Employee Information Packet

August 2, 2011

1

What’s Inside

| | | | |

Memo to Employees | | | 3 | |

| |

Copy of Press Release | | | 4 | |

| |

Key Points | | | 9 | |

| |

Employee Questions & Answers | | | 10 | |

| |

Guide to Answering Customer Questions | | | 13 | |

| |

Town Hall Meeting Schedule | | | 15 | |

| |

Employee Feedback Instructions | | | 16 | |

2

| To: | CommunityONE Employees |

| From: | Larry Campbell, Bob Reid and Brian Simpson |

We are excited to announce that our company has secured the capital commitments needed to complete the recapitalization plan and pending merger with Bank of Granite Corporation., contingent upon receipt of regulatory and shareholder approvals and certain other conditions. We now have commitments for the private placement of $310 million in FNB United Corp. common stock. We believe this capital will enable the company to work through its remaining credit challenges, meet the requirements established by the regulators to become “well capitalized,” and better position us for future profitability.

While today’s announcement is a major achievement, the capital raise is one of numerous conditions that must be met before the merger agreement with Bank of Granite Corporation can be consummated. Most notably, the OCC, the FDIC, the North Carolina Commissioner of Banks and the Federal Reserve Bank of Richmond must approve the capital plan and merger, the shareholders of Bank of Granite Corporation must approve the merger and the shareholders of FNB United Corp. must approve a number of matter related to the capital raise and the merger. These are the areas on which we are now focusing our efforts.

With this announcement, we can now begin sharing more information with employees, customers, shareholders and our communities at large. Included with this packet you will find a schedule of town hall meetings where we’ll meet each other in person and spend time talking about future plans. Until then, we have also included a copy of the press release, which contains additional details about the capital raise, and other information to help you better understand future plans and answer any questions you may receive. We look forward to seeing you in person soon!

3

Copy of the Press Release

************************************************************************

August 2, 2011

For Immediate Release

FNB United Corp. Announces Full Subscription of

$310 Million Common Stock Private Placement

Completion of Capital Raise Fulfills Key Contingency

for FNB Acquisition of Bank of Granite

Regulatory and Shareholder Approvals Represent

Next Steps in the Merger Process

ASHEBORO, N.C., (August 2, 2011) – FNB United Corp. (Nasdaq: FNBN), parent company of CommunityONE Bank, N.A., today announced that investors have agreed to subscribe for a total of $310 million in company common stock in a private placement, contingent on obtaining shareholder and regulatory approvals and satisfaction of other conditions. Issuance of the common stock at $0.16 per share will complete the recapitalization of FNB United, which is a key contingency in its plan to acquire Bank of Granite Corporation (Nasdaq: GRAN), parent company of Bank of Granite.

The proposed acquisition will unite two 100-year-old institutions, creating a North Carolina community banking organization with approximately $2.8 billion in assets, $2.4 billion in deposits and 63 full-service banking offices located in some of the state’s most robust markets. The transaction remains subject to receipt of regulatory approvals and shareholder approval of both banking companies.

“Completion of the capital raise is a significant event for community banking in North Carolina,” said Brian Simpson, who will serve as CEO of the combined organization. “Two banking companies that have served their communities faithfully for more than 100 years will be revitalized so that the traditions of service to business owners and consumers can continue. We believe this is positive news for each of the communities served by CommunityONE and Bank of Granite and for our entire state.”

The Carlyle Group and Oak Hill Capital Partners are lead investors in the capital raise, each having entered into definitive agreements with FNB United to invest $79

4

million, each subject to conditions contained in the investment agreements. FNB United has now entered into additional definitive subscription agreements with additional investors providing the investment of the remaining capital of $152 million, subject to conditions contained in the subscription agreements.

Jim Burr, Managing Director of The Carlyle Group, said: “This strong and experienced leadership team is well positioned to address current challenges and build for the future. The revitalization of any bank franchise begins with seasoned leadership, and Brian, Bob and their team have the depth and breadth of experience needed for this opportunity.”

FNB United will be headquartered in Asheboro, N.C. Subject to the satisfaction or waiver of the remaining conditions, the transaction is expected to close in October of 2011. The two bank subsidiaries (CommunityONE and Bank of Granite) will be operated as separate entities for a period of time; it is anticipated that the merged bank will be named CommunityONE Bank, N.A. at a future date to be determined.

