SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

| Filed | | by the Registrant x |

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to Section 240.14a-12 | | |

FNB Corp.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

FNB CORP.

101 Sunset Avenue

Asheboro, North Carolina 27203

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 9, 2006

Notice is hereby given that the regular Annual Meeting of Shareholders of FNB Corp. (the “Corporation”) will be held at the AVS Banquet Centre, 2045 North Fayetteville Street, Asheboro, North Carolina, on Tuesday, the 9th day of May, 2006, at one o’clock p.m., preceded by a buffet luncheon beginning at 12:15 p.m., for the following purposes:

| | 1. | | To elect two Class I Directors to serve for two-year terms expiring at the Annual Meeting in 2008. |

| | 2. | | To elect four Class II Directors to serve for three-year terms expiring at the Annual Meeting in 2009. |

| | 3. | | To consider and act upon any other business as may come before the meeting or any adjournment thereof. |

All shareholders are invited to attend the meeting. Only those shareholders of record at the close of business on March 23, 2006, shall be entitled to notice of the meeting and to vote at the meeting.

Information relating to the activities and operations of FNB Corp. during the fiscal year ended December 31, 2005, is contained in the Corporation’s Annual Report, which is enclosed.

By Order of the Board of Directors

JERRY A. LITTLE

Treasurer and Secretary

April 7, 2006

Whether or not you plan to attend the meeting in person, your Board of Directors urges you to mark, date, sign and return the enclosed proxy as promptly as possible or to vote by the Internet or telephone as described on the proxy form.

FNB CORP.

101 Sunset Avenue

Asheboro, North Carolina 27203

PROXY STATEMENT

GENERAL INFORMATION

The following information is furnished in connection with the solicitation of proxies by the Board of Directors of FNB Corp. (the “Corporation” or “FNB”) for use at the Annual Meeting of Shareholders to be held on May 9, 2006. The principal executive offices of the Corporation are located at its wholly owned subsidiary, First National Bank and Trust Company (“First National Bank”), 101 Sunset Avenue, Asheboro, North Carolina 27203 (Telephone: 336-626-8300). This proxy statement and the enclosed form of proxy, together with the Corporation’s 2005 Annual Report, were first sent to shareholders on or about April 7, 2006.

Shareholders may vote either by completing and returning the enclosed form of proxy or through the Internet or by telephone. Information and applicable deadlines for voting through the Internet or by telephone are set forth on the enclosed form of proxy. Regardless of the method of voting, a shareholder may revoke a proxy before it is voted at the meeting by completing and returning a proxy form with a later date, by voting by telephone or on the Internet at a later date and prior to the close of the telephone or Internet voting facilities, by writing to the Secretary of the Corporation and stating that the shareholder is revoking an earlier proxy, or by voting in person at the meeting. If a shareholder votes more than once, the latest vote will be counted. The shares represented by all properly executed proxies received by the Corporation in time to be taken to the meeting will be voted; and, if a choice is specified on the proxy, the shares represented thereby will be voted in accordance with such specification. If a specification is not made, the proxy will be voted for the proposals set forth in the Notice of Annual Meeting of Shareholders.

FNB will pay the costs of the Annual Meeting and the solicitation of proxies. Solicitation of proxies may be made in person or by mail or telephone by directors, officers and regular employees of the Corporation or First National Bank without additional compensation therefor. The Corporation may also request banking institutions, brokerage firms, custodians, nominees and fiduciaries to forward solicitation material to the beneficial owners of FNB Common Stock held of record by such person, and the Corporation will reimburse such forwarding expenses.

VOTING SECURITIES OUTSTANDING AND PRINCIPAL SHAREHOLDERS

Only holders of record of FNB Common Stock at the close of business on March 23, 2006 (the “Record Date”), are entitled to a notice of and to vote on matters to come before the Annual Meeting or any adjournment thereof. On the Record Date, there were 6,387,086 shares of FNB Common Stock issued and outstanding.

Each share is entitled to one vote on all matters. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of FNB Common Stock entitled to vote is necessary to constitute a quorum.

The Corporation is not aware of any holders of more than 5% of the outstanding shares of FNB Common Stock as of March 23, 2006.

1

EXECUTIVE OFFICERS

The following table sets forth the current executive officers of the Corporation and also shows their positions with First National Bank.

| | | | | | |

Name

| | Age

| | Position in Corporation

| | Position in First National Bank

|

Michael C. Miller | | 55 | | Chairman and President | | Chairman and President |

R. Larry Campbell | | 61 | | Vice President | | Executive Vice President |

Jerry A. Little | | 62 | | Treasurer and Secretary | | Senior Vice President and Secretary |

The above officers have held executive positions with the Corporation and First National Bank for at least the past five years. Officers are elected annually by the Board of Directors.

ELECTION OF DIRECTORS

The bylaws of the Corporation provide that the number of directors shall consist of not less than nine nor more than twenty-five, with the exact number of directors within such maximum and minimum limits to be fixed and determined from time to time by resolution adopted by a majority of the full Board of Directors or by resolution of the shareholders at any annual or special meeting thereof. The Board of Directors has set the total number of directors at 14, all of whom either will be elected at the 2006 Annual Meeting or were previously elected and will remain in office after that meeting.

The Board of Directors is divided into three classes: Class I, Class II and Class III. In accordance with this classification, the members of Class II of the Board of Directors are to be elected at this Annual Meeting. In addition, two individuals who were elected by the Board of Directors to serve as Class I directors since the 2005 Annual Meeting of Shareholders are to be elected at this Annual Meeting. It is intended that the persons named in the accompanying form of proxy will vote for the five nominees listed below for directors of the Corporation in Class II and the two nominees listed below in Class I, unless authority so to vote is withheld. Each nominee is at present a member of the Board of Directors. Class II directors will serve for three-year terms expiring at the 2009 Annual Meeting and the additional members of Class I will serve for two-year terms expiring at the 2008 Annual Meeting or until their successors shall be elected and shall qualify. Directors are elected by a plurality of the votes cast. Abstentions and broker nonvotes will not affect the election results if a quorum is present.

The following information is furnished with respect to the nominees for election as directors of the Corporation in Classes II and I, and for the directors in Classes I and III whose terms expire at the Annual Meetings occurring in 2008 and 2007, respectively.

