UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04257

Deutsche DWS Variable Series I

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 12/31 |

| | |

| Date of reporting period: | 12/31/2024 |

| Item 1. | Reports to Stockholders. |

| | |

| | (a) |

0000764797 dws:DWSIndexRussell1000Index18678BroadBasedIndexMember 2019-11-30

DWS CROCI International VIP

Annual Shareholder Report—December 31, 2024

This annual shareholder report contains important information about DWS CROCI International VIP (the "Fund") for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund on the Fund's website at dws.com/vipreports. You can also request this information by contacting us at (800) 728-3337.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $85 | 0.84% |

|---|

Gross expense ratio as of the latest prospectus: 0.95%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. Fund costs do not reflect any fees or sales charges imposed by a variable contract for which the Fund is an investment option.

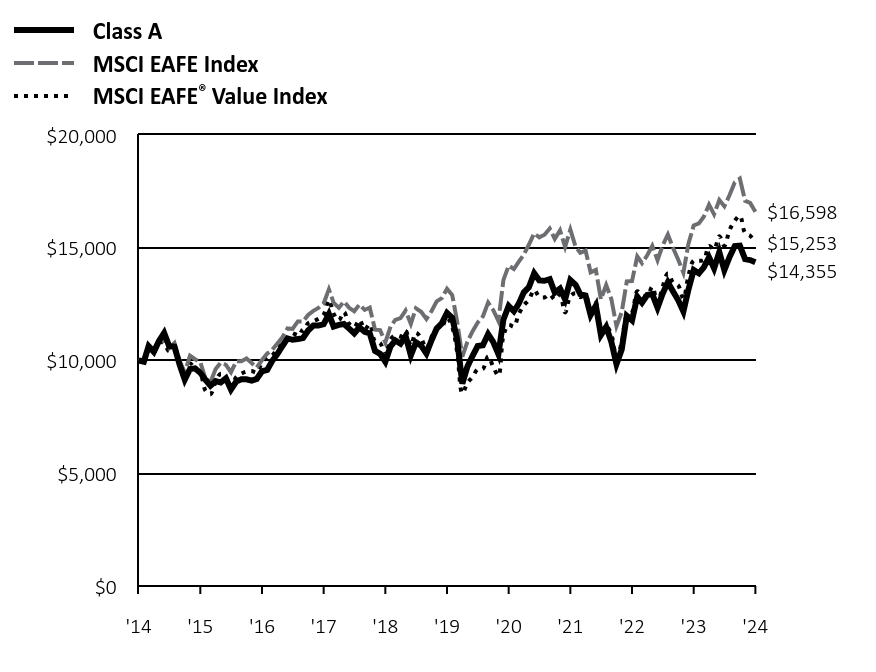

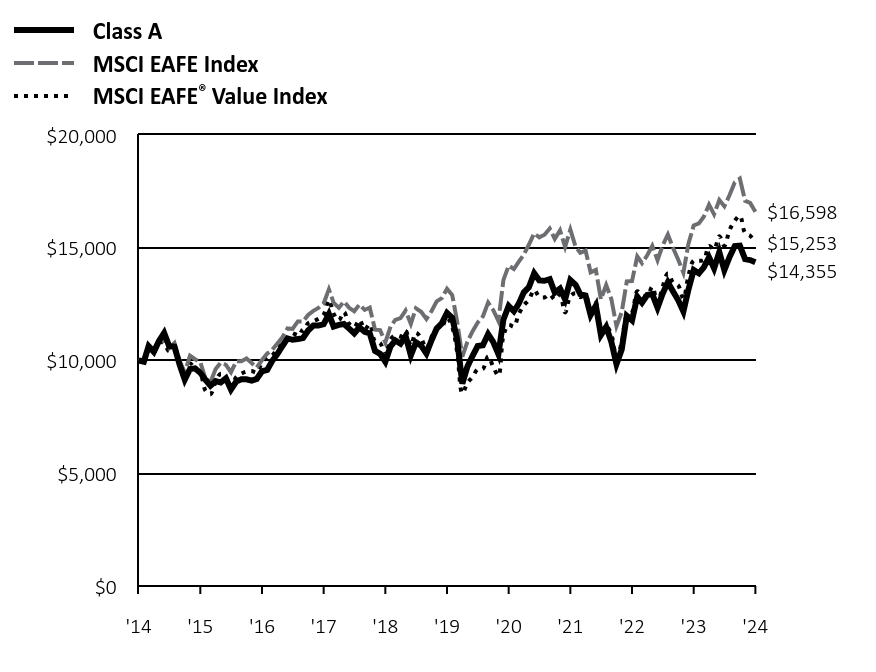

How did the Fund perform last year and what affected its performance?

Class A shares of the Fund returned 2.45% for the period ended December 31, 2024. The Fund's broad-based index, the MSCI EAFE Index, returned 3.82% for the same period, while the Fund's additional, more narrowly based index, the MSCI EAFE® Value Index, returned 5.68%.

Stock selection and sector allocation each played a role in the Fund’s underperformance relative to the MSCI EAFE® Value Index.

The weakest selection occurred in the information technology sector, primarily due to poor performance for the Netherlands-based semiconductor producer STMicroelectronics NV.* The stock trailed its industry peers due to softness in its auto and industrial end markets, together with weaker-than-expected earnings and reduced forward guidance. Infineon Technologies AG (2.5%), which was hurt by weakening electric vehicle sales and declining market share, was also a laggard in technology.

The industrials sector was another area of weakness. The stock price of the German chemicals producer Brenntag SE (0.7%) fell as profits came in below expectations due to the combination of weaker demand and intensifying pricing headwinds. The Dutch human resources consulting firm Randstad NV,* which was pressured by slower hiring trends, was a further detractor in industrials.

Outside of these two sectors, the largest detractors were the automaker Stellantis NV* and the Japanese healthcare companies Ono Pharmaceutical Co., Ltd.* and Shionogi & Co., Ltd. (4.3%).

In terms of sector allocations, an underweight in the financials sector was the leading detractor from performance. Overweights in consumer discretionary and materials also negatively affected returns. On the plus side, the Fund benefited from underweights in energy and utilities. A zero weighting in the underperforming real estate sector was an additional contributor.

Stock selection in materials contributed positively. The Swiss building materials producer Holcim AG (2.8%) gained ground on the strength of robust cash flows, growth related to the global decarbonization trend, and a recovery in its U.S. roofing business. Nitto Denko Corp. (1.6%), a Japanese maker of building products that was helped by better earnings visibility and a focus on shareholder returns, was also a top contributor in materials. Overseas-Chinese Banking Corp., Ltd. (5.3%), which topped estimates in an improving environment for the banking sector was the leading contributor in the Fund as a whole.

Percentages in parentheses are based on the Fund’s net assets as of December 31, 2024.

* Not held at December 31, 2024.

Cumulative Growth of an Assumed $10,000Investment

MSCI EAFE Index is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the US and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI EAFE Index is a broad-based index that represents the fund’s overall equity market. It replaces the MSCI EAFE® Value Index as the Fund’s broad-based index in compliance with updated regulatory requirements.

MSCI EAFE® Value Index captures large and mid-capitalization securities exhibiting overall value style characteristics across developed markets countries around the world, excluding the U.S. and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

The MSCI EAFE® Value Index is a more narrowly based index that reflects the market sector in which the fund invests.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

