INVESTOR PRESENTATION September 2019 Discovery Village at Palm Beach Gardens (Palm Beach Gardens, FL)

DISCLAIMERS This presentation is being presented solely for your information, is subject to change and speaks only as of the date hereof. This presentation is not complete and is only a summary of the more detailed information included elsewhere, including in our Securities and Exchange Commission (“SEC”) filings. No representation or warranty, expressed or implied is made and you should not place undue reliance on the accuracy, fairness or completeness of the information presented. FORWARD-LOOKING STATEMENTS Statements contained in this presentation, as well as statements made by management, that are not historical facts are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “may,” “will,” “project,” “expect,” “believe,” “intend,” “anticipate,” “seek,” “target,” “forecast,” “plan,” “potential,” “estimate,” “could,” “would,” “should” and other comparable and derivative terms or the negatives thereof. Forward- looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations. While forward-looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained. Further, we cannot guarantee the accuracy of any such forward-looking statement contained in this presentation, and such forward-looking statements are subject to known and unknown risks and uncertainties that are difficult to predict. These risks and uncertainties include, but are not limited to: HCP, Inc.’s (“HCP” or the “Company”) reliance on a concentration of a small number of tenants and operators for a significant percentage of its revenues and net operating income; the financial condition of the Company’s existing and future tenants, operators and borrowers, including potential bankruptcies and downturns in their businesses, and their legal and regulatory proceedings, which results in uncertainties regarding the Company’s ability to continue to realize the full benefit of such tenants’ and operators’ leases and borrowers’ loans; the ability of the Company’s existing and future tenants, operators and borrowers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and manage their expenses in order to generate sufficient income to make rent and loan payments to the Company and the Company’s ability to recover investments made, if applicable, in their operations; the Company’s concentration in the healthcare property sector, particularly in senior housing, life sciences and medical office buildings, which makes its profitability more vulnerable to a downturn in a specific sector than if the Company were investing in multiple industries; operational risks associated with third party management contracts, including the additional regulation and liabilities of RIDEA lease structures; the effect on the Company and its tenants and operators of legislation, executive orders and other legal requirements, including compliance with the Americans with Disabilities Act, fire, safety and health regulations, environmental laws, the Affordable Care Act, licensure, certification and inspection requirements, and laws addressing entitlement programs and related services, including Medicare and Medicaid, which may result in future reductions in reimbursements or fines for noncompliance; the Company’s ability to identify replacement tenants and operators and the potential renovation costs and regulatory approvals associated therewith; the risks associated with property development and redevelopment, including costs above original estimates, project delays and lower occupancy rates and rents than expected; the potential impact of uninsured or underinsured losses; the risks associated with the Company’s investments in joint ventures and unconsolidated entities, including its lack of sole decision making authority and its reliance on its partners’ financial condition and continued cooperation; competition for the acquisition and financing of suitable healthcare properties as well as competition for tenants and operators, including with respect to new leases and mortgages and the renewal or rollover of existing leases; the Company’s or its counterparties’ ability to fulfill obligations, such as financing conditions and/or regulatory approval requirements, required to successfully consummate acquisitions, dispositions, transitions, developments, redevelopments, joint venture transactions or other transactions; the Company’s ability to achieve the benefits of acquisitions or other investments within expected time frames or at all, or within expected cost projections; the potential impact on the Company and its tenants, operators and borrowers from current and future litigation matters, including the possibility of larger than expected litigation costs, adverse results and related developments; changes in federal, state or local laws and regulations, including those affecting the healthcare industry that affect the Company’s costs of compliance or increase the costs, or otherwise affect the operations, of its tenants and operators; the Company’s ability to foreclose on collateral securing its real estate-related loans; volatility or uncertainty in the capital markets, the availability and cost of capital as impacted by interest rates, changes in the Company’s credit ratings, and the value of its common stock, and other conditions that may adversely impact the Company’s ability to fund its obligations or consummate transactions, or reduce the earnings from potential transactions; changes in global, national and local economic and other conditions, including currency exchange rates; the Company’s ability to manage its indebtedness level and changes in the terms of such indebtedness; competition for skilled management and other key personnel; the Company’s reliance on information technology systems and the potential impact of system failures, disruptions or breaches; the Company’s ability to maintain its qualification as a real estate investment trust; and other risks and uncertainties described from time to time in the Company’s SEC filings. Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward-looking statements, which speak only as of the date on which they are made. The estimated stabilized cash capitalization rates and yield ranges included in this presentation are calculated by dividing projected cash net operating income (adjusting for the impact of upfront rental concessions) for the applicable properties by the aggregate purchase price or development cost, as applicable, for such properties. The estimated net contributions to FFO as adjusted included in this presentation are calculated as projected net operating income for the applicable properties, plus capitalized interest, less an imputed 5.5% cost of capital on cumulative development costs. The net operating income and cash net operating income projections used in these calculations are based on information currently available to us, including, in certain cases, information made available to us by third parties, and certain assumptions applied by us related to anticipated occupancy, rental rates, property taxes and other expenses over a specified period of time in the future based on historical data and the Company’s knowledge of and experience with this submarket. Newly acquired operating assets are generally considered stabilized at the earlier of lease-up (typically when the tenant(s) control(s) the physical use of at least 80% of the space) or 12 months from the acquisition date. Newly completed developments are considered stabilized at the earlier of lease-up or 24 months from the date the property is placed in service. The actual cash capitalization rates, yield ranges and contributions to FFO as adjusted for these properties may differ materially and adversely from the estimates included in this presentation based on numerous factors, including our difficulties achieving assumed occupancy and/or rental rates, development delays, unanticipated expenses not payable by a tenant, increases in the Company’s financing costs, tenant defaults, the results of our final purchase price allocation, as well as the risk factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2018 and our subsequent filings with the SEC. As such, we can provide no assurance that the actual cash capitalization rates, yield ranges and contributions to FFO as adjusted for these properties will be consistent with the estimates set forth in this presentation. Moreover, the 35 CambridgePark Drive acquisition remains subject to customary closing conditions. As such, we cannot assure you that the 35 CambridgePark Drive acquisition will be consummated on time or at all, nor can we assure you that if consummated, the property will perform to our expectations. MARKET AND INDUSTRY DATA This presentation also includes market and industry data that HCP has obtained from market research, publicly available information and industry publications. The accuracy and completeness of such information are not guaranteed. Such data is often based on industry surveys and preparers’ experience in the industry. Similarly, although HCP believes that the surveys and market research that others have performed are reliable, such surveys and market research is subject to assumptions, estimates and other uncertainties and HCP has not independently verified this information. NON-GAAP FINANCIAL MEASURES This presentation contains certain supplemental non-GAAP financial measures. While HCP believes that non-GAAP financial measures are helpful in evaluating its operating performance, the use of non-GAAP financial measures in this presentation should not be considered in isolation from, or as an alternative for, a measure of financial or operating performance as defined by GAAP. You are cautioned that there are inherent limitations associated with the use of each of these supplemental non-GAAP financial measures as an analytical tool. Additionally, HCP’s computation of non-GAAP financial measures may not be comparable to those reported by other REITs. You can find reconciliations of the non‐GAAP financial measures to the most directly comparable GAAP financial measures, to the extent available without unreasonable efforts, at “2Q 2019 Discussion and Reconciliation of Non-GAAP Financial Measures” on the Investor Relations section of our website at www.hcpi.com HCP, Inc. 2

TABLE OF CONTENTS 1. Introduction to HCP 4 - 10 2. Recent Investments 11 - 21 3. Development Overview 22 - 27 4. Segment Overviews A. Life Science 29- 32 B. Medical Office 33 - 38 C. Senior Housing 39 - 44 5. Balance Sheet & Sustainability 45 - 50 Appendix 51-52 HCP, Inc. 3

INTRODUCTION TO HCP HCP, Inc. The Cove and The Shore at Sierra Point | South San Francisco, CA

INTRODUCTION HCP at a glance DIVERSIFIED SCALE BALANCED PORTFOLIO 745 PROPERTIES 21 Million Sq. Ft. Medical Office $25 Billion in Enterprise Value(1) 8 Million Sq. Ft. Life Science $18 Billion in Market Cap(1) 27,200 Senior Housing Units HIGH-QUALITY PRIVATE PAY DIVERSIFIED INVESTMENT GRADE ESTABLISHED STRONG BALANCE SHEET 34 YEARS AS A PUBLIC COMPANY S&P: BBB+ (Stable) Member of S&P 500 Moody’s: Baa1 (Stable) 4.2% Dividend Yield(2) Fitch: BBB (Positive Outlook) ___________________________ 1. Enterprise value and market capitalization based on HCP’s share price of $35.35 on 09/05/19 and total consolidated debt and HCP’s share of unconsolidated JV debt as of 6/30/19. 2. Based on share price as of 09/05/19. HCP, Inc. 5

SENIOR LEADERSHIP TOM HERZOG President & Chief Executive Officer Mr. Herzog is our President and Chief Executive Officer, and a member of our Board of Directors. He became our Chief Executive Officer and a member of our Board in January 2017. From June 2016 to December 2016, Mr. Herzog served as our Executive Vice President and Chief Financial Officer, a role he formerly held from April 2009 to May 2011. Before joining HCP, he was Chief Financial Officer of UDR, Inc. from January 2013 until June 2016. Prior to joining UDR, Mr. Herzog served in various Chief Financial Officer and Chief Accounting Officer roles in the real estate industry, along with a decade at Deloitte & Touche LLP. SCOTT BRINKER Chief Investment Officer PETER SCOTT Chief Financial Officer Mr. Brinker is our EVP and Chief Investment Officer. In addition to Mr. Scott is our EVP and Chief Financial Officer and is responsible leading the Company’s investment activities, Mr. Brinker also for all aspects of the Company’s finance, treasury, tax, risk oversees our senior housing platform. Prior to HCP, Mr. Brinker management, and investor relations activities. Mr. Scott also most recently served as EVP and Chief Investment Officer at oversees our life science platform and sits on our Investment Welltower from July 2014 to January 2017. Prior to that, he served as Committee. Prior to joining HCP in 2017, he served as Managing Welltower’s EVP of Investments from January 2012 to July 2014. Director in the Real Estate Banking Group of Barclays from 2014 to From July 2001 to January 2012, he served in various investment and 2017. His experience also includes various positions of increasing portfolio management related capacities with Welltower. responsibility at the financial services firms Credit Suisse from 2011 to 2014, Barclays from 2008 to 2011 and Lehman Brothers from 2002 to 2008. TOM KLARITCH Chief Operating Officer & TROY McHENRY General Counsel & Corporate Secretary Chief Development Officer Mr. McHenry is our EVP, General Counsel and Corporate Secretary Mr. Klaritch is our EVP, Chief Operating Officer and Chief and serves as the Chief Legal Officer. He is responsible for providing Development Officer. He oversees the Company’s medical office oversight and a legal perspective for the Company’s real estate and platform, working closely with the team to advance competitive financing transactions, litigation, as well as corporate governance performance and growth. He also oversees the management of HCP’s and SEC/NYSE compliance. He previously served as SVP – Legal and development and redevelopment projects. Prior to his current role, HR from July 2013 to February 2016, as well as other legal related Mr. Klaritch served as Senior Managing Director – Medical Office capacities since December 2010. Prior to HCP, Mr. McHenry held Properties from April 2008 to August 2017. Mr. Klaritch has over 35 various legal leadership roles with MGM Resorts International, Boyd years of operational and financial management experience in the Gaming Corp., and DLA Piper. medical office and hospital sectors. HCP, Inc. 6

THE OPPORTUNITY HCP has a significant pipeline for future growth U.S. HEALTHCARE REAL ESTATE(1) HCP’s PRO FORMA PORTFOLIO INCOME(2)(3) Other owners of healthcare real estate Medical Office Senior Housing 30% 31% $1.1 $25B HCP Trillion Enterprise Other Value public REITs Other, 11% Life Science 28% ___________________________ 1. Source: National Investment Center for Seniors Housing & Care (NIC), HCP research as of 6/30/2019. 2. Portfolio income represents Cash NOI plus interest income plus our pro rata share of Cash NOI from our unconsolidated JVs. 3. Includes pro forma adjustments to reflect previously announced asset sales, the sale of our U.K. holdings, asset transitions from senior housing triple-net/other to SHOP, the July 2019 acquisitions of The Hartwell Innovation Campus and the five property Oakmont Senior Living (“Oakmont”) portfolio, and the pending acquisition of 35 CambridgePark Drive. Portfolio income is further adjusted to reflect acquisitions, dispositions and operator transitions as if they occurred on the first day of the second quarter. Please see appendix for pro forma reconciliation. HCP, Inc. 7

HCP’S PORTFOLIO & STRATEGY OVERVIEW Strategic growth initiatives across segments As Baby Boomers Age, They Will Continue to Seek… Senior Housing communities Outpatient services and specialist New and innovative drugs, offering social activities, daily doctor visits performed more treatments, and healthcare living assistance, and efficiently in a Medical Office devices, which will be created in coordination with outside building setting our Life Science portfolio healthcare providers Parker Adventist Denver, CO The Cove San Francisco, CA Oakmont Whittier Los Angeles MSA . Grow relationships with top . Focus on the three major Life . Focus on locations with strong hospitals and health systems Science markets demographics . Pursue on-campus and select off- . Assemble clusters of assets . Aligned management contracts campus assets with strong hospitals through acquisitions, with top-tier operating partners and health systems in relevant development, and redevelopment . Active asset management markets . Grow existing relationships by including redevelopment and . Redevelop portions of our older, on- providing expansion opportunities capital recycling campus portfolio to our tenants HCP, Inc. 8

WHAT DIFFERENTIATES HCP • High-quality portfolio with a balanced emphasis on Medical Office, Life Science, and Senior Housing real estate • ~58% of portfolio NOI(1)(2) from on-campus Medical Office portfolio and premier Life Science properties, primarily in San Francisco, San Diego, and Boston • ~37% of portfolio NOI(1)(2) from a diversified senior housing portfolio that is being transformed to capture upside • $1.1 billion development pipeline that is over 55% pre-leased • Deep relationships with industry leading operating partners, health systems, and life science tenants • Investment grade balance sheet with ample liquidity • Global leader in sustainability Briargate MOB Colorado Springs, CO The Shore (Rendering) San Francisco, CA ___________________________ 1. Portfolio NOI represents Cash NOI plus interest income plus our pro rata share of Cash NOI from our unconsolidated JVs as of 6/30/2019. 2. Includes pro forma adjustments to reflect previously announced asset sales, the sale of our U.K. holdings, asset transitions from senior housing triple-net/other to SHOP, the July 2019 acquisitions of The Hartwell Innovation Campus and the five property Oakmont portfolio, and the pending acquisition of 35 CambridgePark Drive. Portfolio income is further adjusted to reflect acquisitions, dispositions and operator transitions as if they occurred on the first day of the quarter. Please see appendix for pro forma reconciliation. HCP, Inc. 9

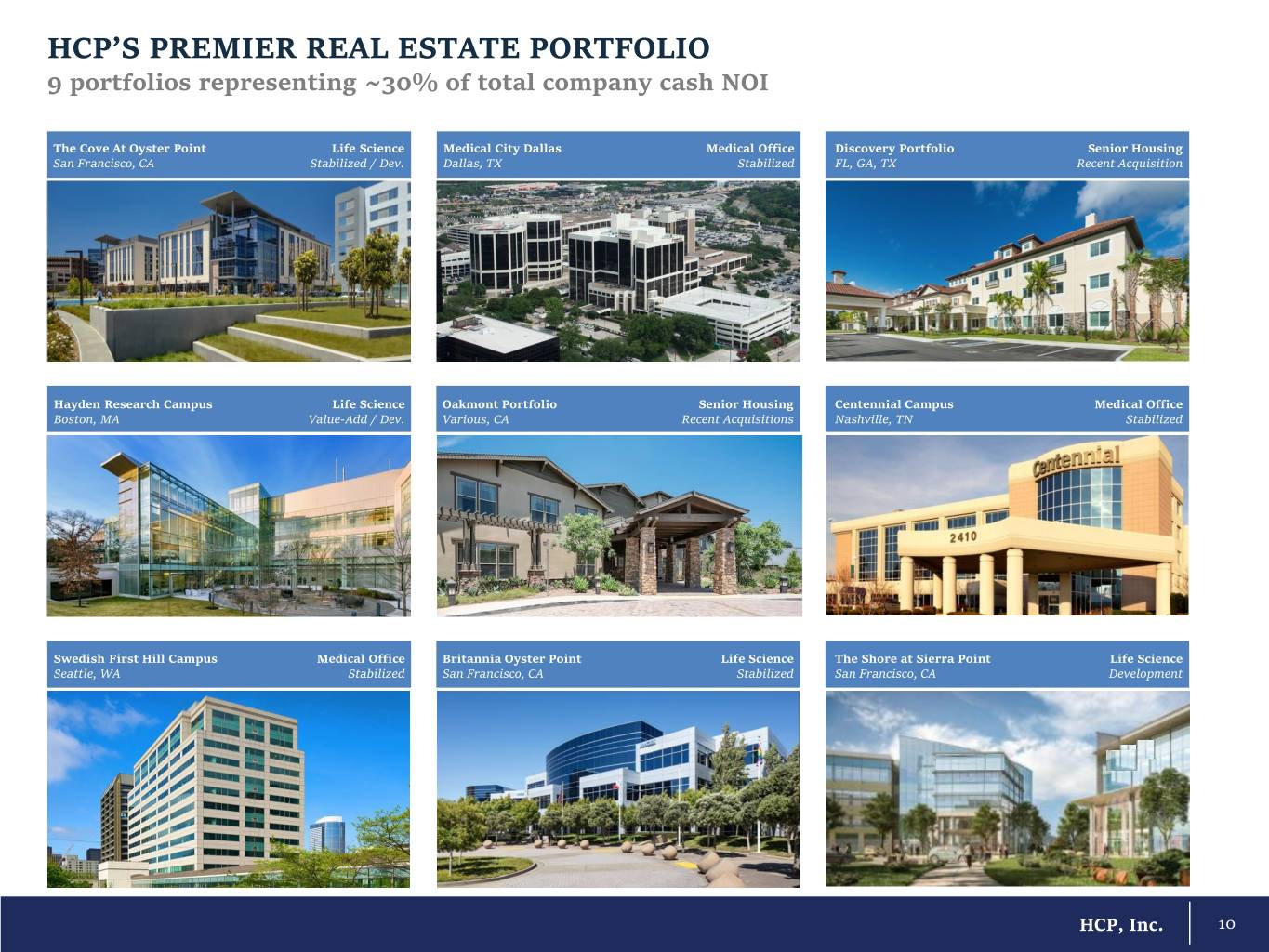

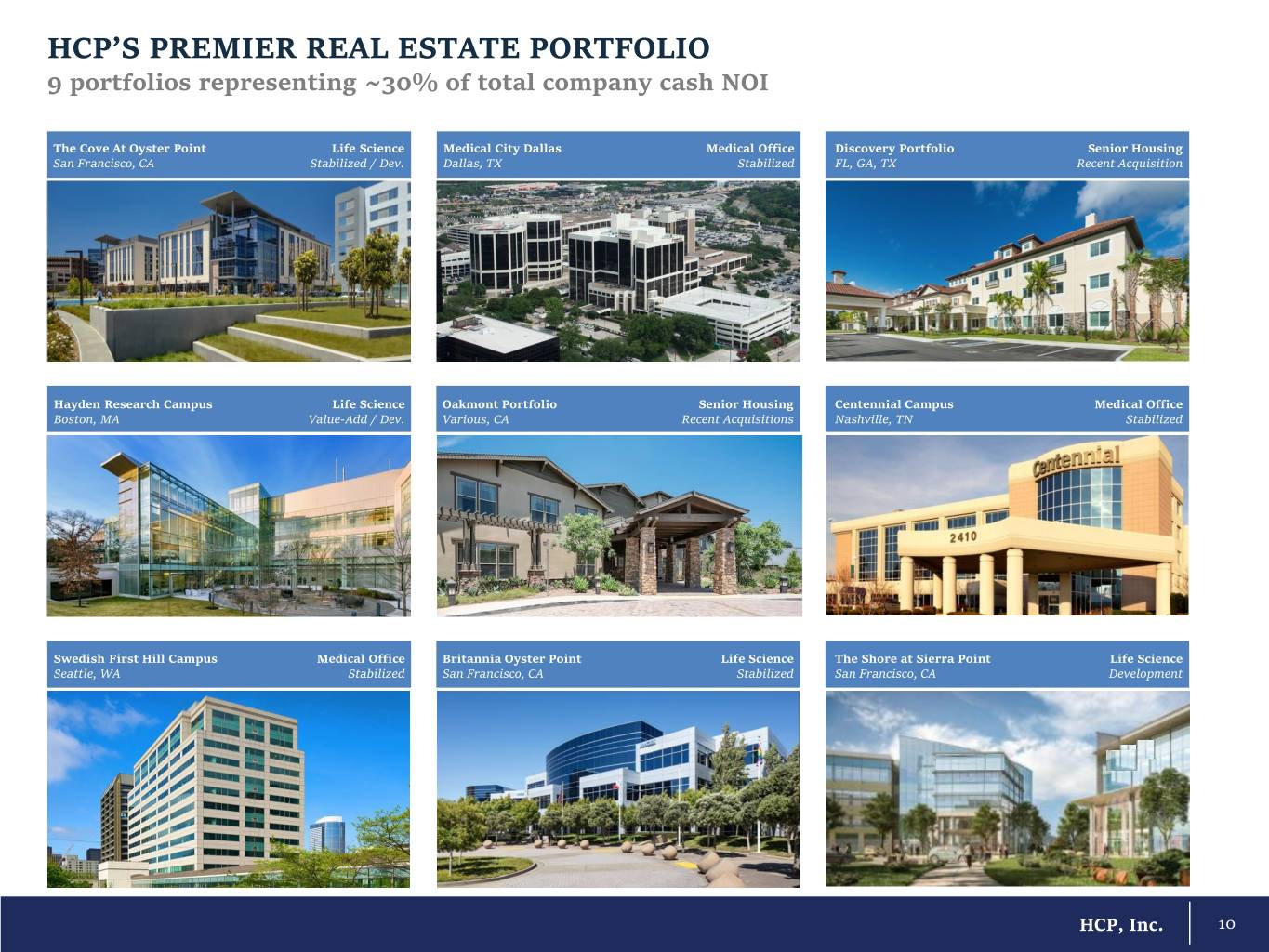

HCP’S PREMIER REAL ESTATE PORTFOLIO 9 portfolios representing ~30% of total company cash NOI The Cove At Oyster Point Life Science Medical City Dallas Medical Office Discovery Portfolio Senior Housing San Francisco, CA Stabilized / Dev. Dallas, TX Stabilized FL, GA, TX Recent Acquisition Hayden Research Campus Life Science Oakmont Portfolio Senior Housing Centennial Campus Medical Office Boston, MA Value-Add / Dev. Various, CA Recent Acquisitions Nashville, TN Stabilized Swedish First Hill Campus Medical Office Britannia Oyster Point Life Science The Shore at Sierra Point Life Science Seattle, WA Stabilized San Francisco, CA Stabilized San Francisco, CA Development B L D G . A HCP, Inc. 10

