Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-270934

PROSPECTUS SUPPLEMENT TO PROSPECTUS DATED MARCH 29, 2023

Caterpillar Financial Services Corporation

Medium-Term Notes, Series K

With Maturities of 9 Months or More from Date of Issue

We plan to offer and sell notes with various terms, which may include the following:

| · | Maturity of 9 months or more from the date of issue |

| · | Interest at fixed or floating rates, or no interest at all. The floating interest rate may be based on one or more of the following indices, plus or minus a spread and/or spread multiplier: |

| | · | CD Rate | · | Prime Rate |

| | · | CMT Rate | · | Treasury Rate |

| | · | Commercial Paper Rate | · | Any combination of rates specified by us in the pricing supplement |

| | · | Eleventh District Cost of Funds Rate | · | Any other rate specified by us in the pricing supplement |

| | · | EURIBOR | | |

| | · | Federal Funds Rate | | |

| | · | SOFR | | |

| · | A currency in which the notes will be denominated, which may be U.S. dollars or any foreign currency |

| · | An interest payment date or dates |

| · | Book-entry (through The Depository Trust Company) or certificated form |

| · | Minimum denominations of $1,000 increased in multiples of $1,000 or other specified denominations for foreign currencies |

| · | Redemption and/or repayment provisions, if applicable, whether mandatory or at our option or the option of the holder |

We will specify the final terms for each note, which may be different from the terms described in this prospectus supplement, in the applicable pricing supplement.

You must pay for the notes in the currency specified in the applicable pricing supplement by delivering the purchase price to an agent or, if we sell directly to you, to us, unless you make other payment arrangements.

Investing in the notes involves certain risks. See “Risk Factors” beginning on page S-2.

Unless otherwise indicated in the applicable pricing supplement, the notes will be offered at a public offering price of 100% and the agents’ discounts or commissions will equal between 0.050% and 0.600%, and proceeds, before expenses, to us will equal between 99.950% and 99.400%. We may also sell notes without the assistance of the agents (whether acting as principal or as agent).

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement, the accompanying prospectus or any pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| Barclays | BofA Securities | Citigroup | J.P. Morgan | MUFG | SOCIETE

GENERALE |

| | | | | | |

| ANZ Securities | BBVA | BNP PARIBAS | BNY Mellon

Capital

Markets, LLC | COMMERZBANK | HSBC |

| | | | | | |

ICBC Standard

Bank | ING | Itaú BBA | KBC

Securities

USA | Lloyds Securities | Santander |

| | | | | | |

| Scotiabank | SMBC Nikko | Standard

Chartered Bank | TD Securities | US Bancorp | Wells Fargo

Securities |

| | | | | | |

| | | | Westpac

Capital

Markets LLC | | |

March 29, 2023

TABLE OF CONTENTS

Prospectus Supplement

We are responsible only for the information contained in this prospectus supplement, the accompanying prospectus, the documents incorporated by reference therein and any related free writing prospectus issued or authorized by us. We have not, and the agents have not, authorized anyone to provide you with any other information, and we and the agents take no responsibility for any other information that others may give you. You should assume that the information included in this prospectus supplement or the accompanying prospectus, or incorporated by reference therein, or any free writing prospectus is accurate as of the date on the front cover of this prospectus supplement, the accompanying prospectus, the document incorporated by reference or the free writing prospectus, as applicable. Our business, financial condition, results of operations and prospects may have changed since then. We are not, and the agents are not, making an offer to sell the notes offered by this prospectus supplement in any jurisdiction where the offer or sale is not permitted.

Some statements contained in this document or incorporated by reference into this document are forward-looking and involve uncertainties that could significantly impact results. The words “believes,” “expects,” “estimates,” “anticipates,” “will be” and similar words or expressions identify forward-looking statements made on behalf of Caterpillar Financial. Uncertainties include factors that affect international businesses, as well as matters specific to Caterpillar Financial and the markets it serves, including the creditworthiness of customers, interest rate and currency rate fluctuations and estimated residual values of leased equipment. Please see Caterpillar Financial’s filings with the Securities and Exchange Commission for additional discussion of these uncertainties and factors. Caterpillar Financial disclaims any obligation to update or revise any forward-looking statement, whether as a result of new information, future results or otherwise.

ABOUT THIS PROSPECTUS SUPPLEMENT AND PRICING SUPPLEMENTS

This prospectus supplement sets forth certain terms of the Medium-Term Notes, Series K (the “notes”), that we may offer and supplements the prospectus that is attached to the back of this prospectus supplement. This prospectus supplement supersedes the prospectus to the extent it contains information that is different from the information in the prospectus.

Each time we offer notes pursuant to this prospectus supplement, we will attach a pricing supplement. The pricing supplement will contain the specific description of the notes we are offering and the terms of the offering. The pricing supplement will supersede this prospectus supplement or the prospectus to the extent it contains information that is different from the information contained in this prospectus supplement or the prospectus.

It is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus and pricing supplement in making your investment decision. You should also read and consider the information contained in the documents identified in “Where You Can Find More Information” and “Documents Incorporated by Reference” in the prospectus.

In this prospectus supplement, the terms “Caterpillar Financial,” “we,” “us” and “our” mean Caterpillar Financial Services Corporation and its wholly owned subsidiaries.

RISK FACTORS

Your investment in the notes will involve certain risks. This prospectus supplement does not describe all of those risks, including those that result from the denomination of or payment on any notes in a foreign currency or that result from the calculation of any amounts payable under any notes by reference to one or more interest rates, currencies or other indices or formulas.

In consultation with your own financial and legal advisors, you should carefully consider, among other matters, the following discussion of risks, as well as the “Risk Factors” section included in our most recently filed annual report on Form 10-K and any subsequently filed quarterly report on Form 10-Q or any applicable Current Report on Form 8-K, before deciding whether an investment in the notes is suitable for you, as well as the factors relating to our business generally and the other information that is included or incorporated by reference in this prospectus supplement and the accompanying prospectus. The notes are not an appropriate investment for you if you are unsophisticated with respect to the significant elements of the notes or financial matters. In particular, those notes denominated or payable in a foreign currency are not suitable for you if you are unsophisticated with respect to foreign currency transactions, and those notes with payments calculated by reference to one or more interest rates, currencies or other indices or formulas are not suitable for you if you are unsophisticated with respect to transactions involving the applicable interest rate index or currency index or other indices or formulas.

Structure and Market Risks

Investment in indexed notes and foreign currency notes entails significant risks not associated with similar investments in conventional fixed rate or floating rate notes, and indices can be subject to change or termination.

If you invest in notes indexed to one or more interest rates, currencies or composite currencies, including exchange rates and swap indices between currencies or composite currencies, commodities or other indices or formulas, there will be significant risks that are not associated with similar investments in a conventional fixed rate or floating rate debt security. These risks include fluctuation of the indices or formulas and the possibility that you will receive a lower or no amount of principal, premium or interest, and at different times, than you expected. An index could perform differently than it has in the past or be the subject of reform or termination. Developments such as manipulation claims, and related investigations or other legal actions, as have happened with the London Interbank Offered Rate (“LIBOR”), could have such effects or other consequences that cannot currently be predicted. We have no control over a number of matters, including economic, financial and political events that are important in determining the existence, magnitude and longevity of these risks and their results. In addition, if an index or formula used to determine any amounts payable in respect of the notes contains a multiplier or leverage factor, the effect of any change in the index or formula will be magnified. In recent years, values of certain indices and formulas have been highly volatile, and volatility in those and other indices and formulas may be expected in the future. However, past experience is not necessarily indicative of what may occur in the future.

