UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant¨ Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Fountain Powerboat Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

FOUNTAIN POWERBOAT INDUSTRIES, INC.

Post Office Drawer 457

1653 Whichard’s Beach Road

Washington, North Carolina 27889

NOTICEOF ANNUAL MEETINGOF SHAREHOLDERS

The Annual Meeting of Shareholders of Fountain Powerboat Industries, Inc. will be held at our headquarters located at 1653 Whichard’s Beach Road, Washington, North Carolina, at 10:00 a.m. on Tuesday, November 9, 2004. The purposes of the meeting are:

| 1. | Election of Directors. To elect eight directors for one-year terms; |

| 2. | Amendment of 1995 Stock Option Plan.To consider a proposal to amend our 1995 Stock Option Plan. |

| 3. | Ratification of Appointment of Independent Accountants.To consider a proposal to ratify the appointment of Dixon Hughes PLLC as our independent public accountants for Fiscal 2005; |

| 4. | Other Business. To transact any other business properly presented for action at the Annual Meeting. |

You are invited to attend the Annual Meeting in person. However, even if you plan to attend, we ask that you complete, sign and date the enclosed appointment of proxy and return it to us as soon as you can in the accompanying envelope. Doing that will help us ensure that your shares are represented and that a quorum is present at the Annual Meeting. Even if you sign an appointment of proxy, you may still revoke it later or attend the Annual Meeting and vote in person.

This notice and the enclosed Proxy Statement and form of appointment of proxy are being mailed to our shareholders on or about October 15, 2004.

|

| By Order of the Board of Directors |

|

|

| Carol J. Price |

| Secretary |

FOUNTAIN POWERBOAT INDUSTRIES, INC.

Post Office Drawer 457

1653 Whichard’s Beach Road

Washington, North Carolina 27889

PROXY STATEMENT

ANNUAL MEETINGOF SHAREHOLDERS

General

This Proxy Statement is dated October 15, 2004, and is being furnished to our shareholders in connection with our solicitation of appointments of proxy in the enclosed form for use at the Annual Meeting of our shareholders and at any adjournments of the meeting. The Annual Meeting will be held at 10:00 a.m. on Tuesday November 9, 2004, at our headquarters located at 1653 Whichard’s Beach Road, Washington, North Carolina.

In this Proxy Statement, the terms “you,” “your” and similar terms refer to the shareholder receiving it. The terms “we,” “us,” “our” and similar terms refer to Fountain Powerboat Industries, Inc. The term “Fountain” refers to our wholly-owned operating subsidiary, Fountain Powerboats, Inc.

Solicitation and Voting of Proxies

A form of “appointment of proxy” is included with this Proxy Statement which names two of our officers, Carol J. Price and Irving L. Smith, to act as your “Proxies” and vote your shares at the Annual Meeting. So that your shares will be represented at the Annual Meeting, we ask that you sign and date an appointment of proxy and return it to us in the enclosed envelope.

If you sign an appointment of proxy and return it to us before the Annual Meeting, then shares of our common stock you hold of record will be voted by the Proxies according to your instructions. If you sign and return an appointment of proxy but do not give any voting instructions, then your shares will be voted by the Proxies“FOR” the election of each of the eight nominees for director named in Proposal 1 below, and“FOR”Proposals 2 and 3. If, before the Annual Meeting, any nominee named in Proposal 1 has become unavailable or unwilling to serve as a director for any reason, the Proxies will have the discretion to vote for a substitute nominee named by our Board of Directors. We are not aware of any other business that will be brought before the Annual Meeting but, if any other matter is properly presented for action by our shareholders, the Proxies will be authorized to vote your shares according to their best judgment. The Proxies also will be authorized to vote your shares according to their best judgment on matters incident to the conduct of the Annual Meeting, including adjournments.

Revocation of Appointment of Proxy

If you sign and return an appointment of proxy you can revoke it at any time before the voting takes place at the Annual Meeting either by filing with our Secretary a written instrument revoking it or an executed appointment of proxy dated as of a later date, or by attending the Annual Meeting and announcing your intention to vote in person.

Expenses and Method of Solicitation

We will pay all costs of soliciting appointments of proxy for the Annual Meeting, including costs of preparing and mailing this Proxy Statement. In addition to solicitation by mail, our directors, officers and employees may solicit appointments of proxy, personally or by telephone, without additional compensation.

Record Date

The close of business on October 1, 2004, is the “Record Date” for determining which shareholders are entitled to receive notice of and to vote at the Annual Meeting. You must have been a record holder of our common stock on the Record Date in order to be eligible to vote at the Annual Meeting.

Voting Securities

Our voting securities are the 4,814,275 shares of our common stock which were outstanding on the Record Date. Fountain holds 15,000 of those shares which are treated as treasury shares and may not be voted at the Annual Meeting. You may cast one vote for each share of our common stock you held of record on the Record Date on each director to be elected and on each other matter voted on by shareholders at the Annual Meeting.

Voting Procedures; Votes Required for Approval

Our directors are elected by a plurality of the votes cast in elections. So, in the election of directors, the eight nominees receiving the highest numbers of votes will be elected. You may not vote cumulatively in the election of directors. For each of Proposal 2 and 3 to be approved, the votes cast in favor of the proposal must exceed the votes cast against it. Abstentions and broker non-votes will have no effect in the election of directors or in the voting on Proposals 2 and 3.

Beneficial Ownership of Securities

Principal Shareholders. The following table describes the beneficial ownership of our common stock on the Record Date by persons believed by us to own, beneficially or of record, 5% or more of our common stock.

| | | | | | |

Name and address of beneficial owner

| | Amount and nature of beneficial ownership

| | | Percentage of class (1)

| |

Reginald M. Fountain, Jr. Post Office Drawer 457 Washington, North Carolina 27889 | | 2,700,472 | (2) | | 51.44 | % |

| | |

Triglova Finanz, A.G. Edificio Torre Swiss Bank Piso 16, Apartado Postal 1824 Panama 1, Republica de Panama | | 314,250 | (3) | | 6.55 | % |

| (1) | Percentages are calculated based on 4,814,275 total outstanding shares, minus 15,000 shares held by Fountain, plus, in the case of Mr. Fountain, the number of additional shares that he could purchase upon the exercise of stock options. |

| (2) | Includes 450,000 shares which could be purchased by Mr. Fountain from us upon the exercise of stock options and as to which shares he may be considered to have sole investment power only. Also includes 10,000 shares held by a family member and as to which Mr. Fountain disclaims beneficial ownership. |

| (3) | Based solely on information contained in the shareholder’s most recent filing with the Securities and Exchange Commission (which was made during January 1997), as adjusted for the effect of the three-for-two split in our common stock which we effected during 1997. |

2

Management Ownership. The following table describes the beneficial ownership of our common stock on the Record Date by our current directors, nominees for election as directors, and certain executive officers, individually, and by all our current directors and executive officers as a group:

| | | | | | |

Name of beneficial owner

| | Amount and nature of beneficial ownership (1)

| | | Percentage of class (2)

| |

Reginald M. Fountain, Jr. | | 2,700,472 | (3) | | 51.44 | % |

A. Myles Cartrette | | 26,800 | | | * | |

George L. Deichmann III | | 24,100 | | | * | |

Guy L. Hecker, Jr. | | -0- | | | — | |

David C. Miller | | 1,000 | | | * | |

Irving L. Smith | | 10,600 | | | * | |

Mark L. Spencer | | 33,525 | | | * | |

Robert L. Stallings III | | -0- | | | — | |

David L. Woods. | | 52,500 | | | 1.09 | % |

All current directors and executive officers as a group (10 persons) | | 2,848,997 | | | 53.97 | % |

| (1) | Except as otherwise noted, and to the best of our knowledge, the individuals named and included in the group exercise sole voting and investment power with respect to all shares. The listed shares include the following numbers of shares with respect to which the individuals named and included in the group have shared voting and investment power: Mr. Miller - 1,000 shares; Mr. Smith – 10,600 shares; and all persons included in the group – 11,600 shares. The listed shares include the following numbers of shares that could be acquired by the individuals named and included in the group pursuant to currently exercisable stock options and with respect to which shares those persons may be considered to have sole (or shared) investment power only: Mr. Fountain - 450,000 shares; Mr. Spencer - 30,000 shares; all persons included in the group - 480,000 shares. |

| (2) | Percentages are calculated based on 4,814,275 total outstanding shares, minus 15,000 shares held by Fountain, plus, in the case of each individual and the group, the number of additional shares (if any) that could be purchased by that individual or by persons included in the group upon the exercise of stock options. An asterisk indicates less than 1.0%. |

| (3) | Includes 10,000 shares held by a family member and as to which Mr. Fountain disclaims beneficial ownership. |

