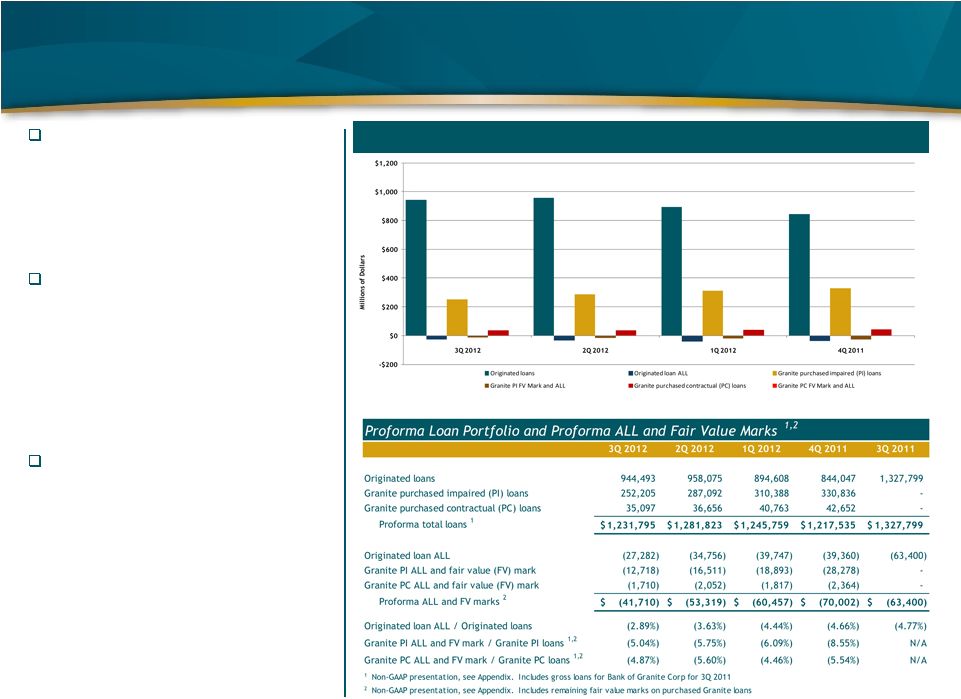

18 Non-GAAP Measures Reconciles non-GAAP measures to the most directly comparable GAAP measure Reconciliation of Non-GAAP Measures Dollars in thousands 3Q 2012 2Q 2012 3Q 2011 Total shareholders' equity 106,873 $ 108,002 $ (129,932) $ Less: Goodwill (4,205) (4,205) - Core deposit and other intangibles (7,369) (7,473) (3,577) Tangible shareholders' equity 95,299 $ 96,324 $ (133,509) $ 3Q 2012 2Q 2012 1Q 2012 4Q 2011 3Q 2011 Originated loan ALL (27,282) $ (34,756) $ (39,747) $ (39,360) $ (44,121) $ Purchased contractual (PC) loan ALL (281) (459) (48) - - Purchased impaired (PI) loan ALL (3,296) (3,336) - - - Total allowance for loan losses (30,859) (38,551) (39,795) (39,360) (44,121) Plus: Pre purchase Bank of Granite Corp ALL - - - - (19,279) Fair value (FV) mark on PC loans (1,429) (1,593) (1,769) (2,364) - Fair value (FV) mark on PI loans (9,422) (13,175) (18,893) (28,278) - Proforma total ALL and FV mark (41,710) $ (53,319) $ (60,457) $ (70,002) $ (63,400) $ 3Q 2012 2Q 2012 1Q 2012 4Q 2011 3Q 2011 Pass rated loans 979,993 $ 998,025 $ 931,211 $ 910,650 $ 952,668 $ Special mention rated loans 81,616 91,655 106,687 130,677 165,554 Classified loans 170,186 192,143 207,861 176,208 209,577 Total loans 1,231,795 1,281,823 1,245,759 1,217,535 890,888 Plus: Pre purchase BOG Corp pass rated loans - - - - 274,465 Pre purchase BOG Corp special mention loans - - - - 79,961 Pre purchase BOG Corp classified loans - - - - 82,485 Proforma total loans 1,231,795 $ 1,281,823 $ 1,245,759 $ 1,217,535 $ 1,327,799 $ 3Q 2012 2Q 2012 1Q 2012 4Q 2011 3Q 2011 Nonperforming Loans 86,143 $ 95,537 $ 105,341 $ 105,973 $ 145,344 $ OREO and Foreclosed Assets 80,800 86,400 104,379 110,386 96,275 Total nonperforming assets 166,943 181,937 209,720 216,359 241,619 Plus: Pre purchase BOG Corp Nonperforming Loans - - - - 32,224 Pre purchase BOG Corp OREO - - - - 23,836 Proforma nonperforming assets 166,943 $ 181,937 $ 209,720 $ 216,359 $ 297,679 $ |