Redemption—We may choose to redeem notes when prevailing interest rates are relatively low.

If your notes are redeemable, we may choose to redeem your notes from time to time. In the event that prevailing interest rates are relatively low when we elect to redeem your notes, you may not be able to reinvest the redemption proceeds in a comparable security at an effective interest rate as high as the interest rate on the notes being redeemed.

Uncertain Trading Markets—We cannot assure that a trading market for your notes will ever develop or be maintained, and any trading market and the market value of your notes may be affected by a variety of factors.

We cannot assure you that a trading market for your notes will ever develop or be maintained. Many factors independent of our creditworthiness affect the trading market and market value of your notes. These factors include:

| · | the complexity and volatility of any index or formula applicable to the notes; |

| · | the method of calculating the principal, premium and interest for the notes; |

| · | the time remaining to the maturity of the notes; |

| · | the outstanding amount of the notes; |

| · | the redemption features of the notes; |

| · | the amount of other debt securities linked to any index or formula applicable to the notes; |

| · | the market for similar securities; |

| · | the level, direction and volatility of market interest rates generally; and |

| · | our financial condition, liquidity, results of operations and prospects and general economic conditions. |

In addition, certain notes may have a more limited trading market and experience more price volatility because they were designed for specific investment objectives or strategies. There may be a limited number of buyers when you decide to sell your notes. This may affect the price you receive for your notes or your ability to sell your notes at all. You should not purchase notes unless you understand and know you can bear the foregoing investment risks.

Our credit ratings may not reflect all risks of an investment in the notes.

Our credit ratings are an assessment by independent rating agencies of our ability to pay our obligations. Consequently, actual or anticipated changes in these credit ratings will generally affect the market value and marketability of your notes. These credit ratings, however, may not reflect the potential impact of risks related to structure, market or other factors discussed in this prospectus supplement on the value of your notes.

The price at which the notes may be sold prior to maturity will depend on a number of factors and may be substantially less than the amount for which they were originally purchased.

The price at which the notes may be sold prior to maturity will depend on a number of factors, including, but not limited to: (i) actual or anticipated changes in the level of the index upon which notes are linked, (ii) volatility of the level of the index upon which notes are linked, (iii) changes in interest and yield rates, (iv) any actual or anticipated changes in our credit ratings or credit spreads and (v) the time remaining to maturity of the notes. Generally, the longer the time remaining to maturity and the more tailored the exposure, the more the market price of the notes will be affected by the other factors described in the preceding sentence. This can lead to significant adverse changes in the market price of securities such as the notes. Depending on the actual or anticipated level of the index upon which notes are linked, the market value of the notes may decrease and you may receive substantially less than 100% of the issue price if you sell your notes prior to maturity.

Exchange Rates and Exchange Controls

Investment in foreign currency notes entails significant risks that are not associated with an investment in a debt security denominated and payable in U.S. dollars.

If you invest in notes denominated and/or payable in a currency other than U.S. dollars (foreign currency notes), there will be significant risks that are not associated with an investment in a debt security denominated and payable in U.S. dollars. These risks include the possibility of significant changes in the exchange rate between U.S. dollars and your payment currency and the possibility that either the United States or foreign governments will impose or modify foreign exchange controls.

We have no control over the factors that generally affect these risks, such as economic, financial and political events and the supply and demand for the applicable currencies. Moreover, if payments on your foreign currency notes are determined by reference to a formula containing a multiplier or leverage factor, the effect of any change in the exchange rates between the applicable currencies will be magnified. In recent years, the exchange rates between certain currencies have been highly volatile, and volatility between these currencies or with other currencies may be expected in the future. However, fluctuations between currencies in the past are not necessarily indicative of fluctuations that may occur in the future. Depreciation of your payment currency would result in a decrease in the U.S. dollar equivalent yield of your foreign currency notes, in the U.S. dollar equivalent value of the principal and any premium payable at maturity or earlier redemption of your foreign currency notes and, generally, in the U.S. dollar equivalent market value of your foreign currency notes.

Governmental exchange controls could affect exchange rates and the availability of your payment currency on a required payment date. Even if there are no exchange controls, it is possible that your payment currency will not be available on a required payment date due to circumstances beyond our control or because the payment currency is no longer in use. In such cases, we will be allowed to satisfy our obligations on your foreign currency notes in U.S. dollars.

SOFR Notes

The Secured Overnight Financing Rate published by the New York Federal Reserve has a limited history and the future performance of the Secured Overnight Financing Rate cannot be predicted based on the historical performance of the Secured Overnight Financing Rate.

You should note that publication of the Secured Overnight Financing Rate (as defined below) began on April 3, 2018 and it therefore has a limited history. In addition, the future performance of the Secured Overnight Financing Rate cannot be predicted based on the limited historical performance. The level of the Secured Overnight Financing Rate during the term of any notes with an interest rate that is related to the Secured Overnight Financing Rate (such notes, “SOFR notes”) may bear little or no relation to the historical level of the Secured Overnight Financing Rate. Prior observed patterns, if any, in the behavior of market variables and their relation to the Secured Overnight Financing Rate, such as correlations, may change in the future. While some prepublication historical information has been released by the New York Federal Reserve (as defined below), analysis of such information inherently involves assumptions, estimates and approximations. The future performance of the Secured Overnight Financing Rate is impossible to predict and therefore no future performance of the Secured Overnight Financing Rate or any SOFR notes may be inferred from any of the historical simulations or historical performance. Hypothetical or historical performance data are not indicative of, and have no bearing on, the future performance of the Secured Overnight Financing Rate or any SOFR notes. Changes in the levels of the Secured Overnight Financing Rate will affect the calculation of Compounded SOFR (as described in “Description of Notes—Interest Rate—Floating Rate Notes—SOFR Notes”) and, therefore, the return on any SOFR notes and the trading price of such SOFR notes, but it is impossible to predict whether such levels will rise or fall.

Any failure of the Secured Overnight Financing Rate to gain market acceptance could adversely affect any SOFR notes.

The Secured Overnight Financing Rate may fail to gain market acceptance. The Secured Overnight Financing Rate was developed for use in certain U.S. dollar derivatives and other financial contracts as an alternative to U.S. dollar LIBOR in part because it is considered to be a good representation of general funding conditions in the overnight U.S. Treasury repurchase agreement (repo) market. However, as a rate based on transactions secured by U.S. Treasury securities, it does not measure bank-specific credit risk and, as a result, is less likely to correlate with the unsecured short-term funding costs of banks. This may mean that market participants would not consider the Secured Overnight Financing Rate to be a suitable substitute or successor for all of the purposes for which U.S. dollar LIBOR historically has been used (including, without limitation, as a representation of the unsecured short-term funding costs of banks), which may, in turn, lessen market acceptance of the Secured Overnight Financing Rate. Any failure of the Secured Overnight Financing Rate to gain market acceptance could adversely affect the return on SOFR notes and the price at which you can sell such notes.

The interest rate on SOFR notes may be based on Compounded SOFR, which is relatively new in the marketplace.