Certain Arrangements Relating to Our Common Stock.During Fiscal 2004, Fountain entered into an $18 million secured, long-term financing arrangement to refinance existing long-term debt, pay current liabilities, and provide additional operating funds. Fountain’s obligations under that credit facility are secured by certain assets of Fountain, as well as certain assets owned by Reginald M. Fountain, Jr. Those obligations also are guaranteed by Mr. Fountain, individually, and by Brunswick Corporation (“Brunswick”) which, through one of its divisions, supplies marine engines used in Fountain’s products.

In connection with the loan transaction, and in consideration for Brunswick’s agreement to guarantee Fountain’s obligations, Mr. Fountain gave Brunswick the right to purchase (the “Purchase Right”) any or all shares of our common stock held by him (generally at a price to be determined at the time of exercise), as well as all options held by Mr. Fountain to purchase shares of our common stock. (See “Proposal 2: Amendment of 1995 Stock Option Plan.”) Brunswick’s Purchase Right becomes exercisable on the earlier of July 1, 2007, or the date on which Fountain’s obligations under the above loan transaction have been paid in full. Mr. Fountain also pledged to Brunswick the shares of our common stock that he owns as collateral for his personal obligation to indemnify Brunswick for amounts in excess of $14.7 million that Brunswick may become obligated to pay to Fountain’s lender. Finally, we gave Brunswick an option to purchase, directly from us, and at any time while its Purchase Right remains in effect, a number of newly issued shares of our common stock which, when combined with Mr. Fountain’s shares, would give Brunswick 50.1% of our outstanding common stock. In the future, those arrangements could result in a change in control of our company.

3

Section 16(a) Beneficial Ownership Reporting Compliance

Our directors and executive officers are required by federal law to file reports with the Securities and Exchange Commission regarding the amount of and changes in their beneficial ownership of our common stock. Based on our review of copies of those reports, our Proxy Statements are required to disclose failures to report shares beneficially owned or changes in beneficial ownership, and failures to timely file required reports, during previous years. It has come to our attention that, during Fiscal 2004, a trust in which our director, A. Myles Cartrette, serves as trustee made one purchase of our shares for which the required report was not filed. That transaction has now been reported.

PROPOSAL 1: ELECTIONOF DIRECTORS

Our Bylaws provide that our Board of Directors will consist of not less than three nor more than 25 members and authorize the Board to set and change the number of directors from time to time within those limits. Our directors are elected each year at the Annual Meeting for terms of one year or until their respective successors have been elected and have qualified. The number of our directors currently is set at eight, and our current directors named below have been nominated by our Board of Directors for reelection at the Annual Meeting.

| | | | | | |

Name and age (1)

| | Position(s) with us and Fountain

| | First elected (2)

| | Principal occupation and business experience for past five years

|

Reginald M. Fountain, Jr. (64) | | Chairman, President and Chief Executive Officer | | 1979 | | Our chief executive officer |

| | | |

A. Myles Cartrette * (48) | | Director | | 2002 | | Owner of Cartrette, LLC (land development and residential construction), Greenville, NC |

| | | |

George L. Deichmann III * (60) | | Director | | 1998 | | Owner and President of Trent Olds-Cadillac-Buick-Pontiac-GMC Trucks, Inc. (auto dealership), New Bern, NC |

| | | |

Guy L. Hecker, Jr. * (3) (72) | | Director | | 2000 | | President, Stafford, Burke & Hecker, Inc. (high technology consultants), Alexandria, VA |

| | | |

David C. Miller * (53) | | Director | | 2002 | | Owner of David C. Miller, CPA/ABV (certified public accountant and business valuation practice), Greenville, NC |

| | | |

Mark L. Spencer * (48) | | Director | | 1992 | | Owner of Spencer Communications (advertising and public relations firm), Montrose, CA |

| | | |

Robert L. Stallings III * (57) | | Director | | 2003 | | Owner and President of Eastern Aviation Fuels, Inc. (aviation fuel sales), New Bern, NC |

| | | |

David L. Woods (46) | | Director | | 2001 | | Co-owner and manager, Woods & McCauley, LLC, d/b/a Pier 57 Boat Sales and Service (boat sales and service), Counce, TN |

| (1) | Asterisks denote individuals who we believe are “independent directors” as that term is defined by the listing standards of The Nasdaq Stock Market. |

| (2) | The term “First elected” refers to the calendar year in which each individual first became our director or, in Mr. Fountain’s case, when he first became a director of Fountain prior to our organization. |

| (3) | Mr. Hecker also serves as a director of 8x8, Inc., a public company headquartered in Santa Clara, CA, which develops, manufactures and markets telecommunications equipment. |

Our Board of Directors recommends that you vote “FOR” the eight nominees named above. In the election of directors, the eight nominees receiving the highest numbers of votes will be elected.

4

Director Compensation

Our directors currently do not receive any fees or other compensation for their services as directors, but they are reimbursed for travel and other out-of-pocket expenses in connection with their attendance at meetings of our and Fountain’s Boards of Directors.

Attendance by Directors at Meetings

Board of Directors Meetings.Our Board of Directors met four times during Fiscal 2004. Each director attended 75% or more of the aggregate number of meetings of the Board of Directors and any committees on which he served.

Annual Meetings.Attendance by our directors at Annual Meetings gives directors an opportunity to meet, talk with and hear the concerns of shareholders who attend those meetings, and it gives those shareholders access to our directors that they may not have at any other time during the year. Our Board of Directors recognizes that directors have their own business interests and are not our full-time employees and that it is not always possible for them to attend Annual Meetings. However, our Board’s policy is that attendance by directors at our Annual Meetings is beneficial to us and to our shareholders and that our directors are strongly encouraged to attend each Annual Meeting whenever possible. Four of our seven directors then in office attended our last Annual Meeting held during November 2003.

Committees

As further described below, our Board of Directors has appointed several standing committees, including an Audit Committee and a Corporate Governance Committee that performs the functions of both a nominations committee and a compensation committee.

Audit Committee

Function.The Audit Committee acts under a written charter that was revised and reapproved by our Board of Directors during 2004. Under its revised charter, the Committee, among other things, appoints our independent accountants each year and approves the compensation and terms of engagement of our accountants, approves services proposed to be provided by the independent accountants, and monitors and oversees the quality and integrity of our accounting process and systems of internal controls. The Committee reviews various reports by our independent accountants, including its annual report on our audited consolidated financial statements, and it oversees our internal audit program. A copy of the Audit Committee’s revised charter is attached as an Appendix to this Proxy Statement. The Committee met twice during Fiscal 2004.

Members.Current members of the Audit Committee are David C. Miller - Chairman, George L. Deichmann III and Guy L. Hecker, Jr. We believe that each member of the Committee is “independent” as that term is defined by the current listing standards of The Nasdaq Stock Market.

Our Audit Committee Chairman, David C. Miller, is a certified public accountant with a total of 23 years of experience in public accounting. Our Board of Directors has determined that Mr. Miller is an “audit committee financial expert” as that term is defined by rules of the Securities and Exchange Commission.

