Investor Presentation Healthpeak Properties June 2021 Sorrento Gateway (Rendering) Sorrento Mesa, San Diego

Disclaimers is subject to change and speaks only as of the date hereof. This presentation is not complete and is only a summary of the more detailed information included elsewhere, including in our expressed or implied is made and you should not place undue reliance on the accuracy, fairness or completeness of the information presented. Forward-Looking Statements Statements contained in this presentation that are not historical facts are "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking negatives thereof. Examples of forward-looking statements include, among other things, (i) statements regarding timing, outcomes and other details relating to current, pending or contemplated acquisitions, dispositions, transitions, developments, redevelopments, densifications, joint venture transactions, capital recycling plans, financing activities, or other transactions; (ii) development, densification and land bank opportunities; (iii) outlooks related to life science, medical office and CCRCs; and (iv) potential capital sources and uses. You should not place undue reliance on these forward-looking statements. Pending acquisitions and dispositions, including those that are subject to binding agreements, remain subject to closing conditions and may not close within the anticipated timeframes or at all. Forward-looking statements reflect our current expectations and views about future events and are subject to risks and uncertainties that could significantly affect our future financial condition and results of operations. While forward-looking statements reflect our good faith belief and assumptions we believe to be reasonable based upon current information, we can give no assurance that our expectations or forecasts will be attained. Further, we cannot guarantee the accuracy of any such forward-looking statement contained in this presentation, and such forward-looking statements are subject to known and unknown risks and uncertainties that are difficult to predict. These risks and uncertainties include, but are not limited to: the COVID-19 pandemic and health and safety measures intended to reduce its spread; operational risks associated with third party management contracts, including the additional regulation and liabilities of our RIDEA lease structures; the ability of our existing and future tenants, operators and borrowers to conduct their respective businesses in a manner sufficient to maintain or increase their revenues and manage their expenses in order to generate sufficient income to make rent and loan payments to us and our ability to recover investments made, if applicable, in their operations; increased competition, operating costs and market changes affecting our tenants, operators and borrowers; the financial condition of our tenants, operators and borrowers, including potential bankruptcies and downturns in their businesses, and their legal and regulatory proceedings; our concentration of investments in the healthcare property sector, which makes us more vulnerable to a downturn in a specific sector than if we invested in multiple industries; our ability to identify replacement tenants and operators and the potential renovation costs and regulatory approvals associated therewith; our property development and redevelopment activity risks, including costs above original estimates, project delays and lower occupancy rates and rents than expected; changes within the life science industry; high levels of regulation, funding requirements, expense and uncertainty faced by our life science tenants; the ability of the hospitals on whose campuses our MOBs are located and their affiliated healthcare systems to remain competitive or financially viable; our ability to maintain or expand our hospital and health system client relationships; economic and other conditions that negatively affect geographic areas from which we recognize a greater percentage of our revenue; uninsured or underinsured losses, which could result in significant losses and/or performance declines by us or our tenants and operators; our investments in joint ventures and unconsolidated financial condition and continued cooperation; our use of contingent rent provisions and/or rent escalators based on the Consumer Price Index; competition for suitable healthcare properties to grow our investment portfolio; our ability to make material acquisitions and successfully integrate them; the potential impact on us and our tenants, operators and borrowers from litigation matters, including rising liability and insurance costs; our ability to foreclose on collateral securing our real estate-related loans; laws or regulations prohibiting eviction of our tenants; the failure of our tenants and operators to comply with federal, state and local laws and regulations, including resident health and safety requirements, as well as licensure, certification and inspection requirements; required regulatory approvals to transfer our healthcare properties; compliance with the Americans with Disabilities Act and fire, safety and other health regulations; the requirements of, or changes to, governmental reimbursement programs such as Medicare or Medicaid; legislation to address federal government operations and administration decisions affecting the Centers for Medicare and Medicaid Services; our participation in the CARES Act Provider Relief Program and other COVID-19 related stimulus and relief programs; volatility or uncertainty in the capital markets, the availability and cost of capital as impacted by interest rates, changes in our credit ratings, the value of our common stock, and other conditions that may adversely impact our ability to fund our obligations or consummate transactions, or reduce the earnings from potential transactions; cash available for distribution to stockholders and our ability to make dividend distributions at expected levels; our ability to manage our indebtedness level and covenants in and changes to the terms of such indebtedness; changes in global, national and local economic and other conditions; provisions of Maryland law and our charter that could prevent a transaction that may otherwise be in the interest of our stockholders; environmental compliance costs and liabilities associated with our real estate investments; U.S. federal income tax laws, and potential deferred and contingent tax liabilities from corporate acquisitions; calculating non-REIT tax earnings and profits; ownership limits in our charter that restrict ownership in our stock; our reliance on information technology systems and the potential impact of system failures, disruptions or breaches; unfavorable litigation resolution or disputes; and the loss or limited availability of our key personnel. Except as required by law, we do not undertake, and hereby disclaim, any obligation to update any forward-looking statements, which speak only as of the date on which they are made. Calculations The estimated capitalization rates and yield ranges included in this presentation are calculated by dividing projected cash net operating income (adjusting for the impact of upfront rental concessions) for the applicable properties by the aggregate purchase price or development cost, as applicable, for such properties. Newly acquired operating assets are generally considered stabilized at the earlier of lease-up (typically when the tenant(s) control(s) the physical use of at least 80% of the space) or 12 months from the acquisition date. Newly completed developments are considered stabilized at the earlier of lease-up or 24 months from the date the property is placed in service. The aggregate cash net operating income projections used in calculating the capitalization rates and yield ranges included in this presentation are based on (i) information currently available to us, including, in connection with acquisitions, information made available to us by the seller in the diligence process, and (ii) certain assumptions applied by us related to anticipated occupancy, rental rates, property taxes and other expenses over a specified experience with the submarket. Accordingly, the capitalization rates and yield ranges included in this presentation are inherently based on inexact projections that may be incorrect or imprecise and may change as a result of events or factors currently unknown to the Company. The actual cash capitalization rates for these properties may differ materially and adversely from the estimated stabilized cash capitalization rates and yield ranges discussed in this presentation based on numerous factors, including any difficulties achieving assumed occupancy and/or rental rates, development delays, unanticipated expenses not Annual Report on Form 10-K for the year ended December 31, 2020 and its subsequent filings with the SEC. As such, we can provide no assurance that the actual cash capitalization rates for these properties will be consistent with the estimated cash capitalization rates and yield ranges set forth in this presentation. Market and Industry Data This presentation also includes market and industry data that the Company has obtained from market research, publicly available information and industry publications. The accuracy and completeness of such information are not guaranteed. Such data is often based on believes that the surveys and market research that others have performed are reliable, such surveys and market research are subject to assumptions, estimates and other uncertainties and Healthpeak has not independently verified this information. Non-GAAP Financial Measures This presentation contains certain supplemental non-GAAP financial measures. While the Company believes that non-GAAP financial measures are helpful in evaluating its operating performance, the use of non-GAAP financial measures in this presentation should not be considered in isolation from, or as an alternative for, a measure of financial or operating performance as defined by GAAP. We caution you that there are inherent limitations associated with the use of each of these supplemental non-GAAP financial measures as an may not be comparable to those reported by other REITs. You can find reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures in the first quarter 2021 Discussion and Reconciliation of Non-GAAP Financial Measures available on our website. Investor Presentation - March 2021 2