2

Nominees for Class II Directors to Serve for Three-Year Terms Expiring at the Annual Meeting in 2009

| | | | | | |

Name

| | Age

| | Principal Occupation During the Past Five Years

| | Director

Since

|

Larry E. Brooks | | 65 | | Vice President and Accountant, Cobb Ezekiel Brown & Co., PA (certified public accountants) | | 2005 |

| | | |

W. L. Hancock | | 70 | | President and Treasurer, Hancock Farms, Inc. (feeder cattle) | | 1973 |

| | | |

Eugene B. McLaurin, II | | 49 | | Manager of Industrial Business Unit, Total Lubricants USA, Inc. (manufacturer of industrial lubricating oils and metalworking fluids) | | 2002 |

| | | |

R. Reynolds Neely, Jr. | | 52 | | Planning Director, City of Asheboro Planning Department | | 1980 |

| | | |

Richard K. Pugh | | 71 | | Retired; Chairman (until retirement in 1999), Pugh Oil Company, Inc. (convenience stores and petroleum products distribution) | | 1988 |

Nominees for Class I Directors to Serve for Two-Year Terms Expiring at the Annual Meeting in 2008

| | | | | | |

Name

| | Age

| | Principal Occupation During the Past Five Years

| | Director

Since

|

Jacob F. Alexander III | | 56 | | President, The Alexander Companies, Inc. (commercial real estate development) and A & H Investments (real estate investments) | | 2005 |

| | | |

Lynn S. Lloyd | | 55 | | Owner and President (effective 2003), Digital Imaging and Professional Services, LLC (digital photography and presentation services); Division Quality Control Manager (until retirement in 2002), Burlington Industries, Inc. (manufacturer of textile products) | | 2005 |

Class I Directors with Continuing Terms Expiring at the Annual Meeting in 2008

| | | | | | |

Name

| | Age

| | Principal Occupation During the Past Five Years

| | Director

Since

|

Darrell L. Frye | | 60 | | Vice President of Finance, Harriss & Covington Hosiery (manufacturer of men’s and ladies’ athletic socks) | | 1999 |

| | | |

Dale E. Keiger | | 75 | | Owner and Operator, Dale’s Sporting Goods institutional sales of sporting (retail and goods) | | 2002 |

| | | |

J. M. Ramsay III | | 58 | | President, Elastic Therapy, Inc. (manufacturer of medical and specialty hosiery) | | 1989 |

3

Class III Directors with Continuing Terms Expiring at the Annual Meeting in 2007

| | | | | | |

Name

| | Age

| | Principal Occupation During the Past Five Years

| | Director

Since

|

James M. Campbell, Jr. | | 67 | | Private Investor; President and Treasurer (until retirement in 2005), Sew Special, Inc. (manufacturer of private label apparel) | | 1984 |

| | | |

R. Larry Campbell | | 61 | | Vice President of FNB (effective 2002) and Executive Vice President (effective 2003) and Senior Vice President (effective 2000) of First National Bank | | 2000 |

| | | |

Thomas A. Jordan | | 66 | | President, Michael Thomas Furniture, Inc. (manufacturer of upholstered furniture) | | 1984 |

| | | |

Michael C. Miller | | 55 | | Chairman and President of FNB and First National Bank | | 1992 |

In the event that any nominee should not be available to serve for any reason (which is not anticipated), it is intended that the persons acting under the proxy will vote for the election, in his stead, of such other persons as the Board of Directors of the Corporation may recommend.

Director Independence

Rules of the Nasdaq Stock Market require that a majority of the Board of Directors be independent directors, as defined in Nasdaq Marketplace Rule 4200. FNB has reviewed the independence of each of its directors. In conducting this review, the Corporation has considered transactions and relationships between each director, or any member of his family, and FNB and its subsidiaries. As a result of this review, the Board of Directors has determined that all of the directors, including those nominated for election at the annual meeting, are “independent” under the Nasdaq listing standards, with the exceptions of Michael C. Miller, Chairman and President of FNB and First National Bank, and R. Larry Campbell, Vice President of FNB and Executive Vice President of First National Bank.

The Board, Committees of the Board and Meetings

The Board of Directors holds regular quarterly meetings to conduct the normal business of the Corporation and meets on other occasions when required for special circumstances. In addition, certain board members serve on standing committees. Among these committees are the Audit, Compensation, and Nominating and Corporate Governance Committees, whose members and principal functions are described below. During the fiscal year ended December 31, 2005, the Board of Directors held a total of seven meetings. Each incumbent Director attended 75% or more of the total number of meetings of the Board and of the committees of the Board on which he served.

Audit Committee. The Audit Committee reviews the Corporation’s external and internal auditing systems, and monitors compliance with prescribed accounting and regulatory procedures. It operates under a formal charter, which governs its conduct and responsibilities. Among its duties, the Audit Committee is responsible for the engagement, retention and replacement of the independent auditors, approval of transactions between the Corporation and a director or executive officer unrelated to service as a director or officer, approval of nonaudit services provided by the Corporation’s independent auditor, review of the Corporation’s internal controls and the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters. Additionally, the committee reviews the audited consolidated financial statements to be included in the Corporation’s Annual Report on Form 10-K. Dixon Hughes PLLC, the Corporation’s independent public

4

accountants, reports directly to the Audit Committee. Members of the committee are Directors Neely, Brooks, J. Campbell, Frye, Keiger and Pugh. Each of the members of the committee is independent as defined by Nasdaq listing standards and the Board of Directors has determined that Mr. Frye is an audit committee financial expert. The Audit Committee met five times during the 2005 fiscal year.

Compensation Committee. The Compensation Committee deals in broad terms with personnel matters and reviews the compensation of the senior officers of the Corporation and its subsidiaries. Members of this committee are Directors Jordan, McLaurin, Neely and Ramsay, each of whom is independent as defined by Nasdaq listing standards. The Compensation Committee met six times during the 2005 fiscal year.

Nominating and Corporate Governance Committee. The primary purpose of the Nominating and Corporate Governance Committee is to assist the Board of Directors in fulfilling its responsibilities by reviewing and making recommendations to the Board regarding the Board’s composition and structure, establishing criteria for Board membership, evaluating the corporate policies relating to the recruitment of Board members and assisting the Board in establishing and maintaining effective corporate governance policies and practices. The committee identifies, investigates and recommends to the full Board of Directors the nominees for election as directors at the annual shareholder meetings and is responsible for filling any vacancies that may occur in the interval between annual meetings. It operates under a formal charter, which governs its conduct and responsibilities. The charter is available through the FNB Corp. Investor Relations link on the Corporation’s website at www.MyYesBank.com. The committee considers various factors when evaluating potential nominees, including their independence, ability to read and understand basic financial statements, expertise and business experience, character, judgment and vision. Members of the committee are Directors McLaurin, J. Campbell, Hancock, Keiger, Lloyd and Pugh, each of whom is independent as defined by Nasdaq listing standards. The Nominating and Corporate Governance Committee met three times during the 2005 fiscal year.

The committee will consider qualified candidates recommended by shareholders. Shareholders can submit the names of qualified candidates, together with a written description of the candidate’s qualifications and appropriate biographical information, to the Nominating and Corporate Governance Committee at FNB Corp., 101 Sunset Avenue, Asheboro, North Carolina 27203. Submissions will be forwarded to the Chair of the Nominating and Corporate Governance Committee for review and consideration. Any shareholder desiring to recommend a director candidate for consideration at our 2007 Annual Meeting must ensure that the submission is received by the Corporation no later than December 6, 2006, to provide adequate time for the committee to consider the candidate. The committee does not have any formal policies regarding the consideration of candidates recommended by shareholders other than any such candidate will be considered at the same time and under the same criteria used to evaluate all other candidates.

