Earnings Release and Supplemental Report fourth quarter 2018 The Cove at Oyster Point South San Francisco, CA 1

Earnings Release 3 Overview 9 Consolidated Financial Statements 10 Portfolio Summary 14 Same Property Portfolio 16 Capitalization and Indebtedness 17 Investment Summary 20 Developments and Redevelopments 22 Capital Expenditures 24 Portfolio Diversification 25 Expirations and Maturities 27 Triple-net Master Lease Profile 28 Portfolio Senior Housing Triple-net 29 Senior Housing Operating Portfolio 32 Life Science 37 Medical Office 40 Other 43 Guidance 48 Glossary and Debt Ratios 49 TABLE OF Company Information 55 Contents Forward-Looking Statements & Risk Factors 56 Discussion and Reconciliation of Non-GAAP Financial Measures 2

HCP Reports Fourth Quarter and Year Ended 2018 Results IRVINE, CA, February 13, 2019 -- HCP, Inc. (NYSE: HCP) today announced results for the fourth quarter and full year ended December 31, 2018. FOURTH QUARTER 2018 AND RECENT HIGHLIGHTS – Diluted net income of $1.73 per share, diluted NAREIT FFO of $0.41 per share and diluted FFO as adjusted of $0.43 per share – Closed on the previously announced sale of Shoreline Technology Center in Mountain View, California for gross proceeds of $1.0 billion – Completed the previously disclosed sale of 19 senior housing communities to an investment fund managed by affiliates of Apollo Global Management for $377 million – Acquired our partner's interests in four life science assets for $92 million – Under contract to acquire Sierra Point Towers, an office and life science campus adjacent to our 591,000 square foot development, The Shore at Sierra Point, in the South San Francisco life science submarket, for $245 million – Acquired 87 CambridgePark Drive, a 64,000 square foot life science facility in Cambridge, Massachusetts for $71 million and development rights on an adjacent site, 101 CambridgePark Drive, for total consideration of up to $27 million – Accelerated commencement of Phases II and III of The Shore at Sierra Point development in response to tenant demand and our leasing success of Phase I, which is 100% pre-leased – Repaid $1.2 billion of debt using proceeds from dispositions and capital markets transactions – Raised gross proceeds of $156 million through our ATM offering program and completed a public offering of 17 million shares of common stock – Received credit ratings upgrades from S&P and Moody's – Expanded leadership responsibilities of Peter Scott and Tom Klaritch, promoted Shawn Johnston and Glenn Preston to Executive Vice President and welcomed Jeff Miller to lead senior housing asset management FULL YEAR 2018 HIGHLIGHTS – Diluted net income of $2.24 per share, diluted NAREIT FFO of $1.66 per share and diluted FFO as adjusted of $1.82 per share – Reduced operator concentration and improved the quality of our senior housing portfolio through the completion of $1.1 billion of non-core asset sales and transitions to new operators at 38 communities – Entered into a $605 million 51%/49% joint venture in a two million square foot medical office portfolio with Morgan Stanley Real Estate Investing – Sold our Tandem Mezzanine Loan investment, which eliminated our exposure to both stand-alone post-acute/skilled-nursing assets and highly-leveraged mezzanine investments – Closed on the sale of a 51% interest in our U.K. holdings and expect to sell the remaining 49% interest by no later than 2020 – Created a program with HCA Healthcare, Inc. ("HCA") to develop primarily on-campus MOBs – Strengthened our balance sheet with $2.3 billion of debt repayments – Signed approximately 865,000 square feet of leases for our life science development projects – Appointed Kent Griffin, Lydia Kennard and Katherine Sandstrom as independent directors to the Company's Board of Directors – Recognized for our continued sustainability leadership and performance by several prominent Environmental, Social and Governance ("ESG") benchmarking institutions 3

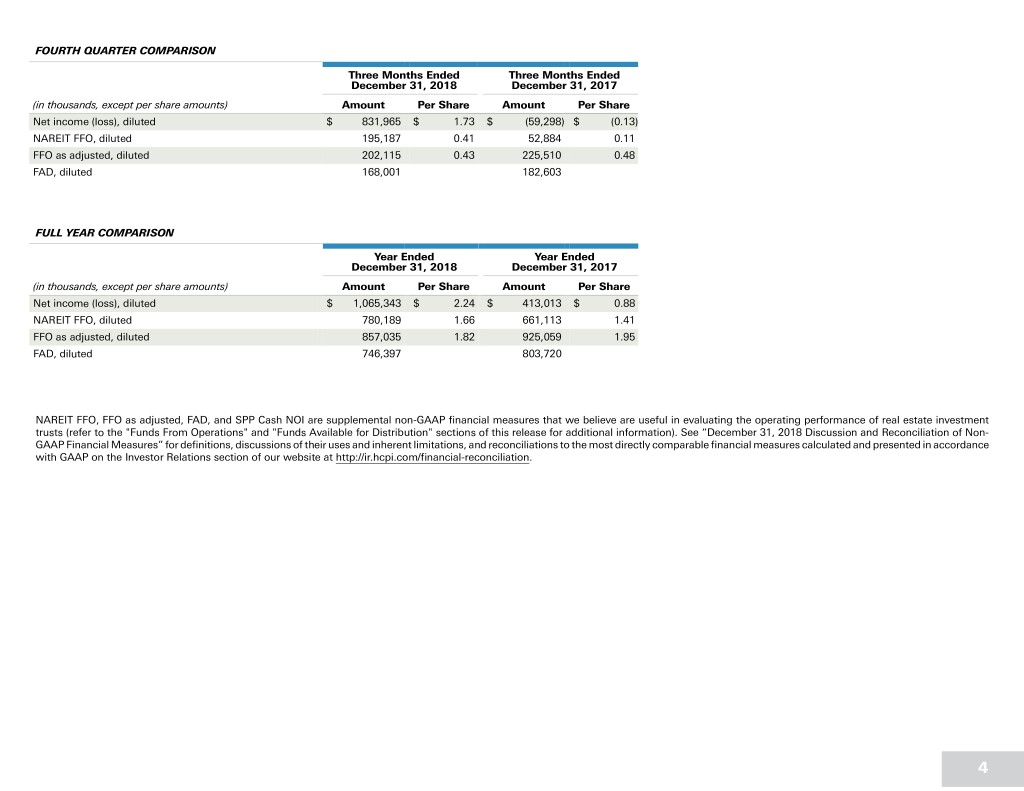

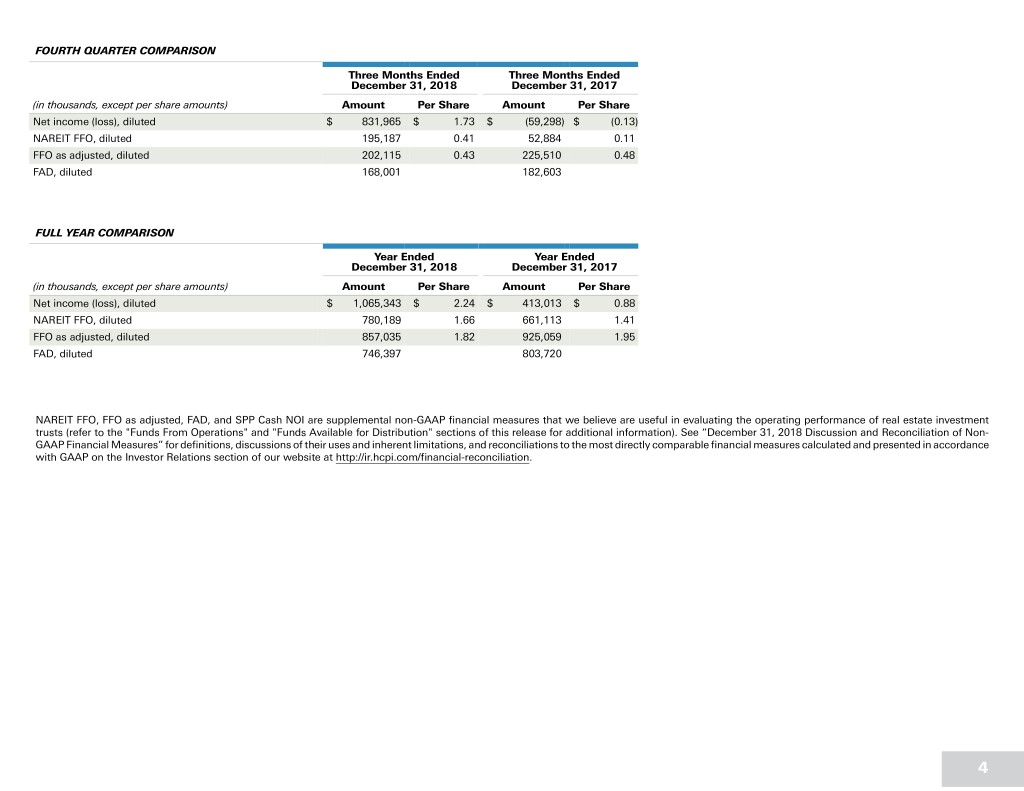

FOURTH QUARTER COMPARISON Three Months Ended Three Months Ended December 31, 2018 December 31, 2017 (in thousands, except per share amounts) Amount Per Share Amount Per Share Net income (loss), diluted $ 831,965 $ 1.73 $ (59,298) $ (0.13) NAREIT FFO, diluted 195,187 0.41 52,884 0.11 FFO as adjusted, diluted 202,115 0.43 225,510 0.48 FAD, diluted 168,001 182,603 FULL YEAR COMPARISON Year Ended Year Ended December 31, 2018 December 31, 2017 (in thousands, except per share amounts) Amount Per Share Amount Per Share Net income (loss), diluted $ 1,065,343 $ 2.24 $ 413,013 $ 0.88 NAREIT FFO, diluted 780,189 1.66 661,113 1.41 FFO as adjusted, diluted 857,035 1.82 925,059 1.95 FAD, diluted 746,397 803,720 NAREIT FFO, FFO as adjusted, FAD, and SPP Cash NOI are supplemental non-GAAP financial measures that we believe are useful in evaluating the operating performance of real estate investment trusts (refer to the "Funds From Operations" and "Funds Available for Distribution" sections of this release for additional information). See “December 31, 2018 Discussion and Reconciliation of Non- GAAP Financial Measures” for definitions, discussions of their uses and inherent limitations, and reconciliations to the most directly comparable financial measures calculated and presented in accordance with GAAP on the Investor Relations section of our website at http://ir.hcpi.com/financial-reconciliation. 4

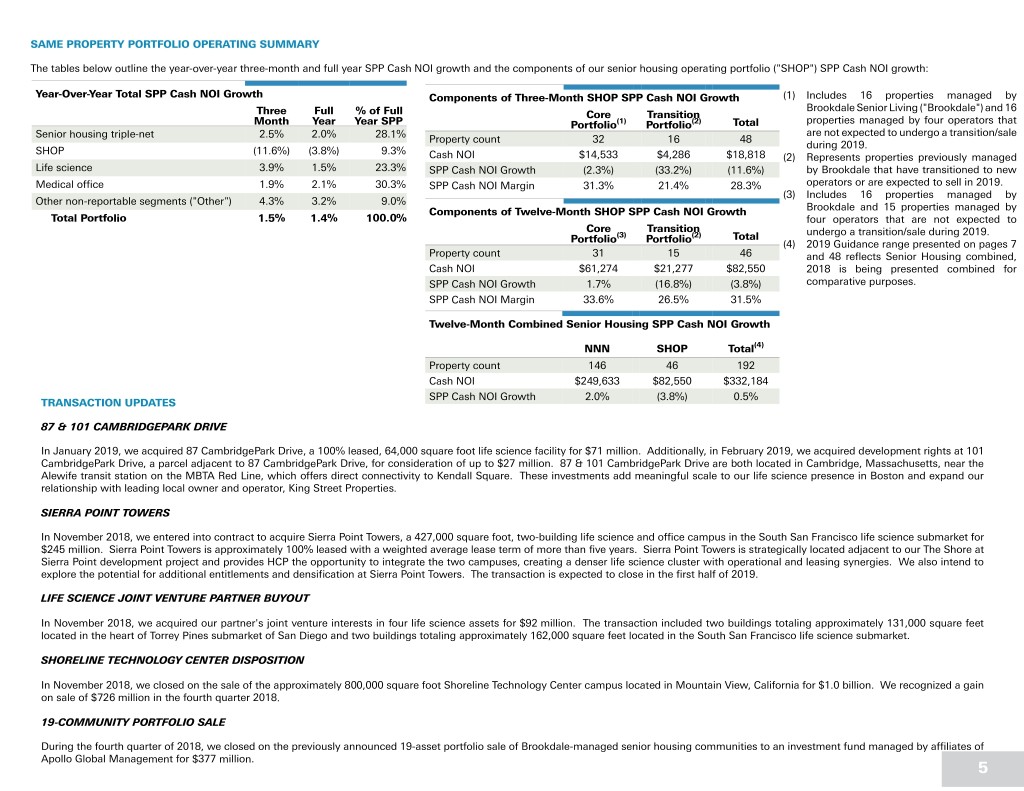

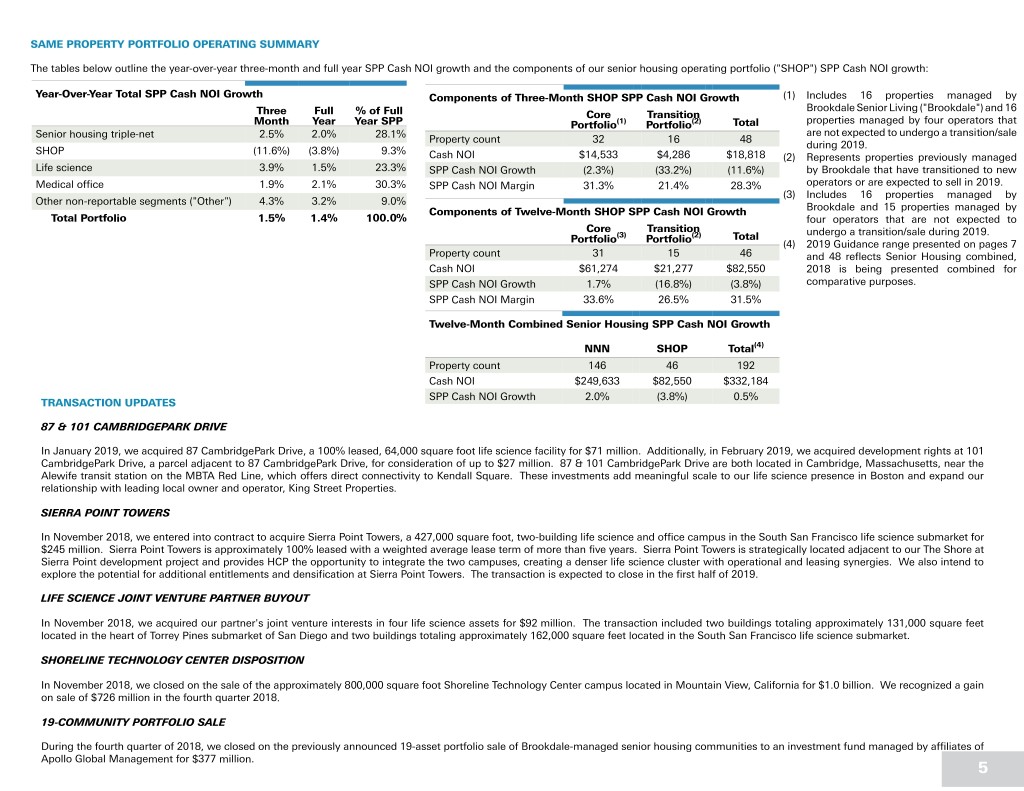

SAME PROPERTY PORTFOLIO OPERATING SUMMARY The tables below outline the year-over-year three-month and full year SPP Cash NOI growth and the components of our senior housing operating portfolio ("SHOP") SPP Cash NOI growth: Year-Over-Year Total SPP Cash NOI Growth Components of Three-Month SHOP SPP Cash NOI Growth (1) Includes 16 properties managed by Brookdale Senior Living ("Brookdale") and 16 Three Full % of Full Core Transition Month Year Year SPP Portfolio(1) Portfolio(2) Total properties managed by four operators that are not expected to undergo a transition/sale Senior housing triple-net 2.5% 2.0% 28.1% Property count 32 16 48 during 2019. SHOP (11.6%) (3.8%) 9.3% Cash NOI $14,533 $4,286 $18,818 (2) Represents properties previously managed Life science 3.9% 1.5% 23.3% SPP Cash NOI Growth (2.3%) (33.2%) (11.6%) by Brookdale that have transitioned to new Medical office 1.9% 2.1% 30.3% SPP Cash NOI Margin 31.3% 21.4% 28.3% operators or are expected to sell in 2019. (3) Includes 16 properties managed by Other non-reportable segments ("Other") 4.3% 3.2% 9.0% Components of Twelve-Month SHOP SPP Cash NOI Growth Brookdale and 15 properties managed by Total Portfolio 1.5% 1.4% 100.0% four operators that are not expected to Core Transition undergo a transition/sale during 2019. Portfolio(3) Portfolio(2) Total (4) 2019 Guidance range presented on pages 7 Property count 31 15 46 and 48 reflects Senior Housing combined, Cash NOI $61,274 $21,277 $82,550 2018 is being presented combined for SPP Cash NOI Growth 1.7% (16.8%) (3.8%) comparative purposes. SPP Cash NOI Margin 33.6% 26.5% 31.5% Twelve-Month Combined Senior Housing SPP Cash NOI Growth NNN SHOP Total(4) Property count 146 46 192 Cash NOI $249,633 $82,550 $332,184 SPP Cash NOI Growth 2.0% (3.8%) 0.5% TRANSACTION UPDATES 87 & 101 CAMBRIDGEPARK DRIVE In January 2019, we acquired 87 CambridgePark Drive, a 100% leased, 64,000 square foot life science facility for $71 million. Additionally, in February 2019, we acquired development rights at 101 CambridgePark Drive, a parcel adjacent to 87 CambridgePark Drive, for consideration of up to $27 million. 87 & 101 CambridgePark Drive are both located in Cambridge, Massachusetts, near the Alewife transit station on the MBTA Red Line, which offers direct connectivity to Kendall Square. These investments add meaningful scale to our life science presence in Boston and expand our relationship with leading local owner and operator, King Street Properties. SIERRA POINT TOWERS In November 2018, we entered into contract to acquire Sierra Point Towers, a 427,000 square foot, two-building life science and office campus in the South San Francisco life science submarket for $245 million. Sierra Point Towers is approximately 100% leased with a weighted average lease term of more than five years. Sierra Point Towers is strategically located adjacent to our The Shore at Sierra Point development project and provides HCP the opportunity to integrate the two campuses, creating a denser life science cluster with operational and leasing synergies. We also intend to explore the potential for additional entitlements and densification at Sierra Point Towers. The transaction is expected to close in the first half of 2019. LIFE SCIENCE JOINT VENTURE PARTNER BUYOUT In November 2018, we acquired our partner's joint venture interests in four life science assets for $92 million. The transaction included two buildings totaling approximately 131,000 square feet located in the heart of Torrey Pines submarket of San Diego and two buildings totaling approximately 162,000 square feet located in the South San Francisco life science submarket. SHORELINE TECHNOLOGY CENTER DISPOSITION In November 2018, we closed on the sale of the approximately 800,000 square foot Shoreline Technology Center campus located in Mountain View, California for $1.0 billion. We recognized a gain on sale of $726 million in the fourth quarter 2018. 19-COMMUNITY PORTFOLIO SALE During the fourth quarter of 2018, we closed on the previously announced 19-asset portfolio sale of Brookdale-managed senior housing communities to an investment fund managed by affiliates of Apollo Global Management for $377 million. 5

OPERATOR TRANSITION UPDATE During 2018, we transitioned 38 HCP-owned senior housing communities from Brookdale to new operators, including Atria Senior Living, Sunrise Senior Living, Elmcroft by Eclipse Senior Living, Discovery Senior Living and Sonata Senior Living. DEVELOPMENT UPDATES ADDITIONAL PHASES OF THE SHORE AT SIERRA POINT The Shore at Sierra Point is a 23-acre waterfront life science development located in the South San Francisco life science submarket that will offer state-of-the-art laboratory and office space along with high-end amenities. We have pre-leased 100% of Phase I, which consists of two buildings totaling approximately 222,000 square feet with an approximate total cost of $224 million. In response to our Phase I leasing success and continued demand for life science space in the South San Francisco life science submarket, we accelerated commencement of Phases II and III of the development. Phases II and III combined will consist of three Class A life science office buildings totaling approximately 369,000 square feet with total estimated development costs of $385 million. ON-CAMPUS MEDICAL OFFICE DEVELOPMENT PROGRAM WITH HCA During the quarter, we began construction on a 90,000 square foot medical office building on the campus of Grand Strand Medical Center ("Grand Strand") in Myrtle Beach, South Carolina with an estimated cost of $26 million. Grand Strand is operated by HCA and is the leading hospital in the market. Grand Strand will anchor the development and occupy 42,000 square feet upon completion. BALANCE SHEET AND CAPITAL MARKET ACTIVITIES In the fourth quarter of 2018, we used proceeds from dispositions to repay approximately $1.2 billion of debt consisting of $450 million of our 3.75% senior unsecured notes due in February 2019, $224 million of our unsecured term loan due in January 2019 and $557 million of outstanding borrowings under our $2.0 billion unsecured revolving line of credit. At December 31, 2018, we had $1.9 billion of availability under our $2.0 billion credit facility. In the fourth quarter of 2018, we raised gross proceeds of approximately $156 million under our ATM common stock offering program. Additionally, we completed a public offering of 17,250,000 shares of common stock (including the exercise of the underwriter's option to purchase additional shares) priced at $28.90 per share before underwriting discounts and commissions. As part of the offering, 15,250,000 shares were structured as a forward sale for up to 12 months. We expect to settle the forward and use the proceeds during 2019 to fund our acquisition and development activities. EXECUTIVE LEADERSHIP To further advance our competitive performance and execute on the internal and external growth opportunities within our portfolio, HCP today announced expanded leadership responsibilities for Peter Scott and Tom Klaritch, promotions to Executive Vice President for Shawn Johnston and Glenn Preston and the addition of Jeff Miller to lead senior housing asset management. • Peter Scott has assumed leadership of our Life Science segment where he will lead a seasoned team with expertise and relationships in the major life science markets. Mr. Scott will also continue to serve as Chief Financial Officer. • Tom Klaritch has assumed responsibility for the management of HCP’s development and redevelopment projects in the newly-created role of Chief Development Officer. Mr. Klaritch will continue to serve as Chief Operating Officer and provide oversight of our Medical Office segment. "Pete and Tom are proven leaders and I’m excited to broaden the scope of their responsibilities,” said Tom Herzog, HCP’s Chief Executive Officer. “These changes support HCP's continued execution of its strategic initiatives.” HCP also announced today it has promoted Shawn Johnston and Glenn Preston to Executive Vice President. Mr. Johnston joined HCP in 2017 as Chief Accounting Officer and is responsible for our accounting, financial reporting, property tax and financial systems. Mr. Preston joined HCP in 2003 and leads day-to-day operations for all aspects of our Medical Office segment. Additionally, HCP announced the addition of Jeff Miller as Senior Vice President, who will be responsible for the day-to-day execution of the company's Senior Housing finance and asset management functions. Mr. Miller will report directly to Scott Brinker, Chief Investment Officer and leader of our Senior Housing segment. Prior to joining HCP, Mr. Miller served as Chief Operating Officer at Welltower, Inc. from July 2014 to January 2017, and General Counsel from July 2004 to July 2014. "Jeff joins us with over 30 years of experience in health care real estate,” said Mr. Herzog. “His addition to our team is yet another tangible step we’ve taken to remake our senior housing business to capture the embedded upside in our portfolio.” 6

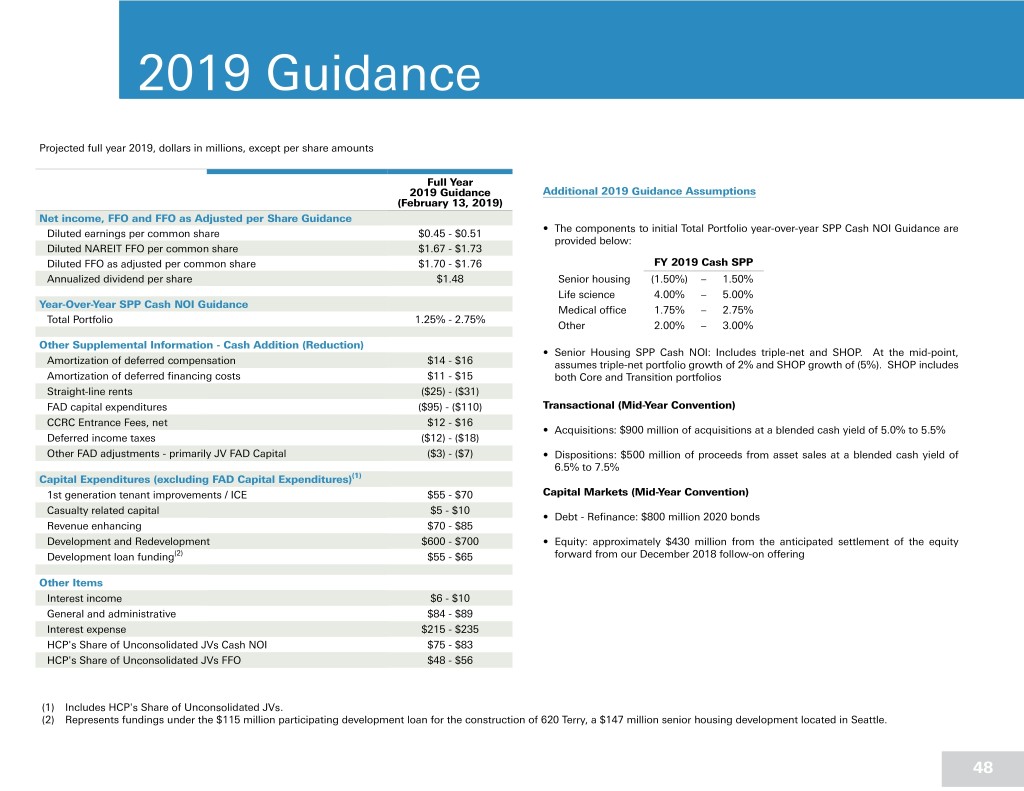

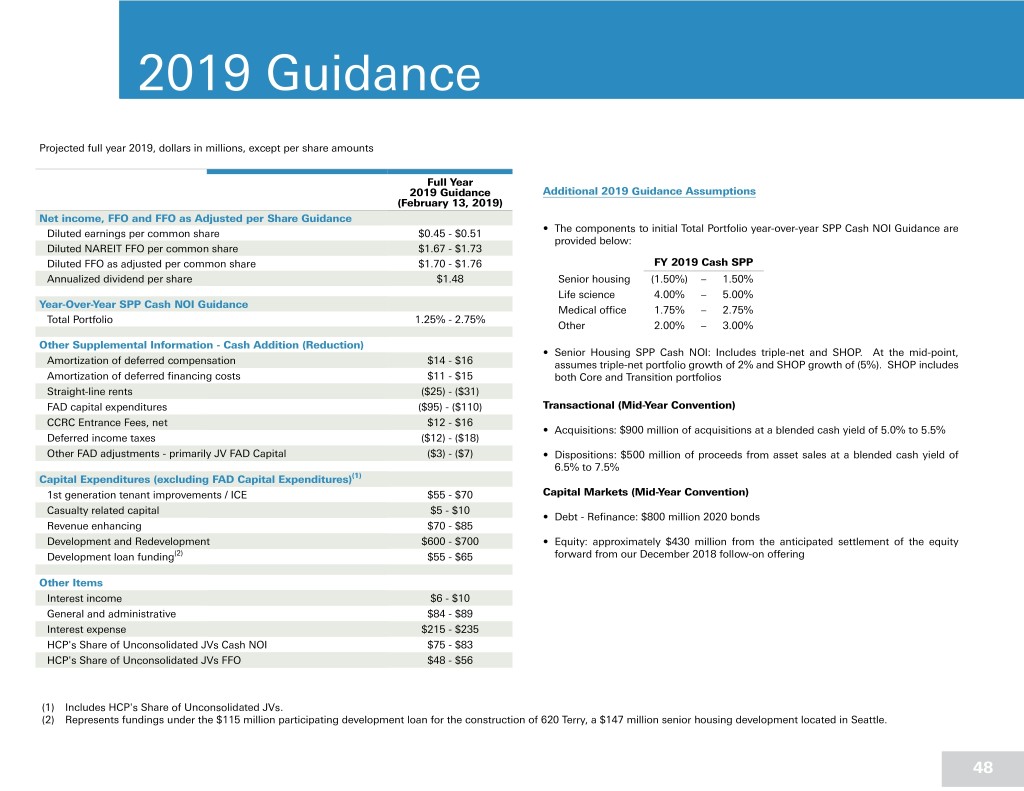

DIVIDEND On January 31, 2019, we announced that our Board declared a quarterly cash dividend of $0.37 per common share. The dividend will be paid on February 28, 2019 to stockholders of record as of the close of business on February 19, 2019. SUSTAINABILITY HCP’s leadership and performance in environmental, social and governance ("ESG") sustainability initiatives were recognized by the CDP (formerly the Carbon Disclosure Project) 2018 Climate Change Program. We completed CDP's annual investor survey for the seventh consecutive year, received a 2018 score of A- for our disclosure and were named to the Leadership Band. Additionally, HCP was named a constituent in the FTSE4Good Index for the seventh consecutive year and achieved the Green Star designation from the Global Real Estate Sustainability Benchmark ("GRESB") for the seventh consecutive year. HCP was also named a constituent in the North America Dow Jones Sustainability Index ("DJSI") for the sixth consecutive year and was included in The Sustainability Yearbook 2018, a listing of the world's most sustainable companies. The list is compiled according to the results of RobecoSAM's annual Corporate Sustainability Assessment, which also determines constituency for the DJSI series. For additional information regarding our ESG sustainability initiatives and our approach to climate change, please visit our website at www.hcpi.com/ sustainability. 2019 GUIDANCE For full year 2019, we have established the following guidance ranges: • Diluted net income per share to range between $0.45 to $0.51 • Diluted NAREIT FFO per share of $1.67 to $1.73 • Diluted FFO as adjusted per share of $1.70 to $1.76 • Blended Total Portfolio SPP Cash NOI growth of 1.25% to 2.75% Key Assumptions • Components to initial blended Total Portfolio SPP Cash NOI guidance: ◦ Senior Housing: (1.50%) to 1.50% ◦ Medical Office: 1.75% to 2.75% ◦ Life Science: 4.00% to 5.00% ◦ Other: 2.00% to 3.00% • Senior Housing SPP Cash NOI: Includes triple-net and SHOP. At the mid-point, assumes triple-net portfolio growth of 2% and SHOP growth of (5%). SHOP includes both Core and Transition portfolios. • Capital Markets: ◦ Debt: mid-year refinancing of $800 million of our 2.625% senior notes due February 2020 ◦ Equity: approximately $430 million from the anticipated settlement of the equity forward from our December 2018 follow-on offering • Development and Redevelopment: $600 to $700 million of spend; an amount elevated relative to 2018 in order to capture significant value creation opportunities • Acquisitions: $900 million at a blended cash yield of 5.0% to 5.5%, mid-year convention • Dispositions: $500 million at a blended cash yield of 6.5% to 7.5%, mid-year convention These estimates do not reflect the potential impact from unannounced future transactions other than capital recycling activities. For additional detail and information regarding these estimates, refer to the 2019 Guidance section of our corresponding Supplemental Report and the Discussion and Reconciliation of Non-GAAP Financial Measures, both available in the Investor Relations section of our website at http://ir.hcpi.com. 7

