CNB CORPORATION AND SUBSIDIARY |

| Conway, South Carolina |

|

CONSOLIDATED BALANCE SHEET |

(Unaudited) |

| | |

| ASSETS: | Dec. 31, 2005 | Dec. 31, 2004 |

| Cash and due from banks | $ 33,461,000 | $ 25,793,000 |

| Interest-bearing deposits with banks | 0 | 0 |

| Investment securities: | | |

| United States government securities | 0 | 0 |

| Obligations of United States government agencies | | |

| and corporations | 159,127,000 | 191,352,000 |

| Obligations of states and political subdivisions | 21,028,000 | 22,838,000 |

| Other securities | 1,788,000 | 1,636,000 |

| Total investment securities | 181,943,000 | 215,826,000 |

| Federal funds sold and securities purchased | | |

| under agreement to resell | 46,000,000 | 0 |

| Loans | 503,926,000 | 406,983,000 |

| Less allowance for loan losses | (5,918,000) | (5,104,000) |

| Net loans | 498,008,000 | 401,879,000 |

| Bank premises and equipment | 20,574,000 | 17,628,000 |

| Other assets | 13,362,000 | 10,443,000 |

| Total assets | $793,348,000 | $ 671,569,000 |

| | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY: | | |

| Liabilities: | | |

| Deposits: | | |

| Noninterest-bearing | $ 135,081,000 | $ 118,580,000 |

| Interest-bearing | 532,024,000 | 441,784,000 |

| Total deposits | $ 667,105,000 | $ 560,364,000 |

| | |

Federal funds purchased and securities sold under

agreement to repurchase | 43,296,000 | 33,950,000 |

| Other short-term borrowings | 2,197,000 | 2,895,000 |

| Other liabilities | 10,192,000 | 6,775,000 |

| Total Liabilities | $ 722,790,000 | $ 603,984,000 |

| | |

| Stockholders' Equity: | | |

| Common stock, par value $10.00 per share: | | |

| Authorized 1,500,000; issued 789,774 in 2004 and 2005 | 7,898,000 | 7,898,000 |

| Surplus | 43,547,000 | 43,543,000 |

| Undivided profits | 21,093,000 | 15,558,000 |

| Net unrealized holding gains (losses) on | (1,810,000) | 734,000 |

| available-for-sale securities | | |

| Less treasury stock | (170,000) | (148,000) |

| Total stockholders' equity | $ 70,558,000 | $ 67,585,000 |

| Total liabilities and stockholders' equity | $ 793,348,000 | $ 671,569,000 |

| | |

| | |

Member Federal Reserve System - Member FDIC

CNB CORPORATION AND SUBSIDIARY |

| Conway, South Carolina |

|

CONSOLIDATED STATEMENT OF INCOME |

(Unaudited) |

| |

| | Twelve Months Ended |

| INTEREST INCOME: | Dec. 31, 2005 | Dec. 31, 2004 |

| Interest and fees on loans | $ 30,725,000 | $ 24,030,000 |

| Interest on investment securities: | | |

| Taxable investment securities | 6,396,000 | 6,599,000 |

| Tax-exempt investment securities | 881,000 | 956,000 |

| Other securities | 65,000 | 57,000 |

| Interest on federal funds sold and securities purchased | | |

| under agreement to resell | 782,000 | 328,000 |

| Total interest income | 38,849,000 | 31,970,000 |

| | | |

| INTEREST EXPENSE: | | |

| Interest on deposits | 9,778,000 | 6,573,000 |

| Interest on federal funds purchased and securities | | |

| sold under agreement to repurchase | 667,000 | 351,000 |

| Interest on other short-term borrowings | 14,000 | 14,000 |

| Total interest expense | 10,459,000 | 6,938,000 |

| | | |

| Net interest income | 28,390,000 | 25,032,000 |

| Provision for loan losses | 1,275,000 | 1,155,000 |

| Net interest income after provision for loan losses | 27,115,000 | 23,877,000 |

