|

| | | | | | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

|

FORM 10-K |

| (Mark One) | | |

| | [X] | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 |

| |

| |

OR |

| | [ ] | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________. |

| Commission File No. 001-11241 |

CATERPILLAR FINANCIAL SERVICES CORPORATION (Exact name of Registrant as specified in its charter) |

Delaware (State or other jurisdiction of incorporation or organization) | 37-1105865 (I.R.S. Employer Identification No.) |

2120 West End Ave., Nashville, Tennessee (Address of principal executive offices) | 37203-0001 (Zip Code) |

Registrant's telephone number, including area code: (615) 341-1000 |

The Registrant is a wholly-owned subsidiary of Caterpillar Inc. and meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K, and is therefore filing this Form with the reduced disclosure format.

|

| | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | Title of each class | | Name of each exchange on which registered |

| | Medium-Term Notes, Series H, 3.300% Notes Due 2024 | | New York Stock Exchange |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ü] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [ü]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ü] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ü] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ü]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ü] (Do not check if a smaller reporting company)

Smaller reporting company [ ] Emerging Growth Company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [ü]

As of February 15, 2018, one share of common stock of the registrant was outstanding, which is owned by Caterpillar Inc.

|

| | | |

| TABLE OF CONTENTS |

| | | | Page |

| | Business | 4 |

| | | Risk Factors | 6 |

| | | Unresolved Staff Comments | 11 |

| | | Properties | 11 |

| | | Legal Proceedings | 12 |

| | | Mine Safety Disclosures | 12 |

| | Market for Registrant's Common Equity, Related Stockholder Matters

and Issuer Purchases of Equity Securities | 12 |

| | | Management's Discussion and Analysis of Financial Condition and Results of Operations | 13 |

| | | Quantitative and Qualitative Disclosures About Market Risk | 28 |

| | | Financial Statements and Supplementary Data | 29 |

| | | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 29 |

| | | Controls and Procedures | 29 |

| | | Other Information | 29 |

| | Principal Accounting Fees and Services | 30 |

| | Exhibits and Financial Statement Schedules | 30 |

| | Item 16. | Form 10-K Summary | 32 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K may be considered "forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements may relate to future events or our future financial performance, which may involve known and unknown risks and uncertainties and other factors that may cause our actual results, levels of activity, performance or achievement to be materially different from those expressed or implied by any forward-looking statements. From time to time, we may also provide forward-looking statements in oral presentations to the public or in other materials we issue to the public. Forward-looking statements give current expectations or forecasts of future events about the company. You may identify these statements by the fact that they do not relate to historical or current facts and may use words such as "believes," "expects," "estimates," "anticipates," "will," "should," "plan," "project," "intend," "could" and similar words or phrases. These statements are only predictions. Actual events or results may differ materially due to factors that affect international businesses, including changes in economic conditions, disruptions in the global financial and credit markets, and changes in laws, regulations and political stability, as well as factors specific to Cat Financial and the markets we serve, including the market’s acceptance of our products and services, the creditworthiness of our customers, interest rate and currency rate fluctuations and estimated residual values of leased equipment. These risk factors may not be exhaustive. We operate in a continually changing business environment, and new risk factors emerge from time to time. We cannot predict these new risk factors, nor can we assess the impact, if any, of these new risk factors on our businesses or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those projected in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results. All of the forward-looking statements are qualified in their entirety by reference to the factors discussed under the captions "Risk Factors" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in this Form 10-K and could cause results to differ materially from those projected in the forward-looking statements. Cat Financial undertakes no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You may, however, consult any related disclosures we may make in our subsequent Form 10-Q and Form 8-K reports filed with the Securities and Exchange Commission ("SEC").

General

Caterpillar Financial Services Corporation was organized in 1981 in the State of Delaware (together with its subsidiaries, "Cat Financial," "the Company," "we" or "our"). We are a wholly-owned finance subsidiary of Caterpillar Inc. (together with its other subsidiaries, "Caterpillar" or "Cat") and our corporate headquarters is located in Nashville, Tennessee.

Nature of Operations

Our primary business is to provide retail and wholesale financing alternatives for Caterpillar products to customers and dealers around the world. Retail financing is primarily comprised of financing of Caterpillar equipment, machinery and engines. We also provide financing for vehicles, power generation facilities and marine vessels that, in most cases, incorporate Caterpillar products. In addition to retail financing, we also provide wholesale financing to Caterpillar dealers and purchase short-term receivables from Caterpillar. The various financing plans offered by Cat Financial are primarily designed to increase the opportunity for sales of Caterpillar products and generate financing income for Cat Financial. A significant portion of our activity is conducted in North America with additional offices and subsidiaries in Latin America, Asia/Pacific, Europe, Africa and Middle East. We have more than 35 years of experience in providing financing for Caterpillar products, contributing to our knowledge of asset values, industry trends, product structuring and customer needs.

The Company’s retail leases and installment sale contracts (totaling 56 percent*) include:

| |

| • | Tax leases that are classified as either operating or finance leases for financial accounting purposes, depending on the characteristics of the lease. For tax purposes, we are considered the owner of the equipment (12 percent*). |

| |

| • | Finance (non-tax) leases, where the lessee for tax purposes is considered to be the owner of the equipment during the term of the lease, that either require or allow the customer to purchase the equipment for a fixed price at the end of the term (21 percent*). |

| |

| • | Installment sale contracts, which are equipment loans that enable customers to purchase equipment with a down payment or trade-in and structure payments over time (22 percent*). |

| |

| • | Governmental lease-purchase plans in the U.S. that offer low interest rates and flexible terms to qualified non-federal government agencies (1 percent*). |

The Company’s wholesale notes receivable, finance leases and installment sale contracts (totaling 14 percent*) include:

| |

| • | Inventory/rental programs, which provide assistance to dealers by financing their new Caterpillar inventory and rental fleets (3 percent*). |

| |

| • | Short-term receivables we purchase from Caterpillar at a discount (11 percent*). |

The Company’s retail notes receivable (30 percent*) include:

| |

| • | Loans that allow customers and dealers to use their Caterpillar equipment or other assets as collateral to obtain financing. |

*Indicates the percentage of total portfolio as of December 31, 2017. We define total portfolio as finance receivables, net plus equipment on operating leases, less accumulated depreciation.

Competitive Environment

We operate in a highly competitive environment, with financing for users of Caterpillar equipment available through a variety of sources, principally commercial banks and finance and leasing companies. Our competitors include Wells Fargo Equipment Finance Inc. and various other banks and finance companies. In addition, many of the manufacturers that compete with Caterpillar also own financial subsidiaries, such as Volvo Financial Services, Komatsu Financial L.P. and John Deere Capital Corporation, that utilize below-market interest rate programs (funded by the manufacturer) to assist machine sales.

We provide financing only when certain criteria are met. Credit decisions are based on a variety of credit quality factors, including prior payment experience, customer financial information, credit-rating agency ratings, loan-to-value ratios and other internal metrics. We typically maintain a security interest in retail financed equipment and require physical damage insurance coverage on financed equipment. We finance a significant portion of Caterpillar dealers' sales and inventory of Caterpillar equipment throughout the world (see Note 16 of Notes to Consolidated Financial Statements for more information regarding our segments and geographic areas). Our competitive position is improved by marketing programs offered in conjunction with Caterpillar and/or Caterpillar dealers that allow us to periodically offer financing to customers at interest rates that are below market rates. Under these programs, Caterpillar, or the dealer, funds an amount at the outset of the transaction, which we then recognize as revenue over the term of the financing. We believe that these marketing programs provide us with a significant competitive advantage in financing Caterpillar products.

In certain instances, our operations are subject to supervision and regulation by state, federal and various foreign governmental authorities and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions which, among other things, (i) regulate credit granting activities and the administration of loans, (ii) establish maximum interest rates, finance charges and other charges, (iii) require disclosures to customers and investors, (iv) govern secured transactions, (v) set collection, foreclosure, repossession and other trade practices and (vi) regulate the use and reporting of information related to a borrower's credit experience. Our ability to comply with these and other governmental and legal requirements and restrictions affects our operations.

We also have agreements with Caterpillar that are significant to our operations. These agreements provide us with certain types of operational and administrative support from Caterpillar such as the administration of employee benefit plans, financial support, funding support and various forms of corporate services that are integral to the conduct of our business. For more information on these agreements, please refer to Note 14 of Notes to Consolidated Financial Statements.

Employment

As of December 31, 2017, the Company had 1,855 full-time employees, an increase of 2 percent from December 31, 2016.