COMPANY INFORMATION HCP has scheduled a conference call and webcast for Thursday, February 14, 2019, at 9:00 a.m. Pacific Time (12:00 p.m. Eastern Time) to present its performance and operating results for the fourth quarter and full year 2018. The conference call is accessible by dialing (888) 317-6003 (U.S.) or (412) 317-6061 (International). The conference ID number is 3594115. You may also access the conference call via webcast in the Investor Relations section of our website at http://ir.hcpi.com. An archive of the webcast will be available through March 1, 2019 on our website, and a telephonic replay can be accessed by dialing (877) 344-7529 (U.S.) or (412) 317-0088 (International) and entering conference ID number 10128000. Our Supplemental Report for the current period is also available, with this earnings release, in the Investor Relations section of our website. ABOUT HCP HCP, Inc. is a fully integrated real estate investment trust (REIT) that invests in real estate serving the healthcare industry in the United States. HCP owns a large-scale portfolio primarily diversified across life science, medical office and senior housing. Recognized as a global leader in sustainability, HCP has been a publicly-traded company since 1985 and was the first healthcare REIT selected to the S&P 500 index. For more information regarding HCP, visit www.hcpi.com. FORWARD-LOOKING STATEMENTS Statements in this release that are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “may,” “will,” “project,” “expect,” “believe,” “intend,” “anticipate,” “seek,” "target," “forecast,” “plan,” “potential,” “estimate,” “could,” “would,” “should” and other comparable and derivative terms or the negatives thereof. Examples of forward-looking statements include, among other things: (i) statements regarding timing, outcomes and other details relating to current, pending or contemplated acquisitions, dispositions, transitions, developments, redevelopments, joint venture transactions, capital recycling plans, financing activities, or other transactions discussed in this release, including without limitation those described under the headings "Transaction Updates", "Development Updates" and "Balance Sheet and Capital Markets Activities"; (ii) statements regarding the payment of a quarterly cash dividend; and (iii) all statements under the heading “2019 Guidance,” including without limitation with respect to expected net income, FFO per share, FFO as adjusted per share, SPP Cash NOI and other financial projections and assumptions, as well as comparable statements included in other sections of this release. Forward-looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations. While forward-looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained. Further, we cannot guarantee the accuracy of any such forward-looking statement contained in this release, and such forward-looking statements are subject to known and unknown risks and uncertainties that are difficult to predict. These risks and uncertainties include, but are not limited to: our reliance on a concentration of a small number of tenants and operators for a significant percentage of our revenues; the financial condition of our existing and future tenants, operators and borrowers, including potential bankruptcies and downturns in their businesses, and their legal and regulatory proceedings, which results in uncertainties regarding our ability to continue to realize the full benefit of such tenants' and operators' leases and borrowers' loans; the ability of our existing and future tenants, operators and borrowers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and to generate sufficient income to make rent and loan payments to us and our ability to recover investments made, if applicable, in their operations; competition for the acquisition and financing of suitable healthcare properties as well as competition for tenants and operators, including with respect to new leases and mortgages and the renewal or rollover of existing leases; our concentration in the healthcare property sector, particularly in senior housing, life sciences and medical office buildings, which makes our profitability more vulnerable to a downturn in a specific sector than if we were investing in multiple industries; our ability to identify replacement tenants and operators and the potential renovation costs and regulatory approvals associated therewith; the risks associated with property development and redevelopment, including costs above original estimates, project delays and lower occupancy rates and rents than expected; the risks associated with our investments in joint ventures and unconsolidated entities, including our lack of sole decision making authority and our reliance on our partners' financial condition and continued cooperation; our ability to achieve the benefits of acquisitions and other investments, including those discussed above, within expected time frames or at all, or within expected cost projections; the potential impact on us and our tenants, operators and borrowers from current and future litigation matters, including the possibility of larger than expected litigation costs, adverse results and related developments; operational risks associated with third party management contracts, including the additional regulation and liabilities of our RIDEA lease structures; the effect on us and our tenants and operators of legislation, executive orders and other legal requirements, including compliance with the Americans with Disabilities Act, fire, safety and health regulations, environmental laws, the Affordable Care Act, licensure, certification and inspection requirements, and laws addressing entitlement programs and related services, including Medicare and Medicaid, which may result in future reductions in reimbursements or fines for noncompliance; changes in federal, state or local laws and regulations, including those affecting the healthcare industry that affect our costs of compliance or increase the costs, or otherwise affect the operations, of our tenants and operators; our ability to foreclose on collateral securing our real estate-related loans; volatility or uncertainty in the capital markets, the availability and cost of capital as impacted by interest rates, changes in our credit ratings, and the value of our common stock, and other conditions that may adversely impact our ability to fund our obligations or consummate transactions, or reduce the earnings from potential transactions; changes in global, national and local economic or other conditions, including currency exchange rates; our ability to manage our indebtedness level and changes in the terms of such indebtedness; competition for skilled management and other key personnel; the potential impact of uninsured or underinsured losses; our reliance on information technology systems and the potential impact of system failures, disruptions or breaches; the ability to maintain our qualification as a real estate investment trust; and other risks and uncertainties described from time to time in our Securities and Exchange Commission filings. Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward-looking statements, which speak only as of the date on which they are made. CONTACT Andrew Johns Vice President – Finance and Investor Relations 949-407-0400 8

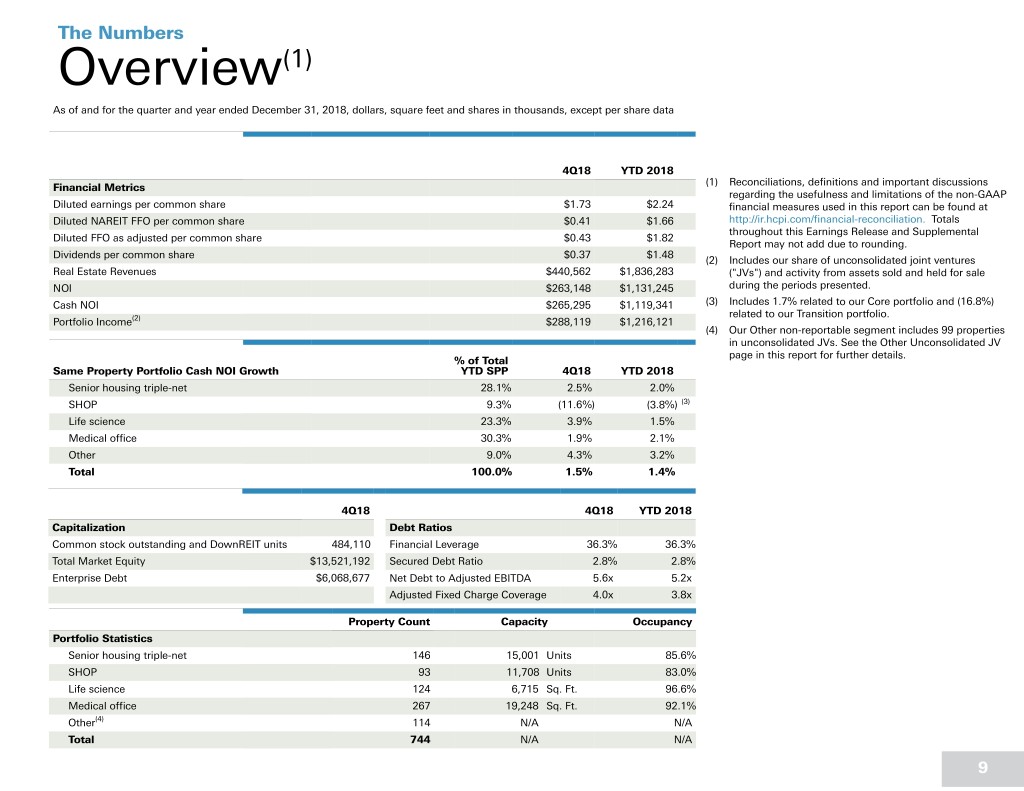

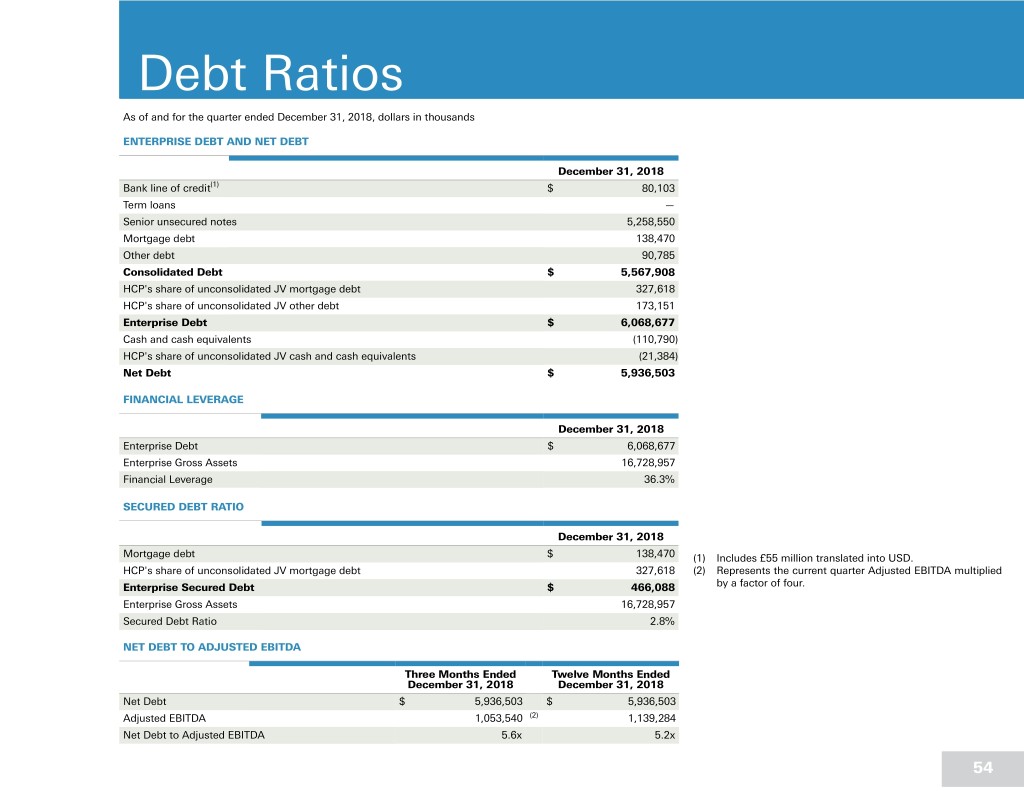

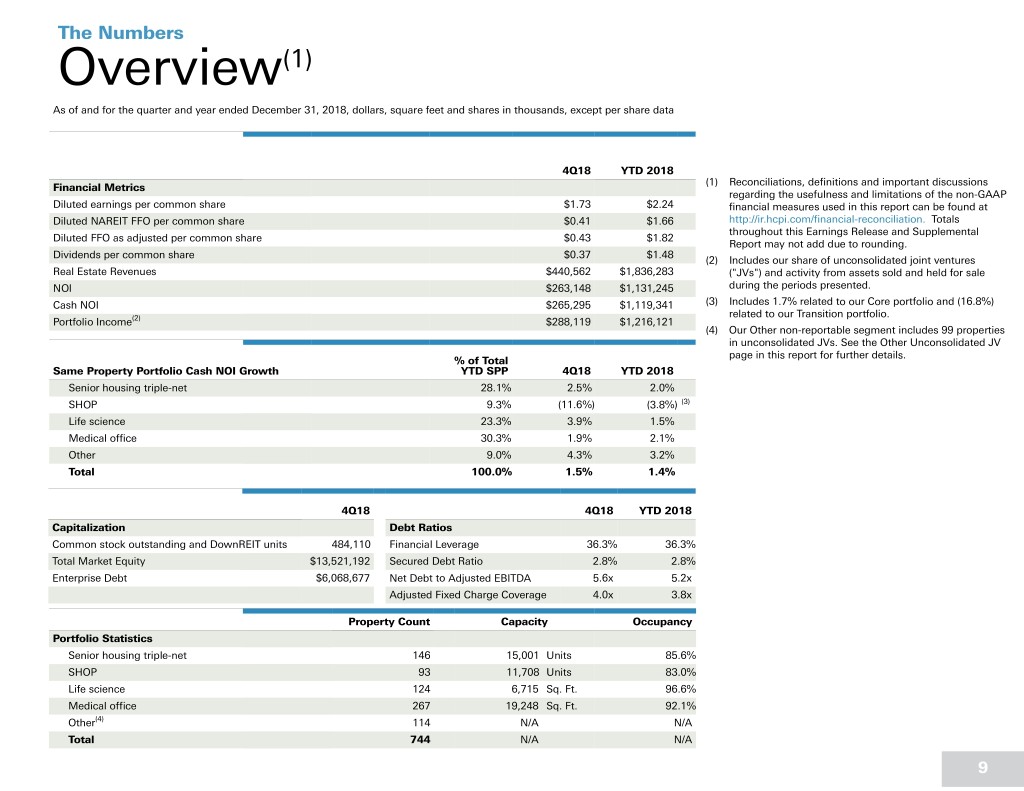

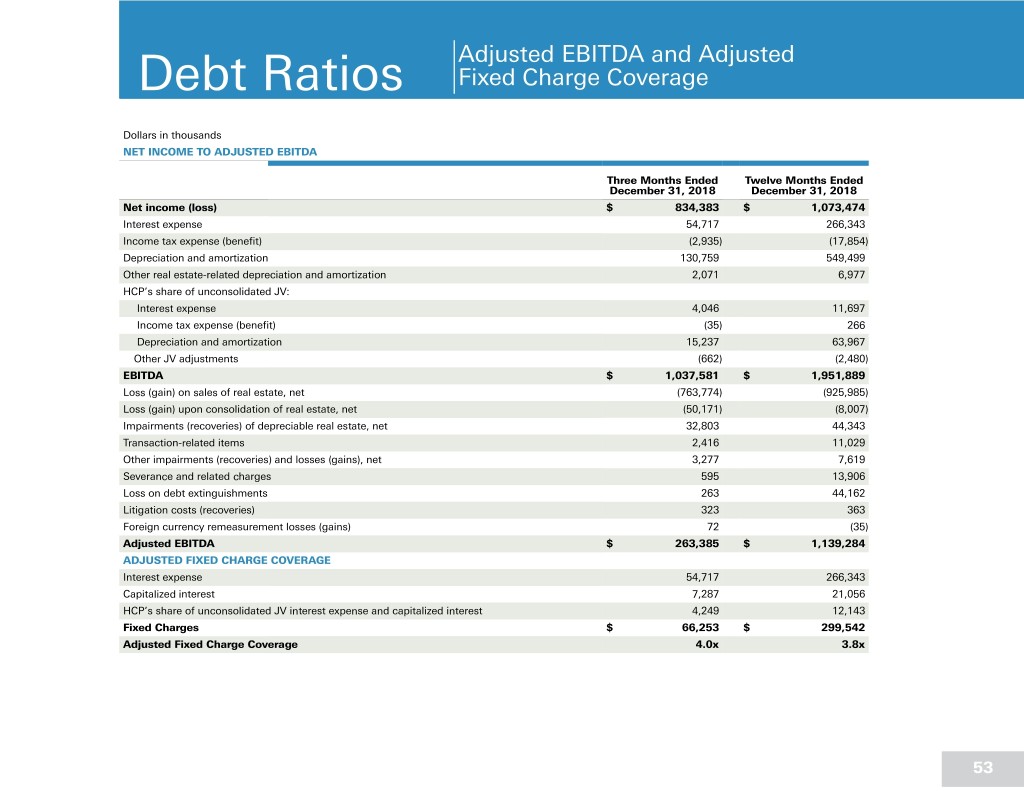

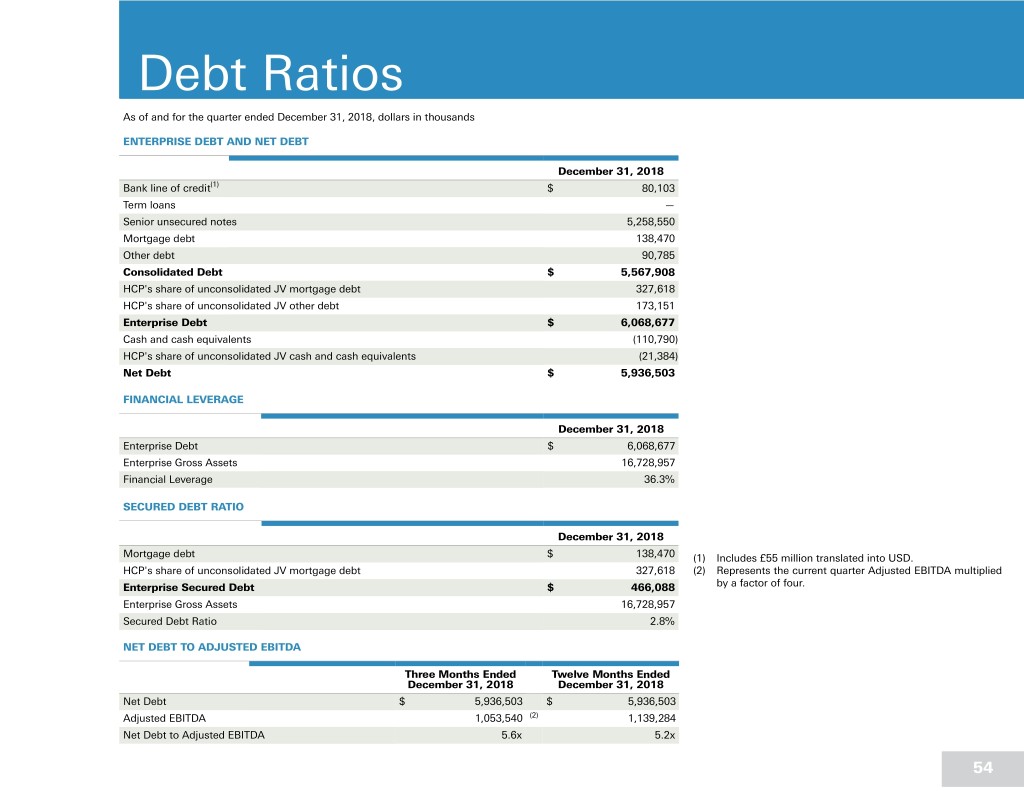

The Numbers Overview(1) As of and for the quarter and year ended December 31, 2018, dollars, square feet and shares in thousands, except per share data 4Q18 YTD 2018 (1) Reconciliations, definitions and important discussions Financial Metrics regarding the usefulness and limitations of the non-GAAP Diluted earnings per common share $1.73 $2.24 financial measures used in this report can be found at Diluted NAREIT FFO per common share $0.41 $1.66 http://ir.hcpi.com/financial-reconciliation. Totals throughout this Earnings Release and Supplemental Diluted FFO as adjusted per common share $0.43 $1.82 Report may not add due to rounding. Dividends per common share $0.37 $1.48 (2) Includes our share of unconsolidated joint ventures Real Estate Revenues $440,562 $1,836,283 ("JVs") and activity from assets sold and held for sale NOI $263,148 $1,131,245 during the periods presented. Cash NOI $265,295 $1,119,341 (3) Includes 1.7% related to our Core portfolio and (16.8%) related to our Transition portfolio. Portfolio Income(2) $288,119 $1,216,121 (4) Our Other non-reportable segment includes 99 properties in unconsolidated JVs. See the Other Unconsolidated JV page in this report for further details. % of Total Same Property Portfolio Cash NOI Growth YTD SPP 4Q18 YTD 2018 Senior housing triple-net 28.1% 2.5% 2.0% SHOP 9.3% (11.6%) (3.8%) (3) Life science 23.3% 3.9% 1.5% Medical office 30.3% 1.9% 2.1% Other 9.0% 4.3% 3.2% Total 100.0% 1.5% 1.4% 4Q18 4Q18 YTD 2018 Capitalization Debt Ratios Common stock outstanding and DownREIT units 484,110 Financial Leverage 36.3% 36.3% Total Market Equity $13,521,192 Secured Debt Ratio 2.8% 2.8% Enterprise Debt $6,068,677 Net Debt to Adjusted EBITDA 5.6x 5.2x Adjusted Fixed Charge Coverage 4.0x 3.8x Property Count Capacity Occupancy Portfolio Statistics Senior housing triple-net 146 15,001 Units 85.6% SHOP 93 11,708 Units 83.0% Life science 124 6,715 Sq. Ft. 96.6% Medical office 267 19,248 Sq. Ft. 92.1% Other(4) 114 N/A N/A Total 744 N/A N/A 9

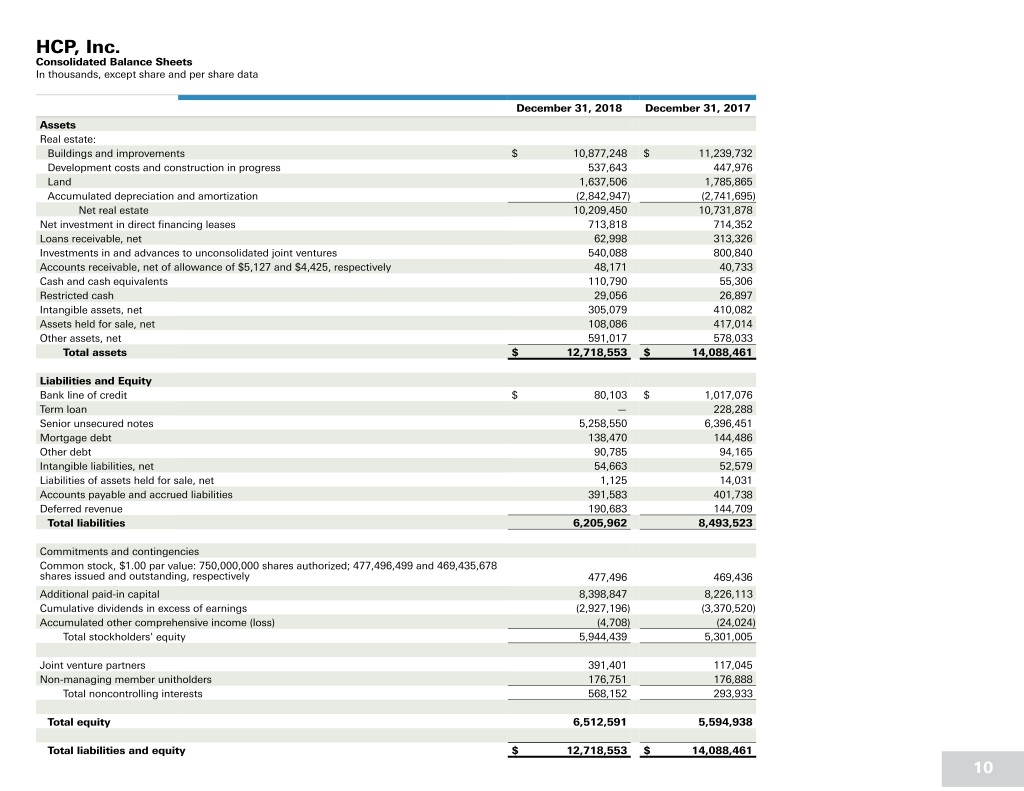

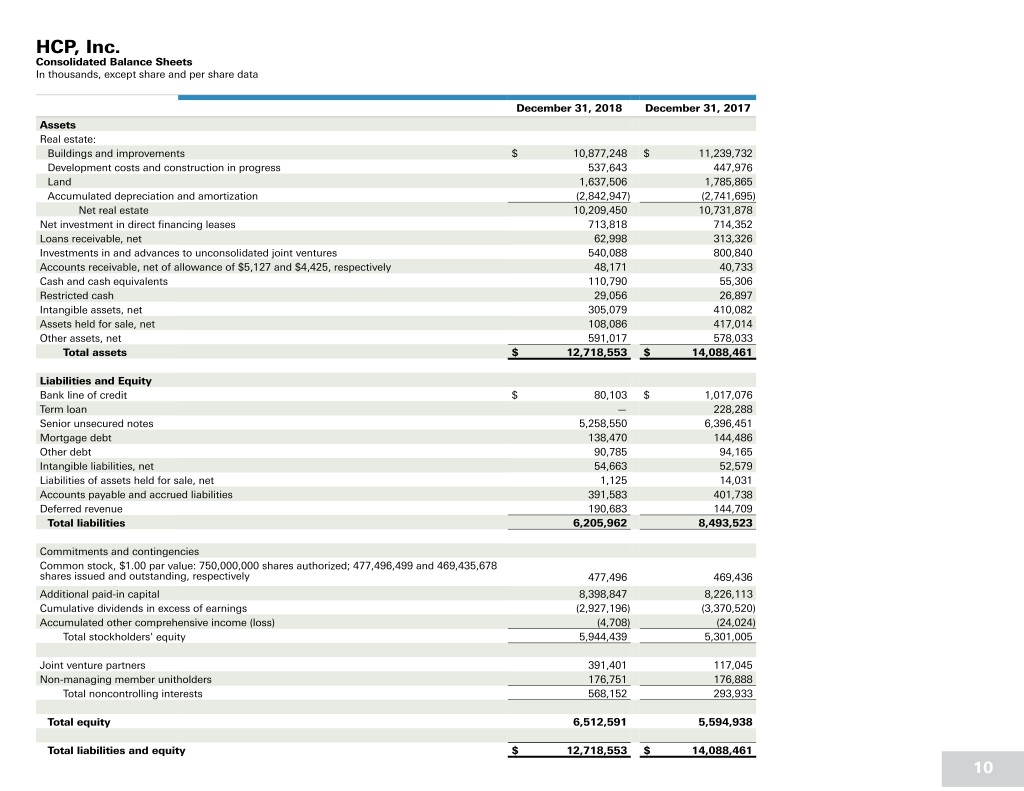

HCP, Inc. Consolidated Balance Sheets In thousands, except share and per share data December 31, 2018 December 31, 2017 Assets Real estate: Buildings and improvements $ 10,877,248 $ 11,239,732 Development costs and construction in progress 537,643 447,976 Land 1,637,506 1,785,865 Accumulated depreciation and amortization (2,842,947) (2,741,695) Net real estate 10,209,450 10,731,878 Net investment in direct financing leases 713,818 714,352 Loans receivable, net 62,998 313,326 Investments in and advances to unconsolidated joint ventures 540,088 800,840 Accounts receivable, net of allowance of $5,127 and $4,425, respectively 48,171 40,733 Cash and cash equivalents 110,790 55,306 Restricted cash 29,056 26,897 Intangible assets, net 305,079 410,082 Assets held for sale, net 108,086 417,014 Other assets, net 591,017 578,033 Total assets $ 12,718,553 $ 14,088,461 Liabilities and Equity Bank line of credit $ 80,103 $ 1,017,076 Term loan — 228,288 Senior unsecured notes 5,258,550 6,396,451 Mortgage debt 138,470 144,486 Other debt 90,785 94,165 Intangible liabilities, net 54,663 52,579 Liabilities of assets held for sale, net 1,125 14,031 Accounts payable and accrued liabilities 391,583 401,738 Deferred revenue 190,683 144,709 Total liabilities 6,205,962 8,493,523 Commitments and contingencies Common stock, $1.00 par value: 750,000,000 shares authorized; 477,496,499 and 469,435,678 shares issued and outstanding, respectively 477,496 469,436 Additional paid-in capital 8,398,847 8,226,113 Cumulative dividends in excess of earnings (2,927,196) (3,370,520) Accumulated other comprehensive income (loss) (4,708) (24,024) Total stockholders' equity 5,944,439 5,301,005 Joint venture partners 391,401 117,045 Non-managing member unitholders 176,751 176,888 Total noncontrolling interests 568,152 293,933 Total equity 6,512,591 5,594,938 Total liabilities and equity $ 12,718,553 $ 14,088,461 10

