As Filed with the Securities and Exchange Commission on March 3, 2011

Securities Act File No. 333-171876

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

| | | | |

| | THE SECURITIES ACT OF 1933 | | x |

| | Pre-Effective Amendment No. 1 | | x |

| | Post-Effective Amendment No. | | ¨ |

DWS VARIABLE SERIES I

(Exact Name of Registrant as Specified in Charter)

345 Park Avenue

New York, NY 10154

(Address of Principal Executive Offices) (Zip Code)

617-295-1000

(Registrant’s Area Code and Telephone Number)

John Millette, Secretary

One Beacon Street

Boston, Massachusetts 02108

(Name and Address of Agent for Service)

With copies to:

| | |

John W. Gerstmayr, Esq. Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, Massachusetts 02199 | | David A. Sturms, Esq. Vedder Price P.C. 222 North LaSalle Street Chicago, Illinois 60601 |

Approximate date of proposed public offering: As soon as practicable after the effective date of this Registration Statement.

TITLE OF SECURITIES BEING REGISTERED: Shares of Beneficial Interest (par value $0.01 per share) of the Registrant.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Questions & Answers

DWS Health Care VIP, a series of DWS Variable Series I

DWS Technology VIP, a series of DWS Variable Series II

Q&A

Q What issue am I being asked to vote on?

A You are being asked to vote on one or both of two proposals below, as applicable.

| | |

Proposal | | Shareholders Voting |

To merge DWS Health Care VIP into DWS Capital Growth VIP | | DWS Health Care VIP |

| |

To merge DWS Technology VIP into DWS Capital Growth VIP | | DWS Technology VIP |

After carefully reviewing the proposals, the Board of Trustees of DWS Variable Series I, of which DWS Health Care VIP (an “Acquired Fund”) is a series, and of DWS Variable Series II, of which DWS Technology VIP (an “Acquired Fund” and, together with DWS Health Care VIP, the “Acquired Funds”) is a series, has determined that each merger is in the best interests of the applicable Acquired Fund. The Board unanimously recommends that you vote for this proposal.

Q I am the owner of a variable life insurance policy or variable annuity contract offered by my insurance company. I am not a direct shareholder of either Acquired Fund. Why am I being asked to vote on a proposal for shareholders of an Acquired Fund?

A You have previously directed your insurance company to invest certain proceeds relating to your variable life insurance policy and/or variable annuity contract (each a “Contract”) in an Acquired Fund. Although you receive the gains, losses and income from this investment, your insurance company holds on your behalf any shares corresponding to your investment in the Acquired Fund. Thus, you are not the “shareholder” of the Acquired Fund; rather, your insurance company is the shareholder. However, you have the right to instruct your insurance company on how to vote the Acquired Fund shares corresponding to your investment through your Contract.

The attached Prospectus/Proxy Statement is used to solicit voting instructions from you and other owners of Contracts (“Contract Owners”). All persons entitled to direct the voting shares of an Acquired Fund, whether or not they are shareholders, are described as voting for purposes of the Prospectus/Proxy Statement.

Q Why has this proposal been made for my Acquired Fund?

A DWS Investments believes the proposed merger is in the best interests of each Acquired Fund for several reasons. In light of the decline of asset flows into actively managed “sector” funds such as the Acquired Funds, DWS Investments advised the Boards that the Acquired Funds have limited opportunities to attract new investments. As a result, each Acquired Fund is facing the likely prospect, over time, of declining assets and minimal opportunities to reduce costs through economies of scale. Given these considerations, and in order to provide shareholders with continuity of investment within the DWS fund family, DWS Investments believes that a merger into DWS Capital Growth VIP is the best alternative for shareholders of each Acquired Fund. Among other benefits, the mergers would result in lower management fees and lower operating expenses for shareholders of each Acquired Fund.

The Acquired Funds and DWS Capital Growth VIP have similar investment objectives and strategies, as they each seek to achieve growth of capital by investing primarily in growth-oriented U.S. equity securities. Even

though each of the funds has over 90% of its assets invested in U.S. stocks (with over 65% of those investments in large cap growth stocks), there are significant differences in the portfolios of DWS Capital Growth VIP and each Acquired Fund because each Acquired Fund concentrates its investments in a particular economic sector (health care and technology, respectively), while DWS Capital Growth VIP invests in a broad range of economic sectors. If the mergers are approved by shareholders, DWS Investments has estimated that approximately 90% and 70% of the portfolios of DWS Health Care VIP and DWS Technology VIP, respectively, will be liquidated and the proceeds will be reinvested in other securities so that upon the merger, DWS Capital Growth VIP will remain invested primarily in growth-oriented U.S. equity securities across a broad range of economic sectors. The repositioning of each Acquired Fund’s portfolio prior to the merger will involve transaction costs which will be borne by the relevant Acquired Fund.

Contract Owners may continue to instruct their insurance company on how to invest proceeds relating to their Contract, including effecting sales into or out of DWS Health Care VIP or DWS Technology VIP, as appropriate. Contract Owners should contact their insurance company for further information regarding their investment.

Q Will I have to pay taxes as a result of the merger?

A Each merger is expected to be a tax-free reorganization for federal income tax purposes and will not take place unless tax counsel provides an opinion for each merger to that effect. Before or after the mergers, you may instruct your insurance company to direct proceeds relating to your Contract out of DWS Health Care VIP or DWS Technology VIP and into other investments (such direction, a “Transfer”). A Contract Owner will not be subject to tax at the time of a Transfer. However, a Contract Owner’s insurance company may charge a fee for Transfers. If you choose to redeem or exchange your investment by surrendering your Contract or initiating a partial withdrawal before or after the merger, you may be subject to taxes and tax penalties; therefore, you may wish to consult a tax advisor before doing so.

Q Upon the merger, how will the value of my investment change?

A The aggregate value of your investment will not change as a result of the merger. However, the number of shares owned by your insurance company on your behalf will likely change as a result of the merger because your insurance company’s shares will be exchanged at the net asset value per share of either DWS Health Care VIP or DWS Technology VIP, which will probably be different from the net asset value per share of DWS Capital Growth VIP.

Q When would the merger take place?

A If approved, the merger would occur on or about May 2, 2011, or as soon as reasonably practicable after shareholder approval is obtained. Shortly after completion of the merger, shareholders whose accounts are affected by the merger (i.e., your insurance company) will receive a confirmation statement reflecting their new account number and the number of shares of DWS Capital Growth VIP they are receiving. Subsequently, you will be notified of changes to your account information by your insurance company.

Q Is either merger contingent upon approval of the other merger?

A No. Each Acquired Fund’s shareholders will vote separately on the merger of their Acquired Fund into DWS Capital Growth VIP. The merger of one Acquired Fund into DWS Capital Growth VIP is not contingent upon the approval of the other Acquired Fund’s shareholders. Each merger is separate and distinct from the other.

Q How can I vote?

A Contract Owners can vote in any one of three ways:

| | • | | Through the Internet, by going to the website listed on your voting instruction form; |

| | • | | By telephone, with a toll-free call to the number listed on your voting instruction form; or |

| | • | | By mail, by sending the enclosed voting instruction form, signed and dated, to us in the enclosed envelope. |

We encourage you to vote over the Internet or by telephone, following the instructions that appear on your voting instruction form. Whichever method you choose, please take the time to read the full text of the Prospectus/Proxy Statement before you vote.

Q Whom should I call for additional information about this Prospectus/Proxy Statement?

A Please call Computershare Fund Services, Inc., your fund’s information agent, at 866-963-6127, or your insurance company.

March , 2011

DWS HEALTH CARE VIP

DWS TECHNOLOGY VIP

A Message from the President of DWS Variable Series I and DWS Variable Series II

Dear Investor:

I am writing to ask you to instruct your insurance company as to how to vote on an important matter that affects your investment in DWS Health Care VIP (“Health Care”) and/or DWS Technology VIP (“Technology”), as applicable. You may provide your instructions by filling out and signing the enclosed voting instruction form, or by recording your instructions by telephone or through the Internet.

