AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MARCH 12, 2009

SECURITIES ACT FILE NO. 333- 156991

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| | | | |

| | THE SECURITIES ACT OF 1933 | | x |

| | |

| | Pre-Effective Amendment No. 1 | | x |

| | Post-Effective Amendment No. | | ¨ |

DWS VARIABLE SERIES I

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154

(Address of Principal Executive Offices) (Zip Code)

617-295-1000

(Registrant’s Area Code and Telephone Number)

John Millette, Secretary

One Beacon Street

Boston, Massachusetts 02108

(Name and Address of Agent for Service)

With copies to:

Thomas Hiller, Esq.

Ropes & Gray

One International Place

Boston, MA 02110

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

TITLE OF SECURITIES BEING REGISTERED: Shares of Beneficial Interest (no par value) of the Registrant.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Questions & Answers

DWS Janus Growth & Income VIP

DWS Variable Series II

Q&A

Q What is happening?

A DWS Investments is proposing to merge DWS Janus Growth & Income VIP into DWS Capital Growth VIP.

Q What issue am I being asked to vote on?

A You are being asked to vote on a proposal to merge DWS Janus Growth & Income VIP into DWS Capital Growth VIP.

After carefully reviewing the proposal, the Board of DWS Variable Series II, of which DWS Janus Growth & Income VIP is a series, has determined that this action is in the best interests of the fund. The Board unanimously recommends that you vote for this proposal.

Q I am the owner of a variable life insurance policy or variable annuity contract offered by my insurance company. I am not a shareholder of the fund. Why am I being asked to vote on a proposal for DWS Janus Growth & Income VIP shareholders?

A You have previously directed your insurance company to invest certain proceeds relating to your variable life insurance policy and/or variable annuity contract (each a “Contract”) in DWS Janus Growth & Income VIP. Although you receive the gains, losses and income from this investment, your insurance company holds on your behalf any shares corresponding to your investment in the fund. Thus, you are not the “shareholder” of DWS Janus Growth & Income VIP; rather, your insurance company is

Q&A continued

the shareholder. However, you have the right to instruct your insurance company on how to vote the fund shares corresponding to your investment.

The attached proxy statement is, therefore, used to solicit voting instructions from you and other owners of Contracts. All persons entitled to direct the voting shares of the fund, whether or not they are shareholders, are described as voting for purposes of the proxy statement.

Q Why has this proposal been made for the fund?

A DWS Investments believes that the proposed merger is in the best interests of DWS Janus Growth & Income VIP for several reasons. DWS Investments believes that the merger will result in lower management fees and lower operational expenses through economies of scale. In addition, DWS Investments believes that the merger will benefit Contract Owners (as defined on page 1 of the enclosed Prospectus/Proxy Statement) by transitioning their investment into DWS Capital Growth VIP, a fund with more favorable performance over recent years and that is open to broader distribution, both of which may subsequently lead to additional sales and additional economies of scale. Finally, the proposed merger is consistent with ongoing efforts by DWS Investments to consolidate overlapping fund products. Accordingly, DWS Investments proposed the merger of DWS Janus Growth & Income VIP into DWS Capital Growth VIP.

While DWS Investments believes that DWS Capital Growth VIP should provide a comparable investment opportunity for shareholders of DWS Janus Growth & Income VIP, there are a number of differences in the portfolios of the funds. If the merger is approved by shareholders of DWS Janus Growth & Income VIP, DWS Investments expects that all of DWS Janus Growth & Income VIP’s holdings will be liquidated after shareholder approval and prior to the merger. Proceeds from the liquidation will be used to acquire securities consistent with DWS Capital Growth VIP’s current implementation of its investment objective, policies, restrictions and strategies. The repositioning of DWS Janus Growth & Income VIP’s portfolio prior to the merger will involve transaction costs which will be borne by DWS Janus Growth & Income VIP subject to an expense cap agreed to by Deutsche Investment Management Americas Inc.

Q&A continued

(“DIMA”), DWS Janus Growth & Income VIP’s investment adviser. Pursuant to the expense cap, DIMA will pay any one-time merger costs, including the transaction costs associated with repositioning DWS Janus Growth & Income VIP’s portfolio, to the extent those costs exceed the estimated total one-year benefit expected to be realized by DWS Janus Growth & Income VIP through the proposed merger. See page 23 of the enclosed Prospectus/Proxy Statement for more information regarding the costs of the merger and DIMA’s agreement to cap expenses.

Contract Owners may continue to instruct their insurance company on how to invest proceeds relating to their Contract, including effecting sales into or out of DWS Janus Growth & Income VIP. Contract Owners should contact their insurance company for further information regarding their investment.

Q Will I have to pay taxes as a result of the merger?

A The merger is expected to be a tax-free reorganization for federal income tax purposes and will not take place unless special tax counsel provides an opinion to that effect. Before or after the merger, you may instruct your insurance company to direct proceeds relating to your Contract out of DWS Janus Growth & Income VIP and into other investments (such direction, a “Transfer”). A Contract Owner will not be subject to tax at the time of a Transfer. However, a Contract Owner’s insurance company may charge a fee for Transfers. If you choose to redeem or exchange your investment by surrendering your Contract or initiating a partial withdrawal before or after the merger, you may be subject to taxes and tax penalties; therefore, you may wish to consult a tax advisor before doing so.

Q Upon the merger, how will the value of my investment change?

A The aggregate value of your investment will not change as a result of the merger. However, the number of shares owned by your insurance company on your behalf will likely change as a result of the merger because your insurance company’s shares will be exchanged at the net asset value per share of DWS Janus Growth & Income VIP, which will probably be different from the net asset value per share of DWS Capital Growth VIP.

Q&A continued

Q When would the merger take place?

A If approved, the merger would occur on or about April 27, 2009, or as soon as reasonably practicable after shareholder approval is obtained. Shortly after completion of the merger, shareholders whose accounts are affected by the merger (i.e., your insurance company) will receive a confirmation statement reflecting their new account number and the number of shares of DWS Capital Growth VIP they are receiving. Subsequently, you will be notified of changes to your account information by your insurance company.

Q How can I vote?

A You can vote in any one of three ways:

| n | | Through the Internet, by going to the website listed on your voting instruction form; |

| n | | By telephone, with a toll-free call to the number listed on your voting instruction form; or |

| n | | By mail, by sending the enclosed voting instruction form, signed and dated, to us in the enclosed envelope. |

We encourage you to vote over the Internet or by telephone, following the instructions that appear on your voting instruction form. Whichever method you choose, please take the time to read the full text of the Prospectus/Proxy Statement before you vote.

Q Whom should I call for additional information about this Prospectus/Proxy Statement?

A Please call Computershare Fund Services, Inc., your fund’s information agent, at 1-866-963-6127, or your insurance company.

DWS JANUS GROWTH & INCOME VIP

A Message from the President of DWS Variable Series II

, 2009

Dear Investor:

I am writing to ask you to instruct your insurance company as to how to vote on an important matter that affects your investment in DWS Janus Growth & Income VIP (“Janus Growth & Income”). You may provide your instructions by filling out and signing the enclosed voting instruction form, or by recording your instructions by telephone or through the Internet.

We are asking for your voting instructions on the following matter:

| | |

| Proposal: | | Approving an Agreement and Plan of Reorganization and the transactions it contemplates, including the transfer of all of the assets of Janus Growth & Income to DWS Capital Growth VIP (“Capital Growth”), in exchange for shares of Capital Growth and the assumption by Capital Growth of all the liabilities of Janus Growth & Income, and the distribution of such shares, on a tax-free basis for federal income tax purposes, to the shareholders of Janus Growth & Income in complete liquidation and termination of Janus Growth & Income. |

DWS Investments has proposed the merger of Janus Growth & Income into Capital Growth because it believes the proposed merger is in the best interests of Janus Growth & Income for several reasons. DWS Investments believes that the merger will result in lower management fees and lower operational expenses through economies of scale. In addition, DWS Investments believes that the merger will benefit contract owners by transitioning their investment into DWS Capital Growth VIP, a fund with more favorable performance over recent years and that is open to broader distribution, both of which may subsequently lead to additional sales and additional economies of scale. Finally, the proposed merger is consistent with ongoing efforts by DWS Investments to consolidate overlapping fund products. The Board of Trustees of DWS Variable Series II has unanimously approved the proposed merger.

