DISCLAIMERS This presentation is being presented by HCP, Inc. (“HCP” or the “Company”) solely for your information, is subject to change and speaks only as of the date hereof. This presentation and comments made by management do not constitute an offer to sell or the solicitation of an offer to buy any securities of HCP or any investment interest in any of our business ventures. This presentation is not complete and is only a summary of the more detailed information included elsewhere, including in our Securities and Exchange Commission (“SEC”) filings. No representation or warranty, expressed or implied is made and you should not place undue reliance on the accuracy, fairness or completeness of the information presented. FORWARD-LOOKING STATEMENTS Statements contained in this presentation, as well as statements made by management, that are not historical facts are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include, among other things, statements regarding our and our officers’ intent, belief or expectation as identified by the use of words such as “may,” “will,” “project,” “expect,” “believe,” “intend,” “anticipate,” “seek,” “target,” “forecast,” “plan,” “potential,” “estimate,” “could,” “would,” “should” and other comparable and derivative terms or the negatives thereof. Forward-looking statements include, without limitation, our statements regarding: (i) timing, outcomes and other details relating to current or pending transactions and financing activities; (ii) financial forecasts, estimates and projections, including with respect to the estimated impact of transactions; and (iii) pro forma operator exposure and rent coverage. Forward-looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations. While forward-looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained. Further, we cannot guarantee the accuracy of any such forward-looking statement contained in this presentation, and such forward-looking statements are subject to known and unknown risks and uncertainties that are difficult to predict. These risks and uncertainties include, but are not limited to: the Company’s reliance on a concentration of a small number of tenants and operators for a significant percentage of its revenues and net operating income; the financial condition of the Company’s existing and future tenants, operators and borrowers, including potential bankruptcies and downturns in their businesses, and their legal and regulatory proceedings, which results in uncertainties regarding the Company’s ability to continue to realize the full benefit of such tenants’ and operators’ leases and borrowers’ loans; the ability of the Company’s existing and future tenants, operators and borrowers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and manage their expenses in order to generate sufficient income to make rent and loan payments to the Company and the Company’s ability to recover investments made, if applicable, in their operations; the Company’s concentration in the healthcare property sector, particularly in senior housing, life sciences