We are asking for your voting instructions on the following matter:

| | |

Proposal for Health Care | | To approve an Agreement and Plan of Reorganization and the transactions it contemplates, including the transfer of all of the assets of Health Care to DWS Capital Growth VIP (“Capital Growth”), in exchange for shares of Capital Growth and the assumption by Capital Growth of all the liabilities of Health Care, and the distribution of such shares, on a tax-free basis for federal income tax purposes, to the shareholders of Health Care in complete liquidation and termination of Health Care. |

| |

Proposal for Technology | | To approve an Agreement and Plan of Reorganization and the transactions it contemplates, including the transfer of all of the assets of Technology to DWS Capital Growth VIP (“Capital Growth”), in exchange for shares of Capital Growth and the assumption by Capital Growth of all the liabilities of Technology, and the distribution of such shares, on a tax-free basis for federal income tax purposes, to the shareholders of Technology in complete liquidation and termination of Technology. |

DWS Investments believes the proposed mergers are in the best interests of Health Care and Technology for several reasons. In light of the decline of asset flows into actively managed “sector” funds such as Health Care and Technology, DWS Investments believes that Health Care and Technology have limited opportunities to attract new investments. As a result, Health Care and Technology face the likely prospect, over time, of declining assets and minimal opportunities to reduce costs through economies of scale. Given these considerations, and in order to provide shareholders with continuity of investment within the DWS fund family, DWS Investments believes that a merger into Capital Growth is the best alternative for shareholders of both Health Care and Technology. Among other benefits, the mergers would result in lower management fees and lower operating expenses for shareholders of Health Care and Technology. In addition, DWS Investments believes that the mergers will benefit Contract Owners (as defined on page of the enclosed Prospectus/Proxy Statement) by transitioning their investment into a fund with a broader equity strategy that is open to broader distribution, resulting in potential for greater asset growth and future economies of scale.

In determining to approve the mergers, the Board of each of Health Care and Technology conducted a thorough review of the potential implications of each merger, and concluded that participation of Health Care

and Technology in the proposed mergers would be in the best interests of each fund and would not dilute the interests of its existing shareholders. A discussion of the factors the Boards considered is included in the enclosed Prospectus/Proxy Statement. If the proposed mergers are approved, the Board expects that the proposed changes will take effect during the second calendar quarter of 2011.

Included in this booklet is information about the upcoming shareholders’ meetings:

| | • | | A Notice of Special Meetings of Shareholders, which summarizes the issues for which you are being asked to provide voting instructions; and |

| | • | | A Prospectus/Proxy Statement, which provides detailed information on Capital Growth, the specific proposals that will be considered at the shareholders’ meetings and why the proposals are being made. |

We need your voting instructions and urge you to review the enclosed materials thoroughly. Once you’ve determined how you would like your interests to be represented, please promptly complete, sign, date and return the enclosed voting instruction form, vote by telephone or record your voting instructions on the Internet. A postage-paid envelope is enclosed for mailing, and telephone and Internet voting instructions are listed at the top of your voting instruction form. You may receive more than one voting instruction form. If so, please vote each one.

I’m sure that you, like most people, lead a busy life and are tempted to put this Prospectus/Proxy Statement aside for another day. Please don’t. Your prompt return of the enclosed voting instruction form (or your voting by telephone or through the Internet) may save the necessity and expense of further solicitations.

Your vote is important to us. We appreciate the time and consideration I am sure you will give to this important matter. If you have questions about the proposal, please call Computershare Fund Services, Inc., your fund’s information agent, at 866-963-6127 or contact your insurance company. Thank you for your continued support of DWS Investments.

|

| Sincerely yours, |

|

|

| Michael Clark |

| President |

| DWS Variable Series I |

| DWS Variable Series II |

DWS HEALTH CARE VIP

DWS TECHNOLOGY VIP

Notice of Special Meetings of Shareholders

Please take notice that Special Meetings of Shareholders of DWS Health Care VIP, a series of DWS Variable Series I (“Health Care”) and DWS Technology VIP, a series of DWS Variable Series II (“Technology”) will be held at the offices of Deutsche Investment Management Americas Inc., 345 Park Avenue, 24th Floor, New York, NY 10154, on April 11, 2011 at 3:00 p.m., Eastern time (each a “Meeting”), to consider the following:

| | |

Proposal for Health Care | | To approve an Agreement and Plan of Reorganization and the transactions it contemplates, including the transfer of all of the assets of Health Care to DWS Capital Growth VIP (“Capital Growth”), in exchange for shares of Capital Growth and the assumption by Capital Growth of all the liabilities of Health Care, and the distribution of such shares, on a tax-free basis for federal income tax purposes, to the shareholders of Health Care in complete liquidation and termination of Health Care. |

| |

Proposal for Technology | | To approve an Agreement and Plan of Reorganization and the transactions it contemplates, including the transfer of all of the assets of Technology to DWS Capital Growth VIP (“Capital Growth”), in exchange for shares of Capital Growth and the assumption by Capital Growth of all the liabilities of Technology, and the distribution of such shares, on a tax-free basis for federal income tax purposes, to the shareholders of Technology in complete liquidation and termination of Technology. |

The appointed proxies will vote in their discretion on any other business as may properly come before a Meeting or any postponement(s) or adjournment(s) thereof. Holders of record of shares of Health Care and Technology at the close of business on February 18, 2011 are entitled to vote at the applicable Meeting and at any postponement(s) or adjournment(s) thereof.

In the event that the necessary quorum to transact business or the vote required to approve a merger is not obtained at a Meeting, the appointed proxies may propose one or more adjournments of the Meeting in accordance with applicable law to permit such further solicitation of proxies as may be deemed necessary or advisable.

|

| By order of the Trustees, |

|

|

|

| John Millette, |

|

| Secretary |

March , 2011

IMPORTANT — We urge you to sign and date the enclosed proxy card or voting instruction form (unless you choose to record your voting instructions by touch-tone telephone or through the Internet) and return it in the enclosed addressed envelope which requires no postage and is intended for your convenience.

IMPORTANT INFORMATION

FOR OWNERS OF VARIABLE ANNUITY OR

LIFE INSURANCE CONTRACTS INVESTED IN

DWS HEALTH CARE VIP OR

DWS TECHNOLOGY VIP

This document contains a Prospectus/Proxy Statement and a voting instruction form. You can use your voting instruction form to tell your insurance company how to vote on your behalf on an important issue relating to your investment in DWS Health Care VIP or DWS Technology VIP (each an “Acquired Fund”), as applicable. If you complete and sign the voting instruction form (or tell your insurance company by telephone or through the Internet how you want it to vote), your insurance company will vote the shares corresponding to your insurance contract exactly as you indicate. If you simply sign the voting instruction form, your insurance company will vote the shares corresponding to your insurance contract in accordance with the Board’s recommendations on page . If you do not return your voting instruction form or record your voting instructions by telephone or through the Internet, your insurance company will vote the shares corresponding to your insurance contract in the same proportion as shares for which instructions have been received.

We urge you to review the Prospectus/Proxy Statement carefully, and either fill out your voting instruction form and return it by mail, or record your voting instructions by telephone or through the Internet. You may receive more than one voting instruction form. If so, please vote each one. Your prompt return of the enclosed voting information form (or your providing voting instructions by telephone or through the Internet) may save the necessity and expense of further solicitations.

We want to know how you would like your interests to be represented and welcome your comments. Please take a few minutes to read these materials and return your voting instruction form. If you have any questions, please call Computershare Fund Services, Inc., information agent for your Acquired Fund, at the special toll-free number we have set up for you, 866-963-6127, or contact your insurance company.