Available Information

The Company files electronically with the SEC required reports on Form 8-K, Form 10-Q, Form 10-K and registration statements on Form S-3 and other forms or reports as required. The SEC maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. Copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports filed or furnished with the SEC are available free of charge through Caterpillar Inc.’s website (www.caterpillar.com/secfilings) as soon as reasonably practicable after filing with the SEC. Copies may also be obtained free of charge by writing to: Legal Dept., Caterpillar Financial Services Corporation, 2120 West End Ave., Nashville, Tennessee 37203-0001. In addition, the public may obtain more detailed information about our parent company, Caterpillar Inc., by visiting its website (www.caterpillar.com). None of the information contained at any time on our website, Caterpillar’s website or the SEC’s website is incorporated by reference into this document.

The statements in this section describe the most significant risks to our business and may contain "forward-looking statements" that are subject to the caption "CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS" presented prior to Item 1 of this report. The statements in this section should also be considered carefully in conjunction with "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and the "Notes to Consolidated Financial Statements" to this Form 10-K. The risk factors described below are a cautionary discussion of risks, uncertainties and assumptions that we believe are significant to our business. These are factors that, individually or in the aggregate, we believe could make our actual results differ materially from expected or past results. Because it is impossible to predict or identify all such factors, the following factors should not be considered to be a complete discussion of risks, uncertainties and assumptions.

FINANCIAL RISKS

Disruptions or volatility in global financial markets could adversely impact the industries and markets in which we serve and operate

Continuing to meet our cash requirements over the long-term could require substantial liquidity and access to sources of funds, including capital and credit markets. Global economic conditions may cause volatility and disruptions in the capital and credit markets. We have continued to maintain access to key global medium-term note and commercial paper markets, but there can be no assurance that such markets will continue to represent a reliable source of financing. If global economic conditions were to deteriorate, we could face materially higher financing costs, become unable to access adequate funding to operate and grow our business and/or meet our debt service obligations as they mature, and we could be required to draw upon contractually committed lending agreements primarily provided by global banks and/or by seeking other funding sources. However, under extreme market conditions, there can be no assurance that such agreements and other funding sources would be available or sufficient. Any of these events could negatively impact our business, results of operations and financial condition.

The extent of any impact on our ability to meet our funding or liquidity needs would depend on several factors, including our operating cash flows, the duration of any market disruptions, changes in counterparty credit risk, the impact of government intervention in financial markets including the effects of any programs or legislation designed to increase or restrict liquidity for certain areas of the market, general credit conditions, the volatility of equity and debt markets, our credit ratings and credit capacity and the cost of financing and other general economic and business conditions. Market disruption and volatility may also lead to a number of other risks in connection with these events, including but not limited to:

| |

| • | Market developments that may affect the demand for Caterpillar products and/or customer confidence levels and may cause declines in the demand for financing and adverse changes in payment patterns, causing increases in delinquencies and default rates, which could impact our write-offs and provision for credit losses; |

| |

| • | The process we use to estimate losses inherent in our credit exposure requires a high degree of management’s judgment regarding numerous subjective, qualitative factors, including forecasts of economic conditions and how economic predictors might impair the ability of our borrowers to repay their loans. If financial market disruption and volatility is experienced, the accuracy of these judgments may be impacted; |

| |

| • | Our ability to engage in routine funding transactions or borrow from other financial institutions on acceptable terms or at all could be adversely affected by disruptions in the capital markets or other events, including actions by rating agencies and deteriorating investor expectations; and |

| |

| • | Because our lending agreements are primarily with financial institutions, their ability to perform in accordance with any of our underlying agreements could be adversely affected by market volatility and/or disruptions in the equity and credit markets. |

Failure to maintain our credit ratings would increase our cost of borrowing and could adversely affect our cost of funds, liquidity, competitive position and access to capital markets

Each of Caterpillar and Cat Financial's costs of borrowing and their respective ability to access the capital markets are affected not only by market conditions but also by the short-term and long-term credit ratings assigned to our respective debt by the major credit rating agencies. These ratings are based, in significant part, on each of Caterpillar's and Cat Financial's performance as measured by financial metrics such as net worth, interest coverage and leverage ratios, as well as transparency with rating agencies and timeliness of financial reporting. There can be no assurance that Caterpillar or Cat Financial will be able to maintain their credit ratings. On December 13, 2016, Moody’s Investors Service (Moody’s) downgraded the long- and short-term ratings of Caterpillar and Cat Financial to A3 from A2 and to Prime-2 from Prime-1. A further downgrade of Caterpillar or Cat Financial’s credit ratings by Moody’s or one of the other major credit rating agencies would result in increased borrowing costs and could adversely affect Caterpillar's and our liquidity, competitive position and access to the capital markets, including restricting, in whole or in part, access to the commercial paper market. There can be no assurance that the commercial paper market will continue to be a reliable source of short-term financing for Cat Financial or an available source of short-term financing for Caterpillar. An inability to access the capital markets could have a material adverse effect on our cash flows, results of operations and financial condition.

Changes in interest rates, foreign currency exchange rates or market liquidity conditions could adversely affect our earnings and/or cash flows

Changes in interest rates, foreign currency exchange rates and market liquidity conditions could have a material adverse effect on our earnings and cash flows. Because our financial results are reported in U.S. dollars, but our operations are conducted internationally, currency exchange rates can have a significant impact on our results. Additionally, because a significant number of our loans are made at fixed interest rates, our business is impacted by fluctuations in interest rates. Changes in market interest rates may influence our financing costs, returns on financial investments and the valuation of derivative contracts and could reduce our earnings and cash flows. In addition, because we make a significant number of loans in currencies other than the U.S. dollar, fluctuations in foreign currency exchange rates could also reduce our earnings and cash flows. There has been, and may continue to be, volatility in currency exchange rates as a result of the United Kingdom’s withdrawal from the European Union (commonly known as “Brexit”), especially between the U.S. dollar and the British pound. We also rely on a number of diversified global debt capital markets and funding programs to provide liquidity for our global operations, including commercial paper, medium-term notes, retail notes, variable denomination floating rate demand notes and bank loans. Significant changes in market liquidity conditions could impact our access to funding and the associated funding cost and reduce our earnings and cash flows.

Although we manage interest rate, foreign currency exchange rate and market liquidity risks with a variety of techniques, including a match-funding program that addresses interest rate risk by aligning the interest rate profile (fixed or floating rate and duration) of our debt portfolio with the interest rate profile of our receivables portfolio within predetermined ranges on an ongoing basis, the selective use of derivatives and a broadly diversified funding program, there can be no assurance that fluctuations in interest rates, currency exchange rates and market liquidity conditions will not have a material adverse effect on our earnings and cash flows. If any of the variety of instruments and strategies we use to hedge our exposure to these various types of risk is ineffective, we may incur losses.

Our business is significantly influenced by the credit risk associated with our customers and an increase in delinquencies, repossessions or net losses could adversely affect our results

Our business is significantly influenced by the credit risk associated with our customers. The creditworthiness of each customer and the rate of delinquencies, repossessions and net losses on customer obligations are directly impacted by several factors, including, but not limited to, relevant industry (particularly construction-related industries) and economic conditions, the availability of capital, the experience and expertise of the customer's management team, commodity prices, political events and the sustained value of the underlying collateral. Any increase in delinquencies, repossessions and net losses on customer obligations could have a material adverse effect on our earnings and cash flows.

In addition, although we evaluate and adjust our allowance for credit losses related to past due and non-performing receivables on a regular basis, adverse economic conditions or other factors that might cause deterioration of the financial health of our customers could change the timing and level of payments received and necessitate an increase in our estimated losses, which could also have a material adverse effect on our earnings and cash flows.

A decrease in the residual value of the equipment that we finance could adversely affect our results

Declines in the residual value of equipment financed by us may reduce our earnings. The residual value of leased equipment is determined based on its estimated end-of-term market value at the time of the expiration of the lease term. We estimate the residual value of leased equipment at the inception of the lease based on a number of factors, including historical wholesale market sales prices, past remarketing experience and any known significant market/product trends. If estimated end-of-term market values significantly decline due to economic factors, obsolescence or other adverse circumstances, we may not realize such residual value, which could reduce our earnings, either through an increase in depreciation expense or a decrease in finance revenue.

Restrictive covenants in our debt agreements could limit our financial and operating flexibility

Cat Financial and certain subsidiaries have credit agreements under which we borrow or have the ability to borrow funds for use in our respective businesses that are utilized primarily for general corporate purposes. Certain of these agreements include covenants relating to our financial performance and financial position. The two most significant financial covenants included in these agreements are: (1) a leverage ratio covenant that requires us to maintain a ratio of consolidated debt to consolidated net worth of not greater than 10 to 1, calculated (i) on a monthly basis as the average of the leverage ratios determined on the last day of each of the six preceding calendar months and (ii) at each December 31; and (2) an interest coverage ratio that requires us to maintain a ratio of (i) profit excluding income taxes, interest expense and net gain/(loss) from interest rate derivatives to (ii) interest expense of not less than 1.15 to 1, in each case, calculated at the end of each calendar quarter for the rolling four-quarter period then most recently ended for us and our subsidiaries on a consolidated basis in accordance with generally accepted accounting principles. In addition, we are restricted in a number of our agreements from terminating, amending or modifying our support agreement with Caterpillar. We are also restricted in our ability to incur secured indebtedness or consolidate, merge or sell assets. Similarly, we are also bound by covenants in various agreements that involve Caterpillar and its obligation to maintain a consolidated net worth of not less than $9 billion at all times during each fiscal year.