RECENT INVESTMENTS HCP, Inc. The Hartwell Innovation Campus | Lexington, MA

GROWING OUR BALANCED PORTFOLIO OF HIGH-QUALITY ASSETS Recent Transactions Transaction Rationale $333M pending acquisition of 35 Increasing density in our core markets CambridgePark Drive (Boston) Capturing scale to satisfy demand from growing $228M acquisition of four-building tenants Hartwell Innovation Campus Life Science Expanding HCP’s partnership with leading local life (Boston) science operator King Street Properties and new Delivery of $250M development of relationship with The Davis Companies The Cove Phase III (SSF) bringing total delivery of The Cove to ~$700M Attractive total returns $284M acquisition of five recently- Investing in modern, highly-amenitized communities built properties operated by in high-barrier markets Oakmont Expanding relationship with top tier operating Senior Housing $274M disposition of direct partner financing lease interests in 13-non- Attractive total returns core properties Recycle capital out of non-core properties $109M in total estimated investment Proprietary development program sourced through in five developments through HCA strong relationship Healthcare (“HCA”) development Significant pre-leasing with HCA (50-70%) program totaling 373,000 SF Medical Office Attractive stabilized return on cost and total returns Expect $70-$100M per year of MOB developments with HCA, the country’s premier for-profit health system HCP, Inc. 12

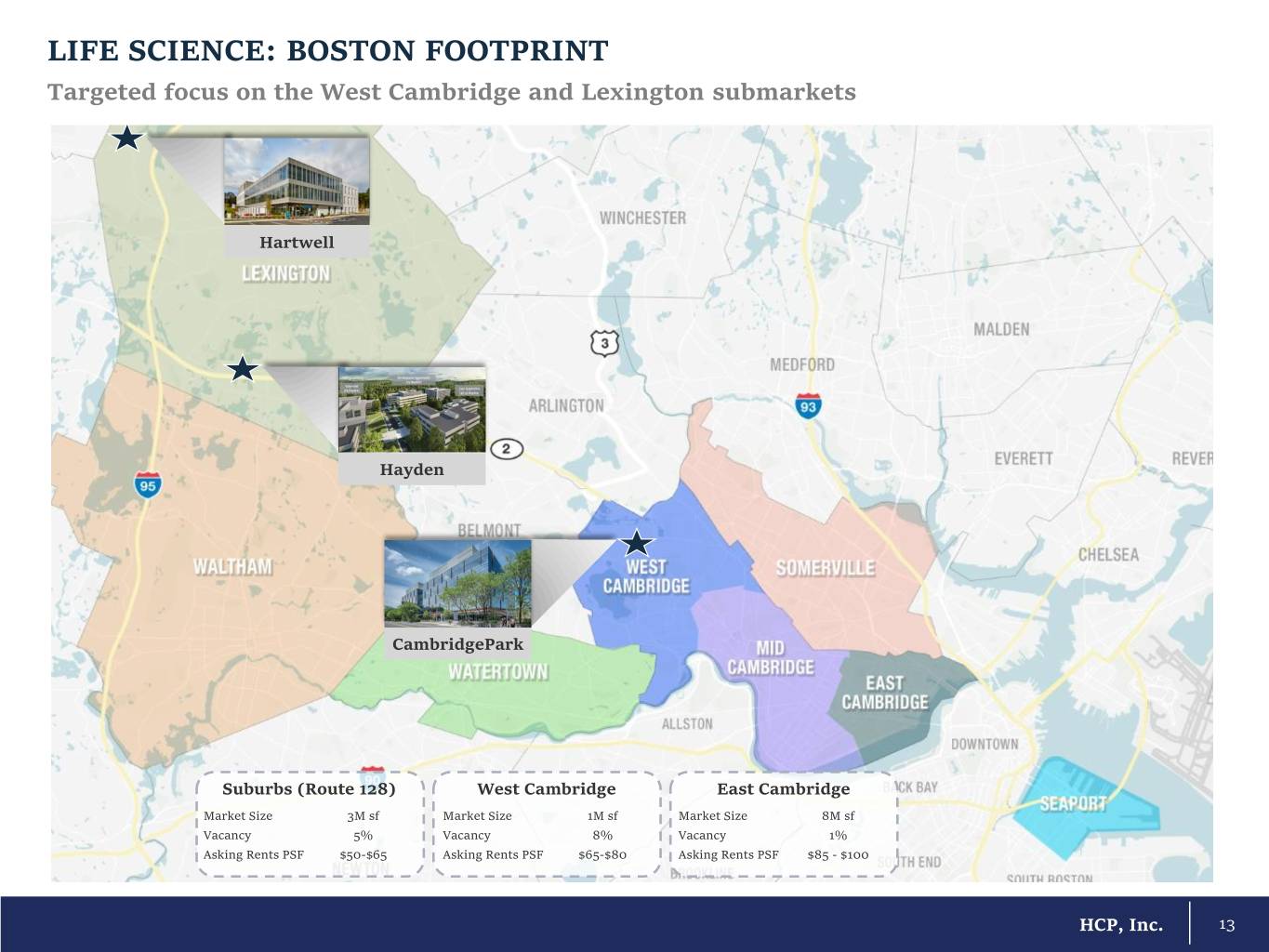

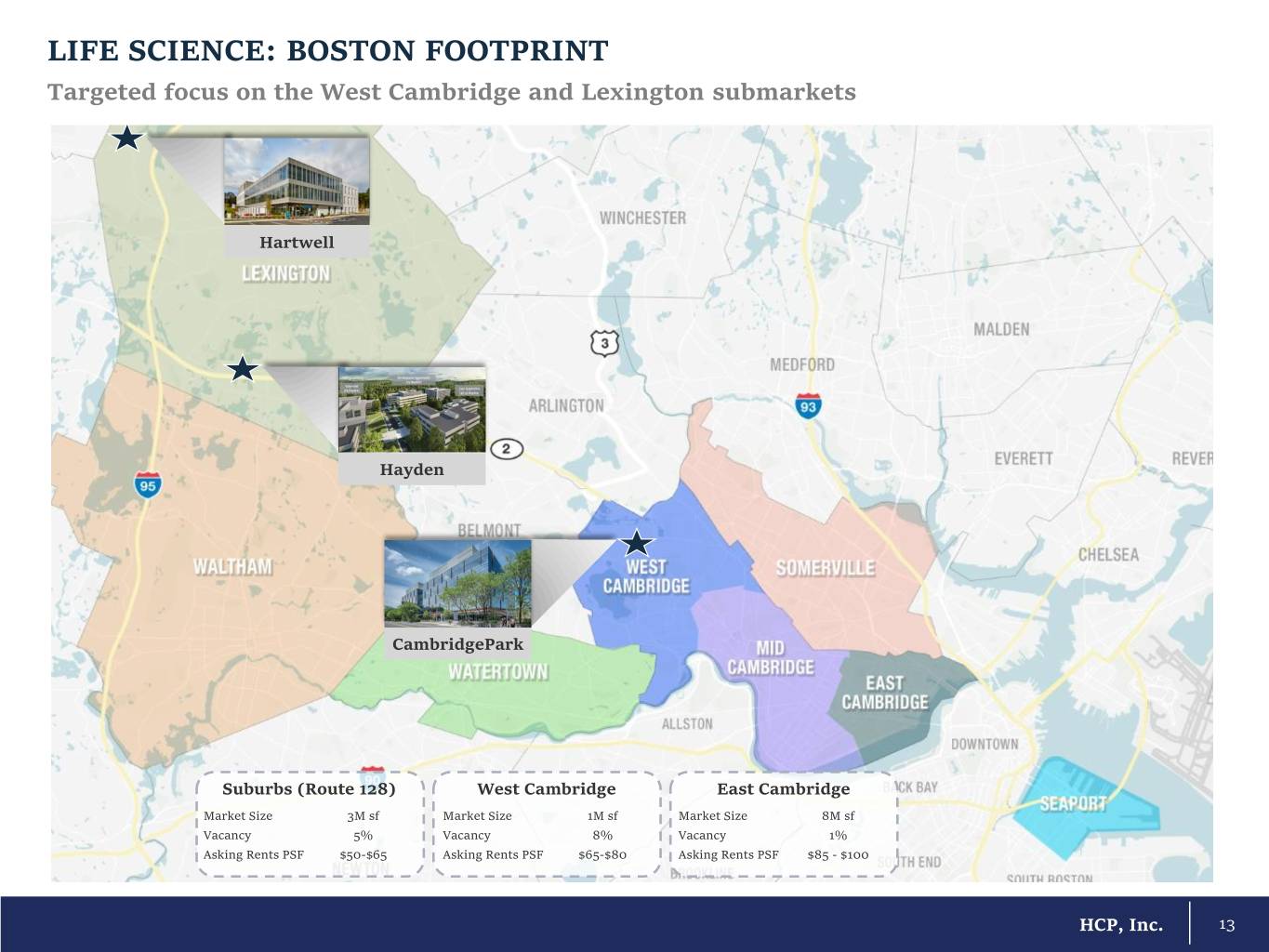

LIFE SCIENCE: BOSTON FOOTPRINT Targeted focus on the West Cambridge and Lexington submarkets Hartwell Hayden CambridgePark Suburbs (Route 128) West Cambridge East Cambridge Market Size 3M sf Market Size 1M sf Market Size 8M sf Vacancy 5% Vacancy 8% Vacancy 1% Asking Rents PSF $50-$65 Asking Rents PSF $65-$80 Asking Rents PSF $85 - $100 HCP, Inc. 13

LIFE SCIENCE: BOSTON PORTFOLIO In less than two years since re-entry into the Boston market, HCP has expanded to three core campuses with more than 1.3M square feet at an average stabilized yield of 6%+(1) HARTWELL HAYDEN CAMPUS CAMBRIDGEPARK DRIVE CAMPUS CAMPUS 45-55-65 75 Hayden Hartwell 101 CPD 35 CPD 87 CPD Combined Hayden (Active Dev.) Innovation Campus (Future Dev.) (Under Contract) Acquisition / Q4 2017 Q4 2020 Q3 2019 Q1 2019 2022+ Q4 2019 Completion Date (est. completion) (est. completion) (est. close) # of Properties 3 1 4 1 1 1 11 Stabilized & Opportunistic Opportunistic Investment Type Stabilized Stabilized Stabilized Value Add Development Development Square Feet 397K 214K 277K 64K ±150K 224K 1.3M % Leased 100% -- 100% 100% -- 100% 100% Purchase Price / $228M $160M $228M $71M $150M - $175M $333M $1.2B Total Cost Stabilized Yield(1) 6.5% 7.5% - 8.0% 5.3% 6.0% 7.0% - 8.0% 4.8% 6%+ ___________________________ 1. See “Disclaimers” on page 2 for information on how we calculate estimated cash capitalization rate, yield and stabilization. HCP, Inc. 14

LIFE SCIENCE: CAMBRIDGEPARK DRIVE CAMPUS Created a West Cambridge footprint through a series of strategic investments CAMPUS OVERVIEW HCP has executed a targeted expansion strategy, creating a scalable footprint in West Cambridge expected to reach 440K contiguous square feet through the following three strategic investments: Acquisition of 87 CambridgePark Drive, 64K square feet (100% leased) for $71M in January 2019 Acquisition of a development site at 101 CambridgePark Drive for a price up to $26.5M including a potential future earn-out in February 2019 Entered into a binding contract for the acquisition of 35 CambridgePark Drive, 224K square feet (100% leased) for $332.5M The weighted average stabilized yield of these investments is in the mid-t0-high 5’s(1) R&D rich life science destination in a highly sought after, transit oriented submarket Expansion of HCP’s strategic partnership with leading local life science owner / operator King Street Properties and new relationship with The Davis Companies Parking Structure 35 CPD 87 CPD 101 CPD ___________________________ 1. See “Disclaimers” on page 2 for information on how we calculate estimated cash capitalization rate, yield and stabilization. HCP, Inc. 15

LIFE SCIENCE: EXPANSION OF CAMBRIDGEPARK DRIVE CAMPUS LEED Gold® property ACQUISITION OVERVIEW TRANSACTION RATIONALE Entered into a binding contract to acquire a 100% fee simple interest in a Highly strategic location; creating a scalable 224K square foot, five-story lab and R&D building located in West Cambridge, CambridgePark Drive cluster with up to 440K of MA for $332.5M contiguous square feet Represents a 4.8% cash capitalization rate and 5.7% on a GAAP basis(1) State-of-the-art build quality; LEED Gold® certified The building reached shell completion in late 2018 with tenant build-outs Long-term in-place leases and no capital needs for expected to be completed by Q1 2020 foreseeable future 100% leased to five tenants with a weighted average lease term of over 10 Modern on-site amenities, indoor / outdoor community years and weighted average annual escalators of 3% spaces and street level retail Next door to HCP’s 87 and 101 CambridgePark Drive properties Delivers on strategy to grow presence in Boston Established a new property management partnership with highly reputable local owner / operator, The Davis Companies Expands strategic local partnerships ___________________________ 1. See “Disclaimers” on page 2 for information on how we calculate estimated cash capitalization rate, yield and stabilization. HCP, Inc. 16

LIFE SCIENCE: THE HARTWELL INNOVATION CAMPUS Core life science campus of scale in a premier suburban lab cluster CAMPUS OVERVIEW In July 2019, completed the accretive acquisition of The Hartwell Innovation Campus for $228M which represents a 5.3% year one cash capitalization rate and ~6.5% GAAP capitalization rate(1) The four-building, 277K square foot life science campus is located in the suburban Boston submarket of Lexington, MA Five minutes from HCP’s Hayden Research Campus and directly adjacent to MIT’s Lincoln Laboratories Campus features a recently constructed food and beverage pavilion offering a well amenitized urban feel in a suburban environment Dynamic tenant roster, 100% leased to seven biopharmaceutical and medical diagnostic tenants with seven years of weighted average lease term remaining Strategically expands partnership with leading local life science operator King Street Properties ___________________________ 1. See “Disclaimers” on page 2 for information on how we calculate estimated cash capitalization rate, yield and stabilization. HCP, Inc. 17

LIFE SCIENCE: THE HAYDEN RESEARCH CAMPUS Premier research and innovation campus in suburban Boston CAMPUS OVERVIEW 45, 55 and 65 Hayden (397K square feet) were acquired in December 2017 for $228M which represented a 6.5% stabilized cash capitalization rate(1) The development rights for 75 Hayden were acquired in March 2018 for $21M Executed on value-add strategy and campus repositioning to bring occupancy from 66% at acquisition to 100% today Tenant roster includes leading biopharmaceutical players such as Shire/Takeda and Merck Launched 214K square foot new development at 75 Hayden in the second quarter of 2018 (est. delivery in 2020), expected to generate a stabilized yield between 7.5% and 8%(1) Upon completion of 75 Hayden, the campus will provide ±600K total square feet of fully-amenitized, state-of-the-art Class A office and lab The Hayden Campus represented HCP’s initial transaction with local partner, King Street Properties, which grew to include CambridgePark Drive and Hartwell 65 Hayden 75 Hayden Parking Structure 45 - 55 Hayden ___________________________ 1. See “Disclaimers” on page 2 for information on how we calculate estimated cash capitalization rate, yield and stabilization. HCP, Inc. 18

SENIOR HOUSING ACQUISITIONS: OAKMONT SENIOR LIVING High-quality, recently-built communities in high-barrier markets with a best-in-class operator July 2019 May 2019 Combined Purchase Price $284M $113M $397M Mid-5% range Mid-5% range Cap Rate Mid 5-% range (year one)(1) (year one)(1) 5 3 # of Properties 8 AL/MC Oakmont prototypes AL/MC Oakmont prototypes Units 430 200 630 Huntington Beach, Los Angeles, San Jose, Location High-quality markets San Francisco / Bay Area, Sacramento Avg Age <2 years 3 years <3 years Fair Oaks Mariner Point Sacramento MSA San Francisco MSA ___________________________ 1. See “Disclaimers” on page 2 for information on how we calculate estimated cash capitalization rate and stabilization. HCP, Inc. 19

SENIOR HOUSING ACQUISITIONS: DISCOVERY SENIOR LIVING High-quality, recently-built communities with attractive future rights to grow our relationship with a top-tier operator TRANSACTION OVERVIEW FUTURE RIGHTS Purchase Price $445M 4 “Discovery Village” senior housing development properties: Low-4% (initial), 2 properties underway (development cost per unit on the Cap Rate ~6% (stabilized)(1) most recent project of $370K compares favorably to our 9 acquisition cost basis of $360K per unit on the 9-property # of Properties “Discovery Village” IL/AL/MC campuses acquisition) Units 1,242 2 properties to commence construction in 2019 / 2020 Fixed price purchase options aggregating ~$300M at 6.25% Florida (7), Georgia (1), Location cap rate at stabilization Texas (1) ROFO on future “Discovery Village” IL/AL/MC campuses within Avg Age 3 years certain geographic markets Discovery Village at Palm Beach Gardens Discovery Village at Naples Palm Beach Gardens, FL Naples, FL ___________________________ 1. See “Disclaimers” on page 2 for information on how we calculate estimated cash capitalization rate, yield and stabilization. HCP, Inc. 20

MEDICAL OFFICE: GROWING OUR HCA DEVELOPMENT PROGRAM Grand Strand Lee’s Summit Brentwood Ogden Oak Hill • Myrtle Beach, SC • Kansas City, MO • Nashville, TN • Ogden, UT • Tampa, FL • 90,000 SF • 52,000 SF • 119,000 SF • 70,000 SF • 42,000 SF • $26M estimated • $16M estimated total • $37M estimated • $18M estimated • $12M estimated total total cost cost total cost total cost cost • 71% pre-leased to • 50% pre-leased to • 49% pre-leased to • 66% pre-leased to • 55% pre-leased to HCA HCA HCA HCA HCA Partnering with HCA, the country’s leading for-profit health system, to build on-campus medical office buildings at stabilized yields in the 7.0%-7.5% range(1) ___________________________ 1. See “Disclaimers” on page 2 for information on how we calculate estimated cash capitalization rate, yield and stabilization. HCP, Inc. 21

