UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2005

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 1-8895

HEALTH CARE PROPERTY INVESTORS, INC.

(Exact name of registrant as specified in its charter)

Maryland | | 33-0091377 |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | Identification No.) |

3760 Kilroy Airport Way, Suite 300 | | |

Long Beach, California | | 90806 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (562) 733-5100

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Name of each exchange

on which registered |

Common Stock | | New York Stock Exchange |

7.25% Series E Cumulative Redeemable Preferred Stock | | New York Stock Exchange |

7.10% Series F Cumulative Redeemable Preferred Stock | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant; (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “Accelerated Filer and Large Accelerated Filer” in Rule 12b-2 of the Exchange Act. (check one): Large Accelerated Filer x Accelerated Filer o Non-accelerated Filer o

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act.) Yes o No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $3,667,965,184.

As of January 31, 2006 there were 136,199,799 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the registrant’s 2006 Annual Meeting of Stockholders have been incorporated into Part III of this Report.

PART I

ITEM 1. Business

Business Overview

Health Care Property Investors, Inc., together with its consolidated subsidiaries and joint ventures (collectively, “HCP” or the “Company”), invests primarily in real estate serving the healthcare industry in the United States. Health Care Property Investors, Inc. is a Maryland real estate investment trust (“REIT”) organized in 1985. The Company is headquartered in Long Beach, California, with operations in Nashville, Tennessee, and its portfolio includes interests in 527 properties in 42 states. The Company acquires healthcare facilities and leases them to healthcare providers and provides mortgage financing secured by healthcare facilities. The Company’s portfolio includes: (i) senior housing, including independent living facilities (“ILFs”), assisted living facilities (“ALFs”), and continuing care retirement communities (“CCRCs”); (ii) medical office buildings (“MOBs”); (iii) hospitals; (iv) skilled nursing facilities (“SNFs”); and (v) other healthcare facilities, including laboratory and office buildings. For business segment financial data, see our consolidated financial statements included elsewhere in this report.

References herein to “HCP,” the “Company,” “we,” “us” and “our” include Health Care Property Investors, Inc. and its consolidated subsidiaries and joint ventures, unless the context otherwise requires.

On our internet website, www.hcpi.com, you can access, free of charge, our annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). In addition, the SEC maintains an internet website that contains reports, proxy and information statements, and other information regarding issuers, including HCP, that file electronically with the SEC at www.sec.gov.

Healthcare Industry

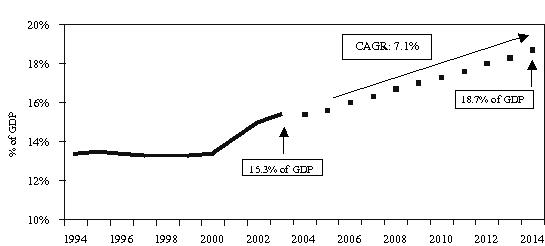

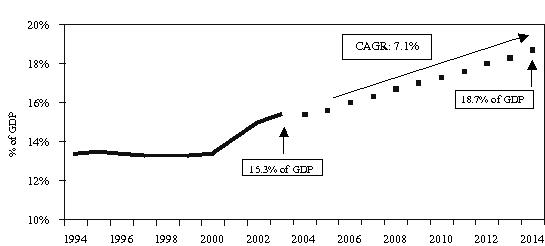

Healthcare is the single largest industry in the United States, representing 15.3% of U.S. Gross Domestic Product (“GDP”) in 2003 and growing at a rate faster than the overall economy.

Healthcare Expenditures Rising as a Percentage of GDP

Source: Centers for Medicare and Medicaid, December 2005. Compound Annual Growth Rate (“CAGR”)

2

The delivery of healthcare services requires real estate and as a consequence, healthcare providers depend on real estate to maintain and grow their businesses. HCP believes that the current healthcare real estate market provides an investment opportunity for investors based on:

· Likelihood of consolidation of the fragmented healthcare real estate sector;

· Specialized nature of healthcare real estate investing; and

· Compelling demographics driving the demand for healthcare services.

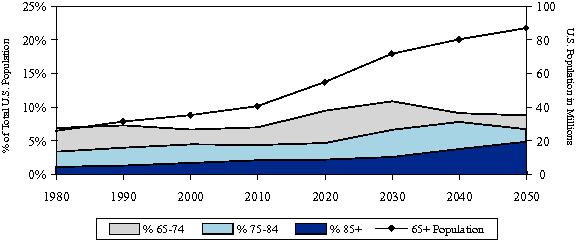

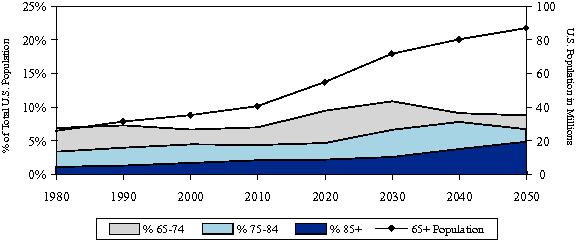

Senior citizens are the largest consumers of healthcare services. According to the Centers for Medicare and Medicaid, on a per capita basis, the 75 years and older segment of the population spends 75% more on healthcare than the 65 to 74-year-old segment and nearly 400% more than the population average.

U.S. Population Over 65 Years Old

Source: U.S. Census Bureau, Statistical Abstract of the United States: 2004-2005.

Business Strategy

We are organized to invest in healthcare related facilities. Our primary goal is to increase shareholder value through profitable growth. Our investment strategy to achieve this goal is based on three principles—opportunistic investing, portfolio diversification, and conservative financing.

Opportunistic Investing

We make real estate investments that are expected to drive profitable growth and create long-term shareholder value. We attempt to position ourselves to create and take advantage of situations where we believe the opportunities meet our goals and investment criteria. We invest in properties directly and through joint ventures, and provide secured financing, depending on the nature of the investment opportunity.

Portfolio Diversification

We believe in maintaining a portfolio of healthcare-related real estate diversified by sector, geography, operator and investment product. Diversification within the healthcare industry reduces the likelihood that a single event would materially harm our business. This allows us to take advantage of opportunities in different markets based on individual market dynamics. While pursuing our strategy of

3

maintaining diversification in our portfolio, there are no specific limitations on the percentage of our total assets that may be invested in any one property, property type, geographic location or in the number of properties which we may invest, lease or lend to a single operator. With investments in multiple sectors of healthcare real estate, HCP can focus on opportunities with the best risk/reward profile for the portfolio as a whole, rather than having to choose from transactions within a specific property type.

Conservative Financing

We believe a conservative balance sheet provides us with the ability to execute our opportunistic investing approach and portfolio diversification principles. We maintain our conservative balance sheet by actively managing our debt to equity levels and maintaining available sources of liquidity, such as our revolving line of credit. Our debt is primarily fixed rate, which reduces the impact of rising interest rates on our operations. Generally, we attempt to match the long-term duration of our leases with long-term fixed rate financing.

In underwriting our investments, we structure and adjust the price of the investment in accordance with our assessment of risk. We may structure transactions as master leases, require indemnifications, obtain enhancements in the form of letters of credit or security deposits, and take other measures to mitigate risk. We finance our investments based on our evaluation of available sources of funding. For short-term purposes, we may utilize our revolving line of credit or arrange for other short-term borrowings from banks or other sources. We arrange for longer-term financing through public offerings or from institutional investors. We may incur additional indebtedness or issue preferred or common stock.

We may incur additional mortgage indebtedness on real estate we acquire. We may also obtain non-recourse or other mortgage financing on unleveraged properties in which we have invested or may refinance existing debt on properties acquired.

