POWERING GROWTH DELIVERING VALUE Fourth Quarter & Full Year 2022 Results February 27, 2023 1

Forward Looking Statements 2 This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project,” "anticipate," "goal," "seek," "strategy," "likely," "should," "will," "could," and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: the current economic environment and its effects, such as lower economic growth, a tight labor market, inflation, supply chain delays, increased expenses, volatile capital markets, or other unpredictable effects; our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; variations in demand for electricity, including those due to weather, seasonality (including large increases in ambient temperatures), the general economy or social conditions, customer, and sales growth (or decline), the effects of energy conservation measures and distributed generation, and technological advancements; the potential effects of climate change on our electric system, including as a result of weather extremes such as prolonged drought and high temperature variations in the area where APS conducts its business; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments, and proceedings; new legislation, ballot initiatives and regulation or interpretations of existing legislation or regulations, including those relating to environmental requirements, regulatory and energy policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs through our rates and adjustor recovery mechanisms, including returns on and of debt and equity capital investment; our ability to meet renewable energy and energy efficiency mandates and recover related costs; the ability of APS to achieve its clean energy goals (including a goal by 2050 of 100% clean, carbon-free electricity) and, if these goals are achieved, the impact of such achievement on APS, its customers, and its business, financial condition, and results of operations; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona; the direct or indirect effect on our facilities or business from cybersecurity threats or intrusions, data security breaches, terrorist attack, physical attack, severe storms, or other catastrophic events, such as fires, explosions, pandemic health events or similar occurrences; the development of new technologies which may affect electric sales or delivery, including as a result of delays in the development and application of new technologies; the cost of debt, including increased cost as a result of rising interest rates, and equity capital and the ability to access capital markets when required; environmental, economic, and other concerns surrounding coal-fired generation, including regulation of GHG emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant landowners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders. Fourth Quarter 2022

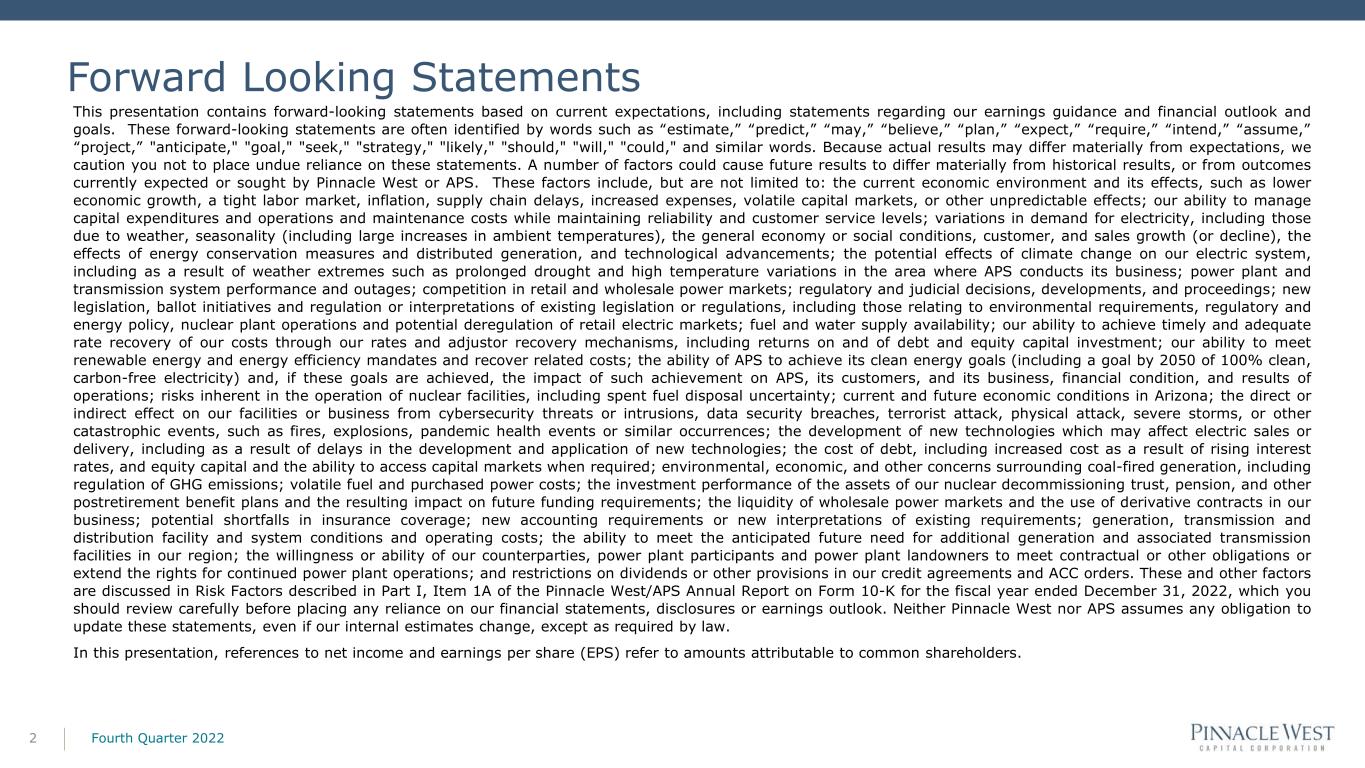

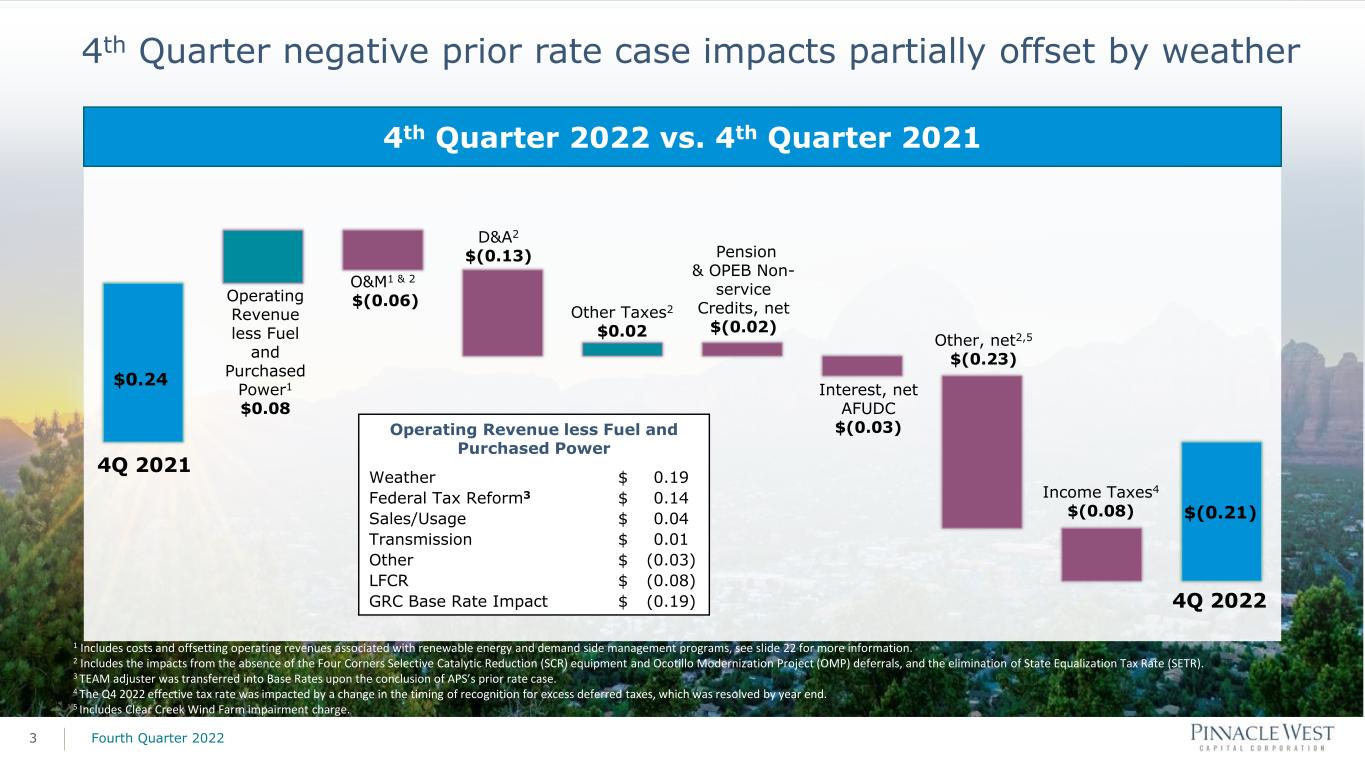

4th Quarter negative prior rate case impacts partially offset by weather 3 4th Quarter 2022 vs. 4th Quarter 2021 4Q 2021 4Q 2022 $0.24 $(0.21) Operating Revenue less Fuel and Purchased Power1 $0.08 O&M1 & 2 $(0.06) D&A2 $(0.13) Operating Revenue less Fuel and Purchased Power Weather Federal Tax Reform3 Sales/Usage Transmission Other LFCR GRC Base Rate Impact $ $ $ $ $ $ $ 0.19 0.14 0.04 0.01 (0.03) (0.08) (0.19) Pension & OPEB Non- service Credits, net $(0.02) Other, net2,5 $(0.23) 1 Includes costs and offsetting operating revenues associated with renewable energy and demand side management programs, see slide 22 for more information. 2 Includes the impacts from the absence of the Four Corners Selective Catalytic Reduction (SCR) equipment and Ocotillo Modernization Project (OMP) deferrals, and the elimination of State Equalization Tax Rate (SETR). 3 TEAM adjuster was transferred into Base Rates upon the conclusion of APS’s prior rate case. 4 The Q4 2022 effective tax rate was impacted by a change in the timing of recognition for excess deferred taxes, which was resolved by year end. 5 Includes Clear Creek Wind Farm impairment charge. Fourth Quarter 2022 Other Taxes2 $0.02 Interest, net AFUDC $(0.03) Income Taxes4 $(0.08)

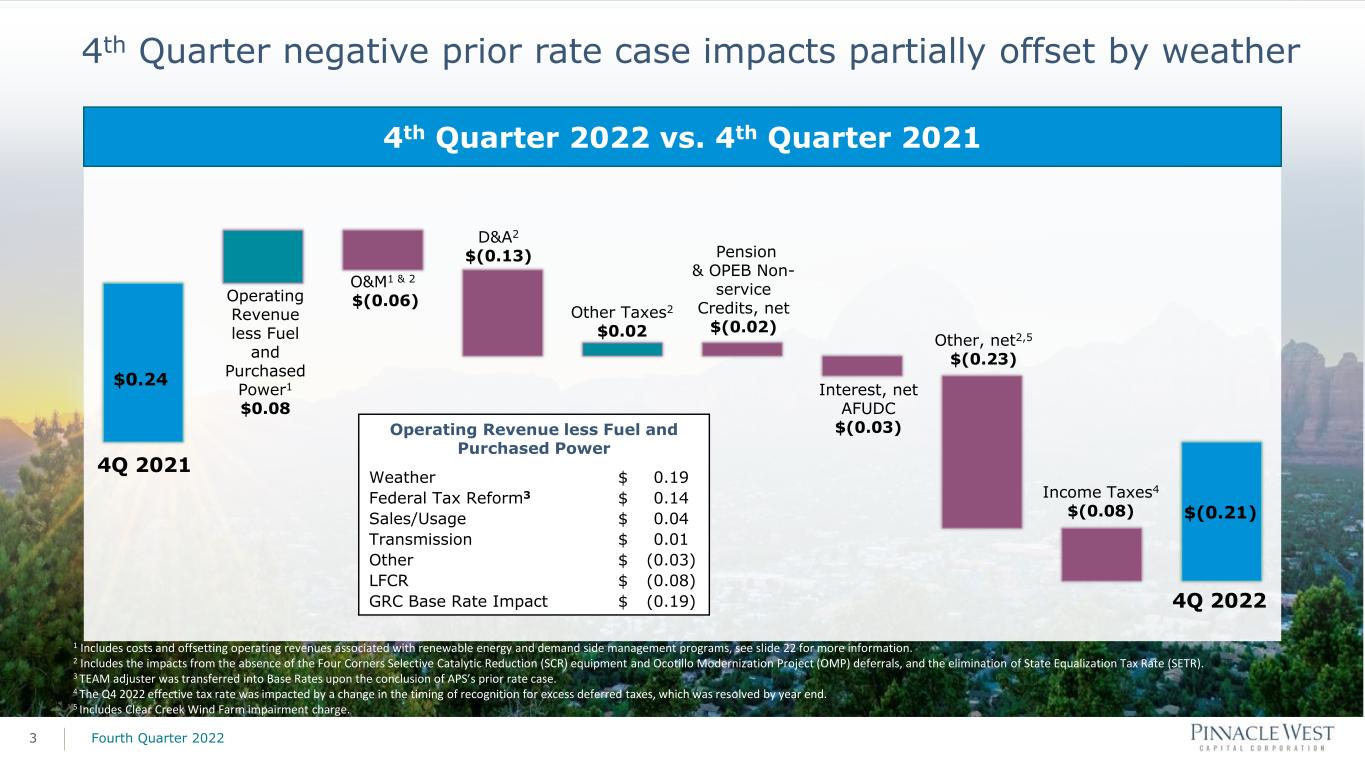

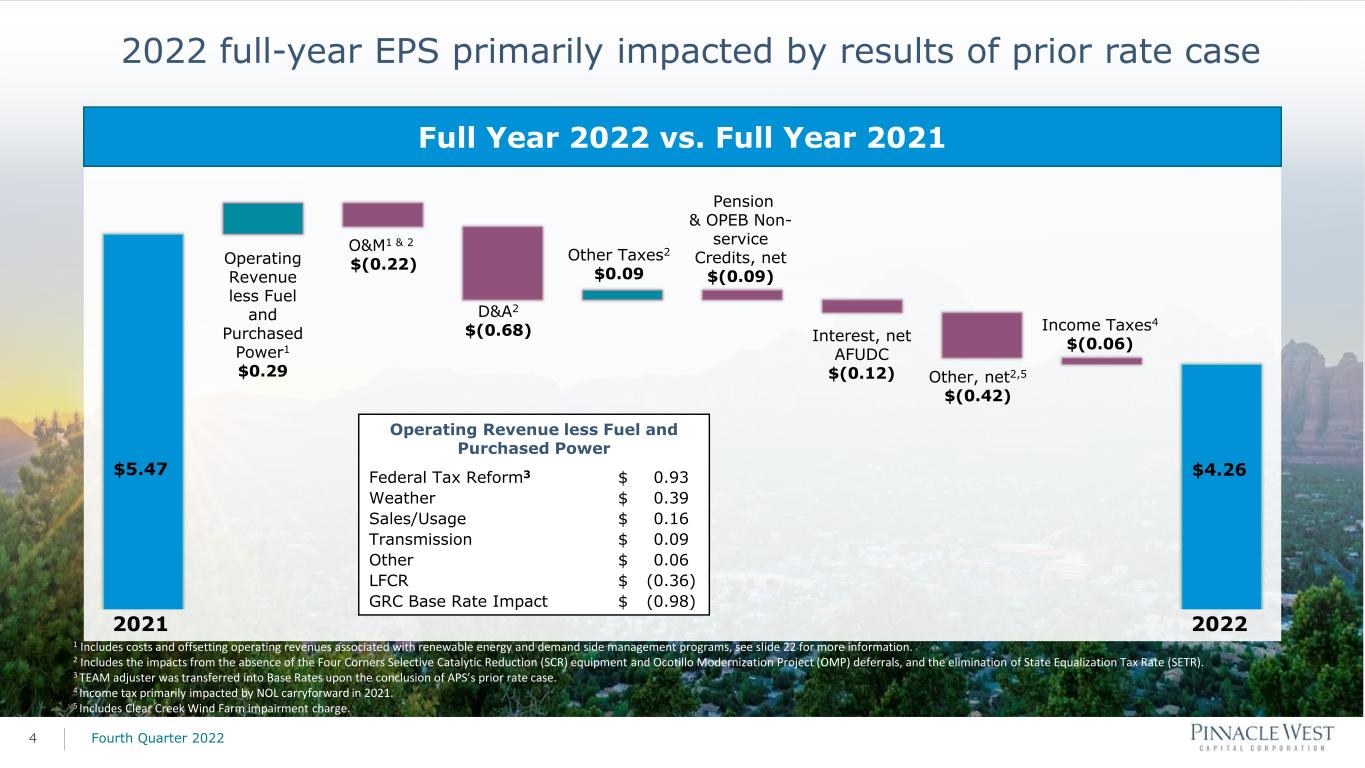

2022 full-year EPS primarily impacted by results of prior rate case 4 Full Year 2022 vs. Full Year 2021 2021 2022 $5.47 $4.26 Operating Revenue less Fuel and Purchased Power1 $0.29 O&M1 & 2 $(0.22) D&A2 $(0.68) Operating Revenue less Fuel and Purchased Power Federal Tax Reform3 Weather Sales/Usage Transmission Other LFCR GRC Base Rate Impact $ $ $ $ $ $ $ 0.93 0.39 0.16 0.09 0.06 (0.36) (0.98) Pension & OPEB Non- service Credits, net $(0.09) Other, net2,5 $(0.42) 1 Includes costs and offsetting operating revenues associated with renewable energy and demand side management programs, see slide 22 for more information. 2 Includes the impacts from the absence of the Four Corners Selective Catalytic Reduction (SCR) equipment and Ocotillo Modernization Project (OMP) deferrals, and the elimination of State Equalization Tax Rate (SETR). 3 TEAM adjuster was transferred into Base Rates upon the conclusion of APS’s prior rate case. 4 Income tax primarily impacted by NOL carryforward in 2021. 5 Includes Clear Creek Wind Farm impairment charge. Fourth Quarter 2022 Other Taxes2 $0.09 Interest, net AFUDC $(0.12) Income Taxes4 $(0.06)

