Exhibit 99.2

Perspectives and Observations on COVID - 19 Impact April 7, 2020 35 CambridgePark Drive Boston, MA

Introduction ■ The COVID - 19 pandemic and global economic crisis continue to evolve rapidly. The purpose of this presentation is to provide our current observations and perspectives on each of our three core business segments, along with an update on development and our balance sheet and liquidity. ■ This presentation is based on our assessment of information available to us as of the current date, and we do not undertake any obligations to provide further updates . Furthermore, the information provided does not represent guidance, which we plan to issue at the appropriate time. Please refer to the “Disclaimers” included on page 12 of this presentation. 2

Life Science (31% of NOI) (1) – Portfolio Observations 3 ■ Acquisition: On April 1, closed on the previously announced $320M acquisition of The Post, a 426K sq. ft. life science and innovation asse t in the Route 128 submarket of Boston, which expands our life science holdings in the Boston region. ■ Leasing : Executed 314K sq. ft. of leasing in the first quarter (40% of which was executed in March) consisting of 239K sq. ft. of new leasing and 75K sq. ft. of renewals at a 30% mark - to - market increase – leasing ahead of plan through 1Q. □ Currently have nearly 400K sq. ft. of space under a letter of intent, split roughly 80 % new leasing and 20% renewals – new leasing driven largely by existing tenants looking to expand within our portfolio. □ Expecting slowdown in leasing activity through the duration of the pandemic. ■ Construction: Since our last update in March, tenant improvement projects have been paused in the Bay Area and Boston into early May due to r ecent governmental restrictions related to the pandemic. □ Limited exceptions for work deemed essential by local authorities and for projects directly related to COVID - 19 response. □ Tenant improvement build - outs are currently continuing in the San Diego region, with safety protocols in place related to social distancing and proper hygiene and sanitization . ■ Rent relief: □ We have received a limited number of rent deferral requests and are in the process of reviewing them on a case - by - case basis. (1) See page 11 for reconciliation of Portfolio Income (“NOI ”).

Medical Office (29% of NOI) – Portfolio Observations 4 ■ Impact on operations varies by market: □ Many physician practices have discontinued nonessential surgeries and procedures, which has negatively impacted their cash fl ows . Accordingly, we have received requests for rent relief from many of our physician tenants. □ However, n ew and renewal leasing activity across our portfolio resulted in a 10 bps increase in occupancy in March. □ Virtual tours are becoming more prevalent as we expand our capabilities with this technology. □ Planned tenant move - outs are likely to be delayed, so retention during the pandemic is likely to increase. □ As hospitals limit elective procedures and volume decreases, we expect a decline in Medical City add - rent as well as parking rev enue. ■ Continue to see enhanced procedures and protocols by our MOB tenants and affiliated hospitals across the portfolio: □ Restrictions on the number of entry points to our buildings attached to affiliated hospitals. □ Screening visitors at many building entrances . ■ Rent relief: □ We are implementing a deferred rent program for our non - health system / hospital tenants subject to certain conditions. ● We will provide a two month deferral of rent for May and June with the requirement that rent for these periods will be repaid by year end. ● The program will be available to tenants in good standing that have applied for relief under the CARES Act. ● HCA , Healthpeak’s largest MOB health system relationship, is also providing a program to their MOB tenants where they are the landlord. ■ We continue to support COVID - 19 medical efforts by providing available space to hospitals / tenants at no charge: □ Providing vacant suites, as well as parking lots, for the testing, diagnoses and triage of patients. ■ Hospitals continue to see lower volumes as they prepare to provide availability for COVID - 19 cases : □ Many of our hospitals are preparing for a surge in COVID - 19 cases in mid to late April as significant increases in cases are expected. □ We do not expect a significant impact to our owned hospital portfolio, which had an overall EBITDAR coverage exceeding 3.7x as of 12/31/2019.