“Brian and I have been gratified by the response we have received from the investment community,” said Bob Reid, who will serve as President of the combined banking company. “A great deal of work remains ahead, but with this commitment of capital and the talented teams being put in place at CommunityONE and Bank of Granite, we believe that the resulting institution will be positioned to effectively serve its communities in the future.”

Jim Campbell, Chairman of FNB United, said: “I would like to commend all of our employees for their commitment to customer service as we have navigated through these challenging times. This focus on the customer has been invaluable in assuring that we are well positioned for the revitalization that is planned with our new capital and our new banking partners.”

John Bray, Chairman of Bank of Granite, said: “The success of the capital raise is great news for our customers, our employees and the communities we serve. CommunityONE and Bank of Granite have long traditions of personalized service that is a hallmark of community banking. The addition of capital and the merger of our organizations will ensure that this spirit lives on.”

5

The Transaction

FNB United Corp. will be operated by new management after the recapitalization and merger, led by Brian Simpson as Chief Executive Officer and Bob Reid as President.

The merger agreement provides that Bank of Granite shareholders will receive 3.375 shares of FNB United Corp.’s common stock in exchange for each share of Bank of Granite common stock they own immediately prior to completion of the merger.

Completion of the merger and the investments are dependent on each other and the satisfactory completion of a number of other conditions, including the exchange of FNB preferred stock held by the U.S. Treasury for FNB common stock on the terms specified in the merger and investment agreements, CommunityONE having repurchased SunTrust’s outstanding debt and preferred stock on the terms specified in the agreements, receipt of regulatory approvals, the approval of the shareholders of both FNB United Corp. and Bank of Granite Corporation, and FNB and Bank of Granite meeting specified financial condition requirements contained in the merger and investment agreements.

Sandler O’Neill & Partners, L.P. and Raymond James & Associates, Inc. are acting as placement agents in connection with the private placement of the FNB United common stock.

About FNB United Corp.

FNB United Corp. is the Asheboro, N.C.-based bank holding company for CommunityONE Bank, N.A. Opened in 1907, CommunityONE Bank operates 45 offices in 38 communities throughout central, southern and western North Carolina, and offers a complete line of consumer, mortgage and business banking services, including loan, deposit, cash management, wealth management and internet banking services.

About Bank of Granite Corporation

Bank of Granite Corporation is the parent company of Bank of Granite. Founded in 1906, Bank of Granite operates 18 full-service banking offices in seven North Carolina counties – Burke, Caldwell, Catawba, Iredell, Mecklenburg, Watauga and Wilkes.

6

Cautionary Statement

The issuance of the securities by FNB United pursuant to the investment agreements and the subscription agreements have not been and will not be registered under the Securities Act of 1933, as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state securities laws. This document shall not constitute an offer to sell or the solicitation of an offer to buy the securities, nor shall there be any sale of the securities in any jurisdiction or state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction or state.

Forward-Looking Statements

This document contains forward-looking statements concerning FNB United’s plans for raising capital, the conditions necessary for closing on proposed capital investments, concerning plans and objectives of management for future operations, concerning future economic performance, or concerning any of the assumptions underlying or relating to any of the foregoing. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts, and may include the words “believes”, “plans”, “intends”, “expects”, “anticipates”, “forecasts” or words of similar meaning. While we believe that our forward-looking statements and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could materially differ from projections for a variety of reasons, to include, but not limited to: the impact of local, national, and international economies and events, including natural disasters, on FNB United’s business and operations and on tourism, the military, and other major industries operating within the North Carolina market in which FNB United does business; the impact of regulatory actions on FNB United and its bank subsidiary, including the Consent Order agreed to by CommunityONE Bank, N.A, with the Office of the Comptroller of the Currency and the Written Agreement agreed to by FNB United with the Federal Reserve Bank of Richmond; the impact of legislation affecting the banking industry including the Emergency Economic Stabilization Act of 2008 and the Dodd-Frank Act Wall Street Reform and Consumer Protection Act; the impact of competitive products, services, pricing, and other competitive forces; movements in interest rates; loan delinquency rates and changes in asset quality generally; the price of FNB United’s stock; volatility in the financial markets and uncertainties concerning the availability of debt or equity financing; and the impact of regulatory supervision. For further information on factors that could cause actual results to materially differ from projections, please see FNB United’s publicly available Securities and Exchange Commission filings, including FNB United’s Forms 8-K filed on April 27, 2011 and June 16 2011. FNB United does not update any of its forward-looking statements.

