Exhibit 4.2

September 13, 2002

Best Buy Canada Ltd.

8800 Glenlyon Parkway

Burnaby, British Columbia

V5J 5K3

Attention: Kevin Layden

President and Chief Operating Officer

Dear Sirs:

On the basis of the financial statements and other information provided by Best Buy Canada Ltd. Magasins Best Buy Ltée. (formerly known as Future Shop Ltd. Future Shop Ltée.) in connection with your request for continued financing, HSBC Bank Canada (the “Bank”) has authorized and hereby offers to make available the following credit facilities (collectively, the “Loans”) on the terms and conditions indicated below:

1. Borrower:

Best Buy Canada Ltd. Magasins Best Buy Ltée (the “Borrower”)

2. Guarantors:

2.1. Best Buy Co., Inc. (“Best Buy Co.”)

2.2. Best Buy Stores, L.P. (“Stores L.P.”)

3. Credit Facilities:

3.1. The existing Operating Loan and Bulge Facility (each as defined in the offer letter dated August 15, 2000, as amended or supplemented by offer letters dated May 7, 2001, October 26, 2001 and November 28, 2001 (collectively, the “Prior Offer Letter”)) and the outstanding term loan with an unpaid balance of CDN $11,660,000 (the “Term Loan”) shall be replaced with a committed 364 day revolving operating loan in the principal amount of CDN $50,000,000 (the “Operating Loan”), which Operating Loan shall be available on the terms and conditions set out herein for a 364 day term (the “Operating Term”) commencing on the date of acceptance of this Offer Letter by the Borrower and which shall, if the Borrower so elects, include a bank guarantee and letter of credit facility in the principal amount of up to CDN $10,000,000 (the “Documentary Credit Sub-Facility”),

it being understood that, without limiting any of the other terms and conditions of this Offer Letter, including, without limitation, the Margin Requirements set out below, the maximum principal amount available to the Borrower under the Operating Loan, including the face amount of any outstanding Letters of Credit or Bankers’ Acceptances issued by the Bank shall not at any time exceed CDN $50,000,000;

3.2. The existing F/X Facility (as defined in the Prior Offer Letter) shall be replaced with a demand foreign exchange contract line of credit (the “F/X Facility”) under which the Aggregate F/X Credit Risk (as defined below) shall at no time exceed CDN $5,000,000 (the “F/X Credit Limit”).

3.3. A new CDN $13,000,000 electronic funds transfer line (the “EFT Limit”) shall be available independent and exclusive from the Operating Loan;

3.4. The CDN $15,000,000 Bulge Facility, the Term Loan (under which the amount of CDN $11,660,000 is outstanding as at September 13, 2002) and the Swap Facility (all as described in the Prior Offer Letter) shall be fully repaid and cancelled.

4. Definitions and Interpretation:

The capitalized terms used in this Offer Letter shall have the meanings given to such terms either in the body of this Offer Letter or at the end of Schedule “A” attached hereto (“Schedule “A””), whichever is applicable, and Schedule “A”, any additional schedules and all of the provisions thereof are hereby incorporated into and shall form an integral part of this Offer Letter.

5. Purpose:

5.1. The Operating Loan shall be used to assist in financing the general corporate purposes of the Borrower and to repay in full the Term Loan and the Swap Facility;

5.2. The F/X Facility shall be used to assist the Borrower in hedging against currency fluctuations. In particular, the F/X Facility shall be used to enable the Borrower to enter into forward exchange contracts with the Bank for the purchase or sale of U.S. Dollars (or other major currencies approved by the Bank) having terms to maturity of up to one year (any one such forward exchange contract being hereinafter referred to as a “F/X Contract”); and

5.3. The EFT Limit will be used to facilitate the Borrower making its bi-weekly payroll obligations to its employees.

2

6. Availability:

6.1. So long as there is no Event of Default (as defined below) and subject to the Margin Requirements (as defined below) and upon satisfaction of the Conditions Precedent specified below, the Operating Loan shall, at the Borrower’s option, be made available by way of:

6.1.1 direct advances, in either Canadian Dollars or U.S. Dollars, or any combination thereof, by way of current account overdraft;

6.1.2 Bankers’ Acceptances in face amounts of not less than CDN $500,000 and in integral multiples of CDN $100,000 and otherwise pursuant to section 4 of Schedule “A”; and

6.1.3 Canadian Dollar or U.S. Dollar Letters of Credit (as defined in Schedule “A”) issued under the Documentary Credit Sub-Facility,

or any combination thereof.

6.2. Upon satisfaction of the Conditions Precedent set out below, the F/X Facility shall be made available to the Borrower by way of the Bank entering into F/X Contracts with and at the request of the Borrower, provided that the Aggregate F/X Credit Risk applicable to all F/X Contracts entered into by the Bank and in effect at any given time shall not exceed the F/X Credit Limit specified under the heading “Credit Facilities” above, namely, CDN $5,000,000. For the purposes of this Offer Letter, “Aggregate F/X Credit Risk” means the aggregate of the F/X Credit Risk Values applicable to all F/X Contracts entered into by the Bank and remaining in effect at any given time; “F/X Credit Risk Value” means the value obtained when the face value of a given F/X Contract (converted to Canadian Dollars, where applicable, in accordance with the Bank’s standard rates of conversion) is multiplied by the F/X Credit Risk Factor assigned by the Bank to such F/X Contract; “F/X Credit Risk Factor” means the foreign exchange credit risk factor with respect to any particular F/X Contract, expressed as a percentage, as determined by the Bank from time to time in its absolute discretion, based upon the term to maturity of the applicable F/X Contract and the Bank’s assessment of the risk associated with the market for the subject currency(ies).

For clarification purposes:

6.2.1 based on the F/X Credit Risk Factors utilized by the Bank and the F/X Credit Limit applicable to the F/X Facility, the Borrower would at the date hereof be permitted to enter into 12-month U.S. Dollar F/X Contracts having an aggregate value of up to approximately US $28,000,000, provided that the aggregate value of the F/X Contracts which the Borrower may be entitled to enter into at any given time will

3

vary based upon the length of the term of the individual F/X Contracts and the F/X Credit Risk Factors applicable thereto, which F/X Credit Risk Factors may be varied by the Bank from time to time, in its absolute discretion; and

6.2.2 as at September 10, 2002, the F/X Credit Risk Factor is 29% and the conversion rate for purposes of determining the value of the U.S. Dollar F/X Contracts is 1.6.

7. Margin Requirements:

In addition to the loan limits specified under the heading Credit Facilities above, the amounts available to the Borrower under the Loans shall be limited by the following margin requirements (the “Margin Requirements”).

The aggregate of:

7.1. 100% of the Canadian Dollar advances outstanding under the Operating Loan;

7.2. the Canadian Dollar Equivalent of 100% of the U.S. Dollar advances outstanding under the Operating Loan;

7.3. 100% of the face amounts of all Canadian Dollar Banker’s Acceptances made available and outstanding under the Operating Loan;

7.4. 100% of the face amounts of all Canadian Dollar Letters of Credit issued and outstanding under the Documentary Credit Sub-Facility; and

7.5. the Canadian Dollar Equivalent of the face amounts of 100% of the U.S. Dollar Letters of Credit issued and outstanding under the Documentary Credit Sub-Facility;

shall at no time exceed the aggregate of:

7.6. 50% of Acceptable Inventory; and

7.7. 75% of Acceptable Receivables.

8. Repayment:

All amounts outstanding under the Loans, including the liabilities of the Bank under any Letters of Credit issued and outstanding under the Documentary Credit Sub-Facility, any Bankers’ Acceptances issued and outstanding under the Operating Loan, any F/X Contracts entered into and outstanding under the F/X Facility and any amounts outstanding under the EFT Limit, shall, at the option of the Bank, immediately come due and be payable upon the occurrence of an Event of Default (as defined below) provided that:

4

8.1. all amounts outstanding under the Operating Loan shall be repaid by no later than the date on which the Operating Term expires;

8.2. all amounts advanced by the Bank as a result of any demand for payment under any Letter of Credit issued under the Documentary Credit Sub-Facility shall be repaid forthwith upon demand by the Bank;

8.3. all amounts advanced by the Bank upon the maturity of any Bankers’ Acceptance shall be repaid forthwith upon demand by the Bank;

8.4. any and all liabilities of or losses suffered by the Bank in connection with any F/X Contract shall be paid to the Bank by the Borrower on demand, provided that unless and until otherwise demanded, the Borrower shall fulfill all of its obligations under all F/X Contracts as and when they become due;

8.5. all amounts outstanding under the EFT Limit shall be repaid by no later than the date on which the Operating Term expires; and

8.6. interest on the Loans shall be payable as hereinafter set out.

