Carphone Warehouse Group plc PROPOSED ACQUISITION OF BEST BUY CO., INC.’S 50% SHARE IN CPW EUROPE PROPOSED FUNDING INCLUDING 9.99% CASHBOX PLACING Q4 TRADING UPDATE FOR THE QUARTER ENDED 31 MARCH 2013 THIS DOCUMENT IS CONFIDENTIAL AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES, CANADA, AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY JURISDICTION WHERE SUCH DISTRIBUTION IS UNLAWFUL. THIS DOCUMENT IS NOT AN OFFER OR INVITATION TO BUY OR SELL SECURITIES.

THIS DOCUMENT IS CONFIDENTIAL AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES, CANADA, AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY JURISDICTION WHERE SUCH DISTRIBUTION IS UNLAWFUL. THIS DOCUMENT IS NOT AN OFFER OR INVITATION TO BUY OR SELL SECURITIES. This document has been prepared and issued by and is the sole responsibility of Carphone Warehouse Group plc (the “Company”). This document is being supplied to you solely for your information. No information made available to you in connection with the presentation may be passed on, copied, summarised, referred to, reproduced or otherwise disseminated, directly or indirectly, to any other person or published, in whole or in part, without the written consent of the Company. The contents of this document are to be kept confidential. This document is only directed at persons in member states of the European Economic Area ("EEA") who are qualified investors within the meaning of Article 2(1)(e) of the Prospectus Directive (Directive 2003/71/EC) ("Qualified Investors"). In addition, in the United Kingdom, this document is addressed to and directed only at, Qualified Investors who (i) are persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "Order"), (ii) are persons who are high net worth entities falling within Article 49(2)(a) to (d) of the Order, or (iii) are other persons to whom this document may otherwise lawfully be communicated (all such persons together being referred to as "relevant persons"). This document must not be acted on or relied on (i) in the United Kingdom, by persons who are not relevant persons, and (ii) in any member state of the EEA other than the United Kingdom, by persons who are not Qualified Investors. Any investment or investment activity to which this document relates is available only to relevant persons in the United Kingdom and Qualified Investors in any member state of the EEA other than the United Kingdom, and will be engaged in only with such persons. This document and the information contained herein is not intended for publication or distribution in, and does not constitute an offer of securities in, the United States or to any U.S. person (as defined in Regulation S under the U.S. Securities Act of 1933, as amended (the "Securities Act"), Canada, Australia, Japan, South Africa or any other jurisdiction where such distribution or offer is unlawful. The Securities have not been and will not be registered under the Securities Act or with the securities regulatory authority of any state or other jurisdiction of the U.S.. By accepting the delivery of this document, the recipient warrants and acknowledges that it and any of its customers fall are outside the United States, as defined in Regulation S under the Securities Act. Neither this document nor any copy of it may be taken, transmitted or distributed, directly or indirectly, into the United States, its territories or possessions. Any failure to comply with the foregoing restrictions may constitute a violation of U.S. securities laws. 1