Although we do not believe any of these covenants presently materially restrict our operations, our ability to meet any one particular financial covenant may be affected by events that could be beyond our control and could result in material adverse consequences that negatively impact our business, results of operations and financial condition. These consequences may include the acceleration of repayment of amounts outstanding under certain of our credit agreements, the triggering of an obligation to redeem certain debt securities, the termination of existing unused credit commitments by our lenders, the refusal by our lenders to extend further credit under one or more of our credit agreements or the lowering or modification of our credit ratings, including those of any of our subsidiaries. We cannot provide assurance that we will continue to comply with each credit covenant, particularly if we were to encounter challenging and volatile market conditions.

MACROECONOMIC RISKS

Changes in government monetary or fiscal policies may negatively impact our results

Most countries where Caterpillar products and services are sold have established central banks to regulate monetary systems and influence economic activities, generally by adjusting interest rates. Interest rate changes affect overall economic growth, which in turn affects Caterpillar’s sales and our financing activities. Interest rate changes may also affect customers’ ability to finance machine purchases, can change the optimal time to keep machines in a fleet and can impact the ability of Caterpillar’s suppliers to finance the production of parts and components necessary to manufacture and support Caterpillar products. Increases in interest rates could negatively impact Caterpillar sales and create supply chain inefficiencies that could in turn adversely impact our business, results of operations and financial condition.

Central banks and other policy arms of many countries may take actions to vary the amount of liquidity and credit available in an economy. The impact from a change in liquidity and credit policies could negatively affect the customers and markets we serve or our suppliers, which could adversely impact our business, results of operations and financial condition.

Government policies on taxes and spending also affect our business. Throughout the world, government spending finances a significant portion of infrastructure development, such as highways, airports, sewer and water systems and dams. Tax regulations determine asset depreciation lives and impact the after-tax returns on business activity and investment, both of which influence investment decisions. Unfavorable developments, such as declines in government revenues, decisions to reduce public spending or increases in taxes, could negatively impact our results.

Our global operations are exposed to political and economic risks, commercial instability and events beyond our control in the countries in which we operate

Our global operations are dependent upon products manufactured, purchased, sold and financed in the U.S. and internationally, including in countries with political and economic instability or uncertainty. This includes, for example, the uncertainty related to Brexit. Some countries have greater political and economic volatility and greater vulnerability to infrastructure and labor disruptions than others. Operating in different regions and countries exposes us to a number of risks, including:

| |

| • | Multiple and potentially conflicting legal and regulatory requirements that are subject to change, including but not limited to, those legal and regulatory requirements described in Item 1 of this report under the heading Competitive Environment; |

| |

| • | Imposition of currency restrictions, restrictions on repatriation of earnings or other restraints; |

| |

| • | Difficulty of enforcing agreements and collecting receivables through foreign legal systems; |

| |

| • | Changes in trade agreements; |

| |

| • | Imposition of new or additional trade and economic sanctions laws imposed by the U.S. or foreign governments; |

| |

| • | War or terrorist acts; and |

| |

| • | Political and economic instability or civil unrest that may severely disrupt economic activity in affected countries. |

The occurrence of one or more of these events may negatively impact our business, results of operations and financial condition.

OPERATIONAL RISKS

The success of our business depends upon the demand for Caterpillar’s products

Our primary business is to provide retail and wholesale financing alternatives for Caterpillar products to customers and dealers and is therefore largely dependent upon the demand for Caterpillar’s products and customers’ willingness to enter into financing or leasing agreements, which may be negatively affected by challenging global economic conditions. As a result, a significant or prolonged decrease in demand could have a material adverse effect on our business, financial condition, results of operations and cash flows. The demand for Caterpillar’s products and our products and services is influenced by a number of factors, including:

| |

| • | General world economic conditions and the level of energy, mining, construction and manufacturing activity; |

| |

| • | Changes and uncertainties in the monetary and fiscal policies of various governmental and regulatory entities; |

| |

| • | Fluctuations in demand and prices for certain commodities; |

| |

| • | Fluctuations in currency exchange rates and interest rates; |

| |

| • | Political, economic and legislative changes; |

| |

| • | Caterpillar’s ability to produce products that meet customers' needs; |

| |

| • | Caterpillar’s ability to maintain key dealer relationships; |

| |

| • | The ability of Caterpillar dealers to sell Caterpillar products and their practices regarding inventory control; and |

| |

| • | Changes in pricing policies by Caterpillar or its competitors. |

Any significant adverse changes to these factors could negatively impact our results.

Changes in the marketing, operational or administrative support that we receive from Caterpillar could adversely affect our results

We participate in certain marketing programs offered in conjunction with Caterpillar and/or Caterpillar dealers that allow us to offer financing to customers at interest rates that are below market rates. These marketing programs provide us with a significant competitive advantage in financing Caterpillar products. Any change in these marketing programs or reduction in our ability to offer competitively priced financing to customers could reduce the percentage of Caterpillar products financed by us, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. Caterpillar also provides us with other types of operational and administrative support, such as the administration of employee benefit plans, which is integral to the conduct of our business. Any changes in the levels of support from Caterpillar could also negatively impact our results.

The success of our business depends on our ability to develop, produce and market quality products and services that meet our customers’ needs

We operate in a highly competitive environment, with financing for users of Caterpillar equipment available through a variety of sources, principally commercial banks and finance and leasing companies. Increasing competition may adversely affect our business if we are unable to match the products and services of our competitors. Also, as noted above, any changes to the marketing programs offered in conjunction with Caterpillar and/or Caterpillar dealers, which allow us to offer financing to customers at interest rates that are below market rates, could have a materially adverse effect on our business.

Increased information technology security threats and more sophisticated computer crime pose a risk to our systems, networks, products and services

We rely upon information technology systems and networks, some of which are managed by third parties, in connection with a variety of business activities. Additionally, we collect and store data that is sensitive to us and our customers. The secure operation of these information technology systems and networks, and the processing and maintenance of this data, in a secure manner, is critical to our business operations and strategy. Information technology security threats -- from user error to attacks designed to gain unauthorized access to our systems, networks and data -- are increasing in frequency and sophistication. Attacks may range from random attempts to coordinated and targeted attacks, including sophisticated computer crime and advanced persistent threats. These threats pose a risk to the security of our systems and networks and the confidentiality, availability and integrity of our data. Cybersecurity attacks could also include attacks targeting customer data or the security, integrity and/or reliability of the hardware and software installed in our products. We have experienced cybersecurity attacks that have resulted in unauthorized parties gaining access to our information technology systems and networks, and we could in the future experience similar attacks. However, to date, no cybersecurity attack has had a material impact on our financial condition, results of operations or liquidity. If an attack against us were to succeed it could expose us, and our customers, dealers and suppliers to misuse of information or systems, the compromising of confidential information, manipulation and destruction of data and operations disruptions. The consequences associated with the occurrence of any of these events include reputational damage, litigation with third parties, disruption to systems, unauthorized release of confidential or otherwise protected information, corruption of data, and increased cybersecurity protection and remediation costs, which in turn could adversely affect our competitiveness, results of operations and financial condition. The amount of insurance coverage we maintain may be inadequate to cover claims or liabilities relating to a cybersecurity attack.

LEGAL & REGULATORY RISKS

Our global operations are subject to extensive trade and anti-corruption laws and regulations

Due to the international scope of our operations, we are subject to a complex system of laws and regulations, including U.S. regulations issued by the Office of Foreign Assets Control. Any alleged or actual violations may subject us to government scrutiny, investigation and civil and criminal penalties, and may limit our ability to provide financing outside the United States and/or potentially require us to divest portions of our existing portfolio under certain circumstances. Furthermore, embargoes and sanctions imposed by the U.S. and other governments prohibiting providing financing to specific persons or countries may expose us to potential criminal and civil sanctions. We cannot predict the nature, scope or effect of future regulatory requirements to which our operations might be subject or the manner in which existing laws might be administered or interpreted.

In addition, the U.S. Foreign Corrupt Practices Act and similar anti-corruption laws of other countries generally prohibit companies and their intermediaries from making improper payments or providing anything of value to improperly influence foreign government officials for the purpose of obtaining or retaining business, or obtaining an unfair advantage. Recent years have seen a substantial increase in the global enforcement of anti-corruption laws. Our continued operation and expansion outside the United States, including in developing countries, could increase the risk of such violations. Violations of anti-corruption laws by our employees or by intermediaries acting on our behalf, may result in severe criminal or civil sanctions, could disrupt our business, and result in an adverse effect on our reputation, business and results of operations or financial condition.