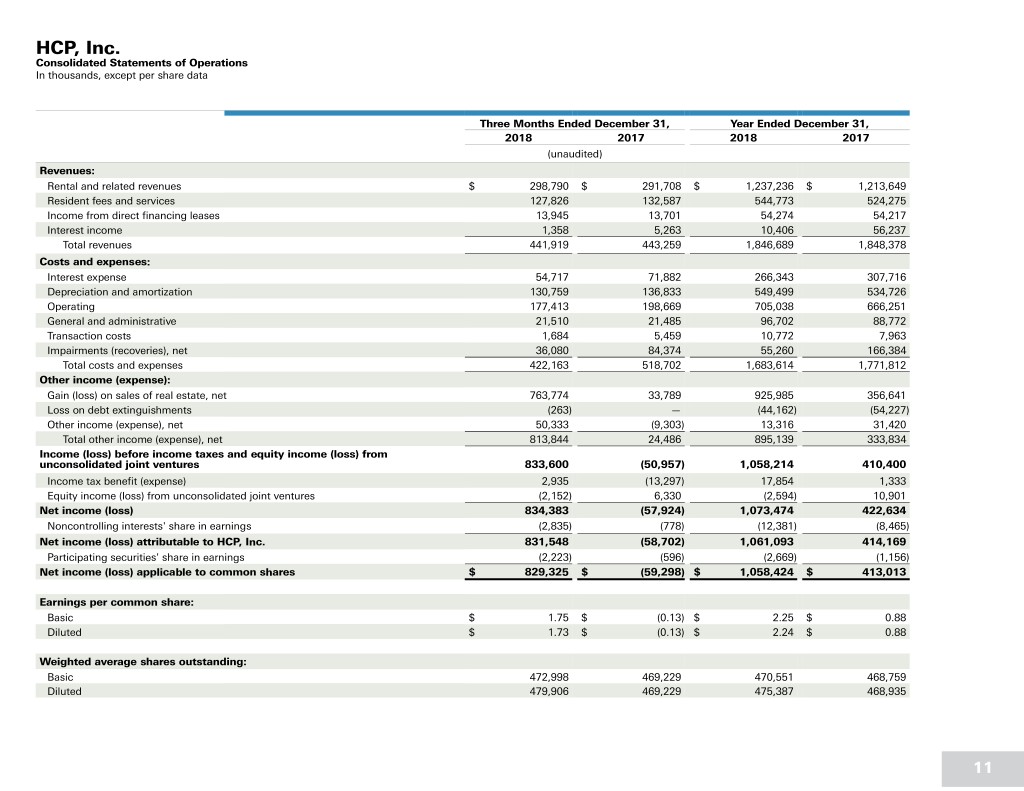

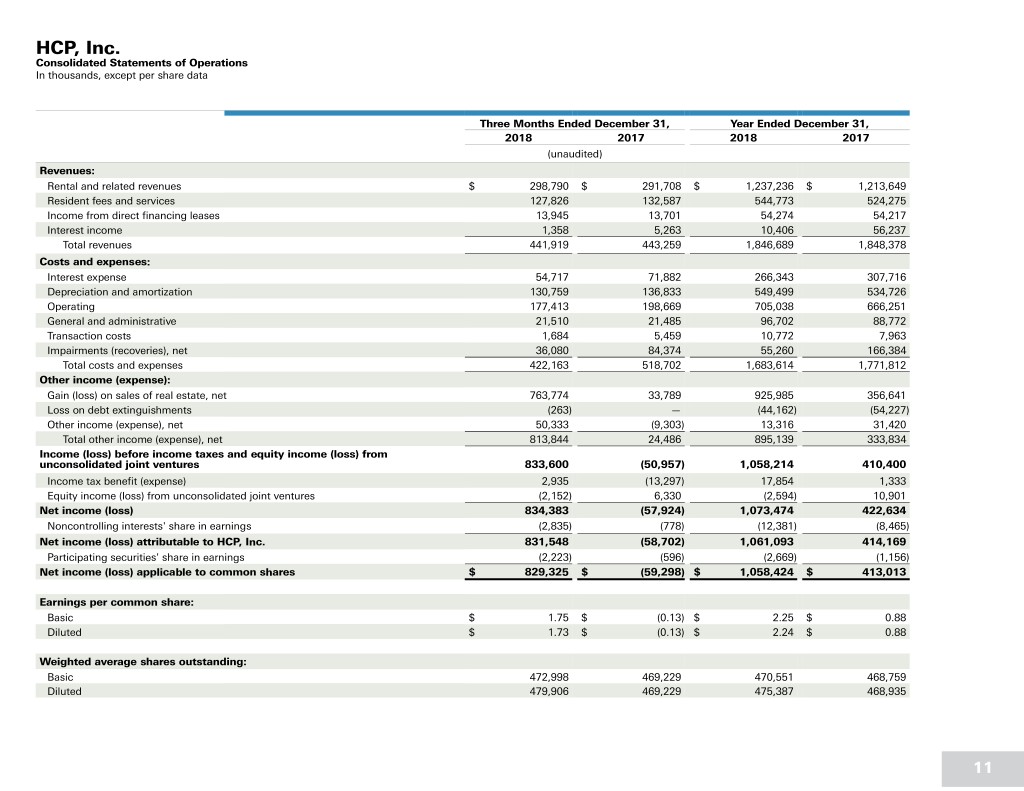

HCP, Inc. Consolidated Statements of Operations In thousands, except per share data Three Months Ended December 31, Year Ended December 31, 2018 2017 2018 2017 (unaudited) Revenues: Rental and related revenues $ 298,790 $ 291,708 $ 1,237,236 $ 1,213,649 Resident fees and services 127,826 132,587 544,773 524,275 Income from direct financing leases 13,945 13,701 54,274 54,217 Interest income 1,358 5,263 10,406 56,237 Total revenues 441,919 443,259 1,846,689 1,848,378 Costs and expenses: Interest expense 54,717 71,882 266,343 307,716 Depreciation and amortization 130,759 136,833 549,499 534,726 Operating 177,413 198,669 705,038 666,251 General and administrative 21,510 21,485 96,702 88,772 Transaction costs 1,684 5,459 10,772 7,963 Impairments (recoveries), net 36,080 84,374 55,260 166,384 Total costs and expenses 422,163 518,702 1,683,614 1,771,812 Other income (expense): Gain (loss) on sales of real estate, net 763,774 33,789 925,985 356,641 Loss on debt extinguishments (263) — (44,162) (54,227) Other income (expense), net 50,333 (9,303) 13,316 31,420 Total other income (expense), net 813,844 24,486 895,139 333,834 Income (loss) before income taxes and equity income (loss) from unconsolidated joint ventures 833,600 (50,957) 1,058,214 410,400 Income tax benefit (expense) 2,935 (13,297) 17,854 1,333 Equity income (loss) from unconsolidated joint ventures (2,152) 6,330 (2,594) 10,901 Net income (loss) 834,383 (57,924) 1,073,474 422,634 Noncontrolling interests' share in earnings (2,835) (778) (12,381) (8,465) Net income (loss) attributable to HCP, Inc. 831,548 (58,702) 1,061,093 414,169 Participating securities' share in earnings (2,223) (596) (2,669) (1,156) Net income (loss) applicable to common shares $ 829,325 $ (59,298) $ 1,058,424 $ 413,013 Earnings per common share: Basic $ 1.75 $ (0.13) $ 2.25 $ 0.88 Diluted $ 1.73 $ (0.13) $ 2.24 $ 0.88 Weighted average shares outstanding: Basic 472,998 469,229 470,551 468,759 Diluted 479,906 469,229 475,387 468,935 11

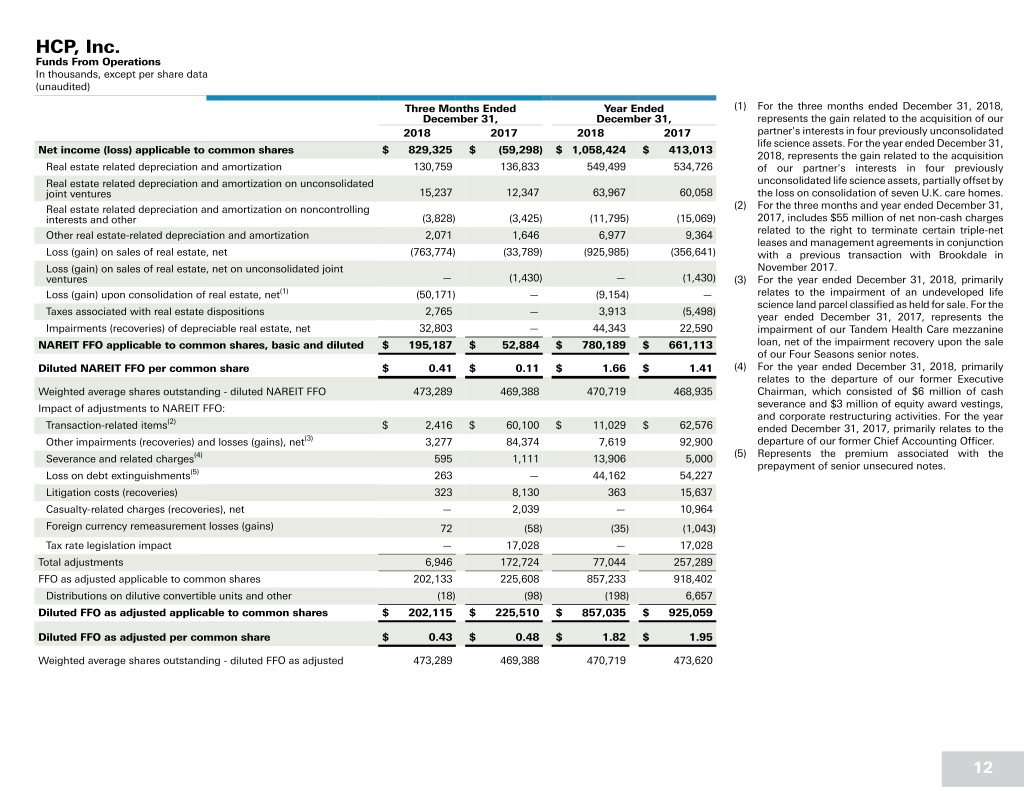

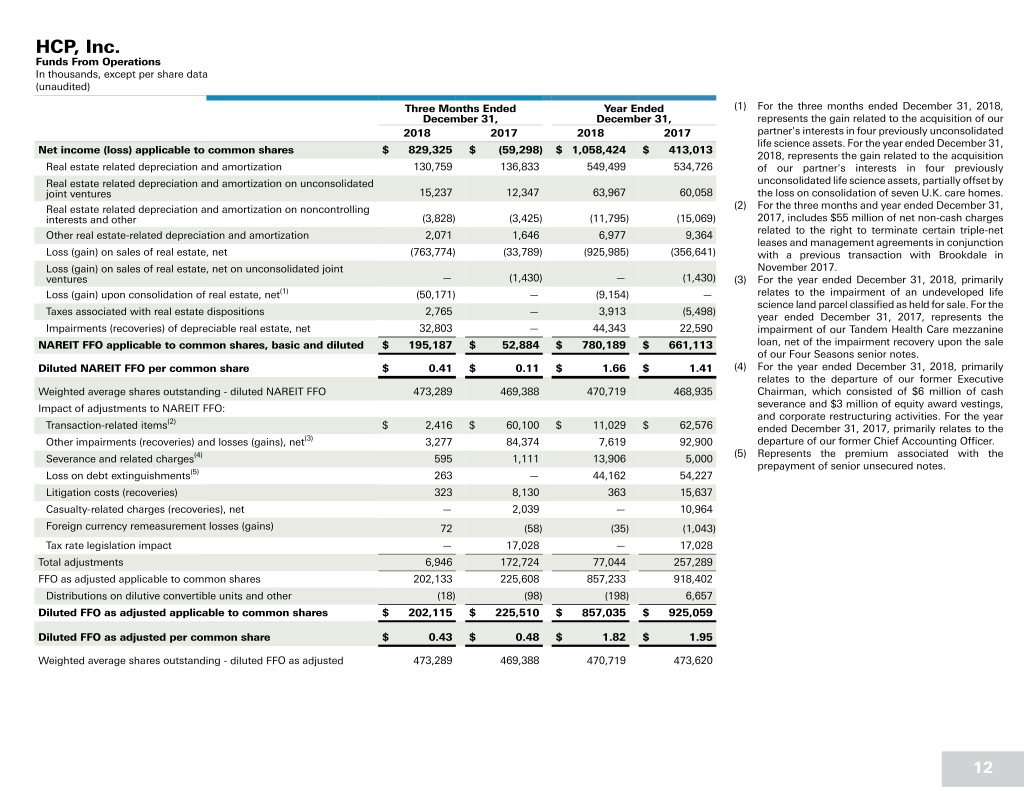

HCP, Inc. Funds From Operations In thousands, except per share data (unaudited) Three Months Ended Year Ended (1) For the three months ended December 31, 2018, December 31, December 31, represents the gain related to the acquisition of our 2018 2017 2018 2017 partner's interests in four previously unconsolidated life science assets. For the year ended December 31, Net income (loss) applicable to common shares $ 829,325 $ (59,298) $ 1,058,424 $ 413,013 2018, represents the gain related to the acquisition Real estate related depreciation and amortization 130,759 136,833 549,499 534,726 of our partner's interests in four previously Real estate related depreciation and amortization on unconsolidated unconsolidated life science assets, partially offset by joint ventures 15,237 12,347 63,967 60,058 the loss on consolidation of seven U.K. care homes. Real estate related depreciation and amortization on noncontrolling (2) For the three months and year ended December 31, interests and other (3,828) (3,425) (11,795) (15,069) 2017, includes $55 million of net non-cash charges Other real estate-related depreciation and amortization 2,071 1,646 6,977 9,364 related to the right to terminate certain triple-net leases and management agreements in conjunction Loss (gain) on sales of real estate, net (763,774) (33,789) (925,985) (356,641) with a previous transaction with Brookdale in Loss (gain) on sales of real estate, net on unconsolidated joint November 2017. ventures — (1,430) — (1,430) (3) For the year ended December 31, 2018, primarily Loss (gain) upon consolidation of real estate, net(1) (50,171) — (9,154) — relates to the impairment of an undeveloped life science land parcel classified as held for sale. For the Taxes associated with real estate dispositions 2,765 — 3,913 (5,498) year ended December 31, 2017, represents the Impairments (recoveries) of depreciable real estate, net 32,803 — 44,343 22,590 impairment of our Tandem Health Care mezzanine NAREIT FFO applicable to common shares, basic and diluted $ 195,187 $ 52,884 $ 780,189 $ 661,113 loan, net of the impairment recovery upon the sale of our Four Seasons senior notes. Diluted NAREIT FFO per common share $ 0.41 $ 0.11 $ 1.66 $ 1.41 (4) For the year ended December 31, 2018, primarily relates to the departure of our former Executive Weighted average shares outstanding - diluted NAREIT FFO 473,289 469,388 470,719 468,935 Chairman, which consisted of $6 million of cash Impact of adjustments to NAREIT FFO: severance and $3 million of equity award vestings, (2) and corporate restructuring activities. For the year Transaction-related items $ 2,416 $ 60,100 $ 11,029 $ 62,576 ended December 31, 2017, primarily relates to the Other impairments (recoveries) and losses (gains), net(3) 3,277 84,374 7,619 92,900 departure of our former Chief Accounting Officer. (4) (5) Represents the premium associated with the Severance and related charges 595 1,111 13,906 5,000 prepayment of senior unsecured notes. Loss on debt extinguishments(5) 263 — 44,162 54,227 Litigation costs (recoveries) 323 8,130 363 15,637 Casualty-related charges (recoveries), net — 2,039 — 10,964 Foreign currency remeasurement losses (gains) 72 (58) (35) (1,043) Tax rate legislation impact — 17,028 — 17,028 Total adjustments 6,946 172,724 77,044 257,289 FFO as adjusted applicable to common shares 202,133 225,608 857,233 918,402 Distributions on dilutive convertible units and other (18) (98) (198) 6,657 Diluted FFO as adjusted applicable to common shares $ 202,115 $ 225,510 $ 857,035 $ 925,059 Diluted FFO as adjusted per common share $ 0.43 $ 0.48 $ 1.82 $ 1.95 Weighted average shares outstanding - diluted FFO as adjusted 473,289 469,388 470,719 473,620 12

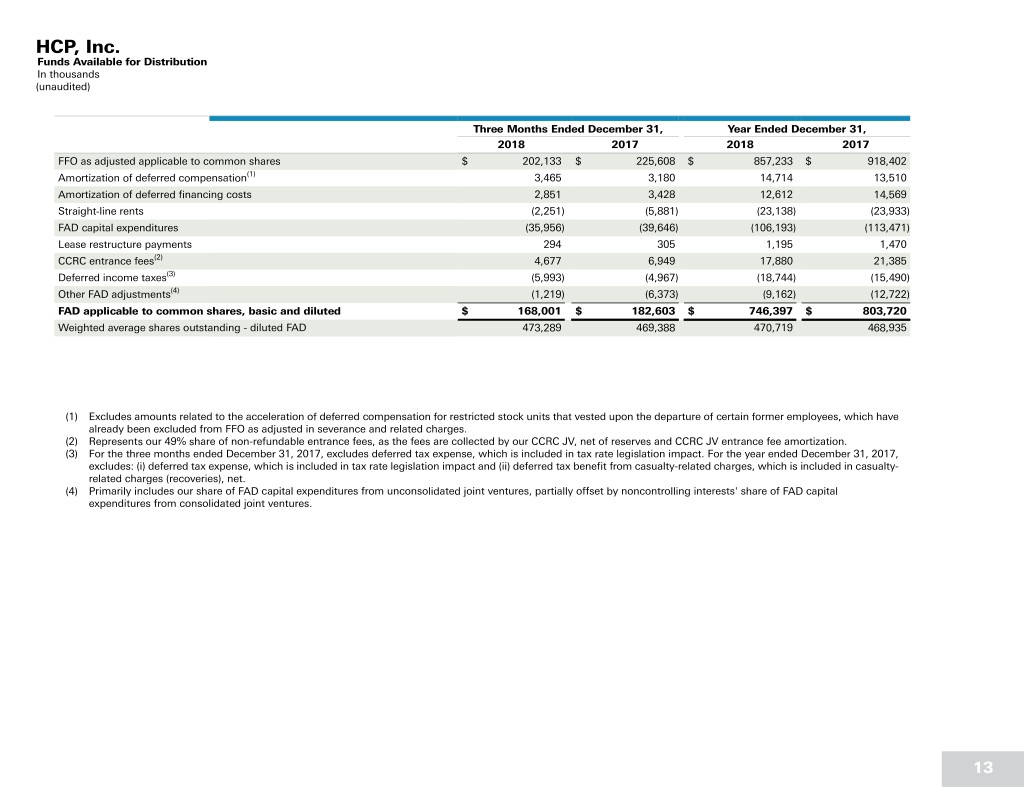

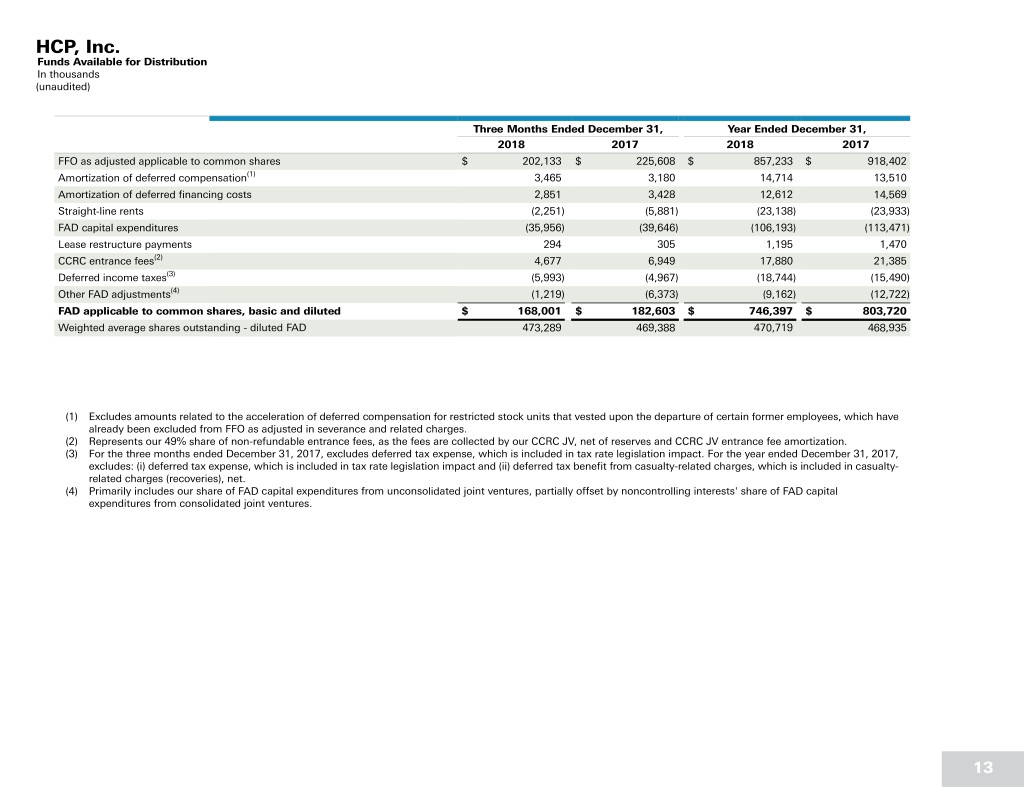

HCP, Inc. Funds Available for Distribution In thousands (unaudited) Three Months Ended December 31, Year Ended December 31, 2018 2017 2018 2017 FFO as adjusted applicable to common shares $ 202,133 $ 225,608 $ 857,233 $ 918,402 Amortization of deferred compensation(1) 3,465 3,180 14,714 13,510 Amortization of deferred financing costs 2,851 3,428 12,612 14,569 Straight-line rents (2,251) (5,881) (23,138) (23,933) FAD capital expenditures (35,956) (39,646) (106,193) (113,471) Lease restructure payments 294 305 1,195 1,470 CCRC entrance fees(2) 4,677 6,949 17,880 21,385 Deferred income taxes(3) (5,993) (4,967) (18,744) (15,490) Other FAD adjustments(4) (1,219) (6,373) (9,162) (12,722) FAD applicable to common shares, basic and diluted $ 168,001 $ 182,603 $ 746,397 $ 803,720 Weighted average shares outstanding - diluted FAD 473,289 469,388 470,719 468,935 (1) Excludes amounts related to the acceleration of deferred compensation for restricted stock units that vested upon the departure of certain former employees, which have already been excluded from FFO as adjusted in severance and related charges. (2) Represents our 49% share of non-refundable entrance fees, as the fees are collected by our CCRC JV, net of reserves and CCRC JV entrance fee amortization. (3) For the three months ended December 31, 2017, excludes deferred tax expense, which is included in tax rate legislation impact. For the year ended December 31, 2017, excludes: (i) deferred tax expense, which is included in tax rate legislation impact and (ii) deferred tax benefit from casualty-related charges, which is included in casualty- related charges (recoveries), net. (4) Primarily includes our share of FAD capital expenditures from unconsolidated joint ventures, partially offset by noncontrolling interests' share of FAD capital expenditures from consolidated joint ventures. 13

Portfolio Summary As of and for the quarter ended December 31, 2018, dollars in thousands Property Average Portfolio Portfolio Private (1) Count Age Investment Income Pay % PORTFOLIO INCOME Wholly Owned Property Portfolio Senior housing triple-net 146 21 $ 2,997,663 $ 65,111 92.7 Unconsolidated JVs(2) SHOP 83 22 2,228,265 26,522 98.5 7% Life science 105 21 3,753,815 70,671 100.0 SHOP 9% Medical office 263 22 4,636,805 82,960 100.0 Hospitals 7% Other 15 29 550,211 20,031 87.6 612 22 $ 14,166,759 $ 265,295 97.1 Developments Senior Life science 13 N/A $ 488,547 $ — — housing triple-net Medical office 1 N/A 2,882 — — 23% 14 N/A $ 491,430 $ — — $288.1M Medical Redevelopments(3) office 29% SHOP 10 N/A $ 86,976 $ — — Life science 6 N/A 233,336 — — Medical office 3 N/A 11,031 — — 19 N/A $ 331,342 (3) $ — — Debt Investments Other — N/A $ 82,200 $ 1,358 — Life science 25% Total Senior housing triple-net 146 21 $ 2,997,663 $ 65,111 92.7 SHOP 93 22 2,315,240 26,522 98.5 Life science 124 21 4,475,699 70,671 100.0 Medical office 267 22 4,650,718 82,960 100.0 Other 15 29 632,411 21,389 87.6 645 22 $ 15,071,731 $ 266,653 97.1 HCP's Share of Unconsolidated JVs(4) Other(5) 99 25 $ 1,157,191 $ 21,466 73.1 Total Portfolio 744 22 $ 16,228,922 $ 288,119 95.3 (1) Self-pay and private insurance (including managed care) revenues as a percentage of total property revenues for the most recent trailing 12 months available, weighted based on current quarter Portfolio Income including assets sold in the quarter. Revenues for medical office buildings are considered 100% private pay. (2) Includes 4.9% related to 15 assets in our unconsolidated CCRC JV and 1.6% related to 68 assets contributed to our U.K. JV. (3) Includes Construction in Process ("CIP") and buildings or portions of buildings placed in Redevelopment. Portfolio Income for Redevelopments is reflected in the Wholly Owned Property Portfolio section above. (4) HCP’s pro rata share information is prepared on a basis consistent with the comparable consolidated amounts by applying our actual ownership percentage for the period, and is intended to reflect our proportionate economic interest in the financial position and operating results of properties in our portfolio. (5) Our 99 properties in unconsolidated JVs are reported in the Other non-reportable segment. See the Other Unconsolidated JV page in this report for further details. 14

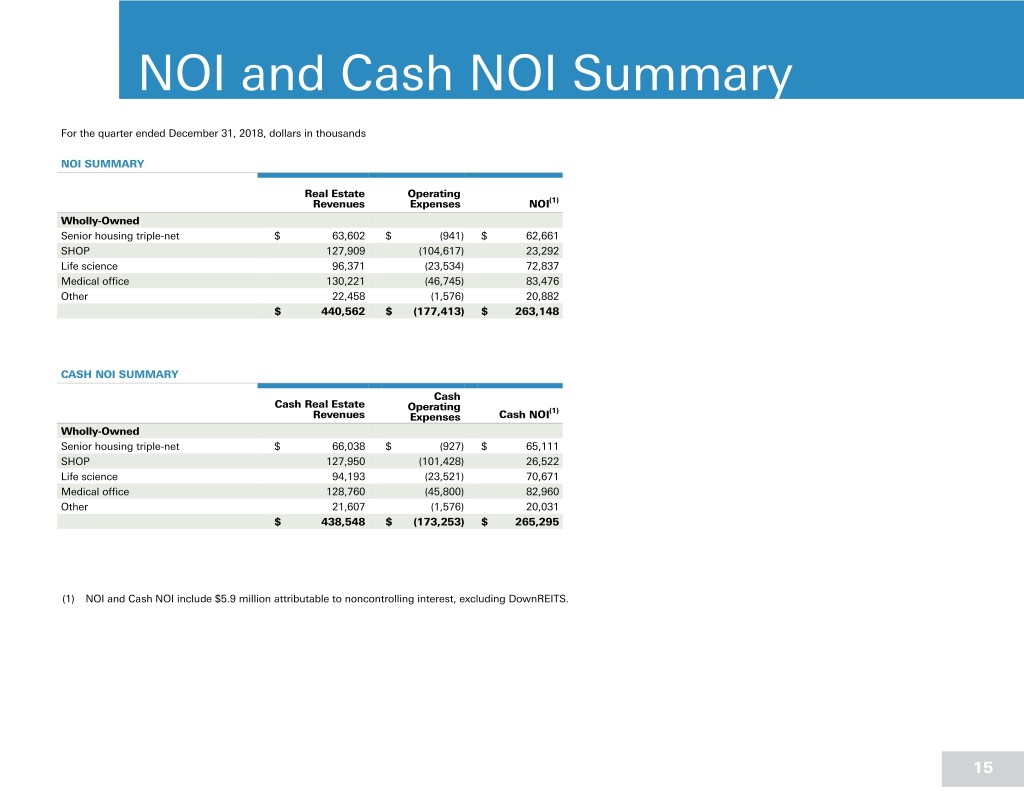

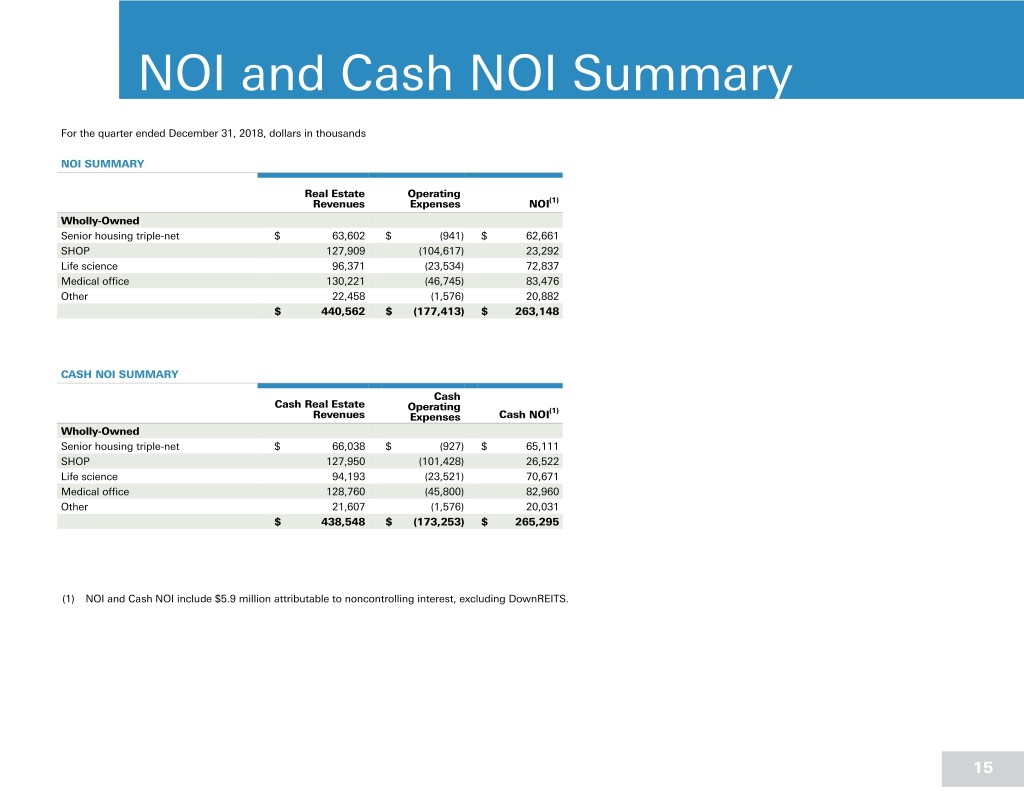

NOI and Cash NOI Summary For the quarter ended December 31, 2018, dollars in thousands NOI SUMMARY Real Estate Operating Revenues Expenses NOI(1) Wholly-Owned Senior housing triple-net $ 63,602 $ (941) $ 62,661 SHOP 127,909 (104,617) 23,292 Life science 96,371 (23,534) 72,837 Medical office 130,221 (46,745) 83,476 Other 22,458 (1,576) 20,882 $ 440,562 $ (177,413) $ 263,148 CASH NOI SUMMARY Cash Cash Real Estate Operating (1) Revenues Expenses Cash NOI Wholly-Owned Senior housing triple-net $ 66,038 $ (927) $ 65,111 SHOP 127,950 (101,428) 26,522 Life science 94,193 (23,521) 70,671 Medical office 128,760 (45,800) 82,960 Other 21,607 (1,576) 20,031 $ 438,548 $ (173,253) $ 265,295 (1) NOI and Cash NOI include $5.9 million attributable to noncontrolling interest, excluding DownREITS. 15