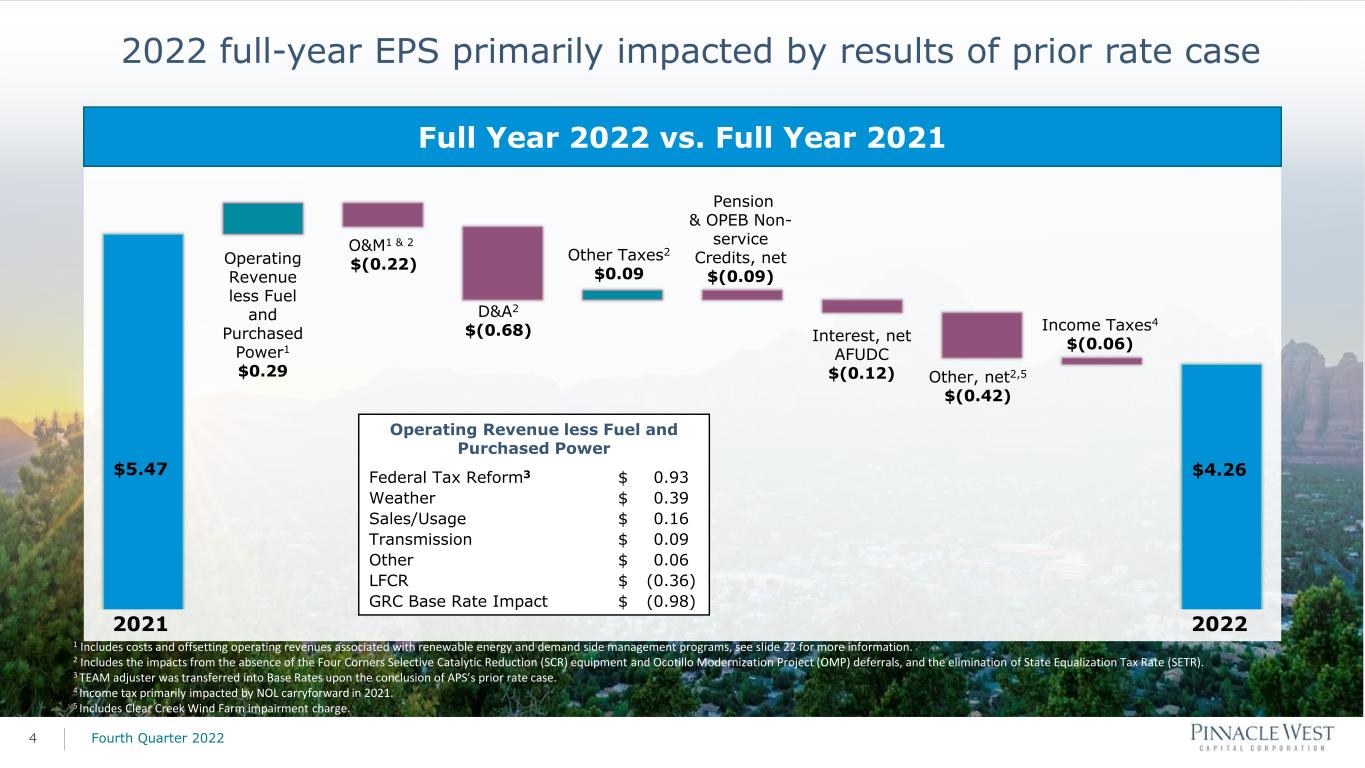

2023 EPS guidance Fourth Quarter 20225 Key Factors and Assumptions as of February 27, 2023 2023 Adjusted gross margin (operating revenues, net of fuel and purchased power expenses, x/RES,DSM,CCT)1 $2.67 – $2.72 billion • Retail customer growth 1.5%-2.5% • Weather-normalized retail electricity sales growth of 3.5%-5.5% • Includes 2.0%-4.0% contribution to sales growth of new large manufacturing facilities and several large data centers • Assumes normal weather for full-year forecast Adjusted operating and maintenance expense (O&M x/RES,DSM,CCT)1 $885 - $905 million Other operating expenses (depreciation and amortization, and taxes other than income taxes) $1.02 - $1.03 billion Other income (pension and other post-retirement non-service credits, other income and other expense) $39 - $43 million Interest expense, net of allowance for borrowed and equity funds used during construction (Total AFUDC ~$70 million) $280 – $300 million Net income attributable to noncontrolling interests $17 million Effective tax rate 10.8% Average diluted common shares outstanding 113.6 million EPS Guidance $3.95 - $4.15 1 Excludes costs and offsetting operating revenues associated with renewable energy and demand side management programs.

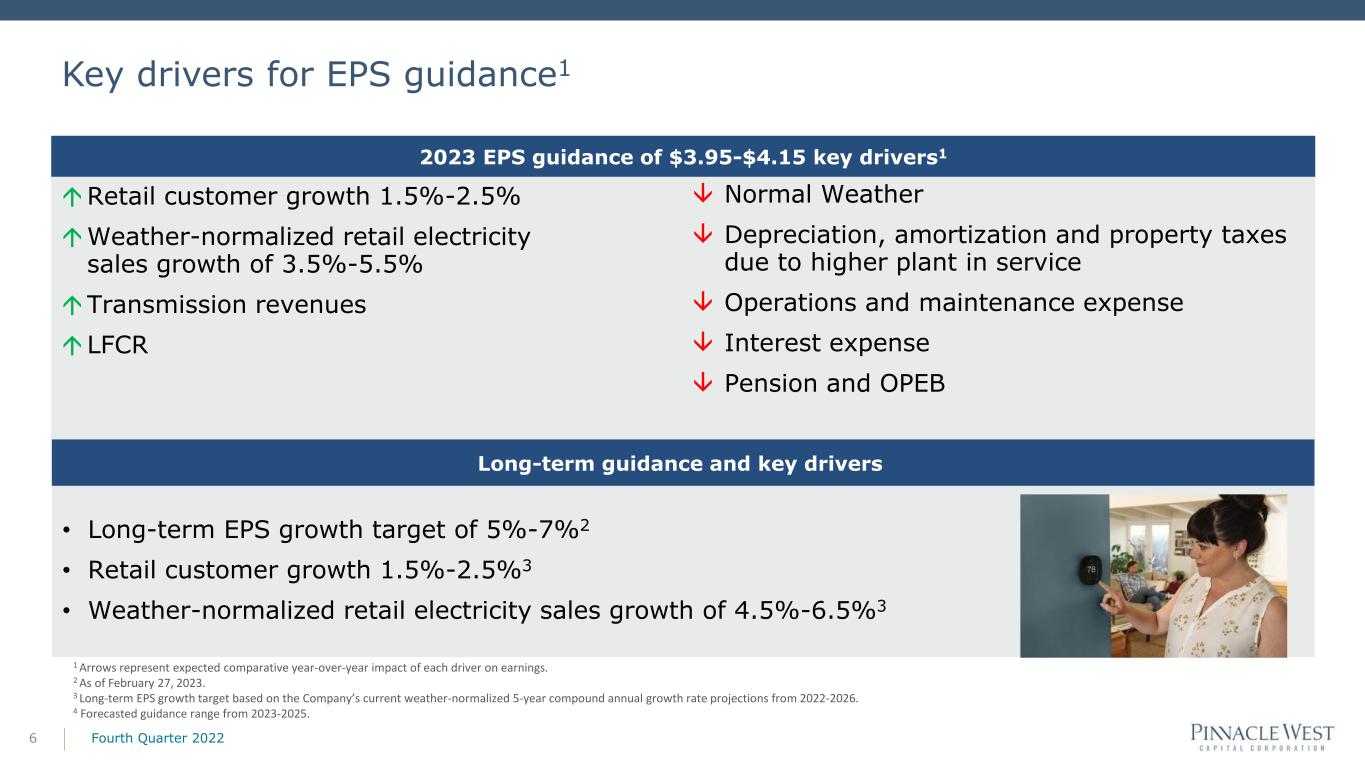

Key drivers for EPS guidance1 1 Retail customer growth 1.5%-2.5% Weather-normalized retail electricity sales growth of 3.5%-5.5% Transmission revenues LFCR Fourth Quarter 20226 2023 EPS guidance of $3.95-$4.15 key drivers1 • Long-term EPS growth target of 5%-7%2 • Retail customer growth 1.5%-2.5%3 • Weather-normalized retail electricity sales growth of 4.5%-6.5%3 1 Arrows represent expected comparative year-over-year impact of each driver on earnings. 2 As of February 27, 2023. Long-term guidance and key drivers Normal Weather Depreciation, amortization and property taxes due to higher plant in service Operations and maintenance expense Interest expense Pension and OPEB 3 Long-term EPS growth target based on the Company’s current weather-normalized 5-year compound annual growth rate projections from 2022-2026. 4 Forecasted guidance range from 2023-2025.

$167 $265 $260 $255 $577 $520 $530 $530 $217 $260 $300 $300 $345 $360 $465 $520 $226 $265 $245 $245 2022 2023E 2024E 2025E Other Generation Clean Generation Transmission Distribution Other APS Total 2023-2025 $5.32B $1.53B $1.67B $1.80B $1.85B 7 Managed capital plan to support customer growth, reliability, and clean transition 2023–2025 as disclosed in the 2022 Form 10-K. Fourth Quarter 2022

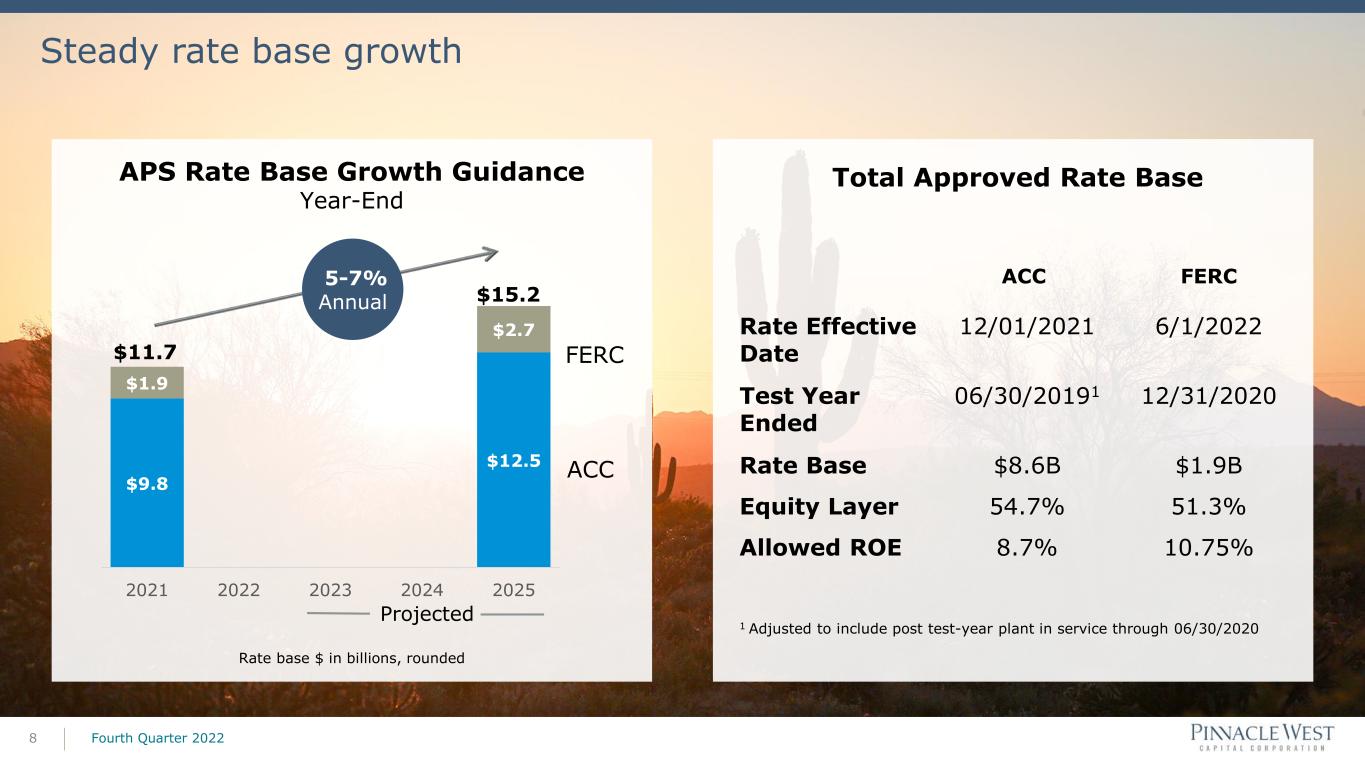

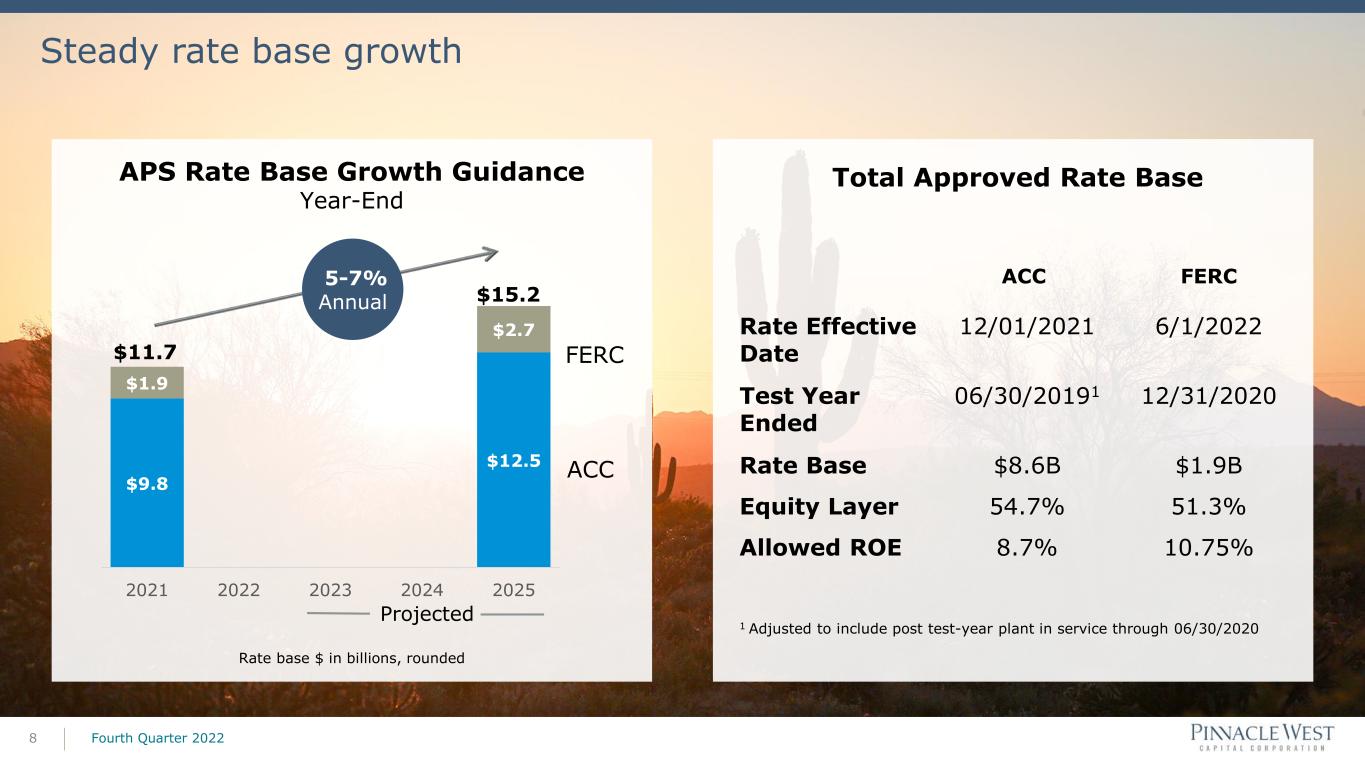

Total Approved Rate BaseAPS Rate Base Growth Guidance Year-End Steady rate base growth Fourth Quarter 20228 ACC FERC Rate Effective Date 12/01/2021 6/1/2022 Test Year Ended 06/30/20191 12/31/2020 Rate Base $8.6B $1.9B Equity Layer 54.7% 51.3% Allowed ROE 8.7% 10.75% 1 Adjusted to include post test-year plant in service through 06/30/2020 Rate base $ in billions, rounded $9.8 $12.5 $1.9 $2.7 2021 2022 2023 2024 2025 Projected 5-7% Annual FERC ACC $11.7 $15.2

