SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

FNB United Corp.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other than Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and O-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule O-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

FNB UNITED CORP.

150 South Fayetteville Street

Asheboro, North Carolina 27203

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 25, 2010

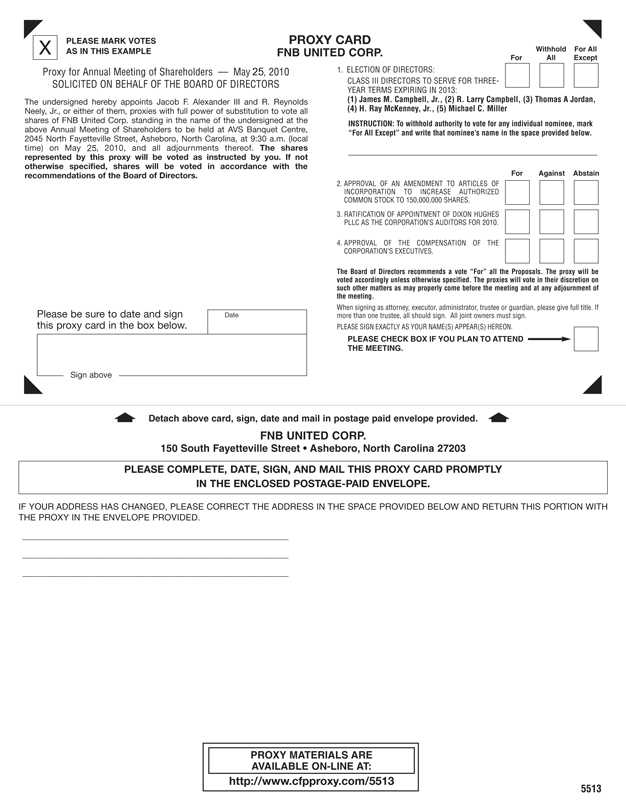

Notice is hereby given that the Annual Meeting of Shareholders of FNB United Corp. (the “Corporation”) will be held at the AVS Banquet Centre, 2045 North Fayetteville Street, Asheboro, North Carolina, on Tuesday, the 25th day of May, 2010, at nine-thirty o’clock a.m. for the following purposes:

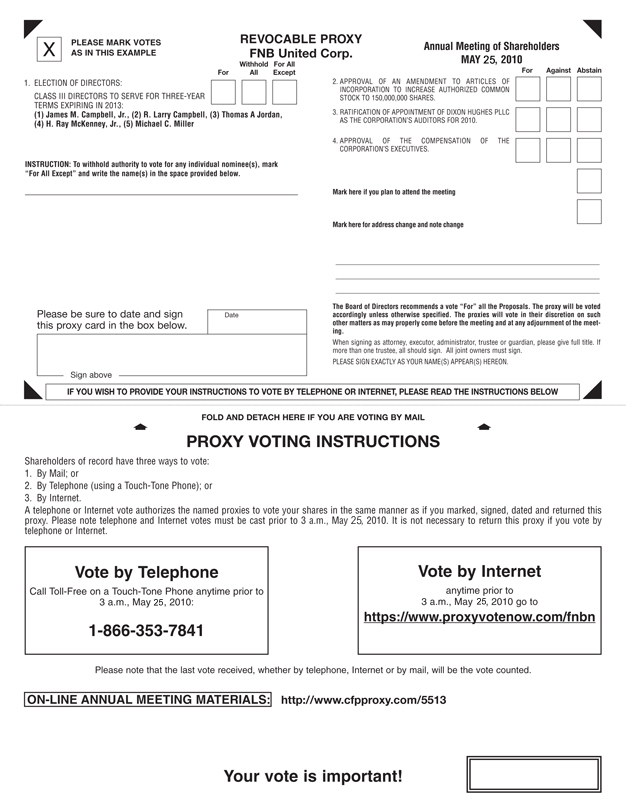

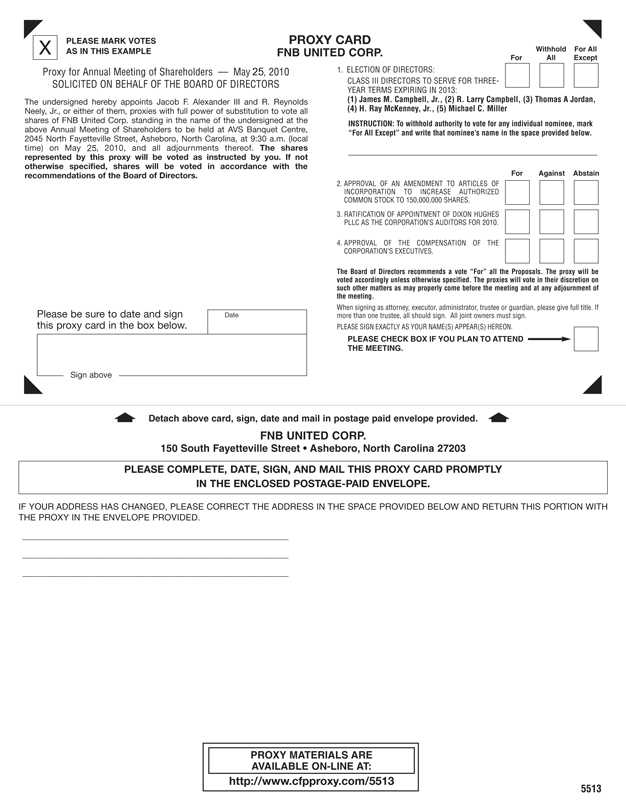

| | 1. | To elect five Class III Directors to serve for three-year terms expiring at the Annual Meeting in 2013. |

| | 2. | To approve an amendment to the Corporation’s articles of incorporation to increase the number of authorized shares of common stock from 50,000,000 to 150,000,000. |

| | 3. | To ratify the appointment of Dixon Hughes PLLC as the Corporation’s independent registered public accounting firm for 2010. |

| | 4. | To approve the compensation of the Corporation’s named executive officers as determined by the Compensation Committee. |

| | 5. | To consider and act upon any other business as may come before the meeting or any adjournment thereof. |

All shareholders are invited to attend the meeting. Only those shareholders of record at the close of business on March 18, 2010, shall be entitled to notice of the meeting and to vote at the meeting.

Information relating to the activities and operations of FNB United Corp. during the fiscal year ended December 31, 2009, is contained in the Corporation’s Annual Report, which is enclosed.

|

| By Order of the Board of Directors |

|

|

| R. Larry Campbell |

| Secretary |

April 19, 2010

Whether or not you plan to attend the meeting in person, your Board of Directors urges you to mark, date, sign and return the enclosed proxy as promptly as possible or to vote by the Internet or telephone as described on the proxy form.

FNB UNITED CORP.