DEVELOPMENT OVERVIEW HCP, Inc. 75 Hayden (Rendering)| Boston, MA

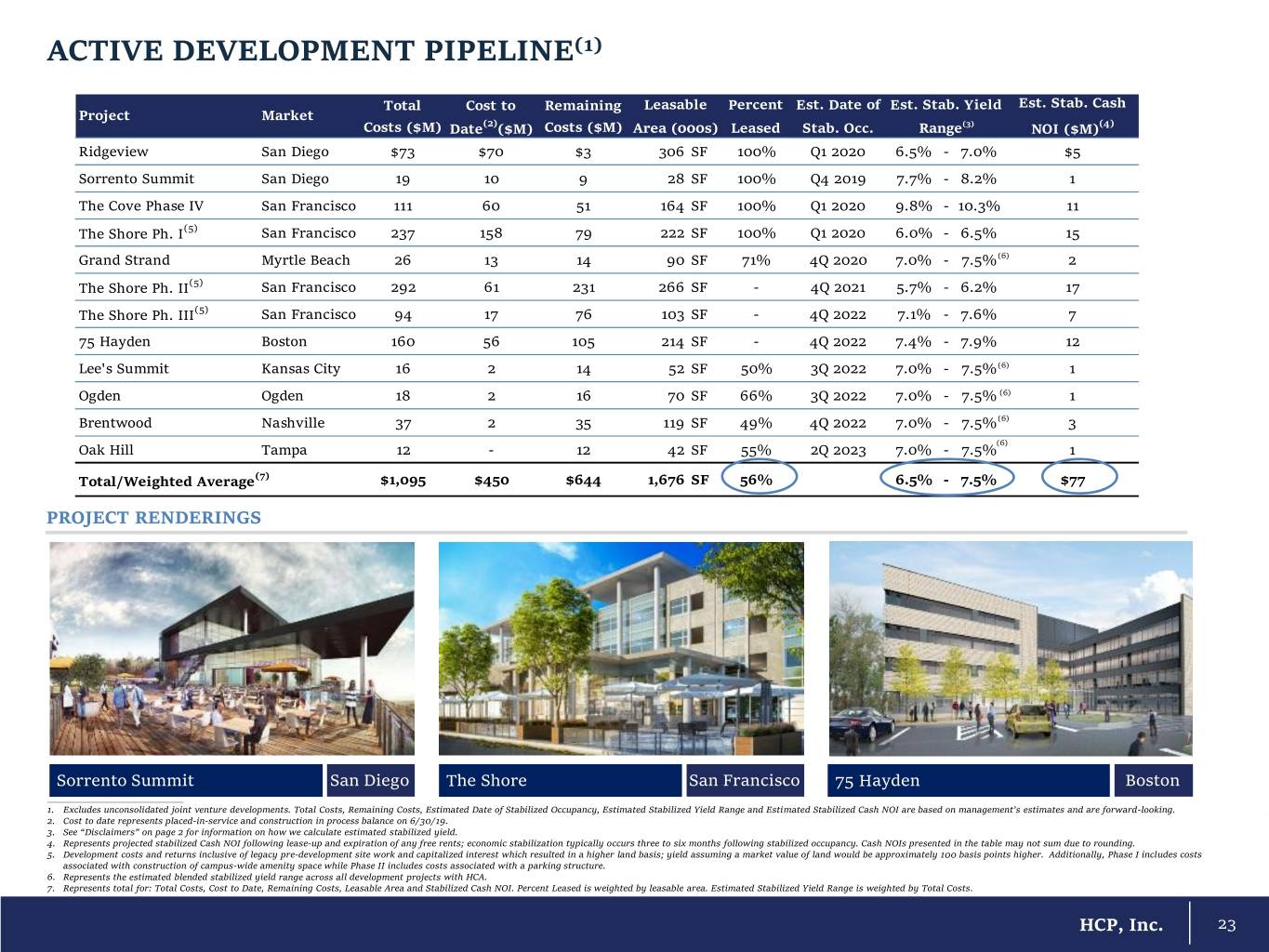

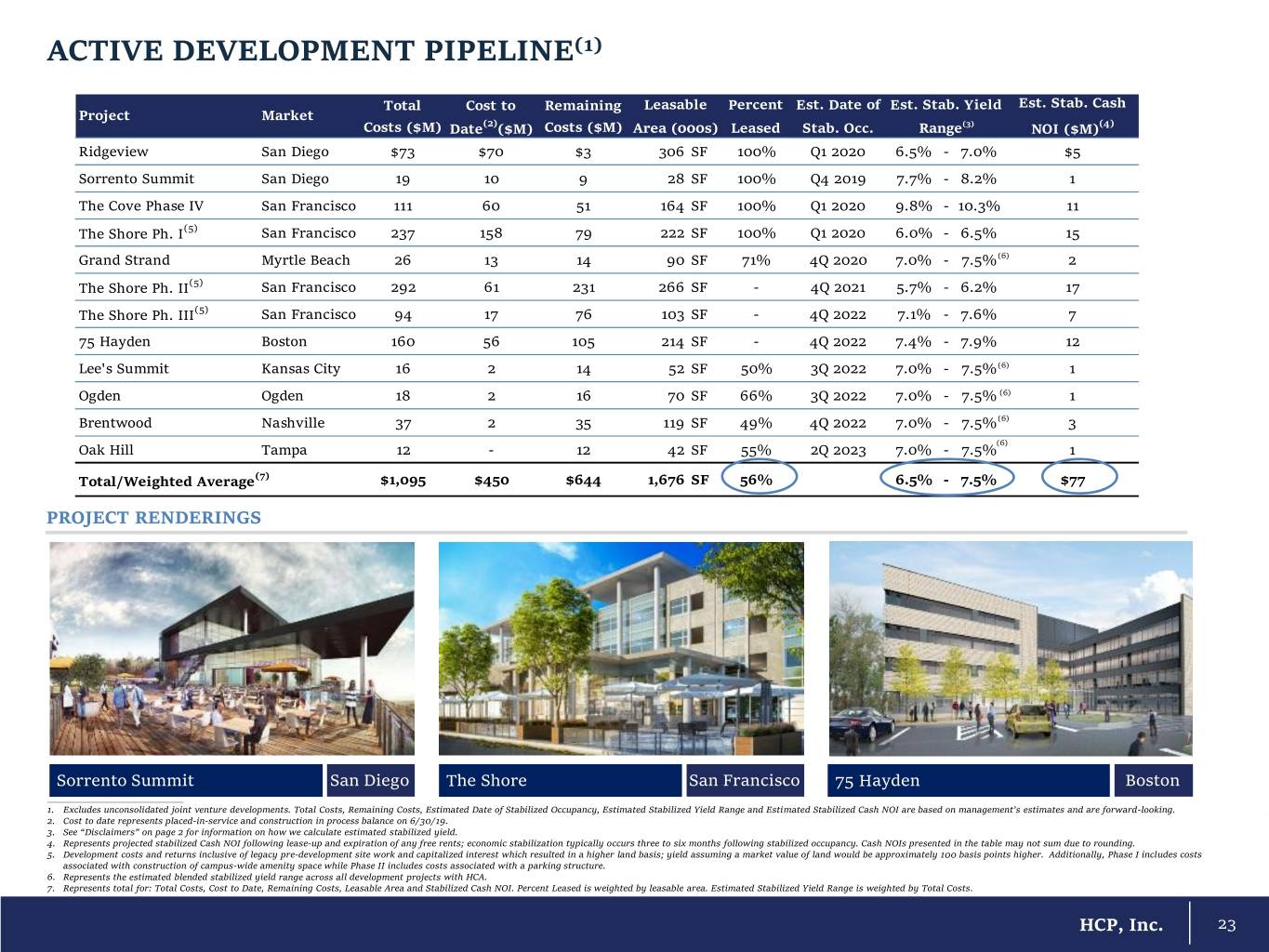

ACTIVE DEVELOPMENT PIPELINE(1) Total Cost to Remaining Leasable Percent Est. Date of Est. Stab. Yield Est. Stab. Cash Project Market Costs ($M) Date(2)($M) Costs ($M) Area (000s) Leased Stab. Occ. Range(3) NOI ($M)(4) Ridgeview San Diego $73 $70 $3 306 SF 100% Q1 2020 6.5% - 7.0% $5 Sorrento Summit San Diego 19 10 9 28 SF 100% Q4 2019 7.7% - 8.2% 1 The Cove Phase IV San Francisco 111 60 51 164 SF 100% Q1 2020 9.8% - 10.3% 11 The Shore Ph. I(5) San Francisco 237 158 79 222 SF 100% Q1 2020 6.0% - 6.5% 15 Grand Strand Myrtle Beach 26 13 14 90 SF 71% 4Q 2020 7.0% - 7.5%(6) 2 The Shore Ph. II(5) San Francisco 292 61 231 266 SF - 4Q 2021 5.7% - 6.2% 17 The Shore Ph. III(5) San Francisco 94 17 76 103 SF - 4Q 2022 7.1% - 7.6% 7 75 Hayden Boston 160 56 105 214 SF - 4Q 2022 7.4% - 7.9% 12 Lee's Summit Kansas City 16 2 14 52 SF 50% 3Q 2022 7.0% - 7.5%(6) 1 Ogden Ogden 18 2 16 70 SF 66% 3Q 2022 7.0% - 7.5% (6) 1 Brentwood Nashville 37 2 35 119 SF 49% 4Q 2022 7.0% - 7.5%(6) 3 (6) Oak Hill Tampa 12 - 12 42 SF 55% 2Q 2023 7.0% - 7.5% 1 Total/Weighted Average(7) $1,095 $450 $644 1,676 SF 56% 6.5% - 7.5% $77 PROJECT RENDERINGS Sorrento Summit San Diego The Shore San Francisco 75 Hayden Boston ___________________________ 1. Excludes unconsolidated joint venture developments. Total Costs, Remaining Costs, Estimated Date of Stabilized Occupancy, Estimated Stabilized Yield Range and Estimated Stabilized Cash NOI are based on management’s estimates and are forward-looking. 2. Cost to date represents placed-in-service and construction in process balance on 6/30/19. 3. See “Disclaimers” on page 2 for information on how we calculate estimated stabilized yield. 4. Represents projected stabilized Cash NOI following lease-up and expiration of any free rents; economic stabilization typically occurs three to six months following stabilized occupancy. Cash NOIs presented in the table may not sum due to rounding. 5. Development costs and returns inclusive of legacy pre-development site work and capitalized interest which resulted in a higher land basis; yield assuming a market value of land would be approximately 100 basis points higher. Additionally, Phase I includes costs associated with construction of campus-wide amenity space while Phase II includes costs associated with a parking structure. 6. Represents the estimated blended stabilized yield range across all development projects with HCA. 7. Represents total for: Total Costs, Cost to Date, Remaining Costs, Leasable Area and Stabilized Cash NOI. Percent Leased is weighted by leasable area. Estimated Stabilized Yield Range is weighted by Total Costs. HCP, Inc. 23

EARNINGS CONTRIBUTIONS FROM ACTIVE DEVELOPMENT PIPELINE ESTIMATED NET CONTRIBUTIONS TO FFO AS ADJUSTED PER SHARE(1)(2) (Based on HCP’s current active development pipeline) $0.11 $0.09 $0.07 Net Accretion: +$0.05 YOY Δ: +$0.02 Net Accretion: +$0.03 $0.05 YOY Δ: +$0.04 $0.03 $0.05 $0.04 $0.01 $0.01 ($0.01) ($0.00) ($0.01) ($0.02) ($0.03) Net Drag: ($0.01) YOY Δ: +$0.01 ($0.05) 2019 2020 2021 HCP’s development pipeline is a major driver of future growth, producing net accretion in 2020 and beyond ___________________________ 1. Estimated net contribution to FFO as adjusted calculated as projected NOI plus capitalized interest less an imputed 5.5% cost of capital on cumulative spend. See “Disclaimers” on page 2 for information on how we calculate projected NOI. 2. Includes the Cove Phase III which was delivered in the second quarter of 2019. HCP, Inc. 24

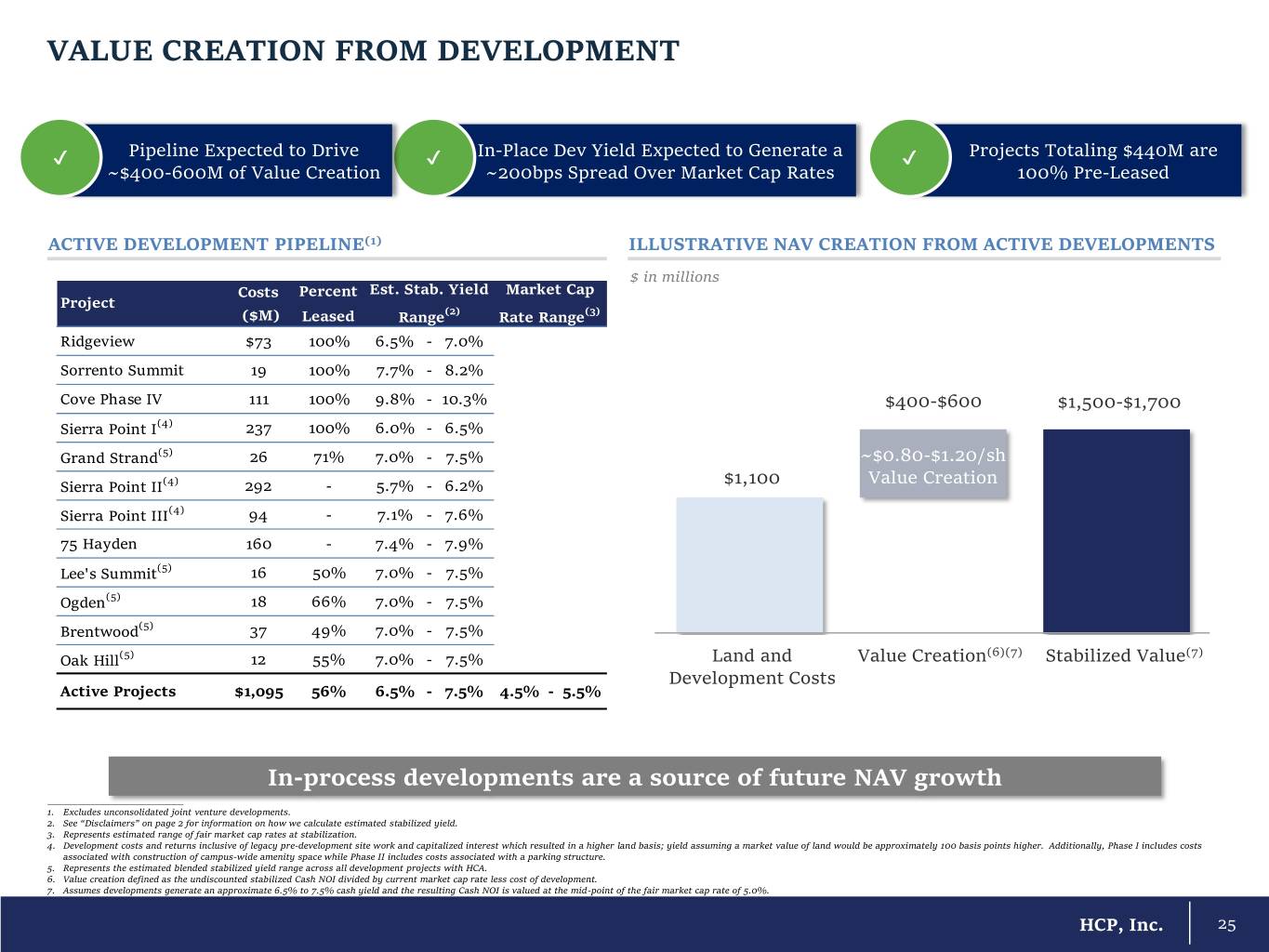

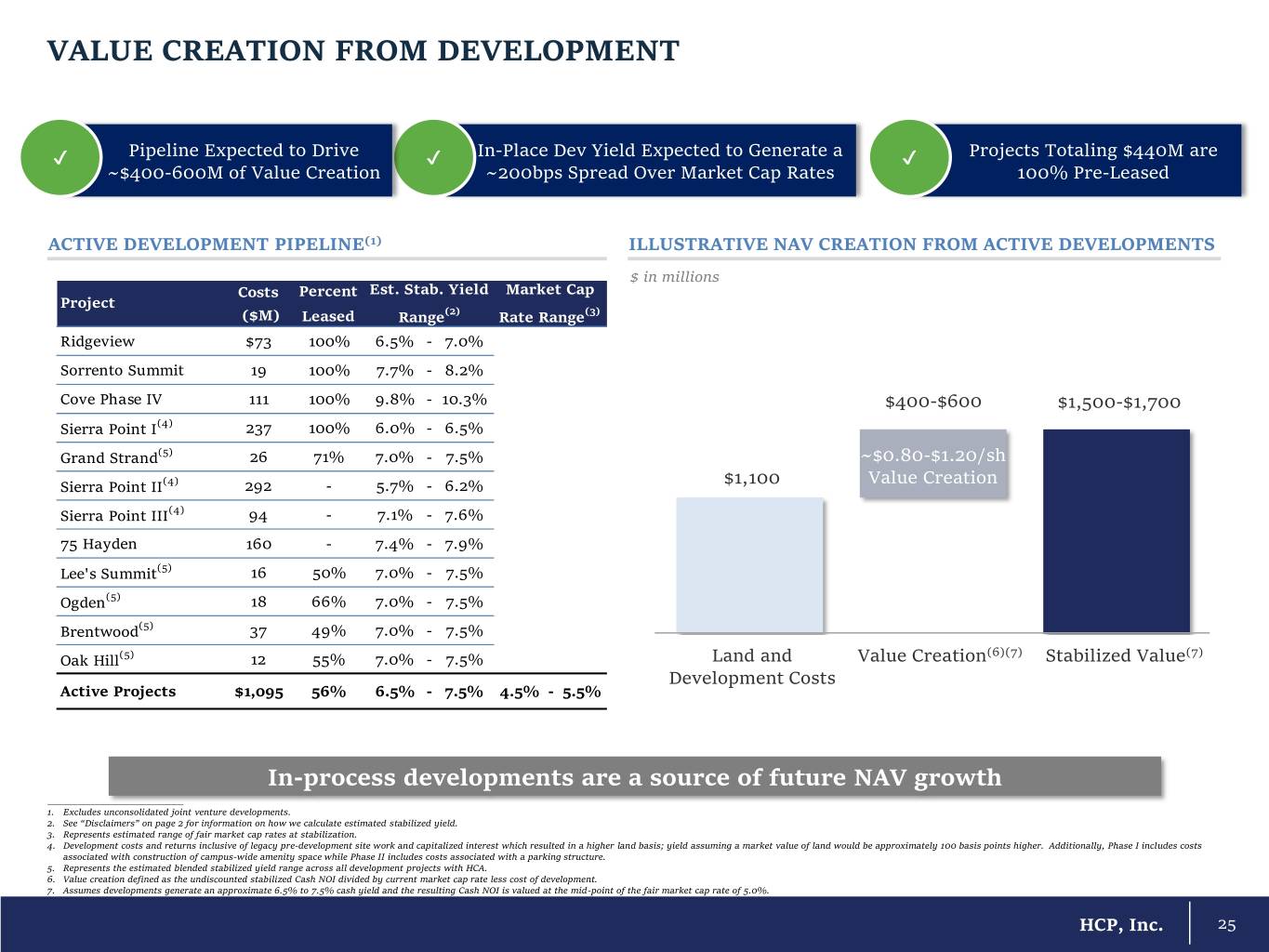

VALUE CREATION FROM DEVELOPMENT ✔ Pipeline Expected to Drive ✔ In-Place Dev Yield Expected to Generate a ✔ Projects Totaling $440M are ~$400-600M of Value Creation ~200bps Spread Over Market Cap Rates 100% Pre-Leased ACTIVE DEVELOPMENT PIPELINE(1) ILLUSTRATIVE NAV CREATION FROM ACTIVE DEVELOPMENTS $ in millions Costs Percent Est. Stab. Yield Market Cap Project ($M) Leased Range(2) Rate Range(3) Ridgeview $73 100% 6.5% - 7.0% Sorrento Summit 19 100% 7.7% - 8.2% Cove Phase IV 111 100% 9.8% - 10.3% $400-$600 $1,500-$1,700 Sierra Point I(4) 237 100% 6.0% - 6.5% Grand Strand(5) 26 71% 7.0% - 7.5% ~$0.80-$1.20/sh Sierra Point II(4) 292 - 5.7% - 6.2% $1,100 Value Creation Sierra Point III(4) 94 - 7.1% - 7.6% 75 Hayden 160 - 7.4% - 7.9% Lee's Summit(5) 16 50% 7.0% - 7.5% Ogden(5) 18 66% 7.0% - 7.5% Brentwood(5) 37 49% 7.0% - 7.5% (6)(7) (7) Oak Hill(5) 12 55% 7.0% - 7.5% Land and Value Creation Stabilized Value Development Costs Active Projects $1,095 56% 6.5% - 7.5% 4.5% - 5.5% In-process developments are a source of future NAV growth ___________________________ 1. Excludes unconsolidated joint venture developments. 2. See “Disclaimers” on page 2 for information on how we calculate estimated stabilized yield. 3. Represents estimated range of fair market cap rates at stabilization. 4. Development costs and returns inclusive of legacy pre-development site work and capitalized interest which resulted in a higher land basis; yield assuming a market value of land would be approximately 100 basis points higher. Additionally, Phase I includes costs associated with construction of campus-wide amenity space while Phase II includes costs associated with a parking structure. 5. Represents the estimated blended stabilized yield range across all development projects with HCA. 6. Value creation defined as the undiscounted stabilized Cash NOI divided by current market cap rate less cost of development. 7. Assumes developments generate an approximate 6.5% to 7.5% cash yield and the resulting Cash NOI is valued at the mid-point of the fair market cap rate of 5.0%. HCP, Inc. 25

LIFE SCIENCE LAND BANK AND ENTITLEMENTS Land bank is comprised of sites located in the life science markets of San Francisco, San Diego and Cambridge Plan to strategically activate land bank over time as leasing progress and market conditions warrant KEY FUTURE LIFE SCIENCE DEVELOPMENT OPPORTUNITIES Est. Rentable Book Value Project Market Sq. Ft. (in 000s) ($M) Forbes Research Center San Francisco 326 $49 Modular Labs III San Francisco 106 12 Torrey Pines Science Center San Diego 93 13 Directors Place San Diego 150 7 101 CambridgePark Drive Cambridge ±150 21 Director’s Place (Rendering) San Diego Land bank represents a shadow development pipeline in excess of $750 million HCP, Inc. 26

REDEVELOPMENT OPPORTUNITY • Our portfolio has approximately $75 to $100 million per year of redevelopment potential over the next few years • Cash-on-cash returns average 9% to 12% BEFORE AFTER LIFE SCIENCE Wateridge San Diego, CA $16M project cost MOB Yorktown 50 Fairfax, VA $7M project cost SENIOR HOUSING Atria Woodbridge Irvine, CA $10M project cost HCP, Inc. 27