and medical office buildings, which makes its profitability more vulnerable to a downturn in a specific sector than if the Company were investing in multiple industries; operational risks associated with third party management contracts, including the additional regulation and liabilities of RIDEA lease structures; the effect on the Company and its tenants and operators of legislation, executive orders and other legal requirements, including compliance with the Americans with Disabilities Act, fire, safety and health regulations, environmental laws, the Affordable Care Act, licensure, certification and inspection requirements, and laws addressing entitlement programs and related services, including Medicare and Medicaid, which may result in future reductions in reimbursements or fines for noncompliance; the Company’s ability to identify replacement tenants and operators and the potential renovation costs and regulatory approvals associated therewith; the risks associated with property development and redevelopment, including costs above original estimates, project delays and lower occupancy rates and rents than expected; the potential impact of uninsured or underinsured losses; the risks associated with the Company’s investments in joint ventures and unconsolidated entities, including its lack of sole decision making authority and its reliance on its partners’ financial condition and continued cooperation; competition for the acquisition and financing of suitable healthcare properties as well as competition for tenants and operators, including with respect to new leases and mortgages and the renewal or rollover of existing leases; the Company’s or its counterparties’ ability to fulfill obligations, such as financing conditions and/or regulatory approval requirements, required to successfully consummate acquisitions, dispositions, transitions, developments, redevelopments, joint venture transactions or other transactions; the Company’s ability to achieve the benefits of acquisitions or other investments within expected time frames or at all, or within expected cost projections; the potential impact on the Company and its tenants, operators and borrowers from current and future litigation matters, including the possibility of larger than expected litigation costs, adverse results and related developments; changes in federal, state or local laws and regulations, including those affecting the healthcare industry that affect the Company’s costs of compliance or increase the costs, or otherwise affect the operations, of its tenants and operators; the Company’s ability to foreclose on collateral securing its real estate-related loans; volatility or uncertainty in the capital markets, the availability and cost of capital as impacted by interest rates, changes in the Company’s credit ratings, and the value of its common stock, and other conditions that may adversely impact the Company’s ability to fund its obligations or consummate transactions, or reduce the earnings from potential transactions; changes in global, national and local economic