150 South Fayetteville Street

Asheboro, North Carolina 27203

PROXY STATEMENT

GENERAL INFORMATION

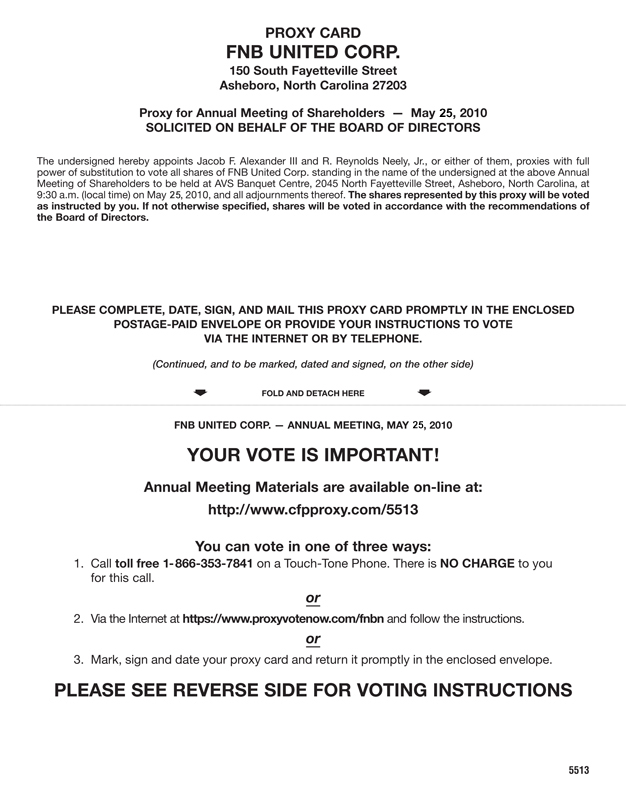

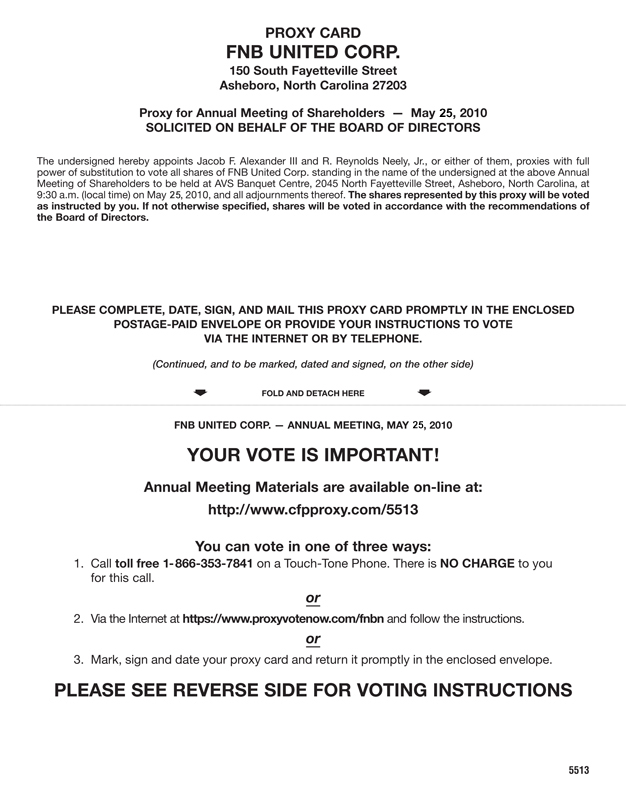

The following information is furnished in connection with the solicitation of proxies by the Board of Directors of FNB United Corp. (the “Corporation” or “FNB United”) for use at the Annual Meeting of Shareholders to be held on May 25, 2010, at 9:30 a.m. at the AVS Banquet Centre, 2045 North Fayetteville Street, Asheboro, North Carolina. The principal executive offices of the Corporation are located at 150 South Fayetteville Street, Asheboro, North Carolina 27203 (Telephone: 336-626-8300). This proxy statement and the enclosed form of proxy, together with the Corporation’s 2009 Annual Report, were first sent to shareholders on or about April 19, 2010.

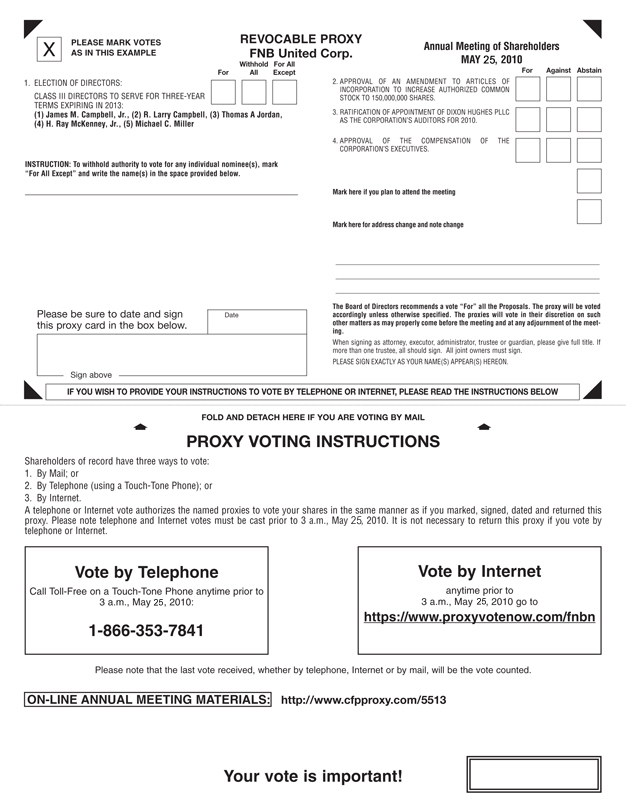

Shareholders may vote either by completing and returning the enclosed form of proxy or through the Internet or by telephone. Information and applicable deadlines for voting through the Internet or by telephone are set forth on the enclosed form of proxy. Regardless of the method of voting, a shareholder may revoke a proxy before it is voted at the meeting by completing and returning a proxy form with a later date, by voting by telephone or on the Internet at a later date and prior to the close of the telephone or Internet voting facilities, by writing to the Secretary of the Corporation and stating that the shareholder is revoking an earlier proxy, or by voting in person at the meeting. If a shareholder votes more than once, the latest vote will be counted. The shares represented by all properly executed proxies received by the Corporation in time to be taken to the meeting will be voted; and, if a choice is specified on the proxy, the shares represented thereby will be voted in accordance with such specification. If a specification is not made, the proxy will be voted for the proposals set forth in the Notice of Annual Meeting of Shareholders.

FNB United will pay the costs of the Annual Meeting and the solicitation of proxies. Solicitation of proxies may be made in person or by mail or telephone by directors, officers and regular employees of the Corporation or its subsidiary, CommunityONE Bank, National Association (“CommunityONE Bank”), without receiving additional compensation. The Corporation may also request banking institutions, brokerage firms, custodians, nominees and fiduciaries to forward solicitation material to the beneficial owners of FNB United common stock held of record by such person, and the Corporation will reimburse such forwarding expenses. In addition, the Corporation has engaged The Altman Group, Inc. to assist in the solicitation of proxies and has agreed to pay them $6,000 plus reasonable expenses for these services.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on May 25, 2010.

This proxy statement, the Corporation’s annual report on Form 10-K for the year ended December 31, 2009, and the Corporation’s 2009 annual report are available athttp://www.cfpproxy.com/5513.

VOTING SECURITIES OUTSTANDING AND PRINCIPAL SHAREHOLDERS

Only holders of record of FNB United common stock at the close of business on March 18, 2010 (the “Record Date”), are entitled to a notice of and to vote on matters to come before the Annual Meeting or any adjournment thereof. On the Record Date, there were 11,426,413 shares of FNB United common stock issued and outstanding.

1

Each share is entitled to one vote on all matters. The presence, in person or by proxy, of the holders of a majority of the outstanding shares of FNB United common stock entitled to vote is necessary to constitute a quorum. Abstentions and broker nonvotes will be counted as present and entitled to vote for purposes of determining a quorum.

The Corporation is not aware of any holders of more than 5% of the outstanding shares of FNB United common stock as of March 18, 2010.

EXECUTIVE OFFICERS

The following table sets forth the current executive officers of FNB United and also shows their positions with CommunityONE Bank.

| | | | | | |

Name | | Age | | Position in FNB United | | Position in CommunityONE Bank |

| | | |

| Michael C. Miller | | 59 | | President and Chief Executive Officer | | President and Chief Executive Officer |

| | | |

| R. Larry Campbell | | 65 | | Executive Vice President and Secretary | | Executive Vice President and Secretary |

| | | |

| Mark A. Severson | | 56 | | Executive Vice President and Treasurer | | Executive Vice President and Chief Financial Officer |

| | | |

| R. Mark Hensley | | 51 | | — | | Executive Vice President and Chief Banking Officer |

The above officers, other than Mr. Severson, have held executive positions with FNB United or CommunityONE Bank or both for at least the past five years. Prior to joining FNB United in 2007, Mr. Severson served as chief financial officer of Camco Financial Corporation, a bank holding company based in Cambridge, Ohio, a position he held since November 2001. He served in the same role for FCNB Corp., a bank holding company in Frederick, Maryland, from 1990 to 2001. Officers are elected annually by the Board of Directors.

PROPOSAL 1 – ELECTION OF DIRECTORS

The bylaws of the Corporation provide that the number of directors shall consist of not less than nine nor more than twenty-five, with the exact number of directors within such maximum and minimum limits to be fixed and determined from time to time by resolution adopted by a majority of the full Board of Directors or by resolution of the shareholders at any annual or special meeting thereof. The Board of Directors has set the total number of directors at 15, all of whom either will be elected at the 2010 Annual Meeting or were previously elected and will remain in office after that meeting.

The Board of Directors is divided into three classes: Class I, Class II and Class III. In accordance with this classification, the members of Class III of the Board of Directors are to be elected at this Annual Meeting. It is intended that the persons named in the accompanying form of proxy will vote for the five nominees listed below for directors of the Corporation in Class III unless authority so to vote is withheld. Each nominee is at present a member of the Board of Directors. Class III directors will serve for three-year terms expiring at the 2013 Annual Meeting, or until their successors shall be elected and shall qualify. Directors are elected by a plurality of the votes cast. “Plurality” means that the nominees receiving the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting. Abstentions and broker nonvotes will not affect the election results if a quorum is present.