SEGMENT OVERVIEWS HCP, Inc. Plano MOB III | Plano, TX

LIFE SCIENCE HCP, Inc. Scripps Wateridge | San Diego, CA

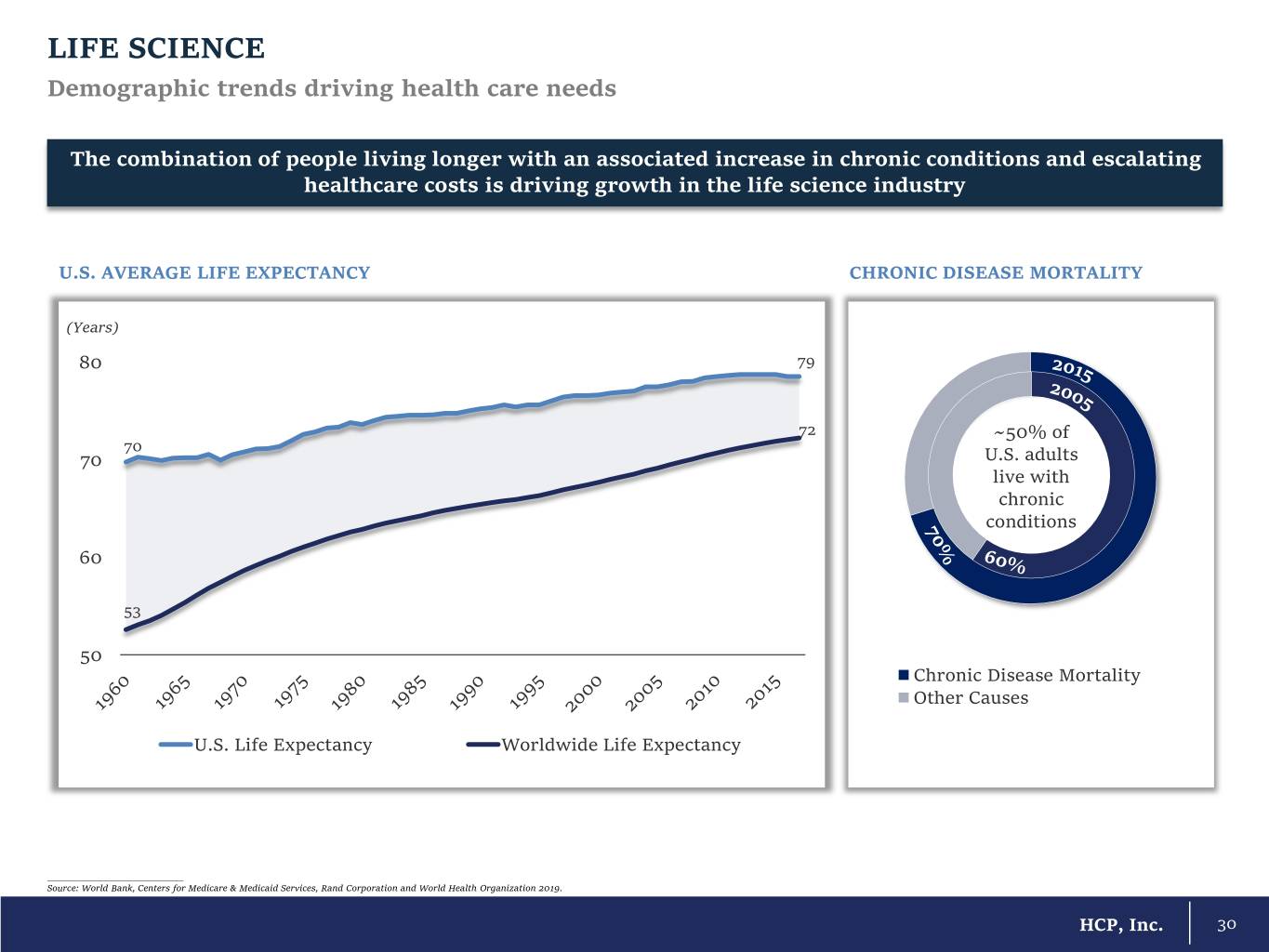

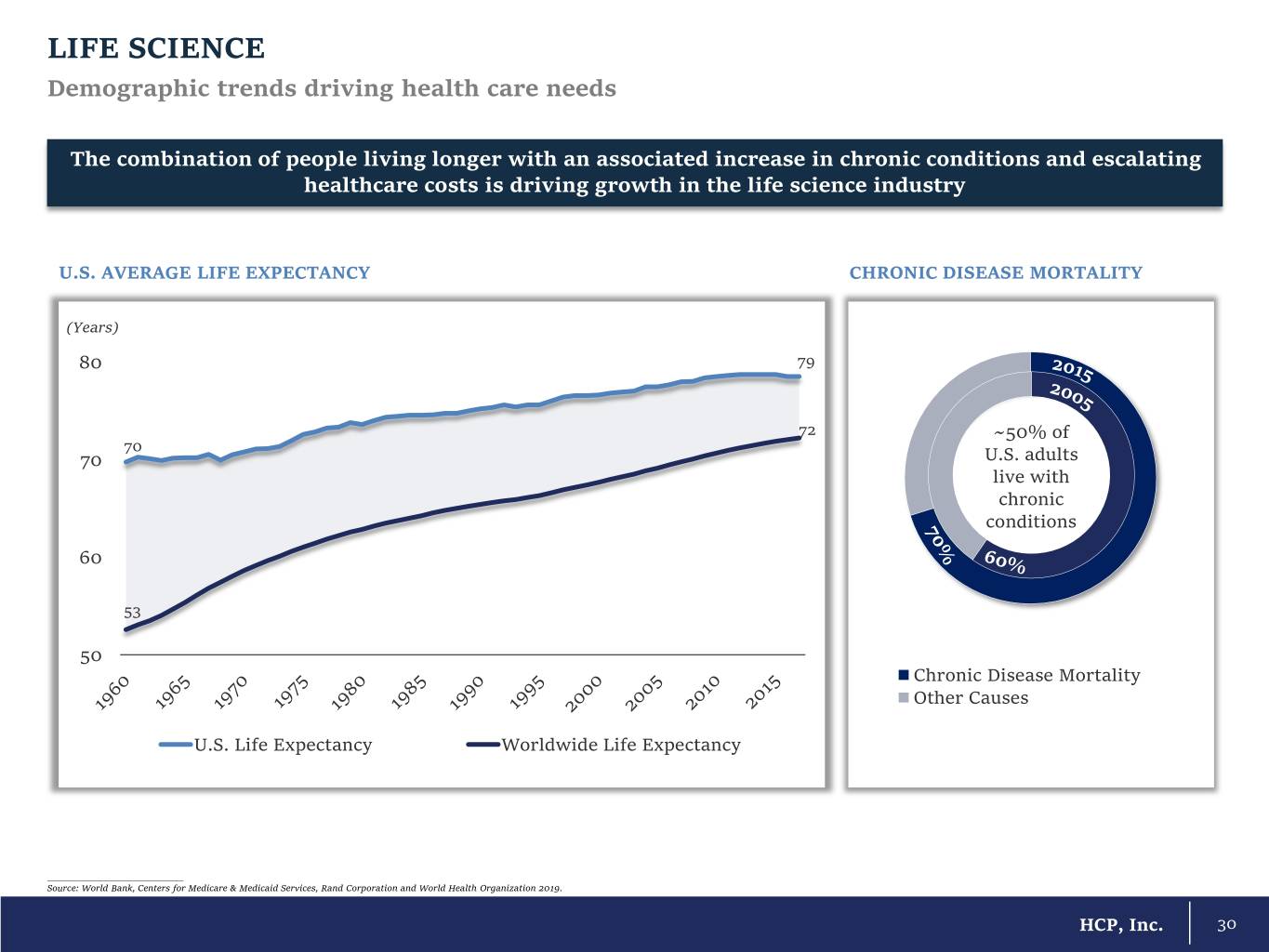

LIFE SCIENCE Demographic trends driving health care needs The combination of people living longer with an associated increase in chronic conditions and escalating healthcare costs is driving growth in the life science industry U.S. AVERAGE LIFE EXPECTANCY CHRONIC DISEASE MORTALITY (Years) 80 79 72 ~50% of 70 70 U.S. adults live with chronic conditions 60 53 50 Chronic Disease Mortality Other Causes U.S. Life Expectancy Worldwide Life Expectancy ___________________________ Source: World Bank, Centers for Medicare & Medicaid Services, Rand Corporation and World Health Organization 2019. HCP, Inc. 30

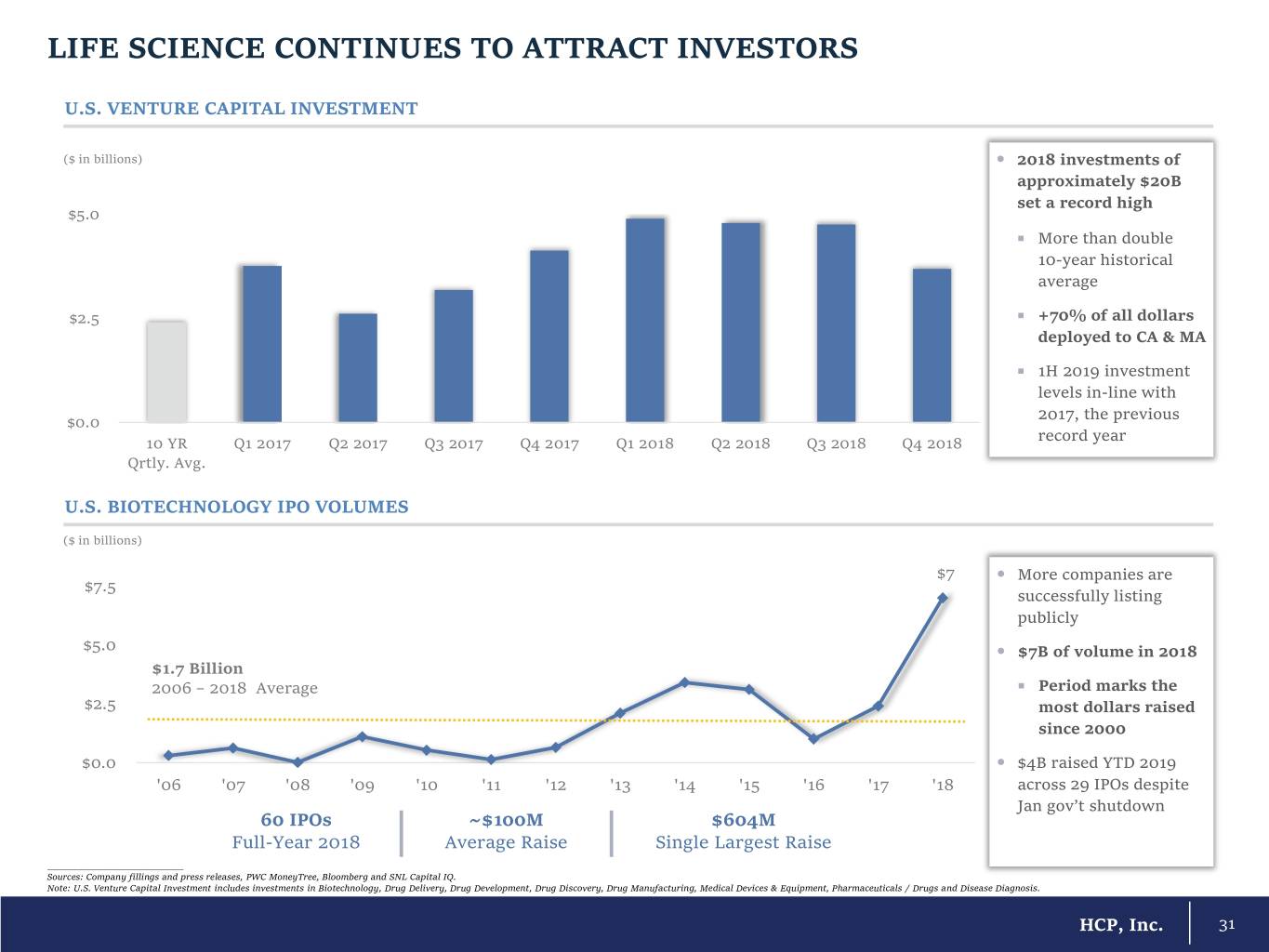

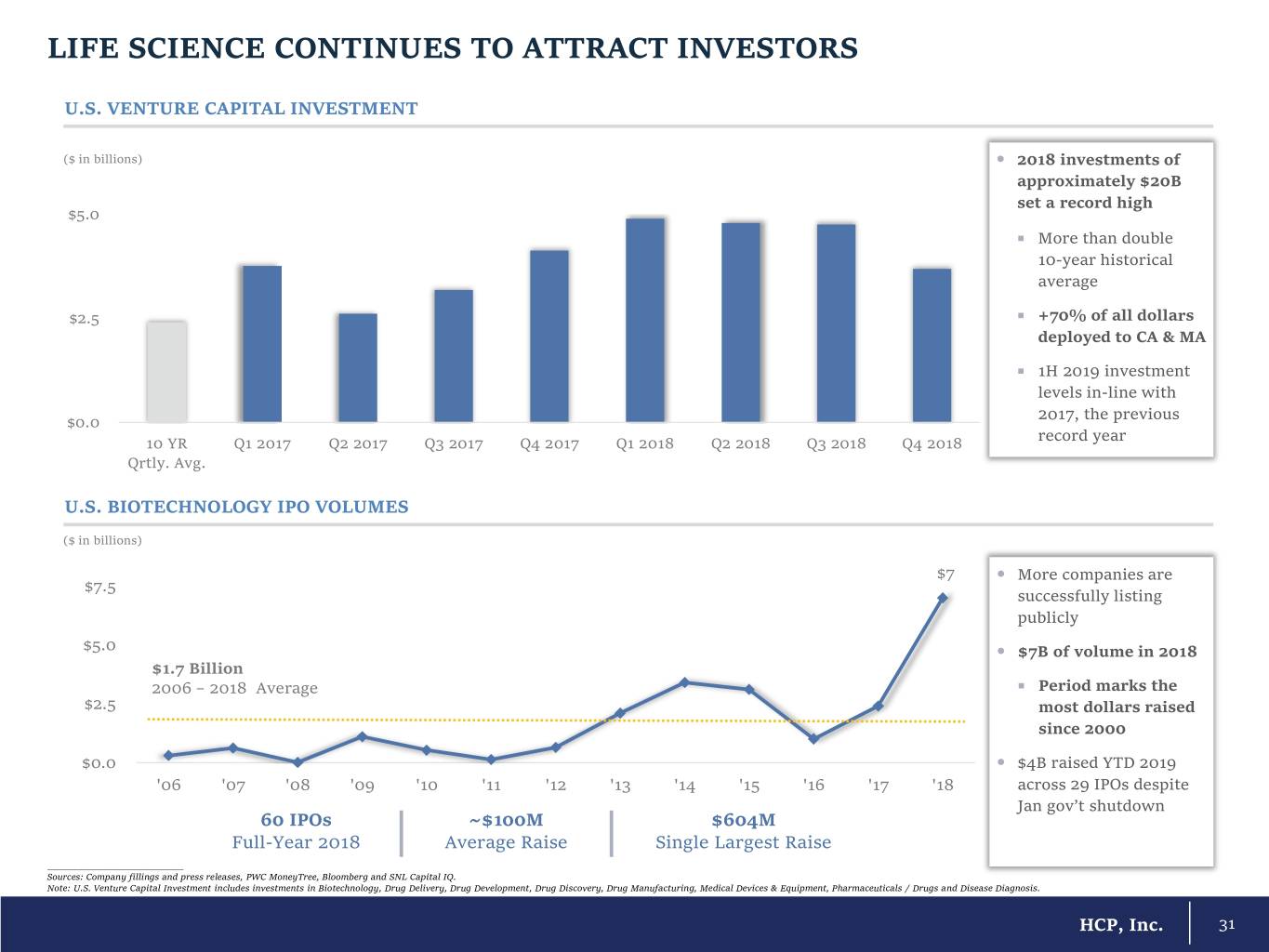

LIFE SCIENCE CONTINUES TO ATTRACT INVESTORS U.S. VENTURE CAPITAL INVESTMENT ($ in billions) 2018 investments of approximately $20B set a record high $5.0 More than double 10-year historical average $2.5 +70% of all dollars deployed to CA & MA 1H 2019 investment levels in-line with 2017, the previous $0.0 10 YR Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 record year Qrtly. Avg. U.S. BIOTECHNOLOGY IPO VOLUMES ($ in billions) $7 More companies are $7.5 successfully listing publicly $5.0 $7B of volume in 2018 $1.7 Billion 2006 – 2018 Average Period marks the $2.5 most dollars raised since 2000 $0.0 $4B raised YTD 2019 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 across 29 IPOs despite Jan gov’t shutdown 60 IPOs ~$100M $604M Full-Year 2018 Average Raise Single Largest Raise ___________________________ Sources: Company fillings and press releases, PWC MoneyTree, Bloomberg and SNL Capital IQ. Note: U.S. Venture Capital Investment includes investments in Biotechnology, Drug Delivery, Drug Development, Drug Discovery, Drug Manufacturing, Medical Devices & Equipment, Pharmaceuticals / Drugs and Disease Diagnosis. HCP, Inc. 31

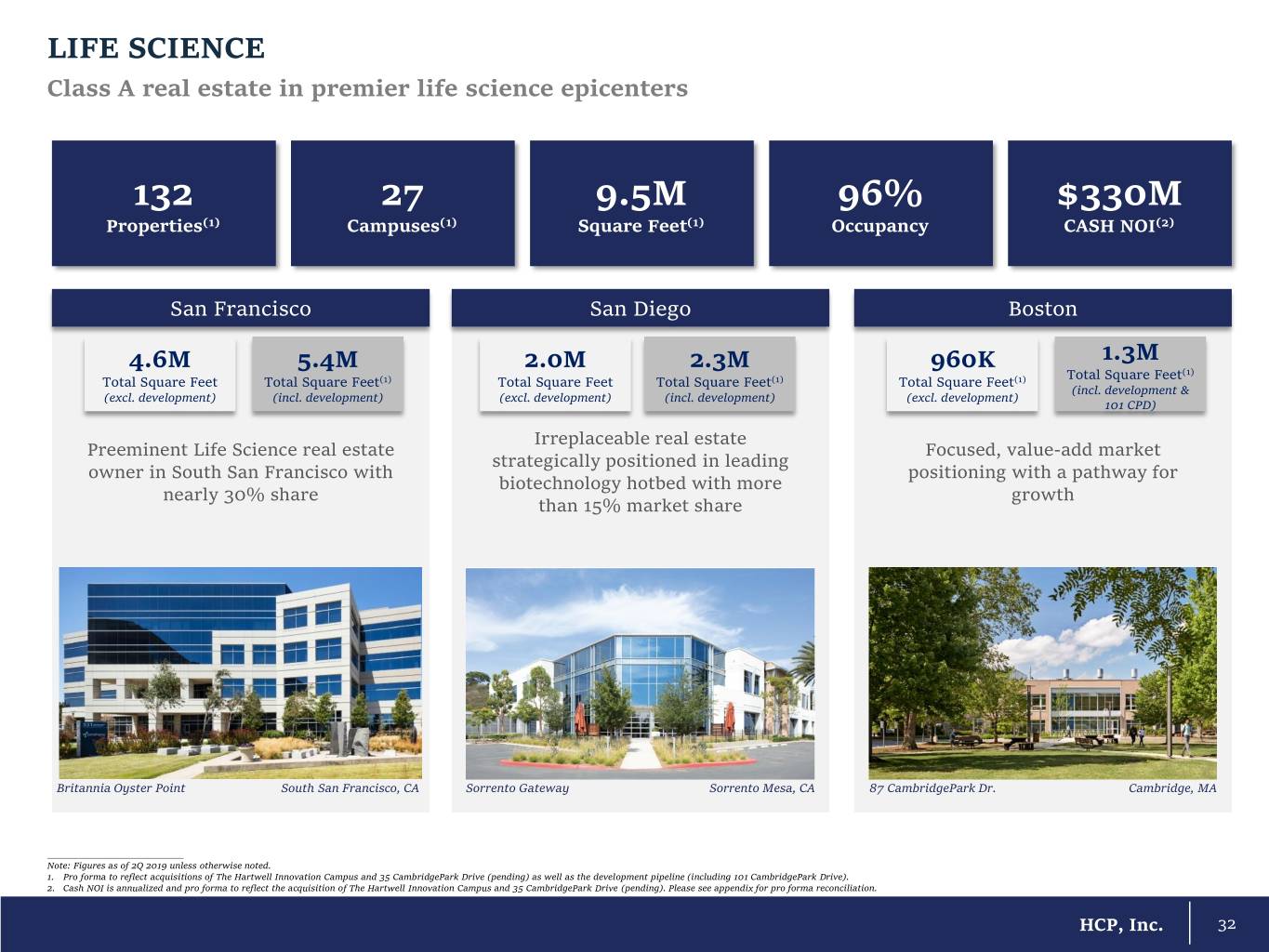

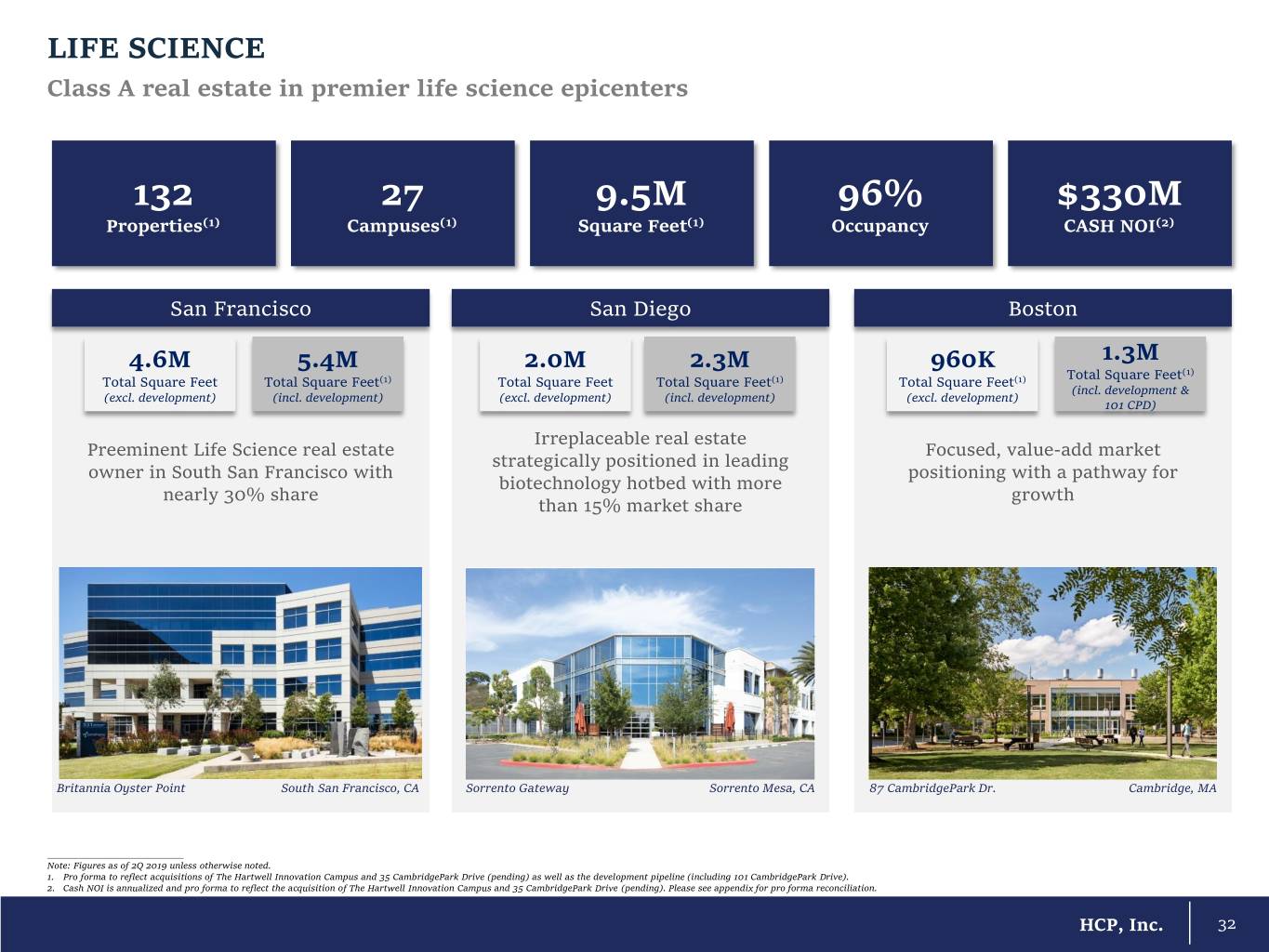

LIFE SCIENCE Class A real estate in premier life science epicenters 13281% / 94% 27 9.5M 96% $330M PropertiesOn-Campus(1) / AffiliatedCampuses(1) Square Feet(1) Occupancy CASH NOI(2) San Francisco San Diego Boston 4.6M 5.4M 2.0M 2.3M 960K 1.3M Total Square Feet(1) Total Square Feet Total Square Feet(1) Total Square Feet Total Square Feet(1) Total Square Feet(1) (incl. development & (excl. development) (incl. development) (excl. development) (incl. development) (excl. development) 101 CPD) Irreplaceable real estate Preeminent Life Science real estate Focused, value-add market strategically positioned in leading owner in South San Francisco with positioning with a pathway for biotechnology hotbed with more nearly 30% share growth than 15% market share Britannia Oyster Point South San Francisco, CA Sorrento Gateway Sorrento Mesa, CA 87 CambridgePark Dr. Cambridge, MA ___________________________ Note: Figures as of 2Q 2019 unless otherwise noted. 1. Pro forma to reflect acquisitions of The Hartwell Innovation Campus and 35 CambridgePark Drive (pending) as well as the development pipeline (including 101 CambridgePark Drive). 2. Cash NOI is annualized and pro forma to reflect the acquisition of The Hartwell Innovation Campus and 35 CambridgePark Drive (pending). Please see appendix for pro forma reconciliation. HCP, Inc. 32

