Renewed, Reliable and Resilient Third-Quarter 2024 Financial Results November 6, 2024

2 This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project,” "anticipate," "goal," "seek," "strategy," "likely," "should," "will," "could," and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: uncertainties associated with the current and future economic environment, including economic growth rates, labor market conditions, inflation, supply chain delays, increased expenses, volatile capital markets, or other unpredictable effects; our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; variations in demand for electricity, including those due to weather, seasonality (including large increases in ambient temperatures), the general economy or social conditions, customer, and sales growth (or decline), the effects of energy conservation measures and distributed generation, and technological advancements; the potential effects of climate change on our electric system, including as a result of weather extremes such as prolonged drought and high temperature variations in the area where APS conducts its business; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments, and proceedings; new legislation, ballot initiatives and regulation or interpretations of existing legislation or regulations, including those relating to environmental requirements, regulatory and energy policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs through our rates and adjustor recovery mechanisms, including returns on and of debt and equity capital investment; the ability of APS to meet renewable energy and energy efficiency mandates and recover related costs; the ability of APS to achieve its clean energy goals (including a goal by 2050 of 100% clean, carbon-free electricity) and, if these goals are achieved, the impact of such achievement on APS, its customers, and its business, financial condition, and results of operations; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona; the direct or indirect effect on our facilities or business from cybersecurity threats or intrusions, data security breaches, terrorist attack, physical attack, severe storms, or other catastrophic events, such as fires, explosions, pandemic health events or similar occurrences; the development of new technologies which may affect electric sales or delivery, including as a result of delays in the development and application of new technologies; the cost of debt, including increased cost as a result of rising interest rates, and equity capital and our ability to access capital markets when required; environmental, economic, and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facilities and system conditions and operating costs; our ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant landowners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in the most recent Pinnacle West/APS Form 10-K along with other public filings with the Securities and Exchange Commission, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders. Forward Looking Statements

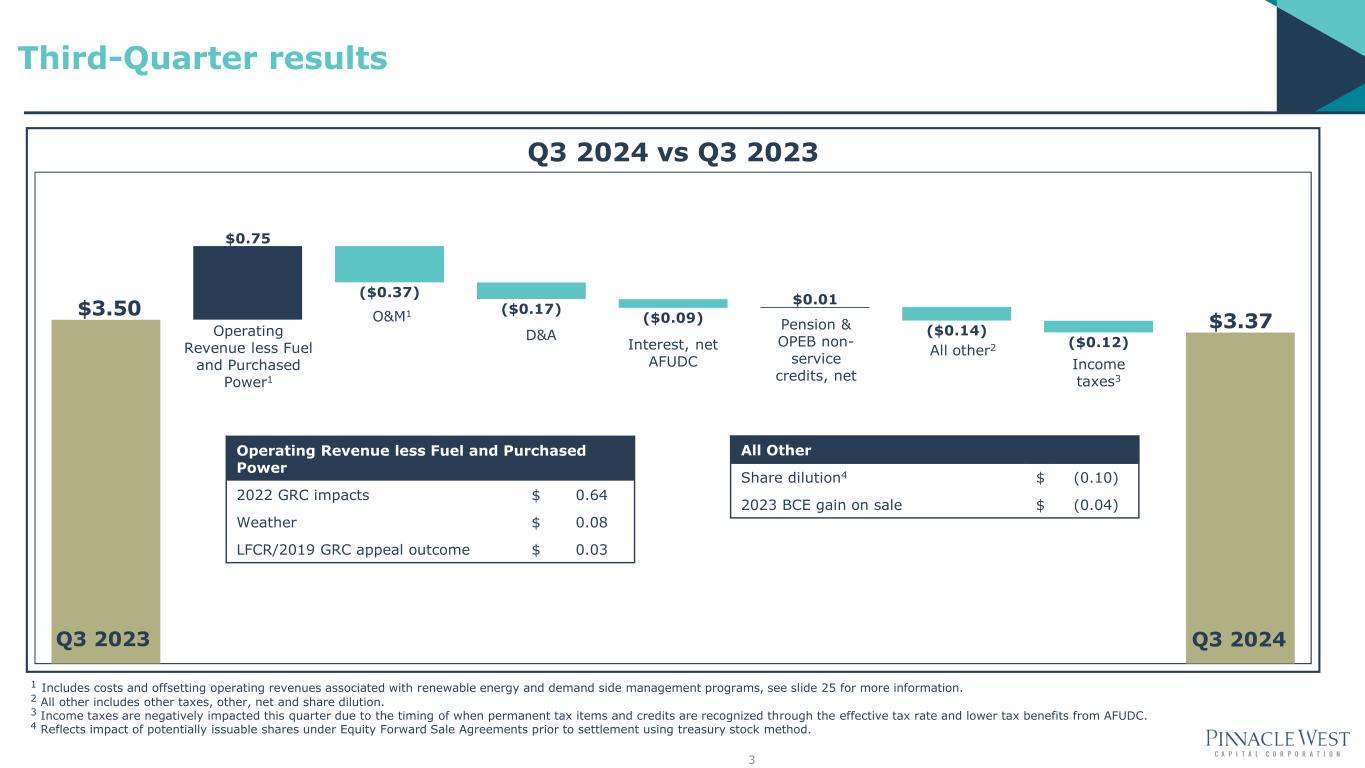

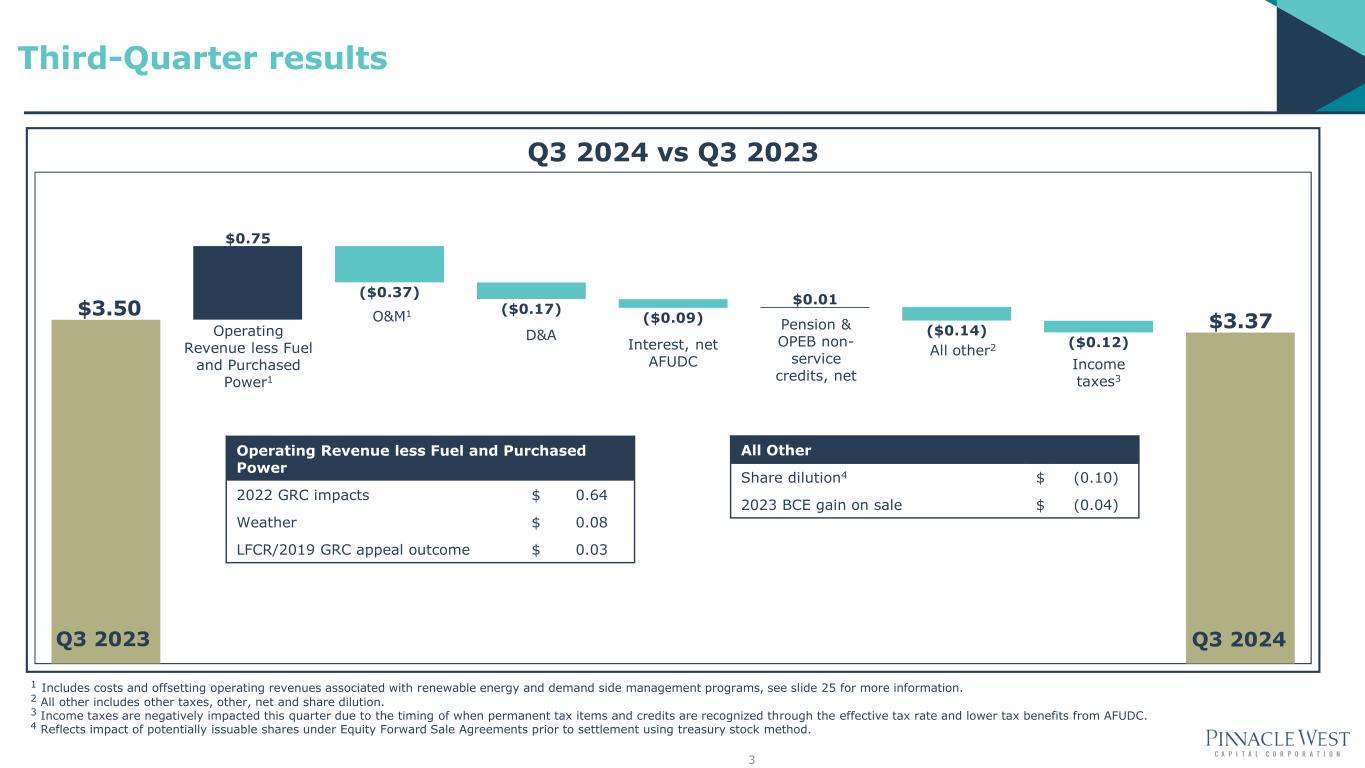

Q3 2024 vs Q3 2023 Operating Revenue less Fuel and Purchased Power 2022 GRC impacts $ 0.64 Weather $ 0.08 LFCR/2019 GRC appeal outcome $ 0.03 Q3 2023 Q3 2024 1 Includes costs and offsetting operating revenues associated with renewable energy and demand side management programs, see slide 25 for more information. 2 All other includes other taxes, other, net and share dilution. 3 Income taxes are negatively impacted this quarter due to the timing of when permanent tax items and credits are recognized through the effective tax rate and lower tax benefits from AFUDC. 4 Reflects impact of potentially issuable shares under Equity Forward Sale Agreements prior to settlement using treasury stock method. Operating Revenue less Fuel and Purchased Power1 O&M1 D&A Pension & OPEB non- service credits, net Interest, net AFUDC All other2 Income taxes3 3 Third-Quarter results All Other Share dilution4 $ (0.10) 2023 BCE gain on sale $ (0.04)

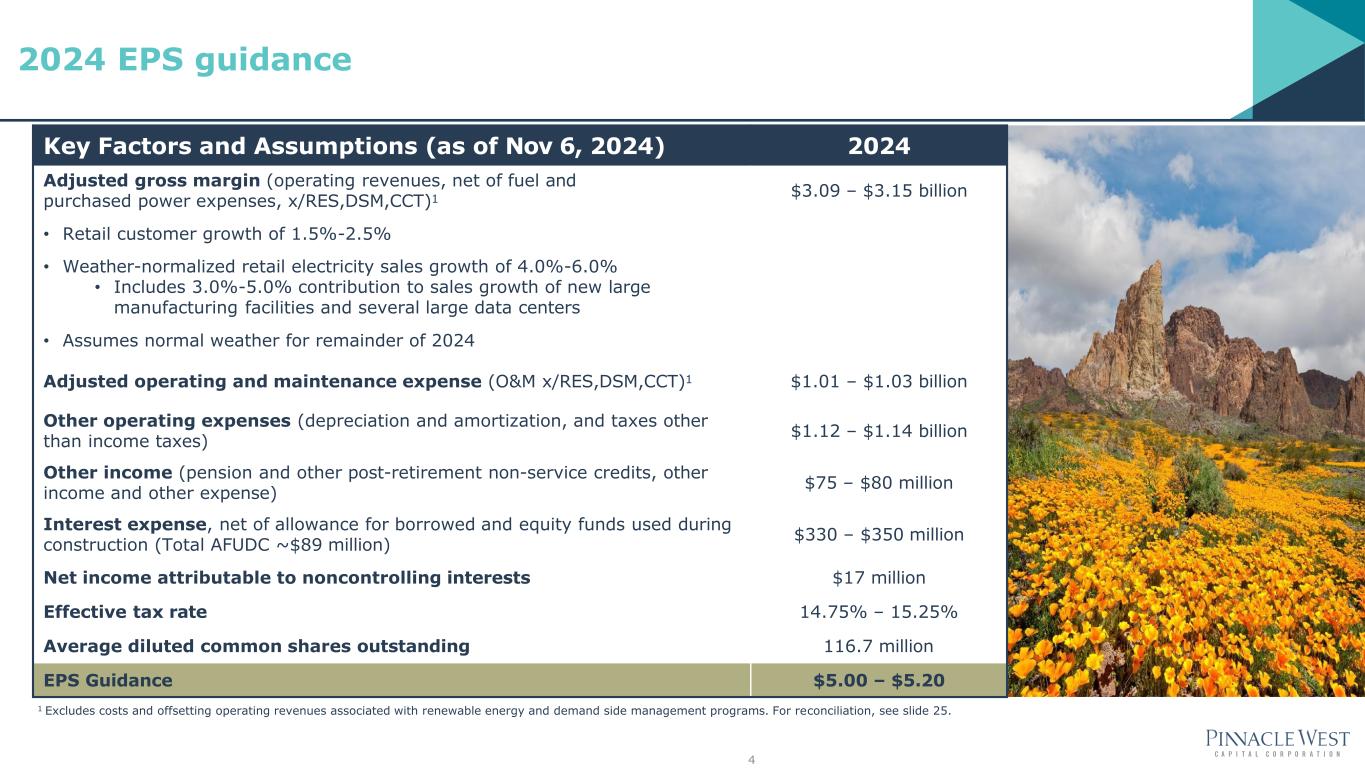

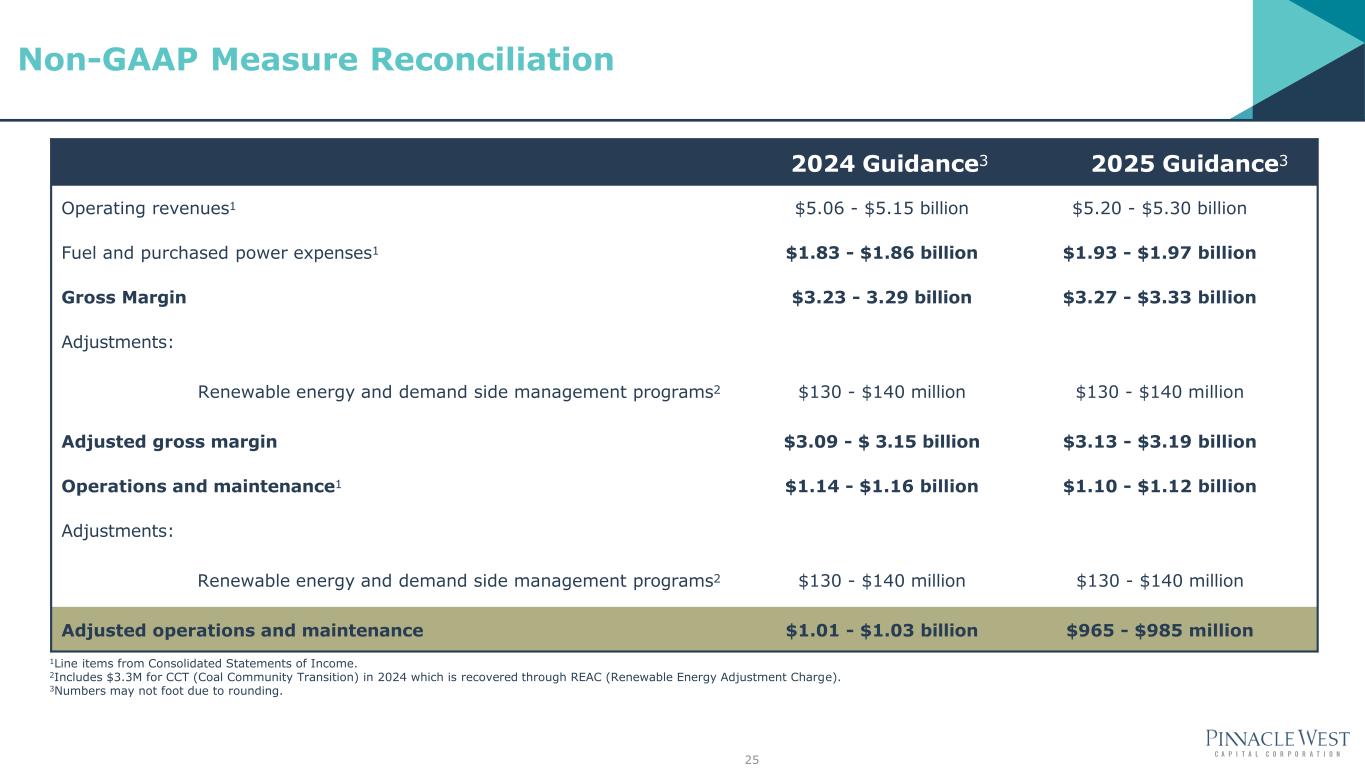

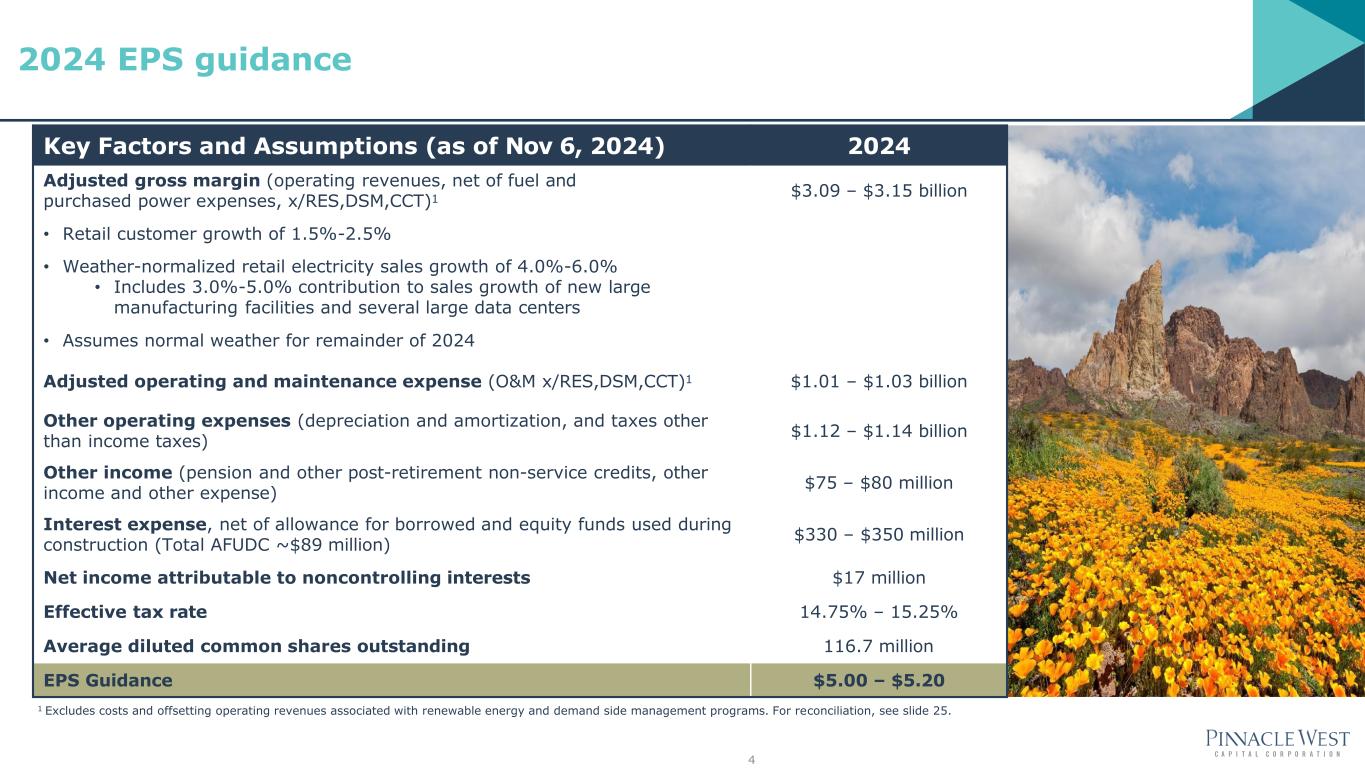

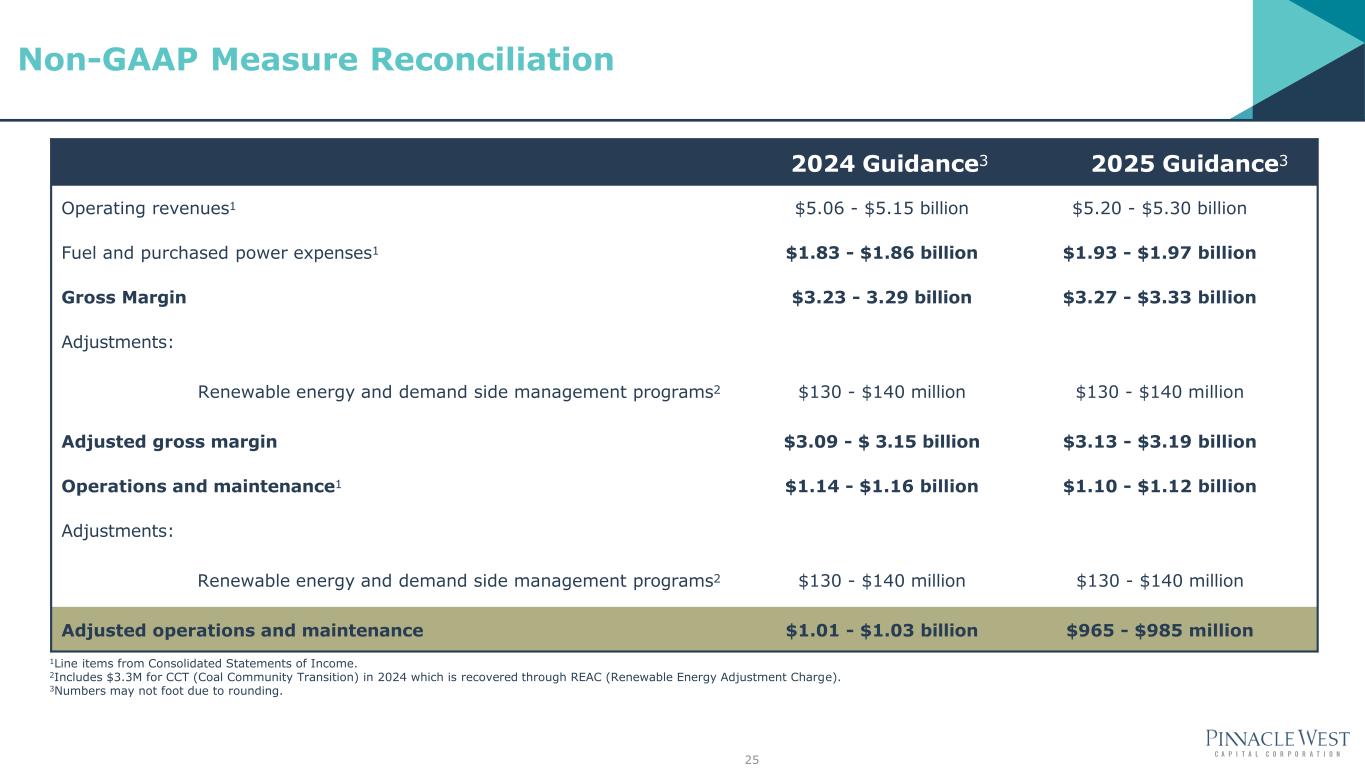

Key Factors and Assumptions (as of Nov 6, 2024) 2024 Adjusted gross margin (operating revenues, net of fuel and purchased power expenses, x/RES,DSM,CCT)1 $3.09 – $3.15 billion • Retail customer growth of 1.5%-2.5% • Weather-normalized retail electricity sales growth of 4.0%-6.0% • Includes 3.0%-5.0% contribution to sales growth of new large manufacturing facilities and several large data centers • Assumes normal weather for remainder of 2024 Adjusted operating and maintenance expense (O&M x/RES,DSM,CCT)1 $1.01 – $1.03 billion Other operating expenses (depreciation and amortization, and taxes other than income taxes) $1.12 – $1.14 billion Other income (pension and other post-retirement non-service credits, other income and other expense) $75 – $80 million Interest expense, net of allowance for borrowed and equity funds used during construction (Total AFUDC ~$89 million) $330 – $350 million Net income attributable to noncontrolling interests $17 million Effective tax rate 14.75% – 15.25% Average diluted common shares outstanding 116.7 million EPS Guidance $5.00 – $5.20 1 Excludes costs and offsetting operating revenues associated with renewable energy and demand side management programs. For reconciliation, see slide 25. 4 2024 EPS guidance