| Class A | MSCI EAFE Index | MSCI EAFE® Value Index |

|---|

| '14 | $10,000 | $10,000 | $10,000 |

|---|

| '15 | $9,949 | $10,049 | $9,972 |

|---|

| '15 | $10,636 | $10,650 | $10,597 |

|---|

| '15 | $10,382 | $10,488 | $10,389 |

|---|

| '15 | $10,853 | $10,916 | $10,848 |

|---|

| '15 | $11,223 | $10,860 | $10,743 |

|---|

| '15 | $10,628 | $10,552 | $10,411 |

|---|

| '15 | $10,615 | $10,772 | $10,592 |

|---|

| '15 | $9,809 | $9,979 | $9,796 |

|---|

| '15 | $9,148 | $9,472 | $9,185 |

|---|

| '15 | $9,624 | $10,213 | $9,862 |

|---|

| '15 | $9,650 | $10,054 | $9,617 |

|---|

| '15 | $9,452 | $9,919 | $9,432 |

|---|

| '16 | $9,135 | $9,201 | $8,664 |

|---|

| '16 | $8,883 | $9,033 | $8,497 |

|---|

| '16 | $9,082 | $9,620 | $9,057 |

|---|

| '16 | $9,021 | $9,899 | $9,414 |

|---|

| '16 | $9,213 | $9,809 | $9,265 |

|---|

| '16 | $8,712 | $9,480 | $8,805 |

|---|

| '16 | $9,065 | $9,960 | $9,267 |

|---|

| '16 | $9,168 | $9,967 | $9,417 |

|---|

| '16 | $9,168 | $10,090 | $9,509 |

|---|

| '16 | $9,110 | $9,883 | $9,531 |

|---|

| '16 | $9,183 | $9,687 | $9,472 |

|---|

| '16 | $9,522 | $10,018 | $9,905 |

|---|

| '17 | $9,580 | $10,308 | $10,149 |

|---|

| '17 | $9,963 | $10,456 | $10,219 |

|---|

| '17 | $10,272 | $10,744 | $10,505 |

|---|

| '17 | $10,632 | $11,017 | $10,725 |

|---|

| '17 | $10,980 | $11,421 | $10,973 |

|---|

| '17 | $10,917 | $11,401 | $11,006 |

|---|

| '17 | $10,948 | $11,730 | $11,375 |

|---|

| '17 | $10,996 | $11,726 | $11,304 |

|---|

| '17 | $11,328 | $12,017 | $11,652 |

|---|

| '17 | $11,549 | $12,200 | $11,743 |

|---|

| '17 | $11,549 | $12,328 | $11,848 |

|---|

| '17 | $11,613 | $12,526 | $12,029 |

|---|

| '18 | $12,056 | $13,154 | $12,679 |

|---|

| '18 | $11,502 | $12,560 | $12,076 |

|---|

| '18 | $11,581 | $12,334 | $11,785 |

|---|

| '18 | $11,619 | $12,615 | $12,149 |

|---|

| '18 | $11,412 | $12,332 | $11,622 |

|---|

| '18 | $11,204 | $12,181 | $11,475 |

|---|

| '18 | $11,476 | $12,481 | $11,804 |

|---|

| '18 | $11,268 | $12,240 | $11,375 |

|---|

| '18 | $11,204 | $12,346 | $11,610 |

|---|

| '18 | $10,421 | $11,364 | $10,839 |

|---|

| '18 | $10,293 | $11,349 | $10,779 |

|---|

| '18 | $9,941 | $10,798 | $10,252 |

|---|

| '19 | $10,628 | $11,508 | $10,938 |

|---|

| '19 | $10,884 | $11,801 | $11,120 |

|---|

| '19 | $10,740 | $11,876 | $11,063 |

|---|

| '19 | $11,084 | $12,210 | $11,321 |

|---|

| '19 | $10,228 | $11,623 | $10,666 |

|---|

| '19 | $10,804 | $12,313 | $11,234 |

|---|

| '19 | $10,656 | $12,157 | $10,981 |

|---|

| '19 | $10,310 | $11,842 | $10,530 |

|---|

| '19 | $10,887 | $12,181 | $11,038 |

|---|

| '19 | $11,414 | $12,619 | $11,436 |

|---|

| '19 | $11,644 | $12,761 | $11,482 |

|---|

| '19 | $12,106 | $13,176 | $11,901 |

|---|

| '20 | $11,892 | $12,900 | $11,471 |

|---|

| '20 | $10,936 | $11,734 | $10,385 |

|---|

| '20 | $8,976 | $10,168 | $8,545 |

|---|

| '20 | $9,728 | $10,825 | $9,003 |

|---|

| '20 | $10,209 | $11,296 | $9,276 |

|---|

| '20 | $10,637 | $11,681 | $9,607 |

|---|

| '20 | $10,672 | $11,953 | $9,626 |

|---|

| '20 | $11,169 | $12,568 | $10,189 |

|---|

| '20 | $10,826 | $12,241 | $9,721 |

|---|

| '20 | $10,277 | $11,752 | $9,330 |

|---|

| '20 | $11,821 | $13,574 | $11,097 |

|---|

| '20 | $12,422 | $14,205 | $11,588 |

|---|

| '21 | $12,182 | $14,054 | $11,498 |

|---|

| '21 | $12,508 | $14,369 | $12,046 |

|---|

| '21 | $13,022 | $14,700 | $12,451 |

|---|

| '21 | $13,253 | $15,142 | $12,689 |

|---|

| '21 | $13,868 | $15,636 | $13,128 |

|---|

| '21 | $13,552 | $15,460 | $12,826 |

|---|

| '21 | $13,534 | $15,576 | $12,795 |

|---|

| '21 | $13,604 | $15,851 | $12,939 |

|---|

| '21 | $13,007 | $15,391 | $12,702 |

|---|

| '21 | $13,183 | $15,769 | $12,904 |

|---|

| '21 | $12,708 | $15,035 | $12,128 |

|---|

| '21 | $13,569 | $15,805 | $12,850 |

|---|

| '22 | $13,358 | $15,041 | $12,984 |

|---|

| '22 | $12,936 | $14,776 | $12,808 |

|---|

| '22 | $12,884 | $14,871 | $12,893 |

|---|

| '22 | $12,016 | $13,908 | $12,241 |

|---|

| '22 | $12,433 | $14,013 | $12,542 |

|---|

| '22 | $11,126 | $12,713 | $11,294 |

|---|

| '22 | $11,489 | $13,346 | $11,529 |

|---|

| '22 | $10,818 | $12,712 | $11,140 |

|---|

| '22 | $9,838 | $11,523 | $10,141 |

|---|

| '22 | $10,491 | $12,143 | $10,795 |

|---|

| '22 | $11,980 | $13,510 | $11,982 |

|---|

| '22 | $11,780 | $13,521 | $12,133 |

|---|

| '23 | $12,833 | $14,616 | $13,070 |

|---|

| '23 | $12,560 | $14,311 | $12,886 |

|---|

| '23 | $12,905 | $14,666 | $12,853 |

|---|

| '23 | $12,942 | $15,080 | $13,267 |

|---|

| '23 | $12,342 | $14,442 | $12,553 |

|---|

| '23 | $12,961 | $15,099 | $13,259 |

|---|

| '23 | $13,468 | $15,587 | $13,861 |

|---|

| '23 | $13,055 | $14,990 | $13,450 |

|---|

| '23 | $12,680 | $14,478 | $13,336 |

|---|

| '23 | $12,173 | $13,891 | $12,750 |

|---|

| '23 | $13,149 | $15,181 | $13,760 |

|---|

| '23 | $14,012 | $15,987 | $14,432 |

|---|

| '24 | $13,862 | $16,079 | $14,423 |

|---|

| '24 | $14,124 | $16,373 | $14,449 |

|---|

| '24 | $14,574 | $16,912 | $15,079 |

|---|

| '24 | $14,084 | $16,479 | $14,925 |

|---|

| '24 | $14,802 | $17,117 | $15,513 |

|---|

| '24 | $14,006 | $16,841 | $15,081 |

|---|

| '24 | $14,588 | $17,335 | $15,788 |

|---|

| '24 | $15,073 | $17,899 | $16,192 |

|---|

| '24 | $15,093 | $18,064 | $16,422 |

|---|

| '24 | $14,491 | $17,081 | $15,651 |

|---|

| '24 | $14,452 | $16,985 | $15,530 |

|---|

| '24 | $14,355 | $16,598 | $15,253 |

|---|

Yearly periods ended December 31

Average Annual Total Returns

| Class/Index | 1-Year | 5-Year | 10-Year |

|---|

| Class A | 2.45% | 3.47% | 3.68% |

|---|

| MSCI EAFE Index | 3.82% | 4.73% | 5.20% |

|---|

MSCI EAFE® Value Index | 5.68% | 5.09% | 4.31% |

|---|

Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.Please contact your participating insurance company for the Fund's most recent month end performance. Performance does not reflect charges and fees (contract charges) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. Fund performance includes reinvestment of all distributions.

| Net Assets ($) | 71,538,705 |

|---|

| Number of Portfolio Holdings | 60 |

|---|

| Portfolio Turnover Rate (%) | 60 |

|---|

| Total Net Advisory Fees Paid ($) | 409,575 |

|---|

What did the Fund invest in?

| Asset Type | % of Net Assets |

| Common Stocks | 99% |

| Cash Equivalents | 1% |

| Preferred Stocks | 0% |

| Other Assets and Liabilities, Net | 0% |

| Total | 100% |

Holdings-based data is subject to change.

| Sector | % of Net Assets |

| Financials | 25% |

| Health Care | 21% |

| Consumer Discretionary | 12% |

| Materials | 11% |

| Industrials | 9% |

| Communication Services | 6% |

| Consumer Staples | 5% |

| Information Technology | 5% |

| Energy | 3% |

| Utilities | 2% |

Geographical Diversification

| Country | % of Net Assets |

| Japan | 26% |

| United Kingdom | 15% |

| Singapore | 10% |

| Switzerland | 10% |

| France | 8% |

| Luxembourg | 6% |

| Germany | 4% |

| Denmark | 4% |

| Sweden | 4% |

| Spain | 3% |

| Other | 10% |

Ten Largest Equity Holdings

| Holdings | 34.6% of Net Assets |

|---|

| Oversea-Chinese Banking Corp., Ltd. (Singapore) | 5.3% |

| Shionogi & Co., Ltd. (Japan) | 4.3% |

| ArcelorMittal SA (Luxembourg) | 3.8% |

| Takeda Pharmaceutical Co., Ltd. (Japan) | 3.4% |

| Volvo AB (Sweden) | 3.3% |

| Lloyds Banking Group PLC (United Kingdom) | 3.3% |

| HSBC Holdings PLC (United Kingdom) | 2.8% |

| Subaru Corp. (Japan) | 2.8% |

| Holcim AG (Switzerland) | 2.8% |

| Otsuka Holdings Co., Ltd. (Japan) | 2.8% |

If you wish to view additional information about the Fund, including, but not limited to, its prospectus, quarterly holdings, Board fee evaluation reports, and financial statements and other information, please visit dws.com/vipreports. For information about the Fund's proxy voting policies and procedures and how the Fund voted proxies related to its portfolio securities, please visit dws.com/en-us/resources/proxy-voting. This additional information is also available free of charge by contacting us at (800) 728-3337.

Investing in foreign securities, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Stocks may decline in value. The Fund will be managed on the premise that stocks with lower CROCI® Economic P/E Ratios may outperform stocks with higher CROCI® Economic P/E Ratios over time. This premise may not always be correct and prospective investors should evaluate this assumption prior to investing in the Fund. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. The Fund may lend securities to approved institutions. Please read the prospectus for details.

This report must be preceded or accompanied by a prospectus. We advise you to consider the Fund's objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other important information about the Fund, which can be requested by calling (800) 728-3337, contacting your financial representative, or visit dws.com/vipreports to view or download a prospectus. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

©2025 DWS Group GmbH&Co. KGaA. All rights reserved

VS1cint-TSRA-A

R-104184-1 (02/25)

Annual Shareholder Report—December 31, 2024

This annual shareholder report contains important information about DWS Global Small Cap VIP (the "Fund") for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund on the Fund's website at dws.com/vipreports. You can also request this information by contacting us at (800) 728-3337.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $91 | 0.88% |

|---|

Gross expense ratio as of the latest prospectus: 1.09%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. Fund costs do not reflect any fees or sales charges imposed by a variable contract for which the Fund is an investment option.