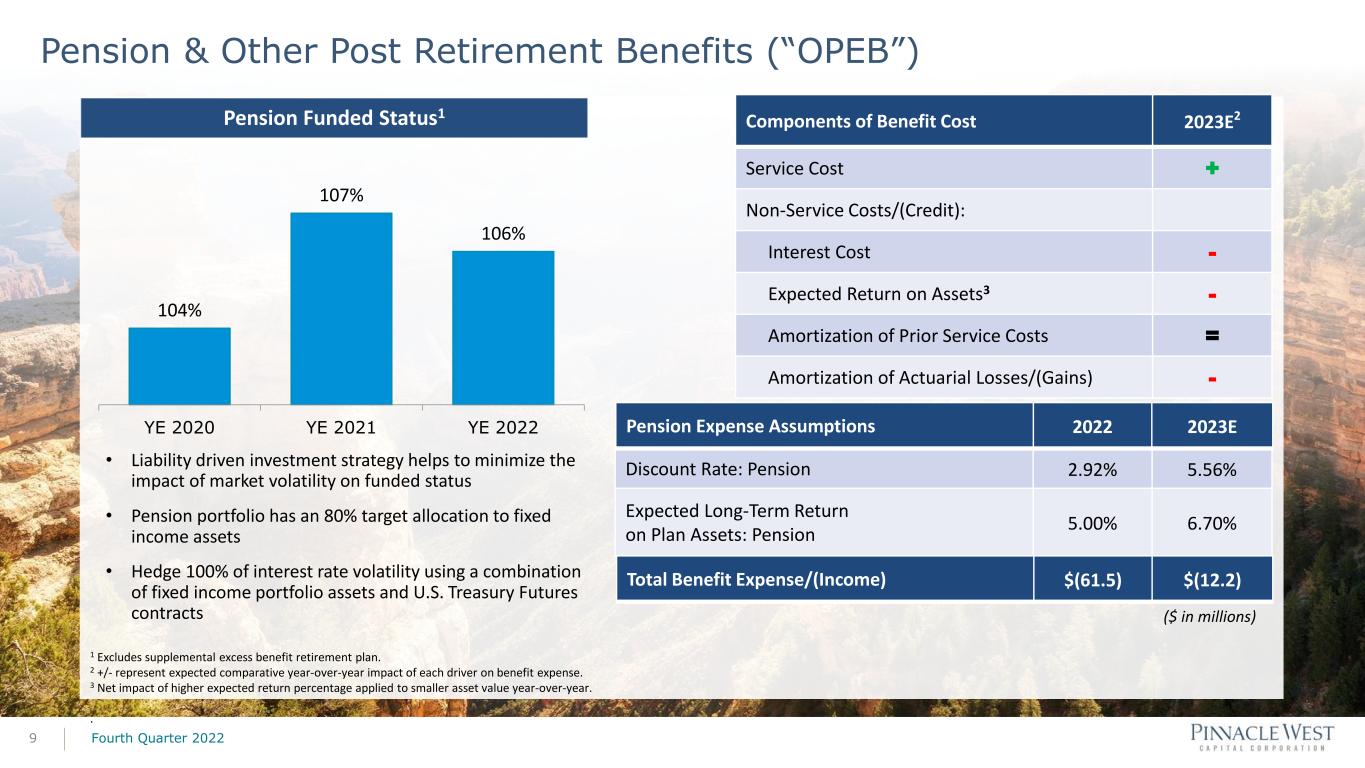

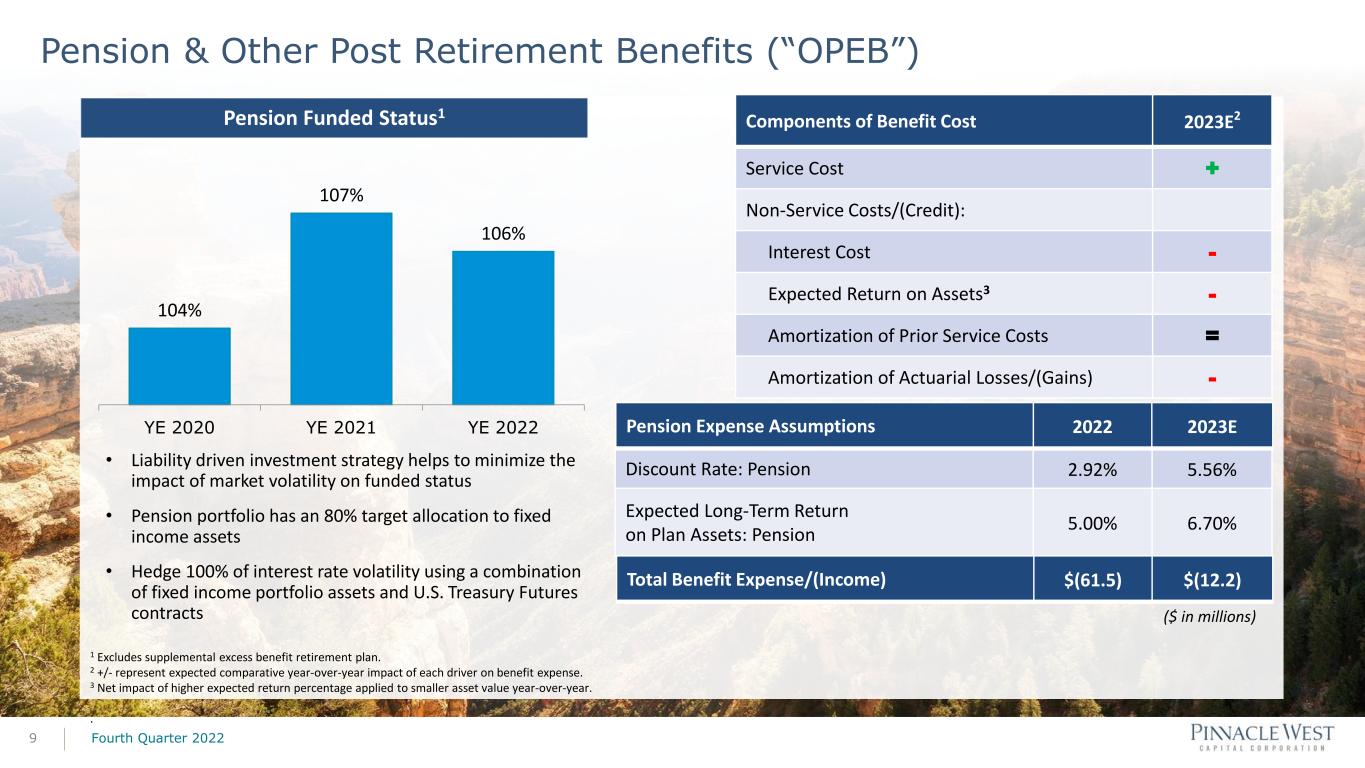

Pension & Other Post Retirement Benefits (“OPEB”) 9 Fourth Quarter 2022 104% 107% 106% YE 2020 YE 2021 YE 2022 Pension Funded Status1 • Liability driven investment strategy helps to minimize the impact of market volatility on funded status • Pension portfolio has an 80% target allocation to fixed income assets • Hedge 100% of interest rate volatility using a combination of fixed income portfolio assets and U.S. Treasury Futures contracts ($ in millions) 1 Excludes supplemental excess benefit retirement plan. 2 +/- represent expected comparative year-over-year impact of each driver on benefit expense. 3 Net impact of higher expected return percentage applied to smaller asset value year-over-year. . Components of Benefit Cost 2023E2 Service Cost + Non-Service Costs/(Credit): Interest Cost - Expected Return on Assets3 - Amortization of Prior Service Costs = Amortization of Actuarial Losses/(Gains) - Discount Rate: Pension 2.92% 5.56% Expected Long-Term Return on Plan Assets: Pension 5.00% 6.70% Pension Expense Assumptions 2022 2023E Total Benefit Expense/(Income) $(61.5) $(12.2)

Our goal continues to be declining O&M (as adjusted) per MWh 10 O&M (as adjusted) per MWh Total O&M (as adjusted)1 2022: $892M 2023: $885M-$905M 1 O&M amounts, as adjusted, exclude RES/DSM amounts of $95M in 2022 and $115M-$125M in 2023. Planned outage amounts included in O&M are $43M in 2022 and a projected $45M-$55M in 2023. O&M per MWh was $33/MWh in 2022. Fourth Quarter 2022 ~$29/MWh

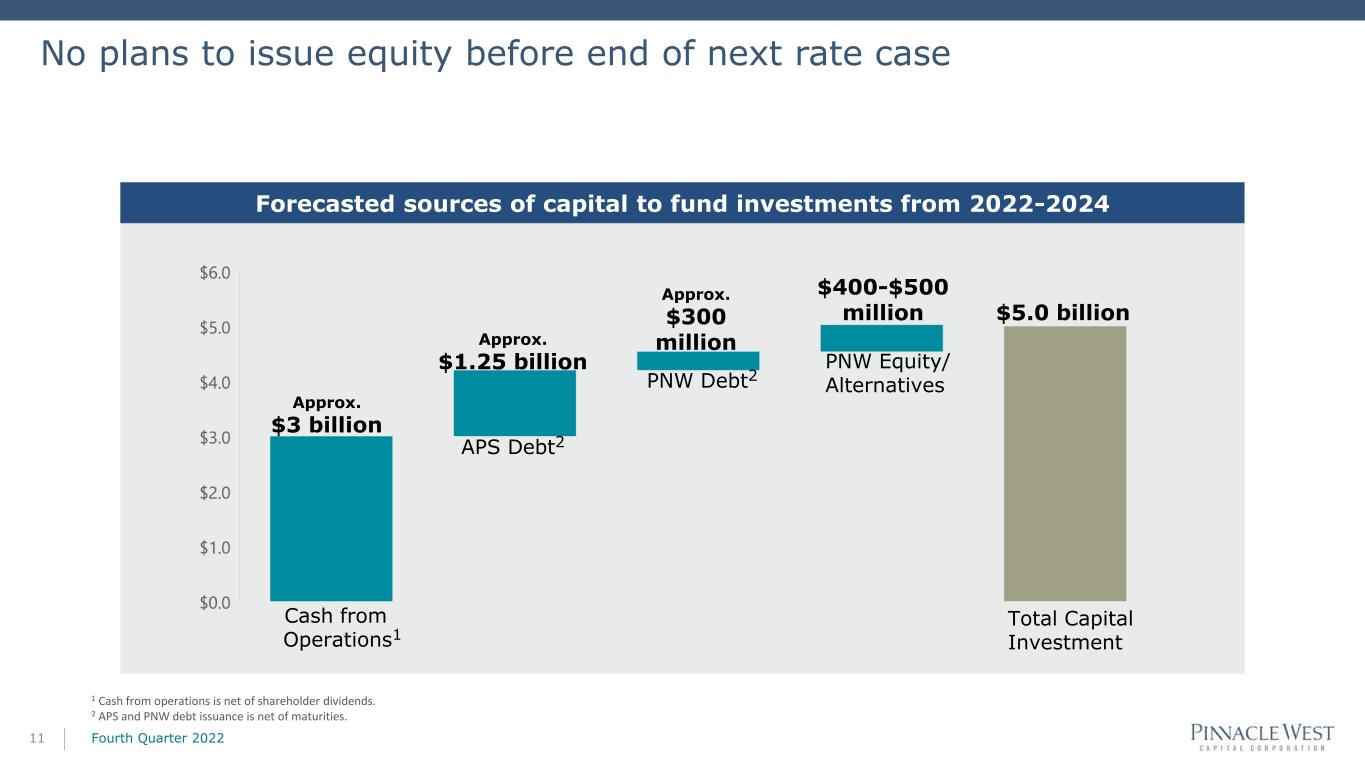

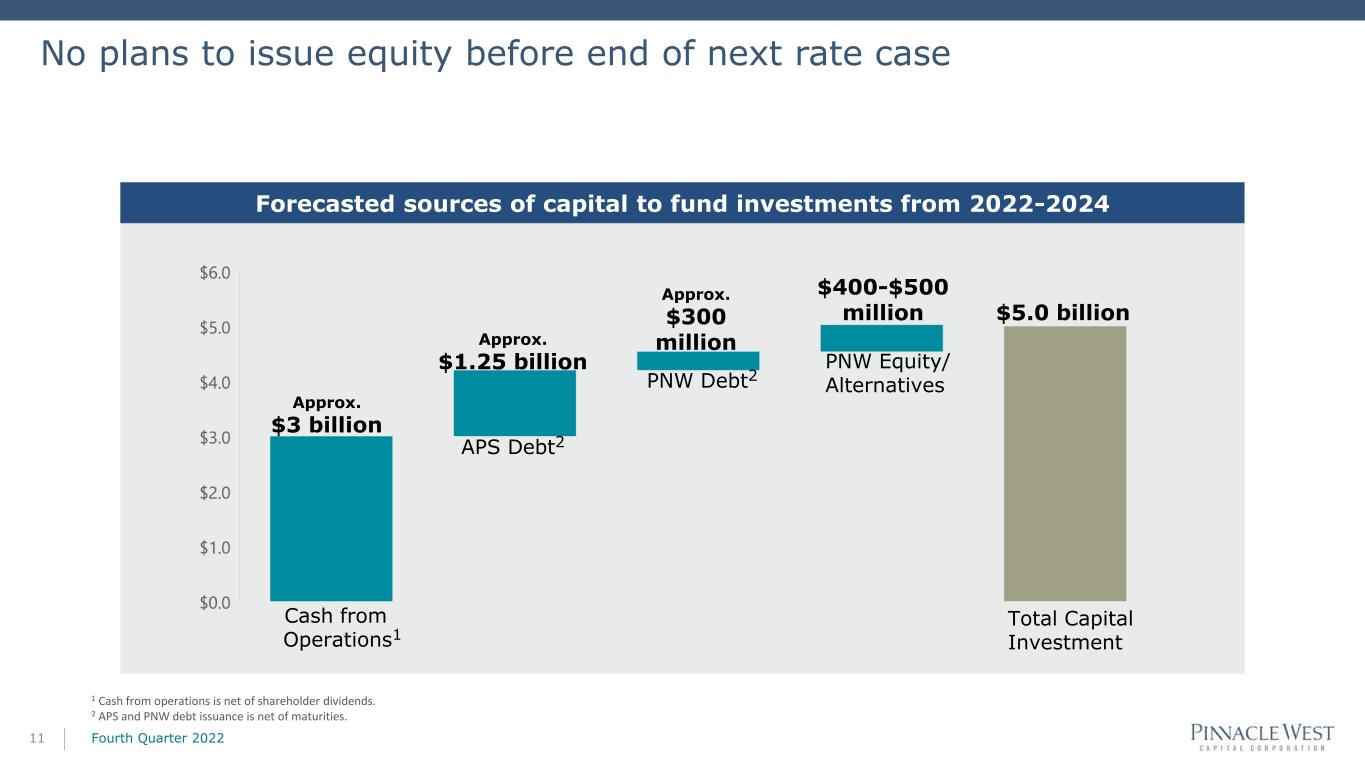

Forecasted sources of capital to fund investments from 2022-2024 No plans to issue equity before end of next rate case 11 Approx. $3 billion Approx. $1.25 billion $5.0 billion APS Debt2 PNW Debt2 Cash from Operations1 Approx. $300 million $400-$500 million 1 Cash from operations is net of shareholder dividends. 2 APS and PNW debt issuance is net of maturities. Fourth Quarter 2022 Total Capital Investment PNW Equity/ Alternatives

Strong balance sheet with attractive long-term debt maturity profile1 12 $M PNW Long-Term DebtAPS Long-Term Debt $0 $200 $400 $600 $800 $1,000 $1,200 2022 2024 2026 2028 2030 2032 2034 2036 2038 2040 2042 2044 2046 2048 2050 As of December 31, 2022 Fourth Quarter 2022 1 Does not include debt at Bright Canyon Energy.

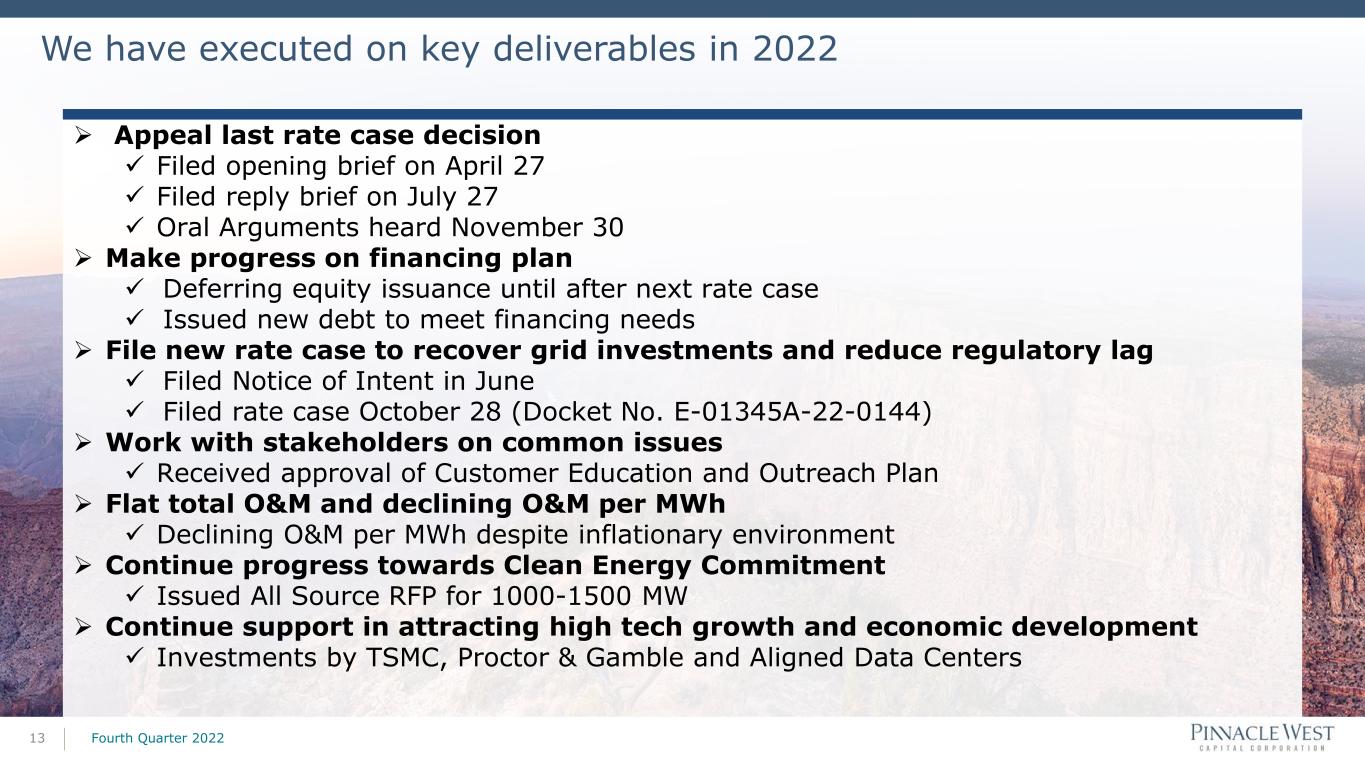

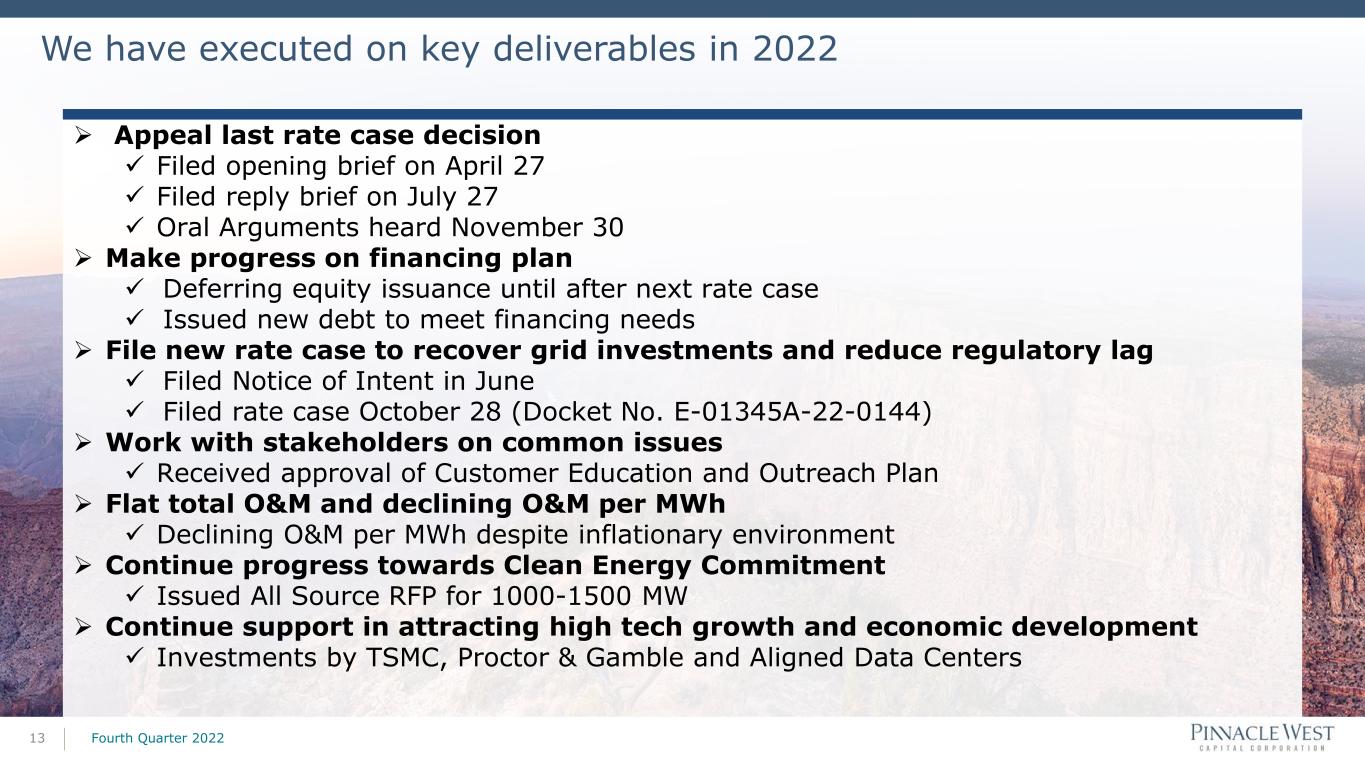

We have executed on key deliverables in 2022 Fourth Quarter 202213 ➢ Appeal last rate case decision ✓ Filed opening brief on April 27 ✓ Filed reply brief on July 27 ✓ Oral Arguments heard November 30 ➢ Make progress on financing plan ✓ Deferring equity issuance until after next rate case ✓ Issued new debt to meet financing needs ➢ File new rate case to recover grid investments and reduce regulatory lag ✓ Filed Notice of Intent in June ✓ Filed rate case October 28 (Docket No. E-01345A-22-0144) ➢ Work with stakeholders on common issues ✓ Received approval of Customer Education and Outreach Plan ➢ Flat total O&M and declining O&M per MWh ✓ Declining O&M per MWh despite inflationary environment ➢ Continue progress towards Clean Energy Commitment ✓ Issued All Source RFP for 1000-1500 MW ➢ Continue support in attracting high tech growth and economic development ✓ Investments by TSMC, Proctor & Gamble and Aligned Data Centers