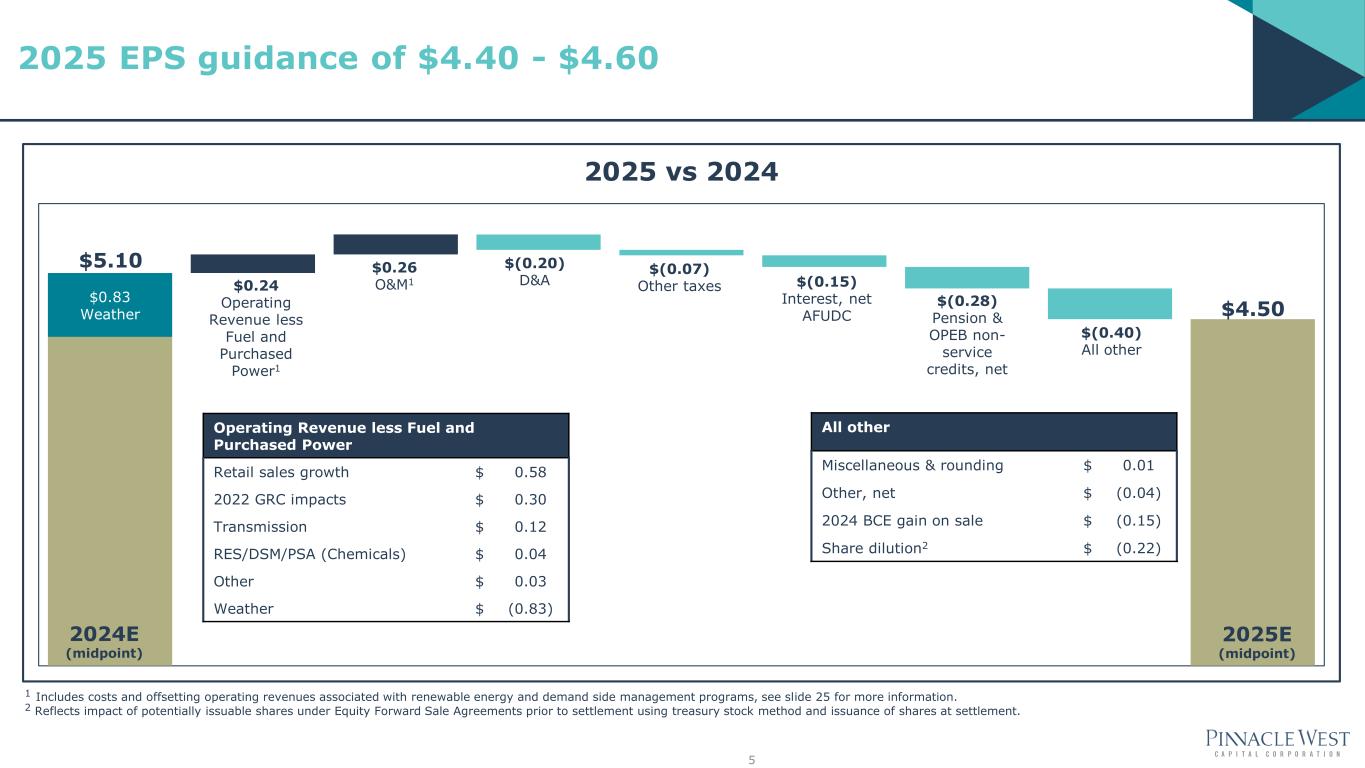

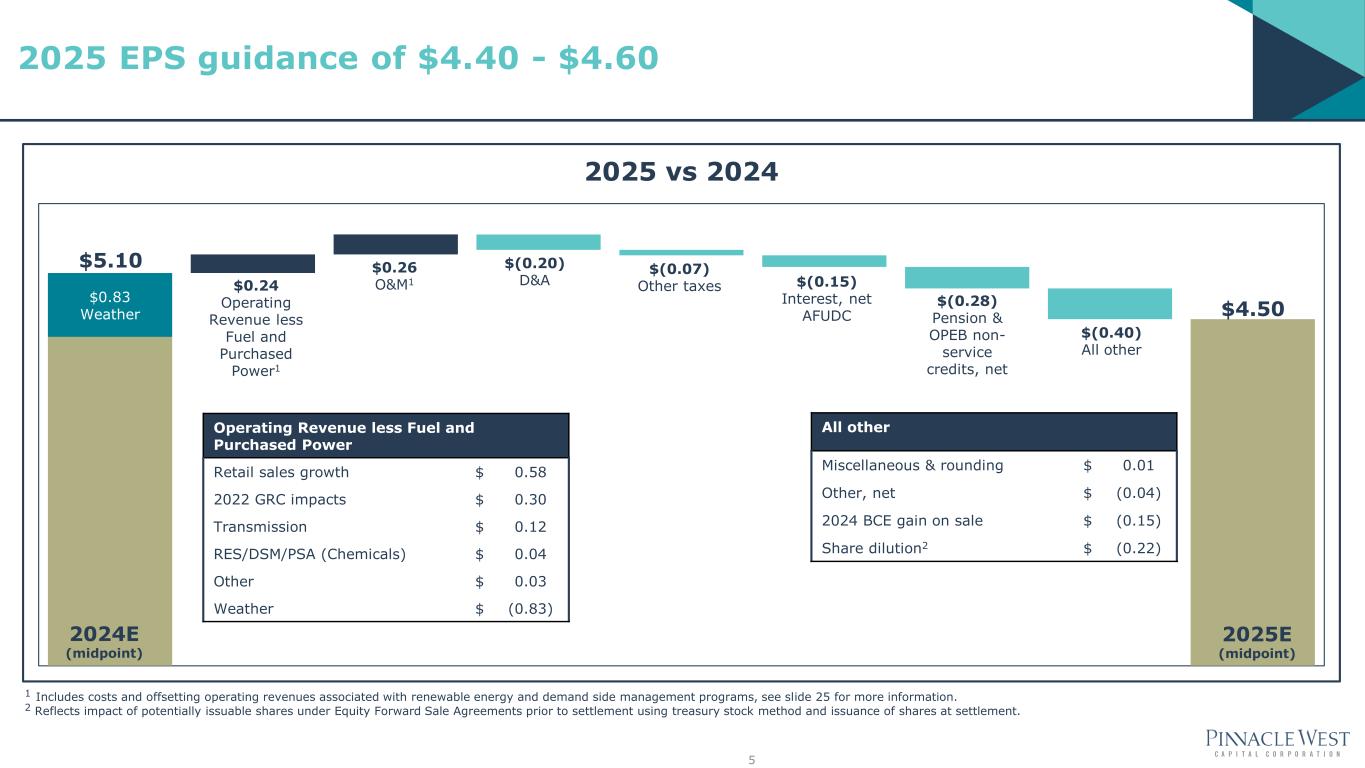

$0.83 Weather 2025 vs 2024 Operating Revenue less Fuel and Purchased Power Retail sales growth $ 0.58 2022 GRC impacts $ 0.30 Transmission $ 0.12 RES/DSM/PSA (Chemicals) $ 0.04 Other $ 0.03 Weather $ (0.83) All other Miscellaneous & rounding $ 0.01 Other, net $ (0.04) 2024 BCE gain on sale $ (0.15) Share dilution2 $ (0.22) $0.24 Operating Revenue less Fuel and Purchased Power1 $0.26 O&M1 $(0.20) D&A $(0.07) Other taxes $(0.15) Interest, net AFUDC 2025E (midpoint) $4.50 $5.10 1 Includes costs and offsetting operating revenues associated with renewable energy and demand side management programs, see slide 25 for more information. 2 Reflects impact of potentially issuable shares under Equity Forward Sale Agreements prior to settlement using treasury stock method and issuance of shares at settlement. 5 2025 EPS guidance of $4.40 - $4.60 2024E (midpoint) $(0.28) Pension & OPEB non- service credits, net $(0.40) All other

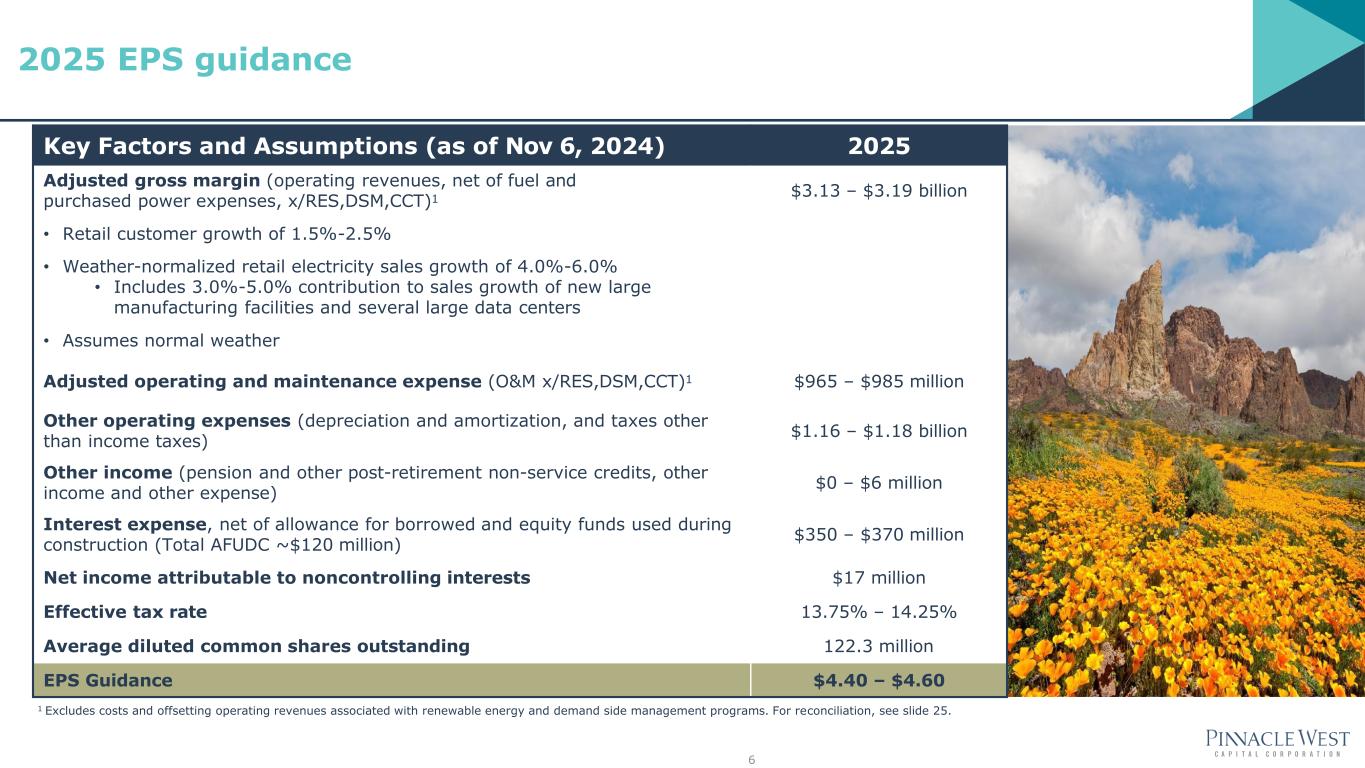

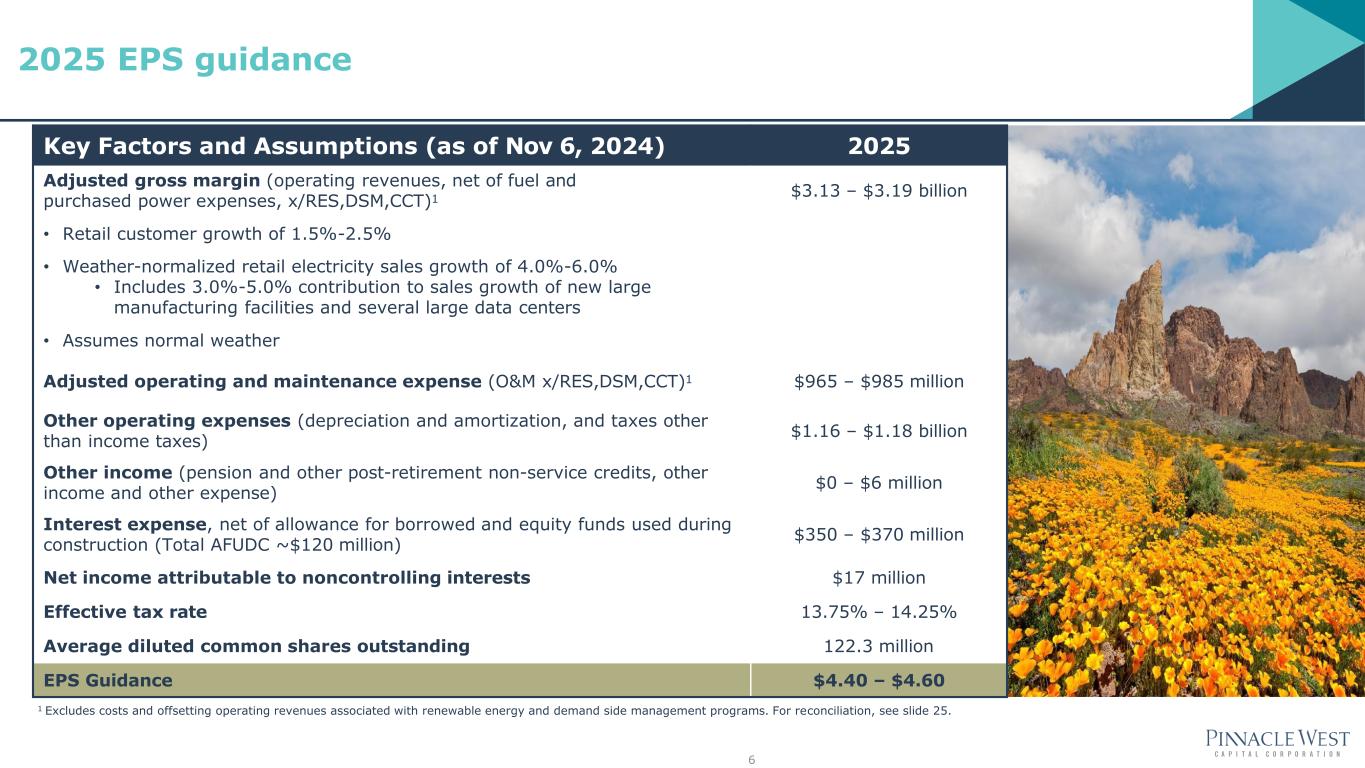

Key Factors and Assumptions (as of Nov 6, 2024) 2025 Adjusted gross margin (operating revenues, net of fuel and purchased power expenses, x/RES,DSM,CCT)1 $3.13 – $3.19 billion • Retail customer growth of 1.5%-2.5% • Weather-normalized retail electricity sales growth of 4.0%-6.0% • Includes 3.0%-5.0% contribution to sales growth of new large manufacturing facilities and several large data centers • Assumes normal weather Adjusted operating and maintenance expense (O&M x/RES,DSM,CCT)1 $965 – $985 million Other operating expenses (depreciation and amortization, and taxes other than income taxes) $1.16 – $1.18 billion Other income (pension and other post-retirement non-service credits, other income and other expense) $0 – $6 million Interest expense, net of allowance for borrowed and equity funds used during construction (Total AFUDC ~$120 million) $350 – $370 million Net income attributable to noncontrolling interests $17 million Effective tax rate 13.75% – 14.25% Average diluted common shares outstanding 122.3 million EPS Guidance $4.40 – $4.60 1 Excludes costs and offsetting operating revenues associated with renewable energy and demand side management programs. For reconciliation, see slide 25. 6 2025 EPS guidance