9. Interest and Fees:

9.1. Accrued interest on the daily balance of the principal advanced under the Loans and remaining unpaid from time to time, including, without limitation, all direct advances and amounts outstanding as a result of unpaid liabilities pursuant to paragraphs 8.1 through 8.4 inclusive above, shall be payable on the last day of each month at a rate equal to the Bank’s Prime Rate plus one quarter of one percent (0.25%) per annum, in the case of monies advanced in Canadian Dollars, and the Bank’s U.S. Base Rate plus one quarter of one percent (0.25%) per annum, in the case of monies advanced in U.S. Dollars, calculated monthly from the date of advance, both before and after demand, default and judgment, until actual payment. By accepting this Offer Letter, the Borrower acknowledges that the Bank’s Prime Rate was four and one-half of one percent (4.5%) per annum and that the “Bank’s U.S. Base Rate” was five and one-quarter of one percent (5.25%) per annum, in each case as at September 10, 2002. A certificate of a Vice-President or Assistant Vice-President of the Bank shall be, absent manifest error, conclusive evidence of the Bank’s Prime Rate or the Bank’s U.S. Base Rate from time to time;

9.2. The Borrower shall pay to the Bank:

9.2.1 at the time of issuance by the Bank of each Letter of Credit under the Documentary Credit Sub-Facility, the Bank’s prevailing fees in respect thereof which, in any event, shall be not less than 1.25% per annum of the face amount of the Letter of Credit calculated over the term thereof;

5

9.2.2 at the time of presentation for acceptance of each Bankers’ Acceptance, a stamping fee of 1.50% per annum of the face amount of each Bankers’ Acceptance calculated over the term thereof;

9.2.3 a monthly standby fee equal to 0.125% per annum of that portion of the Operating Loan which remains un-utilized on a daily basis, such fee to be calculated daily and payable on the last day of each month during the Operating Term;

9.2.4 a fee of 0.10% of the principal amount authorized and available under the Operating Loan upon the annual renewal of the Loans; and

9.2.5 the Bank’s prevailing activity fees existing from time to time in respect of such matters as extensions of review dates due to delay in delivery of financial information, late management information systems reporting, and the Bank’s additional requirements such as interim applications;

Notwithstanding anything to the contrary contained herein, the Bank may, at its discretion, make an advance under the Operating Loan, or make a reduction from an advance otherwise requested under the Operating Loan, to pay any interest or fees which have become due and payable under the terms of this Offer Letter.

10. Loan Documents:

The Loans and the Borrower’s liabilities and obligations hereunder shall be evidenced and supported by the following documents (the “Loan Documents”) completed in a form and content satisfactory to the Bank’s solicitors:

10.1. line of credit by way of current account overdraft agreement for execution by the Borrower in the principal amount of CDN $50,000,000;

10.2. agreement for U.S. Dollar line of credit by way of account overdraft for execution by the Borrower in the principal amount of the United States Dollar Equivalent of CDN $50,000,000;

10.3. Depository Bills Agreement in respect of Bankers’ Acceptances for execution by the Borrower;

10.4. Power of Attorney in respect of Bankers’ Acceptances for execution by the Borrower;

10.5. Application and indemnity agreements for execution by the Borrower in respect of the issuance of Letters of Credit under the Documentary Credit Sub-Facility;

10.6. Forward exchange contract agreement for execution by the Borrower in respect of the F/X Contracts entered into under the F/X Facility;

6

10.7. unlimited guarantee of indebtedness and obligations of the Borrower to the Bank for execution by Best Buy Co.;

10.8. assignment and postponement agreement in respect of any shareholder or other loans or indebtedness made to the Borrower by Best Buy Co. (excluding trade debt as therein defined). For purposes of this agreement, “trade debt” shall include license fees, royalties, expense reimbursements, capital purchases and inventory purchases;

10.9. unlimited guarantee of indebtedness and obligations of the Borrower to the Bank for execution by Stores L.P.;

10.10. confirmation of placement by the Borrower of an all risk insurance policy (including extended coverage from earthquake and flood endorsements) on all buildings, improvements, equipment, inventory and all other tangible assets owned by the Borrower, which policy includes business interruption and public liability insurance in amounts and from an insurer or insurers satisfactory to the Bank;

10.11. subordination agreement (the “FSAI Subordination Agreement”) with respect to any present or future shareholder or other loans (excluding royalties and services and supply debt as described in the agreement) made to the Borrower by Future Shop Acquisition Inc. which FSAI Subordination Agreement shall permit interest only payments due and owing by the Borrower to Future Shop Acquisition Inc. for so long as no Event of Default has occurred or providing the making of any such interest payments will not create an Event of Default;

10.12. such supporting certificates, opinions and other documentation as the Bank and its solicitors may reasonably require.

11. Release of Security

Upon satisfaction of the conditions precedent set forth in section 13 below, any security interests granted by the Borrower to the Bank prior to the date of this Offer Letter (the “Prior Security Documents”) shall be released and any assets covered thereby re-conveyed by the Bank to the Borrower and any registrations or filings made with respect to the Prior Security Documents shall also be discharged by the Bank, all at the Borrower’s cost.

12. Conditions of Loans:

12.1. The following covenants, terms and conditions shall apply so long as the Borrower is indebted to the Bank:

12.1.1 The Borrower shall maintain the Margin Requirements specified above;

7

12.1.2 The Borrower shall not, without the prior written consent of the Bank:

12.1.2.1 declare or pay dividends on any class or kind of its shares, repurchase or redeem any of its shares, reduce its capital in any way whatsoever or repay shareholder advances (except for the repayment of shareholder advances, interest thereon and trade debt contemplated by the FSAI Subordination Agreement);

12.1.2.2 except in the ordinary course of the Borrower’s business, pay remuneration of any kind, including salaries, management fees and bonuses, to any shareholder of the Borrower or any Affiliate of any shareholder of the Borrower if the payment of such remuneration causes the Borrower to record a pre-tax operating loss or causes the Borrower to be in breach of any Financial Covenants;

12.1.2.3 grant or allow any Lien or other encumbrance, whether fixed or floating, to be registered against or exist on any of the assets of the Borrower except as specifically provided herein and in particular without limiting the generality of the foregoing, shall not grant a trust deed or other instrument in favour of a trustee, other than Existing Liens and Purchase Money Mortgages to a maximum aggregate amount of CDN $15,000,000;

12.1.2.4 become guarantor or endorser or otherwise become liable upon any note or other obligation other than in the normal course of the Borrower’s business, unless the Borrower is required to deliver a guarantee of the indebtedness of Best Buy Co. to U.S. Bank National Association pursuant to the terms of the U.S. Credit Agreement;

12.1.2.5 permit minimum cash flow ratio as calculated at the end of each fiscal quarter to be less than 1.0:1.0, calculated in accordance with Canadian GAAP. For purposes of this Offer Letter, the minimum cash flow ratio shall mean the quotient arrived at from time to time when dividing the aggregate of:

12.1.2.5.1 the Borrower’s net income plus the aggregate of taxes, depreciation, rental and lease payments, and cash investment in the Borrower made by Best Buy Co.,

by:

8

12.1.2.5.2 capital expenditures incurred by the Borrower, plus

12.1.2.5.3 building, property, rental and lease expenses of the Borrower, plus

12.1.2.5.4 principal repayment obligations (excluding repayment of the Term Loan), plus

12.1.2.5.5 cash interest expense, including inter-company debt

such minimum cash flow ratio to be calculated quarterly on a trailing 12 month basis based upon the Borrower’s quarterly unaudited financial statements;

12.1.2.6 consolidate, amalgamate or merge with any other Person, enter into any corporate reorganization or other transaction intended to effect or otherwise permit a material change in its existing organizational documents, liquidate, wind-up or dissolve itself; or

12.1.2.7 make any Investments in joint ventures, partnerships, Subsidiaries or other business ventures, unless such joint venture, partnership, Subsidiary or other business venture is engaged in activities substantially similar or complementary to the business activities of the Borrower as at the date hereof.