This document does not constitute or form part of any offer or invitation to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities of the Company or any related company nor shall it or any part of it nor the fact of its distribution form the basis of, or be relied on in connection with, any contractual commitment or investment decision in relation thereto nor does it constitute a recommendation regarding any securities. This document is intended to present information on a proposed acquisition by the Company and the Company's Q4 trading update and is not intended to provide complete disclosure upon which an investment decision could be made. Any investment decision should be made solely on the basis of publicly available information. The merit and suitability of an investment in the Company should be independently evaluated and any person considering such an investment in the Company is advised to obtain independent advice as to any applicable legal, regulatory, tax, accounting, financial, credit and other related issues prior to making an investment. Nothing herein should be construed as financial, legal, tax, accounting, actuarial or other specialist advice. In particular, nothing herein shall be taken as constituting the giving of investment advice and this document is not intended to provide, and must not be taken as, the basis of any investment decision or other valuation and should not be considered as a recommendation by the Company, Deutsche Bank AG, London Branch or UBS Limited (together the “Managers”) or any of their respective affiliates that any person makes any investment. Any person considering an investment in the Company must make its own independent assessment and such investigation as it deems necessary to determine its interest in making an investment. This document does not purport to contain all of the information that any such person may require to make a decision with regards to any investment. Before making any investment, each such person should take steps to ensure that it fully understands such investment and has made an independent assessment of the appropriateness of such investment in the light of its own objectives and circumstances, including the possible risks and benefits of entering into such investment. This document speaks as of the date hereof. The views expressed herein are subject to change based upon a number of factors, including, without limitation, macroeconomic and equity market conditions and other specific issues. This document does not purport to contain a complete description of the Company or the market in which the Company operates, nor does it provide an audited valuation of the Company. No reliance may be placed for any purposes whatsoever on the information contained in this document or on its completeness, accuracy or fairness. This document and any materials distributed in connection with this document may include certain “forward-looking statements”, beliefs or opinions, including statements with respect to the Company’s business, financial condition and results of operations. These statements, which may contain the words “anticipate”, “believe”, “intend”, “estimate”, “expect” and words of similar meaning, reflect the directors’ beliefs and expectations and involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. No representation or warranty is made that any of these statements or forecasts will come to pass or that any forecast results will be achieved. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by these statements and forecasts. Past performance of the Company cannot be relied on as a guide to future performance. Forward-looking statements speak only as at the date of this document and the Company expressly disclaims any obligations or undertaking to release any update of, or revisions to, any forward-looking statements in this document. No statement in this document is intended to be a profit forecast. As a result, you are cautioned not to place any undue reliance on such forward-looking statements. Neither Manager (nor any of their respective affiliates) has verified the achievability of any forward looking statements, nor of the methods underlying their preparation. 2

The document has not been independently verified and no representation or warranty, express or implied, is made or given by or on behalf of the Company, and/or the Managers or any of their respective affiliates, advisers or any person acting on their behalf, as to, and no reliance should be placed on, the accuracy, completeness, reasonableness or fairness of the information, opinions contained or any of the results that can be derived from opinions contained, in this document and no responsibility or liability is assumed by any such persons for any such information or opinions or for any errors or omissions. The Company, the Managers, its and their advisers and any of their respective affiliates, advisers or any person acting on their behalf are under no obligation to update, modify or otherwise revise or keep current information contained in this document, to correct any inaccuracies which may become apparent, or to notify any person in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate, or to publicly announce the result of any revision to the statements made herein except where they would be required to do so under applicable law, and any opinions expressed in them are subject to change without notice. Without limiting a person’s liability for fraud, no responsibility or liability is or will be accepted by any Manager (or any of their respective affiliates or any of their or their respective affiliates’ respective directors, officers, representatives, employees, advisers or agents) as to, or in relation to, this document, its contents, the accuracy, reliability, adequacy or completeness of the information used in preparing this document, any of the results that can be derived from this document or any discussions relating hereto. No audit of this document has been undertaken by an independent third party. Deutsche Bank AG is authorised under German Banking Law (competent authority: BaFin – Federal Financial Supervisory Authority) and authorised and subject to limited regulation by the UK Financial Conduct Authority. Details about the extent of Deutsche Bank AG's authorisation and regulation by the Financial Conduct Authority are available on request. UBS Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Each Manager is acting exclusively for the Company and no one else in connection with matters related to this document. Neither Manager will regard any other person (whether or not a recipient of this document) as a client in relation to such matters and will not be responsible to anyone other than the Company for providing the protections afforded to their respective clients nor for the giving of advice in relation to any transaction, matter or arrangement referred to in this document. By attending the presentation and/or accepting or viewing a copy of this document, you agree to be bound by the foregoing limitations and conditions and, in particular, will be taken to have represented, warranted and undertaken that you have read, understood and agreed to comply with the contents of this notice including, without limitation, the obligation to keep this document and its contents confidential. 3

Summary of Proposed Acquisition • Carphone Warehouse to acquire Best Buy Co., Inc.'s 50% share in CPW Europe for a net consideration of £471m • Net consideration funded by: • £250m in new bank debt • 9.99% cashbox placing of new equity • The issue of an £80m stake in Carphone Warehouse Group to Best Buy Co., Inc. (c.7.5% stake) • £50m cash to be deferred over two years • Global Connect relationship and joint venture with Best Buy in China and Mexico will come to an end. Global sourcing alliance to be maintained. • Expected completion in June 2013 (subject to shareholder approval) 4