PROSPECTUS/PROXY STATEMENT

March , 2011

| | |

| Acquisition of the assets of: | | By and in exchange for shares of: |

| |

DWS Health Care VIP, a series of DWS Variable Series I and/or DWS Technology VIP, a series of DWS Variable Series II 345 Park Avenue New York, NY 10154 800-778-1482 | | DWS Capital Growth VIP, a series of DWS Variable Series I 345 Park Avenue New York, NY 10154 800-778-1482 |

This Prospectus/Proxy Statement is furnished in connection with two proposals: (i) the proposed merger of DWS Health Care VIP (“Health Care”) into DWS Capital Growth VIP (“Capital Growth”) and (ii) the proposed merger of DWS Technology VIP (“Technology” and, together with Health Care, the “Acquired Funds”) into Capital Growth. As a result of the proposed mergers, each Acquired Fund shareholder will receive a number of full and fractional shares of the corresponding class of Capital Growth equal in value as of the Valuation Time (as defined below on page ) to the total value of such shareholder’s Acquired Fund shares. Each Acquired Fund’s shareholders will vote separately on the merger of their Acquired Fund into Capital Growth, with each merger being separate and distinct from the other. The merger of one Acquired Fund into Capital Growth is not contingent upon the approval of the other Acquired Fund’s shareholders.

The following table identifies the fund whose shareholders are entitled to vote on each proposal:

| | | | |

| | | | | Proposal |

| | | |

| Fund | | Approval of Proposed Merger of

Health Care into Capital Growth | | Approval of Proposed Merger of

Technology into Capital Growth |

Health Care | | X | | |

Technology | �� | | | X |

Shares of the Acquired Funds are available exclusively as a funding vehicle for variable life insurance policies and variable annuity contracts (each a “Contract”) offered by the separate accounts, or sub-accounts thereof, of certain life insurance companies (“Participating Insurance Companies”). The Participating Insurance Companies own shares of the Acquired Funds as depositors for the owners of their respective Contracts (each a “Contract Owner”). Thus, individual Contract Owners are not the “shareholders” of the Acquired Funds. Rather, the Participating Insurance Companies and their separate accounts are the shareholders of record. (Depending on the context, references to “you” or “your” herein refer to the Contract Owner and/or to the Participating Insurance Company separate accounts.) To the extent required to be consistent with the interpretations of voting requirements by the staff of the Securities and Exchange Commission (“SEC”), each Participating Insurance Company will offer to Contract Owners the opportunity to instruct it as to how it should vote shares held by it and the separate accounts on the proposed mergers. This Prospectus/Proxy Statement is, therefore, furnished to Contract Owners entitled to give voting instructions with regard to the Acquired Funds. All persons entitled to direct the voting of shares of an Acquired Fund, whether or not they are shareholders, are described as voting for purposes of this Prospectus/Proxy Statement. This Prospectus/Proxy Statement, the Notice of Special Meetings of Shareholders and the proxy card or voting instruction form are first being mailed to shareholders and Contract Owners on or about March , 2011, or as soon as practicable thereafter. The Prospectus/Proxy Statement explains concisely what you should know before voting on the matter described herein or investing in Capital Growth, a diversified series of an open-end management investment company. Please read it carefully and keep it for future reference.

The securities offered by this Prospectus/Proxy Statement have not been approved or disapproved by the SEC, nor has the SEC passed upon the accuracy or adequacy of this Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

1

The following documents have been filed with the SEC and are incorporated into this Prospectus/Proxy Statement by reference:

| | (i) | the prospectus of Capital Growth, dated May 1, 2010, as supplemented from time to time, relating to Class A shares (File No. 811-04257), a copy of which, if applicable, is included with this Prospectus/Proxy Statement; |

| | (ii) | the prospectus of Capital Growth, dated May 1, 2010, as supplemented from time to time, relating to Class B shares (File No. 811-04257), a copy of which, if applicable, is included with this Prospectus/Proxy Statement; |

| | (iii) | the prospectus of Health Care, dated May 1, 2010, as supplemented from time to time, relating to Class A shares (File No. 811-04257); |

| | (iv) | the prospectus of Health Care, dated May 1, 2010, as supplemented from time to time, relating to Class B shares (File No. 811-04257); |

| | (v) | the prospectus of Technology, dated May 1, 2010, as supplemented from time to time, relating to Class A shares (File No. 811-05002); |

| | (vi) | the prospectus of Technology, dated May 1, 2010, as supplemented from time to time, relating to Class B shares (File No. 811-05002); |

| | (vii) | the statement of additional information of Health Care, dated May 1, 2010, as revised May 10, 2010, and as supplemented from time to time, relating to Class A and Class B shares (File No. 811-04257); |

| | (viii) | the statement of additional information of Technology, dated May 1, 2010, as revised October 4, 2010, and as supplemented from time to time, relating to Class A and Class B shares (File No. 811-05002); |

| | (ix) | the statement of additional information relating to the proposed mergers, dated , 2011 (the “Merger SAI”); and |

| | (x) | the financial statements and related reports of the independent registered public accounting firm included in the Annual Report to Shareholders for the fiscal year ended December 31, 2010 for each of Health Care (File No. 811-04257) and Technology (File No. 811-05002). |

Except as noted below, no other parts of either of Health Care or Technology’s Annual Report are incorporated by reference herein.

The financial highlights for Capital Growth and for each of the Acquired Funds contained in each fund’s Annual Report for the period ended December 31, 2010, are attached to this Prospectus/Proxy Statement as Appendix C.

You may get free copies of the funds’ annual reports, semi-annual reports, prospectuses, statements of additional information and/or the Merger SAI, request other information about a fund, or make shareholder inquiries, by contacting your insurance company or by calling the corresponding fund at 1-800-728-3337.

Like shares of the Acquired Funds, shares of Capital Growth are not deposits or obligations of, or guaranteed or endorsed by, any financial institution, are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other agency, and involve risk, including the possible loss of the principal amount invested.

This document is designed to give you the information you need to vote on the proposals listed in the Notice of Special Meetings of Shareholders. Much of the information is required disclosure under rules of the SEC; some of it is technical. If there is anything you don’t understand, please contact Computershare Fund Services, Inc., information agent for the Acquired Funds, at 866-963-6127, or contact your insurance company.

2

Capital Growth, Health Care and Technology are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith file reports and other information with the SEC. You may review and copy information about the funds, including prospectuses and statements of additional information, at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. You may call the SEC at 1-202-551-8090 for information about the operation of the public reference room. You may obtain copies of this information, with payment of a duplication fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the Public Reference Branch, Office of Consumer Affairs and Information Services, Securities and Exchange Commission, Washington, D.C. 20549. You may also access reports and other information about the funds on the EDGAR database on the SEC’s Internet site at http://www.sec.gov.

I. SYNOPSIS

The responses to the questions that follow provide an overview of key points typically of concern to shareholders and Contract Owners considering a proposed merger between mutual funds. These responses are qualified in their entirety by the remainder of this Prospectus/Proxy Statement, which you should read carefully because it contains additional information and further details regarding the proposed mergers.

1. What is being proposed?

The Boards of Health Care and Technology are recommending that shareholders approve the transactions contemplated by the Agreements and Plans of Reorganization (as described below in Part IV and the form of which is attached hereto as Appendix B), which we refer to herein as a merger of each Acquired Fund into Capital Growth. If approved by shareholders of your Acquired Fund, all of the assets of your Acquired Fund will be transferred to Capital Growth solely in exchange for (a) the issuance and delivery to your Acquired Fund of Class A and Class B shares of Capital Growth (“Merger Shares”) with a value equal to the value of your Acquired Fund’s assets net of liabilities, and (b) the assumption by Capital Growth of all the liabilities of your Acquired Fund. Immediately following the merger, the appropriate class of Merger Shares received by your Acquired Fund will be distributed pro rata, on a tax-free basis for federal income tax purposes, to each of its shareholders of record.

2. What will happen to my investment in my Acquired Fund as a result of the merger?

Your investment in your Acquired Fund will, in effect, be exchanged for an investment in the same share class of Capital Growth with an equal aggregate net asset value as of the Valuation Time (as defined below on page ).