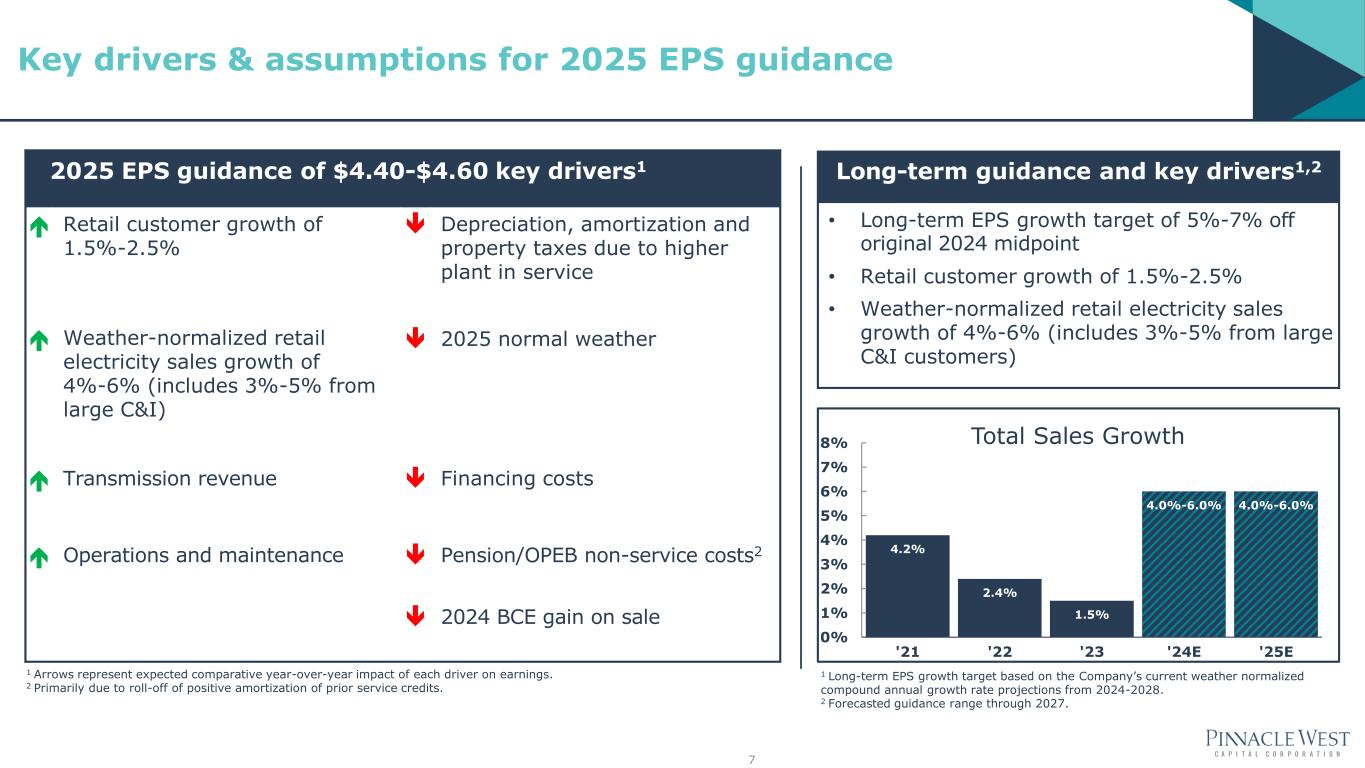

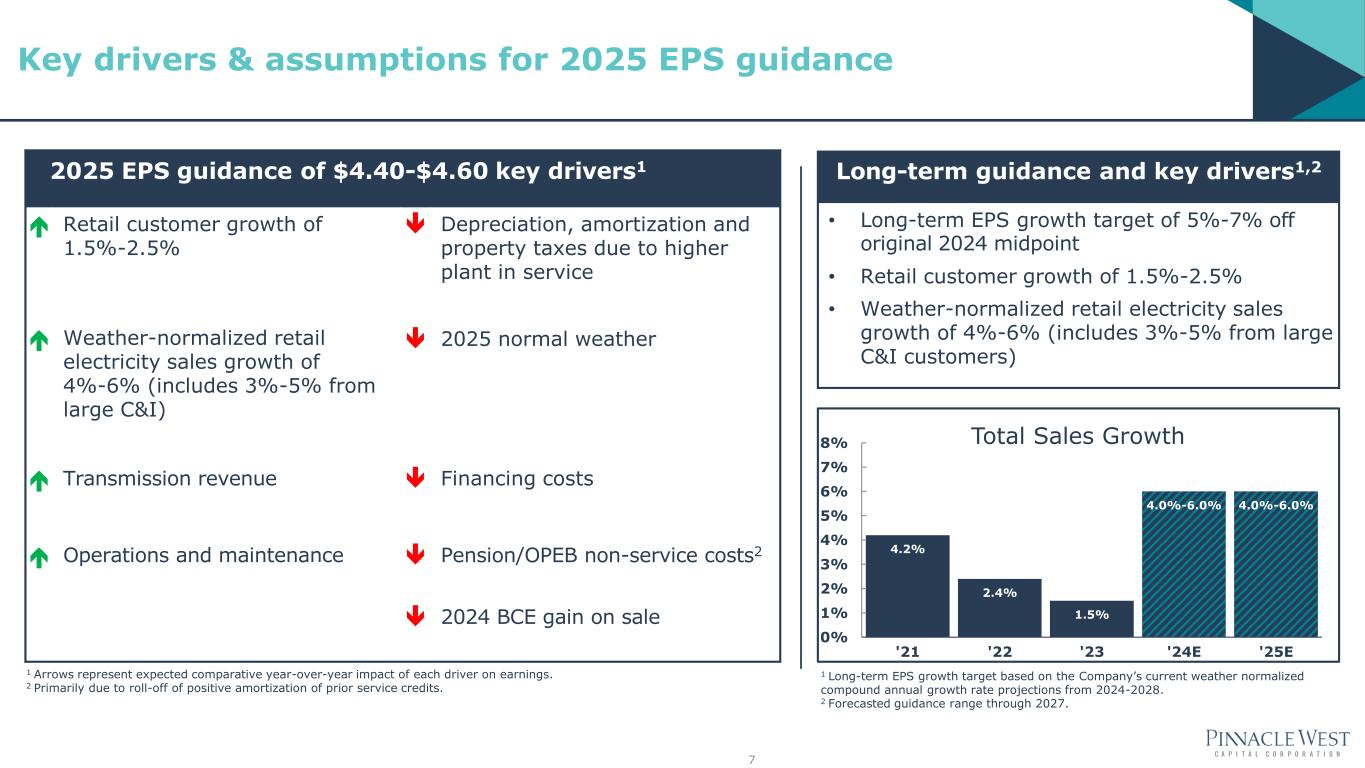

2025 EPS guidance of $4.40-$4.60 key drivers1 Retail customer growth of 1.5%-2.5% Depreciation, amortization and property taxes due to higher plant in service Weather-normalized retail electricity sales growth of 4%-6% (includes 3%-5% from large C&I) 2025 normal weather Transmission revenue Financing costs Operations and maintenance Pension/OPEB non-service costs2 2024 BCE gain on sale Long-term guidance and key drivers1,2 • Long-term EPS growth target of 5%-7% off original 2024 midpoint • Retail customer growth of 1.5%-2.5% • Weather-normalized retail electricity sales growth of 4%-6% (includes 3%-5% from large C&I customers) 4.2% 2.4% 1.5% 4.0%-6.0% 4.0%-6.0% 0% 1% 2% 3% 4% 5% 6% 7% 8% '21 '22 '23 '24E '25E Total Sales Growth 7 1 Arrows represent expected comparative year-over-year impact of each driver on earnings. 2 Primarily due to roll-off of positive amortization of prior service credits. Key drivers & assumptions for 2025 EPS guidance 1 Long-term EPS growth target based on the Company’s current weather normalized compound annual growth rate projections from 2024-2028. 2 Forecasted guidance range through 2027.

$7.80B $9.65B 2023-2026E 2024E-2027E CapEx Profile $320 $380 $335 $275 $620 $665 $670 $675 $320 $450 $675 $750 $790 $905 $870 $950 2024E 2025E 2026E 2027E APS Total 2024-2027 $9.65B Generation Transmission Distribution Other $2.05B $2.40B $2.55B $2.65B Source: 2024-2027 as disclosed in the Third Quarter 2024 Form 10-Q Q4 2023 Today 8 Capital plan to support reliability and continued growth within our service territory

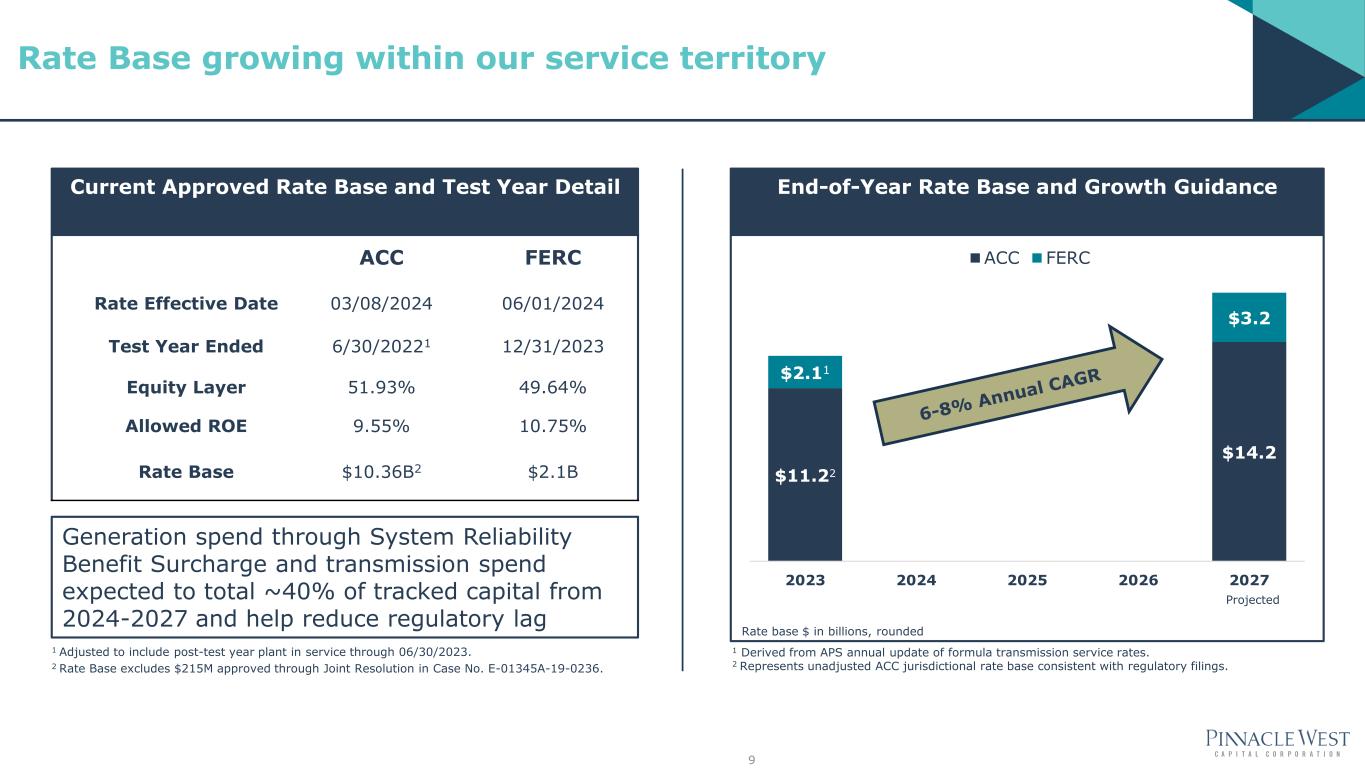

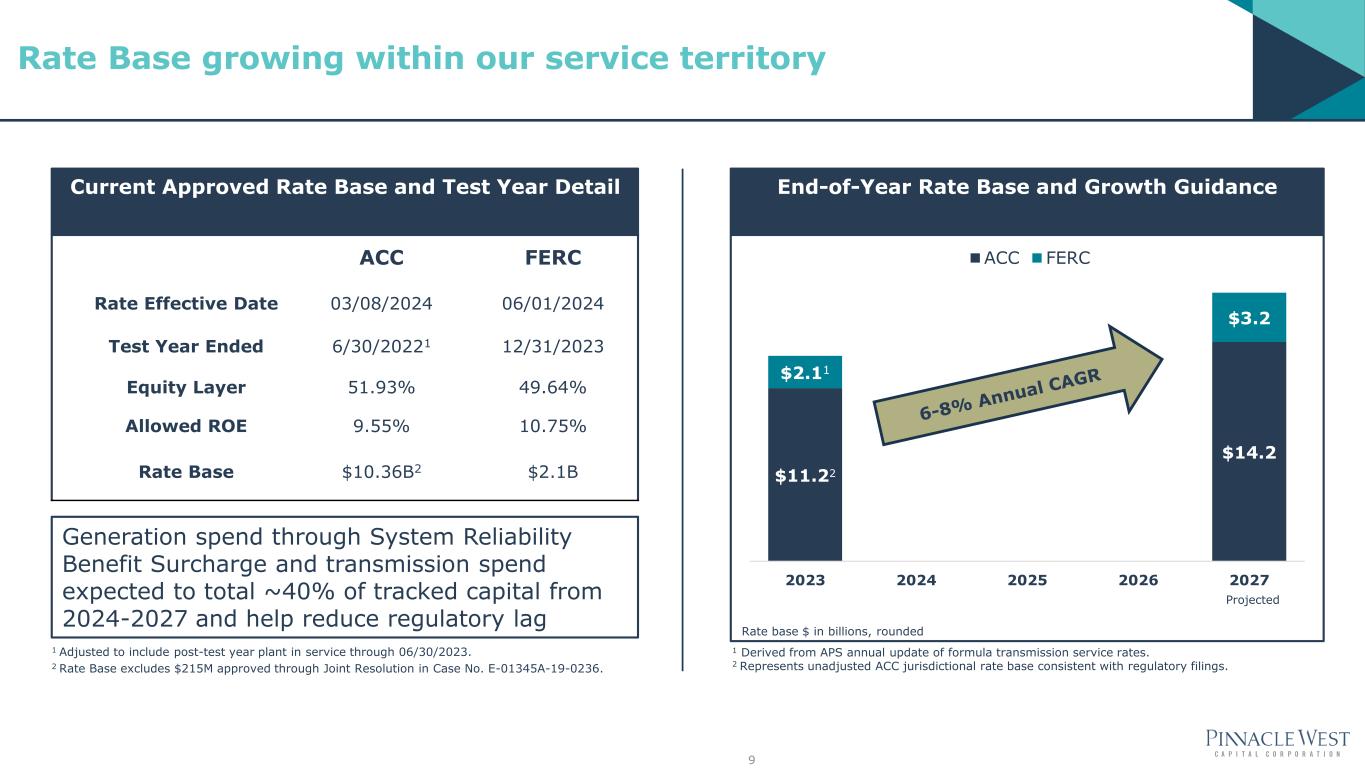

Current Approved Rate Base and Test Year Detail End-of-Year Rate Base and Growth Guidance ACC FERC Rate Effective Date 03/08/2024 06/01/2024 Test Year Ended 6/30/20221 12/31/2023 Equity Layer 51.93% 49.64% Allowed ROE 9.55% 10.75% Rate Base $10.36B2 $2.1B $11.22 $14.2 $2.11 $3.2 2023 2024 2025 2026 2027 ACC FERC 9 Rate base $ in billions, rounded Projected 1 Derived from APS annual update of formula transmission service rates. 2 Represents unadjusted ACC jurisdictional rate base consistent with regulatory filings. 1 Adjusted to include post-test year plant in service through 06/30/2023. 2 Rate Base excludes $215M approved through Joint Resolution in Case No. E-01345A-19-0236. Generation spend through System Reliability Benefit Surcharge and transmission spend expected to total ~40% of tracked capital from 2024-2027 and help reduce regulatory lag Rate Base growing within our service territory

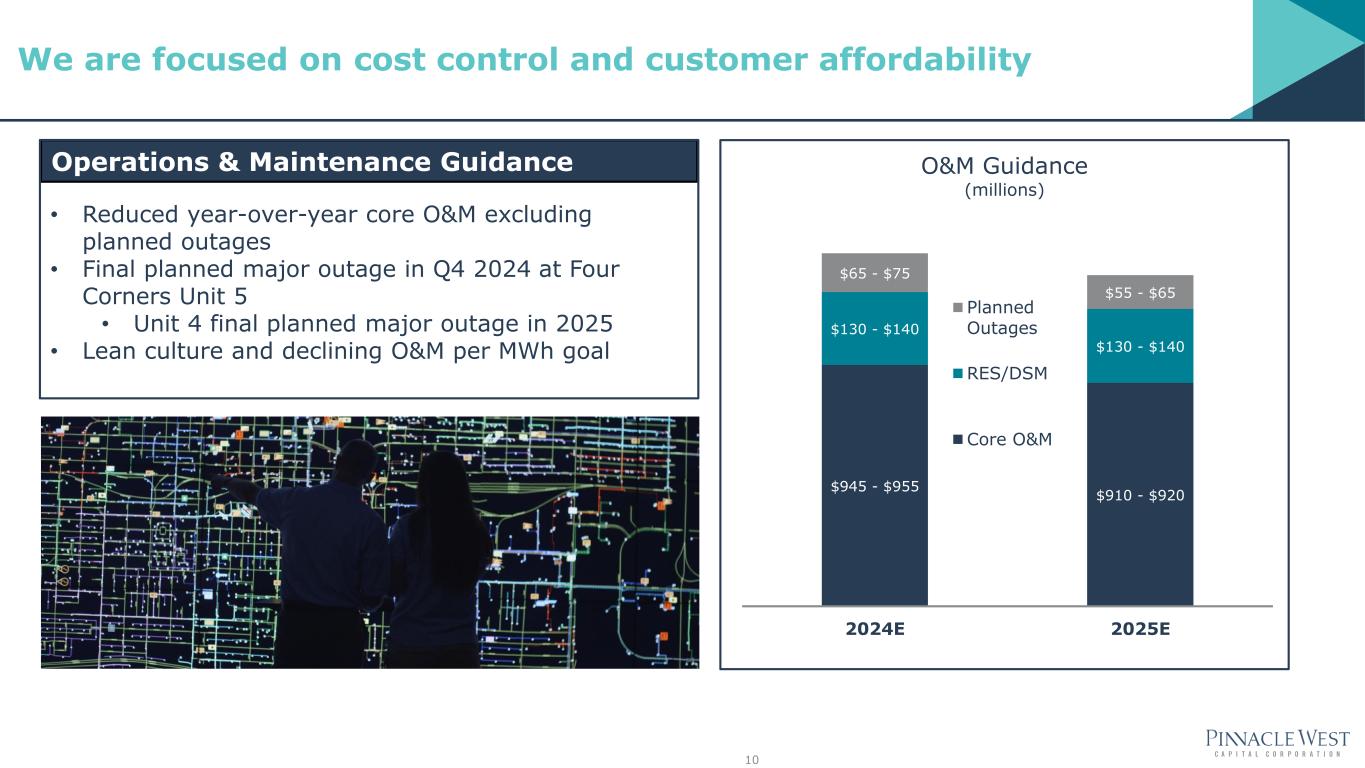

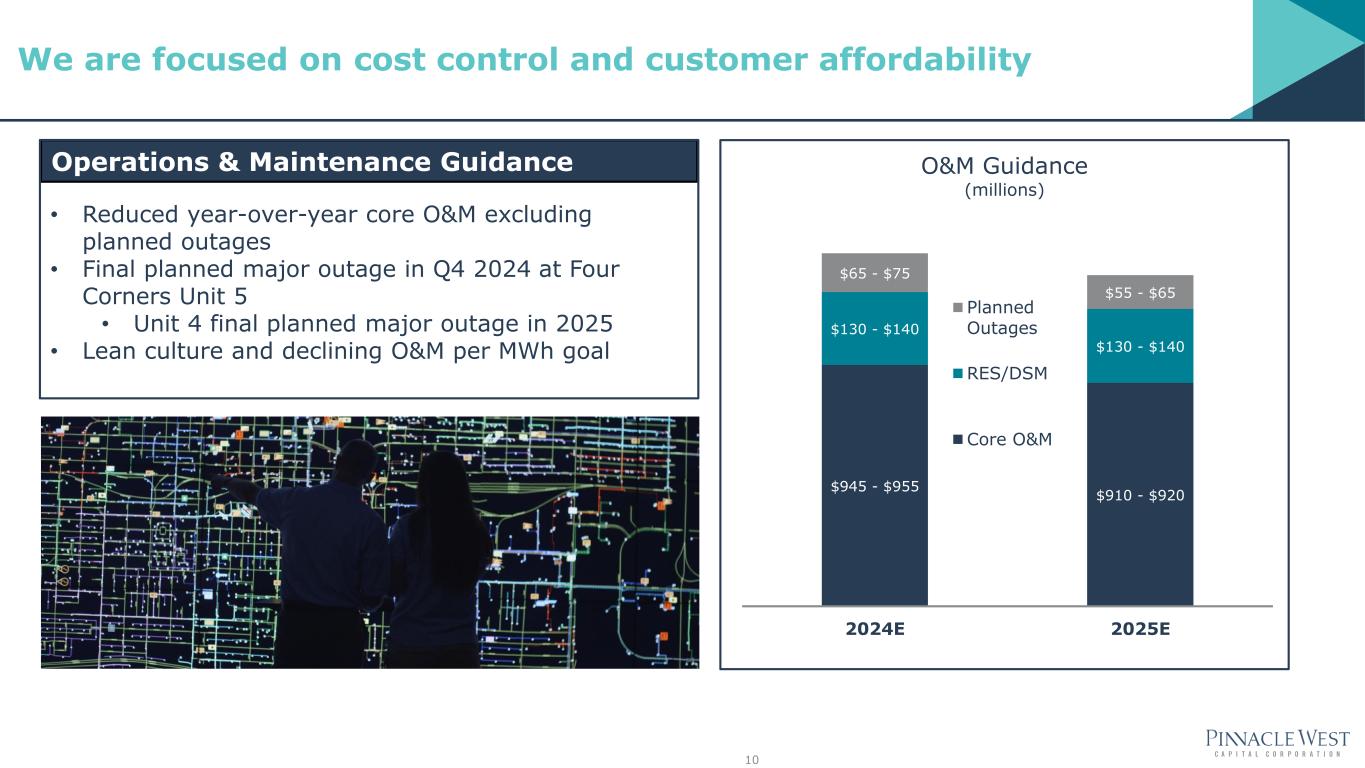

10 Operations & Maintenance Guidance • Reduced year-over-year core O&M excluding planned outages • Final planned major outage in Q4 2024 at Four Corners Unit 5 • Unit 4 final planned major outage in 2025 • Lean culture and declining O&M per MWh goal We are focused on cost control and customer affordability $945 - $955 $910 - $920 $130 - $140 $130 - $140 $65 - $75 $55 - $65 2024E 2025E O&M Guidance (millions) Planned Outages RES/DSM Core O&M