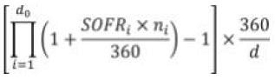

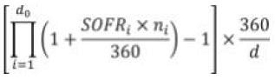

For each Interest Period (as described herein), the interest rate on any SOFR notes may be based on Compounded SOFR, which is calculated according to the specific formula described under “Description of Notes— Interest Rate—Floating Rate Notes—SOFR Notes” below and not by using the Secured Overnight Financing Rate published on or in respect of a particular date during such Interest Period or an arithmetic average of the Secured Overnight Financing Rates during such period. For this and other reasons, the interest rate on SOFR notes during any Interest Period will not necessarily be the same as the interest rate on other Secured Overnight Financing Rate-linked investments that use an alternative basis to determine the applicable interest rate. Further, if the Secured Overnight Financing Rate in respect of a particular date during an Interest Period is negative, its contribution to SOFR will be less than one, resulting in a reduction to Compounded SOFR used to calculate the interest payable on such SOFR notes on the Interest Payment Date for such Interest Period.

In addition, a more limited market precedent exists for securities that use the Secured Overnight Financing Rate as the interest rate and the method for calculating an interest rate based upon the Secured Overnight Financing Rate in those precedents varies. Accordingly, Compounded SOFR used in SOFR notes may not be widely adopted by other market participants, if at all. You should carefully review the specific formula for Compounded SOFR used in SOFR notes before making an investment in such notes. If the market adopts a different calculation method than used in such SOFR notes, that could adversely affect the market value of such notes.

The total amount of interest payable on Compounded SOFR notes with respect to a particular Interest Period will only be capable of being determined near the end of the relevant Interest Period.

Compounded SOFR applicable to a particular Interest Period and therefore, the total amount of interest payable with respect to such Interest Period will be determined on the Interest Determination Date (as set forth under “Description of Notes— Interest Rate—Floating Rate Notes—SOFR Notes” below) for such Interest Period. Because each such date is near the end of such Interest Period, you will not know the total amount of interest payable with respect to a particular Interest Period until shortly prior to the related Interest Payment Date and it may be difficult for you to reliably estimate the total amount of interest that will be payable on each such Interest Payment Date. In addition, some investors may be unwilling or unable to trade the SOFR notes without changes to their information technology systems, both of which could adversely impact the liquidity and trading price of such notes.

The composition and characteristics of the Secured Overnight Financing Rate may be more volatile and are not the same as those of LIBOR. There is no guarantee that the Secured Overnight Financing Rate is a comparable substitute for LIBOR.

In June 2017, the New York Federal Reserve’s Alternative Reference Rates Committee (the “ARRC”) announced the Secured Overnight Financing Rate as its recommended alternative to U.S. dollar LIBOR. However, the composition and characteristics of the Secured Overnight Financing Rate are not the same as those of LIBOR. The Secured Overnight Financing Rate is a broad Treasury repo financing rate that represents overnight secured funding transactions. This means that the Secured Overnight Financing Rate is fundamentally different from LIBOR for two key reasons. First, the Secured Overnight Financing Rate is a secured rate, while LIBOR is an unsecured rate. Second, the Secured Overnight Financing Rate is an overnight rate, while LIBOR represents interbank funding over different maturities. As a result, there can be no assurance that the Secured Overnight Financing Rate will perform in the same way as LIBOR would have at any time, including, without limitation, as a result of changes in interest and yield rates in the market, market volatility or global or regional economic, financial, political, regulatory, judicial or other events. For example, since publication of the Secured Overnight Financing Rate began on April 3, 2018, daily changes in the Secured Overnight Financing Rate have, on occasion, been more volatile than daily changes in comparable benchmark or other market rates. The return on and value of any SOFR notes may fluctuate more than floating rate securities that are linked to less volatile rates. In addition, the volatility of the Secured Overnight Financing Rate has reflected the underlying volatility of the overnight U.S. Treasury repo market. The New York Federal Reserve has at times conducted operations in the overnight U.S. Treasury repo market in order to help maintain the federal funds rate within a target range. There can be no assurance that the New York Federal Reserve will continue to conduct such operations in the future, and the duration and extent of any such operations is inherently uncertain. The effect of any such operations, or of the cessation of such operations to the extent they are commenced, is uncertain and could be materially adverse to investors in the SOFR notes. For additional information regarding the Secured Overnight Financing Rate, see “Description of Notes—Secured Overnight Financing Rate” below.

The secondary trading market for notes linked to the Secured Overnight Financing Rate may be limited.

SOFR notes will not have an established trading market when issued. Since the Secured Overnight Financing Rate is a relatively new market rate, an established trading market may never develop or may not be very liquid. Market terms for debt securities that are linked to the Secured Overnight Financing Rate may evolve over time and, as a result, trading prices of any SOFR notes may be lower than those of later-issued debt securities that are linked to the Secured Overnight Financing Rate. Similarly, if the Secured Overnight Financing Rate does not prove to be widely used in debt securities that are similar to the SOFR notes, the trading price of such notes may be lower than that of debt securities that are linked to rates that are more widely used. Investors in such notes may not be able to sell their notes at all or may not be able to sell their notes at prices that will provide them with a yield comparable to similar investments that have a developed secondary market. Further, investors wishing to sell such notes in the secondary market will have to make assumptions as to the future performance of the Secured Overnight Financing Rate during the applicable Interest Period in which they intend the sale to take place. As a result, investors may suffer from increased pricing volatility and market risk.

The manner of adoption or application of reference rates based on the Secured Overnight Financing Rate in the bond markets may differ materially compared with the application and adoption of the Secured Overnight Financing Rate in other markets, such as the derivatives and loan markets. Investors should carefully consider how any potential inconsistencies between the adoption of reference rates based on the Secured Overnight Financing Rate across these markets may impact any hedging or other financial arrangements which they may put in place in connection with any acquisition, holding or disposal of securities that are linked to the Secured Overnight Financing Rate.

The administrator of the Secured Overnight Financing Rate may make changes that could change the value of the Secured Overnight Financing Rate or discontinue the Secured Overnight Financing Rate and has no obligation to consider your interests in doing so.

The New York Federal Reserve, as administrator of the Secured Overnight Financing Rate, may make methodological or other changes that could change the value of the Secured Overnight Financing Rate, including changes related to the method by which the Secured Overnight Financing Rate is calculated, eligibility criteria applicable to the transactions used to calculate the Secured Overnight Financing Rate, or timing related to the publication of the Secured Overnight Financing Rate. If the manner in which the Secured Overnight Financing Rate is calculated is changed, that change may result in a reduction of the amount of interest payable on any SOFR notes, which may adversely affect the trading prices of such notes. In addition, the administrator may alter, discontinue or suspend calculation or dissemination of the Secured Overnight Financing Rate (in which case a fallback method of determining the interest rate on SOFR notes as further described under “Description of Notes—Interest Rate— Floating Rate Notes—SOFR Notes” will apply). The administrator has no obligation to consider your interests in calculating, adjusting, converting, revising or discontinuing the Secured Overnight Financing Rate.

SOFR notes may bear interest by reference to a rate other than Compounded SOFR, which could adversely affect the value of such notes.

