UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

June 30, 2011

FORM 20-F

ANNUAL REPORT

(Mark One)

[ ]

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

[x]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2010

OR

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ……………………………… to ………………………………

Commission file number 013345

OR

[ ]

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report ……………………………………………

CALEDONIA MINING CORPORATION

(Exact name of Registrant as specified in its charter)

Caledonia Mining Corporation is variously referred to in this Report

as “Caledonia”, “the Corporation” or “the Company”

Canada

(Jurisdiction of incorporation or organization)

24 Ninth Street, Lower Houghton, Johannesburg, Gauteng 2198, South Africa

(Address of principal executive offices)

Carl R. Jonsson, 1710-1177 West Hastings Street,

Vancouver, BC V6E 2L3, Canada; tel: (604) 640-6357; fax: (604) 681-0139

email: jonsson@securitieslaw.bc.ca

(Name, telephone, email and/or facsimile number and address of Company Contact Person)

2

Securities registered or to be registered pursuant to Section 12(b) of the Act.

(Title of Class)

(Title of Class)

Securities registered or to be registered pursuant to Section 12(g) of the Act

Title of each class

Name of each exchange on which registered

Common shares

Toronto Stock Exchange

London Stock Exchange Alternative Investment Market

NASD OTC Bulletin Board

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the closing of the period covered by the annual report

500,169,280

Indicate by check mark if the registration is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes

No x

Note – checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days

Yes x

No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

3

Large accelerated filer ______ Accelerated filer ______

Non-accelerated filer __x____

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

Item 17 x

Item 18

U.S. GAAP …… International Financial Reporting Standards as issued by the International Accounting Standards Board

Other:

Canadian GAAP

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes

No

NOTE: All references to monies herein are to Canadian dollars unless otherwise specifically indicated

FORWARD LOOKING STATEMENTS

The Company cautions readers regarding forward looking statements found in this Annual Report and in any other statement made by, or on behalf of the Company, whether or not in future filings with the United States Securities Exchange Commission. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by or on behalf of the Company. The Company disclaims any obligation to update forward looking statements.

PART 1

4

1.

IDENTITY of DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not required as this is an annual report under the Securities Exchange Act of 1934 (“Exchange Act”).

However, the information required above can readily be determined from Caledonia’s Proxy and Information Circular dated April 15, 2010 attached as Exhibit #14b. Information is also given in Section 14A.

2.

OFFER STATISTICS AND TIMETABLE

Not required as this is an annual report under the Exchange Act.

3.

KEY INFORMATION

Selected Financial Data

Table 3 A shows the applicable selected financial data for the 5-year period 2006 to 2010 in Canadian Generally Accepted Accounting Principles.

Table 3 A (i)shows the applicable selected financial data for the 5-year period 2006 to 2010 in United States Generally Accepted Accounting Principles.

Table 3 A (ii) shows the US$exchange rates against the Canadian $ for each of the 5-year periods indicated, for the period end and average exchange rate and the range of high and low rates for each year and the high and low exchange rates for the individual six months ending May 31, 2011.

5

Table 3A - Selected Financial Information - Canadian Generally Accepted Accounting Principles - the figures presented being as of the end of each such year.

| | | | | |

Financial – All in C$ 000’s unless otherwise indicated | 2010 | 2009 | 2008 | 2007 | 2006 |

Revenue from Sales | 22,401 | 11,559 | 7,696 | 10,039 | 13,586 |

Gross Operating Profit (Loss) | 8,278 | 2,916 | 3,039 | 166 | 4,604 |

Expense - (General and administration, interest, amortization and foreign exchange including provisions and impairments) | (4,591) | (6,007) | (7,543) | (4,195) | (2,047) |

Net loss from discontinued operations | - | - | (436) | (582) | (7,579) |

Net Income /(Loss) – after income taxes | 2,257 | (3,950) | (4,940) | (4,615) | (5,675) |

Cash and cash equivalent | 1,145 | 1,623 | 3,652 | 76 | 1,252 |

Current Assets | 6,194 | 5,917 | 5025 | 4,408 | 8,773 |

Assets | 27,488 | 22,090 | 23,657 | 29,492 | 31,456 |

Current Liabilities | 4,629 | 2,759 | 1,308 | 4,343 | 5,899 |

Long Term Liabilities | 4,017 | 2,589 | 1,153 | 1,054 | 1,221 |

Working Capital | 1,565 | 3,158 | 3,717 | 65 | 2,874 |

Shareholders’ Equity | 18,842 | 16,742 | 21,196 | 24,095 | 24,336 |

Total Capital Expenditures including Mineral Properties | 7,290 | 1,547 | 3,023 | 3,250 | 3,579 |

Financing Raised | 187 | 588 | 1,106 | 4,380 | 7,559 |

Share Information

| | | | | |

Market Capitalization ($ Thousands) at December 31 | 80,021 | 32,508 | 32,511 | 53,666 | 45,798 |

Shares Outstanding (Thousands) | 500,169 | 500,169 | 500,169 | 487,869 | 457,981 |

Warrants & Options (Thousands) | 32,580 | 32,580 | 46,430 | 34,026 | 102,354 |

Basic and diluted net income (loss) per share for continuing operations | $0.0045 | ($0.008) | ($0.010) | ($0.009) | $0.003 |

Basic and diluted net income (loss) per share for discontinued operations | - | - | ($0.000) | ($0.000) | ($0.016) |

Basic and diluted net income (loss) per share for the year | $0.0045 | $(0.008) | $(0.010) | $(0.009) | $(0.013) |

6

Table 3A (i) - Selected Financial Information - United States Generally Accepted Accounting Principles - the figures presented being as of the end of each such year

| | | | | |

| 2010 | 2009 | 2008 | 2007 | 2006 |

- In Thousands of Canadian Dollars except per share amounts | | | | | |

Revenue from Operations | 22,401 | 11,559 | 7,696 | 10,039 | 13,586 |

Gross Profit (Loss) | 9,013 | 3,930 | 851 | (2,467) | 3,9455 |

Expenses (General and Administration, Interest and Amortization) | 5,416 | 6,247 | 7,543 | 4,195 | 2,047 |

Net Income (Loss) from continuing operations | 2,167 | (3,176) | (6,692) | (6,662) | 1,246 |

Loss from discontinued operations | - | -- | (436) | (582) | (7,595) |

Net Income(Loss) | 2,167 | (3,176) | (7,128) | (7,248) | (6,334) |

Cash | 1,145 | 1,622 | 3,652 | 76 | 1,252 |

Current Assets | 6,194 | 5,917 | 5,025 | 4,408 | 8,773 |

Total Assets | 17,999 | 12,691 | 13,484 | 21,507 | 26,135 |

Current Liabilities | 4,629 | 2,759 | 1,308 | 4,343 | 5,899 |

Long Term Liabilities | 4,017 | 2,589 | 1,153 | 1,054 | 1,221 |

Working Capital (Deficiency) | 1,565 | 3,158 | 3,717 | 65 | 2,874 |

Shareholders’ Equity (Deficiency) | 9,353 | 7,343 | 11,023 | 16,110 | 19,015 |

Capital Expenditures (excluding Mineral Property expenditure) | 4,304 | 830 | 136 | 571 | 2,920 |

Expenditures on Mineral Properties | 2,319 | 650 | - | 45 | - |

Financing Raised | 187 | 588 | 1,119 | 4,380 | 7,559 |

Deemed Dividends | - | - | - | 134 | - |

Share Information | | | | | |

Market Capitalization ($ Thousands) | 80,021 | 32,508 | 32,511 | 53,666 | 45,798 |

Shares Outstanding (Thousands) | 500,169 | 500,169 | 500,169 | 487,869 | 457,981 |

Warrants & Options (Thousands) | 32,580 | 32,580 | 46,430 | 34,026 | 102,354 |

Basic and Diluted Income (Loss) per share - continuing operations | 0.004 | (0.006) | (0.013) | (0.01) | 0.00 |

Basic and Diluted Loss per Share | 0.004 | (0.006) | (0.014) | (0.01) | (0.02) |

7

Table 3A (ii) - Summary of Exchange Rates for the 5-year Period -2006 to 2010 2006 to 2010

The following table sets forth, for each of the years indicated, the exchange rate of the United States dollar into Canadian currency at the end of such year, the average exchange rate during each such year and the range of high and low rates for each such year as supplied by the Bank of Canada.

| | | | | |

Exchange Rate | 2010 |

2009 |

2008 |

2007 |

2006 |

Rate at the End of the Period(1) | 0.9999 | 1.049 | 1.218 | 0.982 | 1.1654 |

Average Rate (2) | 1.03 | 1.14 | 1.066 | 1.0744 | 1.34 |

High Rate (1) | 1.0766 | 1.036 | 0.9711 | 1.185 | 1.1794 |

Low Rate (1) | 0.9966 | 1.2907 | 1.3008 | 0.9145 | 1.0948 |

Notes:

(1)

The rate of exchange is the Bank of Canada closing rate for the period.