Competition

Our properties compete with the facilities of other landlords and healthcare providers. The landlords and operators of these competing properties may have capital resources substantially in excess of ours or of the operators of our facilities. The occupancy and rental income at our properties depend upon several factors, including the number of physicians using the healthcare facilities or referring patients to the facilities, competing properties and healthcare providers, and the size and composition of the population in the surrounding area. Private, federal and state payment programs and the effect of laws and regulations may also have a significant influence on the profitability of the properties and their tenants. Virtually all of our properties operate in a competitive environment in which tenants, patients and referral sources, including physicians, may change their preferences for a healthcare facility from time to time.

Investing in real estate is highly competitive. We face competition from other REITs, investment companies, healthcare operators and other institutional investors when we attempt to acquire properties. Increased competition reduces the number of opportunities that meet our investment criteria. If we do not identify investments that meet our investment criteria, our ability to increase shareholder value through profitable growth may be limited.

2005 Overview

Real Estate Transactions

During 2005, we acquired interests in properties and made secured loans aggregating $647 million with an average yield of 7.7%. Our 2005 investments were made in the following healthcare sectors: (i) 62% senior housing facilities; (ii) 32% medical office buildings; and (iii) 6% hospitals. 2005 investments included the following:

· On April 20, 2005, we acquired five assisted living facilities for $58 million through a sale-leaseback transaction. These facilities have an initial lease term of 15 years, with two ten-year renewal options. The initial annual lease rate is 9.0% with annual escalators based on the Consumer Price Index

4

(“CPI”) that have a floor of 2.75%. These properties are included in a master lease that has 21 properties leased to the operator.

· On April 28, 2005, we acquired five medical office buildings for approximately $81 million, including assumed debt valued at $29 million. The initial yield is 7.0%, with two properties currently in lease-up. The yield following lease-up is expected to be 8.2%. The medical office buildings include approximately 537,000 rentable square feet.

· On July 1, 2005, we acquired an assisted living facility for $16 million through a sale-leaseback transaction. The facility has an initial lease term of 15 years, with two ten-year renewal options. The initial annual lease rate is 8.75% with annual CPI-based escalators that have a floor of 2.75%.

· On July 22, 2005, we acquired twelve independent and assisted living facilities for approximately $252 million, including assumed debt and non-managing member LLC units (“DownREIT units”) valued at $52 million and $19 million, respectively, through a sale-leaseback transaction. These facilities have an initial lease term of 15 years, with three ten-year renewal options. The initial annual lease rate is 7.1% with annual CPI-based escalators that have a floor of 3%.

· On August 31, 2005, we acquired five assisted living facilities for $41 million through a sale-leaseback transaction. These facilities have an initial lease term of 15 years, with two ten-year renewal options. The initial annual lease rate is 8.5% with annual CPI-based escalators that have a floor of 2.75%. These properties are included in a master lease that has 21 properties leased to the operator.

· On October 19, 2005, we acquired seven medical office buildings for $51 million, including assumed debt and DownREIT units valued at $24 million and $11 million, respectively. The medical office buildings include approximately 351,000 rentable square feet and have an initial yield of 8.2%.

· On December 22, 2005, we acquired two independent and assisted living facilities for $18 million through a sale-leaseback transaction. The facilities have an initial lease term of 15 years, with two ten-year renewal options. The initial annual lease rate is 8.5% with annual CPI-based escalators that have a floor of 2.75%. These properties are included in a master lease that has 21 properties leased to the operator.

· On December 23, 2005, we acquired two medical office buildings for $25 million. The medical office buildings include approximately 152,000 rentable square feet and have an initial yield of 7.4%.

· On December 28, 2005, we closed a $40 million loan secured by a hospital in Texas. The note bears interest at 8.75% per annum. Subject to certain performance conditions, we may fund an additional $10 million under the existing loan agreement.

· During 2005, we sold interests in 20 properties for $71 million and recognized gains of $10 million.

Capital Markets Transactions

· On April 27, 2005, we issued $250 million of 5.625% senior unsecured notes due 2017. The notes were priced at 99.585% of the principal amount with an effective yield of 5.673%. We received proceeds of $247 million, which were used to repay outstanding indebtedness and for general corporate purposes.

· On September 16, 2005, we issued $200 million of 4.875% senior unsecured notes due 2010. The notes were priced at 99.567% of the principal amount with an effective yield of 4.974%. We received net proceeds of $198 million, which were used to repay outstanding indebtedness and for general corporate purposes.

· During the year ended December 31, 2005, we issued approximately 878,000 shares of our common stock under our Dividend Reinvestment and Stock Purchase Plan at an average price per share of $25.80 for proceeds of $23 million.

5

Other Events

· Quarterly dividends paid during 2005 aggregated to $1.68 per share. On February 6, 2006, we announced that our Board of Directors declared a quarterly common stock cash dividend of $0.425 per share. The common stock dividend will be paid on February 23, 2006, to stockholders of record as of the close of business on February 13, 2006. This dividend equals $1.70 per share on an annualized basis. Our Board of Directors has determined to continue its policy of considering dividend increases on an annual rather than quarterly basis.

Properties

Portfolio Summary

Our portfolio of investments at December 31, 2005 includes direct investments in healthcare related properties, mortgage loans, and investments through joint ventures. Our properties include senior housing facilities, medical office buildings, hospitals, skilled nursing facilities, and other healthcare facilities. As of and for the year ended December 31, 2005, our portfolio of investments, excluding assets held for sale and classified as discontinued operations, consists of the following (square feet and dollars in thousands):

| | | | | | | | | | 2005 | |

Property Type | | | | Number

of

Properties | | Capacity(1) | | Square Feet | | Investment(2) | | Total

Revenues | | Total

Operating

Expenses | | NOI(3) | |

Owned properties: | | | | | | | | | | | | | | | | | | | | | | | | | |

Senior housing

facilities | | | 127 | | | 13,204 Units | | | 12,949 | | | | $ | 1,290,169 | | | | $ | 115,937 | | | | $ | 8,887 | | | $ | 107,050 | |

Medical office

buildings | | | 107 | | | 6,530 Sq. ft. | | | 6,530 | | | | 982,647 | | | | 126,898 | | | | 44,905 | | | 81,993 | |

Hospitals | | | 26 | | | 3,269 Beds | | | 3,272 | | | | 713,454 | | | | 91,122 | | | | — | | | 91,122 | |

Skilled nursing

facilities | | | 152 | | | 18,171 Beds | | | 5,948 | | | | 650,553 | | | | 87,665 | | | | — | | | 87,665 | |

Other healthcare facilities | | | 23 | | | 1,591 Sq. ft. | | | 1,591 | | | | 243,166 | | | | 30,623 | | | | 5,191 | | | 25,432 | |

Total owned properties | | | 435 | | | | | | 30,290 | | | | $ | 3,879,989 | | | | $ | 452,245 | | | | $ | 58,983 | | | $ | 393,262 | |

Mortgage loans: | | | | | | | | | | | | | | | | | | | | | | | | | |

Senior housing

facilities | | | 9 | | | 537 Units | | | 407 | | | | $ | 27,816 | | | | | | | | | | | | |

Hospitals | | | 3 | | | 226 Beds | | | 411 | | | | 96,476 | | | | | | | | | | | | |

Skilled nursing

facilities | | | 13 | | | 1,850 Beds | | | 540 | | | | 51,134 | | | | | | | | | | | | |

Total mortgage

loans | | | 25 | | | | | | 1,358 | | | | $ | 175,426 | | | | | | | | | | | | |

Unconsolidated Joint Ventures: | | | | | | | | | | | | | | | | | | | | | | | | | |

Senior housing

facilities | | | 4 | | | 412 Units | | | 235 | | | | $ | 260 | | | | | | | | | | | | |

Medical office

buildings | | | 63 | | | 4,286 Sq. ft. | | | 4,286 | | | | 44,538 | | | | | | | | | | | | |

Total

unconsolidated joint ventures | | | 67 | | | | | | 4,521 | | | | $ | 44,798 | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Senior housing facilities are stated in units (e.g., studio, one or two bedroom units). Medical office buildings and other healthcare facilities are measured in square feet. Hospitals and skilled nursing facilities are measured by licensed bed count.