New regulations or changes in financial services regulation could adversely impact our results of operations and financial condition

Our operations are highly regulated by governmental authorities in the locations where we operate, which can impose significant additional costs and/or restrictions on our business. In the U.S. for example, certain of our activities are subject to the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank"), a comprehensive financial reform act that includes extensive provisions regulating the financial services industry. Certain aspects of Dodd-Frank remain to be implemented under the rulemaking and regulatory authority of the SEC, the Commodity Futures Trading Commission and federal banking regulators and certain or all aspects of Dodd-Frank could be substantially modified or repealed. As such, we have become and could continue to become subject to additional regulatory costs that could be significant and could have an adverse effect on our results of operations and financial condition. Additional regulations in the U.S. or internationally impacting the financial services industry could also add significant cost or operational constraints that might have an adverse effect on our results of operations and financial condition.

We may incur additional tax expense or become subject to additional tax exposure

We are subject to income taxes in the United States and numerous other jurisdictions. Our future results of operations could be adversely affected by changes in the effective tax rate as a result of a change in the mix of earnings in jurisdictions with differing statutory tax rates, changes in our overall profitability, changes in tax laws or treaties or in their application or interpretation, changes in tax rates, changes in generally accepted accounting principles, changes in the valuation of deferred tax assets and liabilities, changes in the amount of earnings indefinitely reinvested in certain non-U.S. jurisdictions, the results of audits and examinations of previously filed tax returns and continuing assessments of our tax exposures. We are also subject to the continuous examination of our income tax returns by the U.S. Internal Revenue Service and other tax authorities. We regularly assess the likelihood of an adverse outcome resulting from these examinations. If our effective tax rates were to increase, or if the ultimate determination of our taxes owed is for an amount in excess of amounts previously accrued, our operating results, cash flows and financial condition could be adversely affected.

Changes in accounting guidance could have an adverse effect on our results of operations

Our consolidated financial statements are subject to the application of generally accepted accounting principles in the United States, which is periodically revised and/or expanded. Accordingly, from time to time we are required to adopt new or revised accounting guidance and related interpretations issued by recognized authoritative bodies, including the Financial Accounting Standards Board and the SEC. Market conditions have prompted accounting standard setters to issue new guidance, which further interprets or seeks to revise accounting pronouncements related to various transactions, as well as to issue new guidance expanding disclosures. The impact of accounting pronouncements that have been issued but not yet implemented is disclosed in our annual and quarterly reports on Form 10-K and Form 10-Q. An assessment of proposed guidance is not provided, as such proposals are subject to change through the exposure process and, therefore, their effects on our financial statements cannot be meaningfully assessed. It is possible that future accounting guidance we are required to adopt, or future changes in accounting principles, could change the current accounting treatment that we apply to our consolidated financial statements and that such changes could have a material adverse effect on our business, results of operations and financial condition.

|

| |

| Item 1B. | Unresolved Staff Comments. |

None.

Our corporate headquarters are located in Nashville, Tennessee. We maintain forty-five offices in total, of which nine are located in North America (eight in the U.S. and one in Canada), twenty are located in Europe, one is located in Africa, one is located in the Middle East, eight are located in Asia/Pacific and six are located in Latin America (see Note 16 of Notes to Consolidated Financial Statements for more information regarding our segments and geographic areas). As of December 31, 2017, all of our offices were leased, though we had a commitment to purchase the corporate headquarters building for $91 million. The corporate headquarters building purchase closed on January 4, 2018.

|

| |

| Item 3. | Legal Proceedings. |

We are involved in unresolved legal actions that arise in the normal course of business. Although it is not possible to predict with certainty the outcome of our unresolved legal actions, we believe that these unresolved legal actions will neither individually nor in the aggregate have a material adverse effect on our consolidated results of operations, financial position or liquidity.

|

| |

| Item 4. | Mine Safety Disclosures. |

Not applicable.

|

| |

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

Our stock is not publicly traded. Caterpillar Inc. is the owner of our one outstanding share. Cash dividends of $725 million, $275 million and $600 million were paid to Caterpillar in 2017, 2016 and 2015, respectively.

|

| |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. |

OVERVIEW

We reported revenues of $2.69 billion for 2017, an increase of $94 million, or 4 percent, compared with 2016. Profit was $586 million, a $202 million, or 53 percent, increase from 2016.

The increase in revenues was primarily due to a $61 million favorable impact from higher average financing rates and a $48 million favorable impact from lending activity with Caterpillar, partially offset by a $29 million unfavorable impact from lower average earning assets.

Profit before income taxes was $590 million for 2017, compared with $561 million for 2016. The increase was primarily due to a $33 million increase in net yield on average earning assets and a $30 million favorable impact from lending activity with Caterpillar, partially offset by a $38 million increase in general, operating and administrative expenses primarily due to higher incentive compensation.

The provision for income taxes reflects an annual tax rate of negative 1 percent for 2017, compared with 30 percent for 2016. The provision for income taxes for 2017 includes a provisionally estimated net benefit of $151 million due to the enactment of U.S. tax reform legislation on December 22, 2017. The provisionally estimated net benefit includes a $334 million write-down of net deferred tax liabilities to reflect the reduction in the U.S. corporate tax rate from 35 percent to 21 percent beginning January 1, 2018, partially offset by the cost of a mandatory deemed repatriation of non-U.S. earnings. We believe this net benefit is a reasonable estimate, as of January 18, 2018, that may change as additional required information is prepared and analyzed, interpretations and assumptions are refined, additional guidance is issued, and due to actions we may take as a result of the legislation. The decrease in the annual tax rate is primarily due to this net benefit, an increase in available foreign tax credits and changes in the geographic mix of profits.

Retail new business volume for 2017 was $11.22 billion, an increase of $316 million, or 3 percent, from 2016. The increase was primarily driven by higher volume in Asia/Pacific, partially offset by decreases in Latin America and North America.

At the end of 2017, past dues were 2.78 percent, compared with 2.38 percent at the end of 2016. Write-offs, net of recoveries, were $114 million for 2017, compared with $123 million for 2016. As of December 31, 2017, the allowance for credit losses totaled $365 million, or 1.33 percent of net finance receivables, compared with $343 million, or 1.29 percent of net finance receivables at year-end 2016.

2017 COMPARED WITH 2016

Consolidated Total Revenues

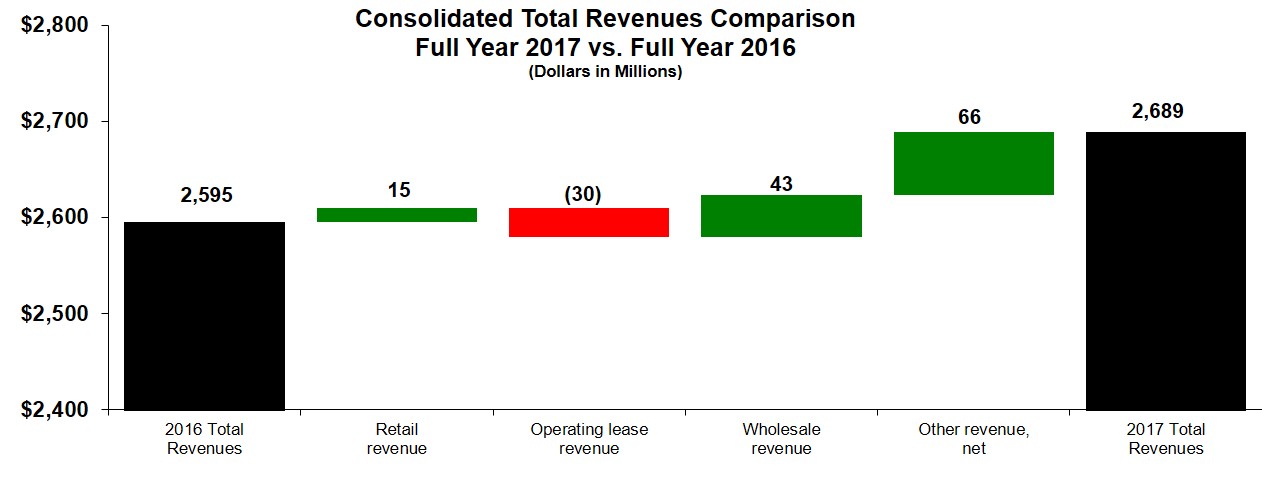

The chart above graphically illustrates reasons for the change in Consolidated Total Revenues between 2016 (at left) and 2017 (at right). Items favorably impacting total revenues appear as upward stair steps with corresponding dollar amounts above each bar, while items negatively impacting total revenues appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Management utilizes these charts internally to visually communicate results.