In determining to approve the merger, the Board conducted a thorough review of the potential implications of the merger, and concluded that Janus Growth & Income’s participation in the proposed merger would be in the best interests of Janus Growth & Income and would not dilute the interests of existing shareholders. A discussion of the factors the Board considered is included in the attached Prospectus/Proxy Statement. If the merger is approved, the Board expects that the proposed changes will take effect during the second calendar quarter of 2009.

Included in this booklet is information about the upcoming shareholders’ meeting:

| | • | | A Notice of a Special Meeting of Shareholders, which summarizes the issue for which you are being asked to provide voting instructions; and |

| | • | | A Prospectus/Proxy Statement, which provides detailed information on Capital Growth, the specific proposal that will be considered at the shareholders’ meeting, and why the proposal is being made. |

We need your voting instructions and urge you to review the enclosed materials thoroughly. Once you’ve determined how you would like your interests to be represented, please promptly complete, sign, date and return the enclosed voting instruction form, or record your voting instructions by telephone or on the Internet. A postage-paid envelope is enclosed for mailing, and telephone and Internet voting instructions are listed at the top of your voting instruction form. You may receive more than one voting instruction form. If so, please vote each one.

I’m sure that you, like most people, lead a busy life and are tempted to put this Prospectus/Proxy Statement aside for another day. Please don’t. Your prompt return of the enclosed voting instruction form (or your voting by telephone or through the Internet) may save the necessity and expense of further solicitations.

Your vote is important to us. We appreciate the time and consideration I am sure you will give to this important matter. If you have questions about the proposal, please call Computershare Fund Services, Inc., DWS Janus Growth & Income VIP’s information agent, at 1-866-963-6127 or contact your insurance company. Thank you for your continued support of DWS Investments.

Sincerely yours,

Michael Clark

President

DWS Variable Series II

DWS JANUS GROWTH & INCOME VIP

NOTICE OF A SPECIAL MEETING OF SHAREHOLDERS

This is the formal agenda for your Fund’s special meeting of shareholders. It tells you what matter will be voted on and the time and place of the meeting.

To the Shareholders of DWS Janus Growth & Income VIP (“Janus Growth & Income”):

A Special Meeting of Shareholders of Janus Growth & Income will be held April 13, 2009 at 2:15 p.m. Eastern time, at the offices of Deutsche Investment Management Americas Inc., 345 Park Avenue, 27th Floor, New York, New York 10154 (the “Meeting”), to consider the following (the “Proposal”):

| | |

| Proposal: | | Approving an Agreement and Plan of Reorganization and the transactions it contemplates, including the transfer of all of the assets of Janus Growth & Income to DWS Capital Growth VIP (“Capital Growth”), in exchange for shares of Capital Growth and the assumption by Capital Growth of all the liabilities of Janus Growth & Income, and the distribution of such shares, on a tax-free basis for federal income tax purposes, to the shareholders of Janus Growth & Income in complete liquidation and termination of Janus Growth & Income. |

The persons named as proxies will vote in their discretion on any other business that may properly come before the Meeting or any adjournments or postponements thereof.

Holders of record of shares of Janus Growth & Income at the close of business on February 10, 2009 are entitled to vote at the Meeting and at any adjournments or postponements thereof.

The chairman of the Meeting may adjourn the Meeting without further notice with respect to the proposal to a designated time and place, whether or not a quorum is present with respect to the proposal. Upon motion of the chairman of the Meeting, the question of adjournment may be submitted to a vote of the shareholders, and in that case, any adjournment must be approved by the vote of holders of a majority of the shares present and entitled to vote with respect to the proposal and without further notice. The Board may postpone the Meeting with notice to shareholders entitled to vote at the Meeting.

By order of the Board of Trustees

John Millette

Secretary

, 2009

WE URGE YOU TO MARK, SIGN, DATE AND MAIL THE ENCLOSED PROXY IN THE POSTAGE-PAID ENVELOPE PROVIDED OR RECORD YOUR VOTING INSTRUCTIONS BY TELEPHONE OR THROUGH THE INTERNET SO THAT YOU WILL BE REPRESENTED AT THE MEETING.

IF YOU SIMPLY SIGN THE VOTING INSTRUCTION FORM, IT WILL BE VOTED IN ACCORDANCE WITH THE BOARD’S RECOMMENDATION ON THE PROPOSAL. YOUR PROMPT RETURN OF THE ENCLOSED VOTING INSTRUCTION FORM (OR YOUR VOTING BY TELEPHONE OR VIA THE INTERNET) MAY SAVE THE NECESSITY AND EXPENSE OF FURTHER SOLICITATIONS.

INSTRUCTIONS FOR SIGNING VOTING INSTRUCTION FORMS

The following general rules for signing voting instruction forms may be of assistance to you and avoid the time and expense involved in validating your vote if you fail to sign your voting instruction form properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the voting instruction form.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the voting instruction form.

3. All Other Accounts: The capacity of the individual signing the voting instruction form should be indicated unless it is reflected in the form of registration. For example:

| | |

Registration | | Valid Signature |

Corporate Accounts: | | |

(1) ABC Corp. | | ABC Corp.

John Doe, Treasurer |

(2) ABC Corp. | | John Doe, Treasurer |

(3) ABC Corp. c/o John Doe, Treasurer | | John Doe |

(4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| |

Partnership Accounts | | |

(1) The XYZ Partnership | | Jane B. Smith, Partner |

(2) Smith and Jones, Limited Partnership | | Jane B. Smith, General Partner |

| |

Trust Accounts | | |

(1) ABC Trust Account | | Jane B. Doe, Trustee |

(2) Jane B. Doe, Trustee u/t/d 12/28/78 | | Jane B. Doe |

| |

Custodial or Estate Accounts | | |

(1) John B. Smith, Cust. f/b/o John B. Smith Jr.

UGMA/UTMA | | John B. Smith |

(2) Estate of John B. Smith | | John B. Smith, Jr., Executor |

IMPORTANT INFORMATION FOR OWNERS OF VARIABLE ANNUITY OR LIFE INSURANCE CONTRACTS INVESTED IN DWS JANUS GROWTH & INCOME VIP

This document contains a Prospectus/Proxy Statement and a voting instruction form. A voting instruction form is, in essence, a ballot. You can use your voting instruction form to tell your insurance company how to vote on your behalf on an important issue relating to your investment in DWS Janus Growth & Income VIP. If you complete and sign the voting instruction form (or tell your insurance company by telephone or through the Internet how you want it to vote), your insurance company will vote the shares corresponding to your insurance contract exactly as you indicate. If you simply sign the voting instruction form, your insurance company will vote the shares corresponding to your contract in accordance with the Board’s recommendation on page 22. If you do not return your voting instruction form or record your voting instructions by telephone or through the Internet, your insurance company will vote your shares in the same proportion as shares for which instructions have been received. As a result, a small number of Contract Owners may determine the outcome of the vote.

We urge you to review the Prospectus/Proxy Statement carefully, and either fill out your voting instruction form and return it by mail, or record your voting instructions by telephone or through the Internet. Your prompt return of the enclosed voting instruction form (or your providing voting instructions by telephone or through the Internet) may save the necessity and expense of further solicitations.

We want to know how you would like your interests to be represented and welcome your comments. Please take a few minutes to read these materials and return your voting instruction form. If you have any questions, please call Computershare Fund Services, Inc., DWS Janus Growth & Income VIP’s information agent, at the special toll-free number we have set up for you 1-866-963-6127 or contact your insurance company.

