CommunityOne Bancorp April 30, 2014 First Quarter 2014 Earnings Presentation

Presenters Brian Simpson Chief Executive Officer David Nielsen Chief Financial Officer Neil Machovec Chief Credit Officer 2

Forward Looking Statements & Other Information Forward Looking Statements This presentation contains certain forward-looking statements within the safe harbor rules of the federal securities laws. These statements generally relate to COB’s financial condition, results of operations, plans, objectives, future performance or business. They usually can be identified by the use of forward-looking terminology, such as “believes,” “expects,” or “are expected to,” “plans,” “projects,” “goals,” “estimates,” “may,” “should,” “could,” “would,” “intends to,” “outlook” or “anticipates,” or variations of these and similar words, or by discussions of strategies that involve risks and uncertainties. Forward looking statements are subject to risks and uncertainties, including but not limited to, those risks described in COB’s Annual Report on Form 10-K for the year ended December 31, 2013 under the section entitled “Item 1A, Risk Factors,” and in the Quarterly Reports of Form 10-Q and other reports that are filed by COB with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which are subject to numerous assumptions, risks and uncertainties, and which change over time. These forward-looking statements speak only as of the date of this presentation. Actual results may differ materially from those expressed in or implied by any forward looking statements contained in this presentation. We assume no duty to revise or update any forward-looking statements, except as required by applicable law. Non-GAAP Financial Measures In addition to the results of operations presented in accordance with Generally Accepted Accounting Principles (GAAP), COB management uses and this presentation contains or references, certain non-GAAP financial measures, such as core earnings, core noninterest expense, core noninterest expense to average assets, core noninterest income, and tangible shareholders’ equity. COB believes these non-GAAP financial measures provide information useful to investors in understanding our underlying operational performance and our business and performance trends as they facilitate comparisons with the performance of others in the financial services industry; however, these non-GAAP financial measures should not be considered an alternative to GAAP. The non-GAAP financial measures contained within this presentation should be read in conjunction with the audited financial statements and analysis as presented in COB’s Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in COB’s Quarterly Reports on Form 10-Q. A reconciliation of non-GAAP measures to the most directly comparable GAAP measure is included within tables in the presentation or with the appendix to this presentation. 3

Operating Highlights Third consecutive profitable quarter Net income before taxes of $1.3 million – Increase of 5% from 4Q 2013 and $4.0 million better than the same quarter in 2013 Net interest margin of 3.43% – Increase of 23 bps from 1Q 2013 and decline of 9 bps from 4Q 2013 Positive credit quarter – Annualized net charge-offs of 0.02%, OREO expenses of $(0.3) million and recovery of provision of $0.7million – NPA’s fell to 2.9% of assets $5.5 million (23%) reduction in year over year NIE Loan portfolio grew $7.5 million in 1Q at an annualized growth rate of almost 3% Deposits grew $19.2 million in 1Q at an annualized growth rate of over 4% 4 Quarterly Results Results of Operations Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Net interest income 15,173$ 15,414$ 17,382$ 16,464$ 15,479$ Recovery of Provision (Provision) for loan losses (110) 1,057 350 (1,820) 684 Noninterest income 6,533 5,247 4,487 4,147 3,943 Noninterest expense (24,339) (24,665) (17,927) (17,550) (18,806) Net income (loss) before tax (2,743) (2,947) 4,292 1,241 1,300 Income tax benefit (expense) (1,853) (236) (286) 1,049 (23) Net income (loss) (4,596) (3,183) 4,006 2,290 1,277 40$ 1,821$ 4,698$ 3,808$ 1,642$ 1 Non-GAAP measure. See Appendix for reconciliation to GAAP presentation. Core Earnings 1 Quarterly Performance Metrics Dollars in thousands except per share data 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Net income (loss) before taxes (2,743)$ (2,947)$ 4,292$ 1,241$ 1,300$ Net income (loss) (4,596) (3,183) 4,006 2,290 1,277 Net income (loss) per share (0.21) (0.15) 0.18 0.11 0.06 Return on average assets (0.88%) (0.62%) 0.79% 0.45% 0.26% Return on average equity (19.3%) (14.5%) 21.0% 11.1% 6.2% Net interest margin 3.20% 3.27% 3.76% 3.52% 3.43% C re no interest expense to average assets 1 3.66% 3.59% 3.42% 3.34% 3.59% Loans held for investment 1,113,765 1,189,413 1,195,142 1,212,2 8 1,219,785 D p sits 1,856,561 1,811,485 1,790,607 1,748,705 1,767,930 NPA's to total assets 5.6% 4.7% 4.1% 3.2% 2.9% 1 Non-GAAP measure. See page 7 for reconciliation to GAAP presentation.