APPENDIX

Arizona remains among the fastest growing states in the U.S. 15 Consistent Residential Growth Past Five Years Strong 2.5% Sales CAGR Past Three Years 0.6% 0.8% 4.2% 2.4% 3.5%-5.5% 0% 1% 2% 3% 4% 5% 6% '19 '20 '21 '22 '23E Total Sales Growth2,3 2Weather-normalized 32019-2021 as reported in PNW Statistical Reports Fourth Quarter 2022 1.9% 2.1% 2.3% 2.4% 2.2% 1.5%-2.5% 0% 1% 2% 3% '18 '19 '20 '21 '22 '23E APS Residential Growth Natn'l Avg. - Residential Residential Customer Growth1 1National average from 2022 Itron Annual Energy Survey Report

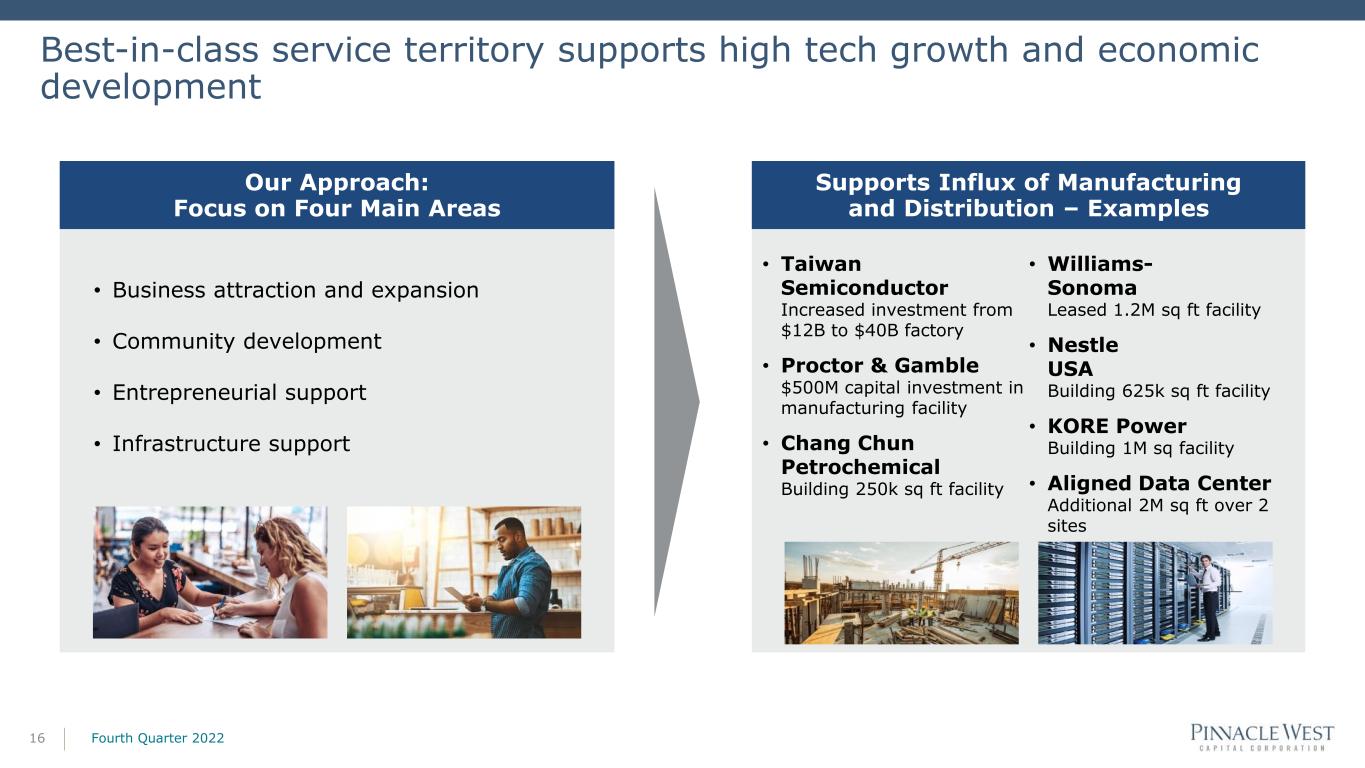

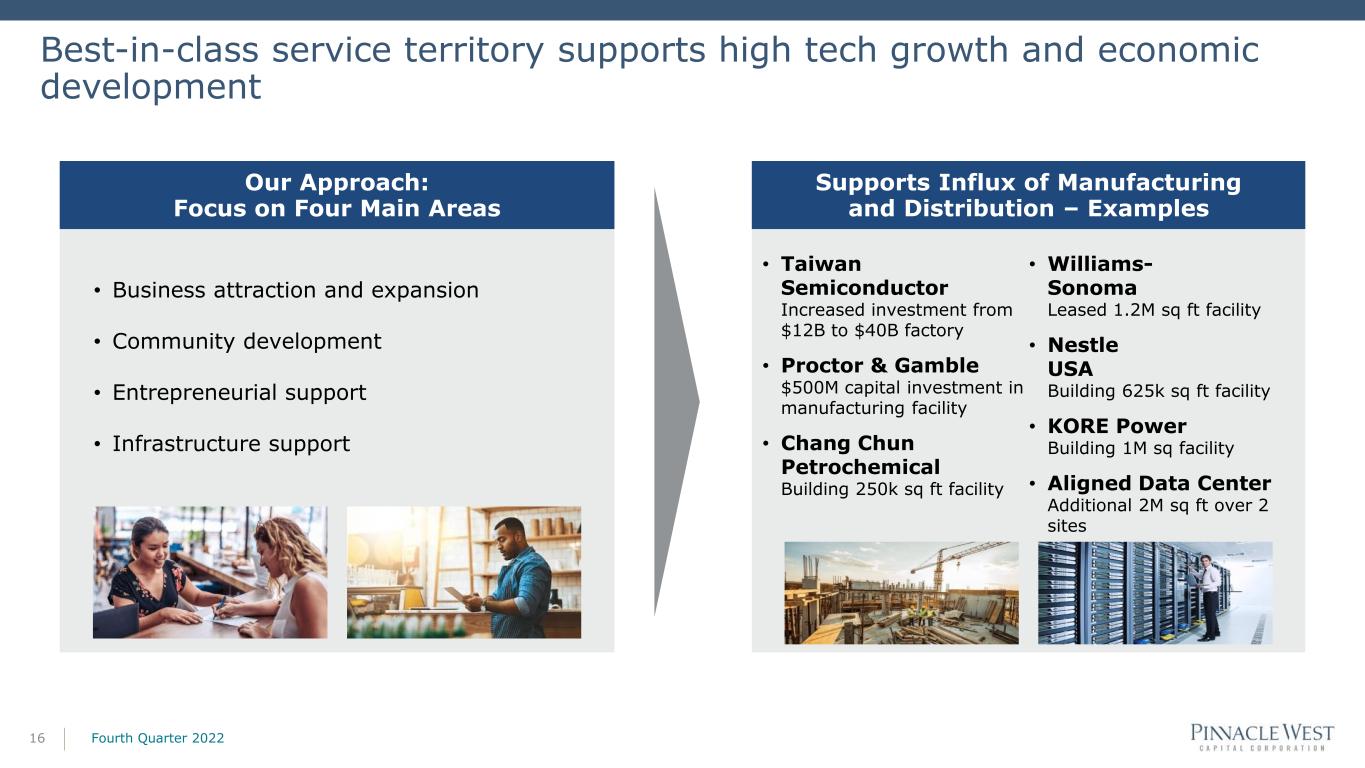

Best-in-class service territory supports high tech growth and economic development 16 Our Approach: Focus on Four Main Areas Supports Influx of Manufacturing and Distribution – Examples • Business attraction and expansion • Community development • Entrepreneurial support • Infrastructure support • Taiwan Semiconductor Increased investment from $12B to $40B factory • Proctor & Gamble $500M capital investment in manufacturing facility • Chang Chun Petrochemical Building 250k sq ft facility • Williams- Sonoma Leased 1.2M sq ft facility • Nestle USA Building 625k sq ft facility • KORE Power Building 1M sq facility • Aligned Data Center Additional 2M sq ft over 2 sites Fourth Quarter 2022

A clear plan for clean energy transition 17 Progress Towards Meeting Clean Energy Commitment Pathway 2005 2019 2030 2050 Since 2020, have contracted over 2,100 MW of clean energy and storage to be in service for APS customers by end of 2025 Issued All-Source RFP which seeks 1,000 – 1,500 MWs of resources, including up to 600 – 800 MWs of renewable resources to be in service from 2025 – 2027 Charted course for healthy mix of APS-owned and third party- owned assets, to be continued through future planned RFPs 24% 50% 65% 100% Fourth Quarter 2022

Clean Energy Commitment – ~2,100MW in development since 2020 Fourth Quarter 202218 Robust, Diverse Procurement Activity Energy Storage • 201 MW APS-owned resources to retrofit entire fleet of AZ Sun facilities • 300 MW under two long-term PPAs • All resources to be in service between 2022 and 2024 Solar • 150 MW owned by APS and sited near Redhawk generating facility • 160 MW under two long-term PPAs • All resources to be in service in 2023 Solar + Storage • 575 MW under three long-term innovative tolling PPAs • Resources to be in service in 2023, 2024, and 2025 Wind • 654 MW under three long-term PPAs • Resources in service or will be in-service 2023 and 2024 Demand Response • 75 MW under 5-year load management agreement; service began in 2021 • APS can call up to 18 load reduction events between June and September annually

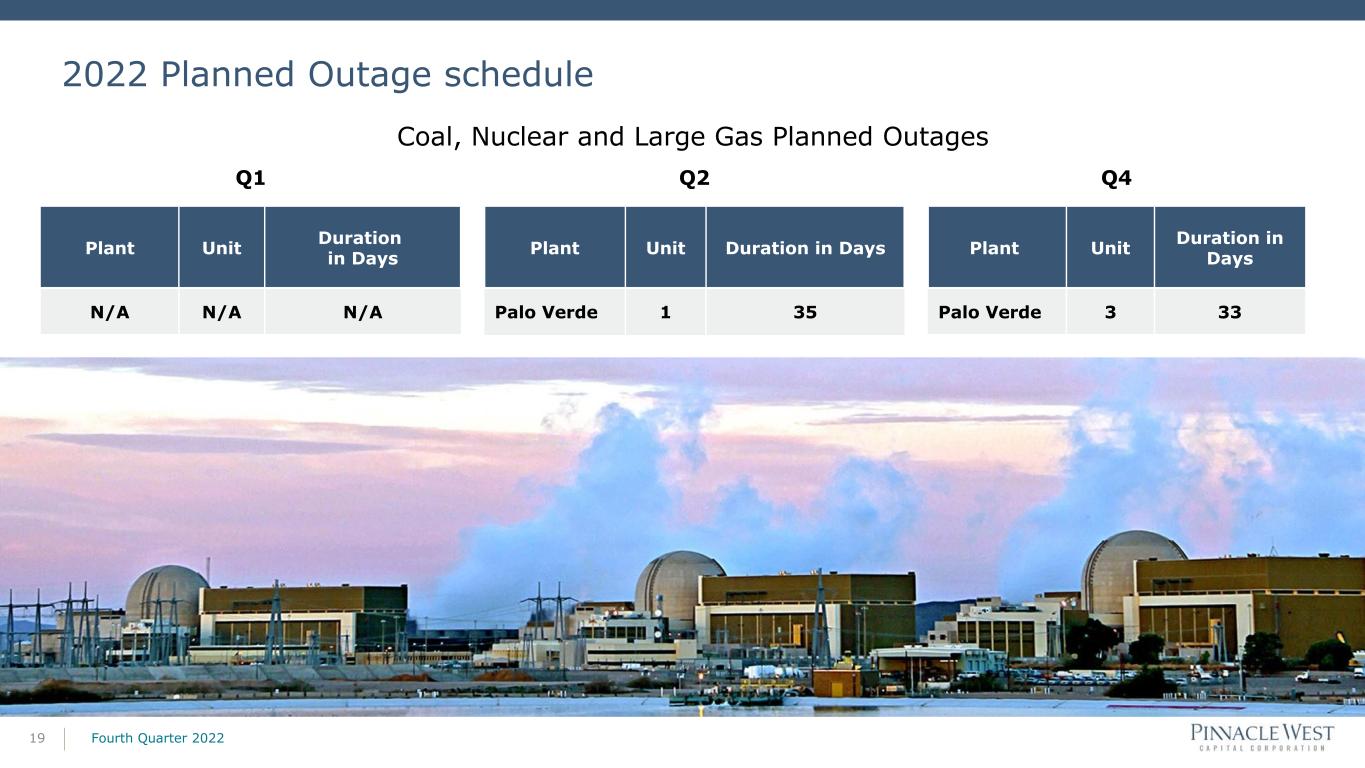

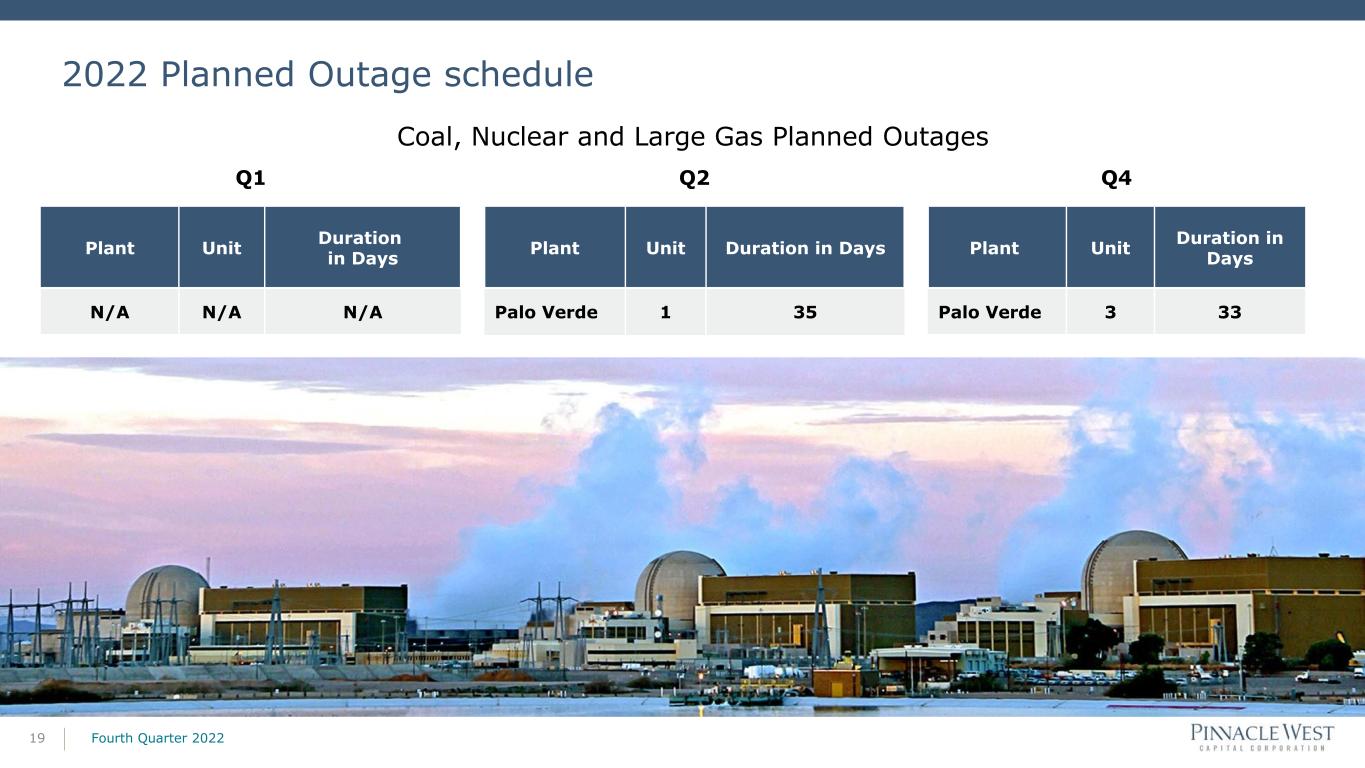

2022 Planned Outage schedule Fourth Quarter 202219 Coal, Nuclear and Large Gas Planned Outages Q1 Q2 Q4 Plant Unit Duration in Days Plant Unit Duration in Days Plant Unit Duration in Days N/A N/A N/A Palo Verde 1 35 Palo Verde 3 33

2023 Planned Outage schedule Fourth Quarter 202220 Coal, Nuclear and Large Gas Planned Outages Q2 Q4 Plant Unit Estimated Duration in Days Plant Unit Estimated Duration in Days Palo Verde 2 35 Palo Verde 1 35 Redhawk CC1 34

$1 $26 $6 $4 Q1 Q2 Q3 Q4 Gross margin effects of weather Fourth Quarter 202221 Variances vs. Normal$ in millions pretax 2022 $37 Million All periods recalculated to current 10-year rolling average (2011 – 2020). Numbers may not foot due to rounding.