(2) Investment for owned properties represents the carrying amount of real estate assets, including intangibles, after adding back accumulated depreciation and amortization, and excludes assets held for sale and classified as discontinued operations. Investment for mortgage loans receivable and unconsolidated joint ventures represents the carrying amount of our investment.

6

(3) Net Operating Income from Continuing Operations (“NOI”) is a non-GAAP supplemental financial measure used to evaluate the operating performance of real estate properties. We define NOI as rental revenues, including tenant reimbursements, less property level operating expenses, which exclude depreciation and amortization, general and administrative expenses, impairments, interest expense and discontinued operations. We believe NOI provides investors relevant and useful information because it measures the operating performance of our real estate at the property level on an unleveraged basis. We use NOI to make decisions about resource allocations and assess property level performance. We believe that net income is the most directly comparable GAAP (U.S. generally accepted accounting principals) measure to NOI. NOI should not be viewed as an alternative measure of operating performance to net income as defined by GAAP since it does not reflect the aforementioned excluded items. Further, NOI may not be comparable to that of other real estate investment trusts, as they may use different methodologies for calculating NOI. The following reconciles NOI to Net Income for 2005 (in thousands):

| | Amount | |

Net operating income from continuing operations | | $ | 393,262 | |

Equity loss from unconsolidated joint ventures | | (1,123 | ) |

Interest and other income | | 26,154 | |

Interest expense | | (107,201 | ) |

Depreciation and amortization | | (106,934 | ) |

General and administrative expense | | (32,067 | ) |

Minority interests | | (12,950 | ) |

Total discontinued operations | | 13,916 | |

Net income | | $ | 173,057 | |

Unconsolidated Joint Ventures

The following is summarized unaudited information for our unconsolidated joint ventures as of and for the year ended December 31, 2005 (square feet and dollars in thousands):

| | | | | | | | | | 2005 | | |

Property Type | | | | Number of

Properties | | Capacity(1) | | Square

Feet | | Joint Venture

Investment(2) | | Total

Revenues | | Total

Operating

Expenses | | NOI(3) | | |

Senior housing facilities | | | 4 | | | 412 Units | | | 235 | | | | $ | 20,111 | | | | $ | 2,205 | | | | $ | 344 | | | $ | 1,861 | |

Medical office buildings | | | 63 | | | 4,286 Sq. ft. | | | 4,286 | | | | 420,703 | | | | 73,786 | | | | 32,666 | | | 41,120 | |

Total | | | 67 | | | | | | 4,521 | | | | $ | 440,814 | | | | $ | 75,991 | | | | $ | 33,010 | | | $ | 42,981 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1) Senior housing facilities are stated in units (e.g., studio, one or two bedroom units) and medical office buildings are measured in square feet.

(2) Represents the carrying amount of real estate assets within the joint venture, including intangibles, after adding back accumulated depreciation and amortization and excludes assets held for sale and classified as discontinued operations.

(3) Net Operating Income from Continuing Operations (“NOI”) is a non-GAAP supplemental financial measure used to evaluate the operating performance of real estate properties. We define NOI as rental revenues, including tenant reimbursements, less property level operating expenses, which exclude depreciation and amortization, general and administrative expenses, impairments, interest expense and discontinued operations. We believe NOI provides investors relevant and useful information because it measures the operating performance of our real estate at the property level on an unleveraged basis. We use NOI to make decisions about resource allocations and assess property level performance. We believe that net income is the most directly comparable GAAP measure to NOI. NOI should not be viewed as an alternative measure of operating performance to net income as defined by GAAP since it does not reflect the aforementioned excluded items. Further, NOI may not be comparable to that of other real estate investment trusts, as they may use different methodologies for calculating NOI.

Healthcare Sectors and Property Types

We have investments in senior housing facilities, medical office buildings, hospitals, skilled nursing facilities, and other healthcare facilities. Certain tenants of our properties are reliant on government reimbursements, such as those from Medicare and Medicaid—See Governmental Regulation for the

7

potential impact on the value of our investments and our results of operations. The following describes the nature of the operations of our tenants and borrowers.

Senior Housing Facilities. We have interests in 140 senior housing facilities, including four properties in unconsolidated joint ventures. Senior housing properties include ILFs, ALFs and CCRCs, which cater to different segments of the elderly population based upon their needs. Services provided by our tenants in these facilities are primarily paid for by the residents directly or through private insurance and are less reliant on government reimbursement such as Medicaid and Medicare.

· Independent Living Facilities. ILFs are designed to meet the needs of seniors who choose to live in an environment surrounded by their peers with services such as housekeeping, meals and activities. These residents generally do not need assistance with activities of daily living (“ADLs”), including bathing, eating and dressing; however, residents have the option to contract for these services.

· Assisted Living Facilities. ALFs are licensed care facilities that provide personal care services, support and housing for those who need help with ADLs yet require limited medical care. The programs and services may include transportation, social activities, exercise and fitness programs, beauty or barber shop access, hobby and craft activities, community excursions, meals in a dining room setting and other activities sought by residents. These facilities are often in apartment-like buildings with private residences ranging from single rooms to large apartments. Certain ALFs may offer higher levels of personal assistance for residents with Alzheimer’s disease or other forms of dementia, based in part on local regulations.

· Continuing Care Retirement Communities. CCRCs provide housing and health-related services under long-term contracts. This alternative is appealing to residents as it eliminates the need for relocating when health and medical needs change, thus allowing residents to “age in place.” Some CCRCs require a substantial entry fee or buy-in fee, and most also charge monthly maintenance fees in exchange for a living unit, meals and some health services. CCRCs typically require the individual to be in relatively good health and independent upon entry.

Medical Office Buildings. We have interests in 170 MOBs, including 63 properties owned by HCP Medical Office Portfolio, LLC (“HCP MOP”). These facilities typically contain physicians’ offices and examination rooms, and may also include pharmacies, hospital ancillary service space and outpatient services such as diagnostic centers, rehabilitation clinics and day-surgery operating rooms. While these facilities are similar to commercial office buildings, they require more plumbing, electrical and mechanical systems to accommodate multiple exam rooms that require sinks in every room, brighter lights and special equipment such as medical gases.

Hospitals. We have interests in 29 hospitals, which include 17 acute care, three long-term acute care and nine rehabilitation hospitals. Services provided by our tenants in these facilities are paid for by private sources, third party payors (e.g., insurance and HMOs), or through the Medicare and Medicaid programs.

· Acute Care Hospitals. Acute care hospitals offer a wide range of services such as fully-equipped operating and recovery rooms, obstetrics, radiology, intensive care, open heart surgery and coronary care, neurosurgery, neonatal intensive care, magnetic resonance imaging, nursing units, oncology, clinical laboratories, respiratory therapy, physical therapy, nuclear medicine, rehabilitation services and outpatient services.

· Long-Term Acute Care Hospitals. Long-term acute care hospitals provide care for patients with complex medical conditions that require longer stays and more intensive care, monitoring, or emergency back-up than that available in most skilled nursing-based sub-acute programs.

8

· Rehabilitation Hospitals. Rehabilitation hospitals provide inpatient and outpatient care for patients who have sustained traumatic injuries or illnesses, such as spinal cord injuries, strokes, head injuries, orthopedic problems, work-related disabilities and neurological diseases.

Skilled Nursing Facilities. We have interests in 165 SNFs. SNFs offer restorative, rehabilitative and custodial nursing care for people not requiring the more extensive and sophisticated treatment available at hospitals. Ancillary revenues and revenue from sub-acute care services are derived from providing services to residents beyond room and board and include occupational, physical, speech, respiratory and intravenous therapy, wound care, oncology treatment, brain injury care and orthopedic therapy as well as sales of pharmaceutical products and other services. Certain skilled nursing facilities provide some of the foregoing services on an out-patient basis. Skilled nursing services provided by our tenants in these facilities are primarily paid for either by private sources, or through the Medicare and Medicaid programs.