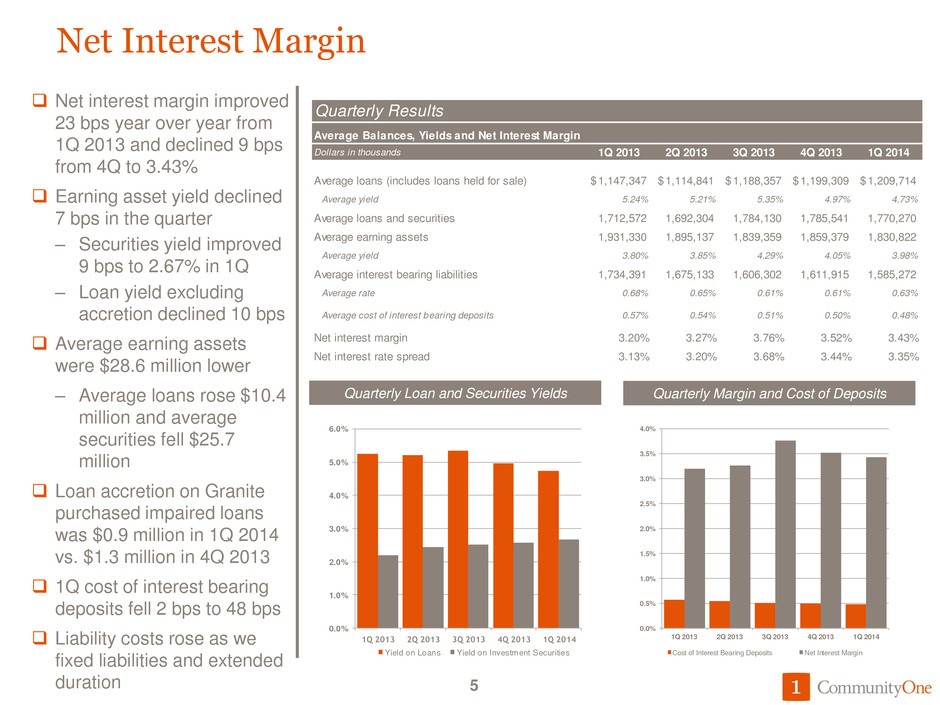

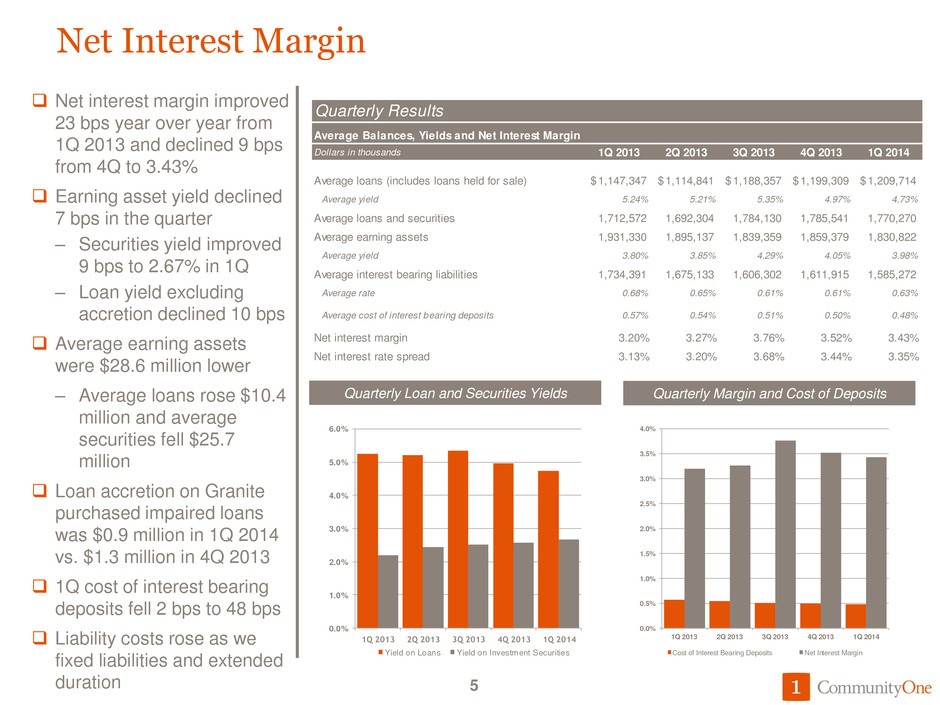

0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Yield on Loans Yield on Investment Securities 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Cost of Interest Bearing Deposits Net Interest Margin Net Interest Margin Net interest margin improved 23 bps year over year from 1Q 2013 and declined 9 bps from 4Q to 3.43% Earning asset yield declined 7 bps in the quarter – Securities yield improved 9 bps to 2.67% in 1Q – Loan yield excluding accretion declined 10 bps Average earning assets were $28.6 million lower – Average loans rose $10.4 million and average securities fell $25.7 million Loan accretion on Granite purchased impaired loans was $0.9 million in 1Q 2014 vs. $1.3 million in 4Q 2013 1Q cost of interest bearing deposits fell 2 bps to 48 bps Liability costs rose as we fixed liabilities and extended duration 5 Quarterly Loan and Securities Yields Quarterly Margin and Cost of Deposits Quarterly Results Average Balances, Yields and Net Interest Margin Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Average loans (includes loans held for sale) 1,147,347$ 1,114,841$ 1,188,357$ 1,199,309$ 1,209,714$ Average yield 5.24% 5.21% 5.35% 4.97% 4.73% Average loans and securities 1,712,572 1,692,304 1,784,130 1,785,541 1,770,270 Average earning assets 1,931,330 1,895,137 1,839,359 1,859,379 1,830,822 Average yield 3.80% 3.85% 4.29% 4.05% 3.98% Average interest bearing liabilities 1,734,391 1,675,133 