12.1.3 The Consolidated Net Worth (of Best Buy Co.) shall not at any time be less than US $2,000,000,000 minus the aggregate amount (not to exceed US $1,000,000,000) paid by Best Buy Co. in cash after the date of execution and delivery of the U.S. Credit Agreement to repurchase shares in Best Buy Co.’s common stock pursuant to Best Buy Co.’s stock repurchase programs;

12.1.4 The Cash Flow Leverage Ratio (of Best Buy Co.) shall not (a) at the end of any fiscal year of the Best Buy Co. exceed 3.00 to 1.00 and (b) at the end of each fiscal quarter of Best Buy Co. (other than the last fiscal quarter) during any such fiscal year exceed 3.25 to 1.00;

12.1.5 The Interest Coverage Ratio (of Best Buy Co.), as at the end of any fiscal quarter for the Measurement Period ending on that date, shall not be less than 3.00 to 1.00;

12.1.6 No Change of Control shall occur;

9

12.2. The Borrower and Best Buy Co. shall cause each Subsidiary that becomes a Restricted Subsidiary (as such terms are defined in the U.S. Credit Agreement) to immediately thereafter execute and deliver to the Bank a guarantee of the indebtedness and obligations of the Borrower to the Bank, under which the quantum of liability shall be unlimited or in such lesser amount as determined by the Bank in consultation with its solicitors;

13. Financial Statements, Reports and Notices:

The Borrower and Best Buy Co. shall from time to time deliver or cause to be delivered to the Bank the following:

13.1. monthly, within 45 days of each calendar month end, a written inventory and receivables statement setting forth the value of the Borrower’s accounts receivable and inventory as of the end of such calendar month, with the value of Acceptable Receivables and Acceptable Inventory listed separately; notwithstanding the delivery by the Borrower of the foregoing statement, the Bank may, from time to time and at any time, require the Borrower to additionally provide the Bank with:

13.1.1 internally prepared financial statements for the Borrower, including a balance sheet and income statement, in a form and containing information satisfactory to the Bank;

13.1.2 list of accounts receivable of the Borrower; and

13.1.3 declaration of inventory of the Borrower in accordance with the Bank’s format, together with any supporting data that the Bank may reasonably require;

13.2. quarterly, within 45 days of each calendar quarter year end:

13.2.1 internally prepared financial statements for the Borrower, including a balance sheet, income statement and cash flow statement for the Borrower, in a form and containing information satisfactory to the Bank;

13.2.2 internally prepared financial statements for Best Buy Co.; and

13.2.3 compliance certificate from a senior officer of the Borrower in a form acceptable to the Bank, setting forth the manner in which the Borrower has calculated its minimum cash flow and its compliance with paragraph 12.1.2.5;

13.3. annually, within 120 days of Best Buy Co.’s fiscal year end:

10

13.3.1 aged list of accounts receivable of the Borrower with those accounts outstanding for over 60 days and any holdback monies being listed separately;

13.3.2 unaudited financial statements in respect of the Borrower, including a balance sheet, income statement and comparison to plan, by an accountant acceptable to the Bank, acting reasonably, in accordance with Canadian GAAP;

13.3.3 pro forma financial statements, budget and financial projections in respect of the Borrower for the following fiscal year, which shall include, without limitation, a capital expenditures budget for the Borrower; and

13.3.4 audited Consolidated Financial Statements in respect of Best Buy Co. by an accountant acceptable to the Bank in accordance with US GAAP;

13.4. all financial statements and information required to be delivered by Best Buy Co. and Stores L.P. to U.S. Bank National Association pursuant to the terms of the U.S. Credit Agreement; and

13.5. all additional financial statements and information as and when reasonably requested by the Bank.

Best Buy Co. shall from time to time deliver or cause to be delivered to the Bank the following promptly after any officer of Best Buy Co. or any Subsidiary becomes aware of the same (all capitalized terms shall have the definitions ascribed to them in the U.S. Credit Agreement. For example, the Company means Best Buy Co.):

13.6. any Event of Default or Unmatured Event of Default, specifying the nature and extent thereof and the corrective action (if any) proposed to be taken with respect thereto;

13.7. the filing or commencement of, or receipt of notice of intention of any person to file or commence, any action, suit or proceeding, whether at law or in equity or by or before any Governmental Authority, against the Company or any Subsidiary which has had or would likely have a Material Adverse Effect on the Company;

13.8. any development affecting or relating to the Company or any Subsidiary, including without limitation any development in litigation, that in the reasonable judgment of the Company has had, or would likely have, a Material Adverse Effect on the Company;

13.9. the issuance by any Governmental Authority of any injunction, order, decision or other restraint prohibiting, or having the effect of prohibiting, the Loans or Letters of Credit, or the initiation of any litigation or similar proceeding seeking any such injunction, order or other restraint;

11

13.10. the occurrence of any Reportable Event with respect to any Plan and the action which is proposed to be taken with respect thereto, together with a copy of the notice of such Reportable Event to the PBGC;

13.11. any violation as to any environmental matter by the Company or any Subsidiary or the commencement of any judicial or administrative proceeding relating to health, safety or environmental matters (i) in which an adverse determination or result could result in the revocation of or have a material adverse effect on any operating permits, air emission permits, water discharge permits, hazardous waste permits or other permits held by the Company or any Subsidiary which are material to the operations of the Company or such Subsidiary, or (ii) which will or threatens to impose a material liability on the Company or such Subsidiary to any Person or which will require a material expenditure by the Company or such Subsidiary to cure any alleged problem or violation; or

13.12. the issuance of any Governmental Authority of any injunction, order or decision, or the entry by the Company or any Subsidiary into an agreement with any Governmental Agency, materially restricting the business of the Company or any Subsidiary or concerning any material business practice of the Company or any Subsidiary.

14. Lapse, Cancellation, Annual Review:

This Offer Letter shall lapse and all obligations of the Bank hereunder and in respect of the Loans shall cease, all at the option of the Bank, if there has been, in the opinion of the Bank, a material adverse change in risk or in the financial condition of the Borrower, Best Buy Co. or Stores L.P. or if the conditions precedent hereunder have not been met by October 31, 2002. The Bank shall have the option to at any time, acting reasonably, conduct corporate, personal property registry and Priority Claims searches in respect of the Borrower in such jurisdictions as the Bank deems necessary. Upon the occurrence of an Event of Default, any unadvanced portion of the Loans shall be immediately cancelled and the Borrower shall, in respect of each, Letter of Credit and Bankers’ Acceptance issued under the Loans within 15 days from the date demand is made, either:

14.1. pay to the Bank the face amount of the applicable Letter of Credit or Bankers’ Acceptance, as the case may be; or

14.2. pledge in favour of and on terms and conditions acceptable to the Bank, as continuing security for its contingent obligations and liabilities to the Bank in respect of the applicable Letter of Credit or Bankers’ Acceptance, as the case may be, cash collateral or a deposit instrument or other liquid collateral security in a form acceptable to the Bank in an amount equal to the face amount of the applicable, Letter of Credit or Bankers’ Acceptance.

12

15. Earlier Offer Letters:

This Offer Letter shall stand in substitution for and replacement of all previous offer letters issued by the Bank in favour of the Borrower (including the Prior Offer Letter) and the terms and conditions set forth herein shall govern the Loans exclusively and shall supersede the terms and conditions contained in any earlier offer letters issued by the Bank to the Borrower or to any other parties.

This offer may be accepted by the Borrower, and acknowledged by each of the Guarantors, by signing, dating and returning to the Bank by 5:00 p.m. on September 13, 2002 the enclosed copy of this letter executed by the Borrower and each of the Guarantors. The Bank has instructed its solicitors to commence preparation of the Loan Documents.

Yours very truly,

HSBC BANK CANADA

By: | /s/ Bruce Clarke | | By: | /s/ Kerry Hutchinson | |

| Bruce Clarke | | Kerry Hutchinson |

| Vice President | | Senior Account Manager |

| Commercial Financial Services | | |

• • • • • • •

AGREED TO AND ACCEPTED THIS 13 DAY OF September 2002.

THE BORROWER:

BEST BUY CANADA LTD. MAGASINS BEST BUY LTÉE.

Per: | /s/ Kevin Layden | |

| |

| |

Per: | | |

13

ACKNOWLEDGED AND AGREED TO THIS DAY OF , 2002.

THE GUARANTORS:

BEST BUY CO., INC. | BEST BUY STORES, L.P by its general

partner |

| BBC | PROPERTY | CO. |

| | | |

| | | |

Per: | /s/ Darren R. Jackson | | Per: | /s/ Darren R. Jackson | |

| | | |

| | | |

Per: | | | Per: | | |

| | | | | | |

14

SCHEDULE “A” TO OFFER LETTER

FROM HSBC BANK CANADA

TO BEST BUY CANADA LTD. MAGASINS BEST BUY LTÉE.

