Filed by FNB United Corp.

Pursuant to Rule 425 under the

Securities Act of 1933

And deemed filed pursuant to

Rule 14a-12 under the

Securities Exchange Act of 1934

Registration Statement No.: 333-176357

Subject Company: FNB United Corp.

Commission File No.: 000-13823

FNB United Corp. – Employee Q&A

Below is the employee information package distributed by

FNB United Corp. to its employees regarding the proposed acquisition of

Bank of Granite Corporation by FNB United Corp.

1

Employee Information Packet

September 22, 2011

2

What’s Inside

Memo to Employees | 4 | |||

Key Points | 5 | |||

Guide to Answering Customer Questions | 6 | |||

Information About Shareholder Meetings and Proxy Mailing | 8 | |||

Employee Feedback Instructions | 11 | |||

3

| Date: | September 22, 2011 |

| To: | CommunityONE Employees |

| From: | Larry Campbell, Bob Reid and Brian Simpson |

| Re: | Company Update |

As we shared with you at the recent town hall meetings, work is underway to obtain regulatory and shareholder approval of the proposed recapitalization of FNB United and the merger with Bank of Granite Corporation. Most notably, the OCC and the Federal Reserve Board of Governors must approve the capital plan and merger in order for it to proceed. Late last week, the Joint Proxy and Prospectus was filed with the Securities and Exchange Commission. Shareholders will be receiving copies later this week, and the stockholders of Bank of Granite Corporation must approve the merger and the shareholders of FNB United Corp. must approve a number of matters related to the capital raise and the merger. These are the areas we are currently focusing on. A special thank you goes to the Finance and Credit Teams at both organizations for their hard work on this phase of the transaction.

Attached are Key Points, an updated Guide to Answering Customer Questions and information about Shareholder Meetings and the Proxy Mailing.

Many of you have asked “what should we be doing now?”

| • | Be vocal and honest about what is working well and what needs improvement. |

| • | Be visible in the community and fully engaged with customers. |

| • | Connect with your peers and support each other. |

Please submit feedback by using the Service Requests feature located on the home page of Jack or by sending an e-mail to the new merger mailbox atMerger@MyYesBank.com. We look forward to getting to know you better and working with you in the coming months. Thank you for taking care of each other and our customers.

4

Key Points

| • | The company has secured capital commitments for the private placement of $310 million in common stock of FNB United Corp., contingent on receipt of regulatory and shareholder approvals and certain other conditions. A little more than half of the capital is coming from the Carlyle Group and Oak Hill Capital Partners, two major private equity firms with a history of successful investing in the financial services sector, with the remaining capital coming from a series of smaller investors. |

| • | These new funds will enable FNB United Corp., CommunityONE and Bank of Granite to meet the capital requirements set by the regulators. |

| • | The new capital will help us resolve our remaining credit issues, which have been steadily improving due to the incredible job by all employees on the front line and credit sides of our bank. |

| • | FNB United Corp. has reached an agreement to merge with Bank of Granite Corporation contingent on receipt of regulatory and shareholder approvals and the meeting of numerous other conditions. |

| • | Shareholder Meeting Dates: |

| • | Bank of Granite, Tuesday, October 18, 9:30 a.m., Crown Plaza, Hickory, NC |

| • | FNB United Corp., parent company of CommunityONE Bank, Wednesday, October 19, 9:30 a.m., Pinewood Country Club, Asheboro, NC |

| • | The merger of these two 100+-year-old institutions will create a North Carolina community banking organization with approximately $2.8 billion in assets, $2.4 billion in deposits and 63 full-service banking offices. |

| • | The combined company will operate as FNB United Corp. with headquarters in Asheboro, NC. |

| • | The two bank subsidiaries will operate as separate entities until a future date, after which the merged entity will be named CommunityONE Bank, N.A. |

| • | CommunityONE Bank and SunTrust Bank have reached a settlement agreement on the obligation owed by CommunityONE to SunTrust. In addition, FNB United and the U.S. Treasury have reached an agreement for the exchange of FNB United preferred stock held by the U.S. Treasury for FNB United common stock. |

| • | FNB United stock continues to trade on The NASDAQ Capital Market under the symbol FNBN. Bank of Granite stock continues to trade on The NASDAQ Capital Market under the symbol GRAN until the closing of the merger. |

5

Guide to Answering Customer Questions

What is happening?

FNB United Corp. has reached an agreement to acquire Bank of Granite Corporation and has secured capital commitments for the private placement of $310 million in the common stock of FNB United Corp., valued at $0.16 per share. The transaction is still subject to receipt of regulatory and shareholder approvals and certain other conditions. Once received, this capital will enable the combined banking company to meet regulatory capital requirements, work through our credit challenges and better position our company for stability and profitability.

By bringing together these two franchises, we are taking advantage of a unique opportunity to preserve, protect and enhance the 100+ year-old community banking heritage shared by CommunityONE and Bank of Granite. The combined company will continue to follow the proud tradition of community banking by providing deposit and lending services to consumers and small-to-medium-sized businesses. The focus of the company will be serving our local communities.