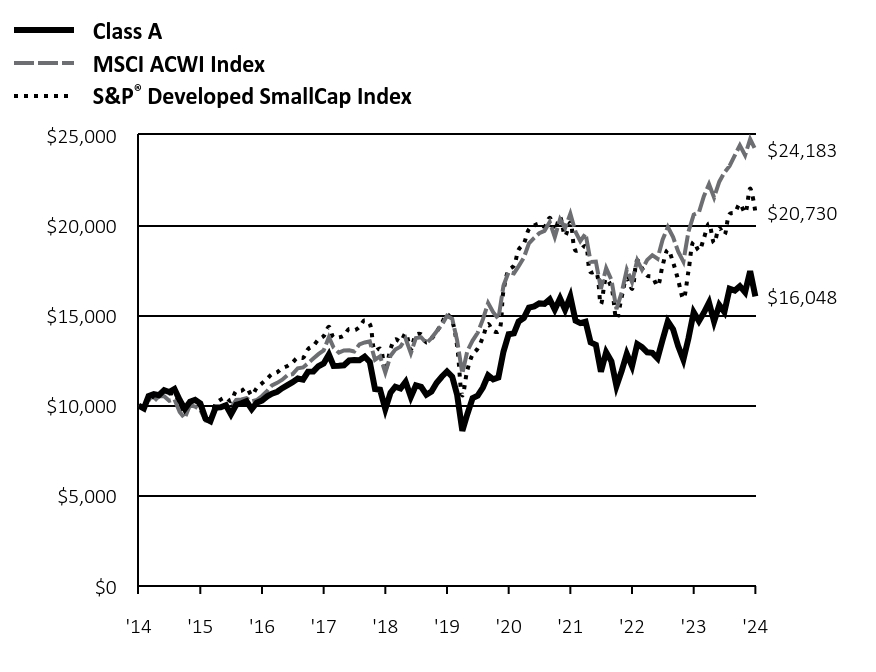

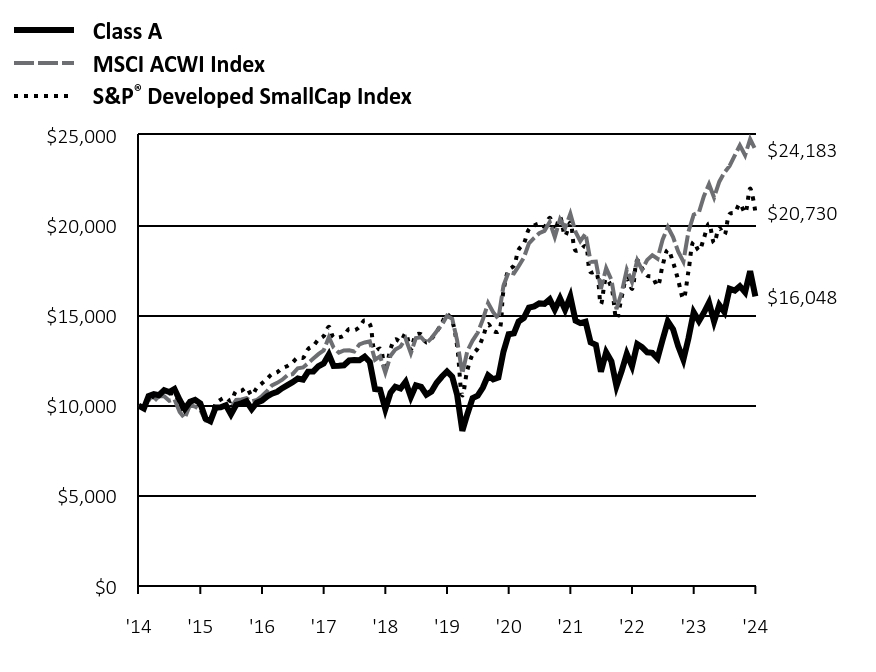

How did the Fund perform last year and what affected its performance?

Class A shares of the Fund returned 5.76% for the period ended December 31, 2024. The Fund's broad-based index, the MSCI ACWI Index, returned 17.49% for the same period, while the Fund's additional, more narrowly based index, the S&P® Developed SmallCap Index, returned 8.64%.

Stock selection was the primary reason for the Fund’s underperformance relative to the S&P® Developed SmallCap Index. The weakest results occurred in the industrials sector, where Atkore, Inc. (1.3%) — a maker of products used in electricity infrastructure — was hurt by softer pricing conditions for one of its key products. Avis Budget Group, Inc. (0.4%) and Hillenbrand, Inc. (0.7%) also weighed on performance in the industrial sector.

Technology was another area of relative weakness for the Fund. Aixtron SE (0.8%), a German company whose technology is used in semiconductor manufacturing, was the largest detractor in both the sector and the Fund as a whole. The stock fell on expectations that slowing sales for electric vehicles would depress demand for its products. The French engineering and technology consulting company Alten SA (0.6%), which was pressured by weakness in the European economy, was a further detractor of note.

Stock selection in healthcare detracted, as well. Bridgebio Pharma, Inc. (1.1%), which lost ground due to concerns about the impact of a competitor’s drug, and Option Care Health, Inc. (0.9%), a provider of infusion services whose shares declined due to the reduced profitability of a key product, were the largest detractors.

Selection in the consumer discretionary sector contributed positively. The used car retailer Carvana Co. (1.3%) rallied on the strength of volume growth, market share gains, and rising profit margins, helping Fund performance. The thermal management company Modine Manufacturing Co. (1.6%), a beneficiary of demand from data centers, was an additional contributor in the sector.

The financials sector was another area of strength for the Fund. Jefferies Financial Group, Inc. (1.7%), which reported strong results throughout the year, was the top contributor. Synovus Financial Corp. (1.3%) also made a positive contribution. The Georgia-based financial services provider benefited as interest rate cuts by the U.S. Federal Reserve led to lower funding costs, boosting its long-term growth prospects.

Outside of these two sectors, the regional airline SkyWest, Inc. (0.4%) and the convenience store operator Casey’s General Stores, Inc. (2.0%) were top contributors.

Percentages in parentheses are based on the Fund’s net assets as of December 31, 2024.

Cumulative Growth of an Assumed $10,000Investment

MSCI ACWI Index captures large and mid-cap representation across Developed Markets and Emerging Markets countries. The index covers approximately 85% of the global investable equity opportunity set.

The MSCI ACWI Index is a broad-based index that represents the fund’s overall equity market. It replaces the S&P® Developed SmallCap Index as the Fund’s broad-based index in compliance with updated regulatory requirements.

S&P® Developed SmallCap Index comprises the stocks representing the lowest 15% of float-adjusted market cap in each developed country.

The S&P® Developed SmallCap Index is a more narrowly based index that reflects the market sector in which the fund invests.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