DATED SEPTEMBER 13, 2002

1. Representations and Warranties:

Each of the Borrower and the Guarantors represents and warrants to the Bank that:

1.1. each of the Borrower and Best Buy Co. has been duly incorporated and organized, is properly constituted, is in good standing and is entitled to conduct its business in all jurisdictions in which it carries on business or has assets;

1.2. Stores L.P. has been duly established, is properly constituted, is in good standing and is entitled to conduct its business in all jurisdictions in which it carries on business or has assets;

1.3. the execution of the Offer Letter and the Loan Documents and the incurring of liability and indebtedness to the Bank does not and will not contravene:

1.3.1 any Legal Requirement applicable to the Borrower or the Guarantors; or

1.3.2 any provision contained in any other loan or credit agreement or borrowing instrument or contract to which the Borrower or either of the Guarantors is a party;

1.4. all necessary Legal Requirements have been met and all other authorizations, approvals, consents and orders have been obtained with respect to the Loans and the execution and delivery of the Offer Letter and the Loan Documents;

1.5. all financial and other information provided to the Bank in connection with the Loans is true and accurate in all material respects, and each of the Borrower and the Guarantors acknowledges that the offer of credit contained in the Offer Letter is made in reliance on the truth and accuracy of this information and the above representations and warranties; and

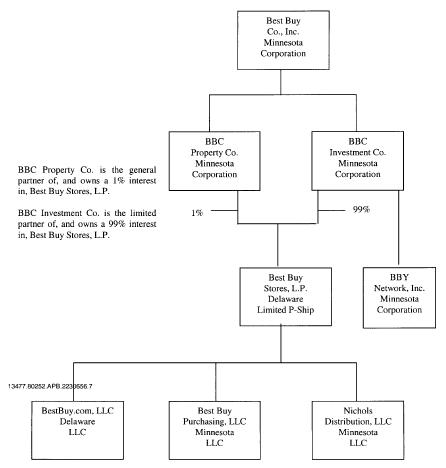

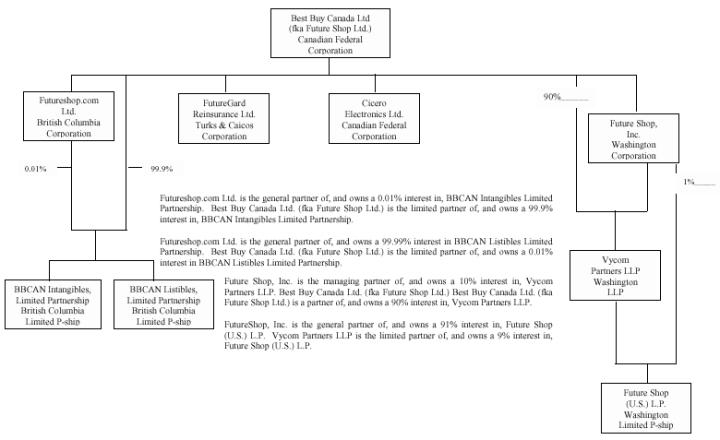

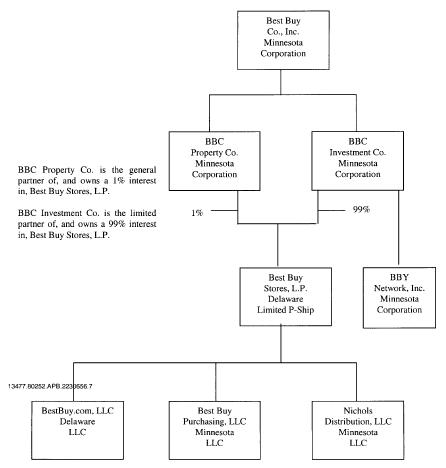

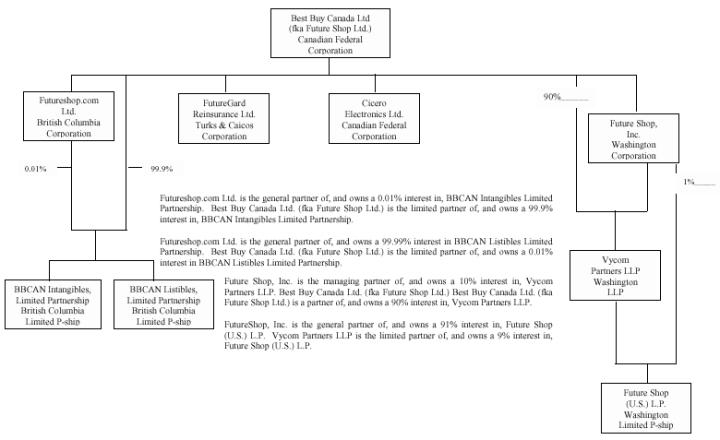

1.6. attached as Schedule “B” hereto is a true, accurate and comprehensive corporate structural chart in respect of the Borrower, Best Buy Co., and their Affiliates;

1.7. the Offer Letter and each of the Loan Documents have been or will be, upon execution thereof, duly and validly authorized, execute and delivered by each of the Borrower and the Guarantors;

1.8. The Offer Letter and each of the Loan Documents constitutes, or when executed and delivered will constitute, a legal, valid and binding obligation of each of the Borrower and the Guarantors enforceable against each such party in accordance with its terms, subject to:

1.8.1 bankruptcy, insolvency and other laws affecting the rights of creditors generally; and

1.8.2 the discretionary nature of equitable remedies;

1.9. Neither the execution and delivery of the Offer Letter or any of the Loan Documents or any other document contemplated thereby by the Borrower or the Guarantors which is or will be a party thereto, nor the observance or performance of the obligations arising thereunder in accordance therewith does or will:

1.9.1 violate or conflict with the organization documents of the Borrower or the Guarantors or with any agreements to which the Borrower or either of the Guarantors is a party thereto;

1.9.2 conflict with or violate any Legal Requirement applicable to the Borrower or the Guarantors or their businesses; or

1.9.3 result in any breach of, or constitute a default (or event which with the giving of notice or lapse of time, or both, would become a default) under, or give to others any rights of termination, acceleration or cancellation of any agreements to which the Borrower or either of the Guarantors is a party, or result in the creation of any Lien on any of the Property.

2. Interest, Fees and Payment:

2.1. Interest on the daily balance of principal advanced under the Loans and remaining unpaid from time to time shall be payable by the Borrower as set out in the Offer Letter both before and after demand, default and judgment;

2.2. In the case of interest based on the Bank’s Prime Rate and the Bank’s U.S. Base Rate, interest shall be compounded and payable on the last day of each month;

2.3. If the Borrower repays any portion of the Loans made available by way of a Bankers’ Acceptance on a date other than the maturity date for such Banker’s Acceptance, whether as a result of a demand for repayment by the Bank or otherwise, it shall also concurrently pay to the Bank the applicable Compensating Amount;

2.4. Interest based on the Bank’s U.S. Base Rate shall be computed on the basis of a year of 360 days and for actual days that the amounts are outstanding under the Loans on this basis. For the purpose of the Interest Act (Canada), the annual rate of interest to which interest computed on the basis of a year of 360 days is equivalent is the rate of interest as provided in the Offer Letter multiplied by the number of days in such year and divided by 360;

2.5. Upon the maturity of a Bankers’ Acceptance, unless another interest rate option is selected by the Borrower, interest shall accrue at the applicable rate in the Offer Letter based on the Bank’s Prime Rate or the Bank’s U.S. Base Rate, as the case

2

may be, depending on whether the funds are outstanding in Canadian or U.S. Dollars;

2.6. The fees collected by the Bank in connection with the Loans, or any of them, shall be its property as consideration for the time, effort and expense incurred by it in the review of documents and financial statements, and the Borrower acknowledges and agrees that the determination of these costs is not feasible and that the fees set out in the Offer Letter represent a reasonable estimate of such-costs;

2.7. All payments by the Borrower to the Bank shall be made at the address of the branch of the Bank issuing the Offer Letter or at such other place as the Bank may specify in writing from time to time. Any payment delivered or made to the Bank by 1:00 p.m. local time at the place where such payment is to be made shall be credited as of that day, but if made afterwards shall be credited as of the next day on which the said branch is open for business;

2.8. The obligation of the Borrower to make all payments under the Offer Letter and the Loan Documents shall be absolute and unconditional and shall not be limited or affected by any circumstance, including, without limitation:

2.8.1 any set-off, compensation, counterclaim, recoupment, defence or other right which the Borrower may have against the Bank or anyone else for any reason whatsoever; or

2.8.2 any insolvency, bankruptcy, reorganization or similar proceedings by or against the Borrower.