Senior Housing (34% of NOI) – Portfolio Observations 5 ■ Occupancy: Total blended occupancy in our SHOP and CCRC portfolio was 83.8% on February 29, 83.7% on March 15, and 83.4% on March 31. Move - ins were in line with our expectations through mid - March. Thereafter , move - ins declined in response to COVID - 19 protocols, sheltering in place, and reduced in - person tours. □ Move - ins in our SHOP and CCRC portfolio in March declined 41% from February 2020 and 50% from March 2019. □ Industry sources and discussions with operators indicate that involuntary move - outs comprise approximately two thirds of all mov e - outs in our portfolio, with the remaining third being voluntary move - outs. Voluntary move - outs will likely decline during the pandemic as more seniors elect to shelter in place, but the extent of that impact is difficult to predict at this time. ■ Leading indicators: □ Leads in our SHOP and CCRC portfolio in March declined by 33% compared to February 2020, and by 32% compared to March 2019. □ Tours in our SHOP and CCRC portfolio in March declined by 53% compared to February 2020, and by 53% compared to March 2019. □ While digital marketing has been strengthened, the elimination of marketing events and in - person outreach to referral sources ha s negatively affected leads. □ As of mid - March, almost all tours are being done virtually / digitally. □ We did observe an improvement in our month - over - month conversion ratios, which suggests that more inquiries are from potential residents whose desire or need to move is greater. ■ Expenses : As previously disclosed, COVID - 19 will continue increasing costs as operators respond to higher staffing demands and increased usag e and inventory of critical medical supplies and personal protective equipment (PPE). □ Based on our daily discussions, our operators are paying a premium for labor in many markets, particularly in communities tha t h ave been impacted by COVID - 19. These premiums vary based on the circumstances, but we expect that labor costs, which historically accounted for approximately 60% of total cos ts, may increase by 5 - 15% overall during the pandemic. □ PPE, which historically accounted for about 2% of total costs, may increase by 2x – 5x during this period. □ We expect that the balance of remaining costs, which includes food, repairs and maintenance, insurance, real estate taxes, an d o ther operating expenses, will be generally in line with our original expectations. □ Overall, while we expect some offsetting expense savings with variable costs, total costs during the pandemic impact period m ay be 5 - 15% higher than our original 2020 annual plan. Depending upon the ultimate severity of the pandemic in different areas, these increases may be higher or lower. ■ Known infections: Based on the daily reports we receive from our operators across 222 communities, we currently have 22 communities managed by 9 d ifferent operators with confirmed resident COVID - 19 cases, and 11 of those affected communities have experienced resident deaths.