Executive Sessions. The members of the Board of Directors who are independent within the meaning of the Nasdaq listing standards meet regularly in executive session without management present. Although executive sessions are generally held in conjunction with a regularly scheduled Board meeting, other sessions may be called by two or more independent directors in their own discretion or at the request of the Board of Directors.

Contacting the Board of Directors

Any shareholder who desires to contact the Board of Directors may do so by writing to Michael C. Miller, Chairman and President, FNB Corp., 101 Sunset Avenue, Asheboro, North Carolina 27203. Communications received in writing are distributed to the full Board of Directors or a committee of the Board, as appropriate, depending on the facts and circumstances outlined in the communication received. For example, a complaint regarding compensation matters will be forwarded to the Chair of the Compensation Committee and complaints relating to accounting, internal controls or auditing matters will be forwarded to the Chair of the Audit Committee.

5

Codes of Ethics

FNB has adopted a Code of Ethics for Senior Financial Officers, which is applicable to the Corporation’s chief executive officer, principal financial and accounting officer, controller and such other officers as the Audit Committee of the Board of Directors may designate from time to time. The purposes of this code of ethics are to promote honest and ethical conduct, full and accurate disclosure in a timely and understandable manner in periodic reports filed by the Corporation, and compliance with applicable laws, and to deter wrongdoing. A copy of the Code of Ethics for Senior Financial Officers is filed as an exhibit to the Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 2005.

The Corporation has also adopted a Code of Business Ethics applicable to all of the officers, directors, and employees of FNB and its subsidiaries. This code establishes guidelines for professional and ethical conduct in the workplace. A copy of the Code of Business Ethics is available online through the FNB Corp. Investor Relations link on the Corporation’s website at www.MyYesBank.com.

EXECUTIVE COMPENSATION

Except as otherwise noted, the following table shows for the fiscal years ended December 31, 2005, 2004 and 2003, the cash and certain other compensation paid to or received or deferred by persons who were at December 31, 2005, the chief executive officer of the Corporation and the other executive officers of the Corporation whose total salary and bonus in 2005 exceeded $100,000.

Summary Compensation Table

| | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long Term

Compensation

| | | |

Name and Principal Position on December 31, 2005

| | Year

| | Salary

| | Bonus

| | Securities

Underlying

Stock Options

(#)

| | All Other

Compensation

| |

Michael C. Miller, | | 2005 | | $ | 289,583 | | $ | 100,745 | | — | | $ | 7,000 | (1) |

Chairman and President of the Corporation | | 2004 | | | 275,000 | | | 69,713 | | 7,500 | | | 6,500 | |

and First National Bank | | 2003 | | | 275,000 | | | 86,095 | | 7,500 | | | 6,000 | |

| | | | | |

R. Larry Campbell, | | 2005 | | $ | 130,520 | | $ | 43,619 | | — | | $ | 4,970 | (1) |

Vice President of the Corporation, Executive Vice | | 2004 | | | 121,000 | | | 35,689 | | 5,000 | | | 4,731 | |

President of First National Bank | | 2003 | | | 115,000 | | | 40,921 | | 5,000 | | | 4,649 | |

| | | | | |

Jerry A. Little, | | 2005 | | $ | 112,624 | | $ | 37,563 | | — | | $ | 4,321 | (1) |

Treasurer and Secretary of the Corporation, | | 2004 | | | 105,248 | | | 34,562 | | 5,000 | | | 4,217 | |

Senior Vice President and Secretary of | | 2003 | | | 101,200 | | | 40,838 | | 5,000 | | | 4,198 | |

First National Bank | | | | | | | | | | | | | | |

| (1) | | Amount shown consists of a contribution by the Corporation to a 401(k) plan. |

Stock Options

There were no stock options granted to the executive officers named in the above Summary Compensation Table in the 2005 fiscal year. Information concerning stock options granted to directors is set forth under the heading “Director Compensation.”

The following table shows information regarding stock options exercised by the executive officers named in the Summary Compensation Table in 2005 and the number of shares covered by exercisable and unexercisable options held by the named executive officers as of December 31, 2005.

6

Aggregated Option Exercises in 2005 and Option Values at December 31, 2005

| | | | | | | | | | | | | | | |

| | | Number of

Shares

Acquired on

Exercise (#)

| | Value

Realized

| | Number of Securities

Underlying

Unexercised Options at

December 31, 2005 (#)

| | Value of Unexercised

In-the-Money Options at

December 31, 2005 (1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

Michael C. Miller | | 10,000 | | $ | 120,000 | | 56,500 | | 13,500 | | $ | 305,600 | | $ | 8,550 |

R. Larry Campbell | | — | | | — | | 32,500 | | 10,000 | | | 236,535 | | | 8,550 |

Jerry A. Little | | 3,000 | | | 36,000 | | 20,500 | | 10,000 | | | 99,935 | | | 8,550 |

| (1) | | The closing price of the Corporation’s Common Stock on December 31, 2005, the last trading day of 2005, was $19.00. |

The following table presents information on securities authorized for issuance under equity compensation plans at December 31, 2005.

Equity Compensation Plan Information at December 31, 2005

| | | | | | | |

Plan Category

| | Number of

Securities to Be

Issued upon

Exercise of

Outstanding

Options (#)

| | Weighted-Average

Exercise Price of

Outstanding

Options

| | Number of

Securities

Remaining

Available for

Future Issuance

under Equity

Compensation

Plans (#) (1)

|

Equity Compensation Plans | | | | | | | |

Approved by Shareholders | | 768,693 | | $ | 16.54 | | 103,900 |

Equity Compensation Plans Not | | | | | | | |

Approved by Shareholders (2) | | — | | | — | | — |

| | |

| |

|

| |

|

Total | | 768,963 | | | 16.54 | | 103,900 |

| | |

| |

|

| |

|

| (1) | | The number of securities remaining available for issuance at December 31, 2005 excludes the number of securities to be issued upon exercise of outstanding options. |

| (2) | | There were no equity compensation plans at December 31, 2005 that had not been approved by shareholders. |

7

Pension Plan Table

The following table shows the estimated annual retirement benefits payable at the normal retirement age of 65 to participants in the Corporation’s qualified and nonqualified defined benefit plans with salaries in the classifications indicated.