PROSPECTUS/PROXY STATEMENT

, 2009

| | |

Acquisition of the assets of: | | By and in exchange for shares of: |

| |

DWS Janus Growth & Income VIP, a series of DWS Variable Series II | | DWS Capital Growth VIP, a series of DWS Variable Series I |

345 Park Avenue New York, NY 10154 800-778-1482 | | 345 Park Avenue New York, NY 10154 800-778-1482 |

This Prospectus/Proxy Statement is being furnished in connection with the proposed merger of DWS Janus Growth & Income VIP (“Janus Growth & Income”) into DWS Capital Growth VIP (“Capital Growth”). Janus Growth & Income and Capital Growth are referred to herein collectively as the “Funds,” and each is referred to herein individually as a “Fund.” As a result of the proposed merger, each shareholder of Janus Growth & Income will receive a number of full and fractional shares of the corresponding class of Capital Growth equal in aggregate value as of the Valuation Time (as defined below on page 22) to the aggregate value of such shareholder’s Janus Growth & Income shares.

Shares of Janus Growth & Income are available exclusively as a funding vehicle for variable life insurance policies and variable annuity contracts (each a “Contract”) offered by the separate accounts, or sub-accounts thereof, of certain life insurance companies (“Participating Insurance Companies”). The Participating Insurance Companies own shares of Janus Growth & Income as depositors for the owners of their respective Contracts (each a “Contract Owner”). Thus, individual Contract Owners are not the “shareholders” of Janus Growth & Income. Rather, the Participating Insurance Companies and their separate accounts are the shareholders. To the extent required to be consistent with the interpretations of voting requirements by the staff of the Securities and Exchange Commission (“SEC”), each Participating Insurance Company will offer to Contract Owners the opportunity to instruct it as to how it should vote shares held by it and the separate accounts on the proposed merger. This Prospectus/Proxy Statement is, therefore, furnished to Contract Owners entitled to give voting instructions with regard to Janus Growth & Income. All persons entitled to direct the voting of shares of Janus Growth & Income, whether or not they are shareholders, are described as voting for purposes of this Prospectus/Proxy Statement.

This Prospectus/Proxy Statement is being mailed on or about , 2009. It explains concisely what you should know before voting on the matter described herein or investing in Capital Growth, a series of DWS Variable Series I, an open-end management investment company. Please read it carefully and keep it for future reference.

The securities offered by this Prospectus/Proxy Statement have not been approved or disapproved by the Securities and Exchange Commission (the “SEC”), nor has the SEC passed upon the accuracy or adequacy of this Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

1

The following documents have been filed with the SEC and are incorporated into this Prospectus/Proxy Statement by reference:

| | (i) | | the prospectus of Capital Growth dated May 1, 2008, as supplemented from time to time, for Class A shares, a copy of which is included with this Prospectus/Proxy Statement (File No. 002-96461); |

| | (ii) | | the prospectus of Janus Growth & Income dated May 1, 2008, as supplemented from time to time, for Class A shares (File No. 033-11802); |

| | (iii) | | the statement of additional information of Janus Growth & Income dated May 1, 2008, as supplemented from time to time (File No. 033-11802); |

| | (iv) | | the statement of additional information relating to the proposed merger, dated �� 2009 (the “Merger SAI”) (File No. 333-156991); and |

| | (v) | | the audited financial statements and related independent registered public accounting firm’s report for Janus Growth & Income contained in the Annual Report for the fiscal year ended December 31, 2008. |

No other parts of Janus Growth & Income’s Annual Report are incorporated by reference herein.

The financial highlights for Capital Growth contained in the Annual Report to shareholders for the period ended December 31, 2008, are attached to this Prospectus/Proxy Statement as Exhibit B.

You may receive free copies of the Funds’ Annual Reports, Semi-annual Reports, prospectuses, statements of additional information (the “SAIs”) and/or the Merger SAI, request other information about a Fund, or make shareholder inquiries, by contacting your insurance company or by calling the corresponding Fund at 1-800-778-1482.

Like shares of Janus Growth & Income, shares of Capital Growth are not deposits or obligations of, or guaranteed or endorsed by, any financial institution, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and involve risk, including the possible loss of the principal amount invested.

This document is designed to give you the information you need to vote on the proposal. Much of the information is required disclosure under rules of the SEC; some of it is technical. If there is anything you don’t understand, please contact Computershare Fund Services, Inc., Janus Growth & Income’s information agent, at 1-866-963-6127, or contact your insurance company.

Each Fund is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith files reports and other information with the SEC. You may review and copy information about the Funds, including the SAIs, at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. You may call the SEC at 1-202-551-5850 for information about the operation of the public reference room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the Public Reference Branch, Office of Consumer

2

Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the Funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

I. SYNOPSIS

The responses to the questions that follow provide an overview of key points typically of concern to shareholders considering a proposed merger between mutual funds. These responses are qualified in their entirety by the remainder of this Prospectus/Proxy Statement, which you should read carefully because it contains additional information and further details regarding the proposed merger.

| 1. | | What is being proposed? |

The Board of DWS Variable Series II (the “Trust”), of which Janus Growth & Income is a series, is recommending that shareholders approve the transactions contemplated by the Agreement and Plan of Reorganization (as described below in Part IV and the form of which is attached hereto as Exhibit A), which are referred to herein as a merger of Janus Growth & Income into Capital Growth. If approved by shareholders, all of the assets of Janus Growth & Income will be transferred to Capital Growth solely in exchange for the issuance and delivery to Janus Growth & Income of Class A shares of Capital Growth (“Merger Shares”) with an aggregate value equal to the value of Janus Growth & Income’s assets net of liabilities and for the assumption by Capital Growth of all the liabilities of Janus Growth & Income. All Merger Shares delivered to Janus Growth & Income will be delivered at net asset value without a sales load, commission or other similar fee being imposed. Immediately following the transfer, the Merger Shares received by Janus Growth & Income will be distributed pro rata, on a tax-free basis for federal income tax purposes, to its shareholders of record.

| 2. | | What will happen to an investment in Janus Growth & Income as a result of the merger? |

An investment in Janus Growth & Income will, in effect, be exchanged on a federal income tax-free basis for an investment in the same class of Capital Growth with an equal aggregate net asset value as of the Valuation Time (as defined below on page 22).

| 3. | | Why has the Board of the Trust recommended that shareholders approve the merger? |

DWS Investments advised the Board that it believes the proposed merger is in the best interests of Janus Growth & Income for several reasons. DWS Investments believes that the merger will result in lower management fees and lower operational expenses through economies of scale. In addition, DWS Investments believes that the merger will benefit contract owners by transitioning their investment into Capital Growth, a fund with more favorable performance over recent years and that is open to broader distribution, both of which may subsequently lead to additional sales and additional economies of scale. In addition, the proposed merger is consistent with ongoing efforts by DWS Investments to consolidate overlapping fund products. In determining to

3

recommend that shareholders of Janus Growth & Income approve the merger, the Board considered, among others, the following factors:

| | • | | The compatibility of Janus Growth & Income’s and Capital Growth’s investment strategies. |

| | • | | The effective advisory fees paid by the combined fund will be lower at all asset levels as compared to the advisory fees currently paid by Janus Growth & Income. |

| | • | | The estimated total operating expense ratio of the relevant class of the combined fund is expected to be lower than the current operating expense ratio of Janus Growth & Income. |

The Board has concluded that: (1) the merger is in the best interests of Janus Growth & Income and (2) the interests of the existing shareholders of Janus Growth & Income will not be diluted as a result of the merger. Accordingly, the Board unanimously recommends that shareholders approve the Agreement (as defined on page 20) effecting the merger. For a complete discussion of the Board’s considerations please see “Information About the Proposed Merger—Background and Board’s Considerations Relating to the Proposed Merger” below.

| 4. | | What are the investment goals, policies and restrictions of the Funds? |

While not identical, the two Funds have similar investment objectives and techniques. Janus Growth & Income seeks long-term capital growth and current income. In contrast, Capital Growth seeks to provide long-term growth of capital.