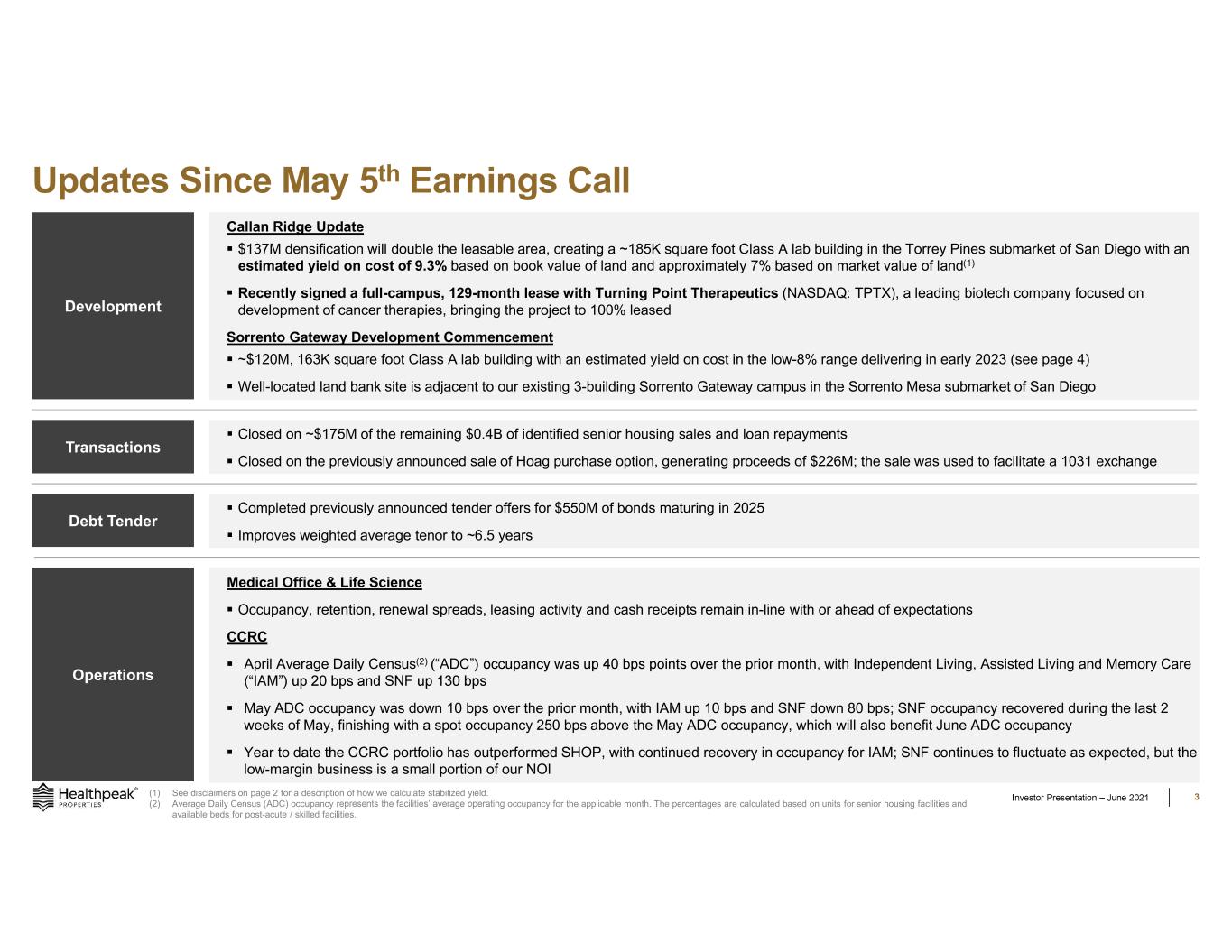

Updates Since May 5th Earnings Call 3 Development Debt Tender Callan Ridge Update $137M densification will double the leasable area, creating a ~185K square foot Class A lab building in the Torrey Pines submarket of San Diego with an estimated yield on cost of 9.3% based on book value of land and approximately 7% based on market value of land(1) Recently signed a full-campus, 129-month lease with Turning Point Therapeutics (NASDAQ: TPTX), a leading biotech company focused on development of cancer therapies, bringing the project to 100% leased Sorrento Gateway Development Commencement ~$120M, 163K square foot Class A lab building with an estimated yield on cost in the low-8% range delivering in early 2023 (see page 4) Well-located land bank site is adjacent to our existing 3-building Sorrento Gateway campus in the Sorrento Mesa submarket of San Diego Completed previously announced tender offers for $550M of bonds maturing in 2025 Improves weighted average tenor to ~6.5 years (1) See disclaimers on page 2 for a description of how we calculate stabilized yield. (2) Average Daily Census (ADC) occupancy r occupancy for the applicable month. The percentages are calculated based on units for senior housing facilities and available beds for post-acute / skilled facilities. Operations Medical Office & Life Science Occupancy, retention, renewal spreads, leasing activity and cash receipts remain in-line with or ahead of expectations CCRC April Average Daily Census(2) with Independent Living, Assisted Living and Memory Care May ADC occupancy was down 10 bps over the prior month, with IAM up 10 bps and SNF down 80 bps; SNF occupancy recovered during the last 2 weeks of May, finishing with a spot occupancy 250 bps above the May ADC occupancy, which will also benefit June ADC occupancy Year to date the CCRC portfolio has outperformed SHOP, with continued recovery in occupancy for IAM; SNF continues to fluctuate as expected, but the low-margin business is a small portion of our NOI Transactions Closed on ~$175M of the remaining $0.4B of identified senior housing sales and loan repayments Closed on the previously announced sale of Hoag purchase option, generating proceeds of $226M; the sale was used to facilitate a 1031 exchange

Sorrento Gateway Rendering Sorrento Mesa, CA 4 163K square foot, Class A life science building with an estimated total spend of approximately $120M Highly strategic location in the Sorrento Mesa submarket of San Diego adjacent to our existing 100% leased 3-building Sorrento Gateway campus Creates a largely contiguous 359K square foot campus, further building upon our pr Expected completion in early 2023 with an estimated yield on cost in the low-8% range based on book value of land and high-6% based on market value of land(1) Sorrento Gateway Development Start Sorrento Gateway Rendering Sorrento Mesa, CA Commencing development at our Directors Place land bank site to capitalize on highly favorable supply and demand dynamics in Sorrento Mesa (San Diego) (1) See disclaimers on page 2 for a description of how we calculate stabilized yield.

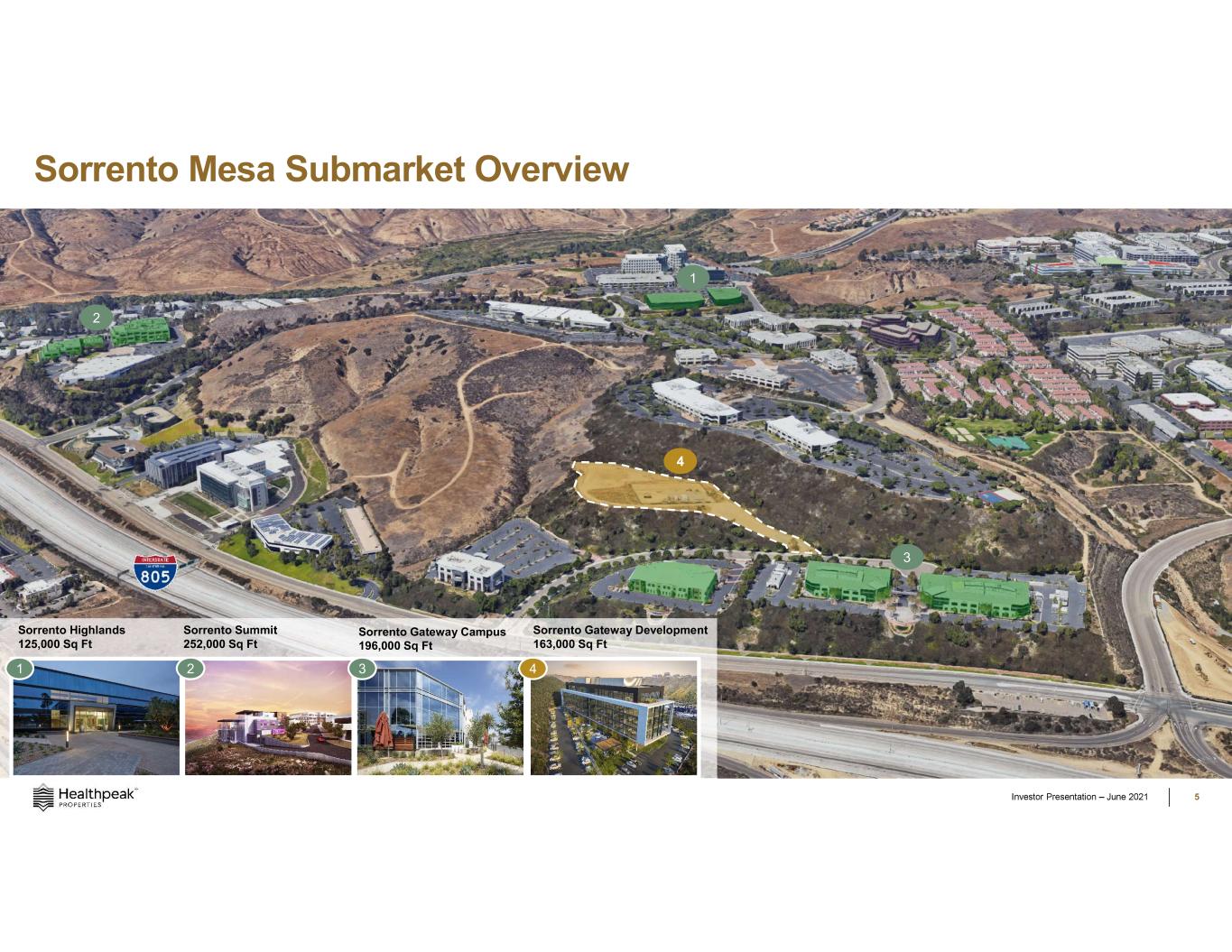

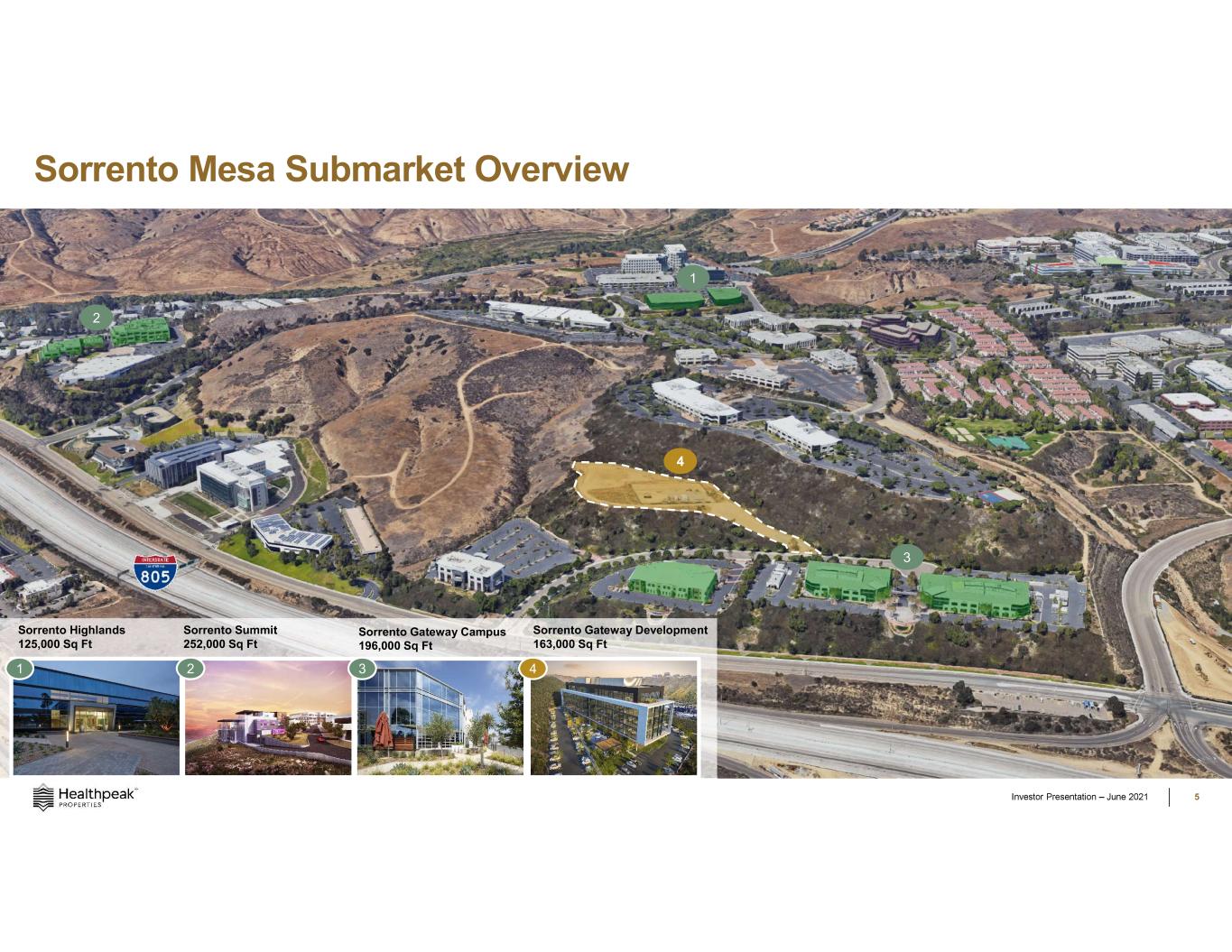

1 4 3 2 5 Sorrento Mesa Submarket Overview Sorrento Summit 252,000 Sq Ft Sorrento Gateway Campus 196,000 Sq Ft Sorrento Gateway Development 163,000 Sq Ft Sorrento Highlands 125,000 Sq Ft 1 2 3 4