7

Important Information for Investors and Shareholders

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The proposed transactions will be submitted to the stockholders of FNB United and Bank of Granite Corporation. FNB United and Bank of Granite Corporation will file a registration statement on Form S-4, a joint proxy statement/prospectus and other relevant documents concerning the proposed transaction with the SEC. FNB United and Bank of Granite Corporation will each provide the final joint proxy statement/prospectus to its respective stockholders. Investors and security holders are urged to read the registration statement and the joint proxy statement/prospectus and any other relevant documents filed with the SEC when they become available, as well as any amendments or supplements to those documents, because they will contain important information about FNB United, Bank of Granite Corporation and the proposed transaction. Investors and security holders will be able to obtain a free copy of the registration statement and joint proxy statement/prospectus, as well as other filings containing information about FNB United and Bank of Granite Corporation free of charge at the SEC’s web site athttp://www.sec.gov. In addition, the joint proxy statement/prospectus, and other documents filed with the SEC by FNB United may be obtained free of charge by directing such request to: Investor Relations, FNB United, P O Box 1328, Asheboro, N. C. 27204 or from FNB United’s Investor Relations page on its corporate web site atwww.MyYesBank.com, and the joint proxy statement/prospectus and the other documents filed with the SEC by Bank of Granite Corporation may be obtained free of charge by directing such request towww.bankofgranite.com.

FNB United, Bank of Granite Corporation and their respective directors, executive officers, and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in favor of the proposed transactions from the shareholders of FNB United and from the shareholders of Bank of Granite Corporation, respectively. Information about the directors and executive officers of FNB United and Bank of Granite Corporation, respectively, will be set forth in the joint proxy statement/prospectus on Form S-4. Additional information regarding participants in the proxy solicitation may be obtained by reading the joint proxy statement/prospectus regarding the proposed transaction when it becomes available.

| | |

CONTACT: | | Media Contacts: |

| | Mark Brock |

| | 704-926-1305 |

| | mbrock@wrayward.com |

| |

| | John Mader |

| | 704-926-1316 |

| | jmader@wrayward.com |

8

Key Points

| | • | | The company has secured capital commitments for the private placement of $310 million in common stock of FNB United Corp., contingent on receipt of regulatory and shareholder approvals and certain other conditions. A little more than half of the capital is coming from the Carlyle Group and Oak Hill Capital Partners, two major private equity firms with a history of successful investing in the financial services sector, with the remaining capital coming from a series of smaller investors. |

| | • | | These new funds will enable the company to meet the capital requirements set by the regulators. |

| | • | | The new capital will help us resolve our remaining credit issues, which have been steadily improving due to the incredible job by all employees on the front line and credit sides of our bank. |

| | • | | FNB United Corp. has reached an agreement to merge with Bank of Granite Corporation contingent on receipt of regulatory and shareholder approvals and the meeting of numerous other conditions. |

| | • | | The merger of these two 100+-year-old institutions will create a North Carolina community banking organization with approximately $2.8 billion in assets, $2.4 billion in deposits and 63 full-service banking offices. |

| | • | | The combined company will operate as FNB United Corp. with headquarters in Asheboro, NC. |

| | • | | The two bank subsidiaries will operate as separate entities until a future date, after which the merged entity will be named CommunityONE Bank, N.A. |

| | • | | CommunityONE Bank and SunTrust Bank have reached a settlement agreement on the obligation owed by CommunityONE to SunTrust. In addition, FNB United and the U.S. Treasury have reached an agreement for the exchange of FNB United preferred stock held by the U.S. Treasury for FNB United common stock. |

| | • | | FNB United stock continues to trade on The NASDAQ Capital Market under the symbol FNBN. Bank of Granite stock continues to trade on The NASDAQ Capital Market under the symbol GRAN until the closing of the merger. |

9

Employee Questions & Answers

What has to happen in order for the merger of FNB and Bank of Granite to move forward?

