Exhibit 99.1

Investor Presentation Healthpeak Properties November 9, 2020 200 Cambridge Discovery Park Boston, MA

Disclaimers This Healthpeak Properties, Inc . (the “Company”) presentation is solely for your information, is subject to change and speaks only as of the date hereof . This presentation is not complete and is only a summary of the more detailed information included elsewhere, including in our Securities and Exchange Commission (“SEC”) filings . No representation or warranty, expressed or implied is made and you should not place undue reliance on the accuracy, fairness or completeness of the information presented . Forward - Looking Statements Statements contained in this presentation that are not historical facts are "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . Forward - looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “may,” “will,” “project,” “expect,” “believe,” “intend,” “anticipate,” “seek,” “target,” “forecast,” “plan,” “potential,” “estimate,” “could,” “would,” “should” and other comparable and derivative terms or the negatives thereof . Examples of forward - looking statements include, among other things, (i) statements regarding timing, outcomes and other details relating to current, pending or contemplated acquisitions, dispositions, transitions, developments, redevelopments, joint venture transactions, capital recycling plans, financing activities, or other transactions ; (ii) development and densification opportunities ; (iii) tenant growth and new users in the life science market ; and (iv) potential liquidity sources and uses . You should not place undue reliance on these forward - looking statements . Pending acquisitions and dispositions, including those that are subject to binding agreements, remain subject to closing conditions and may not close within the anticipated timeframes or at all . Forward - looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations . While forward - looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained . Further, we cannot guarantee the accuracy of any such forward - looking statement contained in this presentation, and such forward - looking statements are subject to known and unknown risks and uncertainties that are difficult to predict . These risks and uncertainties include, but are not limited to : the severity and duration of the COVID - 19 pandemic ; actions that have been taken and may continue to be taken by governmental authorities to contain the COVID - 19 pandemic or to treat its impact ; the impact of the COVID - 19 pandemic and health and safety measures taken to reduce the spread ; operational risks associated with third party management contracts, including the additional regulation and liabilities of RIDEA lease structures ; the ability of the Company’s existing and future tenants, operators and borrowers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and manage their expenses in order to generate sufficient income to make rent and loan payments to the Company and the Company’s ability to recover investments made, if applicable, in their operations ; the imposition of laws or regulations prohibiting eviction of our tenants or operators, including new governmental efforts in response to COVID - 19 ; the financial condition of the Company’s existing and future tenants, operators and borrowers, including potential bankruptcies and downturns in their businesses, and their legal and regulatory proceedings, which results in uncertainties regarding the Company’s ability to continue to realize the full benefit of such tenants’ and operators’ leases and borrowers’ loans ; the Company’s concentration in the healthcare property sector, particularly in senior housing, life sciences and medical office buildings, which makes its profitability more vulnerable to a downturn in a specific sector than if the Company were investing in multiple industries ; the effect on the Company and its tenants and operators of legislation, executive orders and other legal requirements, including compliance with the Americans with Disabilities Act, fire, safety and health regulations, environmental laws, the Affordable Care Act, licensure, certification and inspection requirements, and laws addressing entitlement programs and related services, including Medicare and Medicaid, which may result in future reductions in reimbursements or fines for noncompliance ; the Company’s ability to identify replacement tenants and operators and the potential renovation costs and regulatory approvals associated therewith ; the risks associated with property development and redevelopment, including costs above original estimates, project delays and lower occupancy rates and rents than expected ; the potential impact of uninsured or underinsured losses, including as a result of hurricanes, earthquakes and other natural disasters, pandemics such as COVIID - 19 , acts of war and/or terrorism and other events that may cause such losses and/or performance declines by the Company or its tenants and operators ; the risks associated with the Company’s investments in joint ventures and unconsolidated entities, including its lack of sole decision making authority and its reliance on its partners’ financial condition and continued cooperation ; competition for the acquisition and financing of suitable healthcare properties as well as competition for tenants and operators, including with respect to new leases and mortgages and the renewal or rollover of existing leases ; the Company’s or its counterparties’ ability to fulfill obligations, such as financing conditions and/or regulatory approval requirements, required to successfully consummate acquisitions, dispositions, transitions, developments, redevelopments, joint venture transactions or other transactions ; the Company’s ability to achieve the benefits of acquisitions or other investments within expected time frames or at all, or within expected cost projections ; the potential impact on the Company and its tenants, operators and borrowers from current and future litigation matters, including the possibility of larger than expected litigation costs, adverse results and related developments ; changes in federal, state or local laws and regulations, including those affecting the healthcare industry that affect the Company’s costs of compliance or increase the costs, or otherwise affect the operations, of its tenants and operators ; the Company’s ability to foreclose on collateral securing its real estate - related loans ; volatility or uncertainty in the capital markets, the availability and cost of capital as impacted by interest rates, changes in the Company’s credit ratings, and the value of its common stock, and other conditions that may adversely impact the Company’s ability to fund its obligations or consummate transactions, or reduce the earnings from potential transactions ; changes in global, national and local economic and other conditions, including epidemics or pandemics such as the COVID - 19 pandemic ; the Company’s ability to manage its indebtedness level and changes in the terms of such indebtedness ; competition for skilled management and other key personnel ; the Company’s reliance on information technology systems and the potential impact of system failures, disruptions or breaches ; the Company’s ability to maintain its qualification as a real estate investment trust ; and other risks and uncertainties described from time to time in the Company’s SEC filings . Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward - looking statements, which speak only as of the date on which they are made . Non - GAAP Financial Measures This presentation contains certain supplemental non - GAAP financial measures . While the Company believes that non - GAAP financial measures are helpful in evaluating its operating performance, the use of non - GAAP financial measures in this presentation should not be considered in isolation from, or as an alternative for, a measure of financial or operating performance as defined by GAAP . We caution you that there are inherent limitations associated with the use of each of these supplemental non - GAAP financial measures as an analytical tool . Additionally, the Company’s computation of non - GAAP financial measures may not be comparable to those reported by other REITs . You can find reconciliations of the non - GAAP financial measures to the most directly comparable GAAP financial measures in the third quarter 2020 Discussion and Reconciliation of Non - GAAP Financial Measures available on our website . Investor Presentation - November 2020 2