and other conditions, including currency exchange rates; the Company’s ability to manage its indebtedness level and changes in the terms of such indebtedness; competition for skilled management and other key personnel; the Company’s reliance on information technology systems and the potential impact of system failures, disruptions or breaches; the Company’s ability to maintain its qualification as a real estate investment trust; and other risks and uncertainties described from time to time in the Company’s SEC filings. Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward-looking statements, which speak only as of the date on which they are made. MARKET AND INDUSTRY DATA This presentation also includes market and industry data that HCP has obtained from market research, publicly available information and industry publications. The accuracy and completeness of such information are not guaranteed. Such data is often based on industry surveys and preparers’ experience in the industry. Similarly, although HCP believes that the surveys and market research that others have performed are reliable, such surveys and market research is subject to assumptions, estimates and other uncertainties and HCP has not independently verified this information. NON-GAAP FINANCIAL MEASURES This presentation contains certain supplemental non-GAAP financial measures. While HCP believes that non-GAAP financial measures are helpful in evaluating its operating performance, the use of non-GAAP financial measures in this presentation should not be considered in isolation from, or as an alternative for, a measure of financial or operating performance as defined by GAAP. You are cautioned that there are inherent limitations associated with the use of each of these supplemental non-GAAP financial measures as an analytical tool. Additionally, HCP’s computation of non-GAAP financial measures may not be comparable to those reported by other REITs. You can find reconciliations of the non‐GAAP financial measures to the most directly comparable GAAP financial measures, to the extent available without unreasonable efforts, at “2Q 2019 Discussion and Reconciliation of Non-GAAP Financial Measures” on the Investor Relations section of our website at www.hcpi.com HCP, Inc. 2

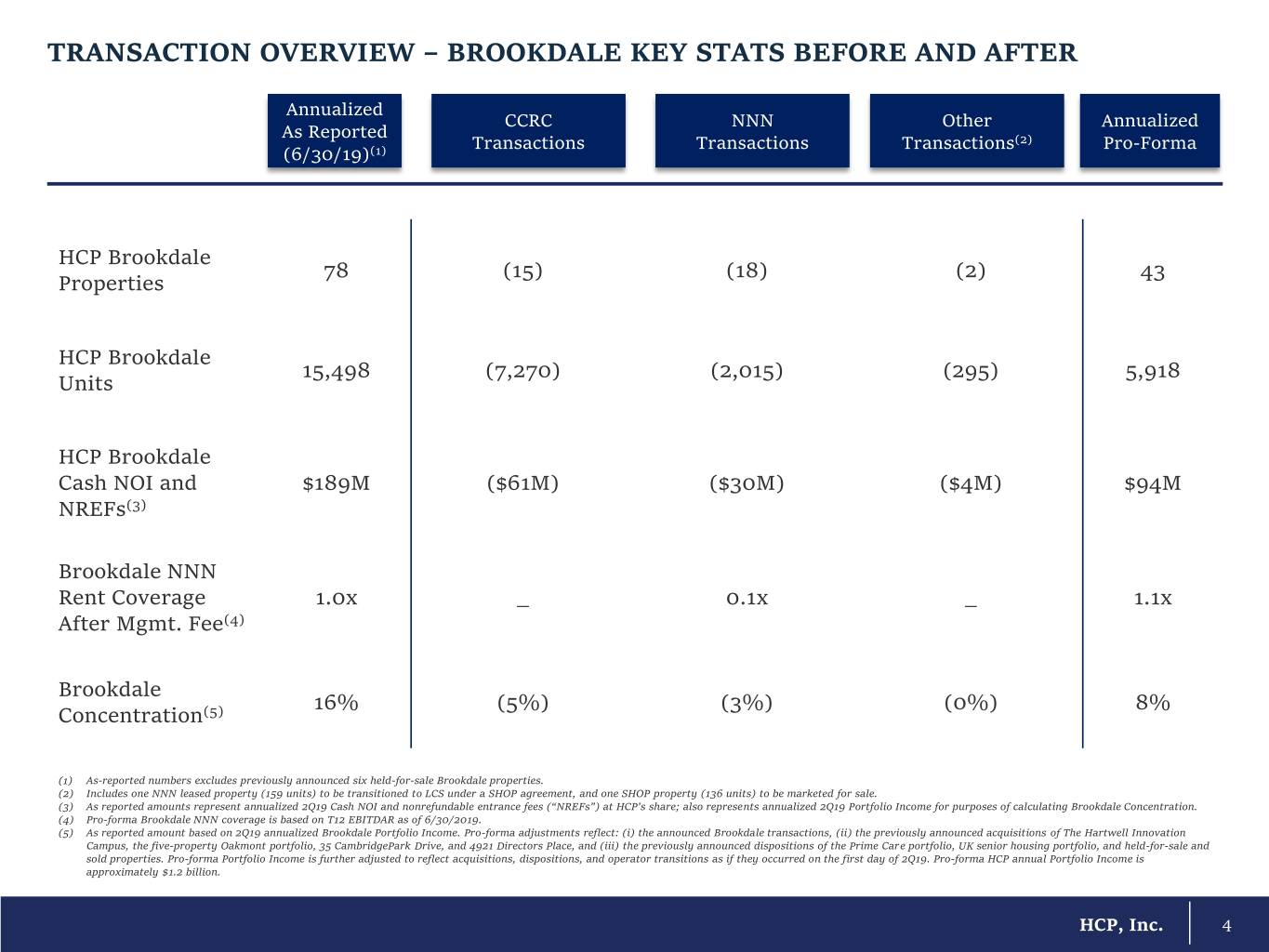

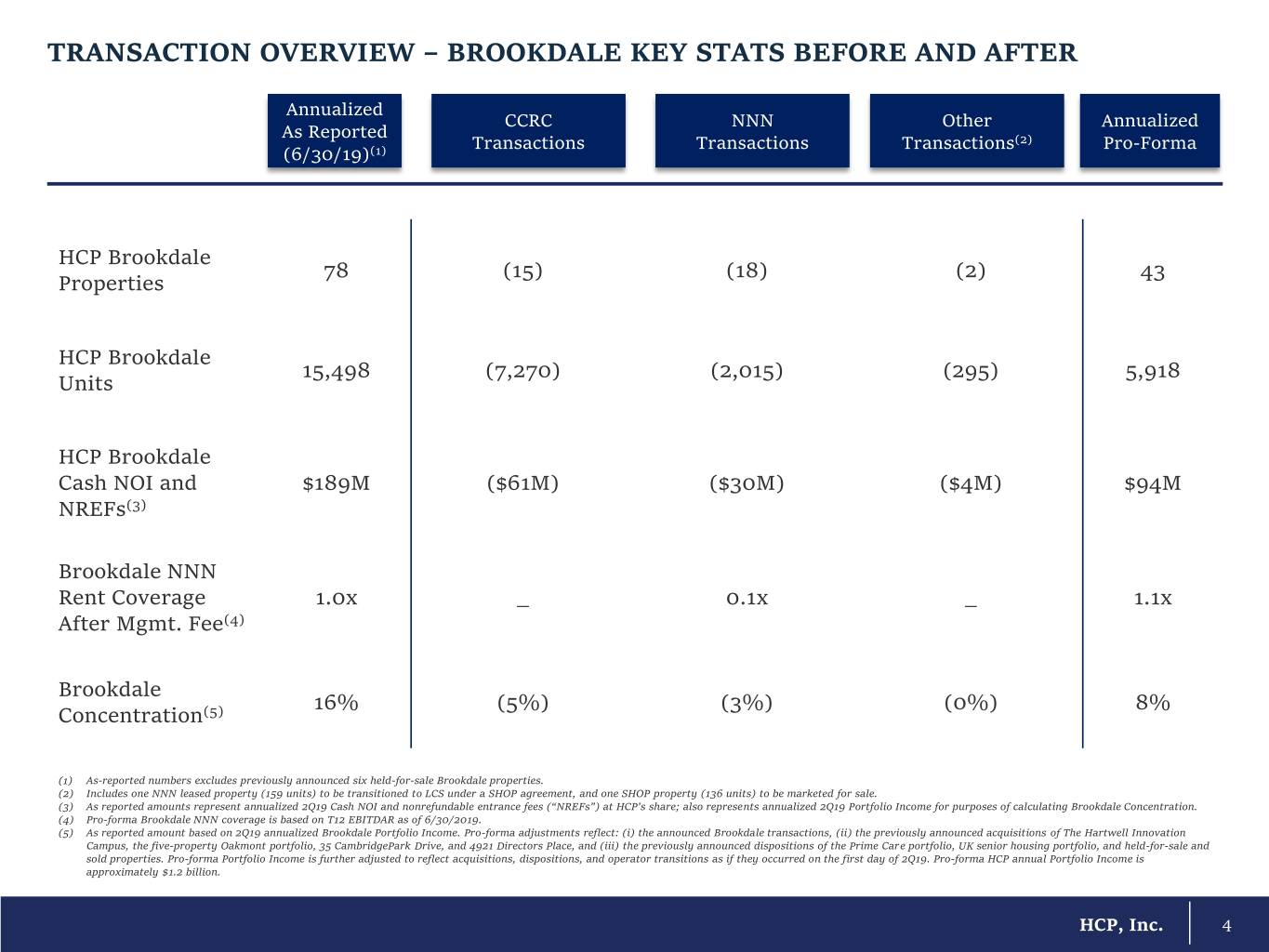

TRANSACTION OVERVIEW – BROOKDALE KEY STATS BEFORE AND AFTER Annualized CCRC NNN Other Annualized As Reported Transactions Transactions Transactions(2) Pro-Forma (6/30/19)(1) HCP Brookdale 78 (15) (18) (2) 43 Properties HCP Brookdale 15,498 (7,270) (2,015) (295) 5,918 Units HCP Brookdale Cash NOI and $189M ($61M) ($30M) ($4M) $94M NREFs(3) Brookdale NNN Rent Coverage 1.0x _ 0.1x _ 1.1x After Mgmt. Fee(4) Brookdale 16% (5%) (3%) (0%) 8% Concentration(5) (1) As-reported numbers excludes previously announced six held-for-sale Brookdale properties. (2) Includes one NNN leased property (159 units) to be transitioned to LCS under a SHOP agreement, and one SHOP property (136 units) to be marketed for sale. (3) As reported