Retail revenue for 2017 was $1.24 billion, an increase of $15 million from 2016. The increase was due to a $35 million favorable impact from higher interest rates on retail finance receivables, partially offset by a $20 million unfavorable impact from lower average earning assets. For the year ended December 31, 2017, retail average earning assets were $23.09 billion, a decrease of $374 million from 2016. The average yield was 5.35 percent for 2017, compared with 5.20 percent in 2016.

Operating lease revenue for 2017 was $985 million, a decrease of $30 million from 2016. The decrease was due to a $28 million unfavorable impact from lower average earning assets and a $2 million unfavorable impact from lower average rental rates on operating leases.

Wholesale revenue for 2017 was $307 million, an increase of $43 million from 2016. The increase was due to a $36 million favorable impact from higher interest rates on wholesale finance receivables and a $7 million favorable impact from higher average earning assets. For the year ended December 31, 2017, wholesale average earning assets were $3.82 billion, an increase of $93 million from 2016. The average yield was 8.04 percent for 2017, compared with 7.09 percent in 2016.

Other revenue, net, items were as follows:

|

| | | | | | | | | | | | |

| (Millions of dollars) | | | | | | |

| | | 2017 | | 2016 | | $ Change |

Finance receivable and operating lease fees (including late charges)(1) | | $ | 80 |

| | $ | 73 |

| | $ | 7 |

|

| Fees on committed credit facility extended to Caterpillar | | 40 |

| | 40 |

| | — |

|

Interest income on Notes Receivable from Caterpillar(2) | | 74 |

| | 30 |

| | 44 |

|

| Net loss on returned or repossessed equipment | | (48 | ) | | (61 | ) | | 13 |

|

| Miscellaneous other revenue, net | | 16 |

| | 14 |

| | 2 |

|

| Total Other revenue, net | | $ | 162 |

| | $ | 96 |

| | $ | 66 |

|

| | | | | | | |

(1) Portfolio-related revenues

(2) For the years ended December 31, 2017 and 2016, includes $26 million and $30 million, respectively, of portfolio-related revenues.

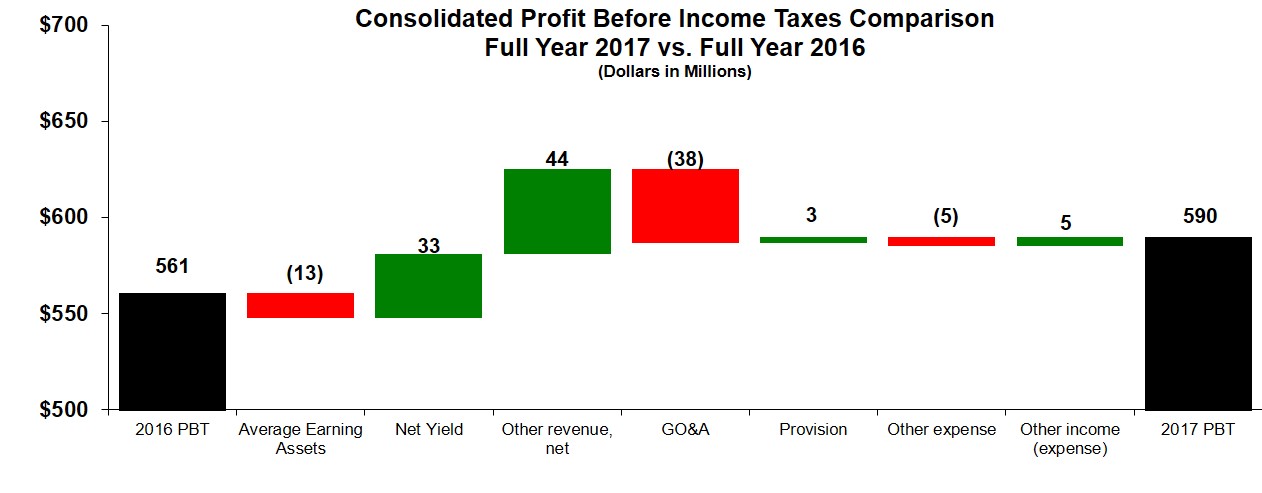

Consolidated Profit Before Income Taxes

The chart above graphically illustrates reasons for the change in Consolidated Profit Before Income Taxes between 2016 (at left) and 2017 (at right). Items favorably impacting profit before income taxes appear as upward stair steps with corresponding dollar amounts above each bar, while items negatively impacting profit before income taxes appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Management utilizes these charts internally to visually communicate results.

Profit before income taxes was $590 million for 2017, compared with $561 million for 2016. The increase was primarily due to a $33 million increase in net yield on average earning assets and a $30 million favorable impact from lending activity with Caterpillar, partially offset by a $38 million increase in general, operating and administrative expenses primarily due to higher incentive compensation.

Provision for Income Taxes

The provision for income taxes reflects an annual tax rate of negative 1 percent for 2017, compared with 30 percent for 2016. The provision for income taxes for 2017 includes a provisionally estimated net benefit of $151 million due to the enactment of U.S. tax reform legislation on December 22, 2017. The provisionally estimated net benefit includes a $334 million write-down of net deferred tax liabilities to reflect the reduction in the U.S. corporate tax rate from 35 percent to 21 percent beginning January 1, 2018, partially offset by the cost of a mandatory deemed repatriation of non-U.S. earnings. We believe this net benefit is a reasonable estimate, as of January 18, 2018, that may change as additional required information is prepared and analyzed, interpretations and assumptions are refined, additional guidance is issued, and due to actions we may take as a result of the legislation. The decrease in the annual tax rate is primarily due to this net benefit, an increase in available foreign tax credits and changes in the geographic mix of profits.

Finance Receivables and Equipment on Operating Leases

New Business Volume

|

| | | | | | | | | | | | |

| (Millions of dollars) | | | | | | |

| | | 2017 | | 2016 | | $ Change |

| New retail financing | | $ | 9,844 |

| | $ | 9,260 |

| | $ | 584 |

|

| New operating lease activity | | 1,388 |

| | 1,670 |

| | (282 | ) |

| New wholesale financing | | 36,299 |

| | 30,642 |

| | 5,657 |

|

| Total | | $ | 47,531 |

| | $ | 41,572 |

| | $ | 5,959 |

|

| | | | | | | |

New retail financing increased primarily due to higher volume in Asia/Pacific, Europe and North America, partially offset by lower volume in Latin America. New operating lease activity (which is substantially related to retail) decreased primarily due to lower rentals of Cat equipment in North America, Europe and Asia/Pacific. New wholesale financing increased primarily due to higher purchases of trade receivables from Caterpillar.

Total Managed Portfolio

We define total portfolio as finance receivables, net plus equipment on operating leases, less accumulated depreciation. We also manage and service receivables and leases that have been sold by us to third parties with limited or no recourse in order to mitigate our concentration of credit risk with certain customers. These assets are not available to pay our creditors. Total managed portfolio as of December 31, was as follows:

|

| | | | | | | | | | | | |

| (Millions of dollars) | | | | | | |

| | | 2017 | | 2016 | | $ Change |

| Finance receivables, net | | $ | 27,126 |

| | $ | 26,212 |

| | $ | 914 |

|

| Equipment on operating leases, less accumulated depreciation | | 3,568 |

| | 3,708 |

| | (140 | ) |

| Total portfolio | | $ | 30,694 |

| | $ | 29,920 |

| | $ | 774 |

|

| | | | | | | |

| Retail finance leases | | $ | 103 |

| | $ | 41 |

| | $ | 62 |

|

| Retail installment sale contracts | | 74 |

| | 79 |

| | (5 | ) |

| Retail notes receivable | | 55 |

| | 87 |

| | (32 | ) |

| Operating leases | | 39 |

| | 79 |

| | (40 | ) |

| Total off-balance sheet managed assets | | $ | 271 |

| | $ | 286 |

| | $ | (15 | ) |

| | | | | | | |

| Total managed portfolio | | $ | 30,965 |

| | $ | 30,206 |

| | $ | 759 |

|

| | | | | | | |

At the end of 2017, past dues were 2.78 percent, compared with 2.38 percent at the end of 2016. Total non-performing finance receivables, which represent finance receivables currently on non-accrual status, were $684 million and $580 million at December 31, 2017 and 2016, respectively. Total non-performing finance receivables as a percentage of our recorded investment in finance receivables were 2.49 percent and 2.18 percent at December 31, 2017 and 2016, respectively.

Our allowance for credit losses as of December 31, 2017 was $365 million or 1.33 percent of net finance receivables compared with $343 million or 1.29 percent as of December 31, 2016. The allowance is subject to an ongoing evaluation based on many quantitative and qualitative factors, including past loss experience, known and inherent risks in the portfolio, adverse situations that may affect the borrower’s ability to repay, estimated value of underlying collateral and current economic conditions. We believe our allowance is sufficient to provide for losses inherent in our existing finance receivable portfolio as of December 31, 2017.