3. Why have the Boards of the Trusts recommended that shareholders approve the merger?

DWS Investments advised the Boards that it believes that the proposed mergers are in the best interests of Health Care and Technology for several reasons. In light of the decline of asset flows into actively managed “sector” funds such as Health Care and Technology, DWS Investments advised the Boards that Health Care and Technology have limited opportunities to attract new investments. As a result, Health Care and Technology are facing the likely prospect, over time, of declining assets and minimal opportunities to reduce costs through economies of scale. Given these considerations, and in order to provide shareholders with continuity of investment within the DWS fund family, DWS Investments believes that a merger into Capital Growth is the best alternative for shareholders of Health Care and Technology. In determining to recommend that shareholders of Health Care and Technology approve the mergers, the Boards considered, among others, the following factors:

| | • | | The mergers would help to protect shareholders of Health Care and Technology from the cost increases associated with small, declining asset bases, and provide continuity of investment within the DWS fund family, including access to DWS Investments’ U.S. equity investment expertise; |

3

| | • | | The effective advisory fees paid by the combined fund will be lower at all asset levels as compared to the advisory fees paid by Health Care and Technology; |

| | • | | The estimated total operating expense ratios of each class of shares of the combined fund are lower than the current total operating expense ratios of the corresponding classes of Health Care and Technology; |

| | • | | Similarities and differences between Health Care’s and Technology’s investment objectives, policies and restrictions relative to those of Capital Growth. The Acquired Funds and Capital Growth have similar investment objectives and strategies, as they each seek to achieve growth of capital by investing primarily in growth-oriented U.S. equity securities. Even though each of the funds has over 90% of its assets invested in U.S. stocks (with over 65% of those investments in large cap growth stocks), there are significant differences in the portfolios of Capital Growth and each Acquired Fund because each Acquired Fund concentrates its investments in a particular economic sector (health care and technology, respectively), while Capital Growth invests in a broad range of economic sectors; and |

| | • | | The commitment by Deutsche Investment Management Americas Inc. (“DIMA”), each fund’s investment advisor, to cap certain expenses to be incurred by each of Health Care and Technology in connection with the merger. More specifically, DWS Investments has agreed to bear certain types of expenses incurred by Health Care or Technology in connection with the merger to the extent such expenses exceed the expected cost savings to be realized by shareholders of the applicable fund at the time of the merger during the one-year period following the merger (See “Agreement and Plan of Reorganization” below for additional information regarding this cap). |

Based on the foregoing: (1) the Board of Health Care concluded that the merger of Health Care into Capital Growth is in the best interests of Health Care, and that the interests of the existing shareholders of Health Care will not be diluted as a result of the merger; and (2) the Board of Technology concluded that the merger of Technology into Capital Growth is in the best interests of Technology, and that the interests of the existing shareholders of Technology will not be diluted as a result of the merger. Accordingly, the Trustees unanimously recommend that shareholders of Health Care and Technology approve the Agreement (as defined on page ). For a complete discussion of the Boards’ considerations please see “Background and Boards’ Considerations Relating to the Proposed Mergers” below.

4. How do the investment goals, policies and restrictions of the funds compare?

The funds’ investment goals are similar — each fund seeks growth of capital (Health Care and Capital Growth seek long-term growth of capital, while Technology’s investment objective is growth of capital). Each fund seeks to achieve its objective mainly through investment in equity securities, primarily common stocks, though the specific focus of each fund’s investment portfolio differs. Capital Growth normally invests at least 65% of total assets in equities, mainly common stocks of US companies. Capital Growth generally focuses on established companies that are similar in size to the companies in the S&P 500® Index or the Russell 1000® Growth Index. Although Capital Growth can invest in companies of any size, the fund intends to invest primarily in companies whose market capitalizations fall within the normal range of these indexes. Capital Growth may also invest in other types of equity securities such as preferred stocks or convertible securities. Health Care, under normal circumstances, invests at least 80% of total assets, plus the amount of any borrowing for investment purposes, in common stock of companies in the health care sector. For purposes of the fund’s 80% investment policy, to be considered part of the health care sector, companies must commit at least half of their assets to, or derive at least half of the revenues or net income from, that sector. Health Care invests primarily in securities of US companies, but may invest in foreign companies as well. Health Care may invest in companies of any market capitalization. Technology, under normal circumstances, invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in common stocks of companies in the technology sector. For purposes of the fund’s 80% investment policy, the fund defines a company as being in the technology sector if it commits at least half its assets to, or derives at least half its revenues or net income from, that sector.

4

Technology may invest in companies of any size and may invest in initial public offerings. While Technology invests mainly in US stocks, it could invest up to 35% of net assets in foreign securities (including emerging markets securities). Technology’s equity investments are mainly common stocks, but may also include other types of equities such as preferred stocks or convertible securities. Please see Part II — Investment Strategies and Risk Factors, below, for a more detailed comparison of each Fund’s investment policies and restrictions.

The following two tables set forth a summary of the composition of each fund’s investment portfolio as of December 31, 2010, and DWS Investments’ estimation of the portfolio composition of Capital Growth assuming consummation of the proposed mergers.

Sector Diversification (as a % of common stocks)

| | | | | | | | | | | | |

| | | Health Care | | | Technology | | | Capital Growth | |

Information Technology | | | — | | | | 97 | % | | | 31 | % |

Consumer Discretionary | | | — | | | | 3 | % | | | 16 | % |

Industrials | | | — | | | | — | | | | 14 | % |

Energy | | | — | | | | — | | | | 12 | % |

Health Care | | | 100 | % | | | — | | | | 10 | % |

Materials | | | — | | | | — | | | | 6 | % |

Consumer Staples | | | — | | | | — | | | | 5 | % |

Financials | | | — | | | | — | | | | 5 | % |

Telecommunication Services | | | — | | | | — | | | | 1 | % |

Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| | | | | | | | | | | | |

| | | Capital Growth —

Estimated(1) (assuming

consummation of

Health Care merger) | | | Capital Growth —

Estimated(1) (assuming

consummation of

Technology merger) | | | Capital Growth —

Estimated(1) (assuming

consummation of both

mergers) | |

Information Technology | | | 31 | % | | | 31 | % | | | 31 | % |

Consumer Discretionary | | | 16 | % | | | 16 | % | | | 16 | % |

Industrials | | | 14 | % | | | 14 | % | | | 14 | % |

Energy | | | 12 | % | | | 12 | % | | | 12 | % |

Health Care | | | 10 | % | | | 10 | % | | | 10 | % |

Materials | | | 6 | % | | | 6 | % | | | 6 | % |

Consumer Staples | | | 5 | % | | | 5 | % | | | 5 | % |

Financials | | | 5 | % | | | 5 | % | | | 5 | % |

Telecommunication Services | | | 1 | % | | | 1 | % | | | 1 | % |

Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| (1) | Reflects DWS Investments’ estimation of the portfolio composition of Capital Growth subsequent to the mergers, taking into account that prior to the mergers, pursuant to each Agreement and Plan of Reorganization, a significant portion of the portfolio of each Acquired Fund will be liquidated and the proceeds will be used to acquire other securities consistent with the investment objective, policies, restrictions and strategies of Capital Growth. There can be no assurance as to the actual portfolio composition of Capital Growth subsequent to the mergers. |

5. How do the management fees and expense ratios of the two funds compare?

The following tables summarize the fees and expenses an investor may pay when investing in the funds, the expenses that each fund incurred during its fiscal year ended December 31, 2010 and the pro forma estimated expense ratios of Capital Growth assuming consummation of the mergers as of that date. The information below does not reflect charges and fees associated with separate accounts that invest in the funds and any Contract for which the funds are investment options. These charges and fees will increase expenses.