MEDICAL OFFICE HCP, Inc. East Mesa | Phoenix, AZ

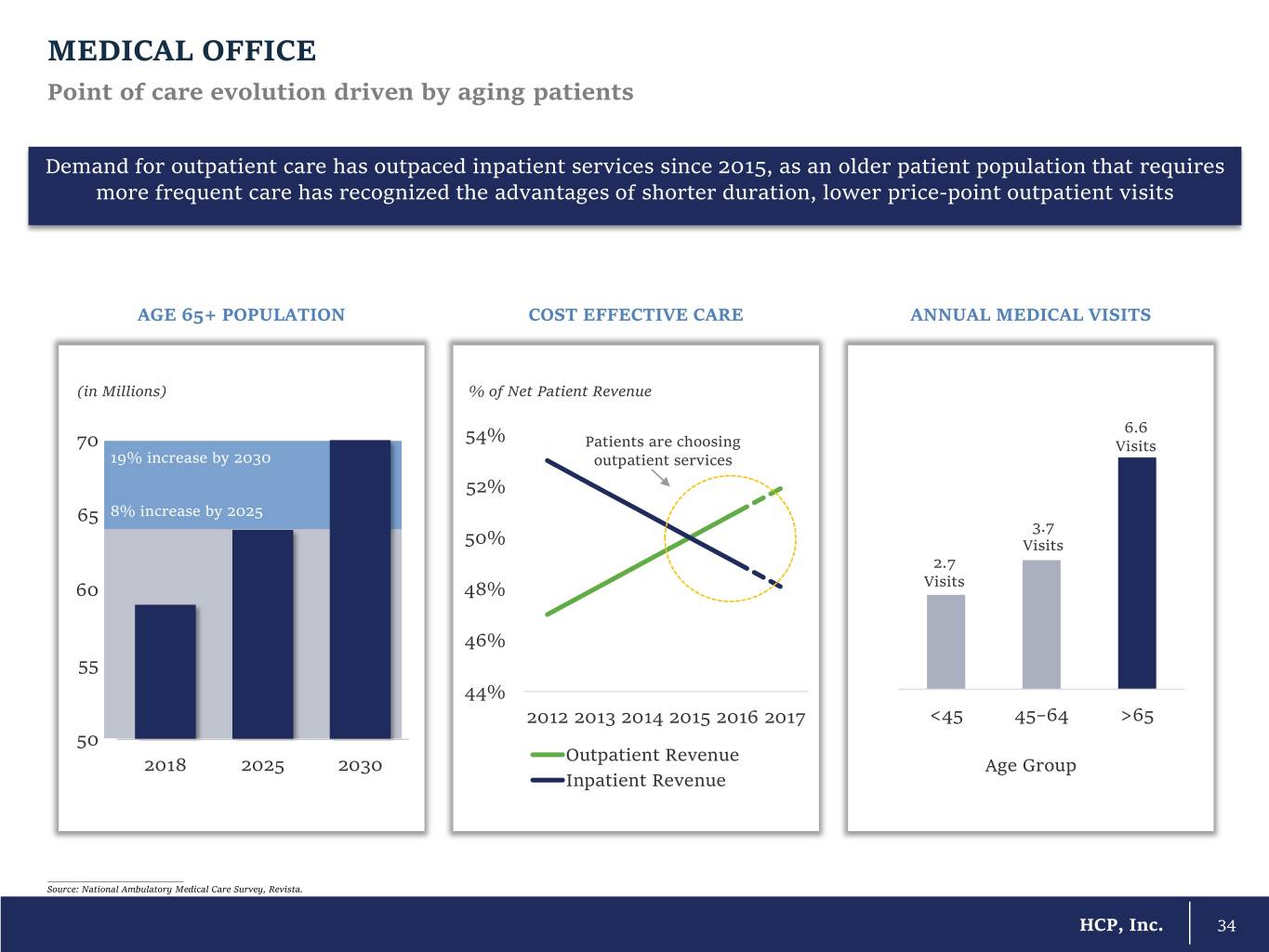

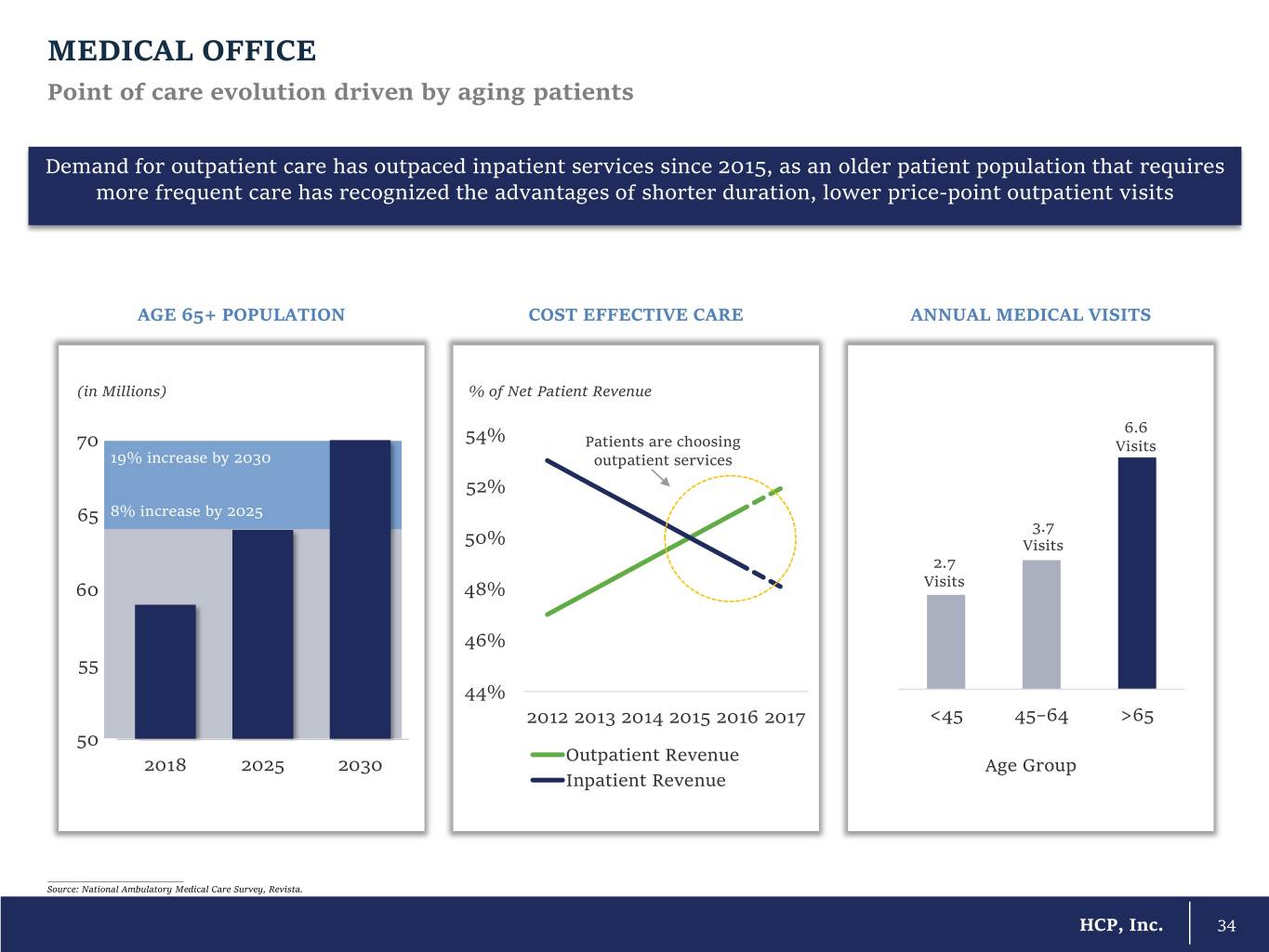

MEDICAL OFFICE Point of care evolution driven by aging patients Demand for outpatient care has outpaced inpatient services since 2015, as an older patient population that requires more frequent care has recognized the advantages of shorter duration, lower price-point outpatient visits AGE 65+ POPULATION COST EFFECTIVE CARE ANNUAL MEDICAL VISITS (in Millions) % of Net Patient Revenue 54% 6.6 70 Patients are choosing Visits 1940%% increase increase by by 2030 2030 outpatient services 52% 65 8% increase by 2025 3.7 50% Visits 2.7 60 48% Visits 46% 55 44% 2012 2013 2014 2015 2016 2017 <45 45–64 >65 50 Outpatient Revenue 2018 2025 2030 Age Group Inpatient Revenue ___________________________ Source: National Ambulatory Medical Care Survey, Revista. HCP, Inc. 34

INDUSTRY-LEADING ON-CAMPUS MEDICAL OFFICE PORTFOLIO Top ten markets represent 67% of segment cash NOI 21M 80%+ 84% / 95% 92%+ Specialty Focused square feet On-Campus / Affiliated Consistent Occupancy Physicians(1) Seattle Salt Philadelphia Lake City Denver Louisville Nashville Greenville Phoenix Dallas Houston HCP Top 10 MOB Markets Additional Locations ___________________________ 1. Represents percentage of physician tenants classified as non-primary care. HCP, Inc. 35

MEDICAL OFFICE Strong relationships drive steady performance HISTORICAL SAME-PROPERTY OCCUPANCY KEY RELATIONSHIPS Occupancy % 95% 90% 85% . Largest for-profit hospital 91% 92% 93% 91% 91% 92% 92% 92% operator in the U.S. . 80% 40% of HCP’s medical office square footage affiliated with HCA 75% 2011 2012 2013 2014 2015 2016 2017 2018 HISTORICAL SAME-PROPERTY CASH NOI GROWTH % Growth 4% 3% . Largest non-profit health system in southeast Texas 2% . A1 investment-grade credit 3.0% 3.0% 2.8% 2.7% rating 1% 2.3% 2.1% 2.1% 2.0% . 9% of HCP’s medical office square footage affiliated with Memorial Hermann 0% 2011 2012 2013 2014 2015 2016 2017 2018 HCP, Inc. 36

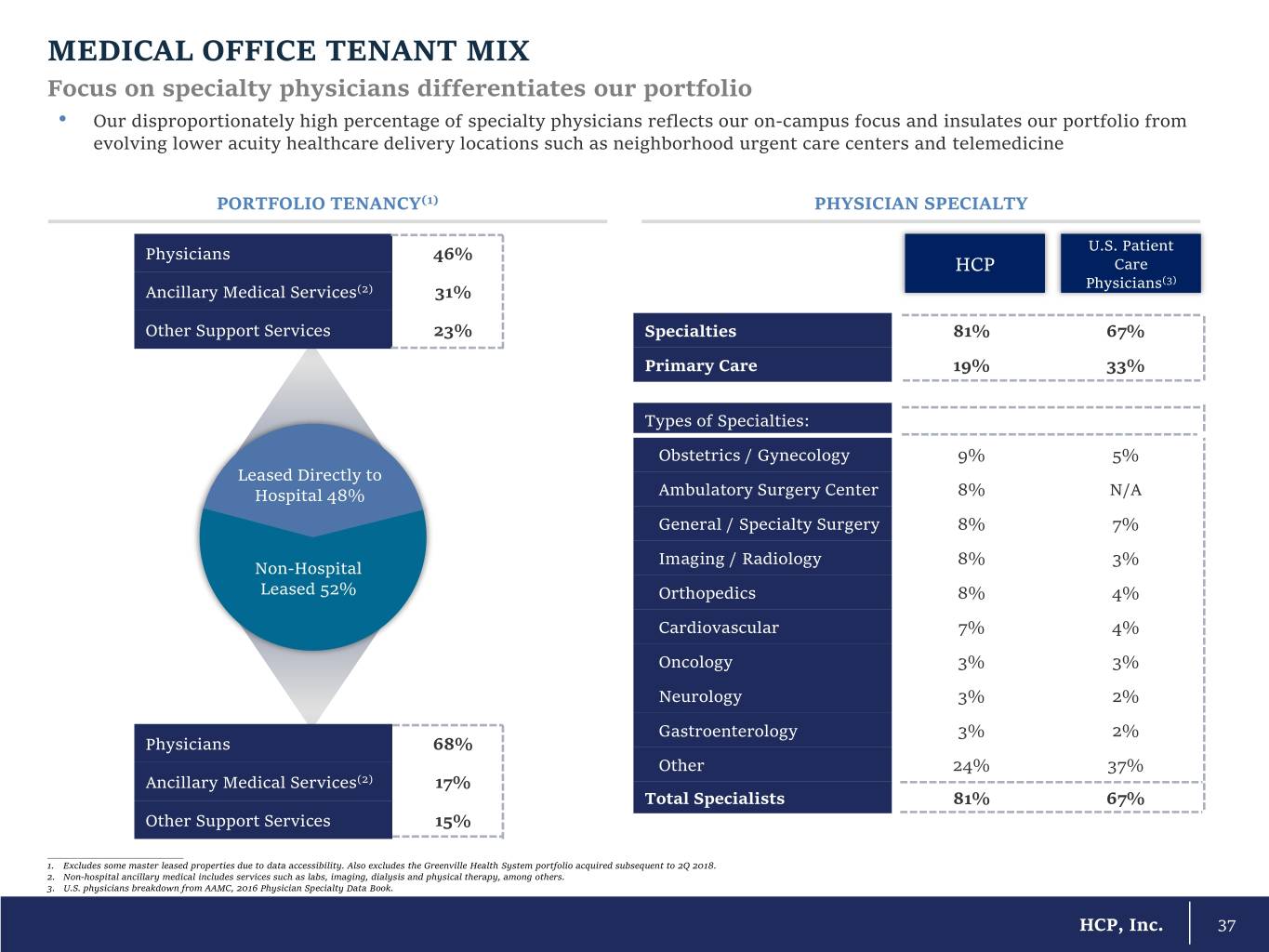

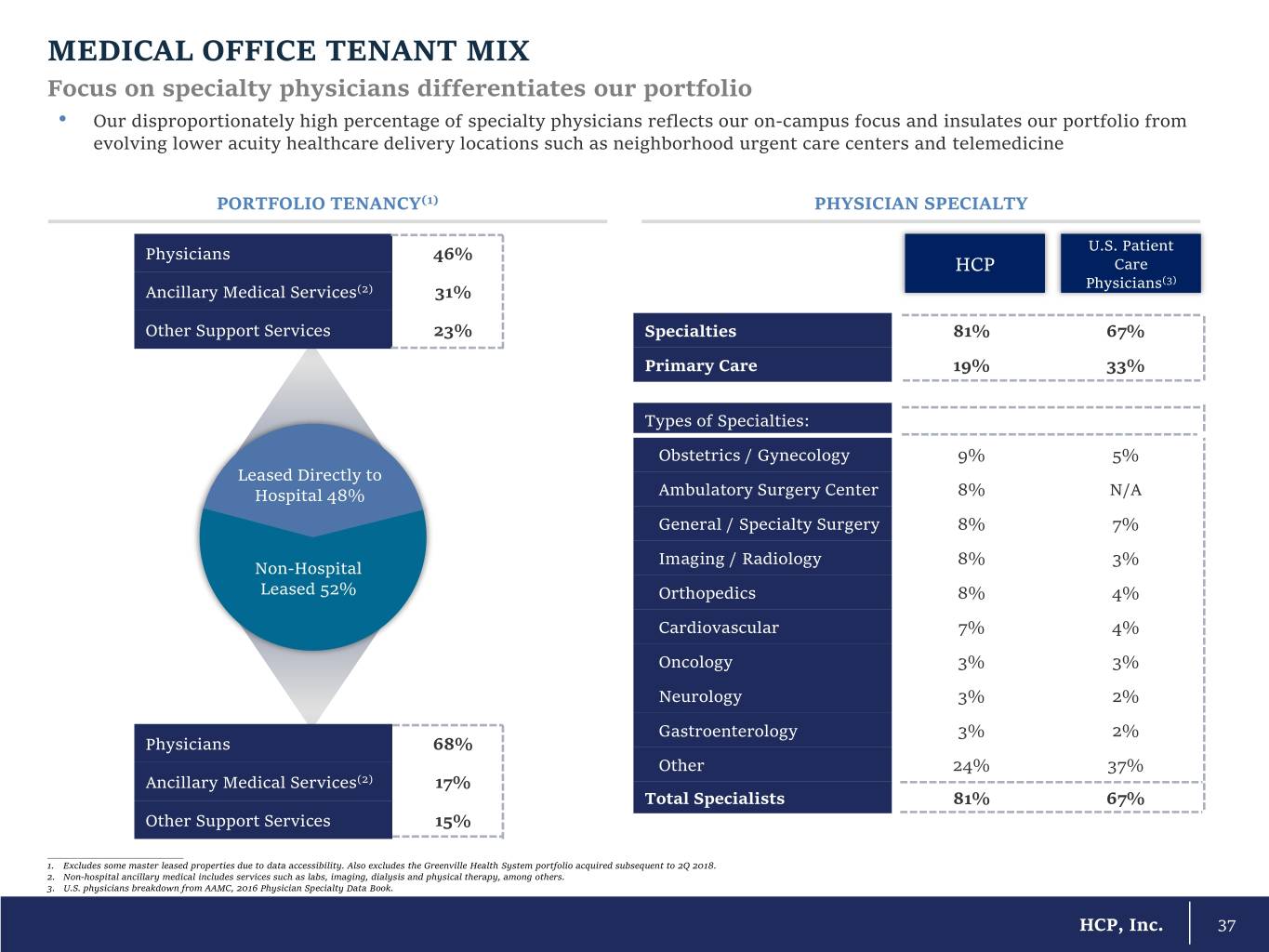

MEDICAL OFFICE TENANT MIX Focus on specialty physicians differentiates our portfolio • Our disproportionately high percentage of specialty physicians reflects our on-campus focus and insulates our portfolio from evolving lower acuity healthcare delivery locations such as neighborhood urgent care centers and telemedicine PORTFOLIO TENANCY(1) PHYSICIAN SPECIALTY Physicians 46% U.S. Patient HCP Care Physicians(3) Ancillary Medical Services(2) 31% Other Support Services 23% Specialties 81% 67% Primary Care 19% 33% Types of Specialties: Obstetrics / Gynecology 9% 5% Leased Directly to Hospital 48% Ambulatory Surgery Center 8% N/A General / Specialty Surgery 8% 7% Imaging / Radiology 8% 3% Non-Hospital Leased 52% Orthopedics 8% 4% Cardiovascular 7% 4% Oncology 3% 3% Neurology 3% 2% Gastroenterology 3% 2% Physicians 68% Other 24% 37% Ancillary Medical Services(2) 17% Total Specialists 81% 67% Other Support Services 15% ___________________________ 1. Excludes some master leased properties due to data accessibility. Also excludes the Greenville Health System portfolio acquired subsequent to 2Q 2018. 2. Non-hospital ancillary medical includes services such as labs, imaging, dialysis and physical therapy, among others. 3. U.S. physicians breakdown from AAMC, 2016 Physician Specialty Data Book. HCP, Inc. 37

MEDICAL CITY DALLAS Fully-integrated, highly-specialized, two million square foot campus anchored by HCA 5 2.1M 96% $39M Properties Square Feet Occupancy 2019 Cash NOI(1) Building A A Building B B D C $202 $210 $183 $186 $189 $194 Building C $170 $179 C B A Building D D ___________________________ Note: Figures as of 2Q 2019 unless otherwise noted. 1. Represents annualized 2Q 2019 Cash NOI. HCP, Inc. 38

SENIOR HOUSING HCP, Inc. Aegis Dana Point | Dana Point, CA

SENIOR HOUSING DEMAND FUNDAMENTALS ARE STRONG AND GETTING EVEN BETTER An aging population, declining caregiver ratio, and increasing penetration rate will drive a dramatic increase in demand DECLINING ADULT CHILD STEADILY INCREASING AGE 80+ POPULATION CAREGIVER RATIO PENETRATION RATE(1) (in Millions) Ratio of 45-64 to 80+ 80+ Occupied Penetration (NIC31) 10.7% 20 7.5 54% increase by 2030 7.0 10.4% 18 6.5 16 10.1% 19% increase by 2025 6.0 A 22% decline 14 5.5 9.8% from ’19E to ’27E 5.0 12 9.5% 4.5 Forecast Actual Forecast 10 4.0 9.2% Current 2025E 2030E ___________________________ Source: US Census, American Community Survey (ACS), NIC. 1. Penetration rate from 2012-2019 is based on NIC occupancy data for the NIC 31 markets and population data from StratoDem Analytics. Future penetration rate assumes an annual increase of 7bps. HCP, Inc. 40