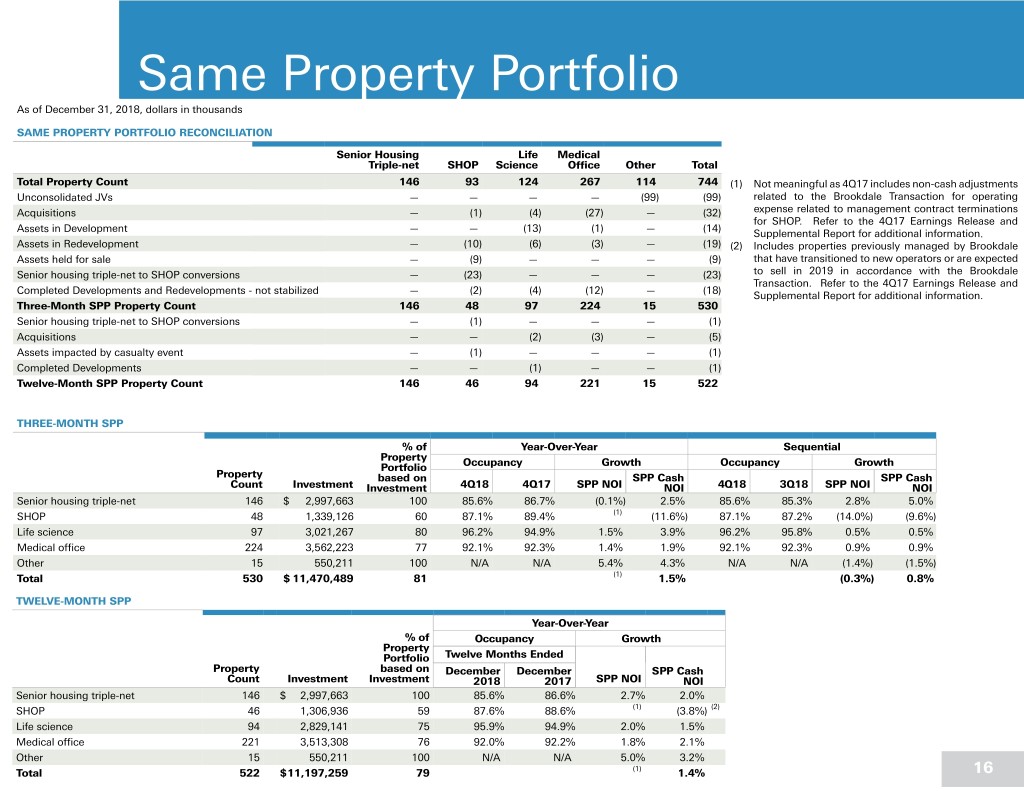

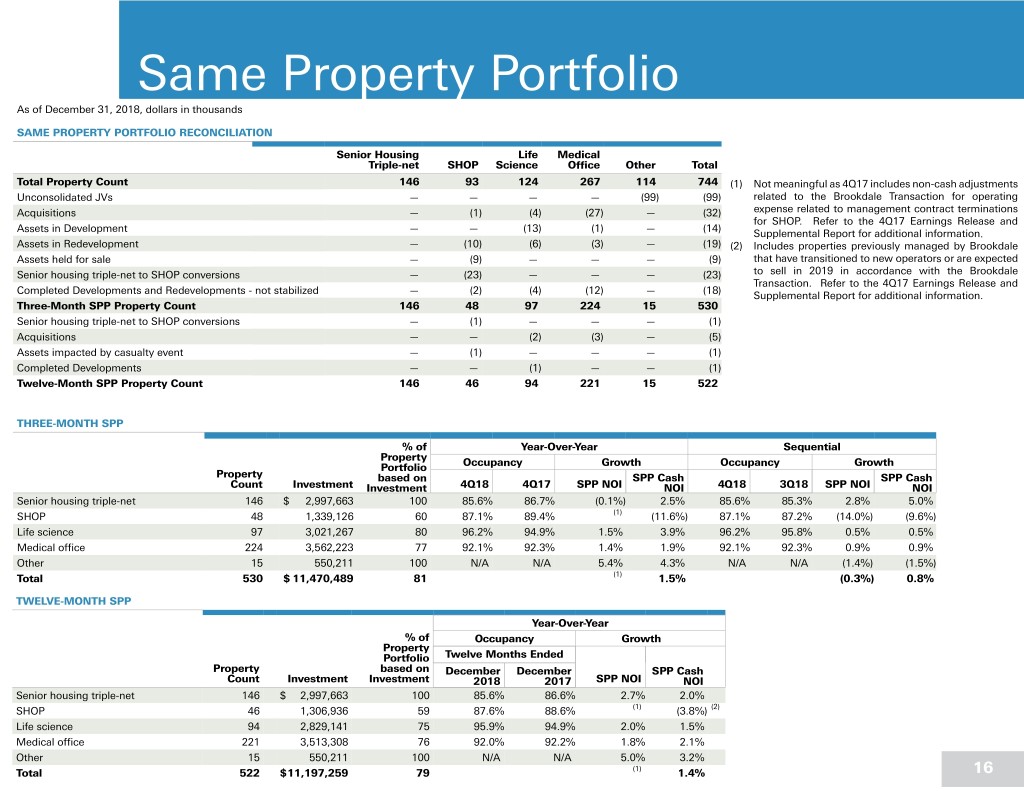

Same Property Portfolio As of December 31, 2018, dollars in thousands SAME PROPERTY PORTFOLIO RECONCILIATION Senior Housing Life Medical Triple-net SHOP Science Office Other Total Total Property Count 146 93 124 267 114 744 (1) Not meaningful as 4Q17 includes non-cash adjustments Unconsolidated JVs — — — — (99) (99) related to the Brookdale Transaction for operating Acquisitions — (1) (4) (27) — (32) expense related to management contract terminations for SHOP. Refer to the 4Q17 Earnings Release and Assets in Development — — (13) (1) — (14) Supplemental Report for additional information. Assets in Redevelopment — (10) (6) (3) — (19) (2) Includes properties previously managed by Brookdale Assets held for sale — (9) — — — (9) that have transitioned to new operators or are expected Senior housing triple-net to SHOP conversions — (23) — — — (23) to sell in 2019 in accordance with the Brookdale Transaction. Refer to the 4Q17 Earnings Release and Completed Developments and Redevelopments - not stabilized — (2) (4) (12) — (18) Supplemental Report for additional information. Three-Month SPP Property Count 146 48 97 224 15 530 Senior housing triple-net to SHOP conversions — (1) — — — (1) Acquisitions — — (2) (3) — (5) Assets impacted by casualty event — (1) — — — (1) Completed Developments — — (1) — — (1) Twelve-Month SPP Property Count 146 46 94 221 15 522 THREE-MONTH SPP % of Year-Over-Year Sequential Property Portfolio Occupancy Growth Occupancy Growth Property based on SPP Cash SPP Cash Count Investment Investment 4Q18 4Q17 SPP NOI NOI 4Q18 3Q18 SPP NOI NOI Senior housing triple-net 146 $ 2,997,663 100 85.6% 86.7% (0.1%) 2.5% 85.6% 85.3% 2.8% 5.0% SHOP 48 1,339,126 60 87.1% 89.4% (1) (11.6%) 87.1% 87.2% (14.0%) (9.6%) Life science 97 3,021,267 80 96.2% 94.9% 1.5% 3.9% 96.2% 95.8% 0.5% 0.5% Medical office 224 3,562,223 77 92.1% 92.3% 1.4% 1.9% 92.1% 92.3% 0.9% 0.9% Other 15 550,211 100 N/A N/A 5.4% 4.3% N/A N/A (1.4%) (1.5%) Total 530 $ 11,470,489 81 (1) 1.5% (0.3%) 0.8% TWELVE-MONTH SPP Year-Over-Year % of Occupancy Growth Property Portfolio Twelve Months Ended Property based on December December SPP Cash Count Investment Investment 2018 2017 SPP NOI NOI Senior housing triple-net 146 $ 2,997,663 100 85.6% 86.6% 2.7% 2.0% SHOP 46 1,306,936 59 87.6% 88.6% (1) (3.8%) (2) Life science 94 2,829,141 75 95.9% 94.9% 2.0% 1.5% Medical office 221 3,513,308 76 92.0% 92.2% 1.8% 2.1% Other 15 550,211 100 N/A N/A 5.0% 3.2% Total 522 $11,197,259 79 (1) 1.4% 16

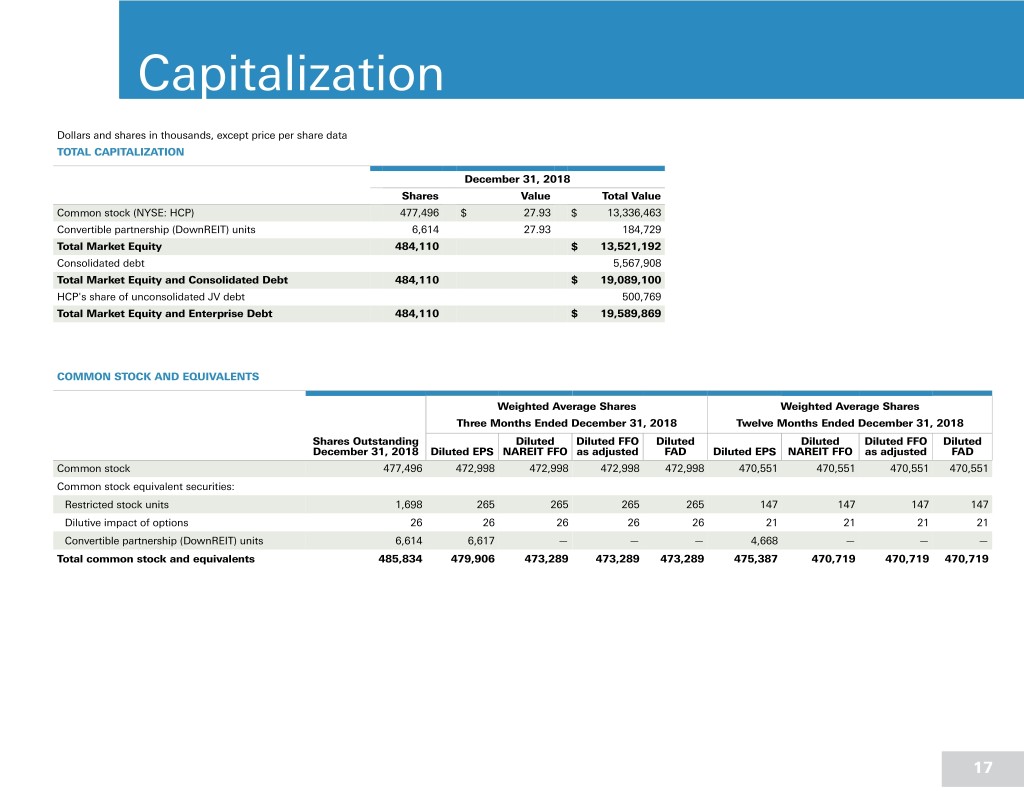

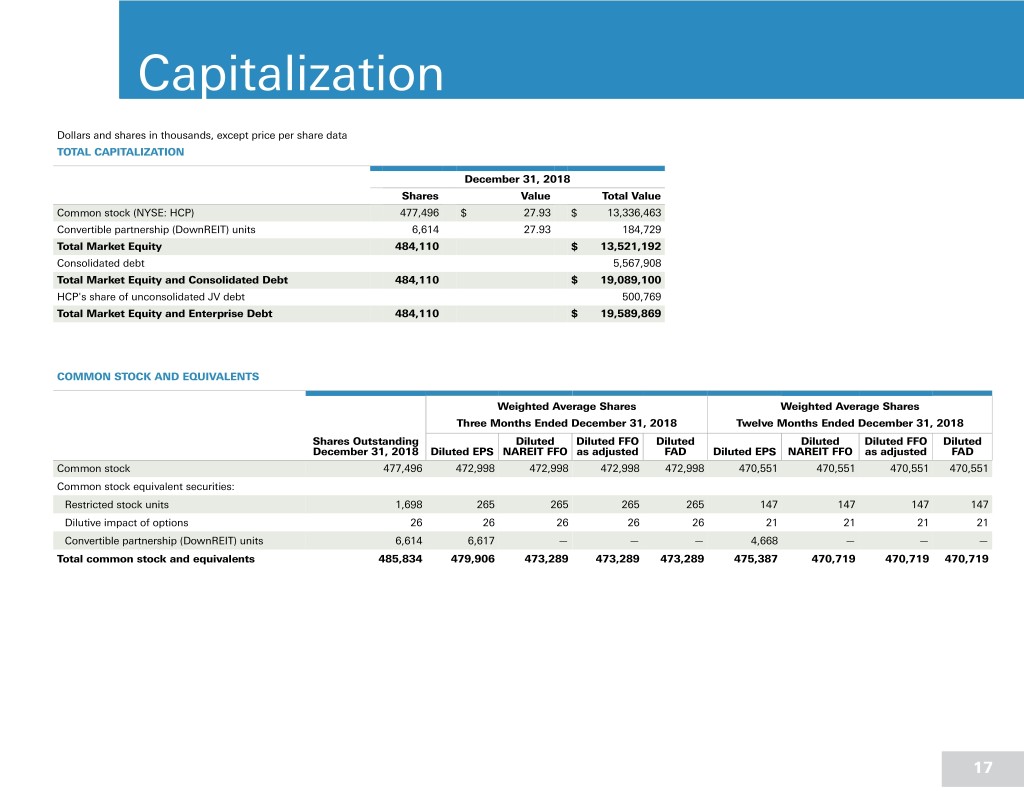

Capitalization Dollars and shares in thousands, except price per share data TOTAL CAPITALIZATION December 31, 2018 Shares Value Total Value Common stock (NYSE: HCP) 477,496 $ 27.93 $ 13,336,463 Convertible partnership (DownREIT) units 6,614 27.93 184,729 Total Market Equity 484,110 $ 13,521,192 Consolidated debt 5,567,908 Total Market Equity and Consolidated Debt 484,110 $ 19,089,100 HCP's share of unconsolidated JV debt 500,769 Total Market Equity and Enterprise Debt 484,110 $ 19,589,869 COMMON STOCK AND EQUIVALENTS Weighted Average Shares Weighted Average Shares Three Months Ended December 31, 2018 Twelve Months Ended December 31, 2018 Shares Outstanding Diluted Diluted FFO Diluted Diluted Diluted FFO Diluted December 31, 2018 Diluted EPS NAREIT FFO as adjusted FAD Diluted EPS NAREIT FFO as adjusted FAD Common stock 477,496 472,998 472,998 472,998 472,998 470,551 470,551 470,551 470,551 Common stock equivalent securities: Restricted stock units 1,698 265 265 265 265 147 147 147 147 Dilutive impact of options 26 26 26 26 26 21 21 21 21 Convertible partnership (DownREIT) units 6,614 6,617 — — — 4,668 — — — Total common stock and equivalents 485,834 479,906 473,289 473,289 473,289 475,387 470,719 470,719 470,719 17

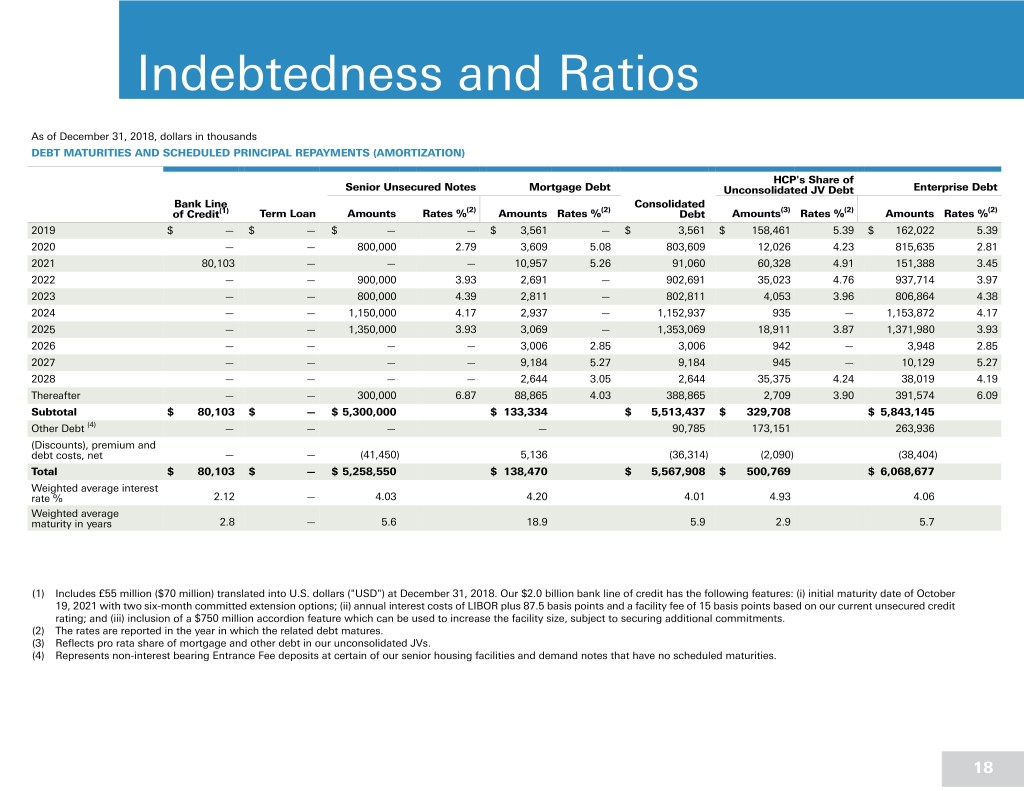

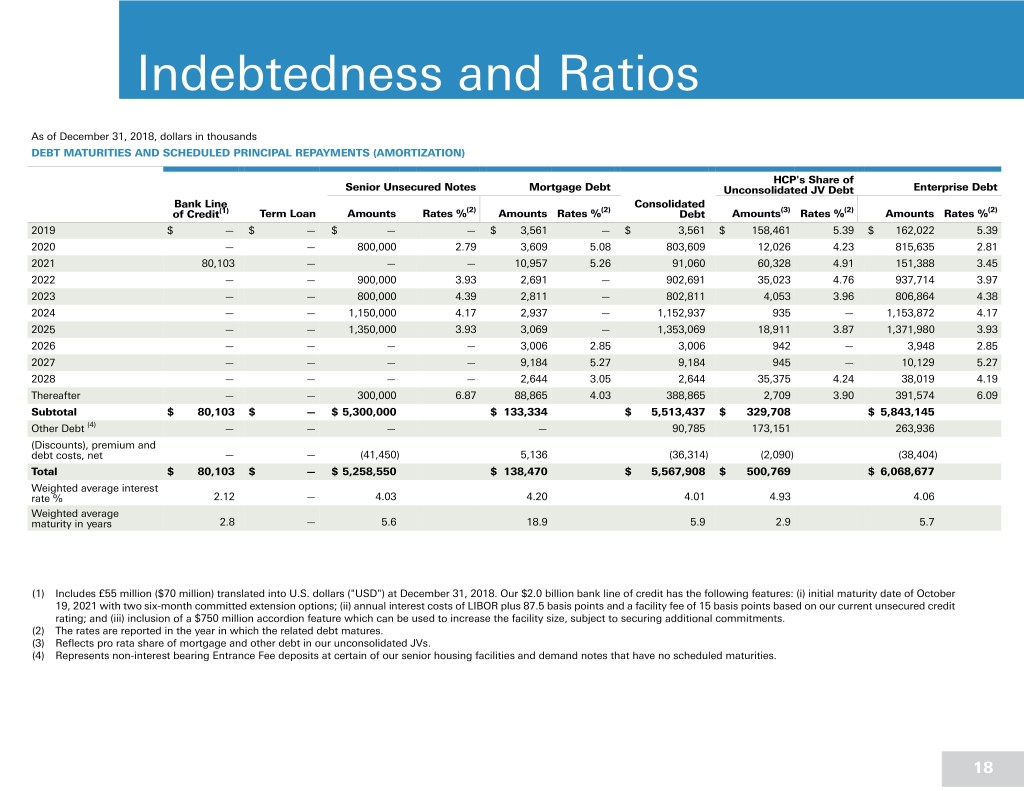

Indebtedness and Ratios As of December 31, 2018, dollars in thousands DEBT MATURITIES AND SCHEDULED PRINCIPAL REPAYMENTS (AMORTIZATION) HCP's Share of Senior Unsecured Notes Mortgage Debt Unconsolidated JV Debt Enterprise Debt Bank Line Consolidated of Credit(1) Term Loan Amounts Rates %(2) Amounts Rates %(2) Debt Amounts(3) Rates %(2) Amounts Rates %(2) 2019 $ — $ — $ — — $ 3,561 — $ 3,561 $ 158,461 5.39 $ 162,022 5.39 2020 — — 800,000 2.79 3,609 5.08 803,609 12,026 4.23 815,635 2.81 2021 80,103 — — — 10,957 5.26 91,060 60,328 4.91 151,388 3.45 2022 — — 900,000 3.93 2,691 — 902,691 35,023 4.76 937,714 3.97 2023 — — 800,000 4.39 2,811 — 802,811 4,053 3.96 806,864 4.38 2024 — — 1,150,000 4.17 2,937 — 1,152,937 935 — 1,153,872 4.17 2025 — — 1,350,000 3.93 3,069 — 1,353,069 18,911 3.87 1,371,980 3.93 2026 — — — — 3,006 2.85 3,006 942 — 3,948 2.85 2027 — — — — 9,184 5.27 9,184 945 — 10,129 5.27 2028 — — — — 2,644 3.05 2,644 35,375 4.24 38,019 4.19 Thereafter — — 300,000 6.87 88,865 4.03 388,865 2,709 3.90 391,574 6.09 Subtotal $ 80,103 $ — $ 5,300,000 $ 133,334 $ 5,513,437 $ 329,708 $ 5,843,145 Other Debt (4) — — — — 90,785 173,151 263,936 (Discounts), premium and debt costs, net — — (41,450) 5,136 (36,314) (2,090) (38,404) Total $ 80,103 $ — $ 5,258,550 $ 138,470 $ 5,567,908 $ 500,769 $ 6,068,677 Weighted average interest rate % 2.12 — 4.03 4.20 4.01 4.93 4.06 Weighted average maturity in years 2.8 — 5.6 18.9 5.9 2.9 5.7 (1) Includes £55 million ($70 million) translated into U.S. dollars ("USD") at December 31, 2018. Our $2.0 billion bank line of credit has the following features: (i) initial maturity date of October 19, 2021 with two six-month committed extension options; (ii) annual interest costs of LIBOR plus 87.5 basis points and a facility fee of 15 basis points based on our current unsecured credit rating; and (iii) inclusion of a $750 million accordion feature which can be used to increase the facility size, subject to securing additional commitments. (2) The rates are reported in the year in which the related debt matures. (3) Reflects pro rata share of mortgage and other debt in our unconsolidated JVs. (4) Represents non-interest bearing Entrance Fee deposits at certain of our senior housing facilities and demand notes that have no scheduled maturities. 18

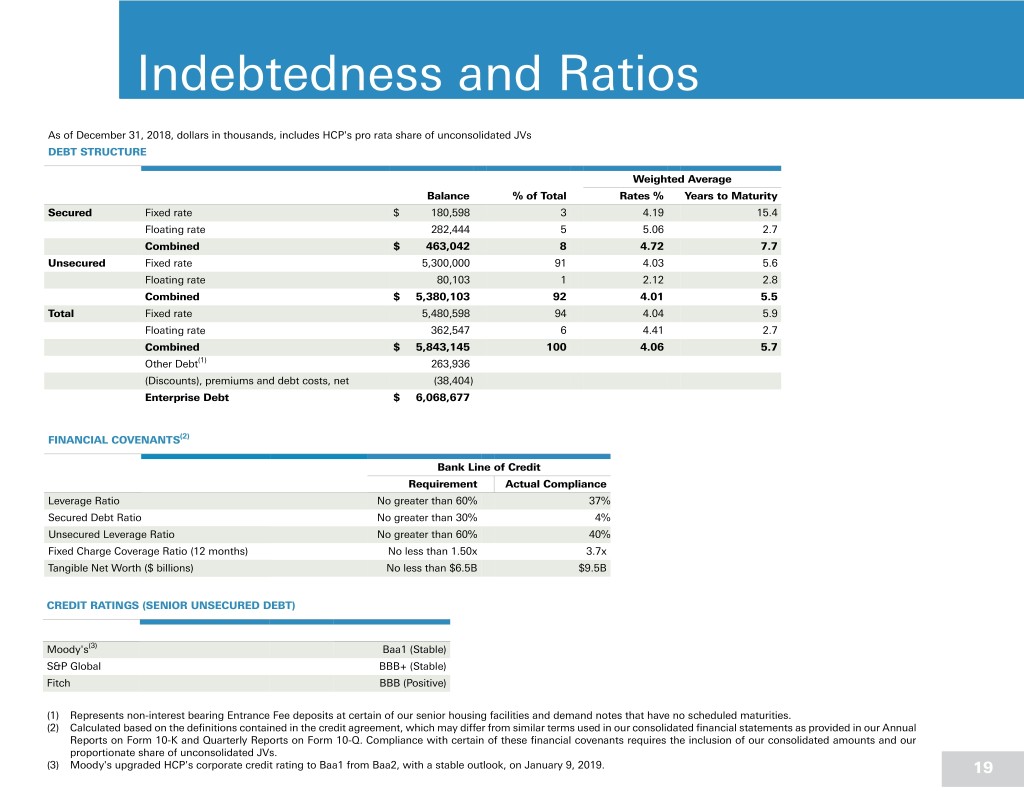

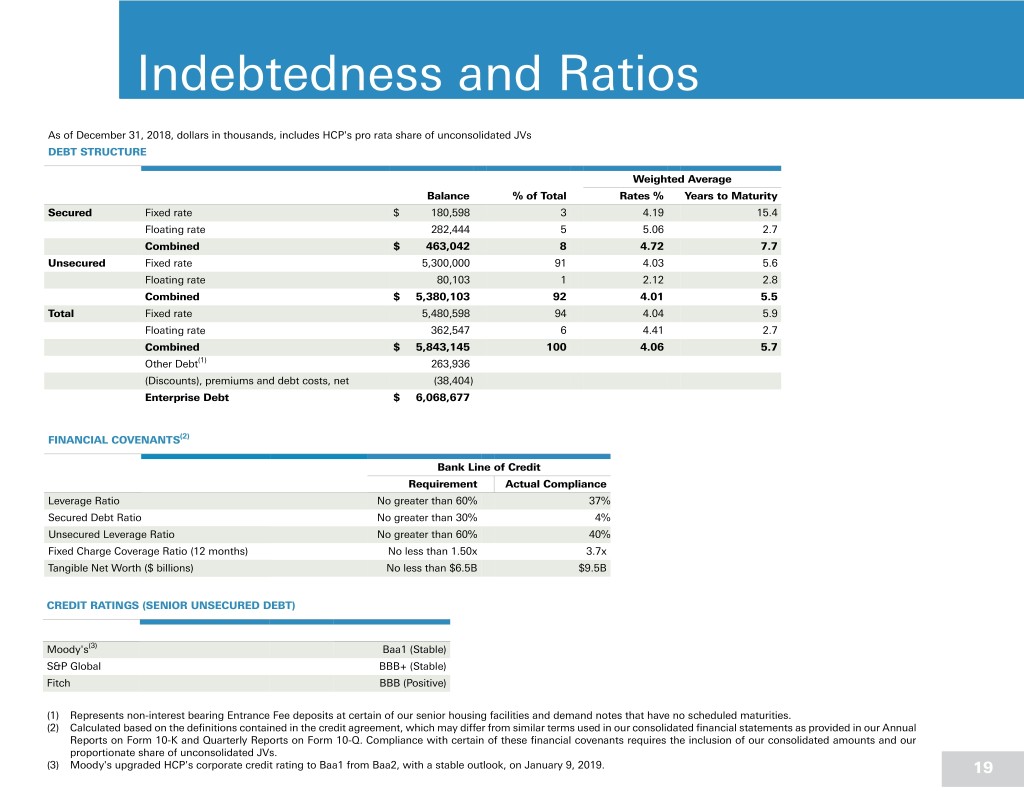

Indebtedness and Ratios As of December 31, 2018, dollars in thousands, includes HCP's pro rata share of unconsolidated JVs DEBT STRUCTURE Weighted Average Balance % of Total Rates % Years to Maturity Secured Fixed rate $ 180,598 3 4.19 15.4 Floating rate 282,444 5 5.06 2.7 Combined $ 463,042 8 4.72 7.7 Unsecured Fixed rate 5,300,000 91 4.03 5.6 Floating rate 80,103 1 2.12 2.8 Combined $ 5,380,103 92 4.01 5.5 Total Fixed rate 5,480,598 94 4.04 5.9 Floating rate 362,547 6 4.41 2.7 Combined $ 5,843,145 100 4.06 5.7 Other Debt(1) 263,936 (Discounts), premiums and debt costs, net (38,404) Enterprise Debt $ 6,068,677 FINANCIAL COVENANTS(2) Bank Line of Credit Requirement Actual Compliance Leverage Ratio No greater than 60% 37% Secured Debt Ratio No greater than 30% 4% Unsecured Leverage Ratio No greater than 60% 40% Fixed Charge Coverage Ratio (12 months) No less than 1.50x 3.7x Tangible Net Worth ($ billions) No less than $6.5B $9.5B CREDIT RATINGS (SENIOR UNSECURED DEBT) Moody's(3) Baa1 (Stable) S&P Global BBB+ (Stable) Fitch BBB (Positive) (1) Represents non-interest bearing Entrance Fee deposits at certain of our senior housing facilities and demand notes that have no scheduled maturities. (2) Calculated based on the definitions contained in the credit agreement, which may differ from similar terms used in our consolidated financial statements as provided in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q. Compliance with certain of these financial covenants requires the inclusion of our consolidated amounts and our proportionate share of unconsolidated JVs. (3) Moody's upgraded HCP's corporate credit rating to Baa1 from Baa2, with a stable outlook, on January 9, 2019. 19