Benefits of Proposed Acquisition • Simplified ownership structure; easier day-to-day management; streamlined decision making; leverage CPW Europe’s asset base and know-how • Simplified investment case; fully consolidated accounts • Full ownership of growth opportunities across Europe and other potential markets • Opportunity for significant value creation over the medium term • Intention to seek future Premium Listing and FTSE index inclusion Significantly earnings enhancing in current financial year 5

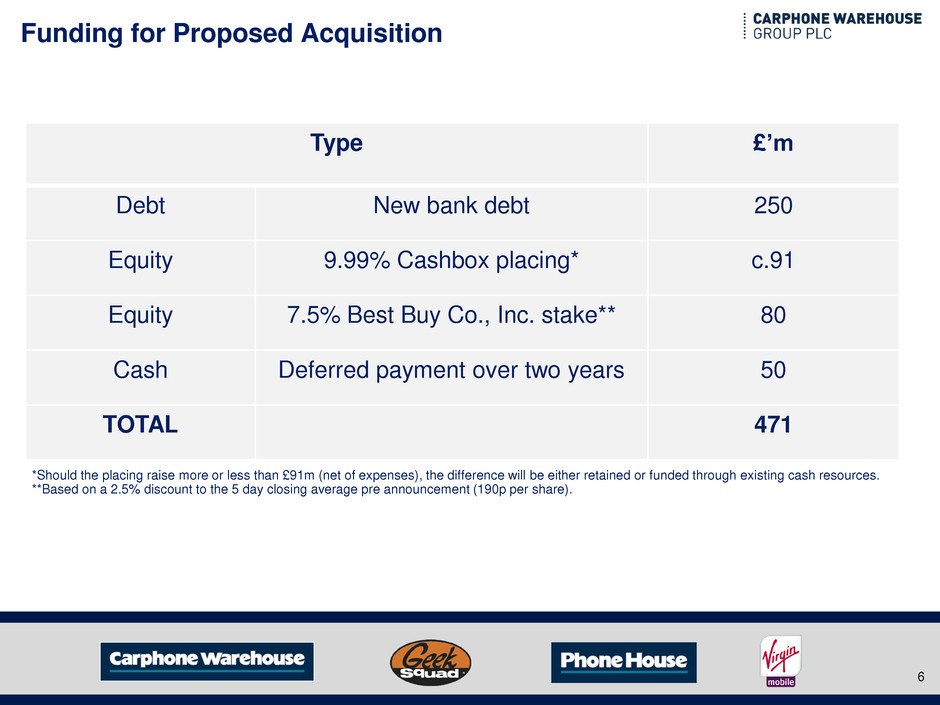

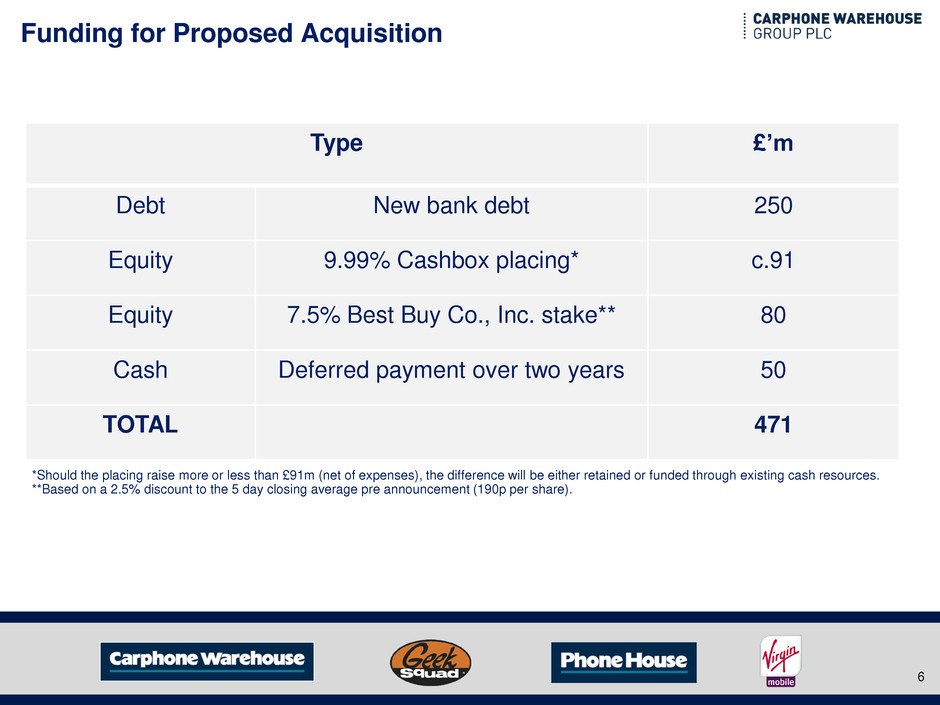

Funding for Proposed Acquisition *Should the placing raise more or less than £91m (net of expenses), the difference will be either retained or funded through existing cash resources. **Based on a 2.5% discount to the 5 day closing average pre announcement (190p per share). Type £’m Debt New bank debt 250 Equity 9.99% Cashbox placing* c.91 Equity 7.5% Best Buy Co., Inc. stake** 80 Cash Deferred payment over two years 50 TOTAL 471 6