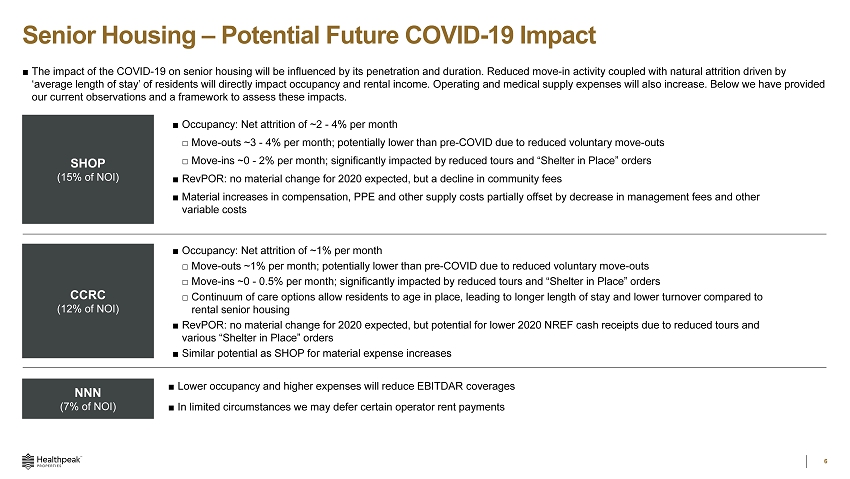

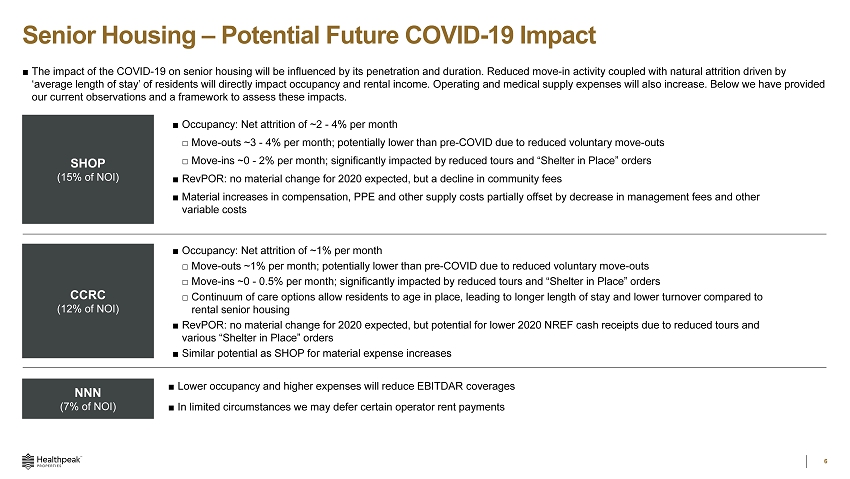

Senior Housing – Potential Future COVID - 19 Impact 6 SHOP (15% of NOI) CCRC (12% of NOI ) NNN (7% of NOI ) Improving Performance / Declining Performance ■ Lower occupancy and higher expenses will reduce EBITDAR coverages ■ In limited circumstances we may defer certain operator rent payments ■ Occupancy: Net attrition of ~2 - 4% per month □ Move - outs ~3 - 4% per month; potentially lower than pre - COVID due to reduced voluntary move - outs □ Move - ins ~0 - 2% per month; significantly impacted by reduced tours and “Shelter in Place” orders ■ RevPOR: no material change for 2020 expected, but a decline in community fees ■ Material increases in compensation, PPE and other supply costs partially offset by decrease in management fees and other variable costs ■ Occupancy: Net attrition of ~1% per month □ Move - outs ~1% per month; potentially lower than pre - COVID due to reduced voluntary move - outs □ Move - ins ~0 - 0.5% per month; significantly impacted by reduced tours and “Shelter in Place” orders □ Continuum of care options allow residents to age in place, leading to longer length of stay and lower turnover compared to rental senior housing ■ RevPOR: no material change for 2020 expected, but potential for lower 2020 NREF cash receipts due to reduced tours and various “Shelter in Place ” orders ■ Similar potential as SHOP for material expense increases ■ The impact of the COVID - 19 on senior housing will be influenced by its penetration and duration. Reduced move - in activity couple d with natural attrition driven by ‘average length of stay’ of residents will directly impact occupancy and rental income. Operating and medical supply expenses wi ll also increase. Below we have provided our current observations and a framework to assess these impacts.