1,606,302 1,611,915 1,585,272 Average rate 0.68% 0.65% 0.61% 0.61% 0.63% Average cost of interest bearing deposits 0.57% 0.54% 0.51% 0.50% 0.48% Net interest margin 3.20% 3.27% 3.76% 3.52% 3.43% Net interest rate spread 3.13% 3.20% 3.68% 3.44% 3.35%

Noninterest Income Core noninterest income excluding mortgage was up $0.4 million (10%) on comparable quarter basis Core noninterest income fell slightly ($0.2 million) to $3.9 million from 4Q 2013 Mortgage income fell $61 thousand from last quarter on lower seasonal volume and mix shift to portfolio assets vs Fannie Mae sales – Quarter end pipeline growth Service charge income was down in 1Q but seasonally consistent, and 14% higher than the same quarter of 2013 Wealth fee income up 49% year over year and 5% over 4Q 2013 6 Quarterly Results Noninterest Income Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Service charges on deposit accounts 1,376$ 1,681$ 1,858$ 1,798$ 1,564$ Mortgage loan income 744 921 420 235 174 Cardholder and merchant services income 1,069 1,174 1,161 1,127 1,113 Trust and investment services 241 394 329 341 358 Bank-owned life insurance 263 276 267 267 252 Other service charges, commissions and fees 258 337 365 356 352 Securities gains, net 2,377 345 50 - - Other income 205 119 37 23 130 Total noninterest income 6,533$ 5,247$ 4,487$ 4,147$ 3,943$ Less: Securities gains, net 2,377 345 50 - - Core noninterest income 1 4,156$ 4,902$ 4,437$ 4,147$ 3,943$ 1 Non-GAAP measure. Reconciliation included in this table.