amounts represent annualized 2Q19 Cash NOI and nonrefundable entrance fees (“NREFs”) at HCP’s share; also represents annualized 2Q19 Portfolio Income for purposes of calculating Brookdale Concentration. (4) Pro-forma Brookdale NNN coverage is based on T12 EBITDAR as of 6/30/2019. (5) As reported amount based on 2Q19 annualized Brookdale Portfolio Income. Pro-forma adjustments reflect: (i) the announced Brookdale transactions, (ii) the previously announced acquisitions of The Hartwell Innovation Campus, the five-property Oakmont portfolio, 35 CambridgePark Drive, and 4921 Directors Place, and (iii) the previously announced dispositions of the Prime Care portfolio, UK senior housing portfolio, and held-for-sale and sold properties. Pro-forma Portfolio Income is further adjusted to reflect acquisitions, dispositions, and operator transitions as if they occurred on the first day of 2Q19. Pro-forma HCP annual Portfolio Income is approximately $1.2 billion. HCP, Inc. 4

PROPERTIES LIST Property Name Location Property Type Status Village at Gleannloch Farms Spring, TX CCRC To be 100% Owned Freedom Village at Holland Holland, MI CCRC To be 100% Owned Galleria Woods Birmingham, AL CCRC To be 100% Owned South Port Square Port Charlotte, FL CCRC To be 100% Owned Lake Port Square Leesburg, FL CCRC To be 100% Owned Freedom Plaza Sun City Center Sun City Center, FL CCRC To be 100% Owned Regency Oaks Clearwater Clearwater, FL CCRC To be 100% Owned Lake Seminole Square Seminole, FL CCRC To be 100% Owned Cypress Village Jacksonville, FL CCRC To be 100% Owned Freedom Pointe at the Villages The Villages, FL CCRC To be 100% Owned Freedom Square Seminole, FL CCRC To be 100% Owned Freedom Village at Brandywine Chester County, PA CCRC To be 100% Owned Freedom Village at Bradenton Bradenton, FL CCRC Sale to 3rd Party Foxwood Springs Raymore, MO CCRC Sale to 3rd Party Robin Run Village Indianapolis, IN CCRC Sale to 3rd Party Brookdale River Road Keizer, OR NNN Sale to Brookdale Brookdale Wilsonville Wilsonville, OR NNN Sale to Brookdale Brookdale Lodi Lodi, CA NNN Sale to Brookdale Brookdale Oswego Springs Portland, OR NNN Sale to Brookdale Brookdale South Bay S Kingstown, RI NNN Sale to Brookdale Brookdale Oak Park Oak Park, IL NNN Sale to Brookdale Brookdale Belle Meade Nashville, TN NNN Sale to Brookdale Brookdale College Place College Place, WA NNN Sale to Brookdale Brookdale Newnan Newnan, GA NNN Sale to Brookdale Brookdale Wekiwa Springs Apopka, FL NNN Sale to Brookdale Brookdale St Augustine St Augustine, FL NNN Sale to Brookdale Hillside Campus McMinnville, OR NNN Sale to Brookdale Brookdale Greenwood Vlg Greenwood Vlg, CO NNN Sale to Brookdale Brookdale Lawrenceville Lawrenceville, GA NNN Sale to Brookdale Brookdale Hartwell Hartwell, GA NNN Sale to Brookdale Brookdale Murray Murray, KY NNN Sale to Brookdale Brookdale Parkplace Denver, CO NNN Sale to Brookdale Brookdale Sakonnet Bay Tiverton, RI NNN Sale to Brookdale Brookdale Northridge Northridge, CA NNN to SHOP Transition to LCS/SHOP Brookdale West Bay Warwick, RI SHOP Sale to 3rd Party HCP, Inc. 7