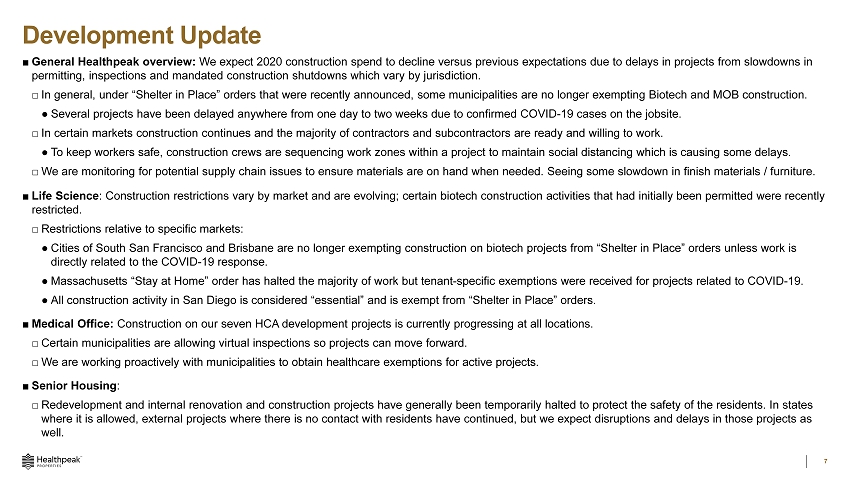

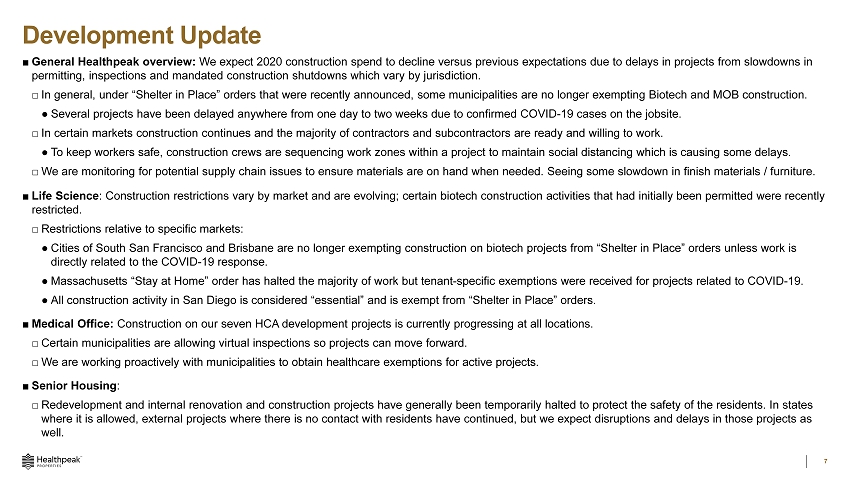

Development Update 7 ■ General Healthpeak overview : We expect 2020 construction spend to decline versus previous expectations due to delays in projects from slowdowns in permitting, inspections and mandated construction shutdowns which vary by jurisdiction . □ In general, under “ Shelter in Place” orders that were recently announced, some municipalities are no longer exempting Biotech and MOB construction. ● Several projects have been delayed anywhere from one day to two weeks due to confirmed COVID - 19 cases on the jobsite . □ In certain markets construction continues and the majority of contractors and subcontractors are ready and willing to work. ● To keep workers safe, construction crews are sequencing work zones within a project to maintain social distancing which is ca usi ng some delays. □ We are monitoring for potential supply chain issues to ensure materials are on hand when needed. Seeing some slowdown in fini sh materials / furniture. ■ Life Science : Construction restrictions vary by market and are evolving; certain biotech construction activities that had initially been permitted were recently restricted. □ Restrictions relative to specific markets: ● Cities of South San Francisco and Brisbane are no longer exempting construction on biotech projects from “Shelter in Place” orders unless work is directly related to the COVID - 19 response. ● Massachusetts “ Stay at Home” order has halted the majority of work but tenant - specific exemptions were received for projects related to COVID - 19. ● All construction activity in San Diego is considered “essential” and is exempt from “Shelter in Place” orders . ■ Medical Office: Construction on our seven HCA development projects is currently progressing at all locations. □ Certain municipalities are allowing virtual inspections so projects can move forward. □ We are working proactively with municipalities to obtain healthcare exemptions for active projects. ■ Senior Housing : □ Redevelopment and internal renovation and construction projects have generally been temporarily halted to protect the safety of the residents. In states where it is allowed, external projects where there is no contact with residents have continued, but we expect disruptions and de lays in those projects as well.