5

As shown below, the mergers are expected to result in lower management fee ratios and lower total expense ratios for shareholders of each Acquired Fund. However, there can be no assurance that the mergers will result in expense savings.

| | | | |

Shareholder Fees (paid directly from your investment) | | | None | |

| | | | |

Management Fee Schedule (expressed as a percentage of net assets) —

Capital Growth (Pre- and Post-Merger) | | | |

First $250 million | | | 0.390 | % |

Next $750 million | | | 0.365 | % |

Thereafter | | | 0.340 | % |

| | | | |

Management Fee Schedule (expressed as a percentage of net assets) —

Health Care | | | |

First $250 million | | | 0.665 | % |

Next $750 million | | | 0.640 | % |

Next $1.5 billion | | | 0.615 | % |

Next $2.5 billion | | | 0.595 | % |

Next $2.5 billion | | | 0.565 | % |

Next $2.5 billion | | | 0.555 | % |

Next $2.5 billion | | | 0.545 | % |

Thereafter | | | 0.535 | % |

| | | | |

Management Fee Schedule (expressed as a percentage of net assets) —

Technology | | | |

First $250 million | | | 0.665 | % |

Next $750 million | | | 0.635 | % |

Next $1.5 billion | | | 0.615 | % |

Next $2.5 billion | | | 0.595 | % |

Next $2.5 billion | | | 0.565 | % |

Next $2.5 billion | | | 0.555 | % |

Next $2.5 billion | | | 0.545 | % |

Thereafter | | | 0.535 | % |

A discussion regarding the basis for the Board’s approval of each fund’s advisory agreements is contained in each fund’s most recent shareholder report for the annual period ended December 31.

6

The table below describes the fees and expenses paid by each of the funds. As shown below, the mergers are expected to result in lower total expense ratios for each Acquired Fund. However, there can be no assurance that the mergers will result in lower expense ratios. The information set forth below is based on each fund’s average net assets and fees and expenses for the year ended December 31, 2010, and Capital Growth’s post-merger estimated annualized fees and expenses assuming the mergers were consummated on December 31, 2010.

Annual Fund Operating Expenses

(expenses that are deducted from fund assets)

(as a percentage of average net assets)

| | | | | | | | | | | | | | | | |

| | | Management

Fee | | | Distribution/

Service

(12b-1) Fees | | | Other

Expenses | | | Total Annual

Fund

Operating

Expenses | |

Health Care | | | | | | | | | | | | | | | | |

Class A | | | 0.67 | % | | | 0.00 | % | | | 0.23 | % | | | 0.90 | % |

Class B | | | 0.67 | % | | | 0.25 | % | | | 0.33 | % | | | 1.25 | % |

Technology | | | | | | | | | | | | | | | | |

Class A | | | 0.67 | % | | | 0.00 | % | | | 0.26 | % | | | 0.93 | % |

Class B | | | 0.67 | % | | | 0.25 | % | | | 0.37 | % | | | 1.29 | % |

Capital Growth | | | | | | | | | | | | | | | | |

Class A | | | 0.37 | % | | | 0.00 | % | | | 0.14 | % | | | 0.51 | % |

Class B | | | 0.37 | % | | | 0.25 | % | | | 0.23 | % | | | 0.85 | % |

| Capital Growth (Pro forma combined, assuming consummation of Health Care merger)(2) | | | | | | | | | | | | | | | | |

Class A | | | 0.37 | % | | | 0.00 | % | | | 0.14 | %(1) | | | 0.51 | % |

Class B | | | 0.37 | % | | | 0.25 | % | | | 0.23 | %(1) | | | 0.85 | % |

| Capital Growth (Pro forma combined, assuming consummation of Technology merger)(2) | | | | | | | | | | | | | | | | |

Class A | | | 0.37 | % | | | 0.00 | % | | | 0.14 | %(1) | | | 0.51 | % |

Class B | | | 0.37 | % | | | 0.25 | % | | | 0.23 | %(1) | | | 0.85 | % |

| Capital Growth (Pro forma combined, assuming consummation of both mergers)(2) | | | | | | | | | | | | | | | | |

Class A | | | 0.37 | % | | | 0.00 | % | | | 0.14 | %(1) | | | 0.51 | % |

Class B | | | 0.37 | % | | | 0.25 | % | | | 0.23 | %(1) | | | 0.85 | % |

| (1) | Other expenses are estimated, accounting for the effect of the mergers. |

| (2) | Pro forma expenses do not include reorganization costs related to the mergers that will be borne by each Acquired Fund prior to the merger, currently estimated to be $200,000 or 0.40% for Health Care and $225,000 or 0.31% for Technology. |

7

Examples

These examples translate the expenses shown in the preceding table into dollar amounts. By doing this, you can more easily compare the costs of investing in the funds. The examples make certain assumptions. They assume that you invest $10,000 in a fund for the time periods shown and reinvest all dividends and distributions. They also assume a 5% return on your investment each year and that a fund’s operating expenses remain the same (except as described below). The examples are hypothetical; your actual costs and returns may be higher or lower.

| | | | | | | | | | | | | | | | |

| | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | |

Health Care | | | | | | | | | | | | | | | | |

Class A shares | | $ | 92 | | | $ | 287 | | | $ | 498 | | | $ | 1,108 | |

Class B shares | | $ | 127 | | | $ | 397 | | | $ | 686 | | | $ | 1,511 | |

Technology | | | | | | | | | | | | | | | | |

Class A shares | | $ | 95 | | | $ | 296 | | | $ | 515 | | | $ | 1,143 | |

Class B shares | | $ | 131 | | | $ | 409 | | | $ | 708 | | | $ | 1,556 | |

Capital Growth | | | | | | | | | | | | | | | | |

Class A shares | | $ | 52 | | | $ | 164 | | | $ | 285 | | | $ | 640 | |

Class B shares | | $ | 87 | | | $ | 271 | | | $ | 471 | | | $ | 1,049 | |

Capital Growth (Pro forma combined, assuming consummation of Health Care merger) | | | | | | | | | | | | | | | | |

Class A shares | | $ | 52 | | | $ | 164 | | | $ | 285 | | | $ | 640 | |

Class B shares | | $ | 87 | | | $ | 271 | | | $ | 471 | | | $ | 1,049 | |

Capital Growth (Pro forma combined, assuming consummation of Technology merger) | | | | | | | | | | | | | | | | |

Class A shares | | $ | 52 | | | $ | 164 | | | $ | 285 | | | $ | 640 | |

Class B shares | | $ | 87 | | | $ | 271 | | | $ | 471 | | | $ | 1,049 | |

Capital Growth (Pro forma combined, assuming consummation of both Health Care and Technology mergers) | | | | | | | | | | | | | | | | |

Class A shares | | $ | 52 | | | $ | 164 | | | $ | 285 | | | $ | 640 | |

Class B shares | | $ | 87 | | | $ | 271 | | | $ | 471 | | | $ | 1,049 | |

6. What are the federal income tax consequences of the proposed mergers?

Each merger is expected to be a tax-free reorganization for federal income tax purposes. Accordingly, no gain or loss is expected to be recognized by either Acquired Fund or by the separate accounts as shareholders of an Acquired Fund as a direct result of its merger. As long as the Contracts qualify as life insurance contracts under Section 7702(a) of the Internal Revenue Code of 1986, as amended, (the “Code”) or annuity contracts under Section 72 of the Code, the mergers, whether or not treated as tax-free reorganizations, will not create any tax liability for Contract Owners. For more information, please see “Information about the Proposed Mergers — Certain Federal Income Tax Consequences” below.

7. Will my dividends be affected by the mergers?

The mergers will not result in a change in dividend policy.

8. Do the procedures for purchasing, redeeming and exchanging shares of the funds differ?

No. The procedures for purchasing and redeeming shares of each fund are identical. Each fund continuously sells shares to Participating Insurance Company separate accounts, without a sales charge, at the net asset value per share next determined after a proper purchase order is placed by a Participating Insurance Company. A Participating Insurance Company offers Contract Owners units in its separate accounts which correspond to

8

shares in the fund. A Participating Insurance Company submits purchase and redemption orders to the fund based on allocation instructions for premium payments, transfer instructions and surrender or partial withdrawal requests for Contract Owners, as set forth in the prospectus for the Participating Insurance Company’s Contracts. These orders reflect the amount of premium payments to be invested, surrender and transfer requests and other matters. Redemption orders are effected at the next net asset value per share determined after a proper redemption order is placed by a Participating Insurance Company. Contract Owners should refer to their Contract prospectuses for redemption procedures and fees.