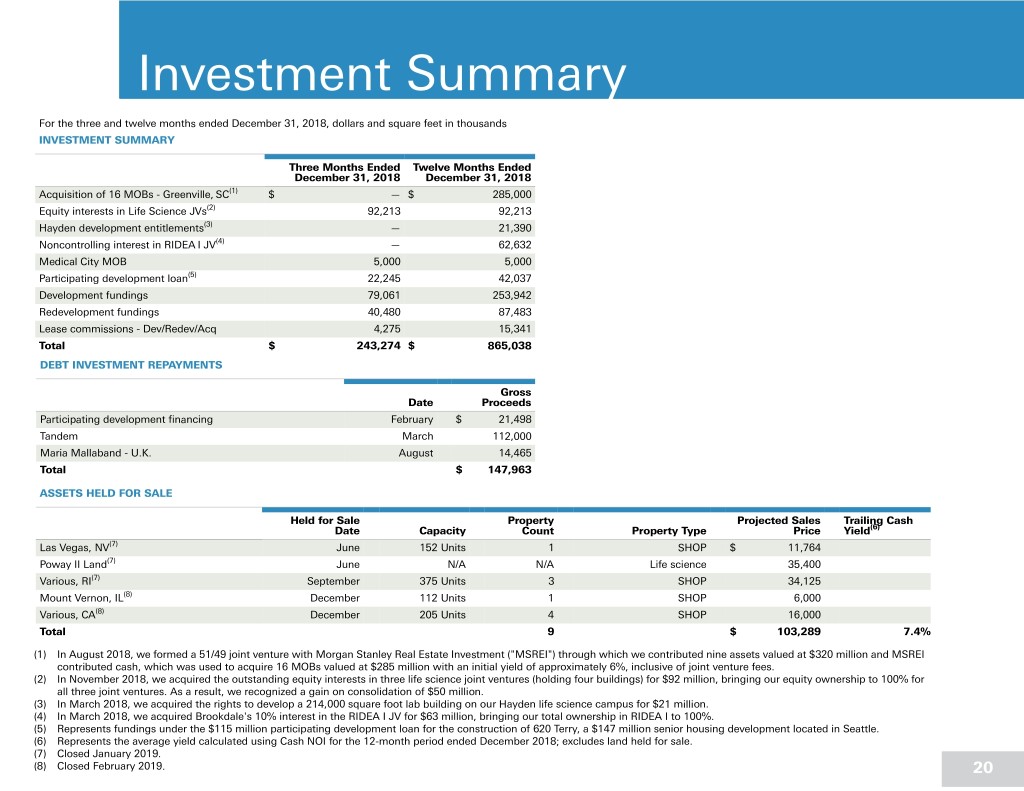

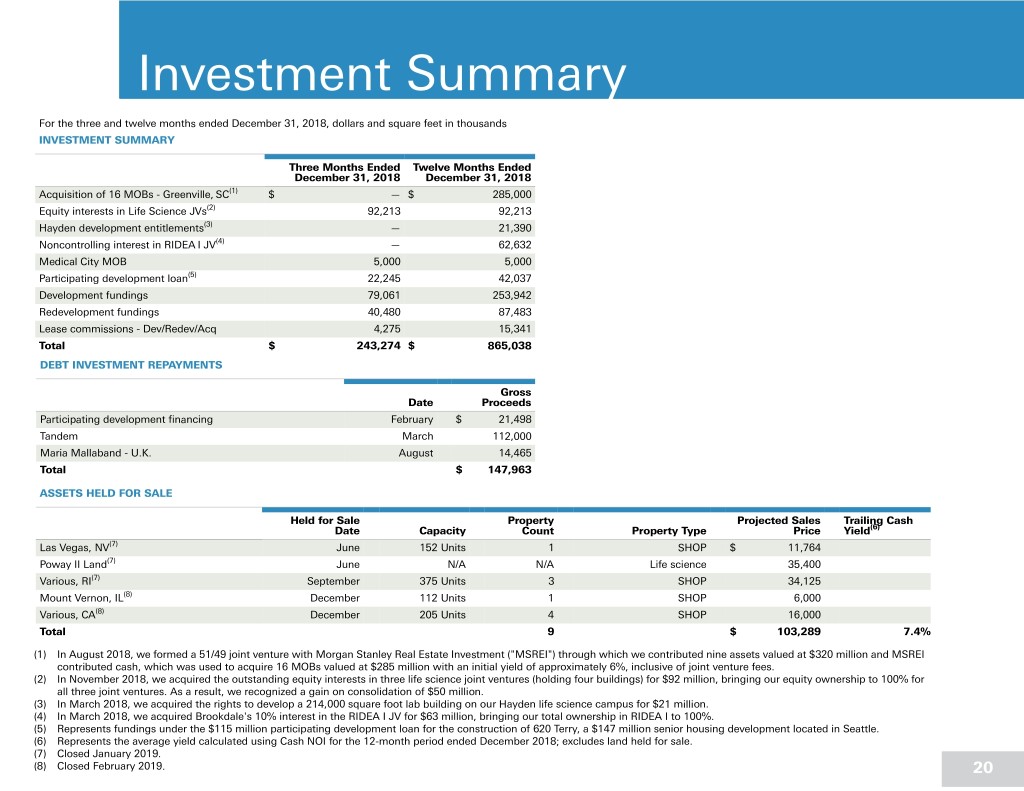

Investment Summary For the three and twelve months ended December 31, 2018, dollars and square feet in thousands INVESTMENT SUMMARY Three Months Ended Twelve Months Ended December 31, 2018 December 31, 2018 Acquisition of 16 MOBs - Greenville, SC(1) $ — $ 285,000 Equity interests in Life Science JVs(2) 92,213 92,213 Hayden development entitlements(3) — 21,390 Noncontrolling interest in RIDEA I JV(4) — 62,632 Medical City MOB 5,000 5,000 Participating development loan(5) 22,245 42,037 Development fundings 79,061 253,942 Redevelopment fundings 40,480 87,483 Lease commissions - Dev/Redev/Acq 4,275 15,341 Total $ 243,274 $ 865,038 DEBT INVESTMENT REPAYMENTS Gross Date Proceeds Participating development financing February $ 21,498 Tandem March 112,000 Maria Mallaband - U.K. August 14,465 Total $ 147,963 ASSETS HELD FOR SALE Held for Sale Property Projected Sales Trailing Cash Date Capacity Count Property Type Price Yield(6) Las Vegas, NV(7) June 152 Units 1 SHOP $ 11,764 Poway II Land(7) June N/A N/A Life science 35,400 Various, RI(7) September 375 Units 3 SHOP 34,125 Mount Vernon, IL(8) December 112 Units 1 SHOP 6,000 Various, CA(8) December 205 Units 4 SHOP 16,000 Total 9 $ 103,289 7.4% (1) In August 2018, we formed a 51/49 joint venture with Morgan Stanley Real Estate Investment ("MSREI") through which we contributed nine assets valued at $320 million and MSREI contributed cash, which was used to acquire 16 MOBs valued at $285 million with an initial yield of approximately 6%, inclusive of joint venture fees. (2) In November 2018, we acquired the outstanding equity interests in three life science joint ventures (holding four buildings) for $92 million, bringing our equity ownership to 100% for all three joint ventures. As a result, we recognized a gain on consolidation of $50 million. (3) In March 2018, we acquired the rights to develop a 214,000 square foot lab building on our Hayden life science campus for $21 million. (4) In March 2018, we acquired Brookdale's 10% interest in the RIDEA I JV for $63 million, bringing our total ownership in RIDEA I to 100%. (5) Represents fundings under the $115 million participating development loan for the construction of 620 Terry, a $147 million senior housing development located in Seattle. (6) Represents the average yield calculated using Cash NOI for the 12-month period ended December 2018; excludes land held for sale. (7) Closed January 2019. (8) Closed February 2019. 20

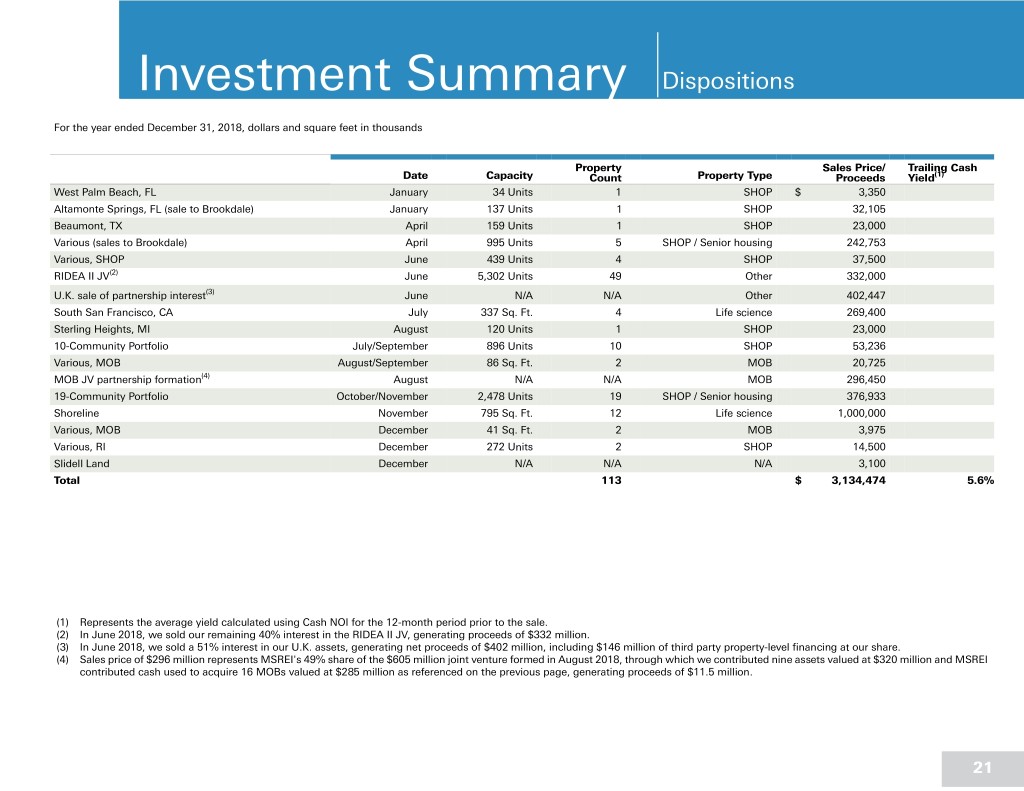

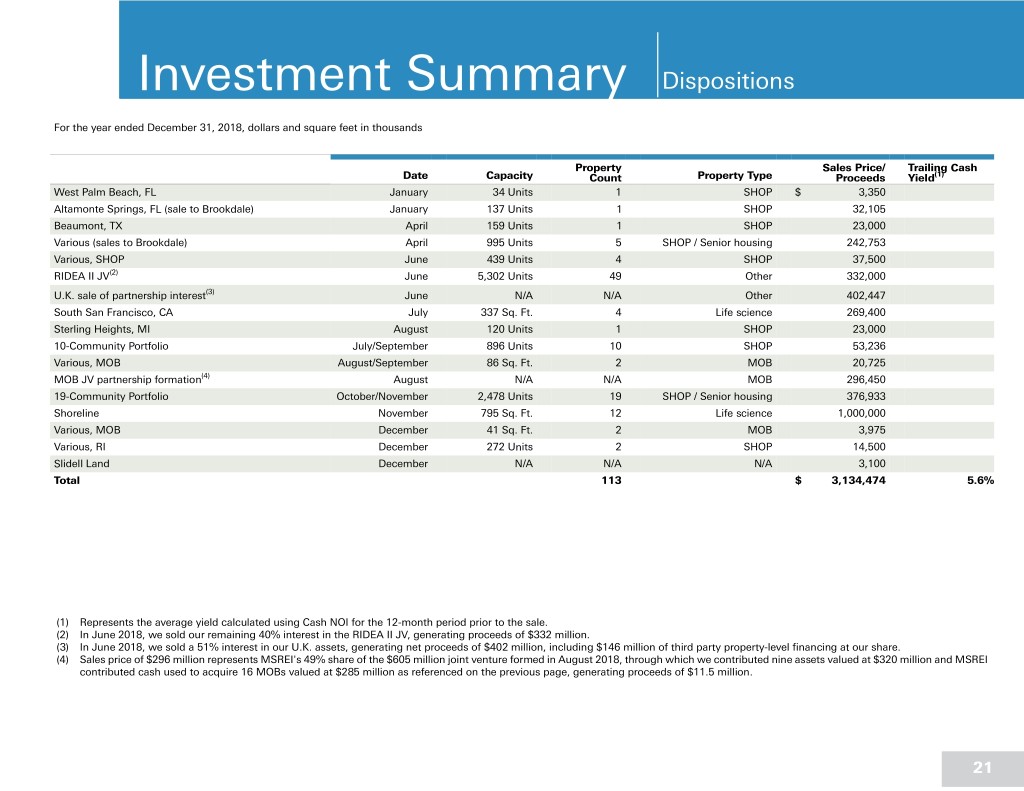

Investment Summary Dispositions For the year ended December 31, 2018, dollars and square feet in thousands Property Sales Price/ Trailing Cash Date Capacity Count Property Type Proceeds Yield(1) West Palm Beach, FL January 34 Units 1 SHOP $ 3,350 Altamonte Springs, FL (sale to Brookdale) January 137 Units 1 SHOP 32,105 Beaumont, TX April 159 Units 1 SHOP 23,000 Various (sales to Brookdale) April 995 Units 5 SHOP / Senior housing 242,753 Various, SHOP June 439 Units 4 SHOP 37,500 RIDEA II JV(2) June 5,302 Units 49 Other 332,000 U.K. sale of partnership interest(3) June N/A N/A Other 402,447 South San Francisco, CA July 337 Sq. Ft. 4 Life science 269,400 Sterling Heights, MI August 120 Units 1 SHOP 23,000 10-Community Portfolio July/September 896 Units 10 SHOP 53,236 Various, MOB August/September 86 Sq. Ft. 2 MOB 20,725 MOB JV partnership formation(4) August N/A N/A MOB 296,450 19-Community Portfolio October/November 2,478 Units 19 SHOP / Senior housing 376,933 Shoreline November 795 Sq. Ft. 12 Life science 1,000,000 Various, MOB December 41 Sq. Ft. 2 MOB 3,975 Various, RI December 272 Units 2 SHOP 14,500 Slidell Land December N/A N/A N/A 3,100 Total 113 $ 3,134,474 5.6% (1) Represents the average yield calculated using Cash NOI for the 12-month period prior to the sale. (2) In June 2018, we sold our remaining 40% interest in the RIDEA II JV, generating proceeds of $332 million. (3) In June 2018, we sold a 51% interest in our U.K. assets, generating net proceeds of $402 million, including $146 million of third party property-level financing at our share. (4) Sales price of $296 million represents MSREI's 49% share of the $605 million joint venture formed in August 2018, through which we contributed nine assets valued at $320 million and MSREI contributed cash used to acquire 16 MOBs valued at $285 million as referenced on the previous page, generating proceeds of $11.5 million. 21

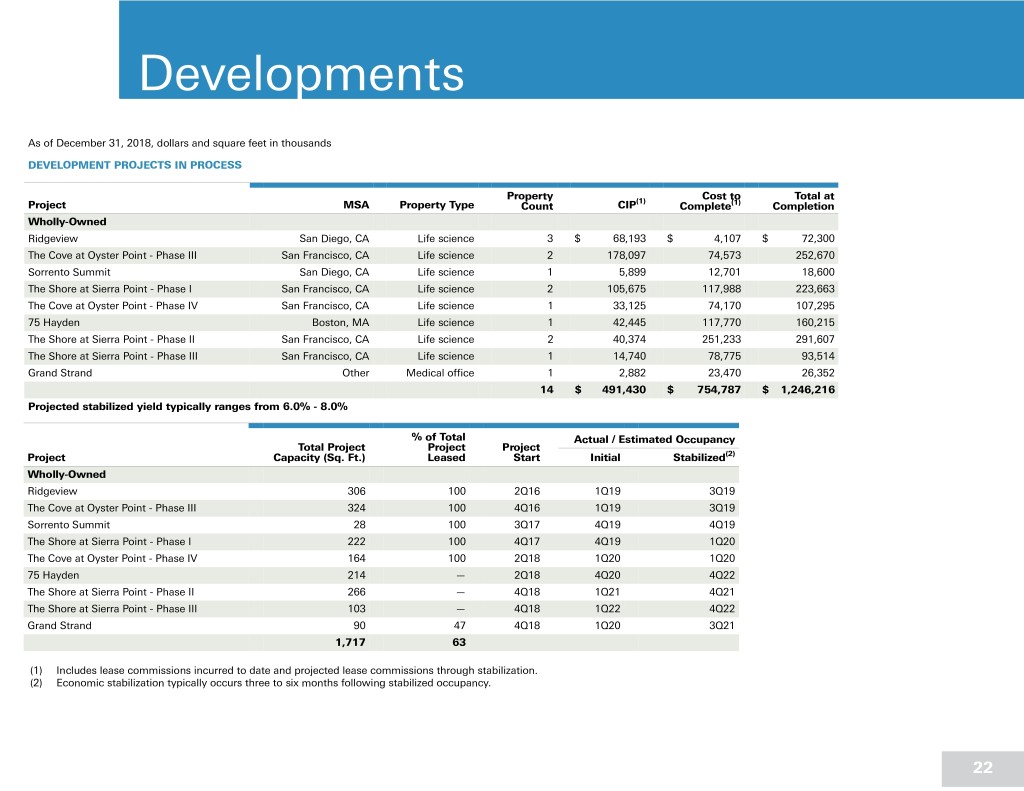

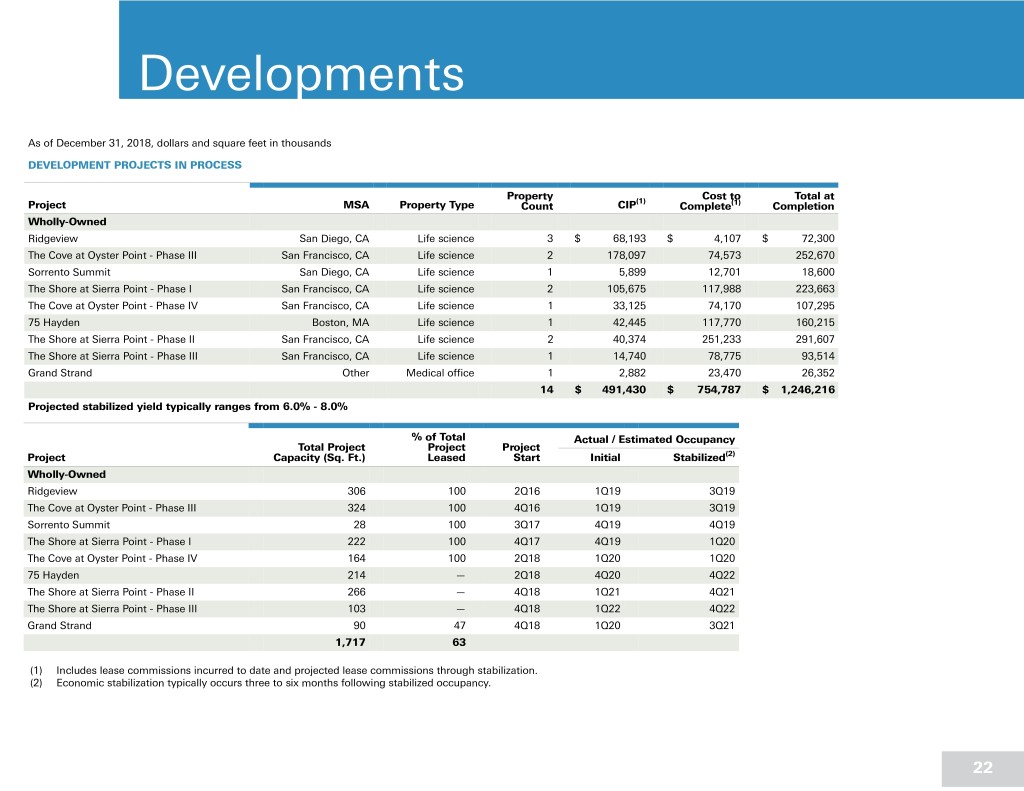

Developments As of December 31, 2018, dollars and square feet in thousands DEVELOPMENT PROJECTS IN PROCESS Property (1) Cost to Total at Project MSA Property Type Count CIP Complete(1) Completion Wholly-Owned Ridgeview San Diego, CA Life science 3 $ 68,193 $ 4,107 $ 72,300 The Cove at Oyster Point - Phase III San Francisco, CA Life science 2 178,097 74,573 252,670 Sorrento Summit San Diego, CA Life science 1 5,899 12,701 18,600 The Shore at Sierra Point - Phase I San Francisco, CA Life science 2 105,675 117,988 223,663 The Cove at Oyster Point - Phase IV San Francisco, CA Life science 1 33,125 74,170 107,295 75 Hayden Boston, MA Life science 1 42,445 117,770 160,215 The Shore at Sierra Point - Phase II San Francisco, CA Life science 2 40,374 251,233 291,607 The Shore at Sierra Point - Phase III San Francisco, CA Life science 1 14,740 78,775 93,514 Grand Strand Other Medical office 1 2,882 23,470 26,352 14 $ 491,430 $ 754,787 $ 1,246,216 Projected stabilized yield typically ranges from 6.0% - 8.0% % of Total Actual / Estimated Occupancy Total Project Project Project Project Capacity (Sq. Ft.) Leased Start Initial Stabilized(2) Wholly-Owned Ridgeview 306 100 2Q16 1Q19 3Q19 The Cove at Oyster Point - Phase III 324 100 4Q16 1Q19 3Q19 Sorrento Summit 28 100 3Q17 4Q19 4Q19 The Shore at Sierra Point - Phase I 222 100 4Q17 4Q19 1Q20 The Cove at Oyster Point - Phase IV 164 100 2Q18 1Q20 1Q20 75 Hayden 214 — 2Q18 4Q20 4Q22 The Shore at Sierra Point - Phase II 266 — 4Q18 1Q21 4Q21 The Shore at Sierra Point - Phase III 103 — 4Q18 1Q22 4Q22 Grand Strand 90 47 4Q18 1Q20 3Q21 1,717 63 (1) Includes lease commissions incurred to date and projected lease commissions through stabilization. (2) Economic stabilization typically occurs three to six months following stabilized occupancy. 22

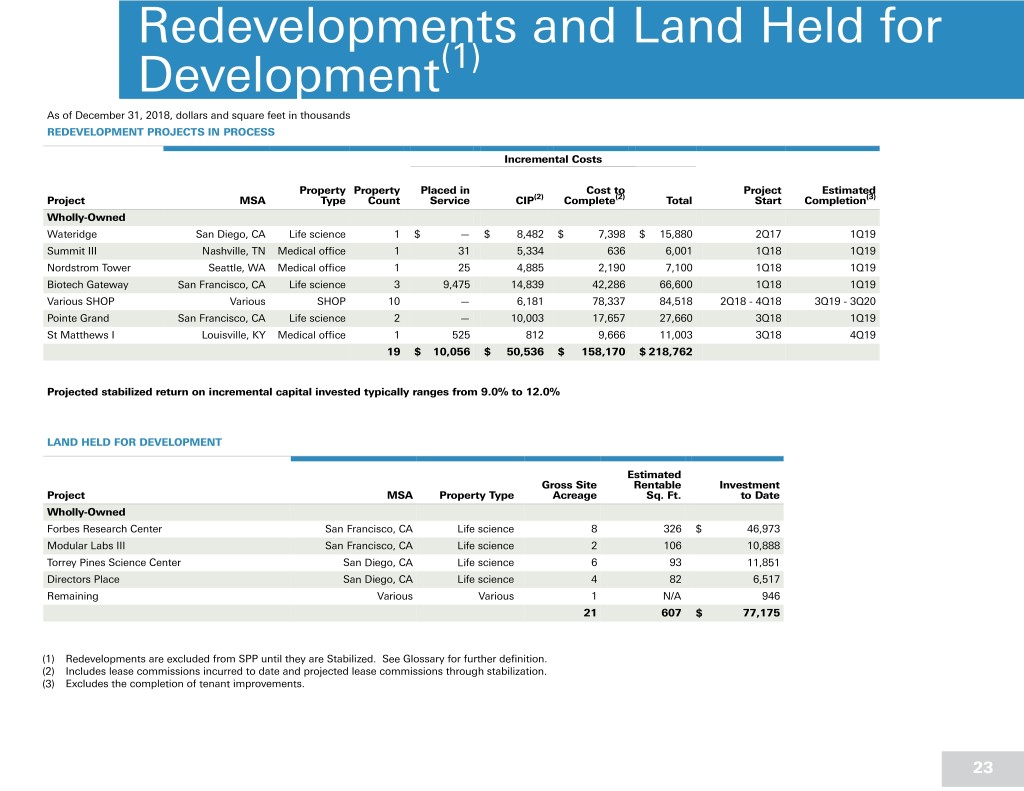

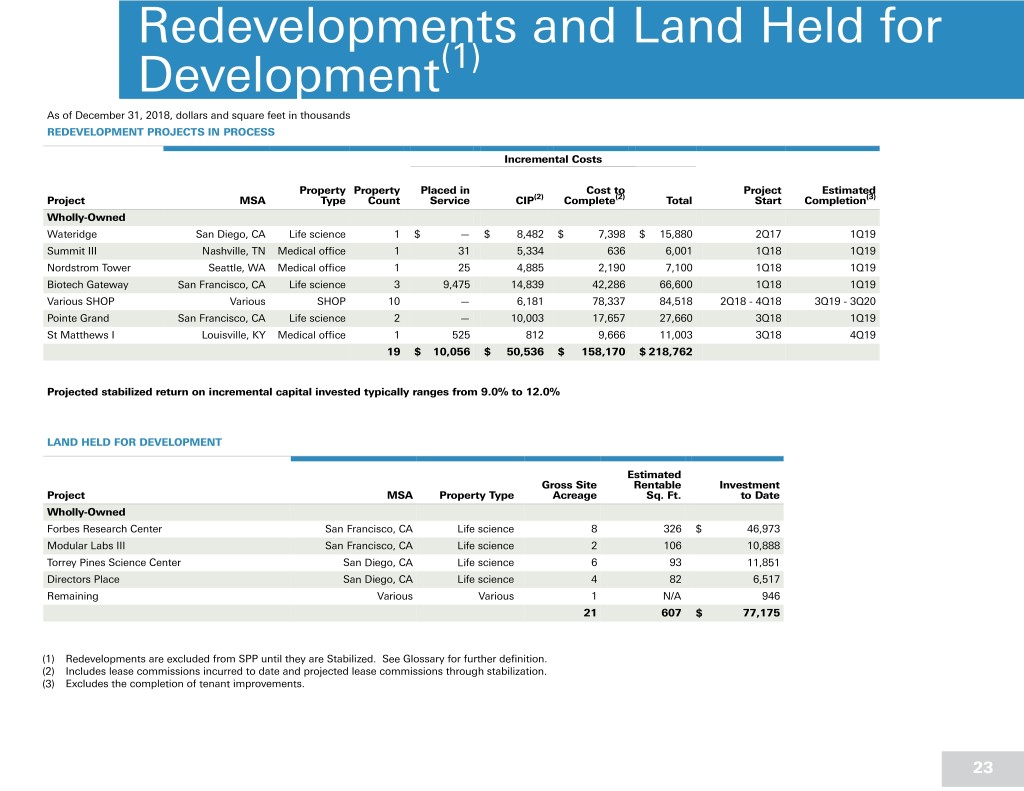

Redevelopments and Land Held for Development(1) As of December 31, 2018, dollars and square feet in thousands REDEVELOPMENT PROJECTS IN PROCESS Incremental Costs Property Property Placed in Cost to Project Estimated Project MSA Type Count Service CIP(2) Complete(2) Total Start Completion(3) Wholly-Owned Wateridge San Diego, CA Life science 1 $ — $ 8,482 $ 7,398 $ 15,880 2Q17 1Q19 Summit III Nashville, TN Medical office 1 31 5,334 636 6,001 1Q18 1Q19 Nordstrom Tower Seattle, WA Medical office 1 25 4,885 2,190 7,100 1Q18 1Q19 Biotech Gateway San Francisco, CA Life science 3 9,475 14,839 42,286 66,600 1Q18 1Q19 Various SHOP Various SHOP 10 — 6,181 78,337 84,518 2Q18 - 4Q18 3Q19 - 3Q20 Pointe Grand San Francisco, CA Life science 2 — 10,003 17,657 27,660 3Q18 1Q19 St Matthews I Louisville, KY Medical office 1 525 812 9,666 11,003 3Q18 4Q19 19 $ 10,056 $ 50,536 $ 158,170 $ 218,762 Projected stabilized return on incremental capital invested typically ranges from 9.0% to 12.0% LAND HELD FOR DEVELOPMENT Estimated Gross Site Rentable Investment Project MSA Property Type Acreage Sq. Ft. to Date Wholly-Owned Forbes Research Center San Francisco, CA Life science 8 326 $ 46,973 Modular Labs III San Francisco, CA Life science 2 106 10,888 Torrey Pines Science Center San Diego, CA Life science 6 93 11,851 Directors Place San Diego, CA Life science 4 82 6,517 Remaining Various Various 1 N/A 946 21 607 $ 77,175 (1) Redevelopments are excluded from SPP until they are Stabilized. See Glossary for further definition. (2) Includes lease commissions incurred to date and projected lease commissions through stabilization. (3) Excludes the completion of tenant improvements. 23

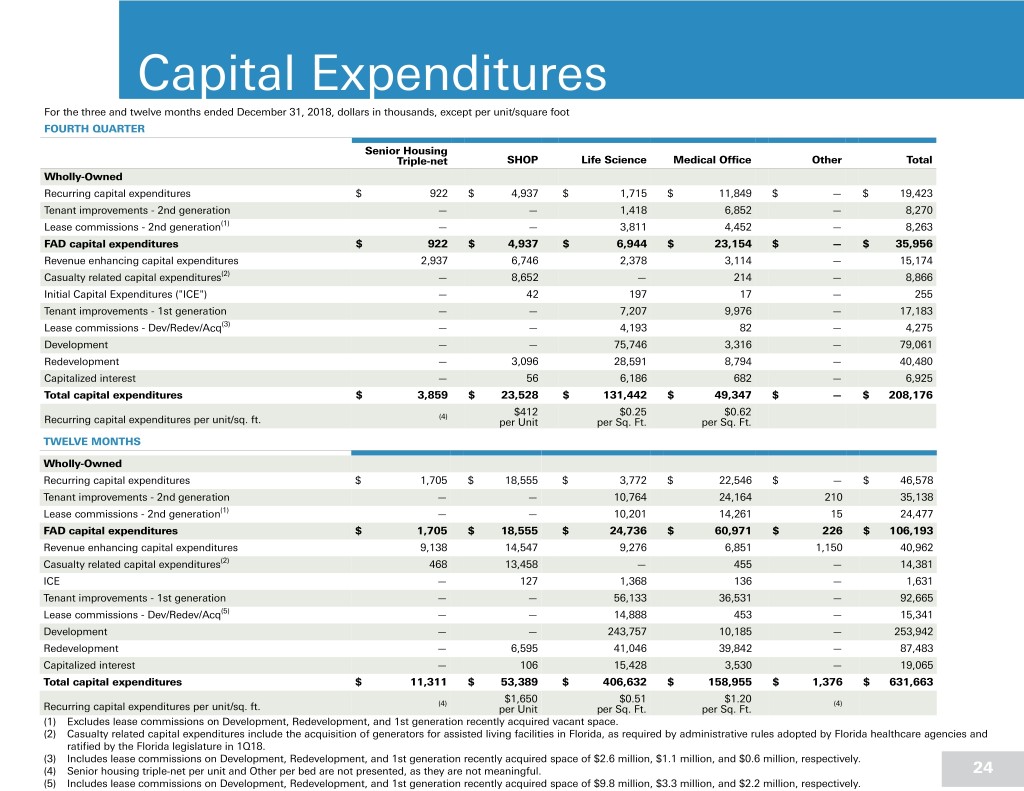

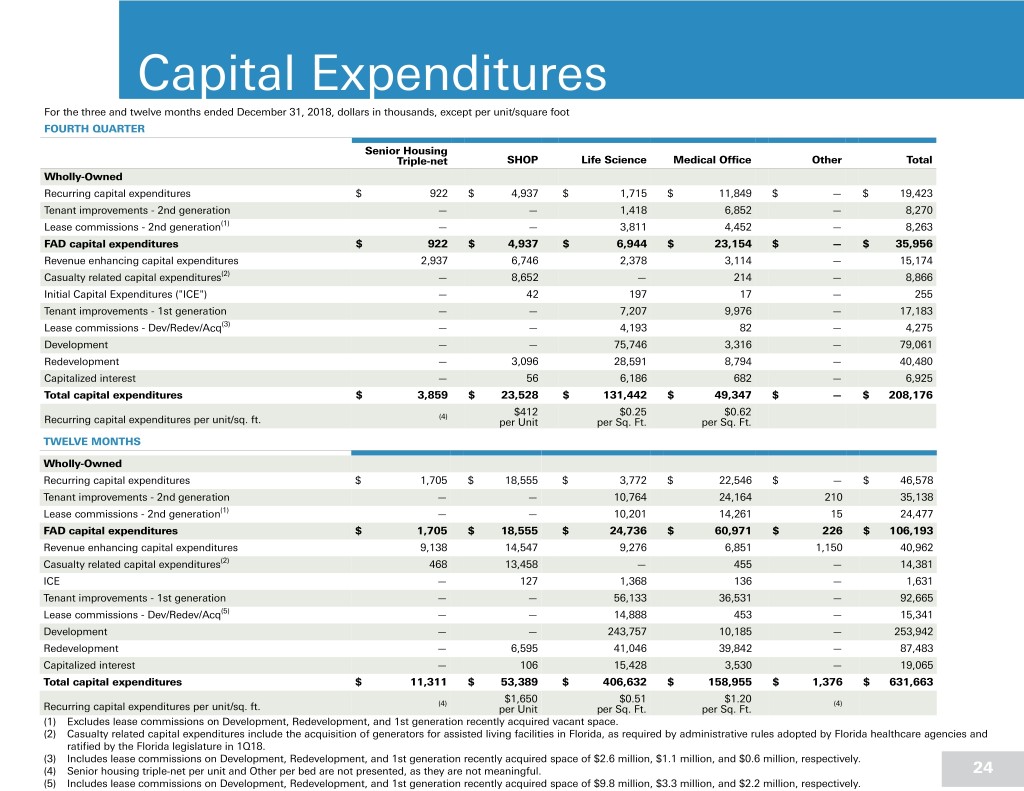

Capital Expenditures For the three and twelve months ended December 31, 2018, dollars in thousands, except per unit/square foot FOURTH QUARTER Senior Housing Triple-net SHOP Life Science Medical Office Other Total Wholly-Owned Recurring capital expenditures $ 922 $ 4,937 $ 1,715 $ 11,849 $ — $ 19,423 Tenant improvements - 2nd generation — — 1,418 6,852 — 8,270 Lease commissions - 2nd generation(1) — — 3,811 4,452 — 8,263 FAD capital expenditures $ 922 $ 4,937 $ 6,944 $ 23,154 $ — $ 35,956 Revenue enhancing capital expenditures 2,937 6,746 2,378 3,114 — 15,174 Casualty related capital expenditures(2) — 8,652 — 214 — 8,866 Initial Capital Expenditures ("ICE") — 42 197 17 — 255 Tenant improvements - 1st generation — — 7,207 9,976 — 17,183 Lease commissions - Dev/Redev/Acq(3) — — 4,193 82 — 4,275 Development — — 75,746 3,316 — 79,061 Redevelopment — 3,096 28,591 8,794 — 40,480 Capitalized interest — 56 6,186 682 — 6,925 Total capital expenditures $ 3,859 $ 23,528 $ 131,442 $ 49,347 $ — $ 208,176 (4) $412 $0.25 $0.62 Recurring capital expenditures per unit/sq. ft. per Unit per Sq. Ft. per Sq. Ft. TWELVE MONTHS Wholly-Owned Recurring capital expenditures $ 1,705 $ 18,555 $ 3,772 $ 22,546 $ — $ 46,578 Tenant improvements - 2nd generation — — 10,764 24,164 210 35,138 Lease commissions - 2nd generation(1) — — 10,201 14,261 15 24,477 FAD capital expenditures $ 1,705 $ 18,555 $ 24,736 $ 60,971 $ 226 $ 106,193 Revenue enhancing capital expenditures 9,138 14,547 9,276 6,851 1,150 40,962 Casualty related capital expenditures(2) 468 13,458 — 455 — 14,381 ICE — 127 1,368 136 — 1,631 Tenant improvements - 1st generation — — 56,133 36,531 — 92,665 Lease commissions - Dev/Redev/Acq(5) — — 14,888 453 — 15,341 Development — — 243,757 10,185 — 253,942 Redevelopment — 6,595 41,046 39,842 — 87,483 Capitalized interest — 106 15,428 3,530 — 19,065 Total capital expenditures $ 11,311 $ 53,389 $ 406,632 $ 158,955 $ 1,376 $ 631,663 (4) $1,650 $0.51 $1.20 (4) Recurring capital expenditures per unit/sq. ft. per Unit per Sq. Ft. per Sq. Ft. (1) Excludes lease commissions on Development, Redevelopment, and 1st generation recently acquired vacant space. (2) Casualty related capital expenditures include the acquisition of generators for assisted living facilities in Florida, as required by administrative rules adopted by Florida healthcare agencies and ratified by the Florida legislature in 1Q18. (3) Includes lease commissions on Development, Redevelopment, and 1st generation recently acquired space of $2.6 million, $1.1 million, and $0.6 million, respectively. (4) Senior housing triple-net per unit and Other per bed are not presented, as they are not meaningful. 24 (5) Includes lease commissions on Development, Redevelopment, and 1st generation recently acquired space of $9.8 million, $3.3 million, and $2.2 million, respectively.