Pension Plan Table

| | | | | | | | | | | | |

Assumed Average Compensation for Final Ten Years

| | Approximate Annual Benefit Upon Retirement

For Years of Service Indicated

|

| | 15 Years

| | 20 Years

| | 25 Years

| �� | 30 Years

| | 35 Years

| | 40 Years

|

$100,000 | | 43,200 | | 48,200 | | 48,200 | | 48,200 | | 48,200 | | 51,100 |

125,000 | | 57,000 | | 63,200 | | 63,200 | | 63,200 | | 63,200 | | 66,800 |

150,000 | | 70,700 | | 78,200 | | 78,200 | | 78,200 | | 78,200 | | 82,500 |

175,000 | | 84,500 | | 93,200 | | 93,200 | | 93,200 | | 93,200 | | 98,200 |

200,000 | | 98,200 | | 108,200 | | 108,200 | | 108,200 | | 108,200 | | 113,800 |

225,000 | | 112,000 | | 123,200 | | 123,200 | | 123,200 | | 123,200 | | 126,400 |

250,000 | | 125,700 | | 138,200 | | 138,200 | | 138,200 | | 138,200 | | 138,200 |

300,000 | | 153,200 | | 168,200 | | 168,200 | | 168,200 | | 168,200 | | 168,200 |

350,000 | | 180,700 | | 198,200 | | 198,200 | | 198,200 | | 198,200 | | 198,200 |

400,000 | | 208,200 | | 228,200 | | 228,200 | | 228,200 | | 228,200 | | 228,200 |

450,000 | | 235,700 | | 258,200 | | 258,200 | | 258,200 | | 258,200 | | 258,200 |

500,000 | | 263,200 | | 288,200 | | 288,200 | | 288,200 | | 288,200 | | 288,200 |

The Corporation’s defined benefit plans include a noncontributory, qualified Pension Plan and a noncontributory, nonqualified supplemental executive retirement plan (“SERP”). The Pension Plan covers substantially all full-time employees who qualify as to age and length of service. Benefits under the Pension Plan are based on the employee’s compensation, which is comprised of total annual salary and bonus, total years of service, age at retirement and the employee’s covered compensation under the Social Security laws. As of January 1, 2006, the individuals named in the Summary Compensation Table had the following credited years of service under the Pension Plan: Mr. Miller, 20 years; Mr. Campbell, 6 years and Mr. Little, 21 years.

The SERP applies to certain executive employees, including the individuals named in the Summary Compensation Table other than Mr. Campbell. Annual benefits payable under the SERP are based on factors similar to those for the Pension Plan and are limited to 60% of Average Compensation, offset by amounts payable under the Pension Plan and by 50% of Social Security benefits. Average Compensation for purposes of both the Pension Plan and the SERP means the average annual compensation during the final ten years of employment.

The benefit amounts listed in the above Pension Plan Table reflect a straight life annuity. Due to limitations on benefits payable under the SERP, the annual benefits in the table for 40 years of service result from application of the Pension Plan for compensation amounts of $210,000 or less. Annual compensation amounts over $220,000 exceed the current maximum limit allowable for provision of retirement benefits under qualified plans under the Internal Revenue Code.

In connection with the acquisition by the Corporation of Carolina Fincorp, Inc. in 2000, First National Bank assumed the obligations of Richmond Savings Bank, Inc., SSB under its Nonqualified Supplemental Retirement Plan with Mr. R. Larry Campbell. Under that plan, Mr. Campbell is entitled to a retirement benefit of $30,000 per year payable for 10 years commencing at age 65. The plan also provides for a $300,000 death benefit payable to Mr. Campbell’s beneficiaries if his employment is terminated by his death prior to age 65.

8

Director Compensation

Directors who are not also employees of the Corporation or a subsidiary are paid $750 for each Board meeting they attend and receive additional fees for committee meetings attended of $500 each for Audit Committee meetings and $400 each for other committee meetings. Each committee chair receives a $1,000 annual retainer. The directors also receive a monthly retainer and fees for meetings attended of the board of any subsidiary of the Corporation on which they serve, in accordance with the policies and practices of such subsidiary. Directors may elect to defer receipt of their fees until their retirement from the Board. Any deferred fees become a general obligation of the Corporation to be credited with interest at First National Bank’s deposit rate applied to individual retirement accounts with a two-year term and priced on a monthly variable-rate basis, subject to a minimum rate of 5.5% per annum.

There were no stock options granted to the directors in the 2005 fiscal year.

Employment Agreements

First National Bank has entered into employment agreements with Michael C. Miller and R. Larry Campbell to assure their continuing services to First National Bank.

Effective as of January 1, 2006, the Corporation entered into a new employment agreement with Michael C. Miller pursuant to which Mr. Miller will continue to be employed as chief executive officer and president of the Corporation and its principal subsidiary, First National Bank. The employment agreement supersedes in its entirety the prior employment agreement between First National Bank and Mr. Miller dated December 27, 1995.

The employment agreement has an annually renewing three-year term, unless the Corporation notifies Mr. Miller of its intent not to extend the term. In any event, the employment agreement will not extend beyond December 31 of the year in which Mr. Miller attains age 65. The employment agreement provides for an annual base salary, subject to annual review, in an amount not less than Mr. Miller’s base salary as of January 1, 2006, which was $300,000, participation in all of the Corporation’s compensation and other benefit plans and programs, and various perquisites, including club memberships, vacation, and use of an automobile, all as are set forth in the employment agreement.

The employment agreement provides that it may be terminated by the Corporation with cause or as a result of Mr. Miller’s death or disability. If terminated for cause, Mr. Miller would be entitled to receive only his base salary through the date of termination and the amount of any compensation previously deferred. If the agreement is terminated due to Mr. Miller’s death, the Corporation will pay to his designated beneficiary or legal representative his then base salary through the last day of the calendar month in which the death occurs and a prorated bonus for the year of death based on his performance during the immediately preceding year. In the event of Mr. Miller’s disability, he would continue to receive his then annual base salary for the otherwise remaining term of the agreement, less any disability payments to him from any disability plan of the Corporation or First National Bank. Mr. Miller may terminate the agreement without good reason upon 60 days’ notice to the Corporation. If he does so, the Corporation may cause the termination to be effective at any time during the notice period and Mr. Miller will be entitled to receive only his base salary and the other benefits of the agreement through the date of termination.

The employment agreement provides that if Mr. Miller’s employment is terminated by the Corporation other than for cause or by Mr. Miller with good reason, then the Corporation will (a) continue Mr. Miller’s then annual salary through the end of the otherwise remaining term of the agreement, (b) pay to Mr. Miller for the year of termination and for each subsequent calendar year or partial year through the end of the then current term of the agreement an amount (prorated in the case of any partial year) equal to the average of the bonuses paid to him for the three calendar years immediately preceding the year of termination, and (c) pay to Mr. Miller the amount of any compensation previously deferred by him. All stock options and restricted stock awards granted to

9

Mr. Miller and outstanding at the date of termination (other than those under which vesting is performance-based or is dependent upon the satisfaction of conditions other than continued employment) will immediately and fully vest and Mr. Miller will have up to three years to exercise such outstanding options following the date of termination but not beyond their specified term. In addition, the Corporation will continue to provide Mr. Miller with group health, disability and life insurance benefits, or their economic equivalent, until the first to occur of: (i) Mr. Miller’s return to employment with the Corporation, First National Bank or another employer, (ii) December 31 of the year in which Mr. Miller reaches age 65, (iii) Mr. Miller’s death, (iv) the end of the term otherwise remaining under the agreement, or (v) December 31 of the second calendar year following the year in which Mr. Miller’s employment is terminated.