2

The following information is furnished with respect to the nominees for election as directors of the Corporation in Class III and for the directors in Classes I and II whose terms expire at the Annual Meetings occurring in 2011 and 2012, respectively.

In the event that any nominee should not be available to serve for any reason (which is not anticipated), it is intended that the persons acting under the proxy will vote for the election, in his or her stead, of such substitute nominee as may be designated by the Nominating and Corporate Governance Committee and approved by the Board of Directors of the Corporation.

The Board of Directors recommends a vote “FOR” the nominees named below:

Nominees for Class III Directors to Serve for Three-Year Terms Expiring at the Annual Meeting in 2013

| | | | | | |

Name | | Age | | Biographical Information | | Director

Since |

| | | |

| James M. Campbell, Jr. | | 71 | | Mr. J. Campbell is a private investor. He retired from his position as President and Treasurer of Sew Special, Inc., a manufacturer of private label apparel, in 2005. Active in community affairs, Mr. Campbell serves as the Chairman of the Randolph Community College Board of Trustees. He also serves on the boards of the Randolph Community College Foundation and Randolph Hospital. He has previously served as a director of the Randolph Community Health Foundation, the Randolph Community Foundation and the North Carolina Pottery Museum. | | 1984 |

| | | |

| R. Larry Campbell | | 65 | | Mr. R. Campbell is the Executive Vice President and Secretary of FNB United and CommunityONE Bank. He previously was president and a director of Carolina Fincorp, Inc. and its subsidiary, Richmond Savings Bank, SSB, Rockingham, North Carolina, which were acquired by FNB United in 2000. Mr. Campbell has 45 years of operational and management experience in the banking industry in North Carolina and Virginia. | | 2000 |

| | | |

| Thomas A. Jordan | | 70 | | Mr. Jordan is the president of Michael Thomas Furniture, Inc., a manufacturer of upholstered furniture he founded in 1983. He has served as a director of the Federal Reserve Bank of Richmond. | | 1984 |

| | | |

| H. Ray McKenney, Jr. | | 55 | | Mr. McKenney is President of McKenney Family Dealerships, a group of automobile dealerships located in the Charlotte, North Carolina area. He is also President of MBM Auto Management, a multi-franchise automobile and powersports management company with five locations in Gaston County, North Carolina. Mr. McKenney previously served on the Boards of Directors of First Gaston Bank of North Carolina and its holding company, Integrity Financial Corporation, which were acquired by FNB United in 2006. | | 2006 |

3

| | | | | | |

| Michael C. Miller | | 59 | | Mr. Miller has served as President of CommunityONE Bank since 1991 and became President and Chief Executive Officer of FNB United in 1994. Mr. Miller has served as Chairman of the North Carolina Bankers Association and Dean of the North Carolina School of Banking. He currently serves on the Board of Directors of the American Bankers Association and has served on the Board for the Charlotte Branch of the Federal Reserve Bank of Richmond. Active in state and community affairs, he is Past Chairman for the North Carolina Center for Public Policy Research, former Chair of the IOLTA Committee of the North Carolina State Bar, and currently a member of the Board of Visitors for the University of North Carolina – Greensboro. He also serves on the Boards of Directors of Randolph Hospital and the Ferree Education Foundation. | | 1992 |

|

| Class I Directors with Continuing Terms Expiring at the Annual Meeting in 2011 |

| | | |

Name | | Age | | Biographical Information | | Director

Since |

| | | |

| Jacob F. Alexander III | | 60 | | Mr. Alexander is President and owner of The Alexander Companies, Inc., a commercial real estate developer, and President and an owner of A & H Investments, which makes investments in real estate, in the Salisbury, North Carolina area. He is also an account executive for Liberty Tire Recycling, LLC, for the Southeastern United States region. Mr. Alexander is former Deputy Secretary of the North Carolina Department of Transportation and former Chairman of the Salisbury/Rowan Economic Development Commission. | | 2005 |

| | | |

| Darrell L. Frye | | 64 | | Mr. Frye is Vice President of Finance for Harriss & Covington Hosiery, a manufacturer of men’s and ladies’ athletic socks. He holds a bachelor’s degree with a concentration in accounting and serves on the Finance and Audit committees of the Board of Directors of High Point Regional Health System. He has been a member of the Randolph County, North Carolina Board of Commissioners since 1982. | | 1999 |

| | | |

| Hal F. Huffman, Jr. | | 55 | | Mr. Huffman is President of Huffman Enterprises, Inc., which operates Ace Hardware of Hickory, North Carolina, a retail hardware store. Mr. Huffman previously served on the Boards of Directors of Catawba Valley Bank and Integrity Financial Corporation, which FNB United acquired in 2006. He has served as a trustee of the Unifour Foundation since its formation in 1996. | | 2007 |

4

| | | | | | |

| Lynn S. Lloyd | | 59 | | Mr. Lloyd is the owner and President of Digital Imaging and Professional Services, LLC, which supplies digital photography and presentation services. He retired from his position as Division Quality Control Manager for Burlington Industries, Inc. in 2002. Mr. Lloyd was a director of Alamance Bank and its holding company, United Financial, Inc., which were acquired by FNB United in 2005. | | 2005 |

| | | |

| J. M. Ramsay III | | 62 | | Mr. Ramsay is the President and an owner of Elastic Therapy, Inc., located in Asheboro, North Carolina, a manufacturer and seller of medical hosiery products for vascular disorders of the legs. | | 1989 |

|

| Class II Directors with Continuing Terms Expiring at the Annual Meeting in 2012 |

| | | |

Name | | Age | | Biographical Information | | Director

Since |

| | | |

| Larry E. Brooks | | 69 | | Mr. Brooks is an accountant with Cobb Ezekiel Loy & Company, P.A., certified public accountants, in Graham, North Carolina. Mr. Brooks served on the Boards of Directors of United Financial, Inc. and its subsidiary, Alamance Bank, which were acquired by FNB United in 2005. | | 2005 |

| | | |

| Eugene B. McLaurin, II | | 53 | | Mr. McLaurin is President of Quality Oil Company, a Rockingham, North Carolina distributor of petroleum products. Until 2007, Mr. McLaurin was General Manager and Business Unit Manager for TOTAL Lubricants USA, Inc., a subsidiary of an international oil company headquartered in Paris, France. Active in the community, he has been Mayor of Rockingham, North Carolina since 1997. He also is Chairman of the Foundation for Richmond County and Past President of the Richmond County Chamber of Commerce. | | 2002 |

| | | |

| R. Reynolds Neely, Jr. | | 56 | | Mr. Neely is the Planning Director of the City of Asheboro, North Carolina Planning Department. Active in the community, he has served on various boards, committees and task forces at the county, city and regional levels. Mr. Neely has also been a strong supporter and advocate for the Boy Scouts of America, serving on various committees and holding leadership positions within the organization. | | 1980 |

| | | |

| Suzanne B. Rudy | | 55 | | Ms. Rudy is Vice President and Corporate Treasurer of RF Micro Devices, Inc., a supplier of radio and other systems for the wireless communications industry. She also serves as Assistant Secretary and Compliance Officer for the | | 2008 |

5

| | | | | | |

| | | | corporation. She is a certified public accountant and holds a master’s degree in accounting. | | |

| | | |

| Carl G. Yale | | 58 | | Mr. Yale is a certified public accountant and partner in the firm of Hemric & Yale, certified public accountants. He formerly served on the boards of directors of Integrity Financial Corporation and its subsidiary, First Gaston Bank of North Carolina, which FNB United acquired in 2006. | | 2006 |

PROPOSAL 2 – AMENDMENT TO THE ARTICLES OF INCORPORATION

The Corporation’s Board of Directors has adopted, subject to shareholder approval, an amendment to FNB United’s articles of incorporation, as amended, to provide for an increase in the number of shares of FNB United common stock authorized for issuance from 50,000,000 to 150,000,000. Under FNB United’s existing articles of incorporation, as amended, the Corporation is authorized to issue 50,000,000 shares of common stock and 200,000 shares of preferred stock. As of March 18, 2010, the record date, 11,426,413 shares of common stock were issued and outstanding. An additional 535,232 shares of common stock are reserved for issuance pursuant to issued and outstanding stock options, 839,534 shares are reserved for issuance pursuant to the Corporation’s stock option and incentive plans, and 2,207,143 shares are reserved for issuance pursuant to the warrant issued by FNB United to the United States Department of the Treasury as part of the Capital Purchase Program. 34,991,678 shares of common stock remain available for issuance. The Board of Directors recommends that shareholders approve the increase in the number of authorized shares of common stock. Adoption of the amendment requires the affirmative vote of a majority of the votes cast on the proposal at the annual meeting.