Noninterest Expense Continued cost control, merger completion and improved credit reduced noninterest expense (NIE) by $5.5 million, or 21%, year over year 1Q NIE rose $1.3 million over the prior quarter on higher personnel costs related to incentives and payroll taxes – Core NIE rose $1.0 million Average FTE was reduced by 20, or 3%, during 1Q – Follows 12 average FTE reduction in 4Q 2013 – 6% FTE reduction from a year ago 7 Quarterly Results Noninterest Expense Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Personnel expense 10,679$ 10,807$ 9,663$ 9,512$ 10,393$ Net occupancy expense 1,831 1,671 1,558 1,331 1,553 Furniture, equipment and data processing expense 2,368 2,094 2,050 2,126 2,003 Professional fees 1,493 760 222 625 633 Stationery, printing and supplies 186 187 136 135 162 Advertising and marketing 665 179 150 141 153 Other real estate owned expense 883 3,332 (98) 21 261 Credit/debit card expense 425 473 627 618 595 FDIC insurance 670 664 646 663 639 Loan collection expense 1,519 1,146 1,120 548 657 Merger-related expense 1,509 1,989 - - - Core deposit intangible amortization 352 352 352 351 352 Other expense 1,759 1,011 1,501 1,479 1,405 Total noninterest expense 24,339$ 24,665$ 17,927$ 17,550$ 18,806$ Less: Other real estate owned expense 883$ 3,332$ (98)$ 21$ 261$ Merger-related expense 1,509 1,989 - - - Loan collection expense 1,519 1,146 1,120 548 657 Branch closure and restructuring expenses 587 15 (105) 178 183 Mortgage and litigation accruals - (370) (117) - (75) Rebranding expense 552 58 6 - - Core noninterest expense 1 19,289$ 18,495$ 17,121$ 16,803$ 17,780$ Average Quarterly FTE Employees 613 630 608 596 576 1 Non-GAAP measure. Reconciliation included in this table.

13% 4% 5% 3% 5% 25% 26% 26% 29% 27% 47% 51% 51% 60% 60% 8% 8% 8% 8% 8% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Other assets Loans Investment securities Cash and bank balances Balance Sheet Total assets grew at 5% annualized growth rate in 1Q, 1.2% for the quarter Cash increased $37.5 million in 1Q as we held cash for future loan growth Investment portfolio decreased from $566.4 million in 4Q to $551.5 million in 1Q – Portfolio positioned to fund loan growth – Portfolio weighted toward liquid GSE MBS – Yield on portfolio rose 9 bps to 2.67% in 1Q Lower interest rates in 1Q resulted in $3.3 million decrease in unrealized loss, net of tax 8 Quarterly Balance Sheet Composition Quarterly Balance Sheet Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Cash and interest bearing bank balances 262,293$ 88,470$ 103,074$ 67,430$ 104,951$ Investment securities 565,870 608,207 593,396 566,409 551,528 Loans and loans held for sale, net 1,089,136 1,168,404 1,172,489 1,187,299 1,195,707 Other real estate owned 46,537 35,762 33,179 28,395 24,624 Intangible assets 11,650 11,608 11,402 11,119 10,802 Other assets 117,825 123,862 123,633 124,380 120,869 Total assets 2,093,311$ 2,036,313$ 2,037,173$ 1,985,032$ 2,008,481$ Deposits 1,856,161$ 1,811,485$ 1,790,608$ 1,748,705$ 1,767,930$ Borrowings 122,320 124,117 147,663 142,165 140,406 25,456 24,665 18,100 13,801 14,814 Equity 89,374 76,046 80,802 80,361 85,331 Total liabilities and equity 2,093,311$ 2,036,313$ 2,037,173$ 1,985,032$ 2,008,481$ Other liabilities