9. How will I be notified of the outcome of the merger of my Acquired Fund?

If the proposed merger of your Acquired Fund is approved by shareholders, shareholders whose accounts are affected by the merger (i.e., Participating Insurance Companies) will receive a confirmation statement reflecting their new account number, if applicable, and the number of shares of Capital Growth they have received. Subsequently, affected Contract Owners will be notified of changes to their account information by their respective Participating Insurance Companies. If the proposed merger of your Acquired Fund is not approved, this result will be noted in the next shareholder report of your fund.

10. Will the value of my investment change?

The number of shares owned by each Participating Insurance Company will most likely change. However, the total value of your investment in Capital Growth will equal the total value of your investment in your Acquired Fund at the Valuation Time (as defined below on page ). Even though the net asset value per share of each fund is likely to be different, the total value of your holdings will not change as a result of the mergers.

11. What vote is required to approve the merger?

Approval of each merger will require the affirmative vote of the shareholders of the applicable Acquired Fund entitled to vote more than fifty percent (50%) of the votes entitled to be cast on the matter at the special meeting.

The Board believes that each proposed merger is in the best interests of the applicable Acquired Fund. Accordingly, the Board recommends that shareholders vote FOR approval of the proposed mergers.

II. INVESTMENT STRATEGIES AND RISK FACTORS

What are the main investment strategies and related risks of Capital Growth, and how do they compare with those of the Acquired Funds?

Investment Objectives and Strategies. Capital Growth and Health Care seek long-term growth of capital, while Technology’s investment objective is growth of capital. All of the funds invest mainly in equity securities, primarily common stocks, though the specific focus of each fund’s investment portfolio differs. Capital Growth normally invests at least 65% of total assets in equities, mainly common stocks of US companies. The fund generally focuses on established companies that are similar in size to the companies in the S&P 500® Index (generally 500 of the largest companies in the US) or the Russell 1000® Growth Index (generally those stocks among the 1,000 largest US companies that have above-average price-to-earnings ratios). Although Capital Growth can invest in companies of any size, the fund intends to invest primarily in companies whose market capitalizations fall within the normal range of these indexes. Capital Growth may also invest in other types of equity securities such as preferred stocks or convertible securities. Health Care, under normal circumstances, invests at least 80% of total assets, plus the amount of any borrowing for investment purposes, in common stock of companies in the health care sector. For purposes of the fund’s 80% investment policy, to be considered part

9

of the health care sector, companies must commit at least half of their assets to, or derive at least half of the revenues or net income from, that sector. Examples of industries in the health care sector include pharmaceuticals, biotechnology, medical products and supplies, and health care services. Health Care invests primarily in securities of US companies, but may invest in foreign companies as well. Health Care may invest in companies of any market capitalization. Technology, under normal circumstances, invests at least 80% of net assets, plus the amount of any borrowings for investment purposes, in common stocks of companies in the technology sector. For purposes of the fund’s 80% investment policy, the fund defines a company as being in the technology sector if it commits at least half its assets to, or derives at least half its revenues or net income from, that sector. Examples of industries within the technology sector are semiconductors, software, telecom equipment, computer/hardware, IT services, the Internet and health technology. Technology may invest in companies of any size and may invest in initial public offerings. While Technology invests mainly in US stocks, it could invest up to 35% of net assets in foreign securities (including emerging markets securities). Technology’s equity investments are mainly common stocks, but may also include other types of equities such as preferred stocks or convertible securities.

Each fund may use various types of derivatives (contracts whose value is based on, for example, indices, currencies or securities) for hedging, risk management or non-hedging purposes to seek to enhance potential gains. The funds may use derivatives as a substitute for direct investment in a particular asset class or to keep cash on hand to meet shareholder redemptions or other needs. Capital Growth may use futures and options, and write covered call options. Technology may also use futures and options, including sales of covered put and call options. Each fund may lend securities (up to one third of total assets) to approved institutions.

In choosing stocks, portfolio management for Capital Growth begins by utilizing a proprietary quantitative model to rank stocks based on a number of factors including valuation and profitability. Portfolio management also applies fundamental techniques to seek to identify companies that display above-average earnings growth compared to other companies and that have strong product lines, effective management and leadership positions within core markets. The factors considered and models used by the portfolio managers may change over time. Portfolio management will normally sell a security when it believes the potential risks have increased, its price is unlikely to go higher, its fundamental factors have changed, other investments offer better opportunities or in the course of adjusting the fund’s emphasis on a given industry.

In choosing stocks, portfolio management of Health Care uses a combination of three analytical disciplines: (1) Bottom-up research — Portfolio management looks for individual companies with a history of above-average growth, strong competitive positioning, new tests or treatments, the ability to take advantage of demographic trends, attractive prices relative to potential growth, sound financial strength and effective management, among other factors; (2) Growth orientation — Portfolio management generally looks for companies that it believes have above-average potential for sustainable growth of revenue or earnings and whose market value appears reasonable in light of their business prospects; and (3) Top-down analysis — Portfolio management considers the economic outlook for various industries within the health care sector while looking for those that it believes may benefit from changes in the overall business environment. Portfolio management may favor securities from different industries and companies within the health care sector at different times. Portfolio management will normally sell a stock when it believes the stock’s price is unlikely to go higher, its fundamental factors have changed, other investments offer better opportunities, or in the course of adjusting their emphasis on a given health care industry.

In choosing securities, portfolio management of Technology also uses a combination of three analytical disciplines: (1) Bottom-up research — Portfolio management looks for individual companies with a history of above-average growth, strong competitive positioning, attractive prices relative to potential growth, innovative products and services, sound financial strength and effective management, among other factors; (2) Growth orientation — Portfolio management generally looks for companies that they believe have above-average potential for sustainable growth of revenue or earnings and whose market value appears reasonable in light of their business prospects; and (3) Top-down analysis — Portfolio management considers the economic outlooks

10

for various industries within the technology sector and looks for those that may benefit from changes in the overall business environment. In addition, portfolio management uses quantitative analytic tools to attempt to manage the price volatility of the fund as compared to appropriate benchmarks and peer groups. Portfolio management may favor securities from various industries and companies within the technology sector at different times. Portfolio management will normally sell a stock when they believe its price is unlikely to go higher, its fundamentals have changed, other investments offer better opportunities, or in adjusting their emphasis on a given technology industry.

Although major changes tend to be infrequent, each fund’s Board could change the fund’s investment objective without seeking shareholder approval. However, in the case of Health Care or Technology, the Board will provide shareholders with at least 60 days’ notice prior to making any changes to the fund’s 80% investment policy.

When in the opinion of portfolio management it is advisable to adopt a temporary defensive position because of unusual and adverse or other market conditions, up to 100% of each fund’s assets may be held in cash or invested in money market securities or other short-term investments. Short-term investments consist of (1) foreign and domestic obligations of sovereign governments and their agencies and instrumentalities, authorities and political subdivisions; (2) other short-term rated debt securities or, if unrated, determined to be of comparable quality in the opinion of portfolio management; (3) commercial paper; (4) bank obligations, including negotiable certificates of deposit, time deposits and bankers’ acceptances; and (5) repurchase agreements. Short-term investments may also include shares of money market mutual funds. This could prevent losses, but, while engaged in a temporary defensive position, the fund will not be pursuing its investment objective. However, portfolio management may choose not to use these strategies for various reasons, even in volatile market conditions.

Although DWS Investments believes that Capital Growth should provide a comparable investment opportunity for shareholders of Health Care and of Technology, there are a number of significant differences in the portfolios of each Acquired Fund and Capital Growth. Each Acquired Fund concentrates its investments in a particular economic sector (health care and technology, respectively), while Capital Growth invests in a broad range of economic sectors. DWS Investments has estimated that approximately 90% and 70% of the portfolios of Health Care and Technology, respectively, will be liquidated prior to each merger. Proceeds from the liquidation will be reinvested in other securities so that upon the merger, the combined fund will remain invested primarily in growth-oriented U.S. equity securities across a broad range of economic sectors.

