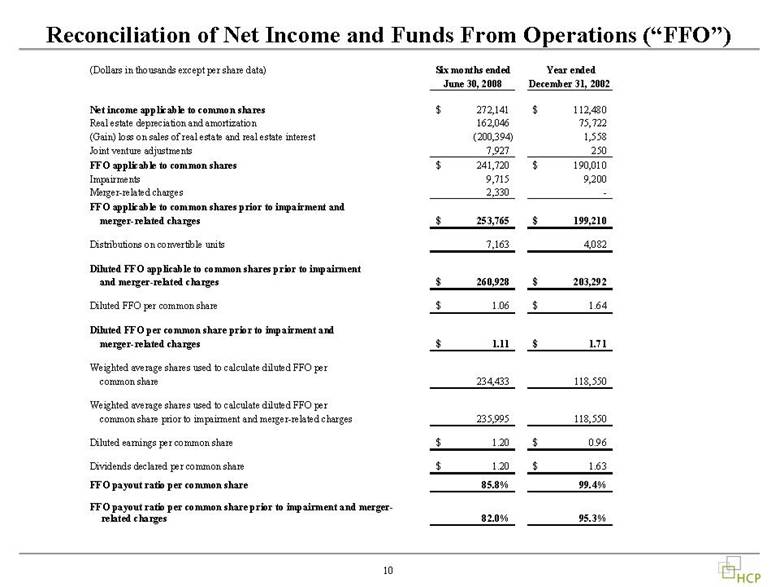

| 12 Reporting Definitions (cont’d) Financial Leverage. Total Debt divided by Total Gross Assets. The Company believes that its Financial Leverage is a meaningful supplemental measure of its financial position, which enables both management and investors to analyze its leverage and to compare its leverage to that of other companies. The Company believes that the ratio of consolidated debt to consolidated gross assets is the most directly comparable GAAP measure to Financial Leverage. The Company’s computation of its Financial Leverage may not be identical to the computations of financial leverage reported by other companies. The Company’s share of total debt is not intended to reflect its actual liability or ability to access assets should there be a default under any or all of such loans or a liquidation of the joint ventures. Fixed Charge Coverage. Adjusted EBITDA divided by Fixed Charges. The Company uses Fixed Charge Coverage, a non-GAAP financial measure, as a measure of liquidity. The Company believes Fixed Charge Coverage provides investors, particularly fixed income investors, relevant and useful information because it measures the Company’s ability to meet its interest payments on outstanding debt and pay dividends to its preferred shareholders. The Company’s various debt agreements contain covenants that require the Company to maintain ratios similar to Fixed Charge Coverage and credit rating agencies utilize similar ratios in evaluating and determining the credit rating on certain debt instruments of the Company. However, since this ratio is derived from Adjusted EBITDA and Fixed Charges, its usefulness is limited by the same factors that limit the usefulness of Adjusted EBITDA and Fixed Charges. Further, the Company’s computation of Fixed Charge Coverage may not be comparable to similar fixed charge coverage ratios reported by other companies. Fixed Charges. Total interest expense plus capitalized interest plus preferred stock dividends. The Company uses Fixed Charges to measure its interest payments on outstanding debt and dividends to its preferred shareholders for purposes of presenting Fixed Charge Coverage. However, the usefulness of Fixed Charges is limited as, among other things, it does not include all contractual obligations. The Company’s computation of Fixed Charges should not be considered an alternative to fixed charges as defined by Item 503(d) of Regulation S-K and may not be comparable to fixed charges reported by other companies. Funds From Operations (“FFO”). The Company believes that net income as defined by GAAP is the most appropriate earnings measure. The Company also believes that Funds From Operations, or FFO, as defined by the National Association of Real Estate Investment Trusts (“NAREIT”), FFO applicable to common shares, Diluted FFO applicable to common shares, and Basic and Diluted FFO per common share are important non-GAAP supplemental measures of operating performance for a real estate investment trust. Because the historical cost accounting convention used for real estate assets requires straight-line depreciation (except on land), such accounting presentation implies that the value of real estate assets diminishes predictably over time. However, since real estate values have historically risen or fallen with market and other conditions, presentations of operating results for a real estate investment trust that use historical cost accounting for depreciation could be less informative. Thus, NAREIT created FFO as a supplemental measure of operating performance for real estate investment trusts that excludes historical cost depreciation and amortization, among other items, from net income, as defined by GAAP. FFO is defined as net income, computed in accordance with GAAP, excluding gains or losses from real estate dispositions, plus real estate depreciation and amortization, with adjustments to derive the Company’s pro rata share of FFO from consolidated and unconsolidated joint ventures. Adjustments for joint ventures are calculated to reflect FFO on the same basis. The Company believes that the use of FFO, combined with the required GAAP presentations, improves the understanding of operating results of real estate investment trusts among investors and makes comparisons of operating results among such companies more meaningful. The Company considers FFO to be a useful measure for reviewing comparative operating and financial performance because, by excluding gains or losses related to sales of previously depreciated operating real estate assets and real estate depreciation and amortization, FFO can help investors compare the operating performance of a real estate investment trust between periods or as compared to other companies. While FFO is a relevant and widely used measure of operating performance of real estate investment trusts, it does not represent cash flow from operations or net income as defined by GAAP and should not be considered an alternative to those measures in evaluating the Company’s liquidity or operating performance. FFO also does not consider the costs associated with capital expenditures related to the Company’s real estate assets nor is FFO necessarily indicative of cash available to fund the Company’s future cash requirements. Further, the Company’s computation of FFO may not be comparable to FFO reported by other real estate investment trusts that do not define the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently from the Company. |