The Board of Directors believes that the increase in the number of authorized shares of common stock from 50,000,000 to 150,000,000 is advisable and in the best interests of FNB United and its shareholders for several reasons. The increase in the number of authorized shares of common stock would permit the Board of Directors to issue common stock without further shareholder approval and thus provide FNB United with maximum flexibility in maintaining or increasing the Corporation’s capital levels, including regulatory capital in the event the bank regulatory agencies require FNB United to raise additional capital, structuring capital-raising transactions, acquisitions, joint ventures, strategic alliances, and for other corporate purposes. FNB United may consider, for example, issuing additional equity to replace or restructure some or all of the investment the Corporation received from the Treasury. Although the Corporation anticipates that it may issue and sell shares of its common stock in the coming year to raise capital, it has no specific plans, agreements, understandings or arrangements currently in place to do so. Approval of the proposed amendment would enable FNB United to respond promptly to, and take advantage of, market conditions and other favorable opportunities without incurring the delay and expense associated with calling a special shareholders’ meeting to approve a contemplated common stock issuance. The Corporation’s Board of Directors believes it is in FNB United’s best interests to have the additional flexibility provided by the proposed increase in the number of authorized shares of common stock.

The additional shares of authorized common stock would be part of the Corporation’s existing class of common stock and, if and when issued, would have the same rights and privileges as the shares of common stock that are currently outstanding. The additional shares of FNB United common stock will not be entitled to preemptive rights nor will existing shareholders have any preemptive right to acquire any of those shares when issued. Approval of the proposed amendment will not cause any change or dilution to the rights of existing shareholders, unless and until such time as any shares of common stock are actually issued. The degree of any dilution that would occur following the issuance of additional shares of common stock would depend upon the number of shares that are actually issued in the future, which number cannot be determined at this time. Issuance of a large number of additional shares of common stock could significantly dilute the voting power of the existing FNB United common shareholders.

6

The issuance of additional shares of common stock could be deemed under certain circumstances to have an antitakeover effect where, for example, the shares were issued to dilute the equity ownership and corresponding voting power of a shareholder or group of shareholders who may oppose the policies or strategic plan of the Corporation’s existing management. On this basis, the proposed amendment could enable the Board of Directors to render more difficult or discourage an attempt by another person or entity to obtain control of FNB United.

If the amendment is not adopted by the shareholders, the Corporation will have 34,911,678 shares of common stock available for future issuance, after taking into account the shares currently outstanding and reserved for other purposes. This number of shares could restrict the Corporation’s ability to raise capital or take advantage of financing techniques that receive favorable treatment from regulatory agencies. Without sufficient shares of common stock to issue in financing transactions with little or no delay, the Corporation may be unable to take full advantage of changing market conditions that will best position FNB United to remain strong through these challenging economic times.

The Board of Directors unanimously recommends a vote “FOR” the proposal to amend FNB United’s articles of incorporation to increase the number of authorized shares of common stock from 50,000,000 to 150,000,000.

PROPOSAL 3 – RATIFICATION OF AUDITOR APPOINTMENT

The Audit Committee has appointed the firm of Dixon Hughes PLLC independent auditors for the Corporation for the 2010 fiscal year. Although shareholder approval of the appointment of Dixon Hughes PLLC as the independent auditors is not required by law, the Corporation’s bylaws or otherwise, the appointment is being submitted to shareholders for ratification.

The Sarbanes-Oxley Act of 2002 requires the Audit Committee to be directly responsible for the appointment, compensation and oversight of the audit work and the independent auditors. In the event the appointment is not ratified by a majority of the votes cast, in person or by proxy, it is anticipated that no change in auditors would be made for the current year because of the difficulty and expense of making any changes during the year, but that vote would be considered in connection with the auditors’ appointment for 2011. Conversely, even if Dixon Hughes’s appointment is ratified by the shareholders, the Audit Committee may, in its discretion, appoint a new independent registered public accounting firm at any time if it determines that such a change would be in the best interests of the Corporation.

Dixon Hughes PLLC were the Corporation’s auditors for the years ended December 31, 2009, and have served in that capacity since 2004. A representative of Dixon Hughes is expected to be present at the Annual Meeting of Shareholders. The representative will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions, including those relating to the 2009 audit of the Corporation’s financial statements.

The Board of Directors unanimously recommends a vote “FOR” ratification of the appointment of the auditors. Proxies, unless indicated to the contrary, will be voted “FOR” ratification.

PROPOSAL 4 – ADVISORY VOTE ON EXECUTIVE COMPENSATION

On February 17, 2009, the President of the United States signed into law the American Recovery and Reinvestment Act of 2009 (“ARRA”). In addition to a wide variety of programs intended to stimulate the economy, ARRA revised section 111(e) of the Emergency Economic Stabilization Act of 2008 to impose significant new requirements and restrictions relating to the compensation arrangements of financial institutions that received government funds through the U.S. Department of the Treasury’s Troubled Asset Relief Program (“TARP”), including institutions like FNB United that participated in the Capital Purchase Program under TARP prior to the enactment of ARRA. These requirements and restrictions apply until a participant repays the

7

financial assistance received through TARP. One of the new requirements is that a recipient of TARP funds must permit, at a shareholders’ meeting at which directors are to be elected, a separate shareholder vote to approve the compensation of executives, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission. These proposals are commonly referred to as “say on pay” proposals.

This proposal gives the shareholders of FNB United the opportunity to endorse or not endorse the Corporation’s executive pay program through the following resolution:

RESOLVED, that the shareholders approve the compensation of the Corporation’s executives, as described under the headings “Compensation Discussion and Analysis” and “Executive Compensation” in this proxy statement for the Corporation’s 2010 Annual Meeting.

Because the vote of the shareholders on this proposal is advisory, it will not be binding upon the Board of Directors and it will not overrule or override any decisions made by the Board of Directors relating to executive compensation. The Compensation Committee may, however, take into account the outcome of the vote when considering future executive compensation arrangements. FNB United believes that its compensation policies and procedures are reasonable, effective and appropriate and that the compensation paid to its named executive officers for 2009 is reasonable and not excessive. As described under “Compensation Discussion and Analysis,” FNB United believes that its executive compensation arrangements appropriately reward executives and align the interests of the executives with those of its shareholders.

Approval of the proposal requires the affirmative vote of a majority of the shares of FNB United common stock voted on the proposal at the Annual Meeting. Abstentions and broker non-votes will not count as votes on either proposal and will not affect the outcome of the vote.

The Board of Directors unanimously recommends a vote “FOR” approval of the compensation of the Corporation’s executives.

CORPORATE GOVERNANCE

Director Independence

Rules of the Nasdaq Stock Market require that a majority of the Board of Directors be independent directors, as defined in Nasdaq Rule 5605. FNB United has reviewed the independence of each of its directors. In conducting this review, the Corporation has considered transactions and relationships between each director, or any member of his family, and FNB United and its subsidiaries. As a result of this review, the Board of Directors has determined that all of the directors, including those nominated for election at the annual meeting, are “independent” under the Nasdaq listing standards, with the exceptions of Michael C. Miller, President and Chief Executive Officer of FNB United and CommunityONE Bank, R. Larry Campbell, Executive Vice President and Secretary of FNB United and CommunityONE Bank, and Jacob F. Alexander III.

The Board, Committees of the Board and Meetings

The directors of the Corporation also serve on the board of directors of CommunityONE Bank. The Corporation’s Board of Directors holds regular quarterly meetings to conduct the normal business of the Corporation and meets on other occasions when required for special circumstances. The CommunityONE Bank board holds regular monthly meetings and may meet on other occasions as circumstances warrant. Certain board members serve on standing committees. Among these committees are the Audit, Compensation, and Nominating and Corporate Governance Committees, whose members and principal functions are described below. During the fiscal year ended December 31, 2009, the Board of Directors held a total of eight meetings and the CommunityONE Bank board held 13 meetings. Each incumbent director attended 75% or more of the total number of meetings of the Board and of the committees of the Board on which he or she served. Directors are encouraged to attend the Annual Meeting of Shareholders. Fourteen of the Corporation’s 15 directors attended the Corporation’s last Annual Meeting.