(2)

The average rate means the average of the exchange rates during the year.

The high and low rates of exchange for each of the 6 months from December 2010 to May 2011 are as follows:

| | | | | | |

| Dec 2010 | Jan 2011 | Feb 2011 | March 2011 | April 2011 | May 2011 |

Closing | 0.9999 | 1.0007 | 0.9771 | 0.9722 | 0.95 | 0.9766 |

Average | 1.009 | 0.9939 | 0.9878 | 0.9768 | 0.9582 | 0.9666 |

Hi | 1.0216 | 1.0007 | 1.0006 | 0.9891 | 0.9705 | 0.9781 |

Low | 0.9999 | 0.9871 | 0.9769 | 0.9698 | 0.9491 | 0.9445 |

C.

Risk Factors

An investment in the securities involves a high degree of risk. Investors need to carefully consider the following risk factors, in addition to the other information contained in this document and the Exhibits hereto.

Industry Competition

The mining industry is a highly diverse and competitive international business. The selection of geographic areas of interest are only limited by the degree of risk a company is willing to accept by the acquisition of properties in emerging or developed markets and/or prospecting in explored or virgin territory. Mining, by its nature, is a competitive business with the search for fresh ground with good exploration potential and the raising of the requisite capital to move projects forward to production. Globally the mining industry is prone to cyclical variations in the price of the commodities produced by it, as dictated by supply and demand factors, speculative factors and industry-controlled marketing cartels. Nature provides the ultimate uncertainty with geological and occasionally climatic surprises. Commensurate with the acceptance of this risk profile is the potential for high rewards.

Exploration and Development

Exploration, development and production activities are subject to political, economic and other risks, including:

-

cancellation or renegotiation of contracts;

-

changes in local and foreign laws and regulations;

-

changes in tax laws;

-

delays or refusal in granting prospecting permissions, mining authorizations and work permits for foreign management staff;

-

environmental controls and permitting

8

-

expropriation or nationalization of property or assets;

-

foreign exchange controls;

government mandated social expenditures;

-

import and export regulation, including restrictions on the sale of their production in foreign currencies;

-

industrial relations and the associated stability thereof;

-

inflation of cost that is not compensated for by a currency devaluation;

-

requirement that a foreign subsidiary or operating unit have a domestic joint venture partner, which, possibly, the foreign company must subsidize;

-

restrictions on the ability of local operating companies to sell their production for foreign currencies, and on the ability of such companies to hold these foreign currencies in offshore and/or local bank accounts;

-

restrictions on the ability of a foreign company to have management control of exploration and/or development and/or mining operations;

-

restrictions on the remittance of dividend and interest payments offshore;

-

retroactive tax or royalty claims;

-

risks of loss due to civil strife, acts of war, guerrilla activities, insurrection and

terrorism;

-

royalties and tax increases or claims by governmental entities;

-

unreliable local infrastructure and services such as power, communications and

transport links;

-

demands or actions by native or indigenous groups;

-

other risks arising out of foreign sovereignty over the areas in which operations are conducted.

-

lack of uninterrupted power supplies

-

lack of investment funding

Such risks could potentially arise in any country in which Caledonia operates. In Southern Africa, Black Economic Empowerment Legislation and a number of economic and social issues may result in increased political and economic risks of operating in that area.

The Republic of Zimbabwe brought its Indigenisation and Economic Empowerment Act into law in March 2008. The law seeks to ensure that a majority stake (at least 51%) in all companies is held by indigenous Zimbabweans. Various statutory instruments have been published by the Zimbabwean government in an attempt to accelerate the implementation of the Indigenisation and Economic Empowerment Act. These regulations have confused the industrial community further and at present the mining sector is seeking clarification around the legality of the most recently published General Notice. Many mining companies, Caledonia included, have filed their indigenisation plans with the Ministry of Indigenisation and Economic Empowerment and they await further consultation. Additionally the Mines and Minerals Amendment Bill is the subject of revision and will be presented to Parliament in due course.

In January 2008 the Zambian government announced the following changes to its tax laws that would have had a bearing on the Nama Project. The key changes were:

·

Increase in mineral royalty from 0.6% to 3%

·

Increase in profit tax rate from 25% to 30%

·

Introduction of variable profits tax of 15% for net profits above 8%

·

Introduction of a windfall profit tax for copper and cobalt mines

·

Capital allowances reduced from 100% to 25%

These measures were highly controversial with mining companies, many of which invested in the country under specific tax incentives and formalized their business models accordingly. Various representations were made by the mining companies both directly and through the Chamber of Mines to the government following the budget announcement at the end of January 2008. The Zambian government in January 2009 announced improvements to the taxation of mining companies, in particular:

·

the abolition of windfall tax

·

the return of capital allowances back to 100%.

Whilst these changes are welcome, the royalty remains unchanged at 3% and we make the observation that at low cobalt prices, the royalty can give rise to a very significant tax burden on the project.

Consequently, Caledonia’s exploration, development and production activities may be substantially affected by factors beyond Caledonia’s control, any of which could materially adversely affect Caledonia’s financial position or results from operations. Furthermore, in the event of a dispute arising from such activities, Caledonia may be subject to exclusive jurisdiction of courts outside North America or may not be successful in subjecting persons to the jurisdiction of the courts in North America, which could adversely affect the outcome of a dispute.

9

History of Losses; Accumulated Deficit; No Assurance of Revenue or Operating Profit

Since inception from February 1992, Caledonia has recorded a loss in every year except 1994, 2000 and 2010. As at December 31, 2010, the consolidated accumulated deficit was $178,527,000.

Write-downs on capital assets and mineral properties are typical for the mining industry. Caledonia’s policy is to review the carrying value of assets relative to current market conditions on an annual basis.

Fluctuating Minerals Prices and Foreign Currency Exchange Rates

As Caledonia’s activities primarily relate to the exploration, development and production of minerals, the fluctuating World prices for such minerals have a significant potential effect on the Company’s future activities and the profitability of any of its minerals production activities. There is never any assurance, when activities are undertaken, or production operations are commenced, that the World price of the minerals involved will continue at a sufficiently high price to justify the ongoing activities or the continuation of the production.

Most costs incurred by the Company in its exploration, development and production activities in southern Africa have to be paid in local currencies. However, mineral prices are generally quoted in United States dollars. The profitability of any production operations of the Company and the potential profitability of its exploration and development activities will therefore be seriously affected by adverse changes in the currency exchange rates.

Black Empowerment and Indigenization

The governments of the southern African countries in which the Company operates have, or are proposing, legislation (typically referred to as “black empowerment”) requiring companies to allow participation in their shareholdings and business enterprises by the indigenous (i.e. black) population. In not all instances is it assured that such interests will have to be paid for at full fair value. In Zimbabwe, when Caledonia purchased the Blanket Mine, it agreed to establish a trust for the benefit of the employees of the Blanket Mine into which up to 30% of the issued shares of the wholly owned subsidiary which it acquired and is operating the Blanket Mine would be placed. The ultimate terms and conditions of black empowerment regulations forced on the Company - and the Zimbabwean trust when it is established - could seriously affect the profitability and economic prospects of the Company.

Need for Additional Funds

The Company’s plans for ongoing and increased activity - and the development, ultimately, of copper/cobalt production operations in Zambia - will require funding in excess of the Company’s funds on hand. There is no assurance that all of the required additional funding can be raised and the Company may therefore have to reduce its ongoing activities.

The long-term off take agreements for future sales of cobalt concentrate remain in place with the four large Chinese refiners, who have all indicated continued support during this period of depressed commodity prices and lack of financing facilities.

Where possible the Company seeks, and will continue to seek, for new mineral property acquisitions or exploration activities joint venture agreements with other companies which will be required to supply all, or a significant portion, of the required funding.

Joint Venture Negotiations

Two of the three Rooipoort platinum prospecting rights applied for have been granted to prospect for PGMs on major portions of the Mapochsgronde tribal trust land and are currently in the process of registration. The remaining property to the north of the area where the current rights are under appeal with the DME and its decision is awaited.

10

Joint venture partners are being sought for this project.

Dependence upon Key Personnel

Caledonia’s success depends (i) on the continued contributions of its directors, executive officers, management and consultants, and (ii) on Caledonia’s ability to attract new personnel whenever Caledonia seeks to implement its business strategy. There is no assurance that the Company will always be able to locate and hire all of the personnel that it may consider that it requires. The Company, where it considers it appropriate, engages consulting and service companies to undertake some of the work function.

Chris Harvey retired from his position as Technical Director in December 2005, but continues as a Director and was appointed as a member of the Audit Committee in June 2009. James Johnstone retired from his position as Chief Operating Officer in September, 2006, also continues as a Director and was appointed as a member of the audit committee in December 2010.

Steven Curtis was appointed Vice President Finance and Chief Financial Officer in April 2006,and was appointed as a Director on June 1, 2008.Mark Learmonth, previously a Director of Macquarie First South, was appointed as VP Corporate Development and Investor Relations on July 10, 2008.