Audit Committee Report. Our management is responsible for our financial reporting process, including our system of internal controls and disclosure controls and procedures, and for the preparation of our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America. Our independent accountants are responsible for auditing those financial statements. The Audit Committee oversees and reviews those processes. In connection with the preparation and audit of our consolidated financial statements for Fiscal 2004, the Audit Committee has:

| • | reviewed our audited consolidated financial statements and discussed them with our management; |

5

| • | discussed with our independent accountants the matters required to be discussed by Statement on Auditing Standards No. 61, as amended; |

| • | received written disclosures and a letter from our independent accountants required by Independence Standards Board Standard No. 1; and |

| • | discussed the independence of our accountants with the accountants. |

Based on that review and discussion, the Audit Committee recommended to our Board of Directors that our audited consolidated financial statements be included in our 2004 Annual Report on Form 10-K as filed with the Securities and Exchange Commission.

The Audit Committee:

| | | | |

| David C. Miller | | Guy L. Hecker, Jr. | | George L. Deichmann III |

Corporate Governance Committee

During April 2004, our Board of Directors appointed a new Corporate Governance Committee which will operate under a written charter approved by the Board and perform the function of both a nominations committee and a compensation committee.

Members.Members of the committee are David C. Miller - Chairman, Robert L. Stallings III and A. Myles Cartrette, each of whom we believe is an “independent director” as that term is defined by the current listing standards of The Nasdaq Stock Market. A copy of the Committee’s charter is available to our shareholders on our Internet website atwww.fountainpowerboats.com.

Nominations Committee Functions.Our Board of Directors previously did not have a standing nominations committee or any committee serving a similar purpose. In the future, and among other duties and responsibilities assigned to it from time to time, the Corporate Governance Committee will function as a nominations committee by identifying individuals who are qualified to become directors and recommending candidates to the Board for selection as nominees for election as directors at our Annual Meetings and for appointment to fill vacancies on the Board. After receipt of the Committee’s recommendations, the Board will make all final decisions regarding the selection of nominees. Since the Committee was not appointed until late in Fiscal 2004, it did not meet or take any action during the year in its capacity as a nominations committee.

The Committee’s Charter provides that the Committee will consider recommendations of candidates submitted in writing by shareholders and that, in identifying candidates to be recommended to the Board of Directors, the Committee will seek to identify and recommend individuals who have high personal and professional integrity, who demonstrate exceptional ability and judgment, and who, with other members of the Board, will be effective in collectively serving the long-term interests of our shareholders. We intend for the Committee to develop procedures to be followed by shareholders who wish to recommend candidates to the Committee (including deadlines for submitting recommendations and information regarding candidates that shareholders should provide with their recommendations). The Committee also may develop other criteria or minimum qualifications for use in identifying candidates, but it has not yet done so.

Compensation Committee Functions.We are a separate company from Fountain, but Fountain is our wholly-owned subsidiary and the Boards of Directors of the two companies are the same. Our executive officers are compensated by Fountain for their services as officers of that company and, with the exception of stock options, they receive no separate or additional compensation from us. In the past, Fountain’s full Board of

6

Directors considered and took action on matters pertaining to the compensation of executive officers, and neither we nor Fountain had a standing compensation committee. In the future, and among other duties and responsibilities assigned to it from time to time, the Corporate Governance Committee will operate as a compensation committee of the Boards of Directors. In that capacity, it will make recommendations to the Boards regarding the amounts of cash and other compensation paid or provided to our executive officers, the adoption of incentive or other compensation plans, and other compensation and employee benefit matters. After receipt of the Committee’s recommendations, the Boards will make all final decisions regarding executive compensation matters. However, since the Committee was not appointed until late in the year, it did not meet or take any action during Fiscal 2004 in its capacity as a compensation committee or with respect to compensation paid during Fiscal 2004.

Compensation Committee Interlocks and Insider Participation.Reginald M. Fountain, Jr., who serves as Chairman, President, and Chief Executive Officer of both companies, participates in deliberations of Fountain’s Board of Directors pertaining to executive compensation, but he does not participate in deliberations regarding his own compensation. Mr. Fountain is the owner of a company that leases an airplane to Fountain for business purposes. During Fiscal 2004, Fountain paid that company $259,189 in rentals based on actual hours of business use by Fountain. From time to time, Fountain also rents apartments from a company owned by Mr. Fountain as temporary housing for consultants and new employees. During 2004, Fountain paid that company $18,592 in apartment rental fees.

David L. Woods, one of our directors, is co-owner and manager of Pier 57 Boat Sales and Service, which is a Fountain dealer. During Fiscal 2004, Mr. Woods’ dealership purchased 35 boats from Fountain for an aggregate wholesale price of $6,075,775 (approximately 10.5% of Fountain’s aggregate sales for that fiscal year), received payments of approximately $8,000 from Fountain under dealer sales award and promotion programs that are available to all dealers, and paid Fountain approximately $50,000 for parts and non-warranty service work.

David C. Miller, one of our directors, is a certified public accountant. During 2004, he provided us with certain consulting services regarding accounting and tax issues, auditing, and related financial matters, and we paid Mr. Miller $2,000 per month for those services. Our consulting arrangement with Mr. Miller was discontinued on February 29, 2004, and, since that date, he has not provided any consulting services to us or received any consulting fees or other compensation from us.

Board Report on Executive Compensation.Our goal is to provide an executive compensation program that will enable us to attract and retain qualified and motivated individuals as executive officers. Currently, Fountain’s and our executive compensation program includes only: (1) base salary paid by Fountain, (2) cash bonuses paid by Fountain to selected executive officers, (3) stock options we issue to selected employees, and (4) contributions by Fountain to the individual accounts of all participating employees under Fountain’s Section 401(k) plan. In addition, Fountain provides other employee benefit and welfare plans customary for companies its size.

Base salary paid by Fountain to our President and Chief Executive Officer, Reginald M. Fountain, Jr., is set by Fountain’s Board of Directors from time to time based on its evaluation of Mr. Fountain’s individual level of responsibility and performance and, in particular, his historical importance and current leadership and direction in the development and growth of Fountain’s business. Mr. Fountain’s employment agreement entered into with Fountain during 1989 provides for base salary of not less than $104,000. In recent years, he has received base salary at a rate of $350,000 per year with no salary increase. For a portion of Fiscal 2003, Mr. Fountain voluntarily reduced the rate at which salary was paid to him with the result that, during the year, he actually received aggregate salary payments of only $265,385. However, since that salary reduction was voluntary, the amount of the reduction was still treated as taxable compensation to Mr. Fountain even though he did not receive it, and accounting rules required that we account for the net amount of the reduction, after required tax withholdings, as a contribution by Mr. Fountain to our capital. For that reason, Mr. Fountain’s salary for Fiscal 2003 is listed in the Summary Compensation Table below as the full $350,000 on which he was taxed rather than the reduced amount of salary he actually received.

7

Pursuant to his employment agreement, Mr. Fountain may also receive a cash bonus each year equal to 5% of our consolidated net income before deductions for income taxes, but not more than $250,000. The cash bonuses earned by Mr. Fountain for Fiscal 2004 and 2003 were calculated pursuant to that arrangement and are shown in the Summary Compensation Table below. No cash bonuses were earned for Fiscal 2002.

Salary paid by Fountain to our Chief Financial Officer, Irving L. Smith, is approved by the Board of Directors. Mr. Smith’s salary for Fiscal 2004, 2003, and 2002 is shown in the Compensation Table below.

The salaries and cash bonuses paid to Fountain’s other officers are determined by Mr. Fountain based on his judgment of the levels of responsibility, qualifications, experience, and performance of the individual officers, as well as the company’s size, complexity, growth, and financial performance. The amounts of contributions to the separate accounts of officers under Fountain’s 401(k) plan are determined solely by the terms of that plan. Except as described above with respect to Mr. Fountain’s cash bonus, the performance review process and, thus, the setting of salaries and the awarding of cash bonuses, largely are subjective and there are no specific formulae, objective criteria, or other such mechanisms by which the salary of, or the amount of the cash bonus paid to, any officer, including Mr. Fountain, are tied empirically to his individual performance or to Fountain’s financial performance.