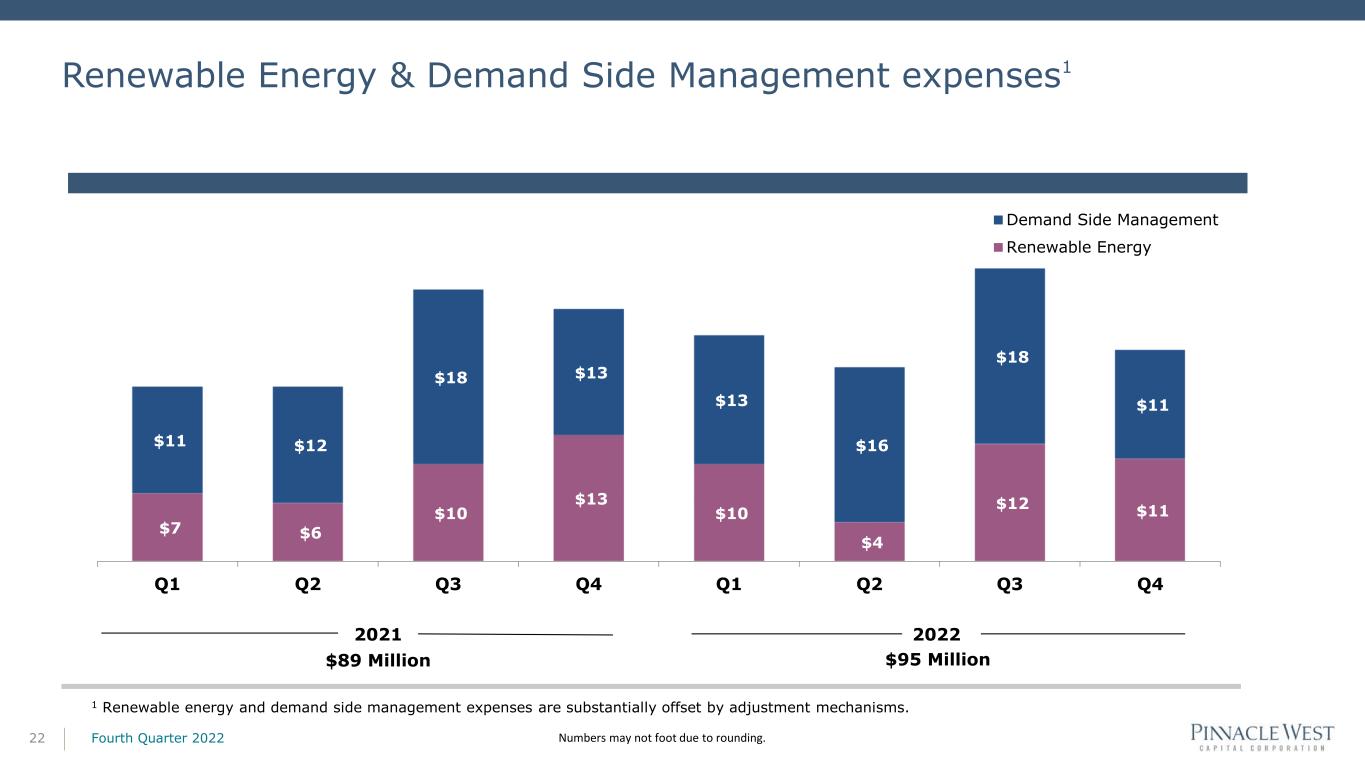

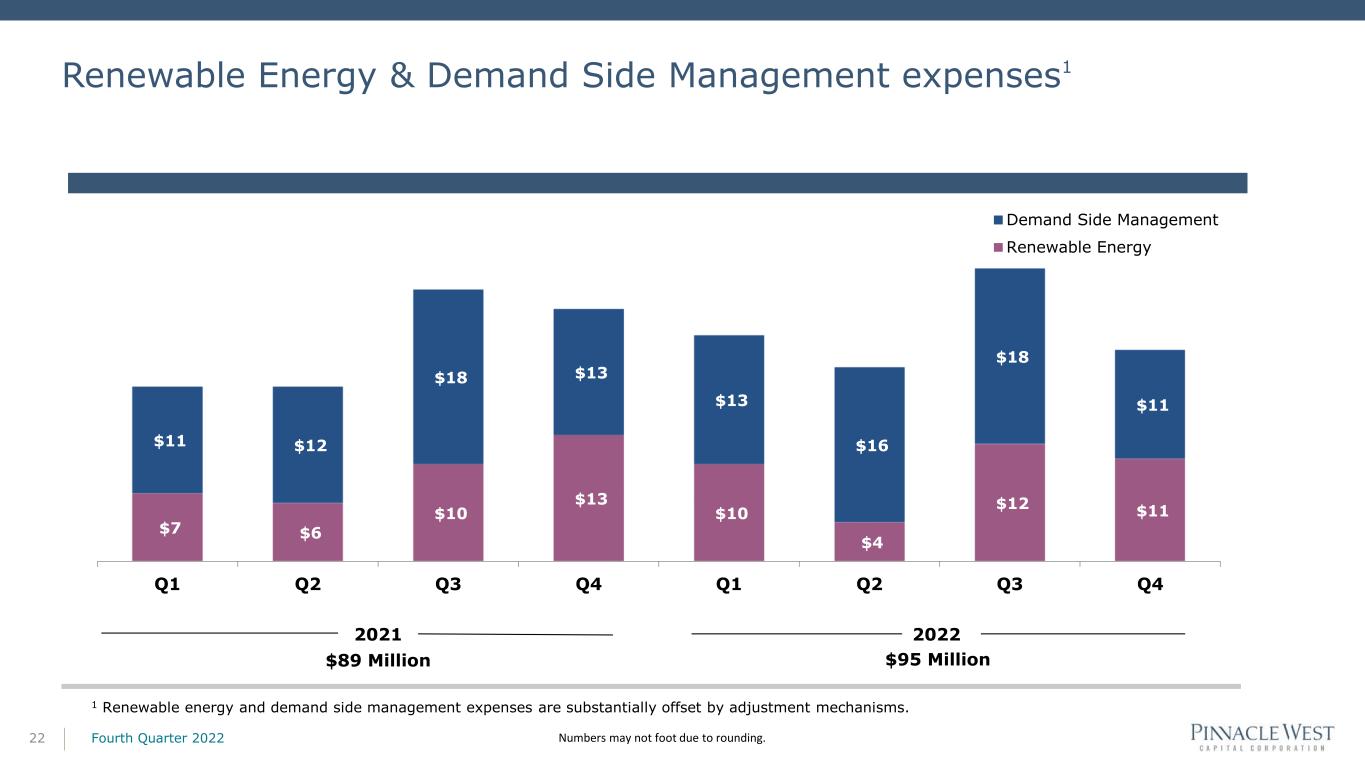

Renewable Energy & Demand Side Management expenses1 Fourth Quarter 202222 $7 $6 $10 $13 $10 $4 $12 $11 $11 $12 $18 $13 $13 $16 $18 $11 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Demand Side Management Renewable Energy 2021 $89 Million 1 Renewable energy and demand side management expenses are substantially offset by adjustment mechanisms. 2022 $95 Million Numbers may not foot due to rounding.

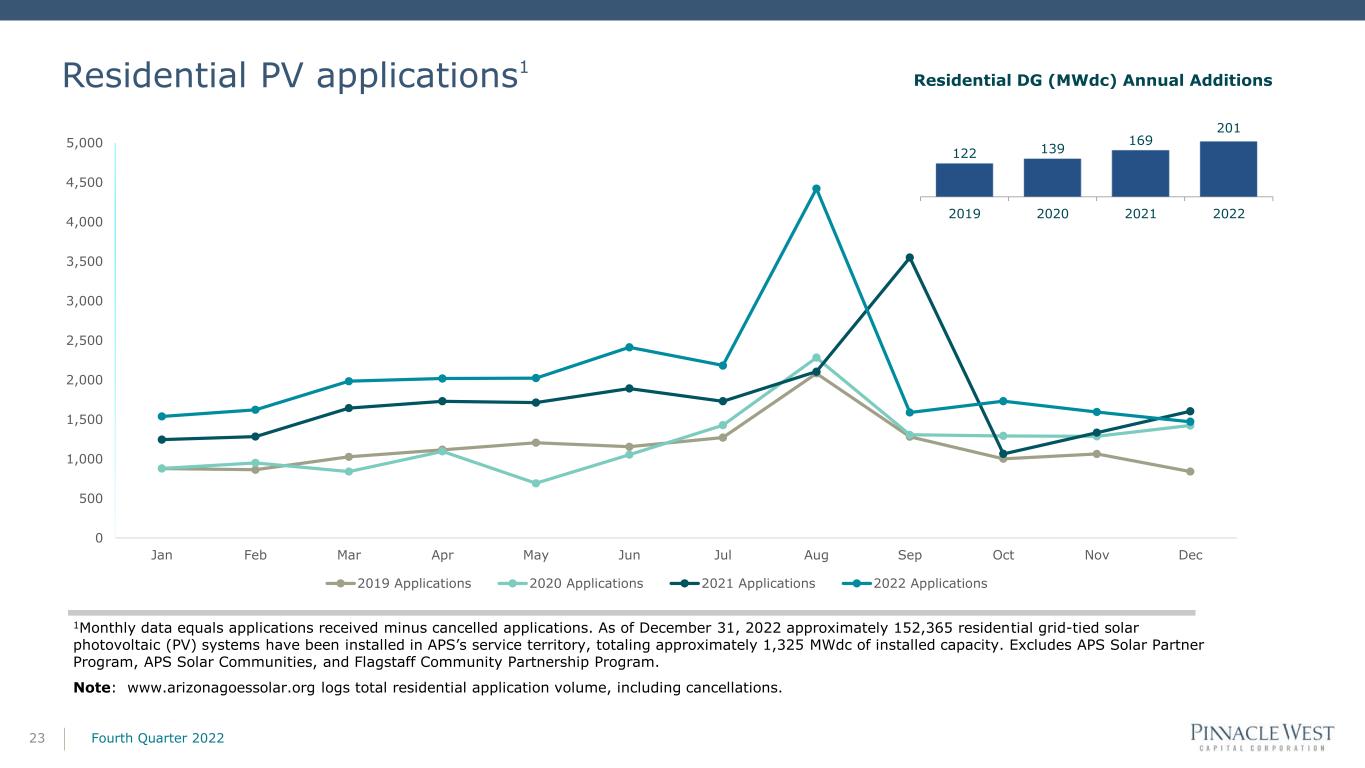

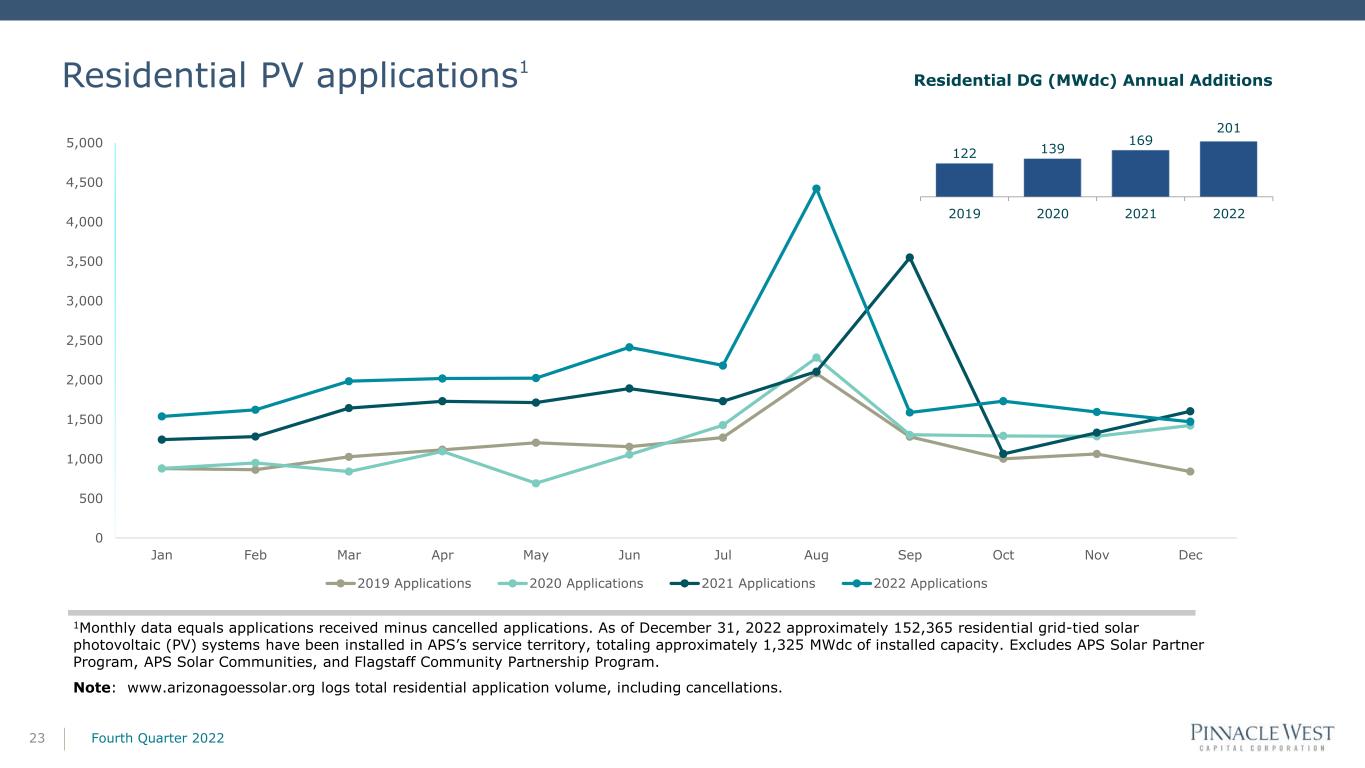

Residential PV applications1 Fourth Quarter 202223 1Monthly data equals applications received minus cancelled applications. As of December 31, 2022 approximately 152,365 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling approximately 1,325 MWdc of installed capacity. Excludes APS Solar Partner Program, APS Solar Communities, and Flagstaff Community Partnership Program. Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Residential DG (MWdc) Annual Additions 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2019 Applications 2020 Applications 2021 Applications 2022 Applications 122 139 169 201 2019 2020 2021 2022

Credit Ratings Summary 24 Corporate Ratings Senior Unsecured Ratings Short-Term Ratings Outlook APS1 Moody’s A3 A3 P-2 Negative S&P BBB+ BBB+ A-2 Negative Fitch BBB+ A- F2 Negative Pinnacle West1 Moody’s Baa1 Baa1 P-2 Negative S&P BBB+ BBB A-2 Negative Fitch BBB+ BBB+ F2 Negative Balance Sheet Targets • Strong investment grade credit ratings • APS equity layer >50% • FFO/Debt range of 16%-18% 1 We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. Ratings are as of February 27, 2023. Fourth Quarter 2022

2022 APS Rate Case Application 1 Fourth Quarter 202225 Overview of Rate Increase Request ($ in Millions) Key Components1 • Filed October 28, 2022 • APS has requested rates become effective December 1, 2023 • Docket Number: E-01345A-22-0144 • Additional details, including filing, can be found at http://www.pinnaclewest.com/investors Additional Details Rate Base Growth $130 12 Months Post Test Year Plant 140 Weighted Average Cost of Capital of 7.17% 78 1% Fair Value Increment 78 New Customer Programs, Coal Community Transition and Other 34 Total Revenue Request $460 Customer Net Bill Impact on Day 1 13.6% 1Numbers may not foot due to rounding.