3. Conditions of Credit:

In addition to the conditions set out in the Offer Letter, the following covenants shall apply until the Loans are repaid in full and cancelled:

3.1. The Borrower shall maintain its corporate status and operate its business in accordance with sound business practice and in compliance in all material respects with all Legal Requirements;

3.2. The Borrower shall maintain or cause to be maintained insurance on all of the Property used in connection with the Business with financially sound and reputable insurance companies or associations, including all-risk property insurance, comprehensive general liability insurance and business interruption insurance, in amounts, with deductibles or retentions, and against risks that would be maintained by a prudent owner carrying on a similar business in a similar location, and shall furnish to the Bank, on written request, satisfactory evidence of the insurance carried by it;

3.3. The Borrower shall:

3

3.3.1 pay all Taxes in respect of itself or its Property, as they become due and payable, unless they are being contested in good faith by appropriate proceedings and adequate provision has been made for the payment of any such contested amount;

3.3.2 withhold from each payment made to any of its past or present employees, officers or directors, and to any non-resident of Canada, the amount of all Taxes and other deductions required to be withheld therefrom and pay the same to the appropriate tax authority within the time required under any applicable Legal Requirements;

3.3.3 collect from all Persons the amount of all Taxes required to be collected from them and remit the same to the proper tax or other receiving officers within the time required under any applicable Legal Requirements;

3.4. All financial terms and covenants shall be determined in accordance with, Canadian GAAP in the case of financial terms and covenants that are exclusive to the Borrower, and US GAAP in the case of financial terms and covenants that apply to the Guarantors;

3.5. If the amount outstanding under any Loan in Canadian Dollars plus the Canadian Dollar Equivalent of the amount outstanding under any Loan in a currency other than Canadian dollars at any time exceeds the amount authorized under that Loan as provided under the heading “Credit Facilities” in the Offer Letter, the Bank may, from time to time, in its sole discretion:

3.5.1 limit the further utilization of that Loan;

3.5.2 convert all or part of the amount outstanding under that Loan to Canadian Dollars in which event, interest shall accrue and be paid on such converted amounts at the rate set out in the Offer Letter for Canadian dollar advances accruing interest with reference to the Bank’s Prime Rate;

3.5.3 require the Borrower to pay down the excess;

3.6. Any amount payable by the Borrower to the Bank under the Offer Letter or the Loan Documents may be debited to any account of the Borrower with the Bank;

3.7. The Borrower shall indemnify the Bank against any loss incurred by it as a result of any judgment or order being given or made for the payment of any amount due under the Offer Letter or the Loan Documents, where:

3.7.1 such judgment or order is expressed and paid in a currency (the “Judgment Currency”) other than the currency of an outstanding loan (the “Loan Currency”); and

4

3.7.2 there is a variation between:

3.7.2.1 the rate of exchange at which the Loan Currency amount is converted into the Judgment Currency for the purposes of such judgment or order; and

3.7.2.2 the rate of exchange at which the Bank is able to purchase the Loan Currency with the amount of the Judgment Currency then actually received by the Bank.

The foregoing indemnity shall constitute a separate and independent obligation of the Borrower and shall apply irrespective of any indulgence granted to the Borrower from time to time, and shall continue in full force and effect notwithstanding any such judgment or order as aforesaid. The term “rate of exchange”, shall include any premiums and costs of exchange payable in connection with the purchase of, or conversion into, the relevant currency.

3.8. Each payment to be made in favour of the Bank in respect of any of the Loans shall be made free and clear and without deduction for or on account of Tax. If any payment made in respect of any of the Loans is required to be made subject to the deduction or withholding of Tax, the sum payable to the Bank with respect to which such deduction or withholding is required to be made shall be increased to the extent necessary to ensure that, after the making of such deduction or withholding, the Bank receives and retains (free from any liability in respect of any such deduction or withholding) a net sum equal to the sum which it would have received and so retained had such deduction or withholding not have been made or required to have been made. If the Bank is required by law to make any payment on account of Tax (not being a Tax on net income) on or in relation to any amount received or receivable hereunder or otherwise in connection with the Loans, the Borrower shall promptly indemnify the Bank against such payment, together with any interest, penalties and expenses payable or incurred in connection therewith.

4. Bankers’ Acceptances:

4.1. Upon satisfaction of the Conditions Precedent set out in this Offer Letter and the additional conditions contemplated in this Schedule “A”, the Borrower may, by delivering to the Bank notice in form and substance satisfactory to the Bank (the “Required Notice”), make availments of the Operating Loan by way of or convert existing advances remaining outstanding under the Operating Loan into Bankers’ Acceptances, subject to the following terms and conditions.

4.2. The Bank will not be obligated to make funds available by way of Banker’s Acceptances:

4.2.1 unless the Borrower has provided the Bank with the Required Notice;

5

4.2.2 unless such Banker’s Acceptance is in a minimum face amount of $500,000 or any greater amount and in integral multiples of $100,000;

4.2.3 which are for a term of other than 30, 60, 90, or 180 days or which mature on a day:

4.2.3.1 which is not a Business Day; or

4.2.3.2 which is a date subsequent to the date of maturity or expiry of the Operating Loan under which the subject Bankers’ Acceptance is to be created;

requested by the Borrower in relation to an original advance under the Operating Loan (as opposed to a Bankers’ Acceptance which the Bank is requested to accept in respect of the conversion of advances previously made by the Bank and remaining outstanding under the Operating Loans or the conversion of an existing Bankers’ Acceptance to a new Bankers’ Acceptance);

4.2.4 if an Event of Default has occurred, or if the Bank has made demand for payment of any of the Loans; or

4.2.5 if the Bank has, by at least one Business Day prior to the proposed acceptance date for the Bankers’ Acceptance, advised the Borrower that, because general market conditions have caused it to become impracticable to do so, the Bank is no longer making funds available by way of Bankers’ Acceptances in the ordinary course of its business.

4.3. Each Bankers’ Acceptance shall be deemed to be an availment of the Operating Loan under which such Bankers’ Acceptance is created for the term of such Bankers’ Acceptance in an amount equal to the face amount thereof.

4.4. The Borrower will pay to the Bank at the time of acceptance of each Bankers’ Acceptance under the Operating Loan, a stamping fee equal to 1.50% of the face amount thereof, such fees will be calculated on the basis of a year of 365 days (or 366 days, in the case of a leap year), provided that where the term of such Bankers’ Acceptance is greater or less than one year, then such annual fee will be prorated according to the ratio that the number of days from the date on which the applicable Bankers’ Acceptance is accepted to the date on which such Bankers’ Acceptance matures (inclusive of both such days), bears to 365 days (or 366 days, in the case of a leap year);

4.5. The Borrower will also pay to the Bank in respect of each Bankers’ Acceptance its prevailing fees and charges for issuing the same and effecting payment thereunder, and will pay on request all other out-of-pocket disbursements or costs incurred by the Bank in relation to the issuance of, or payment pursuant to each Bankers’ Acceptance.

6

4.6. All Bankers’ Acceptances will be issued on and subject to the terms and conditions set forth in the Bank’s standard forms relating thereto and issued on such other terms and conditions as are acceptable to the Bank, acting reasonably. The issuance and availability of Bankers’ Acceptances will be subject to such practices, policies, and procedures as the Bank may impose or dictate from time to time. Upon request by the Bank, acting reasonably, the Borrower will forthwith execute and deliver, or cause to be executed and delivered, the Bank’s standard forms and all such ancillary or related documents and instruments as the Bank may reasonably require in respect of the creation of and terms and conditions applicable to Bankers’ Acceptances.

4.7. Each Bankers’ Acceptance processed will be a valid and binding obligation of the Borrower.

4.8. If requested by the Borrower, the Bank will make arrangements for the sale of the Bankers’ Acceptances in Canada. The Bank may, at its sole discretion, purchase all or any of the Bankers’ Acceptances.

4.9. Unless on or before the date that any moneys become payable by the Bank pursuant to any Bankers’ Acceptance, the Borrower has paid to the Bank funds in the amount becoming so payable, the said amount will be deemed to be an advance on that date by the Bank to the Borrower under the Operating Loan as the case may be.

4.10. Upon demand for payment being made under any one or more of the Loans, or upon the occurrence of an Event of Default, the Bank will not make funds available by way of Bankers’ Acceptances and the face amount of any Bankers’ Acceptances which have not yet matured or become due will thereupon be deemed to have been advanced by the Bank to the Borrower.

4.11. Amounts advanced by the Bank to the Borrower or deemed to have been advanced under paragraph 4.9 or 4.10 will be charged against the Operating Loan, will bear interest at the rate of interest payable under the Operating Loan as the case may be, calculated and payable at the times and in the manner specified under the heading “Repayment” in this Offer Letter.

4.12. The Borrower will not claim any days of grace or require any presentation, demand, protest, or other notice of any kind whatsoever in respect of any Bankers’ Acceptance, all of which are hereby expressly waived.

4.13. If the Borrower repays any amount drawn by way of Bankers’ Acceptance on a date other than the maturity date for such Bankers’ Acceptance, whether as a result of a demand for payment by the Bank or otherwise, it shall also concurrently pay to the Bank the applicable Compensating Amount.

4.14. If upon the maturity of a Banker’s Acceptance, the Borrower fails to convert such maturing Bankers’ Acceptance into a new Bankers’ Acceptance in accordance with the terms and conditions hereof and the Required Notice, interest shall

7

accrue on the amount advanced by the Bank on the maturity of such Bankers’ Acceptance at the rate based on the Bank’s Prime Rate specified in the Offer Letter.