8

Audit Committee. The Audit Committee reviews the Corporation’s external and internal auditing systems, and monitors compliance with prescribed accounting and regulatory procedures. It operates under a formal charter, which governs its conduct and responsibilities. A copy of the charter is available through the FNB United Corp. Investor Relations link on the Corporation’s website at www.MyYesBank.com. Among its duties, the Audit Committee is responsible for the engagement, retention and replacement of the independent auditors, approval of transactions between the Corporation and a director or executive officer unrelated to service as a director or officer, approval of nonaudit services provided by the Corporation’s independent auditor, review of the Corporation’s internal controls and the receipt, retention and treatment of complaints regarding accounting, internal controls and auditing matters. Additionally, the committee reviews the audited consolidated financial statements to be included in the Corporation’s Annual Report on Form 10-K. Dixon Hughes PLLC, the Corporation’s independent public accountants, reports directly to the Audit Committee. Members of the committee are Directors Brooks, Frye, Neely (Chair), Rudy and Yale. Each of the members of the committee is independent as defined by Nasdaq listing standards and the Board of Directors has determined that each of Mr. Frye and Ms. Rudy is an audit committee financial expert. The Audit Committee met eight times during the 2009 fiscal year.

Compensation Committee. The Compensation Committee deals in broad terms with personnel matters affecting the Corporation. The Compensation Committee operates under a formal charter, a copy of which is available through the FNB United Corp. Investor Relations link on the Corporation’s website at www.MyYesBank.com. The committee assists the Board of Directors in fulfilling its responsibilities regarding compensation of the Corporation’s executive and other senior officers and directors, oversight of the administration of the Corporation’s employee compensation and benefit plans and programs, evaluation and review of the Corporation’s management resources, evaluation of the performance of the chief executive officer, including determining and approving the chief executive officer’s compensation, and administration of the Corporation’s equity-based incentive plans, including making awards under such plans. Members of this committee are Directors Jordan (Chair), McKenney, McLaurin, and Ramsay, each of whom is independent as defined by Nasdaq listing standards. The Compensation Committee met seven times during the 2009 fiscal year.

The Compensation Committee’s policy is to review executive officer compensation no less frequently than annually. In consultation with senior management, the committee reviews and approves the Corporation’s compensation philosophy and oversees and monitors the Corporation’s compensation policies, plans and programs in light of that philosophy. The committee determines and recommends to the Board of Directors the compensation of the chief executive officer and, with the recommendations of the chief executive officer, reviews and approves the total compensation for the Corporation’s other executive and senior officers. In making these reviews and recommendations, the committee tries to ensure that senior management compensation is consistent with the Corporation’s compensation philosophy, company and personal performance, changes in market practices, changes in individual’s responsibilities, and general economic conditions.

To assist it in fulfilling its responsibilities, the Compensation Committee retained Amalfi Consulting, LLC, a firm specializing in compensation matters for the financial services industry, in 2009 to advise it on various matters relating to executive compensation and general compensation policies. The consultant reports to the chair of the committee. Specific compensation projects with which Amalfi provided assistance included review of the Corporation’s compensation plans and programs in light of the executive compensation requirements imposed upon the Corporation by its participation in the Capital Purchase Program of the United States Department of the Treasury, advice regarding the development of a new executive long-term incentive compensation plan, and review of the Corporation’s peer group for 2010. Amalfi also assists FNB United’s chief human resources officer on preparation of the executive compensation tables set forth in the Corporation’s annual proxy statement and, as needed and instructed by the Compensation Committee, other compensation and benefit practices. Pursuant to the committee’s charter, the committee has the authority to retain and terminate the consultant and engage other advisors.

The Compensation Committee frequently requests the chief executive officer and senior vice president of Human Resources to be present at committee meetings to discuss executive compensation, the performance of the Corporation and of individual executive and other senior officers. Occasionally, other executives and corporate counsel may attend committee meetings to provide pertinent financial or legal information. Although

9

these executives may give their insights and suggestions, the decision-making authority remains with the committee members.

Nominating and Corporate Governance Committee. The primary purpose of the Nominating and Corporate Governance Committee is to assist the Board of Directors in fulfilling its responsibilities by reviewing and making recommendations to the Board regarding the Board’s composition and structure, establishing criteria for Board membership, evaluating the corporate policies relating to the recruitment of Board members and assisting the Board in establishing and maintaining effective corporate governance policies and practices. The committee identifies, investigates and recommends to the full Board of Directors the nominees for election as directors at the annual shareholder meetings and is responsible for filling any vacancies that may occur in the interval between annual meetings. It operates under a formal charter, which governs its conduct and responsibilities. The charter and the Corporation’s corporate governance guidelines, which were developed by the committee and adopted by the Board, are available through the FNB United Corp. Investor Relations link on the Corporation’s website at www.MyYesBank.com.

The committee considers various factors when evaluating potential nominees to the Board, including their independence, ability to read and understand basic financial statements, expertise and business experience, education, character, judgment and vision. In accordance with FNB United’s corporate governance guidelines, the committee makes its evaluations in light of the current mix of director skills and attributes and also considers an individual candidate’s reputation, age, civic and community relationships, knowledge and experience in matters affecting financial institutions, and the extent to which he or she would bring greater diversity to the Board. FNB United seeks the highest qualified individuals who can represent its diverse constituencies and considers diversity by race, gender and culture when reviewing candidates. The committee also regularly discusses the qualifications and contributions of each incumbent director. All directors are required to complete an activity report each quarter, providing information about their attendance at board and committee meetings, review of relevant materials and activities undertaken on behalf of the Corporation or related to their roles as directors. Members of the committee are Directors J. Campbell, Huffman, Lloyd and McLaurin (Chair), each of whom is independent as defined by Nasdaq listing standards. The Nominating and Corporate Governance Committee met four times during the 2009 fiscal year.

The committee will consider qualified candidates recommended by shareholders. Shareholders can submit the names of qualified candidates, together with a written description of the candidate’s qualifications and appropriate biographical information, to the Nominating and Corporate Governance Committee at FNB United Corp., P.O. Box 1328, 150 South Fayetteville Street, Asheboro, North Carolina 27204. Submissions will be forwarded to the Chair of the Nominating and Corporate Governance Committee for review and consideration. Any shareholder desiring to recommend a director candidate for consideration at our 2011 Annual Meeting must ensure that the submission is received by the Corporation no later than December 7, 2010, to provide adequate time for the committee to consider the candidate. The committee does not have any formal policies regarding the consideration of candidates recommended by shareholders other than any such candidate will be considered at the same time and under the same criteria used to evaluate all other candidates.

Executive Sessions.The members of the Board of Directors who are independent within the meaning of the Nasdaq listing standards meet regularly in executive session without management present. Although executive sessions are generally held in conjunction with a regularly scheduled Board meeting, other sessions may be called by two or more independent directors in their own discretion or at the request of the Board of Directors.

Board Role in Oversight of Risk

FNB United historically has maintained that risk management is an enterprise-wide initiative and the responsibility of every employee. This broad-based approach begins with the Board of Directors and executive management. Executive management is ultimately accountable to the Board of Directors and FNB United shareholders for risk management. The Board of Directors oversees planning and responding to risks arising from changing business conditions or the initiation of new activities or products. The Board of Directors also is responsible for overseeing compliance with laws and regulations, responding to recommendations from auditors and supervisory authorities, and overseeing management’s compliance with internal policies and controls addressing the operations and risks of significant activities.

Executive management seeks to implement fully integrated and effective risk management throughout the organization. This is primarily accomplished through a committee structure in which individual committees comprised of FNB United management personnel are assigned primary responsibility for monitoring and managing a particular type of risk associated with FNB United’s operations, including credit risk, liquidity risk, market risk, operational risk, reputational risk and compliance risk, and these risks reviewed and supervised by a corresponding committee of the Board of Directors.

The Board of Directors, as a whole, and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors has the responsibility to satisfy itself that the risk management processes implemented by management are working as designed. While the full Board is charged with ultimate oversight responsibility of risk management, various committees of the Board, to ensure objectivity, have specific responsibilities with respect to the Corporation’s risk oversight. Executive or senior management has direct involvement in risk management via reporting and regular communications to committees of the Board. Minutes and reports of all board committee meetings are reviewed by the Board of Directors. Policies for all major risk areas are approved annually by Board committees or the full Board or both.

FNB United has also appointed a Chief Risk Officer who has the responsibility to ensure the Corporation’s ongoing management of risk by implementing strategies and processes that limit risk through identification, measurement, and control. The Chief Risk Officer is responsible for the compliance and security functions of the Corporation, works closely with the Director of Audit and reports to the Board on a quarterly basis, or more often as needed.

The Audit and Compliance Committee plays a large role in monitoring and assessing our financial, legal and organizational risks, and receives regular reports from the management team’s Chief Risk Officer regarding comprehensive organizational risk. The Board’s Compensation Committee assesses the various risks associated with compensation policies and oversees incentive plans. The Board’s Credit Management Committee, working with the Chief Credit Officer, is charged with overseeing credit risk, including, but not limited to, setting credit policy, setting risk limits, determining the adequacy of loan loss reserves and monitoring results.