Section 162(m) of the Internal Revenue Code of 1986, as amended, limits the deductibility of annual compensation in excess of $1,000,000 paid to certain executive officers of public corporations. As none of the companies’ officers receive annual compensation approaching that amount, Fountain’s Board of Directors has not yet adopted a policy with respect to Section 162(m).

In the future, the Corporate Governance Committee will operate as a compensation committee of our and Fountain’s Boards of Directors and make recommendations to the Boards regarding the amounts of cash and other compensation paid or provided to our executive officers, the adoption of incentive or other compensation plans, and other compensation and employee benefit matters. After receipt of the Committee’s recommendations, the Boards still will make all final decisions regarding executive compensation matters.

Fountain’s Board of Directors:

| | | | | | |

A. Myles. Cartrette | | George L. Deichmann III | | Reginald M. Fountain, Jr. | | Guy L. Hecker, Jr. |

David C. Miller | | Mark L. Spencer | | Robert L. Stallings III | | David L. Woods |

Executive Officers

We consider Fountain’s and our officers who are listed below to be our executive officers.

Reginald M. Fountain, Jr., age 64, currently serves as our and Fountain’s Chairman, President, and Chief Executive Officer. He founded Fountain during 1979 and became our Chief Executive Officer upon our acquisition of Fountain during 1986.

Irving L. Smith, age 61, was appointed to serve as our and Fountain’s Chief Financial Officer during March 2003. Prior to that, he served as our Director for Information Technology from March 2001 through February 2003. Previously, he was President and owner of ISA Group, Inc., a financial, manufacturing and information technology consulting firm.

Robert D. Knight,age 47, was appointed to serve as Fountain’s Executive Vice President of Business Development on September 15, 2004. Prior to becoming our employee, he served as Vice President of Invensys, where he had been employed for 12 years. The company engaged in energy services automation, controls and process solutions.

8

Executive Compensation

Cash Compensation. The following table contains information regarding cash and other compensation paid to or deferred by our named executive officers for the fiscal years listed. Our executive officers serve and are compensated as officers and employees of Fountain, and they receive no separate cash compensation from us.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | | |

Name and principal position

| | Fiscal year

| | Annual Compensation

| | Long term compensation

| |

| | | Salary

| | | Bonus

| | Other annual compensation (2)

| | Restricted

stock awards

| | Securities

underlying

options (#)

| | | All other compensation

| |

Reginald M. Fountain Chairman, President and Chief Executive Officer | | 2004

2003

2002 | | $

| 350,000

350,000

350,000 |

(1)

| | $

| 72,456

58,315

-0- | | $

| -0-

-0-

-0- | | $

| -0-

-0-

-0- | | -0-

-0-

-0- |

| | $

| -0-

-0-

-0- |

|

Irving L. Smith Chief Financial Officer | | 2004

2003

2002 | |

| 120,000

95,000

80,000 |

| |

| -0-

-0-

-0- | |

| -0-

-0-

-0- | |

| -0-

-0-

-0- | | -0-

-0-

10,000 |

(4) | |

| 3,669

346

-0- | (3)

|

| (1) | As described above under the caption “Board Report on Executive Compensation,” for a portion of Fiscal 2003 Mr. Fountain voluntarily reduced the rate at which salary was paid to him with the result that he actually received aggregate salary payments of only $265,385. However, since the salary reduction was voluntary, the amount of the reduction was still treated as taxable compensation to Mr. Fountain even though he did not actually receive it, and accounting rules required that we account for the net amount of the reduction, after required tax withholdings, as a contribution by Mr. Fountain to our capital. For that reason, Mr. Fountain’s Fiscal 2003 salary is listed in the table above as the full $350,000 on which he was taxed rather than the reduced amount of salary he actually received. |

| (2) | In addition to compensation paid in cash, Fountain’s executive officers receive certain personal benefits. The value of such benefits received each year by each officer did not exceed 10% of his cash compensation for that year. |

| (3) | The Fiscal 2004 amounts consist entirely of matching contributions on behalf of the named officer under our Section 401(k) plan. |

| (4) | Includes options for 5,000 shares granted to Mr. Smith’s spouse who also is employed by Fountain. |

Employment Agreement. Mr. Fountain is employed as an officer of Fountain pursuant to a 1989 employment agreement which provides for automatic renewal at the end of each year for an additional one-year period until the agreement terminated. Pursuant to the agreement, Mr. Fountain receives base salary in an amount approved by our Board of Directors (but not less than $104,000), an annual cash bonus in an amount equal to 5% of our consolidated net income (calculated after deductions of profit sharing contributions and before deductions for income taxes, but not more than $250,000), and certain other benefits.

9

Stock Options. The following table contains information regarding options to purchase shares of our common stock held or exercised by our executive officers listed in the Summary Compensation Table above.

AGGREGATED OPTION EXERCISESIN LAST FISCAL YEARAND

FISCAL YEAR-END OPTION VALUES (1)

| | | | | | | | | | | | | | | | | |

| | | Shares acquired on exercise

| | | Value Realized

| | Number of securities underlying unexercised options at fiscal year-end

| | Value of unexercised in-the-money options at fiscal year-end

|

Name

| | | | Exercisable

| | | Unexercisable

| | Exercisable

| | | Unexercisable

|

Reginald M. Fountain, Jr. | | (2 | ) | | | N/A | | 450,000 | (3) | | -0- | | $ | -0- | (4) | | N/A |

Irving L. Smith | | 10,000 | (5) | | $ | 34,100 | | -0- | | | -0- | | | N/A | | | N/A |

| (1) | Information contained in the table is for Fiscal 2004 which ended on June 30, 2004. |

| (2) | Mr. Fountain did not exercise any options during Fiscal 2004. |

| (3) | The options are exercisable at a price of $4.67 per share and currently are scheduled to expire on August 4, 2005.(See Proposal 2: Amendment of 1995 Stock Option Plan.”) |

| (4) | Mr. Fountain’s options had no value on June 30, 2004, or on September 30, 2004, since, on those dates, the exercise price of the options exceeded the aggregate market value of the underlying shares (based on the closing sale prices of our common stock). |

| (5) | Includes options for 5,000 shares which were held and exercised by Mr. Smith’s spouse who also is employed by Fountain. |

Performance Graph

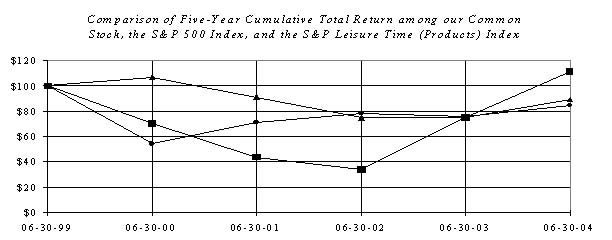

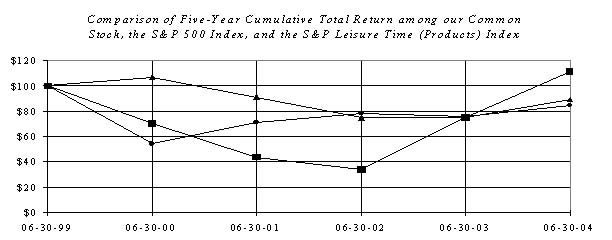

The following line graphs compare the cumulative total shareholder return (the “CTSR”) on our common stock during the previous five fiscal years with the CTSR over the same measurement period of the S&P 500 Index and the S&P Leisure Time (Products) Index. Each line graph assumes that $100 was invested on June 30, 1999, and that any dividends were reinvested in additional shares. Note, however, that we have not paid dividends on our common stock during the previous five years, so no reinvestment is included in the calculation of the CTSR on our common stock.

| | | | | | | | | | | | | | | | | | |

| | | GRAPH POINTS

|

| | | 06-30-99

| | 06-30-00

| | 06-30-01

| | 06-30-02

| | 06-30-03

| | 06-30-04

|

n Our Common Stock | | $ | 100.00 | | $ | 70.27 | | $ | 43.35 | | $ | 33.51 | | $ | 74.59 | | $ | 110.92 |

Ù S&P 500 Index | | | 100.00 | | | 107.25 | | | 91.34 | | | 74.91 | | | 75.10 | | | 89.45 |

· S&P Leisure Time (Products) Index | | | 100.00 | | | 53.83 | | | 71.42 | | | 78.14 | | | 75.69 | | | 84.95 |

10

Transactions with Related Parties

Information regarding certain transactions during Fiscal 2004 between us and certain of our directors is contained in this Proxy Statement under the caption “Corporate Governance Committee - Compensation Committee Interlocks and Insider Participation.” During Fiscal 2004, our Board of Directors adopted a policy requiring that, in the future, certain transactions between us or Fountain and any of our “related parties,” including our directors and executive officers, be reviewed and approved by the Board’s Corporate Governance Committee.

