establish a policy for considering shareholder nominees for election to our Board. |

A copy of the current charter of the Nominating and Governance Committee (the “Nominating and Governance Committee Charter”) is available on our website at www.vbivaccines.com (under the “Investors” section).

Our Nominating and Governance Committee is comprised of Steven Gillis, Damian Braga, and Joanne Cordeiro, with Dr. Gillis serving as committee Chairperson.

| ● | Between April 17, 2019 and March 24, 2020, the Nominating and Governance committee was comprised of Dr. Gillis (committee Chairperson), Dr. De Wilde, and Ms. Cordeiro. |

The Board has determined that all members of our Nominating and Governance Committee are independent under the NASDAQ rules and NI 58-101.

During 2020, the Nominating and Governance Committee met by video conference one time.

The Board and each individual director are periodically assessed regarding its or their effectiveness and contribution. The assessment considers: (i) in the case of the Board, its mandate; and (ii) in the case of an individual director, the competencies and skills he/she is expected to possess in the context of the current composition of the Board. This process is done informally by the Chairperson of the Board and other Directors on an as-needed basis, and done formally each year as part of the discussion at the Nominating and Governance Committee meeting. Board self-evaluation assessments are conducted every three years. The most recent Board self-evaluation assessment was conducted in 2019, and the next such assessment is anticipated to occur in 2022.

Orientation for new directors includes meetings with the Chief Executive Officer, and other members of senior management, as well as with existing directors, including and notably the Chairperson of the Board. As needed, further documentation regarding VBI or the industry is offered, as are invitations to visit any of the three Company sites.

The Nominating and Governance Committee is responsible for identifying candidates for Board positions, vetting the proposed candidate and ensuring the competencies and skills possessed by the candidate meet expectations for a director of the Company, and then nominating such candidates for election to our Board. All of the members of the Nominating and Governance Committee are independent.

The Board seeks independent directors who represent a diversity of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. Candidates should have substantial experience with one or more publicly-traded companies or should have achieved a high level of distinction in their chosen fields. The Board is particularly interested in maintaining a mix that includes individuals who are active or retired executive officers and senior executives, particularly those with experience in immunology; research and development; market access and commercialization; finance and accounting.

There is no difference in the manner in which the Nominating and Governance Committee evaluates nominees for director based on whether the nominee is recommended by a shareholder. In evaluating nominations to the Board, the Nominating and Governance Committee also looks for certain personal attributes, such as integrity, ability and willingness to apply sound and independent business judgment, comprehensive understanding of a director’s role in corporate governance, availability for meetings and consultation on Company matters, and the willingness to assume and carry out fiduciary responsibilities. Each of the candidates nominated for election to our Board was recommended by the Nominating and Governance Committee.

| 13 |

Procedures by which Shareholders may Recommend Nominees to our Board of Directors

There have been no material changes to the procedures by which shareholders may recommend nominees to our Board.

Effective September 25, 2013, shareholders of the Company approved an amendment to the Articles of the Company and adopted advance notice provisions (the “Advance Notice Provisions”). The Advance Notice Provisions include, among other things, a provision that requires advance notice be given to the Company in circumstances where nomination of persons for election to the Board are made by shareholders of the Company. The Advance Notice Provisions set a deadline by which shareholders must submit nominations (a “Notice”) for the election of directors to the Company prior to any annual or special meeting of shareholders. The Advance Notice Provisions also set forth the information that a shareholder must include in the Notice to the Company, and establish the form in which the shareholder must submit the Notice for that notice to be in proper written form.

In the case of an annual meeting of shareholders, a notice must be provided to the Company not less than 30 days and not more than 65 days prior to the date of the annual meeting.

As of the date of this Proxy Statement, the Company has not received Notice of a nomination in compliance with the Advance Notice Provisions.

Director Term Limits and Other Mechanisms of Board Renewal

In the fall of 2014, the CSA introduced policies requiring companies to either adopt or explain why they have not adopted policies with respect to term limits for directors. As a result, the Board adopted the below policy on term limits in April 2020.

The Board has not adopted term limits for directors or other mechanisms of board renewal as it believes the implementation of term limits may cause unnecessary disruption in the continuity and expertise of the Board. Moreover, term limits may also be detrimental to the Company as it may result in the loss of experience and expertise on the Board due to arbitrary determinations. The Board believes that the ongoing review of the qualification and effectiveness of the Board sufficiently aligns the composition of the Board against the varying and developing needs of the Company and that long tenure does not necessarily impair a director’s ability to act independently of management.