If the manner in which the Secured Overnight Financing Rate is calculated, is changed, that change may result in a reduction in the amount of interest payable on SOFR notes and the trading prices of such notes. In addition, the New York Federal Reserve may withdraw, modify or amend the published Secured Overnight Financing Rate data in its sole discretion and without notice and such modifications or amendments will apply to future determinations of the interest rate for such notes. With respect to any SOFR notes, the interest rate for any Interest Period may not be adjusted for any modifications or amendments to Secured Overnight Financing Rate data that the New York Federal Reserve may publish after the interest rate for that Interest Period has been determined.

If the Secured Overnight Financing Rate is discontinued, SOFR notes will bear interest by reference to a different base rate with, potentially a spread adjustment, which could adversely affect the value of such notes, the return on such notes and the price at which you can sell such notes; there is no guarantee that any replacement base rate will be a comparable substitute for the Secured Overnight Financing Rate.

Under certain circumstances, the interest rate on SOFR notes will no longer be determined by reference to the Secured Overnight Financing Rate, but instead will be determined by reference to a different rate, which will be a different Benchmark than the Secured Overnight Financing Rate plus a spread adjustment, which is referred to as a “Benchmark Replacement” and a “Benchmark Replacement Adjustment,” respectively.

If a particular Benchmark Replacement or Benchmark Replacement Adjustment cannot be determined, then the next-available Benchmark Replacement or Benchmark Replacement Adjustment will apply. These replacement rates and adjustments may be selected, recommended or formulated by (i) the Relevant Governmental Body (such as the ARRC), (ii) ISDA (as defined herein) or (iii) in certain circumstances, us or our designee. In addition, the terms of SOFR notes we may issue will expressly authorize us or our designee to make Benchmark Replacement Conforming Changes with respect to, among other things, the definition of “Interest Period,” timing and frequency of determining rates and making payments of interest and other administrative matters. The determination of a Benchmark Replacement, the calculation of the interest rate on the notes by reference to a Benchmark Replacement (including the application of a Benchmark Replacement Adjustment), any implementation of Benchmark Replacement Conforming Changes and any other determinations, decisions or elections that may be made under the terms of such notes in connection with a Benchmark Transition Event could adversely affect the value of such notes, the return on such notes and the price at which you can sell such notes.

In addition, (i) the composition and characteristics of the Benchmark Replacement will not be the same as those of the Secured Overnight Financing Rate, the Benchmark Replacement will not be the economic equivalent of the Secured Overnight Financing Rate, there can be no assurance that the Benchmark Replacement will perform in the same way as the Secured Overnight Financing Rate would have at any time and there is no guarantee that the Benchmark Replacement will be a comparable substitute for the Secured Overnight Financing Rate (each of which means that a Benchmark Transition Event could adversely affect the value of any SOFR notes, the return on any SOFR notes and the price at which you can sell any SOFR notes), (ii) any failure of the Benchmark Replacement to gain market acceptance could adversely affect any SOFR notes, (iii) the Benchmark Replacement may have a more limited history and the future performance of the Benchmark Replacement cannot be predicted based on historical performance, (iv) the secondary trading market for any notes linked to the Benchmark Replacement may be limited, (v) the administrator of the Benchmark Replacement may make changes that could change the value of the Benchmark Replacement or discontinue the Benchmark Replacement and has no obligation to consider your interests in doing so and (vi) the Benchmark Replacement Adjustment may be zero or may not be adequate to compensate you for use of the Benchmark Replacement.

We or our designee will have authority to make determinations, elections, calculations and adjustments that could affect the value of and your return on any SOFR notes.

We or our designee will make determinations, decisions, elections, calculations and adjustments with respect to SOFR notes as set forth under “Description of Notes—Interest Rate—Floating Rate Notes—SOFR Notes” below that may adversely affect the value of and your return on the SOFR notes. In addition, we or our designee may determine the Benchmark Replacement and the Benchmark Replacement Adjustment and can apply any Benchmark Replacement Conforming Changes deemed reasonably necessary to adopt the Benchmark Replacement. Although we or our designee will exercise judgment in good faith when performing such functions, potential conflicts of interest may exist between us or our designee and you. All determinations, decisions and elections by us or our designee are in our or the designee’s sole discretion and will be conclusive for all purposes and binding on us and holders of the SOFR notes absent manifest error. Further, notwithstanding anything to the contrary in the documentation relating to the SOFR notes, all determinations, decisions and elections by us or our designee will become effective without consent from the holders of the SOFR notes or any other party. In making the determinations, decisions and elections noted under “Description of Notes—Interest Rate—Floating Rate Notes —SOFR Notes” below, we or our designee may have economic interests that are adverse to your interests, and such determinations, decisions, elections, calculations and adjustments may adversely affect the value of and your return on the SOFR notes. Because the Benchmark Replacement is uncertain, we or our designee are likely to exercise more discretion in respect of calculating interest payable on the SOFR notes than would be the case in the absence of a Benchmark Transition Event and its related Benchmark Replacement Date. These potentially subjective determinations may adversely affect the value of the SOFR notes, the return on the SOFR notes and the price at which you can sell the SOFR notes.

Reform of EURIBOR and other “Benchmarks” may adversely impact the debt securities.

The Euro Interbank Offered Rate (“EURIBOR”) and other rates or indices which are deemed to be “benchmarks” are the subject of recent national, international, and other regulatory guidance and proposals for reform. Some of these reforms are already effective, while others are still to be implemented. These reforms may cause such benchmarks to perform differently than in the past, or to disappear entirely, or to have other consequences which cannot be predicted. Any such consequence could have a material adverse effect on any debt securities linked to such a “benchmark,” and could, among other things, reduce the payments on those debt securities. Uncertainty as to the nature of potential changes, alternative reference rates or spread adjustments or other reforms may adversely affect the trading market for the notes.

DESCRIPTION OF NOTES

The notes we are offering by this prospectus supplement constitute a part of a series of debt securities for purposes of the indenture dated as of March 29, 2023. The notes will be on a parity in all respects with all debt securities issued under the indenture. For a description of the indenture and the rights of the holders of securities under the indenture, including the notes, see “Description of Debt Securities We May Offer” in the accompanying prospectus.

The following description of the particular terms of the notes we are offering supplements, and to the extent inconsistent replaces, the description of the general terms and provisions of debt securities described in the accompanying prospectus, and we refer you to that description. The terms and conditions described in this section “Description of Notes” will apply to each note unless we otherwise specify in the applicable pricing supplement. Certain terms used in this prospectus supplement have the meanings given to those terms in the prospectus.

Unless we otherwise indicate in the applicable pricing supplement, currency amounts in this prospectus supplement, the accompanying prospectus and any pricing supplement are stated in U.S. dollars.

Legal Ownership

“Street Name” and Other Indirect Holders

Investors who hold notes in accounts at banks or brokers will generally not be recognized by us as legal holders of notes. This is called holding in “street name.” Instead, we would recognize only the bank or broker, or the financial institution the bank or broker uses to hold its notes. These intermediary banks, brokers and other financial institutions pass along principal, interest and other payments on the notes, either because they agree to do so in their customer agreements or because they are legally required to. If you hold notes in “street name,” you should check with your own institution to find out:

| · | How it handles securities payments and notices. |

| · | Whether it imposes fees or charges. |

| · | How it would handle voting if ever required. |

| · | Whether and how you can instruct it to send you notes registered in your own name so you can be a direct holder as described below. |

| · | How it would pursue rights under the notes if there were a default or other event triggering the need for holders to act to protect their interests. |

Direct Holders

Our obligations, as well as the obligations of the trustee and those of any third parties employed by us or the trustee, run only to those persons who are registered as holders of notes. As noted above, we do not have obligations to you if you hold in “street name” or through other indirect means, either because you choose to hold notes in that manner or because the notes are issued in the form of “global securities” as described below. For example, once we make payment to the registered holder, we have no further responsibility for the payment even if that holder is legally required to pass the payment along to you as a “street name” customer but does not do so.