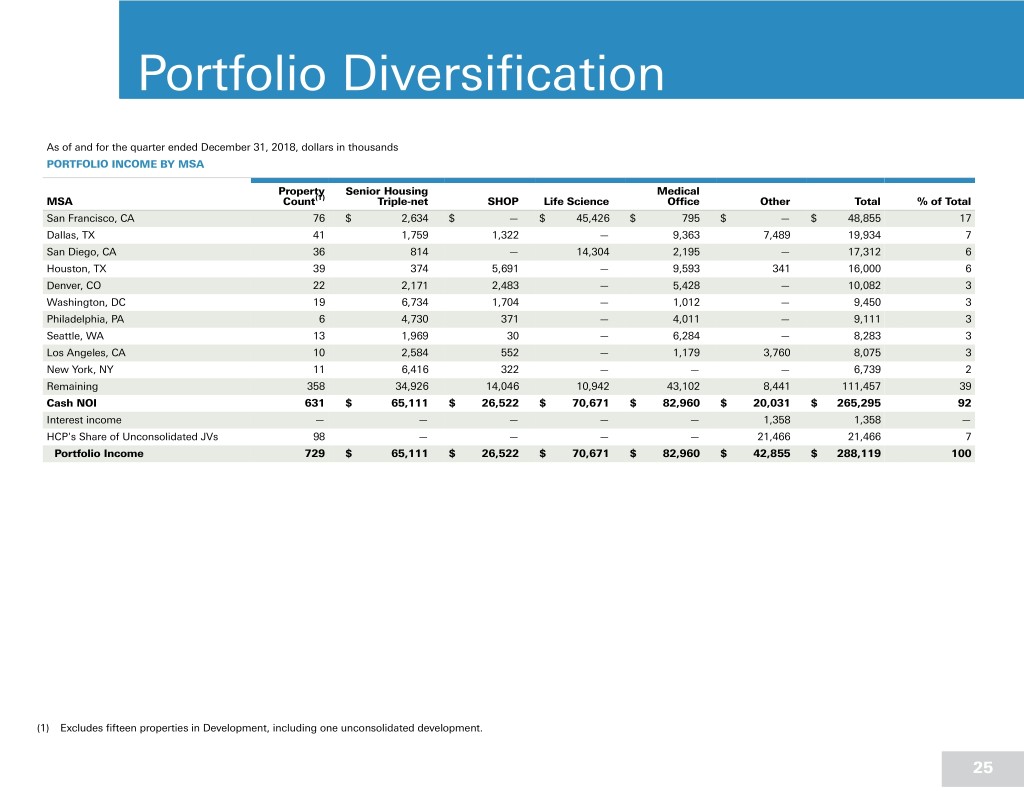

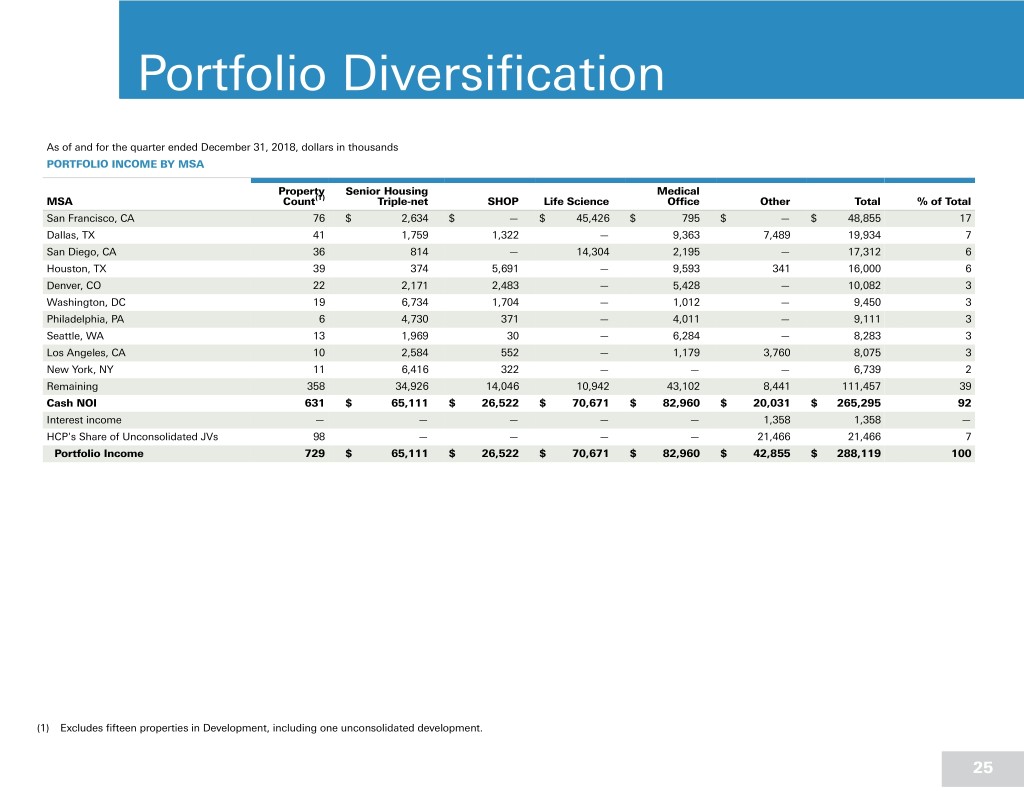

Portfolio Diversification As of and for the quarter ended December 31, 2018, dollars in thousands PORTFOLIO INCOME BY MSA Property Senior Housing Medical MSA Count(1) Triple-net SHOP Life Science Office Other Total % of Total San Francisco, CA 76 $ 2,634 $ — $ 45,426 $ 795 $ — $ 48,855 17 Dallas, TX 41 1,759 1,322 — 9,363 7,489 19,934 7 San Diego, CA 36 814 — 14,304 2,195 — 17,312 6 Houston, TX 39 374 5,691 — 9,593 341 16,000 6 Denver, CO 22 2,171 2,483 — 5,428 — 10,082 3 Washington, DC 19 6,734 1,704 — 1,012 — 9,450 3 Philadelphia, PA 6 4,730 371 — 4,011 — 9,111 3 Seattle, WA 13 1,969 30 — 6,284 — 8,283 3 Los Angeles, CA 10 2,584 552 — 1,179 3,760 8,075 3 New York, NY 11 6,416 322 — — — 6,739 2 Remaining 358 34,926 14,046 10,942 43,102 8,441 111,457 39 Cash NOI 631 $ 65,111 $ 26,522 $ 70,671 $ 82,960 $ 20,031 $ 265,295 92 Interest income — — — — — 1,358 1,358 — HCP's Share of Unconsolidated JVs 98 — — — — 21,466 21,466 7 Portfolio Income 729 $ 65,111 $ 26,522 $ 70,671 $ 82,960 $ 42,855 $ 288,119 100 (1) Excludes fifteen properties in Development, including one unconsolidated development. 25

Portfolio Diversification As of and for the quarter ended December 31, 2018, dollars in thousands, includes HCP's pro rata share of unconsolidated JVs PORTFOLIO INCOME BY OPERATOR/TENANT Tenant/Credit Exposure SHOP/Operator Exposure Senior % of % of Property Housing Life Medical Portfolio Property Portfolio Operator/Tenant Count(1) Triple-net Science Office Other Total Income Count(1) SHOP Other Total Income Brookdale 43 $ 19,021 $ — $ — $ — $ 19,021 6 51 $ 13,874 $ 14,624 $ 28,498 10 Sunrise Senior Living 48 26,901 — — — 26,901 9 6 1,465 — 1,465 1 Hospital Corporation of America ("HCA")(2) 90 — — 13,789 6,112 19,901 7 — — — — — Amgen 7 — 12,990 — — 12,990 5 — — — — — Atria Senior Living — — — — — — — 27 6,169 (52) 6,117 2 Remaining 424 19,189 57,682 69,171 21,261 167,303 58 33 5,013 910 5,923 2 Portfolio Income 612 $ 65,111 $ 70,671 $ 82,960 $ 27,373 $246,116 85 117 $ 26,522 $15,481 $ 42,003 15 (1) Excludes fifteen properties in Development, including one unconsolidated development. (2) Includes Cash NOI for 1.4 million square feet in five properties (including a hospital) that are 100% leased to HCA, and 2.7 million square feet in 85 properties partially leased to HCA. Patewood Medical Office Building C Greenville, SC 26

Expirations and Maturities As of December 31, 2018, dollars in thousands EXCLUDES PURCHASE AND PREPAYMENT OPTIONS Annualized Base Rent Senior Housing Medical Interest Year Total % of Total Triple-net Life Science Office Other Income 2019(1) $ 96,733 9 $ 2,305 $ 24,653 $ 69,775 $ — $ — 2020 133,163 13 40,753 19,890 63,355 8,145 1,019 2021 109,489 11 7,969 50,365 48,606 1,619 930 2022 85,875 8 1,548 21,345 45,566 14,099 3,317 2023 121,791 12 46,215 36,210 39,366 — — 2024(2) 58,751 6 5,558 6,213 24,008 22,972 — 2025 112,262 11 9,354 46,238 36,526 20,051 93 2026 42,312 4 4,316 17,955 20,040 — — 2027 50,485 5 12,359 22,898 15,229 — — 2028(2) 77,993 8 34,754 15,079 28,161 — — Thereafter 145,382 14 87,960 24,447 24,493 8,483 — $ 1,034,237 100 $ 253,090 $ 285,294 $ 415,123 $ 75,370 $ 5,359 Weighted average maturity in years 5.7 8.1 5.4 4.4 6.0 3.3 REFLECTS PURCHASE AND PREPAYMENT OPTIONS Annualized Base Rent Senior Housing Medical Interest Year Total % of Total Triple-net Life Science Office Other Income(3) 2019(1) $ 117,650 11 $ 2,305 $ 24,653 $ 74,559 $ 15,112 $ 1,019 (1) Includes month-to-month and 2020 136,406 13 40,753 26,048 61,459 8,145 — holdover leases. 2021 120,902 12 7,969 50,365 60,019 1,619 930 (2) Senior housing triple-net excludes properties transitioned to SHOP in 2022 83,478 8 1,548 21,345 43,767 13,501 3,317 1Q19. 2023 118,375 11 46,215 36,210 35,949 — — (3) Reflects the earliest point at which 2024(2) 43,637 4 5,558 6,213 23,409 8,458 — there is no prepayment penalty. 2025 113,080 11 9,354 46,238 37,344 20,051 93 2026 33,300 3 4,316 17,955 11,029 — — 2027 50,417 5 12,359 22,898 15,160 — — 2028(2) 77,767 8 34,754 15,079 27,935 — — Thereafter 139,225 13 87,960 18,290 24,493 8,483 — $ 1,034,237 100 $ 253,090 $ 285,294 $ 415,123 $ 75,370 $ 5,359 27

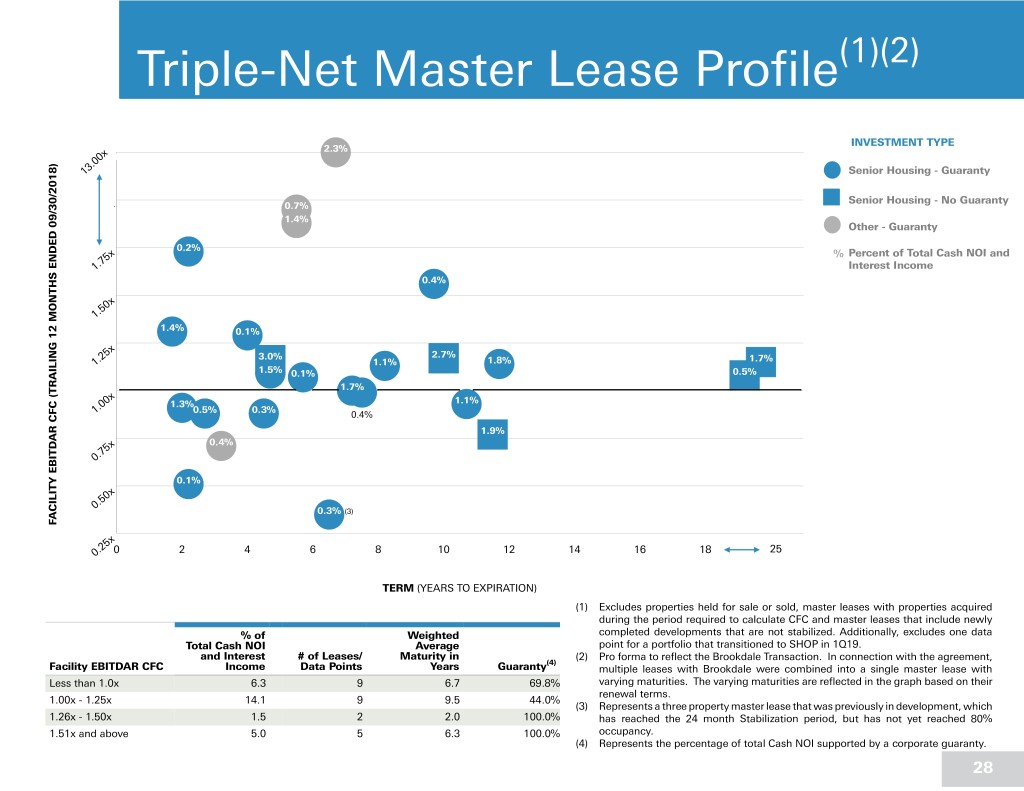

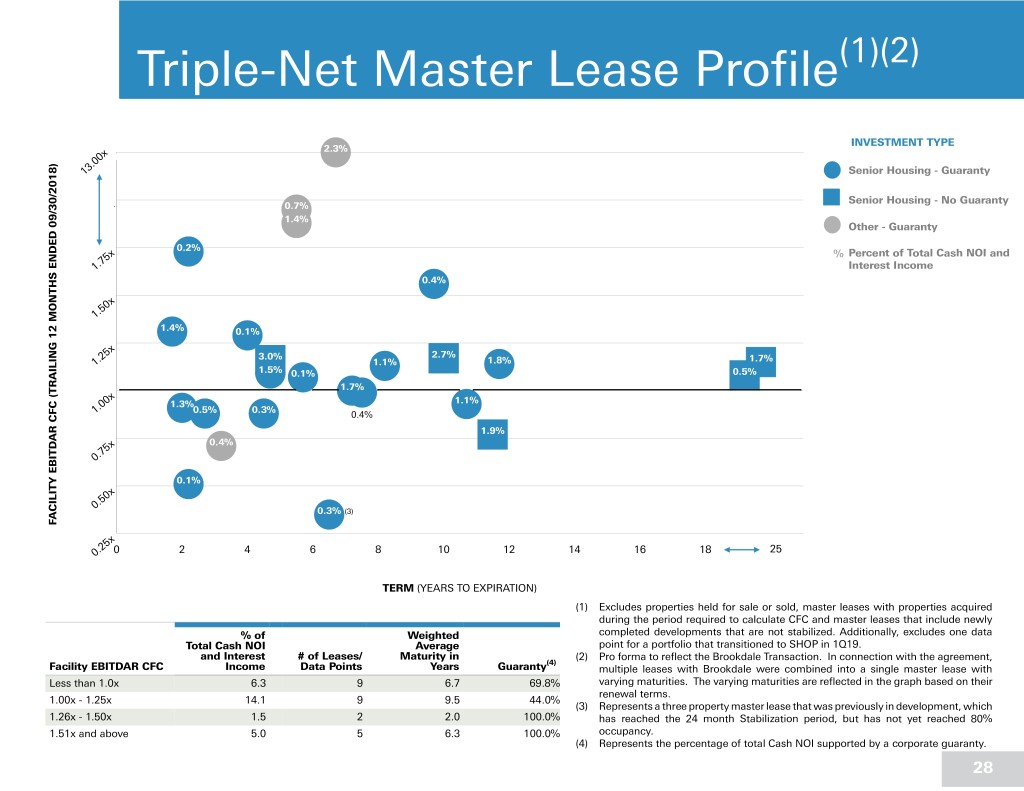

Triple-Net Master Lease Profile(1)(2) INVESTMENT TYPE 2.3% x 25 13.00x2. Senior Housing - Guaranty Senior Housing - No Guaranty x 0.7% 00 2. 1.4% Other - Guaranty 0.2% x % Percent of Total Cash NOI and 75 1. Interest Income 0.4% x 50 1. 1.4% 0.1% x 25 3.0% 2.7% 1.7% 1. 1.1% 1.8% 1.5% 0.1% 0.5% 1.7% x 0 1.3% 1.1% .0 0.5% 0.3% 1 0.4% 1.9% x 0.4% 75 0. 0.1% x 50 0. 0.3% (3) FACILITY EBITDAR CFC (TRAILING 12 MONTHS ENDED 09/30/2018) EBITDAR FACILITY x 25 0. 0 2 4 6 8 10 12 14 16 18 2250 TERM (YEARS TO EXPIRATION) (1) Excludes properties held for sale or sold, master leases with properties acquired during the period required to calculate CFC and master leases that include newly % of Weighted completed developments that are not stabilized. Additionally, excludes one data Total Cash NOI Average point for a portfolio that transitioned to SHOP in 1Q19. and Interest # of Leases/ Maturity in (2) Pro forma to reflect the Brookdale Transaction. In connection with the agreement, (4) Facility EBITDAR CFC Income Data Points Years Guaranty multiple leases with Brookdale were combined into a single master lease with Less than 1.0x 6.3 9 6.7 69.8% varying maturities. The varying maturities are reflected in the graph based on their renewal terms. 1.00x - 1.25x 14.1 9 9.5 44.0% (3) Represents a three property master lease that was previously in development, which 1.26x - 1.50x 1.5 2 2.0 100.0% has reached the 24 month Stabilization period, but has not yet reached 80% 1.51x and above 5.0 5 6.3 100.0% occupancy. (4) Represents the percentage of total Cash NOI supported by a corporate guaranty. 28

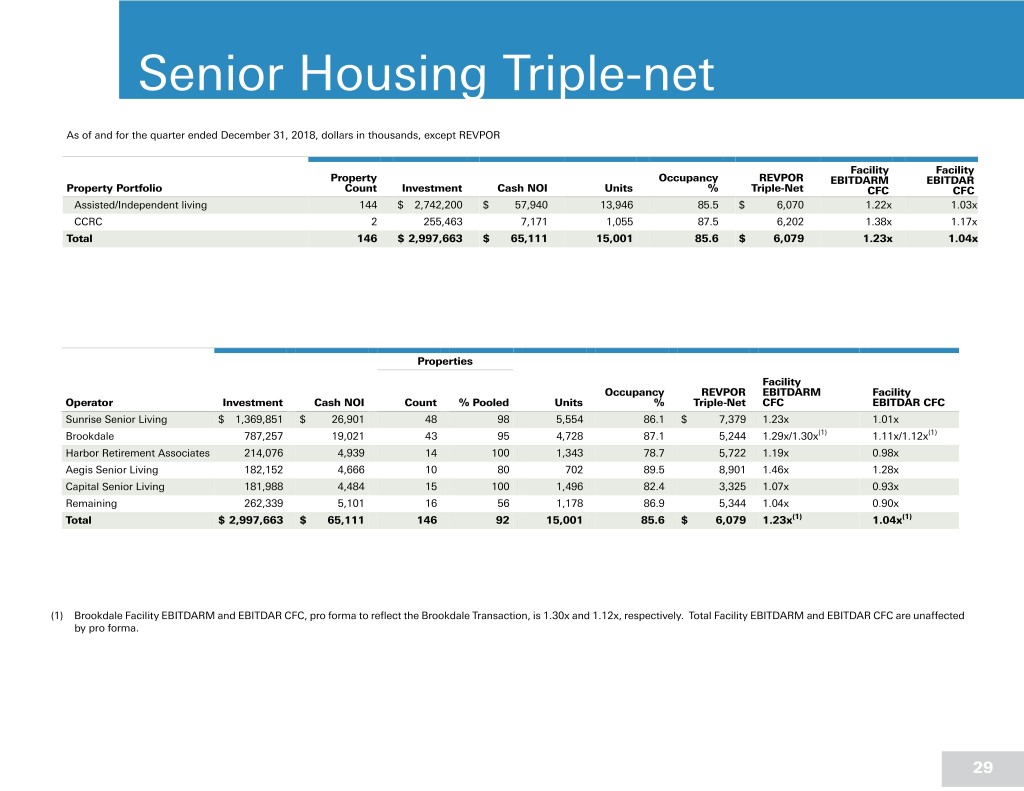

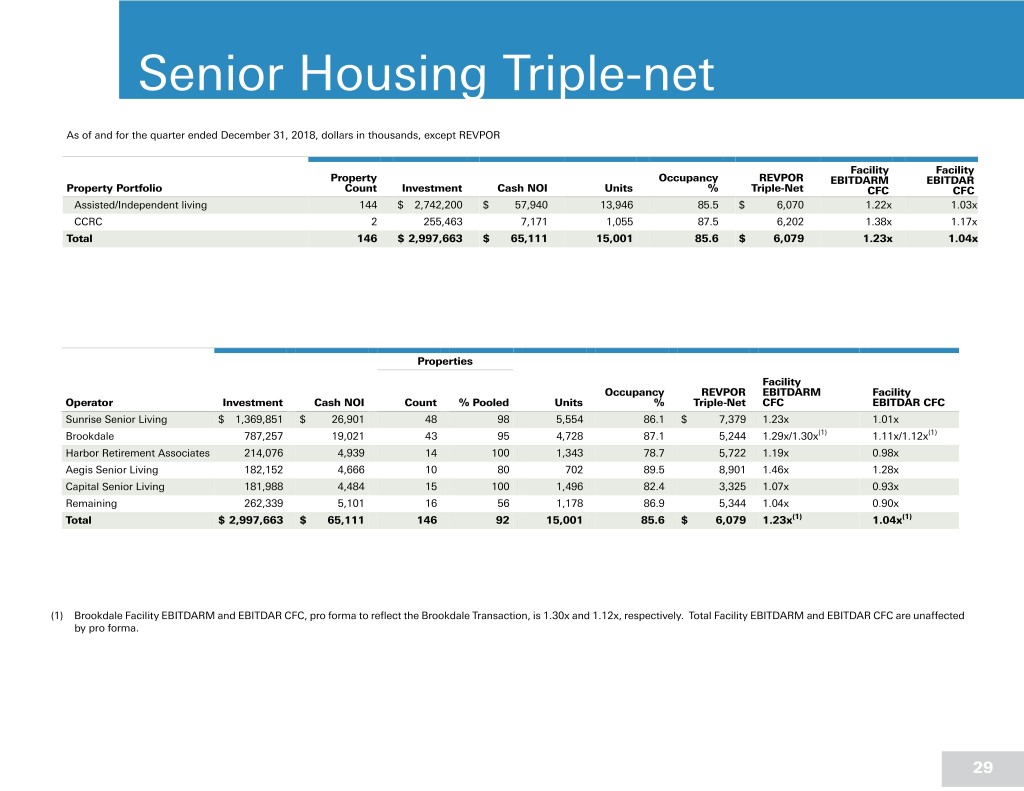

Senior Housing Triple-net As of and for the quarter ended December 31, 2018, dollars in thousands, except REVPOR Facility Facility Property Occupancy REVPOR EBITDARM EBITDAR Property Portfolio Count Investment Cash NOI Units % Triple-Net CFC CFC Assisted/Independent living 144 $ 2,742,200 $ 57,940 13,946 85.5 $ 6,070 1.22x 1.03x CCRC 2 255,463 7,171 1,055 87.5 6,202 1.38x 1.17x Total 146 $ 2,997,663 $ 65,111 15,001 85.6 $ 6,079 1.23x 1.04x Properties Facility Occupancy REVPOR EBITDARM Facility Operator Investment Cash NOI Count % Pooled Units % Triple-Net CFC EBITDAR CFC Sunrise Senior Living $ 1,369,851 $ 26,901 48 98 5,554 86.1 $ 7,379 1.23x 1.01x Brookdale 787,257 19,021 43 95 4,728 87.1 5,244 1.29x/1.30x(1) 1.11x/1.12x(1) Harbor Retirement Associates 214,076 4,939 14 100 1,343 78.7 5,722 1.19x 0.98x Aegis Senior Living 182,152 4,666 10 80 702 89.5 8,901 1.46x 1.28x Capital Senior Living 181,988 4,484 15 100 1,496 82.4 3,325 1.07x 0.93x Remaining 262,339 5,101 16 56 1,178 86.9 5,344 1.04x 0.90x Total $ 2,997,663 $ 65,111 146 92 15,001 85.6 $ 6,079 1.23x(1) 1.04x(1) (1) Brookdale Facility EBITDARM and EBITDAR CFC, pro forma to reflect the Brookdale Transaction, is 1.30x and 1.12x, respectively. Total Facility EBITDARM and EBITDAR CFC are unaffected by pro forma. 29