FOURTH QUARTER 2017 VS. FOURTH QUARTER 2016

CONSOLIDATED STATEMENTS OF PROFIT (UNAUDITED)

(Dollars in Millions)

|

| | | | | | | | |

| | | Three Months Ended December 31, |

| | | 2017 | | 2016 |

| Revenues: | | | | |

| Retail finance | | $ | 311 |

| | $ | 306 |

|

| Operating lease | | 248 |

| | 259 |

|

| Wholesale finance | | 85 |

| | 62 |

|

| Other, net | | 34 |

| | 15 |

|

| Total revenues | | 678 |

| | 642 |

|

| | | | | |

| Expenses: | | |

| | |

|

| Interest | | 168 |

| | 153 |

|

| Depreciation on equipment leased to others | | 202 |

| | 214 |

|

| General, operating and administrative | | 110 |

| | 99 |

|

| Provision for credit losses | | 50 |

| | 39 |

|

| Other | | 10 |

| | 10 |

|

| Total expenses | | 540 |

| | 515 |

|

| | | | | |

| Other income (expense) | | (5 | ) | | (5 | ) |

| | | | | |

| Profit before income taxes | | 133 |

| | 122 |

|

| | | | | |

| Provision (benefit) for income taxes | | (141 | ) | | 35 |

|

| | | | | |

| Profit of consolidated companies | | 274 |

| | 87 |

|

| | | | | |

| Less: Profit (loss) attributable to noncontrolling interests | | 3 |

| | 2 |

|

| | | | | |

Profit1 | | $ | 271 |

| | $ | 85 |

|

| | | | | |

| | | |

| | |

|

1 Profit attributable to Caterpillar Financial Services Corporation.

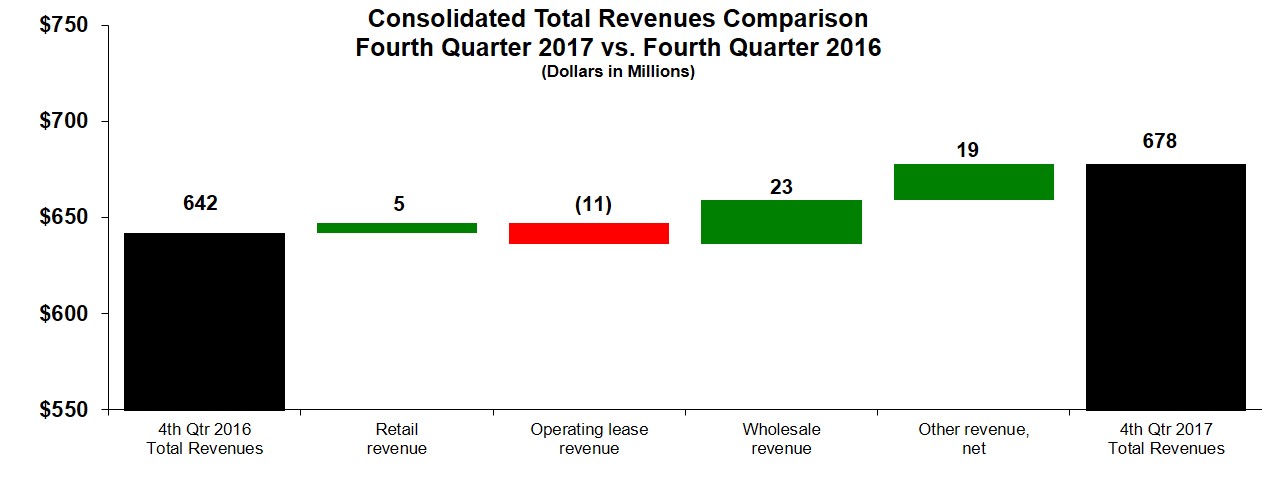

Consolidated Total Revenues

The chart above graphically illustrates reasons for the change in Consolidated Total Revenues between fourth quarter 2016 (at left) and fourth quarter 2017 (at right). Items favorably impacting total revenues appear as upward stair steps with corresponding dollar amounts above each bar, while items negatively impacting total revenues appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Management utilizes these charts internally to visually communicate results.

Retail revenue for the fourth quarter of 2017 was $311 million, an increase of $5 million from the same period in 2016. The increase was due to a $6 million favorable impact from higher interest rates on retail finance receivables, partially offset by a $1 million unfavorable impact from lower average earning assets. For the quarter ended December 31, 2017, retail average earning assets were $23.08 billion, a decrease of $86 million from the same period in 2016. The annualized average yield was 5.39 percent for the fourth quarter of 2017, compared with 5.28 percent for the fourth quarter of 2016.

Operating lease revenue for the fourth quarter of 2017 was $248 million, a decrease of $11 million from the same period in 2016. The decrease was due to a $12 million unfavorable impact from lower average earning assets, partially offset by a $1 million favorable impact from higher average rental rates on operating leases.

Wholesale revenue for the fourth quarter of 2017 was $85 million, an increase of $23 million from the same period in 2016. The increase was due to a $14 million favorable impact from higher average earning assets and a $9 million favorable impact from higher interest rates on wholesale finance receivables. For the quarter ended December 31, 2017, wholesale average earning assets were $4.11 billion, an increase of $724 million from the same period in 2016. The annualized average yield was 8.22 percent for the fourth quarter of 2017, compared with 7.38 percent for the fourth quarter of 2016.

Other revenue, net, items were as follows:

|

| | | | | | | | | | | | |

(Millions of dollars) | | Three Months Ended

December 31, |

| | | 2017 | | 2016 | | $ Change |

Finance receivable and operating lease fees (including late charges)(1) | | $ | 23 |

| | $ | 18 |

| | $ | 5 |

|

| Fees on committed credit facility extended to Caterpillar | | 10 |

| | 10 |

| | — |

|

Interest income on Notes Receivable from Caterpillar(2) | | 15 |

| | 7 |

| | 8 |

|

| Net loss on returned or repossessed equipment | | (18 | ) | | (25 | ) | | 7 |

|

| Miscellaneous other revenue, net | | 4 |

| | 5 |

| | (1 | ) |

| Total Other revenue, net | | $ | 34 |

| | $ | 15 |

| | $ | 19 |

|

| | | | | | | |

(1) Portfolio-related revenues

(2) For the three months ended December 31, 2017 and 2016, includes $6 million and $7 million, respectively, of portfolio-related revenues.

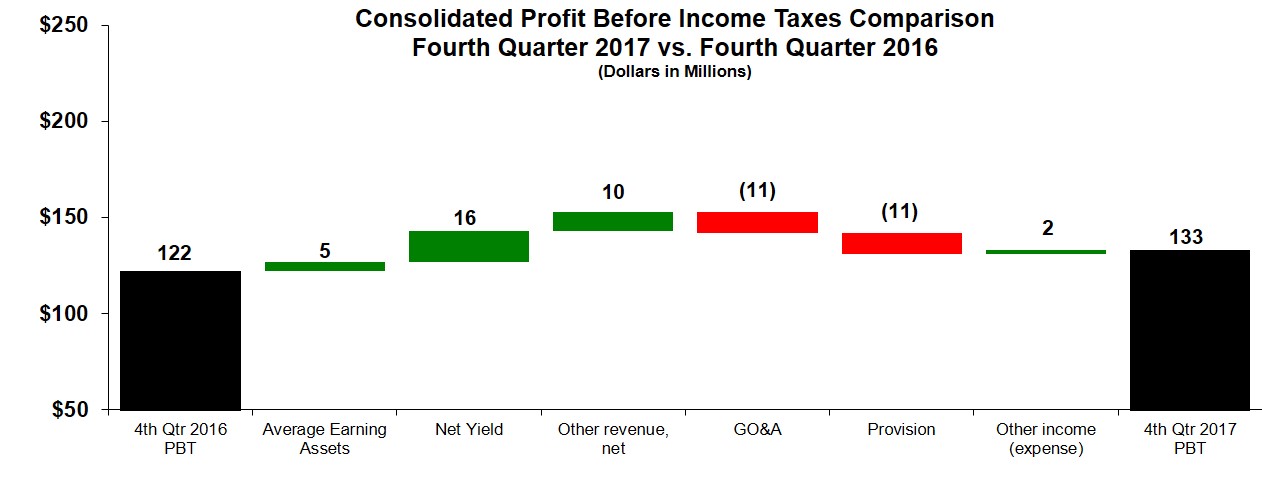

Consolidated Profit Before Income Taxes

The chart above graphically illustrates reasons for the change in Consolidated Profit Before Income Taxes between fourth quarter 2016 (at left) and fourth quarter 2017 (at right). Items favorably impacting profit before income taxes appear as upward stair steps with corresponding dollar amounts above each bar, while items negatively impacting profit before income taxes appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Management utilizes these charts internally to visually communicate results.