Other Healthcare Facilities. We have investments in ten healthcare laboratory and biotech research facilities. These facilities are designed to accommodate research and development in the bio-pharmaceutical industry, drug discovery and development, and predictive and personalized medicine. We also have investments in five physician group practice clinic facilities leased to five different tenants, six health and wellness centers, and two facilities used for other healthcare purposes. The physician group practice clinics generally provide a broad range of medical services through organized physician groups representing various medical specialties. Health and wellness centers provide testing and preventative health maintenance services.

Investment Products

Owned and Joint Venture Property Investments

As of December 31, 2005, we had investments in 527 properties, including 67 properties through joint ventures; Whether owned wholly or through joint ventures, the owned properties may be characterized as one of three types: triple-net leased property, operating property or development property.

Triple-net Leased Properties:

Triple-net leased properties are generally single-tenant buildings leased to a healthcare provider under a triple-net lease. Pursuant to triple-net leases, tenants pay base rent and additional rent to us and pay all operating expenses incurred at the property, including utilities, property taxes, insurance, and repairs and maintenance. Certain leases contain annual base rent escalations based on a predetermined fixed rate, an inflation index or some other factor. Other leases may require tenants to pay additional rent based upon a percentage of the facility’s revenue in excess of the revenue for a specific base period or threshold.

The first year annual base rental rates on properties we acquired during 2005 ranged from 7% to 9% of the purchase price of the property. Rental rates vary by lease, taking into consideration many factors, including:

· creditworthiness of the tenant;

· operating performance of the facility;

· cost of capital at the inception of the lease;

· location, type and physical condition of the facility;

· barriers to entry, such as certificates of need, competitive development and constraining high land costs; and

· lease term.

9

Our hospitals, skilled nursing facilities, and senior housing facilities are typically leased on a triple-net basis with initial terms that range from five to 15 years, and generally have one or more renewal options. As of December 31, 2005, the weighted average remaining term, excluding unexercised renewal options, on these triple-net leased properties is approximately eight years.

Operating Properties:

Our operating properties are typically multi-tenant medical office buildings that are leased to multiple healthcare providers (hospitals and physician practices) under a gross, modified gross or net lease structure. Under a gross or modified gross lease, all or a portion of operating expenses are not reimbursed by tenants. Most of our owned MOBs are managed by third party property management companies and 19 are leased on a net basis while 88 are leased to multiple tenants under gross or modified gross leases pursuant to which we are responsible for certain operating expenses. Regardless of lease structure, most of our leases at operating properties include annual base rent escalation clauses that are either predetermined fixed increases or are a function of an inflation index, and typically have an initial term ranging from one to fourteen years, with a weighted average remaining term of approximately five years as of December 31, 2005.

The following table reflects the reduction in revenue (based on 2005 revenue) for owned triple-net leased and operating properties resulting from lease expirations, absent the impact of renewals, if any (in thousands):

Year | | | | Triple-net

Leased | | Operating

Properties | | Total | |

2006 | | $ | 4,903 | | $ | 10,299 | | $ | 15,202 | |

2007 | | 8,106 | | 12,700 | | 20,806 | |

2008 | | 17,068 | | 20,304 | | 37,372 | |

2009 | | 50,643 | | 15,133 | | 65,776 | |

2010 | | 16,268 | | 12,568 | | 28,836 | |

Thereafter | | 207,607 | | 35,759 | | 243,366 | |

Total | | $ | 304,605 | | $ | 106,753 | | $ | 411,358 | |

Development Properties:

We generally commit to development projects when they are at least 50% pre-leased. We use internal and external construction management expertise to evaluate local market conditions, construction costs and other factors to seek appropriate risk adjusted returns. During 2005, we completed and placed into service approximately $5 million of owned development properties. In addition, during 2005, HCP MOP completed and placed into service approximately $8 million of development properties. As of December 31, 2005, we have an interest in four properties under development.

Secured Loan Investments

We have investments in 13 mortgage loans secured by 25 properties that are owned and operated by 11 healthcare providers. Our secured loan investments typically consist of senior mortgages or mezzanine financing on individual properties or a pool of properties. At December 31, 2005, the carrying amount of these mortgage loans totaled $175.4 million. Initial interest rates on mortgage loans outstanding at December 31, 2005 range from 7.5% to 13.5% per annum. At December 31, 2005, minimum future principal payments to be received on secured loans receivable are $66.5 million in 2006, $8.8 million in 2007, $2.4 million in 2008, $7.2 million in 2009, $39.8 million in 2010, and $50.7 million thereafter. Our mortgage loans generally include prepayment penalties or yield maintenance provisions.

10

Operator Concentration

The following table provides information about the concentration of business with our top five operators for the year ended December 31, 2005 (dollars in thousands):

Operators | | | | Facilities | | Investment(1) | | Percentage

of Revenue | |

Tenet Healthcare Corporation (NYSE:THC) (“Tenet”) | | | 8 | | | | $ | 423,497 | | | | 11 | % | |

American Retirement Corporation (NYSE:ARC) (“ARC”) | | | 15 | | | | 399,854 | | | | 9 | | |

Emeritus Corporation (AMEX:ESC) (“Emeritus”) | | | 36 | | | | 245,775 | | | | 6 | | |

Kindred Healthcare, Inc. (NASDAQ:KIND) | | | 20 | | | | 79,554 | | | | 4 | | |

HealthSouth Corporation (OTC:HLSH.PK) (“HealthSouth”) | | | 9 | | | | 108,301 | | | | 3 | | |

(1) Represents the carrying amount of real estate assets, including intangibles, after adding back accumulated depreciation and amortization.

All of our properties associated with the aforementioned operators are under triple-net leases. These operators are subject to the informational filing requirements of the Securities Exchange Act of 1934, as amended, and are required to file periodic reports with the Securities and Exchange Commission. Financial and other information relating to these operators may be obtained from their public reports.

According to public disclosures by Tenet and HealthSouth, each is experiencing various legal, financial, and regulatory difficulties. We cannot predict with certainty the impact, if any, of the outcome of these uncertainties on their financial condition. The failure or inability of these operators to pay their obligations could materially reduce our revenues, net income and cash flows, which could in turn reduce the amount of cash available for the payment of dividends, cause our stock price to decline and cause us to incur impairment charges or a loss on the sale of the properties.

One of our hospitals located in Tarzana, California is operated by Tenet and is affected by State of California Senate Bill 1953, which requires certain seismic safety building standards for acute care hospital facilities. See “Government Regulation—California Senate Bill 1953” for more information.

Joint Ventures

Consolidated Joint Ventures

At December 31, 2005, we held ownership interests in 22 consolidated limited liability companies and partnerships that together own 91 properties and one mortgage as follows:

· A 77% interest in Health Care Property Partners, which owns two hospitals, 13 skilled nursing facilities and has one mortgage on a skilled nursing facility.

· Interests varying between 90% and 97% in six partnerships (HCPI/San Antonio Ltd. Partnership; HCPI/Colorado Springs Ltd. Partnership; HCPI/Little Rock Ltd. Partnership; HCPI/Kansas Ltd. Partnership; Fayetteville Health Associates Ltd. Partnership; and Wichita Health Associates Ltd. Partnership), that each of which own a hospital.

· A 90% interest in three limited liability companies (ARC La Barc Real Estate Holdings, LLC; ARC Holland Real Estate Holdings, LLC; and ARC Sun City Real Estate Holdings, LLC) that each own a senior housing facility.

· An 80% interest in five limited liability companies (Vista-Cal Associates, LLC; Statesboro Associates, LLC; Ft. Worth-Cal Associates, LLC; Perris-Cal Associates, LLC; and Louisiana-Two Associates, LLC) that own a total of six skilled nursing facilities.