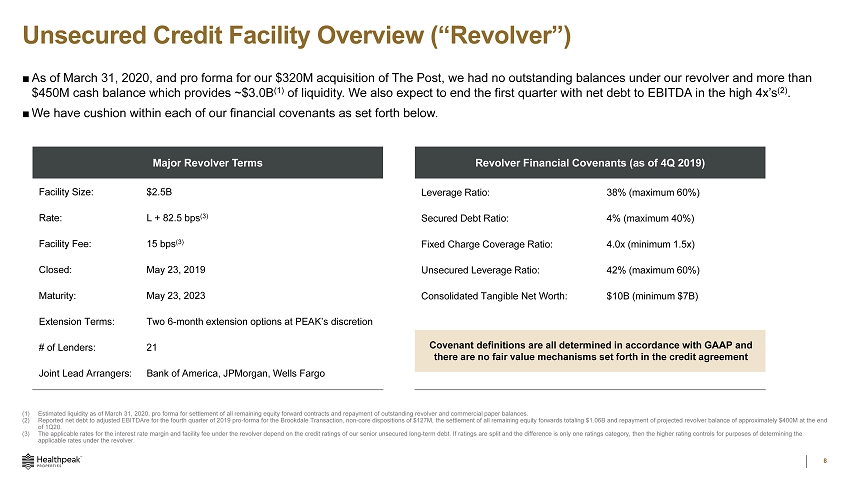

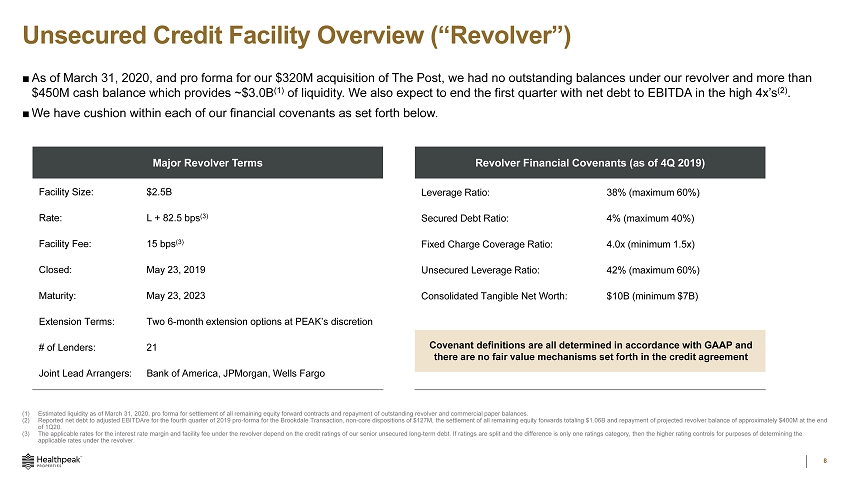

Leverage Ratio: 38% (maximum 60%) Secured Debt Ratio: 4% (maximum 40%) Fixed Charge Coverage Ratio: 4.0x (minimum 1.5x) Unsecured Leverage Ratio: 42% (maximum 60%) Consolidated Tangible Net Worth: $10B (minimum $7B ) Unsecured Credit Facility Overview (“Revolver”) 8 ■ As of March 31, 2020, and pro forma for our $ 320M acquisition of The Post, we had no outstanding balances under our r evolver and more than $ 450M cash balance which provides ~$3.0B (1) of liquidity. We also expect to end the first quarter with net debt to EBITDA in the high 4x’s (2) . ■ We have cushion within each of our financial covenants as set forth below. Major Revolver Terms Revolver Financial Covenants (as of 4Q 2019) Facility Size: $2.5B Rate: L + 82.5 bps (3) Facility Fee: 15 bps (3) Closed: May 23, 2019 Maturity: May 23, 2023 Extension Terms: Two 6 - month extension options at PEAK’s discretion # of Lenders: 21 Joint Lead Arrangers: Bank of America, JPMorgan, Wells Fargo Covenant definitions are all determined in accordance with GAAP and there are no fair value mechanisms set forth in the credit agreement (1) Estimated liquidity as of March 31, 2020, pro forma for settlement of all remaining equity forward contracts and repayment of outstanding revolve r a nd commercial paper balances. (2) Reported net debt to adjusted EBITDAre for the fourth quarter of 2019 pro - forma for the Brookdale Transaction, non - core dispositions of $ 127M, the settlement of all remaining equity forwards totaling $ 1.06B and repayment of projected revolver balance of approximately $ 400M at the end of 1Q20 . (3) The applicable rates for the interest rate margin and facility fee under the revolver depend on the credit ratings of our senior unsecured long - term debt. If ratings are split and the difference is only one ratings category, then the higher rating controls for purposes of determinin g t he applicable rates under the revolver .