Stefan Hayden stepped down as the Chairman in 2005 but continues as a Director and as President and CEO. Carl Jonsson, a Director was appointed Chairman of the Board in December 2010. Robert W. Babensee was appointed as a Director and a member of the Audit Committee on October 31, 2008 and became Chairman of the Audit Committee in December 2010.

Absence of Dividends

The Company has never paid or declared any dividends.

Possible Volatility of Share Price

Market prices for mining company securities, by their nature, are volatile. Factors, such as rapidly changing commodity prices, political unrest globally and in countries where Caledonia operates, speculative interest in mining stocks etc. are but a few factors affecting the volatility of the share price. Caledonia listed its shares on the London Stock Exchange’s Alternative Investment Market (“AIM”) in June 2005 and is trying to attract more institutional and stock analyst coverage of its shares.

4.

INFORMATION ON THE COMPANY

A.

History and Development of Caledonia

Caledonia was incorporated, effective February 05, 1992, by the amalgamation of three predecessor companies. It exists pursuant to the Canada Business Corporations Act

Following the creation of Caledonia its shares were listed for trading on the Toronto Stock Exchange and quoted on the NASDAQ small caps market. In 1997, NASDAQ put Caledonia on notice that new listing requirements were in the process of being implemented. A minimum bid price of US$1.00 per share for a period of ten consecutive trade days is required for Caledonia to regain compliance with the new listing requirements. Caledonia was unable to regain compliance and on October 16th 1998, Caledonia announced that NASDAQ would no longer quote Caledonia’s securities for trading. In addition to trading on the Toronto Stock Exchange, Caledonia’s common stock commenced trading on NASDAQ’s OTC Bulletin Board system under the same symbol, CALVF, immediately after removal from the NASDAQ National Market. In June 2005 Caledonia was admitted to the London Stock Exchange’s AIM market under the ticker symbol “CMCL”. Its Toronto Stock Exchange trading symbol is “CAL”.

11

The addresses and telephone numbers of Caledonia’s three principal offices are:

African Office - South Africa

Representational Office - Canada

Greenstone Management Services

67 Yonge Street, Suite 1201

24, 9th Street, Lower Houghton

Toronto, Ontario, Canada

Johannesburg, Gauteng, 2198

M5E 1J8

South Africa

(416) 369-9507

(27) 11 447 2499

1710-1177 West Hastings Street

Vancouver, B.C. , Canada V6E21

(604) 640-6357

Exploration activities

In August 2000, Caledonia was notified by its joint venture partner on its Mulonga Plain properties in Zambia that it had expended more than US$ 3 million on exploration on the properties and as such had earned a 60% interest in that property. The joint venture partner continued work on the Mulonga Plain properties in 2004 - 2006 in its search for diamondiferous kimberlite pipes but has not yet announced further exploration work for the subsequent exploration seasons. Due to lack of work on the property over the past 2 years the Corporation has written down the carrying value of the investment by $1,044,000 during 2008 to $nil.

In August 2005 the joint venture partners, Motapa Exploration Limited and Caledonia Western Limited, a fully owned subsidiary of Caledonia, formed Motapa Mining Limited, a Zambian company, to hold and maintain the licences of the Mulonga Plain JV on behalf of the JV partners. At present Caledonia holds 40% of Mulonga Mining Limited, Motapa Exploration Limited holds the other 60%. Motapa has withdrawn from the joint venture and intends to transfer all rights in and title to the properties to the Corporation for a nominal amount. The Corporation has applied for a retention license over the properties managed under the joint venture.

In August 2000, Caledonia concluded a deal with a major mining company whereby the company would spend a total of $750,000 over a 3-year period on Caledonia’s Kikerk Lake diamond property in northern Canada to earn a 52.5% interest in the property from Caledonia who at that time held a 70% interest. By the end of 2002 the mining group had spent in excess of $750,000 on the Kikerk property and had earned a 52.5% interest. The joint venture parties signed a 3-way joint venture exploration agreement in early 2002. The operator of the joint venture did approximately $2,440,000 of work on the property in the 2002 – 2004 period. Cost of exploration at Kikerk Lake in 2005 totalled $530,000 During 2007 Caledonia wrote down its investment in Kikerk Lake by $750,000 to a nil balance.

In August 2000, Caledonia signed a heads of agreement with a major mining group over Caledonia’s Nama group licences in Zambia – the “Kalimba project”. The mining group undertook to spend US$ 2,500,000 over a 4-year period to earn a 30% interest in the property by funding all of the exploration work on the Kalimba project. The mining group carried out exploration work on the Kalimba project between 2000 and March 2002 when it withdrew from the joint venture as part of its overall cutback in worldwide exploration. The property is again fully owned by Caledonia. Caledonia collected a 10-tonne bulk sample from Nama during the3rd quarter of 2004 and conducted metallurgical tests to produce a concentrate and confirm whether or not the specifications required by the smelter can be met. Since the end of the above JV, the Corporation has continuously carried out exploration on its Zambian exploration properties.

In 1995 the Company acquired ownership of the shares of the companies which owned the Barbrook and Eersteling Mines in South Africa. The original acquisition was of only 96.4% of the issued shares of Eersteling Gold Mining Company Ltd. - with the remaining 3.6% being acquired in mid 2004. On May 31, 2008 an agreement to sell Barbrook Mine was concluded and Caledonia was paid the full purchase price of $9,130,000 by Eastern Goldfields SA (Pty) Ltd.

Effective April 1, 2006 the Company purchased 100% of the issued shares of the Zimbabwean company “Blanket Mine (1983) (Private) Limited, the owner of the operating Blanket Gold Mine. The purchase consideration was $1,000,000 (U.S.) and the issuance to the vendor of 20,000,000 shares in the capital of Caledonia. Because the Company bought the shares of the company owning the Blanket Mine it thereby acquired all of the assets of that company and assumed all of its liabilities.

12

From time to time Caledonia receives mineral property and business proposals from third parties for review as potential investment opportunities. With the potential of improved political conditions in other Southern African countries, Caledonia’s management is reviewing mining opportunities in certain of these countries.