Janus Growth & Income normally emphasizes investments in equity securities, which may include initial public offerings, and shifts assets between the growth and income components of its holdings based on portfolio management’s analysis of relevant market, financial and economic conditions. Janus Growth & Income may invest up to 75% of its total assets in equity securities selected primarily for their growth potential and at least 25% of its total assets in securities portfolio management believes have income potential. The Fund may invest substantially all of its assets in equity securities if portfolio management believes that equity securities have the potential to appreciate in value. The growth component of the Fund is expected to consist primarily of common stocks, but may also include warrants, preferred stocks or convertible securities selected primarily for their growth potential. The income component of the Fund will consist of securities that portfolio management believes have income potential. Such securities may include equity securities, convertible securities and all types of debt securities, including indexed/structured securities such as equity-linked structured notes.

Capital Growth normally invests at least 65% of total assets in equities, mainly common stocks of U.S. companies, and although the Fund can invest in companies of any size, it intends to invest primarily in companies whose market capitalizations are similar in size to those of the companies in the Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500 Index”) or the Russell 1000 Growth Index (as of December 31, 2008, the S&P 500 Index and the Russell 1000 Growth Index had median market capitalizations of $6.4 billion and $3.3 billion, respectively). Although the portfolio may invest in companies of any size, it intends to invest primarily in

4

companies whose market capitalizations fall within the normal range of these indices. Capital Growth may also invest in other types of equity securities, such as preferred stocks or convertible securities.

In the case of Janus Growth & Income, portfolio management generally seeks to identify equity securities of companies with earnings growth potential that may not be recognized by the market at large. Portfolio management makes this assessment by looking at companies one at a time, regardless of size, country or organization, place of principal business activity, or other similar selection criteria. Similarly, in the case of Capital Growth, in choosing stocks, portfolio management begin by utilizing a proprietary quantitative model to rank stocks based on a number of factors including valuation and profitability. The portfolio managers also apply fundamental techniques to identify companies that display above-average earnings growth compared to other companies that have strong product lines, effective management and leadership positions within core markets. The factors considered and models used by Capital Growth’s portfolio managers may change over time. Portfolio management will normally sell a stock when they believe its potential risks have increased, its price is unlikely to go higher, its fundamental factors have changed, other investments offer better opportunities or in the course of adjusting the portfolio’s emphasis on a given industry.

Janus Growth & Income may invest without limit in foreign securities either indirectly (e.g., depositary receipts) or directly in foreign markets. Foreign securities are generally selected on a stock-by-stock basis without regard to any defined allocation among countries or geographic regions. However, certain factors such as expected levels of inflation, government policies influencing business conditions, currency exchange rates, and prospects for economic growth among countries or geographic regions may warrant greater consideration in selecting foreign securities.

Janus Growth & Income may also invest in debt securities, high-yield/high-risk bonds and securities purchased on a when-issued, delayed delivery or forward commitment basis. Compared to investment-grade bonds, high yield bonds may pay higher yields and have higher volatility and risk of default. Although it is not a principal investment strategy for the Fund, Janus Growth & Income is permitted, but not required, to use various types of derivatives (contracts whose value is based on, for example, indices, currencies or securities). Derivatives may be used for hedging and for risk management or for non-hedging purposes to seek to enhance potential gain. The Fund may use derivatives in circumstances where portfolio management believes they offer an economical means of gaining exposure to a particular asset class or to keep cash on hand to meet shareholder redemptions or other needs while maintaining exposure to the market. As a temporary defensive measure, the Fund could shift up to 100% of assets into investments such as money market securities. This measure could prevent losses, but, while engaged in a temporary defensive position, the Fund will not be pursuing its investment objective. However, the portfolio managers may choose not to use these strategies for various reasons, even in very volatile market conditions. In addition, the Fund may lend its investment securities in an amount up to 33 1/3% of its total assets to approved institutional borrowers.

Although it is not a principal investment strategy for the Fund, Capital Growth is permitted, but not required, to use various types of derivatives (contracts whose value is based on, for example, indices, currencies or securities). Derivatives may be used for hedging and for risk management or for non-hedging purposes to seek to enhance

5

potential gain. Capital Growth may use derivatives in circumstances where portfolio management believes they offer an economical means of gaining exposure to a particular asset class or to keep cash on hand to meet shareholder redemptions or other needs while maintaining exposure to the market. In addition, the Fund may lend its investment securities in an amount up to 33 1/3% of its total assets to approved institutional borrowers. Please also see Part II—Investment Strategies and Risk Factors—below for a more detailed comparison of the Fund’s investment policies and restrictions.

While DWS Investments believes that DWS Capital Growth VIP should provide a comparable investment opportunity for shareholders of DWS Janus Growth & Income VIP, there are a number of differences in the portfolios of the funds. If the merger is approved by shareholders of DWS Janus Growth & Income VIP, DWS Investments expects that all of DWS Janus Growth & Income VIP’s holdings will be liquidated after shareholder approval and prior to the merger. Proceeds from the liquidation will be used to acquire securities consistent with DWS Capital Growth VIP’s current implementation of its investment objective, policies, restrictions and strategies. The repositioning of DWS Janus Growth & Income VIP’s portfolio prior to the merger will involve transaction costs which will be borne by DWS Janus Growth & Income VIP subject to an expense cap agreed to by Deutsche Investment Management Americas Inc. (“DIMA” or “Advisor”), DWS Janus Growth & Income VIP’s investment adviser. Pursuant to the expense cap, DIMA will pay any one-time merger costs, including the transaction costs associated with repositioning DWS Janus Growth & Income VIP’s portfolio, to the extent those costs exceed the estimated total one-year benefit expected to be realized by DWS Janus Growth & Income VIP through the proposed merger. See page 23 of the enclosed Prospectus/Proxy Statement for more information regarding the costs of the merger and DIMA’s agreement to cap expenses.

The following table sets forth a summary of the composition of each Fund’s investment portfolio as of December 31, 2008, and DWS Investments’ estimation of the portfolio composition of Capital Growth assuming consummation of the proposed merger.

Portfolio Composition

(as a % of Fund)

| | | | | | | | | |

| | | Janus Growth &

Income | | | Capital Growth | | | Capital

Growth—Estimated

(assuming

consummation of

merger)(1) | |

Consumer Discretionary | | 10 | % | | 8 | % | | 8 | % |

Consumer Staples | | 22 | % | | 15 | % | | 15 | % |

Energy | | 13 | % | | 10 | % | | 10 | % |

Financials | | 5 | % | | 3 | % | | 3 | % |

Health Care | | 17 | % | | 22 | % | | 22 | % |

Industrials | | 5 | % | | 10 | % | | 10 | % |

Information Technology | | 24 | % | | 22 | % | | 22 | % |

Materials | | 4 | % | | 8 | % | | 8 | % |

Telecommunications Services | | — | | | 1 | % | | 1 | % |

Utilities | | — | | | 1 | % | | 1 | % |

| | | | | | | | | |

Total | | 100 | % | | 100 | % | | 100 | % |

6

(1) | | Reflects DWS Investments’ estimation of the portfolio composition of Capital Growth subsequent to the merger, taking into account its expectation that after shareholder approval and prior to the merger, all of the portfolio holdings of Janus Growth & Income will be liquidated and proceeds will be used to acquire other securities consistent with the current implementation of investment objective, policies, restrictions and strategies of Capital Growth. There can be no assurance as to actual portfolio composition of Capital Growth subsequent to the merger. |

| 5. | | How do the management fees and expense ratios of the two Funds compare, and what are they estimated to be following the merger? |

The following tables summarize the expenses that each of the Funds incurred during its most recent fiscal year and the pro forma estimated expense ratios of Capital Growth assuming consummation of the merger as of that date.

As shown below, the merger is expected to result in a lower total expense ratio for shareholders of Janus Growth & Income. However, there can be no assurance that the merger will result in expense savings. The information below does not reflect charges and fees associated with separate accounts that invest in the Funds and any Contract for which the Funds are investment options. These charges and fees will increase expenses.