There are numerous events that must occur for this merger to be completed: Bank of Granite shareholders must approve the merger; FNB United shareholders must approve a number of matters related to the capital raise and merger; regulatory approvals need to be received; and numerous other customary conditions must be met.

What is the expected timing for the merger to be completed?

Due to the numerous approvals required for the merger, exact timing cannot be determined at this point. Our goal, however, is to merge the holding companies in October, followed by several months of work to integrate the two banks into one.

What will happen to the executive management of FNB and Bank of Granite?

In conjunction with the merger, a new management team led by Brian Simpson, CEO, and Robert Reid, President, will be put in place upon the closing of the recapitalization. Brian and Bob are both native North Carolinians with nearly 50 years of combined banking experience. Brian is a former senior executive at First Union Corporation, where he was responsible for capital markets activities and balance sheet management. Bob has held extensive leadership roles at Wachovia Corporation and its predecessor, First Union, in nearly all aspects of banking, including retail and commercial banking, real estate finance, capital management and wealth management.

Larry Campbell has decided to retire from the company. During the past two years, Larry has generously extended his banking career in order to lead CommunityONE through this transition. While we are thankful and appreciative for all of his hard work and efforts, we are pleased he will now be able to enjoy his retirement.

What will happen to the board of directors of FNB and Bank of Granite?

The new management team will be supported by a new board of directors that includes: Austin Adams (retired Chief Information Officer, JP Morgan Chase, BankOne and First Union); Jerry Licari (retired national banking practice leader, KPMG LLP); Chan Martin (retired treasurer and senior risk executive, Bank of America); Jerry Schmitt (former asset/liability committee chairman, First Union); John Bresnan, a Managing Director of The Carlyle Group in Charlotte, and Scott Kauffman, Principal, Oak Hill Capital

10

Partners. The new board will also include two current FNB United board members, H. Ray McKenney, Jr., President of MBM Auto Management, and R. Reynolds Neely. Jr., the Planning Director of the City of Asheboro, North Carolina Planning Department, and one current Bank of Granite board member, Boyd Wilson, Executive Vice President of Broyhill Investments, Inc, Lenoir, North Carolina.

What will happen with my job?

For the next several months, CommunityONE and Bank of Granite will continue to operate as separate businesses, with no planned changes in roles or operations. During this time we will be focused on integrating the two companies: technology, banking offices, products and services and, most importantly, our team of dedicated employees. We will use a carefully and thoughtfully prepared process to pull our companies together. As we work through this process, there will be several new career positions and routine openings available to employees of both banks. In the meantime, we need for everyone to continue to work hard and support our customers and communities with friendly, helpful service. Our commitment is to communicate with you as often and transparently as circumstances allow so you will be well informed.

What impact does the headquarters being in Asheboro have on Bank of Granite’s headquarters?

The operations center for the combined institution will be located in Asheboro, NC. That consolidation will have the greatest impact on both institutions. As previously stated, management will be focused for the next several months on determining the best operating structure for the new company. Employees from both banks will be notified of any changes to their position, and anyone who is adversely affected by the merger will have the opportunity to look at other openings in the company. We are also designing a severance package that must be approved by the regulators for those employees who are unable to find a position within the newly combined organization.

It looks like the proposed management team is from Charlotte. How long will the headquarters be in Asheboro? Will it eventually move to Charlotte?

There are no specific plans to move the headquarters at this time.

Will any offices be closing? Will there be any consolidation of offices?

While we are not prepared to communicate anything definitively at this time, we have performed a preliminary assessment of markets where offices overlap. During the next

11

several months, with input from both banks, we will determine the best course in those overlapping markets and promptly inform employees who may be impacted by any office consolidation. Later, at the appropriate time, we will communicate our plans to the rest of the employee base. Our commitment is to inform you as soon as possible when final decisions are made and to retain as many employees as is feasible from both companies.

Do I need to do anything differently now that this announcement has been made?

For now, there is nothing that you need to change about how you do your job, but you do need to be prepared to respond positively to customer inquiries. As you interact with customers, they will likely have questions about what impact this announcement will have on their bank accounts and employee’s jobs. Please refer to the Guide to Answering Customer Questions in your information packet to help you respond to these inquiries. The most important thing is for you to continue to do your job well and to serve your customers well.