FNB United encourages open communication between management and the Board of Directors. Certain members of senior management attend many board meetings and they and other management members are available at all times to address any questions or concerns raised by the Board related to risk measurement and risk management.

Board Leadership

In January 2009, the Board of Directors chose to separate the positions of chief executive officer and chairman of the board, electing James M. Campbell, Jr. to succeed Michael C. Miller as chairman. One reason for the separation was to ensure that no one individual is able to assert a controlling influence over the Board. The separation also permits the role of chairman to be rotated among all of the directors while retaining the services of the chief executive officer. The independent chairman further provides additional leadership to be present among management.

10

Stock Ownership

The Board strongly encourages directors to own a meaningful number of shares of FNB United common stock. The Board has adopted a policy requiring each director to own the lesser of 5,000 shares of FNB United common stock or that number of shares of FNB United common stock having a value equal to three times the director’s annual cash retainer. A director should own one-third or more of such shares at the time his or her service on the Board commences and acquire the remaining shares within three years thereafter. The policy is not violated if the Corporation’s stock price declines after the director has met the policy’s requirements.

Contacting the Board of Directors

Any shareholder who desires to contact the Board of Directors may do so by writing to James M. Campbell, Jr., Chairman, or Michael C. Miller, President and Chief Executive Officer, FNB United Corp., P.O. Box 1328, Asheboro, North Carolina 27204. Communications received in writing are distributed to the full Board of Directors or a committee of the Board, as appropriate, depending on the facts and circumstances outlined in the communication received. For example, a complaint regarding compensation matters will be forwarded to the Chair of the Compensation Committee and complaints relating to accounting, internal controls or auditing matters will be forwarded to the Chair of the Audit Committee.

Codes of Ethics

FNB United has adopted a Code of Ethics for Senior Financial Officers, which is applicable to the Corporation’s chief executive officer, principal financial and accounting officer, controller and such other officers as the Audit Committee of the Board of Directors may designate from time to time. The purposes of this code of ethics are to promote honest and ethical conduct, full and accurate disclosure in a timely and understandable manner in periodic reports filed by the Corporation, and compliance with applicable laws, and to deter wrongdoing. A copy of the Code of Ethics for Senior Financial Officers is filed as an exhibit to the Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 2009.

The Corporation has also adopted a Code of Business Ethics applicable to all of the officers, directors, and employees of FNB United and its subsidiaries. This code establishes guidelines for professional and ethical conduct in the workplace. A copy of the Code of Business Ethics is available online through the FNB United Corp. Investor Relations link on the Corporation’s website at www.MyYesBank.com.

COMPENSATION DISCUSSION AND ANALYSIS

The following is a discussion of the compensation program of FNB United, particularly as it pertains to the individuals who served as the Corporation’s principal executive officer and principal financial officer during 2009 and the Corporation’s two other most highly compensated executive officers in 2009. These individuals are Michael C. Miller, principal executive officer; Mark A. Severson, principal financial officer; R. Larry Campbell; and R. Mark Hensley. They are referred to throughout this discussion as the “named executive officers.” This discussion focuses on compensation and practices relating to FNB United’s most recently completed fiscal year.

Philosophy and Objectives

FNB United maintains that a direct link must exist between the Corporation’s financial performance and the total compensation received by its chief executive officer, executive officers and other senior officers. Executive compensation packages reflect the Corporation’s overall financial performance, changes in shareholder value, the success of the business unit directly affected by the executive’s performance, and the performance of the individual executive.The Corporation adheres to a simple philosophy: high performing people on high performing teams get high compensation. The objectives of the Corporation’s compensation program are to:

11

| | • | | Attract and retain excellent officers and employees and to reward and motivate the productivity and commitment of those officers and employees. |

| | • | | Maintain an excited and motivated workforce. |

| | • | | Help the Corporation compete successfully for employees with the mix of experiences and skills vital to its mission. |

| | • | | Set pay in consideration of similar companies and recruiting markets while also within the Corporation’s resources. |

| | • | | Be fiscally responsible. |

At FNB United, compensation is comprised of several components: salary, incentive pay, benefits, and career development opportunities. Pay is designed to recruit and retain excellent officers and employees. Salary reflects the contribution, content, and complexity of the work. Through the use of incentive pay, FNB United rewards excellent performance at all levels when the Corporation’s goals are met. Incentive compensation may be paid in cash or may be equity-based. All grants of equity, whether stock options, shares of restricted stock or other forms of stock awards, are to reflect transparently the Corporation’s financial performance. The Corporation provides a set of core benefits, including health, disability, death and retirement benefits that are structured to be competitive with benefits offered by similar employers.

FNB United’s Board of Directors, through its Compensation Committee, is responsible for identifying performance measures that reflect the strategic direction of the Corporation and the results achieved. It uses short- and long-term performance measures. These measures include core earnings per share growth, core net income, return on average equity, return on average assets, the ratio of nonperforming assets to total assets, and other measures as may be determined by the Board to align executive pay and executive performance. In particular, the Corporation’s total compensation packages for the named executive officers are intended to take into account asset size, earnings growth, and overall performance of the Corporation. In addition and assuming that the Corporation’s performance is at expected, target levels, FNB United endeavors to provide total compensation for the named executive officers that is competitive and at approximately the median of a peer group of comparably-sized, regional community banks.

2009 Summary

Compensation activity in 2009 was highlighted by the following:

| | • | | The base salary of each of the named executive officers was unchanged from that paid in 2008. |

| | • | | No annual cash incentives were paid for 2009 to the named executive officers. |

| | • | | No awards of equity-based compensation were made to any named executive officer in 2009. |

| | • | | The Compensation Committee evaluated the risks associated with the Corporation’s compensation programs and concluded that those programs do not present risks that are reasonably likely to have a material adverse effect on FNB United. |

Competitive Positioning

In determining the amount of total compensation for the named executive officers, the Compensation Committee may review competitive market data from a selected peer group of comparable, regional community banks. Although individual levels of base salary, annual incentives, long-term incentives, and benefits provided by members of the peer group may be identified, the committee generally strives to target the total compensation

12

of the named executive officers to the peer group median of total compensation to be competitive on an overall basis in the market and to emphasize performance-based compensation. The committee may also refer to various market salary surveys for banks of similar asset size in its review of the total compensation levels for the named executive officers and other senior officers.

The committee attempts to make compensation decisions consistent with the objectives and considerations described above, including, in particular, market levels of compensation it believes are necessary to attract, motivate and retain an experienced and effective management team. Notwithstanding the Corporation’s overall competitive pay positioning objectives, compensation opportunities for specific individuals vary based on a number of factors, such as performance, scope and breadth of duties, institutional knowledge, and potential difficulty in recruiting a new executive. Actual total compensation in any given year will vary above or below target compensation levels of the peer group based primarily on the attainment of operating goals.

The peer group for 2009 is comprised of 17 companies listed below. These companies include banks and bank holding companies of similar size and business strategy to that of FNB United. Based on the Corporation’s performance in 2009, the Compensation Committee decided not to raise the base salaries of the named executive officers and other senior officers or to make any incentive awards. In making this decision the committee did not review any data from this peer group.

2009 Peer Group

| | |

•Ameris Bancorp | | •Pinnacle Financial Partners, Inc. |

| |

•Cadence Financial Corporation | | •Seacoast Banking Corporation of Florida |

| |

•Capital Bank Corporation | | •SCBT Financial Corporation |

| |

•Cardinal Financial Corporation | | •Southern Community Financial Corp. |

| |

•Fidelity Southern Corp. | | •StellarONE Corporation |

| |

•First Bancorp | | •TIB Financial Corp |

| |

•First Community Bancshares, Inc. | | •Union Bankshares Corporation |

| |

•First M & F Corp | | •Virginia Commerce Bancorp, Inc. |

| |

•NewBridge Bancorp | | |

The Compensation Committee has reviewed the peer group for 2010. Seeking to limit the peer group to companies located in the states of North Carolina, South Carolina, Tennessee, Virginia, Georgia and Florida with assets between $1.5 to $5 billion, returns on average assets in excess of -5% and average equity in excess of -50%, nonperforming assets of less than 10%, and tangible equity ratios greater than 5%, Cadence Financial Corporation, Cardinal Financial Corporation and First M&F Corporation will be dropped from the peer group and BNC Bancorp, First Financial Holdings, Inc., Green Bancshares, Hampton Roads Bankshares, Inc., Palmetto Bancshares, Inc., TowneBank and Yadkin Valley Financial Corporation will be included.

Components of the Compensation Program

FNB United’s executive compensation program is comprised of four primary components. They are: base salary, annual cash incentives, long-term incentives, and benefits. A brief description of these four components and related programs follows.