| Other income: | | |

| Service charges on deposit accounts | 3,410,000 | 3,504,000 |

| Gains/(losses) on securities | 2,000 | 0 |

| Other operating income | 3,229,000 | 3,073,000 |

| Total other income | 6,641,000 | 6,577,000 |

| Other expenses: | | |

| Salaries and employee benefits | 12,459,000 | 11,359,000 |

| Occupancy expense | 2,728,000 | 2,509,000 |

| Other operating expenses | 4,342,000 | 4,377,000 |

| Total other expenses | 19,529,000 | 18,245,000 |

| Income before income taxes | 14,227,000 | 12,209,000 |

| Income tax provision | 4,749,000 | 3,927,000 |

| Net Income | $ 9,478,000 | $ 8,282,000 |

| | | |

| Per share: | | |

| Net income per weighted average shares outstanding | $ 12.02 | $ 10.50 |

| | | |

| Cash dividend paid per share | $ 5.00 | $ 4.25 |

| | | |

| Book value per actual number of shares outstanding | $ 89.48 | $ 85.70 |

| | | |

| Weighted average number of shares outstanding | 788,496 | 789,006 |

| | | |

| Actual number of shares outstanding | 788,534 | 788,645 |

| | | |

Member Federal Reserve System - Member FDIC |

| | | |

| | | |

| | | |

CNB CORPORATION AND SUBSIDIARY |

| Conway, South Carolina |

| |

| FINANCIAL HIGHLIGHTS |

| (All Dollar Amounts, Except Per Share Data, in Thousands) |

| | | | | |

| | 2004 to 2005 | | 2003 to 2004 | |

| | Percent | | Percent | |

| | Increase | | Increase | |

| FOR THE YEAR | 2005 | (Decrease) | 2004 | (Decrease) | 2003 |

| | | | | |

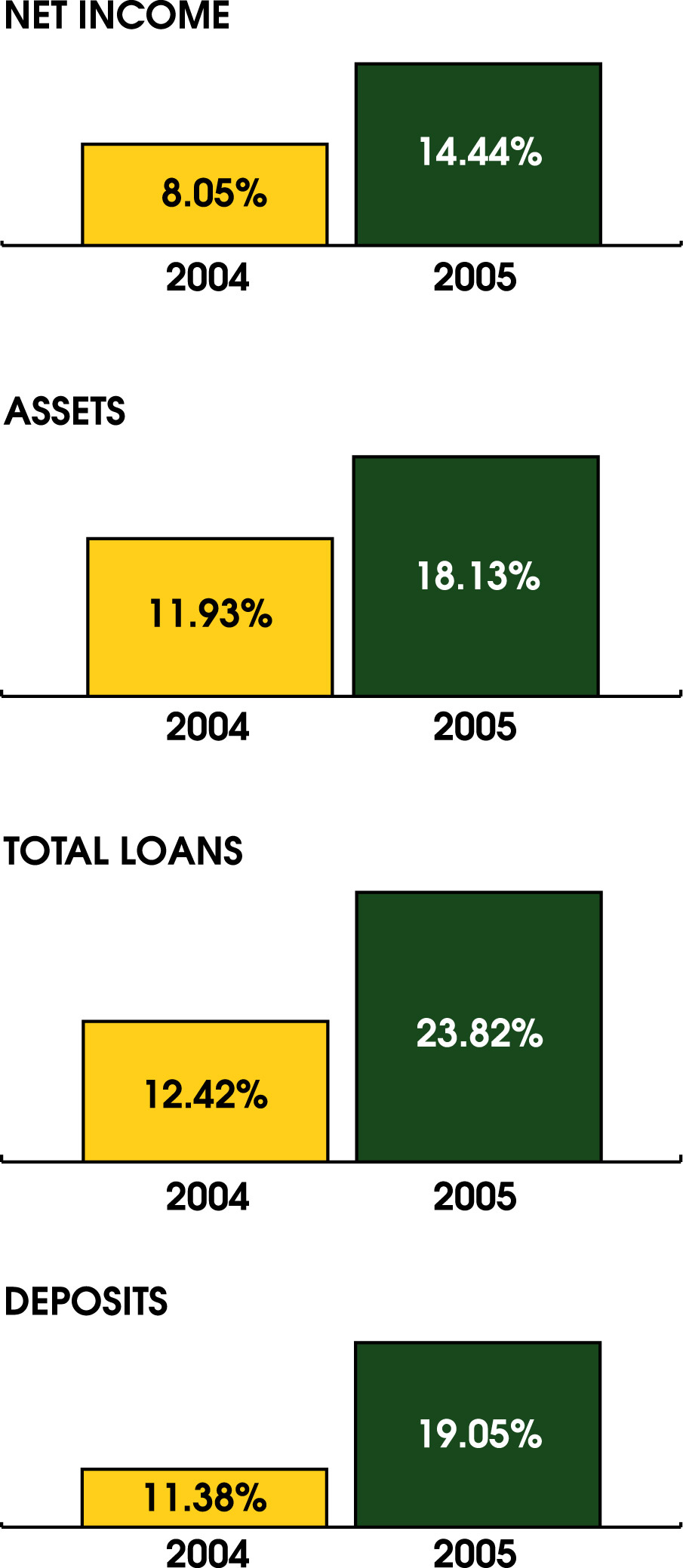

| Net Income | $ 9,478 | 14.44% | $ 8,282 | 8.05% | $ 7,665 |

| | | | | |

| Earnings Per Share of Common Stock (1) | $ 12.02 | 14.48% | $ 10.50 | 8.14% | $ 9.71 |