Annual Fund Operating Expenses(1)

(expenses that are deducted from Fund assets)

| | | | | | | | | | | | | | | | | | |

| | | Management

Fees | | | Distribution/

Service

(12b-1) Fee | | | Other

Expenses | | | Total

Annual

Fund

Operating

Expenses | | | Less

Expense

Waiver/

Reimburse-

ments | | | Net

Annual

Fund

Operating

Expenses | |

Janus Growth & Income | | | | | | | | | | | | | | | | | | |

Class A | | 0.66 | % | | 0.00 | % | | 0.20 | %(2) | | 0.86 | % | | — | | | 0.86 | %(3) |

Capital Growth | | | | | | | | | | | | | | | | | | |

Class A | | 0.37 | % | | 0.00 | % | | 0.13 | %(2) | | 0.50 | % | | (0.01 | )%(4) | | 0.49 | % |

Capital Growth | | | | | | | | | | | | | | | | | | |

(Pro forma combined)(5) | | | | | | | | | | | | | | | | | | |

Class A | | 0.37 | % | | 0.00 | % | | 0.14 | %(2)(6) | | 0.51 | % | | (0.02 | )%(4) | | 0.49 | % |

(1) | | The Annual Fund Operating Expenses table is presented as of each Fund’s fiscal year end (December 31, 2008 for both Funds). The pro forma combined figures assume the consummation of the merger on December 31, 2008 and reflect average net asset levels for both Funds for the 12-month period ended December 31, 2008. It is important for you to understand that a decline in the Fund’s average net assets during the current fiscal year due to recent unprecedented market volatility or other factors could cause the Funds’ expense ratios for the current fiscal year to be higher than the expense information presented. |

(2) | | Includes 0.10% paid to DIMA, the investment manager for the Funds, for administrative and accounting services pursuant to an Administrative Services Agreement. |

7

(3) | | Through September 30, 2009, DIMA has contractually agreed to waive all or a portion of its management fee and reimburse or pay certain operating expenses of the Fund to the extent necessary to maintain the Fund’s total operating expenses at 0.86% for Class A shares, excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest expenses. |

(4) | | Through April 30, 2010, DIMA has contractually agreed to waive all or a portion of its management fee and reimburse or pay certain operating expenses of the Fund to the extent necessary to maintain the Fund’s total operating expenses at 0.49% for Class A shares, excluding certain expenses such as extraordinary expenses, taxes, brokerage and interest expenses. |

(5) | | Pro forma expenses do not include the expenses expected to be borne by Janus Growth & Income in connection with the merger. See page 23 for additional information on these fees. |

(6) | | Other expenses are estimated, accounting for the effect of the merger. |

Examples

These examples translate the expenses shown in the preceding table (including one year of capped expenses in each period) into dollar amounts. By doing this, you can more easily compare the costs of investing in the Funds. The examples make certain assumptions. They assume that you invest $10,000 in a Fund for the time periods shown and reinvest all dividends and distributions. They also assume a 5% return on your investment each year and that a Fund’s operating expenses remain the same. The examples are hypothetical; your actual costs and returns may be higher or lower.

| | | | | | | | | | | | |

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Janus Growth & Income | | | | | | | | | | | | |

Assuming you sold your shares at the end of each period. | | | | | | | | | |

Class A | | $ | 88 | | $ | 274 | | $ | 477 | | $ | 1,061 |

Assuming you kept your shares. | | | | | | | | | | | | |

Class A | | $ | 88 | | $ | 274 | | $ | 477 | | $ | 1,061 |

Capital Growth | | | | | | | | | | | | |

Assuming you sold your shares at the end of each period. | | | | | | | | | |

Class A | | $ | 50 | | $ | 159 | | $ | 279 | | $ | 627 |

Assuming you kept your shares. | | | | | | | | | | | | |

Class A | | $ | 50 | | $ | 159 | | $ | 279 | | $ | 627 |

Capital Growth (Pro forma combined) | | | | | | | | | | | | |

Assuming you sold your shares at the end of each period. | | | | | | | | | |

Class A | | $ | 50 | | $ | 162 | | $ | 283 | | $ | 639 |

Assuming you kept your shares. | | | | | | | | | | | | |

Class A | | $ | 50 | | $ | 162 | | $ | 283 | | $ | 639 |

8

The tables below set forth the annual management fee schedules of the Funds, expressed as a percentage of net assets. As of December 31, 2008, Capital Growth and Janus Growth & Income had net assets of $604.4 million and $72.8 million, respectively.

The fee schedule for each Fund is as follows:

| | | | | | | | | | |

Capital Growth (Pre- and Post Merger) | | | | | Janus Growth & Income | |

First $250 million | | 0.390 | % | | | | First $250 million | | 0.665 | % |

Next $750 million | | 0.365 | % | | | | Next $750 million | | 0.640 | % |

Thereafter | | 0.340 | % | | | | Next $1.5 billion | | 0.615 | % |

| | | | | | | Thereafter | | 0.590 | % |

| 6. | | What are the federal income tax consequences of the proposed merger? |

For federal income tax purposes, no gain or loss is expected to be recognized by Janus Growth & Income or its shareholders as a direct result of the merger. As long as these Contracts qualify as annuity contracts or life insurance under Section 72 of the Internal Revenue Code of 1986, as amended (the “Code”), the merger, whether or not treated as a tax-free reorganization, will not create any tax liability for Contract Owners. For a more detailed discussion of the tax consequences of the merger, please see “Information about the Proposed Merger—Certain Federal Income Tax Consequences,” below.

| 7. | | Will the dividend policy be affected by the merger? |

The merger will not result in a change in dividend policy.

| 8. | | Do the procedures for purchasing, redeeming and exchanging shares of the two Funds differ? |

No. The procedures for purchasing and redeeming shares of each Fund are identical. Each Fund continuously sells shares to Participating Insurance Company separate accounts, without a sales charge, at the net asset value per share next determined after a proper purchase order is placed by a Participating Insurance Company. A Participating Insurance Company offers Contract Owners units in its separate accounts which correspond to shares in the Fund. A Participating Insurance Company submits purchase and redemption orders to the Fund based on allocation instructions for premium payments, transfer instructions and surrender or partial withdrawal requests for Contract Owners, as set forth in the accompanying prospectus for the Participating Insurance Company’s Contracts. These orders reflect the amount of premium payments to be invested, surrender and transfer requests and other matters. Redemption orders are effected at the next net asset value per share is determined after a proper redemption order is place by a Participating Insurance Company. Contract Owners should look at their Contract prospectuses for redemption procedures and fees.

| 9. | | How will I be notified of the outcome of the merger? |

If the proposed merger is approved by separate accounts as shareholders, separate accounts as shareholders whose accounts are affected by the merger will receive a

9

confirmation statement reflecting their new account number and the number of shares of Capital Growth they are receiving after the merger is completed. Subsequently, affected Contract Owners will be notified of changes to their account information by their respective Participating Insurance Companies. If the proposed merger is not approved, this result will be noted in the next shareholder report of Janus Growth & Income.

| 10. | | Will the value of an investment in Janus Growth & Income change? |

The number of shares owned by each Participating Insurance Company will most likely change. However, the total value of an investment in Capital Growth will equal the total value of your indirect investment in Janus Growth & Income as of the Valuation Time (as defined on page 22). Even though the net asset value per share of each Fund is likely to be different, the total value of your holdings will not change as a result of the merger.

| 11. | | What percentage of shareholders’ votes is required to approve the merger? |

Approval of the merger will require the affirmative vote of the shareholders of Janus Growth & Income entitled to vote more than fifty percent (50%) of the votes entitled to be cast on the matter at the special meeting.

The Trustees of the Trust believe that the proposed merger is in the best interests of Janus Growth & Income. Accordingly, the Trustees unanimously recommend that shareholders vote FOR approval of the proposed merger.

II. INVESTMENT STRATEGIES AND RISK FACTORS

What are the main investment strategies and related risks of Capital Growth, and how do they compare with those of Janus Growth & Income?