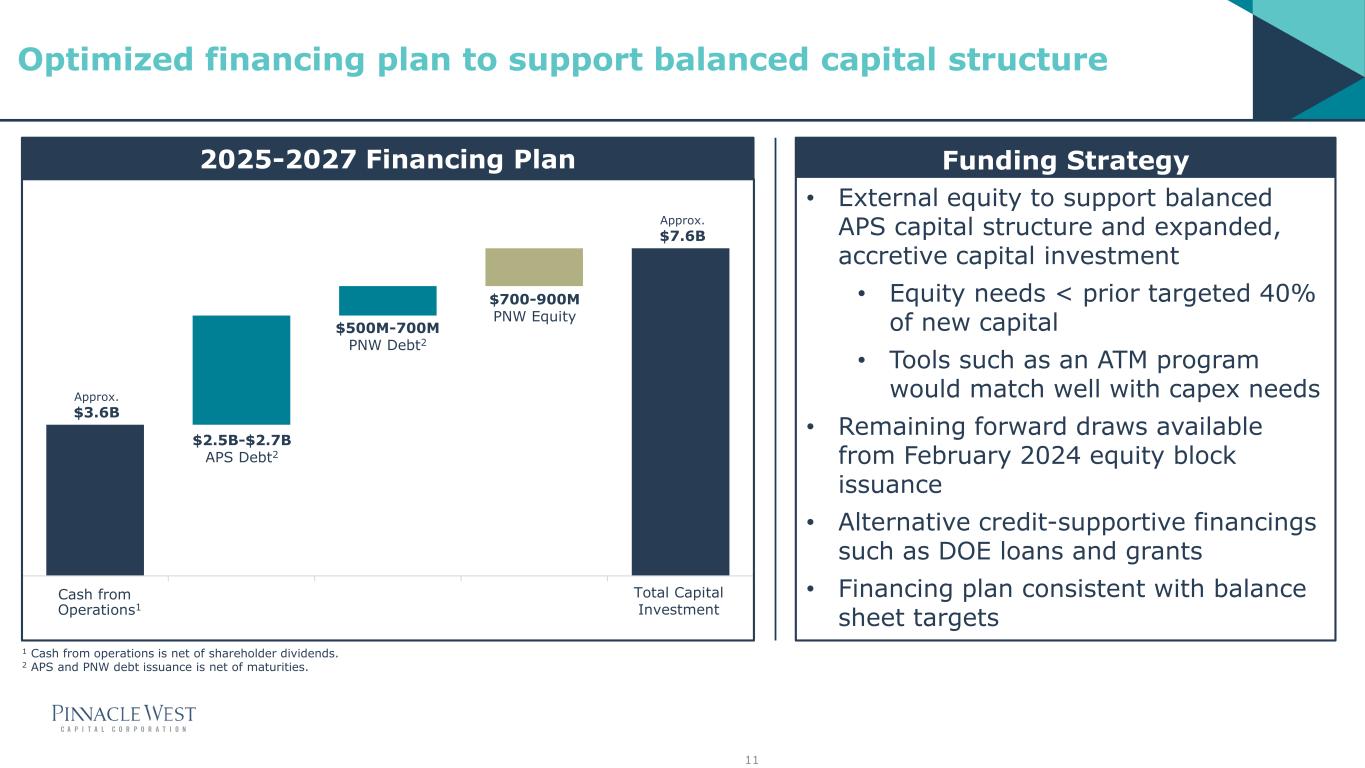

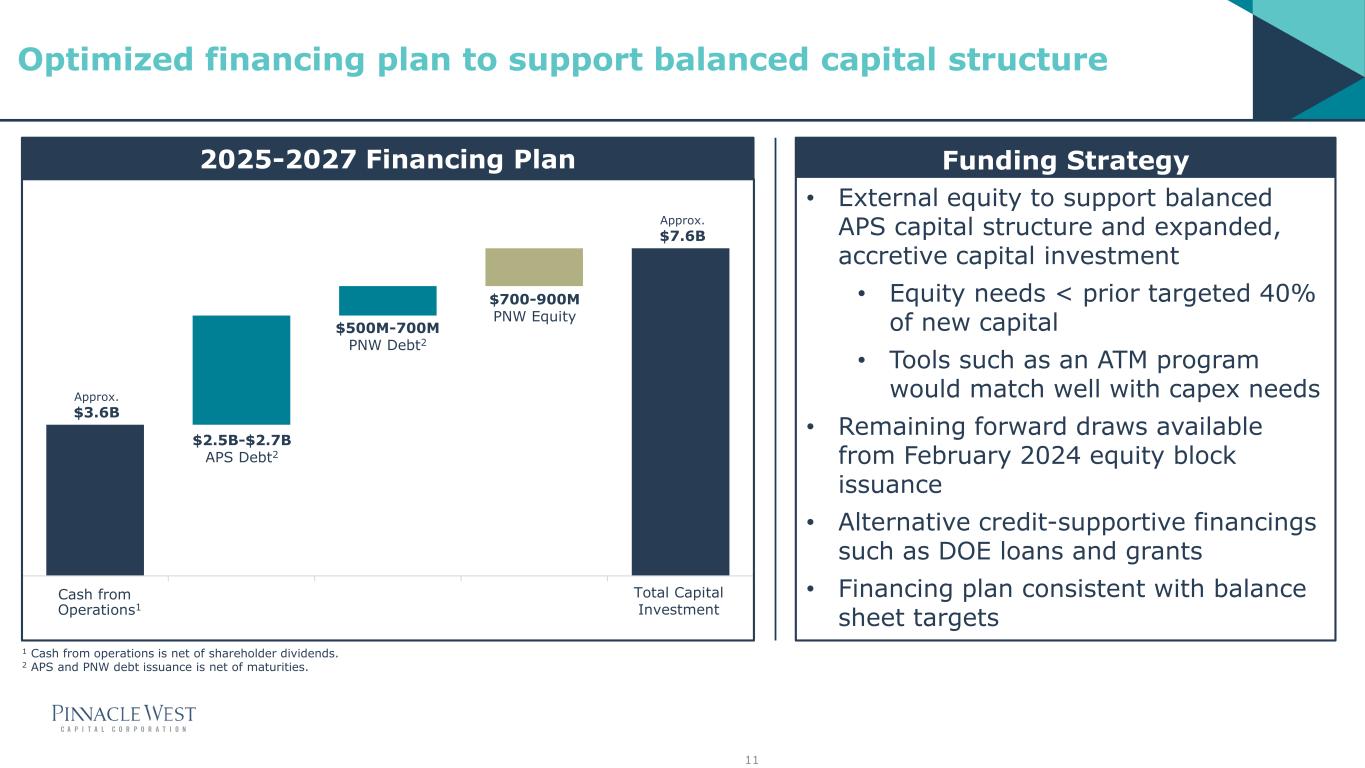

Approx. $3.6B Cash from Operations1 Total Capital Investment $2.5B-$2.7B APS Debt2 $500M-700M PNW Debt2 1 Cash from operations is net of shareholder dividends. 2 APS and PNW debt issuance is net of maturities. • External equity to support balanced APS capital structure and expanded, accretive capital investment • Equity needs < prior targeted 40% of new capital • Tools such as an ATM program would match well with capex needs • Remaining forward draws available from February 2024 equity block issuance • Alternative credit-supportive financings such as DOE loans and grants • Financing plan consistent with balance sheet targets Funding Strategy 2025-2027 Financing Plan Approx. $7.6B $700-900M PNW Equity 11 Optimized financing plan to support balanced capital structure

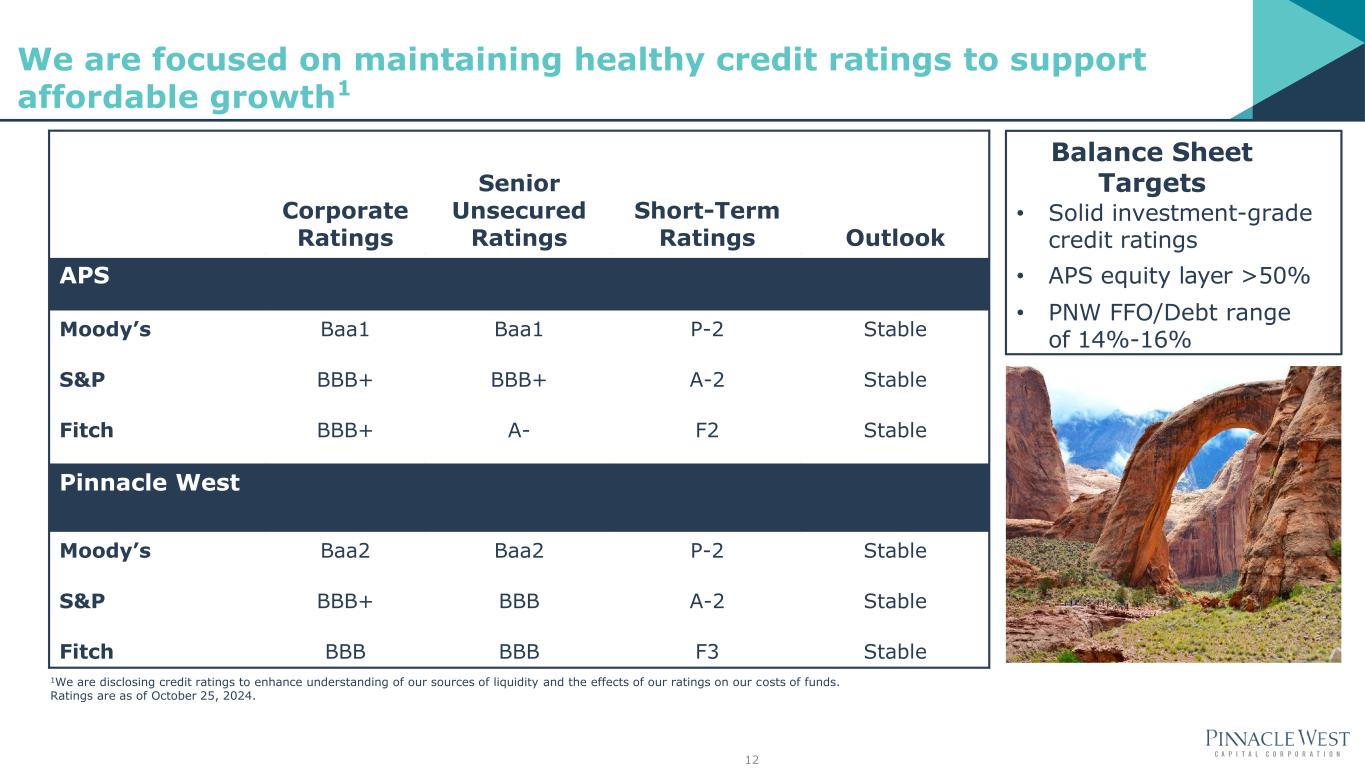

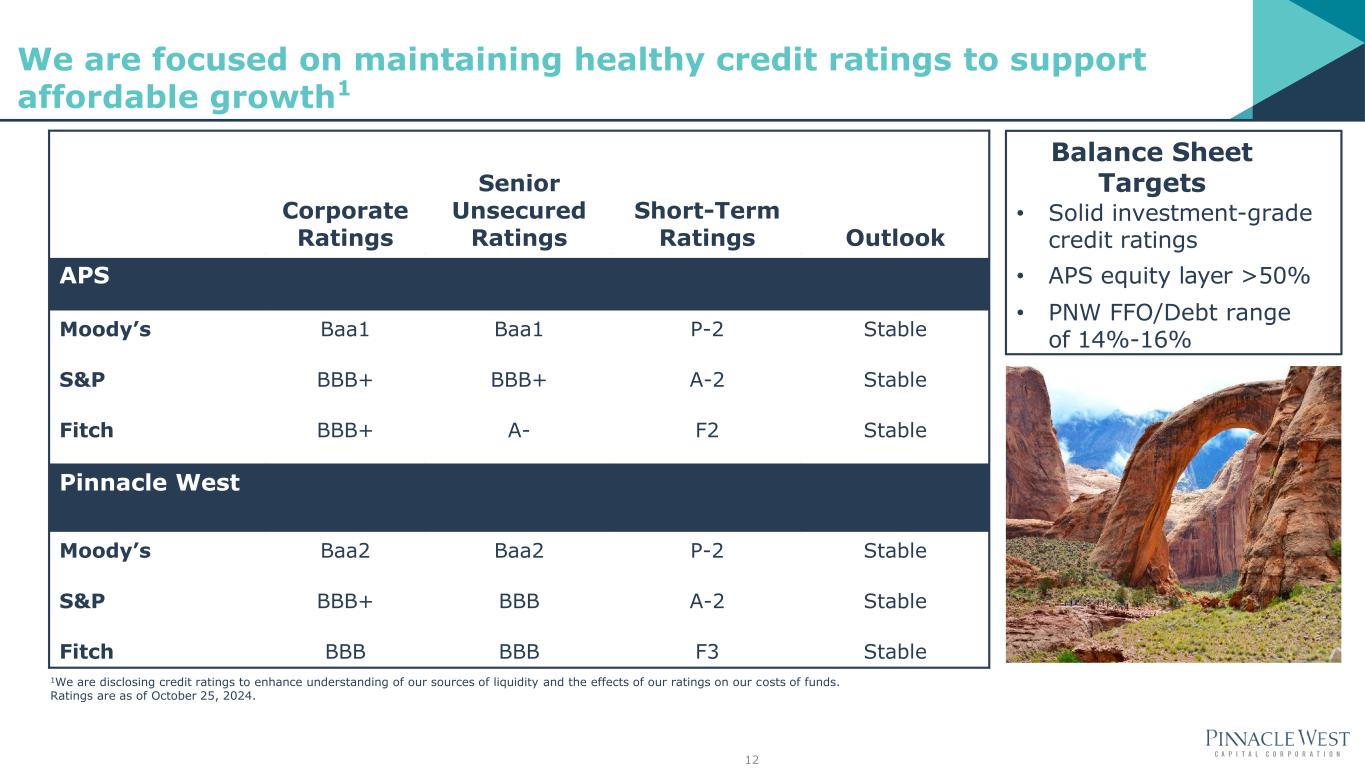

Balance Sheet Targets • Solid investment-grade credit ratings • APS equity layer >50% • PNW FFO/Debt range of 14%-16% Corporate Ratings Senior Unsecured Ratings Short-Term Ratings Outlook APS Moody’s Baa1 Baa1 P-2 Stable S&P BBB+ BBB+ A-2 Stable Fitch BBB+ A- F2 Stable Pinnacle West Moody’s Baa2 Baa2 P-2 Stable S&P BBB+ BBB A-2 Stable Fitch BBB BBB F3 Stable 12 1We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. Ratings are as of October 25, 2024. We are focused on maintaining healthy credit ratings to support affordable growth1

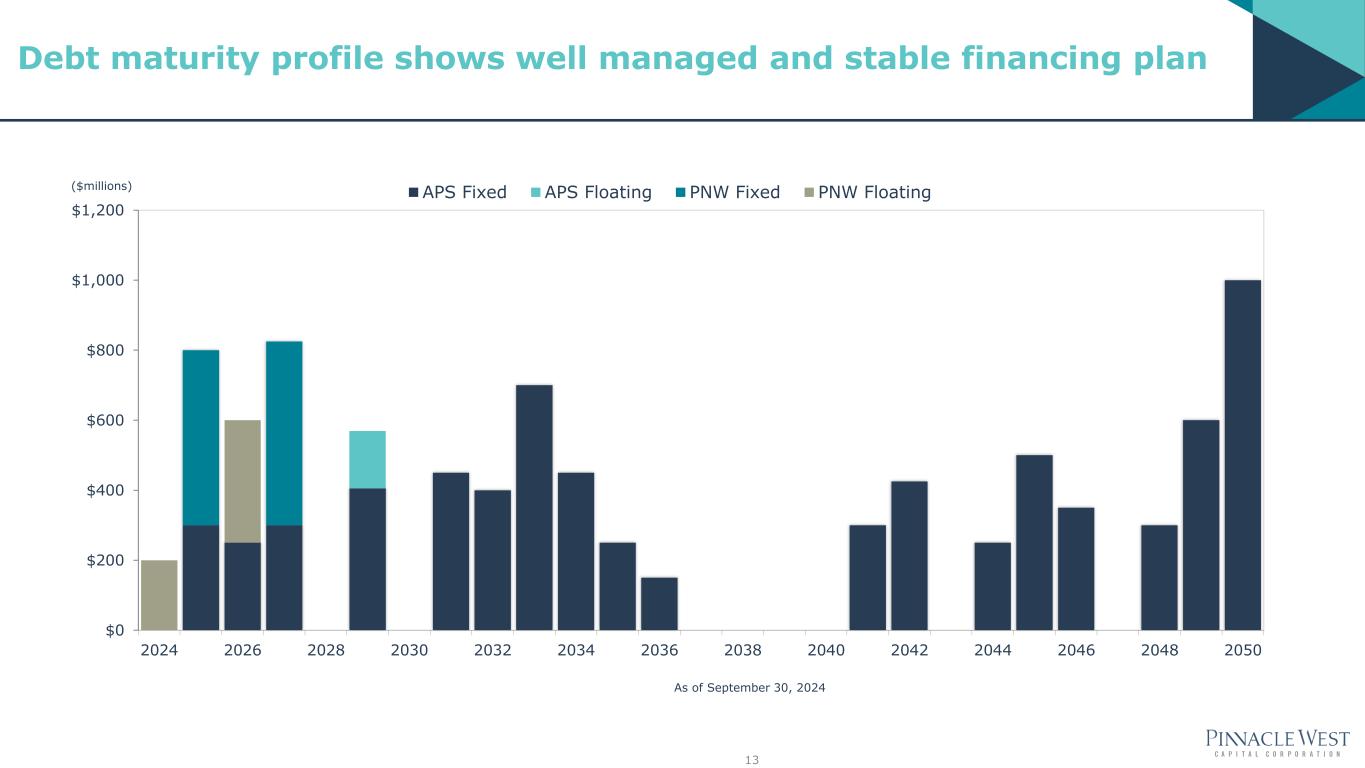

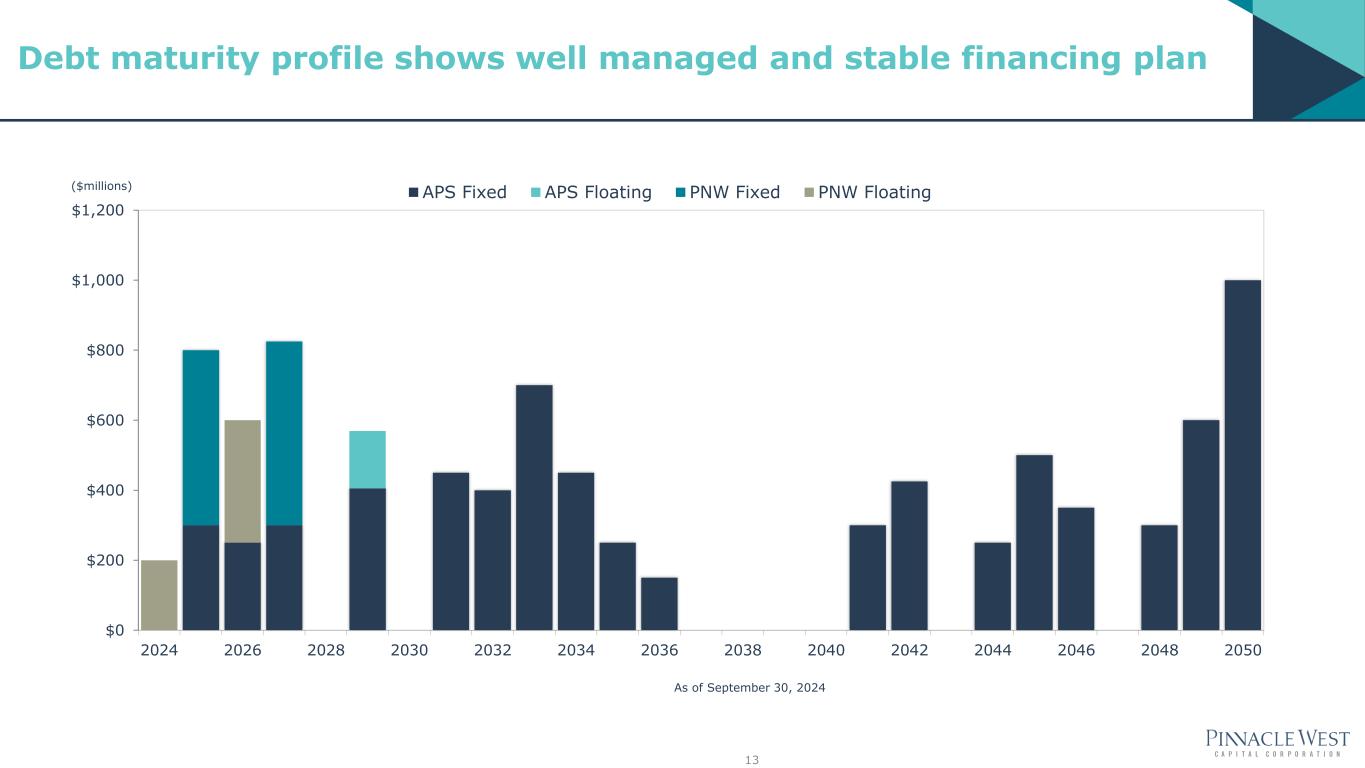

$0 $200 $400 $600 $800 $1,000 $1,200 2024 2026 2028 2030 2032 2034 2036 2038 2040 2042 2044 2046 2048 2050 APS Fixed APS Floating PNW Fixed PNW Floating($millions) As of September 30, 2024 13 Debt maturity profile shows well managed and stable financing plan