Will you still be my banker?

Yes. For the next several months, CommunityONE and Bank of Granite will continue to operate as separate companies with no planned changes in jobs or how we do business. Our focus is on continuing to provide the level of service you expect from us. Once the recapitalization is complete and the merger receives the necessary approvals, we will communicate any changes to our customers before they occur.

Will this office close?

For the next several months, CommunityONE and Bank of Granite will continue to operate as separate businesses and there will be no changes in our business operations. Once the merger receives regulatory and shareholder approvals, we will communicate any changes to our customers before they occur.

Will my account numbers change?

A small number of accounts may be assigned new numbers once our banking systems have been merged, but that event won’t occur for several months. Until you are notified, your account numbers will remain the same.

Will my checks, debit cards and/or credit cards still work?

Yes. You may continue using your current checks, debit cards and credit cards as you have in the past until further notice.

Can I still access my online banking and bill-pay accounts?

Yes. You may continue using your online banking and bill-pay accounts as you have in the past until further notice.

6

Is my money safe?

Yes. When the bank is recapitalized, the combined organization will be well capitalized. Additionally, customer deposits continue to be fully insured by the FDIC up to $250,000 per account. Also, the FDIC is fully insuring deposits held in non-interest bearing transaction accounts through December 31, 2012. We would be happy to review your accounts with you to make certain that your funds are properly insured.

Once the regulatory restrictions are lifted, will we be able to offer higher rates on interest bearing accounts?

Once our regulatory restrictions are lifted we will be able to price our deposits competitively in the market.

If a customer expresses concerns over having deposit accounts at both banks, who can help them determine if their balances exceed FDIC coverage?

Until the bank charters are merged, deposits at each bank will be separately and fully insured up to $250,000 for each account (with no limit on the deposit insurance on non-interest bearing transaction accounts through December 31, 2012). Once the bank merger is finalized, separate insurance will continue on accounts at each bank for six months, or for time deposits, the first time a time deposit comes up for renewal thereafter, giving time for customers to assess the insurance coverage on their accounts and make appropriate changes.

Who must approve the transactions?

Shareholders of both FNB and Bank of Granite must approve the transaction and each will be receiving a package of proxy materials between September 22 and 28.

The Board of Governors of the Federal Reserve System (the “Federal Reserve”) must approve the Merger under the provisions of the Bank Holding Company Act of 1956, as amended, relating to the acquisition of a bank holding company by another bank holding company, and the applicable waiting period must expire before it can be completed. In addition, the exchange of the FNB United preferred stock held by the United States Department of the Treasury for the issuance of FNB United common stock to the United States Department of the Treasury requires Federal Reserve approval.

The Office of the Comptroller of the Currency (the “OCC”) must approve CommunityONE’s capital restoration plan and business plan, and provide non-objection to the new directors and senior executive officers. The OCC must also approve CommunityONE’s settlement of its subordinated debt held by SunTrust and the redemption of its preferred stock held by SunTrust.

The applications and approval requests to the Federal Reserve Bank and the OCC have been filed and are pending.

7

Information about Shareholder Meetings and Proxy Mailing

Why should the shareholders of both companies vote “FOR” the merger and recapitalization?

Both CommunityONE and Bank of Granite have been in existence for over 100 years. They have maintained strong ties to the communities they serve. In recent years, these communities have experienced serious economic troubles.

The proposed transactions would enable both of these banks to resolve their current problems and begin rebuilding a sustainable banking business. The proposed merger and recapitalization offer a real chance for two North Carolina-based banks to regain their footing and rebuild themselves to meet the needs of their respective communities and contribute to the growth of the North Carolina economy.

What will stockholders receive in the merger?

In the proposed merger, holders of Granite common stock will have the right to receive 3.375 shares of FNB United common stock for each share of Granite common stock.

FNB United shareholders will continue to own their existing shares of FNB United common stock after the merger and the recapitalization.

No earlier than January 1, 2012, FNB United currently intends to distribute, after the closing date of the merger and recapitalization, to each holder of record of FNB United common stock as of the close of business on the business day immediately preceding the closing date of the merger, non-transferable warrants to purchase from FNB United one share of common stock for each four shares of FNB United common stock held by such holder at a purchase price of $0.16 per share.

Why did I receive such a large proxy document?

The material contained in the document is required by federal securities law.

Would you please recycle the book once you vote your proxy? If you would like you can drop the book at your local branch and we will recycle it for you.

Donnelley, our printer for the proxy solicitation, is part of the Forest Certification Program.

What are the record and shareholder meeting dates?

Bank of Granite Corporation:

Record Date: August 19, 2011

Shareholder Meeting Date: Tuesday, October 18, 9:30 a.m.

Crown Plaza, Hickory NC

8

FNB United Corporation:

Record Date: August 19, 2011

Shareholder Meeting Date: Wednesday, October 19, 9:30 a.m.