For a more detailed description of the investment techniques used by Capital Growth, Health Care and Technology, please see the applicable fund’s prospectuses and statement of additional information.

Primary Risks. As with any investment, you may lose money by investing in Capital Growth. Certain risks associated with an investment in Capital Growth are summarized below. Subject to certain exceptions, the risks of an investment in Capital Growth are similar to the risks of an investment in Health Care or Technology. More detailed descriptions of the risks associated with an investment in Capital Growth can be found in the Capital Growth prospectuses and statement of additional information.

Stock market risk. When stock prices fall, you should expect the value of your investment to fall as well. Stock prices can be hurt by poor management on the part of the stock’s issuer, shrinking product demand and other business risks. These may affect single companies as well as groups of companies. In addition, movements in financial markets may adversely affect a stock’s price, regardless of how well the company performs. To the extent the fund invests in a particular capitalization or market sector, the fund’s performance may be proportionately affected by that segment’s general performance. An investment in Health Care or Technology is also subject to this risk.

Growth investing risk. As a category, growth stocks may underperform value stocks (and the stock market as a whole) over any period of time. Because the prices of growth stocks are based largely on the expectation of

11

future earnings, growth stock prices can decline rapidly and significantly in reaction to negative news about such factors as earnings, the economy, political developments, or other news. A growth company may fail to fulfill apparent promise or may be eclipsed by competitors or its products or services rendered obsolete by new technologies. Growth stocks also typically lack the dividends associated with value stocks that might otherwise cushion investors from the effects of declining stock prices. In addition, growth stocks selected for investment by portfolio management may not perform as anticipated. An investment in Health Care or Technology is also subject to this risk.

Focus risk. To the extent that the fund focuses its investments in particular industries, asset classes or sectors of the economy, any market price movements, regulatory or technological changes, or economic conditions affecting companies in those industries, asset classes or sectors will have a significant impact on the fund’s performance. For example, consumer goods companies could be hurt by a rise in unemployment or technology companies could be hurt by such factors as market saturation, price competition and rapid product obsolescence. An investment in Health Care or Technology is subject to a similar risk due to the concentration of investments in the health care or technology sectors, respectively.

Security selection risk. The securities in the fund’s portfolio may decline in value. Portfolio management could be wrong in its analysis of industries, companies, economic trends, the relative attractiveness of different securities or other matters. An investment in Health Care or Technology is also subject to this risk.

Securities lending risk. Any decline in the value of a portfolio security that occurs while the security is out on loan is borne by the fund, and will adversely affect performance. Also, there may be delays in recovery of securities loaned or even a loss of rights in the collateral should the borrower of the securities fail financially while holding the security. An investment in Health Care or Technology is also subject to this risk.

Derivatives risk. Risks associated with derivatives include the risk that the derivative is not well correlated with the security, index or currency to which it relates; the risk that derivatives may result in losses or missed opportunities; the risk that the fund will be unable to sell the derivative because of an illiquid secondary market; the risk that a counterparty is unwilling or unable to meet its obligation; and the risk that the derivative transaction could expose the fund to the effects of leverage, which could increase the fund’s exposure to the market and magnify potential losses. There is no guarantee that derivatives, to the extent employed, will have the intended effect, and their use could cause lower returns or even losses to the fund. The use of derivatives by the fund to hedge risk may reduce the opportunity for gain by offsetting the positive effect of favorable price movements. An investment in Health Care or Technology is also subject to this risk.

Foreign investment risk. To the extent the fund invests in companies based outside the US, it faces the risks inherent in foreign investing. Adverse political, economic or social developments could undermine the value of the fund’s investments or prevent the fund from realizing their full value. Financial reporting standards for companies based in foreign markets differ from those in the US. Additionally, foreign securities markets generally are smaller and less liquid than US markets. To the extent that the fund invests in non-US dollar denominated foreign securities, changes in currency exchange rates may affect the US dollar value of foreign securities or the income or gain received on these securities. Foreign governments may restrict investment by foreigners, limit withdrawal of trading profit or currency from the country, restrict currency exchange or seize foreign investments. The investments of the fund may also be subject to foreign withholding taxes. Foreign transactions and custody of assets may involve delays in payment, delivery or recovery of money or investments. An investment in Health Care or Technology is also subject to this risk, with increased risk for Technology to the extent that investments may be made in emerging markets to a greater extent than for Capital Growth or Health Care. Foreign investment risks are greater in emerging markets than in developed markets. Emerging market investments are often considered speculative. Emerging market countries typically have economic and political systems that are less developed, and can be expected to be less stable than developed markets. For example, the economies of such countries can be subject to rapid and unpredictable rates of inflation or deflation.

12

Counterparty risk. A financial institution or other counterparty with whom the fund does business (such as trading or securities lending), or that underwrites, distributes or guarantees any investments or contracts that the fund owns or is otherwise exposed to, may decline in financial health and become unable to honor its commitments. This could cause losses for the fund or could delay the return or delivery of collateral or other assets to the fund. An investment in Health Care or Technology is also subject to this risk.

Liquidity risk. In certain situations, it may be difficult or impossible to sell an investment in an orderly fashion at an acceptable price. This risk can be ongoing for any security that does not trade actively or in large volumes, for any security that trades primarily on smaller markets, and for investments that typically trade only among a limited number of large investors (such as certain types of derivatives or restricted securities). In unusual market conditions, even normally liquid securities may be affected by a degree of liquidity risk. This may affect only certain securities or an overall securities market. An investment in Health Care or Technology is also subject to this risk.

Pricing risk. If market conditions make it difficult to value some investments, the fund may value these investments using more subjective methods, such as fair value pricing. In such cases, the value determined for an investment could be different than the value realized upon such investment’s sale. As a result, you could pay more than the market value when buying fund shares or receive less than the market value when selling fund shares. An investment in Health Care or Technology is also subject to this risk.

Health Care and Technology are also subject to the following risks:

Concentration risk. Any fund that concentrates in a particular segment of the market will generally be more volatile than a fund that invests more broadly. In the case of Health Care, because the fund concentrates its investments in companies in the health care field, it may be vulnerable to setbacks in that industry. In the case of Technology, any market price movements, regulatory or technological changes, or economic conditions affecting technology companies will have a significant impact on the fund’s performance.

Small company risk. Small company stocks tend to be more volatile than large company stocks. Small companies are less widely followed by stock analysts and less information about them is available to investors. Industry-wide reversals may have a greater impact on small companies, since they lack the financial resources of larger companies. Small company stocks are typically less liquid than large company stocks.

Technology is also subject to the following risks:

Non-diversification risk. The fund is classified as non-diversified under the Investment Company Act of 1940, as amended (the “1940 Act”). This means that the fund may invest in securities of relatively few issuers. Thus, the performance of one or a small number of portfolio holdings can affect overall performance.

IPO risk. Prices of securities bought in an initial public offering (IPO) may rise and fall rapidly, often because of investor perceptions rather than economic reasons. IPOs can have more impact on the performance of a small mutual fund because the number of IPO shares the fund is able to buy may represent a significant portion of its overall portfolio compared to the portfolio of a larger fund.

Performance Information

The following information provides some indication of the risks of investing in each fund. Of course, a fund’s past performance is not an indication of future performance.

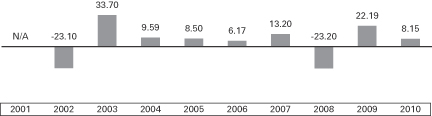

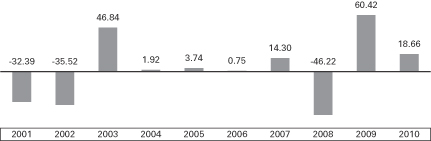

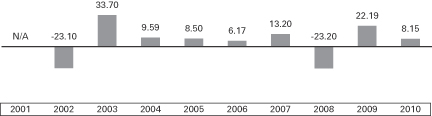

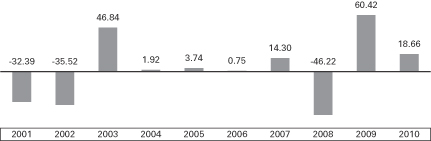

The information shown below does not reflect charges and fees associated with the separate accounts that invest in the funds or any Contract for which the funds are investment options. If it did, performance would be less than that shown. The bar charts show year-to-year changes in the performance of each fund’s Class A shares, which

13

may give some idea of risk. The table following the bar charts shows how each fund’s performance compares to that of one or more broad-based market indices (which, unlike a fund, do not have any fees or expenses). All performance figures below assume that dividends were reinvested.