While the joining of these two companies will bring enhanced opportunities for us to serve our customers, it is important that we maintain distinct and separate business operations until we receive shareholder and regulatory approval of our business plan and the merger. Certain activities, such as joint calling or sharing customer information between CommunityONE and Bank of Granite, are prohibited by law until the merger is approved and the transaction is closed.

Will my benefits change?

Existing benefit programs at each company will continue through 2011. We anticipate all employees will participate in a redesigned FNB United employee benefits plan in 2012. As a part of the merger integration process, we will review existing plans from both banks and select the one that works best for our new company. We will have one plan for all employees in 2012.

Do you have a question not addressed here? Employees will have the following opportunities to ask or submit their own questions:

| | • | | At the employee-only town hall meetings. |

| | • | | By using the Service Request feature located on the home page of Jack. Questions will be collected and posted to Jack periodically as part of an ongoing Q&A for the benefit of all employees. |

12

Guide to Answering Customer Questions

What is happening? What does this announcement mean?

FNB United Corp. has reached an agreement to acquire Bank of Granite Corporation and has secured capital commitments for the private placement of $310 million in the common stock of FNB United Corp., valued at $0.16 per share. The transaction is still subject to receipt of regulatory and shareholder approvals and certain other conditions. Once received, this capital will enable the combined banking company to meet regulatory capital requirements, work through our credit challenges and better position our company for stability and profitability.

By bringing together these two franchises, we are taking advantage of a unique opportunity to preserve, protect and enhance the 100+ year-old community banking heritage shared by CommunityONE and Bank of Granite. The combined company will continue to follow the proud tradition of community banking by providing deposit and lending services to consumers and small-to-medium-sized businesses. The focus of the company will be serving our local communities.

Will you still be my banker?

Yes. For the next several months, CommunityONE and Bank of Granite will continue to operate as separate companies with no planned changes in jobs or how we do business. Our focus is on continuing to provide the level of service you expect from us. Once the recapitalization is complete and the merger receives the necessary approvals, we will communicate any changes to our customers before they occur.

Will this office close?

For the next several months, CommunityONE and Bank of Granite will continue to operate as separate businesses and there will be no changes in our business operations. Once the merger receives regulatory and shareholder approvals, we will communicate any changes to our customers before they occur.

Will my account numbers change?

A small number of accounts may be assigned new numbers once our banking systems have been merged, but that event won’t occur for several months. Until you are notified, your account numbers will remain the same.

13

Will my checks, debit cards and/or credit cards still work?

Yes. You may continue using your current checks, debit cards and credit cards as you have in the past until further notice.

Can I still access my online banking and bill-pay accounts?

Yes. You may continue using your online banking and bill-pay accounts as you have in the past until further notice.

Is my money safe?

Yes. When the bank is recapitalized, the combined organization will be well capitalized. Additionally, customer deposits continue to be fully insured by the FDIC up to $250,000 per account. Also, the FDIC is fully insuring deposits held in non-interest bearing transaction accounts through December 31, 2012. We would be happy to review your accounts with you to make certain that your funds are properly insured.

Once the regulatory restrictions are lifted, will we be able to offer higher rates on interest bearing accounts?

Once our regulatory restrictions are lifted we will be able to price our deposits competitively in the market.

If a customer expresses concerns over having deposit accounts at both banks, who can help them determine if their balances exceed FDIC coverage?

Until the bank charters are merged, deposits at each bank will be separately and fully insured up to $250,000 for each account (with no limit on the deposit insurance on non-interest bearing transaction accounts through December 31, 2012). Once the bank merger is finalized, separate insurance will continue on accounts at each bank for six months, or for time deposits, the first time a time deposit comes up for renewal thereafter, giving time for customers to assess the insurance coverage on their accounts and make appropriate changes.

Special Note:All shareholder inquiries should be directed to Brooke Barlow in the Executive Department.

14

CommunityONE Town Hall Meetings

In order to avoid overcrowding and prolonged driving distances, employees from each office and department will be assigned to attend one of the six “after-hours” town hall meetings listed below. You will receive an invitation by e-mail later this week, which will include your meeting time and location and other pertinent details. Having six meetings also enables employees who have a conflict on their assigned date to attend a different meeting if so inclined.

| | |

Monday, August 8 | | Mooresville |

| |

Wednesday, August 10 | | Hickory |

| |

Thursday, August 11 | | Greensboro |

| |

Monday, August 15 | | Asheboro |

| |

Tuesday, August 16 | | Asheboro |

| |

Wednesday, August 17 | | Southern Pines |

15

How to Make a Service Request

One of the boxes on the left side of the home page is for“Service Requests”. This is the system employees should use to provide feedback to or make inquiries of bank management.