Balance Sheet and Transaction Activity Update (1) Excludes sale of 18 NNN assets related to the Brookdale Transaction. (2) Primarily consists of The Post which closed on 4/1/20 for $320M. Excludes purchase of 51% interest in 13 CCRCs related to the Brookdale Transaction, which closed in January 2020, and ~$500M of acquisition guidance provided in February, which was primarily related to Oakmont ROFO. 9 Transaction February Guidance Pro Forma COVID Equity forwards $1,050 $1,062 Dispositions $500 (1) $250 (1) Debt proceeds $325 $ -- Total Sources $1,875 $1,312 Capital spend $850 $600 Acquisition pipeline $800 (2) $350 (2) Brookdale Transaction $225 $225 Increase in cash $ -- $137 Total Uses $1,875 $1,312 Sources & Uses ▪ Fitch affirmed PEAK’s long - term unsecured debt BBB+ rating and stable outlook ▪ Moody’s affirmed PEAK’s long - term unsecured debt Baa1 rating, revised outlook to negative ▪ Completed acceleration of all equity forward settlements for $1,062M ▪ Closed on The Post acquisition on April 1st for $320M □ Assuming no acquisitions for remainder of year except for a few small pipeline opportunities ▪ Closed on $127M of dispositions to date, and anticipate completing ~$125M of additional medical office dispositions in 2020 ▪ Estimate capital spend reduced by $250M in 2020 due to delays in construction ▪ Expect $0.03 to $0.04 of FFO/AFFO dilution from accelerated settlement of all equity forwards and updates to transaction assumptions Recent Updates Based on currently available information and will be updated with guidance when timing is appropriate. ($ in M)