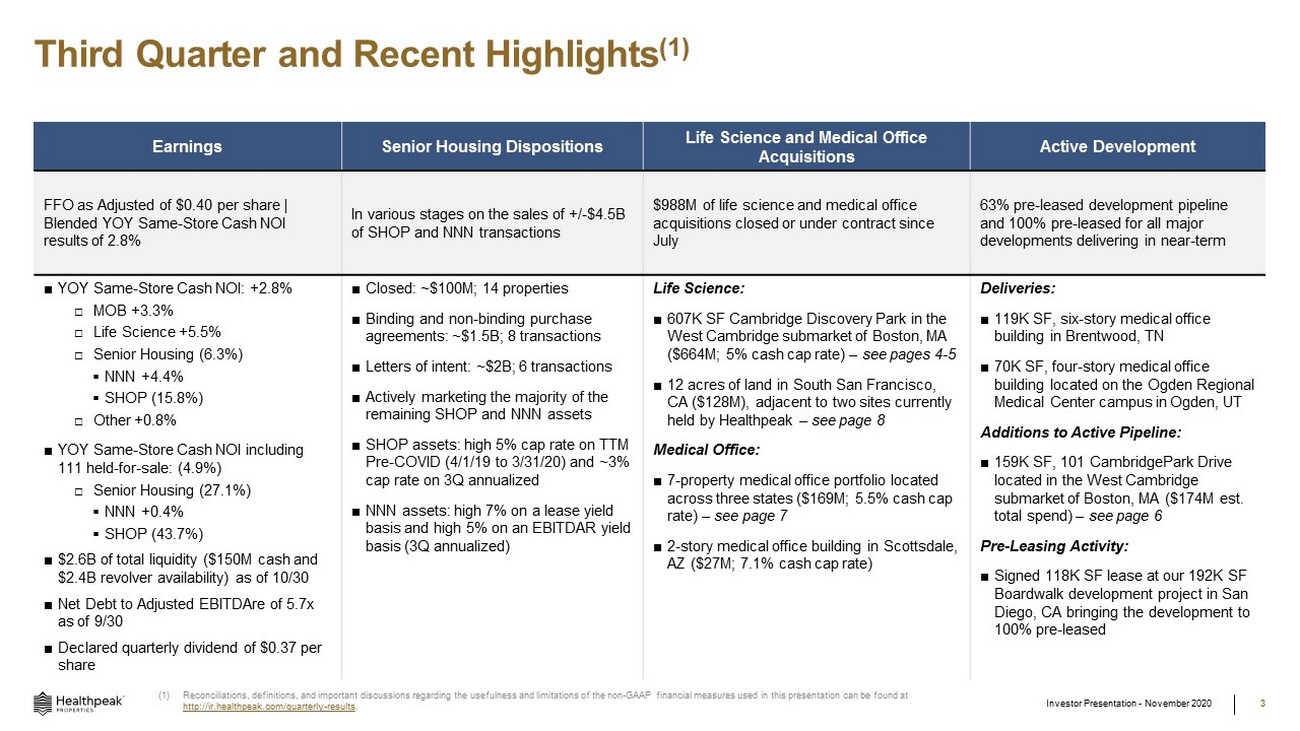

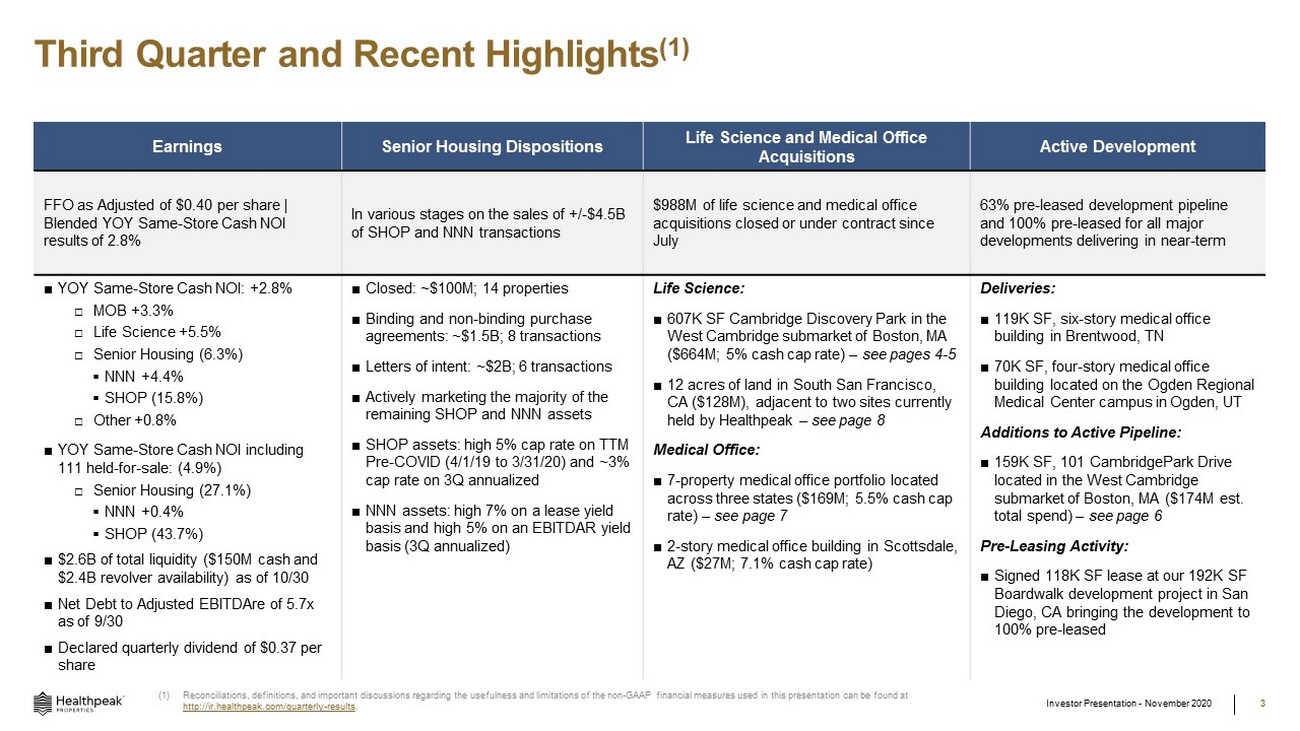

Third Quarter and Recent Highlights (1) Investor Presentation - November 2020 3 Earnings Senior Housing Dispositions Life Science and Medical Office Acquisitions Active Development FFO as Adjusted of $0.40 per share | Blended YOY Same - Store Cash NOI results of 2.8% In various stages on the sales of +/ - $4.5B of SHOP and NNN transactions $ 988M of life science and medical office acquisitions closed or under contract since July 63% pre - leased development pipeline and 100% pre - leased for all major developments delivering in near - term ■ YOY Same - Store Cash NOI: +2.8% □ MOB +3.3% □ Life Science +5.5% □ Senior Housing (6.3%) ▪ NNN +4.4% ▪ SHOP (15.8%) □ Other +0.8% ■ YOY Same - Store Cash NOI including 111 held - for - sale: (4.9%) □ Senior Housing (27.1%) ▪ NNN +0.4% ▪ SHOP (43.7%) ■ $2.6B of total liquidity ($150M cash and $2.4B revolver availability) as of 10/30 ■ Net Debt to Adjusted EBITDAre of 5.7x as of 9/30 ■ Declared quarterly dividend of $0.37 per share ■ Closed: ~$100M; 14 properties ■ Binding and non - binding purchase agreements: ~$1.5B; 8 transactions ■ Letters of intent: ~$2B; 6 transactions ■ Actively marketing the majority of the remaining SHOP and NNN assets ■ SHOP assets: high 5% cap rate on TTM Pre - COVID (4/1/19 to 3/31/20) and ~3% cap rate on 3Q annualized ■ NNN assets: high 7% on a lease yield basis and high 5% on an EBITDAR yield basis (3Q annualized) Life Science: ■ 607K SF Cambridge Discovery Park in the West Cambridge submarket of Boston, MA ($664M; 5% cash cap rate) – see pages 4 - 5 ■ 12 acres of land in South San Francisco, CA ($128M), adjacent to two sites currently held by Healthpeak – see page 8 Medical Office: ■ 7 - property medical office portfolio located across three states ($169M; 5.5% cash cap rate) – see page 7 ■ 2 - story medical office building in Scottsdale, AZ ($27M; 7.1% cash cap rate) Deliveries: ■ 119K SF, six - story medical office building in Brentwood, TN ■ 70K SF, four - story medical office building located on the Ogden Regional Medical Center campus in Ogden, UT Additions to Active Pipeline: ■ 159K SF, 101 CambridgePark Drive located in the West Cambridge submarket of Boston, MA ($174M est. total spend) – see page 6 Pre - Leasing Activity: ■ Signed 118K SF lease at our 192K SF Boardwalk development project in San Diego, CA bringing the development to 100% pre - leased (1) Reconciliations, definitions, and important discussions regarding the usefulness and limitations of the non - GAAP financial measures used in this presentation can be found at http :// ir.healthpeak.com/quarterly - results .