| | | | | |

| Return on Stockholders' Equity | 13.41% | 9.65% | 12.23% | 3.12% | 11.86% |

| | | | | |

| Return on Average Assets | 1.30% | 3.17% | 1.26% | (2.33)% | 1.29% |

| | | | | |

| Cash Dividends Paid Per Share (1) | $ 5.00 | 17.65% | $ 4.25 | 16.76% | $ 3.64 |

| | | | | |

| | | | | |

| AT YEAR-END | | | | | |

| | | | | |

| Assets | $793,348 | 18.13% | $671,569 | 11.93% | $599,978 |

| | | | | |

| Total Loans | $503,926 | 23.82% | $406,983 | 12.42% | $362,034 |

| | | | | |

| Deposits | $667,105 | 19.05% | $560,364 | 11.38% | $503,113 |

| | | | | |

| Total Loans to Deposit Ratio | 75.54% | 4.01% | 72.63% | .93% | 71.96% |

| | | | | |

| Stockholders' Equity | $ 70,558 | 4.40% | $ 67,585 | 4.58% | $ 64,623 |

| | | | | |

| Footnotes: | | | | | |

| | | | | |

| (1) Adjusted for the effect of a 10% stock dividend paid in 2004. |

There’s A New Spirit At

The Conway National Bank

Changes Have Increased Profitability and Other Good News

Positive changes have occured at The Conway National Bank. We’ve expanded our programs and our number of locations to help us better serve our customers and enlarge our presence in the region. We can now better compete with the regional banks as well as the local banks within our market. Here are some of the exciting developments:

• CNB has opened additional mortgage loan offices in strategic locations, making us more available and

easily accessible to more customers.

• CNB has expanded our secondary market mortgage loan program, making our loans more

competitive and reaching a much larger market segment. Our other mortgage loans, consumer

loans, and commercial loans have increased by nearly 24% in the last year allowing us to generate

more income on deposits.

• CNB has completely revamped our online banking website, improving customer service and giving us

technology that is equal to or better than that of other banks entering our market.

• In June 2005, 35 employees were paid below the minimum salary established for their job position by

an outside compensation consultant based on peer bank data. We’ve made changes so that

salaries have been raised and now no employee is paid a salary below the minimum.

• All officers and employees now have email, which is so essential for conducting business in today’s

business environment.

• Our new Pawleys Island Office Grand Opening on January 20 was well attended as we expanded our

presence on Waccamaw Neck.

• Construction is moving along quickly on our new North Conway Office on the corner of North Main

Street and Cultra Road.

• We have purchased a branch site on River Oaks Drive and Village Center Boulevard at Town Center

in Carolina Forest.

Because of our great employees, look at how we’ve progressed from 12-31-04 to 12-31-05.

Changes You Can Measure in CNB’s Financial Growth

Net income increased 14.4% or $1,196,000 to $9,478,000.

Assets increased 18.1% or $121,779,000 to $793,348,000.

Loans increased 23.8% or $96,943,000 to $503,926,000.

Deposits increased 19.1% or $106,105,000.

It’s a pleasure to be in an organization building for the future where morale is high, people are happy, and our

customers are noticing the change. We appreciate your support as we strive to grow and improve your investment

and your local independent bank.