Appendix Medical City Dallas Dallas, TX

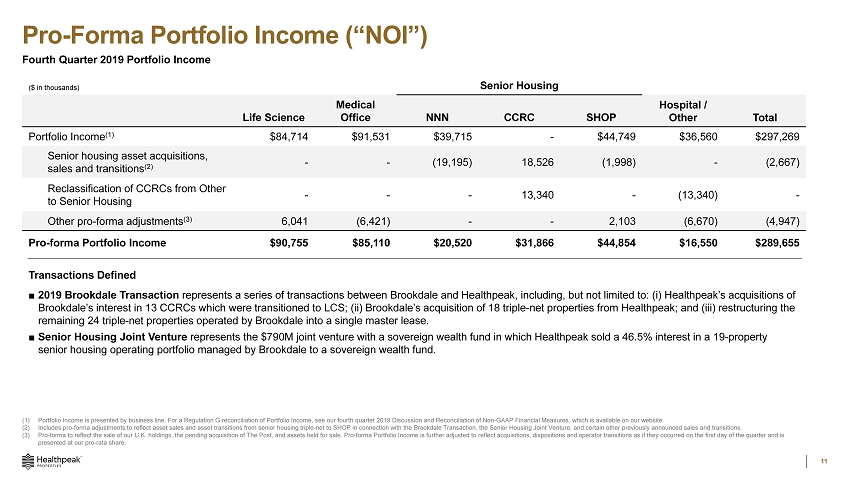

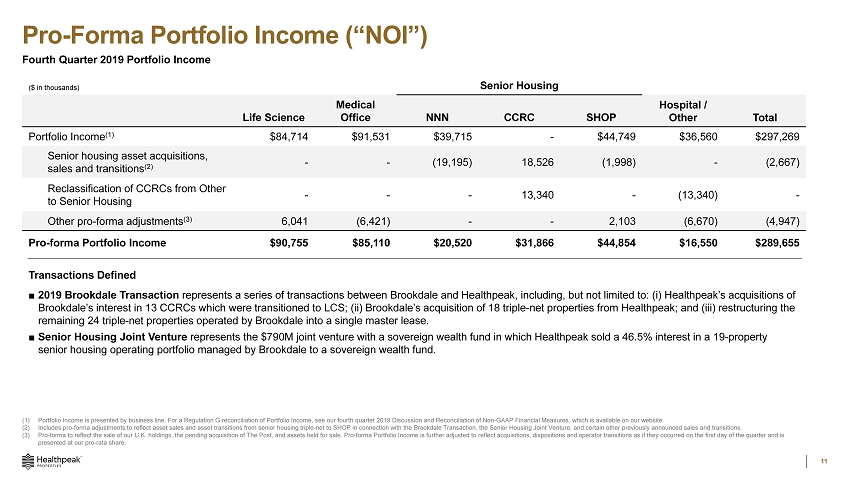

Pro - Forma Portfolio Income (“NOI”) Fourth Quarter 2019 Portfolio Income 11 (1) Portfolio Income is presented by business line. For a Regulation G reconciliation of Portfolio Income, see our fourth quarter 2019 Discussion and Reconciliation of Non - GAAP Financi al Measures, which is available on our website . (2) Includes pro - forma adjustments to reflect asset sales and asset transitions from senior housing triple - net to SHOP in connection with the Brookdale Transaction , the Senior Housing Joint Venture, and certain other previously announced sales and transitions. (3) Pro - forma to reflect the sale of our U.K. holdings, the pending acquisition of The Post, and assets held for sale. Pro - forma Portfolio Income is further adjusted to reflect acquisitions, dispositions and operator transitions as if they occurred on the first da y o f the quarter and is presented at our pro - rata share. ($ in thousands) Senior Housing Life Science Medical Office NNN CCRC SHOP Hospital / O ther Total Portfolio Income (1) $84,714 $91,531 $39,715 - $44,749 $36,560 $297,269 Senior housing asset acquisitions, sales and transitions (2) - - (19,195) 18,526 (1,998) - (2,667) Reclassification of CCRCs from Other to Senior Housing - - - 13,340 - (13,340) - Other pro - forma adjustments (3) 6,041 (6,421) - - 2,103 (6,670) (4,947) Pro - forma Portfolio Income $90,755 $85,110 $20,520 $31,866 $44,854 $16,550 $289,655 Transactions Defined ■ 2019 Brookdale Transaction represents a series of transactions between Brookdale and Healthpeak, including, but not limited to : (i) Healthpeak’s acquisitions of Brookdale’s interest in 13 CCRCs which were transitioned to LCS; (ii) Brookdale’s acquisition of 18 triple - net properties from Healthpeak ; and (iii) restructuring the remaining 24 triple - net properties operated by Brookdale into a single master lease. ■ Senior Housing Joint Venture represents the $ 790M joint venture with a sovereign wealth fund in which Healthpeak sold a 46.5 % interest in a 19 - property senior housing operating portfolio managed by Brookdale to a sovereign wealth fund .