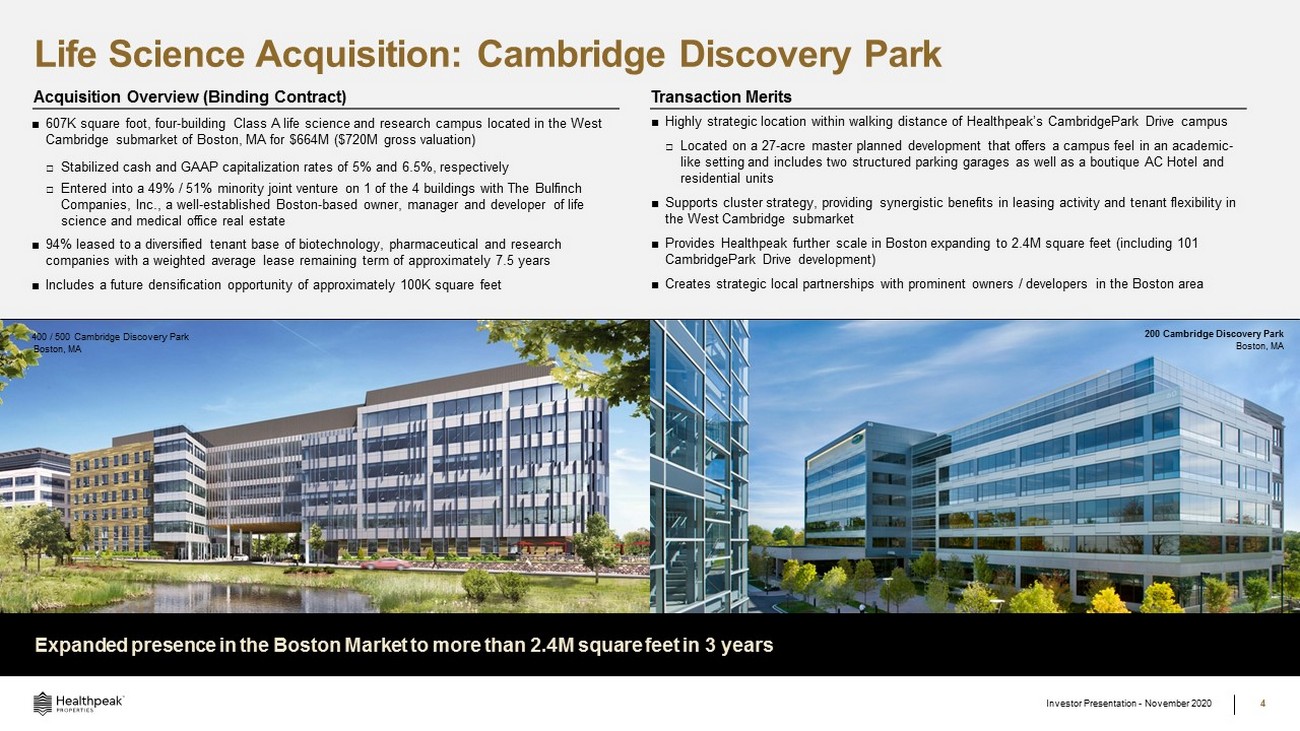

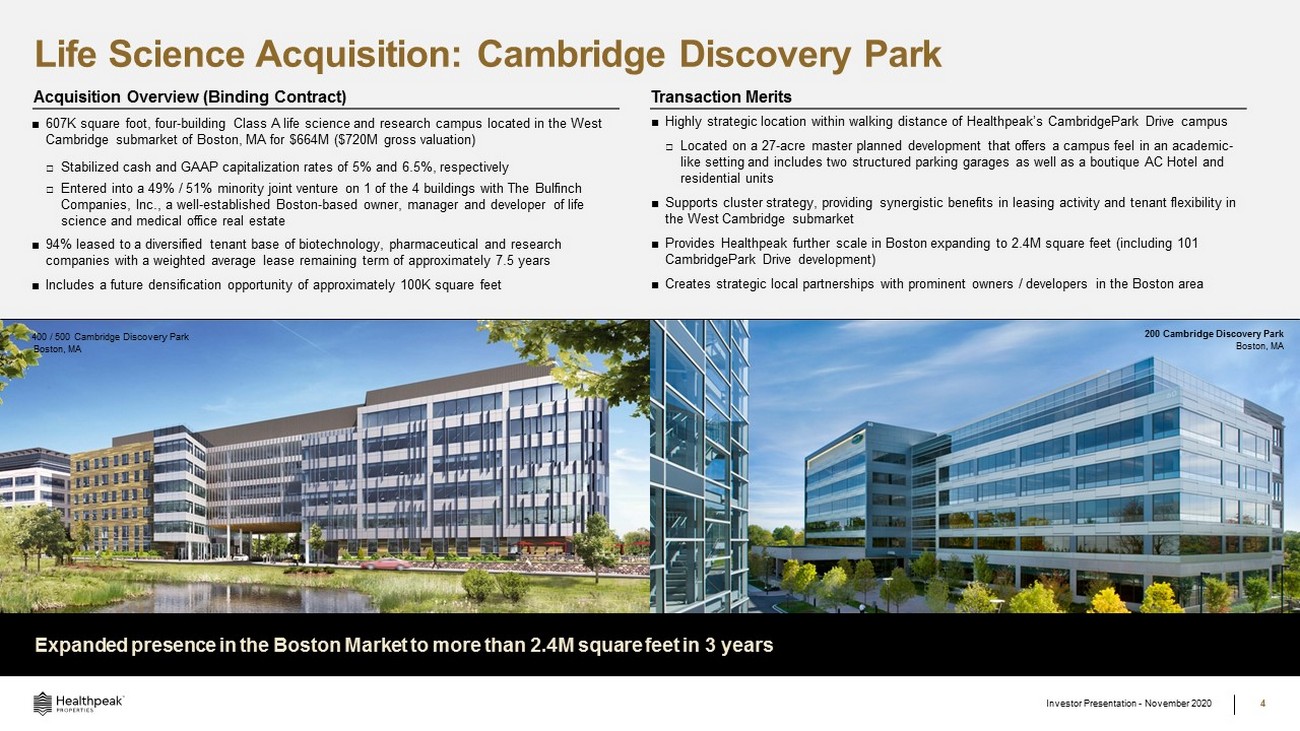

Investor Presentation - November 2020 4 200 Cambridge Discovery Park Boston, MA Acquisition Overview (Binding Contract) ■ Highly strategic location within walking distance of Healthpeak’s CambridgePark Drive campus □ Located on a 27 - acre master planned development that offers a campus feel in an academic - like setting and includes two structured parking garages as well as a boutique AC Hotel and residential units ■ Supports cluster strategy, providing synergistic benefits in leasing activity and tenant flexibility in the West Cambridge submarket ■ Provides Healthpeak further scale in Boston expanding to 2.4M square feet (including 101 CambridgePark Drive development) ■ Creates strategic local partnerships with prominent owners / developers in the Boston area ■ 607K square foot, four - building Class A life science and research campus located in the West Cambridge submarket of Boston, MA for $664M ($720M gross valuation) □ Stabilized cash and GAAP capitalization rates of 5 % and 6.5%, respectively □ Entered into a 49% / 51% minority joint venture on 1 of the 4 buildings with The Bulfinch Companies, Inc., a well - established Boston - based owner, manager and developer of life science and medical office real estate ■ 94% leased to a diversified tenant base of biotechnology, pharmaceutical and research companies with a weighted average lease remaining term of approximately 7.5 years ■ Includes a future densification opportunity of approximately 100K square feet Expanded presence in the Boston Market to more than 2.4M square feet in 3 years 400 / 500 Cambridge Discovery Park Boston, MA Transaction Merits Life Science Acquisition: Cambridge Discovery Park