PROPOSAL 2: AMENDMENTOF 1995 STOCK OPTION PLAN

Background

During 1995, our Board of Directors and shareholders approved our 1995 Stock Option Plan (the “1995 Plan” or the “Plan”) which authorized the grant of options to purchase up to 450,000 shares of our common stock (as adjusted to reflect the effect of the three-for-two split in our common stock that became effective during 1997). Following approval of the 1995 Plan by our shareholders, an option to purchase all those shares was granted to our President and Chief Executive Officer, Reginald M. Fountain, Jr., on August 4, 1995, at a price of $4.67 per share (as adjusted for the stock split). In accordance with the terms of the 1995 Plan which limited the term of options to ten years, Mr. Fountain’s option will expire on August 4, 2005.

During July 2003, Fountain entered into an $18 million secured, long-term financing arrangement to refinance existing long-term debt, pay current liabilities, and provide additional operating funds. Fountain’s obligations under that credit facility are secured by certain assets of Fountain, as well as certain assets owned by Mr. Fountain. Those obligations also are guaranteed by Mr. Fountain, individually, and by Brunswick Corporation (“Brunswick”), a division of which supplies marine engines used in Fountain’s products.

In connection with the loan transaction, and in consideration for Brunswick’s agreement to guarantee Fountain’s obligations, Mr. Fountain gave Brunswick the right (the “Purchase Right”) to purchase any or all shares of our common stock held by him (generally at a price to be determined at the time of exercise), as well as all options held by Mr. Fountain to purchase shares of our common stock. Brunswick’s Purchase Right becomes exercisable on the earlier of July 1, 2007, or the date on which Fountain’s obligations under the above loan transaction have been paid in full. Mr. Fountain also pledged to Brunswick the shares of our common stock that he owns as collateral for his personal obligation to indemnify Brunswick for amounts in excess of $14.7 million that Brunswick may become obligated to pay to Fountain’s lender. Finally, we gave Brunswick an option to purchase, directly from us, and at any time while its Purchase Right remains in effect, a number of newly issued shares of our common stock which, when combined with Mr. Fountain’s shares, would give Brunswick 50.1% of our outstanding common stock.

It has come to the attention of our Board of Directors that the terms of Mr. Fountain’s option under the 1995 Plan conflict with the terms of the Purchase Right in two respects. First, the maximum term for which a “non-qualified option” (an “NSO”), such as the option granted to Mr. Fountain, can be granted under the Plan is ten years. As a result, Mr. Fountain’s option was granted for an original term of ten years and expires on August 4, 2005, which is two years before the Purchase Right likely will first become exercisable. Second, the terms of the Plan provide generally that NSOs are not transferable otherwise than by will or by the laws of descent and distribution, that during an optionee’s lifetime only he may exercise an option, and that any attempt to transfer, assign or otherwise dispose of an option other than as permitted by the Plan will be void and ineffective and, at our discretion, shall result in a forfeiture of the option.

Our Board believes that the financing obtained by Fountain through the above loan transaction was critical to the success of Fountain’s business, and that that financing likely would not have been available to Fountain absent Brunswick’s guarantee. Therefore, in consideration of Mr. Fountain’s actions taken for Fountain’s benefit, the Board desires to accommodate Mr. Fountain’s agreement with Brunswick and has proposed amendments to the 1995 Plan to change the maximum term permitted for non-qualified options granted under the Plan and to give our Board of Directors discretion to permit transfers or other dispositions of non-qualified options granted under the Plan.

11

Proposed Plan Amendments

Article II of the 1995 Plan applies only to non-qualified options, such as the option held by Mr. Fountain, as opposed to “incentive stock options” which also may be granted under the Plan and are covered by another section of the Plan. As they currently exist, Paragraphs 3(a) and 3(d) of Article II read as follows:

(a) Option Period and Conditions and Limitations on Exercise. Subject to Paragraph 4 of this Article, no non-qualified option shall be exercisable by an Employee Optionee later than the date which is the date determined by the Committee upon the grant thereof (the “Non-qualified Option Expiration Date”) which shall be no later than ten years after the date of grant. To the extent not prohibited by other provisions of the Plan, each non-qualified option granted to an Employee Optionee shall be exercisable at such time or times as the Committee in its discretion may, at or prior to the time such option is granted, determine (unless otherwise extended by the Committee pursuant to Paragraph 3(b)(2)(iii) of this Article). In the event the Committee makes no such determination, each non-qualified option granted to an Employee Optionee shall be exercisable from time to time, in whole or in part, at any time prior to the Non-qualified Option Expiration Date.

(d) Option not Transferable. No non-qualified option granted under this Article II shall be transferable otherwise than by will or by the laws of descent and distribution and, during the lifetime of the Employee Optionee to whom any such non-qualified option is granted, such non-qualified option shall be exercisable only by the Employee Optionee. Any attempt to transfer, assign, pledge, hypothecate or otherwise dispose of, or to subject to execution, attachment or similar process, any non-qualified option granted under this Article II, or any right thereunder, contrary to the provisions hereof, shall be void and ineffective, shall give no right to the purported transferee, and shall, at the sole discretion of the Committee, result in forfeiture of the non-qualified option with respect to the shares involved in such attempt.

Our Board of Directors proposes that Paragraphs 3(a) and 3(d) be amended to read as follows. Proposed changes in the two Paragraphs are shown in underlined, italicized type.

(a) Option Period and Conditions and Limitations on Exercise. Subject to Paragraph 4 of this Article, no non-qualified option shall be exercisable by an Employee Optionee later than the date which is the date determined by the Committee upon the grant thereof (the “Non-qualified Option Expiration Date”) which, except to the extent that a longer period is specifically approved by the Board of Directors in the case of a particular non-qualified option, shall be no later than ten years after the date of grant. To the extent not prohibited by other provisions of the Plan, each non-qualified option granted to an Employee Optionee shall be exercisable at such time or times as the Committee in its discretion may, at or prior to the time such option is granted, determine (unless otherwise extended by the Committee pursuant to Paragraphs 3(b)(2)(iii)or 4 of this Article). In the event the Committee makes no such determination, each non-qualified option granted to an Employee Optionee shall be exercisable from time to time, in whole or in part, at any time prior to the Non-qualified Option Expiration Date.

(d) Option not Transferable.Except with the express permission of the Board of Directors, no non-qualified option granted under this Article II shall be transferable otherwise than by will or by the laws of descent and distribution and, during the lifetime of the Employee Optionee to whom any such non-qualified option is granted, such non-qualified option shall be exercisable only by the Employee Optionee. Any attempt to transfer, assign, pledge,

12

hypothecate or otherwise dispose of, or to subject to execution, attachment or similar process, any non-qualified option granted under this Article II, or any right thereunder, contrary to the provisions hereof, shall be void and ineffective, shall give no right to the purported transferee, and shall, at the sole discretion of the Committee, result in forfeiture of the non-qualified option with respect to the shares involved in such attempt.