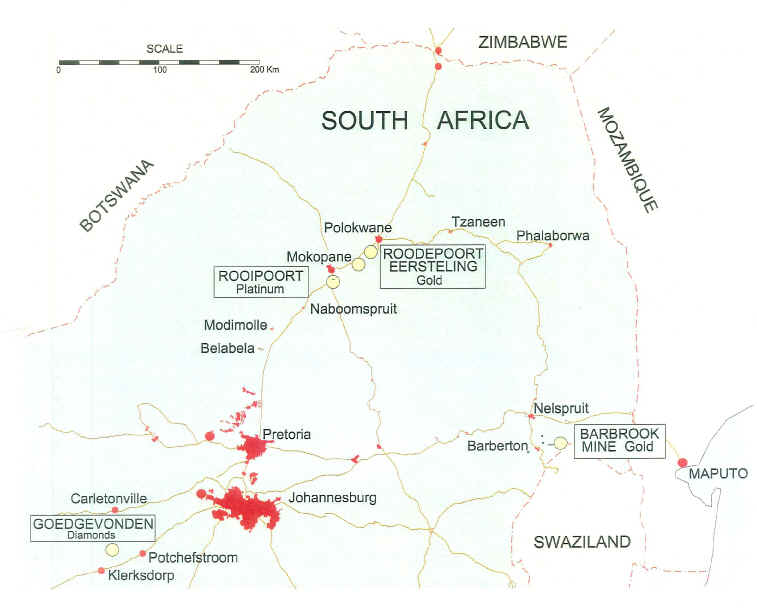

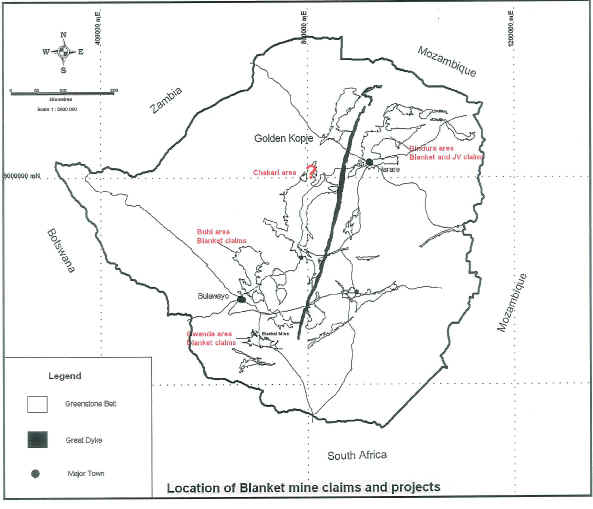

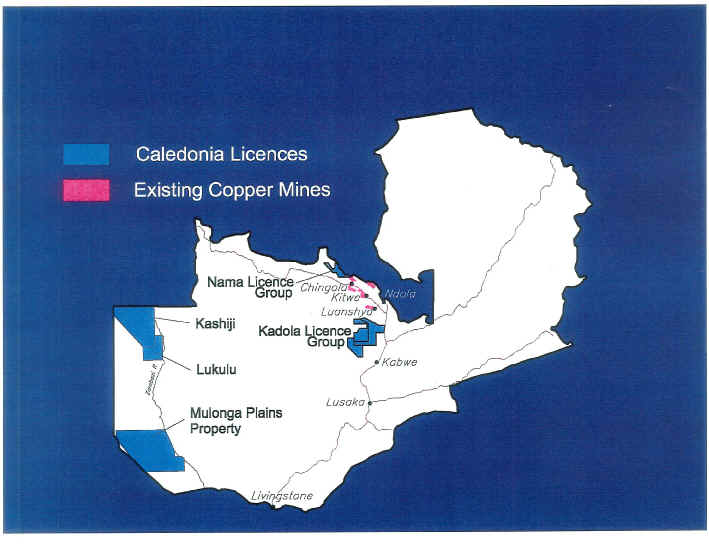

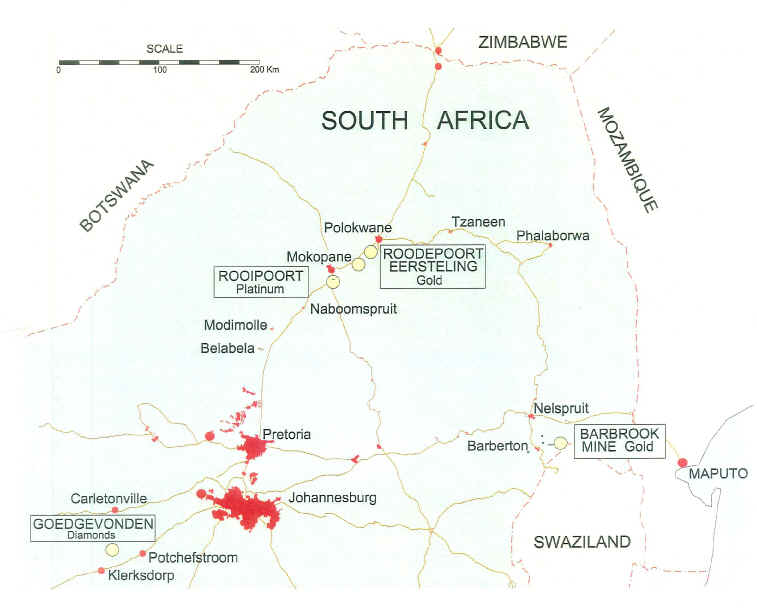

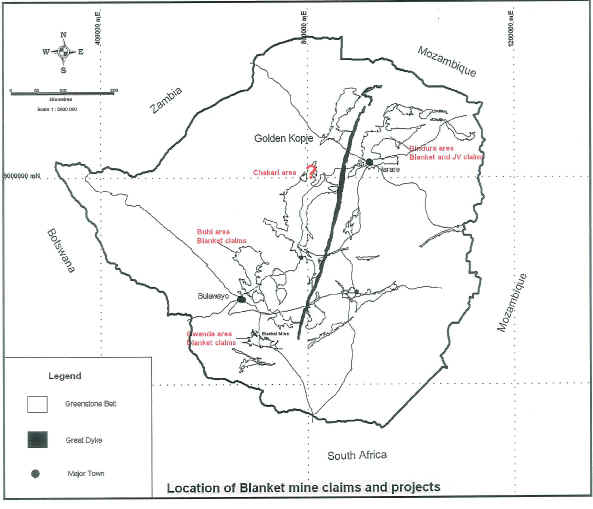

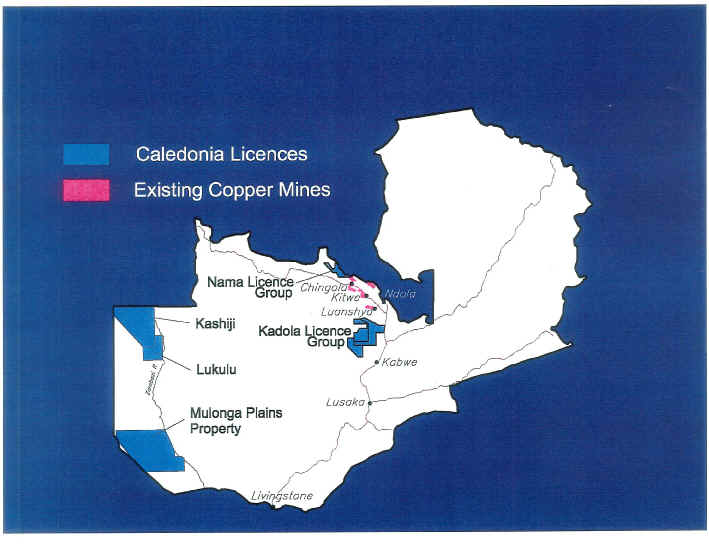

Pages 23,24 and 25 are maps respectively of northern South Africa, Zimbabwe and Zambia – which show the locations of the Company’s exploration and operating properties in those countries.

B.

Business Overview

Mining and Exploration Activities:

Gold Production

Blanket Mine (1983) Private Limited (“Blanket”) - Gold

Blanket continues to export its gold production to Rand Refineries in South Africa and receives 100% of the sale proceeds in US dollars within 5 days of sale. Cash flow at Blanket continues to improve as gold production increases and the production unit costs decrease.

Background

Blanket is wholly owned by the Corporation’s 100% owned Zimbabwe subsidiary. The mine is located 560 km south of Harare, the capital city of Zimbabwe and 150 km south of Bulawayo, the country’s second largest city. The town of Gwanda, the provincial capital of Matabeleland South, is located 16 km east of the mine and is approximately 197 km north north-west of the South African border post of Beit Bridge. The mine is situated in the Gwanda Greenstone Belt from which gold was first produced in the 1800’s. Blanket holds extensive exploration properties throughout this belt. The Blanket property was first staked in 1904 with mining and metallurgical plant operations starting in 1906 and has since produced over a million ounces of gold.

Geological Setting

In common with most of the gold mines in Zimbabwe, Blanket is situated in a typical greenstone terrain, the 70 km long by 15 km wide Gwanda Greenstone belt. This terrain comprises supra crustal metavolcanic rocks similar to those found in the Barberton area of South Africa and the Abitibi area of Canada. The Blanket property is the largest of the three remaining large gold producers on the Gwanda Belt, an area that has given rise to no less than 268 gold mines.

Property Geology

Blanket is part of the group that makes up the North Western Mining camp also called the Sabiwa group of ore zones extending from Sabiwa and Jethro in the south, through Blanket itself to the Feudal, AR South, AR Main, Sheet, Eroica and Lima ore bodies.

The geological sequence strikes north-south, dips vertically and consists, from east to west, of a basal felsic unit which is not known to carry mineralization. It is generally on this lithology type that the various mine tailings disposal sites are located. Above this unit is the ultramafic unit that includes the banded iron formations hosting the eastern dormant cluster of mines and the ore bodies of the adjacent Vubachikwe mine complex. The active Blanket ore bodies are found in the mafic lavas, while the andesitic unit which lies to the west, caps this whole stratigraphy. A regional dolerite sill cuts the entire sequence from Vubachikwe through Blanket to the Smiler prospect. Ore bodies at Blanket are epigenetic and are associated with a later, regionally developed deformation zone characterized by areas of high strain, wrapping around relatively under formed remnants of the original basaltic lava flows. It is within this higher strain regime (highly sheared rocks) that the wider of the ore bodies are located.

13

Production Operations

Mining

Subsequent to the completion of the No. 4 Shaft Expansion Project during Q3 2010, the underground mining areas can now produce up to 1,100 tonnes of ore daily using predominately long-hole open stoping methods. Certain ore handling limitations still existed at the underground on 18 and 22 Levels at the year end. These limitations are currently being addressed by raise boring an ore pass connecting 18 Level to the No. 2 ore bin grizzly tip on 22 Level. The 120 metre long and 1.5 metre diameter ore pass will dramatically improve the efficiency of delivering ore to the new underground crushing and hoist loading station by eliminating the current necessity to double handle ore and waste generated on 18 Level down to 22 Level via the No 6 winze before it is crushed and hoisted from the underground loading station to surface. The raise boring operations had an adverse impact on gold production in the first quarter of 2011resulting in 7,322 ounces being produced which was lower than the increased capacity equivalent of 10,000 ounces per quarter. The second quarter production will be higher than the first quarter but the planned annualized gold production rate of 40,000 ounces will not be achieved in 2011as a result of the lower production rates in the first and second quarters...

Metallurgical Process

The present crushing and milling circuit has been expanded from 600 tonnes per day to about 1,800 tonnes per day capacity. This is more than sufficient to handle the planned increases in mine production from the No. 4 Shaft Expansion Project, and, in future, from any ore mined from the satellite exploration properties currently being developed.