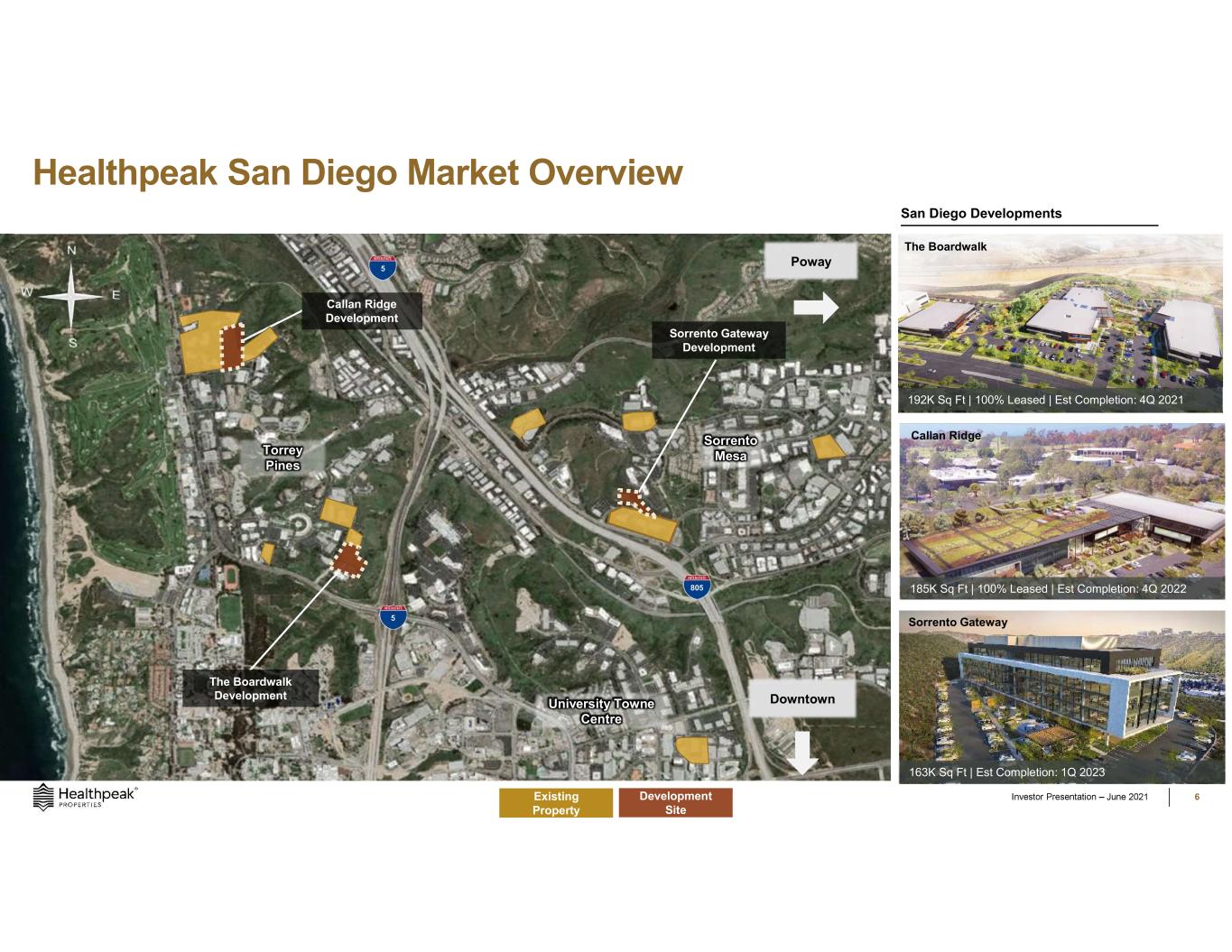

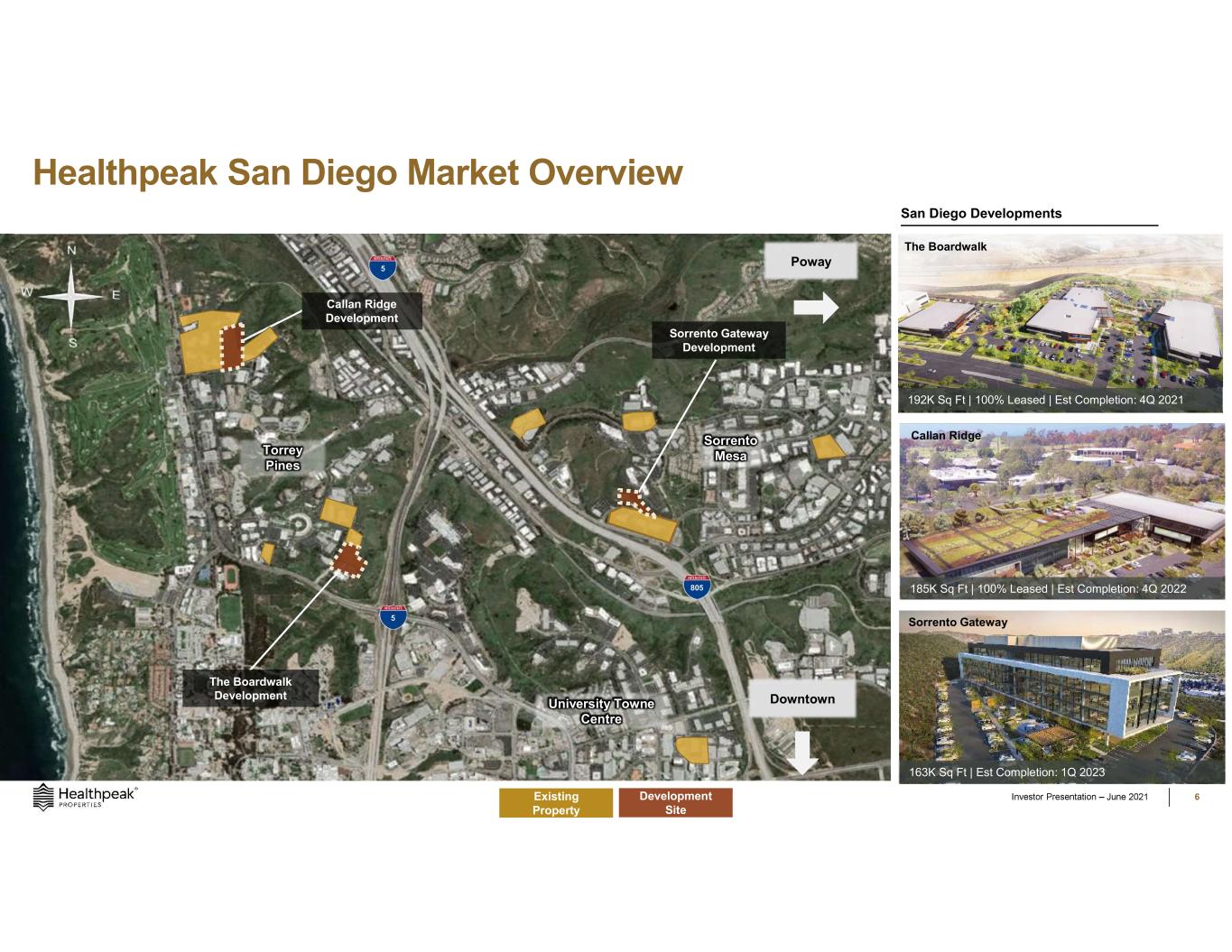

163K Sq Ft | Est Completion: 1Q 2023 Sorrento Gateway 185K Sq Ft | 100% Leased | Est Completion: 4Q 2022 Callan Ridge 192K Sq Ft | 100% Leased | Est Completion: 4Q 2021 The Boardwalk Healthpeak San Diego Market Overview 6 San Diego Developments University Towne Centre Sorrento MesaTorrey Pines 5 5 805 Downtown Poway Callan Ridge Development Sorrento Gateway Development The Boardwalk Development Existing Property Development Site