Diversity of the Board of Directors and Executive Officers

Similarly, in the fall of 2014, the CSA introduced policies requiring companies to either adopt or explain why they have not adopted policies and targets designed to increase participation by women in board matters and in executive positions.

The Company is committed to diversity among its Board and its executive officers. The ability to incorporate a wide range of viewpoints, backgrounds, skills, and experience is critical to the Company’s success. By bringing together individuals with varying backgrounds, expertise, and perspectives into an inclusive and collaborative work environment, we believe we can better achieve our corporate objectives and deliver long-term, sustained value for our shareholders.

The Company recognizes that gender diversity is a significant aspect of diversity and acknowledges the important role that women with appropriate and relevant skills and experience can play in contributing to the diversity of thought on the Board and on the executive team. As such, when reviewing and assessing the qualifications of possible nominees to the Board, the Nominating and Governance Committee is guided by the following considerations:

| ● | the competencies and skills necessary for the Board as a whole should possess; | |

| ● | the experience and skill each new nominee will bring to the Board; | |

| ● | the diversity of the Board as a whole and whether the new nominee would enhance such diversity; and | |

| ● | whether the nominees can devote sufficient time and resources to his or her duties as a Board member. |

Due to the size of the Company and Board, our activities, and our current number of employees across three geographies, we have not yet set measurable objectives or adopted a formal policy for achieving gender diversity on the Board or for women in executive officer positions. However, the Nominating and Governance Committee and the Company continue to monitor and consider the level of female representation on the Board and in executive officer positions and, where appropriate, aim to recruit qualified female candidates as part of the selection process to fill vacancies. The Company will consider establishing measurable objectives as it develops further.

One of six (17%) of the Company’s executive officers are female. The Company currently has one female director (14%) and such director is being nominated to serve as a director of the Company until the next Annual Meeting or until the appointment or election and qualification of her successor.

Code of Business Conduct and Ethics

We have adopted the Code of Business Conduct and Ethics applicable to our principal executive officer and principal financial and accounting officer and any persons performing similar functions. In addition, the Code of Business Conduct and Ethics applies to our employees, officers, directors, agents, and representatives. The Code of Business Conduct and Ethics requires, among other things, that our employees avoid conflicts of interest, comply with all laws and other legal requirements, conduct business in an honest and ethical manner and otherwise act with integrity and in the Company’s best interest. The Code of Business Conduct and Ethics is available on our website at www.vbivaccines.com (under the “Investors” section).

The Code of Business Conduct and Ethics includes procedures for reporting violations of the Code of Business Conduct and Ethics. These include reporting violations to an immediate manager, the CEO, or legal counsel, as necessary. Fraud or potential fraud must be reported to the whistler-blower email account, which is forwarded to the Chair of the Audit Committee and to internal counsel. The Whistleblower Policy is available on our website at www.vbivaccines.com (under the “Investors” section). In addition, the Sarbanes-Oxley Act of 2002, as amended, requires companies to have procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Code of Ethics is intended to comply with the rules of the SEC and includes these required procedures.

| 14 |

Our Board provides risk oversight for our entire company by receiving management presentations, including risk assessments, and discussing these assessments with management. The Board’s overall risk oversight, which focuses primarily on risks and exposures associated with current matters that may present material risk to our operations, plans, prospects or reputation, is supplemented by the various committees. The Audit Committee discusses with management and our independent registered public accounting firm our risk management guidelines and policies, our major financial risk exposures, and the steps taken to monitor and control such exposures. Our Compensation Committee oversees risks related to our compensation programs and discusses with management its annual assessment of our employee compensation policies and programs. Our Nominating and Governance Committee oversees risks related to corporate governance and management and director succession planning.

The Chairperson of the Board presides at all meetings of the Board at which he or she is present. The Board is committed to promoting effective, independent governance of the Company. Our Board believes it is in the best interests of the shareholders and the Company for the Board to have the flexibility to select the best director to serve as Chairperson at any given time, regardless of the independence of that director. Consequently, the Company has no fixed policy with respect to the separation of the offices of the Chairperson of the Board and Chief Executive Officer.