Global Securities

What Is a Global Security? A “global security” is a special type of indirectly held security, as described in “Street Name and Other Indirect Holders.” The ultimate beneficial owners can only be indirect holders of those notes we issue in the form of global securities. We do this by requiring that the global security be registered in the name of a financial institution we select and by requiring that the notes included in the global security not be transferred to the name of any other direct holder unless the special circumstances described below occur. The financial institution that acts as the sole direct holder of the global security is called the “depositary.” Any person wishing to own a note must do so indirectly by virtue of an account with a broker, bank or other financial institution that in turn has an account with the depositary. In general, as described further under “Book-Entry System” below, each series of notes will be issued only in the form of global securities.

Special Investor Considerations for Global Securities. As an indirect holder, an investor’s rights relating to a global security will be governed by the account rules of the investor’s financial institution and of the depositary, as well as general laws relating to securities transfers. We do not recognize this type of investor as a holder of notes and instead deal only with the depositary that holds the global security.

An investor should be aware that if notes are issued only in the form of global securities:

| · | The investor cannot get notes registered in his or her own name. |

| · | The investor cannot receive physical certificates for his or her interest in the notes. |

| · | The investor will be a “street name” holder and must look to his or her own bank or broker for payments on the notes and protection of his or her legal rights relating to the notes. See “Street Name and Other Indirect Holders” above. |

| · | The investor may not be able to sell interests in the notes to some insurance companies and other institutions that are required by law to own their securities in the form of physical certificates. |

| · | The depositary’s policies will govern payments, transfers, exchange and other matters relating to the investor’s interest in the global security. Neither we nor the trustee have responsibility for any aspect of the depositary’s actions or for its records of ownership interests in the global security and neither we nor the trustee supervise the depositary in any way. |

| · | The depositary will require that interests in a global security be purchased or sold within its system using same-day funds for settlement. |

Special Situations When Global Security will be Terminated. In a few special situations, the global security will terminate and interests in it will be exchanged for physical certificates representing notes (called “certificated notes”). After that exchange, the choice of whether to hold notes directly or in “street name” will be up to the investor. Investors must consult their own banks or brokers to find out how to have their interests in notes transferred to their own name, so that they will be direct holders. The rights of “street name” investors and direct holders in the notes have been previously described in the subsections entitled “Street Name and Other Indirect Holders” and “Direct Holders” above. The special situations for termination of a global security are described under “Book-Entry System” below. When a global security terminates, the depositary (and not us or the trustee) is responsible for deciding which institutions will be the initial direct holders.

General Features of the Notes

The notes will be unsecured obligations of Caterpillar Financial and will be issued only in the form of one or more global securities registered in the name of a nominee of The Depository Trust Company, as depositary, except for foreign currency notes and except as specified in “Book-Entry System” below. Foreign currency notes may be represented either by global notes or by certificated notes, as specified in the applicable pricing supplement. As used in this prospectus supplement, the term “holder” means those who own notes registered in their own names and not those who own beneficial interests in notes registered in “street name” or in notes represented by a global note or notes issued in “book-entry” form through the depository. For more information on certificated and global notes, see “Legal Ownership” above and “Book-Entry System” below.

Each note will be denominated either in U.S. dollars or in one or more foreign or composite currencies or currency units. The U.S. dollar equivalent of foreign currency notes, called the market exchange rate, will be determined by the exchange rate agent, as identified below, on the basis of the noon buying rate for cable transfers in The City of New York, as determined by the Federal Reserve Bank of New York for such currencies on the business day immediately preceding the applicable issue dates. The term “business day” has a special meaning described below. Special United States federal income tax considerations apply to foreign currency notes and are described below under “Certain United States Federal Income Tax Consequences—United States Holders—Nonfunctional Currency Notes.”

The notes will be offered on a continuous basis and will mature nine months or more from the date of issue, as selected by the initial purchaser and agreed to by us.

The notes may be issued as original issue discount notes. An original issue discount note is a note, including any zero-coupon note, which is issued at a price lower than its principal amount and provides that, upon redemption or acceleration of its maturity, an amount less than its principal amount will be payable. For additional information regarding payments upon acceleration of the maturity of an original issue discount note and regarding the United States federal tax considerations of original issue discount notes, see “Payment of Principal and Interest” and “Certain United States Federal Income Tax Consequences—United States Holders—Original Issue Discount.” Original issue discount notes will be treated as original issue discount securities for purposes of the indenture.

Purchasers are required to pay for foreign currency notes in U.S. dollars, a foreign currency or other composite currency unit, as specified in the applicable pricing supplement. Such foreign currency or other composite currency unit is called the specified currency. At the present time there are limited facilities in the United States for the conversion of U.S. dollars into foreign currencies and vice versa, and banks generally do not offer non-U.S. dollar checking or savings account facilities in the United States. However, if a purchaser of notes requests the agent who presented the offer to purchase foreign currency notes to us, on or prior to the fifth business day preceding the date of delivery of these foreign currency notes, or by such other day as determined by the agent, the agent is prepared to arrange for the conversion of U.S. dollars into the specified currency described in the applicable pricing supplement to enable the purchasers to pay for the notes. Each such conversion will be made by the applicable agent on terms and subject to conditions, limitations and charges as the applicable agent may from time to time establish in accordance with its regular foreign exchange practices. All costs of exchange will be borne by the purchasers of the notes. See “Special Provisions Relating to Foreign Currency Notes.”

The notes may be registered for transfer or exchange at the principal office of the Corporate Trust Department of U.S. Bank Trust National Association (formerly First Trust of New York, National Association) (the “trustee”) in The City of New York. The transfer or exchange of global notes will be effected as specified in “Book-Entry System” below.

Except as described in “Description of Debt Securities We May Offer—Certain Restrictions—Restrictions on Liens and Encumbrances” in the accompanying prospectus, the indenture does not contain any provision which will restrict us from incurring, assuming or becoming liable with respect to any indebtedness or other obligations. In addition, although the support agreement between Caterpillar Inc. and us does provide that Caterpillar Inc. will ensure that we will maintain a tangible net worth of at least $20 million and will maintain a ratio of earnings and interest expense to interest expense of not less than 1.15 to 1, the indenture does not contain any provision which would afford holders of the notes other protection upon the occurrence of a highly leveraged transaction involving Caterpillar Financial which may adversely affect the creditworthiness of the notes. See “Description of Debt Securities We May Offer—Certain Restrictions” in the accompanying prospectus.