Development Platform

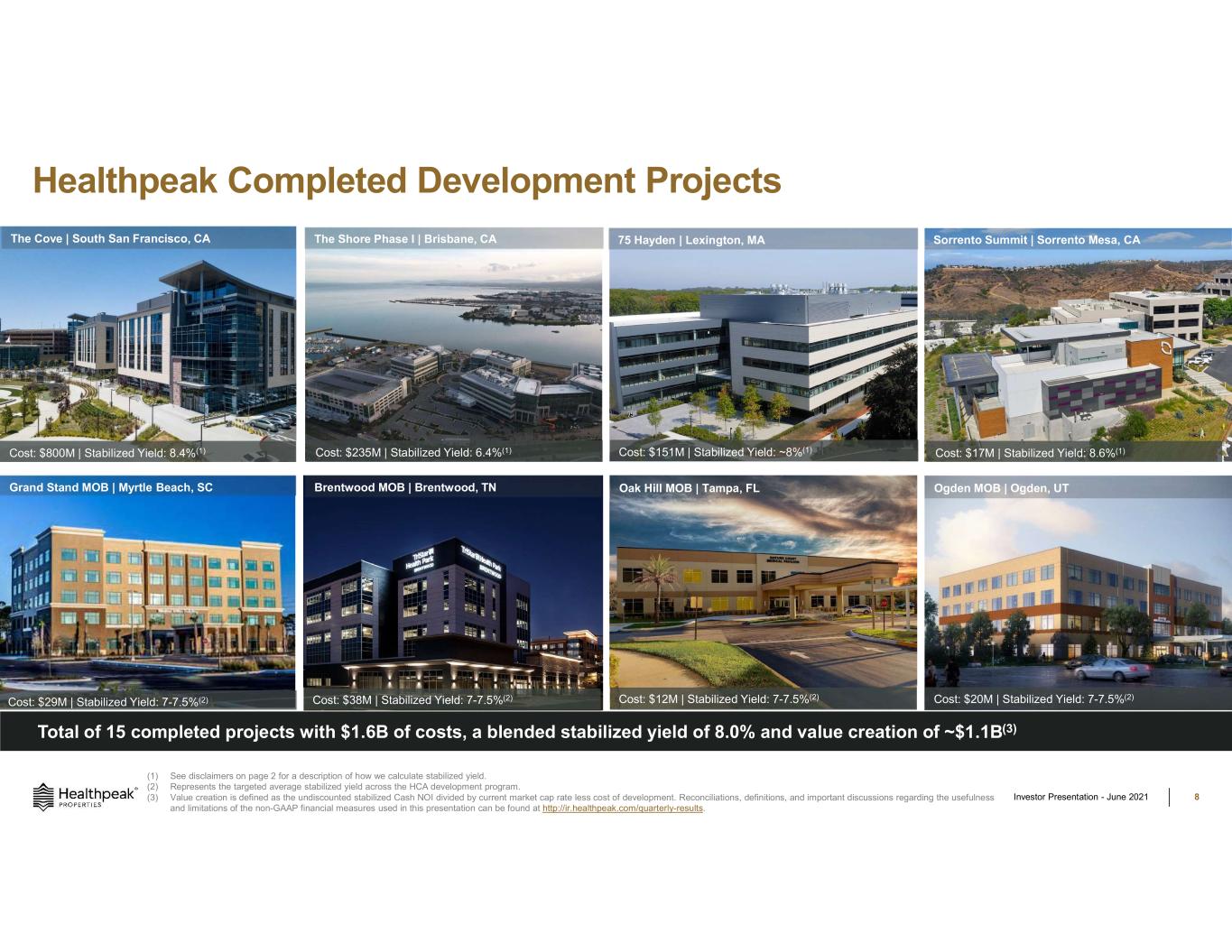

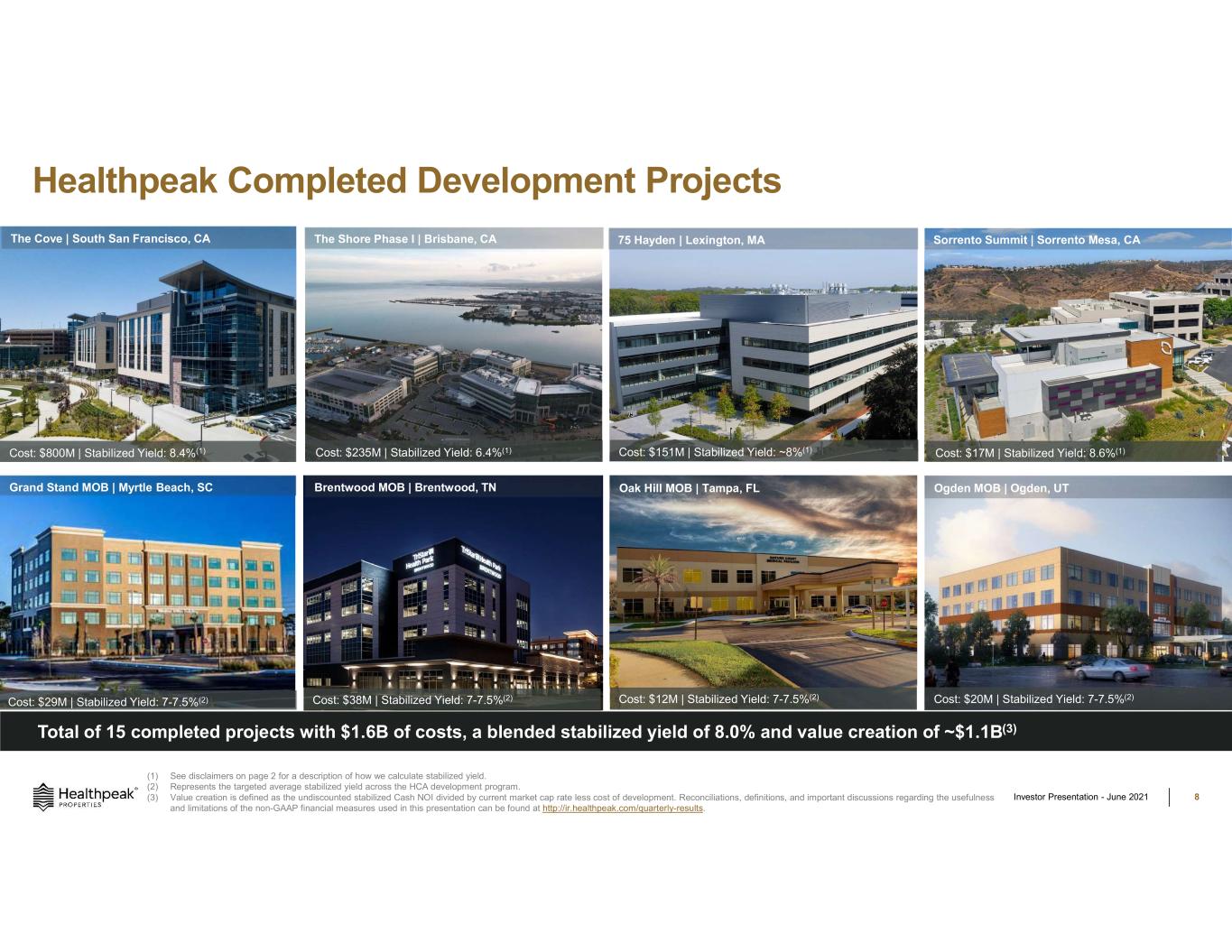

Healthpeak Completed Development Projects Investor Presentation - June 2021 8 Cost: $800M | Stabilized Yield: 8.4%(1) The Cove | South San Francisco, CA Cost: $235M | Stabilized Yield: 6.4%(1) The Shore Phase I | Brisbane, CA Cost: $151M | Stabilized Yield: ~8%(1) 75 Hayden | Lexington, MA (1) See disclaimers on page 2 for a description of how we calculate stabilized yield. (2) Represents the targeted average stabilized yield across the HCA development program. (3) Value creation is defined as the undiscounted stabilized Cash NOI divided by current market cap rate less cost of development. Reconciliations, definitions, and important discussions regarding the usefulness and limitations of the non-GAAP financial measures used in this presentation can be found at http://ir.healthpeak.com/quarterly-results. Cost: $29M | Stabilized Yield: 7-7.5%(2) Grand Stand MOB | Myrtle Beach, SC Cost: $12M | Stabilized Yield: 7-7.5%(2) Oak Hill MOB | Tampa, FL Cost: $38M | Stabilized Yield: 7-7.5%(2) Brentwood MOB | Brentwood, TN Cost: $20M | Stabilized Yield: 7-7.5%(2) Ogden MOB | Ogden, UT Total of 15 completed projects with $1.6B of costs, a blended stabilized yield of 8.0% and value creation of ~$1.1B(3) Cost: $17M | Stabilized Yield: 8.6%(1) Sorrento Summit | Sorrento Mesa, CA