Currently, the offices of Chairperson of the Board and Chief Executive Officer are held by two different people. The Chief Executive Officer is responsible for the day-to-day leadership and performance of the Company, while the Chairperson of the Board provides guidance to the Chief Executive Officer and presides over meetings of the board. The Chairperson of the Board plays a critical role by leading the Board in its management and supervision of the business of the Company. The Board has developed written position descriptions for the Chief Executive Officer, the Chairperson of the Board, and the Chair of each of its committees. The Board believes that the separation of the offices of the Chairperson of the Board and Chief Executive Officer reinforces the independence of the Board in its oversight of the business and our affairs, and creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in the Company’s best interests, and in the best interest of the Company’s shareholders. The Board will review this determination from time to time.

Review, Approval, or Ratification of Transactions with Related Persons

The Board reviews issues involving potential conflicts of interest, and reviews and approves all related party transactions, including those required to be disclosed as a “related party” transaction under applicable federal securities laws. The Board has not adopted any specific procedures or a written policy for conducting reviews of potential conflicts of interest and considers each transaction in light of the specific facts and circumstances presented. However, to the extent a potential related party transaction is presented to the Board, the Company expects that the Board would become fully informed regarding the potential transaction and the interests of the related party, and would have the opportunity to deliberate outside of the presence of the related party. The Company expects that the Board would only approve a related party transaction that is in the best interests of the Company, and further would seek to ensure that any completed related party transaction was on terms no less favorable to the Company than could be obtained in a transaction with an unaffiliated third party. Other than as described under the section titled, “Certain Relationships and Related Transactions,” no transaction, that required disclosure under applicable federal securities laws and that occurred since the beginning of the fiscal year 2020, was submitted to the Board for approval as a “related party” transaction.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers, and persons who own more than 10% of a registered class of our equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of our Common Shares and other equity securities. Officers, directors, and greater-than-10% Shareholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

There were no late reports in the fiscal year ended December 31, 2020, under Section 16(a).

| 15 |

Election Of Directors

Majority Voting Policy

In accordance with good corporate governance practices and procedures, the Board adopted a majority voting policy on August 28, 2015 (the “Majority Voting Policy”). The Majority Voting Policy provides that, at a meeting for the uncontested election of directors (being an election where the number of nominees for director is not greater than the number of directors to be elected), each director of the Company must be elected by the vote of a majority of the Company’s Common Shares represented in person or by proxy at such meeting. The proxy card permits a shareholder to vote in favor of, or to withhold from voting, separately for each director nominee.

If, in an uncontested election of directors, the number of Common Shares withheld for a nominee exceeds the number of Common Shares voted for that nominee at the meeting, either in person or by proxy, that director must immediately tender his or her resignation. The Nominating and Governance Committee will expeditiously recommend to the Board whether or not to accept the resignation. The Board will accept the resignation absent exceptional circumstances and such resignation will be effective when accepted by the Board. In its deliberations, the Nominating and Governance Committee may consider such extenuating circumstances as it deems appropriate.

The Board shall determine whether or not to accept the resignation within 90 days of the relevant shareholders’ meeting. A director who tenders a resignation pursuant to the Majority Voting Policy will not participate in any meeting of the Board or meetings of the Nominating and Governance Committee of the Board at which the resignation is considered. The Company shall promptly issue a news release with the Board’s decision, which must fully state the reasons for that decision.

The Majority Voting Policy can be viewed on our website at http://www.vbivaccines.com (under the “Investors” section).

Nominees for Election

The Board currently is comprised of seven directors. If elected, each nominee agrees to serve until the next Annual Meeting or until the appointment or election and qualification of his or her successor. If any nominee is unable to stand for election, which circumstance we do not anticipate, the Board may provide for a lesser number of directors or designate a substitute. In the latter event, Common Shares represented by proxies may be voted for a substitute nominee. If a quorum is present at the Annual Meeting, the nominees will be elected by the vote of a majority of the Company’s Common Shares, represented in attendance or by proxy, at such meeting.

| 16 |

Our Board, upon the recommendation of the Nominating and Governance Committee, has nominated the seven (7) individuals listed in the table below, each an incumbent director, for election to serve as director. The following table sets forth information with respect to each nominee as of the date of this Proxy Statement:

| Name | Age | State of Residence | Position(s) & Held Since | Share Ownership(1) | ||||||||

| Steven Gillis, Ph.D.(2)(3)(4) | 67 | Washington, US | Chairperson of the Board, May 2016 | 13,687,943 | ||||||||

| Present & Former Principal Occupation, Business, or Employment for the Five Preceding Years | |

| ● | Chairperson and Director of the Company (May 2016 – present) |

| ● | Director of VBI DE (July 2014 – present) and VBI US (December 2006 – present) |