All run of mine (“ROM”) ore is crushed underground to minus 80mm, hoisted to surface and crushed to minus 12mm in the surface 2-stage crushing circuit. This material is then fed into two 1.8m by 3.6m rod mills where it is milled down to approximately 70% passing 75 microns, after which the milled slurry is pumped through two 30 inch Knelson Gravity Concentrators where approximately 49% of total mill gold production is recovered as ‘gravity’ gold. The Knelson Concentrator tails are pumped through cyclones whose underflow reports to the open-circuit regrind ball mill. The product from the Knelson tails cyclone overflow and the regrind mill discharge are pumped into a carbon-in-leach (“CIL”) plant consisting of eight, 600 cubic meter leach tanks where alkaline-cyanide leaching and simultaneous absorption of dissolved gold onto granular activated carbon takes place. Elution of the gold from the loaded carbon and subsequent electro-winning is done on site. During electro winning the gold is deposited on wire wool cathodes, the loaded cathodes are acid-digested and the resultant gold solids from acid digestion and the re-dressed gold concentrate from Knelson Concentrators are smelted into bars. The granular activated carbon is kiln regenerated before it is recirculated back to the CIL section. The gold bullion, in the form of Dore bars is delivered, as required by Zimbabwean gold-mining law, to the Government-operated Fidelity for sampling and onward delivery to the Rand Refineries in South Africa. Rand Refineries undertakes the final refining and sells the resultant gold with 100% of the proceeds being credited to Blanket’s Zimbabwean bank account in US dollars within 5 days of sale.

The CIL plant has an overall design capacity of 3,800 tonnes of milled ore per day, from its previous use for reclaimed tailings processing. The plant tailings from CIL are reduced in cyanide content and deposited on two licensed tailing impoundment areas sited close to the plant. The maximum amount of tailings water is pumped back to the metallurgical plant for re-use. Daily management and operation of the tailing deposition area is contracted out to the Zimbabwean subsidiary of specialized South African company “Fraser Alexander Tailings”

Mineral Reserve Calculations

The Company has had the Blanket Mine gold reserve calculations verified. The work was done by the South African based independent consulting company, MSA Geoservices (Pty) Ltd. ("MSA"). MSA has completed a technical report on the Blanket Mine dated June 28, 2011. A summary of the Report - including the reserve calculations - is attached as Exhibit 14.e. The full Report can be viewed on the Company's website at www.caledoniamining.com. It can also be viewed on SEDAR at www.sedar.com.

DISCONTINUED OPERATIONS

Eersteling Gold Mining Company Limited

The mine is no longer disclosed as “held for sale” but the Board’s decision to sell remains intact. The change in disclosure is as a result of no offer being made for the mine since 2008.

14

No additional impairment has been made against the carrying value as the previously offered price by a 3rd party potential buyer was significantly higher than the carrying value and the Corporation has rejected a purchase offer also in excess of the carrying value. Interested parties continue to investigate the merits of purchasing the mine and the Corporation continues to seek a suitable purchaser.

MARKETING

During 2009 Blanket became entitled to export and sell its entire gold production in its own name. Blanket has since then delivered and sold its gold production to Rand Refineries Limited in South Africa and has been paid the proceeds directly into its foreign currency account held with a Zimbabwe commercial bank.

KEY PERFORMANCE FACTORS

During 2010, the US$ gold price per ounce continued to increase and the increased gold production from Blanket has enabled Blanket to remain cash-flow positive throughout 2010. The cash flow, together with a 6-month loan facility from Blanket’s Zimbabwean bankers allowed Blanket to fund all of the 2010 capital expenditure at the mine. Subsequent to the completion of the No. 4 Shaft Expansion Project the mining of the Level 22 Haulage Extension Project, has recommenced. This project will allow for the further up-dip and down-dip exploration of the Blanket mine-site’s known ore bodies and, provided this exploration is successful, will also allow for the rapid commencement of mining on the new mining areas defined and an increase in the mine’s mineral reserves and resources. It is expected that the 2,400 metre long Level 22 Haulage Development Project will be completed by the end of 2012. The frequency of electrical supply interruptions has decreased significantly since the new supply agreement was signed with ZESA in December 2010. Nevertheless the additional diesel generator sets and the associated transformers and switchgear are proposed to be installed during the 1st quarter of 2011 to ensure continuous power supply is available to the entire surface and underground operations in the event of any power interruption.

OPERATIONAL REVIEW AND RESULTS OF OPERATIONS

The plans for the non-revenue generating exploration projects continue to be determined by the availability of funds and are more fully described below.

8.1

Gold Production

Blanket Mine – Zimbabwe

The operational statistics reported below refer to the period from January 1 to December31, 2010.

Safety, Health and Environment

The table below summarizes Blanket’s safety record of accidents, injuries and safety-related incidents for 2010 and 2009:

| | |

| 2010 | 2009 |

Lost time injuries | 0 | 3 |

Occupational illness | 1 | - |

Medical Aid | 8 | 6 |

Restricted work activity case | 13 | 15 |

First Aid | 15 | 7 |

Total | 37 | 31 |

Incidents | 56 | 36 |

Near misses | 34 | 20 |

The mine had a good year from a safety perspective in that zero (3 – 2009) lost time injuries were recorded during the period and 13 (15 – 2009) restricted work activity cases occurred. Considering the amount of electrical supply interruptions experienced and the extensive capital works carried out in 2010 both on surface and underground this is considered to be an excellent achievement by Blanket’s management and employees. Incidents however increased to 56 (36 - 2009), and near misses also increased to 34 (20 – 2009) primarily due to the increased levels of work activity.

15

Intensive safety training continues under the National Occupational Safety Association (“NOSA”) to ensure that new and existing employees are compliant with the NOSA safety requirements and standards.

The Occupational Health Center continues to operate at the Mine and all employees are screened for occupational ailments. There was 1 (nil – 2009) occupational health illness detected during the year. HIV/AIDS continues to be an area of concern for management despite awareness programs to educate employees and their relatives being in place. The voluntary testing of employees is still at disappointingly low levels.

The Mine continues to monitor the water quality in the ground-water pumping wells downstream of the tailings impoundment areas. The results continue to be well within the Governmental Environmental Management Agent (“EMA”) minimum levels. Re-grassing of the slopes to improve side stability and to reduce wind and rainfall erosion on Dam B is ongoing.

At the higher level of mining and processing activity following completion of the No.4 Shaft Expansion Project, the associated waste material management requirements continue to increase. The typical items covered here include used-oil, scrap metal, used-batteries, domestic refuse, industrial and office waste and clinic waste.

The Zimbabwean Chamber of Mines (“COM”) concluded wage negotiations with the unions in December 2010 which resulted in the mine having to pay back-pay to all its employees for the period October 2009 to November 2010. Wage negotiations will commence again in early 2011 but the Chamber of Mines has made it clear that these negotiations will be for the full calendar year 2011.

In general the labour force is now stable with the number of un-authorized absences and desertions stabilizing at acceptably low levels along with a very low turnover rate.

Capital Projects

Ore Pass from 18 Level (630m) to 22 Level

A 115 meter long by 1.5 metre diameter ore pass is currently being raise-bored which will improve the efficiency of moving mined ore from 18 Level to the underground crushing station. Sustained production at a continuous 1,100 tonnes per day will be achieved once this ore pass and its 18 Level tipping station are completed in April 2011.

22 Level (750m) Haulage Development Project - from Blanket #4 shaft to Lima shaft

The 22 level Haulage Development Project is currently behind the original schedule in the mine plan due to the decision taken in 2010 to concentrate financial resources on completing the No. 4 Shaft Expansion Project. Work on this Project will now be accelerated to link the Blanket and Lima shafts. Included in the work is a 230 meter ventilation raise that will be bored to improve ventilation in this area and that will allow for double-shift blasting. To expedite its completion the ventilation raise- will commence immediately the 18 level to 22 level ore pass is finished. This ventilation raise is expected to be completed in the 2nd quarter of 2011 and will be equipped with a suitable single winder engine and a double-deck conveyance for personnel transportation between the 14 Level and 22 Level. As the 22 level haulage project advances, crosscuts (short side tunnels) will be mined each with a length of up to several hundred meters in order to provide the required drilling platforms from which the deeper ore bodies above and below the 22 level can be drilled, evaluated and developed. It is planned that all of the work on the 22 Level Haulage Project and its cross-cuts will be done alongside normal mining production and should be completed by the end of 2012. The budgeted cost of the 22 level Project utilizing internal resources is about US$ 900 per meter advanced and equipped for the planned 2,400m totalling about $US 2.2 million to be funded from internal cash flows.

Mine Operations

Quarterly gold production has increased since mining and milling operations were resumed from 2,746 ounces in Q2 of 2009 to 6,228 ounces in Q4 of 2010. Monthly production and costs have however been subject to significant fluctuations largely due to the incidence of interruptions to electrical power, particularly prior to the installation of the first generator in late June 2010 and the increased labour costs.

