Exhibit 99.4

Letter from the Chairman

May 31, 2018

Dear Fellow Shareholders

The current Board and executive management team assumed responsibility for Caledonia in November 2014 although Caledonia purchased the Blanket Mine in 2006. Over the past four years Caledonia has undergone comprehensive changes in its governance, financial, operational and communications strategy and has entered a period of sustained organic growth. Today the Company is recognized as an expanding, high-efficiency, low-cost gold mining company with excellent growth prospects.

2017 was a pivotal year for our business and I have pleasure in referring you to the audited accounts for the year which can be found at the Financial Reports section of our website at www.caledoniamining.com. Caledonia delivered record production from the Blanket Mine, made substantial progress on the Central Shaft project, where the Company is effectively building a new mine under the existing mine, whilst achieving record production, listed the Company’s shares on the NYSE American stock exchange and announced a significant increase in our resource base.

The peaceful transition of political leadership in Zimbabwe has created new opportunities for the Zimbabwean mining industry. Recent public policy statements and legislative changes indicate a commitment to policies designed to promote much-needed growth and investment. We look to the future with a great sense of optimism.

Investment Performance

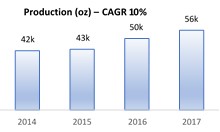

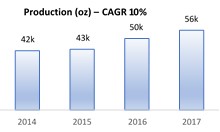

Caledonia has delivered compound annual gold production growth of 10% since 2014 accompanied by annual cost reductions of 4%. The Board expects1these trends to continue until 2021 as Caledonia delivers on its growth strategy. Since 2014 Caledonia has delivered adjusted EPS growth to shareholders of 48%. The Company’s shares have appreciated substantially in absolute terms during this period and, when including dividend distributions, have significantly outperformed the benchmark VanEck Vectors Junior Gold Miners ETF (GDXJ).

Since the Board announced and implemented a dividend policy in 2012, a total of $18.9 million has been paid to shareholders, equating to $1.78 per share. The Board intends to maintain the Company’s dividend policy and to seek opportunities to increase future dividends based upon the Company’s financial and operational condition.

In June 2017 the Company completed the consolidation of its share capital and an upgrade of its US trading platform from the OTCQX to the NYSE American in order to improve liquidity and access to US investors. The Company also expanded its shareholder relations efforts in the US market to support the NYSE American listing with positive results achieved to date.

Trading volume on the NYSE American since the listing represents over 50% of total traded volume on all three stock exchanges on which the Company’s stock is traded. Since the NYSE American listing, total trading volume on the three exchanges has greatly improved.

The Board acknowledges that overall trading liquidity in the Company’s shares is not yet optimal and remains actively engaged with management to improve liquidity through our investor relations activities.

______________________________

1Note: This letter contains certain forward-looking statements. Please refer to our notice about forward looking statements in our latest management discussion and analysis for a warning of the inherent uncertainties and risks in relying on such statements. The notice applies to any such statements in this letter.

Operating performance

Caledonia reported record production in 2017 for the fourth consecutive year. Consistent increases in production since 2014 have generated strong growth in revenue and consolidated operating cash flow, notwithstanding the volatility of the gold price during the period. The Company’s consolidated operating cash flow was reported at $24.5 million at the end of 2017.

Our strong operating cash flow has supported the expansion of the mine commencing in 2015 and continues to support the funding of Caledonia’s dividend policy and expansion plans. Since the commencement of the Central Shaft project in 2015, the Board has allocated total capital of $60 million to the sinking of the new Central Shaft and other sustaining capital investment. Caledonia’s operating cash flows have supported this substantial investment without the need to access capital markets, a testament to the quality of the Blanket Mine.

I am particularly pleased to report that our exploration activity at the Blanket Mine has borne fruit in recent years. Since late 2014 we have increased the average rate of exploration drilling from 724 to 2,080 metres per month (187% increase) as a result of which we have seen growth in the resource base of 17% per annum since 2014 after mining depletion. Blanket has made new discoveries totalling 835koz since 2014. This has been achieved with on-site exploration expenditure of only $3.3 million resulting in a discovery cost of approximately $4 per ounce. At the end of fiscal 2017 Blanket Mine has resources of almost 1.6 million ounces of gold, providing a solid foundation for the future of the Company. The results of continuing deep level exploration at Blanket gives us good grounds to be optimistic that we will see further additions to resources at an increased level of confidence.

On the basis of the revised resource analysis and updated projected consolidated cash flow, the Board announced in November 2017 the further expansion of the Central Shaft project by 250 meters from the original depth target of 1,080 meters to a final depth of 1,330 meters. Two additional operating levels will also be developed. The further expansion of the shaft is intended to substantially improve our operating flexibility, increase opportunities for deep level exploration and extend the life of the Blanket Mine to at least 2031. This project will require an additional investment of $18 million, substantially less than if the decision to extend the shaft had been deferred until after the shaft had been commissioned at the original target depth of 1,080m. The Blanket Mine intends to continue to fund this expansion out of operating cash flow.

The Board and management do not expect this further expansion to affect our target production level of 80,000 ounces annually by 2021.

Safety performance

Blanket is audited annually by NOSA, the National Occupational Safety Association of South Africa and received a 4-star rating. Regrettably our safety performance during 2017 did not meet the very high standards we expect. Two fatal accidents occurred during the year, the first in May and the second in July. A third fatal accident occurred in February 2018.

A comprehensive investigation of the circumstances in which these accidents occurred was conducted in each case by both mine management and the Zimbabwean mining authorities. Caledonia is committed to learning from these incidents in the pursuit of a safer working environment.

My colleagues and fellow Directors join in expressing our sincere condolences to each of the families, friends and colleagues of the deceased. The Board and management remain steadfast in an unwavering commitment to safe and sustainable gold mining to ensure that all employees return home safely each day.

Corporate Citizenship

Caledonia will continue to act as a responsible corporate citizen in Zimbabwe. The Company operates in an economic sector that requires meaningful capital investment and contributes significantly to the generation of foreign exchange for the country from the sale of its gold production.

At a national and a local level Caledonia makes a significant contribution to the economy. Blanket Mine employs approximately 1,400 Zimbabwean citizens and supports them and their families on our mine village. We have invested over $60 million in Zimbabwe since 2015 and plan to invest a further $56 million until 2020. Our operations contributed almost $70 million of foreign exchange inflows and our business paid $7.7 million in taxes and royalty payments in 2017 alone. We expect this contribution to increase substantially as the current investment programme bears fruit in terms of higher production and lower operating costs. Caledonia looks forward to being part of the solution to Zimbabwe’s economic difficulties through investment in sustainable, profitable and safe gold mining projects.

Investment Outlook

Recent developments in Zimbabwe are a reason for optimism. Political and announced legislative changes are encouraging.

The removal of legislated local ownership requirements have already been reflected in the Company’s share price. Furthermore, the recent announcement of the new monetary policy framework by the Reserve Bank of Zimbabwe, which increased the export credit incentive for gold miners from 2.5% to 10%, provides an attractive inducement for the gold mining industry to expand in country.

Caledonia’s strong positive cash flow, operating expertise and in-country knowledge gives us an excellent vantage point from which to identify and evaluate new investment opportunities. Our strong balance sheet, excellent cash generation and our access to international capital markets makes us ideally positioned to take advantage of those opportunites which we believe meet our investment criteria. As has been the case over the past four years, the Board and management will continue to focus on value enhancement for our shareholders.

This is an exciting time in Caledonia’s development. On behalf of my fellow Directors and senior management, I would like to express our appreciation for your continuing support of the business.

Yours truly

Leigh A Wilson