5. Events of Default:

For the purposes of this Offer Letter, any one or more of the following events shall be an “Event of Default” (whether such Event of Default shall be voluntary or involuntary or be effected by operation of law or pursuant to or in compliance with any judgments, decree or order of any court or other rule or regulation of any administrative or governmental body):

5.1. if the Borrower makes default in any payment within 3 days of the due date of principal, interest or other moneys payable by it hereunder or under any of the Loan Documents, or if the Borrower or either of the Guarantors is in default 30 days after receiving written notice thereof by the Bank in the performance or observance of something required to be done or some covenant or condition required to be observed or performed herein, or under any other Loan Document; or

5.2. if an Event of Default (as defined in the U.S. Credit Agreement) occurs under the terms of the U.S. Credit Agreement as amended, supplemented or replaced from time to time provided that if any amendments, supplements or replacements are made to the U.S. Credit Agreement and to the Events of Default defined thereunder, then the Event of Default shall only be deemed to be amended for purposes of this Offer Letter if the amended Events of Default are more onerous on Best Buy Co. than those presently set forth in the U.S. Credit Agreement; or

5.3. if any representation or warranty given by the Borrower or by any director or officer of the Borrower is untrue in any material respect; or

5.4. if a bankruptcy petition is filed or presented against the Borrower or the Borrower commits or threatens to commit any act of bankruptcy, makes an assignment for the benefit of its creditors, is declared bankrupt, makes a proposal or otherwise takes advantage of provisions for relief under the Bankruptcy and Insolvency Act (Canada), the Companies Creditors’ Arrangement Act (Canada) or similar legislation in any jurisdiction; or

5.5. there is instituted by or against the Borrower any formal or informal proceeding for the dissolution or liquidation or winding-up of the affairs of, the Borrower, which proceeding is consented to or acquiesced in by the Borrower or shall not have been dismissed within 30 days; or

5.6. the Borrower ceases to carry on business or makes or agrees to make a bulk sale of assets or commits an act of bankruptcy; or

5.7. a receiver, receiver and manager, receiver-manager or any person with like powers of all or a substantial part of the Property is appointed; or

8

5.8. a distress or analogous process is levied upon all or substantially all of the Property or any part thereof and the same shall not have been vacated or stayed within 30 days after the issuance thereof; or

5.9. an order is made or an effective resolution is passed for winding-up the Borrower; or

5.10. the Borrower enters into any reconstruction, reorganization, amalgamation, merger or other similar arrangement with any other person; or

5.11. if in the opinion of the Bank, acting reasonably, there is a Change of Control; or

5.12. any certificate, statement, representation, warranty or audit report herewith, heretofore or hereafter furnished by or on behalf of the Borrower to the Bank, whether in connection with the Offer Letter, the Loan Documents or otherwise, and whether furnished as an inducement to the Bank to extend any credit to or to enter into the Offer Letter, the Loan Documents or otherwise:

5.12.1 proves to have been false in any material respect at the time as of which the facts therein set forth were stated or certified; or

5.12.2 proves to have omitted any substantial contingent or unliquidated liability or claim against the Borrower, the existence of which would materially adversely affect the business of the Borrower;

or, on or before the date of execution of this Offer Letter or the Loan Documents, there shall have been any material adverse change in any of the facts disclosed by any such certificate, statement, representation, warranty or audit report, which change shall not have been disclosed to the Bank at or prior to the time of such execution.

6. General:

6.1. Conditions Precedent - - It shall be a condition precedent to the availability of the Loans that the Bank shall have received:

6.1.1 the Loan Documents identified above, completed in form and content satisfactory to the Bank’s solicitors;

6.1.2 a fully executed intercreditor agreement among the Bank, U.S. Bank National Association (as agent under the U.S. Credit Agreement), the Borrower and Best Buy Co. in form and content satisfactory to the Bank and its solicitors;

6.1.3 confirmation that the insurance contemplated under the heading “Loan Documents” above has been renewed on terms and conditions acceptable to the Bank;

9

6.1.4 evidence satisfactory to the Bank that the Borrower is in compliance in all material respects with all of the covenants, representations and warranties set out in this Offer Letter and the Loan Documents; and

6.1.5 executed copies of the U.S. Credit Agreement and the Indentures governing the Convertible Debentures;

6.2. Currency - In the Offer Letter, words or figures expressed in dollars or the symbol for dollars without any other indication mean Canadian Dollars; provided that:

6.2.1 all advances made available by the Bank under the Loans shall be repaid in the currency in which they are denominated;

6.2.2 interest on advances made under the Loans in Canadian Dollars, stamping fees with respect to Canadian Dollar Bankers’ Acceptances and fees with respect to Canadian dollar bank guarantees or Letters of Credit shall be payable in Canadian Dollars; and

6.2.3 interest on U.S. Dollar advances, stamping fees with respect to U.S. Dollars Bankers’ Acceptances and fees with respect to U.S. Dollar bank guarantees or Letters of Credit shall be payable in U.S. Dollars;

6.3. Premises Visits - The Bank shall have the right to inspect the Borrower’s business premises at all reasonable times, and in any event not less than quarterly; or

6.4. Credit Reporting - The Borrower consents to the obtaining from any credit reporting agency or from any person all information that the Bank may require at any time. The Bank agrees not to disclose any information (the “Non-Public Financial Information”) concerning the Borrower to any credit grantor with whom the Borrower has financial relations or to any credit reporting agency other than information, including consolidated financial statements for the Borrower which is ordinarily available to the Borrower’s shareholders. Notwithstanding the foregoing, if the Bank by inadvertence or otherwise discloses the Non-Public Financial Information to any such credit grantor or credit reporting agency, the Bank shall not be liable to the Borrower in any way whatsoever.

6.5. Non-Merger and Conflict - - None of the execution, delivery or, where applicable, registration of the Loan Documents or the disbursement of funds under the Loans will in any way merge or extinguish the terms and conditions of the Offer Letter, which terms and conditions will continue in full force and effect. In the event of any inconsistency or conflict between any provision contained in the Offer Letter and any provision contained in any of the Loan Documents, the provisions of the Offer Letter shall prevail, but the omission from the Offer Letter of any provision contained in any of the Loan Documents shall not be considered to be an inconsistency or conflict for the purposes hereof.

10

6.6. Assignment - The Borrower shall not be entitled to assign any of the rights and benefits conferred by the Offer Letter. The Offer Letter and the Loan Documents may be freely assigned by the Bank, in whole or in part, without the consent of the Borrower.

6.7. Waiver - Failure by the Bank to insist upon strict performance by the Borrower of any obligation or covenant under the Offer Letter or any of the Loan Documents or to exercise any option or right herein or therein shall not be a waiver or relinquishment for the future of such obligation or covenant, option or right, but the same shall remain in full force and effect and the Bank shall have the right to insist upon the strict performance by the Borrower of any and all of the terms and provisions of the Offer Letter and the Loan Documents.

6.8. Variation - No term or requirement of the Offer Letter or any of the Loan Documents may be waived or varied orally or by any course of conduct of any officer, employee, or agent of the Bank. Any amendment to the Offer Letter or any of the Loan Documents must be in writing and signed by a duly authorized officer of the Bank.

6.9. Indemnification and Confidentiality - - The Offer Letter is delivered to the Borrower on the understanding that neither the Offer Letter nor its substance shall be disclosed publicly or privately except to counsel, accountants, employees and agents of the Borrower who are specifically involve in the transaction contemplated therein. Without limiting the generality of the foregoing, no such person shall use or refer to the Bank’s name in any disclosure made in connection with any of the transactions contemplated under the Offer Letter without the Bank’s prior written consent.

6.10. Time of Essence - Time shall be of the essence of the Offer Letter.

6.11. each of the Borrower and Best Buy Co. shall promptly notify the Bank of the occurrence of any Event of Default or the occurrence of any event, with the giving of notice, lapse of time, or both, would constitute an Event of Default.

6.12. Legal and Other Expenses - - The Borrower shall pay all reasonable legal fees and disbursements in respect of the Loans, the preparation and issuance of the Offer Letter and the Loan Documents, the enforcement and preservation of the Bank’s rights and remedies, all appraisals, insurance consultation, and similar fees, and all other fees and disbursements of the Bank, whether or not the documentation is completed or any funds are advanced under the Loans.

6.13. Notice

Any notice required to be given hereunder or under any other Loan Document shall be in writing and may effectively be given by a party hereto by delivery of such notice to the other party at the address below or at such other address as

11

either party may in writing notify the other party or by facsimile transmission and confirmed in writing to:

In the case of the Bank:

to the address or telecopier number

of the Lending Branch set out on the

first page hereof

Attention: Senior Vice President & Branch Manager

Telecopier No. 604-641-1808

In the case of the Borrower:

Best Buy Canada Ltd.