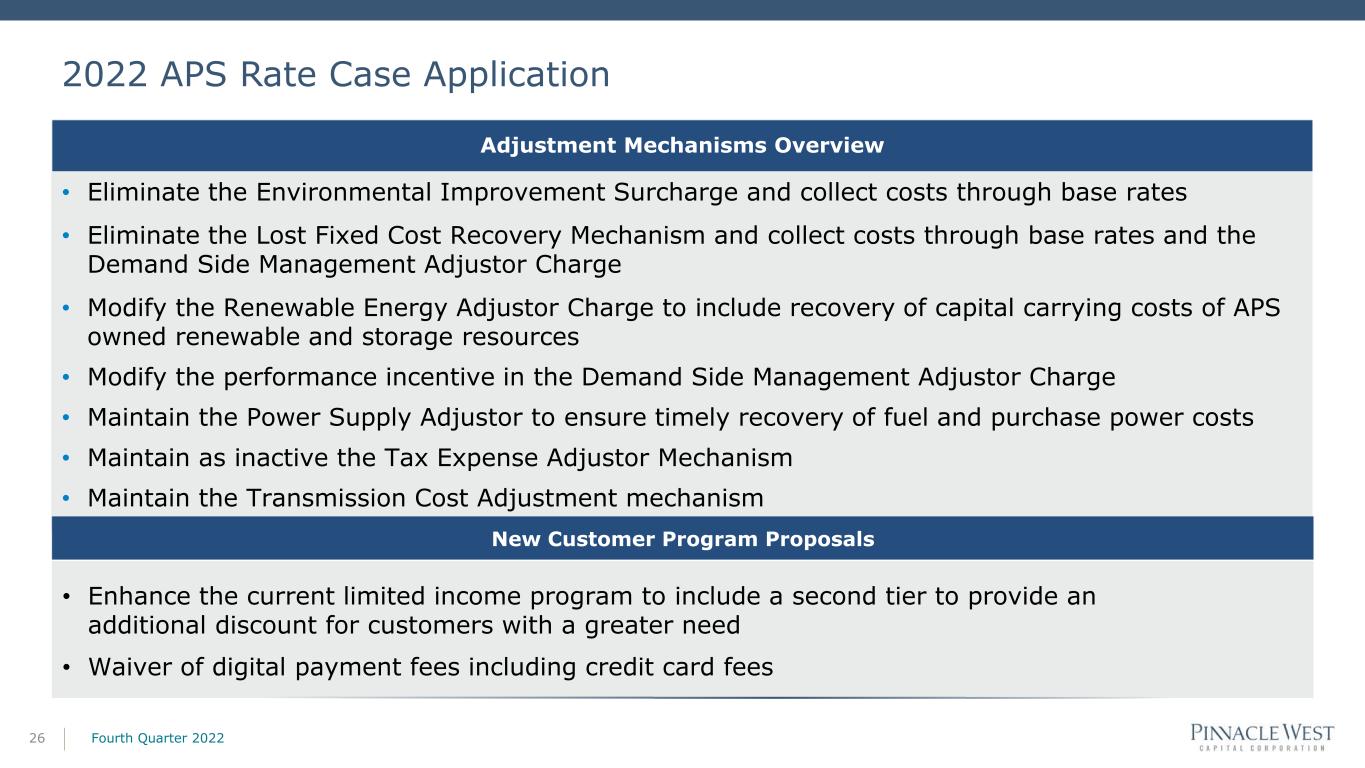

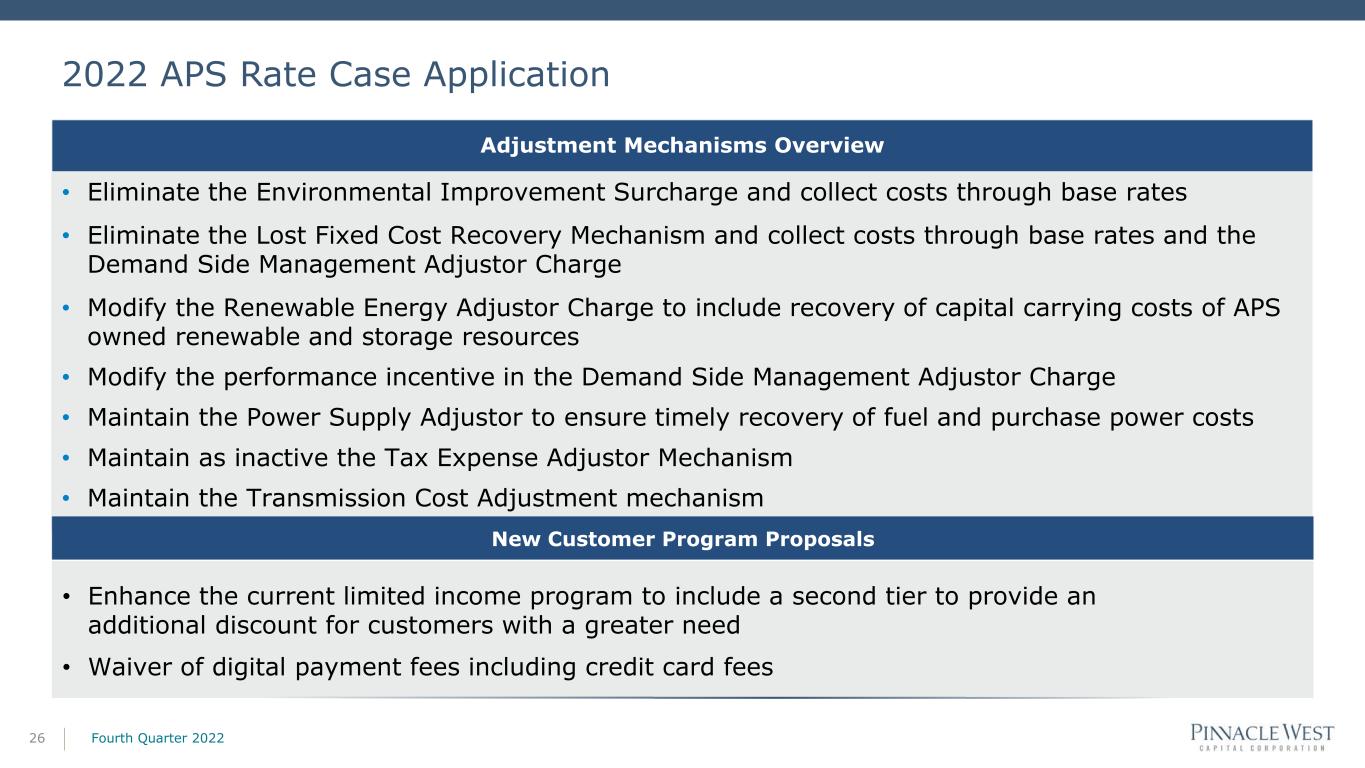

2022 APS Rate Case Application 1 • Eliminate the Environmental Improvement Surcharge and collect costs through base rates • Eliminate the Lost Fixed Cost Recovery Mechanism and collect costs through base rates and the Demand Side Management Adjustor Charge • Modify the Renewable Energy Adjustor Charge to include recovery of capital carrying costs of APS owned renewable and storage resources • Modify the performance incentive in the Demand Side Management Adjustor Charge • Maintain the Power Supply Adjustor to ensure timely recovery of fuel and purchase power costs • Maintain as inactive the Tax Expense Adjustor Mechanism • Maintain the Transmission Cost Adjustment mechanism Fourth Quarter 202226 Adjustment Mechanisms Overview • Enhance the current limited income program to include a second tier to provide an additional discount for customers with a greater need • Waiver of digital payment fees including credit card fees New Customer Program Proposals

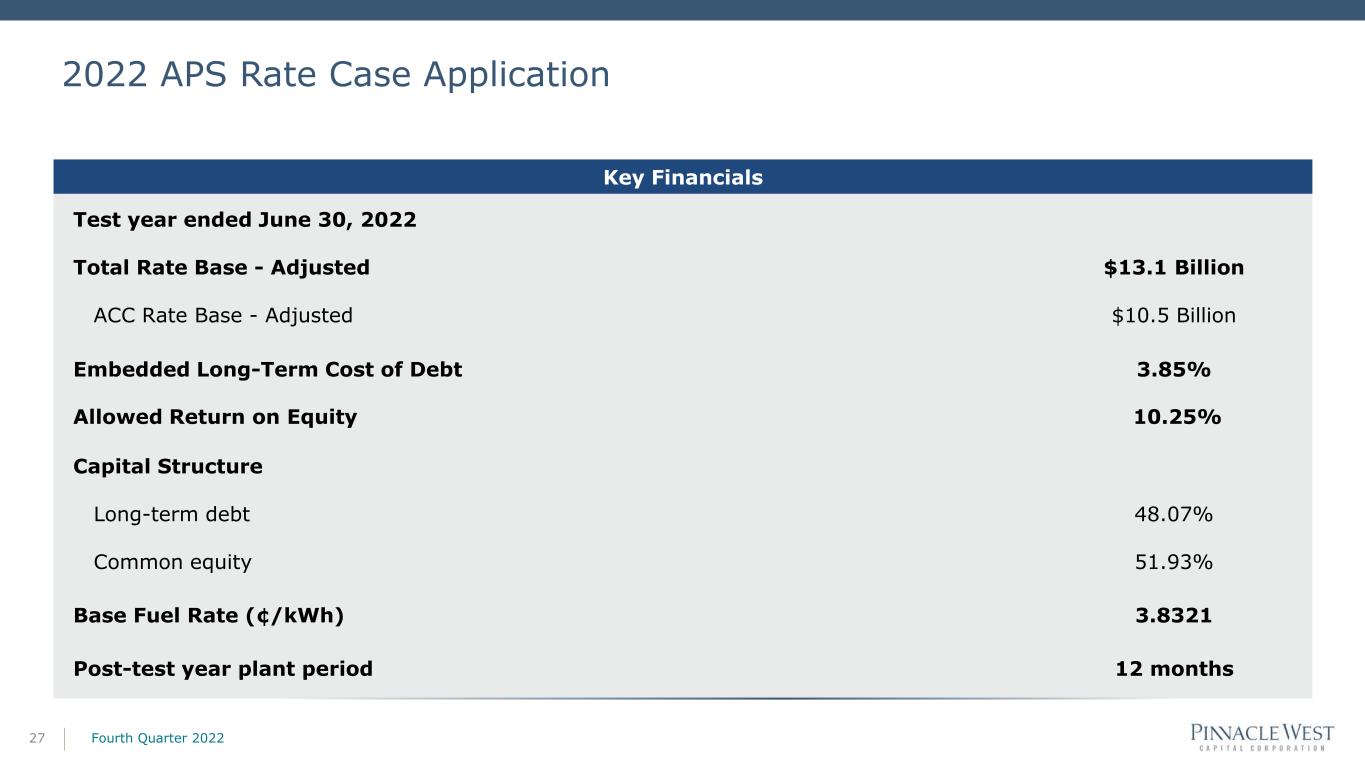

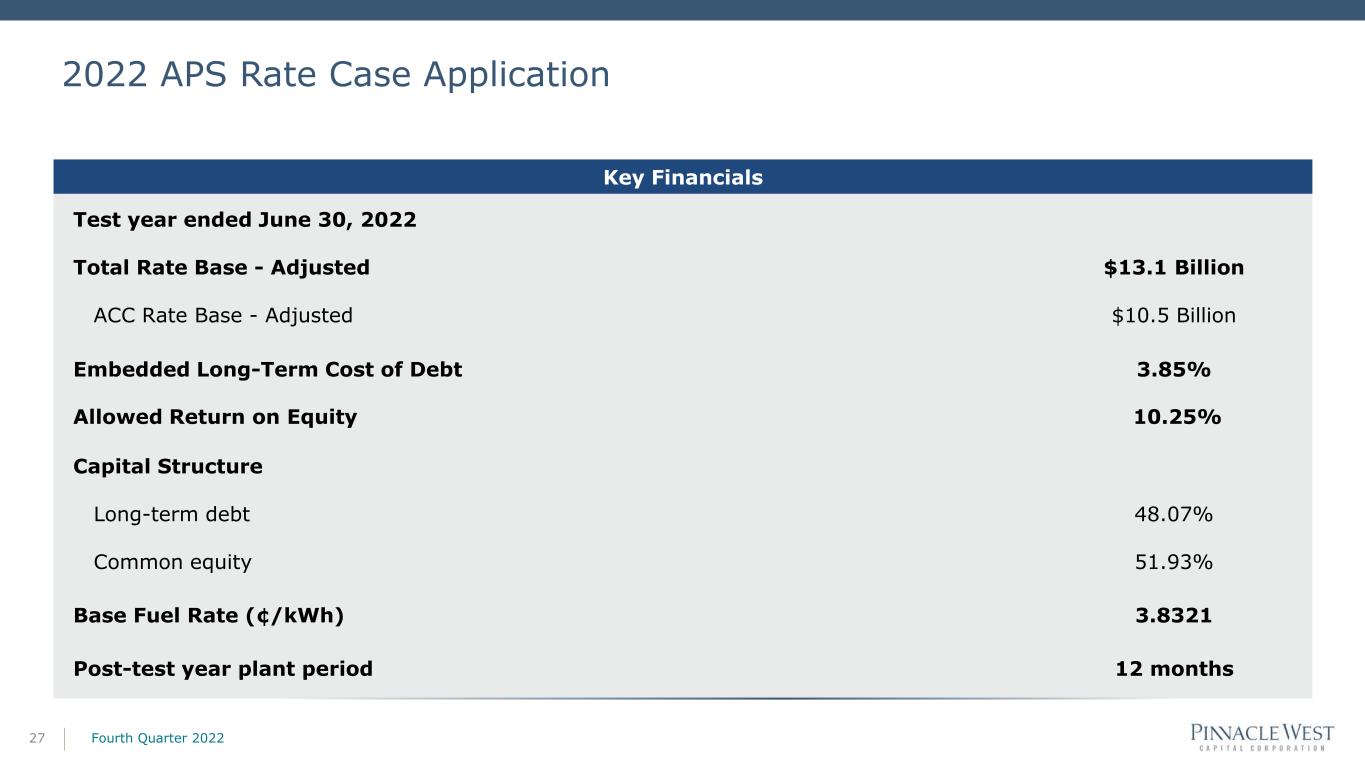

2022 APS Rate Case Application Fourth Quarter 202227 Key Financials Test year ended June 30, 2022 Total Rate Base - Adjusted $13.1 Billion ACC Rate Base - Adjusted $10.5 Billion Embedded Long-Term Cost of Debt 3.85% Allowed Return on Equity 10.25% Capital Structure Long-term debt 48.07% Common equity 51.93% Base Fuel Rate (¢/kWh) 3.8321 Post-test year plant period 12 months

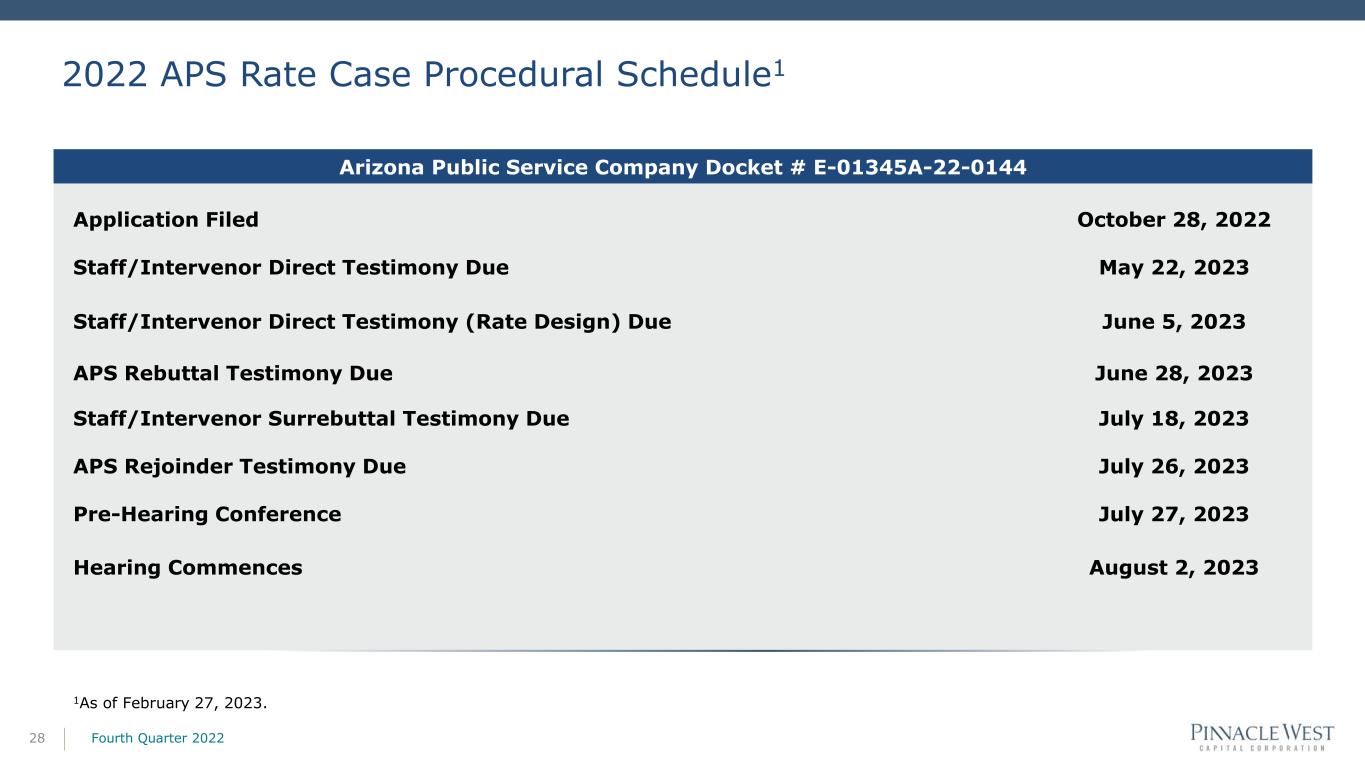

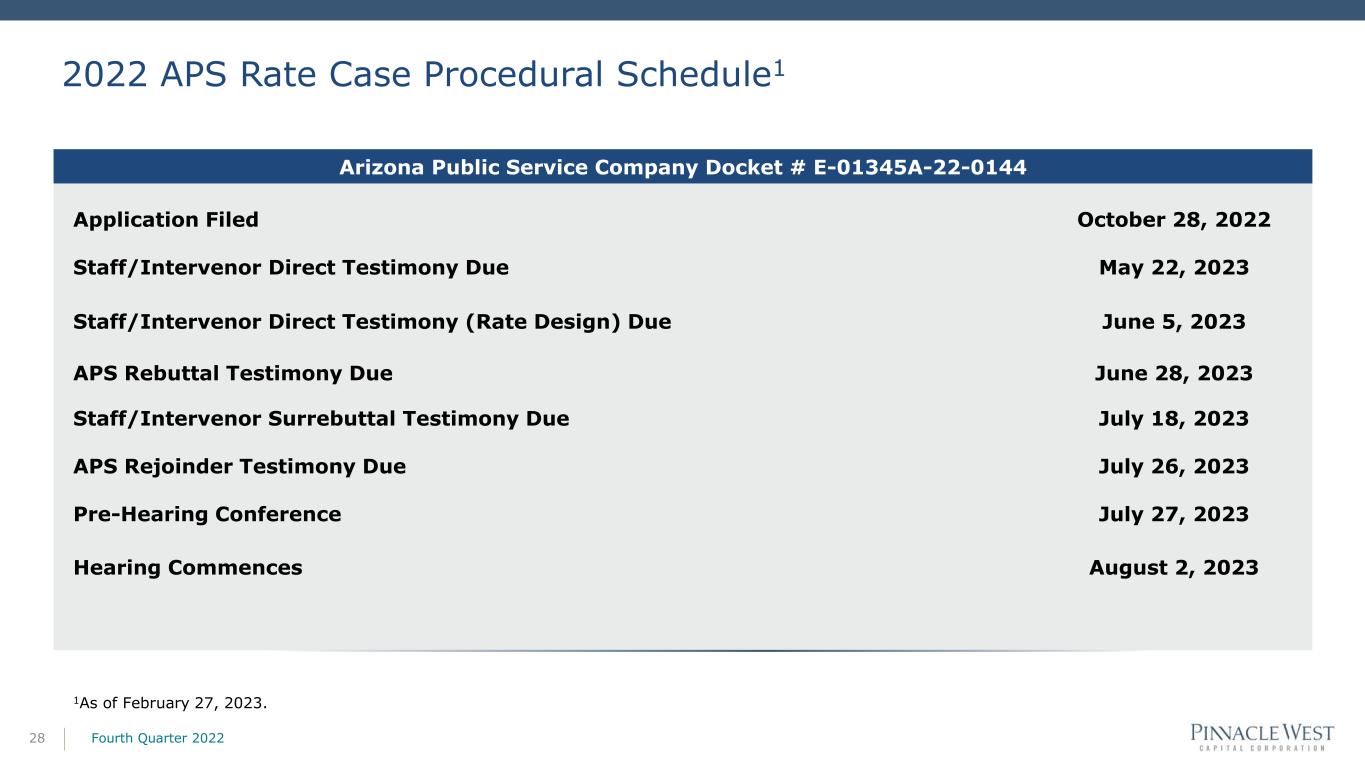

Fourth Quarter 202228 Application Filed October 28, 2022 Staff/Intervenor Direct Testimony Due May 22, 2023 Staff/Intervenor Direct Testimony (Rate Design) Due June 5, 2023 APS Rebuttal Testimony Due June 28, 2023 Staff/Intervenor Surrebuttal Testimony Due July 18, 2023 APS Rejoinder Testimony Due July 26, 2023 Pre-Hearing Conference July 27, 2023 Hearing Commences August 2, 2023 Arizona Public Service Company Docket # E-01345A-22-0144 1As of February 27, 2023. 2022 APS Rate Case Procedural Schedule1