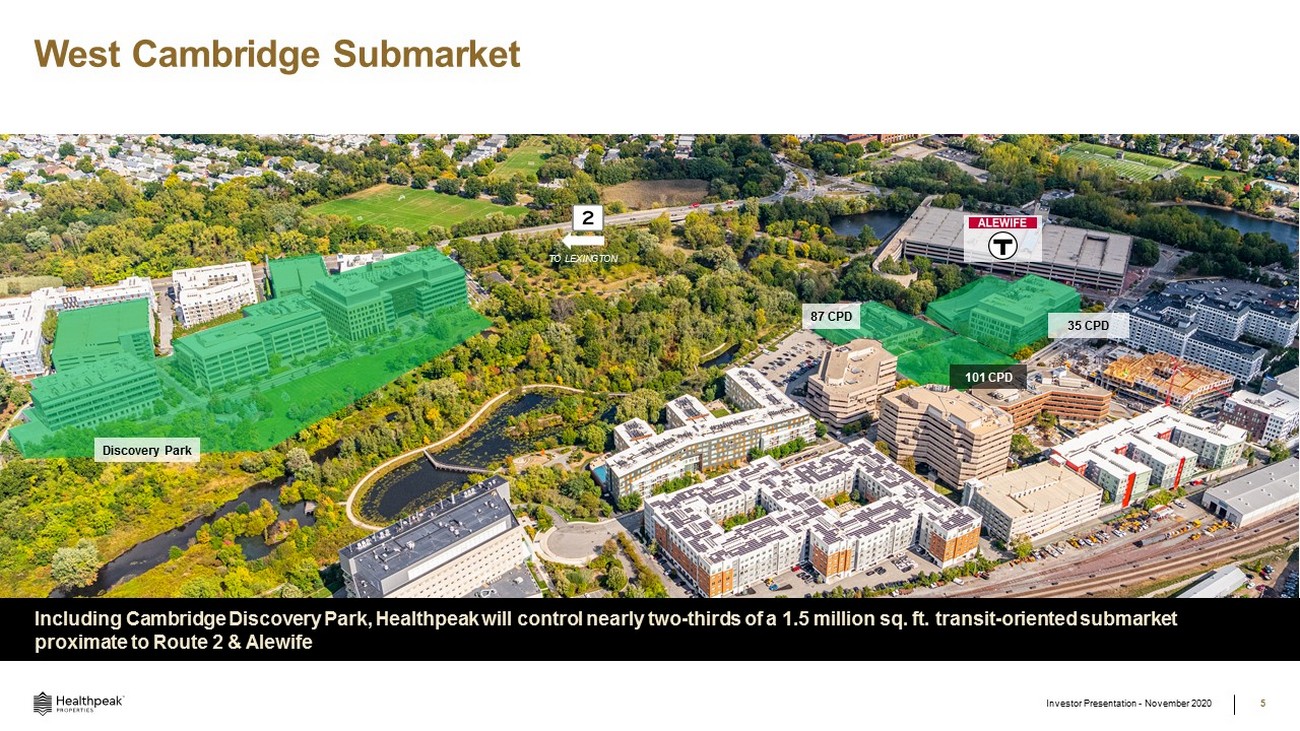

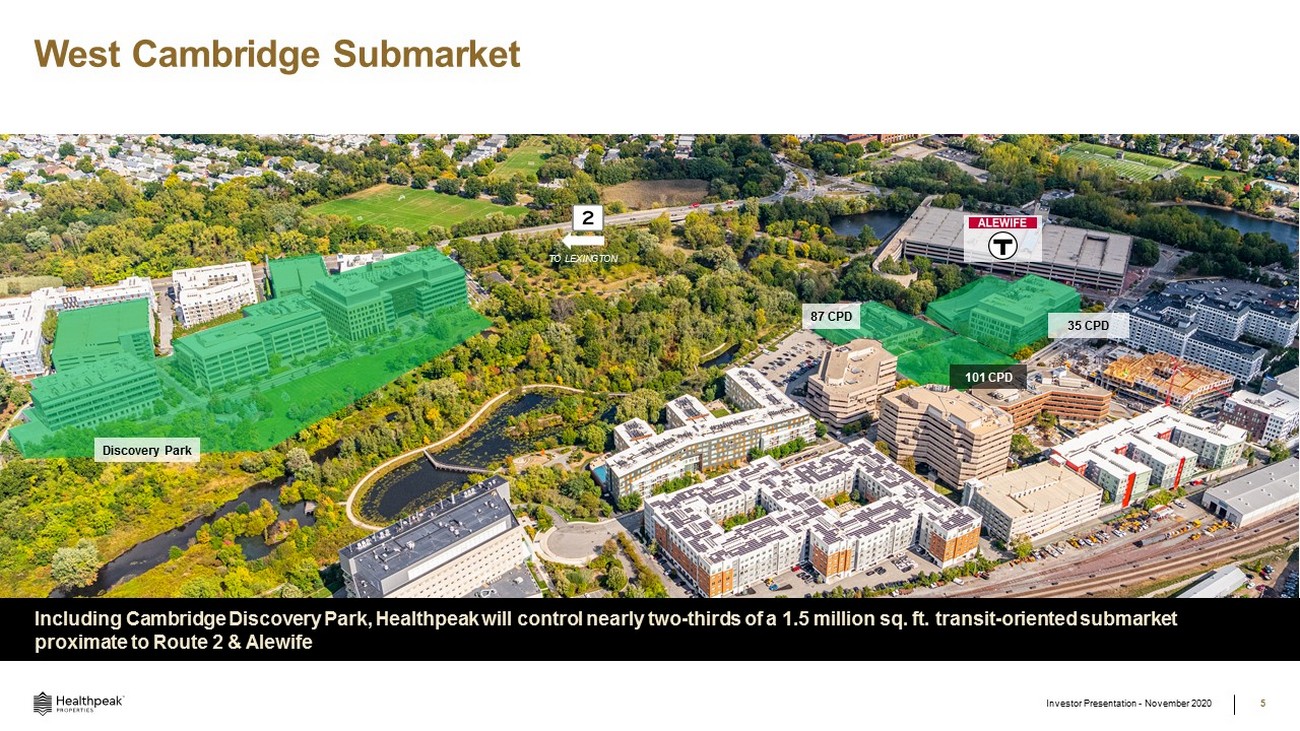

West Cambridge Submarket Investor Presentation - November 2020 5 TO LEXINGTON Including Cambridge Discovery Park, Healthpeak will control nearly two - thirds of a 1.5 million sq. ft. transit - oriented submarket proximate to Route 2 & Alewife Discovery Park 101 CPD 35 CPD 87 CPD