If a change in control (as defined in the employment agreement occurs) and Mr. Miller’s employment is terminated by the Corporation other than for cause or by Mr. Miller with good reason within 24 months after the change in control, then Mr. Miller will be entitled, in lieu of the above severance payments, to a lump sum payment, payable on the date six months after termination of employment, equal to 2.99 multiplied by Mr. Miller’s average annual cash compensation for the five fiscal years immediately preceding the change in control. In addition, the Corporation will continue to provide Mr. Miller with group health, disability and life insurance benefits, or their economic equivalent, until the first to occur of: (i) Mr. Miller’s return to employment with the Corporation, First National Bank or another employer, (ii) December 31 of the year in which Mr. Miller reaches age 65, (iii) Mr. Miller’s death, (iv) the end of the term otherwise remaining under the agreement, or (v) December 31 of the second calendar year following the year in which Mr. Miller’s employment is terminated. The Corporation will also cause Mr. Miller to become fully vested in all plans in which he participated that do not address the effect of a change in control. In the event that payments related to a change in control are subject to the excise tax under Section 4999 of the Internal Revenue Code, the Corporation will provide Mr. Miller with an additional amount sufficient to enable Mr. Miller to retain the full amount of his change in control benefits as if the excise tax had not applied.

The employment agreement contains confidentiality provisions as well as provisions prohibiting Mr. Miller from competing with the Corporation or First National Bank during and for a period of time following his employment with the Corporation and First National Bank.

First National Bank entered into an employment agreement with Mr. Campbell in connection with the acquisition in 2000 of Carolina Fincorp, Inc. The agreement has an annually renewing three-year term, unless either First National Bank or Mr. Campbell notifies the other of its intent not to renew, but the term is not to continue automatically for more than nine years. The employment agreement provides that Mr. Campbell will receive an annual base salary initially set at $100,000 with increases as determined in accordance with First National Bank’s policies and practices for employee compensation. The employment agreement also provides that it may be terminated by First National Bank with cause or as a result of Mr. Campbell’s death or disability. Mr. Campbell may terminate the agreement upon 60 days’ notice to First National Bank. In the event First National Bank terminates Mr. Campbell’s employment other than by reason of death, disability or “cause,” Mr. Campbell would continue to receive his then annual base salary for the otherwise then remaining term of the employment agreement. First National Bank would also continue to provide Mr. Campbell with the benefits to which he is entitled under the agreement, or their economic equivalent, for the remaining term. If Mr. Campbell’s employment is terminated by reason of continued disability, he would continue to receive his then annual base salary for the otherwise then remaining term of the agreement, less any disability payments to him from any disability plan of First National Bank or FNB. The agreement contains confidentiality provisions as well as provisions prohibiting Mr. Campbell from competing with First National Bank during and for a period of time following his employment with First National Bank.

Change of Control Agreements

On November 25, 2003, Jerry A. Little, a named executive officer, and certain other senior officers of First National Bank entered into change of control agreements with FNB and First National Bank. The purpose of the

10

agreements is to secure the continued service of the officers in the event of a change of control and to provide the officers with security in such event so as to ensure their continued loyalty to maximize shareholder value as well as the continued safe and sound operation of the Corporation. Each agreement provides that in the event of a termination of the officer’s employment in connection with, or within 24 months after, a change of control of FNB or First National Bank, for reasons other than cause, the officer will receive a severance benefit, the amount of which varies with the officer’s years of service with FNB and First National Bank and is payable in one lump sum. In addition, the officer may terminate his or her employment upon a change of control of the Corporation or First National Bank and receive the benefits described above if, within 24 months following a change of control, the officer is assigned duties inconsistent with his or her duties at the time of the change of control, the officer’s annual base salary is reduced below the amount in effect prior to the change of control, the officer’s benefits are reduced below their level prior to the change of control (unless benefits are reduced for all employees), or the officer is transferred to a location more than 50 miles from his or her current principal work location. Each agreement has an initial term of three years, which will be automatically extended for an additional one-year period on each anniversary date of the agreement so that the term will again be three years unless either the Corporation, including First National Bank, or the officer elects by written notice to the other not to continue the annual renewal.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee is responsible for setting the compensation for the members of senior management of the Corporation and its subsidiaries. The Committee determines the compensation level of the President, which is reviewed and ratified by the full Board of Directors. The Committee also determines the compensation levels of the other executive officers of FNB and the senior management employees of FNB’s subsidiaries, and in doing so considers the recommendations of the President. Each of the members of the Compensation Committee is independent under the Nasdaq listing standards. The members are: Thomas A. Jordan, Chair, Eugene B. McLaurin, II, R. Reynolds Neely, Jr., and J.M. Ramsay III.

Compensation Philosophy

The Corporation’s compensation policies are designed to attract and retain competent management. The goal of the Compensation Committee and the Board of Directors is to provide competitive base salaries to the management employees of FNB and its subsidiaries and to give these employees, as well as all other employees of the Corporation and its subsidiaries, performance incentives to motivate superior performance on behalf of FNB and its shareholders. The Corporation has generally used two types of incentive compensation: annual cash bonuses based on the overall performance of the subsidiaries and long-term compensation in the form of stock options. The Committee believes that linking long-term compensation to the value of the Corporation’s Common Stock is especially effective because it aligns the interests of management with those of the Corporation’s shareholders.

Executive Officer Compensation

Annual Compensation. The Committee’s determinations of base salary for the President and other executive officers and management employees are based on information available through industry sources regarding the compensation of executives of other financial institutions similar in size and other respects to FNB. The Committee endeavors to provide executives and management employees with an opportunity to earn compensation that is fair, reasonable and competitive with that paid by these similar financial institutions. In determining executive compensation, the Committee reviews a number of factors, including, as appropriate in individual cases, the executives’ general managerial oversight of the Corporation, the quality of their communications with the Board of Directors, the Corporation’s achievement of established performance goals, and the Corporation’s record of compliance with regulatory requirements. The Committee considers annual cash bonuses as an integral part of the Corporation’s financial incentive package to achieve FNB’s goals. Bonuses are

11

paid to all employees of First National Bank based on its operating results for the year in a number of specific areas as measured against established goals, with each employee receiving the same percentage of his or her base salary as every other employee. The Committee generally adopts the goals for the year at the beginning of the year. Goals are generally established for the growth in loans and deposits, profit margins, noninterest income, loan quality and productivity. Senior management employees, including the President, generally receive an additional bonus based on similar criteria in the discretion of the Board, based on the Committee’s recommendations.

Long-Term Compensation. FNB’s long-term incentive compensation awards are designed to encourage the retention of key executives and to align their interests with the interests of the shareholders. Long-term compensation for the President and other management employees consists principally of stock options. The Corporation’s Stock Compensation Plan (the “1993 Plan”), which provided for the grant of incentive and nonqualified stock options, stock bonuses and restricted stock, expired on March 23, 2003. FNB maintains the 2003 Stock Incentive Plan (the “2003 Plan”), which was approved by the Corporation’s shareholders at the 2003 Annual Meeting. The 2003 Plan provides for grants of incentive and nonqualified stock options, performance shares and performance units, stock appreciation rights, restricted stock, deferred shares, and other stock-based awards. The Committee administers the 2003 Plan and uses the analysis and recommendations of the President as guidelines in making awards to participants other than the President. Under the 1993 Plan and the 2003 Plan, stock options have been granted to the President and to other management employees on an annual basis, except in 2001, since 1994. In 2005, the only stock options granted under the 2003 Plan were awarded to four employees, none of whom were executive officers, in connection with integrating the operations of Alamance Bank, acquired by the Corporation in November 2005, into First National Bank. No stock-based awards other than stock options have been granted under either the 1993 Plan or the 2003 Plan.