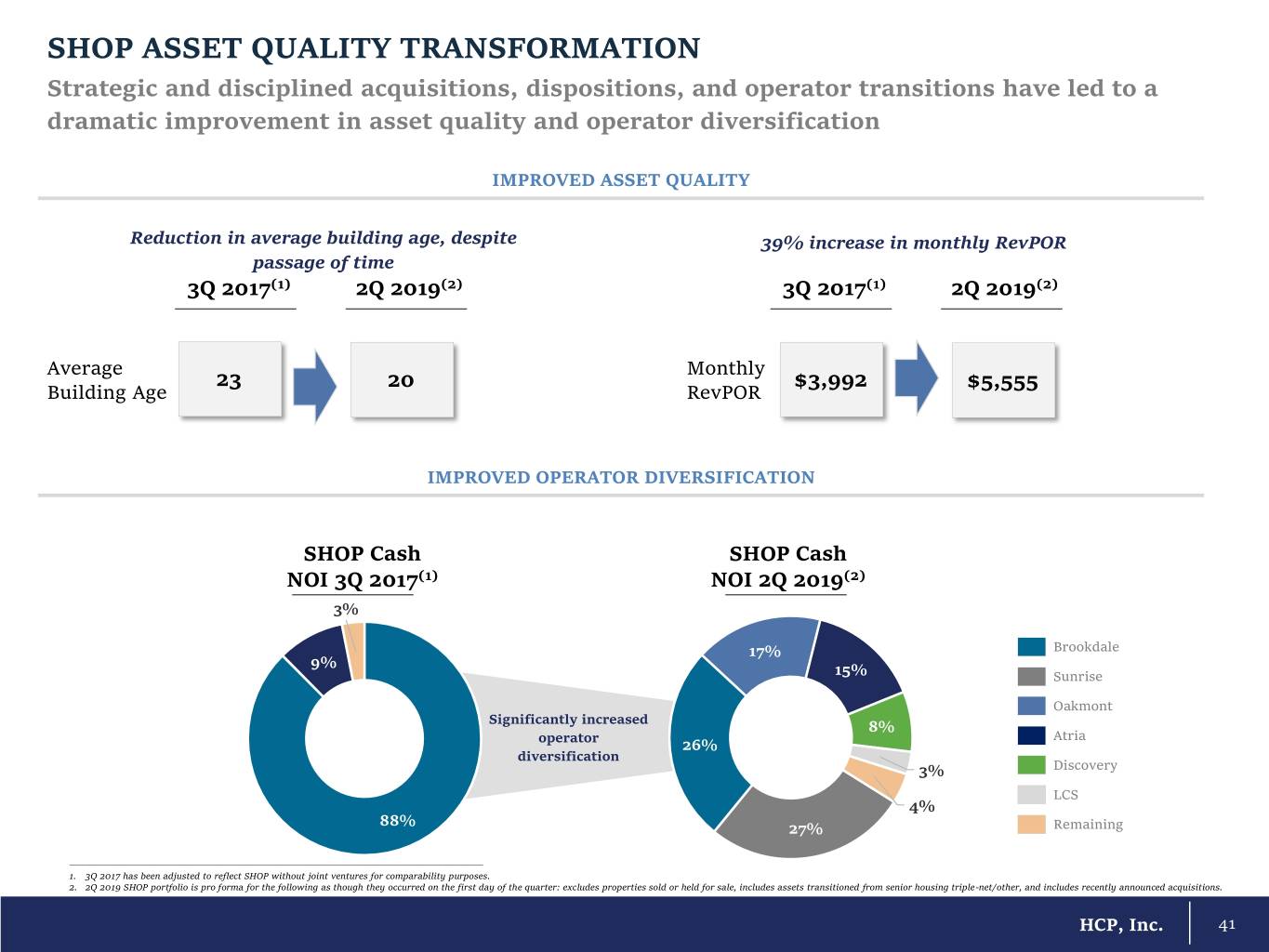

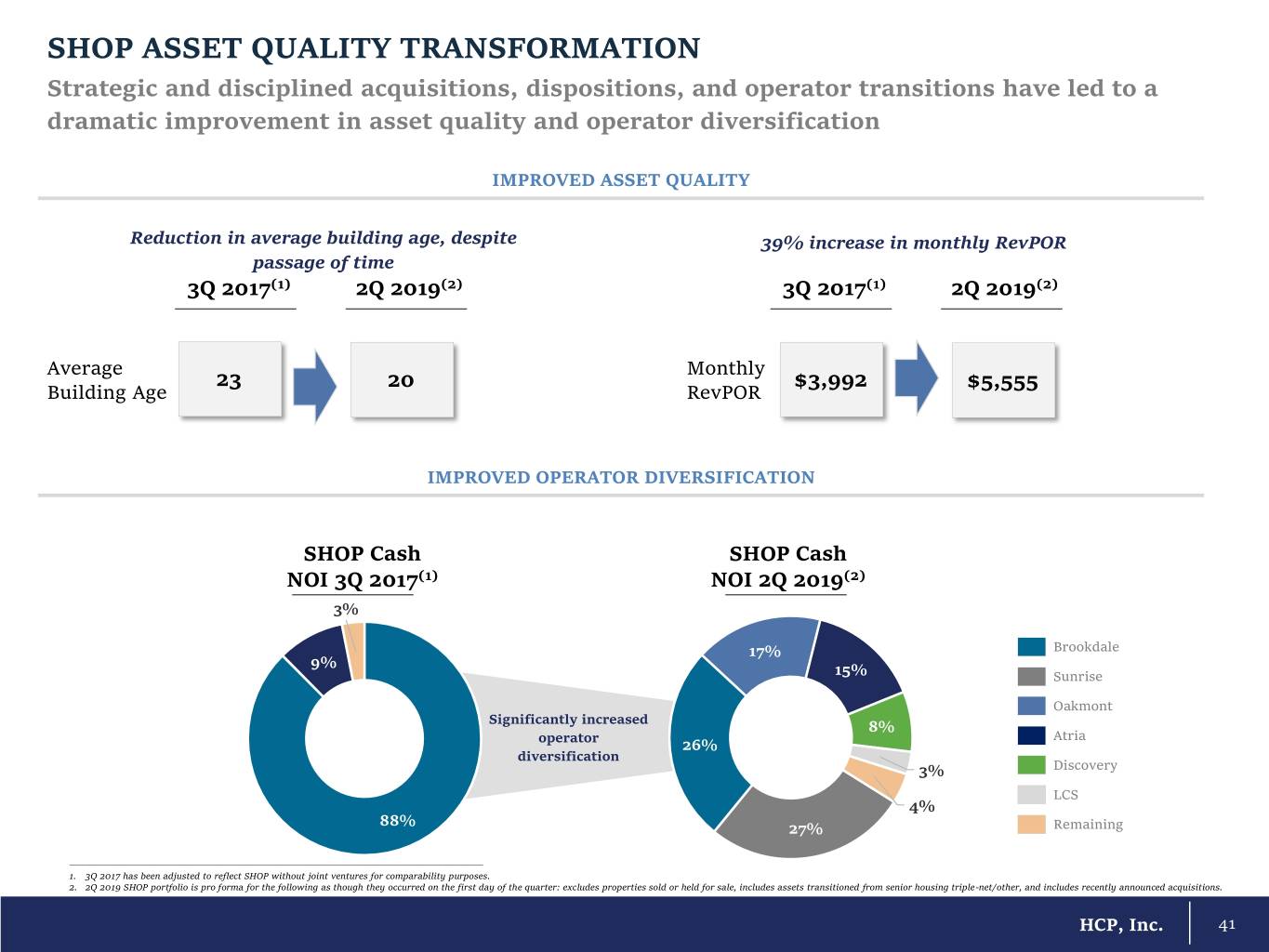

SHOP ASSET QUALITY TRANSFORMATION Strategic and disciplined acquisitions, dispositions, and operator transitions have led to a dramatic improvement in asset quality and operator diversification IMPROVED ASSET QUALITY Reduction in average building age, despite 39% increase in monthly RevPOR passage of time 3Q 2017(1) 2Q 2019(2) 3Q 2017(1) 2Q 2019(2) Average Monthly 23 20 $3,992 $5,555 Building Age RevPOR IMPROVED OPERATOR DIVERSIFICATION SHOP Cash SHOP Cash NOI 3Q 2017(1) NOI 2Q 2019(2) 3% 17% Brookdale 9% 15% Sunrise Oakmont Significantly increased 8% Atria operator 26% diversification 3% Discovery LCS 4% 88% 27% Remaining __________________________________________________________________________________ 1. 3Q 2017 has been adjusted to reflect SHOP without joint ventures for comparability purposes. 2. 2Q 2019 SHOP portfolio is pro forma for the following as though they occurred on the first day of the quarter: excludes properties sold or held for sale, includes assets transitioned from senior housing triple-net/other, and includes recently announced acquisitions. HCP, Inc. 41

SHOP ASSET QUALITY TRANSFORMATION (CONT’D) Strategic capital allocation has led to a dramatic shift towards concentration in high growth and affluent markets IMPROVED REAL ESTATE MARKETS STRONGER DEMOGRAPHICS % of SHOP Cash NOI(2) Improved 80+ population growth, household income, and home value Top MSAs 9/30/2017 6/30/2019 5-Mile Radius Houston 17% 13% Dramatic increase 5 Year 80+ Median Median Washington, DC 4% 9% in NY/ NJ, Population Household Home Value NY/ NJ - 7% Washington DC, Growth % Income Los Angeles 2% 6% Los Angeles, and U.S. National Average 14.1% $63K $218K Chicago 10% 6% San Francisco (1) San Francisco - 5% 3Q17 14.6% $77K $294K (2) Denver 11% 5% Only 1 market with 2Q19 15.7% $88K $410K Miami 12% 3% >10% Improvement +110bps +15% +39% Tampa 6% 1% concentration WELL-LOCATED SENIOR HOUSING PORTFOLIO(2)(3) 240 87% of Senior Denver 6% Housing (SHOP Properties and NNN) Cash NOI from the West Coast East Coast, 22% 27,200 West Coast, Texas, and Units Texas East Coast Denver 17% 42% ___________________________ 1. 3Q 2017 has been adjusted to reflect SHOP without joint ventures for comparability purposes. 2. 2Q 2019 Cash NOI is pro forma for the following as though they occurred on the first day of the quarter: excludes properties sold or held for sale, includes assets transitioned from Senior Housing triple-net/other, and includes recently announced acquisitions. 3. Percentages in map based on percentage of Senior Housing Cash NOI by region. HCP, Inc. 42

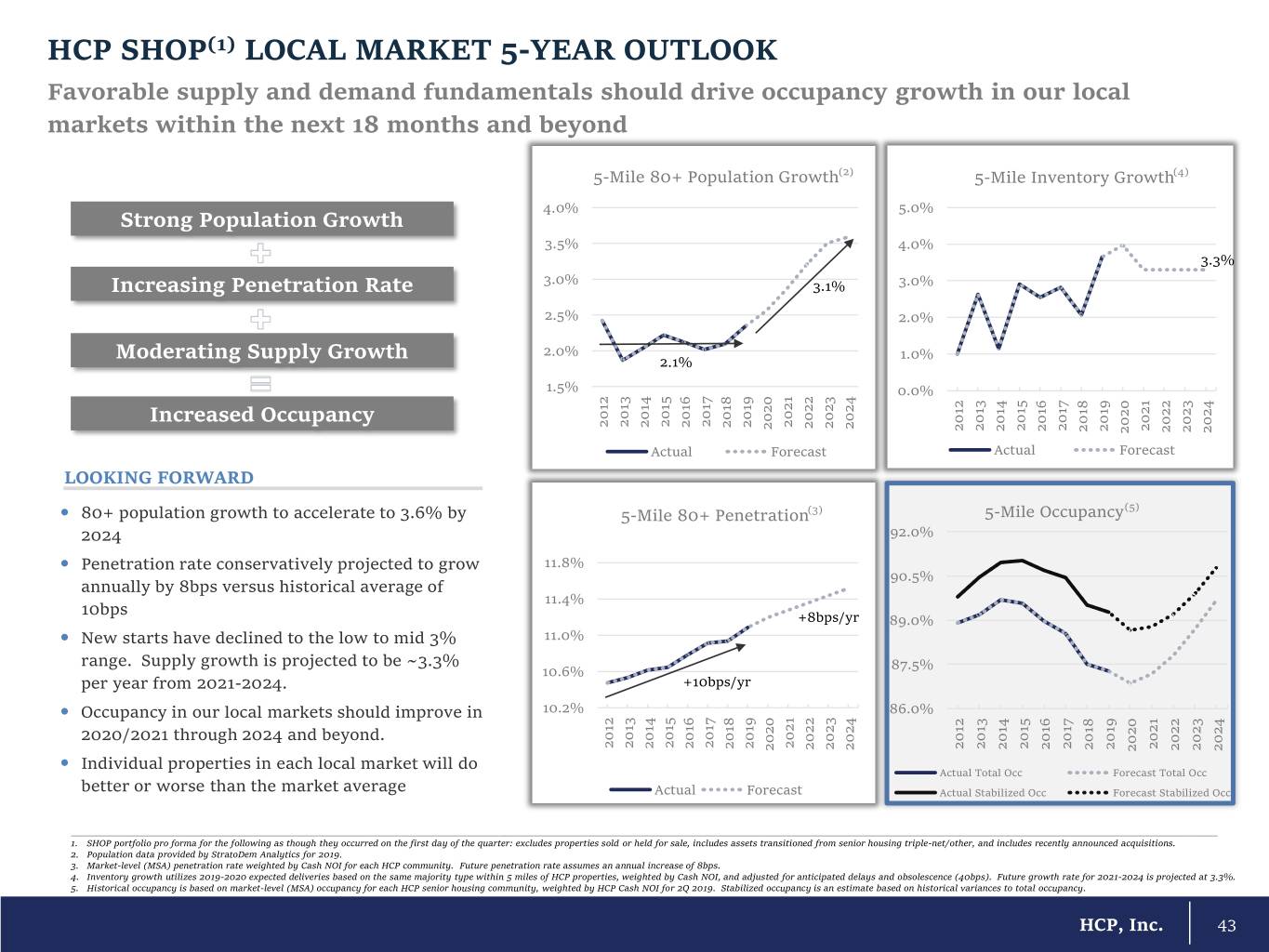

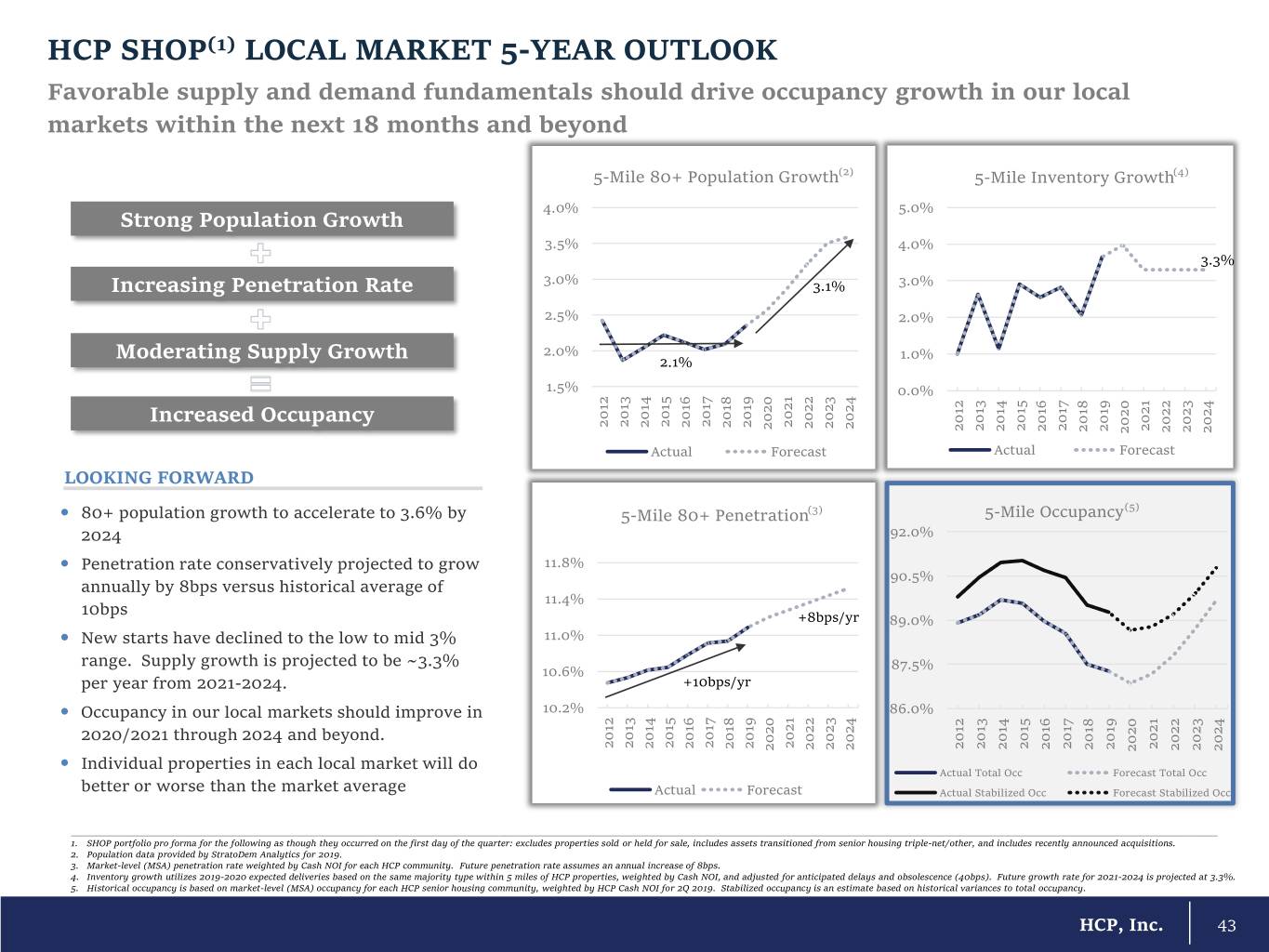

HCP SHOP(1) LOCAL MARKET 5-YEAR OUTLOOK Favorable supply and demand fundamentals should drive occupancy growth in our local markets within the next 18 months and beyond 5-Mile 80+ Population Growth(2) 5-Mile Inventory Growth(4) 4.0% 5.0% Strong Population Growth 3.5% 4.0% 3.3% Increasing Penetration Rate 3.0% 3.1% 3.0% 2.5% 2.0% 2.0% 1.0% Moderating Supply Growth 2.1% 1.5% 0.0% Increased Occupancy 2017 2015 2013 2012 2021 2014 2016 2019 2018 2023 2022 2024 2020 2017 2015 2013 2012 2021 2014 2016 2019 2018 2023 2022 2024 2020 Actual Forecast Actual Forecast LOOKING FORWARD (5) 80+ population growth to accelerate to 3.6% by 5-Mile 80+ Penetration(3) 5-Mile Occupancy 2024 92.0% Penetration rate conservatively projected to grow 11.8% 90.5% annually by 8bps versus historical average of 11.4% 10bps +8bps/yr 89.0% New starts have declined to the low to mid 3% 11.0% range. Supply growth is projected to be ~3.3% 87.5% 10.6% per year from 2021-2024. +10bps/yr Occupancy in our local markets should improve in 10.2% 86.0% 2020/2021 through 2024 and beyond. 2017 2015 2013 2012 2021 2019 2014 2016 2017 2015 2018 2013 2012 2021 2014 2016 2019 2023 2022 2018 2024 2023 2022 2020 2024 2020 Individual properties in each local market will do Actual Total Occ Forecast Total Occ better or worse than the market average Actual Forecast Actual Stabilized Occ Forecast Stabilized Occ ___________________________________________________________________________________________________________________________________________________________________________________________________________________________________ 1. SHOP portfolio pro forma for the following as though they occurred on the first day of the quarter: excludes properties sold or held for sale, includes assets transitioned from senior housing triple-net/other, and includes recently announced acquisitions. 2. Population data provided by StratoDem Analytics for 2019. 3. Market-level (MSA) penetration rate weighted by Cash NOI for each HCP community. Future penetration rate assumes an annual increase of 8bps. 4. Inventory growth utilizes 2019-2020 expected deliveries based on the same majority type within 5 miles of HCP properties, weighted by Cash NOI, and adjusted for anticipated delays and obsolescence (40bps). Future growth rate for 2021-2024 is projected at 3.3%. 5. Historical occupancy is based on market-level (MSA) occupancy for each HCP senior housing community, weighted by HCP Cash NOI for 2Q 2019. Stabilized occupancy is an estimate based on historical variances to total occupancy. HCP, Inc. 43

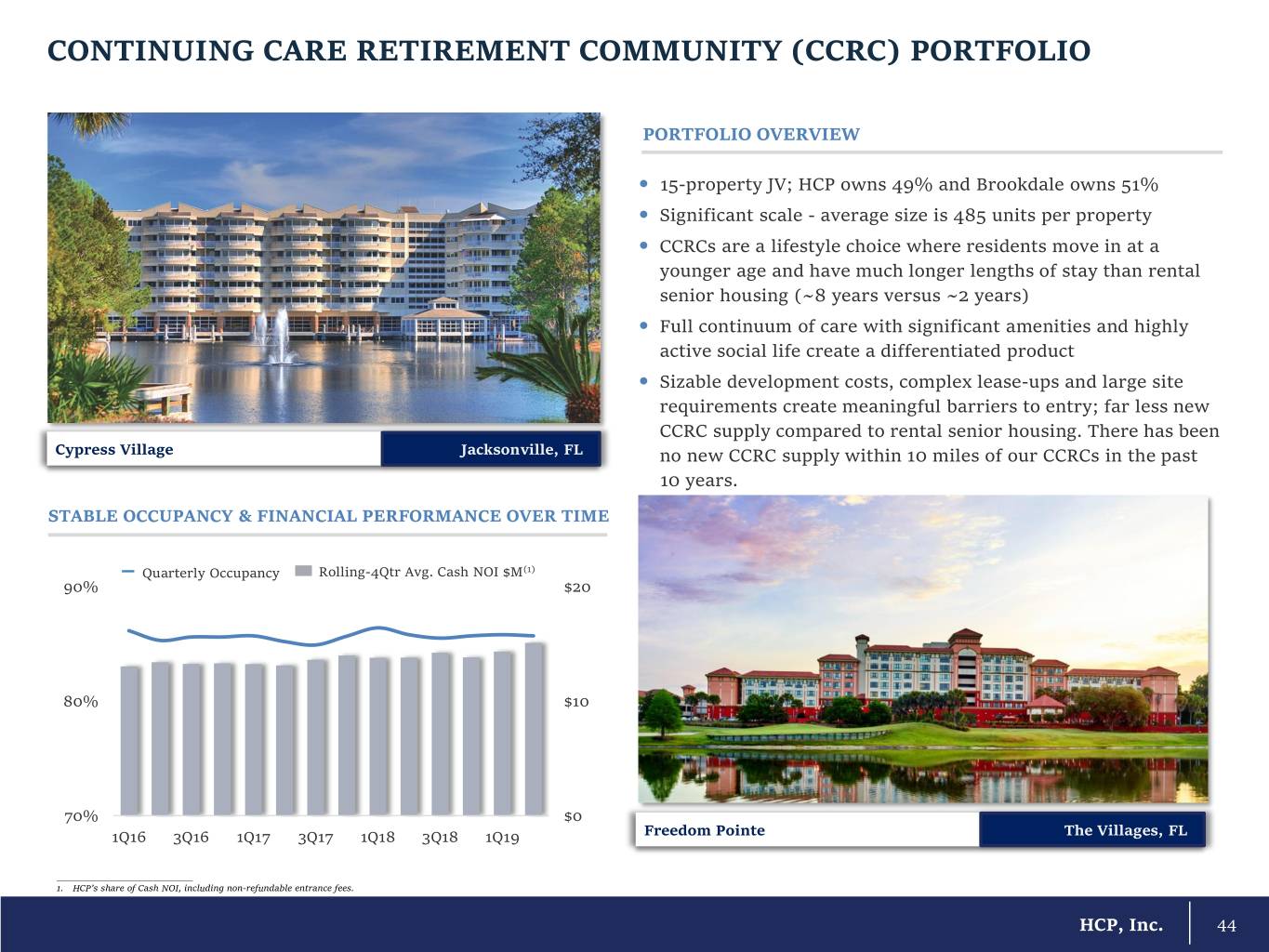

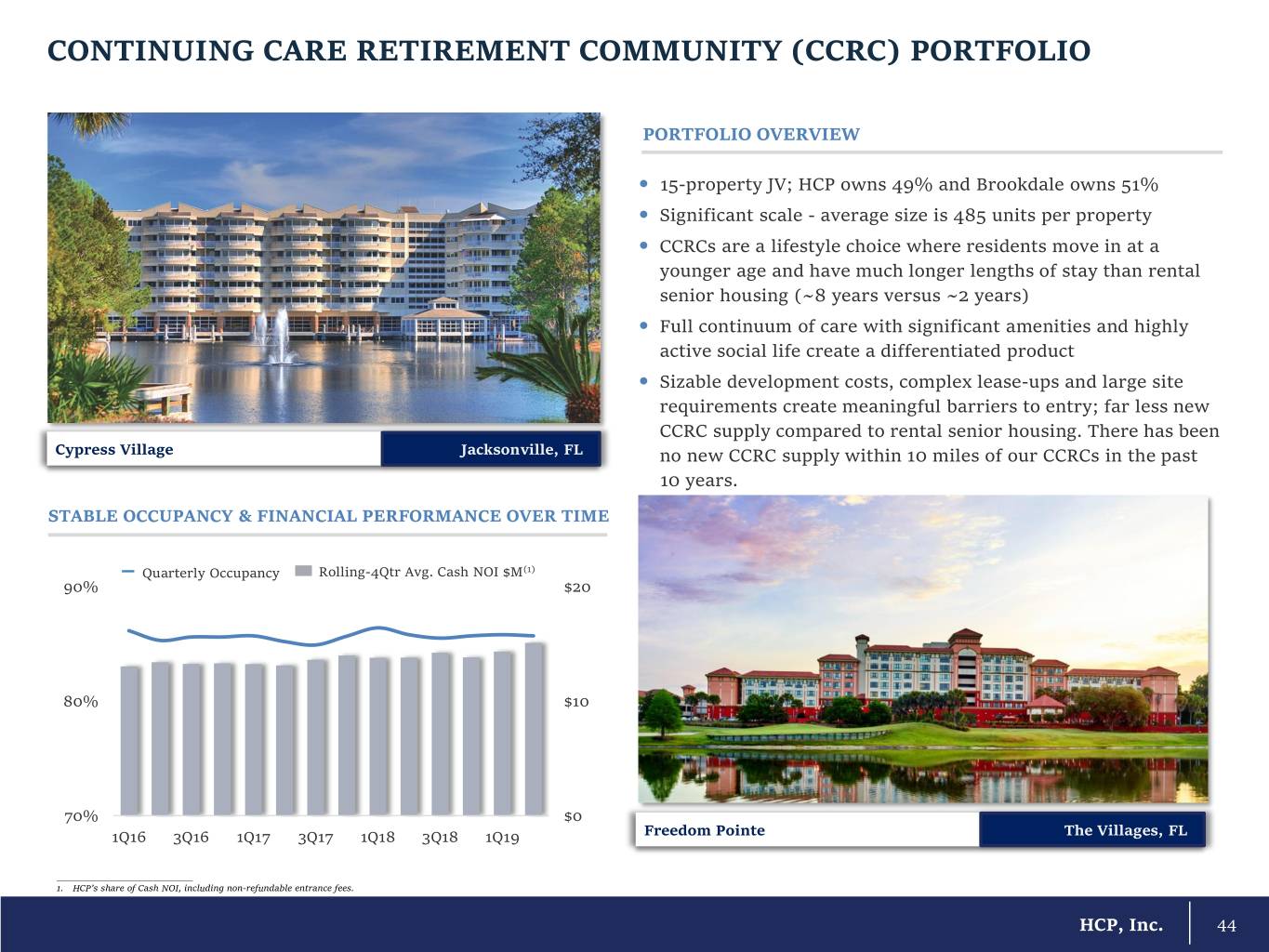

CONTINUING CARE RETIREMENT COMMUNITY (CCRC) PORTFOLIO PORTFOLIO OVERVIEW 15-property JV; HCP owns 49% and Brookdale owns 51% Significant scale - average size is 485 units per property CCRCs are a lifestyle choice where residents move in at a younger age and have much longer lengths of stay than rental senior housing (~8 years versus ~2 years) Full continuum of care with significant amenities and highly active social life create a differentiated product Sizable development costs, complex lease-ups and large site requirements create meaningful barriers to entry; far less new CCRC supply compared to rental senior housing. There has been Cypress Village Jacksonville, FL no new CCRC supply within 10 miles of our CCRCs in the past 10 years. STABLE OCCUPANCY & FINANCIAL PERFORMANCE OVER TIME Quarterly Occupancy Rolling-4Qtr Avg. Cash NOI $M(1) 90% $20 80% $10 70% $0 1Q16 3Q16 1Q17 3Q17 1Q18 3Q18 1Q19 Freedom Pointe The Villages, FL ___________________________ 1. HCP’s share of Cash NOI, including non-refundable entrance fees. HCP, Inc. 44