R. Phil Hucks, President

CNB Corporation and

The Conway National Bank

GROWTH RATES

CONWAY NATIONAL BANK

OFFICERS

R. Phil Hucks | President |

�� Paul R. Dusenbury | Executive Vice President |

| William R. Benson | Senior Vice President |

| Marion E. Freeman, Jr. | Senior Vice President |

| Phillip H. Thomas | Senior Vice President |

| L. Ford Sanders, II | Senior Vice President |

| W.G. Holt, Jr. | Vice President |

| M. Terry Hyman | Vice President |

| Raymond Meeks | Vice President |

| A. Mitchell Godwin | Vice President |

| Jackie C. Stevens | Vice President |

| Dana P. Arneman, Jr. | Vice President |

| Betty M. Graham | Vice President |

| Ernest J. Lareau | Vice President |

| D. Richard Causey | Vice President |

| F. Timothy Howell | Vice President |

| E. Wayne Suggs | Vice President |

| Janice C. Simmons | Vice President |

| Patricia C. Catoe | Vice President |

| W. Michael Altman | Vice President |

| Boyd W. Gainey, Jr. | Vice President |

| William C. Purvis | Vice President |

| Gail S. Sansbury | Assistant Vice President |

| Ray Wells | Assistant Vice President |

| W. Page Ambrose | Assistant Vice President |

| Roger L. Sweatt | Assistant Vice President |

| Linda Kay Benton | Assistant Vice President |

| Virginia B. Hucks | Assistant Vice President |

| Elaine H. Hughes | Assistant Vice President |

| Timothy L. Phillips | Assistant Vice President |

| Helen A. Johnson | Assistant Vice President |

| Gwynn Branton | Assistant Vice President |

| Tammy S. Scarberry | Assistant Vice President |

| D. Scott Hucks | Assistant Vice President |

| Sherry S. Sawyer | Banking Officer |

| Rebecca G. Singleton | Banking Officer |

| Josephine C. Fogle | Banking Officer |

| Jeffrey P. Singleton | Banking Officer |

| Debra B. Johnston | Banking Officer |

| Freeman Holmes | Banking Officer |

| Doris B. Gasque | Banking Officer |

| Carlton A. Terry | Banking Officer |

| James A. Hansen | Banking Officer |

| Jennie L. Hyman | Banking Officer |

| Marsha S. Jordan | Banking Officer |

| Sylvia G. Dorman | Banking Officer |

| Marcie T. Shannon | Banking Officer |

| Caroline P. Juretic | Banking Officer |

| Dana M. Gasque | Banking Officer |

| Sheila A. Graham | Banking Officer |

| John H. Sawyer, Jr. | Banking Officer |

| Robert P. Hucks, II | Banking Officer |

| Nicole Scalise | Banking Officer |

| Janet F. Carter | Branch Manager |

| Dawn L. DePencier | Branch Manager |

| CNB CORPORATION |

| BOARD OF DIRECTORS |

| | |

| James W. Barnette, Jr. | W. Jennings Duncan |

| William R. Benson | Paul R. Dusenbury |

| Harold G. Cushman | R. Phil Hucks |

| H. Buck Cutts | Richard M. Lovelace, Jr. |

| Willis J. Duncan | Howard B. Smith, III |

| | |

BRANCH LOCATIONS

Hours: Monday Thursday 9:00 AM 5:00 PM

Friday 9:00 AM 6:00 PM

Drive-Up Windows Open at 8:30 AM

CNB Access Phone Numbers:

(Account information available 24 hours a day)

248-7118 / 238-9657

Operations & | Aynor Office* |

| Administration | 2605 Hwy. 501 |

| 1400 Third Ave. | PO Box 400 |

| PO Box 320 | Aynor, SC 29511 |

| Conway, SC 29528 | 358-1600 |

| 248-5721 or 238-2600 | |

| |

| Conway Banking Office* | Myrtle Beach Office* |

| 1411 Fourth Avenue | 1353 21st Ave. N. |

| PO Box 320 | PO Drawer 8249 |

| Conway, SC 29528 | Myrtle Beach, SC 29578 |

| 248-5721 or 238-2600 | 626-4441 |

| |

| Surfside Beach Office* | West Conway Office* |

| 425 Hwy. 17 & 5th Ave. N. | 2810 Church Street |

| PO Box 15069 | PO Box 320 |

| Surfside Beach, SC 29587 | Conway, SC 29528 |

| 238-5125 | 365-4500 |

| |

| Northside Office* | North Conway ATM* |

| 9726 Hwy. 17 N. | 2601 Main Street |

| Myrtle Beach, SC 29572 | Conway, SC 29526 |

| 449-3373 | |

| |

| Main Street Office | Murrells Inlet Office* |

| 309 Main Street | 4345 Hwy. 17 Bypass |

| PO Box 320 | PO Box 2490 |

| Conway, SC 29528 | Murrells Inlet, SC 29576 |

| 248-4008 | 651-8135 |

| |

| Coastal Centre Office* | North Myrtle Beach Office* |

| 1212 16th Ave. | 110 Hwy. 17 North |

| PO Box 320 | North Myrtle Beach, |

| Conway, SC 29528 | SC 29582 |

| 248-5751 | 663-5721 |

| |

| |

| Red Hill Office* | Little River ATM* |

| 1360 Hwy. 501 | 2396 Highway 9 West |

| PO Box 320 | Longs, SC 29568 |

| Conway, SC 29528 | |

| 347-4601 | |

| |

| Socastee Office* | Pawleys Island* |

| Hwy. 17 Bypass S. | 10608 Ocean Hwy. |

| 3591 North Gate Rd. | PO Box 4539 |

| Myrtle Beach, SC 29588 | Pawleys Island, SC 29585 |

| 293-4422 | 979-5721 |

| |

| *Denotes ATM on premises |