As used in this prospectus supplement, business day means, with respect to any note, any day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which commercial banks are authorized or required by law, regulation or executive order to close in The City of New York; however

| · | if the note is denominated in a specified currency other than U.S. dollars, the day must also not be a day on which commercial banks are authorized or required by law, regulation or executive order to close in the principal financial center of the country issuing the specified currency (but if the specified currency is the Euro, the day must also be a day on which the Trans-European Automated Real-Time Gross Settlement Express Transfer (TARGET) System, or any successor thereto, is open (a “target settlement day”)), and |

| · | with respect to EURIBOR notes, the day must also be a target settlement day. |

As used in the preceding sentence, principal financial center means the capital city of the country issuing the specified currency, except that with respect to the following currencies, the financial center shall be the city listed next to each currency:

| Currency | Financial Center |

| U.S. dollars | The City of New York |

| Australian dollars | Sydney |

| Canadian dollars | Toronto |

| South African rand | Johannesburg |

| Swiss francs | Zurich |

Payment of Principal and Interest

Unless we otherwise specify in the applicable pricing supplement, payments of principal of, and premium, if any, and interest on all notes will be made in the applicable specified currency, provided, however, that payments of principal of, and premium, if any, and interest on foreign currency notes will nevertheless be made in U.S. dollars:

| · | if the foreign currency notes are certificated notes, at the option of the holders of these notes under the procedures described below, and |

| · | if the foreign currency notes are global notes, unless the depositary has received notice from any of its participants of their election to receive payment in the specified currency as provided in “Book-Entry System” below, and |

| · | at our option if the specified currency is unavailable, in our good faith judgment, due to the imposition of exchange controls or other circumstances beyond our control. |

See “Special Provisions Relating to Foreign Currency Notes—Payment Currency,” for further information regarding payment of foreign currency notes.

Where payments of principal and premium, if any, and interest at maturity are to be made in U.S. dollars, payments will be made in immediately available funds, provided that the note is presented to the trustee in time for the trustee to make the payments in such funds in accordance with its normal procedures. Payments of interest, other than interest payable at maturity, to be made in U.S. dollars with respect to global notes will be paid in immediately available funds to the depositary or its nominee. The depositary will allocate payments relating to a global note and make payments to the owners or holders of the global notes in accordance with its existing operating procedures. Neither we nor the trustee shall have any responsibility or liability for these payments by the depositary. So long as the depositary or its nominee is the registered owner of any global note, the depositary or its nominee will be considered the sole owner or holder of such note for all purposes under the indenture.

Where payments of interest and, in the case of amortizing notes, principal and premium, if any, with respect to any certificated note, other than amounts payable at maturity, are to be made in U.S. dollars, the payments will be paid by check mailed to the address of the person entitled to the payments as it appears in the security register. However, unless otherwise specified in the pricing supplement, a holder of $10,000,000 or more in aggregate principal amount of certificated notes having the same provisions shall be entitled to receive such payment of interest in U.S. dollars by wire transfer of immediately available funds to such account with a bank located in the United States as such holder designates in writing, but only if appropriate payment instructions have been received in writing by the trustee on or prior to the regular record date for such certificated notes.

Unless we otherwise indicate in the applicable pricing supplement, payments of principal and premium, if any, and interest with respect to any note to be made in a specified currency other than U.S. dollars will be paid in immediately available funds by wire transfer to such account maintained by the holder with a bank designated by the holder, which in the case of global notes will be the depositary or its nominee, on or prior to the regular record date or at least 15 days prior to maturity, as the case may be, provided that such bank has the appropriate facilities for such a payment in the specified currency. However, it is also necessary that, with respect to payments of principal and premium, if any, and interest at maturity, the note is presented to the trustee in time for the trustee to make such payment in accordance with its normal procedures, which shall require presentation no later than two business days prior to maturity in order to ensure the availability of immediately available funds in the specified currency at maturity. A holder must make such designation by filing the appropriate information with the trustee and, unless revoked, any such designation made with respect to any note will remain in effect with respect to any further payments payable to such holder with respect to such note.

Unless we otherwise specify in the applicable pricing supplement, if we redeem any original issue discount note as described below under “Redemption and Repurchase,” or we repay any such note at the option of the holder as described below under “Repayment at Option of Holder,” or if the principal of any such note is declared to be due and payable immediately as described in the accompanying prospectus under “Description of Debt Securities We May Offer—Events of Default and Notices,” the amount of principal due and payable with respect to that note shall be limited to the sum of the aggregate principal amount of such note multiplied by the issue price, expressed as a percentage of the aggregate principal amount, plus the original issue discount accrued from the date of issue to the date of redemption, repayment or declaration, as applicable, which accrual shall be calculated using the “interest method,” computed in accordance with generally accepted accounting principles, in effect on the date of redemption, repayment or declaration, as applicable.

If we so specify in the applicable pricing supplement, payments of principal and premium, if any, and interest with respect to any foreign currency note which is a certificated note will be made in U.S. dollars if the holder of such note elects to receive all such payments in U.S. dollars by delivery of a written request to the trustee either on or prior to the regular record date for such certificated note or at least 15 days prior to maturity. Such election may be in writing, mailed or hand delivered, or by facsimile transmission. A holder of a foreign currency note which is a certificated note may elect to receive payment in U.S. dollars for all principal, premium, if any, and interest payments and need not file a separate election for each payment. Such election will remain in effect until revoked by written notice to the trustee, but written notice of such revocation must be received by the trustee either on or prior to the regular record date or at least 15 days prior to maturity.

Holders of foreign currency notes whose notes are held in the name of a broker or nominee should contact such broker or nominee to determine whether and how an election to receive payments in U.S. dollars may be made. Holders of foreign currency notes which are global notes will receive payments in U.S. dollars unless they notify the depositary of their election to receive payments in the specified currency. See “Book-Entry System” for further information regarding payment arrangements with respect to such notes.

The U.S. dollar amount to be received by a holder of a foreign currency note will be based upon the exchange rate as determined by the exchange rate agent based on the highest firm bid quotation for U.S. dollars received by such exchange rate agent at approximately 11:00 a.m., New York City time, on the second business day preceding the applicable payment date from three recognized foreign exchange dealers in The City of New York selected by the exchange rate agent and approved by us, one of which may be the exchange rate agent, for the purchase by the quoting dealer, for settlement on such payment date, of the aggregate amount of the specified currency payable on such payment date in respect of all notes denominated in such specified currency. If no such bid quotations are available, payments will be made in the specified currency, unless such specified currency is unavailable due to the imposition of exchange controls or to other circumstances beyond our control, in which case payment will be made as described below under “Foreign Currency Risks—Payment Currency.” All currency exchange costs will be borne by the holders of such notes by deductions from such payments. Unless we otherwise specify in the applicable pricing supplement, U.S. Bank Trust National Association will be the exchange rate agent for the notes.

Interest Rate

Each note, other than a zero-coupon note, will bear interest from and including the date of issue, or in the case of notes issued upon registration of transfer or exchange from and including the most recent interest payment date to which interest on such note has been paid or duly provided for. Such interest will be payable at the fixed rate per annum, or at the rate per annum determined pursuant to the interest rate formula or formulas, stated in such note and in the applicable pricing supplement until the principal of such note is paid or made available for payment. Interest will be payable on each interest payment date and at maturity. Interest will be payable to the person in whose name a note is registered at the close of business on the regular record date next preceding each interest payment date; provided, however, that interest payable at maturity will be payable to the person to whom principal shall be payable. The first payment of interest on any note originally issued between a regular record date and an interest payment date will be made on the interest payment date following the next succeeding regular record date to the registered owner of such note on such next succeeding regular record date.