$200 $168 $158 $141 $134 $96 $192 $196 $213 $208 $818 $829 $841 $859 $880 - 200 400 600 800 1,000 1,200 1,400 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 $ in M illion s Pass Rated Loans Pass Rated Purchased Residential Loan Pools Non-Pass Rated Loans Loan Portfolio Loans held for investment increased $7.5 million in 1Q 2014 – Annualized growth rate of almost 3% – All lines of business grew loans during the quarter Total pass rated loans grew by $15.0 million – Annualized growth of pass rated loans of 6% – No loan purchases in 1Q Non-pass rated loans fell by $7.4 million, or 5% Loan portfolio composition balanced between consumer and commercial exposure 1-4 family residential mortgage loans held for investment stable at 40% of loans 9 Quarterly Loan Portfolio Mix Quarterly Loan Portfolio Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Loans held for sale 5,012$ 4,076$ 2,734$ 1,836$ 1,961$ Loans held for investment: Commercial and agricultural 77,490 69,343 69,617 72,252 75,977 Real estate-construction 57,653 64,636 67,542 64,083 67,304 Real estate-mortgage: 1-4 family residential 367,389 462,552 470,946 4 9,251 484,511 1-4 family HELOC 153,419 148,192 147,317 146,856 147,263 Commercial 414,995 400,772 395,085 394,924 396,110 Consumer 42,819 43,918 44,635 44,882 48,620 Total Loans held for investment 1,113,765 1,189,413 1,195,142 1,212,248 1,219,785 Total loans 1,118,777$ 1,193,489$ 1,197,876$ 1,214,084$ 1,221,746$

14% 17% 17% 17% 18% 20% 18% 20% 20% 20% 4% 4% 4% 5% 5% 25% 24% 25% 26% 25% 21% 20% 19% 19% 18% 3% 3% 2% 2% 1% 14% 13% 13% 13% 13% 0% 20% 40% 60% 80% 100% 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Noninterest-bearing demand Interest-bearing demand Savings Money market Time deposits < $100,000 Brokered Time deposits > $100,000 Deposits Deposits grew by $19.2 million (1%) from year end – $9.3 million decrease in CD’s, $3.8 million higher cost brokered CD – 4% annualized growth rate in 1Q 2014 Core deposits stable at 85% during 1Q Low cost core grew 2% to 68% of deposits, up from 67% last quarter – 3% growth in low cost core from a year ago Cost of interest bearing deposits fell 2 bps to 48 bps and the cost of all deposits fell to 40 bps from 41 bps last quarter and 54 basis points a year ago 10 Quarterly Deposit Mix Co re N o n Co re Quarterly Deposits Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Noninterest-bearing demand 265,455$ 304,992$ 308,178$ 290,461$ 315,515$ Interest-bearing demand 364,282 334,087 350,889 347,791 346,344 Savings 79,895 80,682 80,435 80,507 85,038 Money market 455,337 442,720 442,887 447,672 448,037 Brokered 47,339 47,220 29,218 29,218 25,468 Time deposits < $100,000 386,087 360,874 343,855 323,661 310,786 Time deposits > $100,000 258,166 240,910 235,145 229,395 236,742 Total deposits 1,856,561$ 1,811,485$ 1,790,607$ 1,748,705$ 1,767,930$

Deferred Tax Asset and Valuation Allowance Consolidated net deferred tax asset of $155.8 million at 1Q 2013 – $8.2 million currently reflected on balance sheet and in equity – $147.6 million remaining DTA valuation allowance The Company evaluates each quarter the continued need for the valuation allowance on the deferred tax assets 11 Deferred Tax Asset Rollforward Dollars in Millions Net DTA DTA Valuation Allowance Unreserved Net DTA Beginning Balance , December 31, 2013 158.2$ 148.0$ 10.2$ Net income, tax strategies and other adjustments (2.4) (0.4) (2.0) Ending Balance, March 31, 2014 155.8$ 147.6$ 8.2$

Capital and Liquidity CommunityOne Bancorp & CommunityOne Bank capital ratios continued to increase in 1Q – Bank leverage ratio of 7.74% – Bancorp and Bank are “well capitalized” Loans to deposits ratio stable at 69% in 1Q Tangible shareholders’ equity impacted by – $1.3 million earnings – $3.3 million, net of tax, unrealized gains in AFS portfolio 12 Quarterly Capital and Liquidity Ratios 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Well Capitalized########## ########## CommunityOne Bancorp Leverage 5.37% 5.38% 5.83% 5.96% 6.20% 5.00% Tier 1 risk based capital 9.19% 8.76% 9.18% 9.48% 9.67% 6.00% Total risk based capital 12.58% 12.08% 12.38% 12.62% 12.80% 10.00% Tangible common equity to tangible assets 3.73% 3.18% 3.43% 3.51% 3.73% Loans to deposits 60% 66% 67% 69% 69% Cash and investment securities to deposits 45% 38% 39% 36% 37% CommunityOne Bank Leverage 6.15% 6.95% 7.39% 7.49% 7.74% 5.00% Tier 1 risk based capital 10.24% 11.31% 11.62% 11.94% 12.09% 6.00% Total risk based capital 11.51% 12.57% 12.88% 13.20% 13.38% 10.00% T ngible Shareholders' Equity Rollf rward Dollars in thousands Tangible shareholders' equity, December 31, 2013 69,242$ Other comprehensive loss - AFS securities, net of tax 3,267 Other comprehensive gain - retirement plans 25 Net income 1,277 Stock compensation to directors 14 Decrease in intangible assets, net 317 Stock compensation to employees 387 Tangible shareholders' equity, March 31, 2014 1 74,529$ 1 Non-GAAP measure. See Appendix for reconciliation to GAAP presentation.