| Class A | MSCI ACWI Index | S&P® Developed SmallCap Index |

|---|

| '14 | $10,000 | $10,000 | $10,000 |

|---|

| '15 | $9,843 | $9,844 | $9,855 |

|---|

| '15 | $10,527 | $10,392 | $10,448 |

|---|

| '15 | $10,637 | $10,231 | $10,467 |

|---|

| '15 | $10,577 | $10,528 | $10,618 |

|---|

| '15 | $10,853 | $10,514 | $10,770 |

|---|

| '15 | $10,754 | $10,266 | $10,670 |

|---|

| '15 | $10,923 | $10,355 | $10,653 |

|---|

| '15 | $10,308 | $9,646 | $10,085 |

|---|

| '15 | $9,809 | $9,296 | $9,682 |

|---|

| '15 | $10,216 | $10,026 | $10,222 |

|---|

| '15 | $10,316 | $9,943 | $10,309 |

|---|

| '15 | $10,116 | $9,764 | $10,065 |

|---|

| '16 | $9,279 | $9,175 | $9,278 |

|---|

| '16 | $9,133 | $9,112 | $9,308 |

|---|

| '16 | $9,893 | $9,787 | $10,100 |

|---|

| '16 | $9,908 | $9,931 | $10,329 |

|---|

| '16 | $10,022 | $9,944 | $10,437 |

|---|

| '16 | $9,516 | $9,884 | $10,241 |

|---|

| '16 | $10,048 | $10,310 | $10,803 |

|---|

| '16 | $10,127 | $10,344 | $10,822 |

|---|

| '16 | $10,240 | $10,408 | $10,981 |

|---|

| '16 | $9,804 | $10,231 | $10,573 |

|---|

| '16 | $10,162 | $10,309 | $10,974 |

|---|

| '16 | $10,275 | $10,531 | $11,232 |

|---|

| '17 | $10,511 | $10,819 | $11,491 |

|---|

| '17 | $10,659 | $11,123 | $11,747 |

|---|

| '17 | $10,764 | $11,259 | $11,853 |

|---|

| '17 | $10,965 | $11,434 | $12,074 |

|---|

| '17 | $11,137 | $11,687 | $12,197 |

|---|

| '17 | $11,300 | $11,740 | $12,390 |

|---|

| '17 | $11,501 | $12,068 | $12,661 |

|---|

| '17 | $11,434 | $12,114 | $12,653 |

|---|

| '17 | $11,883 | $12,348 | $13,131 |

|---|

| '17 | $11,893 | $12,605 | $13,317 |

|---|

| '17 | $12,180 | $12,849 | $13,653 |

|---|

| '17 | $12,332 | $13,056 | $13,849 |

|---|

| '18 | $12,830 | $13,793 | $14,364 |

|---|

| '18 | $12,199 | $13,213 | $13,774 |

|---|

| '18 | $12,208 | $12,931 | $13,777 |

|---|

| '18 | $12,235 | $13,054 | $13,885 |

|---|

| '18 | $12,499 | $13,070 | $14,246 |

|---|

| '18 | $12,521 | $13,000 | $14,175 |

|---|

| '18 | $12,510 | $13,392 | $14,350 |

|---|

| '18 | $12,708 | $13,497 | $14,737 |

|---|

| '18 | $12,422 | $13,555 | $14,516 |

|---|

| '18 | $10,915 | $12,540 | $13,045 |

|---|

| '18 | $10,882 | $12,723 | $13,167 |

|---|

| '18 | $9,803 | $11,827 | $11,938 |

|---|

| '19 | $10,717 | $12,761 | $13,151 |

|---|

| '19 | $11,047 | $13,102 | $13,673 |

|---|

| '19 | $10,948 | $13,267 | $13,553 |

|---|

| '19 | $11,321 | $13,715 | $13,996 |

|---|

| '19 | $10,474 | $12,901 | $13,111 |

|---|

| '19 | $11,124 | $13,746 | $13,925 |

|---|

| '19 | $11,043 | $13,786 | $13,957 |

|---|

| '19 | $10,601 | $13,459 | $13,497 |

|---|

| '19 | $10,776 | $13,742 | $13,717 |

|---|

| '19 | $11,263 | $14,119 | $14,099 |

|---|

| '19 | $11,600 | $14,463 | $14,562 |

|---|

| '19 | $11,890 | $14,973 | $15,058 |

|---|

| '20 | $11,600 | $14,807 | $14,656 |

|---|

| '20 | $10,601 | $13,611 | $13,311 |

|---|

| '20 | $8,604 | $11,774 | $10,556 |

|---|

| '20 | $9,534 | $13,035 | $11,976 |

|---|

| '20 | $10,413 | $13,602 | $12,821 |

|---|

| '20 | $10,554 | $14,036 | $13,158 |

|---|

| '20 | $11,000 | $14,779 | $13,787 |

|---|

| '20 | $11,680 | $15,683 | $14,515 |

|---|

| '20 | $11,457 | $15,178 | $14,145 |

|---|

| '20 | $11,562 | $14,809 | $14,106 |

|---|

| '20 | $12,981 | $16,634 | $16,347 |

|---|

| '20 | $13,955 | $17,406 | $17,498 |

|---|

| '21 | $14,002 | $17,327 | $17,755 |

|---|

| '21 | $14,658 | $17,729 | $18,646 |

|---|

| '21 | $14,858 | $18,202 | $18,993 |

|---|

| '21 | $15,428 | $18,998 | $19,769 |

|---|

| '21 | $15,498 | $19,294 | $19,982 |

|---|

| '21 | $15,663 | $19,548 | $20,084 |

|---|

| '21 | $15,640 | $19,682 | $19,927 |

|---|

| '21 | $15,887 | $20,175 | $20,408 |

|---|

| '21 | $15,322 | $19,342 | $19,737 |

|---|

| '21 | $15,934 | $20,329 | $20,435 |

|---|

| '21 | $15,310 | $19,839 | $19,411 |

|---|

| '21 | $16,040 | $20,633 | $20,153 |

|---|

| '22 | $14,698 | $19,620 | $18,594 |

|---|

| '22 | $14,569 | $19,113 | $18,643 |

|---|

| '22 | $14,651 | $19,527 | $18,861 |

|---|

| '22 | $13,497 | $17,964 | $17,388 |

|---|

| '22 | $13,368 | $17,985 | $17,404 |

|---|

| '22 | $11,881 | $16,469 | $15,619 |

|---|

| '22 | $12,954 | $17,619 | $17,037 |

|---|

| '22 | $12,453 | $16,970 | $16,536 |

|---|

| '22 | $11,081 | $15,346 | $14,813 |

|---|

| '22 | $11,924 | $16,272 | $16,022 |

|---|

| '22 | $12,868 | $17,534 | $17,068 |

|---|

| '22 | $12,182 | $16,844 | $16,463 |

|---|

| '23 | $13,411 | $18,051 | $18,060 |

|---|

| '23 | $13,240 | $17,534 | $17,615 |

|---|

| '23 | $12,954 | $18,075 | $17,198 |

|---|

| '23 | $12,923 | $18,334 | $17,133 |

|---|

| '23 | $12,618 | $18,138 | $16,637 |

|---|

| '23 | $13,649 | $19,191 | $17,762 |

|---|

| '23 | $14,665 | $19,894 | $18,639 |

|---|

| '23 | $14,230 | $19,338 | $17,936 |

|---|

| '23 | $13,300 | $18,538 | $16,961 |

|---|

| '23 | $12,545 | $17,981 | $15,926 |

|---|

| '23 | $13,722 | $19,640 | $17,449 |

|---|

| '23 | $15,174 | $20,584 | $19,081 |

|---|

| '24 | $14,680 | $20,704 | $18,593 |

|---|

| '24 | $15,145 | $21,593 | $19,259 |

|---|

| '24 | $15,711 | $22,271 | $20,091 |

|---|

| '24 | $14,662 | $21,536 | $19,015 |

|---|

| '24 | $15,571 | $22,411 | $19,849 |

|---|

| '24 | $15,186 | $22,910 | $19,471 |

|---|

| '24 | $16,479 | $23,279 | $20,616 |

|---|

| '24 | $16,372 | $23,870 | $20,706 |

|---|

| '24 | $16,618 | $24,425 | $21,179 |

|---|

| '24 | $16,279 | $23,877 | $20,693 |

|---|

| '24 | $17,450 | $24,770 | $22,029 |

|---|

| '24 | $16,048 | $24,183 | $20,730 |

|---|

Yearly periods ended December 31

Average Annual Total Returns

| Class/Index | 1-Year | 5-Year | 10-Year |

|---|

| Class A | 5.76% | 6.18% | 4.84% |

|---|

| MSCI ACWI Index | 17.49% | 10.06% | 9.23% |

|---|

S&P® Developed SmallCap Index | 8.64% | 6.60% | 7.56% |

|---|

Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.Please contact your participating insurance company for the Fund's most recent month end performance. Performance does not reflect charges and fees (contract charges) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. Fund performance includes reinvestment of all distributions.

| Net Assets ($) | 62,297,109 |

|---|

| Number of Portfolio Holdings | 127 |

|---|

| Portfolio Turnover Rate (%) | 37 |

|---|

| Total Net Advisory Fees Paid ($) | 378,312 |

|---|

What did the Fund invest in?

| Asset Type | % of Net Assets |

| Common Stocks | 98% |

| Cash Equivalents | 1% |

| Other Assets and Liabilities, Net | 1% |

| Total | 100% |

Holdings-based data is subject to change.

| Sector | % of Net Assets |

| Industrials | 19% |

| Financials | 15% |

| Information Technology | 13% |

| Consumer Discretionary | 12% |

| Health Care | 11% |

| Real Estate | 7% |

| Materials | 7% |

| Energy | 4% |

| Consumer Staples | 4% |

| Communication Services | 3% |

| Utilities | 3% |

Geographical Diversification

| Country | % of Net Assets |

| United States | 65% |

| United Kingdom | 7% |

| Japan | 6% |

| Canada | 5% |

| France | 2% |

| Australia | 2% |

| Germany | 2% |

| Italy | 2% |

| Switzerland | 1% |

| Jersey | 1% |

| Other | 5% |

Ten Largest Equity Holdings

| Holdings | 17.0% of Net Assets |

|---|

| Casey's General Stores, Inc. (United States) | 2.0% |

| SkyWest, Inc. (United States) | 1.9% |

| Rush Enterprises, Inc. (United States) | 1.9% |

| Jefferies Financial Group, Inc. (United States) | 1.7% |

| TechnipFMC PLC (United Kingdom) | 1.6% |

| SentinelOne, Inc. (United States) | 1.6% |

| Benchmark Electronics, Inc. (United States) | 1.6% |

| Modine Manufacturing Co. (United States) | 1.6% |

| Buzzi SpA (Italy) | 1.6% |

| Madison Square Garden Sports Corp. (United States) | 1.5% |

If you wish to view additional information about the Fund, including, but not limited to, its prospectus, quarterly holdings, Board fee evaluation reports, and financial statements and other information, please visit dws.com/vipreports. For information about the Fund's proxy voting policies and procedures and how the Fund voted proxies related to its portfolio securities, please visit dws.com/en-us/resources/proxy-voting. This additional information is also available free of charge by contacting us at (800) 728-3337.

Stocks may decline in value. Smaller company stocks tend to be more volatile than medium-sized or large company stocks. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as currency fluctuations, political and economic changes, and market risks. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Emerging markets tend to be more volatile and less liquid than the markets of more mature economies, and generally have less diverse and less mature economic structures and less stable political systems than those of developed countries. The Fund may lend securities to approved institutions. Please read the prospectus for details.

This report must be preceded or accompanied by a prospectus. We advise you to consider the Fund's objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other important information about the Fund, which can be requested by calling (800) 728-3337, contacting your financial representative, or visit dws.com/vipreports to view or download a prospectus. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

©2025 DWS Group GmbH&Co. KGaA. All rights reserved

VS1glosc-TSRA-A

R-104185-1 (02/25)

Annual Shareholder Report—December 31, 2024

This annual shareholder report contains important information about DWS Capital Growth VIP (the "Fund") for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund on the Fund's website at dws.com/vipreports. You can also request this information by contacting us at (800) 728-3337.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $56 | 0.49% |

|---|

Gross expense ratio as of the latest prospectus: 0.49%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. Fund costs do not reflect any fees or sales charges imposed by a variable contract for which the Fund is an investment option.

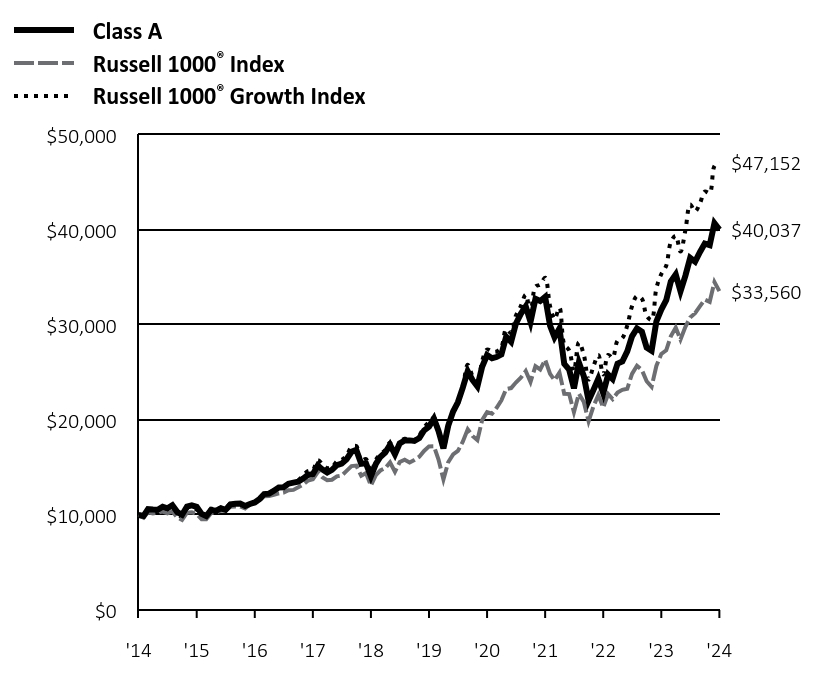

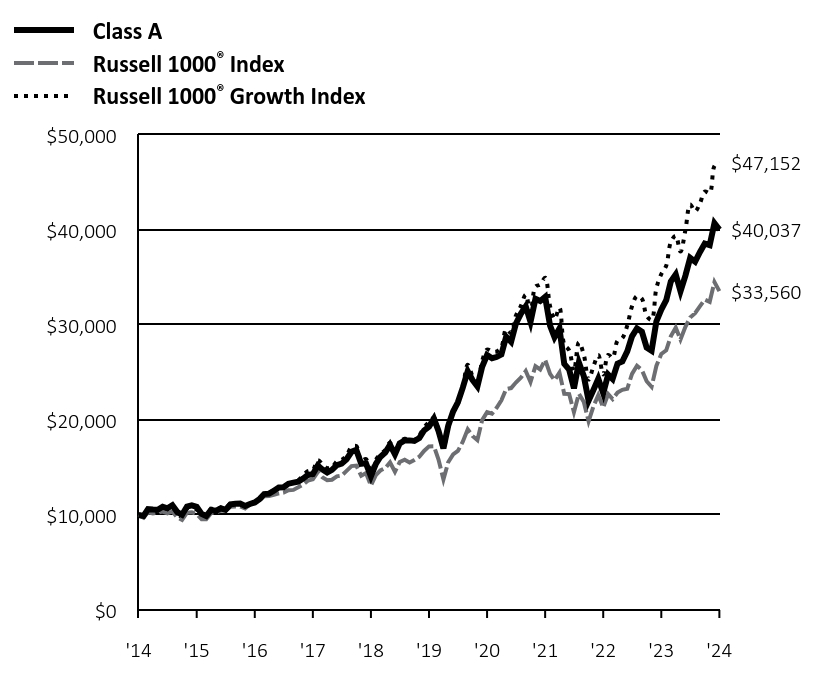

How did the Fund perform last year and what affected its performance?

Class A shares of the Fund returned 26.62% for the period ended December 31, 2024. The Fund's broad-based index, the Russell 1000® Index, returned 24.51% for the same period, while the Fund's additional, more narrowly based index, the Russell 1000® Growth Index, returned 33.36%.