11

· A 93% interest in HCPI/Sorrento, LLC, which owns a life science facility.

· A 94% interest in HCPI/Indiana, LLC, which owns six medical office buildings.

· A 28% interest in HCPI/Tennessee, LLC, which owns 14 medical office buildings and one assisted living facility.

· A 70% interest in HCPI/Utah, LLC, which owns 18 medical office buildings.

· A 66% interest in HCPI/Utah II, LLC, which owns eight medical office buildings and eight other healthcare facilities.

· A 72% interest in HCP DR California, LLC, which owns four independent and assisted living facilities.

· An initial 100% interest in HCPI/Idaho Falls, LLC, which owns one hospital.

Unconsolidated Joint Ventures

At December 31, 2005, we held ownership interests in five unconsolidated limited liability companies and partnerships that together own 97 properties as follows:

· A 33% interest in HCP MOP which owns 93 medical office buildings. At December 31, 2005, 30 assets owned by HPC MOP were held for sale and classified as discontinued operations.

· A 45% to 50% interest in each of four limited liability companies (Seminole Shores Living Center, LLC—50%, Edgewood Assisted Living Center, LLC—45%, Arborwood Living Center, LLC—45%, and Greenleaf Living Center, LLC—45%) that each own an assisted living facility.

Taxation of HCP

We believe that we have operated in such a manner as to qualify for taxation as a REIT under Sections 856 to 860 of the Internal Revenue Code of 1986, as amended (the “Code”), commencing with our taxable year ended December 31, 1985, and we intend to continue to operate in such a manner. No assurance can be given that we have operated or will be able to continue to operate in a manner so as to qualify or to remain so qualified. This summary is qualified in its entirety by the applicable Code provisions, rules and regulations promulgated thereunder, and administrative and judicial interpretations thereof.

If we qualify for taxation as a REIT, we will generally not be required to pay federal corporate income taxes on the portion of our net income that is currently distributed to stockholders. This treatment substantially eliminates the “double taxation” (i.e., at the corporate and stockholder levels) that generally results from investment in a corporation. However, we will be required to pay federal income tax under certain circumstances.

The Code defines a REIT as a corporation, trust or association (i) which is managed by one or more trustees or directors; (ii) the beneficial ownership of which is evidenced by transferable shares, or by transferable certificates of beneficial interest; (iii) which would be taxable, but for Sections 856 through 860 of the Code, as a domestic corporation; (iv) which is neither a financial institution nor an insurance company subject to certain provisions of the Code; (v) the beneficial ownership of which is held by 100 or more persons; (vi) during the last half of each taxable year not more than 50% in value of the outstanding stock of which is owned, actually or constructively, by five or fewer individuals; and (vii) which meets certain other tests, described below, regarding the amount of its distributions and the nature of its income and assets. The Code provides that conditions (i) to (iv), inclusive, must be met during the entire taxable year and that condition (v) must be met during at least 335 days of a taxable year of 12 months, or during a proportionate part of a taxable year of less than 12 months.

12

There are presently two gross income requirements. First, at least 75% of our gross income (excluding gross income from “prohibited transactions” as defined below) for each taxable year must be derived directly or indirectly from investments relating to real property or mortgages on real property or from certain types of temporary investment income. Second, at least 95% of our gross income (excluding gross income from prohibited transactions) for each taxable year must be derived from income that qualifies under the 75% test and all other dividends, interest and gain from the sale or other disposition of stock or securities. A “prohibited transaction” is a sale or other disposition of property (other than foreclosure property) held for sale to customers in the ordinary course of business.

At the close of each quarter of our taxable year, we must also satisfy four tests relating to the nature of our assets. First, at least 75% of the value of our total assets must be represented by real estate assets, certain stock or debt instruments purchased with the proceeds of a stock offering or long term public debt offering by us (but only for the one-year period after such offering), cash, cash items and government securities. Second, not more than 25% of our total assets may be represented by securities other than those in the 75% asset class. Third, of the investments included in the 25% asset class, the value of any one issuer’s securities owned by us may not exceed 5% of the value of our total assets and we may not own more than 10% of the vote or value of the securities of a non-REIT corporation, other than certain debt securities and interests in taxable REIT subsidiaries or qualified REIT subsidiaries, each as defined below. Fourth, not more than 20% of the value of our total assets may be represented by securities of one or more taxable REIT subsidiaries.

We own interests in various partnerships and limited liability companies. In the case of a REIT that is a partner in a partnership or a member of a limited liability company that is treated as a partnership under the Code, Treasury Regulations provide that for purposes of the REIT income and asset tests, the REIT will be deemed to own its proportionate share of the assets of the partnership or limited liability company (determined in accordance with its capital interest in the entity), subject to special rules related to the 10% asset test, and will be deemed to be entitled to the income of the partnership or limited liability company attributable to such share. The ownership of an interest in a partnership or limited liability company by a REIT may involve special tax risks, including the challenge by the Internal Revenue Service (the “Service”) of the allocations of income and expense items of the partnership or limited liability company, which would affect the computation of taxable income of the REIT, and the status of the partnership or limited liability company as a partnership (as opposed to an association taxable as a corporation) for federal income tax purposes.

We also own interests in a number of subsidiaries which are intended to be treated as qualified REIT subsidiaries (each a “QRS”). The Code provides that such subsidiaries will be ignored for federal income tax purposes and all assets, liabilities and items of income, deduction and credit of such subsidiaries will be treated as our assets, liabilities and such items. If any partnership, limited liability company, or subsidiary in which we own an interest were treated as a regular corporation (and not as a partnership, QRS or taxable REIT subsidiary, as the case may be) for federal income tax purposes, we would likely fail to satisfy the REIT asset tests described above and would therefore fail to qualify as a REIT, unless certain relief provisions apply. We believe that each of the partnerships, limited liability companies, and subsidiaries (other than taxable REIT subsidiaries) in which we own an interest will be treated for tax purposes as a partnership, or disregarded entity (in the case of a 100% owned partnership or limited liability company) or QRS, as applicable, although no assurance can be given that the Service will not successfully challenge the status of any such organization.

As of December 31, 2005, we owned interests in two subsidiaries which are intended to be treated as taxable REIT subsidiaries (each a “TRS”). A REIT may own any percentage of the voting stock and value of the securities of a corporation which jointly elects with the REIT to be a TRS, provided certain requirements are met. A TRS generally may engage in any business, including the provision of customary or noncustomary services to tenants of its parent REIT and of others, except a TRS may not manage or

13

operate a hotel or healthcare facility. A TRS is treated as a regular corporation and is subject to federal income tax and applicable state income and franchise taxes at regular corporate rates. In addition, a 100% tax may be imposed on a REIT if its rental, service or other agreements with its TRS, or the TRS’s agreements with the REIT’s tenants, are not on arm’s-length terms.

In order to qualify as a REIT, we are required to distribute dividends (other than capital gain dividends) to our stockholders in an amount at least equal to (A) the sum of (i) 90% of our “real estate investment trust taxable income” (computed without regard to the dividends paid deduction and our net capital gain) and (ii) 90% of the net income, if any (after tax), from foreclosure property, minus (B) the sum of certain items of non-cash income. Such distributions must be paid in the taxable year to which they relate, or in the following taxable year if declared before we timely file our tax return for such year, if paid on or before the first regular dividend payment date after such declaration and if we so elect and specify the dollar amount in our tax return. To the extent that we do not distribute all of our net long-term capital gain or distribute at least 90%, but less than 100%, of our “real estate investment trust taxable income”, as adjusted, we will be required to pay tax thereon at regular corporate tax rates. Furthermore, if we should fail to distribute during each calendar year at least the sum of (i) 85% of our ordinary income for such year, (ii) 95% of our capital gain income for such year, and (iii) any undistributed taxable income from prior periods, we would be required to pay a 4% excise tax on the excess of such required distributions over the amounts actually distributed.