Objectives and Strategies. Capital Growth and Janus Growth & Income have similar investment objectives. Capital Growth seeks long term growth of capital, whereas Janus Growth & Income seeks long term growth and current income. Capital Growth normally invests at least 65% of total assets in equities, mostly common stocks of U.S. companies. Although Capital Growth can invest in companies of any size, it generally focuses on established companies that are similar in size to the companies in the Standard & Poor’s 500 Composite Stock price Index (the “S&P 500 Index”) or the Russell 1000 Growth Index (as of December 31, 2008, the S&P 500 Index and the Russell 1000 Growth Index had median market capitalizations of $6.4 billion and $3.3 billion, respectively). Although Capital Growth may invest in companies of any size, the Fund intends to invest primarily in companies whose market capitalizations fall within the normal range of these indices. The portfolio may also invest in other types of equity securities, such as preferred stocks or convertible securities.

Janus Growth & Income normally emphasizes investments in equity securities, which may include initial public offerings. It may invest up to 75% of its total assets in equity securities selected primarily for their growth potential and at least 25% of its total assets in securities portfolio management believes have income potential. Janus Growth & Income may invest substantially all of its assets in equity securities if portfolio

10

management believes that equity securities have the potential to appreciate in value. Portfolio management generally seeks to identify equity securities of companies with earnings growth potential that may not be recognized by the market at large. Portfolio management makes this assessment by looking at companies one at a time, regardless of size, country or organization, place of principal business activity, or other similar selection criteria.

Janus Growth & Income may invest without limit in foreign securities either indirectly (e.g., depositary receipts) or directly in foreign markets. Foreign securities are generally selected on a stock-by-stock basis without regard to any defined allocation among countries or geographic regions. However, certain factors such as expected levels of inflation, government policies influencing business conditions, currency exchange rates, and prospects for economic growth among countries or geographic regions may warrant greater consideration in selecting foreign securities. Janus Growth & Income shifts assets between the growth and income components of its holdings based on portfolio management’s analysis of relevant market, financial and economic conditions. If portfolio management believes that growth securities may provide better returns than the yields available or expected on income-producing securities, Janus Growth & Income will place a greater emphasis on the growth component of its holdings. The growth component of Janus Growth & Income is expected to consist primarily of common stocks, but may also include warrants, preferred stocks or convertible securities selected primarily for their growth potential. The income component of Janus Growth & Income is expected to consist of securities that portfolio management believes have income potential. Such securities may include equity securities, convertible securities and all types of debt securities, including indexed/structured securities such as equity-linked structured notes. Equity securities may be included in the income component of Janus Growth & Income if they currently pay dividends or if portfolio management believes they have the potential for either increasing their dividends or commencing dividends, if none are currently paid.

The Funds use different investment processes. For Capital Growth, in choosing stocks, the portfolio managers begin by utilizing a proprietary quantitative model to rank stocks based on a number of factors including valuation and profitability. The portfolio managers also apply fundamental techniques to identify companies that display above-average earnings growth compared to other companies and that have strong product lines, effective management and leadership positions within core markets. The factors considered and models used by the portfolio managers may change over time. The portfolio managers will normally sell a stock when they believe its potential risks have increased, its price is unlikely to higher, its fundamental factors have changed, other investments offer better opportunities or in the course of adjusting the Fund's emphasis on a given industry. For Janus Growth & Income, portfolio management applies a “bottom-up” approach in choosing investments. In other words, portfolio management looks mostly for equity and income-producing securities that meet its investment criteria one at a time. If Janus Growth & Income is unable to find such investments, much of the Fund’s assets may be in cash or similar investments.

Other Investments. Janus Growth & Income may invest in debt securities, high-yield/high-risk bonds and securities purchased on a when-issued, delayed delivery or forward commitment basis. Compared to investment-grade bonds, high yield bonds may pay higher yields and have higher volatility and risk of default. Each Fund is permitted, but is not required, to use various types of derivatives (contracts whose value is based

11

on, for example, indices, currencies or securities). Derivatives may be used for hedging and for risk management or for non-hedging purposes to seek to enhance potential gains. Each Fund may use derivatives in circumstances where portfolio management believes they offer economical means of gaining exposure to a particular asset class or to maintain a high level of liquidity to meet shareholder redemptions or other needs while maintaining exposure to the market. In particular, Capital Growth may use futures, options and covered call options.

Securities Lending. Each Fund may lend its investment securities in an amount up to 33 1/3% of its total assets to approved institutional borrowers who need to borrow securities in order to complete certain transactions.

Other Policies. Although major changes tend to be infrequent, each Fund’s Board could change the Fund’s investment objectives without seeking shareholder approval.

As a temporary defensive measure, Capital Growth could shift up to 100% of assets into cash and cash equivalents, U.S. government securities, money market instruments and high quality debt securities without equity features, while Janus Growth & Income could shift up to 100% of assets into investments such as money market securities. For each Fund, this measure could prevent losses, but, while engaged in a temporary defensive position, each Fund will not be pursuing its investment objective. However, the portfolio managers may choose not to use these strategies for various reasons, even in very volatile market conditions.

DWS Investments believes that Capital Growth should provide a comparable investment opportunity for shareholders of Janus Growth & Income.

Primary Risks. As with any investment, you may lose money by investing in Capital Growth. Certain risks associated with an investment in Capital Growth are summarized below. Subject to certain exceptions, the risks of an investment in Capital Growth are similar to the risks of an investment in Janus Growth & Income. More detailed descriptions of the risks associated with an investment in Capital Growth can be found in the Capital Growth prospectus and statement of additional information.

The value of your investment in Capital Growth will change with changes in the values of the investments held by Capital Growth. A wide array of factors can affect those values. In this summary we describe the principal risks that may affect Capital Growth’s investments as a whole.

Stock Market Risk. The Fund is affected by how the stock market performs. To the extent Capital Growth invests in a particular market sector, the Fund’s performance may be proportionally affected by that segment’s general performance. When stock prices fall, you should expect the value of your investment to fall as well. Because a stock represents ownership in its issuer, stock prices can be hurt by poor management, shrinking product demand and other business risks. These may affect single companies as well as groups of companies. In addition, movements in financial markets may adversely affect a stock’s price, regardless of how well the company performs. The market as a whole may not favor the types of investments Capital Growth makes and Capital Growth may not be able to get attractive prices for them. An investment in Janus Growth & Income is also subject to this risk.

12

Growth Investing Risk. Since growth stocks usually reinvest a large portion of earnings in their own businesses, they may lack the dividends associated with value stocks that might otherwise cushion their decline in a falling market. Earnings disappointments in growth stocks often result in sharp price declines because investors buy these stocks for their potential superior earnings growth. Growth stocks may also be out of favor for certain periods in relation to value stocks.

Industry Risk. While Capital Growth does not concentrate in any industry or sector, to the extent that the Fund has exposure to a given industry or sector, any factors affecting that industry or sector could affect the value of portfolio securities. For example, manufacturers of consumer goods could be hurt by a rise in unemployment, or technology companies could be hurt by such factors as market saturation, price competition and rapid obsolescence. An investment in Janus Growth & Income is also subject to this risk.

Security Selection Risk. A risk that pervades all investing is the risk that the securities in the Fund’s portfolio may decline in value. An investment in Janus Growth & Income is also subject to this risk.

IPO Risk. Securities purchased in initial public offerings (IPOs) may be very volatile, due to their stock prices rising and falling rapidly, often based, among other reasons, on investor perceptions rather than economic reasons. Additionally, investments in IPOs may magnify the Fund’s performance if it has a small asset base. The Fund is less likely to experience a similar impact on its performance as its assets grow because it is unlikely that the Fund will obtain proportionately larger IPO allocations. An investment in Janus Growth & Income is also subject to this risk.