Effect of Proposed Amendments

The 1995 Plan permits the grant of stock options at any time during a period of ten years following the Plan’s June 21, 1995 effective date, and the proposed amendment to Paragraph 3(a) above will not extend that period. So, after the Plan expires on June 21, 2005, no further options may be granted. However, the Plan permits the term of an option granted prior to the Plan expiration date to extend beyond that date. The effect of the proposed amendment to Paragraph 3(a) will be to permit our Board of Directors to extend the term of Mr. Fountain’s non-qualified stock option beyond its current ten-year term. In that regard, our Board of Directors has approved an extension of the term of Mr. Fountain’s option by three years to August 4, 2008, subject to approval by our shareholders of the proposed amendments. The proposed amendment to Paragraph 3(d) above will permit our Board to approve Mr. Fountain’s transfer of his option to Brunswick if it chooses to exercise the Purchase Right. In addition to facilitating the arrangement with Brunswick described above, the extension of Mr. Fountain’s option would permit him to benefit from any increases in the value of our common stock that occur after the date on which his option otherwise would have expired under its original terms.

Description of the Plan

The terms of the 1995 Plan, as it originally was adopted by our shareholders, authorized the issuance of up to 450,000 shares of our common stock (as adjusted in accordance with the terms of the Plan for the three-for-two stock split which became effective during 1997) upon the exercise of options granted under the Plan to persons who were our and/or Fountain’s employees and non-employee directors.

The 1995 Plan authorizes our Board of Directors, or a Committee appointed by the Board to administer the Plan (in either case, the “Committee”), to approve the grant of an option to any employee or non-employee director without any further approval. At the discretion of the Committee, options granted to persons who are full-time employees may be designed as incentive stock options (“ISOs”) pursuant to Section 422A of the Internal Revenue Code of 1986, as amended (the “Code”), or they may be “NSOs” (i.e. options which do not qualify for treatment as ISOs under the Code). Any option granted to a non-employee director must be an NSO. Among other things, the Committee is authorized to make determinations regarding the persons to whom and numbers of shares for which options will be granted, to specify certain of the terms of options granted, to interpret and establish rules pertaining to the 1995 Plan, and to make all determinations and take all other actions relating to and reasonable or advisable in administering the Plan.

The price per share (the “Exercise Price”) of common stock covered by each option granted is set by the Committee at the time that option is granted, but may not be less than 100% of the fair market value (as determined by the Committee in the manner described in the 1995 Plan) of a share of our common stock at the time the option is granted (or 110% in the case of an ISO granted to an optionee who owns more than 10% of the voting power of our outstanding common stock). The fair market value of a share of our common stock on September 30, 2004, was approximately $3.59, based on the closing price of our stock reported on The Nasdaq Stock Market for that date.

Each option becomes exercisable as specified by the Committee at the time of grant (but not less than six months following the date of grant in the case of an option granted to a non-employee director). To the extent it has not previously been exercised, each option will expire after the earlier of: (1) the expiration date set by the Committee at the time of grant (which, under the current terms of the Plan, may be no more than ten years after the date of grant, or five years in the case of an ISO granted to an optionee who owns more than 10% of the voting power of our common stock), or (2) upon or at various times following the termination of an optionee’s

13

employment with us or Fountain or, in the case of an optionee who is a non-employee director, the termination of his or her service as a director. With respect to ISOs, the aggregate fair market value (determined as of the date of grant) of common stock for which all such options granted to any optionee may become exercisable for the first time in any calendar year may not exceed $100,000. In connection with any option granted under the 1995 Plan, the Committee may impose such other restrictions or conditions as it considers appropriate, including a schedule by which an option will become exercisable as to a portion of the shares it covers over a period of time.

No payment is received by us at the time an option is granted, but, at the time an option is exercised, the optionee must pay us the aggregate Exercise Price for shares being purchased. Payment by an optionee may be made in cash or by delivery to us of shares of our common stock owned by the optionee and that have a value equal to the amount of payment due, or by a combination of cash and shares. The value of each share so delivered shall be deemed to be equal to the per share price of the last sale of our common stock on the trading day immediately preceding the date the option is exercised. Optionees have no rights as stockholders with respect to any shares covered by options granted to them until those options have been exercised, the Exercise Price of those shares has been paid to us, and the optionees have become the beneficial owners of the shares being purchased.

In the event of increases, decreases, or changes in our outstanding common stock resulting from a stock dividend, recapitalization, reclassification, stock split, consolidation, combination, or similar event, or resulting from certain mergers or other reorganizations in which our outstanding common stock is changed into or exchanged for a different number or type of our stock, the Committee will make such adjustment as it, in its sole discretion, deems to be appropriate in the aggregate number and kind of shares which may be issued and for which options may be granted under the 1995 Plan and which are covered by each then outstanding option, and in the Exercise Price of each unexercised option.

The Plan permits the terms of options granted under the 1995 Plan to be amended by the Committee. Also, our Board of Directors may from time to time amend, suspend or terminate the Plan itself. However, no such action will adversely affect any optionee’s rights under any then outstanding option without that person’s consent, and, except as otherwise permitted by the terms of the Plan, any modification or amendment of the Plan itself that (1) extends the period within which options may be granted, (2) increases the number of shares of common stock that may be issued upon the exercise of options (other than the adjustments as described above), (3) changes the provisions of the Plan with respect to the determination of persons to whom options may be granted, (4) changes any provisions relating to the grant of options to non-employee directors, or (5) materially increases the benefits accruing to optionees under the Plan, will be subject to the approval of our shareholders. The Plan will expire on June 21, 2005 (the date ten years after the date of its approval by our shareholders), but options granted prior to that date will continue to exist and may be exercised in accordance with their terms until they have expired by their own separate terms, even if after the expiration date of the Plan itself.

An ISO granted under the 1995 Plan qualifies for certain favorable income tax treatment. Under the Code, an optionee is not taxed in the year in which an ISO is exercised. If an optionee holds stock purchased upon the exercise of an ISO for a period of at least two years following the date of grant and at least one year following the date the ISO is exercised (or dies while owning the stock) then, upon disposition of the stock (or upon death while owning the stock), he or she will realize capital gain equal to the excess of the sale price of the stock over the Exercise Price. If the optionee disposes of the stock before the holding periods expires, the excess of the fair market value of the stock at the time the option is exercised over the Exercise Price will be treated as ordinary income. We may not take a tax deduction at any time in connection with ISOs unless stock purchased upon exercise is disposed of prior to expiration of the two holding periods. In the year in which an NSO is exercised, the optionee will realize ordinary income equal to the excess of the fair market value of the stock at the time of exercise over the Exercise Price, and we will be allowed to take a deduction for the same amount.

14

Following approval of the 1995 Plan, our Board of Directors approved the grant of one option to our Chief Executive Officer as reflected in the following table for all shares authorized under the Plan.

| | | | | | |

Name or group

| | Exercise price (1)

| | Number of shares (1)

| |

Reginald M. Fountain, Jr. (our Chief Executive Officer) | | $ | 4.67 | | 450,000 | (2) |

Irving L. Smith (our Chief Financial Officer) | | | N/A | | -0- | |

All our current executive officers as a group | | | 4.67 | | 450,000 | (2) |

All our current directors who are not executive officers as a group | | | N/A | | -0- | |

All nominees for election as directors as a group | | | 4.67 | | 450,000 | (2) |

All current employees (other than executive officers) as a group | | | 4.67 | | 450,000 | (2) |

| (1) | Numbers of shares and exercise prices have been adjusted in accordance with the terms of the 1995 Plan for the three-for-two stock split which became effective during 1997. |

| (2) | Consists of one option granted under the 1995 Plan to Reginald M. Fountain, Jr. |

Our Board of Directors recommends that you vote “FOR” Proposal 2. To be approved, the number of votes cast in person and by proxy at the Annual Meeting in favor of the proposal must exceed the votes cast against it.

PROPOSAL 3: RATIFICATIONOF APPOINTMENTOF INDEPENDENT ACCOUNTANTS

Appointment of Independent Accountants

On September 30, 2004, our Audit Committee appointed Dixon Hughes PLLC as our independent accountants to audit our consolidated financial statements for Fiscal 2005 and approved the terms of its engagement. Dixon Hughes PLLC will replace Pritchett, Siler & Hardy, P.C. which was dismissed by the Committee on the same date. Pritchett, Siler & Hardy, P.C. audited our financial statements for Fiscal 2004 and had served as our independent accountants since 1992.