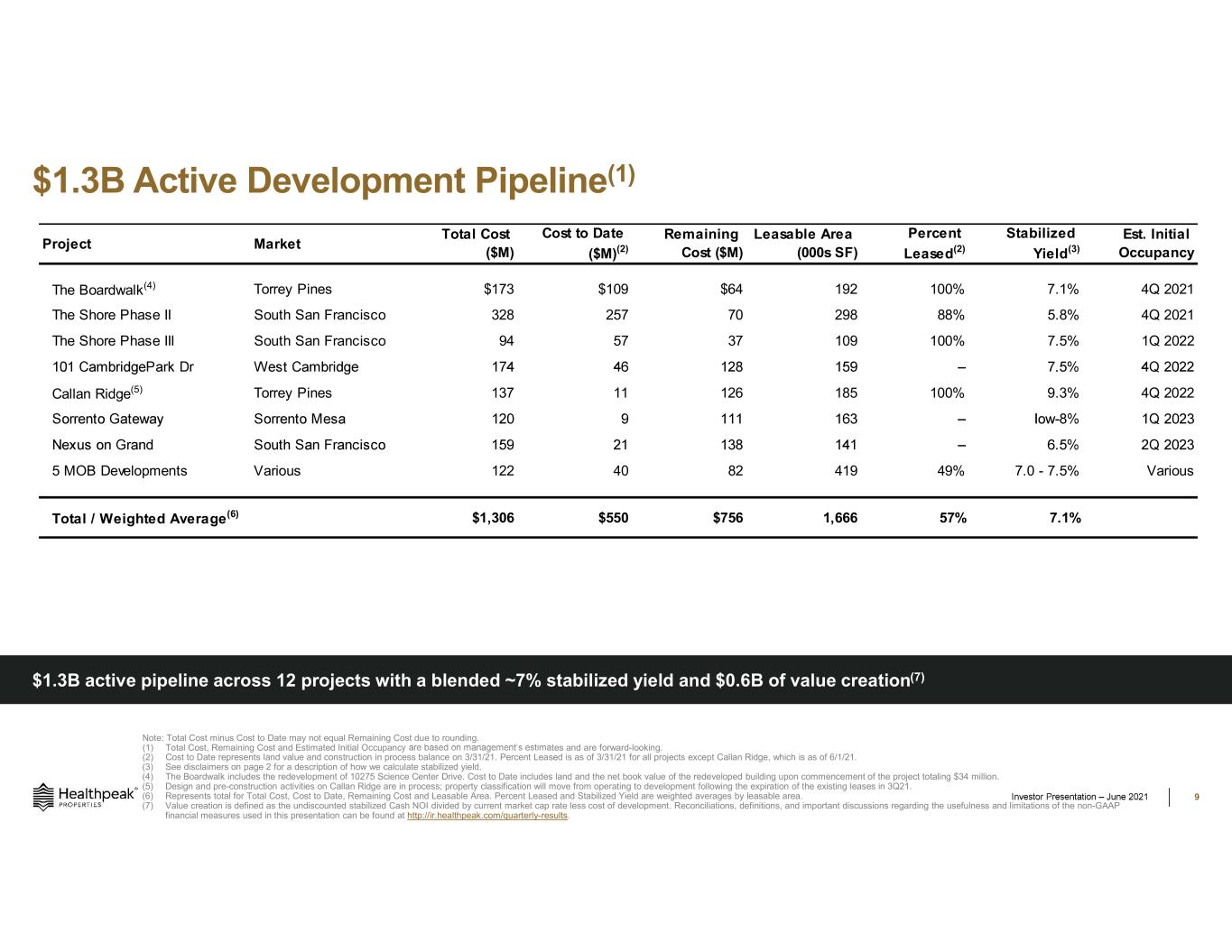

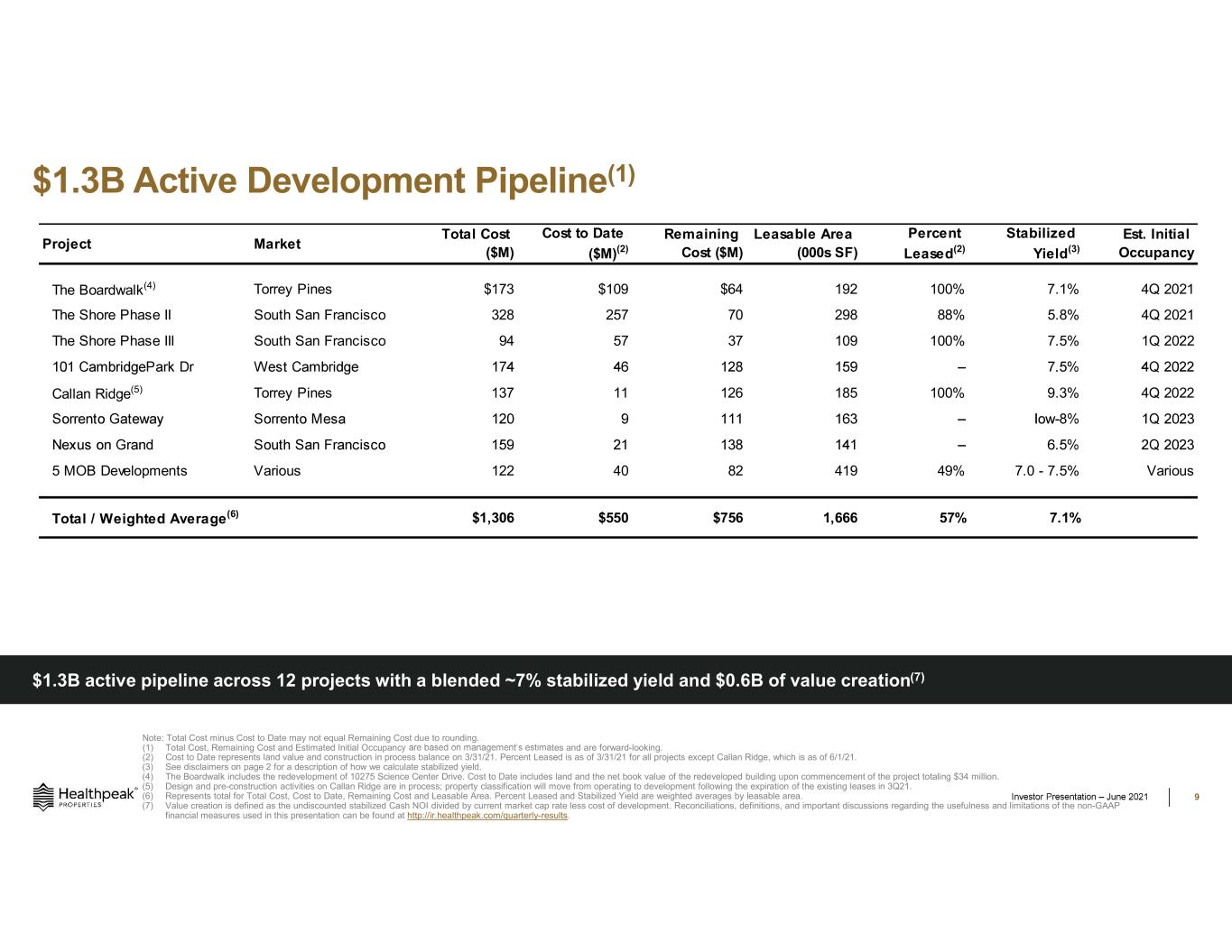

$1.3B Active Development Pipeline(1) 9 Note: Total Cost minus Cost to Date may not equal Remaining Cost due to rounding. (1) Total Cost, Remaining Cost and Estimated Initial Occupanc tes and are forward-looking. (2) Cost to Date represents land value and construction in process balance on 3/31/21. Percent Leased is as of 3/31/21 for all projects except Callan Ridge, which is as of 6/1/21. (3) See disclaimers on page 2 for a description of how we calculate stabilized yield. (4) The Boardwalk includes the redevelopment of 10275 Science Center Drive. Cost to Date includes land and the net book value of the redeveloped building upon commencement of the project totaling $34 million. (5) Design and pre-construction activities on Callan Ridge are in process; property classification will move from operating to development following the expiration of the existing leases in 3Q21. (6) Represents total for Total Cost, Cost to Date, Remaining Cost and Leasable Area. Percent Leased and Stabilized Yield are weighted averages by leasable area. (7) Value creation is defined as the undiscounted stabilized Cash NOI divided by current market cap rate less cost of development. Reconciliations, definitions, and important discussions regarding the usefulness and limitations of the non-GAAP financial measures used in this presentation can be found at http://ir.healthpeak.com/quarterly-results. $1.3B active pipeline across 12 projects with a blended ~7% stabilized yield and $0.6B of value creation(7) Project Market Total Cost ($M) Cost to Date ($M)(2) Remaining Cost ($M) Leasable Area (000s SF) Percent Leased(2) Stabilized Yield(3) Est. Initial Occupancy The Boardwalk(4) Torrey Pines $173 $109 $64 192 100% 7.1% 4Q 2021 The Shore Phase II South San Francisco 328 257 70 298 88% 5.8% 4Q 2021 The Shore Phase III South San Francisco 94 57 37 109 100% 7.5% 1Q 2022 Callan Ridge(5) Torrey Pines 137 11 126 185 100% 9.3% 4Q 2022 5 MOB Developments Various 122 40 82 419 49% 7.0 - 7.5% Various Total / Weighted Average(6) $1,306 $550 $756 1,666 57% 7.1%

$7B+ of Land Bank and Densification Opportunities 10 In addition to our land bank, we have the ability to densify existing campuses due to excess land and FAR, providing a decade plus of development opportunities on core campuses that we can execute based on local supply and demand dynamics at no additional cost for land Life Science Densification Opportunities opportunities including our land bank MOB Densification Opportunities CCRC Densification Opportunities Florida, DC metro, Houston and Philadelphia across our MOB portfolio and Minneapolis (1) Our densification opportunities include utilizing excess land on existing campuses, as well as the potential to replace older one- and two-story buildings with taller, Class A buildings as leases roll (1) Circles represent development and densification opportunities in each market, inclusive of land bank.