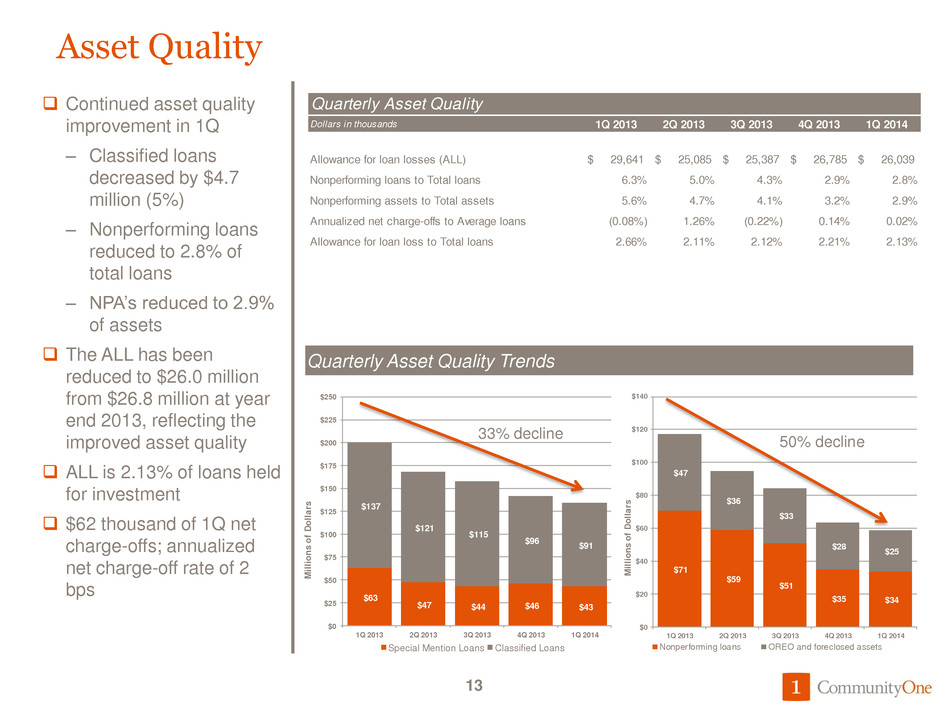

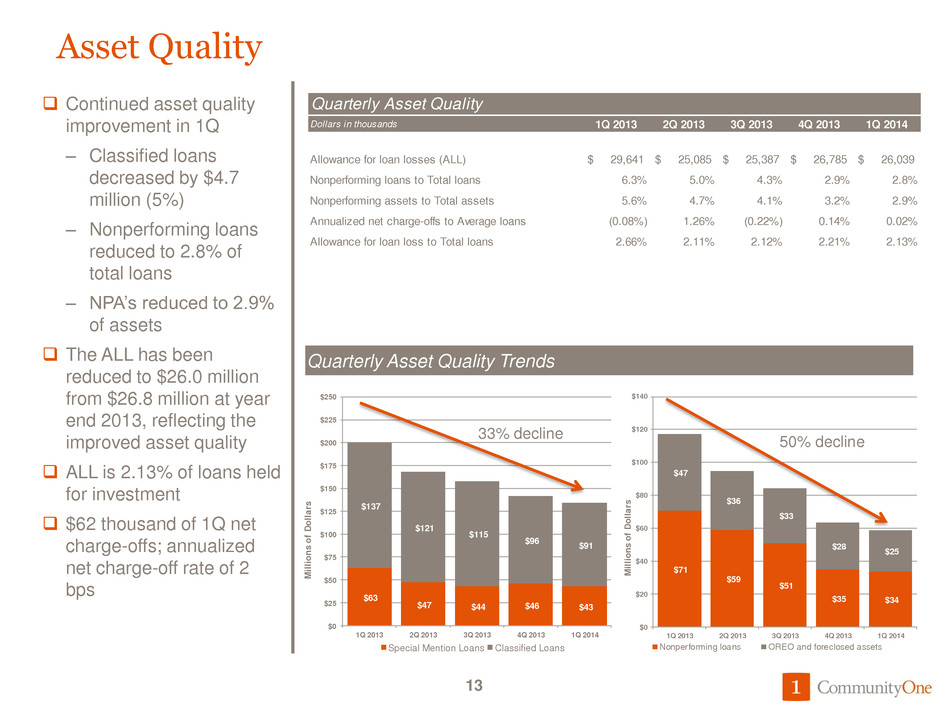

$71 $59 $51 $35 $34 $47 $36 $33 $28 $25 $0 $20 $40 $60 $80 $100 $120 $140 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 M il li o n s o f D o ll a rs Nonperforming loans OREO and foreclosed assets $63 $47 $44 $46 $43 $137 $121 $115 $96 $91 $0 $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 M il li o n s o f D o ll a rs Special Mention Loans Classified Lo s Asset Quality Continued asset quality improvement in 1Q – Classified loans decreased by $4.7 million (5%) – Nonperforming loans reduced to 2.8% of total loans – NPA’s reduced to 2.9% of assets The ALL has been reduced to $26.0 million from $26.8 million at year end 2013, reflecting the improved asset quality ALL is 2.13% of loans held for investment $62 thousand of 1Q net charge-offs; annualized net charge-off rate of 2 bps 13 Quarterly Asset Quality Trends 33% decline 50% decline Quarterly Asset Quality Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Allowance for loan losses (ALL) 29,641$ 25,085$ 25,387$ 26,785$ 26,039$ Nonperforming loans to Total loans 6.3% 5.0% 4.3% 2.9% 2.8% Nonperforming assets to Total assets 5.6% 4.7% 4.1% 3.2% 2.9% Annualized net charge-offs to Average loans (0.08%) 1.26% (0.22%) 0.14% 0.02% Allowance f r loan loss to Total loans 2.66% 2.11% 2.12% 2.21% 2.13%