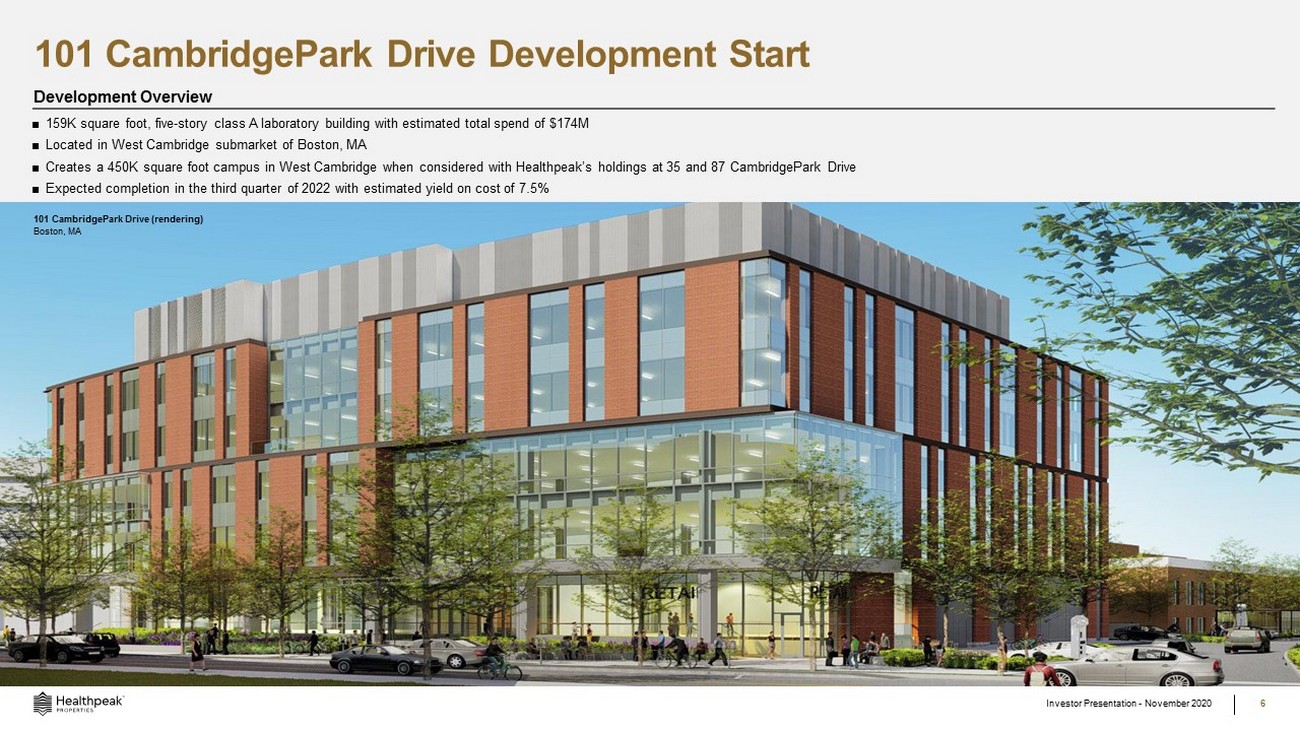

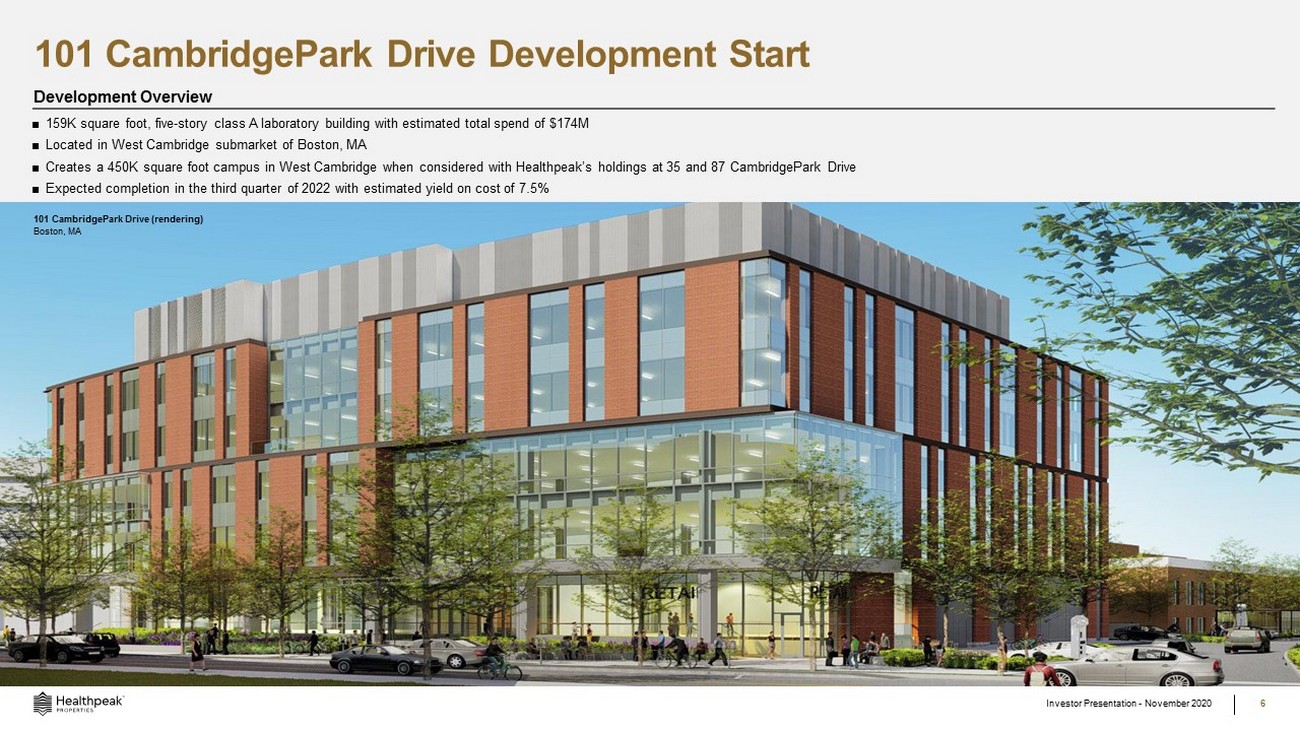

Investor Presentation - November 2020 6 Development Overview ■ 159K square foot, five - story class A laboratory building with estimated total spend of $174M ■ Located in West Cambridge submarket of Boston, MA ■ Creates a 450K square foot campus in West Cambridge when considered with Healthpeak’s holdings at 35 and 87 CambridgePark Drive ■ Expected completion in the third quarter of 2022 with estimated yield on cost of 7.5% 101 CambridgePark Drive Development Start 101 CambridgePark Drive (rendering) Boston, MA

Investor Presentation - November 2020 7 Professional Center II Indianapolis, IN Acquisition Overview (Closed) ■ Primarily on - campus portfolio with 6 of the 7 properties located on - campus with a physical connection to the host hospital ■ Strong tenant base with 77% leased to investment grade health systems (Aa1 Moody’s rated or better) ■ Expands Midwest presence in markets that demonstrate strong medical fundamentals ■ Consists of both single and multi - tenant buildings suited for a variety of medical uses ■ Seven - property Class - A medical office portfolio, totaling 439K square feet, for $169M □ Cash and GAAP capitalization rates of 5.5% and 5.6%, respectively ■ Located across 3 states: Indiana (5), Missouri (1), and Illinois (1 ) ■ 92% leased with a weighted average lease term of 4.1 years and 2.5% average annual rent escalators □ Investment grade Health Systems tenants including Ascension Health, Franciscan Health, AMITA Health, and University of Missouri Health Bolingbrook Medical Office Bolingbrook, IL Transaction Merits Medical Office Acquisition: Midwest Medical Office Portfolio Expands Midwest presence in markets that demonstrate strong medical fundamentals.