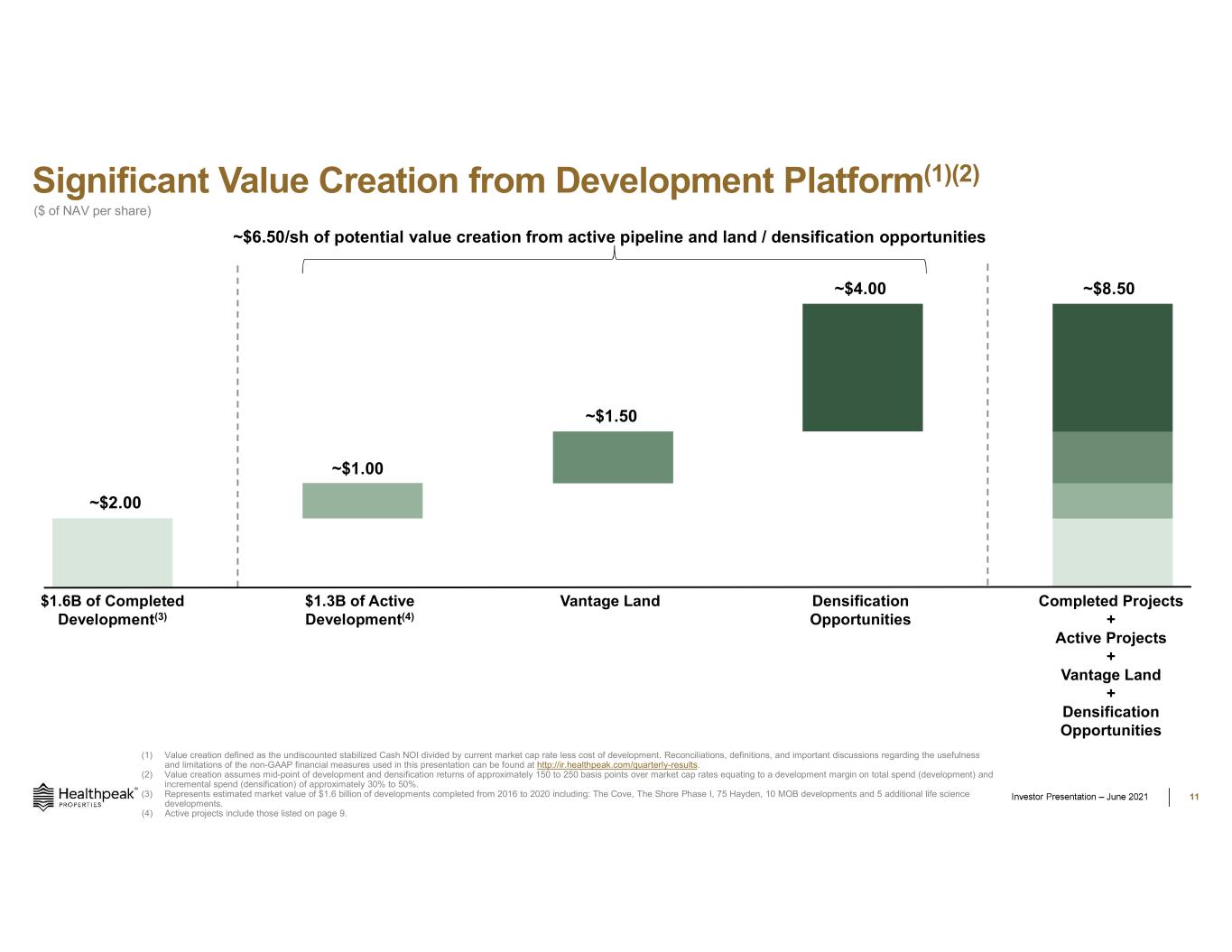

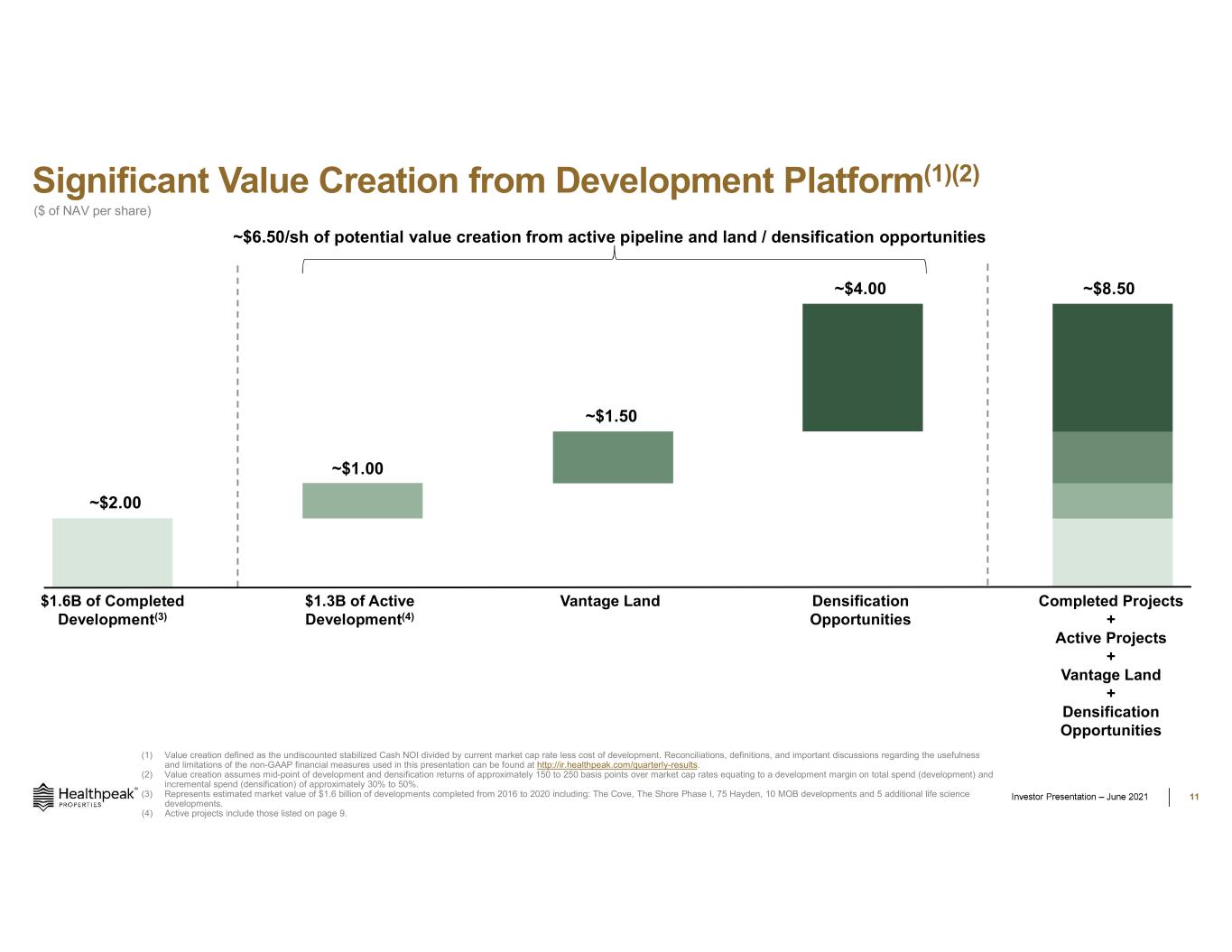

Significant Value Creation from Development Platform(1)(2) 11 ~$2.60/sh Value Creation The Shore | Brisbane, CA $1.3B of Active Development(4) Vantage Land Densification Opportunities ~$1.00 ~$1.50 ~$4.00 ($ of NAV per share) (1) Value creation defined as the undiscounted stabilized Cash NOI divided by current market cap rate less cost of development. Reconciliations, definitions, and important discussions regarding the usefulness and limitations of the non-GAAP financial measures used in this presentation can be found at http://ir.healthpeak.com/quarterly-results. (2) Value creation assumes mid-point of development and densification returns of approximately 150 to 250 basis points over market cap rates equating to a development margin on total spend (development) and incremental spend (densification) of approximately 30% to 50%. (3) Represents estimated market value of $1.6 billion of developments completed from 2016 to 2020 including: The Cove, The Shore Phase I, 75 Hayden, 10 MOB developments and 5 additional life science developments. (4) Active projects include those listed on page 9. $1.6B of Completed Development(3) Completed Projects + Active Projects + Vantage Land + Densification Opportunities ~$8.50 ~$2.00 ~$6.50/sh of potential valu creation from active pipeline and land / densification opportunities