Stock selection in the information technology sector was the primary reason for the Fund’s underperformance. An underweight in the semiconductor company Broadcom, Inc. (2.1%), which surged late in the period after reporting strong results that highlighted the company’s opportunity in artificial intelligence, was the largest detractor. A position in Synopsys, Inc. (1.6%), a provider of software design tools for the semiconductor industry, lost ground on concerns about the impact of increased technology export restrictions and challenges at one of its key customers. On the plus side, the Fund benefited from overweights in NVIDIA Corp. (11.0%) and ServiceNow (1.8%).

Selection in the healthcare sector detracted, as well. Shares of Dexcom, Inc. (0.7%), a producer of continuous glucose monitoring systems, in response to a guidance cut related to poor execution of its salesforce reorganization. The Fund was also hurt by its position in Thermo Fisher Scientific, Inc. (1.5%). After performing well for most of the year, the stock slid in the fourth quarter after the company reported underwhelming results. On the other hand, Boston Scientific Corp. (1.3%) was a notable contributor.

Outside of technology and healthcare, Estee Lauder Companies, Inc.* and Lululemon Athletica, Inc. (0.5%) — both of which were hurt by slowing sales growth — were the largest detractors among stocks held in the portfolio. A zero weighting in Tesla, Inc.* detracted from relative performance, as well.

The Fund strongly outperformed in financials thanks to a position in the insurer Progressive Corp. (2.8%). The stock rallied as a favorable auto insurance environment translated to robust earnings growth. The Fund also exhibited relative strength in communication services, highlighted by Spotify Technology SA (1.3%). The company reported record profits and a rising number of users, and it announced a price increase for its premium service. In addition, shares of Netflix, Inc. (1.8%) staged an impressive rally on continued growth in subscribers and earnings.

Percentages in parentheses are based on the Fund’s net assets as of December 31, 2024.

* Not held at December 31, 2024.

Russell 1000® Index measures the performance of the large-cap segment of the US equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 93% of the US market. The Russell 1000® Index is constructed to provide a comprehensive and unbiased barometer for the large-cap segment and is completely reconstituted annually to ensure new and growing equities are included.

The Russell 1000® Index is a broad-based index that represents the fund’s overall equity market. It replaces the Russell 1000® Growth Index as the Fund’s broad-based index in compliance with updated regulatory requirements.

Russell 1000® Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years). The Russell 1000® Growth Index is constructed to provide a comprehensive and unbiased barometer for the large-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

The Russell 1000® Growth Index is a more narrowly based index that reflects the market sector in which the fund invests.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Cumulative Growth of an Assumed $10,000Investment

| Class A | Russell 1000® Index | Russell 1000® Growth Index |

|---|

| '14 | $10,000 | $10,000 | $10,000 |

|---|

| '15 | $9,896 | $9,725 | $9,847 |

|---|

| '15 | $10,614 | $10,287 | $10,503 |

|---|

| '15 | $10,568 | $10,159 | $10,384 |

|---|

| '15 | $10,554 | $10,231 | $10,436 |

|---|

| '15 | $10,870 | $10,365 | $10,583 |

|---|

| '15 | $10,704 | $10,171 | $10,396 |

|---|

| '15 | $11,031 | $10,367 | $10,749 |

|---|

| '15 | $10,304 | $9,743 | $10,096 |

|---|

| '15 | $10,019 | $9,476 | $9,846 |

|---|

| '15 | $10,893 | $10,243 | $10,694 |

|---|

| '15 | $11,020 | $10,277 | $10,724 |

|---|

| '15 | $10,862 | $10,092 | $10,567 |

|---|

| '16 | $10,108 | $9,549 | $9,977 |

|---|

| '16 | $9,888 | $9,545 | $9,973 |

|---|

| '16 | $10,535 | $10,210 | $10,645 |

|---|

| '16 | $10,437 | $10,266 | $10,548 |

|---|

| '16 | $10,704 | $10,446 | $10,753 |

|---|

| '16 | $10,551 | $10,469 | $10,711 |

|---|

| '16 | $11,115 | $10,868 | $11,216 |

|---|

| '16 | $11,179 | $10,882 | $11,160 |

|---|

| '16 | $11,196 | $10,891 | $11,201 |

|---|

| '16 | $10,950 | $10,679 | $10,938 |

|---|

| '16 | $11,162 | $11,100 | $11,176 |

|---|

| '16 | $11,323 | $11,308 | $11,314 |

|---|

| '17 | $11,696 | $11,536 | $11,696 |

|---|

| '17 | $12,205 | $11,982 | $12,182 |

|---|

| '17 | $12,248 | $11,990 | $12,322 |

|---|

| '17 | $12,558 | $12,116 | $12,604 |

|---|

| '17 | $12,892 | $12,271 | $12,932 |

|---|

| '17 | $12,915 | $12,357 | $12,898 |

|---|

| '17 | $13,295 | $12,601 | $13,241 |

|---|

| '17 | $13,411 | $12,641 | $13,483 |

|---|

| '17 | $13,499 | $12,910 | $13,659 |

|---|

| '17 | $13,828 | $13,206 | $14,188 |

|---|

| '17 | $14,217 | $13,609 | $14,619 |

|---|

| '17 | $14,301 | $13,761 | $14,733 |

|---|

| '18 | $15,218 | $14,516 | $15,776 |

|---|

| '18 | $14,801 | $13,983 | $15,363 |

|---|

| '18 | $14,477 | $13,666 | $14,941 |

|---|

| '18 | $14,748 | $13,712 | $14,994 |

|---|

| '18 | $15,249 | $14,062 | $15,651 |

|---|

| '18 | $15,404 | $14,153 | $15,801 |

|---|

| '18 | $15,868 | $14,642 | $16,265 |

|---|

| '18 | $16,648 | $15,146 | $17,155 |

|---|

| '18 | $16,844 | $15,204 | $17,251 |

|---|

| '18 | $15,383 | $14,128 | $15,708 |

|---|

| '18 | $15,435 | $14,415 | $15,875 |

|---|

| '18 | $14,072 | $13,102 | $14,510 |

|---|

| '19 | $15,373 | $14,200 | $15,814 |

|---|

| '19 | $16,111 | $14,681 | $16,380 |

|---|

| '19 | $16,570 | $14,937 | $16,846 |

|---|

| '19 | $17,383 | $15,540 | $17,607 |

|---|

| '19 | $16,390 | $14,550 | $16,495 |

|---|

| '19 | $17,545 | $15,571 | $17,628 |

|---|

| '19 | $17,853 | $15,813 | $18,026 |

|---|

| '19 | $17,853 | $15,523 | $17,888 |

|---|

| '19 | $17,789 | $15,792 | $17,890 |

|---|

| '19 | $18,091 | $16,127 | $18,394 |

|---|

| '19 | $18,898 | $16,736 | $19,210 |

|---|

| '19 | $19,299 | $17,220 | $19,790 |

|---|

| '20 | $20,146 | $17,238 | $20,232 |

|---|

| '20 | $18,851 | $15,830 | $18,854 |

|---|

| '20 | $17,017 | $13,738 | $17,000 |

|---|

| '20 | $19,390 | $15,553 | $19,515 |

|---|

| '20 | $20,891 | $16,374 | $20,825 |

|---|

| '20 | $21,861 | $16,736 | $21,732 |

|---|

| '20 | $23,400 | $17,716 | $23,404 |

|---|

| '20 | $25,129 | $19,016 | $25,819 |

|---|

| '20 | $24,211 | $18,321 | $24,604 |

|---|

| '20 | $23,527 | $17,879 | $23,769 |

|---|

| '20 | $25,604 | $19,985 | $26,203 |

|---|

| '20 | $26,833 | $20,830 | $27,408 |

|---|

| '21 | $26,497 | $20,658 | $27,205 |

|---|

| '21 | $26,624 | $21,257 | $27,199 |

|---|

| '21 | $26,897 | $22,061 | $27,666 |

|---|

| '21 | $28,759 | $23,249 | $29,548 |

|---|

| '21 | $28,222 | $23,359 | $29,140 |

|---|

| '21 | $30,128 | $23,944 | $30,968 |

|---|

| '21 | $31,174 | $24,442 | $31,988 |

|---|

| '21 | $31,959 | $25,149 | $33,184 |

|---|

| '21 | $30,329 | $23,994 | $31,326 |

|---|

| '21 | $32,757 | $25,659 | $34,039 |

|---|

| '21 | $32,516 | $25,315 | $34,247 |

|---|

| '21 | $32,945 | $26,340 | $34,971 |

|---|

| '22 | $29,926 | $24,855 | $31,970 |

|---|

| '22 | $28,699 | $24,173 | $30,612 |

|---|

| '22 | $29,618 | $24,989 | $31,809 |

|---|

| '22 | $25,908 | $22,761 | $27,968 |

|---|

| '22 | $25,294 | $22,727 | $27,318 |

|---|

| '22 | $23,330 | $20,823 | $25,154 |

|---|

| '22 | $26,044 | $22,763 | $28,173 |

|---|

| '22 | $24,615 | $21,889 | $26,861 |

|---|

| '22 | $22,020 | $19,863 | $24,249 |

|---|

| '22 | $23,170 | $21,456 | $25,667 |

|---|

| '22 | $24,328 | $22,617 | $26,836 |

|---|

| '22 | $22,819 | $21,302 | $24,782 |

|---|

| '23 | $24,783 | $22,730 | $26,847 |

|---|

| '23 | $24,312 | $22,189 | $26,528 |

|---|

| '23 | $25,932 | $22,891 | $28,342 |

|---|

| '23 | $26,156 | $23,175 | $28,621 |

|---|

| '23 | $27,225 | $23,283 | $29,926 |

|---|

| '23 | $28,805 | $24,855 | $31,972 |

|---|

| '23 | $29,640 | $25,710 | $33,050 |

|---|

| '23 | $29,289 | $25,260 | $32,753 |

|---|

| '23 | $27,610 | $24,073 | $30,972 |

|---|

| '23 | $27,275 | $23,491 | $30,531 |

|---|

| '23 | $30,367 | $25,685 | $33,859 |

|---|

| '23 | $31,621 | $26,953 | $35,358 |

|---|

| '24 | $32,607 | $27,329 | $36,240 |

|---|

| '24 | $34,570 | $28,805 | $38,713 |

|---|

| '24 | $35,314 | $29,728 | $39,394 |

|---|

| '24 | $33,545 | $28,463 | $37,723 |

|---|

| '24 | $35,193 | $29,804 | $39,981 |

|---|

| '24 | $37,060 | $30,790 | $42,677 |

|---|

| '24 | $36,659 | $31,238 | $41,951 |

|---|

| '24 | $37,688 | $31,979 | $42,825 |

|---|

| '24 | $38,562 | $32,663 | $44,038 |

|---|

| '24 | $38,407 | $32,434 | $43,893 |

|---|

| '24 | $40,711 | $34,522 | $46,740 |

|---|

| '24 | $40,037 | $33,560 | $47,152 |

|---|

Yearly periods ended December 31

Average Annual Total Returns

| Class/Index | 1-Year | 5-Year | 10-Year |

|---|

| Class A | 26.62% | 15.71% | 14.88% |

|---|

Russell 1000® Index | 24.51% | 14.28% | 12.87% |

|---|

Russell 1000® Growth Index | 33.36% | 18.96% | 16.78% |

|---|

Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.Please contact your participating insurance company for the Fund's most recent month end performance. Performance does not reflect charges and fees (contract charges) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. Fund performance includes reinvestment of all distributions.

| Net Assets ($) | 1,077,023,038 |

|---|

| Number of Portfolio Holdings | 73 |

|---|

| Portfolio Turnover Rate (%) | 15 |

|---|

| Total Net Advisory Fees Paid ($) | 3,869,562 |

|---|

What did the Fund invest in?