If we fail to qualify for taxation as a REIT in any taxable year, and certain relief provisions do not apply, we will be required to pay tax (including any applicable alternative minimum tax) on our taxable income at regular corporate rates. Distributions to stockholders in any year in which we fail to qualify will not be deductible by us nor will they be required to be made. Unless entitled to relief under specific statutory provisions, we will also be disqualified from taxation as a REIT for the four taxable years following the year during which qualification was lost. It is not possible to state whether in all circumstances we would be entitled to the statutory relief. Failure to qualify for even one year could substantially reduce distributions to stockholders and could result in our incurring substantial indebtedness (to the extent borrowings are feasible) or liquidating substantial investments in order to pay the resulting taxes.

We and our stockholders may be required to pay state or local tax in various state or local jurisdictions, including those in which we or they transact business or reside. The state and local tax treatment of us and our stockholders may not conform to the federal income tax consequences discussed above.

We may also be subject to certain taxes applicable to REITs, including taxes in lieu of disqualification as a REIT, on undistributed income, on income from prohibited transactions, on net income from foreclosure property and on built-in gains from the sale of certain assets acquired from C corporations in tax-free transactions.

Government Regulation

The healthcare industry is heavily regulated by federal, state and local laws. This government regulation of the healthcare industry affects us because:

(1) Governmental regulations such as licensure, certification for participation in government programs, and government reimbursement may impact the financial ability of some of our operators to make rent and debt payments to us, which in turn may affect the value of our investments, and

(2) The amount of reimbursement such operators receive from the government and other third parties may affect the amounts we receive in additional rents, which are often based on our operators’ gross revenue from operations.

14

These laws and regulations are subject to frequent and substantial changes resulting from legislation, adoption of rules and regulations, and administrative and judicial interpretations of existing law. These changes may have a dramatic effect on the definition of permissible or impermissible activities, the relative costs associated with doing business and the amount of reimbursement by government and other third-party payors. These changes may be applied retroactively. The ultimate timing or effect of these changes cannot be predicted. The failure of any tenant or borrower to comply with such laws, regulations and requirements could affect its ability to operate its facility or facilities and could adversely affect such operator’s ability to make lease or debt payments to us.

Fraud and Abuse Laws. There are various federal and state laws prohibiting fraud and abusive business practices by healthcare providers who participate in, receive payments from or are in a position to make referrals in connection with a government-sponsored healthcare program, including, but not limited to, the Medicare and Medicaid programs. These include:

· The Federal Anti-Kickback Statute, which prohibits, among other things, the offer, payment, solicitation or receipt of any form of remuneration in return for, or to induce, the referral of Medicare and Medicaid patients.

· The Federal Physician Self-Referral Prohibition (Stark), which restricts physicians from making referrals for certain designated health services for which payment may be made under Medicare or Medicaid programs to an entity with which the physician (or an immediate family member) has a financial relationship.

· The False Claims Act, which prohibits any person from knowingly presenting false or fraudulent claims for payment to the federal government (including the Medicare and Medicaid programs).

· The Civil Monetary Penalties Law, which is imposed by the Department of Health and Human Services for fraudulent acts.

Each of these laws include criminal and/or civil penalties for violations that range from punitive sanctions, damage assessments, penalties, imprisonment, denial of Medicare and Medicaid payments, and/or exclusion from the Medicare and Medicaid programs. Imposition of any of these types of penalties on our tenants or borrowers could result in a material adverse effect on their operations, which could adversely affect our business. Additionally, certain laws, such as the False Claims Act, allow for individuals to bring qui tam (whistleblower) actions on behalf of the government for violations of fraud and abuse laws. Some Medicare fiscal intermediaries (private companies that contract with Centers for Medicare & Medicaid Services (“CMS”) to administer the Medicare program) have also increased scrutiny of cost reports filed by skilled nursing providers.

Environmental Matters. A wide variety of federal, state and local environmental and occupational health and safety laws and regulations affect healthcare facility operations. Under various federal, state and local environmental laws, ordinances and regulations, an owner of real property or a secured lender (such as us) may be liable for the costs of removal or remediation of hazardous or toxic substances at, under or disposed of in connection with such property, as well as other potential costs relating to hazardous or toxic substances (including government fines and damages for injuries to persons and adjacent property). The cost of any required remediation, removal, fines or personal or property damages and the owner’s or secured lender’s liability therefore could exceed the value of the property, and/or the assets of the owner or secured lender. In addition, the presence of such substances, or the failure to properly dispose of or remediate such substances, may adversely affect the owner’s ability to sell or rent such property or to borrow using such property as collateral which, in turn, would reduce our revenue. Although the mortgage loans that we provide and the leases covering our properties require the borrower and the tenant to indemnify us for certain environmental liabilities, the scope of such obligations may be

15

limited and we cannot assure that any such borrower or tenant would be able to fulfill its indemnification obligations.

The Medicare and Medicaid Programs. Sources of revenue for operators may include the federal Medicare program, state Medicaid programs, private insurance carriers, healthcare service plans and health maintenance organizations, among others. Efforts to reduce costs by these payors will likely continue, which may result in reduced or slower growth in reimbursement for certain services provided by some of our operators. In addition, the failure of any of our operators to comply with various laws and regulations could jeopardize their certification and ability to continue to participate in the Medicare and Medicaid programs. Medicaid programs differ from state to state but they are all subject to federally-imposed requirements. At least 50% of the funds available under these programs are provided by the federal government under a matching program. Medicaid programs generally pay for acute and rehabilitative care based on reasonable costs at fixed rates; skilled nursing facilities are generally reimbursed using fixed daily rates. Medicaid payments are generally below retail rates for tenant-operated facilities. Increasingly, states have introduced managed care contracting techniques into the administration of Medicaid programs. Such mechanisms could have the impact of reducing utilization of and reimbursement to facilities. Other third party payors in various states base payments on costs, retail rates or, increasingly, negotiated rates. Negotiated rates can include discounts from normal charges, fixed daily rates and prepaid capitated rates.

Healthcare Facilities. The healthcare facilities in our portfolio, including hospitals, skilled nursing facilities, assisted living facilities, and physician group practice clinics, are subject to extensive federal, state and local licensure, certification and inspection laws and regulations. Failure to comply with any of these laws could result in loss of accreditation, denial of reimbursement, imposition of fines, suspension or decertification from federal and state healthcare programs, loss of license or closure of the facility. Such actions may have an effect on the revenue of the operators of properties owned by or mortgaged to us and therefore adversely impact us.

Entrance Fee Communities. Certain of the senior housing facilities mortgaged to or owned by us are operated as entrance fee communities. Generally, an entrance fee is an upfront fee or consideration paid by a resident, a portion of which may be refundable, in exchange for some form of long-term benefit. Some of the entrance fee communities are subject to significant state regulatory oversight, including, for example, oversight of each facility’s financial condition, establishment and monitoring of reserve requirements and other financial restrictions, the right of residents to cancel their contracts within a specified period of time, lien rights in favor of the residents, restrictions on change of ownership and similar matters. Such oversight and the rights of residents within these entrance fee communities may have an effect on the revenue or operations of the operators of such facilities and therefore may adversely impact us.

California Senate Bill 1953. Our hospital located in Tarzana, California is affected by State of California Senate Bill 1953 (SB 1953), which requires certain seismic safety building standards for acute care hospital facilities. This hospital is operated by Tenet under a lease expiring in February 2009. We and Tenet are currently reviewing the SB 1953 compliance of this hospital, multiple plans of action to cause such compliance, the estimated time for completing the same, and the cost of performing necessary remediation of the property. We cannot currently estimate the remediation costs that will need to be incurred prior to 2013 in order to make the facility SB 1953-compliant through 2030, or the final allocation of any remediation costs between us and Tenet. Rent on the hospital in 2005 and 2004 was $10.8 million and $10.6 million, respectively, and our carrying amount is $76.1 million at December 31, 2005.