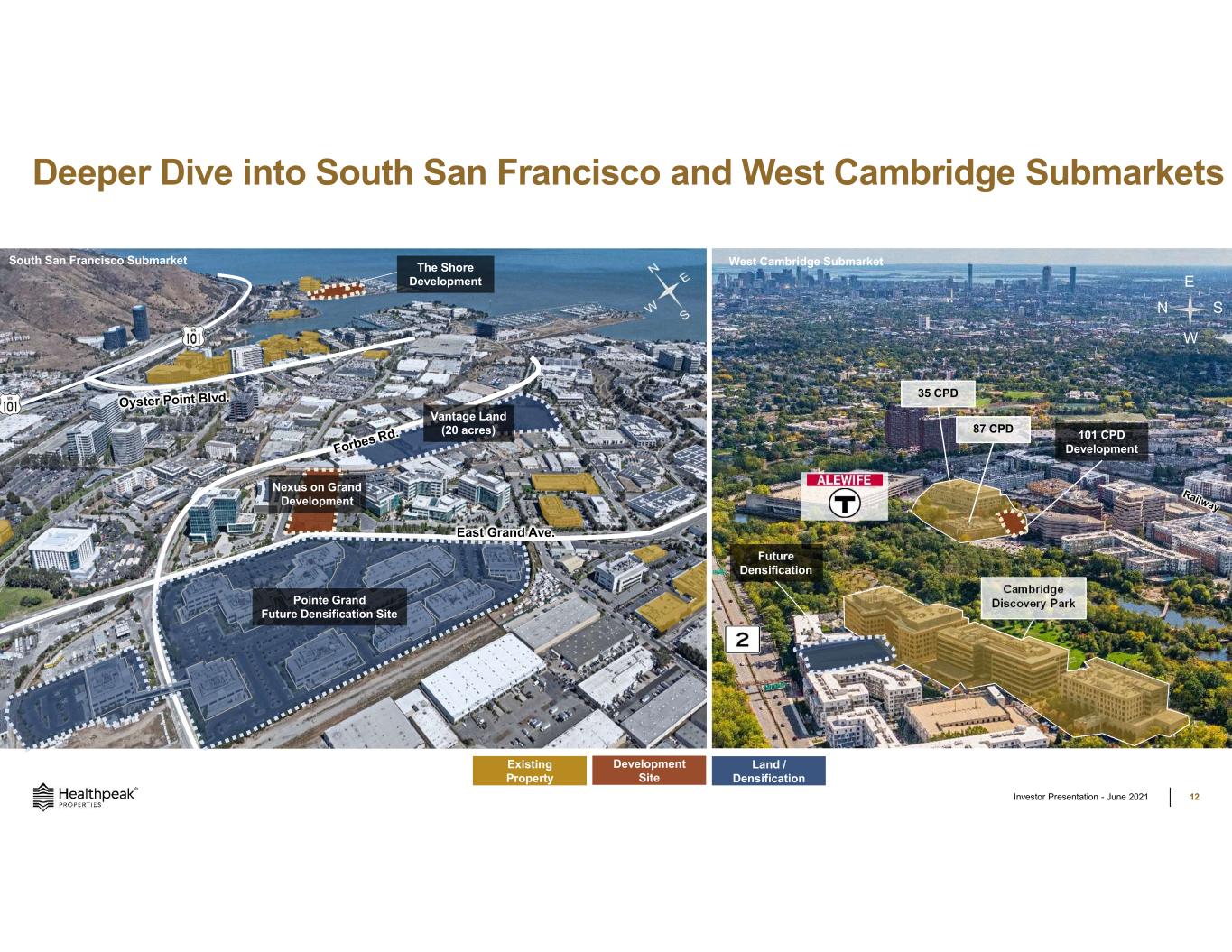

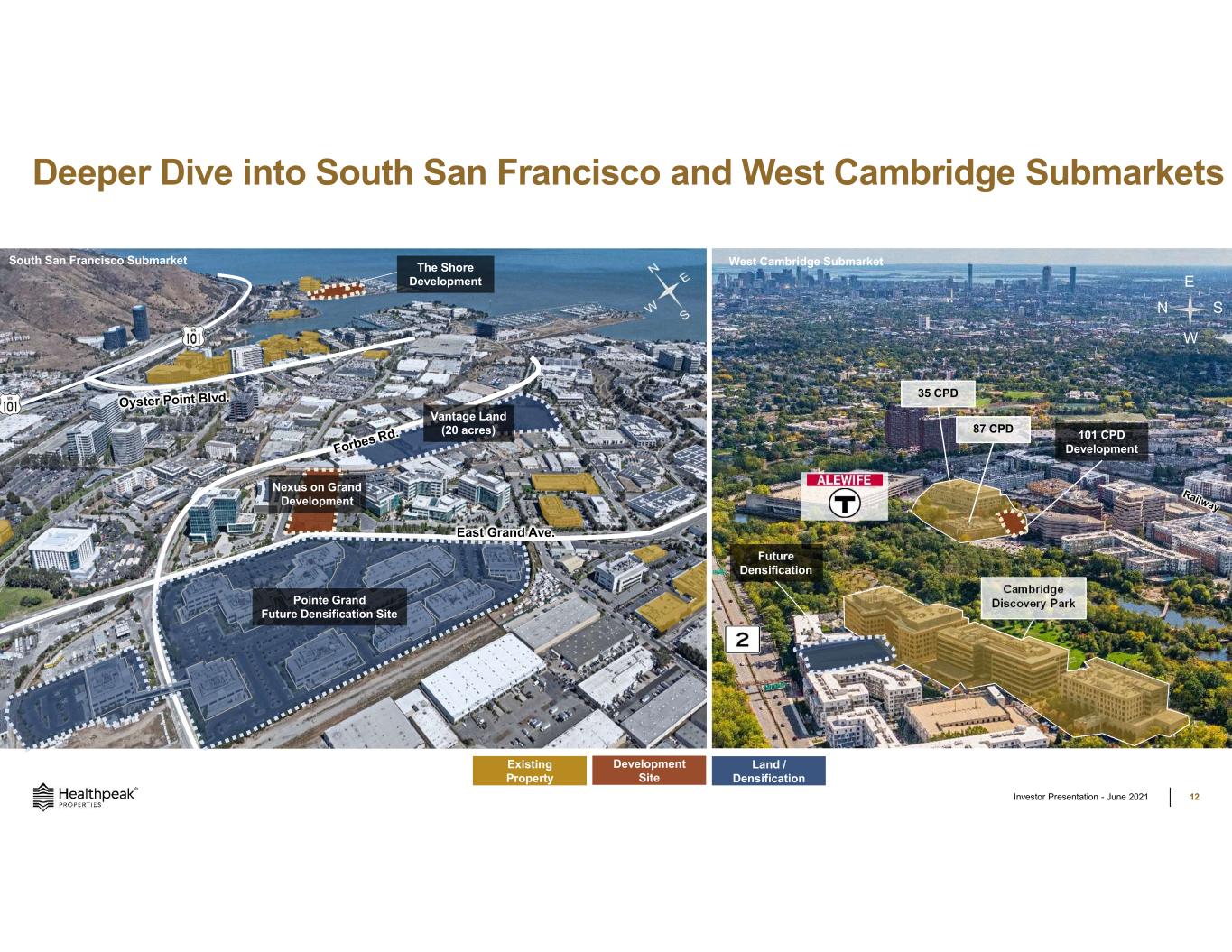

The Shore Development Vantage Land (20 acres) Nexus on Grand Development East Grand Ave. Deeper Dive into South San Francisco and West Cambridge Submarkets Investor Presentation - June 2021 12 Cambridge Discovery Park 87 CPD 35 CPD 101 CPD Development N E W S Existing Property Development Site Land / Densification Future Densification West Cambridge SubmarketSouth San Francisco Submarket Pointe Grand Future Densification Site

MOB Historical Performance Analysis: On-Campus vs Off-Campus

Investor Presentation - June 2021 14 Medical City Dallas | Dallas, TX Swedish Hospital System | Seattle, WA TriStar Centennial Campus | Nashville, TN Sky Ridge | Denver, CO Medical City Dallas | Dallas, TX | 7 properties 2.2M SF Swedish Hospital | Seattle, WA | 4 properties 563K SF Sky Ridge | Denver, CO | 4 properties 421K SFTriStar Centennial | Nashville, TN | 9 properties 833K SF Hospital PEAK MOB Four select on-campus portfolios representing more than $80M of Cash NOI(1) (1) Reconciliations, definitions, and important discussions regarding the usefulness and limitations of the non-GAAP financial measures used in this presentation can be found at http://ir.healthpeak.com/quarterly-results.

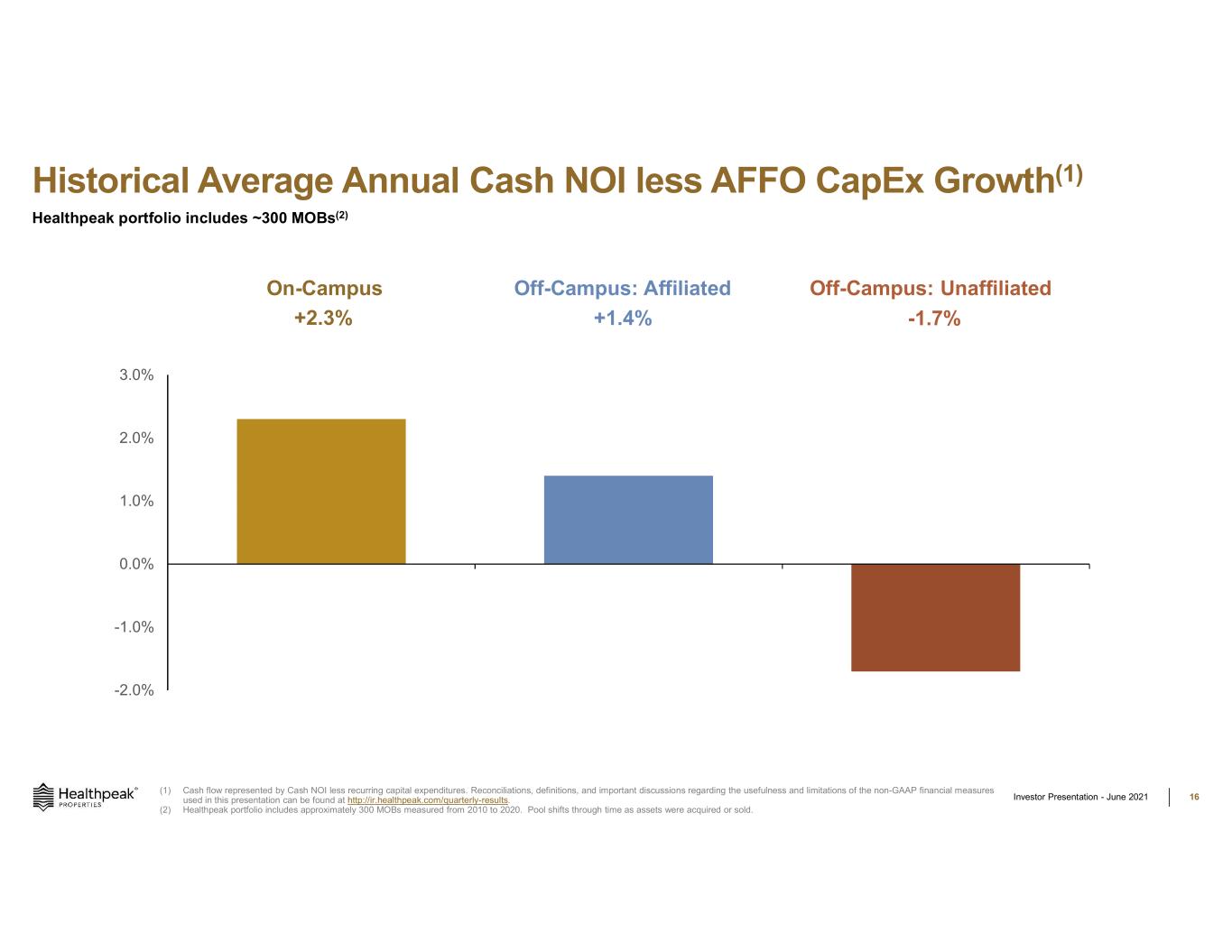

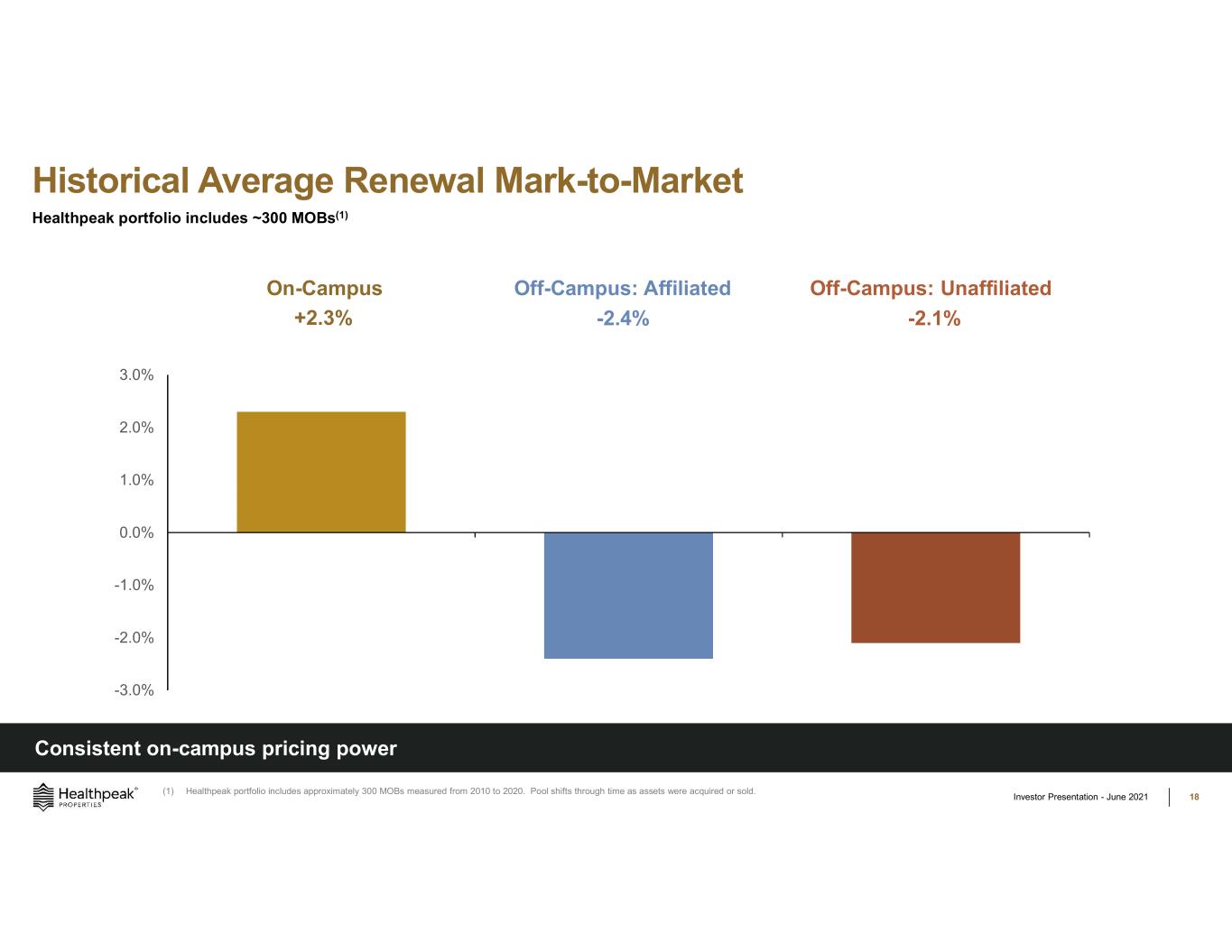

On-Campus vs Off-Campus Historical Performance A key strategic element of our MOB business is to focus on ownership of on-campus and affiliated assets We have the highest percentage of on-campus assets in the industry at 84%, and our portfolio is 97% affiliated During our 2+ decades in the MOB business, we have found ownership of on-campus assets to be preferable for three major reasons: High barriers to entry; on-campus land is extremely limited and only ~30% of new MOB supply is built on-campus Strong tenancy by the hospital drives patient activity and physician demand in the balance of the building High percentage of specialist physicians leads To better quantify how these factors translate into investment returns, we analyzed performance trends across ~300 of our MOBs over a 10 year time period Our study pool included all MOB assets with comparable year-over-year financials owned during the performance period The underlying number of properties varied by year due to acquisition and disposition activity Our data shows on-campus assets had the highest cash flow growth, tenant retention and lease renewal rent mark-to-market Investor Presentation - June 2021 15