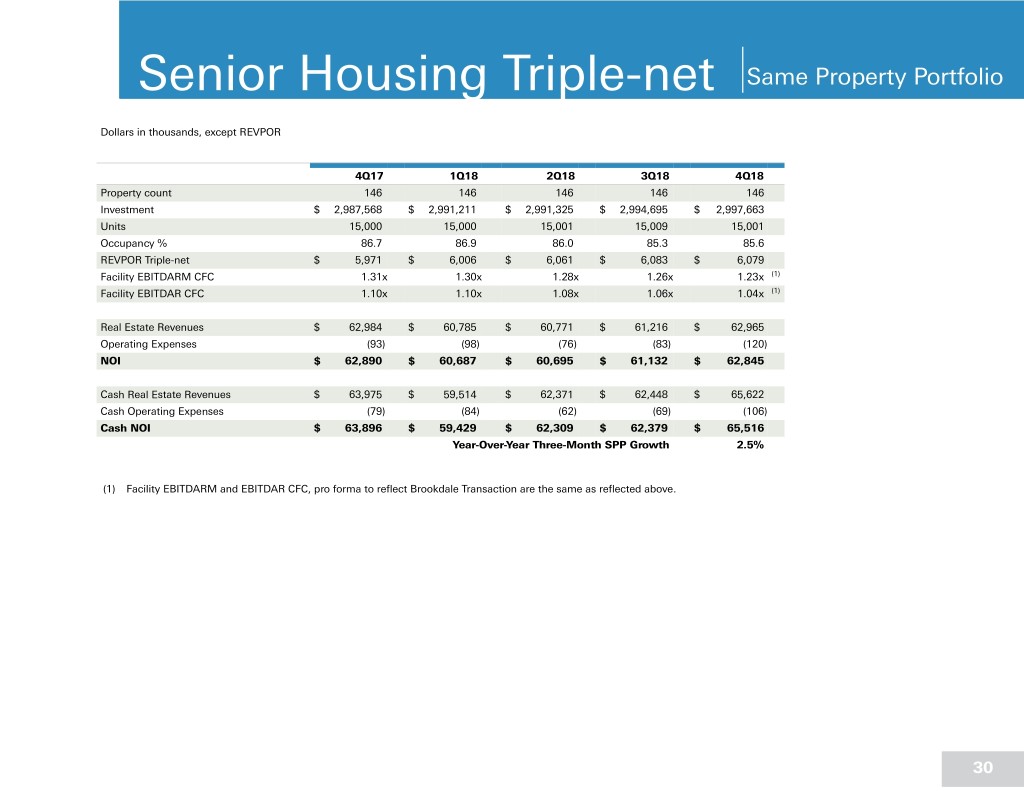

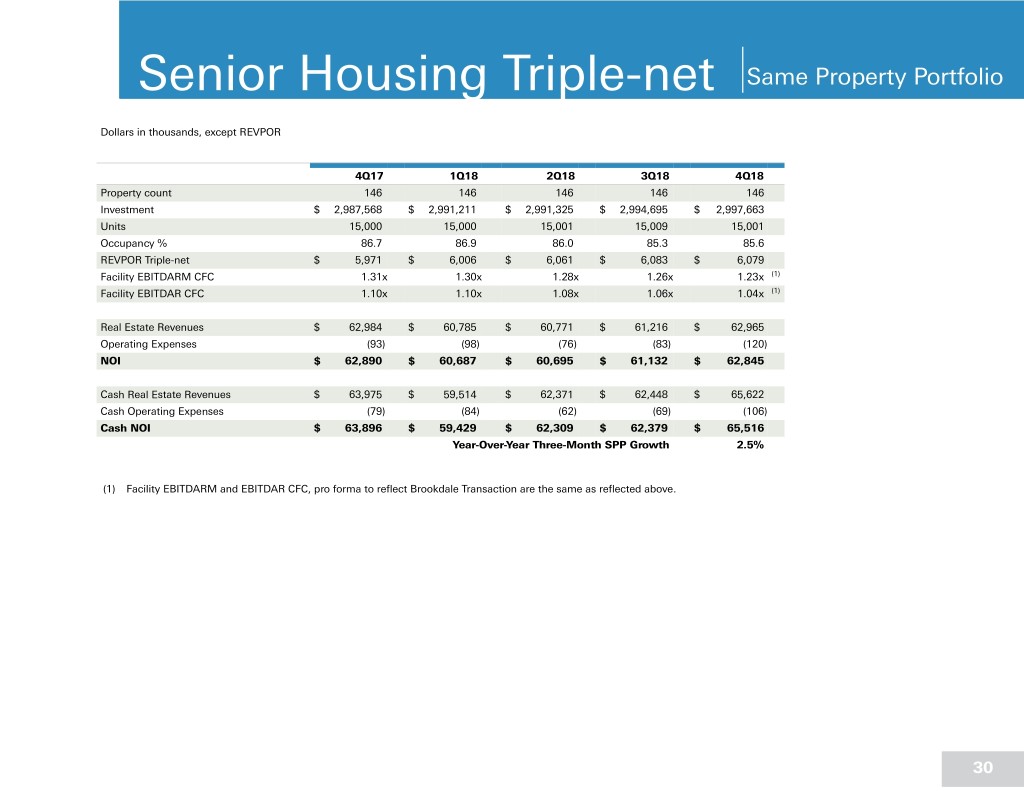

Senior Housing Triple-net Same Property Portfolio Dollars in thousands, except REVPOR 4Q17 1Q18 2Q18 3Q18 4Q18 Property count 146 146 146 146 146 Investment $ 2,987,568 $ 2,991,211 $ 2,991,325 $ 2,994,695 $ 2,997,663 Units 15,000 15,000 15,001 15,009 15,001 Occupancy % 86.7 86.9 86.0 85.3 85.6 REVPOR Triple-net $ 5,971 $ 6,006 $ 6,061 $ 6,083 $ 6,079 Facility EBITDARM CFC 1.31x 1.30x 1.28x 1.26x 1.23x (1) Facility EBITDAR CFC 1.10x 1.10x 1.08x 1.06x 1.04x (1) Real Estate Revenues $ 62,984 $ 60,785 $ 60,771 $ 61,216 $ 62,965 Operating Expenses (93) (98) (76) (83) (120) NOI $ 62,890 $ 60,687 $ 60,695 $ 61,132 $ 62,845 Cash Real Estate Revenues $ 63,975 $ 59,514 $ 62,371 $ 62,448 $ 65,622 Cash Operating Expenses (79) (84) (62) (69) (106) Cash NOI $ 63,896 $ 59,429 $ 62,309 $ 62,379 $ 65,516 Year-Over-Year Three-Month SPP Growth 2.5% (1) Facility EBITDARM and EBITDAR CFC, pro forma to reflect Brookdale Transaction are the same as reflected above. 30

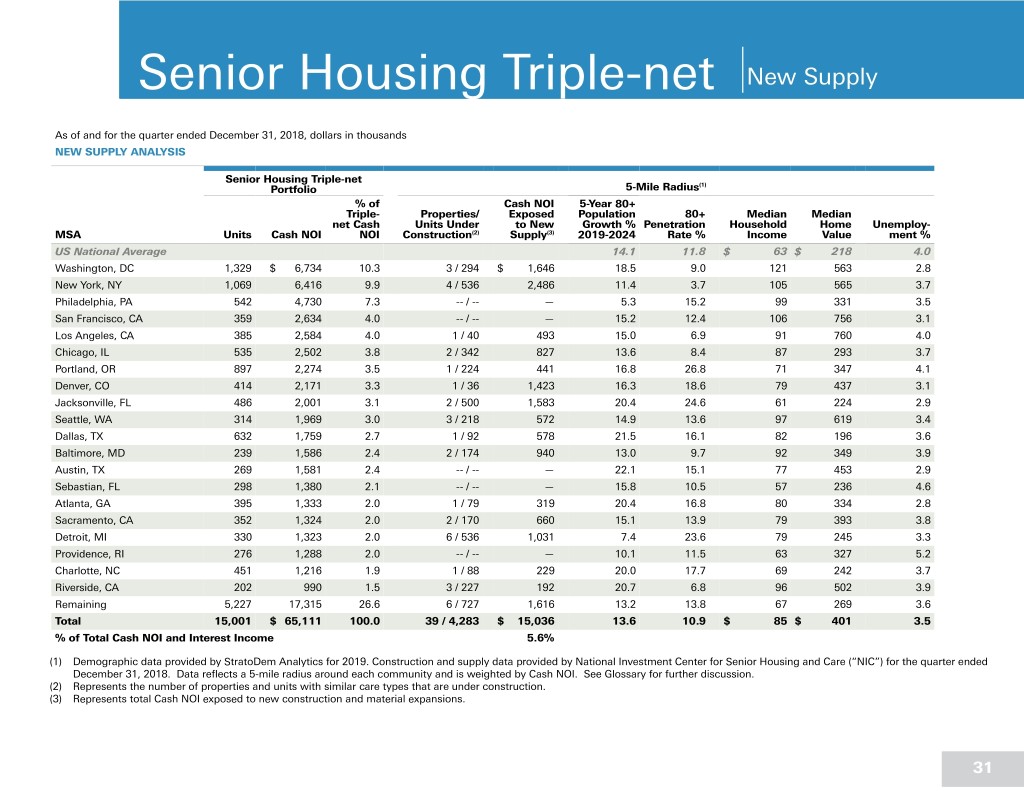

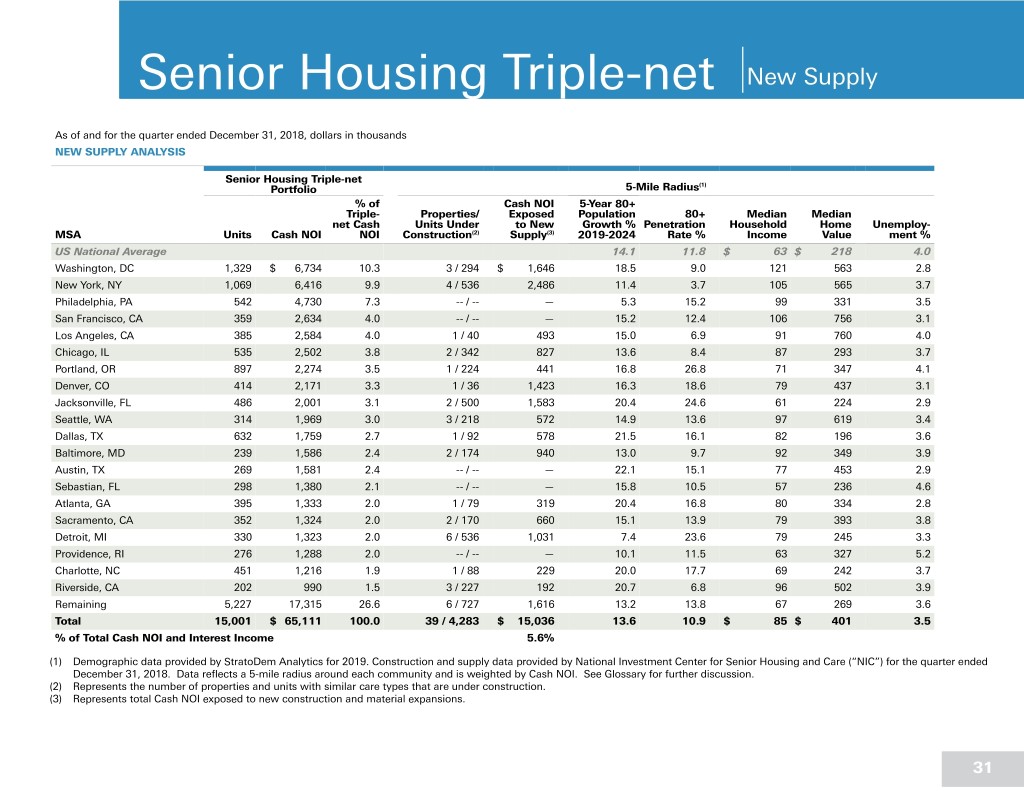

Senior Housing Triple-net New Supply As of and for the quarter ended December 31, 2018, dollars in thousands NEW SUPPLY ANALYSIS Senior Housing Triple-net Portfolio 5-Mile Radius(1) % of Cash NOI 5-Year 80+ Triple- Properties/ Exposed Population 80+ Median Median net Cash Units Under to New Growth % Penetration Household Home Unemploy- MSA Units Cash NOI NOI Construction(2) Supply(3) 2019-2024 Rate % Income Value ment % US National Average 14.1 11.8 $ 63 $ 218 4.0 Washington, DC 1,329 $ 6,734 10.3 3 / 294 $ 1,646 18.5 9.0 121 563 2.8 New York, NY 1,069 6,416 9.9 4 / 536 2,486 11.4 3.7 105 565 3.7 Philadelphia, PA 542 4,730 7.3 -- / -- — 5.3 15.2 99 331 3.5 San Francisco, CA 359 2,634 4.0 -- / -- — 15.2 12.4 106 756 3.1 Los Angeles, CA 385 2,584 4.0 1 / 40 493 15.0 6.9 91 760 4.0 Chicago, IL 535 2,502 3.8 2 / 342 827 13.6 8.4 87 293 3.7 Portland, OR 897 2,274 3.5 1 / 224 441 16.8 26.8 71 347 4.1 Denver, CO 414 2,171 3.3 1 / 36 1,423 16.3 18.6 79 437 3.1 Jacksonville, FL 486 2,001 3.1 2 / 500 1,583 20.4 24.6 61 224 2.9 Seattle, WA 314 1,969 3.0 3 / 218 572 14.9 13.6 97 619 3.4 Dallas, TX 632 1,759 2.7 1 / 92 578 21.5 16.1 82 196 3.6 Baltimore, MD 239 1,586 2.4 2 / 174 940 13.0 9.7 92 349 3.9 Austin, TX 269 1,581 2.4 -- / -- — 22.1 15.1 77 453 2.9 Sebastian, FL 298 1,380 2.1 -- / -- — 15.8 10.5 57 236 4.6 Atlanta, GA 395 1,333 2.0 1 / 79 319 20.4 16.8 80 334 2.8 Sacramento, CA 352 1,324 2.0 2 / 170 660 15.1 13.9 79 393 3.8 Detroit, MI 330 1,323 2.0 6 / 536 1,031 7.4 23.6 79 245 3.3 Providence, RI 276 1,288 2.0 -- / -- — 10.1 11.5 63 327 5.2 Charlotte, NC 451 1,216 1.9 1 / 88 229 20.0 17.7 69 242 3.7 Riverside, CA 202 990 1.5 3 / 227 192 20.7 6.8 96 502 3.9 Remaining 5,227 17,315 26.6 6 / 727 1,616 13.2 13.8 67 269 3.6 Total 15,001 $ 65,111 100.0 39 / 4,283 $ 15,036 13.6 10.9 $ 85 $ 401 3.5 % of Total Cash NOI and Interest Income 5.6% (1) Demographic data provided by StratoDem Analytics for 2019. Construction and supply data provided by National Investment Center for Senior Housing and Care (“NIC”) for the quarter ended December 31, 2018. Data reflects a 5-mile radius around each community and is weighted by Cash NOI. See Glossary for further discussion. (2) Represents the number of properties and units with similar care types that are under construction. (3) Represents total Cash NOI exposed to new construction and material expansions. 31

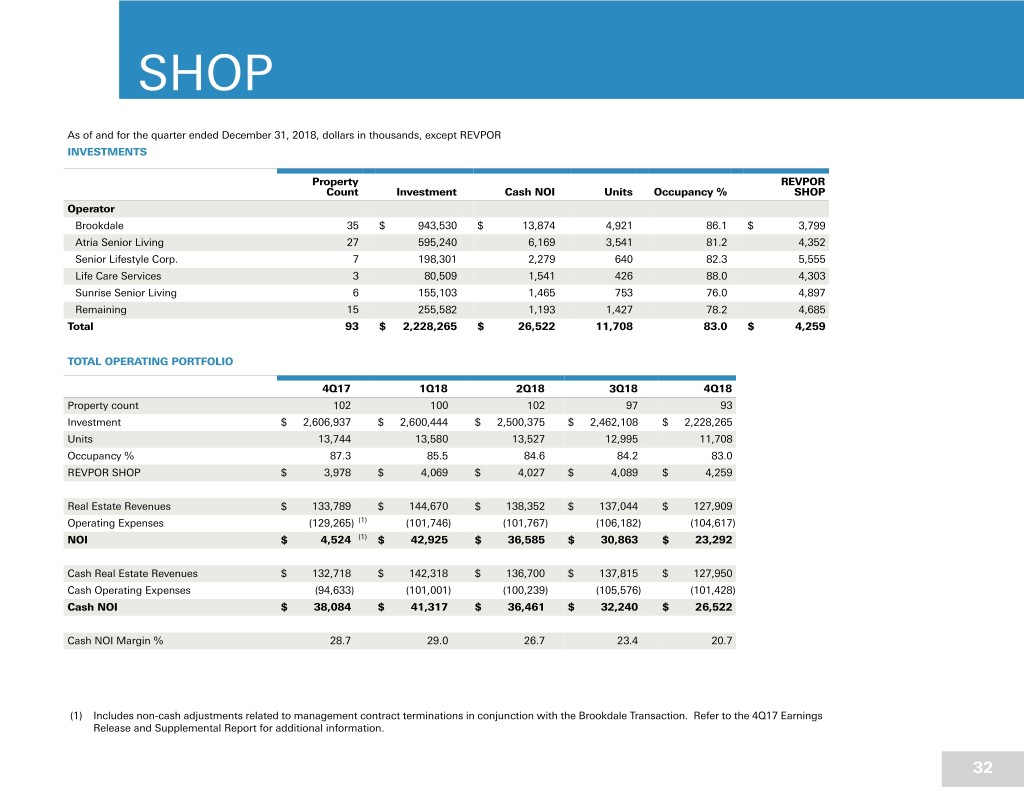

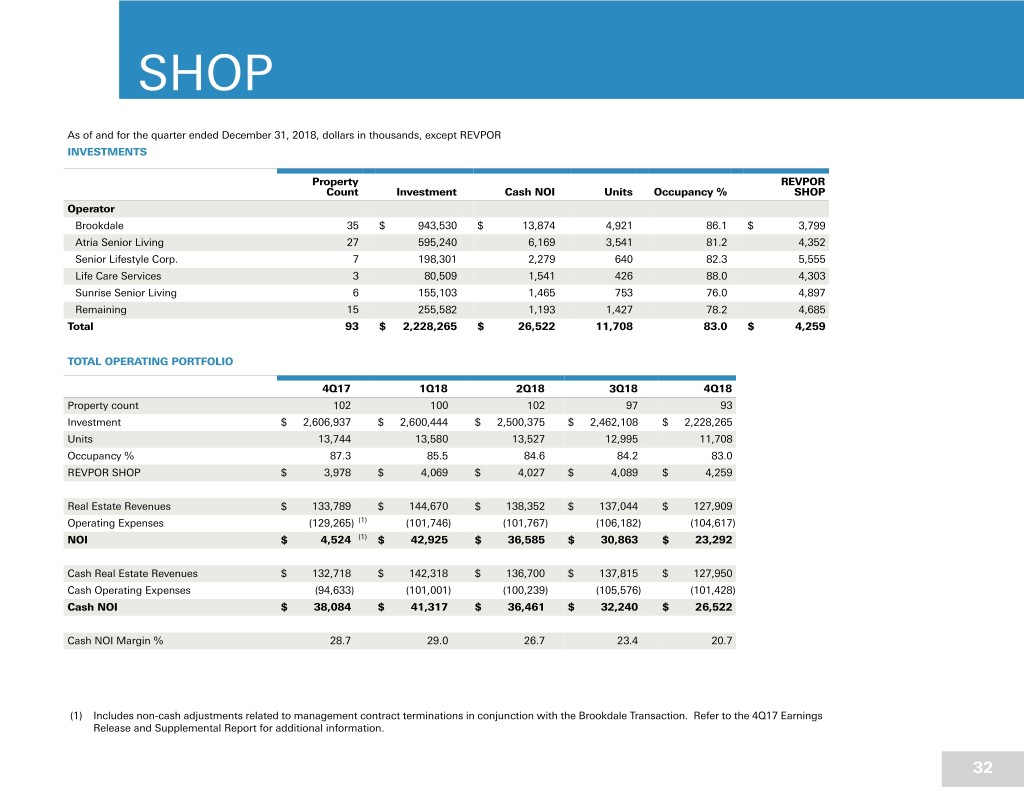

SHOP As of and for the quarter ended December 31, 2018, dollars in thousands, except REVPOR INVESTMENTS Property REVPOR Count Investment Cash NOI Units Occupancy % SHOP Operator Brookdale 35 $ 943,530 $ 13,874 4,921 86.1 $ 3,799 Atria Senior Living 27 595,240 6,169 3,541 81.2 4,352 Senior Lifestyle Corp. 7 198,301 2,279 640 82.3 5,555 Life Care Services 3 80,509 1,541 426 88.0 4,303 Sunrise Senior Living 6 155,103 1,465 753 76.0 4,897 Remaining 15 255,582 1,193 1,427 78.2 4,685 Total 93 $ 2,228,265 $ 26,522 11,708 83.0 $ 4,259 TOTAL OPERATING PORTFOLIO 4Q17 1Q18 2Q18 3Q18 4Q18 Property count 102 100 102 97 93 Investment $ 2,606,937 $ 2,600,444 $ 2,500,375 $ 2,462,108 $ 2,228,265 Units 13,744 13,580 13,527 12,995 11,708 Occupancy % 87.3 85.5 84.6 84.2 83.0 REVPOR SHOP $ 3,978 $ 4,069 $ 4,027 $ 4,089 $ 4,259 Real Estate Revenues $ 133,789 $ 144,670 $ 138,352 $ 137,044 $ 127,909 Operating Expenses (129,265) (1) (101,746) (101,767) (106,182) (104,617) NOI $ 4,524 (1) $ 42,925 $ 36,585 $ 30,863 $ 23,292 Cash Real Estate Revenues $ 132,718 $ 142,318 $ 136,700 $ 137,815 $ 127,950 Cash Operating Expenses (94,633) (101,001) (100,239) (105,576) (101,428) Cash NOI $ 38,084 $ 41,317 $ 36,461 $ 32,240 $ 26,522 Cash NOI Margin % 28.7 29.0 26.7 23.4 20.7 (1) Includes non-cash adjustments related to management contract terminations in conjunction with the Brookdale Transaction. Refer to the 4Q17 Earnings Release and Supplemental Report for additional information. 32

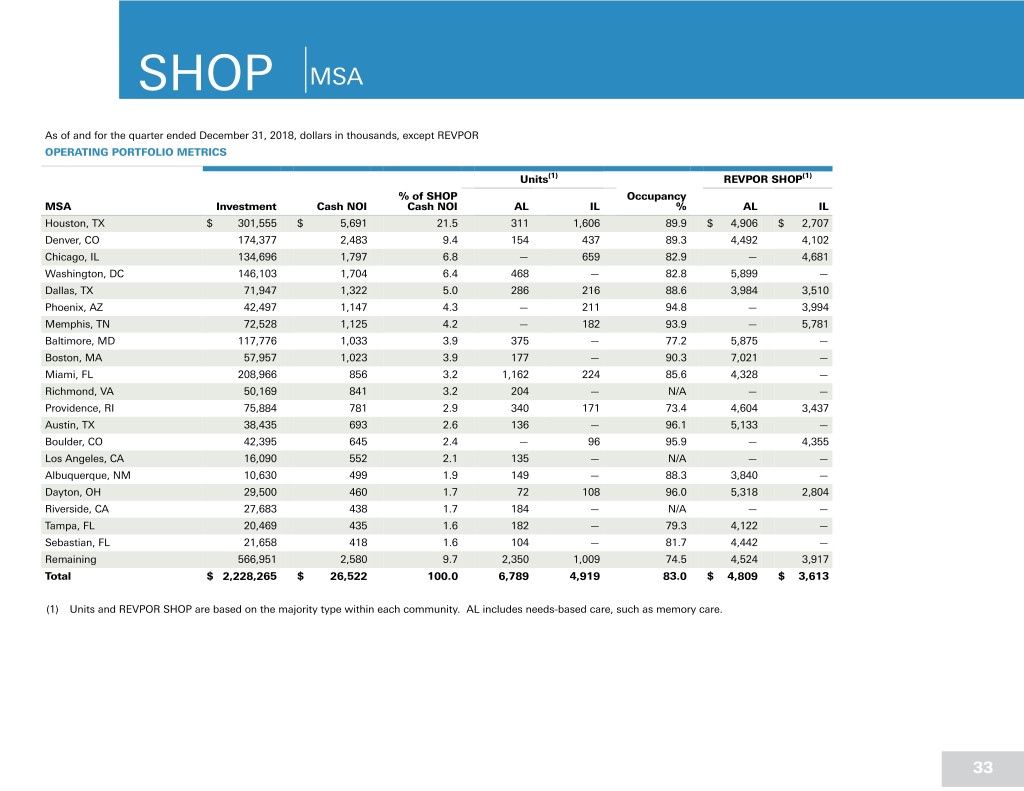

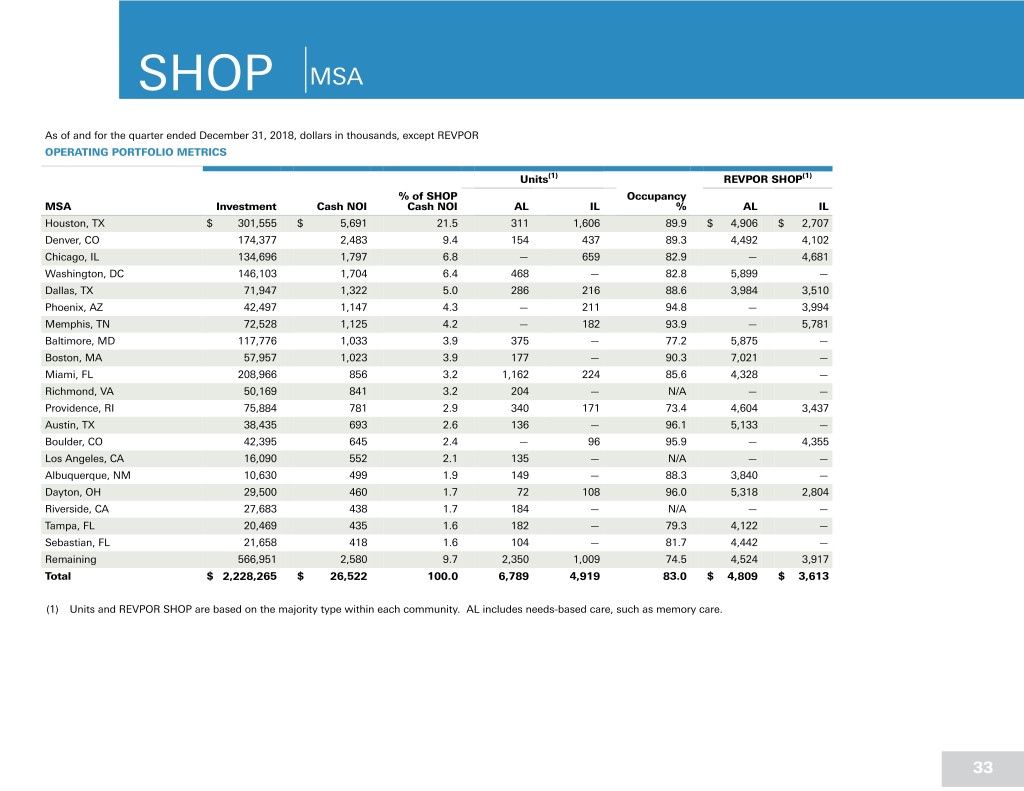

SHOP MSA As of and for the quarter ended December 31, 2018, dollars in thousands, except REVPOR OPERATING PORTFOLIO METRICS Units(1) REVPOR SHOP(1) % of SHOP Occupancy MSA Investment Cash NOI Cash NOI AL IL % AL IL Houston, TX $ 301,555 $ 5,691 21.5 311 1,606 89.9 $ 4,906 $ 2,707 Denver, CO 174,377 2,483 9.4 154 437 89.3 4,492 4,102 Chicago, IL 134,696 1,797 6.8 — 659 82.9 — 4,681 Washington, DC 146,103 1,704 6.4 468 — 82.8 5,899 — Dallas, TX 71,947 1,322 5.0 286 216 88.6 3,984 3,510 Phoenix, AZ 42,497 1,147 4.3 — 211 94.8 — 3,994 Memphis, TN 72,528 1,125 4.2 — 182 93.9 — 5,781 Baltimore, MD 117,776 1,033 3.9 375 — 77.2 5,875 — Boston, MA 57,957 1,023 3.9 177 — 90.3 7,021 — Miami, FL 208,966 856 3.2 1,162 224 85.6 4,328 — Richmond, VA 50,169 841 3.2 204 — N/A — — Providence, RI 75,884 781 2.9 340 171 73.4 4,604 3,437 Austin, TX 38,435 693 2.6 136 — 96.1 5,133 — Boulder, CO 42,395 645 2.4 — 96 95.9 — 4,355 Los Angeles, CA 16,090 552 2.1 135 — N/A — — Albuquerque, NM 10,630 499 1.9 149 — 88.3 3,840 — Dayton, OH 29,500 460 1.7 72 108 96.0 5,318 2,804 Riverside, CA 27,683 438 1.7 184 — N/A — — Tampa, FL 20,469 435 1.6 182 — 79.3 4,122 — Sebastian, FL 21,658 418 1.6 104 — 81.7 4,442 — Remaining 566,951 2,580 9.7 2,350 1,009 74.5 4,524 3,917 Total $ 2,228,265 $ 26,522 100.0 6,789 4,919 83.0 $ 4,809 $ 3,613 (1) Units and REVPOR SHOP are based on the majority type within each community. AL includes needs-based care, such as memory care. 33

SHOP Same Property Portfolio Dollars in thousands, except REVPOR CORE Sequential Year-Over- 4Q17 1Q18 2Q18 3Q18 4Q18 Growth Year Growth Property count 32 32 32 32 32 — — Investment $ 990,521 $ 992,896 $ 997,646 $ 1,002,862 $ 1,010,194 0.7 % 2.0 % Units 4,248 4,248 4,248 4,248 4,249 — % — % Occupancy % 90.0 89.7 89.1 88.7 88.5 (0.2%) (1.5%) REVPOR SHOP $ 3,950 $ 4,075 $ 4,129 $ 4,138 $ 4,123 (0.4%) 4.4 % Real Estate Revenues $ 45,275 $ 46,786 $ 46,833 $ 46,663 $ 46,544 (0.3%) 2.8 % Operating Expenses (30,301) (30,327) (31,102) (31,256) (32,855) 5.1 % 8.4 % NOI $ 14,974 $ 16,459 $ 15,731 $ 15,407 $ 13,689 (11.2%) (8.6%) Cash Real Estate Revenues $ 45,286 $ 46,604 $ 46,865 $ 46,766 $ 46,484 (0.6%) 2.6 % Cash Operating Expenses (30,414) (30,318) (31,078) (31,281) (31,951) 2.1 % 5.1 % Cash NOI $ 14,872 $ 16,286 $ 15,787 $ 15,485 $ 14,533 (6.1%) (2.3%) Cash NOI Margin % 32.8 34.9 33.7 33.1 31.3 (1.8%) (1.5%) TRANSITION(1) Sequential Year-Over- 4Q17 1Q18 2Q18 3Q18 4Q18 Growth Year Growth Property count 16 16 16 16 16 — — Investment $ 318,560 $ 320,666 $ 323,253 $ 324,558 $ 328,931 1.3 % 3.3 % Units 2,004 2,004 2,003 2,004 2,004 — % — % Occupancy % 88.2 87.5 85.4 84.0 84.3 0.3 % (3.9%) REVPOR SHOP $ 3,955 $ 4,066 $ 4,094 $ 4,044 $ 3,955 (2.2%) — % Real Estate Revenues $ 20,863 $ 21,753 $ 21,110 $ 20,303 $ 20,084 (1.1%) (3.7%) Operating Expenses (27,955) (2) (15,540) (15,771) (15,232) (16,162) 6.1 % (2) NOI $ (7,092) (2) $ 6,213 $ 5,338 $ 5,071 $ 3,922 (22.7%) (2) Cash Real Estate Revenues $ 20,975 $ 21,394 $ 21,022 $ 20,427 $ 20,036 (1.9%) (4.5%) Cash Operating Expenses (14,561) (14,766) (15,237) (15,091) (15,750) 4.4 % 8.2 % Cash NOI $ 6,414 $ 6,628 $ 5,785 $ 5,336 $ 4,286 (19.7%) (33.2%) Cash NOI Margin % 30.6 31.0 27.5 26.1 21.4 (4.7%) (9.2%) (1) Represents properties previously managed by Brookdale that have transitioned to new operators or are expected to sell in 2019 in accordance with the Brookdale Transaction. Refer to the 4Q17 Earnings Release and Supplemental Report for additional information. (2) Includes non-cash adjustments related to management contract terminations in conjunction with the Brookdale Transaction. Refer to the 4Q17 Earnings Release and Supplemental Report for additional information. 34