Unless otherwise specified in the applicable pricing supplement, the regular record date with respect to floating rate notes, as such notes are further described in the last paragraph of this subsection, shall be the date 15 calendar days prior to such interest payment date, whether or not such date shall be a business day. Unless otherwise specified in the applicable pricing supplement, the regular record dates with respect to fixed rate notes, as such notes are further described in the last paragraph of this subsection, shall be the fifteenth calendar day (whether or not a business day) next preceding the applicable interest payment date.

Interest rates we offer on the notes may differ depending upon, among other things, the aggregate principal amount of notes purchased in any single transaction. Interest rates, interest rate formulas and other variable terms of the notes are subject to change by us from time to time, but no such change will affect any note already issued or as to which an offer to purchase has been accepted by us.

Unless otherwise specified in the applicable pricing supplement, each note, other than a zero-coupon note, will bear interest at either (a) a fixed rate, in which case the note is a fixed rate note, or (b) a variable rate, in which case the note is a floating rate note.

Fixed Rate Notes

The applicable pricing supplement relating to a fixed rate note will designate a fixed rate of interest per annum payable on such fixed rate note, which rate will also be stated on the face of such note. Each fixed rate note will bear interest from the date of issue, or in the case of notes issued upon registration of transfer or exchange, from the most recent interest payment date to which interest on such note has been paid or duly provided for, at such per annum rate. The applicable pricing supplement relating to a fixed rate note will specify the dates on which interest is payable on such fixed rate note, called the interest payment dates.

Unless we otherwise specify in the applicable pricing supplement, interest payments, if any, on a fixed rate note will be the amount of interest accrued from and including the last date in respect of which interest has been paid or duly provided for, or from and including the date of issue if no interest has been paid or provided for with respect to such note, to but excluding the interest payment date or the date of maturity. Unless otherwise specified in the applicable pricing supplement, interest on fixed rate notes will be computed on the basis of a 360-day year of twelve 30-day months. Interest on fixed rate notes will be payable generally to the person in whose name such a note is registered at the close of business on the regular record date.

If the interest payment date or the maturity for any fixed rate note falls on a day that is not a business day, the payment of principal, premium, if any, and interest may be made on the next succeeding business day, and no interest on such payment shall accrue for the period from and after such interest payment date or maturity, as the case may be.

Floating Rate Notes

Unless we otherwise specify in the applicable pricing supplement, each floating rate note will bear interest at a variable rate determined by reference to an interest rate formula or formulas, which may be adjusted by adding or subtracting the spread and/or multiplying by the spread multiplier, each as described below. A floating rate note may also have either or both of the following: (a) a maximum numerical interest rate limitation, or ceiling, on the rate of interest which may accrue during any interest period; and (b) a minimum numerical interest rate limitation, or floor, on the rate of interest which may accrue during any interest period. The spread is the number of basis points to be added to or subtracted from the related interest rate basis or bases applicable to a floating rate note. The spread multiplier is the percentage of the related interest rate basis or bases applicable to a floating rate note by which the interest rate basis or bases will be multiplied to determine the applicable interest rate. The index maturity is the period to maturity of the instrument or obligation with respect to which the related interest rate basis or bases will be calculated, as specified in the applicable pricing supplement.

The applicable pricing supplement relating to a floating rate note will designate an interest rate basis or bases for such floating rate note. Such basis or bases may be:

| · | the CD Rate, in which case such note will be a CD Rate note, |

| · | the CMT Rate, in which case such note will be a CMT Rate note, |

| · | the Commercial Paper Rate, in which case such note will be a Commercial Paper Rate note, |

| · | the Eleventh District Cost of Funds Rate, in which case such note will be a Eleventh District Cost of Funds Rate note, |

| · | EURIBOR, in which case such note will be a EURIBOR note, |

| · | the Federal Funds Rate, in which case such note will be a Federal Funds Rate note, |

| · | the Prime Rate, in which case such note will be a Prime Rate note, |

| · | the Secured Overnight Financing Rate, in which case such note will be a SOFR note, |

| · | the Treasury Rate, in which case such note will be a Treasury Rate note, or |

| · | such other interest rate formula or formulas (which may include a combination of more than one of the interest rate bases described above) as may be described in such pricing supplement. |

We will also specify in the applicable pricing supplement for a floating rate note the spread and/or spread multiplier, if any, and the maximum or minimum interest rate limitation, if any, applicable to each note. In addition, in such pricing supplement we will define or particularize for each note the following terms, if applicable: initial interest rate, interest payment dates, index maturity, designated CMT maturity index, designated CMT Reuters page and interest reset date or dates with respect to that note.

Change of Interest Rate. Unless we otherwise specify in the applicable pricing supplement, the rate of interest on each floating rate note will be reset daily, weekly, monthly, quarterly, semi-annually or annually, each an interest reset date, as specified in the applicable pricing supplement. Unless otherwise indicated in the applicable pricing supplement, the interest reset date will be as follows:

| · | in the case of floating rate notes which reset daily, each business day; |

| · | in the case of floating rate notes, other than the Treasury Rate notes, which reset weekly, the Wednesday of each week; |

| · | in the case of Treasury Rate notes which reset weekly, the Tuesday of each week (except as described below); |

| · | in the case of floating rate notes which reset monthly, the third Wednesday of each month, with the exception of monthly reset floating rate notes as to which the Eleventh District Cost of Funds Rate is an applicable interest rate basis, which will reset on the first calendar day of the month; |

| · | in the case of floating rate notes which reset quarterly, the third Wednesday of March, June, September and December of each year; |

| · | in the case of floating rate notes which reset semi-annually, the third Wednesday of the two months of each year specified in the applicable pricing supplement; and |

| · | in the case of floating rate notes which reset annually, the third Wednesday of one month of each year specified in the applicable pricing supplement. |

In any event, the interest rate in effect from the date of issue to the first interest reset date with respect to a floating rate note will be the initial interest rate, as described in the applicable pricing supplement. If any interest reset date for any floating rate note would otherwise be a day that is not a business day for such floating rate note, the interest reset date for such floating rate note shall be postponed to the next day that is a business day for such floating rate note. However, in the case of EURIBOR notes and SOFR notes, if such business day is in the next succeeding calendar month, such interest reset date shall be the immediately preceding business day.

Date Interest Rate Is Determined. Unless we otherwise specify in the applicable pricing supplement, the interest determination date pertaining to an interest reset date for a Federal Funds Rate note will be the applicable interest reset date, the interest determination date for a Prime Rate note will be the business day preceding the interest reset date with respect to such note and the interest determination date for a CD Rate note and a Commercial Paper Rate note will be the second business day preceding the interest reset date with respect to such note.

Unless we otherwise specify in the applicable pricing supplement, the interest determination date pertaining to an interest reset date for a CMT Rate note will be the second U.S. Government Securities Business Day preceding such interest reset date. Unless we otherwise specify in the applicable pricing supplement, U.S. Government Securities Business Day means any day except for a Saturday, Sunday or a day on which The Securities Industry and Financial Markets Association recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

Unless we otherwise specify in the applicable pricing supplement, the interest determination date pertaining to an interest reset date for a Eleventh District Cost of Funds Rate note will be the last business day of the month immediately preceding such interest reset date on which the Federal Home Loan Bank of San Francisco publishes the Index, as defined below under “—Eleventh District Cost of Funds Rate Notes.”

Unless we otherwise specify in the applicable pricing supplement, the interest determination date pertaining to an interest reset date for a EURIBOR note will be the second target settlement day preceding such interest reset date.