8800 Glenlyon Parkway

Burnaby, British Columbia

V5J 5K3

Attention: Kevin Layden

President & Chief Operating Officer

Telecopier No. (604) 412-5240

Notice shall be deemed to have been received by a party within 3 Business Days of delivery to the applicable address contemplated above. Notices by facsimile transmission shall be deemed to have been given upon receipt thereof at the address indicated above.

6.14. Governing Law – This Offer Letter shall be governed by and construed in accordance with the laws of the Province of British Columbia and the laws of Canada applicable therein.

6.15. Counterparts and Telecopy - This offer letter may be signed in counterparts and by telecopy, each of which counterparts shall be deemed to be an original, and all such counterparts and telecopies together shall constitute one and the same instrument.

6.16. Bank’s Solicitors - Legal work and documentation is to be performed on behalf of the Bank by Messrs. Lawson Lundell, Barristers and Solicitors, 1600 Cathedral Place, 925 West Georgia Street, Vancouver, British Columbia.

7. Definitions and Interpretation:

In the attached Offer Letter the following terms shall have the following meanings:

7.1. “Acceptable Inventory” means the value based on the lower of cost and fair market value (as reasonably determined by the Bank or its agents) of all materials owned by the Borrower for resale or for the production of goods for resale,

12

excluding work in process and such materials of the Borrower which are financed by other Persons, and from which the Priority Claims shall be deducted from Acceptable Inventory. As at the date of this Offer Letter (and without limiting the Bank’s right at any time to deduct further Priority Claims), it is the Bank’s intention to deduct those Priority Claims accorded to suppliers of inventory pursuant to section 81 of the Bankruptcy and Insolvency Act (Canada), as amended;

7.2. “Acceptable Receivables” means the aggregate of accounts receivable of the Borrower from customers approved by the Bank from which shall be excluded all accounts receivable:

7.2.1 which have been outstanding or not more than 60 days;

7.2.2 from Affiliates of the Borrower;

7.2.3 which are disputed by the Borrower’s customers or a subject to set-off;

7.2.4 from customers from whom other accounts receivable remain outstanding for in excess of 60 days;

7.2.5 accounts receivable from customers resident in the United States,

from which Priority Claims shall be deducted from Acceptable Receivables. As at the date of this Offer Letter (and without limiting the Bank’s right to at any time deduct further Priority Claims), it is the Bank’s intention to deduct those Priority Claims arising under the Employment Standards Act (British Columbia), Excise Tax Act (Canada), Income Tax Act (Canada) and Social Service Tax Act (British Columbia) (and the corresponding legislation in the Province of Quebec);

7.3. “Affiliate” means any party that would, pursuant to the Income Tax Act (Canada), as amended, supplemented or replaced from time to time, not be considered to be dealing at “arms length” with the party in question and any partnership or other organization in which the Borrower or the Guarantors or any of their Affiliates has the right to make or control management decisions and shall include any Affiliate of any such Affiliate;

7.4. “Bank’s Prime Rate” means the floating annual rate of interest established and recorded as such by the Bank from time to time as a reference rate for purposes of determining floating rates of interest it will charge on loans denominated in Canadian Dollars and made in Canada;

7.5. “Bank’s U.S. Base Rate” means the floating annual rate of interest established and recorded as such by the Bank from time to time as a reference rate for the purposes of determining rates of interest it will charge on loans denominated in U.S. Dollars made in Canada based on a year of 360 days;

13

7.6. “Bankers’ Acceptance” means a depository bill as defined in the Depository Bills and Notes Act (Canada) in Canadian Dollars that is in the form of an order signed by the Borrower and accepted by a Lender pursuant to this Agreement or, for Lenders not participating in clearing services contemplated in that Act, a draft or bill of exchange in Canadian Dollars that is drawn by the Borrower and accepted by a Lender pursuant to this Agreement. Orders that become depository bills, drafts and bills of exchange are sometimes collectively referred to in this Agreement as “orders.” Any depository bill may be made payable to “CDS & Co.” and deposited with The Canadian Depository for Securities Limited;

7.7. “Business Day” means a day upon which the branch of Bank issuing the Offer Letter is open for business;

7.8. “Canadian Dollar Equivalent” means at any time on any date in relation to any amount in a currency other than Canadian dollars, the amount of Canadian dollars required for the Borrower to purchase that amount of such other currency at the spot rate of exchange quoted by the Bank at or about 10:30 a.m. (local Vancouver time) on such date, including all premiums and costs of exchange;

7.9. “Canadian Dollars” and “CDN$” each mean lawful currency of Canada;

7.10. “Canadian GAAP” means Canadian generally accepted accounting principles, including such principles recommended by the Canadian Institute of Chartered Accountants as contained in the “CICA Handbook”, as the same may be amended, replaced or restated from time to time, and, in the absence of a specific recommendation contained in the “CICA Handbook”, such accounting principles generally accepted in practice in Canada;

7.11. “Capital Stock�� means, with respect to any Person, any and all present and future shares, partnership or other interests, participations or other equivalent rights in the person’s capital, however designated and whether voting or non-voting;

7.12. “Cash Flow Leverage Ratio” means at any date of determination, the ratio of (a) the Interest-bearing Indebtedness of Best Buy Co. and its Subsidiaries, plus eight times Rental and Lease Expense for the Measurement Period ending on such date, to (b) the sum for the Measurement Period ending on such date of (i) Earnings Before Interest, Income Taxes, Depreciation and Amortization and (ii) Rental and Lease Expense, in all cases determined in accordance with US GAAP and as set forth in Best Buy Co.’s consolidated financial statements delivered hereunder;

7.13. “Change of Control” means the acquisition of Capital Stock by any Person or group of Persons, beneficially or otherwise (whether by purchase, exchange, merger, consolidation or otherwise), directly or indirectly, in one transaction or in a series of related transactions which Person or group of Persons then on account of such acquisition, legally, beneficially or otherwise owns or holds directly or indirectly 50% or more of the Capital Stock of any of the Borrower or the Guarantors;

14

7.14. “Compensating Amount” means an amount determined by the Bank to be the net cost, if any, incurred by the Bank as a direct result of the payment of any amount owing in respect of a Banker’s Acceptance on any date other than the date of maturity for such Banker’s Acceptance, including, without limitation, the loss or expense sustained or incurred by the Bank relating to such payment. A certificate of a manager or account manager of the Bank shall, absent manifest error, be conclusive evidence of the Compensating Amount from time to time;

7.15. “Consolidated Financial Statements” means the consolidated financial statements prepared in respect of Best Buy Co. (and including the Borrower) in accordance with generally accepted accounting principles applied on a consistent basis;

7.16. “Consolidated Net Worth” means as of any date of determination, the sum of the amounts set forth on the consolidated balance sheet of Best Buy Co. as the sum of the common stock, preferred stock, additional paid-in capital and retained earnings of Best Buy Co. (excluding treasury stock);

7.17. “Convertible Debentures” means the US$336,000,000 senior unsecured convertible debentures (issued in 2001) and the US$402,000,000 subordinated convertible debentures (issued in 2002) issued by Best Buy Co.;

7.18. “Draft” means a commercial draft of the Bank in a form approved by the Bank made by the Borrower in accordance with the provisions of the Offer Letter;

7.19. “Earnings Before Interest, Income Taxes, Depreciation and Amortization” means for any period of determination, the consolidated net income of Best Buy Co. and its Subsidiaries before deductions for income taxes, Net Interest Expense, depreciation and amortization, all as determined in accordance with US GAAP, excluding therefrom (a) non-operating gains (including, without limitation, extraordinary or unusual gains, gains from discontinuance of operations, gains arising from the sale of assets and other nonrecurring gains) of Best Buy Co. and its Subsidiaries during the applicable period and (b) similar non-operating losses (including, without limitation, losses arising from the sale of assets and other nonrecurring losses) of Best Buy Co. and its Subsidiaries during such period;

7.20. “Existing Liens” means those Liens described in Schedule “C” attached hereto;

7.21. “Financial Covenants” means any of the financial ratios or calculations to be made or maintained by the Borrower or the Guarantors pursuant to this Offer Letter, including without limitation, the calculations and ratios required to be made or maintained in accordance with paragraphs 12.1.2.5, 12.1.3, 12.1.4 and 12.1.5 of the Offer Letter;

7.22. “Government Authority” means any government legislature, regulatory authority, agency, commission, board or court or other law, regulation or rule

15

making entity having or purporting to have jurisdiction on behalf of any nation, state, country or other subdivision;