Nurse Staffing Ratios. On January 1, 2004, a California law became effective mandating specific minimum nurse staffing ratios for acute care hospitals. As a result of this requirement, hospital labor costs will be materially increased. Facilities may also be forced to limit patient admissions due to an inability to

16

hire the necessary number of nurses to meet the required ratio, which affects net operating revenue. It is unclear the extent to which compliance with these nurse staffing ratios in California may adversely affect hospital operators in California.

Current Developments

The healthcare industry continues to face various challenges, including increased government and private payor pressure on healthcare providers to control costs, the migration of patients from acute care facilities into extended care and home care settings, and the vertical and horizontal consolidation of healthcare providers.

Changes in the law, new interpretations of existing laws, and changes in payment methodologies may have a dramatic effect on the definition of permissible or impermissible activities, the relative costs associated with doing business and the amount of reimbursement furnished by government and other third-party payors. These changes may be applied retroactively under certain circumstances. The ultimate timing or effect of legislative efforts cannot be predicted and may impact us in different ways.

In December of 2003, the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (the “Act”) was signed into law. The Act established an 18-month moratorium on the “whole hospital exception” to the Stark law, whereby physicians have been permitted to refer patients for Designated Health Services to hospitals in which they have an ownership interest. The moratorium removed specialty hospitals from the “whole hospital exception” from December 8, 2003 through June 7, 2005. Specialty hospitals include hospitals primarily or exclusively engaged in the care and treatment of cardiac conditions or orthopedic conditions, or hospitals that perform certain surgical procedures. Specialty hospitals in operation or under development as of November 18, 2003 were grandfathered under the moratorium. The Act requires that MedPAC, an independent federal body established to advise Congress on issues affecting the Medicare program, and HHS conduct studies on the costs of service, utilization, quality of care and financial impact of specialty hospitals and their physician owners relative to community hospitals, particularly nonprofits. On January 14, 2005 MedPAC announced that it would recommend that Congress extend the Stark specialty hospital moratorium for an additional 18 months to January 1, 2007, to address concerns about the effects of physician investments in specialty hospitals. MedPAC’s recommendations were based upon its findings that when compared with community hospitals, physician owned specialty hospitals tend to concentrate on certain more profitable Diagnostic Related Groups (“DRGs”) and on patients with relatively low severity within those DRGs, and tend to treat lower percentages of Medicare patients. Congress is not obligated to follow MedPAC’s recommendations. Legislation has been introduced in Congress (The Hospital Fair Competition Act of 2005) that would extend the moratorium for specialty hospitals. It is uncertain if such legislation will be enacted this year or in subsequent sessions of Congress. Notwithstanding the uncertainty of legislation extending the moratorium, CMS instructed Medicare Fiscal Intermediaries to stop processing new Medicare provider enrollment applications for specialty hospitals after June 8, 2005, pending CMS’s review of how specialty hospitals satisfy core requirements applicable to “hospitals” under Medicare, and how the Emergency Medical Treatment and Active Labor Act should apply to specialty hospitals. CMS expects to complete its review in early 2006, with further changes in 2006 to the hospital inpatient prospective payment system to reduce the ability of specialty hospitals to take advantage of imprecise payment rates under the current system.

In addition to the reforms enacted and considered by Congress from time to time, state legislatures periodically consider various healthcare reform proposals. Congress and state legislatures can be expected to continue to review and assess alternative healthcare delivery systems, new regulatory enforcement initiatives, and new payment methodologies.

We believe that government and private efforts to contain or reduce healthcare costs will continue. These trends are likely to lead to reduced or slower growth in reimbursement for certain services provided

17

by some of our operators. In addition, recent trends of hospitals providing more services to uninsured patients or on an outpatient basis rather than inpatient basis may continue and could adversely affect the profitability of our operators. We believe that the vast nature of the healthcare industry, the financial strength and operating flexibility of our operators, and the diversity of our portfolio will mitigate the impact of any such trends. However, we cannot predict what legislation will be adopted, and no assurance can be given that the healthcare reforms will not have a material adverse effect on our financial condition or results of operations.

Employees

At December 31, 2005, we had 83 full-time employees and no part-time employees, none of whom are subject to a collective bargaining agreement. We consider our relations with our employees to be good.

Legal Entities

We conduct our business through various legal entities, including the following at December 31, 2005:

100% Owned | | | | Consolidated Joint Ventures | | Unconsolidated Joint Ventures |

AHP of Nevada, Inc. AHP of Washington, Inc. ARC Richmond Place Real Estate Holdings, LLC Birmingham HCP, LLC Emeritus Realty V, LLC ESC-La Casa Grande, LLC Health Care Investors III HCP 1101 Madison MOB, LLC HCP 600 Broadway MOB, LLC HCP AL of Florida, LLC HCP Acquisitions, LLC HCP Arnold MOB, LLC HCP Ballard MOB, LLC HCP Birmingham Portfolio, LLC HCP Cullman MOB GP, LLC

Cullman POB Partners I, Ltd.

Cullman POB II, LLC

HCP Cullman MOB GP, LLC HCP Cityview I, L.P. HCP Cityview II, L.P. HCP EGP, Inc. HCP Kirkland, LLC HCP Louisville, Inc.

Faulkner Hinton Suburban I, LLC

Faulkner Hinton Suburban II, LLC HCP Medical Office Buildings I, LLC HCP Medical Office Buildings II, LLC HCP MOP Member, LLC | | ARC Holland Real Estate Holdings, LLC ARC LaBarc Real Estate Holdings LLC ARC Sun City Real Estate Holdings, LLC Fayetteville Health Associates Limited Partnership Ft. Worth-Cal Associates, LLC HCP DR California, LLC

HCP Pleasant, LLC HCPI/Colorado Springs Ltd. Partnership HCP CTE, L.P. HCP ETE, L.P. HCPI/Idaho Falls LLC HCPI/Indiana, LLC HCPI/Kansas Limited Partnership HCPI/Little Rock Limited Partnership HCPI/San Antonio Limited Partnership HCPI/Sorrento, LLC HCPI/Tennessee, LLC

MOB of Denver 1, LLC

MOB of Denver 2, LLC

MOB of Denver 3, LLC

MOB of Denver 4, LLC

MOB of Denver 5, LLC

MOB of Denver 6, LLC

MOB of Denver 7, LLC Medical Office Buildings of California LLC | | Arborwood Living Center, LLC Edgewood Assisted Living Center, LLC Greenleaf Living Centers, LLC HCP Medical Office Portfolio, LLC Seminole Shores Living Center, LLC |

18

HCP NE Retail MOB, LLC HCP Shore, LLC HCP TRS, Inc.

Medical Office Buildings of Reston, LLC HCPI Knightdale, Inc. HCPI Mortgage Corp. HCPI Trust HCP Virginia, Inc. Jackson HCP, LLC McKinney HCP GP, LLC McKinney HCP, L.P. Meadowdome, LLC Medcap HCPI Development, LLC

Aurora HCP, LLC

HCP Owasso MOB, LLC Medical Office Buildings of Colorado II, LLC Medical Office Buildings of Nevada-Southern Hills, LLC Mission Springs AL, LLC Overland Park AL, LLC Tampa HCP, LLC Texas HCP G.P., Inc. Texas HCP Holding, L.P. Texas HCP Medical G.P., Inc. Texas HCP Medical Office Buildings, L.P. Texas HCP, Inc. | | Medical Office Buildings of Utah LLC Westminster HCP, LLC HCPI/Utah, LLC

Davis North I, LLC HCPI/Utah II, LLC

HCPI/Stansbury, LLC

HCPI/Wesley, LLC Health Care Property Partners Louisiana-Two Associates, LLC Perris-Cal Associates, LLC Statesboro Associates, LLC Vista-Cal Associates, LLC Wichita Health Associates Limited Partnership | | |

ITEM 1A. Risk Factors

You should carefully consider the risks described below as well as the risks described in “Competition,” “Government Regulation,” and “Taxation of HCP” and elsewhere in this report, which risks are incorporated by reference into this section, before making an investment decision regarding our company. The risks and uncertainties described herein are not the only ones facing us and there may be additional risks that we do not presently know of or that we currently consider not likely to have a significant impact. All of these risks could adversely affect our business, financial condition, results of operations and cash flows.