Appendix

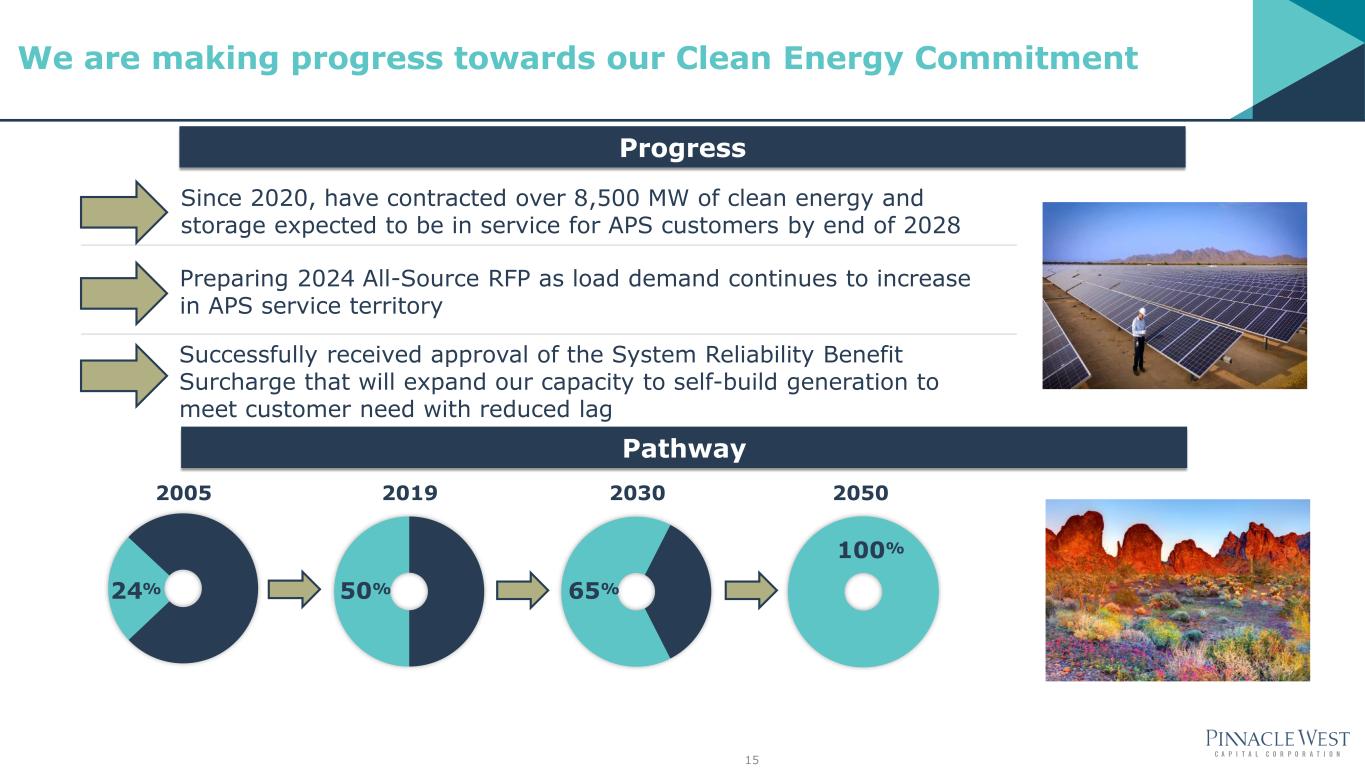

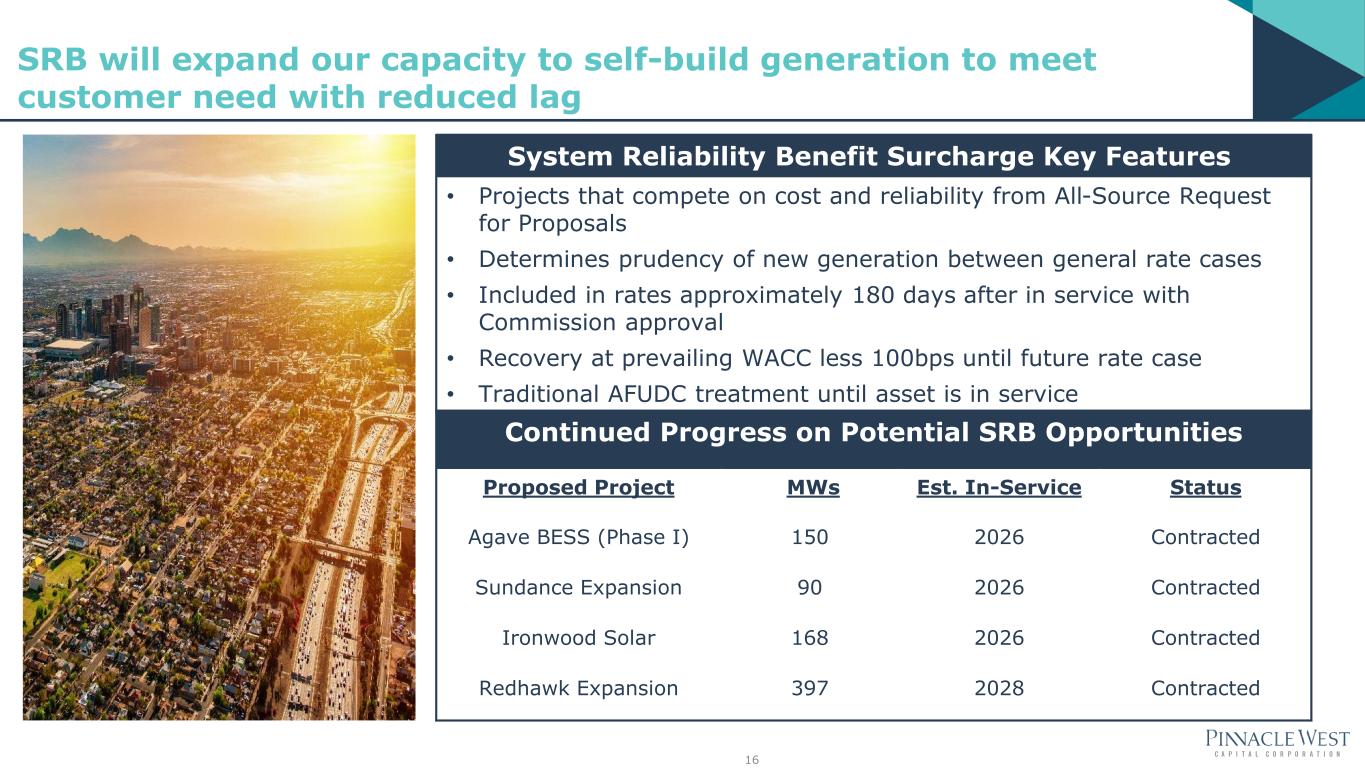

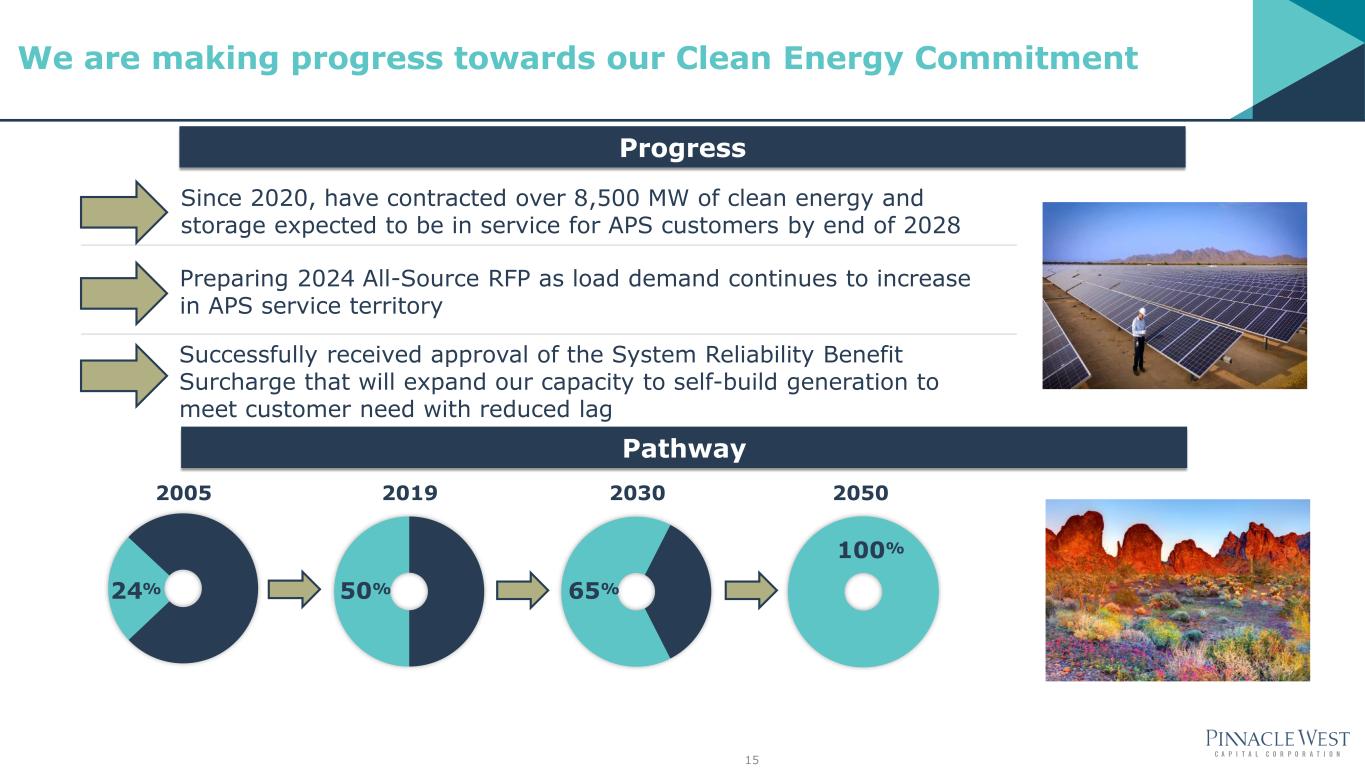

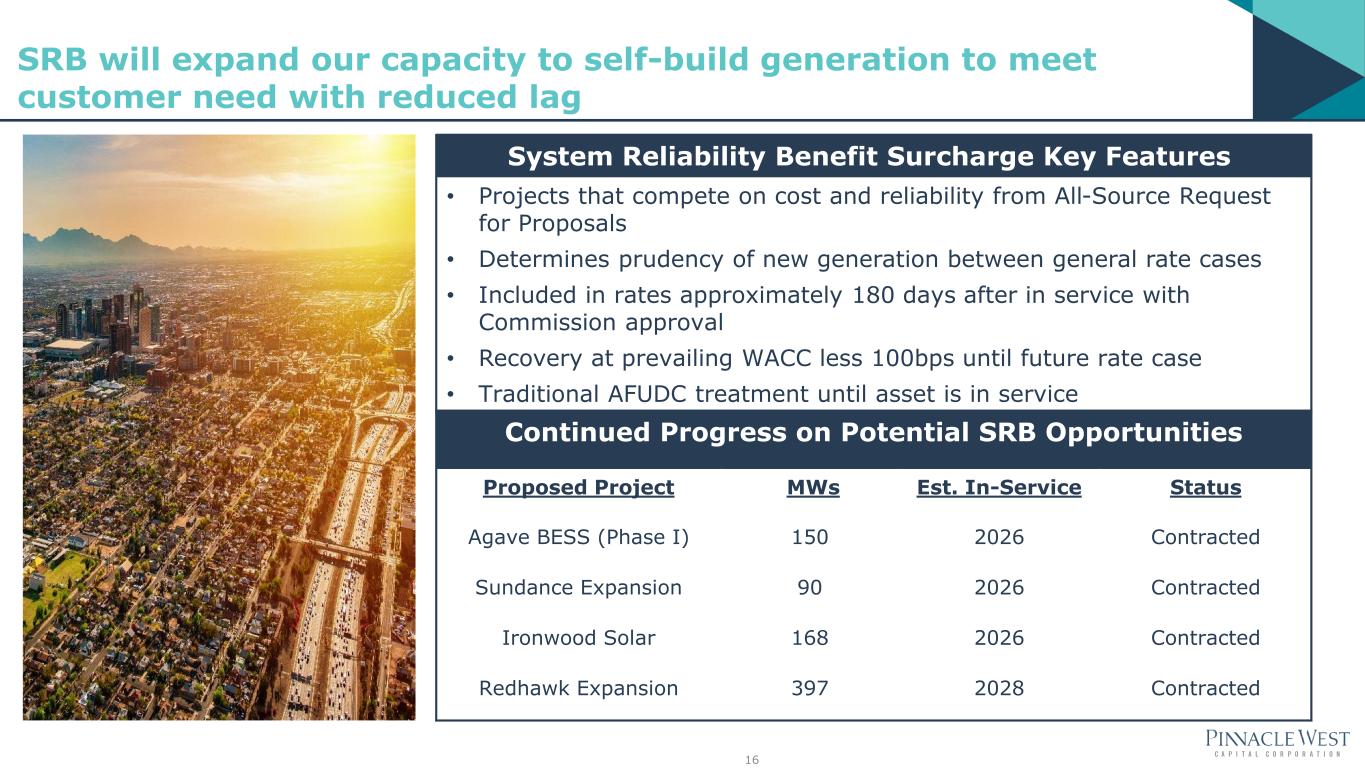

Progress Pathway 2005 2019 2030 2050 Since 2020, have contracted over 8,500 MW of clean energy and storage expected to be in service for APS customers by end of 2028 Preparing 2024 All-Source RFP as load demand continues to increase in APS service territory Successfully received approval of the System Reliability Benefit Surcharge that will expand our capacity to self-build generation to meet customer need with reduced lag 24% 50% 65% 100% 15 We are making progress towards our Clean Energy Commitment

16 • Projects that compete on cost and reliability from All-Source Request for Proposals • Determines prudency of new generation between general rate cases • Included in rates approximately 180 days after in service with Commission approval • Recovery at prevailing WACC less 100bps until future rate case • Traditional AFUDC treatment until asset is in service System Reliability Benefit Surcharge Key Features Continued Progress on Potential SRB Opportunities Proposed Project MWs Est. In-Service Status Agave BESS (Phase I) 150 2026 Contracted Sundance Expansion 90 2026 Contracted Ironwood Solar 168 2026 Contracted Redhawk Expansion 397 2028 Contracted SRB will expand our capacity to self-build generation to meet customer need with reduced lag

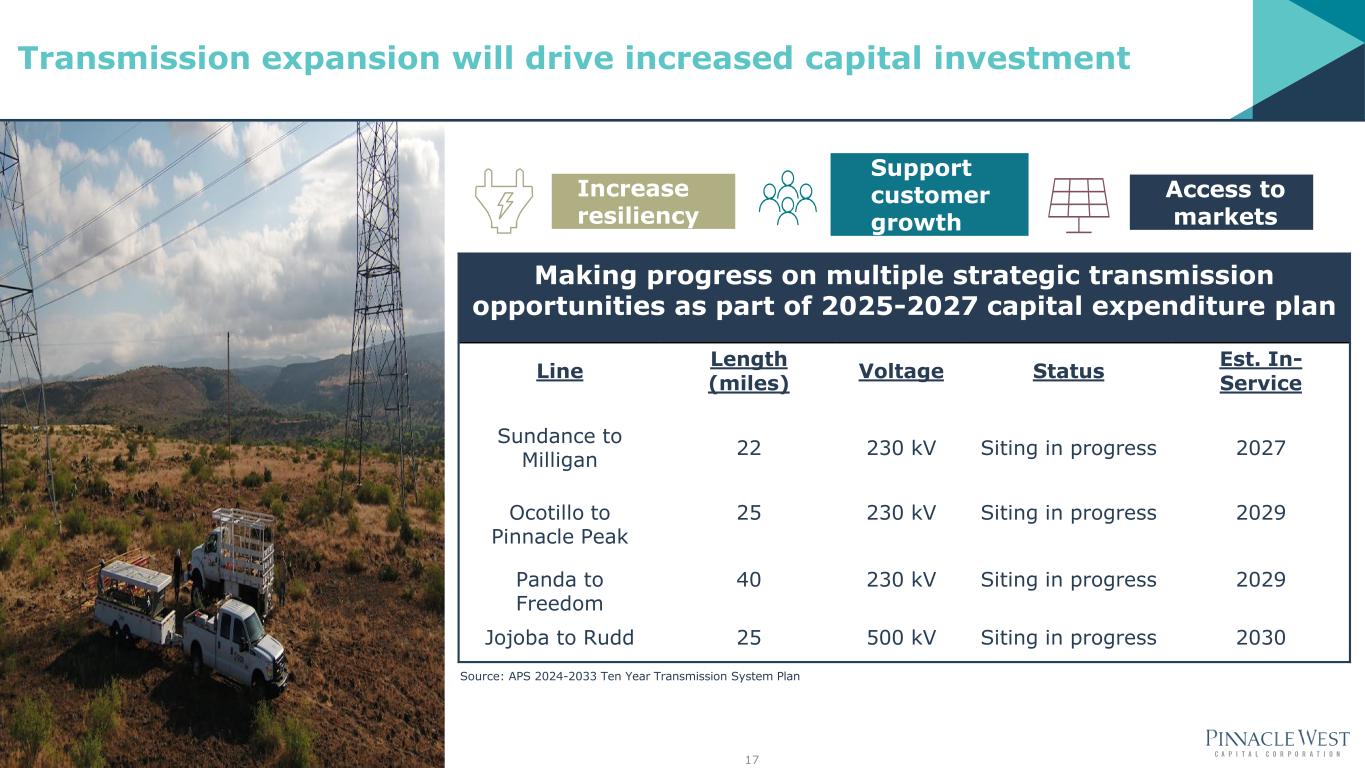

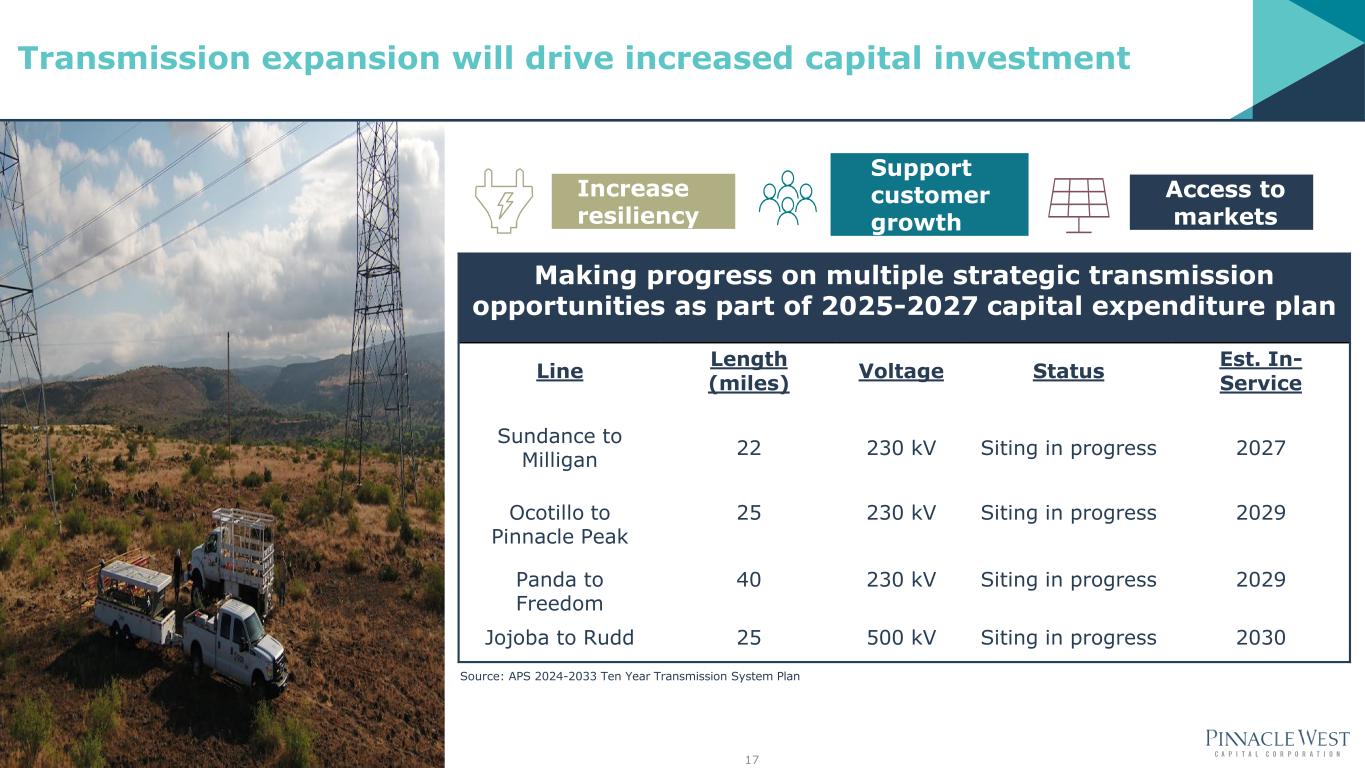

Source: APS 2024-2033 Ten Year Transmission System Plan Support customer growth Access to markets Increase resiliency 17 Making progress on multiple strategic transmission opportunities as part of 2025-2027 capital expenditure plan Line Length (miles) Voltage Status Est. In- Service Sundance to Milligan 22 230 kV Siting in progress 2027 Ocotillo to Pinnacle Peak 25 230 kV Siting in progress 2029 Panda to Freedom 40 230 kV Siting in progress 2029 Jojoba to Rudd 25 500 kV Siting in progress 2030 Transmission expansion will drive increased capital investment