Holdings-based data is subject to change.

| Asset Type | % of Net Assets |

| Common Stocks | 99% |

| Cash Equivalents | 1% |

| Other Assets and Liabilities, Net | 0% |

| Total | 100% |

| Sector | % of Net Assets |

| Information Technology | 47% |

| Communication Services | 14% |

| Health Care | 11% |

| Financials | 9% |

| Consumer Discretionary | 8% |

| Industrials | 6% |

| Real Estate | 2% |

| Consumer Staples | 1% |

| Materials | 1% |

Ten Largest Equity Holdings

| Holdings | 52.1% of Net Assets |

|---|

| NVIDIA Corp. | 11.0% |

| Microsoft Corp. | 9.5% |

| Apple, Inc. | 9.4% |

| Alphabet, Inc. | 5.1% |

| Amazon.com, Inc. | 5.0% |

| Meta Platforms, Inc. | 3.2% |

| Progressive Corp. | 2.8% |

| Mastercard, Inc. | 2.2% |

| Broadcom, Inc. | 2.1% |

| ServiceNow, Inc. | 1.8% |

This is a summary of certain changes of the Fund since January 1, 2024. For more information, review the Fund's current prospectus at dws.com/vipreports, or call (800) 728-3337.

On November 21, 2024, the Fund's shareholders approved a change in the Fund's diversification classification under the Investment Company Act of 1940, as amended, from diversified to non-diversified. This means the Fund may invest in securities of relatively few issuers. Thus, the performance of one or a small number of portfolio holdings can affect the Fund's overall performance.

If you wish to view additional information about the Fund, including, but not limited to, its prospectus, quarterly holdings, Board fee evaluation reports, and financial statements and other information, please visit dws.com/vipreports. For information about the Fund's proxy voting policies and procedures and how the Fund voted proxies related to its portfolio securities, please visit dws.com/en-us/resources/proxy-voting. This additional information is also available free of charge by contacting us at (800) 728-3337.

Stocks may decline in value. This Fund is non-diversified and can take larger positions in fewer issues, increasing its potential risk. The Fund may lend securities to approved institutions. Please read the prospectus for more information.

This report must be preceded or accompanied by a prospectus. We advise you to consider the Fund's objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other important information about the Fund, which can be requested by calling (800) 728-3337, contacting your financial representative, or visit dws.com/vipreports to view or download a prospectus. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

©2025 DWS Group GmbH&Co. KGaA. All rights reserved

VS1capgro-TSRA-A

R-104182-1 (02/25)

Annual Shareholder Report—December 31, 2024

This annual shareholder report contains important information about DWS Core Equity VIP (the "Fund") for the period January 1, 2024 to December 31, 2024. You can find additional information about the Fund on the Fund's website at dws.com/vipreports. You can also request this information by contacting us at (800) 728-3337.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Class A | $65 | 0.59% |

|---|

Gross expense ratio as of the latest prospectus: 0.61%. See prospectus for any contractual or voluntary waivers; without a waiver, costs would have been higher. Fund costs do not reflect any fees or sales charges imposed by a variable contract for which the Fund is an investment option.

How did the Fund perform last year and what affected its performance?

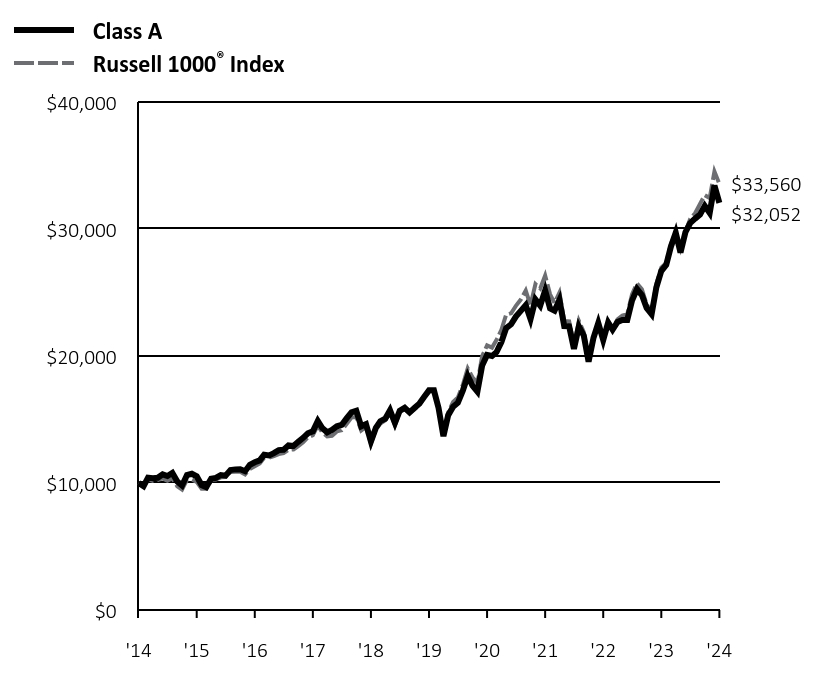

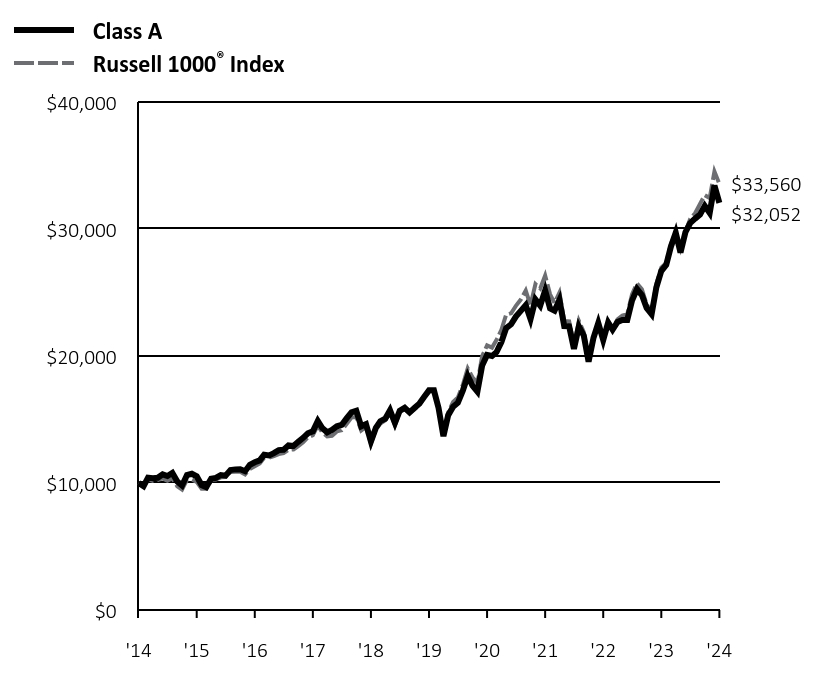

Class A shares of the Fund returned 20.08% for the period ended December 31, 2024. The Russell 1000® Index returned 24.51% for the same period.

Stock selection in the information technology sector was the primary reason for the Fund’s underperformance during the past fiscal year. Much of the shortfall came from an underweight in NVIDIA Corp. (5.9%) and a zero weighting in Broadcom, Inc. Overweight positions in the semiconductor stocks Advanced Micro Devices, Inc.* and Micron Technology, Inc. (0.9%), which posted losses and underperformed their industry peers, also detracted. On the other hand, Oracle Corp. (1.7%) — which consistently reported strong demand and better-than-expected results — was a top contributor both in technology and the Fund as a whole.

Healthcare was another source of underperformance, with four insurance companies — Centene Corp. (0.9%), Elevance Health, Inc. (0.9%), Humana, Inc. (0.8%), and Cigna Group (0.7%) — being the largest negative contributors. The stocks, which had already lagged in 2024 due to weaker-than-expected results, fell sharply late in the year as the shooting of a competitor’s chief executive officer led to an increased focus on the health insurance industry’s business practices. Selection in the consumer discretionary sector further detracted, with a position in Macy’s, Inc. (0.9%) and an underweight in Tesla, Inc. (1.1%) having the largest adverse effects.

On the positive side, the Fund’s stock picks outperformed in communication services thanks largely to a position in the music platform provider Spotify Technology SA (0.9%). The company reported record earnings and continued to take market share from its competitors as it expanded its user base. The financials sector was an additional area of strength, led by the alternative asset manager Apollo Global Management, Inc. (1.5%). JPMorgan Chase & Co. (3.3%), Coinbase Global, Inc. (0.9%), and Ameriprise Financial, Inc. (1.8%) were other notable contributors in financials. Outside of these two sectors, Deckers Outdoor Corp. (1.4%) was the leading contributor. The company experienced robust sales for its Ugg and Hoka brands, boosting its shares.

Percentages in parentheses are based on the Fund’s net assets as of December 31, 2024.

* Not held at December 31, 2024.

Russell 1000® Index measures the performance of the large-cap segment of the US equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® represents approximately 93% of the US market. The Russell 1000® Index is constructed to provide a comprehensive and unbiased barometer for the large-cap segment and is completely reconstituted annually to ensure new and growing equities are included.

Index returns do not reflect any fees or expenses and it is not possible to invest directly into an index.