Investor Presentation - November 2020 8 Acquisition Overview (Binding Contract) ■ When combined with Healthpeak’s Forbes and Modular Labs III sites, it could allow for a campus with an estimated minimum size of approximately 1M square feet over 20 acres ■ Better positions Healthpeak as tenants grow and new users enter the market ■ Solidifies Healthpeak’s long - term market leading share in South San Francisco ■ Provides long - term optionality to South San Francisco development and densification opportunities ■ Approximately 12 acres of land in South San Francisco, CA for $128M ■ Located directly adjacent to Healthpeak’s Forbes Research Center (“Forbes”) development site and Healthpeak’s Modular Labs III development site ■ Assemblage includes sites that are currently utilized as industrial buildings that are subject to short - term leases, as well as a vacant land parcel Transaction Merits Life Science Acquisition: South San Francisco Land Acquisition Solidifies Healthpeak’s long - term dominant market position in the core life science market of South San Francisco. South San Francisco Land Site (12 acres) Forbes Research Center Modular Labs III Pointe Grand Modular Labs I & II Life Science Center

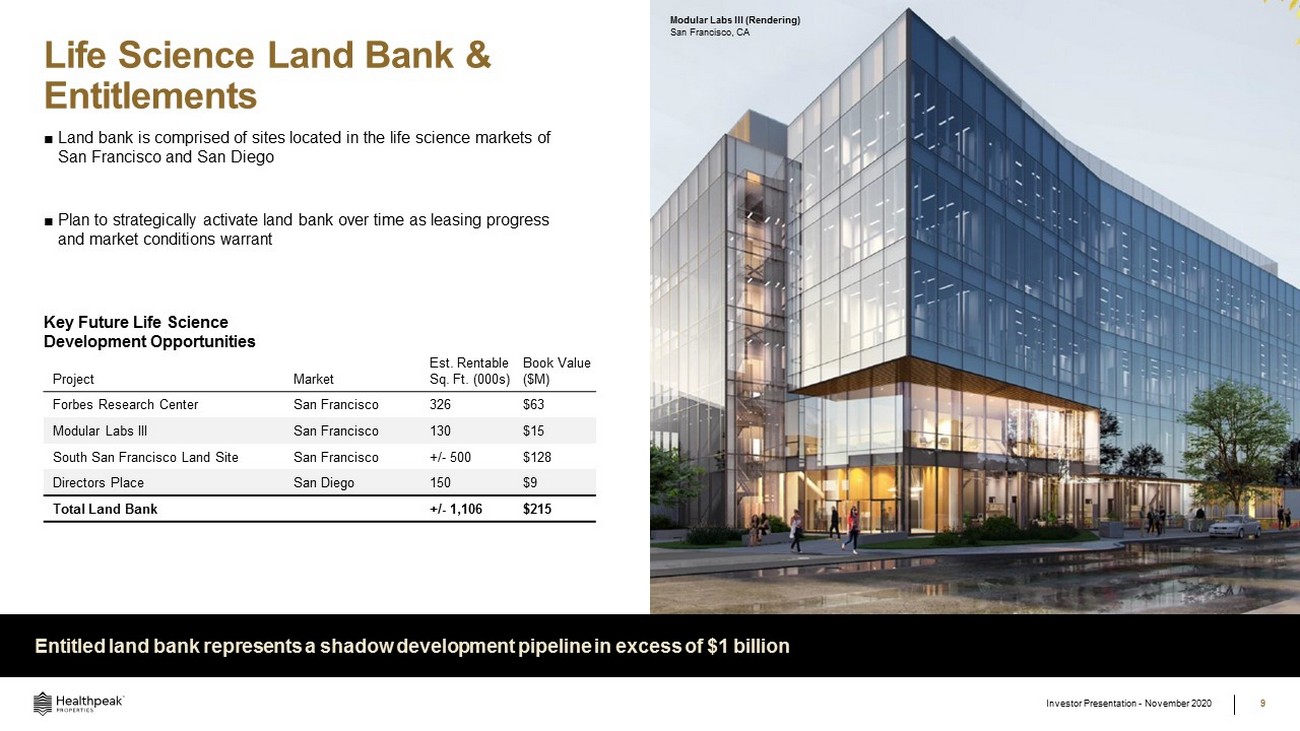

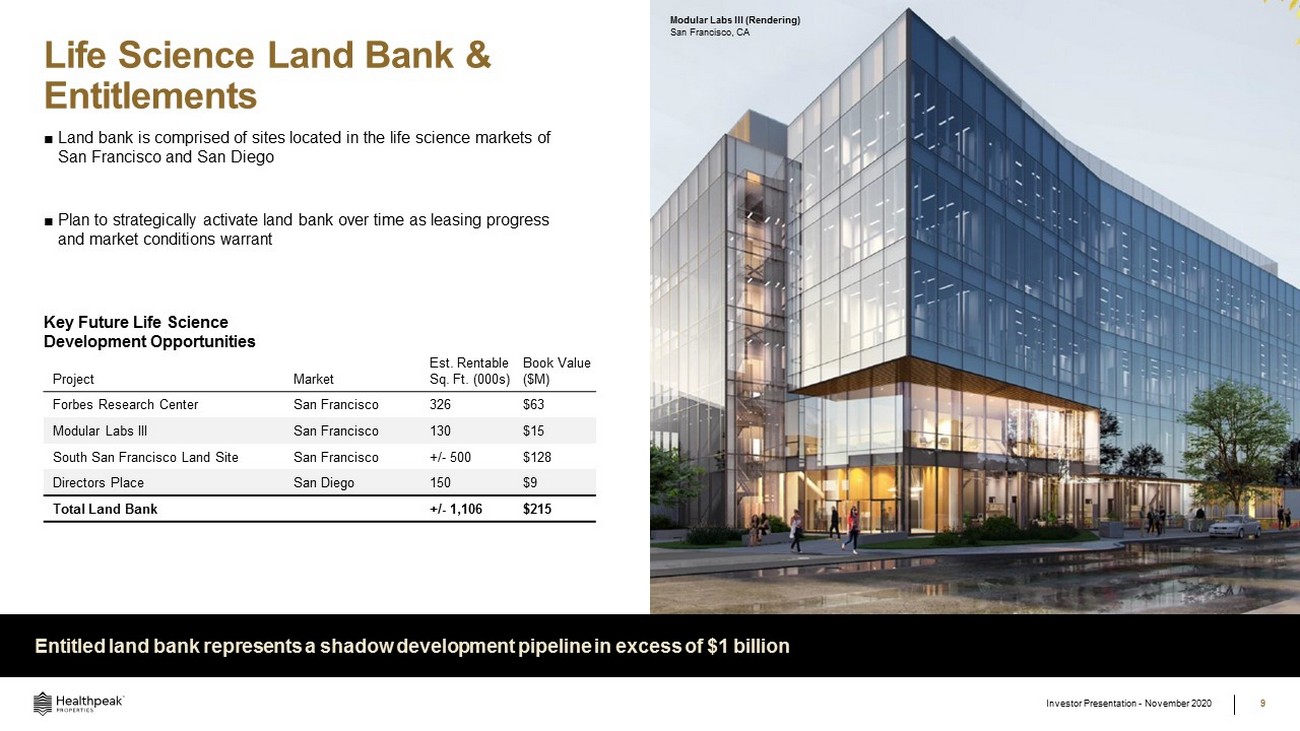

Life Science Land Bank & Entitlements ■ Land bank is comprised of sites located in the life science markets of San Francisco and San Diego ■ Plan to strategically activate land bank over time as leasing progress and market conditions warrant Key Future Life Science Development Opportunities Entitled land bank represents a shadow development pipeline in excess of $1 billion Investor Presentation - November 2020 9 Modular Labs III (Rendering) San Francisco, CA Project Market Est. Rentable Sq. Ft. (000s ) Book Value ($M) Forbes Research Center San Francisco 326 $63 Modular Labs III San Francisco 130 $15 South San Francisco Land Site San Francisco +/ - 500 $128 Directors Place San Diego 150 $9 Total Land Bank +/ - 1,106 $215