CEO Compensation. Compensation for the President is established in accordance with the principles described above and following review by the Committee of his performance. Mr. Miller’s base salary and total bonuses in 2005 are shown in the Summary Compensation Table above. Mr. Miller’s base salary was reviewed and increased to $300,000 effective June 1, 2005. This was Mr. Miller’s first salary increase since January 2003 and was set following the Committee’s consideration of the Corporation’s achievement of various performance goals and review of the compensation paid to chief executive officers of comparable financial institutions of similar asset size. In arriving at Mr. Miller’s bonuses for 2005, the Committee considered FNB’s overall financial performance, noting that the Corporation had achieved a return on assets of 1.06% and a return on equity of 11.25% in 2005. In that same period, First National Bank achieved a return on assets of 1.16% and a return on equity of 11.39%. The Committee and the Board of Directors considered this base salary and these bonuses appropriate in view of their overall assessment of the performance of the President and the Corporation.

Deductibility of Compensation. As part of the Omnibus Budget Reconciliation Act passed by Congress in 1993, the Internal Revenue Code was amended to add Section 162(m), which limits the deductibility for federal income tax purposes of compensation paid to the Chief Executive Officer and the next four most highly compensated executive officers of the Corporation. Under Section 162(m), compensation paid to each of these officers in excess of $1 million per year is not deductible unless it is “performance based.” The Corporation believes that stock options granted under the 1993 Plan and the 2003 Plan are performance based. The Committee did not consider the deductibility limits in making its compensation decisions for any of the officers named in the Summary Compensation Table above for the 2005 fiscal year, as the deductibility limits would not be exceeded under any circumstances. However, the Committee’s policy is to design and administer compensation programs that meet the objectives set forth above and to reward executives for corporate performance that meets established financial goals and, to the extent reasonably practicable and consistent with its other compensation objectives, to maximize the amount of compensation expense that is tax deductible by

12

FNB. The adoptions of the 1993 Stock Compensation Plan and the 2003 Stock Incentive Plan were in keeping with this policy.

Submitted by the Compensation Committee of the Board of Directors:

Thomas A. Jordan, Chair

Eugene B. McLaurin, II

R. Reynolds Neely, Jr.

J. M. Ramsay III

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

None of the members of the Compensation Committee has ever been an officer or employee of the Corporation or any of its subsidiaries or performs services for the Corporation or its subsidiaries other than as a director.

13

PERFORMANCE GRAPH

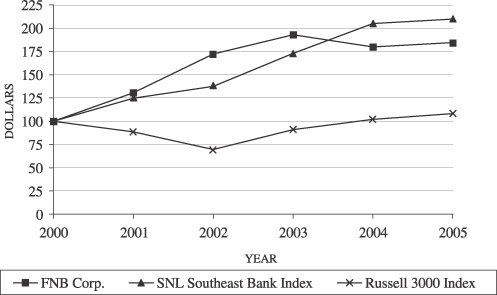

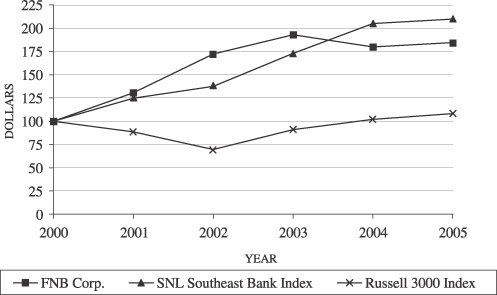

The following graph and table compare the cumulative total shareholder return of FNB Common Stock for the five-year period ended December 31, 2005 with the SNL Southeast Bank Index and the Russell 3000 Stock Index, assuming an investment of $100 at the beginning of the period and the reinvestment of dividends.

| | | | | | | | | | | | | | | | | | |

| | | As of December 31,

|

| | | 2000

| | 2001

| | 2002

| | 2003

| | 2004

| | 2005

|

FNB Corp. | | $ | 100.00 | | $ | 130.56 | | $ | 172.42 | | $ | 192.93 | | $ | 179.84 | | $ | 184.29 |

SNL Southeast Bank Index | | | 100.00 | | | 124.58 | | | 137.62 | | | 172.81 | | | 204.94 | | | 209.78 |

Russell 3000 Index | | | 100.00 | | | 88.54 | | | 69.47 | | | 91.04 | | | 101.92 | | | 108.16 |

BUSINESS RELATIONSHIPS AND RELATED TRANSACTIONS

Certain of the directors and officers of the Corporation and its subsidiaries and companies with which they are affiliated were customers of and borrowers from First National Bank in the ordinary course of business in 2005. Similar banking transactions are expected to take place in the future. In the opinion of management, all outstanding loans and commitments included in such transactions were made substantially on the same terms, including rate and collateral, as those prevailing at the time in comparable transactions with other customers and did not involve more than normal risk of collectibility or contain other unfavorable features.

14

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth as of March 23, 2006, certain information with respect to the beneficial ownership of FNB Common Stock by directors, by the executive officers named in the Summary Compensation Table and by directors and executive officers as a group.

| | | | | |

Name

| | Amount and Nature of

Beneficial Ownership

March 23, 2006 (1) (2)

| | | Percent

of Class

|

Jacob F. Alexander III, Director | | 400 | | | * |

| | |

Larry E. Brooks, Director | | 16,749 | | | * |

| | |

James M. Campbell, Jr., Director | | 67,693 | | | 1.06 |

| | |

R. Larry Campbell, Director and Vice President | | 62,358 | | | * |

| | |

Darrell L. Frye, Director | | 10,700 | | | * |

| | |

W. L. Hancock, Director | | 126,706 | | | 1.98 |

| | |

Thomas A. Jordan, Director | | 39,897 | | | * |

| | |

Dale E. Keiger, Director | | 35,445 | | | * |

| | |

Lynn S. Lloyd, Director | | 13,055 | | | * |

| | |

Eugene B. McLaurin, II, Director | | 7,488 | | | * |

| | |

Michael C. Miller, Director, Chairman and President | | 94,211 | | | 1.46 |

| | |

R. Reynolds Neely, Jr., Director | | 155,160 | (3) | | 2.42 |

| | |

Richard K. Pugh, Director | | 19,500 | | | * |

| | |

J. M. Ramsay III, Director | | 40,416 | | | * |

| | |

Jerry A. Little, Treasurer and Secretary | | 28,899 | | | * |

| | |

Directors and executive officers as a group (15 persons) | | 718,677 | (3) | | 10.95 |

| (1) | | Includes shares held by directors’ and executive officers’ immediate families, including spouse and/or children residing in same household. Does not include 1,000 shares owned by the Ferree Educational and Welfare Fund, of which Mr. Miller is a trustee and treasurer. |

| (2) | | Includes shares subject to stock options exercisable as of March 23, 2006 or within 60 days thereafter for Mr. J. Campbell (11,500 shares), Mr. R. Campbell (32,500 shares), Mr. Frye (9,500 shares), Mr. Hancock (6,600 shares), Mr. Jordan (11,500 shares), Mr. Keiger (1,500 shares), Mr. McLaurin (1,500 shares), Mr. Miller (56,500 shares), Mr. Neely (11,500 shares), Mr. Pugh (9,500 shares), Mr. Ramsay (2,500 shares), Mr. Little (20,500 shares) and all directors and executive officers as a group (175,100 shares). |

| (3) | | Includes 70,143 shares held of record by the estate of Mr. Neely’s mother and over which Mr. Neely and his sister have joint voting and dispository control as co-executors. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the securities laws of the United States, the Corporation’s directors, its executive officers, and any persons holding more than 10 percent of the Corporation’s stock are required to report their ownership of the Corporation’s stock and any changes in that ownership to the Securities and Exchange Commission. Specific due dates for these reports have been established and the Corporation is required to report in this proxy statement any