Derivatives Risk. Risks associated with derivatives include: the risk that the derivative is not well correlated with the security, index or currency to which it relates; the risk that derivatives may result in losses or missed opportunities; the risk that Capital Growth will be unable to sell the derivative because of an illiquid secondary market; the risk that a counterparty is unwilling or unable to meet its obligation; and the risk that the derivatives transaction could expose the Fund to the effects of leverage, which could increase the Fund’s exposure to the market and magnify potential losses. There is no guarantee that these derivatives, to the extent employed, will have the intended effect, and their use could cause lower returns or even losses to Capital Growth. The use of derivatives by Capital Growth to hedge risk may reduce the opportunity for gain by offsetting the positive effect of favorable price movements. An investment in Janus Growth & Income is also subject to this risk.

Securities Lending Risk. Any loss in the market price of securities loaned by Capital Growth that occurs during the term of the loan would be borne by the Fund and would adversely affect the Fund’s performance. Also, there may be delays in recovery of securities loaned or even a loss of rights in the collateral should the borrower of the securities fail financially while the loan is outstanding. However, loans will be made only to borrowers selected by Capital Growth’s delegate after a review of relevant facts and circumstances, including the creditworthiness of the borrower. An investment in Janus Growth & Income is also subject to this risk.

Pricing Risk. At times, market conditions may make it difficult to value some investments, and the Fund may use certain valuation methodologies for some of its investments, such as fair value pricing. Given the subjective nature of such valuation

13

methodologies, it is possible that the value determined for an investment may be different than the value realized upon such investment’s sale. If the Fund has valued its securities too highly, you may pay too much for Fund shares when you buy into the Fund. If the Fund has underestimated the price of its securities, you may not receive the full market value when you sell your Fund shares. An investment in Janus Growth & Income is also subject to this risk.

Other factors that could affect the performance of Capital Growth include:

| | • | | portfolio management could be wrong in the analysis of industries, companies, economic trends, the relative attractiveness of different securities or other matters; and |

| | • | | foreign securities may be more volatile than their U.S. counterparts, for reasons such as currency fluctuations and political and economic uncertainty. |

Performance Information. The following information provides some indication of the risks of investing in each Fund. Of course, a Fund’s past performance is not an indication of future performance. The information shown below does not reflect charges and fees associated with the separate accounts that invest in the Funds or any Contract for which the Funds are investment options. If it did, performance would be less than that shown.

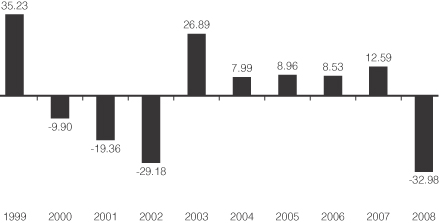

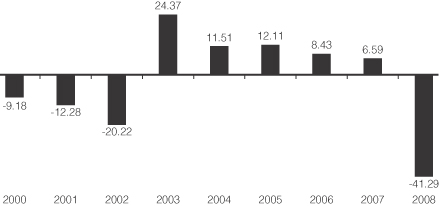

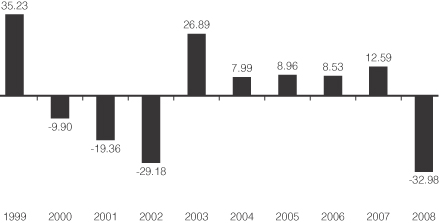

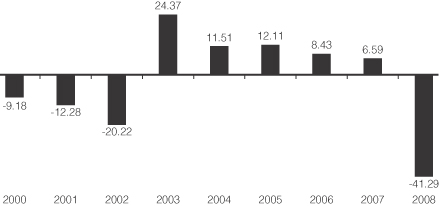

The bar charts show how the performance of each Fund’s Class A shares has varied from year to year, which may give some idea of risk. The tables following the charts show how each Fund’s performance compares with one or more broad-based market indices (which, unlike the Funds, do not have any fees or expenses). The performance of both the Fund and the broad-based market indices vary over time. All figures assume reinvestment of dividends and distributions.

Calendar Year Total Returns (%)

Capital Growth – Class A Shares

For the periods included in the bar chart:

| | |

| Best Quarter: 24.86%, Q4 1999 | | Worst Quarter: -21.49%, Q4 2008 |

14

Janus Growth & Income – Class A Shares

For the periods included in the bar chart:

| | |

| Best Quarter: 12.40%, Q4 2004 | | Worst Quarter: -20.68%, Q4 2008 |

Average Annual Total Returns (%) (for period ended December 31, 2008)

| | | | | | |

| | | Past

1 year | | Past

5 years | | Past

10 Years |

Capital Growth | | | | | | |

Class A | | -32.98 | | -0.74 | | -1.60 |

Russell 1000 Growth Index (reflects no deductions for fees or expenses) | | -38.44 | | -3.42 | | -4.27 |

Standard and Poor’s (S&P) 500 Index (reflects no deductions for fees or expenses) | | -37.00 | | -2.19 | | -1.38 |

| | | Total return would have been lower had certain expenses not been reduced. |

| | Russell 1000® Growth Index is an unmanaged index that consists of those stocks in the Russell 1000 Index with higher price-to-book ratios and higher forecasted growth values. Russell 1000 Index is an unmanaged price-only index of the 1,000 largest capitalized companies that are domiciled in the US and whose common stocks are traded. |

| | | Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. |

15

| | | | | | |

| | | Past

1 year | | Past

5 years | | Since

Inception |

Janus Growth & Income | | | | | | |

Class A | | -41.29 | | -3.24 | | -2.80 |

Russell 1000 Growth Index (reflects no deductions for fees or expenses) | | -38.44 | | -3.42 | | -6.04 |

| | Russell 1000® Growth Index is an unmanaged index that consists of those stocks in the Russell 1000 Index with higher price-to-book ratios and higher forecasted growth values. Russell 1000 Index is an unmanaged price-only index of the 1,000 largest capitalized companies that are domiciled in the US and whose common stocks are traded. |

Current performance may be higher or lower than the performance data quoted above. For more recent performance information, call your insurance company or 1-800-778-1482.

III. OTHER INFORMATION ABOUT THE FUNDS

Advisor and Portfolio Manager. DIMA, with headquarters at 345 Park Avenue, New York, NY 10154, is the investment advisor for each Fund. Under the oversight of the Board of each Fund, DIMA, or a subadvisor, makes investment decisions, buys and sells securities for each Fund and conducts research that leads to these purchase and sale decisions. DIMA provides a full range of global investment advisory services to institutional and retail clients.

DWS Investments is part of Deutsche Bank’s Asset Management division (“DeAM”) and within the U.S. represents the retail asset management activities of Deutsche Bank AG, DIMA, Deutsche Bank Trust Company Americas and DWS Trust Company. Deutsche Asset Management is a global asset management organization that offers a wide range of investing expertise and resources, including hundreds of portfolio managers and analysts and an office network that reaches the world’s major investment centers. This well-resourced global investment platform brings together a wide variety of experience and investment insight across industries, regions, asset classes and investing styles. DIMA is an indirect, wholly owned subsidiary of Deutsche Bank AG. Deutsche Bank AG is a major global banking institution that is engaged in a wide range of financial services, including investment management, mutual funds, retail, private and commercial banking, investment banking and insurance.

Capital Growth. The following individuals implement the investment strategy of Capital Growth:

Owen Fitzpatrick, CFA, is the Co-Portfolio Manager for Capital Growth. Mr. Fitzpatrick is a Managing Director of Deutsche Asset Management. Mr. Fitzpatrick joined Deutsche Asset Management and began managing Capital Growth in 2009. Prior to joining Deutsche Asset Management, Mr. Fitzpatrick was Managing Director of Deutsche Bank Private Wealth Management and served as head of U.S. Equity Strategy and manager of the U.S. large cap, core, value and growth portfolios. Mr. Fitzpatrick joined Deutsche Bank in 1995 after over twenty one years of experience in trust and investment management.

16

Richard Shepley is the Co-Portfolio Manager for Capital Growth. Mr. Shepley is a Managing Director of Deutsche Asset Management. He joined Deutsche Asset Management in 1998 after eight years of investment industry experience at Newton Investment Management and PriceWaterhouse. Mr. Shepley began managing Capital Growth in 2007.