7.23. “Guarantee” means with respect to any Person at the time of any determination, without duplication, any obligation, contingent or otherwise, of such Person guaranteeing or having the economic effect of guaranteeing any Indebtedness of any other Person (the “primary obligor”) in any manner, whether directly or otherwise: (a) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness or to purchase (or to advance or supply funds for the purchase of) any direct or indirect security therefor, (b) to purchase property, securities, or services for the purpose of assuring the owner of such Indebtedness of the payment of such Indebtedness, (c) to maintain working capital, equity capital, or other financial statement condition of the primary obligor so as to enable the primary obligor to pay such Indebtedness or otherwise to protect the owner thereof against loss in respect thereof, or (d) entered into for the purpose of assuring in any manner the owner of such Indebtedness of the payment of such Indebtedness or to protect the owner against loss in respect thereof; provided, that the term “Guarantee” shall not include endorsements for collection or deposit in the ordinary course of business;

7.24. “Guarantors” means together Best Buy Co. and Stores L.P.;

7.25. “Indebtedness” with respect to any Person at the time of any determination, without duplication, all obligations, contingent or otherwise, of such Person which in conformity with US GAAP should be classified upon the balance sheet of such Person as liabilities, but in any event shall include: (a) all obligations of such Person for borrowed money, (b) all obligations of such Person evidenced by bonds, debentures, notes or other similar instruments, (c) all obligations of such Person upon which interest charges are customarily paid or accrued, (d) all obligations of such Person under conditional sale or other title retention agreements relating to property purchased by such Person, (e) all obligations of such Person issued or assumed as the deferred purchase price of property or services, (f) all obligations of others secured by any Lien on property owned or acquired by such Person, whether or not the obligations secured thereby have been assumed, (g) all capitalized lease obligations of such Person, (h) all obligations of such Person in respect of interest rate protection agreements, (i) all obligations of such Person, actual or contingent, as an account party in respect of letters of credit or bankers’ acceptances, (j) all obligations of any partnership or joint venture as to which such Person is or may become personally liable, and (k) all Guarantees by such Person of Indebtedness of others. For clarification purposes, Indebtedness of the Borrower shall include the Indebtedness arising from this Offer Letter;

7.26. “Interest Coverage Ratio” means for any Measurement Period, the ratio of (a) the sum of Best Buy Co.’s (i) Earnings Before Interest, Incomes Taxes, Depreciation and Amortization plus (ii) Rental and Lease Expense to (b) the sum of (i) Net Interest Expense, plus (ii) Rental and Lease Expense;

16

7.27. “Interest Expense” means for any period of determination, the aggregate consolidated amount, without duplication, of interest paid, accrued (including without limitation, payment in kind interest) or scheduled to be paid in respect of any consolidated Indebtedness of Best Buy Co. and its Subsidiaries, including (a) all but the principal component of payments in respect of conditional sale contracts, capitalized leases and other title retention agreements, and (b) net costs (income) under interest rate protection agreements, in each case determined in accordance with US GAAP;

7.28. “Interest Income” means for any period of determination, the aggregate consolidated amount, without duplication, of interest received, accrued (including without limitation, payment in kind interest) or scheduled to be received by Best Buy Co. and its Subsidiaries, including (a) all but the principal component of payments in respect of conditional sale contracts, capitalized leases and other title retention agreements, and (b) net income (costs) under interest rate protection agreements, in each case determined in accordance with US GAAP;

7.29. “Interest-bearing Indebtedness” means at the time of any determination, all of the Indebtedness of Best Buy Co. and its Subsidiaries (a) for borrowed money or (b) to third party financers to finance the purchase of inventory, to the extent not paid before interest begins to accrue;

7.30. “Investments” means all investments, in cash or by delivery of property, made directly or indirectly in any property or assets or in any Persons, whether by acquisition of shares of capital stock, Indebtedness or other obligations or securities or by loan, advance, capital contribution or otherwise;

7.31. “Letter of Credit” means a bank guarantee, standby letter of credit or commercial letter of credit in a form satisfactory to the Bank issued by the Bank at the request of any of the Borrowers in favour of the third party to secure the payment or performance of an obligation of the Borrowers or any of them to the third party;

7.32. “Legal Requirement” means all laws, statutes, codes, ordinances, orders, awards, judgments, decrees, injunctions, rules, regulations, authorizations, consents, approvals, orders, permits, franchises, licences, directions and requirements of all Governmental Authorities;

7.33. “Lien” means, with respect to any item of Property, any security interest, mortgage or deed of trust, pledge, hypothecation, assignment, deposit arrangement, lien, charge, easement (other than any easement not materially impairing usefulness or marketability), encumbrance, preference, priority or other security agreement or preferential arrangement of any kind or nature whatsoever on or with respect to such item of Property (including, without limitation, any conditional sale or other title retention agreement having substantially the same economic effect as any of the foregoing);

17

7.34. “Measurement Period” means each period of four fiscal quarters ending on the last day of a fiscal quarter of Best Buy Co.;

7.35. “Net Interest Expense” means for any period of determination, Interest Expense minus Interest Income.

7.36. “Offer Letter” means the letter from the Bank to the Borrower to which this Schedule “A” is attached, together with this Schedule “A”, and includes all amendments, supplements and replacements thereof;

7.37. “Persons” means any individual, partnership, limited partnership, joint venture, syndicate, sole proprietorship, company or corporation with or without share capital, unincorporated association, trust, trustee, executor, administrator or other legal personal representative, regulatory body or agency, government or governmental agency, authority or entity however designated or constituted;

7.38. “Priority Claims” means the aggregate of any mortgage, security interest, encumbrance, hypothecation, assignment, Lien or other claim over any item of Property which, in the opinion of the Bank or its solicitors, rank in priority to any claim in or to the Property that the Bank may have pursuant to the Loan Documents or otherwise pursuant to any Government Authority;

7.39. “Property” means all or any undertaking, property and assets of the Borrower or the Guarantors;

7.40. “Purchase Money Mortgage” means any Lien, including a lease, created, issued or assumed by the Borrower to secure indebtedness as part of, or issued or incurred to provide funds to pay and not exceeding 100% of the unpaid purchase price (including instalment) of any Property, if the Lien is limited to the Property acquired and is created, issued or assumed substantially concurrently with the acquisition of the Property or in connection with the refinancing of an existing Purchase Money Mortgage, if the principal amount has not increased and the Lien continues to be limited to that Property;

7.41. “Rental and Lease Expense” means for any period of determination, the aggregate consolidated amount, without duplication of all amounts paid or accrued by Best Buy Co. or any Subsidiary under all capital leases and other leases of real or personal property, including net costs (income) under interest rate protection agreements with respect to such amounts, but excluding any portion of such amounts included in calculating Net Interest Expense of Best Buy Co. for such period, in each case determined in accordance with US GAAP;

7.42. “Stock” means all shares, options, warrants, equity interests, equity participations, or other equivalents (regardless of how designated) of or in a corporation, partnership, limited partnership or equivalent entity whether voting or nonvoting or participating or non-participating

18

7.43. “Subsidiary” means with respect to any Person, any corporation, partnership, trust or other Person of which more than 50% of the outstanding capital stock (or similar interests) having ordinary voting power to elect a majority of the board of directors of such corporation (or similar governing body) (irrespective of whether or not, at the time, capital stock of or other similar interests shall or might have voting power upon the occurrence of any contingency) is at the time directly or indirectly owned by such Person, by such Person and one or more other Subsidiaries of such Person;

7.44. “Taxes” includes all present and future taxes, rates, levies or assessments (ordinary or extraordinary), imposts, stamp taxes, royalties, duties, fees, dues, deductions, withholdings, sales taxes or charges, added value charges, charges or taxes on capital or reserves, levied, assessed or imposed by any government or governmental authority, and any restrictions or conditions resulting in a tax and all penalty, interest and other payments on or in respect thereof;

7.45. “U.S. Credit Agreement” means the amended and restated credit agreement dated as of March 21, 2002 by and between Best Buy Co., the lenders from time to time party thereto and U.S. Bank National Association, as agent for the lenders party thereto.

7.46. “U.S. Dollar Equivalent” means - at any time on any date in relation to any amount in a currency other than U.S. Dollars, the amount of U.S. Dollars required for the Borrower to purchase that amount of such other currency at the spot rate of exchange quoted by the Bank at or about 10:30 a.m. (local Vancouver time) on such date, including all premiums and costs of exchange;

7.47. “U.S. Dollars” and “U.S. $” each mean lawful currency of the United States of America; and

7.48. “US GAAP” means generally accepted accounting principles set forth in the opinions and pronouncements of the Accounting Principles Board of the American Institute of Certified Public Accountants and statements and pronouncements of the Financial Accounting Standards Board or in such other statements by such other entity as may be approved by a significant segment of the accounting profession, which are applicable to the circumstances as of March 21, 2002.

19

SCHEDULE “B” TO OFFER LETTER

FROM HSBC BANK CANADA