$19.2 $15.9 $12.8 $11.6 $10.2 $37.2 $31.4 $27.4 $18.4 $19.9 $11.8 $9.8 $10.3 $4.7 $3.4 $0 $20 $40 $60 $80 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 $ i n Mi lli on s Consumer Real estate - construction RE - Commercial RE - 1-4 Family Commercial and agricultural Nonperforming Assets Non-performing assets fell by $5.0 million (8%) during the quarter, and $58.5 million (50%) since 1Q 2013 Nonperforming loans fell by $1.2 million (3%) in 1Q, and by $36.6 million (52%) since 1Q 2013 OREO dispositions have continue to outpace foreclosure additions – OREO reduced by $3.8 million (13%) in 1Q and $21.9 million (47%) since 1Q 2013 As of quarter end, an additional $3.6 million of OREO (15%) was under contract for sale 14 Quarterly Nonperforming Loan Composition 52% decline Nonperforming Loans and OREO Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Commercial and agricultural 2,350$ 1,654$ 590$ 516$ 450$ Real estate - construction 11,762 9,783 10,266 4,677 3,437 Real estate - mortgage: 1-4 family residential 19,166 15,917 12,822 11,580 10,151 Commercial 37,217 31,380 27,425 18,380 19,888 Consumer 63 269 104 12 32 Total nonperforming loans 70,558 59,003 51,207 35,165 33,958 OREO and other foreclosed assets 46,537 35,762 33,179 28,395 24,624 Total nonperforming assets 117,095$ 94,765$ 84,386$ 63,560$ 58,582$