Disclaimers This Healthpeak Properties, Inc . (the “Company”) presentation is solely for your information, is subject to change and speaks only as of the date hereof . This presentation is not complete and is only a summary of the more detailed information included elsewhere, including in our Securities and Exchange Commission (“SEC”) filings . No representation or warranty, expressed or implied is made and you should not place undue reliance on the accuracy, fairness or completeness of the information presented . Forward - Looking Statements Statements contained in this presentation, as well as statements made by management, that are not historical facts are "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Forward - looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “may,” “will,” “project,” “expect,” “believe,” “intend,” “anticipate,” “seek,” “target,” “forecast,” “plan,” “potential,” “estimate,” “could,” “would,” “should” and other comparable and derivative terms or the negatives thereof . Examples of forward - looking statements include, among other things, (i) the impact of COVID - 19 on the Company as a whole, as well as on each of its segments and its hospital portfolio, (ii) the implementation of COVID - 19 procedures and protocols, (iii) occupancy outlooks, (iv) leasing outlooks, (v) tenant improvement project timing, (vi) COVID - 19 - related costs, ( vii) future tenant move - ins and move - outs, (viii) projected development and redevelopment timing and spend, (ix) the impact of equity forward settlements, (x) projected financial metrics, (xi) potential rent deferral and/or abatement, and ( xii) expectations for acquisitions and dispositions . You should not place undue reliance on these forward - looking statements . Forward - looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations . While forward - looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained . Further, we cannot guarantee the accuracy of any such forward - looking statement contained in this presentation, and such forward - looking statements are subject to known and unknown risks and uncertainties that are difficult to predict . These risks and uncertainties include, but are not limited to : COVID - 19 ’s duration, new information concerning its severity, and actions taken to contain or treat its impact ; the financial condition of the Company’s existing and future tenants, operators and borrowers, including potential bankruptcies and downturns in their businesses, and their legal and regulatory proceedings, which results in uncertainties regarding the Company’s ability to continue to realize the full benefit of such tenants’ and operators’ leases and borrowers’ loans ; the ability of the Company’s existing and future tenants, operators and borrowers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and manage their expenses in order to generate sufficient income to make rent and loan payments to the Company and the Company’s ability to recover investments made, if applicable, in their operations ; the Company’s concentration in the healthcare property sector, particularly in senior housing, life sciences and medical office buildings, which makes its profitability more vulnerable to a downturn in a specific sector than if the Company were investing in multiple industries ; operational risks associated with third party management contracts, including the additional regulation and liabilities of RIDEA lease structures ; the effect on the Company and its tenants and operators of legislation, executive orders and other legal requirements, including compliance with the Americans with Disabilities Act, fire, safety and health regulations, environmental laws, the Affordable Care Act, licensure, certification and inspection requirements, and laws addressing entitlement programs and related services, including Medicare and Medicaid, which may result in future reductions in reimbursements or fines for noncompliance ; the Company’s ability to identify replacement tenants and operators and the potential renovation costs and regulatory approvals associated therewith ; the risks associated with property development and redevelopment, including costs above original estimates, project delays and lower occupancy rates and rents than expected ; the potential impact of uninsured or underinsured losses ; the risks associated with the Company’s investments in joint ventures and unconsolidated entities, including its lack of sole decision making authority and its reliance on its partners’ financial condition and continued cooperation ; competition for the acquisition and financing of suitable healthcare properties as well as competition for tenants and operators, including with respect to new leases and mortgages and the renewal or rollover of existing leases ; the Company’s or its counterparties’ ability to fulfill obligations, such as financing conditions and/or regulatory approval requirements, required to successfully consummate acquisitions, dispositions, transitions, developments, redevelopments, joint venture transactions or other transactions ; the Company’s ability to achieve the benefits of acquisitions or other investments within expected time frames or at all, or within expected cost projections ; the potential impact on the Company and its tenants, operators and borrowers from current and future litigation matters, including the possibility of larger than expected litigation costs, adverse results and related developments ; changes in federal, state or local laws and regulations, including those affecting the healthcare industry that affect the Company’s costs of compliance or increase the costs, or otherwise affect the operations, of its tenants and operators ; the Company’s ability to foreclose on collateral securing its real estate - related loans ; volatility or uncertainty in the capital markets, the availability and cost of capital as impacted by interest rates, changes in the Company’s credit ratings, and the value of its common stock, and other conditions that may adversely impact the Company’s ability to fund its obligations or consummate transactions, or reduce the earnings from potential transactions ; changes in global, national and local economic and other conditions, including epidemics or pandemics such as the COVID - 19 pandemic ; the Company’s ability to manage its indebtedness level and changes in the terms of such indebtedness ; competition for skilled management and other key personnel ; the Company’s reliance on information technology systems and the potential impact of system failures, disruptions or breaches ; the Company’s ability to maintain its qualification as a real estate investment trust ; and other risks and uncertainties described from time to time in the Company’s SEC filings . Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward - looking statements, which speak only as of the date on which they are made . Non - GAAP Financial Measures This presentation contains certain supplemental non - GAAP financial measures . While the Company believes that non - GAAP financial measures are helpful in evaluating its operating performance, the use of non - GAAP financial measures in this presentation should not be considered in isolation from, or as an alternative for, a measure of financial or operating performance as defined by GAAP . We caution you that there are inherent limitations associated with the use of each of these supplemental non - GAAP financial measures as an analytical tool . Additionally, the Company’s computation of non - GAAP financial measures may not be comparable to those reported by other REITs . You can find reconciliations of the non - GAAP financial measures to the most directly comparable GAAP financial measures, to the extent available without unreasonable efforts, in the fourth quarter 2019 Discussion and Reconciliation of Non - GAAP Financial Measures available on our website . 12

healthpeak.com