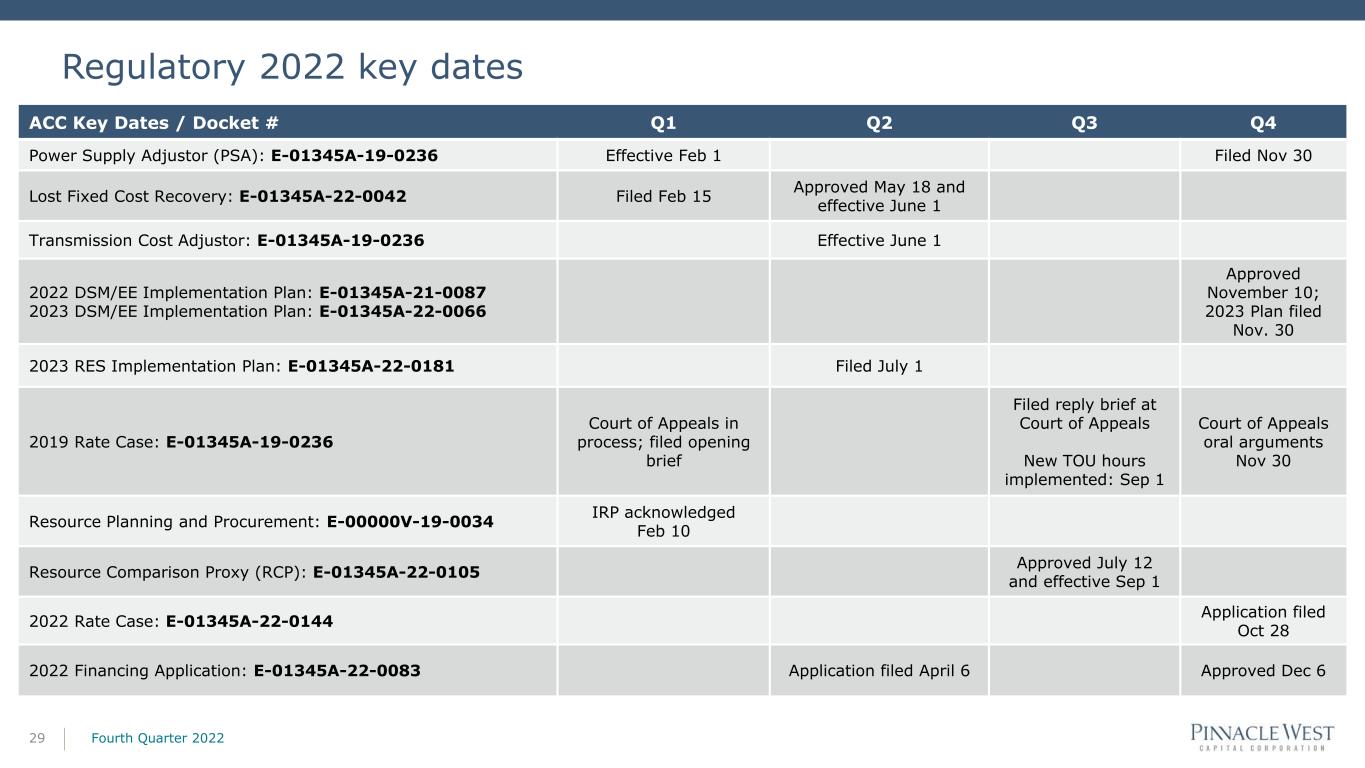

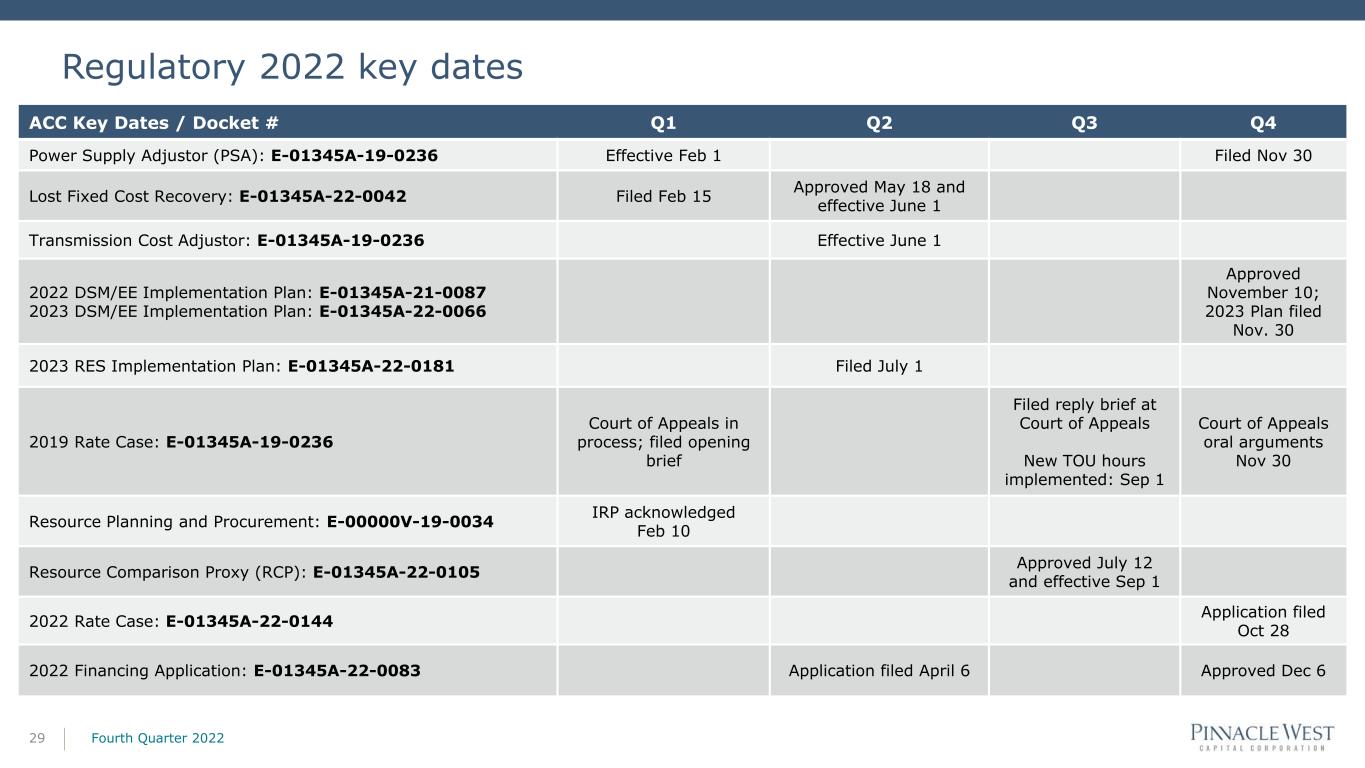

Regulatory 2022 key dates Fourth Quarter 202229 ACC Key Dates / Docket # Q1 Q2 Q3 Q4 Power Supply Adjustor (PSA): E-01345A-19-0236 Effective Feb 1 Filed Nov 30 Lost Fixed Cost Recovery: E-01345A-22-0042 Filed Feb 15 Approved May 18 and effective June 1 Transmission Cost Adjustor: E-01345A-19-0236 Effective June 1 2022 DSM/EE Implementation Plan: E-01345A-21-0087 2023 DSM/EE Implementation Plan: E-01345A-22-0066 Approved November 10; 2023 Plan filed Nov. 30 2023 RES Implementation Plan: E-01345A-22-0181 Filed July 1 2019 Rate Case: E-01345A-19-0236 Court of Appeals in process; filed opening brief Filed reply brief at Court of Appeals New TOU hours implemented: Sep 1 Court of Appeals oral arguments Nov 30 Resource Planning and Procurement: E-00000V-19-0034 IRP acknowledged Feb 10 Resource Comparison Proxy (RCP): E-01345A-22-0105 Approved July 12 and effective Sep 1 2022 Rate Case: E-01345A-22-0144 Application filed Oct 28 2022 Financing Application: E-01345A-22-0083 Application filed April 6 Approved Dec 6

Regulatory 2023 key dates1 Fourth Quarter 202230 ACC Key Dates / Docket # Q1 Q2 Q3 Q4 2019 Rate Case: E-01345A-19-0236 2022 Rate Case: E-01345A-22-0144 Hearing to Begin August 2 Power Supply Adjustor (PSA) E-01345A-19-0236: Effective March 1 Transmission Cost Adjustor E-01345A-19-0236: To be filed May 15; Effective June 1 Environmental Improvement Surcharge E-01345A-19-0236: Filed Feb. 1 Effective April 1 Lost Fixed Cost Recovery (New docket): To be filed July 31 Resource Planning and Procurement: E-99999A-22-0046 To be filed August 1 2023 DSM/EE Implementation Plan E-01345A-22-0066: 2023 RES Implementation Plan E-01345A-22-0181: Resource Comparison Proxy (New docket): To be filed July Effective Sep 1 1Dates are estimated and subject to change.

Components and Key Drivers of Benefit Costs1 Fourth Quarter 202231 Service Cost (a cost that increases Benefit Cost): • When discount rates decrease Service Cost increases and Benefit Cost increases (and vice versa) • Not impacted by asset assumptions Interest Cost (a cost that increases Benefit Cost): • When discount rates increase Interest Cost increases and Benefit Cost increases (and vice versa) • Not impacted by asset assumptions Expected Return on Plan Assets (an offset that decreases Benefit Cost): • Expected Return on Plan Assets increases and lowers Benefit Cost when (and vice versa): ▪ Future year beginning assets increase (e.g., fixed income assets increase when interest rates / yields decrease) ▪ The future year expected return on assets percentage increases (e.g., when interest rates / yields increase the future expected return percentage on fixed income assets increases) Amortization of Prior Service Credit (an offset that decreases Benefit Cost): • Not impacted by changes in discount rates or asset assumptions Amortization of Actuarial Losses (a cost that increases Benefit Cost; the opposite would be true for Actuarial Gains): • Increases when (and vice versa): ▪ Actual dollar return on plan assets is less than the expected return on plan assets (e.g., when fixed income assets decrease due to an increase in interest rates / yields) ▪ Liability increases (e.g., when discount rates decrease) • Note that only the net actuarial cumulative gain or loss is applied to the corridor 1 Represents some of the primary components of benefit cost, being disclosed to enhance the understanding of key drivers; however, these components and drivers may not exhaustively account for all factors that comprise benefit cost in a given period. Benefit cost components are sensitive to changes in interest rates and market returns, often with offsetting impacts from various drivers. The sensitivity of benefit costs to changing interest rates and market returns can not necessarily be extrapolated. While increases in discount rates impact benefit costs, these impacts are less sensitive and impactful to benefit costs the further from 0% the discount rate moves.

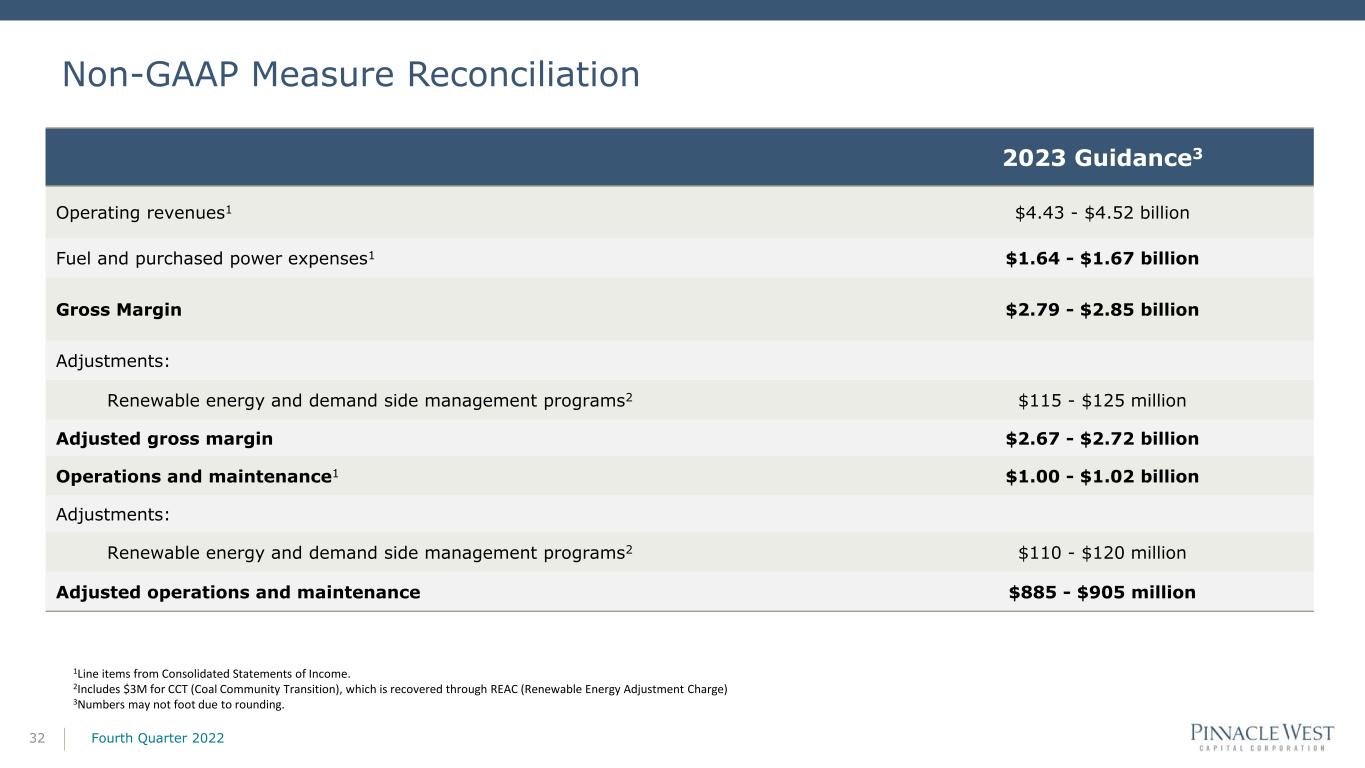

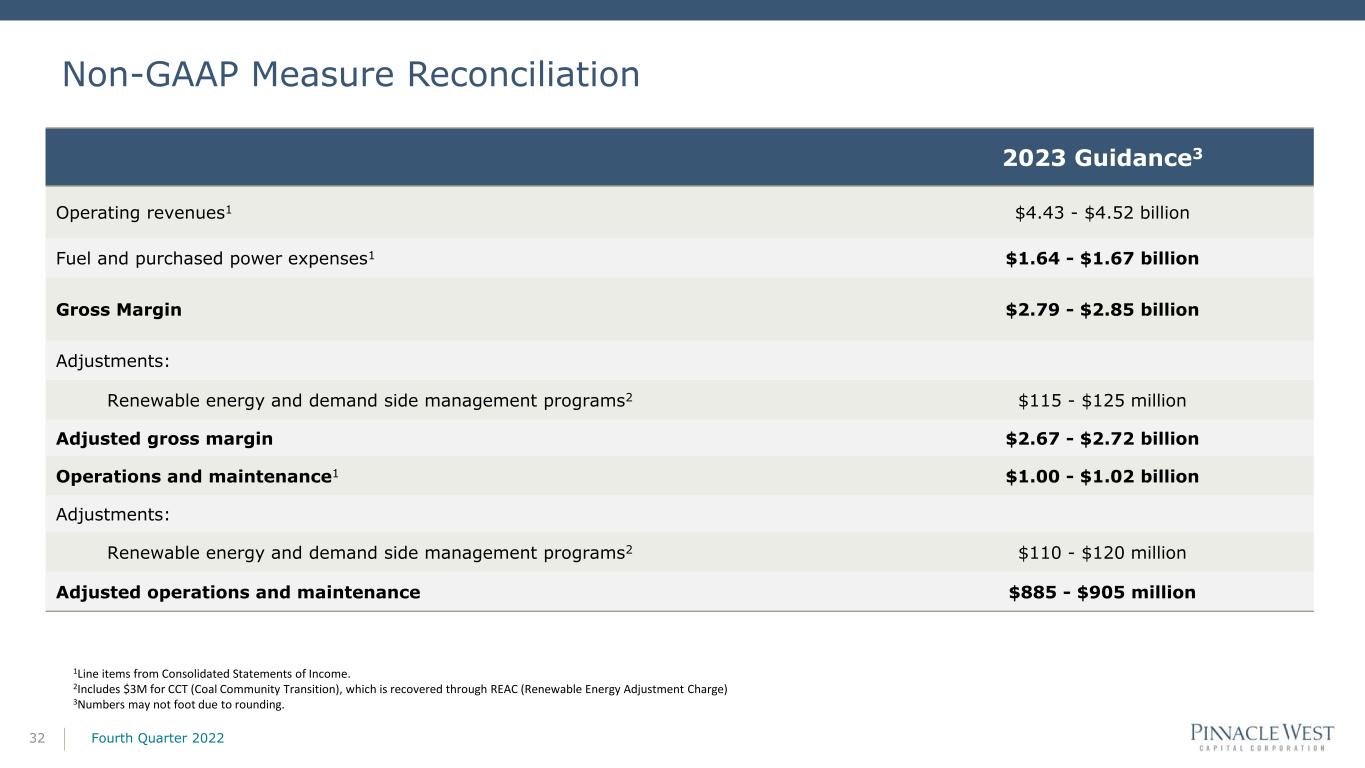

Non-GAAP Measure Reconciliation Fourth Quarter 202232 2023 Guidance3 Operating revenues1 $4.43 - $4.52 billion Fuel and purchased power expenses1 $1.64 - $1.67 billion Gross Margin $2.79 - $2.85 billion Adjustments: Renewable energy and demand side management programs2 $115 - $125 million Adjusted gross margin $2.67 - $2.72 billion Operations and maintenance1 $1.00 - $1.02 billion Adjustments: Renewable energy and demand side management programs2 $110 - $120 million Adjusted operations and maintenance $885 - $905 million 1Line items from Consolidated Statements of Income. 2Includes $3M for CCT (Coal Community Transition), which is recovered through REAC (Renewable Energy Adjustment Charge) 3Numbers may not foot due to rounding.