Annual Base Salary

FNB United pays its executives base cash salaries that are designed to provide competitive levels of compensation, taking into account the individual executive’s experience, performance, responsibilities, and past and potential contributions to the Corporation. Salaries provide a basic level of compensation that is necessary to recruit and retain executives. Periodic increases in salaries are based primarily on judgments of merit, guided by regular appraisals of individual work performance. The Compensation Committee reviews a number of factors, including, as appropriate in individual cases, the executives’ general managerial oversight of the Corporation, the

13

quality of their communications with the Board of Directors, the Corporation’s achievement of established performance goals, and the Corporation’s record of compliance with regulatory requirements. There is no specific weighting applied to the factors considered. The Compensation Committee uses its own judgment and expertise in determining appropriate salaries within the parameters of the Corporation’s compensation philosophy. The goal is to provide executives and management employees with an opportunity to earn compensation that is fair, reasonable and competitive with that paid by other financial institutions similar in size and other respects to FNB United.

Base salary levels are also important because FNB United generally ties the amount of cash incentive compensation and retirement benefits to an executive’s base compensation. For example, participation in the Corporation’s annual cash incentive plan is generally denominated as a designated percentage of one’s base salary.

The Compensation Committee is responsible for recommending to the Board of Directors the base salary for the Corporation’s chief executive officer. The committee also approves the base salaries of the remaining executive and other senior officers of the Corporation based on the recommendations of the chief executive officer.

Based on the performance of the Corporation, the committee placed a general freeze on all salaries at CommunityONE Bank, including those of the named executive officers, throughout 2009. The committee has not approved any increases in base salary for the named executive officers or any other senior officers for 2010. Whether the Compensation Committee approves any salary increases for the named executive officers or other senior officers later in 2010 or for 2011 will be dependent upon improvement in CommunityONE Bank’s performance and general economic conditions, followed by a consideration of individual merit.

Annual Cash Incentive Compensation

FNB United has established an annual cash incentive compensation plan — referred to as the Stakeholders Plan — that is designed to foster achievement of the Corporation’s annual performance goals. All employees of CommunityONE Bank are eligible to participate in the plan. The plan provides for quarterly payments based upon the bank’s performance as measured against key performance indicators approved early each year by the Compensation Committee for that year. These performance indicators are generally established for asset growth and deposit growth, net interest margin, non-interest income, loan quality, and operating productivity. The performance goals were not achieved, and thus there was no payment made to CommunityONE Bank employees under the annual cash incentive compensation plan in 2009.

Seventeen executive and senior officers of FNB United, including the named executive officers, also participate in an executive incentive plan. Under this plan, these officers may receive additional annual cash payments if targeted goals identified by the Compensation Committee are achieved. The purpose of the plan is to provide more competitive rewards, as compared to FNB United’s peer group described above, for more competitive performance. The plan focuses on achievement of specific goals related to core earnings per share growth and core net income. Short-term incentive rewards are targeted at 25% to 33% of base salary for executive and senior officers of the Corporation. Based on the Corporation’s performance, the Compensation Committee determined not to make any awards under the executive incentive plan for 2009. The Compensation Committee is reviewing terminating this plan and no amounts are being accrued for payment for 2010.

Long-Term Incentive Compensation

The Corporation believes that long-term incentives are important to focus attention on long-range objectives and future returns to shareholders. Long-term incentive awards are equity-based and historically have taken the form of stock options and shares of restricted stock. They are designed to align the executives’ interests with those of other shareholders, to encourage the retention of key executives, and to encourage significant stock ownership. Awards are made under the FNB United Corp. 2003 Stock Incentive Plan. The Corporation did not make any awards of equity-based compensation to any named executive officer in 2009.

14

The Compensation Committee oversees the long-term executive incentive plan for senior management and key employees, which was implemented as of January 1, 2008. Under this plan, long-term equity awards in the form of a combination of stock-settled stock appreciation rights (SARs) and performance-vested restricted stock units may be awarded if the Corporation meets or exceeds various predetermined financial measures. These measures include return on average assets, return on average equity, and the ratio of nonperforming assets to total assets, all as compared to the Corporation’s peer group described above. In addition the Corporation must maintain a Tier 1 capital ratio of 7.0%. The Corporation did not meet the requisite financial measures for awards under this plan in 2009 and consequently no awards were made.

FNB United’s policy is to make grants of equity-based compensation only at current market prices. The exercise price of stock options is set at the closing stock price on the date of grant and no “in-the-money” options or options with exercise prices below market value on the date of grant are granted. Similarly, SARs will be granted at fair market value and will not reflect any discount. The Corporation does not endeavor to make restricted stock awards, stock option grants or other equity grants at a particular time of the year but does try to make the awards and grants at times when they will not be influenced by scheduled releases of information. The Corporation believes that it minimizes the influence of its disclosures of nonpublic information on the exercise price of its equity awards by setting vesting periods at one year or longer and by selecting dates several days or weeks after it reports its financial results and well in advance of its next anticipated earnings release. FNB United does not otherwise time or plan the release of material, nonpublic information for the purpose of affecting the value of executive compensation.

The Compensation Committee oversees the administration of, and makes awards under, the Corporation’s equity-based employee incentive plans. The committee is responsible for recommending to the Board of Directors the equity incentive awards for the Corporation’s chief executive officer. The committee also approves the awards for the remaining executive and other senior officers of the Corporation based on the recommendations of the chief executive officer. The Corporation expenses stock option grants in accordance with Statement of Financial Accounting Standards No. 123R (revised 2004), “Share-Based Payment.”

Benefits

401(k) Savings Plan. FNB United sponsors a qualified 401(k) plan to provide a tax-advantaged savings vehicle for employees, including the named executive officers. The Corporation believes that the 401(k) plan, and its contributions to the plan, increases the range of benefits offered to executives and enhances its ability to attract and retain employees. All regular employees are eligible to participate in the plan. Under the terms of the plan for 2009, eligible employees were permitted to defer up to $16,500 of their eligible pay, and FNB United made a matching contribution of $0.50 for each dollar deferred on the first 6% of eligible pay deferred by the employee under the plan. Prior to June 1, 2009, the Corporation’s matching contribution was made on a dollar for dollar basis on the first 6% of eligible pay deferred by the employee. FNB United established its limit on its matching contributions by reference to market and peer practices. An additional discretionary employer contribution may be made each year. Based on the Corporation’s performance, no discretionary contribution was made for 2009. All employer contributions to the 401(k) plan, both matching amounts and discretionary service amounts, are made in cash. The 401(k) plan is the Corporation’s primary retirement benefit plan.

Pension Plan. The Corporation has maintained a noncontributory, qualified pension plan. In September 2006, the Board of Directors approved a modified freeze to the plan. Participants who were at least age 40, had earned 10 years of vesting service as an employee of FNB United and remained an active employee as of December 31, 2006, will continue to accrue benefits under the plan through December 31, 2011. The retirement benefits of all other participants in the pension plan had their retirement benefits frozen as of December 31, 2006. Of the named executive officers, Messrs. Miller and Campbell qualified under the grandfathering provision and are continuing to accrue benefits.

Supplemental Executive Retirement Plans. The Corporation offers a noncontributory, nonqualified supplemental executive retirement plan (“SERP”) to ten executive and senior officers of CommunityONE Bank, including the named executive officers. Adopted following the reduction in qualified pension plan benefits to executive and senior officers caused by limitations imposed by the Internal Revenue Code of 1986, as amended,

15

the SERP is intended to supplement the retirement benefits available under the Corporation’s pension plan and 401(k) plan and to attract and retain key executive talent. Annual benefits payable under the SERP are based on factors similar to those for the pension plan described above and are limited to 60% of average compensation, offset by amounts payable under the pension plan, the 401(k) plan and by 50% of Social Security benefits. Average compensation for purposes of the SERP means the average annual compensation during the final 10 years of employment.

The SERP provides death, disability and voluntary termination benefits and contains a covenant not to compete provision that prohibits a participant from competing with FNB United for two years after his or her separation of service with a vested benefit or during any time that he or she is receiving retirement or disability benefit payments under the SERP.

Participants in the SERP become 100% vested in their accrued benefits upon the occurrence or attainment of any of the following events: death after five or more years of service and survived by an eligible spouse; permanent and total disability; early retirement (age 60 with 10 or more years of service); normal or delayed retirement (age 65 or later with five of more years of service); change of control; involuntary termination without cause; termination by the employee for good reason, meaning substantial reduction in regular and material duties without cause; voluntary termination upon attaining age 58 with at least 10 years of service; and termination of the plan. Termination of employment for any other reason will result in forfeiture of all SERP benefits.