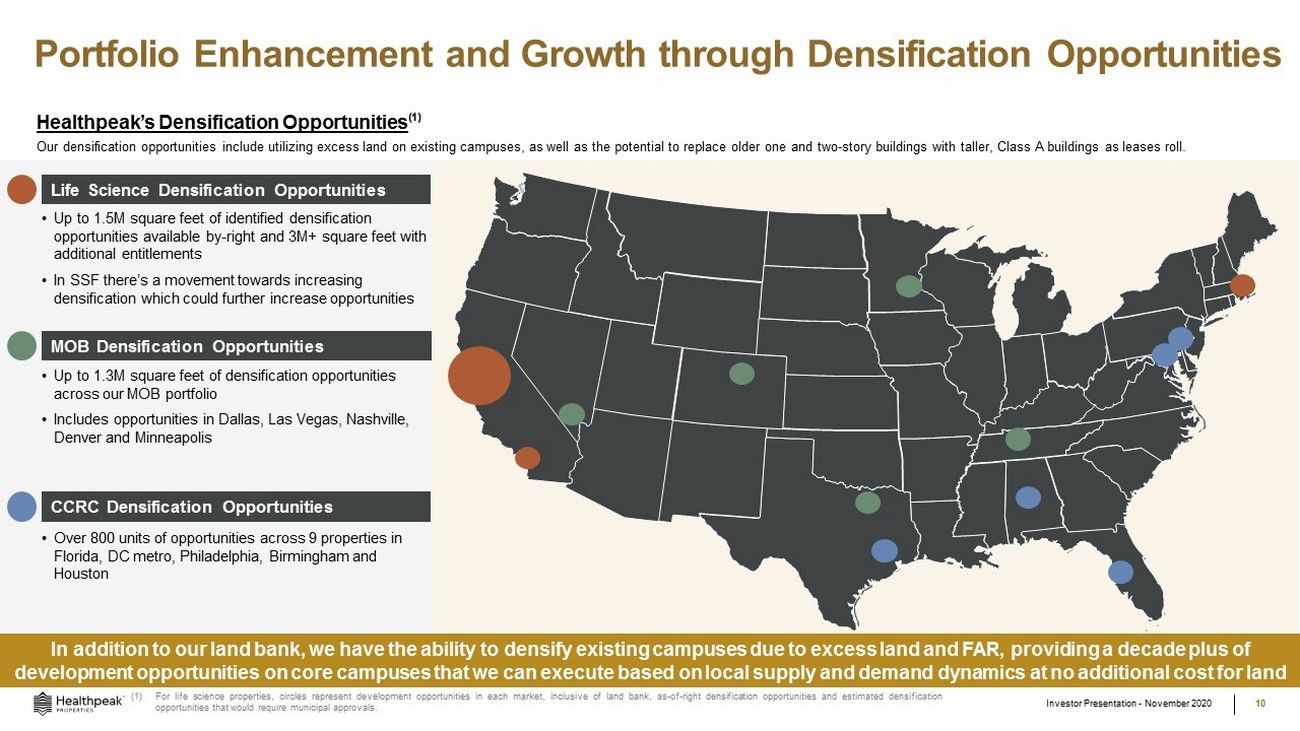

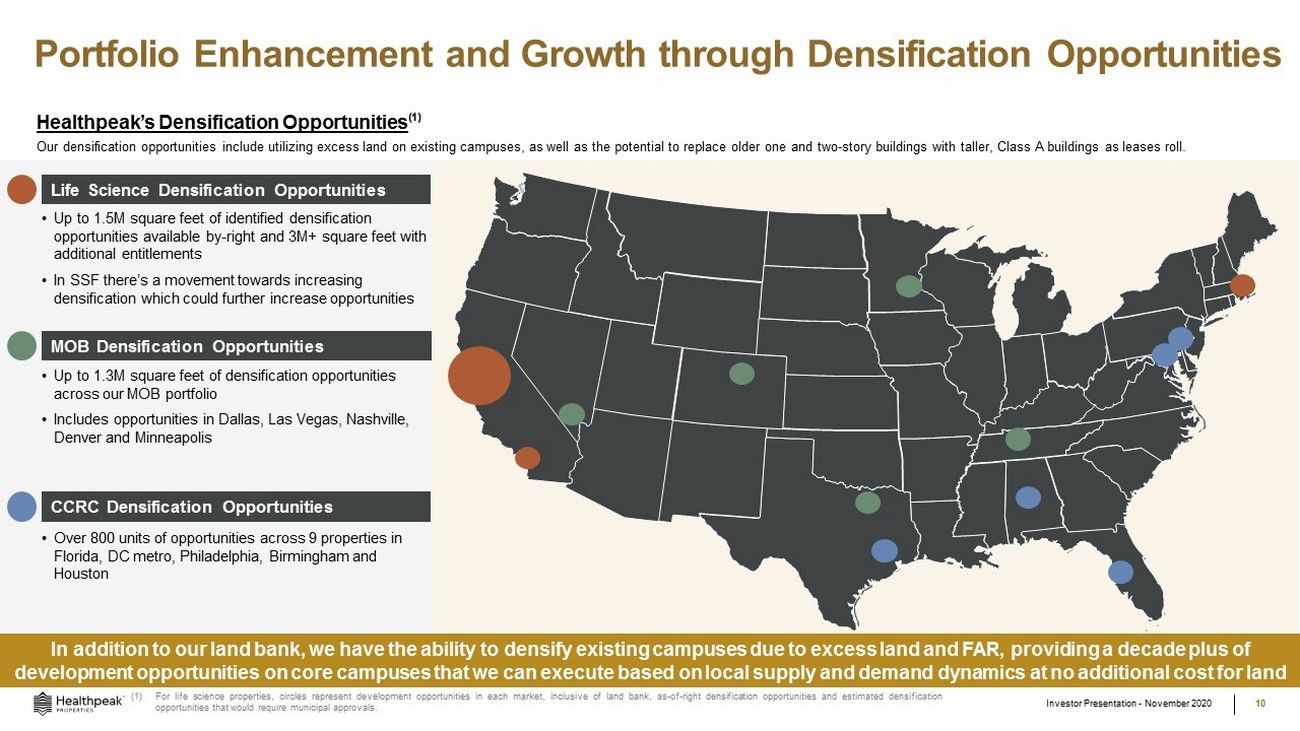

Portfolio Enhancement and Growth through Densification Opportunities 10 Investor Presentation - November 2020 In addition to our land bank, we have the ability to densify existing campuses due to excess land and FAR, providing a decade pl us of development opportunities on core campuses that we can execute based on local supply and demand dynamics at no additional cos t f or land Life Science Densification Opportunities • Up to 1.5M square feet of identified densification opportunities available by - right and 3M+ square feet with additional entitlements • In SSF there’s a movement towards increasing densification which could further increase opportunities MOB Densification Opportunities CCRC Densification Opportunities • Over 800 units of opportunities across 9 properties in Florida, DC metro, Philadelphia, Birmingham and Houston • Up to 1.3M square feet of densification opportunities across our MOB portfolio • Includes opportunities in Dallas, Las Vegas, Nashville, Denver and Minneapolis Healthpeak’s Densification Opportunities (1) Our densification opportunities include utilizing excess land on existing campuses, as well as the potential to replace older one and two - story buildings with taller, Class A buildings as leases roll. (1) For life science properties, circles represent development opportunities in each market, inclusive of land bank, as - of - right densification opportunities and estimated densification opportunities that would require municipal approvals .