Calendar Year Total Returns (%)

Capital Growth — Class A Shares

For the periods included in the bar chart:

| | |

Best Quarter: 15.13%, Q4 2001 | | Worst Quarter: -21.49%, Q4 2008 |

Health Care — Class A Shares

For the periods included in the bar chart:

| | |

Best Quarter: 15.08%, Q2 2003 | | Worst Quarter: -16.45%, Q4 2008 |

14

Technology — Class A Shares

For the periods included in the bar chart:

| | |

Best Quarter: 28.57%, Q4 2001 | | Worst Quarter: -33.64%, Q3 2001 |

Average Annual Total Returns

(for period ended December 31, 2010)

| | | | | | | | | | | | |

| | | Past 1 year | | | Past 5 years | | | Past 10 Years | |

Capital Growth | | | | | | | | | | | | |

Class A | | | 16.71 | % | | | 3.93 | % | | | 0.33 | % |

Class B | | | 16.33 | % | | | 3.59 | % | | | -0.01 | % |

Russell 1000 Growth Index (reflects no deductions for fees or expenses) | | | 16.71 | % | | | 3.75 | % | | | 0.02 | % |

Russell 1000® Growth Index is an unmanaged index that consists of those stocks in the Russell 1000® Index that have higher price-to-book ratios and higher forecasted growth values. Russell 1000® Index is an unmanaged price-only index of the 1,000 largest capitalized companies that are domiciled in the US and whose common stocks are traded.

| | | | | | | | | | | | |

| | | Past 1 year | | | Past 5 years | | | Since Inception | |

Health Care | | | | | | | | | | | | |

Class A (inception date 5/1/01) | | | 8.15 | % | | | 4.05 | % | | | 4.89 | % |

Standard & Poor’s 500 Index (S&P 500) (reflects no deductions for fees or expenses) | | | 15.06 | % | | | 2.29 | % | | | 2.00 | % |

S&P North American Health Care Sector Index (reflects no deductions for fees or expenses) | | | 6.08 | % | | | 2.53 | % | | | 3.12 | % |

Class B (inception date 6/30/02) | | | 7.68 | % | | | 3.68 | % | | | 7.88 | % |

Standard & Poor’s 500 Index (S&P 500) (reflects no deductions for fees or expenses) | | | 15.06 | % | | | 2.29 | % | | | 4.92 | % |

S&P North American Health Care Sector Index (reflects no deductions for fees or expenses) | | | 6.08 | % | | | 2.53 | % | | | 5.76 | % |

Standard & Poor’s 500 Index (S&P 500) is an unmanaged, capitalization-weighted index of 500 stocks. The index is designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

15

S&P North American Health Care Sector Index is an unmanaged, market-capitalization-weighted index of 114 stocks designed to measure the performance of companies in the health care sector. DIMA believes this additional index represents the fund’s overall investment process. Index comparisons begin on 4/30/01.

| | | | | | | | | | | | | | | | |

| | | Past 1 year | | | Past 5 years | | | Past 10 years | | | Since

Inception | |

Technology | | | | | | | | | | | | | | | | |

Class A | | | 18.66 | % | | | 3.35 | % | | | -2.25 | % | | | — | |

Russell 1000 Growth Index (reflects no deductions for fees or expenses) | | | 16.71 | % | | | 3.75 | % | | | 0.02 | % | | | — | |

S&P North American Technology Sector Index (reflects no deductions for fees or expenses) | | | 12.65 | % | | | 5.83 | % | | | -0.86 | % | | | — | |

Class B (inception date 6/30/02) | | | 17.96 | % | | | 2.93 | %% | | | — | | | | 6.34 | % |

Russell 1000 Growth Index (reflects no deductions for fees or expenses) | | | 16.71 | % | | | 3.75 | % | | | — | | | | 5.60 | % |

S&P North American Technology Sector Index (reflects no deductions for fees or expenses) | | | 12.65 | % | | | 5.83 | % | | | — | | | | 7.94 | % |

Russell 1000® Growth Index is an unmanaged index that consists of those stocks in the Russell 1000® Index that have higher price-to-book ratios and higher forecasted growth values. Russell 1000® Index is an unmanaged price-only index of the 1,000 largest capitalized companies that are domiciled in the US and whose common stocks are traded.

S&P North American Technology Sector Index is an unmanaged, capitalization-weighted index based on a universe of technology-related stocks. DIMA believes this additional index represents the fund’s overall investment process.

Current performance may be higher or lower than the performance data quoted above. For more recent performance information, contact your insurance company.

III. OTHER INFORMATION ABOUT THE FUNDS

Investment Advisor. DIMA, with headquarters at 345 Park Avenue, New York, NY 10154, serves as each fund’s investment advisor, pursuant to an investment management agreement with the fund. Under the oversight of the Board of each fund, DIMA provides continuing investment management of the assets of each fund in accordance with the fund’s investment objective(s), policies and restrictions. DIMA also provides administrative services to each fund pursuant to an administrative services agreement. DIMA is an indirect, wholly owned subsidiary of Deutsche Bank AG. Deutsche Bank AG is a major global banking institution that is engaged in a wide range of financial services, including investment management, mutual funds, retail, private and commercial banking, investment banking and insurance. DIMA provides a full range of global investment advisory services to institutional and retail clients.

DWS Investments is part of the Asset Management division of Deutsche Bank AG and, within the US, represents the retail asset management activities of Deutsche Bank AG, Deutsche Bank Trust Company Americas, DIMA and DWS Trust Company. DWS Investments is a global asset management organization that offers a wide range of investing expertise and resources, including hundreds of portfolio managers and analysts and an office network that reaches the world’s major investment centers. This well-resourced global investment platform brings together a wide variety of experience and investment insight across industries, regions, asset classes and investing styles.

DIMA may utilize the resources of its global investment platform to provide investment management services through branch offices located outside the US. In some cases, DIMA may also utilize its branch offices

16

or affiliates located in the US or outside the US to perform certain services such as trade execution, trade matching and settlement, or various administrative, back-office or other services. To the extent services are performed outside the US, such activity may be subject to both US and foreign regulation. It is possible that the jurisdiction in which DIMA or its affiliate performs such services may impose restrictions or limitations on portfolio transactions that are different from, and in addition to, those that apply in the US.

Portfolio Managers. Each fund is managed by a team of investment professionals who collaborate to develop and implement each fund’s investment strategy. Each portfolio manager on a team has authority over all aspects of the fund’s investment portfolio, including but not limited to, purchases and sales of individual securities, portfolio construction techniques, portfolio risk assessment and the management of daily cash flows in accordance with portfolio holdings. The following individuals handle the day-to-day management of each fund’s portfolio:

Capital Growth

Owen Fitzpatrick, CFA, Lead Manager of the fund, is a Managing Director of Deutsche Asset Management (“DeAM”). He joined DeAM in 2009 after over 21 years of experience in trust and investment management, most recently as Managing Director of Deutsche Bank Private Wealth Management. Prior to joining Deutsche Bank, Mr. Fitzpatrick managed an equity income fund, trust and advisory relationships for Princeton Bank & Trust Company and served as a portfolio manager at Manufacturer’s Hanover Trust Company. He began managing the fund in 2009.

Thomas M. Hynes, Jr., CFA, Portfolio Manager of the fund, is a Director of DeAM. He joined DeAM in 1995 in DB Private Wealth Management, then served as US equity portfolio manager at Citigroup Asset Management from 2004-2007 before returning to DeAM in 2007. Mr. Hynes began managing the fund in 2009.