16

| | | | |

Annual Production Results | 2008* | 2009** | 2010 |

Ore mined | Tonnes | 81,688 | 94,714 | 149,372 |

Development advance (ROM) | Meters | 472 | 1,267 | 2,455 |

Development advance (Capital) | meters | - | 165 | 365 |

Ore milled | Tonnes | 81,688 | 103,444 | 153,500 |

Head grade | grams/tonne | 3.33 | 3.75 | 3.9 |

Recovery | percentage | 87.89 | 90.96 | 92.00 |

Gold produced | Ounces | 7,687 | 11,295 | 17,707 |

Gold Sold | Ounces | 8,364 | 10,517 | 17,598 |

Average gold price per ounce sold |

USD |

920 |

1,099 |

1,273 |

Production cost per ounce |

USD |

663 |

744 |

751 |

* Production was temporarily suspended in October 2008.

** For 9 months April to December 2009

Underground

During 2010 the mining operations were affected by the following:

·

Electrical power outages have decreased in duration and frequency since the signing of a new power supply agreement with ZESA in December 2010. Blanket is however continuing with the installation of 2 more diesel generating sets and their associated switchgear, associated transformers, and synchronisation panel and controls. This complete 4 unit generator installation once commissioned in the 2nd quarter will ensure that the entire surface and underground operations will be able to continue to fully operate irrespective of ZESA power outages.

·

Until completion of the No. 4 Shaft Expansion Project, there was a necessity to double and triple handle mined ore and waste from below the 14 Level (510m) mid-shaft loading system via the No 5 and No 6 sub-shafts (winzes), This limited ore production to 500 tonnes per day or less. Ore from below 14 Level is still double-handled but the ore pass which is currently being raised-bored will resolve this problem during the 2nd quarter, 2011.

·

Completion of the No. 4 Shaft Expansion Project was essential in order to increase gold production to the 40,000 ounce per annum level. Completion of the underground construction and installation of components of this large Project required that for approximately 12 hours each day during the 2nd and 3rd quarters of 2010 , the No. 4 shaft winder had to be dedicated to lowering all of the materials used for the shaft expansion and the two shifts of personnel and their equipment rather than raising mined ore for processing. This, in conjunction with the substantial power interruptions, further reduced the time available for hoisting ore necessary for gold production and resulted in lower mining and milling production levels.

·

Furthermore, during the 2nd and 3rd quarters of 2010 the underground works required to complete the No 4 Shaft Expansion Project caused considerable congestion on the 22 Level haulage. Since completion of the 4 shaft project ,the waste generated from the 22 Level Haulage Development Project and from the raise boring above 22 Level has creating further severe congestion on this key production haulage. Until such time as the raise boring of the new ventilation raise between 14 Level and 22 Level has been completed during the 2nd quarter of 2011, the efficiency of rail traffic movement on the 22 Level will need to be carefully managed as production ore and waste from the 22 Level Haulage Development and from the raise-borer will need to be transported (trammed) to the 22 Level tips above the 765m Level Crushing Station. The ore transportation will improve dramatically and the planned 1,100 daily ore tonnage will be readily hoisted to surface. Currently and in future, all ore and waste are transported and hoisted to surface separately. All hoisted waste is conveyed directly from the No. 4 Shaft Headgear bin and deposited into an adjacent near-by disused surface stope.

17

Metallurgical Plant

·

During 2010 the metallurgical plant operations were very efficient with an averaged gold recovery of 92% being sustained for the year. Metallurgical improvements during 2010 included:

·

The No. 6 Regrind mill sump was rebuilt and the mill re-commissioned and is currently operating in the main milling circuit.

·

Both Knelson concentrators were overhauled and recommissioned, and Metallurgical optimisation test work carried out on plant samples has shown that there is little additional gold recovery potential in the existing Gravity Gold recovery section where about 50% of the produced gold is recovered, but that there may be some potential for additional gold recovery in the various plant sections following the Milling section.

·

Additional testwork has been planned on samples taken from the Gemini Table tails, the Cyclone Over and Under flows and the CIL tails to determine their current gold deportment and assess their amenability to gravity concentration and other recovery methods. This could likely result in possible future modifications and additional circuits being added to the gravity section of the plant.

·

The CIL circuit has now been completely equipped with our most recent design of Agitator Gearboxes and impellor mechanisms, and the first leach tank is now being utilised as a pre-conditioning tank which could result in lower reagent usage and more consistent gold recovery in the CIL section.

·

During the 1st quarter of 2011 the Activated Carbon regeneration kiln was refurbished.

It is planned to change the entire gold elution circuit to a more efficient automated system once cash flows allow.

Outlook

The main aims and objectives of Blanket in 2011 are to ensure that the 40,000 ounce production level is achieved and maintained, to successfully install and commission the whole power generating station, to accelerate the 22 Level Haulage Development Project, the exploration of the up and down dip extension of the known ore bodies, and to further develop the GG and Mascot projects as rapidly as Mine cash flow and economic conditions in Zimbabwe allow.

In the 2nd quarter of 2011, the completion of the new ore pass between 18 Level and 22 Level and the installation of the Tipping station on 18 Level will eliminate congestion on 22 Level at Blanket. Also in the 2nd quarter a new ventilation raise will be bored between 14 Level and 22 Level to vastly improve ventilation in this key development area. This will allow for double-shift blasting, thereby speeding up the 22 Level Haulage Development Project. The mid shaft loading station on 14 Level will continue to handle ore as necessary and the less congested 14 Level will be equipped with personnel carriages and utilised as a main personnel transportation level providing faster access to the working places on 14 Level, 18 Level, and 22 Level that are located over 1,500 meters distance from No 4 Shaft. This will result in significant production efficiencies from the mining employees.

The crushing circuits and metallurgical plant currently has the capacity to treat approximately 1,800 tonnes of ore per day which provides the flexibility to further increase production as and when mining is able to supply additional ore from either the Blanket mine underground or our development properties.

However the capital investment required to maintain and expand the underground mining capacity and production from satellite development projects is obviously completely dependent on the investment climate in Zimbabwe being conducive to such investment.

18

EXPLORATION AND PROJECT DEVELOPMENT

Base Metals

Copper and Cobalt Base Metals

Nama Project – Zambia

Property

Caledonia Nama Limited (“Nama”), a wholly owned subsidiary of the Corporation, has been granted four contiguous 25 year Large Scale Mining Licenses covering a combined area of 786.1 square kilometers in northern Zambia on which near-surface Cobalt/Copper mineralization has been discovered. This area lies immediately northwest of the operating Konkola Copper mine and adjoins the extensive land holdings of the Teal Mining/CVRD joint venture (Konnoco).

Types of Mineralization at Nama

Cobalt –rich Minerals:

Two main styles of cobalt (“Co”) mineralization occur in the Nama area, the ‘D-type’ iron oxide bodies which are mostly enriched in Co, and the copper(“Cu”) dominated Ore Shale hosted Cu-Co mineralization, more common elsewhere in the Copperbelt, which is being exploited by neighbouring mines to the east and south of Nama.

Ore Shale hosted Cu-Co deposits

Mineralization of this type occurs within the Ore Shale of the Copperbelt rocks and is imminently/currently being exploited immediately to the east of the Nama license on the Konkola mining property. TheOre Shale is known from previous shallow drilling to extend into the Nama license for a distance of about 4 km from its eastern boundary. The neighbouring Konkola and Konnoco Mines have both defined substantial copper resources on their properties. Recent exploration activities at Nama have resulted in the definition of two resource targets (being “Konkola East” and “Kafwira”) characterized as belonging to the Ore Shale-hosted Cu-Co style of mineralization. These targets will be investigated further during the 2011 exploration field season, including some medium depth diamond drilling to confirm the existence of Copperbelt stratigraphy within the two target areas. Drilling of the first of four sequential holes at the Konkola East target area commenced in early March 2011 and the results of this program are expected to be received in mid-2011. Thereafter, depending on the early results from Konkola east , drilling will continue on further drill-holes at Konkola East, and depending on priority on one or two drill-holes at the Kafwira target area.

Although the existing “A-type” resource body, with its higher ‘oxide’ cobalt mineralization has often been regarded as belonging to the Ore Shale style of mineralization, it should be noted that its unusual stratigraphic position coupled with the its associated iron and manganese enrichments make this a ‘hybrid style’ of mineralization. Metallurgical work on this hybrid material is continuing in order to improve the economics of the current process while ongoing exploration will be undertaken to improve the resource base on which the process is based.

Exploration program for 2011

Diamond core drilling on one of the two target areas discussed below commenced in early March 2011. Also in 2011, field surveys in the form of detailed magnetometer surveys will be carried out over all past and current target areas as a means of understanding the depth potential of the various bodies investigated.