BALANCE SHEET & SUSTAINABILITY HCP, Inc. Centerpoint | Kansas City, MO

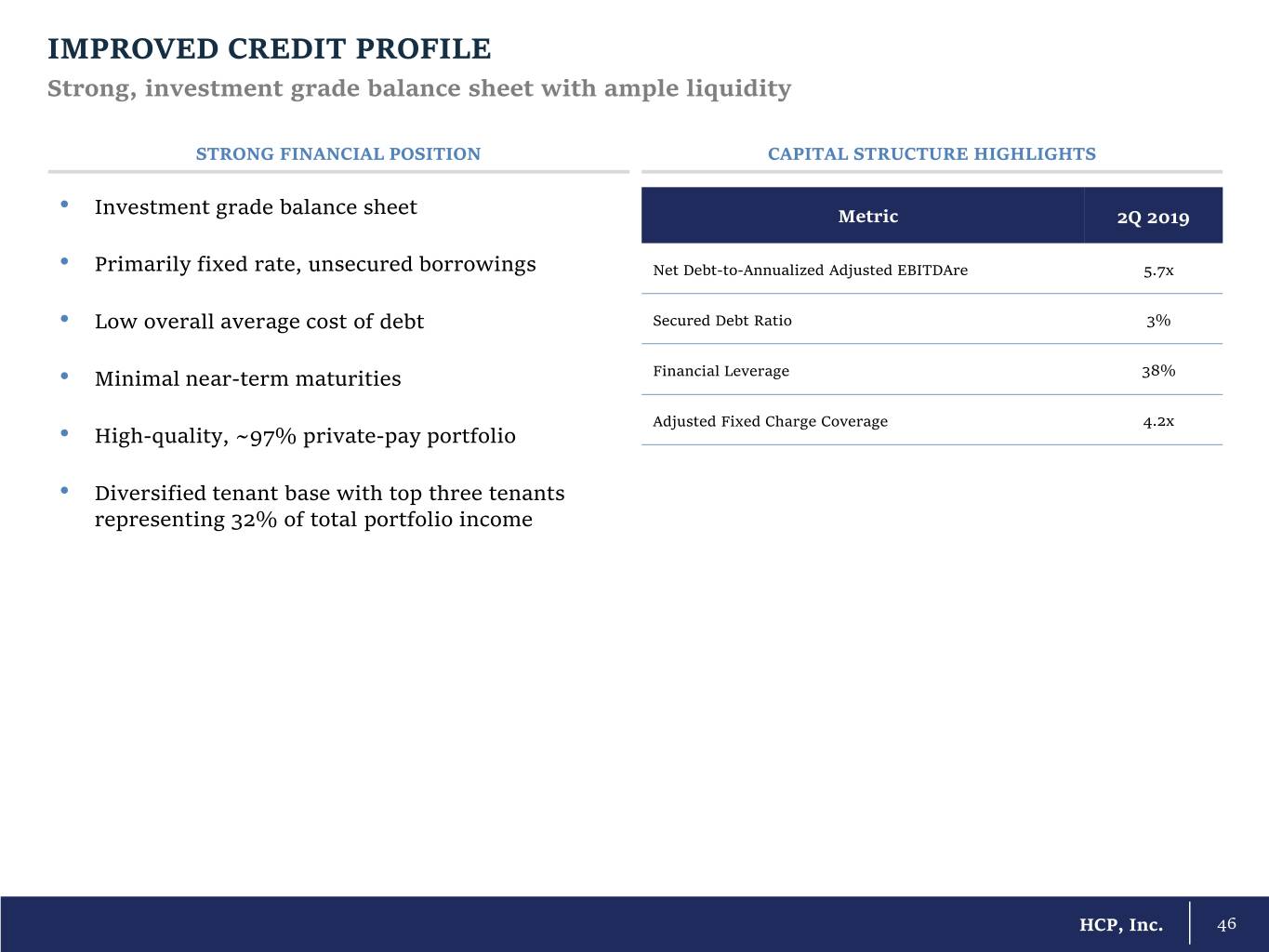

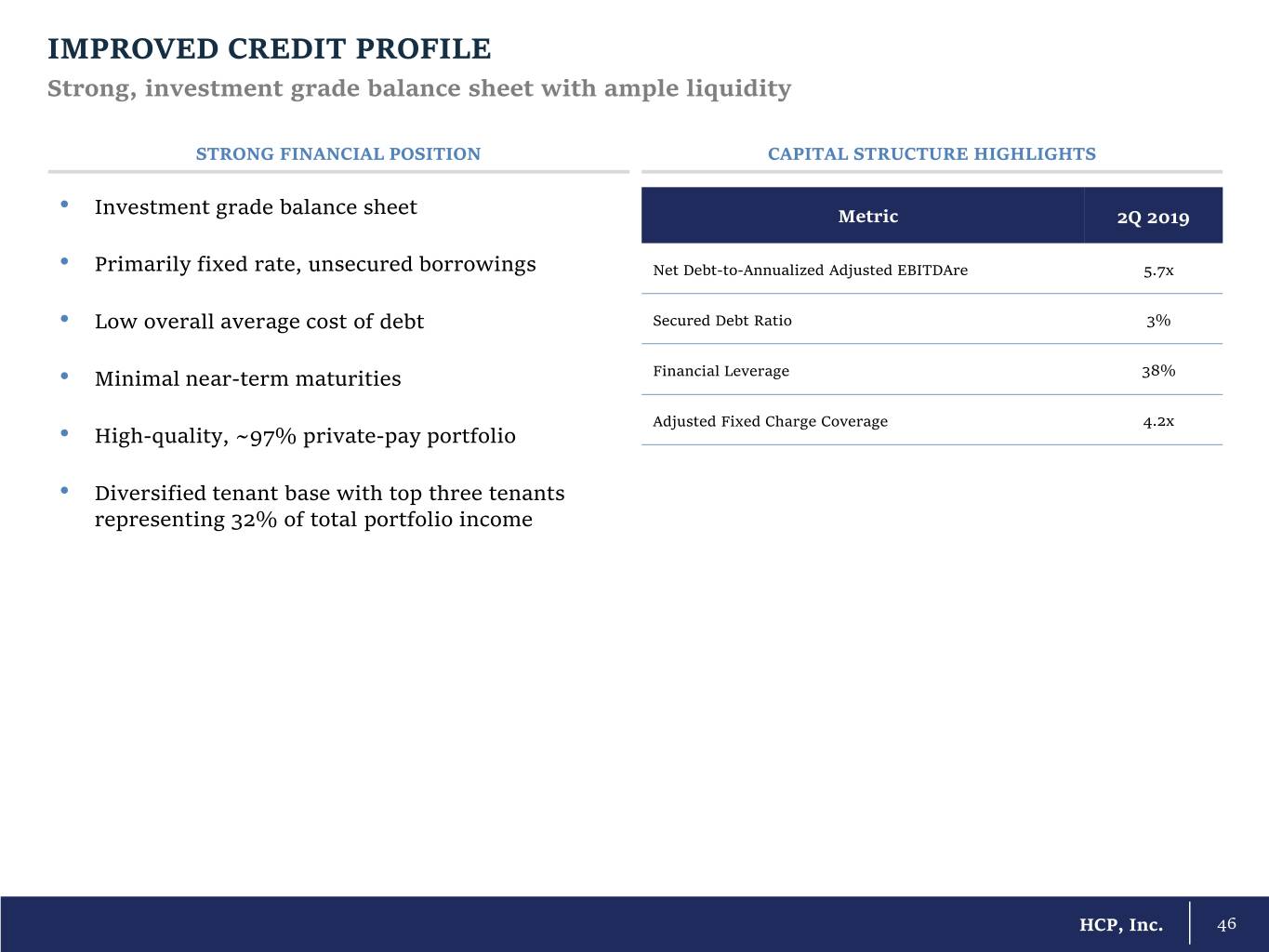

IMPROVED CREDIT PROFILE Strong, investment grade balance sheet with ample liquidity STRONG FINANCIAL POSITION CAPITAL STRUCTURE HIGHLIGHTS • Investment grade balance sheet Metric 2Q 2019 • Primarily fixed rate, unsecured borrowings Net Debt-to-Annualized Adjusted EBITDAre 5.7x • Low overall average cost of debt Secured Debt Ratio 3% • Minimal near-term maturities Financial Leverage 38% Adjusted Fixed Charge Coverage 4.2x • High-quality, ~97% private-pay portfolio • Diversified tenant base with top three tenants representing 32% of total portfolio income HCP, Inc. 46

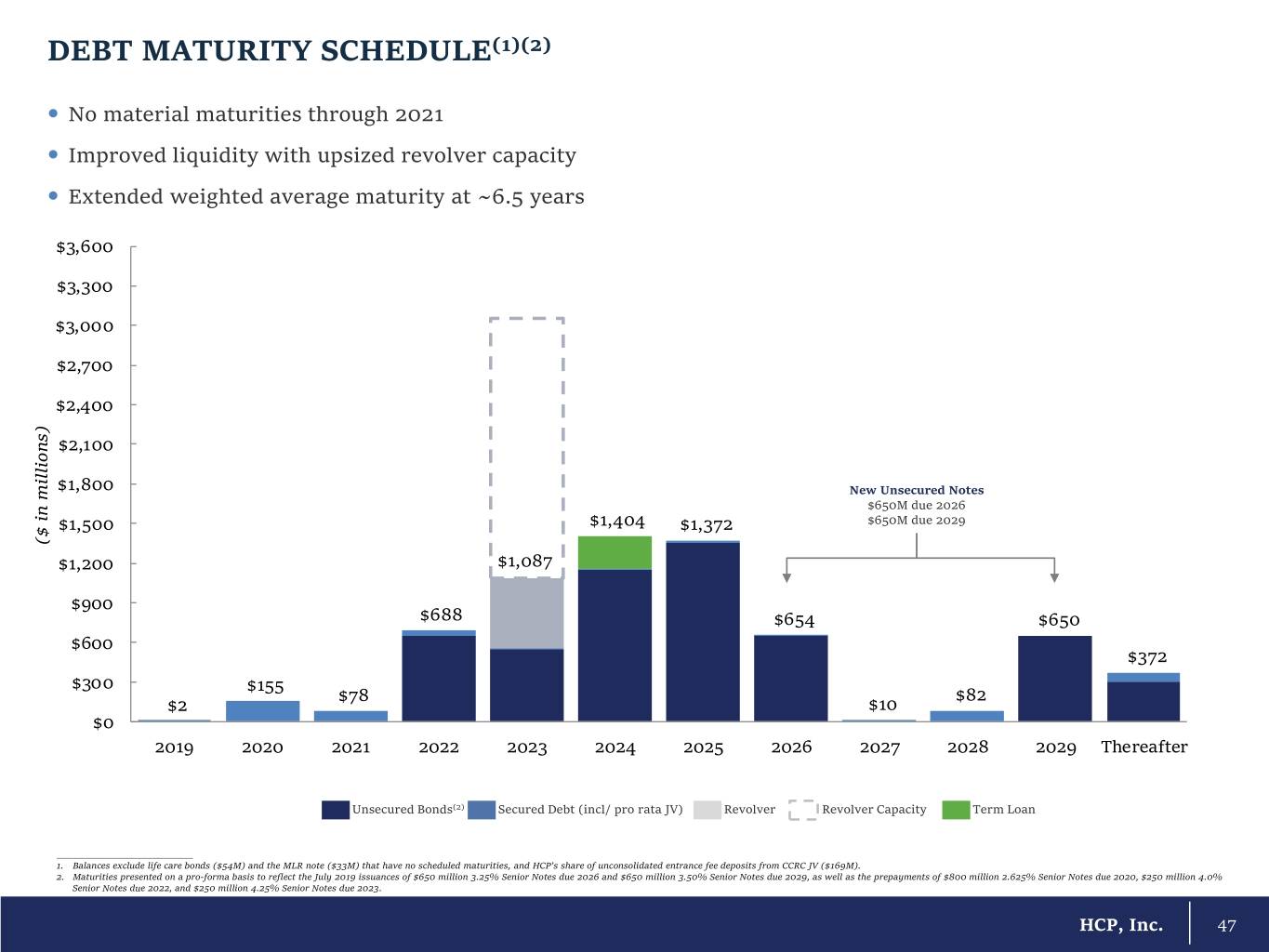

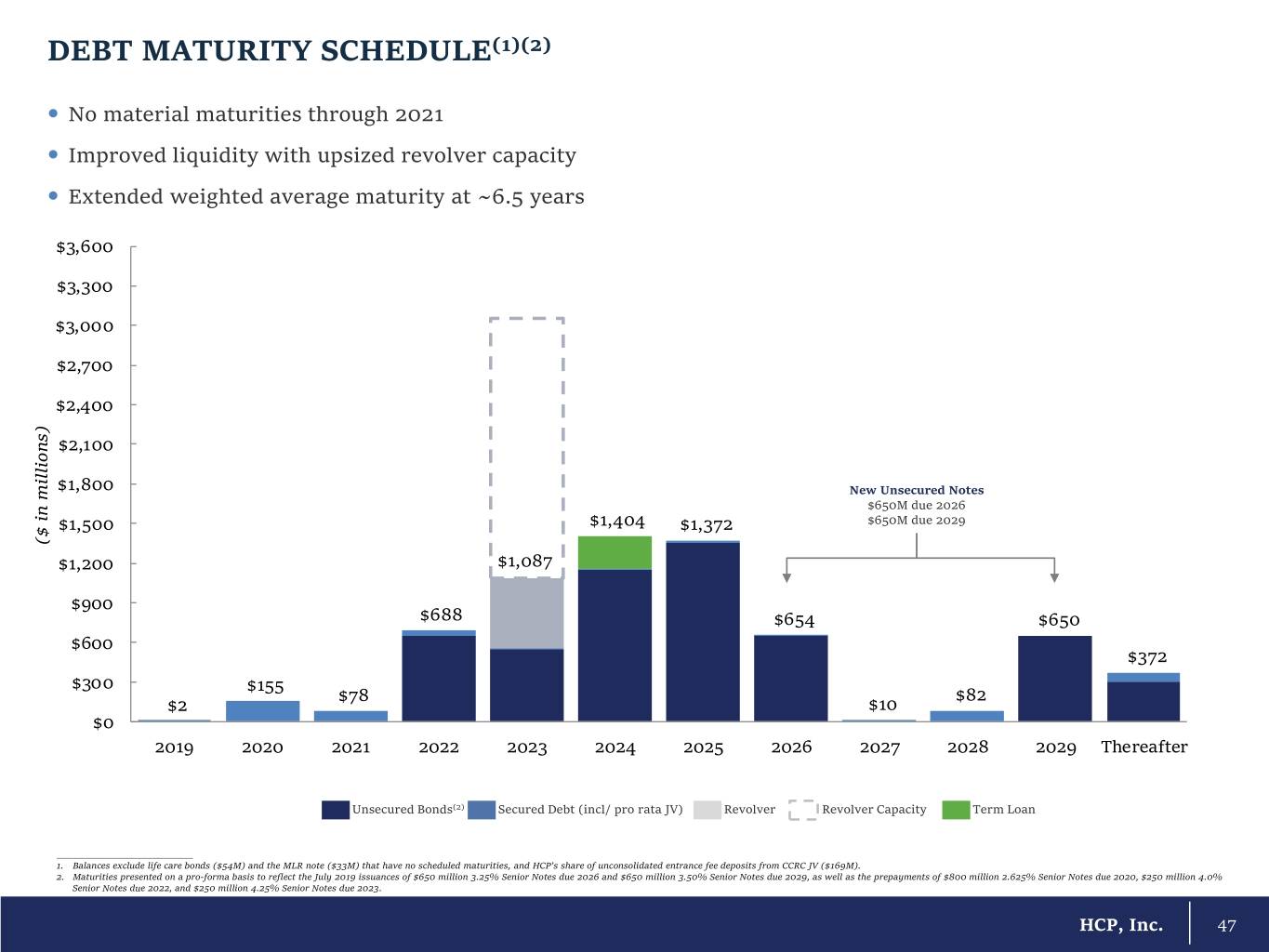

DEBT MATURITY SCHEDULE(1)(2) No material maturities through 2021 Improved liquidity with upsized revolver capacity Extended weighted average maturity at ~6.5 years $3,600 $3,300 $3,000 $2,700 $2,400 $2,100 $1,800 New Unsecured Notes $650M due 2026 $1,500 $1,404 $1,372 $650M due 2029 ($ ($ in millions) $1,200 $1,087 $900 $688 $654 $650 $600 $372 $300 $155 $78 $82 $2 $10 $0 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 Thereafter Unsecured Bonds(2) Secured Debt (incl/ pro rata JV) Revolver Revolver Capacity Term Loan ___________________________ 1. Balances exclude life care bonds ($54M) and the MLR note ($33M) that have no scheduled maturities, and HCP’s share of unconsolidated entrance fee deposits from CCRC JV ($169M). 2. Maturities presented on a pro-forma basis to reflect the July 2019 issuances of $650 million 3.25% Senior Notes due 2026 and $650 million 3.50% Senior Notes due 2029, as well as the prepayments of $800 million 2.625% Senior Notes due 2020, $250 million 4.0% Senior Notes due 2022, and $250 million 4.25% Senior Notes due 2023. HCP, Inc. 47

SPOTLIGHT ON HCP’S GREEN ACCOMPLISHMENTS AND BUILDINGS(1) 115 2.6M ft.2 223 8 Years 8 Times ENERGY STAR Properties with LEED® Certified GRESB Green NAREIT Leader Certified Common Area Properties Star Rating in the Light Buildings LED Lighting Retrofits Soledad, San Diego, CA Sky Ridge, Lone Tree, CO Brookdale Shavano Park, San Antonio, TX Life Science Medical Office Senior Housing The Cove, San Francisco, CA Lone Peak, Draper, UT Brookdale Olney, Olney, MD Life Science Medical Office Senior Housing ____________________________ 1. Data as of June 30, 2019. HCP, Inc. 48