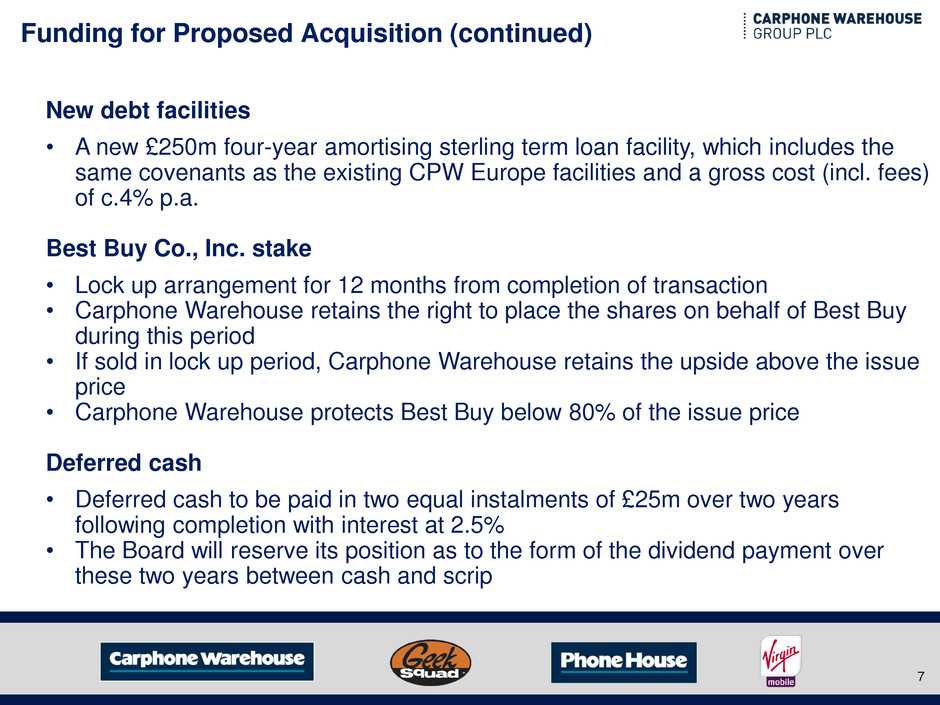

Funding for Proposed Acquisition (continued) New debt facilities • A new £250m four-year amortising sterling term loan facility, which includes the same covenants as the existing CPW Europe facilities and a gross cost (incl. fees) of c.4% p.a. Best Buy Co., Inc. stake • Lock up arrangement for 12 months from completion of transaction • Carphone Warehouse retains the right to place the shares on behalf of Best Buy during this period • If sold in lock up period, Carphone Warehouse retains the upside above the issue price • Carphone Warehouse protects Best Buy below 80% of the issue price Deferred cash • Deferred cash to be paid in two equal instalments of £25m over two years following completion with interest at 2.5% • The Board will reserve its position as to the form of the dividend payment over these two years between cash and scrip 7