Cumulative Growth of an Assumed $10,000Investment

| Class A | Russell 1000® Index |

|---|

| '14 | $10,000 | $10,000 |

|---|

| '15 | $9,749 | $9,725 |

|---|

| '15 | $10,423 | $10,287 |

|---|

| '15 | $10,376 | $10,159 |

|---|

| '15 | $10,414 | $10,231 |

|---|

| '15 | $10,683 | $10,365 |

|---|

| '15 | $10,549 | $10,171 |

|---|

| '15 | $10,794 | $10,367 |

|---|

| '15 | $10,121 | $9,743 |

|---|

| '15 | $9,804 | $9,476 |

|---|

| '15 | $10,628 | $10,243 |

|---|

| '15 | $10,723 | $10,277 |

|---|

| '15 | $10,525 | $10,092 |

|---|

| '16 | $9,836 | $9,549 |

|---|

| '16 | $9,677 | $9,545 |

|---|

| '16 | $10,335 | $10,210 |

|---|

| '16 | $10,400 | $10,266 |

|---|

| '16 | $10,629 | $10,446 |

|---|

| '16 | $10,576 | $10,469 |

|---|

| '16 | $11,018 | $10,868 |

|---|

| '16 | $11,071 | $10,882 |

|---|

| '16 | $11,089 | $10,891 |

|---|

| '16 | $10,930 | $10,679 |

|---|

| '16 | $11,433 | $11,100 |

|---|

| '16 | $11,628 | $11,308 |

|---|

| '17 | $11,778 | $11,536 |

|---|

| '17 | $12,229 | $11,982 |

|---|

| '17 | $12,176 | $11,990 |

|---|

| '17 | $12,351 | $12,116 |

|---|

| '17 | $12,591 | $12,271 |

|---|

| '17 | $12,620 | $12,357 |

|---|

| '17 | $12,957 | $12,601 |

|---|

| '17 | $12,918 | $12,641 |

|---|

| '17 | $13,245 | $12,910 |

|---|

| '17 | $13,553 | $13,206 |

|---|

| '17 | $13,918 | $13,609 |

|---|

| '17 | $14,072 | $13,761 |

|---|

| '18 | $14,889 | $14,516 |

|---|

| '18 | $14,322 | $13,983 |

|---|

| '18 | $13,985 | $13,666 |

|---|

| '18 | $14,176 | $13,712 |

|---|

| '18 | $14,460 | $14,062 |

|---|

| '18 | $14,568 | $14,153 |

|---|

| '18 | $15,081 | $14,642 |

|---|

| '18 | $15,567 | $15,146 |

|---|

| '18 | $15,688 | $15,204 |

|---|

| '18 | $14,460 | $14,128 |

|---|

| '18 | $14,635 | $14,415 |

|---|

| '18 | $13,272 | $13,102 |

|---|

| '19 | $14,338 | $14,200 |

|---|

| '19 | $14,865 | $14,681 |

|---|

| '19 | $15,067 | $14,937 |

|---|

| '19 | $15,734 | $15,540 |

|---|

| '19 | $14,724 | $14,550 |

|---|

| '19 | $15,688 | $15,571 |

|---|

| '19 | $15,917 | $15,813 |

|---|

| '19 | $15,550 | $15,523 |

|---|

| '19 | $15,902 | $15,792 |

|---|

| '19 | $16,238 | $16,127 |

|---|

| '19 | $16,773 | $16,736 |

|---|

| '19 | $17,293 | $17,220 |

|---|

| '20 | $17,293 | $17,238 |

|---|

| '20 | $15,917 | $15,830 |

|---|

| '20 | $13,685 | $13,738 |

|---|

| '20 | $15,338 | $15,553 |

|---|

| '20 | $16,011 | $16,374 |

|---|

| '20 | $16,323 | $16,736 |

|---|

| '20 | $17,259 | $17,716 |

|---|

| '20 | $18,425 | $19,016 |

|---|

| '20 | $17,669 | $18,321 |

|---|

| '20 | $17,193 | $17,879 |

|---|

| '20 | $19,246 | $19,985 |

|---|

| '20 | $20,083 | $20,830 |

|---|

| '21 | $20,001 | $20,658 |

|---|

| '21 | $20,297 | $21,257 |

|---|

| '21 | $21,101 | $22,061 |

|---|

| '21 | $22,201 | $23,249 |

|---|

| '21 | $22,495 | $23,359 |

|---|

| '21 | $23,102 | $23,944 |

|---|

| '21 | $23,552 | $24,442 |

|---|

| '21 | $24,003 | $25,149 |

|---|

| '21 | $22,894 | $23,994 |

|---|

| '21 | $24,454 | $25,659 |

|---|

| '21 | $23,968 | $25,315 |

|---|

| '21 | $25,164 | $26,340 |

|---|

| '22 | $23,743 | $24,855 |

|---|

| '22 | $23,570 | $24,173 |

|---|

| '22 | $24,419 | $24,989 |

|---|

| '22 | $22,353 | $22,761 |

|---|

| '22 | $22,332 | $22,727 |

|---|

| '22 | $20,566 | $20,823 |

|---|

| '22 | $22,332 | $22,763 |

|---|

| '22 | $21,601 | $21,889 |

|---|

| '22 | $19,551 | $19,863 |

|---|

| '22 | $21,439 | $21,456 |

|---|

| '22 | $22,596 | $22,617 |

|---|

| '22 | $21,256 | $21,302 |

|---|

| '23 | $22,637 | $22,730 |

|---|

| '23 | $22,068 | $22,189 |

|---|

| '23 | $22,677 | $22,891 |

|---|

| '23 | $22,832 | $23,175 |

|---|

| '23 | $22,832 | $23,283 |

|---|

| '23 | $24,358 | $24,855 |

|---|

| '23 | $25,274 | $25,710 |

|---|

| '23 | $24,794 | $25,260 |

|---|

| '23 | $23,769 | $24,073 |

|---|

| '23 | $23,290 | $23,491 |

|---|

| '23 | $25,405 | $25,685 |

|---|

| '23 | $26,691 | $26,953 |

|---|

| '24 | $27,171 | $27,329 |

|---|

| '24 | $28,589 | $28,805 |

|---|

| '24 | $29,701 | $29,728 |

|---|

| '24 | $28,136 | $28,463 |

|---|

| '24 | $29,744 | $29,804 |

|---|

| '24 | $30,467 | $30,790 |

|---|

| '24 | $30,816 | $31,238 |

|---|

| '24 | $31,143 | $31,979 |

|---|

| '24 | $31,819 | $32,663 |

|---|

| '24 | $31,259 | $32,434 |

|---|

| '24 | $33,427 | $34,522 |

|---|

| '24 | $32,052 | $33,560 |

|---|

Yearly periods ended December 31

Average Annual Total Returns

| Class/Index | 1-Year | 5-Year | 10-Year |

|---|

| Class A | 20.08% | 13.13% | 12.35% |

|---|

Russell 1000® Index | 24.51% | 14.28% | 12.87% |

|---|

Performance shown is historical. The Fund's past performance is not a good predictor or guarantee of the Fund's future performance. Investment return and principal fluctuate, so your shares may be worth more or less when redeemed. Current performance may be lower or higher than the performance data quoted. The performance graph and returns table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.Please contact your participating insurance company for the Fund's most recent month end performance. Performance does not reflect charges and fees (contract charges) associated with the separate account that invests in the Fund or any variable life insurance policy or variable annuity contract for which the Fund is an investment option. These charges and fees will reduce returns. Fund performance includes reinvestment of all distributions.

| Net Assets ($) | 115,040,970 |

|---|

| Number of Portfolio Holdings | 98 |

|---|

| Portfolio Turnover Rate (%) | 17 |

|---|

| Total Net Advisory Fees Paid ($) | 453,008 |

|---|

What did the Fund invest in?

Holdings-based data is subject to change.

| Asset Type | % of Net Assets |

| Common Stocks | 99% |

| Cash Equivalents | 1% |

| Other Assets and Liabilities, Net | 0% |

| Total | 100% |

| Sector | % of Net Assets |

| Information Technology | 30% |

| Financials | 14% |

| Consumer Discretionary | 11% |

| Health Care | 10% |

| Communication Services | 10% |

| Industrials | 9% |

| Consumer Staples | 5% |

| Energy | 3% |

| Real Estate | 3% |

| Materials | 2% |

| Utilities | 2% |

Ten Largest Equity Holdings

| Holdings | 42.2% of Net Assets |

|---|

| Apple, Inc. | 9.3% |

| Microsoft Corp. | 8.1% |

| NVIDIA Corp. | 5.9% |

| Alphabet, Inc. | 3.7% |

| JPMorgan Chase & Co. | 3.3% |

| Amazon.com, Inc. | 3.2% |

| Meta Platforms, Inc. | 2.7% |

| Visa, Inc. | 2.3% |

| Caterpillar, Inc. | 1.9% |

| Ameriprise Financial, Inc. | 1.8% |

This is a summary of certain changes of the Fund since January 1, 2024. For more information, review the Fund's current prospectus at dws.com/vipreports, or call (800) 728-3337.

Effective May 1, 2024, the Fund’s contractual cap on total annual operating expense for Class A shares changed from 0.60% to 0.70%. In addition, effective October 1, 2024, the Fund’s contractual cap on total annual operating expense for Class A shares changed from 0.70% to 0.66%. The caps exclude certain expenses such as extraordinary expenses, taxes, brokerage, interest expense and acquired fund fees and expenses.

If you wish to view additional information about the Fund, including, but not limited to, its prospectus, quarterly holdings, Board fee evaluation reports, and financial statements and other information, please visit dws.com/vipreports. For information about the Fund's proxy voting policies and procedures and how the Fund voted proxies related to its portfolio securities, please visit dws.com/en-us/resources/proxy-voting. This additional information is also available free of charge by contacting us at (800) 728-3337.

Stocks may decline in value. Fund management could be wrong in its analysis of industries, companies, economic trends and favor a security that underperforms the market. The Fund may lend securities to approved institutions. Investing in derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase volatility. Please read the prospectus for more information.

This report must be preceded or accompanied by a prospectus. We advise you to consider the Fund's objectives, risks, charges, and expenses carefully before investing. The prospectus contains this and other important information about the Fund, which can be requested by calling (800) 728-3337, contacting your financial representative, or visit dws.com/vipreports to view or download a prospectus. Please read the prospectus carefully before you invest.

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.