Portfolio and Allowance for Loan Losses Originated loans of $1.0 billion with ALL of $20.3 million at 1Q Granite PC loans of $29.5 million with ALL of $0.5 million at 1Q No net credit costs in 1Q on loan portfolio – $0.7 million in recovery of provision offset by $(0.3) million net OREO costs Cash flow reforecast of Granite PI loans in 1Q – $149.0 million remaining carrying value – $5.2 million ALL at 1Q 2014 – Additional $1 million in accretable yield forecasted based on 1Q cash flow forecast 15 Quarterly Loan Portfolio and ALL 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Originated loans 876,301 971,086 990,460 1,023,984 1,043,263 Granite purchased impaired (PI) loans 205,884 189,160 176,594 161,651 149,033 Granite purchased contractual (PC) loans 31,580 29,167 28,088 28,449 29,450 Total loans 1,113,765$ 1,189,413$ 1,195,142$ 1,214,084$ 1,221,746$ Originated loan ALL (23,825) (20,841) (20,927) (20,603) (20,286) Granite PI loan ALL (5,373) (4,066) (4,066) (5,650) (5,237) Granite PC loan ALL (443) (178) (394) (532) (516) Pro forma total ALL (29,641)$ (25,085)$ (25,387)$ (26,785)$ (26,039)$ Originated loan ALL / Originated loans (2.72%) (2.15%) (2.11%) (2.01%) (1.94%) Granite PI ALL / Granite PI loans (2.61%) (2.15%) (2.30%) (3.50%) (3.51%) Granite PC ALL / Granite PC loans (1.40%) (0.61%) (1.40%) (1.87%) (1.75%)

16 Loans grew $7.5 million (1%) in 1Q; Annualized growth of almost 3% – Growth ahead of plan in 1Q; Loan to deposit ratio of 69% – Loan growth in all business lines – Pass rated loans grew $15 million; annualized growth of 6% – Resolution activity less of a drag on loan growth than prior years Grow loans Deposits grew over 1% in 1Q; low cost core deposits grew 2% – Ahead of 2014 3% growth target – Treasury Management product and mobile banking infrastructure investments on track Grow core deposits Credit resolution activities ahead of schedule – Reduced NPAs by 8% in 1Q, or $5 million; NPA ratio of 2.9% vs year end goal of 2.3% – Reduced classified assets by $8.4 million with 2014 goal of $40 million – Bank classified asset ratio from 70% to 67% Resolve remaining credit issues Year over year reduction in core noninterest expenses of 8% – Expenses were lower than our internal plan by $1 million in 1Q – NIE to average assets ratio of 3.59% higher than goal based on slightly lower asset levels than expected Invest in new businesses while maintaining focus on expenses Progress on 2014 Goals 16

Appendix 17

Non-GAAP Measures Reconciliation of non- GAAP measures to the most directly comparable GAAP measure 18 Reconciliation of Non-GAAP Measures Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Net income (loss) (4,596)$ (3,183)$ 4,006$ 2,290$ 1,277$ Less taxes, credit costs and nonrecurring items: TaxesIncome tax benefit (expense) (1,853) (236) (286) 1,049 (23) Other real estate owned expenseGain on sales of securiti s 2,377 345 50 - - Provision expenseOther real estate owned expense (883) (3,332) 98 (21) (261) Merger related expenseProvision for loan losses (110) 1,057 350 (1,820) 684 Mortgage and litigation accruals - 370 117 - 75 Loan collection expense (1,519) (1,146) (1,120) (548) (657) Branch closure and restructuring expenses (587) (15) 105 (178) (183) Rebranding expense (552) (58) (6) - - Merger-related expense (1,509) (1,989) - - - Core Earnings 40$ 1,821$ 4,698$ 3,808$ 1,642$ Reconciliation of Non-GAAP Measures Dollars in thousands 1Q 2013 2Q 2013 3Q 2013 4Q 2013 1Q 2014 Total shareholders' equity 89,374$ 76,046$ 80,802$ 80,361$ 85,331$ Less: Goodwill (4,205) (4,205) (4,205) (4,205) (4,205) Core deposit and other intangibles (7,445) (7,403) (7,196) (6,914) (6,597) Tangible shareholders' equity 77,724$ 64,438$ 69,401$ 69,242$ 74,529$