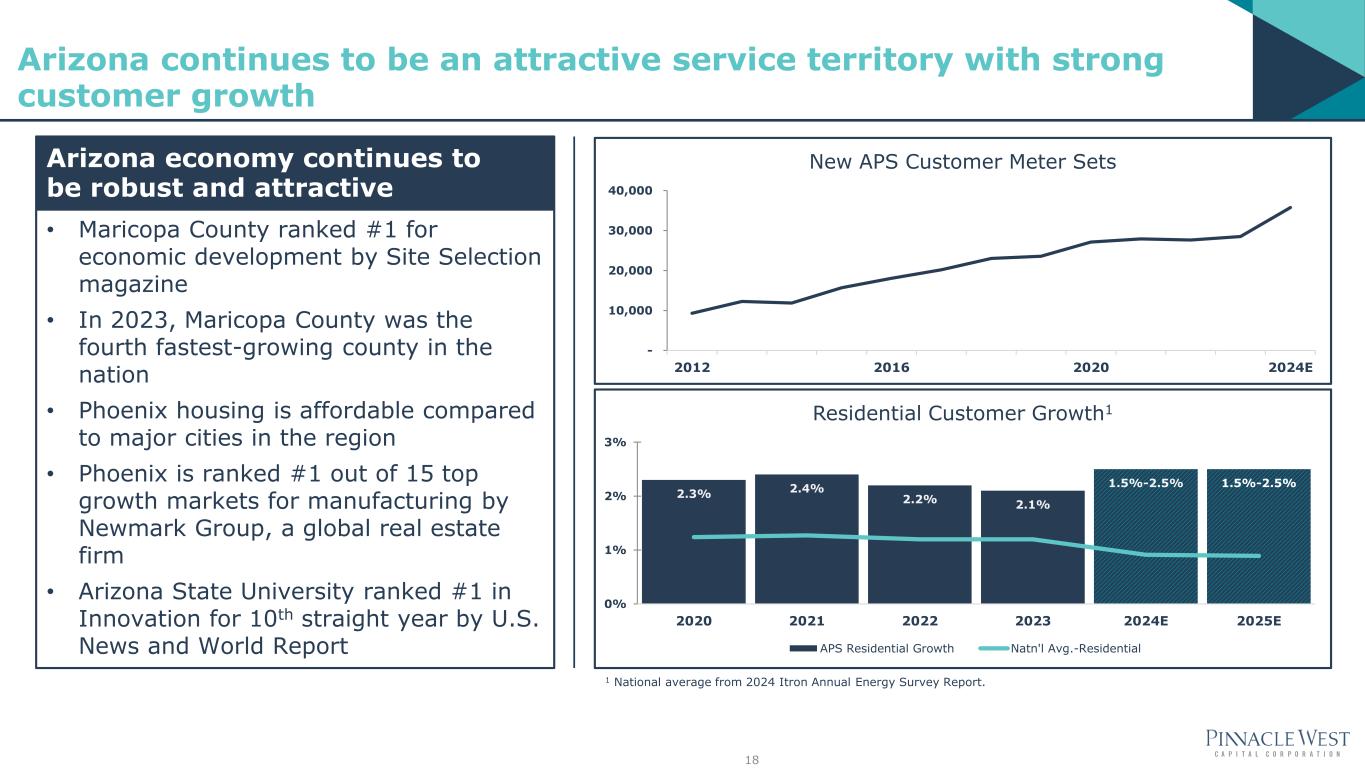

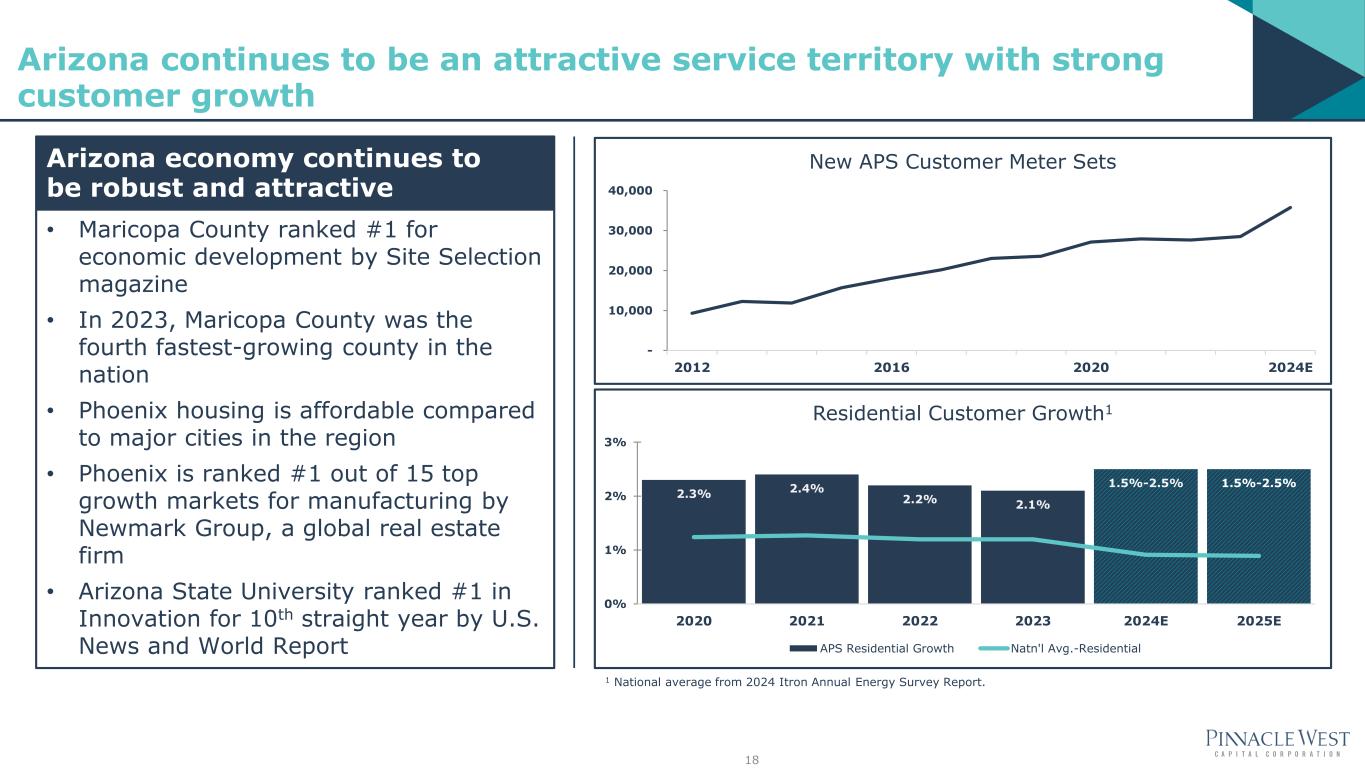

2.3% 2.4% 2.2% 2.1% 1.5%-2.5% 1.5%-2.5% 0% 1% 2% 3% 2020 2021 2022 2023 2024E 2025E Residential Customer Growth1 APS Residential Growth Natn'l Avg.-Residential 18 • Maricopa County ranked #1 for economic development by Site Selection magazine • In 2023, Maricopa County was the fourth fastest-growing county in the nation • Phoenix housing is affordable compared to major cities in the region • Phoenix is ranked #1 out of 15 top growth markets for manufacturing by Newmark Group, a global real estate firm • Arizona State University ranked #1 in Innovation for 10th straight year by U.S. News and World Report Arizona economy continues to be robust and attractive 1 National average from 2024 Itron Annual Energy Survey Report. Arizona continues to be an attractive service territory with strong customer growth - 10,000 20,000 30,000 40,000 2012 2016 2020 2024E New APS Customer Meter Sets

Source: Arizona Commerce Authority 19 Arizona’s commercial and industrial growth is diverse

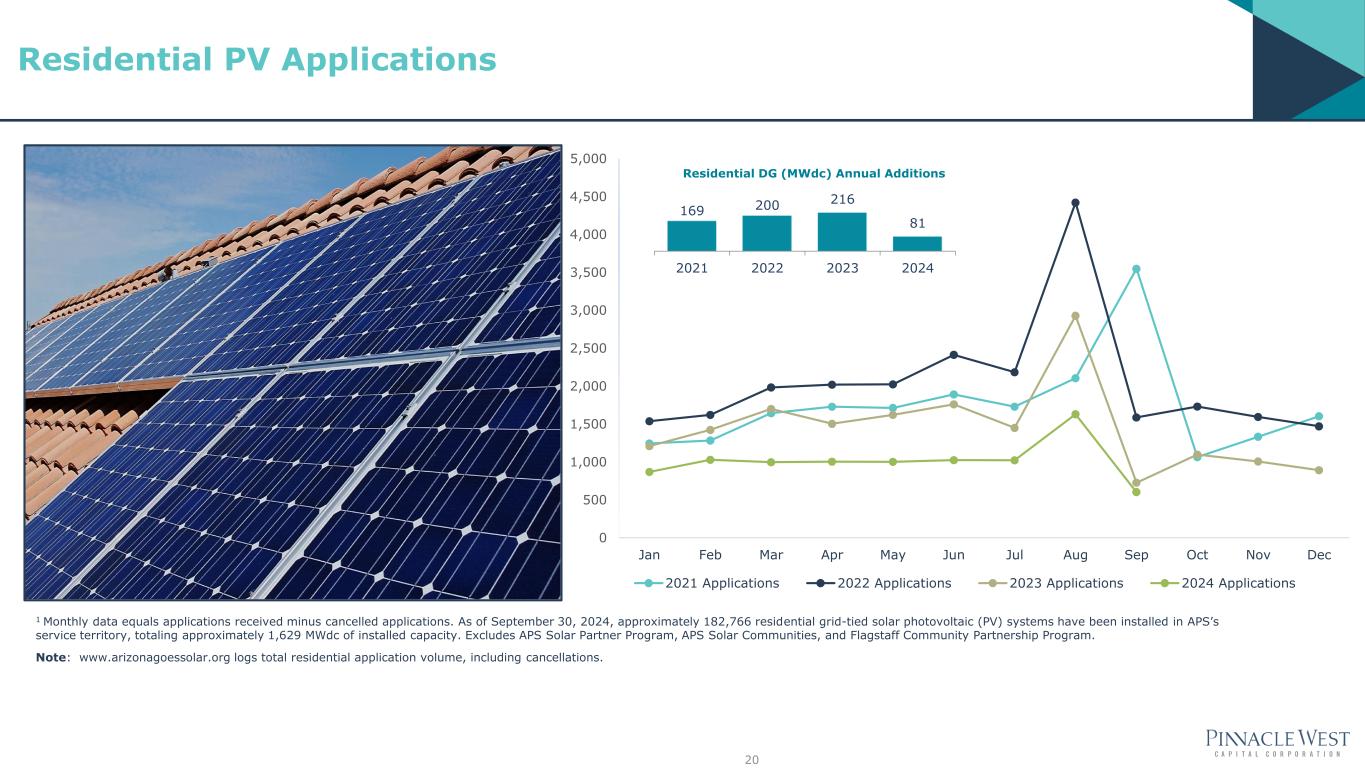

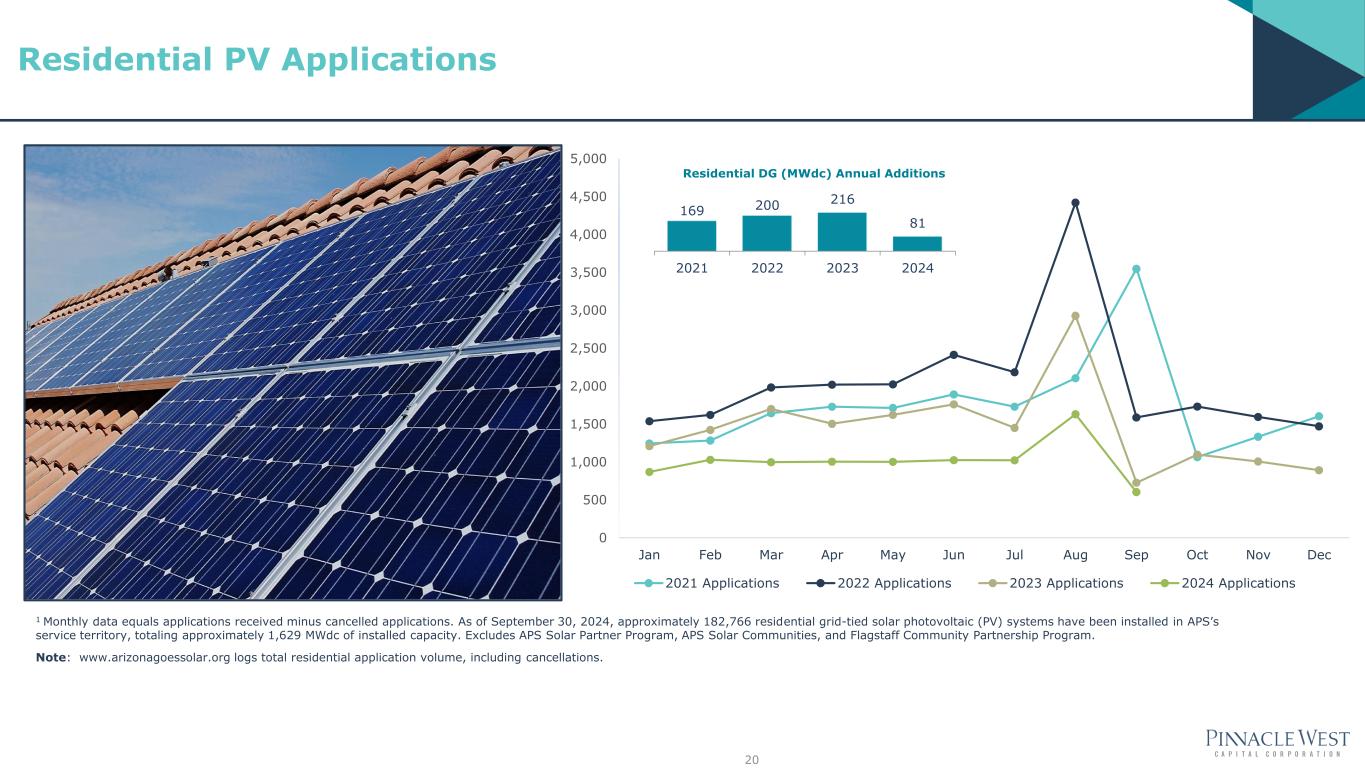

0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2021 Applications 2022 Applications 2023 Applications 2024 Applications 169 200 216 81 2021 2022 2023 2024 1 Monthly data equals applications received minus cancelled applications. As of September 30, 2024, approximately 182,766 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling approximately 1,629 MWdc of installed capacity. Excludes APS Solar Partner Program, APS Solar Communities, and Flagstaff Community Partnership Program. Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Residential DG (MWdc) Annual Additions 20 Residential PV Applications

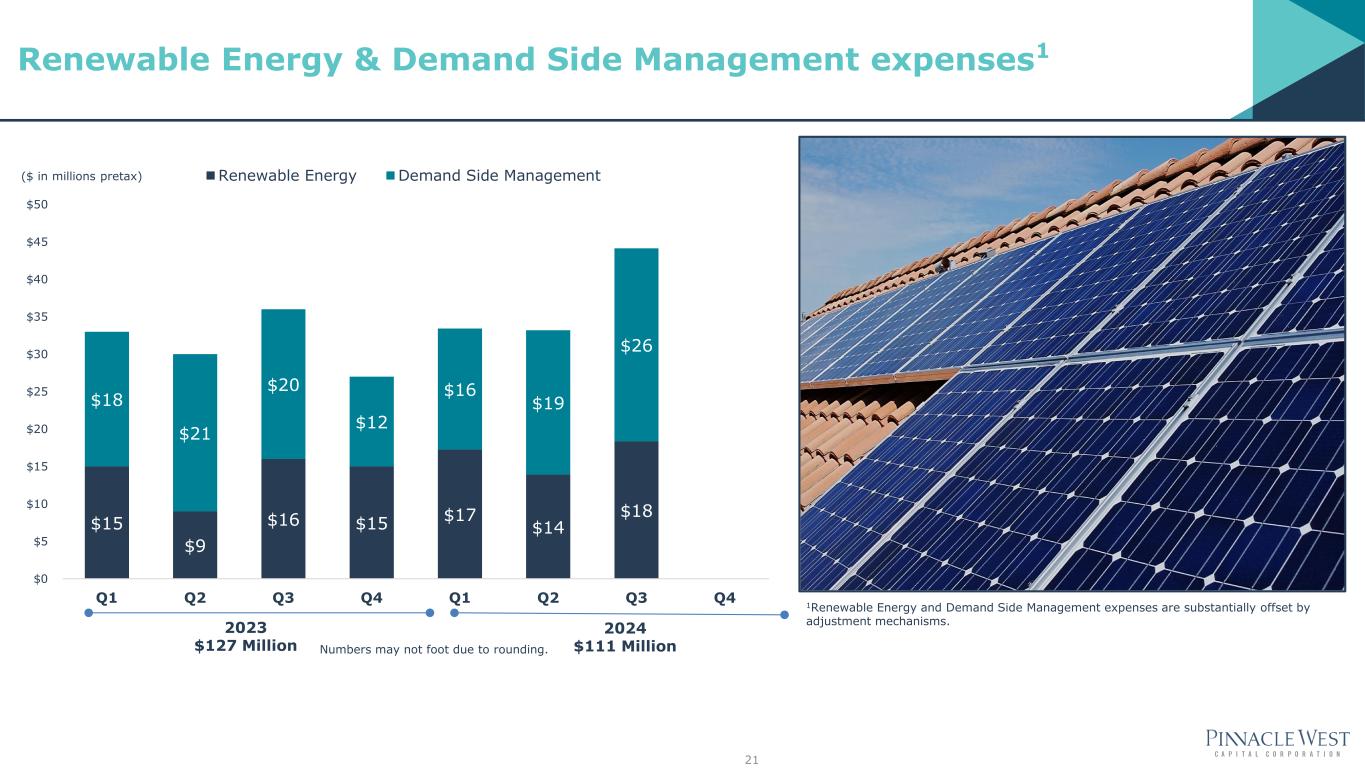

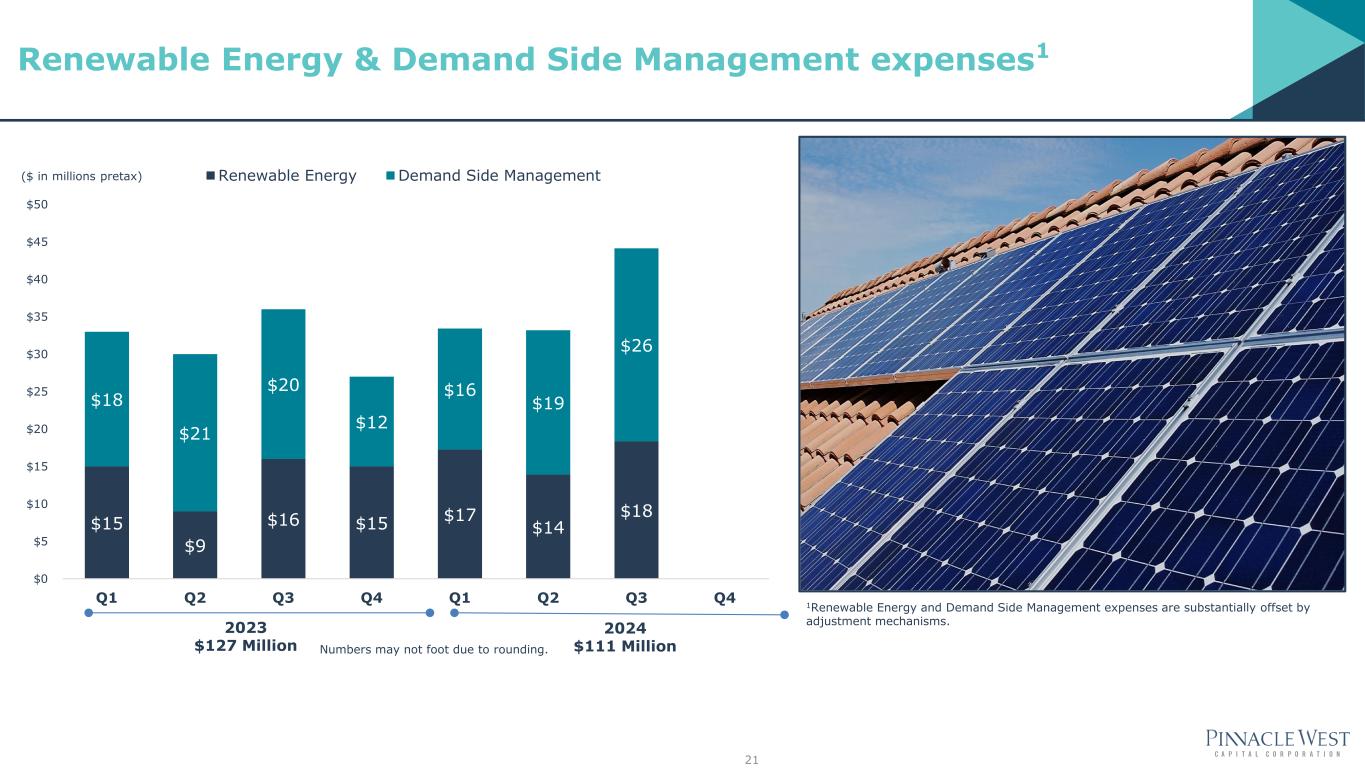

$15 $9 $16 $15 $17 $14 $18 $18 $21 $20 $12 $16 $19 $26 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Renewable Energy Demand Side Management 2023 $127 Million 2024 $111 Million 1Renewable Energy and Demand Side Management expenses are substantially offset by adjustment mechanisms. Numbers may not foot due to rounding. ($ in millions pretax) 21 Renewable Energy & Demand Side Management expenses1

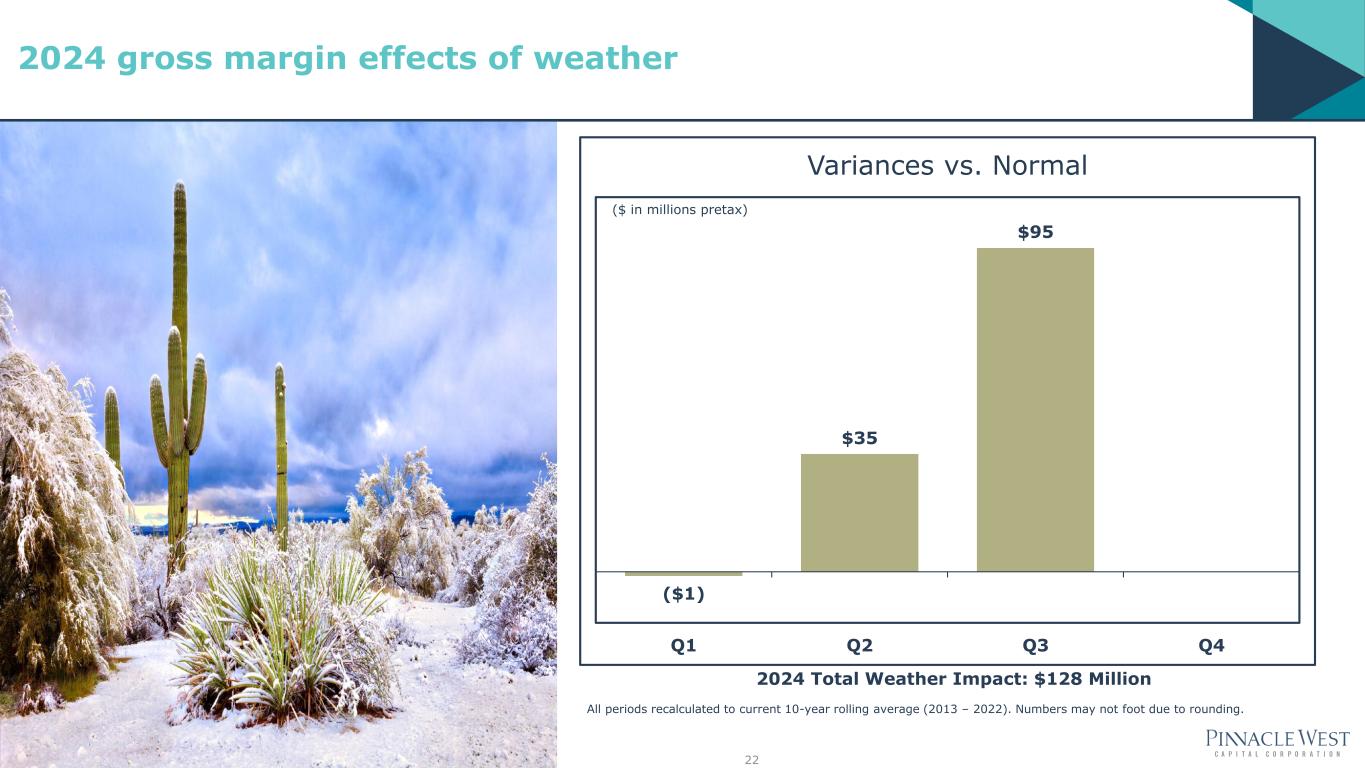

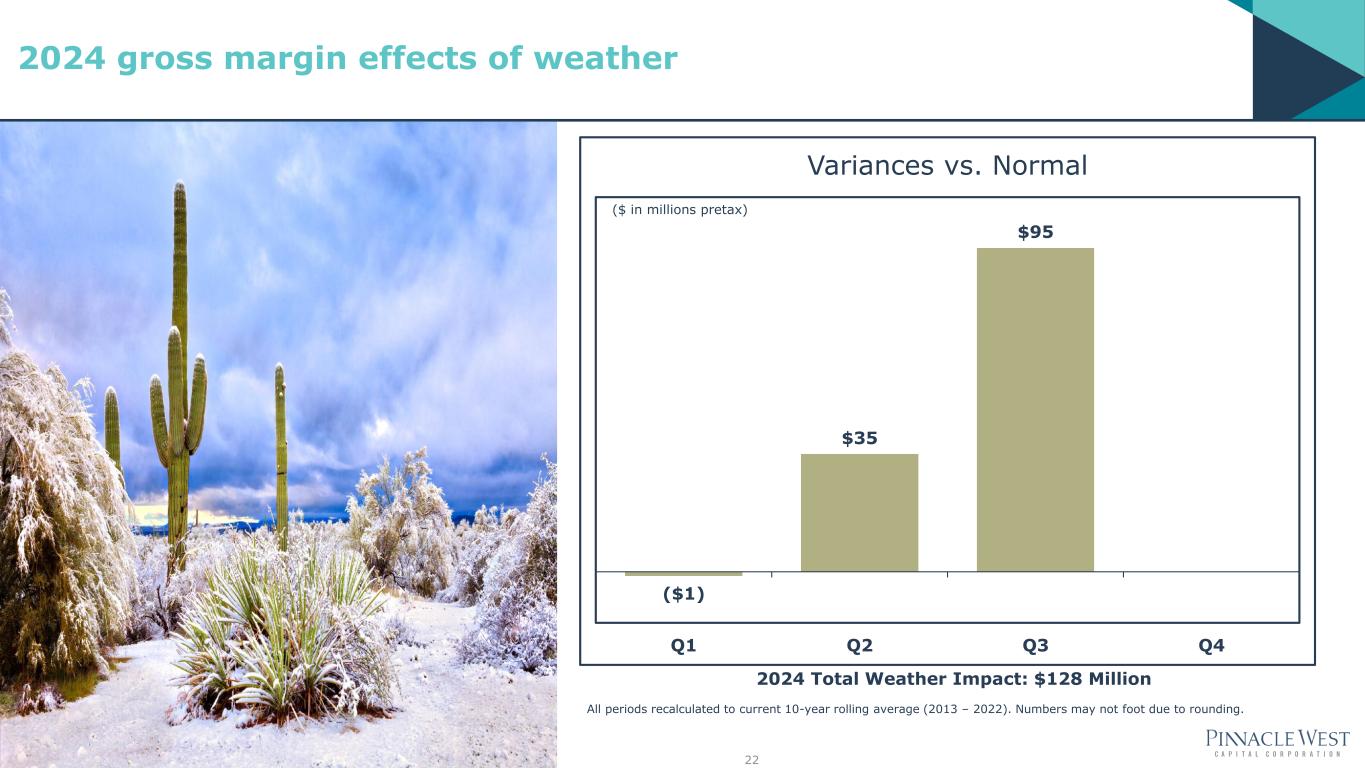

($1) $35 $95 Q1 Q2 Q3 Q4 Variances vs. Normal All periods recalculated to current 10-year rolling average (2013 – 2022). Numbers may not foot due to rounding. ($ in millions pretax) 2024 Total Weather Impact: $128 Million 22 2024 gross margin effects of weather