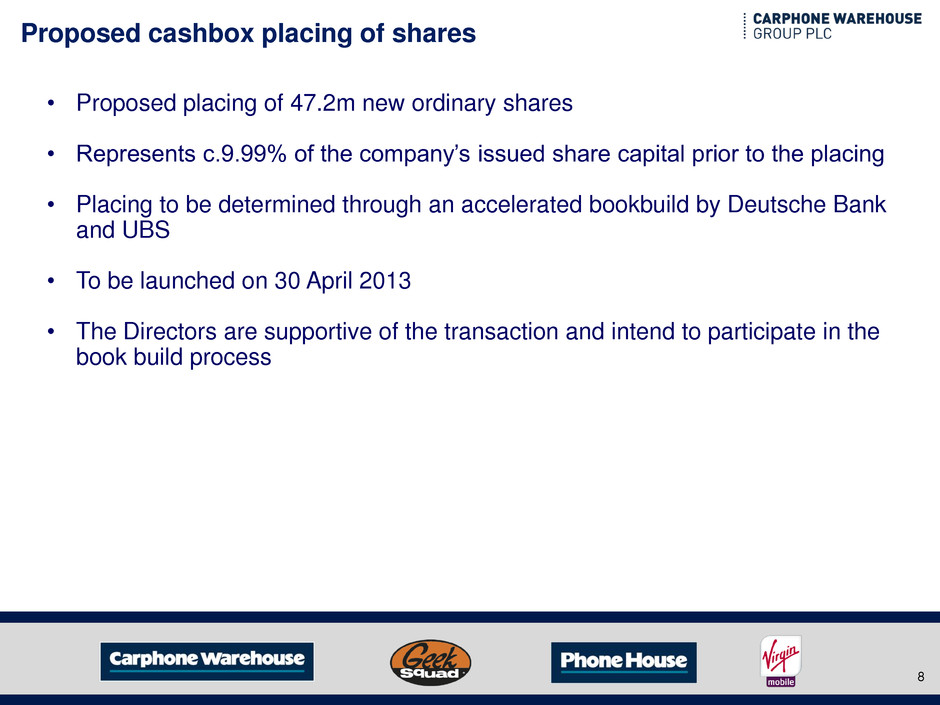

Proposed cashbox placing of shares • Proposed placing of 47.2m new ordinary shares • Represents c.9.99% of the company’s issued share capital prior to the placing • Placing to be determined through an accelerated bookbuild by Deutsche Bank and UBS • To be launched on 30 April 2013 • The Directors are supportive of the transaction and intend to participate in the book build process 8