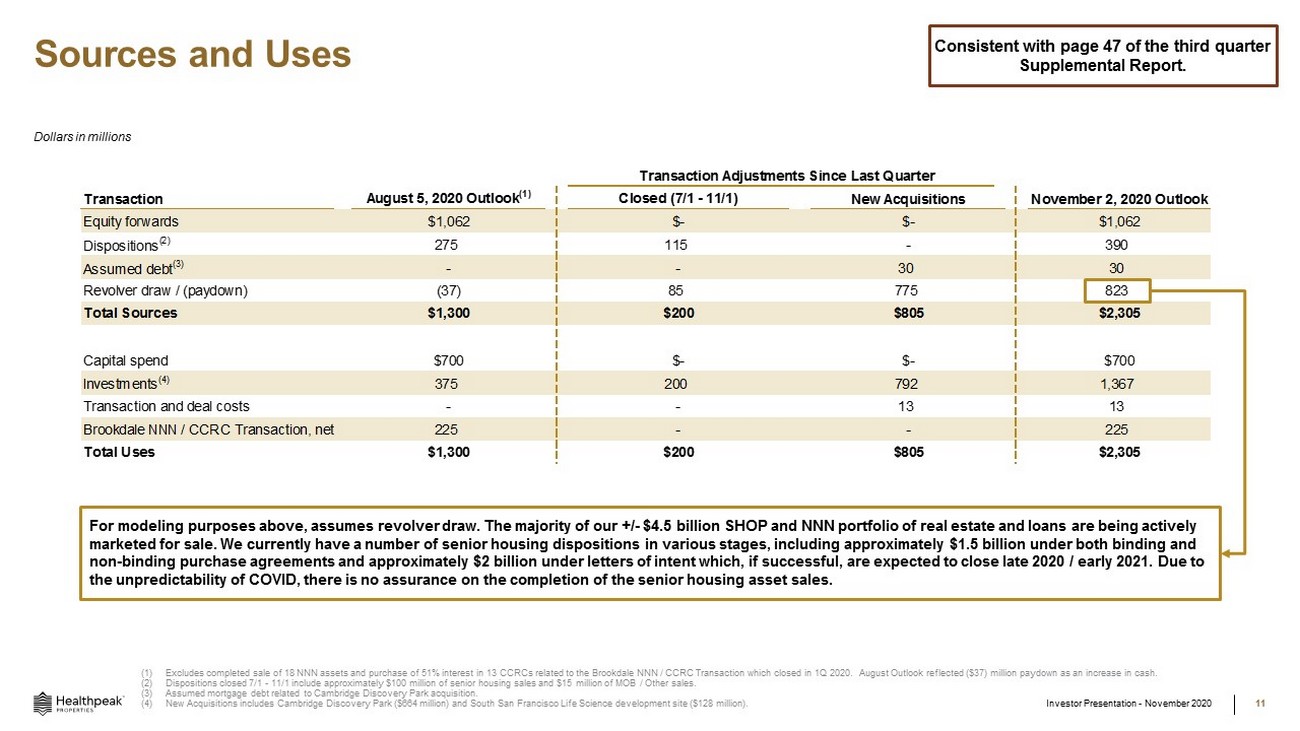

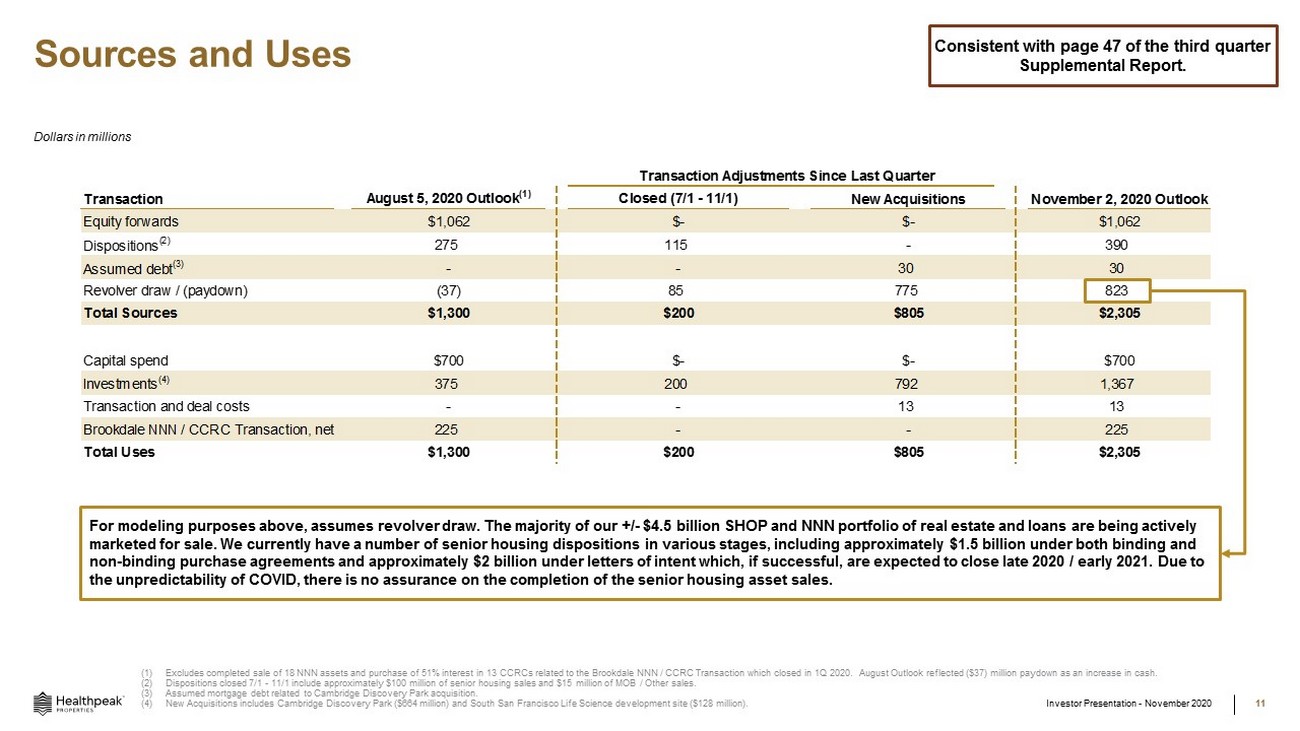

Transaction Adjustments Since Last Quarter Transaction August 5, 2020 Outlook (1) Closed (7/1 - 11/1) New Acquisitions November 2, 2020 Outlook Equity forwards $1,062 $- $- $1,062 Dispositions (2) 275 115 - 390 Assumed debt (3) - - 30 30 Revolver draw / (paydown) (37) 85 775 823 Total Sources $1,300 $200 $805 $2,305 Capital spend $700 $- $- $700 Investments (4) 375 200 792 1,367 Transaction and deal costs - - 13 13 Brookdale NNN / CCRC Transaction, net 225 - - 225 $1,300 $200 $805 $2,305Total Uses Sources and Uses Consistent with page 47 of the third quarter Supplemental Report. (1) Excludes completed sale of 18 NNN assets and purchase of 51% interest in 13 CCRCs related to the Brookdale NNN / CCRC Transaction whic h c losed in 1Q 2020. August Outlook reflected ($37) million paydown as an increase in cash. (2) Dispositions closed 7/1 - 11/1 include approximately $100 million of senior housing sales and $15 million of MOB / Other sales. (3) Assumed mortgage debt related to Cambridge Discovery Park acquisition. (4) New Acquisitions includes Cambridge Discovery Park ($664 million) and South San Francisco Life Science development site ($128 mi llion). Investor Presentation - November 2020 11 For modeling purposes above, assumes revolver draw. The majority of our +/ - $4.5 billion SHOP and NNN portfolio of real estate a nd loans are being actively marketed for sale. We currently have a number of senior housing dispositions in various stages, including approximately $1.5 bil lion under both binding and non - binding purchase agreements and approximately $2 billion under letters of intent which, if successful, are expected to close late 2020 / early 2021. Due to the unpredictability of COVID, there is no assurance on the completion of the senior housing asset sales. Dollars in millions

healthpeak.com