Profit before income taxes was $133 million for the fourth quarter of 2017, compared with $122 million for the fourth quarter of 2016. The increase was primarily due to a $16 million increase in net yield on average earning assets, a $7 million favorable impact from returned or repossessed equipment, a $5 million favorable impact from higher average earning assets and a $4 million favorable impact from lending activity with Caterpillar. These favorable impacts were partially offset by an $11 million increase in provision for credit losses and an $11 million increase in general, operating and administrative expenses primarily due to higher incentive compensation.

Provision for Income Taxes

The provision for income taxes reflects an effective tax rate of negative 107 percent in the fourth quarter of 2017, compared with 29 percent in the fourth quarter of 2016. The provision for income taxes in the fourth quarter of 2017 includes a provisionally estimated net benefit of $151 million due to the enactment of U.S. tax reform legislation on December 22, 2017. The provisionally estimated net benefit includes a $334 million write-down of net deferred tax liabilities to reflect the reduction in the U.S. corporate tax rate from 35 percent to 21 percent beginning January 1, 2018, partially offset by the cost of a mandatory deemed repatriation of non-U.S. earnings. We believe this net benefit is a reasonable estimate, as of January 18, 2018, that may change as additional required information is prepared and analyzed, interpretations and assumptions are refined, additional guidance is issued, and due to actions we may take as a result of the legislation. The decrease in the effective tax rate is primarily due to this net benefit, an increase in available foreign tax credits and changes in the geographic mix of profits.

2016 COMPARED WITH 2015

Consolidated Total Revenues

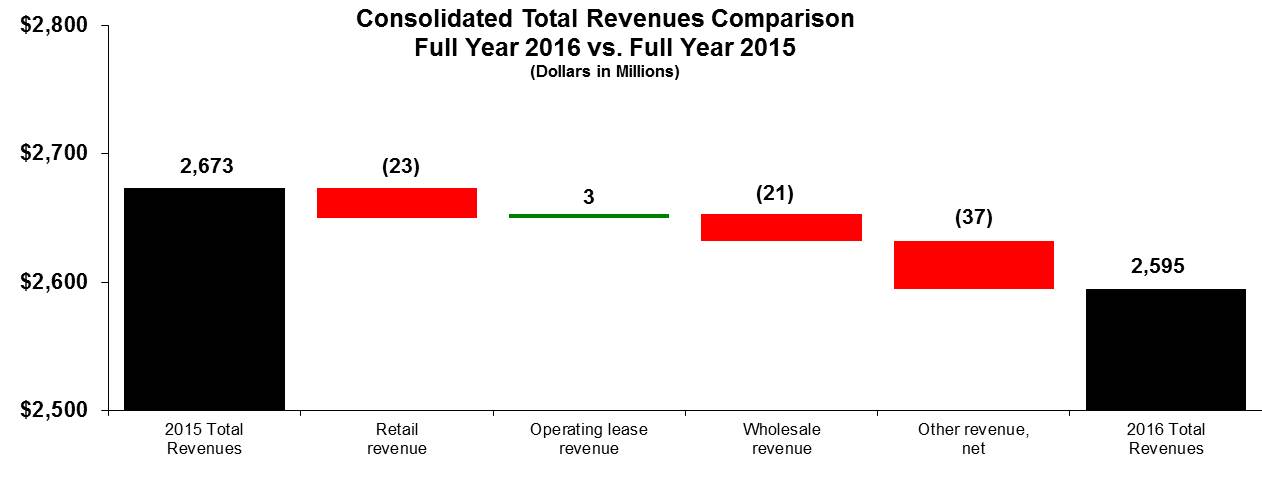

The chart above graphically illustrates reasons for the change in Consolidated Total Revenues between 2015 (at left) and 2016 (at right). Items favorably impacting total revenues appear as upward stair steps with corresponding dollar amounts above each bar, while items negatively impacting total revenues appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Management utilizes these charts internally to visually communicate results.

Retail revenue for 2016 was $1.22 billion, a decrease of $23 million from 2015. The decrease was due to a $19 million unfavorable impact from lower average earning assets and a $4 million unfavorable impact from lower interest rates on retail finance receivables. For the year ended December 31, 2016, retail average earning assets were $23.46 billion, a decrease of $362 million from 2015. The average yield was 5.20 percent for 2016, compared with 5.22 percent in 2015.

Operating lease revenue for 2016 was $1.02 billion, an increase of $3 million from 2015. The increase was due to a $37 million favorable impact from higher average earning assets, partially offset by a $34 million unfavorable impact from lower average rental rates on operating leases.

Wholesale revenue for 2016 was $264 million, a decrease of $21 million from 2015. The decrease was due to a $43 million unfavorable impact from lower average earning assets, partially offset by a $22 million favorable impact from higher interest rates on wholesale finance receivables. For the year ended December 31, 2016, wholesale average earning assets were $3.72 billion, a decrease of $655 million from 2015. The average yield was 7.09 percent for 2016, compared with 6.50 percent in 2015.

Other revenue, net, items were as follows:

|

| | | | | | | | | | | | |

| (Millions of dollars) | | | | | | |

| | | 2016 | | 2015 | | $ Change |

Finance receivable and operating lease fees (including late charges)(1) | | $ | 73 |

| | $ | 68 |

| | $ | 5 |

|

| Fees on committed credit facility extended to Caterpillar | | 40 |

| | 40 |

| | — |

|

Interest income on Notes Receivable from Caterpillar(1) | | 30 |

| | 21 |

| | 9 |

|

| Net loss on returned or repossessed equipment | | (61 | ) | | (18 | ) | | (43 | ) |

| Miscellaneous other revenue, net | | 14 |

| | 22 |

| | (8 | ) |

| Total Other revenue, net | | $ | 96 |

| | $ | 133 |

| | $ | (37 | ) |

| | | | | | | |

(1) Portfolio-related revenues

Consolidated Profit Before Income Taxes

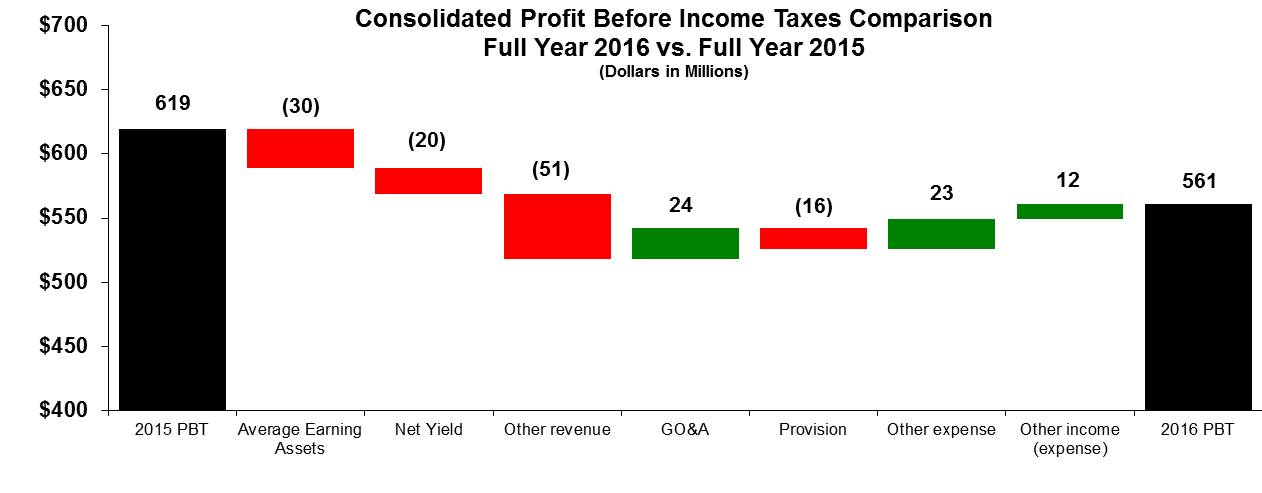

The chart above graphically illustrates reasons for the change in Consolidated Profit Before Income Taxes between 2015 (at left) and 2016 (at right). Items favorably impacting profit before income taxes appear as upward stair steps with corresponding dollar amounts above each bar, while items negatively impacting profit before income taxes appear as downward stair steps with dollar amounts reflected in parentheses above each bar. Management utilizes these charts internally to visually communicate results.

Profit before income taxes was $561 million for 2016, compared with $619 million for 2015. The decrease was primarily due to a $43 million unfavorable impact from returned or repossessed equipment and a $30 million unfavorable impact from lower average earning assets. These unfavorable impacts were partially offset by a $24 million decrease in general, operating and administrative expenses primarily due to lower personnel costs.

Provision for Income Taxes

The provision for income taxes reflects an annual tax rate of 30 percent for 2016, compared with 26 percent for 2015. The increase in the annual tax rate is primarily due to a reduction in available foreign tax credits and changes in the geographic mix of profits.