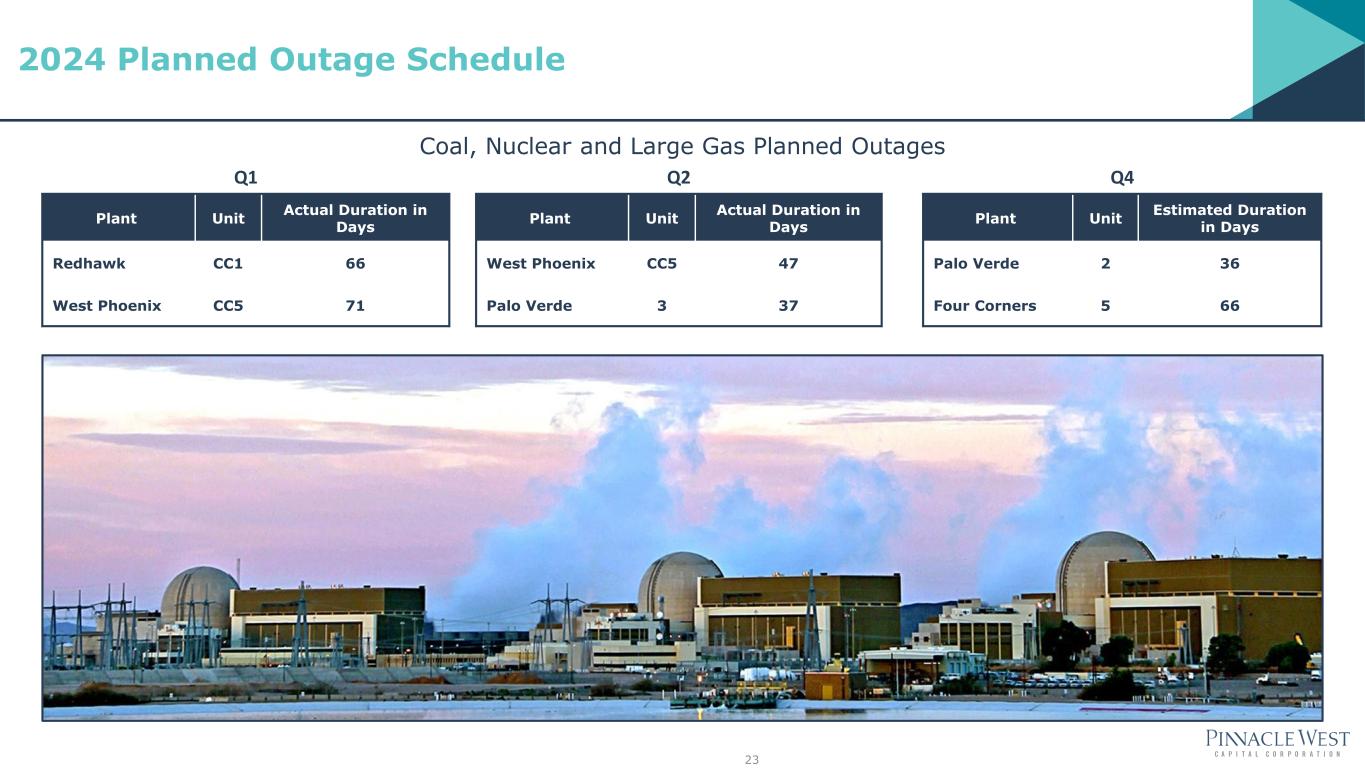

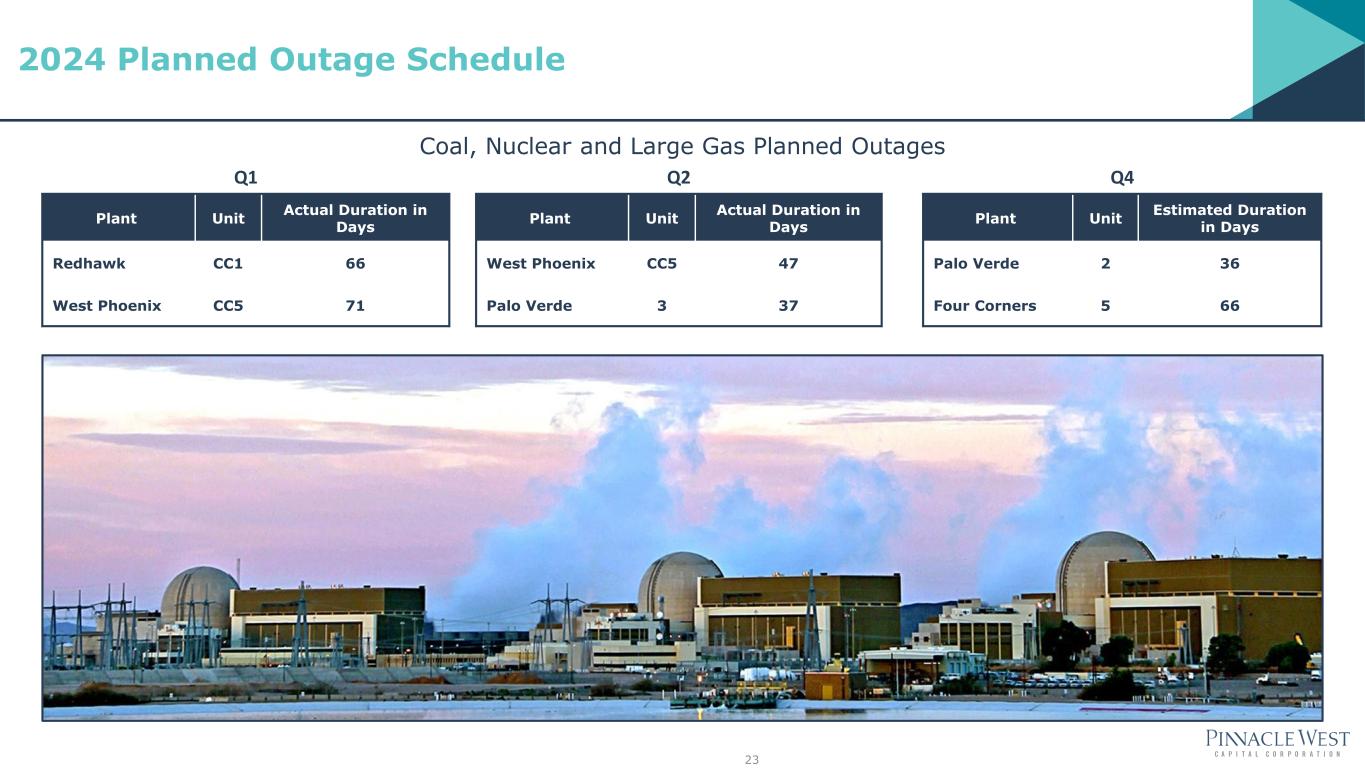

Q2 Plant Unit Actual Duration in Days West Phoenix CC5 47 Palo Verde 3 37 Q1 Plant Unit Actual Duration in Days Redhawk CC1 66 West Phoenix CC5 71 Q4 Plant Unit Estimated Duration in Days Palo Verde 2 36 Four Corners 5 66 Coal, Nuclear and Large Gas Planned Outages 23 2024 Planned Outage Schedule

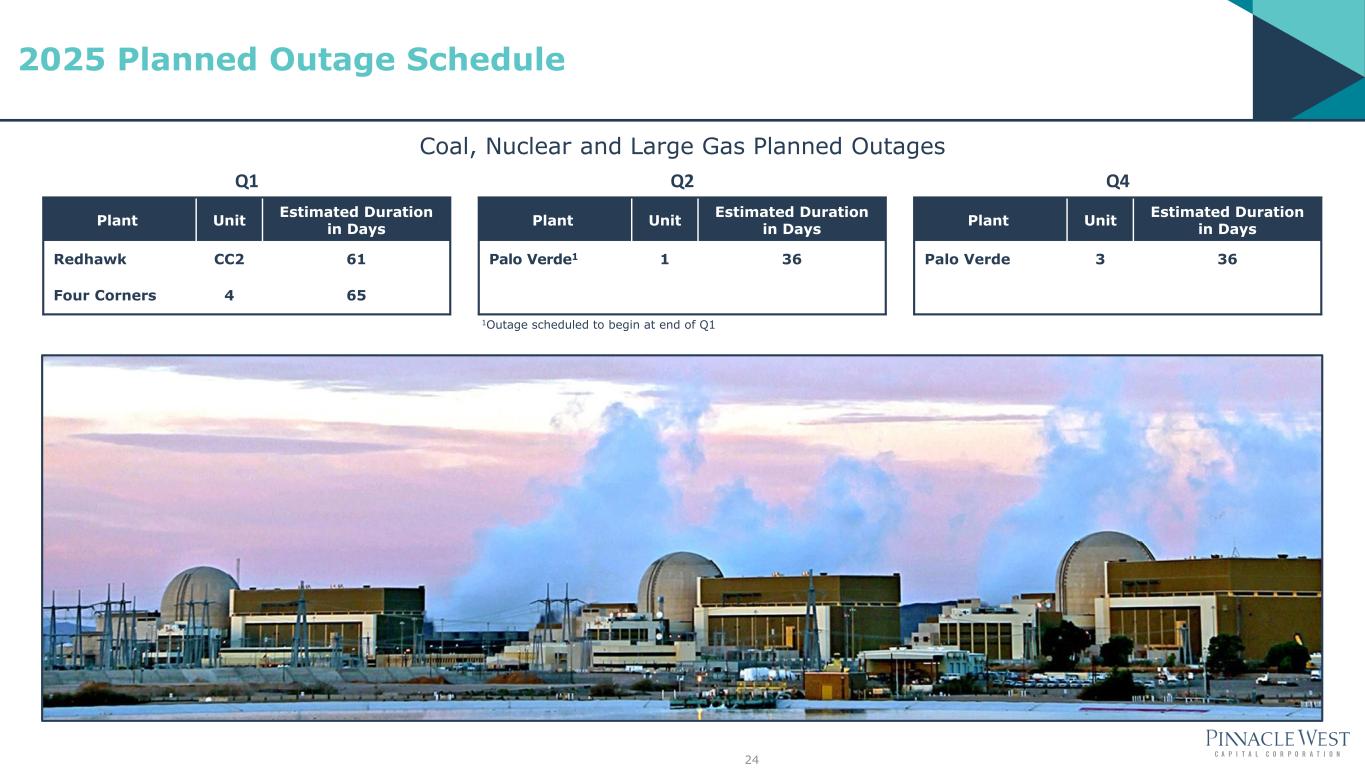

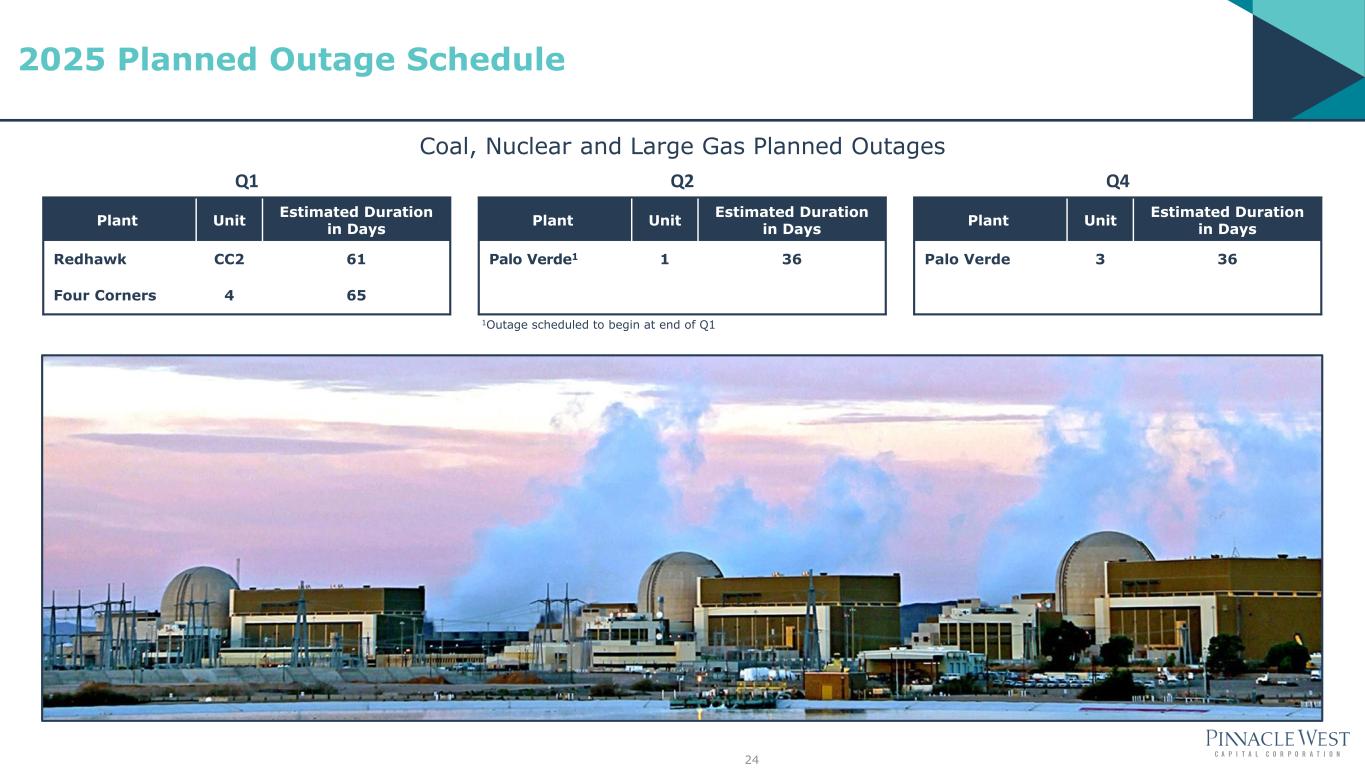

Q1 Plant Unit Estimated Duration in Days Redhawk CC2 61 Four Corners 4 65 Coal, Nuclear and Large Gas Planned Outages 24 2025 Planned Outage Schedule Q2 Plant Unit Estimated Duration in Days Palo Verde1 1 36 Q4 Plant Unit Estimated Duration in Days Palo Verde 3 36 1Outage scheduled to begin at end of Q1

2024 Guidance3 2025 Guidance3 Operating revenues1 $5.06 - $5.15 billion $5.20 - $5.30 billion Fuel and purchased power expenses1 $1.83 - $1.86 billion $1.93 - $1.97 billion Gross Margin $3.23 - 3.29 billion $3.27 - $3.33 billion Adjustments: Renewable energy and demand side management programs2 $130 - $140 million $130 - $140 million Adjusted gross margin $3.09 - $ 3.15 billion $3.13 - $3.19 billion Operations and maintenance1 $1.14 - $1.16 billion $1.10 - $1.12 billion Adjustments: Renewable energy and demand side management programs2 $130 - $140 million $130 - $140 million Adjusted operations and maintenance $1.01 - $1.03 billion $965 - $985 million 25 1Line items from Consolidated Statements of Income. 2Includes $3.3M for CCT (Coal Community Transition) in 2024 which is recovered through REAC (Renewable Energy Adjustment Charge). 3Numbers may not foot due to rounding. Non-GAAP Measure Reconciliation