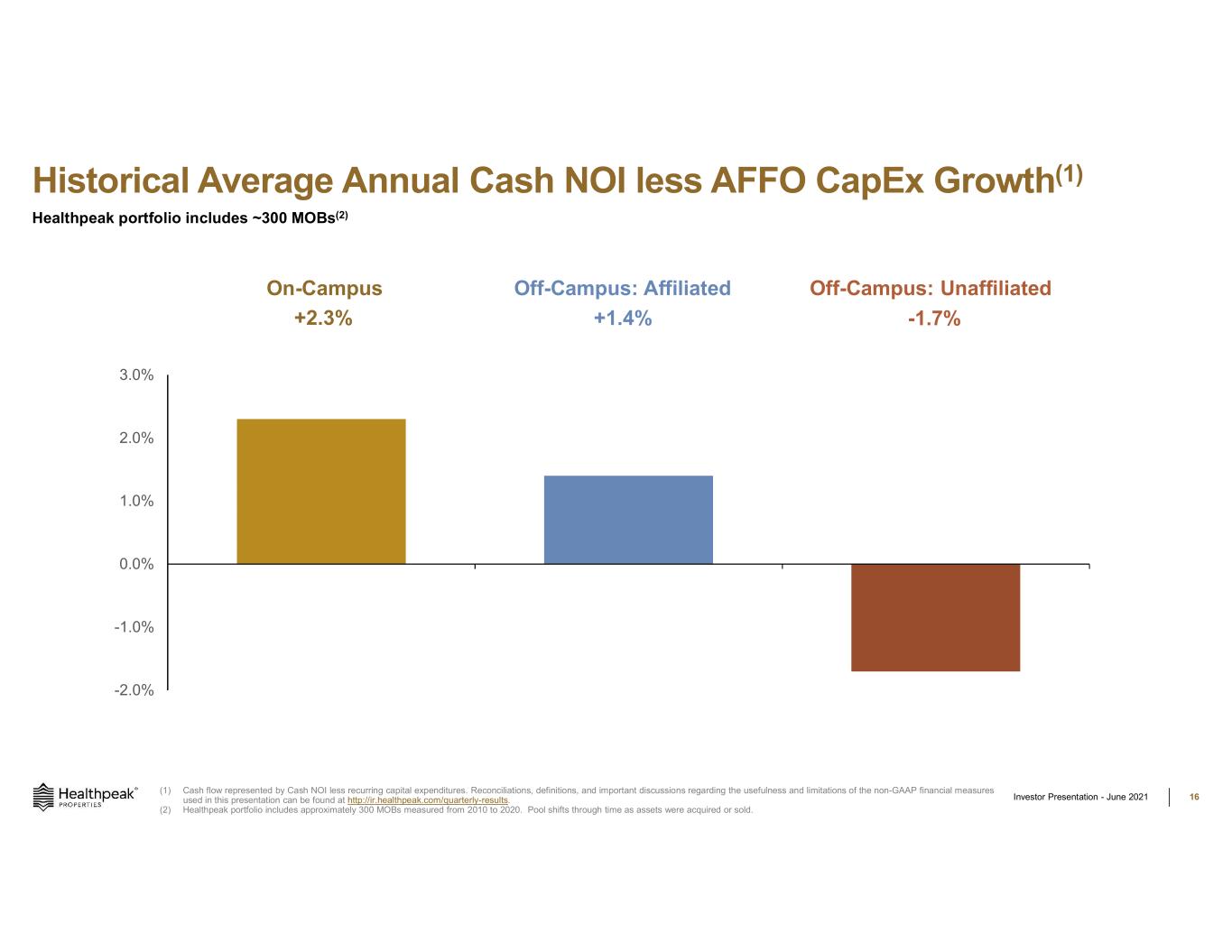

Healthpeak portfolio includes ~300 MOBs(2) Investor Presentation - June 2021 16 Historical Average Annual Cash NOI less AFFO CapEx Growth(1) +1.4%+2.3% -1.7% On-Campus Off-Campus: Affiliated Off-Campus: Unaffiliated -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% (1) Cash flow represented by Cash NOI less recurring capital expenditures. Reconciliations, definitions, and important discussions regarding the usefulness and limitations of the non-GAAP financial measures used in this presentation can be found at http://ir.healthpeak.com/quarterly-results. (2) Healthpeak portfolio includes approximately 300 MOBs measured from 2010 to 2020. Pool shifts through time as assets were acquired or sold.

Healthpeak portfolio includes ~300 MOBs(1) Investor Presentation - June 2021 17 Historical Average Tenant Retention Proximity to hospital provides depth of demand for long-term stability 75.2%80.2% 68.0% On-Campus Off-Campus: Affiliated 50.0% 60.0% 70.0% 80.0% 90.0% Off-Campus: Unaffiliated (1) Healthpeak portfolio includes approximately 300 MOBs measured from 2010 to 2020. Pool shifts through time as assets were acquired or sold.

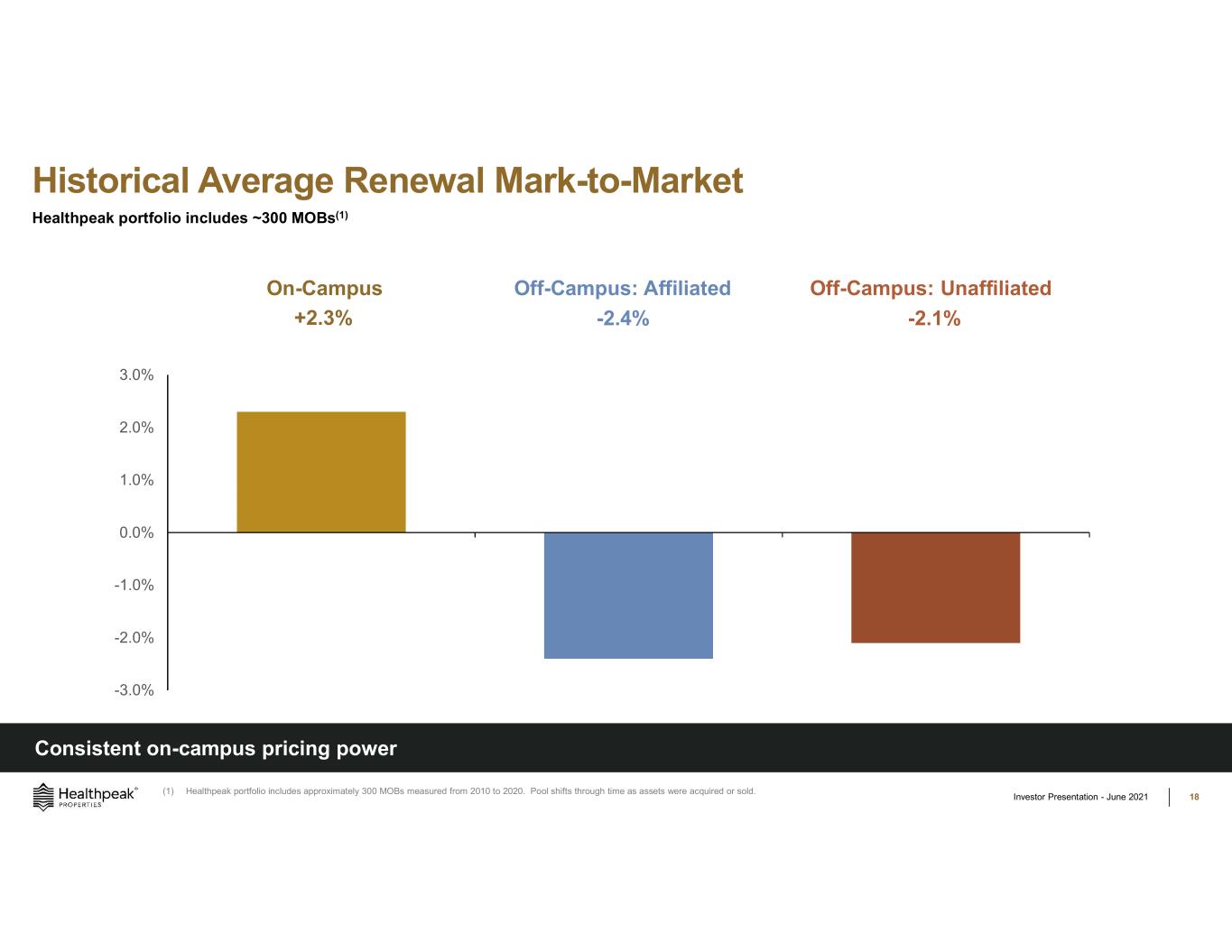

Healthpeak portfolio includes ~300 MOBs(1) Investor Presentation - June 2021 18 Historical Average Renewal Mark-to-Market Consistent on-campus pricing power -2.4%+2.3% -2.1% On-Campus Off-Campus: Affiliated -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% Off-Campus: Unaffiliated (1) Healthpeak portfolio includes approximately 300 MOBs measured from 2010 to 2020. Pool shifts through time as assets were acquired or sold.

healthpeak.com