In connection with the acquisition by the Corporation of Carolina Fincorp, Inc. in 2000, CommunityONE Bank assumed the obligations of Richmond Savings Bank, Inc., SSB under its Nonqualified Supplemental Retirement Plan with Mr. Campbell. Under that plan, Mr. Campbell is entitled to a retirement benefit of $30,000 per year payable for 10 years commencing at retirement upon attaining age 65.

Benefits and Perquisites

Believing that a healthy and secure workforce is best able to contribute to the Corporation’s performance, FNB United strives to provide its employees a set of core benefits, including medical, dental, disability and life insurance coverage that are competitive with those offered by comparable banks and employers. The Corporation also believes that providing benefits that are usual and customary within its peer group assists FNB United in attracting and retaining key executive talent. The named executive officers participate in these benefits on the same terms as other eligible employees of the Corporation.

Perquisites represent a very small part of the Corporation’s overall compensation package, and are offered only after consideration of business need. The Compensation Committee reviews annually the perquisites and other personal benefits provided to senior management. The primary perquisites are reimbursement of country club expenses and the exclusive use of an automobile. Automobiles are provided to Messrs. Miller and Campbell with the Corporation paying all operating and service expenses, including automobile insurance, related to the vehicle. Any personal use of the automobile by the executive is accounted for and reported as additional compensation to the executive. Mr. Hensley receives a $600 automobile allowance each month. Business-related miles are recorded and the remaining allowance, if any, is compensation to Mr. Hensley. The Corporation sponsors golf or country club memberships for certain senior executives who have responsibility for the entertainment of clients and prospective clients. Commencing in April 2010, the Corporation will suspend for an indefinite period sponsorship of golf or country club memberships for executives. The Corporation also pays the expenses for the spouses of Messrs. Miller and Campbell to accompany them to the annual conventions of the American Bankers Association or the North Carolina Bankers Association or both.

Employment Agreements

CommunityONE Bank has entered into employment agreements with Michael C. Miller and R. Larry Campbell to assure their continuing services to the bank. The following summarizes the terms of these agreements without regard to the Corporation’s participation in the United States Department of the Treasury’s Capital Purchase Program. For the period the Corporation is a recipient of funds under the Troubled Assets Relief Program (“TARP”) of the United States Department of the Treasury, these employment agreements are

16

deemed amended or modified to the extent necessary to be in compliance with the TARP compensation standards, which are described under “Capital Purchase Program” below.

Effective as of December 31, 2008, the Corporation amended and restated the employment agreement with Michael C. Miller dated January 1, 2006 to bring the agreement into compliance with Section 409A of the Internal Revenue Code of 1986, as amended. Under this amended agreement, Mr. Miller will continue to be employed as chief executive officer and president of the Corporation and its principal subsidiary, CommunityONE Bank.

The employment agreement has an annually renewing three-year term, unless the Corporation notifies Mr. Miller of its intent not to extend the term. In any event, the employment agreement will not extend beyond December 31 of the year in which Mr. Miller attains age 65. The employment agreement provides for an annual base salary, subject to annual review, in an amount not less than Mr. Miller’s base salary as of December 31, 2008, which was $350,000, participation in all of the Corporation’s compensation and other benefit plans and programs, and various perquisites, including club memberships, vacation, and use of an automobile, all as are set forth in the employment agreement.

The employment agreement provides that it may be terminated by the Corporation with cause or as a result of Mr. Miller’s death or disability. If terminated for cause, Mr. Miller would be entitled to receive only his base salary through the date of termination and the amount of any compensation previously deferred. If the agreement is terminated due to Mr. Miller’s death, the Corporation will pay to his designated beneficiary or legal representative his then base salary through the last day of the calendar month in which the death occurs and a prorated bonus for the year of death based on his performance during the immediately preceding year. In the event of Mr. Miller’s disability, he would continue to receive his then annual base salary for the otherwise remaining term of the agreement, less any disability payments to him from any disability plan of the Corporation or CommunityONE Bank. Mr. Miller may terminate the agreement without good reason upon 60 days’ notice to the Corporation. If he does so, the Corporation may cause the termination to be effective at any time during the notice period and Mr. Miller will be entitled to receive only his base salary and the other benefits of the agreement through the date of termination.

The employment agreement provides that if Mr. Miller’s employment is terminated by the Corporation other than for cause or by Mr. Miller with good reason, then the Corporation will (a) continue Mr. Miller’s then annual salary through the end of the otherwise remaining term of the agreement, (b) pay to Mr. Miller for the year of termination and for each subsequent calendar year or partial year through the end of the then current term of the agreement an amount (prorated in the case of any partial year) equal to the average of the bonuses paid to him for the three calendar years immediately preceding the year of termination, and (c) pay to Mr. Miller the amount of any compensation previously deferred by him. All stock options and restricted stock awards granted to Mr. Miller and outstanding at the date of termination (other than those under which vesting is performance-based or is dependent upon the satisfaction of conditions other than continued employment) will immediately and fully vest and Mr. Miller will have up to three years to exercise such outstanding options following the date of termination but not beyond their specified term. In addition, the Corporation will continue to provide Mr. Miller with various group health, disability and life insurance benefits until the first to occur of: (i) Mr. Miller’s becoming eligible to participate as a full-time employee in the benefit plans of another employer, (ii) December 31 of the year in which Mr. Miller reaches age 65, (iii) Mr. Miller’s death, or (iv) the end of the term otherwise remaining under the agreement, provided that 19 months following termination the Corporation will no longer be obligated to pay the costs of coverage for such benefits.

If a change in control (as defined in the employment agreement) occurs and Mr. Miller’s employment is terminated by the Corporation other than for cause or by Mr. Miller with good reason within 24 months after the change in control, then Mr. Miller will be entitled, in lieu of the above severance payments, to a lump sum payment, payable on the date six months after termination of employment, equal to 2.99 multiplied by Mr. Miller’s average annual cash compensation for the five fiscal years immediately preceding the change in control. In addition, the Corporation will continue to provide Mr. Miller with group health, disability and life insurance benefits until the first to occur of: (i) Mr. Miller’s becoming eligible to participate as a full-time employee in the plans of another employer, (ii) December 31 of the year in which Mr. Miller reaches age 65, (iii) Mr. Miller’s

17

death, or (iv) the end of the term otherwise remaining under the agreement, provided that 19 months following termination the Corporation will no longer be obligated to pay the costs of coverage for such benefits. The Corporation will also cause Mr. Miller to become fully vested in all plans in which he participated that do not address the effect of a change in control. In the event that payments related to a change in control are subject to the excise tax under Section 4999 of the Internal Revenue Code, the Corporation will provide Mr. Miller with an additional amount sufficient to enable Mr. Miller to retain the full amount of his change in control benefits as if the excise tax had not applied.

The employment agreement contains confidentiality provisions as well as provisions prohibiting Mr. Miller from competing with the Corporation or CommunityONE Bank during and for a period of time following his employment with the Corporation and CommunityONE Bank.

Effective as of December 31, 2008, CommunityONE Bank amended and restated the employment agreement with Mr. Campbell, which was originally entered into in connection with the acquisition in 2000 of Carolina Fincorp, Inc. The agreement was amended to bring it into compliance with Section 409A of the Internal Revenue Code, to extend the term of employment, and to provide a change in control feature. The agreement, as amended, will terminate on December 31, 2010. The employment agreement provides that Mr. Campbell will receive an annual base salary of $180,000 with increases as determined in accordance with CommunityONE Bank’s policies and practices for employee compensation. The employment agreement also provides that it may be terminated by CommunityONE Bank with cause or as a result of Mr. Campbell’s death or disability. Mr. Campbell may terminate the agreement upon 60 days’ notice to CommunityONE Bank. In the event CommunityONE Bank terminates Mr. Campbell’s employment other than by reason of death, disability or “cause,” Mr. Campbell would continue to receive his then annual base salary for the otherwise then remaining term of the employment agreement. CommunityONE Bank would also continue to provide Mr. Campbell with various group health, disability and life insurance benefits until the earlier of (i) Mr. Campbell’s death, (ii) Mr. Campbell’s becoming eligible to participate as a full-time employee in the benefit plans of another employer, or (iii) the end of the term otherwise remaining under the agreement, provided that the CommunityONE Bank’s obligation to pay the costs of coverage for such benefits will end as of the 19th month following the employment termination. If Mr. Campbell’s employment is terminated by reason of continued disability, he would continue to receive his then annual base salary for the otherwise then remaining term of the agreement, less any disability payments to him from any disability plan of CommunityONE Bank or FNB United.