Risks Related to Our Operators

If our facility operators are unable to operate our properties in a manner sufficient to generate income, they may be unable to make rent and loan payments to us.

The healthcare industry is highly competitive and we expect that it may become more competitive in the future. Our operators are subject to competition from other healthcare providers that provide similar services. Such competition, which has intensified due to overbuilding in some segments in which we operate, has caused the fill-up rate of newly constructed buildings to slow and the monthly rate that many newly built and previously existing facilities were able to obtain for their services to decrease. The profitability of healthcare facilities depends upon several factors, including the number of physicians using

19

the healthcare facilities or referring patients there, competitive systems of healthcare delivery and the size and composition of the population in the surrounding area. Private, federal and state payment programs and the effect of other laws and regulations may also have a significant influence on the revenues and income of the properties. If our operators are not competitive with other healthcare providers and are unable to generate income, they may be unable to make rent and loan payments to us, which could adversely affect our cash flow and financial performance and condition.

The bankruptcy, insolvency or financial deterioration of our facility operators could significantly delay our ability to collect unpaid rents or require us to find new operators.

Our financial position and our ability to make distributions to our stockholders may be adversely affected by financial difficulties experienced by any of our major operators, including bankruptcy, insolvency or a general downturn in the business, or in the event any of our major operators do not renew or extend their relationship with us as their lease terms expire.

We are exposed to the risk that our operators may not be able to meet their obligations, which may result in their bankruptcy or insolvency. Although our leases and loans provide us the right to terminate an investment, evict an operator, demand immediate repayment and other remedies, the bankruptcy laws afford certain rights to a party that has filed for bankruptcy or reorganization. An operator in bankruptcy may be able to restrict our ability to collect unpaid rents or interest during the bankruptcy proceeding.

Tenet Healthcare Corporation accounts for a significant percentage of our revenues and is currently experiencing significant legal, financial and regulatory difficulties.

During 2005, Tenet Healthcare Corporation accounted for approximately 11% of our revenues. According to public disclosures, Tenet is experiencing significant legal, financial and regulatory difficulties. We cannot predict with certainty the impact, if any, of the outcome of these uncertainties on our consolidated financial statements. The failure or inability of Tenet to pay its obligations could materially reduce our revenue, net income and cash flows, which could adversely affect the value of our common stock and could cause us to incur impairment charges or a loss on the sale of the properties.

Our operators are faced with increased litigation and rising insurance costs that may affect their ability to make their lease or mortgage payments.

In some states, advocacy groups have been created to monitor the quality of care at healthcare facilities, and these groups have brought litigation against operators. Also, in several instances, private litigation by patients has succeeded in winning very large damage awards for alleged abuses. The effect of this litigation and potential litigation has been to materially increase the costs of monitoring and reporting quality of care compliance incurred by our operators. In addition, the cost of liability and medical malpractice insurance has increased and may continue to increase so long as the present litigation environment affecting the operations of healthcare facilities continues. Continued cost increases could cause our operators to be unable to make their lease or mortgage payments, potentially decreasing our revenue and increasing our collection and litigation costs. Moreover, to the extent we are required to take back the affected facilities, our revenue from those facilities could be reduced or eliminated for an extended period of time.

Decline in the skilled nursing sector and changes to Medicare and Medicaid reimbursement rates may have significant adverse consequences to us.

Certain of our skilled nursing operators and facilities continue to experience operating problems in part due to a national nursing shortage, increased liability insurance costs, and low levels of Medicare and Medicaid reimbursement. Due to economic challenges facing many states, nursing homes will likely continue to be under-funded. These challenges have had, and may continue to have, an adverse effect on our long-term care facilities and facility operators.

20

Risks Related to Real Estate Investment and Our Structure

We rely on external sources of capital to fund future capital needs, and if our access to such capital is difficult or on commercially unreasonable terms, we may not be able to meet maturing commitments or make future investments necessary to grow our business.

In order to qualify as a REIT under the Internal Revenue Code, we are required, among other things, to distribute to our stockholders each year at least 90% of our REIT taxable income. Because of this distribution requirement, we may not be able to fund all future capital needs, including capital needs in connection with acquisitions, from cash retained from operations. As a result, we rely on external sources of capital. If we are unable to obtain needed capital at all or only on unfavorable terms from these sources, we might not be able to make the investments needed to grow our business, or to meet our obligations and commitments as they mature, which could negatively affect the ratings of our debt and even, in extreme circumstances, affect our ability to continue operations. Our access to capital depends upon a number of factors over which we have little or no control, including:

· general market conditions;

· the market’s perception of our growth potential;

· our current and potential future earnings and cash distributions; and

· the market price of the shares of our capital stock.

If we are unable to identify and purchase suitable healthcare facilities at a favorable cost, we will be unable to continue to grow through acquisitions.

Our ability to grow through acquisitions is integral to our business strategy and requires us to identify suitable acquisition candidates that meet our criteria and are compatible with our growth strategy. The acquisition and financing of healthcare facilities at favorable costs is highly competitive. We may not be successful in identifying suitable property or other assets that meet our acquisition criteria or in consummating acquisitions on satisfactory terms or at all. If we cannot identify and purchase a sufficient quantity of healthcare facilities at favorable prices, or if we are unable to finance such acquisitions on commercially favorable terms, our business will suffer.

Unforeseen costs associated with the acquisition of new properties could reduce our profitability.

Our business strategy contemplates future acquisitions. The acquisitions we make may not prove to be successful. We might encounter unanticipated difficulties and expenditures relating to any acquired properties, including contingent liabilities. Further, newly acquired properties might require significant management attention that would otherwise be devoted to our ongoing business. We might never realize the anticipated benefits of an acquisition, which could adversely affect our profitability.

Since real estate investments are illiquid, we may not be able to sell properties when we desire.

Real estate investments generally cannot be sold quickly. We may not be able to vary our portfolio promptly in response to changes in the real estate market. This inability to respond to changes in the performance of our investments could adversely affect our ability to service our debt. The real estate market is affected by many factors that are beyond our control, including:

· adverse changes in national and local economic and market conditions;

· changes in interest rates and in the availability, costs and terms of financing;

· changes in governmental laws and regulations, fiscal policies and zoning and other ordinances and costs of compliance with laws and regulations;

21

· the ongoing need for capital improvements, particularly in older structures;

· changes in operating expenses; and

· civil unrest, acts of war and natural disasters, including earthquakes and floods, which may result in uninsured and underinsured losses.

We cannot predict whether we will be able to sell any property for the price or on the terms set by us, or whether any price or other terms offered by a prospective purchaser would be acceptable to us. We also cannot predict the length of time needed to find a willing purchaser and to close the sale of a property. In addition, there are provisions under the federal income tax laws applicable to REITs that may limit our ability to recognize the full economic benefit from a sale of our assets. These factors and any others that would impede our ability to respond to adverse changes in the performance of our properties could have a material adverse effect on our operating results and financial condition.

Transfers of healthcare facilities generally require regulatory approvals, and alternative uses of healthcare facilities are limited.

Because transfers of healthcare facilities may be subject to regulatory approvals not required for transfers of other types of commercial operations and other types of real estate, there may be delays in transferring operations of our facilities to successor operators or we may be prohibited from transferring operations to a successor operator. In addition, substantially all of our properties are healthcare facilities that may not be easily adapted to non-healthcare related uses. If we are unable to transfer properties at times opportune to us, our revenue and operations may suffer.

We may experience uninsured or underinsured losses.