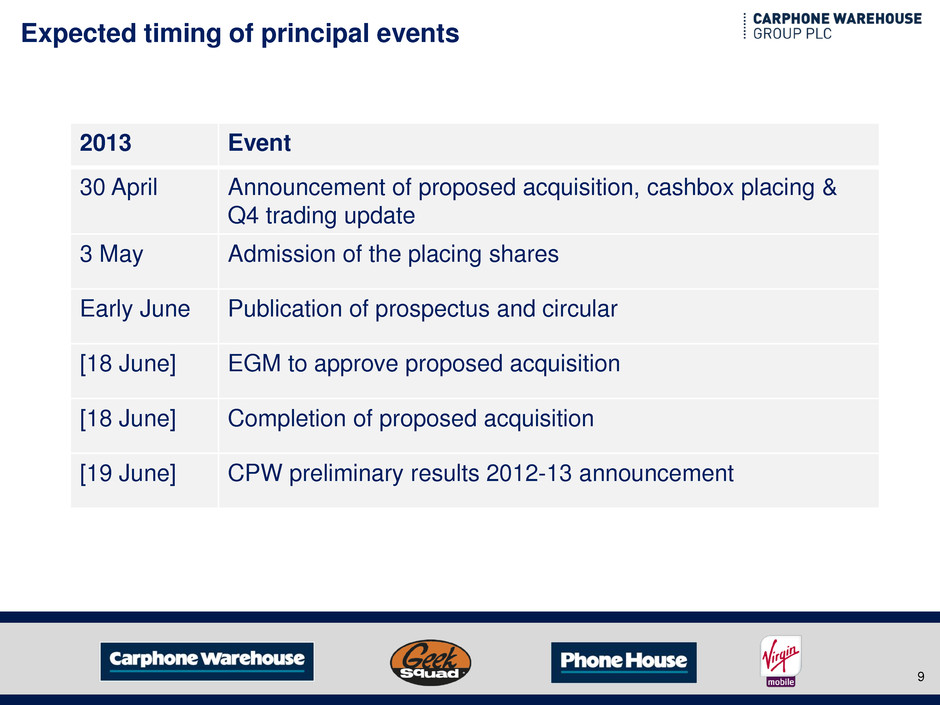

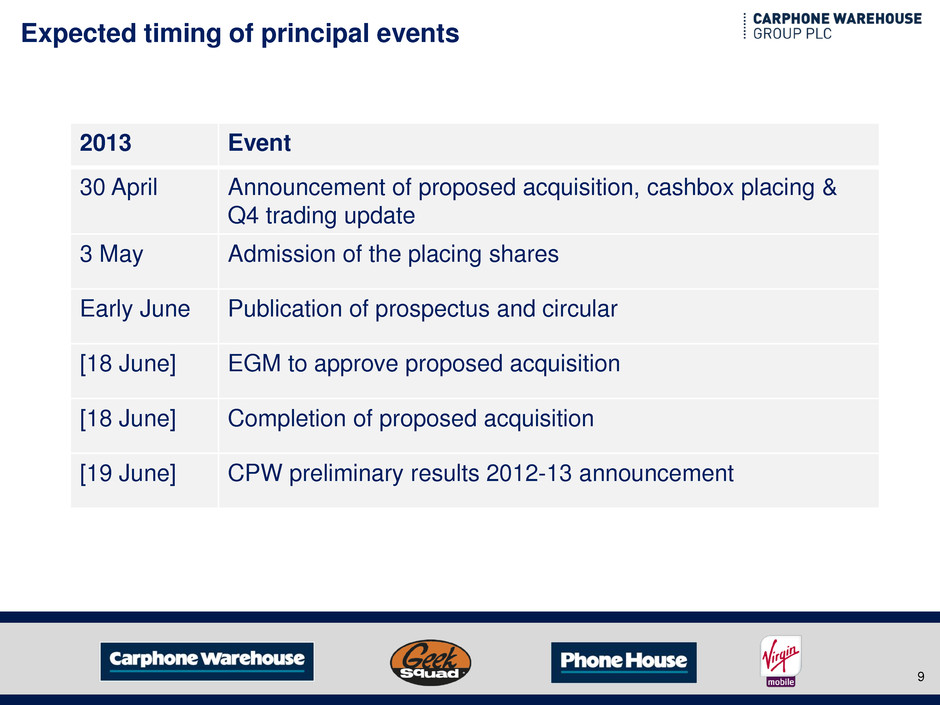

Expected timing of principal events 2013 Event 30 April Announcement of proposed acquisition, cashbox placing & Q4 trading update 3 May Admission of the placing shares Early June Publication of prospectus and circular [18 June] EGM to approve proposed acquisition [18 June] Completion of proposed acquisition [19 June] CPW preliminary results 2012-13 announcement 9

Q4 Trading update Quarter ended 31 March 2013 CPW Europe • Q4 group LFL revenues up 6.5%: continued strong UK performance • Q4 connections up 9.7% • France: challenging conditions remain; £80-90m non-cash goodwill/fixed assets write-off, concluded strategic review • Reiterating full year Headline EBIT guidance of £135m to £145m 10

Q4 Trading update (continued) Quarter ended 31 March 2013 Virgin Mobile France • Revenue: full year growth c.4%, Q4 revenue down 9.7%, as expected • Postpay base: 11,000 net adds for full year, Q4 postpay base down 52,000 • 50% of base on Full MVNO; targeting 80% by November 2013 Group • Sale of two freehold properties for proceeds c.£51m (one post year end) • Reiterating full year Headline EPS guidance of 11.5p to 13.0p 11