Brendan O’Neill is a Portfolio Manager for Capital Growth. Mr. O’Neill is a Director of Deutsche Asset Management. Mr. O’Neill joined Deutsche Asset Management and began managing Capital Growth in 2009. He previously served as an Equity Research Analyst covering the financial services sector and as a member of the Large Cap Core Equity team.

Capital Growth’s statement of additional information provides further information about the portfolio managers’ investments in the Fund, a description of the Fund’s compensation structure and information regarding other accounts the portfolio managers manage.

Janus Growth & Income. The subadvisor for Janus Growth & Income is Janus Capital Management LLC, 151 Detroit Street, Denver, Colorado 80206. Janus Capital Management is an investment advisor registered with the SEC. DIMA compensates Janus Capital Management out of the management fee it receives from the Fund. The following individual handles the day-to-day management of Janus Growth & Income:

Marc Pinto is the Portfolio Manager for Janus Growth & Income. Mr. Pinto is also a portfolio manager of other Janus accounts. He joined Janus in 1994 as an analyst and has acted as portfolio manager of other Janus-advised mutual funds since 2005. Mr. Pinto has managed Janus Growth & Income since November 2007.

Janus Growth & Income’s statement of additional information provides additional information about the portfolio manager’s investments in the Fund, a description of his compensation structure and information regarding other accounts he manages.

Distribution and Service Fees. Pursuant to separate Underwriting and Distribution Services Agreements, DWS Investments Distributors, Inc., 222 South Riverside Plaza, Chicago, Illinois 60606, an affiliate of DIMA, is the principal underwriter and distributor for the Class A shares of Capital Growth and Janus Growth & Income, and acts as the agent of each Fund in the continuous offering of its shares.

Trustees and Officers. The Trustees overseeing Capital Growth are the same as the Trustees who oversee Janus Growth & Income: Paul K. Freeman (Chair), John W. Ballantine, Henry P. Becton, Dawn-Marie Driscoll, Keith R. Fox, Kenneth C. Froewiss, Richard J. Herring, William McClayton, Rebecca W. Rimel, Axel Schwarzer, William N. Searcy, Jr., Jean Gleason Stromberg and Robert H. Wadsworth. The officers of Capital Growth are also the same as those of Janus Growth & Income.

Independent Registered Public Accounting Firm (“Auditor”). PricewaterhouseCoopers LLP, 125 High Street, Boston, MA 02110 serves as Capital Growth’s independent registered public accounting firm. Ernst & Young LLP, 200 Clarendon Street, Boston, MA 02116, serves as Janus Growth & Income’s independent registered public accounting firm, audits the financial statements of the Fund and provides other audit, tax and related services to the Fund.

17

Charter Documents.

Capital Growth is a series of DWS Variable Series I, a Massachusetts business trust organized under the laws of Massachusetts and is governed by an Amended and Restated Declaration of Trust dated June 2, 2008 (the “Variable Series I Declaration of Trust”). Janus Growth & Income is a series of DWS Variable Series II, a Massachusetts business trust organized under the laws of Massachusetts and is governed by an Amended and Restated Declaration of Trust dated June 2, 2008 (the “Variable Series II Declaration of Trust”). The Variable Series I Declaration of Trust and the Variable Series II Declaration of Trust are referred to herein collectively as the “Declarations of Trust,” and each is referred to herein individually as a “Declaration of Trust.” Additional information about the Declarations of Trust is provided below.

Shares. The Trustees have the authority to create additional funds and to designate the relative rights and preferences as between the different funds. The trustees of the Trust also may authorize the division of shares of the Funds into different classes, which may bear different expenses. All shares issued and outstanding are fully paid and non-assessable (except as set forth below), transferable, have no pre-emptive or conversion rights (except as may be determined by the Board of Trustees) and are redeemable as described in the SAIs and the Funds’ prospectuses. Each share has equal rights with each other share of the same class of the Funds as to voting, dividends, exchanges, conversion features and liquidation. Shareholders are entitled to one vote for each full share held and fractional votes for fractional shares held. Shares of the Funds have noncumulative voting rights with respect to the election of Trustees.

Shareholder Meetings. Neither Fund is generally required to hold meetings of its shareholders. Under the Declarations of Trust, however, shareholder meetings will be held in connection with the following matters to the extent and as provided in the Declarations of Trust and as required by applicable law: (a) the election or removal of Trustees if a meeting is called for such purpose; (b) the termination of the Trust; (c) an amendment of the Declaration of Trust; and (d) such additional matters as may be required by law or as the Trustees may determine to be necessary or desirable. Shareholders also vote upon changes in fundamental policies or restrictions. The shareholders shall generally take action by the affirmative vote of the holders of a majority of the shares present in person or by proxy and entitled to vote and voting or voted at a meeting of shareholders at which a quorum is present. The Declarations of Trust provide that shareholder meeting quorum requirements shall be established in the Funds’ By-laws. The By-laws of both Funds currently in effect provide that the presence in person or by proxy of the holders of thirty percent (30%) of the shares entitled to vote at a meeting (or of an individual series or class if required to vote separately) shall constitute a quorum for the transaction of business at meetings of shareholders of the Funds.

On any matter submitted to a vote of shareholders, all shares of the Funds entitled to vote shall, except as otherwise provided in the Funds’ By-Laws, be voted in the aggregate as a single class without regard to series or classes of shares, except (a) when required by applicable law or when the Trustees shall have determined that the matter affects one or more series or classes of shares materially differently, shares shall be voted by individual series or class; and (b) when the Trustees have determined that the matter affects only the interests of one or more series or classes, only shareholders of such series or classes shall be entitled to vote thereon.

18

Shareholder Liability. Under Massachusetts law, shareholders of a Massachusetts business trust could, under certain circumstances, be held personally liable for obligations of a Fund. The Declarations of Trust, however, disclaim shareholder liability for acts or obligations of the Funds and require that notice of such disclaimer be given in each agreement, obligation, or instrument entered into or executed by the Funds. Moreover, the Declarations of Trust provide for indemnification out of the property of the Funds for all losses and expenses of any shareholder held personally liable for the obligations of the Funds and the applicable Fund may be covered by insurance which the Trustees consider adequate to cover foreseeable claims. Thus, the risk of a shareholder incurring financial loss on account of shareholder liability is considered by the Advisor remote and not material, since it is limited to circumstances in which a disclaimer is inoperative and the Funds themselves are unable to meet their obligations.

Trustee Liability. The Declarations of Trust provide that obligations of the Funds are not binding upon the Trustees individually but only upon the property of the Funds and that the Funds will indemnify their Trustees and officers against liabilities and expenses incurred in connection with any claim, action, suit or proceeding in which they may be involved because of their offices with the Funds, except if it is determined in the manner provided in the Declarations of Trust that they have not acted in good faith in the reasonable belief that their actions were in the best interests of the Funds. However, nothing in the Declarations of Trust protects or indemnifies a Trustee or officer against any liability to which he or she would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence, of reckless disregard of duties involved in the conduct of his or her office.

Election and Term of Trustees. Each Trustee serves until the next meeting of shareholders, if any, called for the purpose of electing Trustees and until the election and qualification of a successor or until such Trustee sooner dies, resigns, retires, is removed or incapacitated. Any Trustee who has become incapacitated by illness or injury as determined by a majority of the other Trustees may be retired by written instrument, signed by at least a majority of the other Trustees, specifying the date upon which such removal shall become effective. Any Trustee may be removed with or without cause (i) by the vote of the shareholders holding two-thirds of the outstanding shares of the applicable Trust, or (ii) by the action of two-thirds of the remaining Trustees. The Trustees shall promptly call a meeting of the shareholders for the purpose of voting upon the question of removal of any Trustee or Trustees when requested in writing so to do by the holders of not less than ten percent (10%) of the outstanding shares, and in that connection, the Trustees will assist shareholder communications to the extent provided for in Section 16(c) under the 1940 Act.