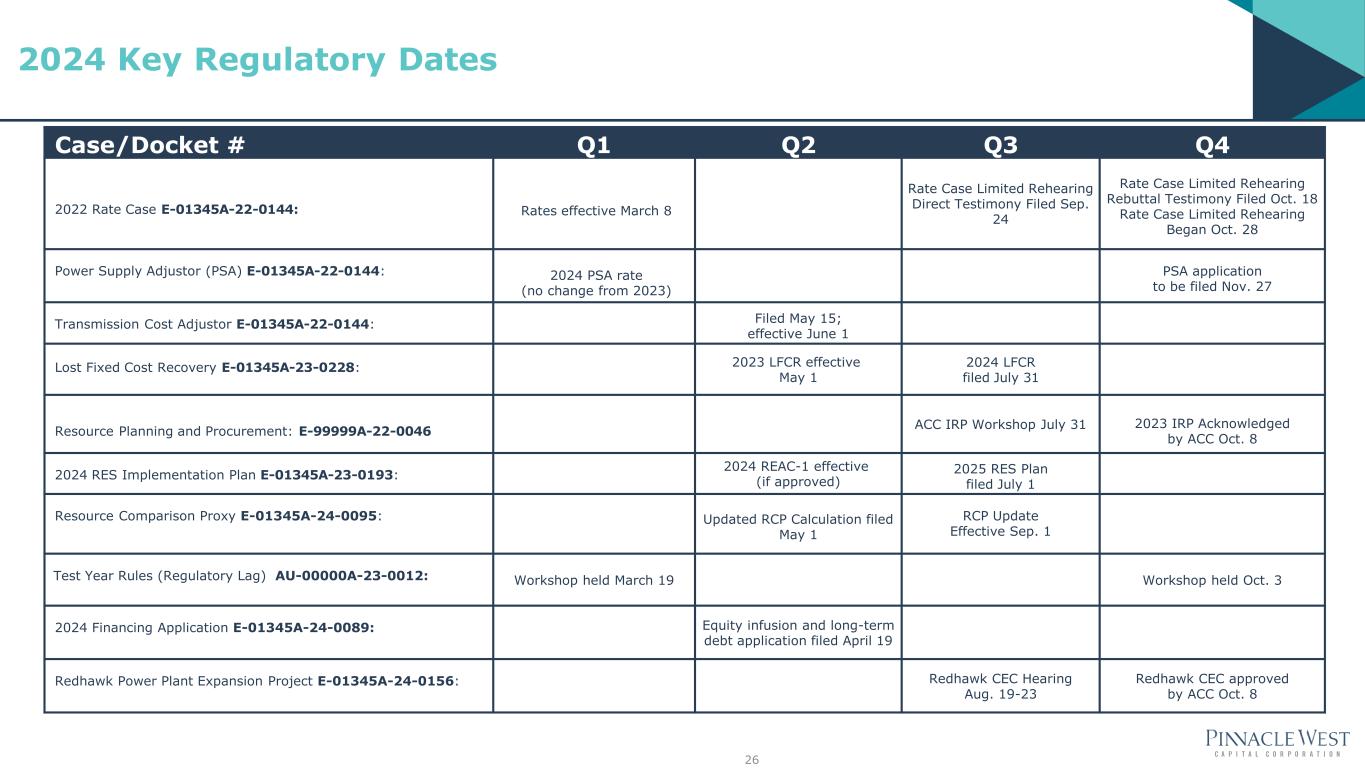

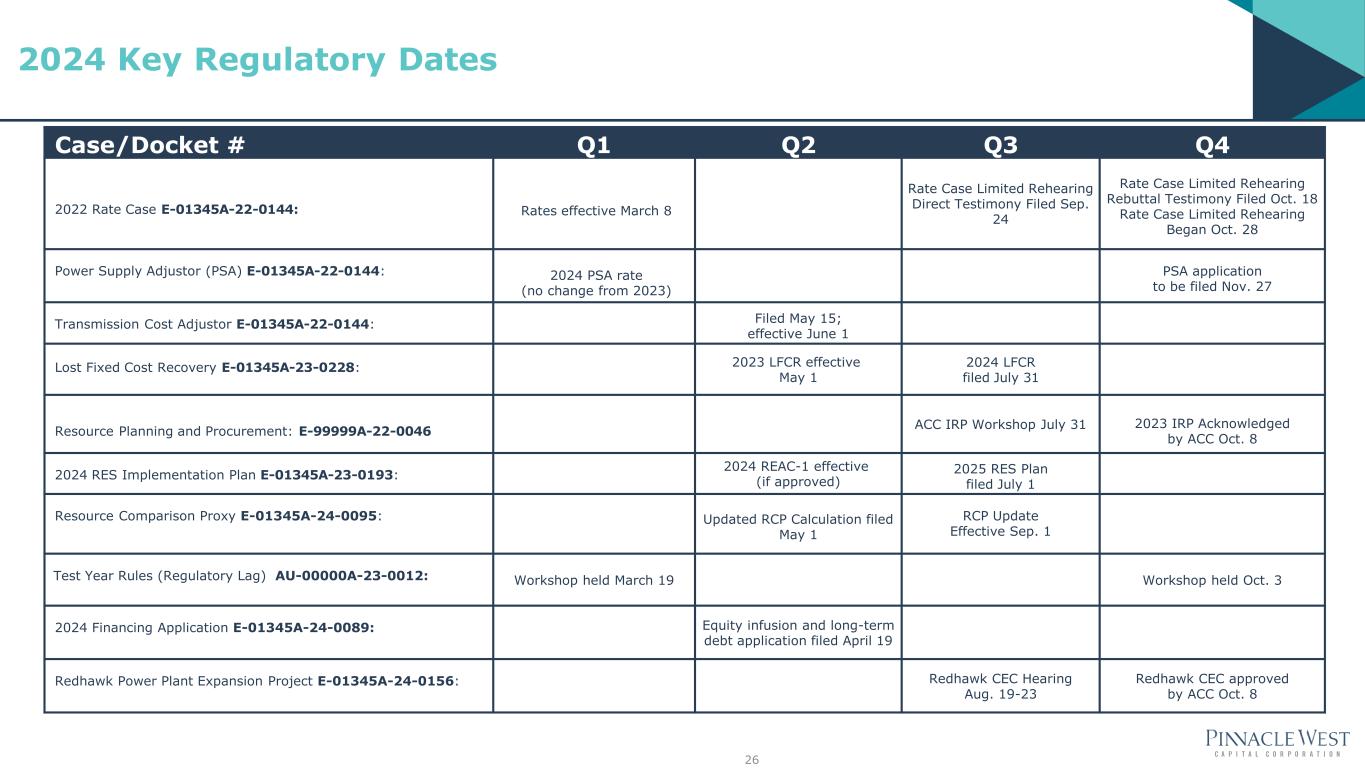

Case/Docket # Q1 Q2 Q3 Q4 2022 Rate Case E-01345A-22-0144: Rates effective March 8 Rate Case Limited Rehearing Direct Testimony Filed Sep. 24 Rate Case Limited Rehearing Rebuttal Testimony Filed Oct. 18 Rate Case Limited Rehearing Began Oct. 28 Power Supply Adjustor (PSA) E-01345A-22-0144: 2024 PSA rate (no change from 2023) PSA application to be filed Nov. 27 Transmission Cost Adjustor E-01345A-22-0144: Filed May 15; effective June 1 Lost Fixed Cost Recovery E-01345A-23-0228: 2023 LFCR effective May 1 2024 LFCR filed July 31 Resource Planning and Procurement: E-99999A-22-0046 ACC IRP Workshop July 31 2023 IRP Acknowledged by ACC Oct. 8 2024 RES Implementation Plan E-01345A-23-0193: 2024 REAC-1 effective (if approved) 2025 RES Plan filed July 1 Resource Comparison Proxy E-01345A-24-0095: Updated RCP Calculation filed May 1 RCP Update Effective Sep. 1 Test Year Rules (Regulatory Lag) AU-00000A-23-0012: Workshop held March 19 Workshop held Oct. 3 2024 Financing Application E-01345A-24-0089: Equity infusion and long-term debt application filed April 19 Redhawk Power Plant Expansion Project E-01345A-24-0156: Redhawk CEC Hearing Aug. 19-23 Redhawk CEC approved by ACC Oct. 8 26 2024 Key Regulatory Dates

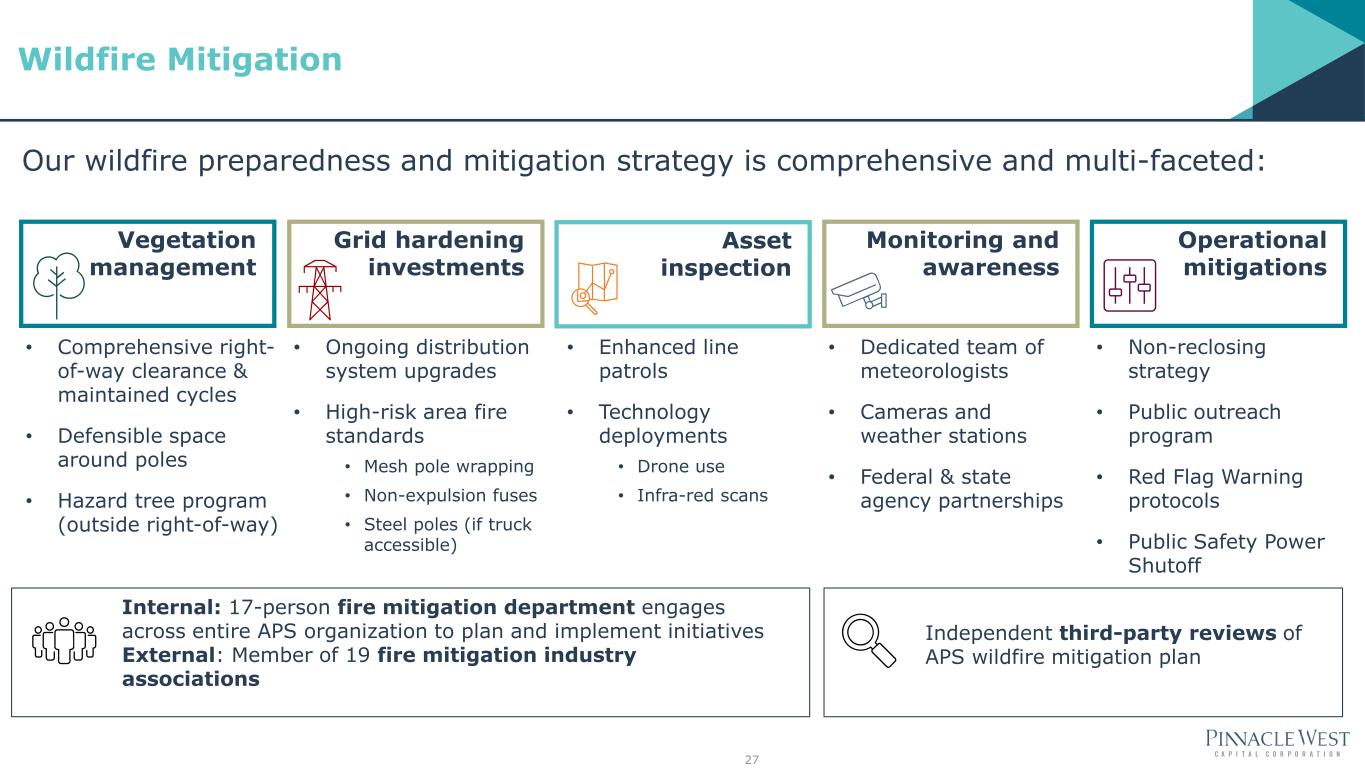

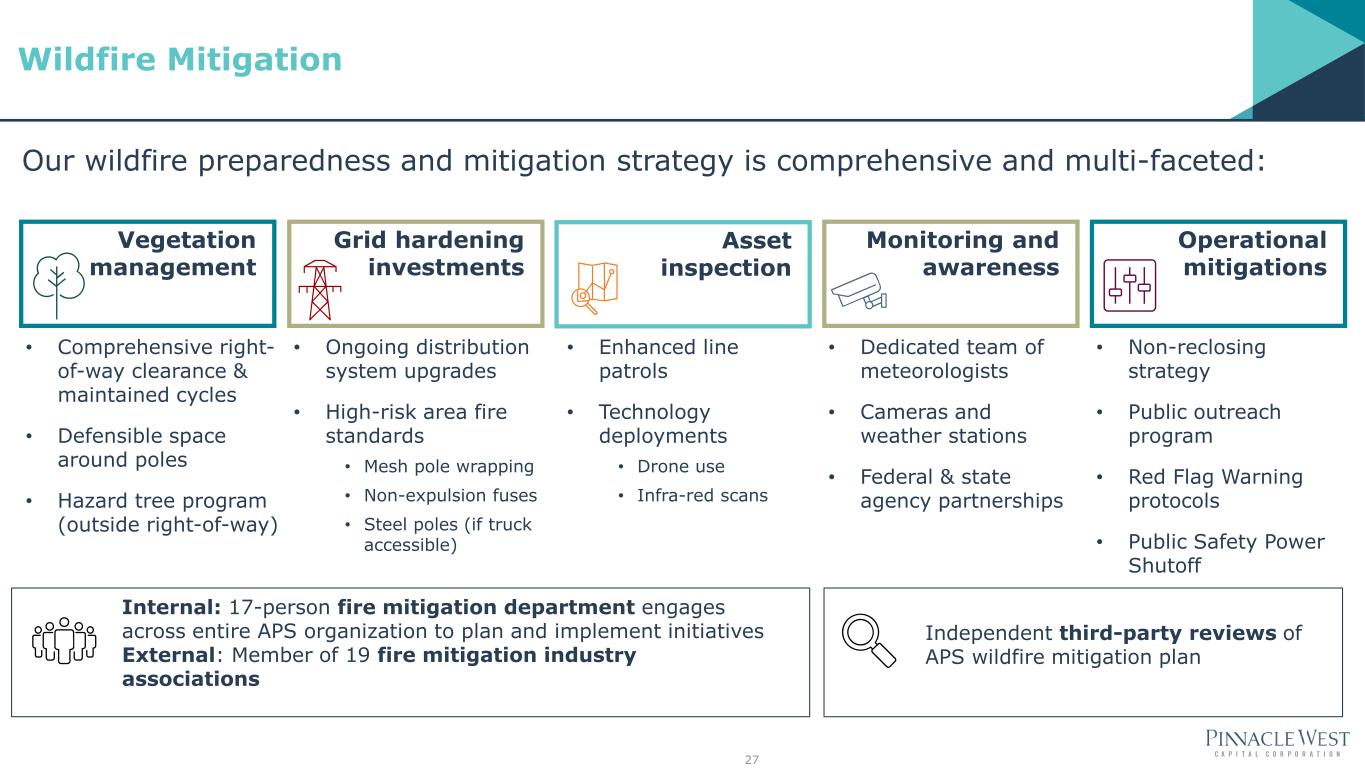

27 Wildfire Mitigation Vegetation management Asset inspection Monitoring and awareness Operational mitigations • Comprehensive right- of-way clearance & maintained cycles • Defensible space around poles • Hazard tree program (outside right-of-way) • Enhanced line patrols • Technology deployments • Drone use • Infra-red scans • Non-reclosing strategy • Public outreach program • Red Flag Warning protocols • Public Safety Power Shutoff • Dedicated team of meteorologists • Cameras and weather stations • Federal & state agency partnerships Grid hardening investments • Ongoing distribution system upgrades • High-risk area fire standards • Mesh pole wrapping • Non-expulsion fuses • Steel poles (if truck accessible) Internal: 17-person fire mitigation department engages across entire APS organization to plan and implement initiatives External: Member of 19 fire mitigation industry associations Independent third-party reviews of APS wildfire mitigation plan Our wildfire preparedness and mitigation strategy is comprehensive and multi-faceted:

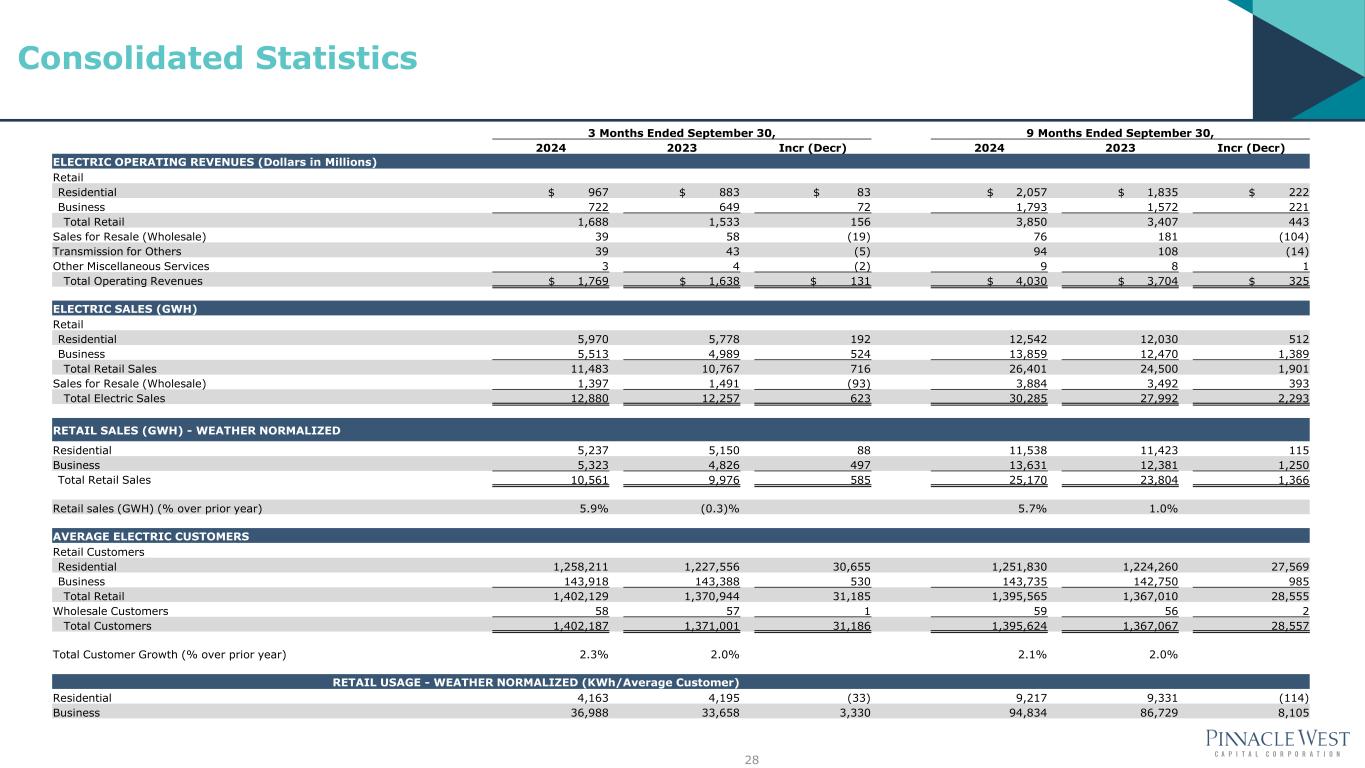

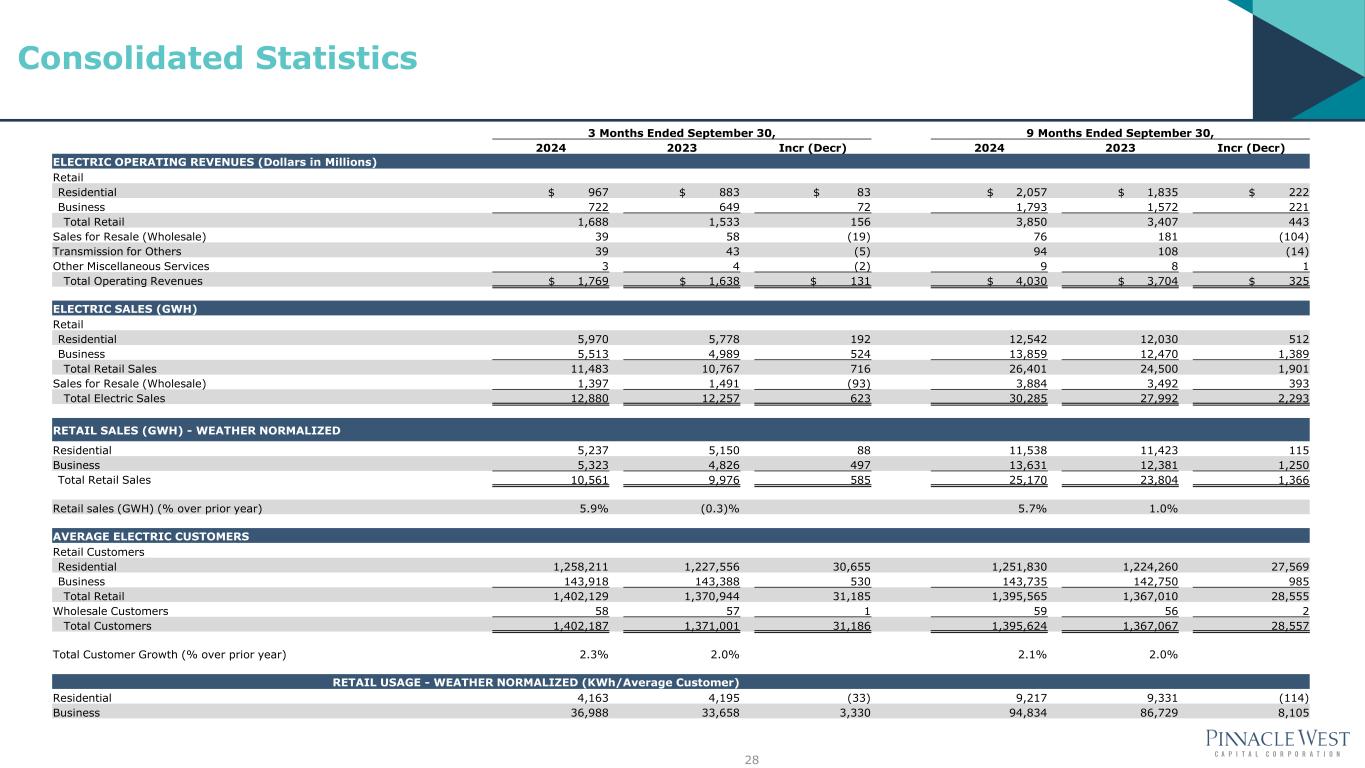

28 Consolidated Statistics 3 Months Ended September 30, 9 Months Ended September 30, 2024 2023 Incr (Decr) 2024 2023 Incr (Decr) ELECTRIC OPERATING REVENUES (Dollars in Millions) Retail Residential $ 967 $ 883 $ 83 $ 2,057 $ 1,835 $ 222 Business 722 649 72 1,793 1,572 221 Total Retail 1,688 1,533 156 3,850 3,407 443 Sales for Resale (Wholesale) 39 58 (19) 76 181 (104) Transmission for Others 39 43 (5) 94 108 (14) Other Miscellaneous Services 3 4 (2) 9 8 1 Total Operating Revenues $ 1,769 $ 1,638 $ 131 $ 4,030 $ 3,704 $ 325 ELECTRIC SALES (GWH) Retail Residential 5,970 5,778 192 12,542 12,030 512 Business 5,513 4,989 524 13,859 12,470 1,389 Total Retail Sales 11,483 10,767 716 26,401 24,500 1,901 Sales for Resale (Wholesale) 1,397 1,491 (93) 3,884 3,492 393 Total Electric Sales 12,880 12,257 623 30,285 27,992 2,293 RETAIL SALES (GWH) - WEATHER NORMALIZED Residential 5,237 5,150 88 11,538 11,423 115 Business 5,323 4,826 497 13,631 12,381 1,250 Total Retail Sales 10,561 9,976 585 25,170 23,804 1,366 Retail sales (GWH) (% over prior year) 5.9% (0.3)% 5.7% 1.0% AVERAGE ELECTRIC CUSTOMERS Retail Customers Residential 1,258,211 1,227,556 30,655 1,251,830 1,224,260 27,569 Business 143,918 143,388 530 143,735 142,750 985 Total Retail 1,402,129 1,370,944 31,185 1,395,565 1,367,010 28,555 Wholesale Customers 58 57 1 59 56 2 Total Customers 1,402,187 1,371,001 31,186 1,395,624 1,367,067 28,557 Total Customer Growth (% over prior year) 2.3% 2.0% 2.1% 2.0% RETAIL USAGE - WEATHER NORMALIZED (KWh/Average Customer) Residential 4,163 4,195 (33) 9,217 9,331 (114) Business 36,988 33,658 3,330 94,834 86,729 8,105

29 Consolidated Statistics 3 Months Ended September 30, 9 Months Ended September 30, 2024 2023 Incr (Decr) 2024 2023 Incr (Decr) ENERGY SOURCES (GWH) Generation Production Nuclear 2,557 2,524 32 7,298 7,022 276 Coal 2,271 2,127 144 5,762 5,325 437 Gas, Oil and Other 3,075 2,971 103 6,445 6,800 (355) Renewables 336 281 55 920 526 394 Total Generation Production 8,239 7,904 335 20,425 19,673 752 Purchased Power Conventional 3,224 3,313 (89) 5,663 5,841 (179) Resales 845 928 (83) 989 1,366 (378) Renewables 1,152 732 420 3,191 2,147 1,044 Total Purchased Power 5,221 4,973 248 9,842 9,354 488 Total Energy Sources 13,460 12,877 583 30,267 29,027 1,240 POWER PLANT PERFORMANCE Capacity Factors - Owned Nuclear 101% 100% 1% 97% 94% 3% Coal 76% 71% 5% 65% 60% 5% Gas, Oil and Other 39% 37% 1% 27% 29% (2)% Solar 41% 56% (15)% 37% 35% 2% System Average 58% 56% 1% 48% 47% 1% 3 Months Ended September 30, 9 Months Ended September 30, 2024 2023 Incr (Decr) 2024 2023 Incr (Decr) WEATHER INDICATORS - RESIDENTIAL Actual Cooling Degree-Days 1,634 1,622 12 2,282 2,046 236 Heating Degree-Days N/A N/A #VALUE! 496 700 (204) Average Humidity 23% 23% 0% 21% 21% 0% 10-Year Averages (2013 - 2022) Cooling Degree-Days 1,239 1,239 - 1,763 1,763 - Heating Degree-Days N/A N/A 440 440 - Average Humidity 32% 32% 0% 26% 26% 0%