The Audit Committee’s charter gives it the responsibility and authority to select and appoint our independent accountants each year and to approve the compensation and terms of the engagement of our accountants, and our shareholders are not required by our Bylaws or the law to ratify the Committee’s selection. However, we will submit a proposal to ratify the appointment of Dixon Hughes PLLC for Fiscal 2005 for voting by shareholders at the Annual Meeting as a matter of good corporate practice and as a way for shareholders to be heard in the selection process. Representatives of Dixon Hughes PLLC are expected to attend the Annual Meeting and be available to answer questions, and they will have an opportunity to make a statement if they desire to do so. Representatives of Pritchett, Siler & Hardy, P.C. are not expected to attend the Annual Meeting. If our shareholders do not ratify the Audit Committee’s selection, the Committee will reconsider its decision, but it could choose to reaffirm its appointment of Dixon Hughes PLLC. Even if our shareholders vote to ratify the Committee’s selection, during the year the Committee could choose to appoint different independent accountants at any time if it determines that a change would be in our best interests.

In connection with Pritchett, Siler & Hardy, P.C.’s audits during the two fiscal years ended June 30, 2004 and 2003, and through the date of the Committee’s action dismissing Pritchett, Siler & Hardy, P.C., there have been no disagreements with Pritchett, Siler & Hardy, P.C. on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which, if not resolved to Pritchett, Siler & Hardy, P.C.’s satisfaction, would have caused it to make reference to the subject matter of the disagreement in connection with its reports on our financial statements.

15

Pritchett, Siler & Hardy, P.C.’s audit reports on our consolidated financial statements as of and for the fiscal years ended June 30, 2004 and 2003 did not contain an adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles, except that Pritchett, Siler & Hardy, P.C.’s report on our consolidated financial statements as of and for the fiscal years ended June 30, 2003 and 2002, appearing in our Annual Report on Form 10-K, as amended, for the fiscal year ended June 30, 2003, contained a separate paragraph stating that “As described in Note 17, the financial statements as of and for the period ended June 30, 2003 have been restated to reflect a decrease in the deferred tax asset valuation allowance in the amount of $400,643. The impact to the financial statements is also described in Note 17.”

During our fiscal years ended June 30, 2004 and 2003, and through the date of the Committee’s action appointing Dixon Hughes PLLC and dismissing Pritchett, Siler & Hardy, P.C., there were no “reportable events” involving Pritchett, Siler & Hardy, P.C. and requiring disclosure pursuant Item 304(a)(1)(v) of Regulation S-K, or any “consultations” with Dixon Hughes PLLC by us, or by anyone on our behalf, requiring disclosure pursuant to Item 304(a)(2) of Regulation S-K.

Our Board of Directors recommends that you vote “FOR” Proposal 3. To be approved, the number of votes cast in person and by proxy at the Annual Meeting in favor of the proposal must exceed the votes cast against it.

Services and Fees During Fiscal 2004 and 2003

As our independent accountants for Fiscal 2004 and 2003, Pritchett, Siler & Hardy, P.C., provided various audit and non-audit services for which we and Fountain were billed for fees as further described below. Under its current procedures our Audit Committee specifically preapproves all audit services and other services provided by our accountants. In the future, the Committee may consider delegating authority to its Chairman to preapprove certain types of non-audit services. The Chairman would report his approval of any additional services to the full Committee at its next regularly scheduled meeting. During Pritchett, Siler & Hardy, P.C.’s tenure as our independent accountants, our Audit Committee considered whether that firm’s provision of non-audit services was compatible with maintaining its independence. The Committee believes that those services did not affect Pritchett, Siler & Hardy, P.C.’s independence.

Audit Fees. During Fiscal 2004 and 2003, we were billed $100,764 and $112,659, respectively, by Pritchett, Siler & Hardy, P.C. for audit services.

Audit Related Fees.During Fiscal 2004 and 2003, we were billed $8,800 and $7,350, respectively, by Pritchett, Siler & Hardy, P.C. for audit related services consisting of audits of our Section 401(k) plan.

Tax Fees.During Fiscal 2004 and 2003, we were billed $11,832 and $14,832, respectively, by Pritchett, Siler & Hardy, P.C. for tax services related to the preparation of our federal and state income tax returns.

All Other Fees. During Fiscal 2004 and 2003, Pritchett, Siler & Hardy, P.C. provided no services other than those listed above.

PROPOSALSOF SHAREHOLDERS

Any proposal of a shareholder which is intended to be presented for action at our next Annual Meeting must be received by us in writing at our main office in Washington, North Carolina, no later than June 17, 2005, to be considered timely received for inclusion in the proxy statement and form of appointment of proxy that we will distribute in connection with that meeting. In order to be included in our proxy materials related to a particular meeting, the person submitting the proposal must own, beneficially or of record, at least 1% or $2,000 in market value of shares of our common stock entitled to be voted on that proposal at the meeting and must have held those shares for a period of at least one year and continue to hold them through the date of the meeting. Also, the proposal and the shareholder submitting it must comply with certain other eligibility and procedural requirements contained in rules of the Securities and Exchange Commission.

16

Written notice of a shareholder proposal intended to be presented for action at our next Annual Meeting, but which is not intended to be included in our proxy statement and form of appointment of proxy, must be received by us at our main office in Washington, North Carolina, no later than August 31, 2005, in order for that proposal to be considered timely received for purposes of the Proxies’ discretionary authority to vote on other matters presented for action by shareholders at that meeting.

ADDITIONAL INFORMATION

Communications with Our Board

Our Board of Directors encourages our shareholders to communicate with it, or with individual directors, regarding their concerns, complaints and other matters related to our business. The Board has established a process by which you may send written communications to the Board or to one or more individual directors. You may address and mail your communication to:

| | | | |

| | | Board of Directors Fountain Powerboat Industries, Inc. Attention: Corporate Secretary 1653 Whichard’s Beach Road PO Drawer 457 Washington, NC 27889 | | |

You also may send them by email todirectors@fountainpowerboats.com. You should indicate whether your communication is directed to the entire Board of Directors, to a particular committee of the Board or its Chairman, or to one or more individual directors. All communications will be reviewed by our Corporate Secretary and forwarded on to the intended recipients. Communications that involve specific comments, questions or complaints from a customer of Fountain relating to a specific product, purchase, warranty claim or other such matter will be forwarded to the head of the department or division that is most closely associated with the subject of the communication.

Annual Report on Form 10-K

We are subject to the reporting requirements of the Securities Exchange Act of 1934 and we file reports and other information, including proxy statements, annual reports, and quarterly reports, with the Securities and Exchange Commission. Our Internet website (www.fountainpowerboats.com) contains links to the Securities and Exchange Commission’s website (www.sec.gov) where you may obtain free copies of reports that we and our officers and directors file electronically with the Commission.

A copy of our Annual Report on Form 10-K for our fiscal year ended June 30, 2004, as filed with the Securities and Exchange Commission, will be provided without charge upon the written request of any shareholder entitled to vote at the Annual Meeting. Requests for copies should be directed to Irving L. Smith, Fountain Powerboat Industries, Inc., Post Office Drawer 457, Washington, North Carolina 27889 (Telephone 252-975-2000).

17

Appendix A

FOUNTAIN POWERBOAT INDUSTRIES, INC.AND SUBSIDIARY

AUDIT COMMITTEE CHARTER

ROLE

The Audit Committee of the Board of Directors assists the Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing, and reporting practices of the company, and such other duties as directed by the Board. The Committee’s role includes a particular focus on the qualitative aspects of financial reporting to shareholders, and on the company’s processes to manage business and financial risk, and for compliance with significant applicable legal, ethical, and regulatory requirements. The Committee is directly responsible for the appointment, compensation, and oversight of the public accounting firm engaged to prepare or issue an audit report on the financial statements of the company.