Drill Targets

The following drill targets have been defined within the Nama Licence areas. Caledonia has budgeted to drill the first these targets during the 2011 field program depending on availability of funding, ground conditions and drilling speeds. The objective of this work is to advance the targets to the stage where there is sufficient confidence that a larger drilling program to determine a potential resource can be justified.

19

Konkola East Target Area

The Konkola East target covers the westward continuation of the Ore Shale from where it crosses the boundary with the Konnoco (Teal/CVRD joint venture) property. The prospect has a strike of 3 km while the Ore Shale is known to extend for about 5 km along strike to the license boundary. Eight shallow boreholes were drilled into this area in 1970 by Zamanglo and an historical resource (non-compliant with NI 43-101) of 5.4 million tonnes, grading at 0.74% Cu was estimated (Co was not assayed). Exploration drilling by Konnoco on the adjoining property to the east of Nama’s Konkola property has proved particularly successful and has established that the Ore Shale dips down to a depth of about 800 m below surface and then extends to their southern boundary in an undulating manner – a distance of approximately 5 km. The resource potential of this 25 square kilometer target area is significant and has the potential to be a large Cu and Co resource. Drilling the first of four sequential holes at the Konkola East target area commenced in early March 2011 and the results of this over 3,200 metre drilling program are expected to be received in mid-2011.

Kafwira Target Area

A significant contribution to the exploration during the 2010 year has been the complete revision of the Corporation’s geological map of the Nama Licence area. This map has contributed to the prioritizing of the various anomalies and will continue to form the basis for the assessment of the full potential of the Nama area. An indirect result of this work has been the development of an understanding of the major structural trends in the Nama area, in particular the identification of those areas where the “Copperbelt” type lithologies are closest to surface but not actually exposed. These areas represent ideal targets for deeper drilling programs (500-1000 meters) and have the advantage that the Ore Shale, if intersected, would have a shallow dip. A target area of approximately 20 square kilometres has been defined in the Kafwira area and drilling of up to four holes could be carried out once the Konkola East target has been defined and any additional drilling prioritized.

‘D-Type’ iron oxide Co bodies

‘D-type’ ores at Nama consist essentially of massive hematite and magnetite concentrations encapsulated by less well mineralized talcose schist alteration zones. These concentrations occur associated with dyke-like gabbroic intrusions which appear to disrupt the iron-rich bodies. On account of the complex metallurgy and hence larger capital and operating cost requirements involved in treating the typical ‘D-type’ iron oxide bodies, further work on this ore type is required before economic extraction of this type of Co resource can be considered. In particular, work is required on developing a more cost effective means of recovering the Co from this ore type. To this end the company is considering various leach technologies which may reduce the metallurgical costs significantly.

Work Completed

Details of the previous years’ exploration work completed at Nama can be found in the MD&A reports included in prior years’ Annual Reports and the 3 quarterly MD&A reports of 2010.

A focus on building up production and improving profitability elsewhere in the corporation meant that certain capital intensive programs at the Nama Project such as diamond drilling had to be postponed to the 2011 exploration season. As a result, the more recent work program at Nama focused on deep sampling and evaluation of targets deemed most suitable for future drilling. Pits were dug in strategic positions, up to 10 meters deep, to expose the bedrock beneath the thick soil cover. This program has contributed substantially to the development of an improved geological map of the Nama project area, which in turn has made it possible to define exploration targets areas on the basis of geological structure alone in areas where no base metal enrichments are present at surface. Sampling and logging of these exposures has increased the control over the various targets such that the follow-up 2011 drilling program currently underway could be more accurately positioned.

Other Nama Areas of Interest:

‘E’ Anomaly – Yembela Clearing

Research into previous geochemical surveys carried out in the 1960’s indicated that further anomalies had been located by localized sampling programs both east and west of the Yembela Clearing.

20

These anomalous sites were located and follow-up sampling has verified the existence of the anomalies – Yembela East and Yembela West. Co values of up to 0.16% were encountered in soils which form a thick cover over the two new anomalous areas. Coincidental geophysical anomalies suggest that the mineralization occurs in the form of steeply dipping fold or shear structures. The association of a prominent fault and tillite floor rocks to the south is a very similar structure to that at the ‘A-type’ resource body and supports the interpretation that this occurrence is likely to be analogous to the ‘A-type’ mineralization which is known to be amenable to lower cost extraction techniques.

Konkola West

During the 2008 field season, exploration established the existence and extent of an Ore Shale horizon along the western margin of the Konkola Dome (south of the ‘A’ Resource Body). A shale unit, approximately 100 meters wide containing anomalous values of Co and Cu has been located in an area of very deep soil cover. Surface material (“float”) from this area was found to contain up to 0.1% Co and 0.2% Cu. This area is referred to as the “Konkola West” area. Two future drill targets have been outlined in this area based on that season’s work, in particular, the use of termite hill sampling. Based on the current interpretation, it appears that the target horizon has a north-south strike extent of about 3 km before crossing into the Democratic Republic of Congo (“DRC”).

A second anomaly with a much stronger geochemical response occurs further to the west of the “Ore Shale” target described above. The area is referred to as the “Fault Target” and appears to be the result of a fault or shear zone mineralization and may therefore be similar in character to the ‘A-type’ cobalt anomaly.

Further information with respect to the Nama properties is given in Exhibits 14c, 14d and 14g.

PGE’s

Rooipoort & Mapochs Platinum, Gold, Palladium /Ni/Cu (“PGM”) Project - South Africa

The Rooipoort rights, previously held by Eersteling Gold Mine, have been transferred into Maid O’ the Mist, which is a wholly owned subsidiary of the Corporation. Maid O’ the Mist is the vehicle that will be used to manage the Rooipoort platinum exploration program.

An application in terms of the provisions of the applicable Act is in progress to treat the 5 adjoining prospecting rights at Rooipoort as a single right and to extend the period of this consolidated right for a further three years.

The prospecting rights granted to the Corporation to prospect for Platinum Group Elements (PGE)s on the major portions of the Mapochsgronde tribal trust land are currently in the process of registration. A further application has been made for an adjoining property to the north of the current rights applied for. The Corporation is still waiting the issuing of the prospecting right following its registration.

The Corporation is actively seeking Joint-Venture partnerships for its Rooipoort and Mapochsgronde properties.

Further information with respect to the Rooipoort property is given in Exhibits 14c, 14f and 14g.

Gold

Zimbabwe Exploration – Gold

The Corporation’s exploration activities in Zimbabwe are conducted by Blanket’s exploration department. Blanket’s current exploration title holdings in the form of registered mining claims in the Gwanda Greenstone Belt total 78 claims, including a small number under option, covering an area of about 2,500 hectares. Forty seven (47) of these claims are registered as precious metal (gold) blocks covering 415 hectares and 31 claims were pegged and are registered as base metal (Cu, Ni, As) blocks covering a total area of 2,085 hectares.

Blanket’s main exploration efforts have been and continue to be focused in certain key areas in the Gwanda Greenstone Belt that are within economic trucking distance of the Blanket plant such as GG prospect and the Mascot Project Area, which are believed to have the greatest potential of success.

Drilling programs were carried out at GG over the past 5 years. Thirteen diamond cored holes were drilled amounting to 2,336 meters of drilling. Two zones of potentially economic gold mineralization have been established down to a depth of approximately 200 m. A prospect shaft has been sunk down to the first level as a first step to exposing the mineralization.

21

At GG, further core drilling from the surface will be done in 2011 to establish the strike extent of previously established mineralization. In addition, the existing prospect shaft will be deepened and underground development on the first and second levels will be advanced to expose the extent of the mineralization and to facilitate evaluation, sampling and mine planning. Depending on the outcome of exploration work, the earliest that production could commence at GG could be in mid-2012 with daily production estimated to be up to a maximum of 200 hundred tonnes of ore per day which could be trucked to the Blanket plant for processing.

The Mascot Project Area comprises three existing shafts (Mascot, Penzance and Eagle Vulture) each of which extend down to depths of up to 450 meters and other infrastructure, much of which is in need of extensive rehabilitation. Each of these shafts operated until the mid-1960’s after which production ceased due to the increasing political difficulties at that time and the limitations of the technology that was then available. Blanket management believe that the application of modern exploration and processing techniques may allow some or all of these shafts to operate profitably on a sustainable basis, and not just at the prevailing high gold price. The rehabilitation and installation of infrastructure at Mascot and Eagle Vulture mines continues and is at an advanced stage and underground activities are planned to resume in the 2nd quarter of 2011. Depending on the rate and extent of rehabilitation and a favourable outcome of exploration work, the earliest that production could commence at the Mascot Project Area would be in early 2012 with the maximum eventual daily production anticipated at a rate of up to 400 hundred tonnes of ore per day from these three shafts. Such mined ore would then be trucked to the Blanket plant.