15

failure to file by these dates during 2005. All of these filing requirements were satisfied by its directors and executive officers. In making these statements, the Corporation has relied on the written representations of its directors and executive officers and copies of the reports that they have filed with the Commission.

INDEPENDENT AUDITORS

The Audit Committee has appointed the firm of Dixon Hughes PLLC independent auditors for the Corporation for the 2006 fiscal year. A representative of Dixon Hughes PLLC is expected to be present at the Annual Meeting of Shareholders. The representative will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions, including those relating to the 2005 audit of the Corporation’s financial statements. In June 2004, the Corporation dismissed KPMG LLP and reported a change in its independent auditors to Dixon Hughes PLLC. The decision to dismiss KPMG LLP was approved by the Audit Committee.

In connection with the audits of the Corporation’s financial statements for the fiscal years ended December 31, 2003 and 2002 and in the subsequent interim periods from December 31, 2003 through and including June 9, 2004, there were no disagreements between the Corporation and KPMG LLP on any matters of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to the satisfaction of KPMG LLP, would have caused KPMG LLP to make reference to the subject matter of the disagreements in connection with its reports.

During the fiscal years ended December 31, 2003 and 2002 and in the subsequent interim periods through and including June 9, 2004, FNB believes that there were no “reportable events,” as that term is defined in Item 304(a)(1)(v) of Regulation S-K. However, KPMG LLP reported to the Audit Committee on March 15, 2004, certain matters involving internal control and its operation at the Corporation’s subsidiary, Dover Mortgage Company, that KPMG LLP considered to be reportable conditions under standards established by the American Institute of Certified Public Accountants. KPMG LLP subsequently advised the Corporation that it believed that these reportable conditions constituted a reportable event under Item 304(a)(1)(v) of Regulation S-K. KPMG LLP also advised FNB that it considered these reportable conditions in determining the nature, timing and extent of the audit tests applied on its audit of the Corporation’s 2003 consolidated financial statements and that its report of these reportable conditions did not affect its report on the 2003 consolidated financial statements. KPMG LLP also reported to the Audit Committee on March 15, 2004 that it did not note any matters involving internal control and its operation that KPMG LLP considered to be material weaknesses under standards established by the American Institute of Certified Public Accountants.

The Corporation did not consult with Dixon Hughes PLLC during the fiscal years ended December 31, 2003 and 2002 or during any subsequent interim period from December 31, 2003 through and including June 9, 2004, on either the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Corporation’s consolidated financial statements.

The Corporation filed a current report on Form 8-K with the Securities and Exchange Commission on June 9, 2004 regarding the change in accountants. A letter from KPMG LLP regarding the change was filed as an exhibit to that report, which is available on the Corporation’s website at www.MyYesBank.com.

16

Disclosure of Auditor Fees

The following is a summary of the fees billed and expected to be billed to the Corporation by Dixon Hughes PLLC for professional services rendered for the fiscal years ended December 31, 2005 and 2004:

| | | | | | |

Fee Category

| | 2005

| | 2004

|

Audit Fees | | $ | 233,300 | | $ | 143,600 |

Audit-Related Fees | | | 20,600 | | | 8,600 |

Tax Fees | | | 22,725 | | | 1,550 |

All Other Fees | | | — | | | 35,000 |

| | |

|

| |

|

|

Total Fees | | $ | 276,625 | | $ | 188,750 |

| | |

|

| |

|

|

Audit Fees. This category consists of fees billed and expected to be billed for professional services rendered for the audit of our annual financial statements, the audit of internal control over financial reporting as of December 31, 2005 as required by Section 404 of the Sarbanes-Oxley Act of 2002, and reviews of our interim financial statements.

Audit-Related Fees. This category consists of fees billed for services that are reasonably related to the performance of the audit or review of our financial statements and are not otherwise reported under “Audit Fees.” During 2005, these fees consisted of the audit of our benefit plans, routine accounting consultations and accounting consultations related to merger transactions. During 2004, these services consisted solely of routine accounting consultations.

Tax Fees. This category consists of fees billed for professional services for tax compliance, tax advice and, during 2005, tax consultations related to merger specific issues.

All Other Fees. This category consists of fees for professional services other than the services reported above. During 2004, these services consisted solely of assistance provided regarding the documentation of internal controls required by Section 404 of the Sarbanes-Oxley Act.

Audit Committee Preapproval Policies and Procedures

The Audit Committee has adopted policies and procedures for the preapproval of audit, audit-related, tax and other services for the purpose of maintaining the independence of our independent auditors. Under the policy, the Audit Committee is required to review and approve, on an annual basis, all audit services, as well as pre-approve non-audit services that may be performed by the independent auditors. Preapproval responsibility for certain activities may be delegated to a subcommittee comprised of two or more members of the Audit Committee. Any such subcommittee must report any preapproval decisions to the Audit Committee at its next scheduled meeting.

During fiscal year 2005, the Audit Committee preapproved all services provided by the independent auditors.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Corporation’s Board of Directors is comprised of five directors who are not officers or employees of the Corporation. All current members of the Committee are independent for purposes of the Nasdaq listing standards and the Sarbanes-Oxley Act of 2002. In accordance with its written charter, the Audit Committee fulfills its oversight responsibilities by reviewing the financial information that will be provided to the shareholders of the Corporation and others, the systems of internal controls established by

17

management and the Board of Directors, and the audit process. The Audit Committee is directly responsible for appointing, compensating and overseeing the work of the Corporation’s independent auditors. The Audit Committee meets with the Corporation’s internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Corporation’s internal controls, and the overall quality of the Corporation’s financial reporting.

In performing its oversight function, the Audit Committee reviewed and discussed the audited consolidated financial statements of the Corporation as of and for the year ended December 31, 2005 with management and Dixon Hughes PLLC, the Corporation’s independent accountants. The Audit Committee also discussed with the Corporation’s independent auditors all matters required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees,” and discussed and reviewed the results of the independent auditors’ examination of the financial statements.