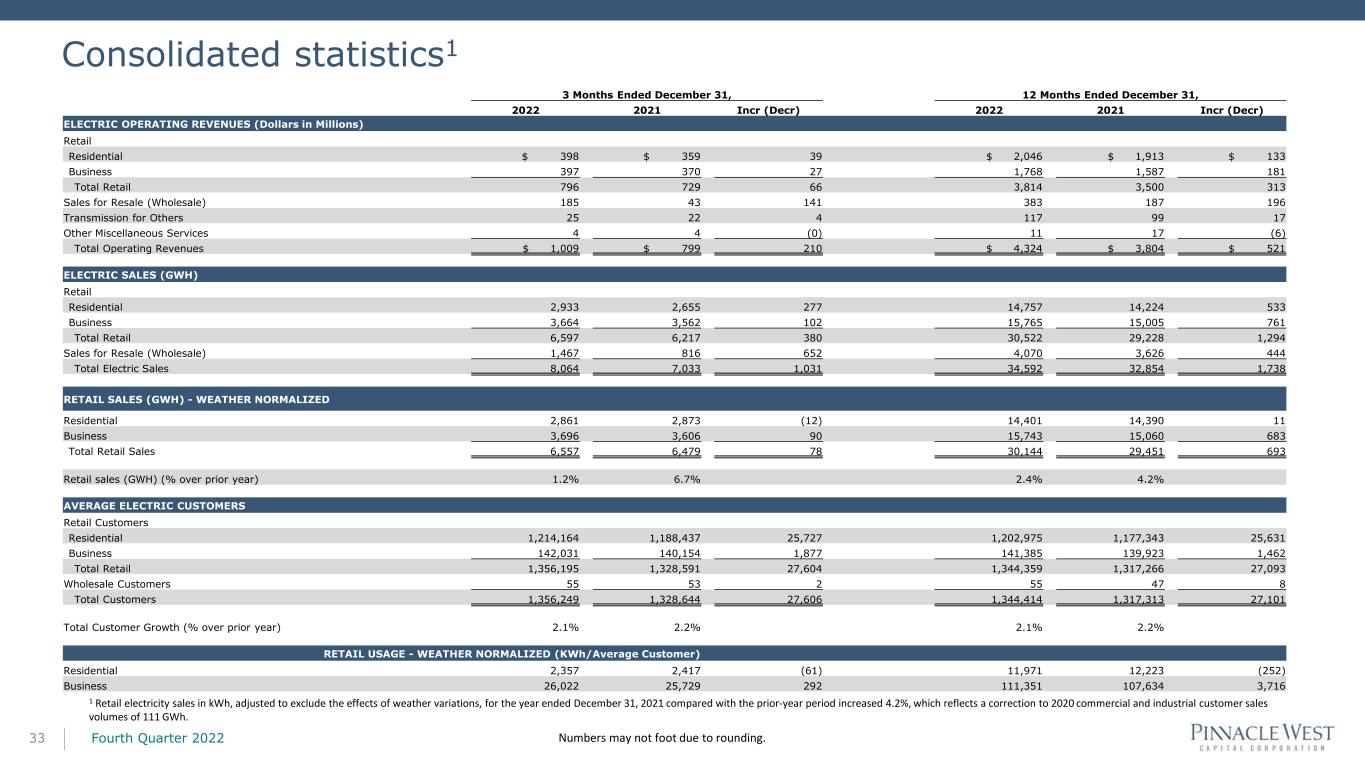

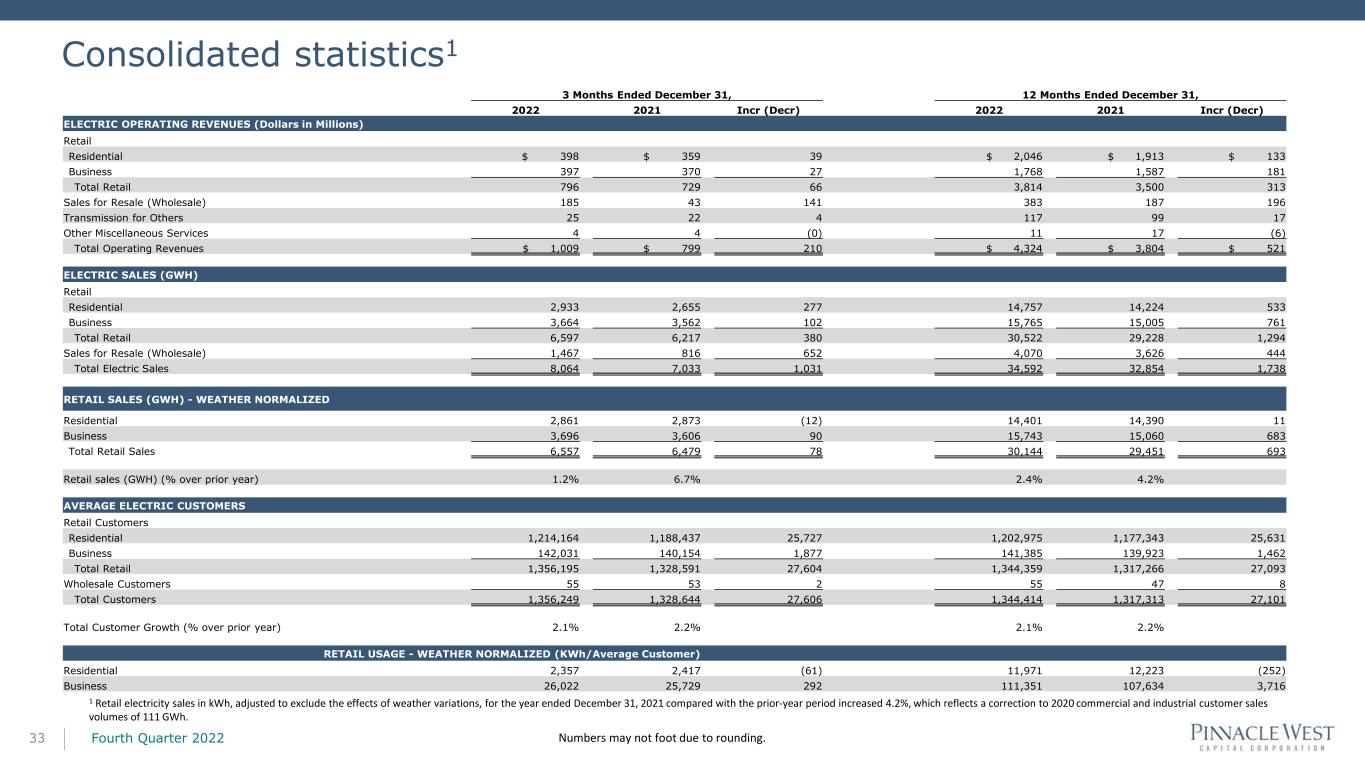

Consolidated statistics1 Fourth Quarter 202233 3 Months Ended June 30 Numbers may not foot due to rounding. 3 Months Ended June 30 1 Retail electricity sales in kWh, adjusted to exclude the effects of weather variations, for the year ended December 31, 2021 compared with the prior-year period increased 4.2%, which reflects a correction to 2020 commercial and industrial customer sales volumes of 111 GWh. 3 Months Ended December 31, 12 Months Ended December 31, 2022 2021 Incr (Decr) 2022 2021 Incr (Decr) ELECTRIC OPERATING REVENUES (Dollars in Millions) Retail Residential $ 398 $ 359 39 $ 2,046 $ 1,913 $ 133 Business 397 370 27 1,768 1,587 181 Total Retail 796 729 66 3,814 3,500 313 Sales for Resale (Wholesale) 185 43 141 383 187 196 Transmission for Others 25 22 4 117 99 17 Other Miscellaneous Services 4 4 (0) 11 17 (6) Total Operating Revenues $ 1,009 $ 799 210 $ 4,324 $ 3,804 $ 521 ELECTRIC SALES (GWH) Retail Residential 2,933 2,655 277 14,757 14,224 533 Business 3,664 3,562 102 15,765 15,005 761 Total Retail 6,597 6,217 380 30,522 29,228 1,294 Sales for Resale (Wholesale) 1,467 816 652 4,070 3,626 444 Total Electric Sales 8,064 7,033 1,031 34,592 32,854 1,738 RETAIL SALES (GWH) - WEATHER NORMALIZED Residential 2,861 2,873 (12) 14,401 14,390 11 Business 3,696 3,606 90 15,743 15,060 683 Total Retail Sales 6,557 6,479 78 30,144 29,451 693 Retail sales (GWH) (% over prior year) 1.2% 6.7% 2.4% 4.2% AVERAGE ELECTRIC CUSTOMERS Retail Customers Residential 1,214,164 1,188,437 25,727 1,202,975 1,177,343 25,631 Business 142,031 140,154 1,877 141,385 139,923 1,462 Total Retail 1,356,195 1,328,591 27,604 1,344,359 1,317,266 27,093 Wholesale Customers 55 53 2 55 47 8 Total Customers 1,356,249 1,328,644 27,606 1,344,414 1,317,313 27,101 Total Customer Growth (% over prior year) 2.1% 2.2% 2.1% 2.2% RETAIL USAGE - WEATHER NORMALIZED (KWh/Average Customer) Residential 2,357 2,417 (61) 11,971 12,223 (252) Business 26,022 25,729 292 111,351 107,634 3,716

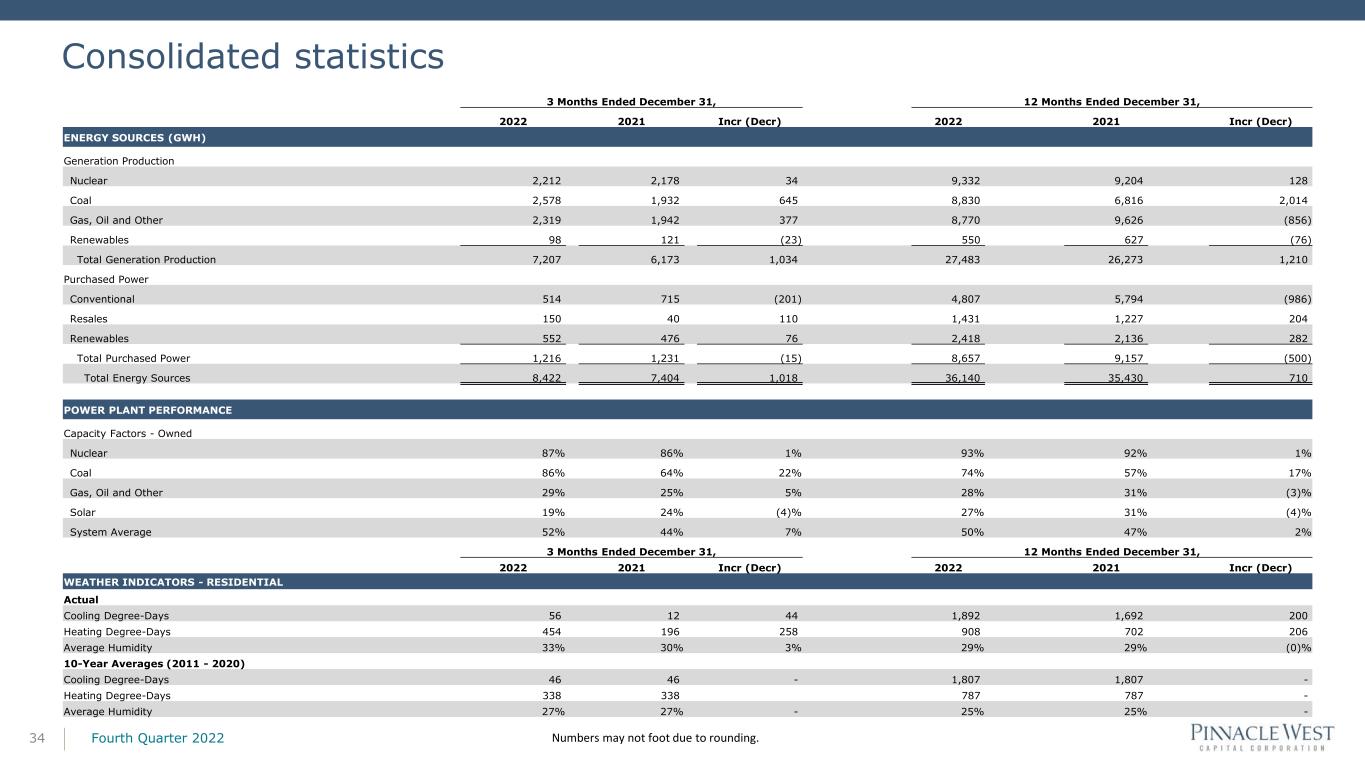

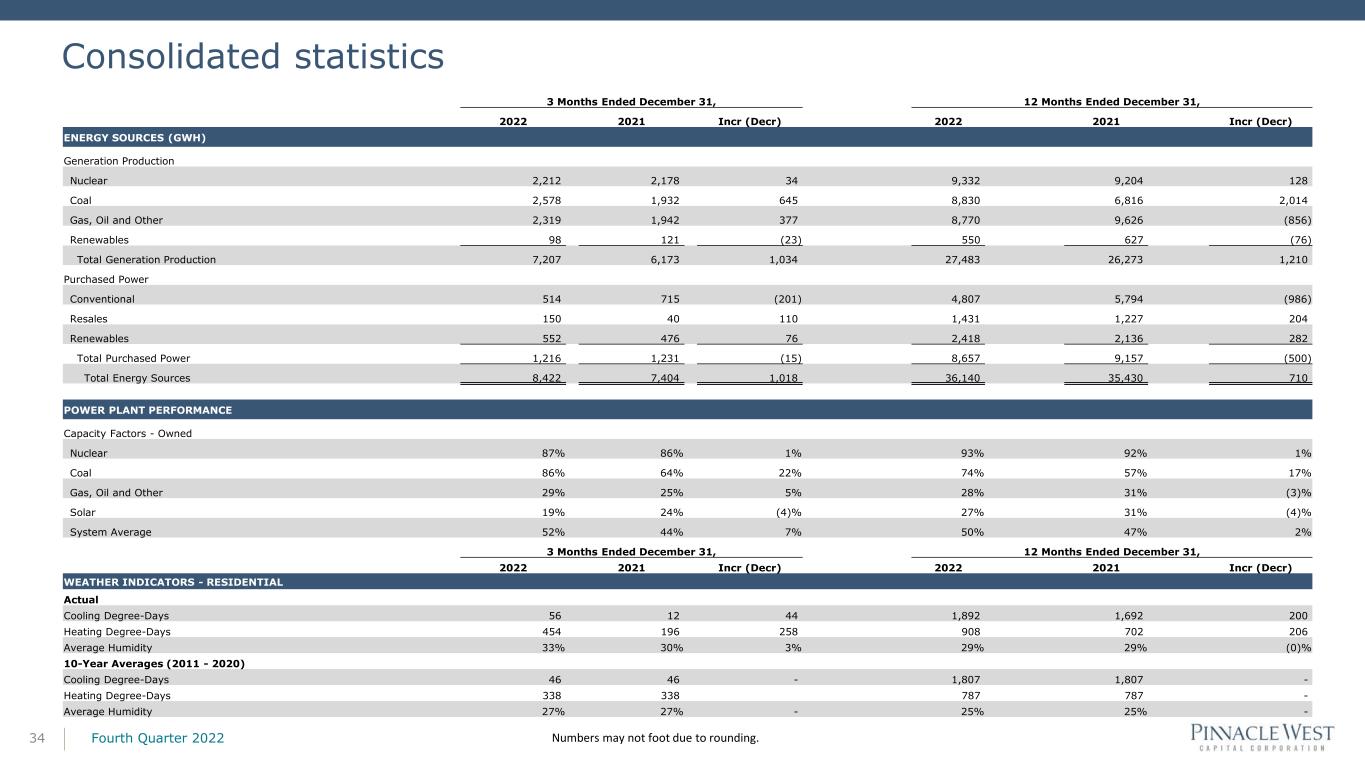

Consolidated statistics Fourth Quarter 202234 Numbers may not foot due to rounding. 3 Months Ended June 30 3 Months Ended December 31, 12 Months Ended December 31, 2022 2021 Incr (Decr) 2022 2021 Incr (Decr) ENERGY SOURCES (GWH) Generation Production Nuclear 2,212 2,178 34 9,332 9,204 128 Coal 2,578 1,932 645 8,830 6,816 2,014 Gas, Oil and Other 2,319 1,942 377 8,770 9,626 (856) Renewables 98 121 (23) 550 627 (76) Total Generation Production 7,207 6,173 1,034 27,483 26,273 1,210 Purchased Power Conventional 514 715 (201) 4,807 5,794 (986) Resales 150 40 110 1,431 1,227 204 Renewables 552 476 76 2,418 2,136 282 Total Purchased Power 1,216 1,231 (15) 8,657 9,157 (500) Total Energy Sources 8,422 7,404 1,018 36,140 35,430 710 POWER PLANT PERFORMANCE Capacity Factors - Owned Nuclear 87% 86% 1% 93% 92% 1% Coal 86% 64% 22% 74% 57% 17% Gas, Oil and Other 29% 25% 5% 28% 31% (3)% Solar 19% 24% (4)% 27% 31% (4)% System Average 52% 44% 7% 50% 47% 2% 3 Months Ended December 31, 12 Months Ended December 31, 2022 2021 Incr (Decr) 2022 2021 Incr (Decr) WEATHER INDICATORS - RESIDENTIAL Actual Cooling Degree-Days 56 12 44 1,892 1,692 200 Heating Degree-Days 454 196 258 908 702 206 Average Humidity 33% 30% 3% 29% 29% (0)% 10-Year Averages (2011 - 2020) Cooling Degree-Days 46 46 - 1,807 1,807 - Heating Degree-Days 338 338 787 787 - Average Humidity 27% 27% - 25% 25% -