To provide feedback, click on the“Service Requests” link inside the box.

| | |

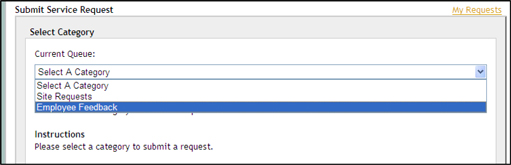

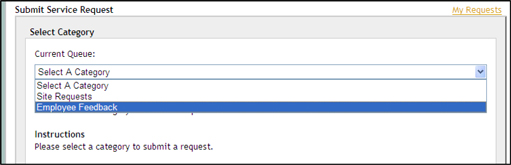

| | This will take you to the“Submit Service Request” page where you will select“Employee Feedback” from the“Select A Category” drop-down menu (see below). |

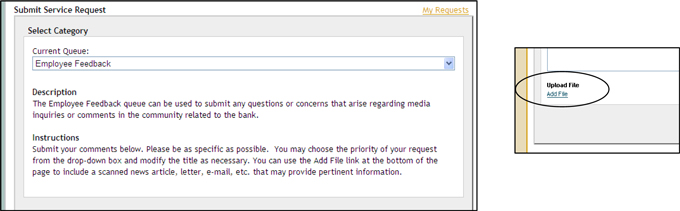

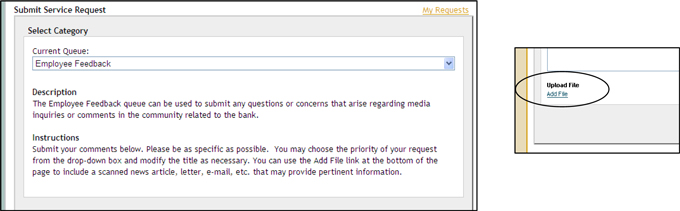

Once you are on the“Employee Feedback” page, you will see instructions on how to submit your request. We plan to respond to questions as soon as we are able to do so.

You can use the“Add File” link at the bottom of the page to include a scanned news article, letter, e-mail, etc. that may provide pertinent information.

16

Important Information for Investors and Shareholders

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The proposed transactions will be submitted to the stockholders of FNB United and Bank of Granite Corporation. FNB United and Bank of Granite Corporation will file a registration statement on Form S-4, a joint proxy statement/prospectus and other relevant documents concerning the proposed transaction with the SEC. FNB United and Bank of Granite Corporation will each provide the final joint proxy statement/prospectus to its respective stockholders. Investors and security holders are urged to read the registration statement and the joint proxy statement/prospectus and any other relevant documents filed with the SEC when they become available, as well as any amendments or supplements to those documents, because they will contain important information about FNB United, Bank of Granite Corporation and the proposed transaction. Investors and security holders will be able to obtain a free copy of the registration statement and joint proxy statement/prospectus, as well as other filings containing information about FNB United and Bank of Granite Corporation free of charge at the SEC’s web site athttp://www.sec.gov. In addition, the joint proxy statement/prospectus, and other documents filed with the SEC by FNB United may be obtained free of charge by directing such request to: Investor Relations, FNB United, P O Box 1328, Asheboro, N. C. 27204 or from FNB United’s Investor Relations page on its corporate web site atwww.MyYesBank.com, and the joint proxy statement/prospectus and the other documents filed with the SEC by Bank of Granite Corporation may be obtained free of charge by directing such request towww.bankofgranite.com.

FNB United, Bank of Granite Corporation and their respective directors, executive officers, and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in favor of the proposed transactions from the shareholders of FNB United and from the shareholders of Bank of Granite Corporation, respectively. Information about the directors and executive officers of FNB United and Bank of Granite Corporation, respectively, will be set forth in the joint proxy statement/prospectus on Form S-4. Additional information regarding participants in the proxy solicitation may be obtained by reading the joint proxy statement/prospectus regarding the proposed transaction when it becomes available.

17