The Audit Committee obtained from the independent auditors a formal written statement describing all relationships between the auditors and the Corporation that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” The Audit Committee discussed with the auditors any relationships that may have an impact on their objectivity and independence and satisfied itself as to the auditors’ independence. The Audit Committee also determined that the provision of the other non-audit services described under “Independent Auditors – Disclosure of Audit Fees” by Dixon Hughes PLLC to the Corporation is compatible with maintaining Dixon Hughes’s independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the Corporation’s audited financial statements be included in the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2005, for filing with the Securities and Exchange Commission.

Audit Committee

R. Reynolds Neely, Jr., Chair

Larry E. Brooks

James M. Campbell, Jr.

Darrell L. Frye

Dale E. Keiger

Richard K. Pugh

SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be presented at the next Annual Meeting of Shareholders must be received by the Secretary of FNB Corp., 101 Sunset Avenue, Asheboro, North Carolina 27203, no later than December 6, 2006 for inclusion in the Corporation’s proxy statement and form of proxy relating to such meeting. If a shareholder notifies the Corporation any later than February 19, 2007 of an intent to present a proposal at the next Annual Meeting of Shareholders, the Corporation will have the right to exercise its discretionary voting authority with respect to such proposal without including information regarding such proposal in its proxy materials related to such meeting.

DELIVERY OF PROXY MATERIALS

To reduce the expenses of delivering duplicate proxy materials to our shareholders, we are relying upon rules of the Securities and Exchange Commission that permit us to deliver only one proxy statement and annual

18

report to multiple shareholders who share an address unless we received contrary instructions from any shareholder at that address. If you share an address with another shareholder and have received only one proxy statement and annual report, you may write or call us as specified below to request a separate copy of these materials and we will promptly send them to you at no cost to you. For future meetings, if you hold shares directly registered in your own name, you may request separate copies of our proxy statement and annual report, or request that we send only one set of these materials to you if you are receiving multiple copies, by contacting us at: Secretary, FNB Corp., 101 Sunset Avenue, Asheboro, North Carolina 27203, or by telephoning us at (336) 626-8300. If your shares are held in the name of a bank, broker, or other nominee and you wish to receive separate copies of our proxy statement and annual report, or request that we send only one set of these materials to you if you are receiving multiple copies, please contact the bank, broker or other nominee.

OTHER MATTERS

There is no business other than as set forth, so far as now known, to be presented for action by the shareholders at the meeting. It is intended that the proxies will be exercised by the persons named therein upon matters that may properly come before the meeting or any adjournment thereof, in accordance with the recommendations of management.

By Order of the Board of Directors

Michael C. Miller

Chairman and President

Date: April 7, 2006

19

PROXY CARD

FNB CORP.

101 Sunset Avenue

Asheboro, North Carolina 27203

Proxy for Annual Meeting of Shareholders – May 9, 2006

SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints R. Larry Campbell and Darrell L. Frye, or either of them, proxies with full power of substitution to vote all shares of FNB Corp. standing in the name of the undersigned at the above Annual Meeting of Shareholders, and all adjournments thereof.The shares represented by this proxy will be voted as instructed by you. If not otherwise specified, shares will be voted in accordance with the recommendations of the Board of Directors.

PLEASE COMPLETE, DATE, SIGN, AND MAIL THIS PROXY CARD PROMPTLY IN THE ENCLOSED POSTAGE-PAID ENVELOPE OR PROVIDE YOUR INSTRUCTIONS TO VOTE VIA THE INTERNET OR BY TELEPHONE.

(Continued, and to be marked, dated and signed, on the other side)

ê FOLD AND DETACH HERE ê

FNB CORP. – ANNUAL MEETING, MAY 9, 2006

YOUR INSTRUCTIONS TO VOTE ARE IMPORTANT!

Proxy Materials are available on-line at:

http://www.MYYESBANK.com

You can provide your instructions to vote in one of three ways:

| | 1. | | Calltoll free 1-866-353-7841on a Touch-Tone Phone and follow the instructions on the reverse side. There isNO CHARGEto you for this call. |

or

| | 2. | | Via the Internet athttps://www.proxyvotenow.com/fnbnand follow the instructions. |

or

| | 3. | | Mark, sign and date your proxy card and return it promptly in the enclosed envelope. |

PLEASE SEE REVERSE SIDE FOR VOTING INSTRUCTIONS

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Please mark as

indicated in this

example | | x | | |

| | | Revocable Proxy FNB Corp. | | |

| | | | | | |

| | | Annual Meeting of Shareholders May 9, 2006 | | For | | Withhold

All | | For All

Except | | | | The Board of Directors recommends a vote for authorization to vote for the nominees. The proxy will be voted accordingly unless otherwise specified. The proxies will vote in their discretion on such other matters as may properly come before the meeting and at any adjournment of the meeting. When signing as attorney, executor, administrator, trustee or guardian, please give full title. If more than one trustee, all should sign. All joint owners must sign. Mark here if you plan to attend the meeting ¨ Mark here for address change and note change ¨ |

| | | 1. ELECTION OF DIRECTORS: CLASS I TO SERVE FOR TWO-YEAR TERMS EXPIRING IN 2008: | | ¨ | | ¨ | | ¨ | | | |

| | | (1) Jacob F. Alexander III (2) Lynn S. Lloyd CLASS II DIRECTORS TO SERVE FOR THREE-YEAR TERMS EXPIRING IN 2009: (3) Larry E. Brooks (4) W. L. Hancock (5) Eugene B. McLaurin, II(6) R. Reynolds Neely, Jr. (7) Richard K. Pugh INSTRUCTION: To withhold authority to vote for any individual nominee, mark “For All Except” and write that nominee’s name in the space provided below. | |

| | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | PLEASE SIGN EXACTLY AS YOUR NAME(S) APPEAR(S) HEREON. |

| | | Please be sure to date and sign

this proxy card in the box below. | | Date | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | Sign Above | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| + | | *** IF YOU WISH TO PROVIDE YOUR PROXY TO VOTE BY TELEPHONE OR INTERNET, PLEASE READ THE INSTRUCTIONS BELOW *** | | + |

| | | | | | | | | | | | | | | | | | | | | | | |

| FOLD AND DETACH HERE IF YOU ARE VOTING BY MAIL |

| é é |

| PROXY VOTING INSTRUCTIONS |

|

Shareholders of record have three ways to vote:

1. By Mail; or

2. By Telephone (using a Touch-Tone Phone); or

3. By Internet.

A telephone or Internet vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed, dated and

returned this proxy. Please note telephone and Internet votes must be cast prior to 3 a.m., May 9, 2006. It is not necessary to return this proxy

if you vote by telephone or Internet. |

| | | | | | | | |

Vote by Telephone Call Toll-Free on a Touch-Tone Phone anytime prior to 3 a.m., May 9, 2006. 1-866-353-7841 | | | | Vote by Internet anytime prior to 3 a.m., May 9, 2006. https://www.proxyvotenow.com/fnbn |

Please note that the last vote received, whether by telephone, Internet or by mail, will be the vote counted.

| | | | |

ON-LINE PROXY MATERIALS : | | Access at http://www.MYYESBANK.com | | |

| | | | | |

| | | Your vote is important! | | |