Blanket is formulating an exploration and project development strategy to prioritize work on its other properties in the Gwanda area

Outlook

The outlook for the aforementioned exploration properties is not possible to quantify. Exploration by its nature is speculative with a high degree of risk accompanied by the potential for high returns. The Corporation manages this risk by using well-qualified exploration professionals. Continuing lower prices for platinum group metals and reduced investor appetite for South African base metals has resulted in a severe contraction of exploration expenditures for platinum group metals by mining companies and could negatively affect the likelihood of the Corporation negotiating joint venture agreements for its wholly-owned PGE exploration properties.

The Corporation intends, where possible, to continue to focus its exploration activities of prospective properties by developing the properties through strategic alliances with other mining companies and metal producers.

The Zimbabwe economy continues to be depressed and Zimbabwe’s economic capacity may struggle to expand further. Pressure for unrealistic wage and price increases from labour and Zimbabwean suppliers continues. There is also continuing pressure for higher taxes, both from national and local government and Blanket has accepted increased supply tariffs from the state-owned electricity utility (ZESA) to secure a more reliable power supply. The resuscitation of the mining industry is a stated high priority of the Government as its ability to quickly generate foreign currency is of paramount importance, but blatant political manoeuvring may over take this. Notwithstanding these difficulties, and in the absence of any unforeseen changes to the operating and commercial environment, Blanket has now achieved sufficient critical mass and should be able to realise substantial economies of scale and an improvement in its cash-generative capacity. The expanded capacity of the Blanket metallurgical plant to a daily rate of approximately 1,800 tonnes enables it to immediately treat additional feed material from the Blanket underground and from the GG and Mascot area mines if the planned exploration/development work in the outside areas is successful.

However, the Government’s aim to foster the rapid regeneration of the Zimbabwean mining sector has been severely undermined by recent regulations and other pronouncements which seek to enforce stringent indigenization requirements which will deter new investment into the Zimbabwean mining industry and contract the mining industry. Caledonia’s proposed response to the indigenization requirements is discussed below.

The Zimbabwe Indigenization and Economic Empowerment Act (the “Act”) became law in March 2008. The law seeks to ensure that at least 51% of all businesses in Zimbabwe are held by Indigenous Zimbabweans. In February 2010, the Minister for Youth Development, Indigenization and Empowerment (the “Minister”) issued Regulations which gave effect to the Act.

22

In June 2010 a second set of regulations were issued amending the initial requirements. Consultations have taken place between the Government and the Chamber of Mines Zimbabwe (“COMZ”). The final outcome of consultations is still unclear and the Corporation is not able to finalise its plans until clarity has been provided. However, the Corporation remains committed to the implementation of indigenization to a level and on terms that are commercially acceptable and technically sustainable for the Caledonia’s investors, the mine and its employees.

The Company has submitted an Indigenization Plan to the Government but has not received any meaningful response.

23

24

25

26

General Comments

Caledonia’s activities are centered in Southern Africa. Generally, in the gold mining industry the work is not seasonal except where heavy seasonal rainfall can affect surface mining or exploration. Caledonia is not dependent, to any material extent, on patents, licenses, contracts, specialized equipment or new manufacturing processes at this time. However, there may be occasions that Caledonia may wish to adopt such patents, licenses, specialized equipment, etc. if these are economically beneficial to its operations.

All mining and exploration activities are conducted under the various Economic, Mining and Environmental Regulations of the country where the operations are being carried out. It is always Caledonia’s standard that these regulations are complied with by Caledonia otherwise its activities risk being suspended.

(C)

Organizational Structure - Subsidiaries

Caledonia Mining Corporation owns 100% of the shares of the following incorporated subsidiary companies:

Zambia:

Barbados:

- Caledonia Mining (Zambia) Limited

- Blanket (Barbados) Holdings Limited

- Caledonia Western Limited

- Caledonia Holdings (Africa) Limited

- Caledonia Nama Limited

- Caledonia Kadola Limited

South Africa:

Zimbabwe:

- Eersteling Gold Mining Company Limited

- Blanket Mine (1983)(Private)( Limited)

- Greenstone Management Services Limited

- Caledonia Holdings Zimbabwe Limited

- Fintona Investments (Proprietary) Ltd

- Caledonia Mining Services Limited

- Maid O’Mist (Proprietary) Limited

- Mapochs Exploration (Pty) Ltd

Panama:

- Dunhill Enterprises Inc.

(D) Property, Plant and Equipment

(a)

South Africa:

The Eersteling gold mine, indirectly owned by the Company through its ownership of 100% of the shares of Eersteling Gold Mining Company Limited, is essentially a fully equipped mine with all of the underground and surface equipment needed to conduct mining operations and the treatment and concentration of ore mined from the properties. Due to the lengthy period of care and maintenance at Eersteling there has been some deterioration in the surface facilities which will require rehabilitation work before operations can be recommenced. The underground workings at Eersteling were allowed to flood and will require dewatering before mining access can be resumed. Because the Company is currently attempting to sell this mine it has no plans to expend further amounts on plant or equipment for them or to in any way expand or improve the facilities.

On February 21, 2008 the Corporation accepted an offer from Eastern Goldfields to purchase the entire issued share capital in Barbrook Mines Limited, its debts to the Corporation, and its payables of approximately $1,440,000 for $9,130,000.

The sale of Barbrook gold mine indirectly owned by the Company through its ownership of 100% of the shares of Barbrook Mines Limited was concluded on May 31, 2008.

27

(b)

Zimbabwe:

The Blanket Mine, in Zimbabwe, which the Company indirectly owns through its ownership of 100% of the shares of Blanket Mine (1983) (Private) Limited, the owner and operator of the Mine, is a fully equipped mine with all of the necessary plant and equipment to conduct mining operations and the production of gold from the ore mined from the Mine. As is noted above the Company completed the #4 shaft expansion project in late 2010. To May 2011 Blanket had expended approximately the equivalent of $10,000,000 (Cdn.) on the Mine and plant expansion. Due to lack foreign currency as a result of lack of payment by the Reserve Bank of Zimbabwe (“RBZ”) for gold sold during 2008, gold production was suspended at Blanket Mine in October 2008 and only recommenced in April 2009 once Blanket had received the Gold Dealing and Export licenses necessary to allow Blanket to export its gold to a refiner of its choice. It was estimated in May 2009 that, to complete the Mine plant expansion and achieve production of 40,000 ounces of gold per annum, would require the further expenditure of approximately US$2,200,000. The necessary funding was raised via local borrowings and from Blanket’s cash flow. The approximately $US 3 million foreign currency owed to Blanket Mine for unpaid gold sales by the RBZ was converted into a Special Gold-Backed Foreign Exchange Bond, with a term of 12 months and an 8% interest rate. This bond plus interest is guaranteed by RBZ but remains outstanding at the end of 2010.

5

OPERATING AND FINANCIAL REVIEW AND PROSPECTS

A

Operating Results

The following information is given for the last three fiscal year-ends of the Corporation:

| | | |

C$000’s except for earnings per share amounts. | December 31, 2010 | December 31, 2009 | December 31, 2008 |

Revenue from sales | 22,401 | 11,559 | 7,696 |

Net income (loss) before income tax and discontinued operations : | 3,687

| (3,091)

| (4,504)

|

Discontinued operations | - | - | (463) |

Net Income (loss) before discontinued operations , after tax | 2,257 | (3,950) | (4,940) |

Net income/(loss) per share - basic and diluted | $0.0045 | ($0.008) | ($0.010) |

Comprehensive Income (loss) | 1,746 | (4,503) | (4,880) |

Total assets | 27,488 | 22,090 | 23,657 |

Total long-term liabilities | 4,017 | 2,589 | 1,153 |

Cash dividends declared per share | Nil | Nil | Nil |

Corporation achieved a gross operating profit of $8,278,000 for the year ($2,916,000 – 2009 and $3,039,000 – 2008) on gold sales of 17,598 ounces (10,517 – 2009 and 8,364 – 2008) at an average gold price of $1,273 ($1,099 – 2009 and $920 – 2008).

Total gold production for the year was 17,707 ounces (11,295 – 2009 and 7,687 – 2008) which was negatively affected by power interruptions during the first 11months of the year.

The profit after tax of $2,257,000 is affected by the unusually large non-operating, non-cash flow items totalling $3,489,000 ($4,830,000 – 2009 and $2,237,000 – 2008) being mainly made up from the impairment of mineral property $577,000 ($1,434,000 – 2009 and $1,168,000 – 2008) , the write down of the RBZ Gold Bonds of $1,040,000 ($2,502,000 – 2009 and $526,000 – 2008), an unrealized foreign exchange loss of $229,000 ($207,000 loss – 2009 and $297,000 loss – 2008) and a future tax liability charge of $1,427,000 ($859,000 – 2009 and $Nil – 2008).

As a result of the dollarization of the Zimbabwean economy in February 2009, Blanket’s functional currency changed to the US dollar and thus the unrealized foreign exchange loss, on translation, of $466,000 ($600,000 – 2009) was debited to other accumulated comprehensive loss and not to the unrealized exchange loss in the Statement of Operations and Comprehensive Income/ (Loss).