MEMBERSHIP

The membership of the Committee shall consist of at least three directors who are generally knowledgeable in financial and auditing matters, including at least one member with accounting or related financial management expertise. Each member shall be free of any relationship that, in the opinion of the Board, would interfere with his or her individual exercise of independent judgment. Applicable laws and regulations shall be followed in evaluating a member’s independence. The chairperson shall be appointed by the full Board.

COMMUNITCATIONS/REPORTING

The public accounting firm shall report directly to the Committee. The Committee is expected to maintain free and open communication with the public accounting firm, the internal auditors, and the company’s management. This communication shall include private executive sessions, at least annually, with each of these parties. The Committee chairperson shall report on Audit Committee activities to the full Board.

EDUCATION

The company is responsible for providing the Committee with educational resources related to accounting principles and procedures, current accounting topics pertinent to the company and other material as may be requested by the Committee. The company shall assist the Committee in maintaining appropriate financial literacy.

AUTHORITY

In discharging its oversight role, the Committee is empowered to investigate any matter brought to its attention, with full power to retain outside counsel or other experts for this purpose.

RESPONSIBILITIES

The Committee’s specific responsibilities in carrying out its oversight role are delineated in the Audit Committee Responsibilities Checklist. The responsibilities checklist will be updated annually to reflect changes in regulatory requirements, authoritative guidance, and evolving oversight practices. As the compendium of Committee responsibilities, the most recently updated responsibilities checklist will be considered to be an addendum to this charter.

A - 1

The Committee relies on the expertise and knowledge of management, the internal auditors, and the public accounting firm in carrying out its oversight responsibilities. Management of the company is responsible for determining the company’s financial statements are complete, accurate, and in accordance with generally accepted accounting principles. The public accounting firm is responsible for auditing the company’s financial statements. It is not the duty of the Committee to plan or conduct audits, to determine that the financial statements are complete and accurate and are in accordance with generally accepted accounting principles, to conduct investigations, or to assure compliance with laws and regulations or the company’s internal policies, procedures, and controls.

The Sarbanes-Oxley Act of 2002 requires the Company to set forth information regarding the adequacy of the Company’s system of internal control and also requires that the Company’s external auditors attest to the same. Additionally, the Act requires that the Company adopt a comprehensive methodology regarding risk management and internal control. The Committee in satisfaction of the requirement has adopted the “Internal Control Integrated Framework” as promulgated by the Committee of Sponsoring Organizations of the Treadwell Commission (COSCO). In order to effect any and all changes to the Company system of internal controls as mandated by COSCO the Audit Committee hereby appoints Irving Smith, Chief Financial Officer, and any other such individuals as he may designate as the Committee’s agent(s) for purposes of effecting the requirements of the Act.

Adopted this 14th day of April, 2004.

A - 2

FOUNTAIN POWERBOAT INDUSTRIES, INC.AND SUBSIDIARY

AUDIT COMMITTEE RESPONSIBILITIES CHECKLIST

| | | | | | | | | | | | |

| | | | | WHEN PERFORMED Audit Committee Meetings

|

| | | | | Winter

| | Spring

| | Summer

| | Fall

| | A/N*

|

1. | | The Committee will perform such other functions as assigned by law, the Company’s charter or bylaws, or the Board of Directors. | | | | | | | | | | X |

| | | | | | |

2. | | The Committee shall have the power to conduct or authorize investigations into any matters within the Committee’s scope of responsibilities. The Committee shall be empowered to retain independent counsel, accountants, or others to assist it in the conduct of any investigation. | | | | | | | | | | X |

| | | | | | |

3. | | The Committee shall meet four times per year or more frequently as circumstances require. The Committee may ask members of management or others to attend the meeting and provide pertinent information as necessary. | | | | | | | | | | X |

| | | | | | |

4. | | The agenda for Committee meetings will be prepared in consultation between the Committee chair (with input from the Committee members), Finance management, the Internal Audit Director and the public accounting firm | | X | | X | | X | | X | | X |

| | | | | | |

5. | | Provide an open avenue of communication between the internal auditors, the public accounting firm, Finance management and the Board of Directors. Report Committee actions to the Board of Directors with such recommendations as the Committee may deem appropriate. | | | | | | | | | | X |

| | | | | | |

6. | | Review and update the Audit Committee Responsibilities Checklist annually. | | | | | | | | X | | |

| | | | | | |

7. | | Provide a report in the annual proxy that includes the Committee’s review and discussion of matters with management and the independent public accounting firm. | | | | | | X | | | | |

| | | | | | |

8. | | Include a copy of the Committee charter as an appendix to the proxy statement at least once every three years. | | | | | | | | | | X |

| | | | | | |

9. | | Appoint, approve the compensation of, and provide oversight of the public accounting firm. | | X | | X | | X | | X | | |

| | | | | | |

10. | | Review and approve the appointment or change in the Internal Audit Director. | | | | | | | | | | X |

| | | | | | |

11. | | Confirm annually the independence of the public accounting firm, and quarterly review the firm’s non-audit services and related fees. | | | | | | X | | | | |

| | | | | | |

12. | | Verify the Committee consists of a minimum of three members who are financially literate, including at least one member who has financial sophistication. | | | | | | | | X | | |

| | | | | | |

13. | | Review the independence of each Committee member based on NYSE and other applicable rules. | | | | | | | | X | | |

| | | | | | |

14. | | Inquire of Finance management, the Internal Auditor head, and the public accounting firm about significant risks or exposures and assess the steps management has taken to minimize such risk to the Company. | | | | | | | | | | X |

| | | | | | |

15. | | Review with the Internal Audit Director, the public accounting firm and Finance management the audit scope and plan, and coordination of audit efforts to assure completeness of coverage, reduction of redundant efforts, the effective use of audit resources, and the use of independent public accountants other than the appointed auditors of MS. | | X | | | | | | | | |

| | | | | | |

16. | | Consider and review with the public accounting firm and the Internal Audit Director: | | | | | | | | | | |

| | | | | | |

| | | a. The adequacy of the Company’s internal controls including computerized information system controls and security. | | | | | | X | | | | |

| | | | | | |

| | | b. Any related significant findings and recommendations of the independent public accountants and internal audit together with management’s responses thereto. | | | | | | X | | | | |

| | | | | | |

17. | | Review with Finance management any significant changes to GAAP and/or MAP policies or standards. | | | | | | X | | | | |

A - 3

FOUNTAIN POWERBOAT INDUSTRIES, INC.AND SUBSIDIARY

AUDIT COMMITTEE RESPONSIBILITIES CHECKLIST

| | | | | | | | | | | | |

| | | | | WHEN PERFORMED Audit Committee Meetings

|

| | | | | Winter

| | Spring

| | Summer

| | Fall

| | A/N*

|

| 18. | | Review with Finance management and the public accounting firm at the completion of the annual audit: | | | | | | | | | | |

| | | | | | |

| | | a. The Company’s annual financial statements and related footnotes. | | | | | | X | | | | X |

| | | | | | |

| | | b. The public accounting firm’s audit of the financial statements and its report thereon. | | | | | | X | | | | X |

| | | | | | |

| | | c. Any significant changes required in the public accounting firm’s audit plan. | | | | | | X | | | | X |

| | | | | | |

| | | d. Any serious difficulties or disputes with management encountered during the course of the audit. | | | | | | X | | | | X |

| | | | | | |

| | | e. Other matters related to the conduct of the audit, which are to be communicated to the Committee under generally accepted auditing standards. | | | | | | X | | | | X |

| | | | | | |

| 19. | | Review with Finance management and the public accounting firm at least annually the Company’s critical accounting policies. | | | | | | X | | | | X |

| | | | | | |

| 20. | | Review policies and procedures with respect to transactions between the Company and officers and directors, or affiliates of officers or directors, or transactions that are not a normal part of the Company’s business. | | | | | | | | X | | |

| | | | | | |

| 21. | | Consider and review with Finance management and the Internal Audit Director: | | | | | | | | | | |

| | | | | | |

| | | a. Significant findings during the year and management’s responses thereto. | | | | | | | | | | X |

| | | | | | |