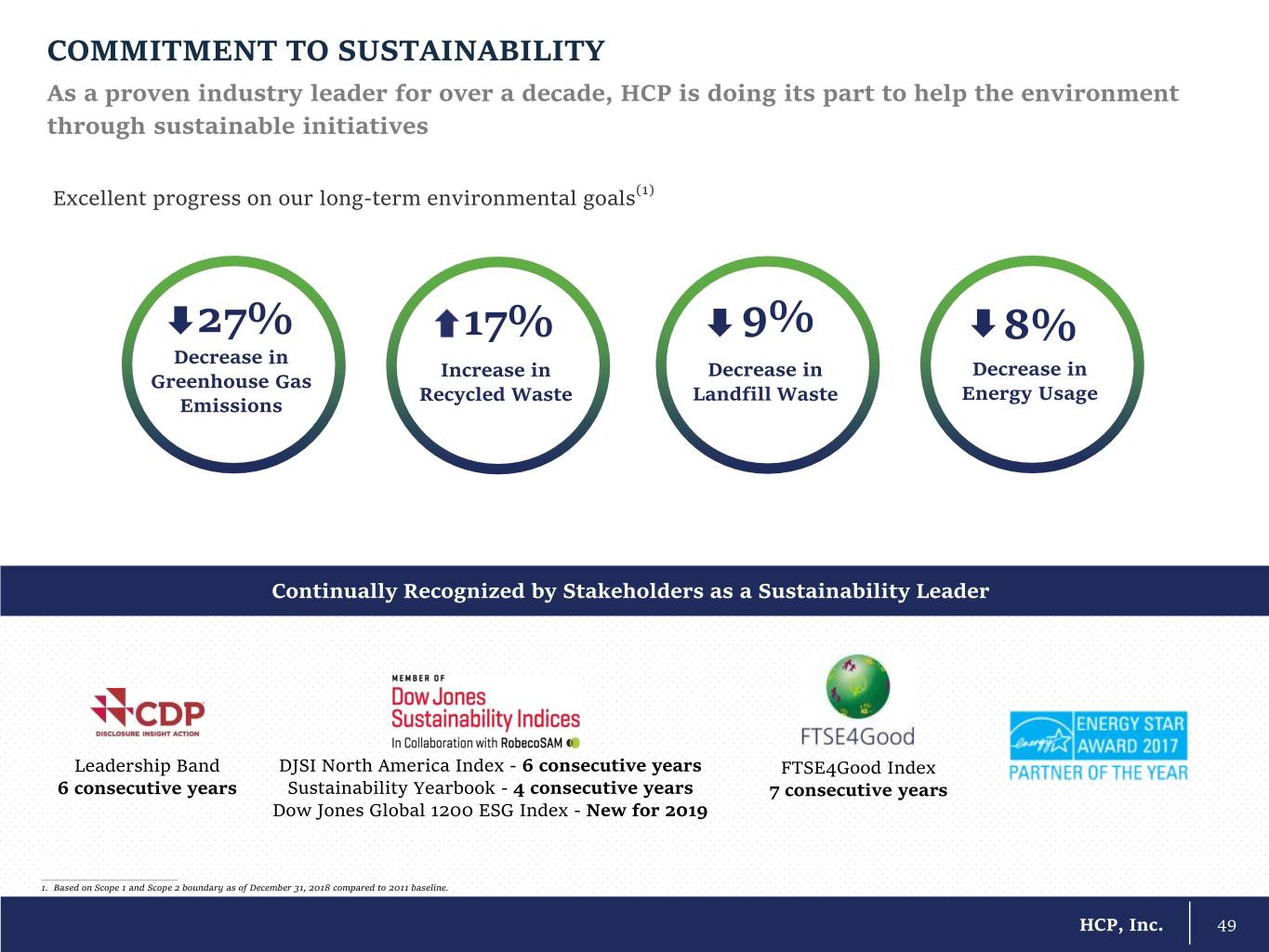

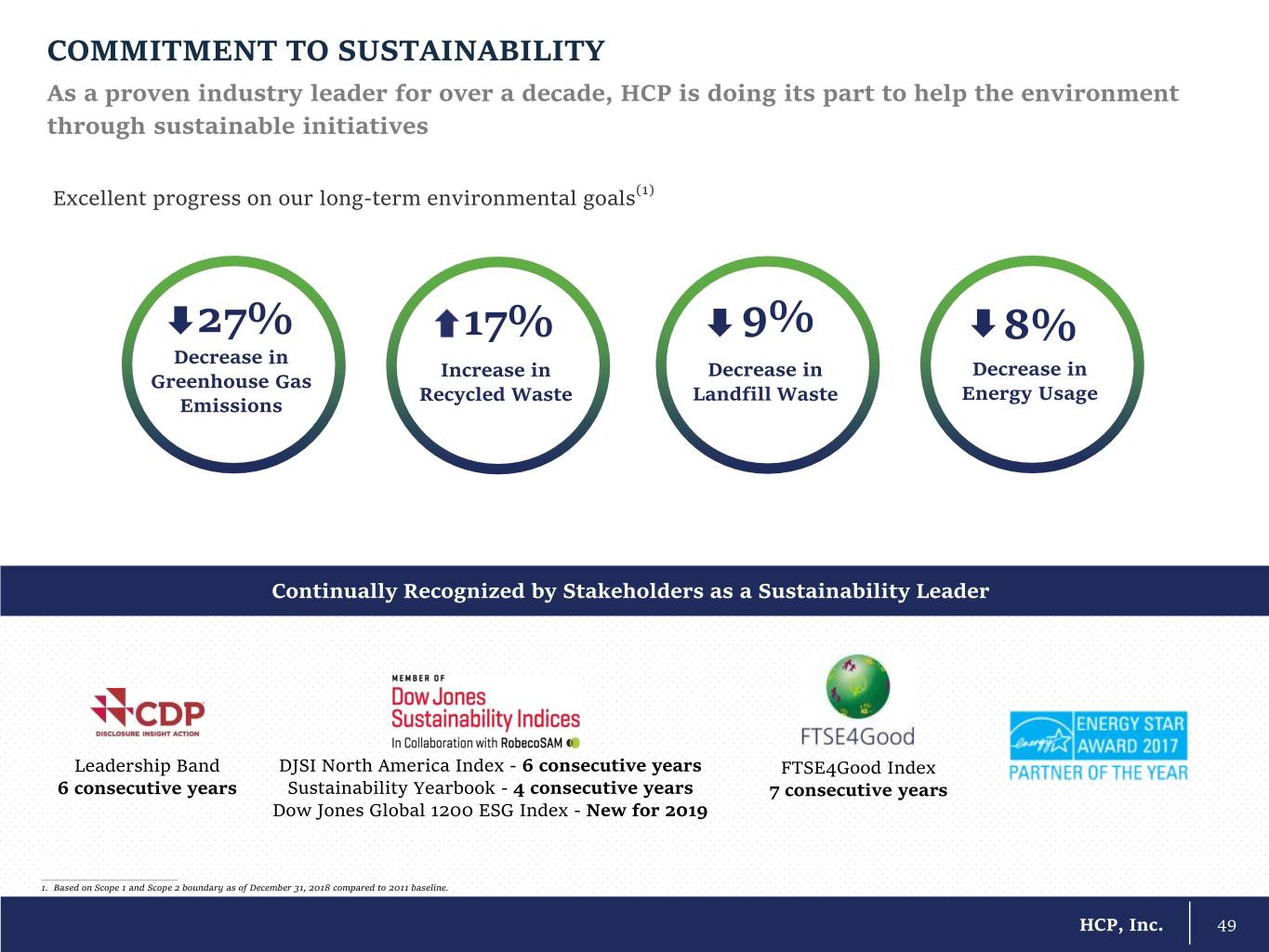

COMMITMENT TO SUSTAINABILITY As a proven industry leader for over a decade, HCP is doing its part to help the environment through sustainable initiatives Excellent progress on our long-term environmental goals(1) 27% 17% 9% 8% Decrease in Increase in Decrease in Decrease in Greenhouse Gas Recycled Waste Landfill Waste Energy Usage Emissions Continually Recognized by Stakeholders as a Sustainability Leader Leadership Band DJSI North America Index - 6 consecutive years FTSE4Good Index 6 consecutive years Sustainability Yearbook - 4 consecutive years 7 consecutive years Dow Jones Global 1200 ESG Index - New for 2019 ___________________________ 1. Based on Scope 1 and Scope 2 boundary as of December 31, 2018 compared to 2011 baseline. HCP, Inc. 49

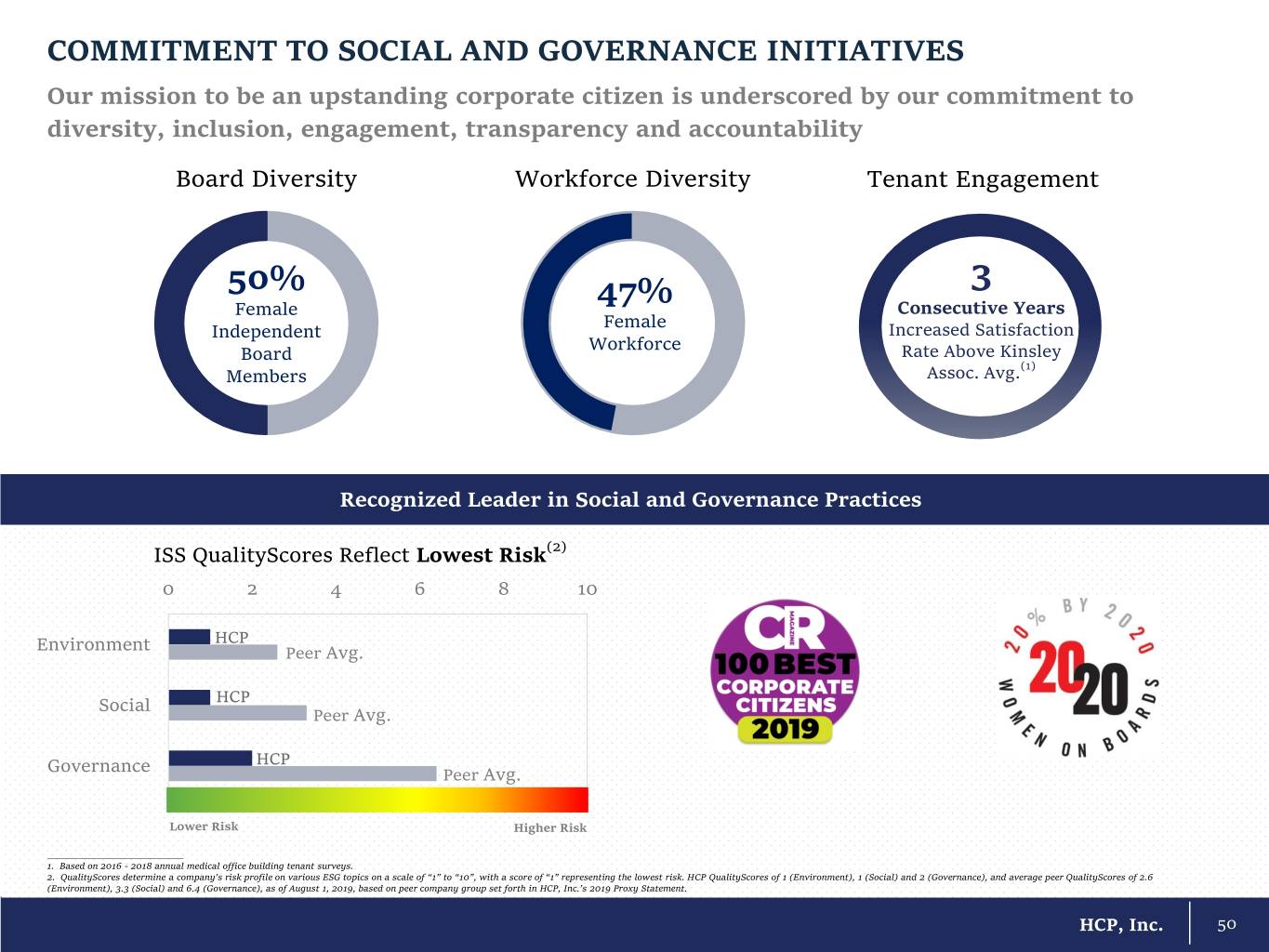

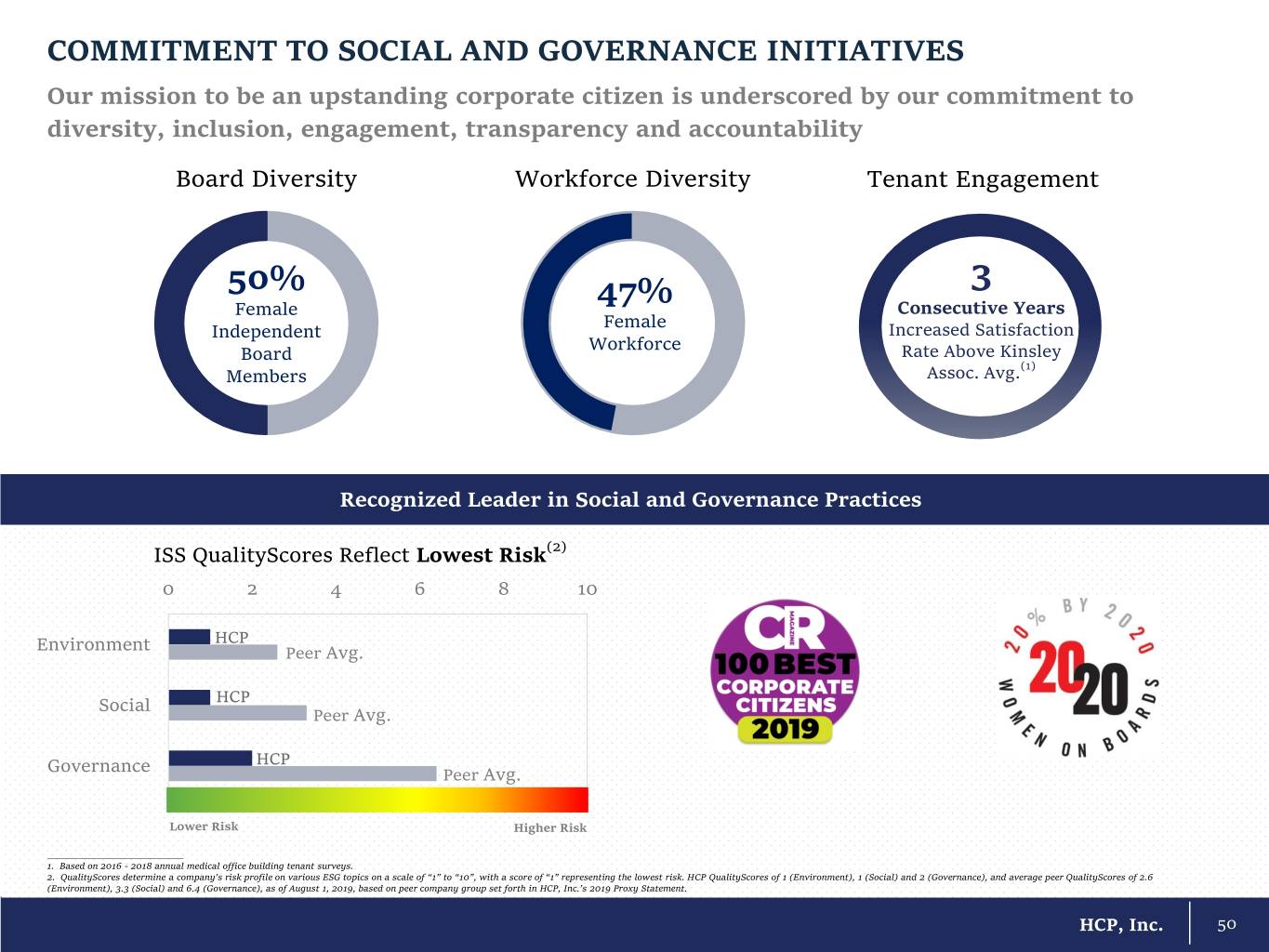

COMMITMENT TO SOCIAL AND GOVERNANCE INITIATIVES Our mission to be an upstanding corporate citizen is underscored by our commitment to diversity, inclusion, engagement, transparency and accountability Board Diversity Workforce Diversity Tenant Engagement 50% 47% 3 Female Consecutive Years Female Independent Increased Satisfaction Workforce Board Rate Above Kinsley (1) Members Assoc. Avg. Recognized Leader in Social and Governance Practices ISS QualityScores Reflect Lowest Risk(2) 0 2 4 6 8 10 HCP Environment Peer Avg. Social HCP Peer Avg. HCP Governance Peer Avg. Lower Risk Higher Risk ___________________________ 1. Based on 2016 - 2018 annual medical office building tenant surveys. 2. QualityScores determine a company’s risk profile on various ESG topics on a scale of “1” to “10”, with a score of “1” representing the lowest risk. HCP QualityScores of 1 (Environment), 1 (Social) and 2 (Governance), and average peer QualityScores of 2.6 (Environment), 3.3 (Social) and 6.4 (Governance), as of August 1, 2019, based on peer company group set forth in HCP, Inc.’s 2019 Proxy Statement. HCP, Inc. 50

APPENDIX HCP, Inc. 87 CambridgePark Drive | Cambridge, MA

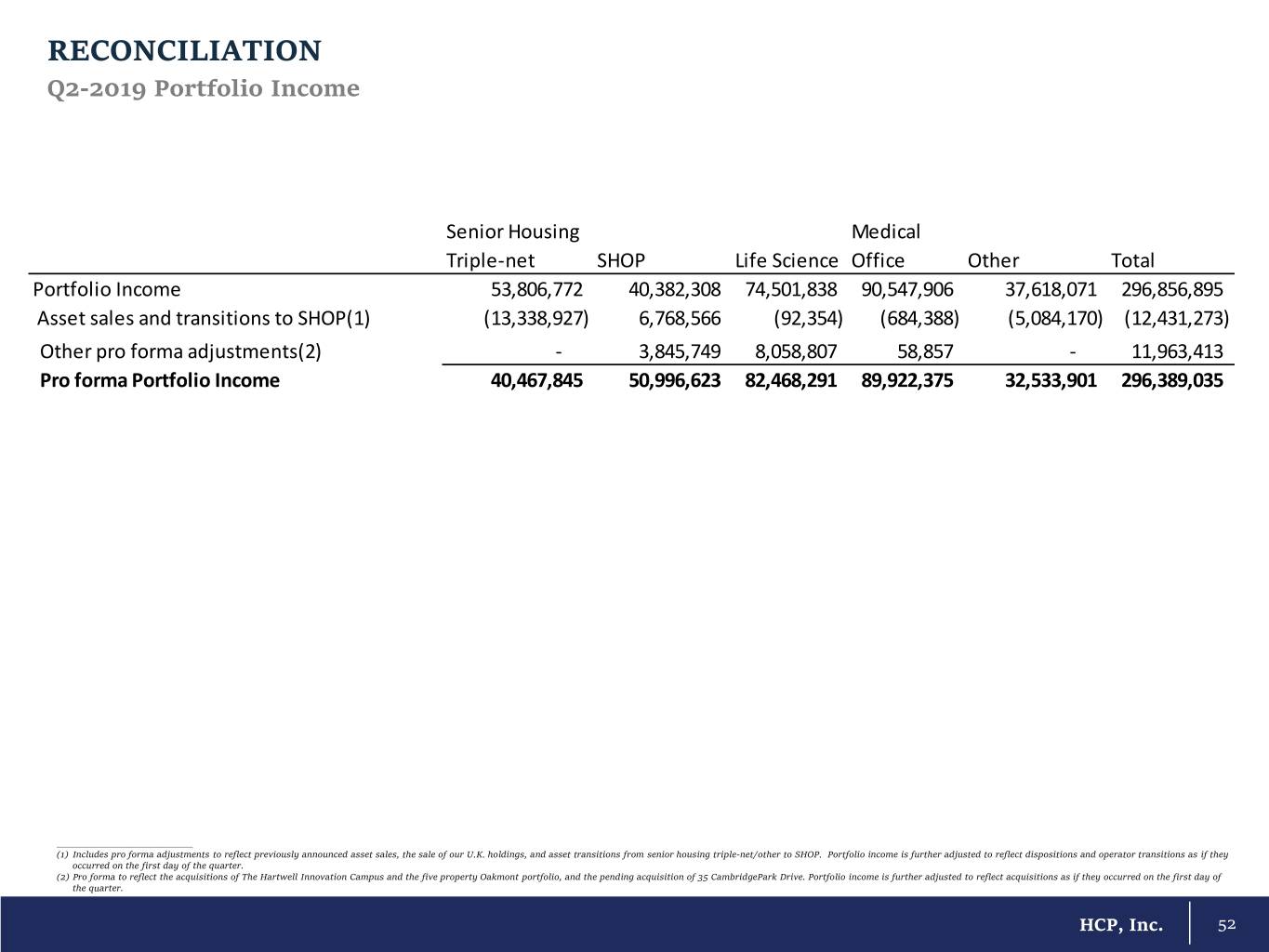

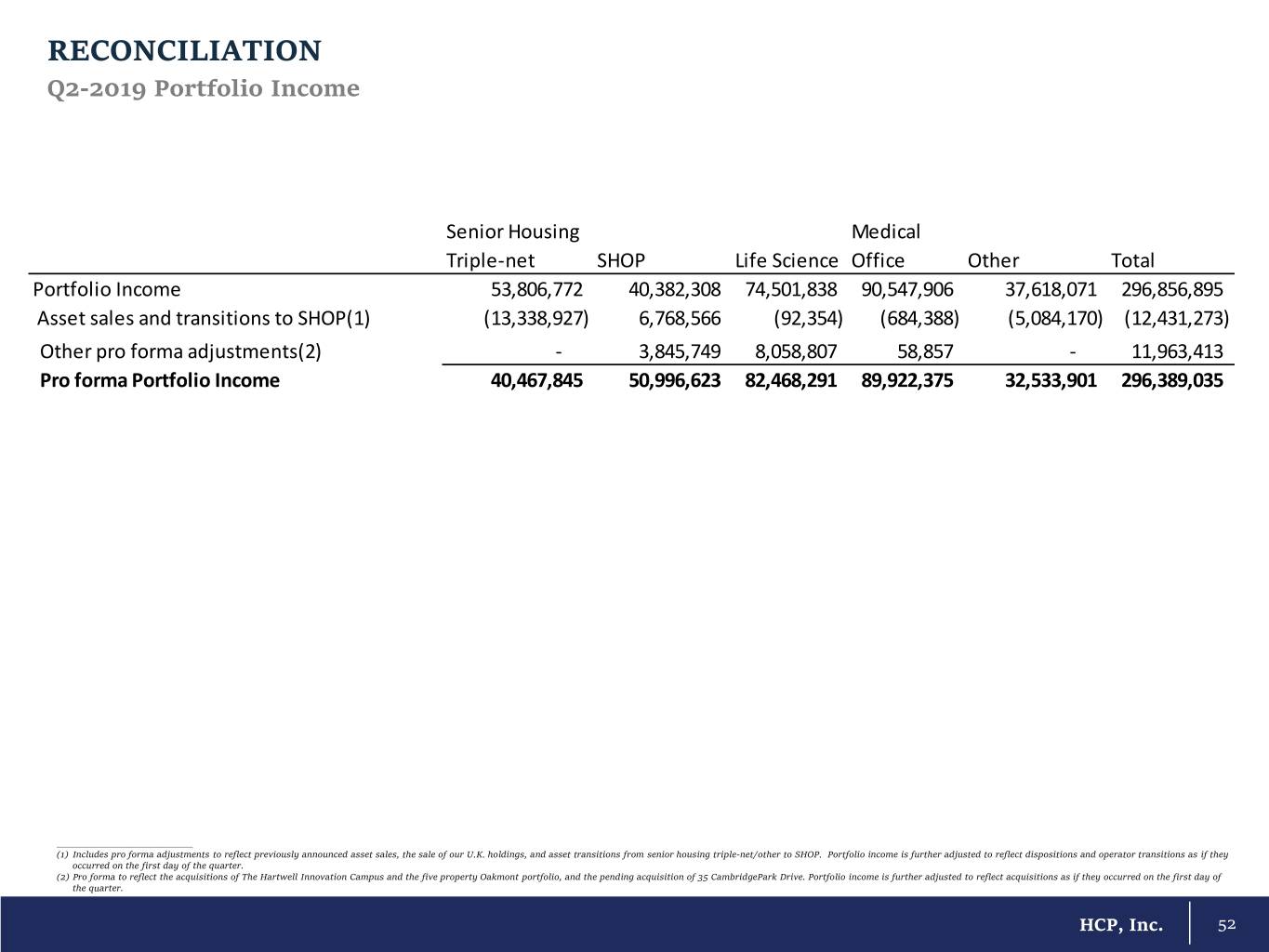

RECONCILIATION Q2-2019 Portfolio Income Senior Housing Medical Triple-net SHOP Life Science Office Other Total Portfolio Income 53,806,772 40,382,308 74,501,838 90,547,906 37,618,071 296,856,895 Asset sales and transitions to SHOP(1) (13,338,927) 6,768,566 (92,354) (684,388) (5,084,170) (12,431,273) Other pro forma adjustments(2) - 3,845,749 8,058,807 58,857 - 11,963,413 Pro forma Portfolio Income 40,467,845 50,996,623 82,468,291 89,922,375 32,533,901 296,389,035 ___________________________ (1) Includes pro forma adjustments to reflect previously announced asset sales, the sale of our U.K. holdings, and asset transitions from senior housing triple-net/other to SHOP. Portfolio income is further adjusted to reflect dispositions and operator transitions as if they occurred on the first day of the quarter. (2) Pro forma to reflect the acquisitions of The Hartwell Innovation Campus and the five property Oakmont portfolio, and the pending acquisition of 35 CambridgePark Drive. Portfolio income is further adjusted to reflect acquisitions as if they occurred on the first day of the quarter. HCP, Inc. 52