Q&A 12

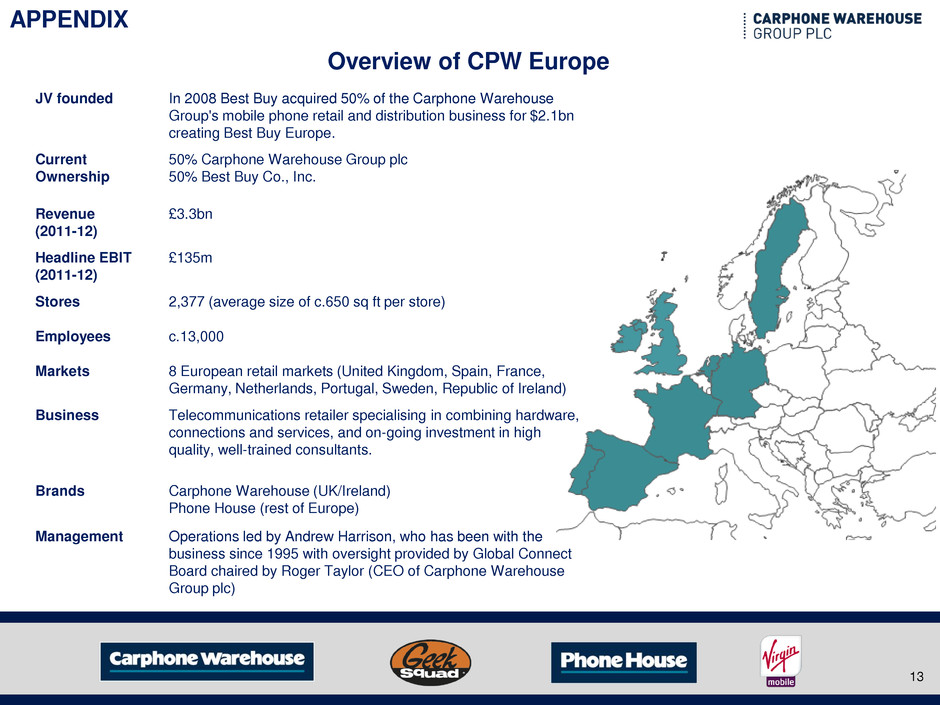

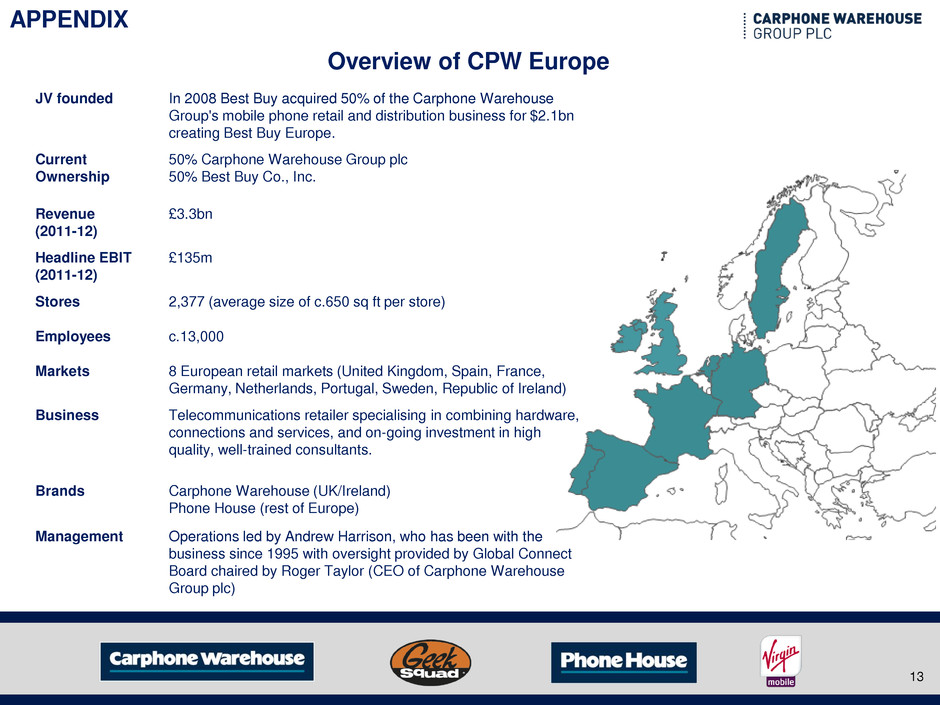

APPENDIX JV founded In 2008 Best Buy acquired 50% of the Carphone Warehouse Group's mobile phone retail and distribution business for $2.1bn creating Best Buy Europe. Current Ownership 50% Carphone Warehouse Group plc 50% Best Buy Co., Inc. Revenue (2011-12) £3.3bn Headline EBIT (2011-12) £135m Stores 2,377 (average size of c.650 sq ft per store) Employees c.13,000 Markets 8 European retail markets (United Kingdom, Spain, France, Germany, Netherlands, Portugal, Sweden, Republic of Ireland) Business Telecommunications retailer specialising in combining hardware, connections and services, and on-going investment in high quality, well-trained consultants. Brands Carphone Warehouse (UK/Ireland) Phone House (rest of Europe) Management Operations led by Andrew Harrison, who has been with the business since 1995 with oversight provided by Global Connect Board chaired by Roger Taylor (CEO of Carphone Warehouse Group plc) Overview of CPW Europe 13