Finance Receivables and Equipment on Operating Leases

New Business Volume

|

| | | | | | | | | | | | |

| (Millions of dollars) | | | | | | |

| | | 2016 | | 2015 | | $ Change |

| New retail financing | | $ | 9,260 |

| | $ | 9,988 |

| | $ | (728 | ) |

| New operating lease activity | | 1,670 |

| | 1,466 |

| | 204 |

|

| New wholesale financing | | 30,642 |

| | 35,540 |

| | (4,898 | ) |

| Total | | $ | 41,572 |

| | $ | 46,994 |

| | $ | (5,422 | ) |

| | | | | | | |

New retail financing decreased due to lower volume across North America, marine and mining, partially offset by an increase in Asia/Pacific and Europe. New operating lease activity (which is substantially related to retail) increased primarily due to higher rentals of Cat equipment in North America. New wholesale financing decreased primarily due to lower purchases of trade receivables from Caterpillar.

Total Managed Portfolio

We define total portfolio as finance receivables, net plus equipment on operating leases, less accumulated depreciation. We also manage and service receivables and leases that have been sold by us to third parties with limited or no recourse in order to mitigate our concentration of credit risk with certain customers. These assets are not available to pay our creditors. Total managed portfolio as of December 31, was as follows:

|

| | | | | | | | | | | | |

| (Millions of dollars) | | | | | | |

| | | 2016 | | 2015 | | $ Change |

| Finance receivables, net | | $ | 26,212 |

| | $ | 27,388 |

| | $ | (1,176 | ) |

| Equipment on operating leases, less accumulated depreciation | | 3,708 |

| | 3,564 |

| | 144 |

|

| Total portfolio | | $ | 29,920 |

| | $ | 30,952 |

| | $ | (1,032 | ) |

| | | | | | | |

| Retail notes receivable | | $ | 87 |

| | $ | 113 |

| | $ | (26 | ) |

| Operating leases | | 79 |

| | 81 |

| | (2 | ) |

| Retail installment sale contracts | | 79 |

| | 67 |

| | 12 |

|

| Retail finance leases | | 41 |

| | 49 |

| | (8 | ) |

| Total off-balance sheet managed assets | | $ | 286 |

| | $ | 310 |

| | $ | (24 | ) |

| | | | | | | |

| Total managed portfolio | | $ | 30,206 |

| | $ | 31,262 |

| | $ | (1,056 | ) |

| | | | | | | |

At the end of 2016, past dues were 2.38 percent, compared with 2.14 percent at the end of 2015. The increase in past dues was primarily driven by the European marine portfolio. Total non-performing finance receivables, which represent finance receivables currently on non-accrual status, were $580 million and $485 million at December 31, 2016 and 2015, respectively. Total non-performing finance receivables as a percentage of our recorded investment in finance receivables were 2.18 percent and 1.75 percent at December 31, 2016 and 2015, respectively.

Our allowance for credit losses as of December 31, 2016 was $343 million or 1.29 percent of net finance receivables compared with $338 million or 1.22 percent as of December 31, 2015. The allowance is subject to an ongoing evaluation based on many quantitative and qualitative factors, including past loss experience, known and inherent risks in the portfolio, adverse situations that may affect the borrower’s ability to repay, estimated value of underlying collateral and current economic conditions. We believe our allowance is sufficient to provide for losses inherent in our existing finance receivable portfolio as of December 31, 2016.

CAPITAL RESOURCES AND LIQUIDITY

Capital resources and liquidity provide us with the ability to meet our financial obligations on a timely basis. Maintaining and managing adequate capital and liquidity resources includes management of funding sources and their utilization based on current, future and contingent needs. Throughout 2017, we experienced favorable liquidity conditions. We ended 2017 with $708 million of cash, a decrease of $1.09 billion from year-end 2016. Our cash balances are held in numerous locations throughout the world with approximately $274 million held by our non-U.S. subsidiaries. U.S. tax reform legislation enacted on December 22, 2017 resulted in a one-time mandatory deemed repatriation of non-U.S. earnings. The resulting tax liability, net of available foreign tax credits, will be payable over eight years, and is not expected to significantly impact liquidity. Amounts held by non-U.S. subsidiaries are available for general corporate use and could be used in the U.S. without incurring significant additional U.S. taxes. We expect to meet our U.S. funding needs without repatriating undistributed profits that are indefinitely reinvested outside the U.S.

BORROWINGS

Borrowings consist primarily of medium-term notes and commercial paper, the combination of which is used to manage interest rate risk and funding requirements. (Please refer to Notes 6, 7 and 8 of Notes to Consolidated Financial Statements for additional discussion.)

We receive debt ratings from the major rating agencies. In December 2016, Moody's Investors Service downgraded our long-term ratings to A3 from A2, and short-term ratings to Prime-2 from Prime-1. The Moody’s downgrade did not have a material impact on our borrowing costs or our overall financial health. A further downgrade of our credit ratings by Moody's or one of the other major credit rating agencies would result in increased borrowing costs and could make access to certain credit markets more difficult. However, our long-term ratings with Fitch and S&P continue to be "mid-A". In the event economic conditions deteriorate such that access to debt markets becomes unavailable, we would rely on cash flows from our existing portfolio, existing cash balances, access to our revolving credit facilities and our other credit facilities and potential borrowings from Caterpillar. In addition, Caterpillar maintains a support agreement with us, which requires Caterpillar to remain as our sole owner and may, under certain circumstances, require Caterpillar to make payments to us should we fail to maintain certain financial ratios.

Total borrowings outstanding as of December 31, 2017, were $28.58 billion, a decrease of $688 million over December 31, 2016. Outstanding borrowings as of December 31 were as follows:

|

| | | | | | | | |

(Millions of dollars) | | 2017 | | 2016 |

| Medium-term notes, net of unamortized discount and debt issuance costs | | $ | 21,303 |

| | $ | 19,667 |

|

| Commercial paper, net of unamortized discount | | 3,680 |

| | 5,985 |

|

| Bank borrowings – long-term | | 803 |

| | 870 |

|

| Bank borrowings – short-term | | 675 |

| | 553 |

|

| Variable denomination floating rate demand notes | | 481 |

| | 556 |

|

| Notes payable to Caterpillar | | 1,638 |

| | 1,637 |

|

| Total outstanding borrowings | | $ | 28,580 |

| | $ | 29,268 |

|

| | | | | |

Medium-term notes

We issue medium-term unsecured notes through securities dealers or underwriters in the U.S., Canada, Europe, Australia, Japan, Hong Kong, China, Argentina and Mexico to both retail and institutional investors. These notes are offered in several currencies and with a variety of maturities. These notes are senior unsecured obligations of the Company. Medium-term notes issued totaled $7.29 billion and redeemed totaled $5.89 billion for the year ended December 31, 2017. Medium-term notes outstanding as of December 31, 2017, mature as follows:

|

| | | |

| (Millions of dollars) | |

| 2018 | $ | 5,888 |

|

| 2019 | 5,440 |

|

| 2020 | 4,195 |

|

| 2021 | 1,643 |

|

| 2022 | 1,986 |

|

| Thereafter | 2,151 |

|

| Total | $ | 21,303 |

|

| | |

|

Commercial paper

We issue unsecured commercial paper in the U.S., Europe and other international capital markets. These short-term promissory notes are issued on a discounted basis and are payable at maturity.

Revolving credit facilities

We have three global credit facilities with a syndicate of banks totaling $10.50 billion (Credit Facility) available in the aggregate to both Caterpillar and us for general liquidity purposes. Based on management's allocation decision, which can be revised from time to time, the portion of the Credit Facility available to us as of December 31, 2017 was $7.75 billion.

| |

| • | The 364-day facility of $3.15 billion (of which $2.33 billion is available to us) expires in September 2018. |

| |

| • | The three-year facility, as amended in September 2017, of $2.73 billion (of which $2.01 billion is available to us) expires in September 2020. |

| |

| • | The five-year facility, as amended in September 2017, of $4.62 billion (of which $3.41 billion is available to us) expires in September 2022. |

At December 31, 2017, Caterpillar’s consolidated net worth was $13.72 billion, which was above the $9.00 billion required under the Credit Facility. The consolidated net worth is defined in the Credit Facility as the consolidated shareholders' equity including preferred stock but excluding the pension and other postretirement benefits balance within Accumulated other comprehensive income/(loss).

At December 31, 2017, our covenant interest coverage ratio was 1.88 to 1. This is above the 1.15 to 1 minimum ratio, calculated as (1) profit excluding income taxes, interest expense and net gain/(loss) from interest rate derivatives to (2) interest expense, calculated at the end of each calendar quarter for the rolling four quarter period then most recently ended, required by the Credit Facility.

In addition, at December 31, 2017, our six-month covenant leverage ratio was 7.38 to 1 and our year-end covenant leverage ratio was 7.71 to 1. This is below the maximum ratio of debt to net worth of 10 to 1, calculated (1) on a monthly basis as the average of the leverage ratios determined on the last day of each of the six preceding calendar months and (2) at each December 31, required by the Credit Facility.