©2025 DWS Group GmbH&Co. KGaA. All rights reserved

VS1coreq-TSRA-A

R-104183-1 (02/25)

| | |

| | (b) Not applicable |

| | |

| Item 2. | Code of Ethics. |

| | |

| | As of the end of the period covered by this report, the registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR that applies to its Principal Executive Officer and Principal Financial Officer. There have been no amendments to, or waivers from, a provision of the code of ethics during the period covered by this report that would require disclosure under Item 2. A copy of the code of ethics is filed as an exhibit to this Form N-CSR. |

| | |

| Item 3. | Audit Committee Financial Expert. |

| | |

| | The fund’s audit committee is comprised solely of trustees who are "independent" (as such term has been defined by the Securities and Exchange Commission ("SEC") in regulations implementing Section 407 of the Sarbanes-Oxley Act (the "Regulations")). The fund’s Board of Trustees has determined that there are several "audit committee financial experts" (as such term has been defined by the Regulations) serving on the fund’s audit committee including Ms. Catherine Schrand, the chair of the fund’s audit committee. An “audit committee financial expert” is not an “expert” for any purpose, including for purposes of Section 11 of the Securities Act of 1933 and the designation or identification of a person as an “audit committee financial expert” does not impose on such person any duties, obligations or liability that are greater than the duties, obligations and liability imposed on such person as a member of the audit committee and board of directors in the absence of such designation or identification. |

| | |

| Item 4. | Principal Accountant Fees and Services. |

| | |

Deutsche DWS Variable Series I

form n-csr disclosure re: AUDIT FEES

The following table shows the amount of fees that Ernst & Young LLP (“EY”), the Fund’s Independent Registered Public Accounting Firm, billed to the Fund during the Fund’s last two fiscal years. The Audit Committee approved in advance all audit services and non-audit services that EY provided to the Fund.

Services that the Fund’s Independent Registered Public Accounting Firm Billed to the Fund

Fiscal Year

Ended

December 31, | Audit Fees Billed to Fund | Audit-Related

Fees Billed to Fund | Tax Fees Billed to Fund | All

Other Fees Billed to Fund |

| 2024 | $203,516 | $0 | $27,195 | $0 |

| 2023 | $198,753 | $0 | $27,195 | $0 |

The above “Tax Fees” were billed for professional services rendered for tax preparation.

Services that the Fund’s Independent Registered Public Accounting Firm Billed to the Adviser and Affiliated Fund Service Providers

The following table shows the amount of fees billed by EY to DWS Investment Management Americas, Inc. (“DIMA” or the “Adviser”), and any entity controlling, controlled by or under common control with DIMA (“Control Affiliate”) that provides ongoing services to the Fund (“Affiliated Fund Service Provider”), for engagements directly related to the Fund’s operations and financial reporting, during the Fund’s last two fiscal years.

Fiscal Year

Ended

December 31, | Audit-Related

Fees Billed to Adviser and Affiliated Fund Service Providers | Tax Fees Billed to Adviser and Affiliated Fund Service Providers | All

Other Fees Billed to Adviser and Affiliated Fund Service Providers |

| 2024 | $0 | $637,276 | $0 |

| 2023 | $0 | $424,143 | $0 |

The above “Tax Fees” were billed in connection with tax compliance services and agreed upon procedures.

Non-Audit Services

The following table shows the amount of fees that EY billed during the Fund’s last two fiscal years for non-audit services. The Audit Committee pre-approved all non-audit services that EY provided to the Adviser and any Affiliated Fund Service Provider that related directly to the Fund’s operations and financial reporting. The Audit Committee requested and received information from EY about any non-audit services that EY rendered during the Fund’s last fiscal year to the Adviser and any Affiliated Fund Service Provider. The Committee considered this information in evaluating EY’s independence.

Fiscal Year

Ended

December 31, | Total

Non-Audit Fees Billed to Fund

(A) | Total Non-Audit Fees billed to Adviser and Affiliated Fund Service Providers (engagements related directly to the operations and financial reporting of the Fund)

(B) | Total Non-Audit Fees billed to Adviser and Affiliated Fund Service Providers (all other engagements)

(C) | Total of

(A), (B) and (C) |

| 2024 | $27,195 | $637,276 | $0 | $664,471 |

| 2023 | $27,195 | $424,143 | $0 | $451,338 |

All other engagement fees were billed for services in connection with agreed upon procedures and tax compliance for DIMA and other related entities.

Audit Committee Pre-Approval Policies and Procedures. Generally, each Fund’s Audit Committee must pre approve (i) all services to be performed for a Fund by a Fund’s Independent Registered Public Accounting Firm and (ii) all non-audit services to be performed by a Fund’s Independent Registered Public Accounting Firm for the DIMA Entities with respect to operations and financial reporting of the Fund, except that the Chairperson or Vice Chairperson of each Fund’s Audit Committee may grant the pre-approval for non-audit services described in items (i) and (ii) above for non-prohibited services for engagements of less than $100,000. All such delegated pre approvals shall be presented to each Fund’s Audit Committee no later than the next Audit Committee meeting.

There were no amounts that were approved by the Audit Committee pursuant to the de minimis exception under Rule 2-01 of Regulation S-X.

According to the registrant’s principal Independent Registered Public Accounting Firm, substantially all of the principal Independent Registered Public Accounting Firm's hours spent on auditing the registrant's financial statements were attributed to work performed by full-time permanent employees of the principal Independent Registered Public Accounting Firm and (i) and (j) are not applicable.

***

In connection with the audit of the 2023 and 2024 financial statements, the Fund entered into an engagement letter with EY. The terms of the engagement letter required by EY, and agreed to by the Audit Committee, include a provision mandating the use of mediation and arbitration to resolve any controversy or claim between the parties arising out of or relating to the engagement letter or services provided thereunder.

***

| | |

| Item 5. | Audit Committee of Listed Registrants |

| | |

| | Not applicable |

| | |

| Item 6. | Investments. |

| | |

| | Not applicable |

| | |

| Item 7. | Financial Statements and Financial Highlights for Open-End Management Investment Companies. |

| | |

| | (a) |

December 31, 2024

Annual Financial Statements and Other Information

Deutsche DWS Variable Series I

The brand DWS represents DWS Group GmbH & Co. KGaA and any of its subsidiaries such as DWS Distributors, Inc., which offers investment products, or DWS Investment Management Americas, Inc. and RREEF America L.L.C., which offer advisory services.DWS Distributors, Inc., 222 South Riverside Plaza, Chicago, IL 60606, (800) 621-1148

| Deutsche DWS Variable Series I — DWS Capital Growth VIP |

Investment Portfolioas of December 31, 2024

| | |

| |

Communication Services 13.7% | |

| |

Live Nation Entertainment, Inc.* | | | |

| | | |

| | | |

| | | |

| | | |

Interactive Media & Services 8.4% | |

| | | |

| | | |

| | | |

| | | |

Wireless Telecommunication Services 1.0% | |

| | | |

Consumer Discretionary 8.6% | |

| |

| | | |

Hotels, Restaurants & Leisure 0.9% | |

| | | |

Planet Fitness, Inc. "A"* | | | |

| | | |

| |

| | | |

| |

| | | |

| | | |

| | | |

Textiles, Apparel & Luxury Goods 0.5% | |

Lululemon Athletica, Inc.* | | | |

| |

| |

Constellation Brands, Inc. "A" | | | |

Consumer Staples Distribution & Retail 1.1% | |

| | | |

| |

| |

Intercontinental Exchange, Inc. | | | |

| | | |

| | | |

| |

| | | |

| | |

| |

| | | |

| | | |

| | | |

| |

| | | |

| |

| |

| | | |

Vertex Pharmaceuticals, Inc.* | | | |

| | | |

Health Care Equipment & Supplies 4.7% | |

| | | |

| | | |

| | | |

Intuitive Surgical, Inc.* | | | |

| | | |

| | | |

Health Care Providers & Services 1.1% | |

| | | |

Life Sciences Tools & Services 2.6% | |

| | | |

| | | |

Thermo Fisher Scientific, Inc. | | | |

| | | |

| |

| | | |

| | | |

| | | |

| |

| |

| | | |

| |

| | | |

Construction & Engineering 0.8% | |

| | | |

Electrical Equipment 2.1% | |

| | | |

| | | |

| | | |

Ground Transportation 0.9% | |

| | | |

The accompanying notes are an integral part of the financial statements.

Deutsche DWS Variable Series I — DWS Capital Growth VIP | |

| | |

Professional Services 1.0% | |

| | | |

| | | |

| | | |

Information Technology 46.9% | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

Semiconductors & Semiconductor Equipment 14.8% | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

Guidewire Software, Inc.* | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Technology Hardware, Storage & Peripherals 9.4% | |

| | | |

| |

Construction Materials 0.6% | |

| | | |

| | |

| |

| |

| | | |

Real Estate Management & Development 0.7% | |

| | | |

| | | |

| | | |

| |

| | | |

Total Common Stocks (Cost $330,381,965) | |

Securities Lending Collateral 0.0% |

DWS Government & Agency Securities Portfolio "DWS Government Cash Institutional Shares", 4.39% (b) (c) (Cost $182,600) | | | |

|

DWS Central Cash Management Government Fund, 4.52% (b) (Cost $14,783,560) | | | |

| | | |

Total Investment Portfolio (Cost $345,348,125) | | | |

Other Assets and Liabilities, Net | | | |

| | | |

A summary of the Fund’s transactions with affiliated investments during the year ended December 31, 2024 are as follows:

| | | Net Realized

Gain/

(Loss) ($) | Net Change in

Unrealized

Appreciation

(Depreciation) ($) | | Capital Gain

Distributions ($) | Number

of Shares

at

12/31/2024 | |

Securities Lending Collateral 0.0% |

DWS Government & Agency Securities Portfolio "DWS Government Cash Institutional Shares",

4.39% (b) (c) |

| | | | | | | | |

The accompanying notes are an integral part of the financial statements.

| Deutsche DWS Variable Series I — DWS Capital Growth VIP |

| | | Net Realized Gain/ (Loss) ($) | Net Change in Unrealized Appreciation (Depreciation) ($) | | Capital Gain Distributions ($) | Number of Shares at 12/31/2024 | |

|

DWS Central Cash Management Government Fund, 4.52% (b) |

| | | | | | | | |

| | | | | | | | |

| Non-income producing security. |

| All or a portion of these securities were on loan. In addition, "Other Assets and Liabilities, Net" may include pending sales that are also on loan. The value of securities loaned at December 31, 2024 amounted to $205,899, which is 0.02% of net assets. |

| Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualized seven-day yield at period end. |

| Represents cash collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. In addition, the Fund held non-cash U.S. Treasury securities collateral having a value of $30,001. |

| Represents the net increase (purchase cost) or decrease (sales proceeds) in the amount invested in cash collateral for the year ended December 31, 2024. |

REIT: Real Estate Investment Trust |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk or liquidity associated with investing in those securities.

The following is a summary of the inputs used as of December 31, 2024 in valuing the Fund's investments. For information on the Fund's policy regarding the valuation of investments, please refer to the Security Valuation section of Note A in the accompanying Notes to Financial Statements.

| | | | |

| | | | |

Short-Term Investments (a) | | | | |

| | | | |

| See Investment Portfolio for additional detailed categorizations. |

The accompanying notes are an integral part of the financial statements.

Deutsche DWS Variable Series I — DWS Capital Growth VIP | |