Pinewood Country Club, Asheboro NC

Where can I find a copy of the Proxy Materials?

Refer FNB United Corp. shareholders tohttp://www.cfpproxy.com/5513

Refer Bank of Granite Corporation stockholders tohttp://www.cfpproxy.com/3843

We encourage the use of the electronic copies of the materials. If paper copies are requested, please contact the following:

FNB United Corp.

Brooke Barlow atBrooke.Barlow@MyYesBank.com

Bank of Granite Corporation

Kathy Starnes atkstarnes@bankofgranite.com

How do I vote?

Shareholders’ should refer to their proxy cards for instructions on voting. This will include information about voting using a toll-free number, visiting a website to submit their proxy or completing, signing, dating and returning their proxy card in the enclosed postage-paid envelope.

Because there are different proxy cards for registered shareholders, 401-K plan participants and shares held in “street name” through a broker, bank or nominee, please encourage voters not to deviate from these instructions. We will not be collecting proxy cards in the branches.

If my customer is a shareholder and has a question about the transaction where can they get their questions answered?

You may direct shareholder questions to Phoenix Advisory Partners, FNB United’s and Bank of Granite’s proxy solicitor, at 1-866-304-2061.

Do I bring my stock certificate to you now?

Please do not send your stock certificate with your proxy cards or bring them to your local branch.

Bank of Granite stockholders will receive written instructions from Registrar and Transfer Company on how to exchange their stock certificates. FNB United shareholders will not be required to exchange stock certificates or take any related action.

9

May I purchase FNB United stock at a purchase price of $0.16 per share as part of the recapitalization?

The stock is being issued as part of a private placement of capital to accredited investors. The stock is fully subscribed and therefore not eligible for purchase.

10

How to Make a Service Request

One of the boxes on the left side of the home page is for“Service Requests”. This is the system employees should use to provide feedback to or make inquiries of bank management.

To provide feedback, click on the“Service Requests” link inside the box.

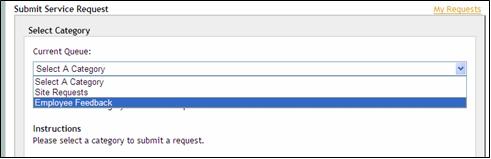

| This will take you to the“Submit Service Request” page where you will select“Employee Feedback” from the“Select A Category” drop-down menu (see below). |

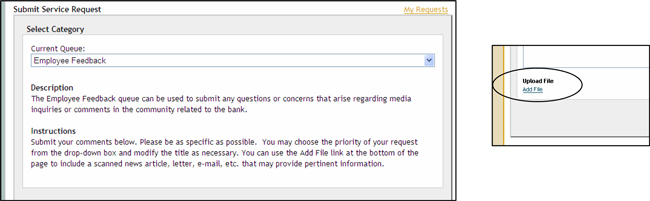

Once you are on the“Employee Feedback” page, you will see instructions on how to submit your request. We plan to respond to questions as soon as we are able to do so.

You can use the“Add File” link at the bottom of the page to include a scanned news article, letter, e-mail, etc. that may provide pertinent information.

11

Cautionary Statement Concerning Forward-Looking Statements

The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs and products, relationships, opportunities, technology and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ from those contemplated by such forward-looking statements include, but are not limited to, the following: the ability to obtain the requisite FNB United and Granite shareholder approvals; the risk that FNB United or Granite may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger or result in the imposition of conditions that could cause the parties to abandon the merger; the inability to realize expected cost savings and synergies from the merger of Granite with FNB United in the amounts or in the timeframe anticipated; costs or difficulties relating to integration matters might be greater than expected; material adverse changes in FNB United or Granite’s operations or earnings; the inability to retain Granite’s customers and employees; or a decline in the economy in FNB United’s primary market areas, mainly in North Carolina, as well as the risk factors set forth in FNB United’s Registration Statement on Form S-4, as amended, as filed with the Securities and Exchange Commission (the “SEC”). Each forward-looking statement speaks only as of the date of the particular statement and FNB United does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

FNB United has filed with the SEC a Registration Statement on Form S-4, including a joint proxy statement/prospectus, in connection with the proposed merger, recapitalization and related matters. The joint proxy statement/prospectus, which has been sent or given to the shareholders of FNB United and Granite, contains important information. Before making any voting decision, FNB United’s and Granite’s shareholders are urged to read the joint proxy statement/prospectus carefully and in its entirety because it contains important information about the proposed merger, recapitalization and related matters. The joint proxy statement/prospectus and other relevant materials, and any other documents filed by FNB United or Granite with the SEC, may be obtained free of charge at the SEC’s website atwww.sec.gov. In addition, security holders will be able to obtain free copies of the joint proxy statement/prospectus by contacting Phoenix Advisory Partners, FNB United’s and Granite’s proxy solicitor, at 110 Wall Street, 27th Floor, New York, NY 10005; telephone number (866) 304-2061 (for stockholders) or (212) 493-3910 (for banks and brokers).

12