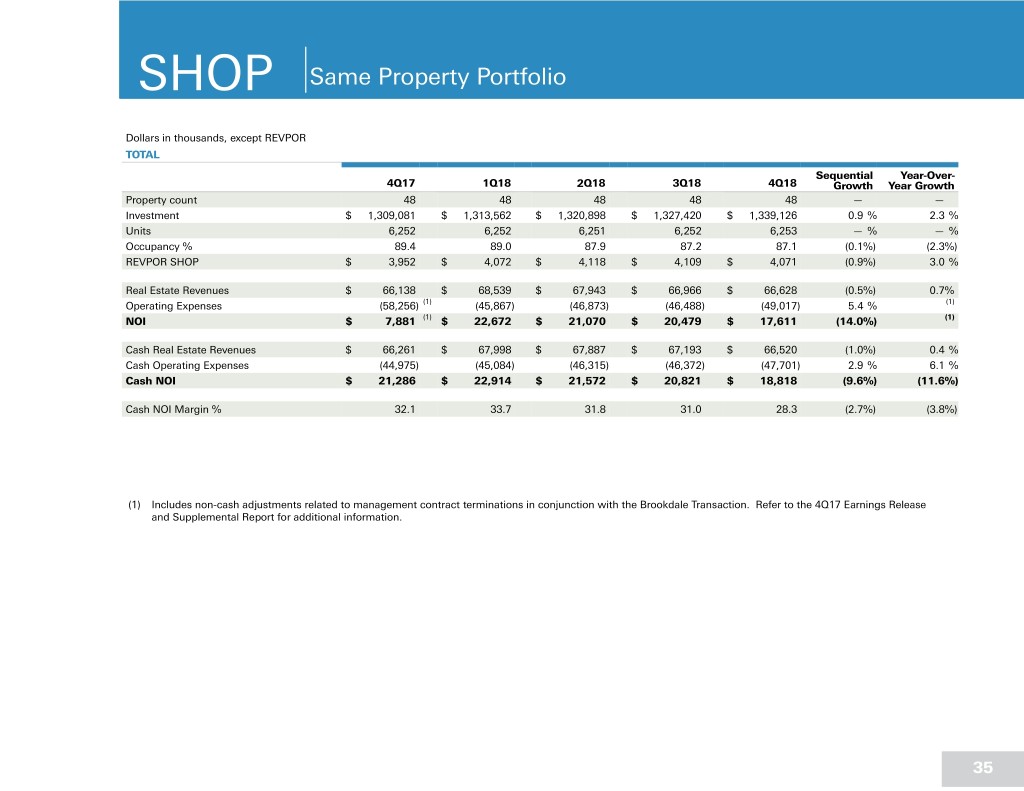

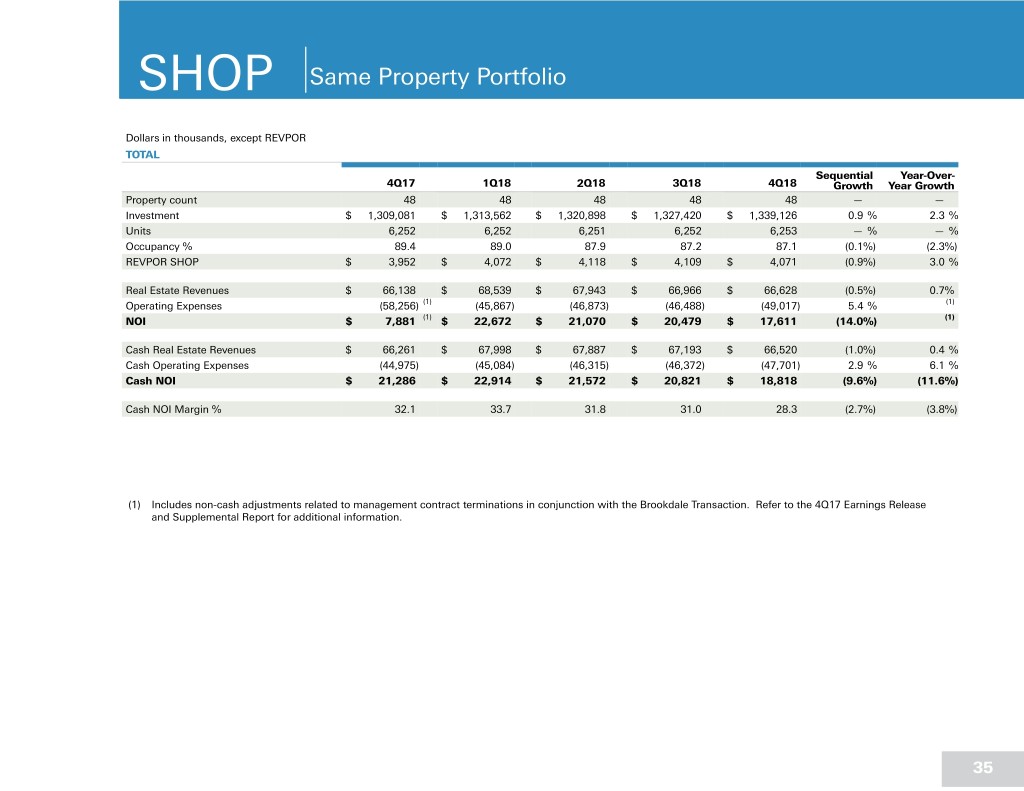

SHOP Same Property Portfolio Dollars in thousands, except REVPOR TOTAL Sequential Year-Over- 4Q17 1Q18 2Q18 3Q18 4Q18 Growth Year Growth Property count 48 48 48 48 48 — — Investment $ 1,309,081 $ 1,313,562 $ 1,320,898 $ 1,327,420 $ 1,339,126 0.9 % 2.3 % Units 6,252 6,252 6,251 6,252 6,253 — % — % Occupancy % 89.4 89.0 87.9 87.2 87.1 (0.1%) (2.3%) REVPOR SHOP $ 3,952 $ 4,072 $ 4,118 $ 4,109 $ 4,071 (0.9%) 3.0 % Real Estate Revenues $ 66,138 $ 68,539 $ 67,943 $ 66,966 $ 66,628 (0.5%) 0.7% Operating Expenses (58,256) (1) (45,867) (46,873) (46,488) (49,017) 5.4 % (1) NOI $ 7,881 (1) $ 22,672 $ 21,070 $ 20,479 $ 17,611 (14.0%) (1) Cash Real Estate Revenues $ 66,261 $ 67,998 $ 67,887 $ 67,193 $ 66,520 (1.0%) 0.4 % Cash Operating Expenses (44,975) (45,084) (46,315) (46,372) (47,701) 2.9 % 6.1 % Cash NOI $ 21,286 $ 22,914 $ 21,572 $ 20,821 $ 18,818 (9.6%) (11.6%) Cash NOI Margin % 32.1 33.7 31.8 31.0 28.3 (2.7%) (3.8%) (1) Includes non-cash adjustments related to management contract terminations in conjunction with the Brookdale Transaction. Refer to the 4Q17 Earnings Release and Supplemental Report for additional information. 35

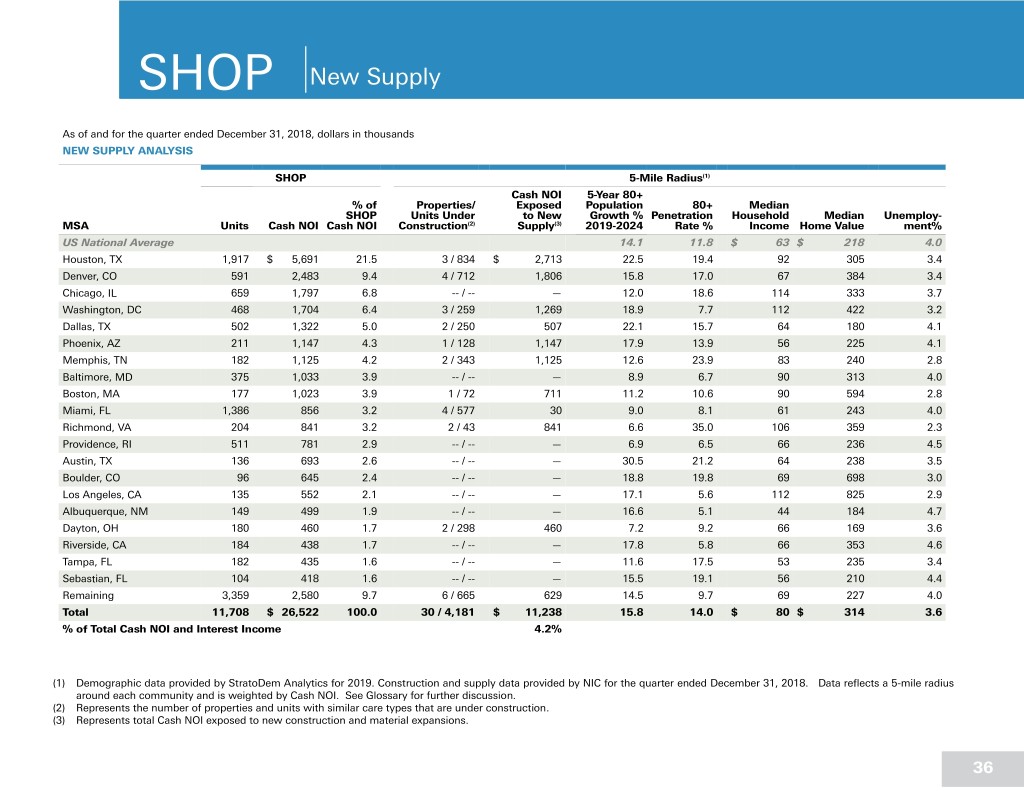

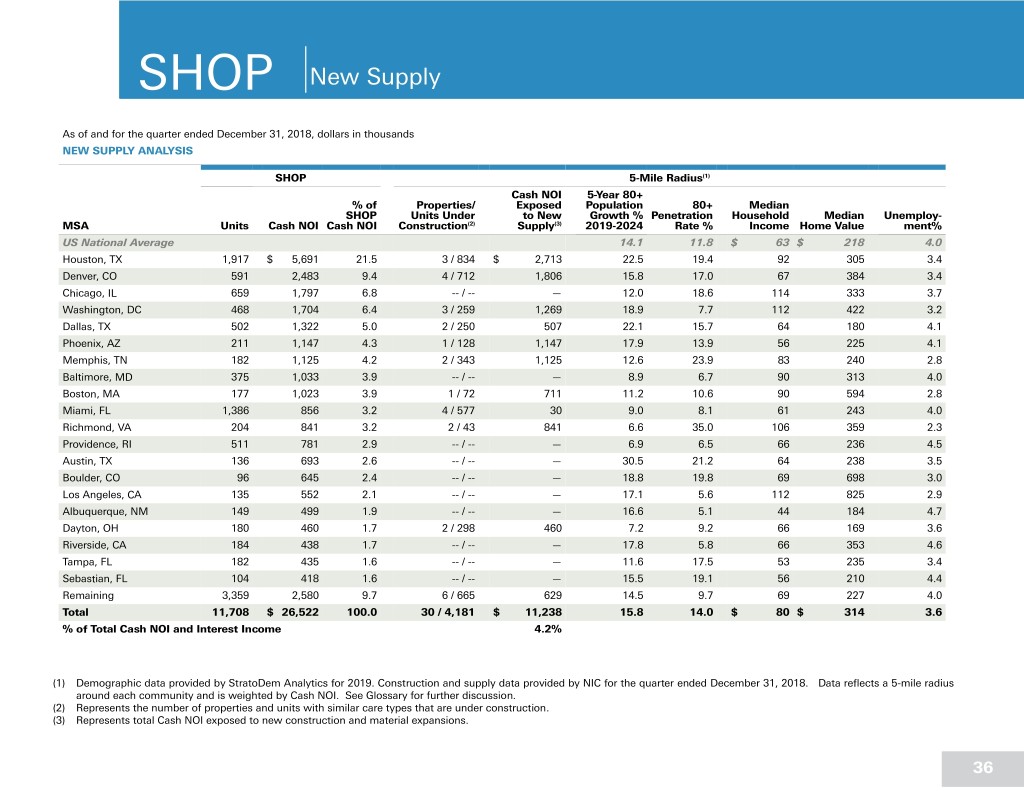

SHOP New Supply As of and for the quarter ended December 31, 2018, dollars in thousands NEW SUPPLY ANALYSIS SHOP 5-Mile Radius(1) Cash NOI 5-Year 80+ % of Properties/ Exposed Population 80+ Median SHOP Units Under to New Growth % Penetration Household Median Unemploy- MSA Units Cash NOI Cash NOI Construction(2) Supply(3) 2019-2024 Rate % Income Home Value ment% US National Average 14.1 11.8 $ 63 $ 218 4.0 Houston, TX 1,917 $ 5,691 21.5 3 / 834 $ 2,713 22.5 19.4 92 305 3.4 Denver, CO 591 2,483 9.4 4 / 712 1,806 15.8 17.0 67 384 3.4 Chicago, IL 659 1,797 6.8 -- / -- — 12.0 18.6 114 333 3.7 Washington, DC 468 1,704 6.4 3 / 259 1,269 18.9 7.7 112 422 3.2 Dallas, TX 502 1,322 5.0 2 / 250 507 22.1 15.7 64 180 4.1 Phoenix, AZ 211 1,147 4.3 1 / 128 1,147 17.9 13.9 56 225 4.1 Memphis, TN 182 1,125 4.2 2 / 343 1,125 12.6 23.9 83 240 2.8 Baltimore, MD 375 1,033 3.9 -- / -- — 8.9 6.7 90 313 4.0 Boston, MA 177 1,023 3.9 1 / 72 711 11.2 10.6 90 594 2.8 Miami, FL 1,386 856 3.2 4 / 577 30 9.0 8.1 61 243 4.0 Richmond, VA 204 841 3.2 2 / 43 841 6.6 35.0 106 359 2.3 Providence, RI 511 781 2.9 -- / -- — 6.9 6.5 66 236 4.5 Austin, TX 136 693 2.6 -- / -- — 30.5 21.2 64 238 3.5 Boulder, CO 96 645 2.4 -- / -- — 18.8 19.8 69 698 3.0 Los Angeles, CA 135 552 2.1 -- / -- — 17.1 5.6 112 825 2.9 Albuquerque, NM 149 499 1.9 -- / -- — 16.6 5.1 44 184 4.7 Dayton, OH 180 460 1.7 2 / 298 460 7.2 9.2 66 169 3.6 Riverside, CA 184 438 1.7 -- / -- — 17.8 5.8 66 353 4.6 Tampa, FL 182 435 1.6 -- / -- — 11.6 17.5 53 235 3.4 Sebastian, FL 104 418 1.6 -- / -- — 15.5 19.1 56 210 4.4 Remaining 3,359 2,580 9.7 6 / 665 629 14.5 9.7 69 227 4.0 Total 11,708 $ 26,522 100.0 30 / 4,181 $ 11,238 15.8 14.0 $ 80 $ 314 3.6 % of Total Cash NOI and Interest Income 4.2% (1) Demographic data provided by StratoDem Analytics for 2019. Construction and supply data provided by NIC for the quarter ended December 31, 2018. Data reflects a 5-mile radius around each community and is weighted by Cash NOI. See Glossary for further discussion. (2) Represents the number of properties and units with similar care types that are under construction. (3) Represents total Cash NOI exposed to new construction and material expansions. 36

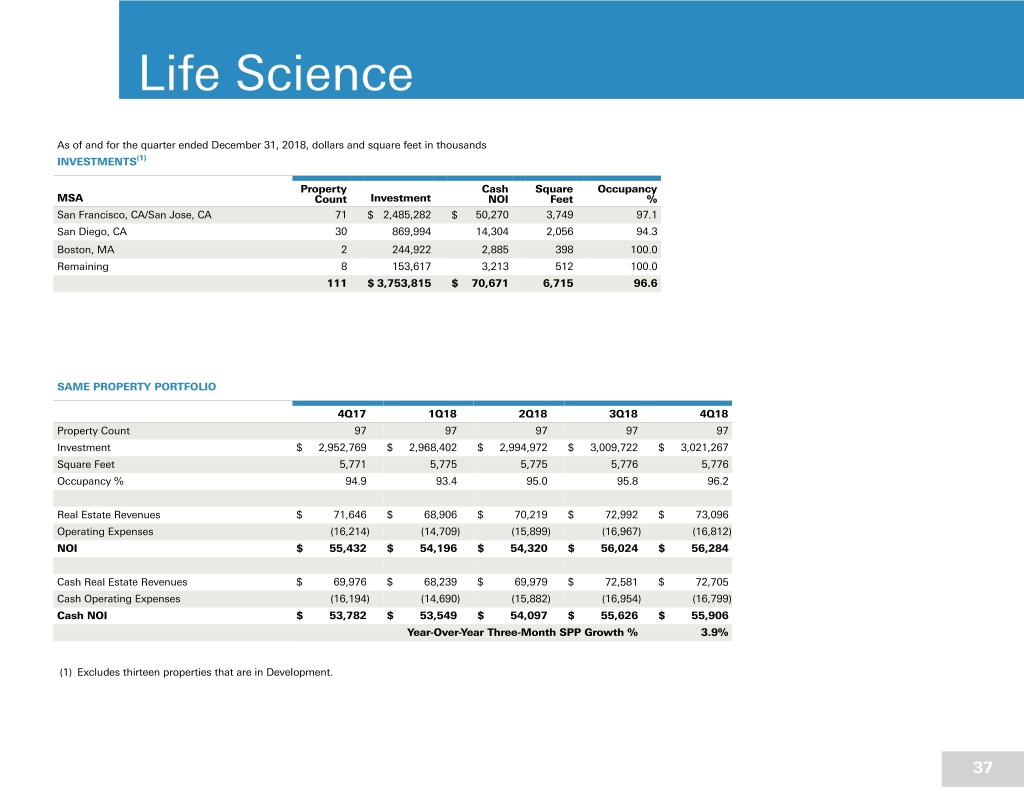

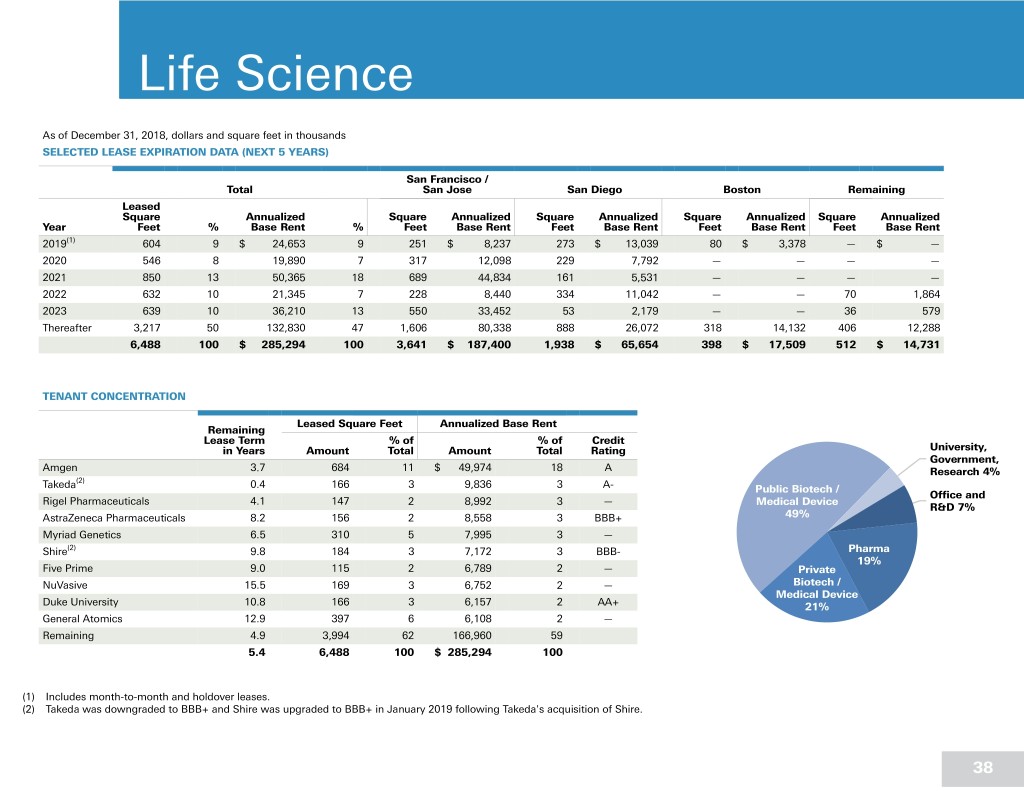

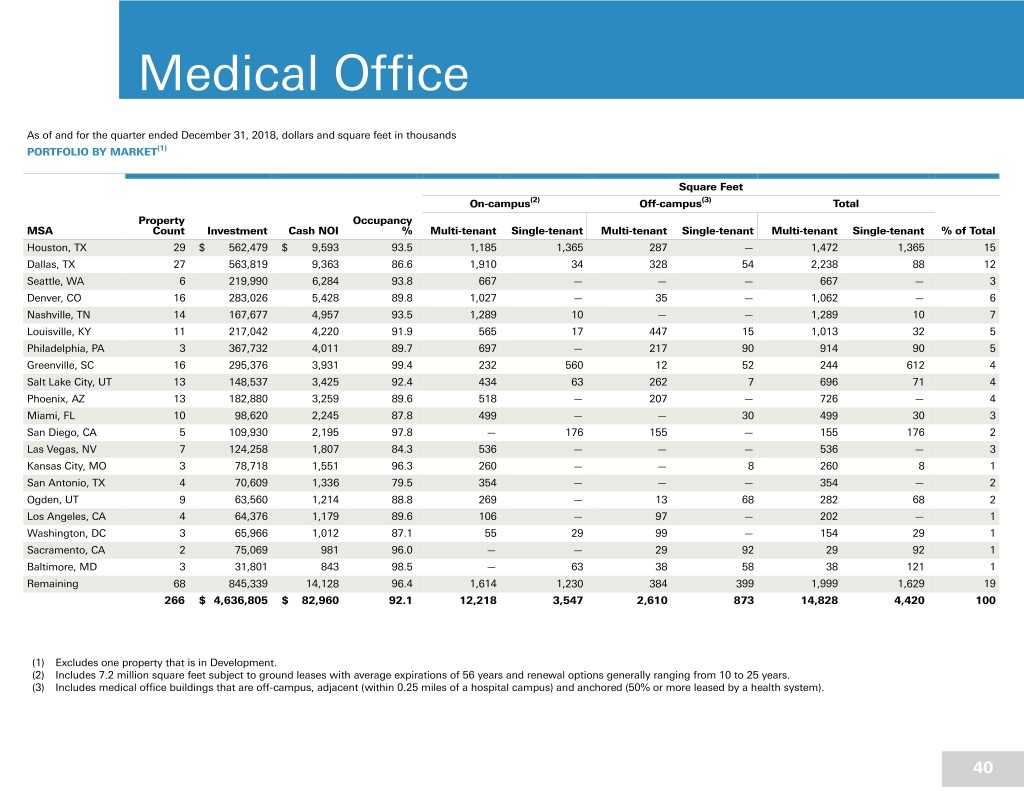

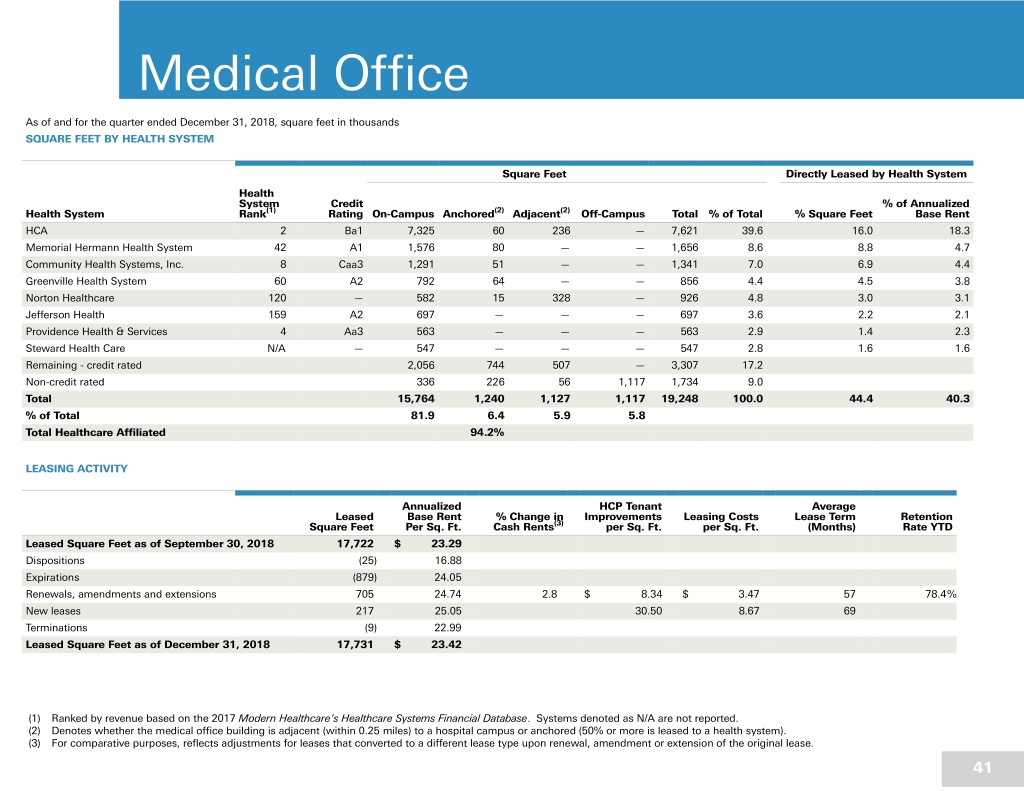

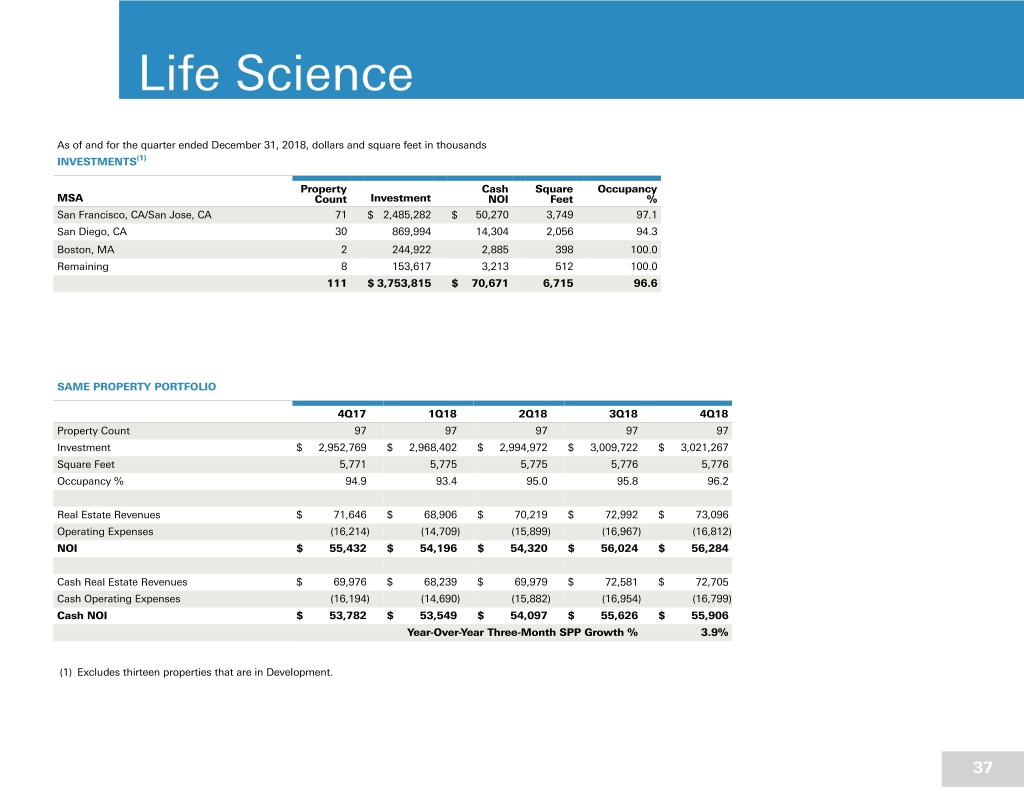

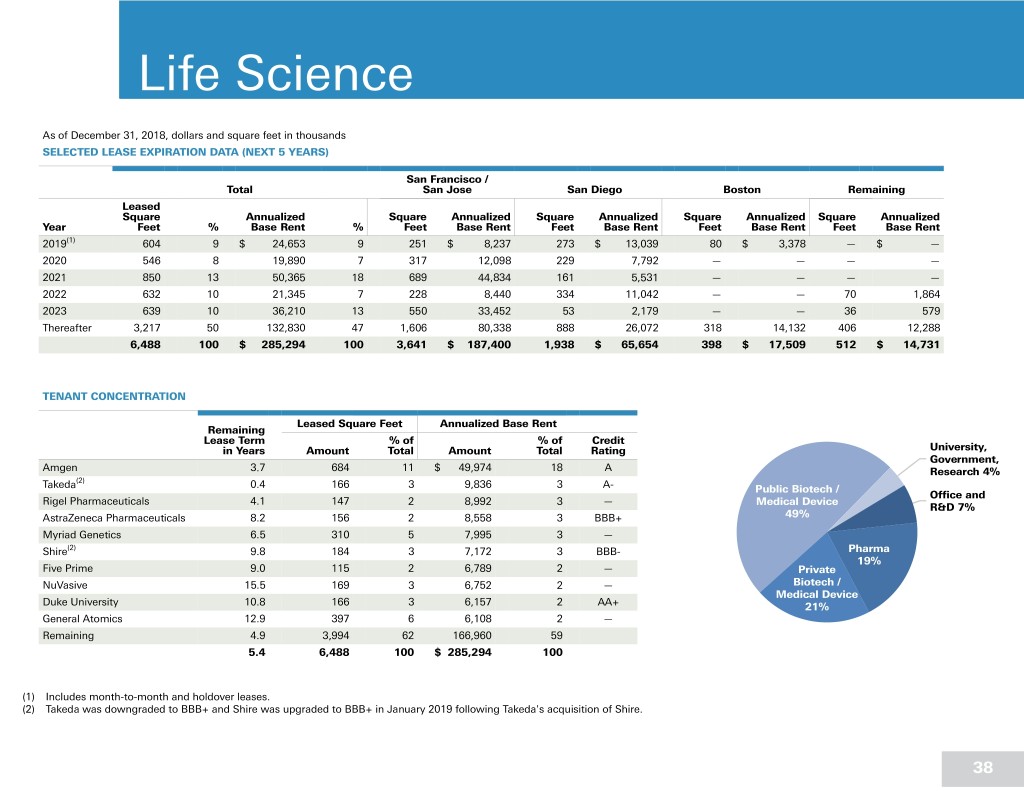

Life Science As of and for the quarter ended December 31, 2018, dollars and square feet in thousands INVESTMENTS(1) Property Cash Square Occupancy MSA Count Investment NOI Feet % San Francisco, CA/San Jose, CA 71 $ 2,485,282 $ 50,270 3,749 97.1 San Diego, CA 30 869,994 14,304 2,056 94.3 Boston, MA 2 244,922 2,885 398 100.0 Remaining 8 153,617 3,213 512 100.0 111 $ 3,753,815 $ 70,671 6,715 96.6 SAME PROPERTY PORTFOLIO 4Q17 1Q18 2Q18 3Q18 4Q18 Property Count 97 97 97 97 97 Investment $ 2,952,769 $ 2,968,402 $ 2,994,972 $ 3,009,722 $ 3,021,267 Square Feet 5,771 5,775 5,775 5,776 5,776 Occupancy % 94.9 93.4 95.0 95.8 96.2 Real Estate Revenues $ 71,646 $ 68,906 $ 70,219 $ 72,992 $ 73,096 Operating Expenses (16,214) (14,709) (15,899) (16,967) (16,812) NOI $ 55,432 $ 54,196 $ 54,320 $ 56,024 $ 56,284 Cash Real Estate Revenues $ 69,976 $ 68,239 $ 69,979 $ 72,581 $ 72,705 Cash Operating Expenses (16,194) (14,690) (15,882) (16,954) (16,799) Cash NOI $ 53,782 $ 53,549 $ 54,097 $ 55,626 $ 55,906 Year-Over-Year Three-Month SPP Growth % 3.9% (1) Excludes thirteen properties that are in Development. 37