Unless we otherwise specify in the applicable pricing supplement, the interest determination date pertaining to an interest reset date for a SOFR note will be the second U.S. Government Securities Business Day prior to each interest payment date.

Unless we otherwise specify in the applicable pricing supplement, the interest determination date pertaining to an interest reset date for a Treasury Rate note will be the day of the week in which such interest reset date falls on which Treasury bills would normally be auctioned. Treasury bills are usually sold at auction on Monday of each week, unless that day is a legal holiday, in which case the auction is usually held on the following Tuesday, except that such auction may be held on the preceding Friday. If, as the result of a legal holiday, an auction is so held on the preceding Friday, such Friday will be the Treasury Rate note interest determination date pertaining to the interest reset date occurring in the next succeeding week. If the interest determination date would otherwise fall on an interest reset date, then this interest reset date will be postponed to the next succeeding business day. The interest determination date pertaining to a floating rate note the interest rate of which is determined by reference to two or more interest rate bases will be the latest business day which is at least two business days before the related interest reset date for the applicable floating rate note on which each interest rate basis is determinable. Each interest rate basis will be determined as of that date, and the applicable interest rate will take effect on the applicable interest reset date.

Payment of Interest. Unless we otherwise indicate in the applicable pricing supplement and except as provided below, interest will be payable as follows:

| · | in the case of floating rate notes which reset daily, weekly or monthly, on the third Wednesday of each month or on the third Wednesday of March, June, September and December of each year, as indicated in the applicable pricing supplement; |

| · | in the case of floating rate notes which reset quarterly, on the third Wednesday of March, June, September and December of each year; |

| · | in the case of floating rate notes which reset semi-annually, on the third Wednesday of the two months of each year specified in the applicable pricing supplement; |

| · | in the case of floating rate notes which reset annually, on the third Wednesday of the month specified in the applicable pricing supplement (each of the foregoing is an interest payment date); and |

| · | in each case, at maturity. |

If an interest payment date with respect to any floating rate note would otherwise fall on a day that is not a business day with respect to such note, such interest payment date will be postponed to the following day that is a business day with respect to such note, except that in the case of a EURIBOR note or a SOFR note, if such day falls in the next calendar month, such interest payment date will be the preceding day that is a business day with respect to such note. If the maturity of any floating rate note falls on a day that is not a business day, the payment of principal, premium, if any, and interest may be made on the next succeeding business day, and no interest on such payment shall accrue for the period from and after maturity.

Unless we otherwise specify in the applicable pricing supplement, interest payments, if any, on a floating rate note will be the amount of interest accrued from and including the last date in respect of which interest has been paid or duly provided for, or from and including the date of issue if no interest has been paid or provided for with respect to such note, to but excluding the interest payment date or the date of maturity.

With respect to a floating rate note, except as set forth below under “—SOFR Notes,” accrued interest is calculated by multiplying its principal amount by an accrued interest factor. The accrued interest factor is computed by adding the interest factor calculated for each day from the date of issue, or from the last date to which interest has been paid, to the date for which accrued interest is being calculated.

The interest factor for each day is computed by dividing the interest rate applicable to such day by 360, in the case of CD Rate notes, Commercial Paper Rate notes, Eleventh District Cost of Funds Rate notes, EURIBOR notes, Federal Funds Rate notes or Prime Rate notes, or by the actual number of days in the year, in the case of CMT Rate notes and Treasury Rate notes. The interest factor for floating rate notes as to which the interest rate is calculated with reference to two or more interest rate bases (excluding SOFR) will be calculated in each period in the same manner as if only the applicable interest rate basis specified in the applicable pricing supplement applied.

All percentages resulting from any calculation on floating rate notes will be rounded to the nearest one hundred-thousandth of a percentage point, with five-one millionths of a percentage point rounded upwards. For example, 9.876545% (or 0.09876545) would be rounded to 9.87655% (or 0.0987655). All dollar amounts used in or resulting from any calculation on floating rate notes will be rounded, in the case of U.S. dollars, to the nearest cent or, in the case of a foreign currency, to the nearest unit (with one-half cent or unit being rounded upwards).

In addition to any maximum interest rate which may be applicable to any floating rate note pursuant to the above provisions, the interest rate on the floating rate notes will in no event be higher than the maximum rate permitted by New York law, as the same may be modified by United States law of general application.

Unless we otherwise specify in the applicable pricing supplement, the calculation date pertaining to any interest determination date, other than with respect to SOFR notes, shall be the earlier of (i) the tenth calendar day after such interest determination date or, if any such day is not a business day, the next succeeding business day or (ii) the business day preceding the applicable interest payment date or maturity, as the case may be.

Upon the request of the holder of any floating rate note, the calculation agent, as described below, will provide the interest rate then in effect, to the extent then known, and, if different, the interest rate which will become effective as a result of a determination made on the most recent interest determination date with respect to such floating rate note. Unless otherwise provided in the applicable pricing supplement, U.S. Bank Trust National Association will be the calculation agent with respect to the floating rate notes. The determination of any interest rate by the calculation agent will be final and binding absent manifest error.

The interest rate(s) on the floating rate notes that are CD Rate notes, CMT Rate notes, Commercial Paper Rate notes, Eleventh District Cost of Funds Rate notes, EURIBOR notes, Federal Funds Rate notes, Prime Rate notes, SOFR notes, or Treasury Rate notes will be determined as described under the following captions, as applicable.

CD Rate Notes

CD Rate notes will bear interest at the interest rates, calculated with reference to the CD Rate and the spread and/or spread multiplier, if any, and will be payable on the dates, that we specify on the face of the CD Rate note and in the applicable pricing supplement.

Unless we otherwise indicate in the applicable pricing supplement, “CD Rate” means, with respect to any interest determination date relating to a CD Rate note (a CD interest determination date), the rate on such date for negotiable U.S. dollar certificates of deposit having the index maturity designated by us in the applicable pricing supplement as published in the H.15 Daily Update (as defined below), or other recognized electronic source used for the purpose of displaying the applicable rate, under the caption “CDs (secondary market).”

The following procedures will be followed if the CD Rate cannot be determined as described above:

| · | If the above rate is not published by 5:00 p.m., New York City time, on the calculation date pertaining to such CD interest determination date, the calculation agent will determine the CD Rate to be the arithmetic mean of the secondary market offered rates as of 10:00 a.m., New York City time, on such CD interest determination date, of three leading nonbank dealers in negotiable U.S. dollar certificates of deposit in The City of New York (which may include the agents or their affiliates) selected by the calculation agent for negotiable U.S. dollar certificates of deposit of major United States money market banks for negotiable U.S. dollar certificates of deposit with a remaining maturity closest to the index maturity in an amount that is representative for a single transaction in that market at that time. |

| · | If the dealers selected by the calculation agent are not quoting as mentioned above, the CD Rate will remain the CD Rate then in effect on such CD interest determination date. |

“H.15 Daily Update” means the Selected Interest Rates (Daily) – H.15 release, published by the Board of Governors of the Federal Reserve System and available on their website at http://www.federalreserve.gov/releases/h15/update/default.htm or any successor site or publication.

CMT Rate Notes

CMT Rate notes will bear interest at the interest rates, calculated with reference to the CMT Rate and the spread and/or spread multiplier, if any, and will be payable on the dates, that we specify on the face of the CMT Rate note and in the applicable pricing supplement.